Attached files

Table of Contents

As filed with the Securities and Exchange Commission on May 14, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Shangri-La Tibetan Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | 2834 | Not applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| 53 Niwang Rd Shangri-La County, Diqing, Yunnan Province, China 674400 |

CT Corporation System 111 Eighth Avenue New York, New York 10011 | |

| (+86) 887 823 2158 | (800) 624-0909 | |

| (Address, including zip code, and telephone number, including area code, of principal executive offices) |

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Bradley A. Haneberg, Esq.

Anthony W. Basch, Esq.

Christopher J. Mugel, Esq.

Kaufman & Canoles, P.C.

Three James Center, 1051 East Cary Street, 12th Floor

Richmond, Virginia 23219

(804) 771-5700 – telephone

(804) 771-5777 – facsimile

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Ordinary Shares(2) |

$15,000,000 | $1,069.50 | ||

| Ordinary Shares(3) |

$2,835,000 | $202.14 | ||

| Placement Agent’s Warrants(3) |

$187 | $0.01 | ||

| Ordinary Shares Underlying Placement Agent’s Warrants(4) |

$1,875,000 | $133.69 | ||

| Total |

$19,710,187 | $1,405.34(5) | ||

| (1) | The registration fee for securities is based on an estimate of the aggregate offering price of the securities, assuming the sale of the securities at the midpoint of the high and low anticipated offering prices set forth in the prospectus, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(a). |

| (2) | In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional ordinary shares that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (3) | This registration statement also covers the resale under a separate resale prospectus by selling shareholders of up to 354,375 ordinary shares previously issued to such selling shareholders named in the resale prospectus. The registrant will not receive any proceeds from the sale of these shares. For purposes of this calculation, the Registrant has assumed the sale of these securities at the midpoint of the high and low anticipated offering prices set forth in the prospectus. |

| (4) | We have agreed to issue, on the closing date of this offering, warrants to our Placement Agent, Anderson & Strudwick, Incorporated (the “Placement Agent”), to purchase up to 10 percent of the aggregate number of ordinary shares sold by the Registrant (the “Placement Agent’s Warrants”). The price to be paid by the Placement Agent for the Placement Agent’s Warrants is $0.001 per warrant. Each Placement Agent’s Warrant may be exercised to purchase one of our ordinary shares. The closing date will be a date mutually acceptable to the Placement Agent and the Registrant after the minimum offering has been sold; provided, however, that the closing date will be on or before October 31, 2010. Assuming a maximum placement, on the closing date the Placement Agent would receive 187,500 Placement Agent’s Warrants at an aggregate purchase price of $187. The exercise price of the Placement Agent’s Warrants is equal to 125% of the price of the ordinary shares offered hereby. Assuming a maximum placement and an exercise price of $10.00 per share, we would receive, in the aggregate, $1,875,000 upon exercise of the Placement Agent’s Warrants. The ordinary shares underlying the Placement Agent’s Warrants are exercisable within one year of the date of this registration statement and are deemed to commence simultaneously with the Placement Agent’s Warrants. |

| (5) | Paid herewith. |

Table of Contents

EXPLANATORY NOTE

This registration statement contains a prospectus to be used in connection with the initial public offering of up to 1,875,000 of the registrant’s ordinary shares on a best-efforts, minimum/maximum basis through the Placement Agent named on the cover page of that prospectus (the “IPO Prospectus”). In addition, the registrant is registering on this registration statement the resale of up to 354,375 ordinary shares (the “Registrable Securities”) held by selling shareholders. Consequently, this registration statement contains a second prospectus to cover these possible resales (the “Resale Prospectus”) by certain of the registrant’s shareholders named under the Resale Prospectus (the “selling shareholders”). The IPO Prospectus and the Resale Prospectus are substantively identical, except for the following principal points:

| • | they contain different front and rear covers (including table of contents); |

| • | they contain different Offering sections in the Prospectus Summary section beginning on page 1; |

| • | they contain different Use of Proceeds sections on page 41; |

| • | the Dilution section is deleted from the Resale Prospectus on page 46; |

| • | a Selling Shareholders section is included in the Resale Prospectus beginning on page 46; |

| • | references in the IPO Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; and |

| • | the Placement section from the IPO Prospectus on page 104 is deleted from the Resale Prospectus and a Plan of Distribution is inserted in its place. |

The registrant has included in this Registration Statement, after the financial statements, alternate pages to reflect the foregoing differences.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 14, 2010

SHANGRI-LA TIBETAN PHARMACEUTICALS, INC.

Minimum Offering: 1,500,000 Ordinary Shares

Maximum Offering: 1,875,000 Ordinary Shares

This is the initial public offering of Shangri-La Tibetan Pharmaceutical, Inc., a British Virgin Islands company. We are offering a minimum of 1,500,000 and a maximum of 1,875,000 our ordinary shares. None of our officers, directors or affiliates may purchase shares in this offering.

We expect that the offering price will be between $7.50 and $8.50 per ordinary share. No public market currently exists for our ordinary shares. The offering price will be determined by the Placement Agent and the Company taking into account apparent demand for the ordinary shares, financial market conditions, market conditions for the Company, and other considerations as deemed to be relevant. We have applied for approval for quotation on the NASDAQ Global Market under the symbol “TBET” for the ordinary shares we are offering. We believe that upon the completion of the offering contemplated by this prospectus, we will meet the standards for listing on the NASDAQ Global Market.

Investing in these ordinary shares involves significant risks. See “Risk Factors” beginning on page 11 of this prospectus.

| Per Ordinary Share | Minimum Offering | Maximum Offering | |||||||

| Assumed public offering price |

$ | 8.00 | $ | 12,000,000 | $ | 15,000,000 | |||

| Placement discount |

$ | 0.56 | $ | 840,000 | $ | 1,056,000 | |||

| Proceeds to us, before expenses |

$ | 7.44 | $ | 11,160,000 | $ | 13,950,000 | |||

We expect our total cash expenses for this offering to be approximately $600,000, exclusive of the above commissions. In addition, we will pay the Placement Agent a non-accountable expense allowance of 1% of the amount of the offering, or $187,500 (maximum offering, exclusive of shares registered under Rule 462(b)) or $150,000 (minimum offering). The Placement Agent must sell the minimum number of securities offered (1,500,000 ordinary shares) if any are sold. The Placement Agent is required to use only its best efforts to sell the securities offered. The offering will terminate upon the earlier of: (i) a date mutually acceptable to us and our Placement Agent after which the minimum offering is sold or (ii) October 31, 2010. Until we sell at least 1,500,000 ordinary shares, all investor funds will be held in an escrow account at SunTrust Bank, Richmond, Virginia. If we do not sell at least 1,500,000 ordinary shares by October 31, 2010, all funds will be promptly returned to investors (within one business day) without interest or deduction. If we complete this offering, net proceeds will be delivered to our company on the closing date. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. If we complete this offering, then on the closing date, we will issue ordinary shares to investors in the offering and Placement Agent Warrants to our Placement Agent exercisable at a rate of one warrant per share to purchase up to 10% of the aggregate number of Ordinary Shares sold in this offering.

