Attached files

| file | filename |

|---|---|

| EX-5.1 - STS TURBO INC | v184884_ex5-1.htm |

| EX-10.6 - STS TURBO INC | v184884_ex10-6.htm |

| EX-23.1 - STS TURBO INC | v184884_ex23-1.htm |

As

filed with the Securities and Exchange Commission on May 14,

2010

Registration

No. 333-164695

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 1 to

Form

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

STS

Turbo, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

3714

|

11-3713948

|

|

(State

or other jurisdiction of

incorporation

or organization

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer

Identification

No.)

|

|

165

N. 1330 West, Suite A-4

Orem,

UT 84057

|

(801)

224-3477

|

|

(Address,

including zip code, of registrant’s

principal

executive offices)

|

(Telephone

number, including area code)

|

Richard

K. Squires

STS

Turbo, Inc.

165 N.

1330 West, Suite A-4

Orem,

UT 84057

(801)

224-3477

(Name,

address, including zip code, and telephone

number,

including area code, of agent for service)

COPIES

TO:

Brian A.

Lebrecht, Esq.

The

Lebrecht Group, APLC

406 W.

South Jordan Parkway, Suite 160

South

Jordan, UT 84095

(801)

983-4948

Approximate

date of commencement of proposed sale to the public:

From time

to time after this registration statement becomes effective.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, check the following

box. x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in

Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company þ

|

(Do not

check if a smaller reporting company)

CALCULATION

OF REGISTRATION FEE

|

|

||||||||||||||||

|

Title of each

class of

securities to be

registered

|

Amount

to be

registered

|

Proposed

maximum

offering price

per share (2)

|

Proposed

maximum

aggregate

offering price

|

Amount of

registration

fee (3)

|

||||||||||||

|

Common

Stock of certain selling

shareholders

|

4,433,500 | (1) | $ | 0.20 | $ | 886,700 | $ | 63.22 | ||||||||

|

Total

Registration Fee

|

$ | 63.22 | ||||||||||||||

|

(1)

|

Pursuant

to Rule 416 of the Securities Act, this registration statement shall be

deemed to cover additional securities (i) to be offered or issued in

connection with any provision of any securities purported to be registered

hereby to be offered pursuant to terms that provide for a change in the

amount of securities being offered or issued to prevent dilution resulting

from stock splits, stock dividends, or similar transactions and (ii) of

the same class as the securities covered by this registration statement

issued or issuable prior to completion of the distribution of the

securities covered by this registration statement as a result of a split

of, or a stock dividend paid with respect to, the registered

securities.

|

|

(2)

|

There

is currently no market for our common stock. The offering price

per share for the selling security holders was estimated solely for the

purpose of calculating the registration fee pursuant to Rule 457(a) and

(o) under the Securities Act of 1933, as amended. For purposes

of this calculation we used the last sale price at which the Company sold

shares, which was in a private

placement.

|

|

(3)

|

Previously

paid by registrant.

|

The registrant hereby amends this

registration statement on such date or dates as may be necessary to delay its

effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until

the registration statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may

determine.

|

The

information in this prospectus is not complete and may be

changed. We may not sell these securities until the

registration statement filed with the SEC is effective. This

prospectus is not an offer to sell and it is not soliciting an offer to

buy these securities in any state where the offer or sale is not

permitted.

|

Subject

to Completion, Dated May 14, 2010

PROSPECTUS

Up to

4,433,500 shares of

common stock

STS

TURBO, INC.

We are

registering up to 4,433,500 shares, representing 13.7% of our current

outstanding common stock, for sale by 212 of our existing

shareholders: This offering will terminate when all 4,433,500 shares

are sold or on _____________, 20__, unless we terminate it earlier.

Investing in the common stock

involves risks. STS Turbo, Inc. currently designs, manufactures, and

markets a patented turbocharger system for the automotive market and while it is

not a development stage company, it is a company with limited operations,

limited income, and limited assets, is in unsound financial condition, and you

should not invest unless you can afford to lose your entire

investment. The company’s independent auditors report on its

financial statements for the years ended December 31, 2009 and 2008 expresses

substantial doubt as to its ability to continue as a going

concern. See “Risk Factors” beginning on page 4. Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a

criminal offense.

All of the common stock registered by

this prospectus will be sold by the selling shareholders on their own behalf at

a price of $0.20 per share. The selling stockholders, and any

participating broker-dealers, may be deemed to be “underwriters” within the

meaning of the Securities Act of 1933, as amended, or the “Securities Act,” and

any commissions or discounts given to any such broker-dealer may be regarded as

underwriting commissions or discounts under the Securities Act.

Our

common stock is not traded on any national securities exchange and is not quoted

on any over-the-counter market. If our shares become quoted on the

Over-The-Counter Bulletin Board, sales will be made at prevailing market prices

or privately negotiated prices. STS Turbo, Inc. is not selling any of

the shares of common stock in this offering and therefore will not receive any

proceeds from this offering. The selling stockholders have informed

us that they do not have any agreement or understanding, directly or indirectly,

with any person to distribute their common stock.

The

date of this prospectus is __________________, 2010

PROSPECTUS

SUMMARY

STS

TURBO, INC.

All references to “STS,” the “Company,”

“we,” “us” or “our” in this prospectus mean STS Turbo, Inc., a Nevada

corporation, and all entities owned or controlled by STS Turbo, Inc., except

where it is made clear that the term means only the parent company.