Table of Contents

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Anderson & Strudwick,

Incorporated

Prospectus dated , 2010

Table of Contents

Conventions That Apply to This Prospectus

Unless otherwise indicated, references in this prospectus to:

| • | “$,” “US$,” “USD” and “U.S. dollars” are to the legal currency of the United States; |

| • | “China” and the “PRC” are to the People’s Republic of China, excluding, for the purposes of this prospectus only, Taiwan and the special administrative regions of Hong Kong and Macau; |

| • | “GMP” means Good Manufacturing Practices, a certification program applicable to Chinese pharmaceutical producers; |

| • | “ordinary shares” or “shares” are to our ordinary shares, par value USD$0.001 per share; |

| • | “NMIP” means the National Medical Insurance Program, China’s national medical insurance program; |

| • | “NDRC” means the National Development and Reform Commission, which imposes price controls on some pharmaceutical products; |

| • | “provinces” are the 31 provincial level governments in China, including 22 provinces, four municipalities directly administered under the PRC central government (for example, Beijing and Shanghai) and five autonomous regions (for example, Guangxi and Tibet); |

| • | “RMB”, “Renminbi” and ¥ are to the legal currency of China; |

| • | “SAFE” means China’s State Administration of Foreign Exchange; |

| • | “SFDA” means the State Food and Drug Administration of the PRC; |

| • | “TCM” means traditional Chinese medicine; and |

| • | “we,” “us,” “our company” and “our” are to Shangri-La Tibetan Pharmaceuticals Inc., a British Virgin Islands company (“TBET”), its predecessor entities and its consolidated subsidiaries, including Chinese Tibetan Pharmaceuticals Limited, a Hong Kong company (“CTP”); Yibo Information Consulting (Shenzhen) Company Ltd., a PRC company (“WFOE”), and Yunnan Shangri-La Tibetan Pharmaceutical Group Limited (“YSTP”) a PRC company, which WFOE controls by contractual arrangements. |

This prospectus contains translations of certain RMB amounts into U.S. dollar amounts at a specified rate solely for the convenience of the reader. Unless otherwise noted, all exchange conversions relating to our financial performance made in this prospectus are based upon a rate of RMB 6.8172 to US$1.00, which was the exchange rate on December 31, 2009. Conversions relating to the health care market and Chinese economy that are based on third-party sources may be based upon exchange rates at different dates.

Unless otherwise stated, we have translated balance sheet amounts with the exception of equity at December 31, 2009 at RMB 6.8172 to US$1.00 as compared to RMB 6.8420 to US$1.00 at December 31, 20082009. We have stated equity accounts at their historical rate. The average translation rates applied to income statement accounts for the year ended December 31, 2009 and the year ended December 31, 2008 were RMB 6.8296 and RMB 7.0685, respectively. We make no representation that the RMB or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all. On May 13, 2010, the exchange rate was $1.00 to RMB6.82792. See “Risk Factors – Fluctuation of the Renminbi could materially affect our financial condition and results of operations” for discussions of the effects of fluctuating exchange rates on the value of our ordinary shares. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

For the sake of clarity, this prospectus follows English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our chief executive officer will be presented as “Taylor Guo” or “Taylor Z. Guo”, even though, in Chinese, his name would be presented as “Ziqiang Guo.”

Table of Contents

Unless otherwise indicated, all information in this prospectus assumes:

| • | no person will exercise any outstanding options; |

| • | the sale of 1,875,000 ordinary shares, the maximum number of shares offered in this offering; and |

| • | an assumed initial public offering price of $8.00 per unit, the midpoint of the range set forth on the cover page of this prospectus. |

We have relied on statistics provided by a variety of publicly-available sources regarding China’s expectations of growth, China’s demand for pharmaceutical products and traditional Tibetan medicine. We did not, directly or indirectly, sponsor or participate in the publication of such materials.

Table of Contents

This summary highlights key aspects of the information contained elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before making an investment decision. You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the accompanying notes to those statements. This summary contains forward-looking statements that involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “should,” “will,” “could,” and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements. You should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements and the notes to those statements.

Overview

Our company is a specialty pharmaceutical company focusing on the research, development, manufacturing and marketing of modernized traditional Tibetan medicines. We develop products in China for promoting health in human respiratory, digestive, urinary and reproductive systems. Our five SFDA-approved modernized traditional Tibetan medicines are designed to address large market opportunities. Our product development pipeline includes potential expanded uses of our existing products for additional medical indications and a number of new product candidates that are intended to address significant medical health needs in China.

We currently sell both prescription and over-the-counter traditional Tibetan medicines. We have developed and presently are selling five pharmaceutical products, all of which have received Chinese-government approval. In addition, we are in the process of developing several additional products for which we hope to secure government approval and to commercialize in the future. We sell our products principally to distributors in China, who in turn sell them chiefly to hospitals, hospital pharmacies and retail pharmacies.

Corporate Information

Our principal executive office is located at 53 Niwang Road, Shangri-La County, Diqing, Yunnan Province, China 674400. Our telephone number is (+86) 887 823 2158. Fax (+86) 887 823 2156. We do not maintain a corporate website at this time.

Geographic Market

Our products are sold throughout China. A majority of our sales are concentrated in the southern provinces of China, most notably Yunnan Province, Guangdong Province, and Zhejiang Province.

1

Table of Contents

Our headquarters and manufacturing facilities are located in Shangri-La County, in Yunnan Province and close to the source of the raw materials we use to formulate our medicines. Yunnan Province is part of the Tibetan Plateau, a massive area at generally high altitude that is the habitat for a wide variety of plant species not readily found elsewhere. The Province has been said to have the greatest biodiversity of any area in China, and to host 60 percent of the plants used in traditional Chinese medicine.

Tibetan Medicine

Tibetan medicine has developed over the past seventeen centuries into a significant system to promote health and treat maladies. While traditional Tibetan medicine is generally considered alternative medicine in the West, it is accepted as mainstream medical practice in China and is regulated as such by the SFDA.

As currently formulated, traditional Tibetan medicine focuses on maintenance of healthy bodily systems and the study and treatment of causes of diseases. By contrast, Western medicine is sometimes said to focus on treatment of diseases rather than the causes of diseases. These different orientations led Yeshi Donden, who served as the current Dalai Lama’s personal physician for twenty years, to remark that, “Western medicine acts quickly and is helpful in cutting acute symptoms. On the other hand, Tibetan medicine acts gradually, over a long period of time.”

Tibetan medicine relies on treatments involving diet, behavior modification, herbal medicines and physical therapies. While changes in diet (types and amount of food and number and times of daily meals) and behavior (meditation, exercise, sleep and eating patterns) are generally considered important first treatments in Tibetan medicine, herbal medicines are typically the most common and important element of treatment. If necessary, Tibetan medicine also incorporates physical therapies such as acupuncture, massage, cupping, moxibustion (heating/burning herbs on the body) baths and inhalation therapy.

Tibetan herbal medications, the type of products we develop and sell, are composed of a wide variety of medicinal herbs, minerals and, to a lesser extent, animal substances. Medications always consist of several ingredients, generally consisting of one major group of ingredients and two minor groups. The major group is addressed to the intended effect. One minor group supports the major group, and the other minor group is intended to help suppress unwanted side effects.

While Tibetan medications have traditionally been used for all types of medical concerns, in the modern context, they have tended to be used to maintain general wellbeing and to treat or ameliorate chronic conditions that conventional Western medications either do not improve or improve only minimally. In such cases, individuals who use Tibetan medications tend to rely on them in part due to their relatively low level of side effects. Because traditional Tibetan medicine is oriented toward prevention, Tibetan medicines are often taken over a long period of time, even in the absence of any symptoms.

2

Table of Contents

Industry and Market Background – Generally

We operate in China’s healthcare industry, which is large and rapidly growing as a result of population growth, and aging of the population, the country’s growing wealth, and substantial government support. A recent OECD study indicates that spending hikes and regulatory changes in China have contributed to significant growth in health-care spending in the country, and that such spending in 2010 is likely to increase another 8.7 percent, with about 4.5 percent of gross domestic product (GDP) allocated to healthcare. The consulting firm Scientia Advisor projects that healthcare spending in China will reach $600 billion by 2015, a threefold increase over 2000 expenditures.

In April 2009, the Chinese government implemented large-scale healthcare reforms in an effort to significantly improve health care facilities and infrastructure and to extent health insurance company to ever larger segments of the population. The State Council allocated $123 billion as part of its New Medical Reform Plan. The Chinese government plans to improve the urban healthcare system by rebuilding and restructuring approximately 3,700 existing urban community health centers and 11,000 community health clinics. The plan will also accommodate the development of approximately 2,400 new urban health centers. In effect, the plan de-emphasizes the prevalence of large, magnet facilities in favor of smaller, more accessible clinics.

As part of its Eleventh Five-Year Plan (2006-2010), the Chinese government has actively supported the Chinese healthcare industry by providing a number of incentives and enacting several programs, including increased funding for building additional hospitals, research centers and other healthcare facilities, enacting healthcare reforms and standards and subsidizing healthcare services for its citizens. The Chinese government has announced it will spend an additional RMB850 billion on healthcare programs from 2009 to 2011, which is designed significantly bolster the Chinese healthcare market.

In addition, the China’s government is working to improve dramatically medical services available for the 800 million rural poor in China. Through the plan, the Chinese government contemplates the development of clinics in every village and a hospital in every county in China by the end of 2011. If successfully implemented, the plan would result in at least 2,000 new county hospitals and 29,000 village clinics.

Pharmaceutical sales and usage play a larger role in the Chinese healthcare market than in the healthcare sectors of many other countries. With a small share of the population presently enjoying insurance coverage, a still-developing state health-care system, and a massive rural and relatively poor population, individuals (who generally must pay for care out of pocket) and health-care providers rely heavily on medicines, both traditional and modern. One report states that the share of healthcare spending devoted to pharmaceuticals in China is three times that of the average for countries in the developed word.

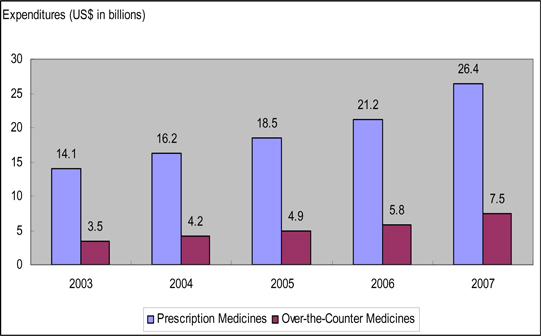

The total sales of medicines in China, including both prescription and over-the-counter medicines, was US$33.9 billion (approximately RMB257 billion) in 2007, representing an increase of 25.6% from 2006 and a 2003-2007 compound average growth rate (“CAGR”) of 17.8%. It has been estimated that the Chinese market became the eighth largest pharmaceutical market in the world in 2007 from ninth in 2006.

Traditional Chinese Medicine (“TCM”) is a major and accepted segment of the health-care industry in China. The market for TCMs in China, including both prescription and over-the-counter medicines, was approximately $5.8 billion in 2005, accounting for approximately 20.9% of all expenditures on medicine in China. TCM products have been widely used in China for thousands of years and are deeply ingrained in the Chinese culture.

Industry and Market Background – Tibetan Medicine

Traditional Tibetan medicine is a sector of the TCM market segment. The market for Tibetan pharmaceuticals in China is a small but growing in relation to the overall pharmaceutical market in China. There are over one hundred producers of traditional Tibetan medicines, of which about 40 (including our company) have received some GMP certification. Many producers are relatively small, engage in little or no research and development, and employ traditional as opposed to modern formulation and manufacturing techniques.

3

Table of Contents

According to China Medicine Source Net (“CMSN”), in 2006, the 17 GMP-certified Tibetan medicine manufacturers in the Tibet Autonomous Region had total annual industrial output of RMB623 million or about $91,018,871. Overall, China’s Tibetan medicine industry in 2006 is estimated to have been about RMB1 billion in size, or about 0.5% of China’s total pharmaceutical industry. Yet, the Tibetan medicine industry as a whole is growing rapidly, CMSN projected that the Tibetan medicine industry is growing at an annual rate of 50 percent.

Our Opportunities

Generally, we believe that a number of demographic, social, economic and policy trends point to continued growth in the Chinese pharmaceutical market generally and the traditional Tibetan pharmaceutical product market in particular. These include:

| • | China’s longstanding preference for TCM and Tibetan medicine remedies; |

| • | the rapid growth of the Chinese economy; |

| • | the aging population in China; |

| • | increases in government spending on public health care, as well as in providing medical care in rural areas; |

| • | government support for modernized TCM and Tibetan medicine as a key component of increasing quality of healthcare; |

| • | the rapidly growing over-the-counter market, of which TCM (including Tibetan medicine) makes up more than half; and |

| • | the relative low price of traditional Chinese medicines compared to Western medicine. |

In addition, we believe that interest in traditional Tibetan medicines outside of China is both significant and growing.

Our Competitive Strengths

We believe that we have developed a strong position in the traditional Tibetan medicine market as a result of access to raw materials, research and development efforts, modern production techniques, an emphasis on quality control, high-quality, effective products and effective marketing. We believe these strengths position us to take advantage of the growth of the Chinese pharmaceutical market generally and the expansion of the traditional Tibetan medicine market in particular. More specifically, we have:

| • | an established portfolio of five SFDA-approved, market-leading pharmaceuticals already in distribution; |

| • | worked to develop promising additional products that are in various stages of clinical testing and review for approval in anticipation of commercialization; |

| • | growing diversity in our product offerings, with four major categories of products for maintenance of health in the respiratory, digestive, urinary and reproductive systems; |

| • | strong research and development capabilities; |

| • | modern, sophisticated formulation and manufacturing techniques; |

| • | strict quality control procedures; |

| • | an experienced management team; |

| • | access to abundant raw materials used in traditional Tibetan medicine, but not generally available outside our geographical region; |

| • | effective marketing capabilities; |

| • | an established distribution network throughout China; and |

| • | received significant governmental support to protect and enhance traditional Tibetan medicine. |