Overview

We sell turbocharger systems for

automobiles. The turbochargers can be installed at our facility in

Orem, Utah, or we can ship the parts to our customer and they can have it

installed by a local mechanic in their area. We sell our

turbochargers through the Internet, and through our network of over 200

distributors. Our advertising and marketing efforts are focused on

creating a known brand and driving potential customers to our website and

encouraging them to contact the company sales staff directly.

We own 3 U.S. patents that cover our

turbochargers. We manufacture some of the parts for our

turbochargers, but most of the parts are purchased from our suppliers and then

packaged and sold to our customers. Our typical customer has

historically been a car enthusiast, however, we are trying to expand our

customer base to include those who want fuel savings and are attracted to the

environmental benefits of our products.

Our future plans are to expand our

product line so that we offer turbochargers for a wider variety of

vehicles. We are also working on a completely new technology that,

although not ready for development yet, might increase the efficiency of larger

vehicles such as tractor trailers.

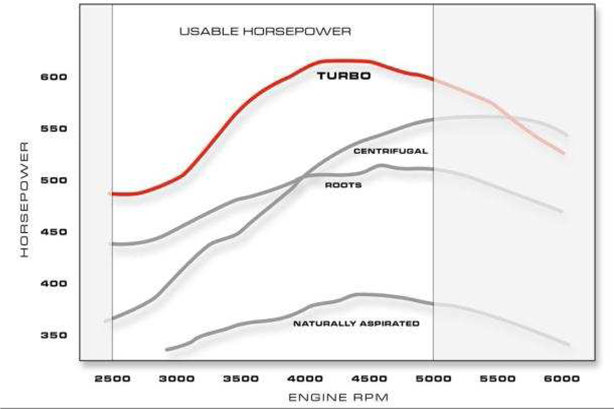

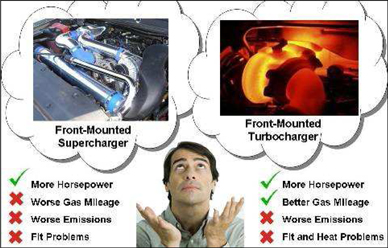

Background

Forced

induction, in the form of a supercharger or turbocharger, was introduced in the

early 1900s and has become the standard for increasing the horsepower and torque

of an engine. Forced induction forces more air into the cylinders of

the engine during the intake stroke in order to increase

power. Centrifugal superchargers are currently the preferred option

of most performance enthusiasts due to their relatively easy installation and

lower cost, even though they inefficiently pull power from the engine itself in

order to operate the air compressor that forces more air into the

engine.

Turbochargers

are actually a more efficient way to “boost” a motor and are used primarily in

aerospace and diesel applications. Turbochargers utilize the normally

wasted energy in the exhaust of the vehicle to operate the air compressor. Many

of the major automobile manufacturers offer turbocharged vehicles as an

option. However, turbochargers have not flourished in the automotive

industry or the aftermarket performance industry because of the difficult task

of finding a location to put a 2,000°F component the size of a basketball under

the hood in an already over-crowded engine compartment. As well as

the fact that traditional front-mounted turbocharger systems have had a very

difficult time passing modern emissions standards. Turbochargers have

done better in the import market because the motors are smaller and cannot

afford the horsepower loss of a belt-driven supercharger. Not

surprisingly, turbochargers are a popular option in the racing industry because

of their efficiency and horsepower potential.

2

The

Technology

We own

three (3) issued U.S. patents with Australian and European patents pending on an

innovative method of turbocharging a vehicle. We expect to start

being granted international patents in 18-24 months. Our U.S. patents

will begin to expire in early 2023.

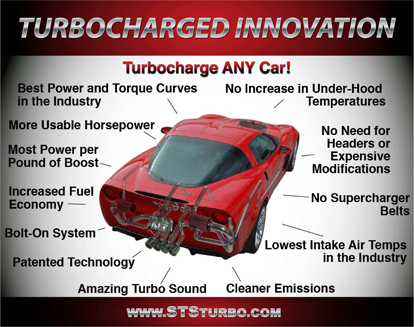

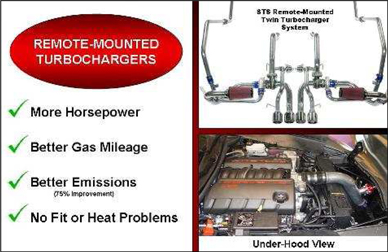

STS

turbocharger systems are not mounted in the traditional location under the hood

in the engine bay, but are instead mounted in the rear of the vehicle where the

stock muffler was originally located. The remote location allows for

a quicker and easier install, cooler oil and under-hood engine components, and

cooler intake air temperatures, which helps to deliver more horsepower per pound

of boost than our competitors. More horsepower per pound of boost

means that the engine does not have to work as hard in order to get the same

horsepower. This prolongs engine life, improves reliability, and

reduces the risk of any engine damage.

Because

the location of the turbocharger is uniquely in the rear of the vehicle behind

the catalytic converters, the turbo system actually helps reduce emissions by

causing the catalytic converters to get up to operating temperature quicker and

to stay at an increased operating efficiency. Also, due to the use of

wasted exhaust energy to create more power from the engine, our own testing has

shown that fuel efficiency normally increases at least 10-20% with the

turbocharger as compared with the stock vehicle, and the turbocharged vehicle

now has more horsepower. Please note that these results come from our

own internal tests, conducted on a limited number of vehicles, and have not been

verified by a third party. It is our belief that an even greater fuel

efficiency improvement can be achieved when comparing two vehicles with

approximately the same horsepower – one with a smaller engine that is

turbocharged, and one that has a larger stock engine.