4

Table of Contents

Our Strategies

Our objectives are to maintain and strengthen the position of our products in the Tibetan medicine healthcare segment in China, develop new products and to increase the sales of our products. We will continue to integrate our marketing, sales, management, technology, research and development and capital resources, to continue build our brand awareness, and to become the market leader for the development, manufacture and commercialization of Tibetan pharmaceutical products throughout the world. We intend to achieve these objectives by:

| • | promoting our existing brands to maintain national recognition; |

| • | developing and introducing additional products to broaden or strengthen our existing product pipeline; |

| • | expanding our distribution network for further market penetration; |

| • | building brand awareness; |

| • | expanding beyond the China healthcare market; and |

| • | pursuing strategic acquisition and licensing opportunities. |

Our Challenges and Risks

Our ability to successfully execute our strategies is subject to certain risks and uncertainties, including those relating to:

| • | competition from other traditional Tibetan medicine producers that, while generally smaller than our company, may also benefit from government support; |

| • | competition from other TCM and modern and Western medicine, which also is making inroads into the Chinese pharmaceutical market; |

| • | possible changes in perception of the efficacy of traditional Chinese and Tibetan medicines; |

| • | possible disruptions in access to needed quality raw materials; |

| • | the inability to forecast with certainty our ability to develop, prove the efficacy of and secure government approval for new pharmaceutical products; |

| • | possible changes in national or regional government policies relating to health care generally and the promotion and approval of traditional Tibetan medicines in particular; |

| • | our abilities to implement successfully our growth strategy; and |

| • | our ability to protect and safeguard our brands and product formulations. |

In addition, we face risks and uncertainties that may materially affect our business, financial condition, results of operations and prospects. Thus, you should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our ordinary shares.

Corporate Structure

Overview

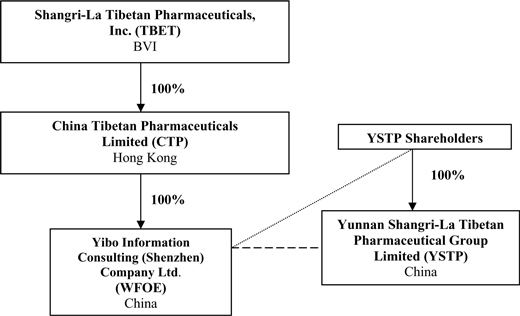

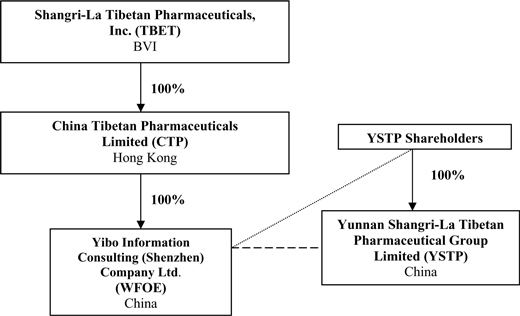

TBET is a holding company incorporated in the British Virgin Islands. TBET owns all of the outstanding capital stock of CTP, our wholly-owned subsidiary in Hong Kong. CTP in turn owns all of the outstanding capital stock of WFOE, our operating subsidiary based in Shenzhen, Guandong Province, China. WFOE has entered into control agreements with all of the owners of YSTP, which agreements allow WFOE to control YSTP. Through our ownership of CTP, CTP’s ownership of WFOE and WFOE’s contractual agreements with the owners of YSTP as well as YSTP itself, we control YSTP.

Corporate History – YSTP

Yunnan Diqing Shangri-La Tibetan Medicine Co., Ltd was incorporated on April 19, 2000 as a domestic Chinese corporation. On December 24, 2002, it changed its name to Yunan Shangri-La Tibetan Pharmaceutical Group Limited (“YSTP”). As YSTP has continued to grow, it has increased its registered capital, which presently stands at RMB 60,000,000 (approximately $8,801,267).

5

Table of Contents

Corporate History – TBET, CPT and WFOE

We formed TBET, CPT and WFOE in 2009, 2010 and 2010, respectively, in anticipation of registering the common shares of TBET in an initial public offering. In connection with the formation of TBET, CPT and WFOE, WFOE entered into certain control agreements with YSTP and its shareholders, pursuant to which we, by virtue of our ownership of CTP and CTP’s ownership of WFOE, control YSTP.

Control Agreements

We conduct our business in China through our subsidiary, WFOE. WFOE, in turn, conducts it business through YSTP, which we consolidate as a variable interest entity. WFOE and YSTP operate in connection with a series of control agreements, rather than through an equity ownership relationship.

Chinese laws and regulations currently do not prohibit or restrict foreign ownership in pharmaceutical businesses. However, Chinese laws and regulations do prevent direct foreign investment in certain industries. On March 26, 2010, to protect the Company’s shareholders from possible future foreign ownership restrictions, YSTP and all of the shareholders of YSTP entered into an Entrusted Management Agreement, Exclusive Option Agreement, Shareholders’ Voting Proxy Agreement and Pledge of Equity Interest Agreement (collectively, the “Control Agreements”) with WFOE in return for ownership interests in TBET. Through the formation of TBET as a holding company, YSTP investors now own 93% of the common shares of TBET. The remaining 7% of TBET’s common shares belong to other investors. TBET, in turn owns 100% of the equity of WFOE.

WFOE, YSTP and each of the shareholders of YSTP entered into the Control Agreements. Through the Control Agreements, we can substantially influence YSTP’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result of these Control Agreements, which enable us to control YSTP and cause WFOE to absorb 100% of the expected losses and gains of YSTP, we are considered the primary beneficiary of YSTP. Accordingly, we consolidate YSTP’s operating results, assets and liabilities in our financial statements. For a description of these contractual arrangements, see “Our Corporate Structure—Contractual Arrangements with YSTP and YSTP’s Shareholders.”

6

Table of Contents

Our corporate structure is as follows:

|

|

Equity interest | |

|

|

Contractual arrangements including Entrusted Management Agreement and Exclusive Option Agreement. For a description of these agreements, see “Corporate Structure— Contractual Arrangements with YSTP and YSTP’s Shareholders.” | |

|

|

Contractual arrangements including Exclusive Option Agreement, Shareholders’ Voting Proxy Agreement and Pledge of Equity Interest Agreement. For a description of these agreements, see “Corporate Structure— Contractual Arrangements with YSTP and YSTP’s Shareholders.” | |