Selected Financial

Information

Our Current Assets, Total Assets,

Current Liabilities, Total Liabilities, Revenue, Gross Profit, and Net Income

(Loss) as of and for the years ended December 31, 2009 and 2008, are as

follows:

|

As of and for the

year ended

December 31, 2009

|

As of and for the

year ended

December 31, 2008

|

|||||||

|

Current

Assets

|

$ | 275,174 | $ | 266,461 | ||||

|

Total

Assets

|

291,139 | 305,995 | ||||||

|

Current

Liabilities

|

574,766 | 1,097,065 | ||||||

|

Total

Liabilities

|

796,439 | 1,260,584 | ||||||

|

Revenue

|

1,741,325 | 1,945,173 | ||||||

|

Gross

Profit

|

747,473 | 690,547 | ||||||

|

Net

Income (Loss)

|

(93,059 | ) | (646,591 | ) | ||||

Our cash on hand as of May 10, 2010

was approximately $118,000, and our monthly cash flow burn rate (net of cost of

goods sold) is approximately $60,000. During the first three months

of 2010, our revenue has averaged nearly double that

amount.

3

Corporate

Information

We were

incorporated on August 28, 2008, in the State of Nevada, as STS Turbo,

Inc. Effective September 12, 2008, we acquired all of the issued and

outstanding securities of Squires Turbo Systems, Inc., a Utah corporation, from

its shareholders. We intend to become a reporting company by filing

of a registration statement with the Commission for the resale of all Shares by

the purchasers herein, followed by a Form 8-A. Following such

registration, we intend to seek a market maker to apply to list our common stock

for trading on the Over the Counter Bulletin Board.

Through

Squires Turbo Systems, Inc., our wholly-owned subsidiary, we develop,

manufacture, and sell a patented turbocharger system that our own testing has

shown increases horsepower, improves fuel efficiency, and reduces the emissions

of any vehicle. Our principal product is the automotive remote-mount

turbocharger.

We have a second wholly-owned

subsidiary, Power-Train Systems, Inc., through which we are developing ‘green’

power production and enhancement technologies, primarily designed to increase

the efficiency and reduce harmful emissions of vehicles and large

equipment. However, this technology is in its research and

development phase and is not ready for us to market.

Our

principal offices are located at 165 N. 1330 West, Suite A-4, Orem,

UT 84057. The telephone is (801)

224-3477. Our website address is www.ststurbo.com. Information

contained on our website is not incorporated into, and does not constitute any

part of, this prospectus.

The

Offering

|

Securities

Offered:

|

||

|

Shares

Offered by

|

||

|

Selling

Shareholders:

|

We

are registering 4,433,500 shares for sale by 212 existing holders of our

common stock (see list of Selling

Shareholders).

|

4

RISK

FACTORS

Any

investment in our common stock involves a high degree of risk. You

should consider carefully the following information, together with the other

information contained in this prospectus, before you decide to buy our common

stock. If any of the following events actually occurs, our business,

financial condition or results of operations would likely suffer. In

this case, the market price, if any, of our common stock could decline, and you

could lose all or part of your investment in our common stock.

We face

risks in completing the research for our products and eventually bringing them

to market. The following risks are material risks that we face. If

any of these risks occur, our business, our ability to achieve revenues, our

operating results and our financial condition could be seriously

harmed.

RISKS

RELATED TO OUR BUSINESS

We have a limited operating history and

no historical financial information upon which you may evaluate our

performance.

You

should consider, among other factors, our prospects for success in light of the

risks and uncertainties encountered by companies that, like us, are in their

early stages of development. We may not successfully address these

risks and uncertainties or successfully implement our existing and new products

and services. If we fail to do so, it could materially harm our

business and impair the value of our common stock. Even if we

accomplish these objectives, we may not generate the positive cash flows or

profits we anticipate in the future. We were incorporated in Nevada

on August 28, 2008, and, on September 12, 2008, acquired Squires Turbo Systems,

Inc., a Utah corporation incorporated on March 1, 2004. Unanticipated

problems, expenses and delays are frequently encountered in establishing a new

business and developing new products and services. These include, but

are not limited to, inadequate funding, lack of consumer acceptance,

competition, product development, and inadequate sales and

marketing. The failure by us to meet any of these conditions would

have a materially adverse effect upon us and may force us to reduce or curtail

operations. No assurance can be given that we can or will ever

operate profitably.

If

we are unable to meet our future capital needs, we may be required to reduce or

curtail operations.

To

date, Squires Turbo Systems, Inc., our wholly-owned subsidiary through which we

operate, has relied on cash flow from operations, funding from its founders,

debt financing, and private stock sales to fund operations. We have

extremely limited cash liquidity and capital resources. Our cash on

hand as of May 10, 2010 was approximately $118,000, and our monthly cash flow

burn rate (net of cost of goods sold) is approximately

$60,000. During the first three months of 2010, our revenue has

averaged nearly double that amount.

Our

future capital requirements will depend on many factors, including our ability

to market our services successfully, cash flow from operations, and competing

market developments. We anticipate that our cash needs can be met

from operations for the next 12 months. However, there can be no

assurance that this will be the case. Consequently, although we

currently have no specific plans or arrangements for financing, we intend to

raise funds through private placements, public offerings or other

financings. Any equity financings would result in dilution to our

then-existing stockholders. Sources of debt financing may result in

higher interest expense. Any financing, if available, may be on

unfavorable terms. If adequate funds are not obtained, we may be

required to reduce or curtail operations.