7

Table of Contents

The Offering

| Ordinary Shares Offered: | Minimum: 1,500,000 ordinary shares(1) Maximum: 1,875,000 ordinary shares(1) | |

| Shares Outstanding Prior to Completion of Offering: | 11,812,500 ordinary shares | |

| Shares to be Outstanding after Offering: | Minimum: 13,312,500 ordinary shares Maximum: 13,687,500 ordinary shares | |

| Assumed Offering Price per Ordinary Share: | $8.00 | |

| Gross Proceeds: | Minimum: $12,000,000 Maximum: $15,000,000 | |

| Proposed NASDAQ Global Market Symbol: | “TBET” (CUSIP No. G80649 109) | |

| Transfer Agent: | Pacific Stock Transfer Company, 4045 S. Spencer Street, Suite 403, Las Vegas, NV 89119 | |

| Risk Factors: | Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus before deciding to invest in our ordinary shares. | |

| Closing of Offering: | The offering contemplated by this prospectus will terminate upon the earlier of: (i) a date mutually acceptable to us and our Placement Agent after the minimum offering is sold or (ii) October 31, 2010. If we complete this offering, net proceeds will be delivered to our company on the closing date (such closing date being the above mutually acceptable date on or before October 31, 2010, provided the minimum offering has been sold). We will not complete this offering unless our application to list on the NASDAQ Global Market is approved. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. If we complete this offering, then on the closing date, we will issue shares to investors and Placement Agent Warrants to our Placement Agent exercisable at a rate of one warrant per share to purchase up to 10% of the aggregate number of ordinary shares sold in this offering. | |

| (1) | We are also concurrently registering for resale under a separate prospectus up to 354,375 ordinary shares held by the selling shareholders named under the prospectus. None of the shares is being offered by us and we will not receive any proceeds from the sale of the ordinary shares. In addition, none of the selling shareholders is an officer or director of our company, CTP, WFOE or YSTP. |

8

Table of Contents

Placement

We have engaged Anderson & Strudwick, Incorporated as our Placement Agent to conduct this offering on a “best efforts, minimum/maximum” basis. The offering is being made without a firm commitment by the Placement Agent, which has no obligation or commitment to purchase any of our ordinary shares. Our Placement Agent is required to use only its best efforts to sell the securities offered. The offering will terminate upon the earlier of: (i) a date mutually acceptable to us and our Placement Agent after which at least 1,500,000 ordinary shares are sold or (ii) October 31, 2010. Until we sell at least 1,500,000 ordinary shares, all investor funds will be held in an escrow account at SunTrust Bank, Richmond, Virginia. If we do not sell at least 1,500,000 ordinary shares by October 31, 2010, all funds will be promptly returned to investors (within one business day) without interest or deduction. If we complete this offering, net proceeds will be delivered to our company on the closing date. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. None of our officers, directors or affiliates may purchase shares in this offering. If we complete this offering, then on the closing date, we will issue shares to investors and Placement Agent Warrants to our Placement Agent exercisable at a rate of one warrant per share to purchase up to 10% of the aggregate number of ordinary shares sold in this offering.

We have agreed with our Placement Agent to value our company based on a multiple of approximately seven times our targeted after-tax earnings for the year ending December 31, 2010, subject to the terms of a Make-Good Escrow Agreement to be executed before effectiveness of this registration statement. Although we do not currently pay any taxes on our income, we refer to this amount as our targeted 2010 audited net after-tax income to reflect our and our Placement Agent’s intention that the targeted amount will be net of any taxes that may apply to our company during 2010. If we are unable to achieve these targeted after-tax earnings, then there is a risk that our company would be considered overvalued based on this multiple. In order to mitigate some of this risk, certain shareholders of our company, Hong Yu and Taylor Z. Guo, have agreed to place 720,000 and 30,000 ordinary shares, respectively, that each owns beneficially into escrow that is equal to 40% of the maximum number of ordinary shares to be sold in this offering. Upon closing of this offering, the escrow agent will return any shares in excess of 40% of the actual number of ordinary shares sold in the offering. Such escrowed shares are referred to as the “Make-Good Shares.” The Make-Good Shares will remain in escrow with SunTrust Bank or another bank acceptable to our Placement Agent pending the filing of our company’s Form 10-K for the year ending December 31, 2010.

To the extent our audited after-tax earnings per share (for purposes of this calculation, earnings per share are to be calculated based solely on the number of ordinary shares issued and outstanding immediately after this offering, and not on any subsequently-issued shares) for the year ending December 31, 2010 are less than $0.9863, excluding any expenses associated with releasing the Make-Good Shares back to the original owners as described below, our company will redeem and cancel, pro rata, the Make-Good Shares without any additional consideration to the extent necessary to cause our audited after-tax earnings per share to be equal to $0.9863. We cannot guarantee that we will be able to redeem a sufficient number of Make-Good Shares to increase audited after-tax earnings per share to $0.9863 if our company either has low net income or any net losses in 2010.

Any remaining Make-Good Shares will be released from escrow to our initial shareholders upon the earlier of (i) one (1) business day after the termination of this offering without closing or (ii) thirty (30) calendar days after the filing of the Form 10-K for the year ending December 31, 2010 after redeeming any Make-Good Shares. Additionally, notwithstanding any other terms of the Make-Good Escrow, if our shares trade at or above 2.5 times the price of this offering for a period of five trading days within a ten day trading period, the Make-Good Escrow will terminate and the Make-Good Shares will be released to the initial shareholders. Any delay in redeeming the Make-Good Shares will delay the release of such remaining Make-Good Shares from escrow.

We believe the Make-Good Escrow arrangement benefits the shareholders of our company (other than those who may forfeit shares without consideration) because it is designed to increase the likelihood that our company will achieve the after-tax earnings per share upon which our valuation is based. To the extent Make-Good Shares are redeemed without cost, the after-tax per-share earnings will increase for all remaining outstanding shares. While we believe the Make-Good Escrow arrangement is a benefit to our shareholders, we may be unable to redeem enough Make-Good Shares to reach our targeted 2010 after-tax earnings per share. This could occur if we either have net losses or substantially lower than anticipated earnings. If this were to happen, our audited after-tax earnings

9

Table of Contents

after redemption of the Make-Good Shares could be less than $0.9863 per share. See “Risk Factors – Redemption of Make-Good Shares may be insufficient to cause our company to achieve targeted earnings and may reduce our management’s involvement and stake in our company.”

Placement Agent’s Warrants

In connection with this offering, we will, for a nominal amount, sell to our Placement Agent Warrants, exercisable at a rate of one warrant per share, to purchase up to ten percent of the shares sold in the offering. These warrants are exercisable for a period of five years from the date of issuance at a price equal to 125% of the price of the shares in this offering. If we complete the maximum offering, then on the closing date we will issue 187,500 warrants to the Placement Agent to purchase one ordinary share each. During the term of the warrants, the holders thereof will be given the opportunity to profit from a rise in the market price of our ordinary shares, with a resulting dilution in the interest of our other shareholders. The terms on which we could obtain additional capital during the life of these warrants may be adversely affected because the holders of these warrants might be expected to exercise them when we are able to obtain any needed additional capital in a new offering of securities at a price greater than the exercise price of the warrants. If the Placement Agent exercises all of its warrants, we would have between 1.27% (minimum offering) and 1.37% (maximum offering) more shares outstanding after the Placement Agent’s Warrant exercise than at the conclusion of the offering, assuming no other issuances (including any issuances under the share incentive plan). See “Placement.”