5

As

we have reported recurring losses from operations, and an accumulated deficit,

there is no assurance that we will be able to continue as a going

concern.

Our

financial statements included with this Registration Statement for the years

ended December 31, 2009 and 2008 have been prepared assuming that we will

continue as a going concern. Our auditors have made reference to the

substantial doubt as to our ability to continue as a going concern in their

audit report on our audited financial statements for the years ended December

31, 2009 and 2008. If we are not able to achieve profitable

operations, then we likely will be forced to cease operations and investors will

likely lose their entire investment.

If

we fail to successfully complete a public offering of our securities, it may

impede your ability to sell our shares.

There is

absolutely no assurance that we will ever successfully complete a public

offering of our securities. Investors in this offering should only purchase the

Shares based on the merits and risks of a long-term investment as disclosed in

this Prospectus. We do not presently have a commitment from any person or

underwriter for any public offering. Any such offering or offerings would

generally be subject to many conditions, including market trends for initial

public offerings, our business plan, results of operations, and other factors.

If we fail to successfully complete a public offering of our securities, it may

impede your ability to sell the Shares.

Because

we face intense competition, we may not be able to operate profitably in our

markets.

The market for turbochargers and

superchargers is highly competitive and is becoming more so, which could hinder

our ability to successfully market our products. We may not have the

resources, expertise or other competitive factors to compete successfully in the

future. We expect to face additional competition from existing

competitors and new market entrants in the future. Many of our competitors,

including, but not limited to, Vortech Engineering, LLC, Procharger, Garrett,

Turbonetics, and APS, have greater name recognition and more established

relationships in the industry than we do. As a result, these

competitors may be able to:

|

|

·

|

develop

and expand their product offerings more

rapidly;

|

|

|

·

|

adapt

to new or emerging changes in customer requirements more

quickly;

|

|

|

·

|

take

advantage of acquisition and other opportunities more readily;

and

|

|

|

·

|

devote

greater resources to the marketing and sale of their products and adopt

more aggressive pricing policies than we

can.

|

6

Our

products and technologies may not be as competitive as other aftermarket forced

induction technologies that have been in use for a long period of time and offer

advantages of being accepted in the marketplace.

The

aftermarket forced induction industry, meaning the market for forced induction

turbochargers sold to consumers after they already own the vehicle, has

significant competition. Other technologies exist which also increase

the horsepower of vehicles. For example, superchargers have been in

use since the early 1900s and offer the advantage that they have been widely

accepted in the marketplace, whereas our products might face some challenges

with respect to broad market acceptance for some currently indeterminable

time. For example, we must overcome the current market perception

that the supercharger technology is superior to our technology because

turbochargers are perceived to have lag. Lag is a term generally

defined to mean a delay between the time when a driver pushes down on the gas

pedal and when the car actually accelerates. Our turbochargers do not

have lag, as supported by our own internal testing and feedback from our

customers. Failure to overcome such product misconceptions and

gain greater market acceptance of our technology could have a material adverse

effect on our business and the value of our common stock.

If

we are unable to maintain brand image or product quality, or if we encounter

product recalls, our business may suffer.

Our

success depends on our ability to maintain and build brand image for our

existing products, new products and brand extensions. We have no assurance

that our advertising, marketing and promotional programs will have the desired

impact on our products’ brand image and on consumer preferences. Product

quality issues, real or imagined, could tarnish the image of the affected brands

and may cause consumers to choose other products. We may be required from

time to time to recall products entirely or from specific retailers, markets or

batches. Product recalls could adversely affect our profitability and our

brand image.

While we

have to date not experienced any credible product liability litigation, there is

no assurance that we will not experience such litigation in the

future. In the event we were to experience product liability claims

or a product recall, our financial condition and business operations could be

materially adversely affected.

If we are unable to keep pace with

technological change, our existing technology may become obsolete which would

materially and adversely affect our future sales and profitability.

The automotive and other industries

on which the market for our products depends are characterized by rapid and

significant technological change. Our success depends on our ability

to continually develop new technologies and to refine products incorporating our

original technology. Due to delay and the rapid pace of technological

innovation in these industries, there is a risk that our products may be

superseded by new technology and become obsolete.

Our products may not be commercially

accepted or we may not be able to enhance existing products or develop new

products. Future technological change may render one or more of our

products obsolete or uneconomical. Our ability to continue to develop

and market new and improved products that can achieve significant market

acceptance will determine our future sales and profitability.

If

we are unable to attract and retain key personnel, we may not be able to compete

effectively in our market.

Our

success will depend, in part, on our ability to attract and retain key

management, including primarily Richard K. Squires, technical experts and sales

and marketing personnel. We attempt to enhance our management and

technical expertise by recruiting qualified individuals who possess desired

skills and experience in certain targeted areas. Our inability to

retain employees and attract and retain sufficient additional employees, and

information technology, engineering and technical support resources, could have

a material adverse effect on our business, financial condition, results of

operations and cash flows. The loss of key personnel could limit our

ability to develop and market our products.

7

Because

our officers, directors and principal shareholders control a large percentage of

our common stock, plus preferred stock, such insiders have the ability to

influence matters affecting our shareholders.

Our

officers and directors as a group beneficially own 50% of the outstanding common

stock, and combined with our Series A Convertible Preferred Stock, control over

80% of our outstanding voting securities. As a result, they have the

ability to influence matters affecting our shareholders, including the election

of our directors, the acquisition or disposition of our assets, and the future

issuance of our shares. Because they control such shares, investors

may find it difficult to replace our management if they disagree with the way

our business is being operated. Because the influence by these

insiders could result in management making decisions that are in the best

interest of those insiders and not in the best interest of the investors, you

may lose some or all of the value of your investment in our common

stock. See “Principal Shareholders.”

Impairment

of our intellectual property rights could negatively affect our business or

could allow competitors to minimize any advantage that our proprietary

technology may give us.

While it

is our practice to enter into agreements with all employees and some of our

customers and suppliers to prohibit or restrict the disclosure of proprietary

information, we cannot be sure that these contractual arrangements or the other

steps we take to protect our proprietary rights will prove sufficient to prevent

illegal use of our proprietary rights or to deter independent, third-party

development of similar proprietary assets.

We

currently have various patents on our automotive remote-mount turbocharger

technology. However, effective copyright, trademark, trade secret and

patent protection may not be available in every country in which our products

and services are offered. In the future, we may be involved in legal

disputes relating to the validity or alleged infringement of our intellectual

property rights or those of a third party. Intellectual property

litigation is typically extremely costly and can be disruptive to business

operations by diverting the attention and energies of management and key

technical personnel. In addition, any adverse decisions could subject

us to significant liabilities, require us to seek licenses from others, prevent

us from using, licensing or selling certain of our products and services, or

cause severe disruptions to operations or the markets in which we compete which

could decrease profitability.

If

we are unable to obtain, maintain and enforce intellectual property protection

covering our products outside of the United States, others may be able to make,

use, or sell our products, which could have a material adverse effect on our

business.

Our

success is dependent in part on obtaining, maintaining and enforcing

intellectual property rights, including patents, both in and outside the United

States. If we are unable to obtain, maintain and enforce intellectual

property legal protection covering our products outside of the United States,

others may be able to make, use or sell products that are substantially

identical to ours, which would adversely affect our ability to compete in the

market.

8

We

have a number of foreign pending patent applications; however, even if we are

issued patents in these foreign jurisdictions, the laws of some foreign

jurisdictions do not protect intellectual property rights to the same extent as

laws in the United States, and many companies have encountered significant

difficulties in protecting and defending such rights in foreign jurisdictions.

If we encounter such difficulties or we are otherwise precluded from

effectively protecting our intellectual property rights in foreign

jurisdictions, our business prospects could be substantially materially

adversely affected.

We may

initiate litigation to enforce our patent rights, which may prompt our

adversaries in such litigation to challenge the validity, scope or

enforceability of our patent. Patent litigation is complex and often

difficult and expensive, and would consume the time of our management and other

significant resources. In addition, the outcome of patent litigation is

uncertain. If a court decides that our patent or patents that may be

issued to us in the future are not valid, not enforceable or of a limited scope,

we may not have the right to stop others from using the subject matter covered

by those patents.

If we

are unable to protect the confidentiality of our proprietary information and

know-how, our competitors may use our technology to develop competing

products.

We

rely on third-party suppliers and manufacturers to provide raw materials for and

to produce our products, and we have limited control over these suppliers and

manufacturers and may not be able to obtain quality products on a timely basis

or in sufficient quantity.

Substantially

all of our products are manufactured by unaffiliated

manufacturers. We have no long-term contracts with our suppliers or

manufacturing sources, and we compete with other companies for raw materials,

production and import quota capacity. We purchase raw materials such

as bent steel tubing, steel flanges, and ceramic coating from third-party

manufacturers such as B&C Industries, Inc., Precision Laser Processing, and

Jet-Hot Coatings. We combine these materials during our manufacturing

process to assemble the kits necessary to retrofit our turbocharger products

onto specific vehicles.

There can

be no assurance that there will not be a significant disruption in the supply of

raw materials from current sources or, in the event of a disruption, that we

would be able to locate alternative suppliers of materials of comparable quality

at an acceptable price, or at all. In addition, we cannot be certain

that our unaffiliated manufacturers will be able to fill our orders in a timely

manner. If we experience significant increased demand, or need to

replace an existing manufacturer, there can be no assurance that additional

supplies of raw materials or additional manufacturing capacity will be available

when required on terms that are acceptable to us, or at all, or that any

supplier or manufacturer would allocate sufficient capacity to us in order to

meet our requirements. In addition, even if we are able to expand

existing or find new manufacturing or raw material sources, we may encounter

delays in production and added costs as a result of the time it takes to train

our suppliers and manufacturers in our methods, products and quality control

standards. Any delays, interruption or increased costs in the supply

of raw materials or manufacture of our products could have an adverse effect on

our ability to meet retail customer and consumer demand for our products and

result in lower revenues and net income both in the short and

long-term.

In

addition, there can be no assurance that our suppliers and manufacturers will

continue to provide raw materials and to manufacture products that are

consistent with our standards. We have occasionally received, and may

in the future continue to receive, shipments of product that fail to conform to

our quality control standards. In that event, unless we are able to

obtain replacement products in a timely manner, we risk the loss of revenues

resulting from the inability to sell those products and related increased

administrative and shipping costs. In addition, because we do not

control our manufacturers, products that fail to meet our standards or other

unauthorized products could end up in the marketplace without our knowledge,

which could harm our reputation in the marketplace.