Summary Financial Information

In the table below, we provide you with summary financial data of our company. This information is derived from our consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read it along with the historical statements and notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| For the Fiscal

Year ended December 31, |

|||||||

| 2009 | 2008 | ||||||

| Total Sales |

$ | 23,008,031 | 15,580,269 | ||||

| Income from Operations |

9,415,877 | 6,091,960 | |||||

| Net Other Income (Expense) |

(170,899 | ) | (158,477 | ) | |||

| Net Income attributable to TBET |

9,244,978 | 5,933,483 | |||||

| Other Comprehensive Income attributable to TBET |

12,709 | 99,172 | |||||

| Comprehensive Income attributable to TBET |

9,257,687 | 6,032,655 | |||||

| Basic and Diluted Earnings per Share (based on 11,782,500 and 11,632,500 TBET shares outstanding, on December 31, 2009 and 2008, respectively) (1) |

0.78 | 0.51 | |||||

| Pro forma Basic and Diluted Earnings per Share (based on 11,062,500 TBET shares outstanding, on each of December 31, 2009 and 2008) (2) |

0.84 | 0.54 | |||||

| December 31, | |||||||

| 2009 | 2008 | ||||||

| Total Assets |

$ | 18,920,333 | 16,787,522 | ||||

| Total Current Liabilities |

3,833,643 | 2,343,715 | |||||

| TBET Shareholders’ Equity |

11,504,574 | 10,874,675 | |||||

| Total Liabilities and Shareholders’ Equity |

18,920,333 | 16,787,522 | |||||

| (1) | We have presented earnings per share in TBET after giving retroactive effect to the reorganization of our company that was completed on March 18, 2010, upon WFOE incorporation approval by Shenzhen Industry and Commerce Bureau. |

10

Table of Contents

| (2) | We have presented these pro forma earnings per share after (a) giving retroactive effect to the WFOE reorganization that was completed on March 18, 2010, and (b) assuming the redemption of all shares placed into escrow as described in the section entitled “Related Party Transactions – Make-Good Shares Subject to Redemption.” Based on 11,812,500 shares issued and outstanding as of May 14, 2010, the number of escrowed shares is based on 40% of an assumed maximum of 1,875,000 common shares. We provide this pro forma earnings for share information to allow potential investors to evaluate our earnings under alternative assumptions that the Make-Good Shares would or would not be redeemed. |

Investment in our securities involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision. The risks and uncertainties described below are not the only ones we face, but represent the material risks to our business. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, you may lose all or part of your investment. You should not invest in this offering unless you can afford to lose your entire investment.

Risks Related to Our Company

Our recent operating history makes it difficult to evaluate our future prospects and results of operations.

While YSTP was incorporated in 2000, it operated as a very small business until recently, when business began to develop rapidly. We first became profitable in 2006. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced in evolving markets such as the growing market for traditional Tibetan medicine products in China. Some of these risks and uncertainties relate to our ability to:

| • | develop additional products to attract and retain a larger customer base; |

| • | secure required governmental approvals; |

| • | attract additional customers and increased spending per customer; |

| • | increase awareness of our brand and continue to develop customer loyalty; |

| • | respond to competitive market conditions; |

| • | respond to changes in our regulatory environment; |

| • | manage continuous growth; |

| • | manage risks associated with intellectual property rights; |

| • | maintain effective control of our costs and expenses; |

| • | raise sufficient capital to sustain and expand our business; |

| • | attract, retain and motivate qualified personnel; and |

| • | upgrade our technology to support additional research and development of new pharmaceutical products. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

Potential disruptions in the capital and credit markets may adversely affect our business, including the availability and cost of short-term funds for liquidity requirements, which could adversely affect our results of operations, cash flows and financial condition.

In the last two years, the global economy has experienced a significant contraction, which has affected the availability of business and consumer credit. We may need to rely on the credit markets, particularly for short-term borrowings from banks in China, as well as the capital markets, to meet our financial commitments and short-term liquidity needs if internal funds are not available from our operations. Disruptions in the credit and capital markets, as have been experienced since mid-2008, could adversely affect our ability to draw on such short-term bank facilities. Our access to funds under such credit facilities is dependent on the ability of the banks that are parties to those facilities to meet their funding commitments, which may be dependent on governmental economic policies in China. Those banks may not be able to meet their funding commitments to us if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests from us and other borrowers within a short period of time.

11

Table of Contents

Long-term disruptions in the credit and capital markets, similar to those that have been experienced since mid-2008, could result from uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions and could adversely affect our access to liquidity needed for our business. Any disruption could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. Such measures could include deferring capital expenditures, and reducing or eliminating discretionary uses of cash.

Continued market disruptions could cause broader economic downturns, which may lead to lower demand for our products and increased likelihood that our customers will be unable to pay for our products. Further, bankruptcies or similar events by customers may cause us to incur bad debt expense at levels higher than historically experienced. These events would adversely impact our results of operations, cash flows and financial position.

Our ability to develop new Tibetan pharmaceutical products is uncertain.

We expend a significant amount of time and effort to develop and prove new products. Our products require long lead times to develop and test to secure regulatory approval and gain market acceptance. The nature of pharmaceutical development is that some products in which substantial investments are made ultimately prove not to be safe or effective, or otherwise prove not to be commercially viable. In addition to the long lead-time needed to develop, test and secure approval for traditional Tibetan medicine, the products often take a relatively long time to demonstrate their efficacy in use. As a result, the commercial success of any product may develop, if it develops at all, only over a long period of time.

Our operations are capital-intensive, and our business could be adversely affected if we fail to maintain sufficient levels of working capital.

Developing and testing these pharmaceutical products requires substantial investments of capital and effort over extended periods of time. Substantial time is needed to develop formulations suitable for use in products, to refine those formulations, and then to conduct clinical trials to determine the efficacy and safety of the products. At times formulations must be modified based on the results of laboratory or clinical testing. Changes in the availability of capital and credit may impair our ability to sustain development and testing efforts.

Our future capital needs are uncertain and we may need to raise additional funds in the future.

We may require additional cash resources in the future due to many factors, including:

| • | changed business conditions or other future developments; |

| • | the time and expenses required to obtain, regulatory clearances and approvals; |

| • | the resources we devote to developing, manufacturing, marketing and selling our products; |

| • | our ability to identify and our desire or need to pursue acquisitions or other investments; and |

| • | the extent to which our products generate market demand. |

If we need to obtain external financing, we cannot assure you that financing will be available in the amounts or on the terms acceptable to us, if at all. Our future capital needs and other business reasons could require us to sell additional equity or debt securities or obtain credit facilities. The sale of additional equity or equity-linked securities could result in additional dilution to our then existing shareholders. Additional debt financing may include conditions that would restrict our freedom to operate our business, such as conditions that:

| • | limit our ability to pay dividends or require us to seek consent for the payment of dividends; |

| • | increase our vulnerability to general adverse economic and industry conditions; |

| • | require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund capital expenditures, working capital and other general corporate purposes; and |

12

Table of Contents

| • | limit our flexibility in planning for, or reacting to, changes in our business and our industry. |

We cannot guarantee that we will be able to obtain any additional financing on terms that are acceptable to us, or at all.

We presently have a limited number of commercialized products, and are dependent on two products for the vast majority of our sales revenue.

At present, we have five products in commercial distribution. Two of these products account for the vast majority of our sales. Our Gentiana product (for certain respiratory conditions) and our Mandrake product (for certain gynecological conditions) together accounted for 70% of our sales revenue in both 2009 and 2008. While we are developing and working to better distribute other products, we expect these products to continue to generate the majority of our sales in the near future. Should we encounter problems in producing these products, or should competition for these types of products intensify, our revenues and operating results could be adversely affected.