9

We

could become subject to product liability claims that could be expensive, divert

management’s attention and harm our business.

Our

business exposes us to potential product liability risks that are inherent in

the manufacturing, marketing and sale of aftermarket automotive products.

We may be held liable if our products cause injury or death or are found

otherwise unsuitable or defective during usage.

Our

turbo systems incorporate mechanical and electrical parts and components, any of

which can have defective or inferior parts or contain defects, errors or

failures. A product liability claim, regardless of its merit or eventual

outcome, could result in significant legal defense costs. Although we

maintain product liability insurance, the coverage is subject to deductibles and

limitations, and may not be adequate to cover future claims. Additionally,

we may be unable to maintain our existing product liability insurance in the

future at satisfactory rates or in adequate amounts. A product liability

claim, regardless of its merit or eventual outcome could result

in:

|

•

|

decreased

demand for our products;

|

|

•

|

injury

to our reputation;

|

|

•

|

diversion

of management’s attention;

|

|

•

|

significant

costs of related litigation;

|

|

•

|

payment

of substantial monetary awards by

us;

|

|

•

|

product

recalls or market withdrawals;

|

|

•

|

a

change in the design, manufacturing process or the indications for which

our products may be used;

|

|

•

|

loss

of revenue; and

|

|

•

|

an

inability to commercialize product

candidates.

|

Our

business may be negatively impacted by a slowing economy or by unfavorable

economic conditions or developments in the United States and/or in other

countries in which we operate.

A general

slowdown in the economy in the United States or unfavorable economic conditions

or other developments may result in decreased consumer demand, business

disruption, supply constraints, foreign currency devaluation, inflation or

deflation. A slowdown in the economy or unstable economic conditions

in the United States or in the countries in which we operate could have an

adverse impact on our business results or financial condition.

In

particular, the automotive industry has declined dramatically in the current

recession. Our products, while providing long term cost savings in

fuel economy and being friendly to the environment, might be seen as luxury or

optional items and thus our revenues are subject to the decreased consumer

spending. In addition, tightening credit markets might negatively

affect our ability to raise capital for expansion.

10

We

may not be able to effectively manage our growth and operations, which could

materially and adversely affect our business.

We may

experience rapid growth and development in a relatively short period of time by

aggressively marketing our automotive remote-mount turbocharger and related

products. The management of this growth will require, among other

things, continued development of our financial and management controls and

management information systems, stringent control of costs, increased marketing

activities, the ability to attract and retain qualified management personnel and

the training of new personnel. We intend to hire additional personnel

in order to manage our expected growth and expansion. Failure to

successfully manage our possible growth and development could have a material

adverse effect on our business and the value of our common stock.

Our

business may be negatively impacted by changes in vehicle emissions requirements

in the United States and/or other countries in which we operate.

Many

governments in countries throughout the world are regulating vehicle emissions

and fuel economy standards and offering incentives to consumers to own and

operate more efficient vehicles. If these regulations change in such

a way as to make our products less desirable or less affordable, it may have a

negative impact on our revenues.

RISKS

RELATED TO OUR COMMON STOCK

There is no

public trading market for our common stock, which may impede your ability to

sell our shares.

Currently,

there is no trading market for our common stock, and there can be no assurance

that such a market will commence in the future. There can be no

assurance that an investor will be able to liquidate his or her investment

without considerable delay, if at all. If a trading market does

commence, the price may be highly volatile. Factors discussed herein

may have a significant impact on the market price of our

shares. Moreover, due to the relatively low price of our securities,

many brokerage firms may not effect transactions in our common stock if a market

is established. Rules enacted by the SEC increase the likelihood that

most brokerage firms will not participate in a potential future market for our

common stock. Those rules require, as a condition to brokers

effecting transactions in certain defined securities (unless such transaction is

subject to one or more exemptions), that the broker obtain from its customer or

client a written representation concerning the customer’s financial situation,

investment experience and investment objectives. Compliance with

these procedures tends to discourage most brokerage firms from participating in

the market for certain low-priced securities.

We

intend to have a market maker apply to list our common stock for trading on the

"Over-the-Counter Bulletin Board," which may make it more difficult for

investors to resell their shares due to suitability requirements.

We

intend to have a market maker apply to list our common stock for trading on the

Over the Counter Bulletin Board (OTCBB). However, there can be no

assurance that we will find a market maker willing to submit an application, or

that such market maker’s application will be accepted. Broker-dealers

often decline to trade in OTCBB stocks given the market for such securities are

often limited, the stocks are more volatile, and the risk to investors is

greater. These factors may reduce the potential market for our common

stock by reducing the number of potential investors. This may make it

more difficult for investors in our common stock to sell shares to third parties

or to otherwise dispose of their shares. This could cause our stock

price to decline.

11

If

we are unable to pay the costs associated with being a public, reporting

company, we may not be able to commence and/or continue trading on the Over the

Counter Bulletin Board and/or we may be forced to discontinue

operations.

We

intend to apply to list our common stock for trading on the OTCBB. We

expect to have significant costs associated with being a public, reporting

company, which may raise substantial doubt about our ability to commence and/or

continue trading on the OTCBB and/or continue as a going

concern. These costs include compliance with the Sarbanes-Oxley Act

of 2002, which will be difficult given the limited size of our management, and

we will have to rely on outside consultants. Accounting controls, in

particular, are difficult and can be expensive to comply with.