We are dependent on access to raw materials, the availability and quality of which may vary.

Our products are each comprised of multiple ingredients, many of which are plants and herbs grown principally, if not exclusively, in the Tibetan highlands. While we have relatively good access to the raw materials we use, changes in weather, disease and insect infestations, supplier business relations and other circumstances could disrupt or interrupt our access to ingredients we require to manufacture our products. To the extent we do not have access to the raw materials necessary for the production of our products, our operating results would suffer.

We may be unable to consistently purchase needed raw materials of high quality.

We require high quality raw materials raw materials to manufacture our products, and as we purchase such raw materials from third parties, we may not consistently have access to raw materials that meet our standards.

We purchase all medicinal raw materials used for production from third parties. Raw medicinal materials for traditional Tibetan medicines are agricultural products difficult to standardize. During planting and processing, there is no uniform quality standard due to differences in natural climate, soil conditions, picking, drying and processing methods. We have established strict internal quality control standards according to medicinal materials quality standards of Chinese Pharmacopoeia, and we have set up strict operation procedures according to GMP requirements. Our purchased medicinal materials are inspected by our Department of Quality before warehousing. Nonetheless, circumstances may lead to shortages of supply of high-quality raw materials. If we cannot obtain needed quantities of quality ingredients, our ability to maintain production, satisfy customers, and obtain desired operational results will be adversely effected.

We depend on the skill and expertise of our research and development executive personnel.

We believe our strong research and development capabilities contribute to our success and prospects for future growth. There is no assurance, however, that we will be able to retain our personnel and add additional, sufficiently-skilled personnel in the future. If we fail to do so, it may adversely affect our ability to develop, manufacture and market our products, and thus adversely affect our financial condition and results of operations. In addition, competition for these individuals could cause us to offer higher compensation and other benefits in order to attract and retain them, which could also materially and adversely affect our financial condition and results of operations.

If we are unable to attract, train, retain and motivate our salespeople, sales of our products may be materially and adversely affected.

We rely on our salespeople, who are dispersed across China, to market our products to distributors. We believe that our leading position in the traditional Tibetan medicine market has resulted, to a significant extent, from the dedication, efforts and performance of our salespeople. We believe that our future success will depend on those same factors. If we are unable to attract, train, retain and motivate our salespeople, sales of our products may be materially and adversely affected.

13

Table of Contents

We operate in a highly competitive marketplace, which could adversely affect our sales and financial condition.

We compete on the basis of quality, price, product availability and security of supply, product development and customer service. Some competitors are larger than us in certain markets and may have greater financial resources that allow them to be in a better position to withstand changes in the industry. Our competitors may introduce new products based on more competitive alternative technologies that may cause us to lose customers which would result in a decline in our sales volume and earnings. Our customers demand high quality and low cost products and services. The costs of research and development and marketing expansion may continue to increase and thus adversely affect the competitiveness of our products. Competition could cause us to lose market share and certain lines of business, or increase expenditures or reduce pricing, each of which would have an adverse effect on our results of operations and cash flows.

As Tibetan Medicine industry has good development prospects and large market potential, more enterprises will enter into Tibetan Medicine industry in the future; current Tibetan Medicine enterprises will increase investment in research and development to become more competitive. Biological medicine and chemical medicine, as an alternative to traditional Tibetan medicine, will continuously be produced and could become threats to sales of our traditional Tibetan products. In addition, foreign pharmaceutical companies have accelerated their speed of entering China market with their new innovative medicines and special treatment medicine. Through localization, they can reduce the cost of production and gain more market share. All these competition will impact our sales and profitability.

We may not be able to manage the expansion of our operations effectively.

We were incorporated in 2000, became profitable in 2006, and have grown significantly in recent years. Our sales have increased 48% and 41% in 2009 and 2008, respectively. We anticipate that we will continue to grow through organic growth and potentially some strategic acquisitions. To manage the potential growth of our operations, we will be required to improve our operational and financial systems, procedures and controls, to increase manufacturing capacity and output, and to expand, train and manage our growing employee base. Furthermore, we will need to maintain and expand our relationships with suppliers, distributors, hospitals, retail pharmacies and other third parties. Our current and planned operations, personnel, systems, internal procedures and controls may not be adequate to support our future growth. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures.

If we do not keep pace with rapid technological change, we will be unable to capture and sustain a strong market position.

The pharmaceutical industry in China is characterized by rapid changes in technology, constant enhancement of industrial know-how and the frequent emergence of new products. Future technological improvements and continued product developments in the pharmaceutical market may render our existing products obsolete or affect their viability and competitiveness. Therefore, our future success will largely depend on our ability to improve our existing products, diversify our product range and develop new and competitively priced products that can meet the requirements of the changing market. Should we fail to respond to these frequent technological advances by improving our existing products or developing new products in a timely manner, or should these products not achieve a desirable level of market acceptance, this may adversely affect our business and profitability.

Our products may prove to have side effects. If side effects associated with our current or future products, or with traditional Tibetan medicines generally, are significant, we may face regulatory, legal and commercial difficulties that could materially adversely affect our revenues and operating results.

Pharmaceutical products sometimes have side effects, which can be minor or life threatening. At present, we know of no material adverse drug reaction among any of our presently-commercialized products. The Chinese National Center for Adverse Drug Reaction Monitoring has not found any adverse reactions among our products. Nonetheless, adverse effects may be discovered over time, or be found in newly-developed products.

14

Table of Contents

If significant side effects of our medicines are identified after they are marketed and sold,

| • | those medicines listed in the national and provincial medicine catalogs may be removed from the catalogs or downgraded to a lower tier; |

| • | regulatory authorities may withdraw or modify their approvals of such medicines; |

| • | we may be required to reformulate these medicines, change the ways in which they are marketed, conduct additional clinical trials, change the labeling of these medicines or implement changes to obtain new approvals for our manufacturing facilities; |

| • | the products may be viewed as less attractive to hospitals, pharmacies and physicians, and as a result we may have less success in marketing and selling those products. |

| • | we may have to recall these medicines from the market and may not be able to re-launch them; |

| • | we may experience a significant decline in sales of the affected products; |

| • | our reputation may suffer; and |

| • | we may become a target of lawsuits. |

The occurrence of any of these events would harm our sales of these products and substantially increase the costs and expenses of marketing these products, which in turn could cause our revenues and net income to decline. In addition, if any severe side effects are discovered to be associated with another manufacturer’s traditional Tibetan medicine products used to treat medical conditions similar to those that our medicines are used to treat, the reputation and, consequently, sales of our medicines could be adversely affected.

If WFOE is required to make a payment under its agreement to bear the losses of YSTP, our liquidity may be adversely affected, which could harm our financial condition and results of operations.

On March 26, 2010, WFOE entered into an Entrusted Management Agreement with YSTP. Pursuant to the Entrusted Management Agreement, WFOE agreed to bear the losses of YSTP. If YSTP suffers losses and WFOE is required to absorb all or a portion of such losses, WFOE will be required to seek reimbursement from YSTP. In such event, it is unlikely that YSTP will be able to make such reimbursement, and WFOE may be unable to recoup the loss WFOE absorbed at such time, if ever. Further, under the Entrusted Management Agreement, WFOE may absorb the losses at a time when WFOE does not have sufficient cash to make such payment and at a time when we or WFOE may be unable to borrow such funds on terms that are acceptable, if at all. As a result, any losses absorbed under the Entrusted Management Agreement may have an adverse effect on our liquidity, financial condition and results of operations.