Our

ability to commence and/or continue trading on the OTCBB and/or continue as a

going concern will depend on positive cash flow, if any, from future operations

and on our ability to raise additional funds through equity or debt

financing. If we are unable to achieve the necessary product sales or

raise or obtain needed funding to cover the costs of operating as a public,

reporting company, our common stock may be deleted from the OTCBB and/or we may

be forced to discontinue operations.

Our

principal stockholders have the ability to exert significant control in matters

requiring stockholder approval and could delay, deter, or prevent a change in

control of our company.

Our

officers and directors collectively own approximately 50% of our outstanding

common stock, and combined with our Series A Convertible Preferred Stock,

control over 80% of our outstanding voting securities.. As a result, they have

the ability to influence matters affecting our shareholders, including the

election of our directors, the acquisition or disposition of our assets, and the

future issuance of our shares. Because they control such shares,

investors may find it difficult to replace our management if they disagree with

the way our business is being operated. Because the influence by

these insiders could result in management making decisions that are in the best

interest of those insiders and not in the best interest of the investors, you

may lose some or all of the value of your investment in our common

stock. Investors who purchase our common stock should be willing to

entrust all aspects of operational control to our current management

team.

We

do not intend to pay dividends in the foreseeable future.

We do not

intend to pay any dividends in the foreseeable future. We do not plan

on making any cash distributions in the manner of a dividend or

otherwise. Our Board presently intends to follow a policy of

retaining earnings, if any.

We

have the right to issue additional common stock and preferred stock without

consent of stockholders. This would have the effect of diluting

investors’ ownership and could decrease the value of their

investment.

We have

additional authorized, but unissued shares of our common stock that may be

issued by us for any purpose without the consent or vote of our stockholders

that would dilute stockholders’ percentage ownership of our

company.

12

In

addition, our certificate of incorporation authorizes the issuance of shares of

preferred stock, the rights, preferences, designations and limitations of which

may be set by the Board of Directors. Our certificate of

incorporation has authorized issuance of up to 10,000,000 shares of preferred

stock in the discretion of our Board. The shares of authorized but

undesignated preferred stock may be issued upon filing of an amended certificate

of incorporation and the payment of required fees; no further stockholder action

is required. If issued, the rights, preferences, designations and

limitations of such preferred stock would be set by our Board and could operate

to the disadvantage of the outstanding common stock. Such terms could

include, among others, preferences as to dividends and distributions on

liquidation.

Our common stock

is governed under The Securities Enforcement and Penny Stock Reform Act of

1990.

The Securities Enforcement and Penny

Stock Reform Act of 1990 requires additional disclosure relating to the market

for penny stocks in connection with trades in any stock defined as a penny

stock. The Commission has adopted regulations that generally define a

penny stock to be any equity security that has a market price of less than $5.00

per share, subject to certain exceptions. Such exceptions include any

equity security listed on NASDAQ and any equity security issued by an issuer

that has (i) net tangible assets of at least $2,000,000, if such issuer has

been in continuous operation for three years, (ii) net tangible assets of

at least $5,000,000, if such issuer has been in continuous operation for less

than three years, or (iii) average annual revenue of at least $6,000,000,

if such issuer has been in continuous operation for less than three

years. Unless an exception is available, the regulations require the

delivery, prior to any transaction involving a penny stock, of a disclosure

schedule explaining the penny stock market and the risks associated

therewith.

SPECIAL

NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have

made forward-looking statements in this prospectus, including the sections

entitled “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and “Business,” that are based on our management’s

beliefs and assumptions and on information currently available to our

management. Forward-looking statements include the information

concerning our possible or assumed future results of operations, business

strategies, financing plans, competitive position, industry environment,

potential growth opportunities, the effects of future regulation, and the

effects of competition. Forward-looking statements include all

statements that are not historical facts and can be identified by the use of

forward-looking terminology such as the words “believe,” “expect,” “anticipate,”

“intend,” “plan,” “estimate” or similar expressions. These statements

are only predictions and involve known and unknown risks and uncertainties,

including the risks outlined under “Risk Factors” and elsewhere in this

prospectus.

Although

we believe that the expectations reflected in our forward-looking statements are

reasonable, we cannot guarantee future results, events, levels of activity,

performance or achievement. We are not under any duty to update any

of the forward-looking statements after the date of this prospectus to conform

these statements to actual results, unless required by law.

USE

OF PROCEEDS

This

prospectus relates to shares of our common stock that may be offered and sold

from time to time by the selling stockholders. We will not receive

any proceeds from the sale of shares of common stock by the selling stockholders

in this offering.

13

DETERMINATION

OF OFFERING PRICE

We are

registering up to 4,433,500 shares for resale by existing holders of our common

stock. There is no established public market for the shares we are

registering. Our management has established the price of $0.20 per

share based upon the price at which recent transactions took place, their

estimates of the market value of STS Turbo, Inc., and the price at which

potential investors might be willing to purchase the shares

offered. Most of the selling shareholders in this offering paid $0.20

per share, and thus will not realize a profit unless and until there is an

active trading market at a higher price.