WFOE’s contractual arrangements with YSTP may result in adverse tax consequences to us.

We could face material and adverse tax consequences if the Chinese tax authorities determine that WFOE’s contractual arrangements with YSTP were not made on an arm’s length basis and adjust our income and expenses for Chinese tax purposes in the form of a transfer pricing adjustment. A transfer pricing adjustment could result in a reduction, for Chinese tax purposes, of adjustments recorded by YSTP, which could adversely affect us by increasing YSTP’s tax liability without reducing WFOE’s tax liability, which could further result in late payment fees and other penalties to YSTP for underpaid taxes.

WFOE’s contractual arrangements with YSTP may not be as effective in providing control over YSTP as direct ownership.

We conduct substantially all of our operations, and generate substantially all of our revenues, through contractual arrangements with YSTP that provide us, through our ownership of WFOE, with effective control over YSTP. We depend on YSTP to hold and maintain contracts with our customers. YSTP also owns substantially all of our intellectual property, facilities and other assets relating to the operation of our business, and employs the personnel for substantially all of our business. Neither our company nor WFOE has any ownership interest in YSTP. Although we have been advised by DeHeng Law Offices, our Chinese legal counsel, that each contract under WFOE’s contractual arrangements with YSTP is valid, binding and enforceable under current Chinese laws and regulations, these contractual arrangements may not be as effective in providing us with control over YSTP as direct ownership of YSTP would be. In addition, YSTP may breach the contractual arrangements. For example, YSTP

15

Table of Contents

may decide not to make contractual payments to WFOE, and consequently to our company, in accordance with the existing contractual arrangements. In the event of any such breach, we would have to rely on legal remedies under Chinese law. These remedies may not always be effective, particularly in light of uncertainties in the Chinese legal system.

The shareholders of YSTP have potential conflicts of interest with us, which may adversely affect our business.

Neither we nor WFOE owns any portion of the equity interests of YSTP. Instead, we rely on WFOE’s contractual obligations to enforce our interest in receiving payments from YSTP. Conflicts of interests may arise between YSTP’s shareholders and our company if, for example, their interests in receiving dividends from YSTP were to conflict with our interest requiring these companies to make contractually-obligated payments to WFOE. As a result, we have required YSTP and each of its shareholders to execute irrevocable powers of attorney to appoint the individual designated by us to be his attorney-in-fact to vote on their behalf on all matters requiring shareholder approval by YSTP and to require YSTP’s compliance with the terms of its contractual obligations. We cannot assure you, however, that when conflicts of interest arise, these companies’ shareholders will act completely in our interests or that conflicts of interests will be resolved in our favor. In addition, these shareholders could violate their agreements with us by diverting business opportunities from us to others. If we cannot resolve any conflicts of interest between us and YSTP’s shareholders, we would have to rely on legal proceedings, which could result in the disruption of our business.

We rely on dividends paid by WFOE for our cash needs.

We rely primarily on dividends paid by WFOE for our cash needs, including the funds necessary to pay dividends and other cash distributions, if any, to our shareholders, to service any debt we may incur and to pay our operating expenses. The payment of dividends by entities organized in China is subject to limitations. Regulations in China currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. Under British Virgin Islands law, we may only pay dividends from surplus (the excess, if any, at the time of the determination of the total assets of our company over the sum of our liabilities, as shown in our books of account, plus our capital), and we must be solvent before and after the dividend payment in the sense that we will be able to satisfy our liabilities as they become due in the ordinary course of business; and the realizable value of assets of our company will not be less than the sum of our total liabilities, other than deferred taxes as shown on our books of account, and our capital. If we determine to pay dividends on any of our ordinary shares in the future, as a holding company, we will be dependent on receipt of funds from WFOE. See “Dividend Policy.”

Pursuant to the Implementation Rules for the new Chinese enterprise income tax law, effective on January 1, 2008, dividends payable by a foreign investment entity to its foreign investors are subject to a withholding tax of up to 10 percent. Pursuant to Article 10 of the Arrangement Between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income effective on December 8, 2006, dividends payable by a foreign investment entity to its Hong Kong investor who owns 25% or above equity are subject to a withholding tax of up to 5 percent.

The payment of dividends by entities organized in China is subject to limitations, procedures and formalities. Regulations in China currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. WFOE is also required to set aside at least 10% of its after-tax profit based on Chinese accounting standards each year to its compulsory reserves fund until the accumulative amount of such reserves reaches 50% of its registered capital.

The transfer to this reserve must be made before distribution of any dividend to shareholders. The surplus reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or converted into share capital by issuing new shares to existing shareholders in proportion to their shareholding or by increasing the par value of the shares currently held by them, provided that the remaining reserve balance after such issue is not less than 25% of the registered capital. For the years ended December 31, 2009, we made reserves of RMB9,532,480 ($1,395,579.64); in 2008, we made reserves of RMB 6,191,330 ($875,904.36).

16

Table of Contents

WFOE is also required to allocate a portion of its after-tax profits, as determined by its board of directors, to the general reserve, the staff welfare and bonus funds, and the enterprise expansion reserve, which may not be distributed to equity owners.

Pursuant to the Implementation Rules of the Law on Foreign-Invested Enterprises, effective on December 12, 1990, Foreign-Invested Enterprises are required to allocate a portion of their after-tax profits in accordance with their Articles of Association, to the general reserve, the staff welfare and bonus funds, and the enterprise expansion reserve. According to the Articles of Association of WFOE, the amount of each reserve is determined by WFOE’s board of directors. The general reserve is used to offset future extraordinary losses. The subsidiaries may, upon a resolution passed by the shareholders, convert the general reserve into capital. The employee welfare and bonus reserve is used for the collective welfare of the employees of the subsidiaries. The enterprise expansion reserve is used for the expansion of the subsidiaries’ operations and can be converted to capital subject to approval by the relevant authorities. These reserves represent appropriations of retained earnings determined according to Chinese law.

As of the date of this prospectus, the amounts of these reserves have not yet been determined, and we have not committed to establishing such amounts at this time. Under current Chinese laws, WFOE is required to set aside reserve amounts, but has not yet done so. WFOE has not done so because Chinese authorities grant companies flexibility in making a determination. Chinese law requires such a determination to be made in accordance with the companies’ organizational documents and WFOE’s organizational documents do not require the determination to be made within a particular timeframe. Although we have not yet been required by Chinese authorities to make such determinations or set aside such reserves, Chinese authorities may require WFOE to rectify its noncompliance and we may be fined if we fail to do so after warning within the time period set in the warning.

Additionally, Chinese law requires that the after-tax profits of foreign invested companies be distributed after a portion of after-tax profits is allocated to the reserve, therefore if for any reason, the dividends from WFOE cannot be repatriated to us or not in time, then it may detrimentally affect our cash flow and even cause us to become insolvent.

The retail prices of our principal products could be subject to government price controls.