14

SELLING

SECURITY HOLDERS

The following table provides

information with respect to shares offered by the selling

stockholders:

|

Selling stockholder

|

Shares for

sale

|

Shares

before

offering

|

Percent

before

offering

|

Shares

after

offering

|

Percent

after

offering (1)

|

|||||||||||||||

|

Dwight

Finnestad

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ikuko

Bergenthal

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kenneth

Bergenthal

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Tenax

LLC

c/o

R. Mark Ward

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Trevor

Sandord

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Gordon

Lonsdale

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Lynn

Lonsdale

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

James

A. McClanahan

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Nelcie

E. Pope

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Snow

Company LLC

c/o

Bradley Taylor

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Leonard

and Susan L. Black

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ryan

Petersen

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Sidney

Clements

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Endless

Sunshine, LLC

c/o

Jody Dorius

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Early

Bird Management, LLC

c/o

Jody Dorius

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Dream

Your Dreams, LLC

c/o

Jody Dorius

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Florence

Klewin

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jared

B. Perry

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jeff

C. Rasmussen

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jeremy

Hall

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Chad

Nowers

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Hubert

Guinn Jr.

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Terry

Niedecken

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Barry

Guinn

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Gary

Gines

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Tolleson

Sisters LLC

c/o

Jenny Tolleson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

William

M. Tolleson

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

William

Jared Tolleson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kenneth

W. Crump

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jill

Johnson

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Nathaniel

Loge

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Brad

Crawford

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Dave

E. Oveson

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Mark

Ramey

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Rodney

B. Ford

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Blaine

B Ford

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ryan

Gardner

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

15

|

Richard

Maldonado Valdez

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jeff

Gardner

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kevin

S. Dorius, DMD, PA

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

The

Metatron Group, LLC

c/o

Bretton K. Hadfield

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kimbalyn

DaNea Hayes

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Tommy

Doyle Hayes

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Nathan

Tye Hayes

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Samuel

Trey Hayes

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

James

F. Walsh

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Carter

Chase

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

John

Chase

|

50,000 | 50,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Lex

Herbert

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jason

Snyder

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jonathan

Wardle

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

K. & Dorothy A. Rosenlof

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Guy

Weber

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Welby

Venture Group, LLC

c/o

Jody Dorius

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jody

Dorius

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Todd

Dorius

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Nancy

A. Martin

|

17,500 | 17,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

James

Glaittli

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kim

Southworth

|

17,500 | 17,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Charles

Leiman

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

C

Michael Vertner

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Laurie

N. Vertner

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Brett

Nielson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Nathan

Delahunty

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ronald

J. Kroonstuiver

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jeffrey

T. Wilding

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jeff

Ford

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kenneth

L. Carling

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Clayton

McKinnon

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Craig

Wright

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Mike

Nielson Enterprizes

c/o

Michael Nielson

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Candland

Investing, LLC

c/o

Paul W. Nelson

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jacqulin

Clavijo

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Greg

Dunford

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Carolyn

Holder

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

William

J. Parkes

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Randal

K. Anderson

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Bereck

LP

c/o

Harvard B. Heaton

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Matthew

Anderson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

Anderson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Russell

Dunbar

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Earl

G. McKee

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Barbara

Iwaniec

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % |

16

|

Art

Lafeber

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Christine

Goff

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Eric

Raynor

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Derek

Raynor

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

E.

Lee Wynne & CaMary Wynne

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Heal

Investments, LLC

c/o

Paul Evans

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Cris

S. Stevens

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Tyler

Dabo

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Williaqm

Trent Ricahrdson

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

RCR&T

Inc./Ryan Brumfiled

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

James

N. Finnestad

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Glen

Nakaoka

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Green

Stream, LLC

c/o

S. David Lewis

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jacob

Clark

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jason

N. Crowther

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Glade

& Emily Walker

|

8,500 | 8,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

C. Dorius

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Dennis

Crump

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Brenda

Crump

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Johnson

Tran

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Doris

Anderson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

David

Brower

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Shon

Colarusso

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Marlon

D. Jones

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Chad

Olsen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Rick

L & Linda A. Crane

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

David

G. Watson

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Maren

Stephenson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

David

L. Whetten

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Joan

Alspach

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Clifford

Brent Stapley

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Dennis

Taylor

|

50,000 | 50,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Amber

J. Benson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

IMA

Producer, LLC

c/o

Bernard Buentipo

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Terry

Dorton

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Allison

Brown

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Riverside

Construction LLC

c/o

Jonathan Price

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Douglas

K. Hardy

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Steve

Chidester

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kevin

Thornock

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

CaMary

Wynne

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

John

& Sherry McMollum

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

AV

Capital LLC

c/o

Chris Seeley

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

DKJB

Limited LLC

c/o

Dennis K. Taylor

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % |

17

|

Tim

Stubbs

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Thomas

H. Dyckman Jr.

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Chad

Anderson

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Green

Lake, LLC

c/o

S. David Lewis

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Gary

& Beverly Hensley

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Lloyd

S. Weber

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Aaron

Merrill

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Billy

K. Allen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Broc

Thompson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

John

Duffy

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Samuel

Bergen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jere

A. Clune

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Randy

& Merrie Hudson

|

50,000 | 50,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

John

A. Dallimore

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Aaron

Steed

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Diane

Bromley

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Christopher

Nakaoka

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

David

K. Drury

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

G. Addario

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Brad

Oler

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Healing

Mana Network LLC

c/o

Maraia Weingarten

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Robert

A. Weingarten

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Suzanne

F. Mark

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Daniel

P. Sternberg

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Spencer

& Robin Park

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ruth

Young

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

David

& Julie Keyser

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Maja

B. Wensel

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Kc

Rock

|

12,500 | 12,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

KnK

Auto Sales, LLC

c/o

Klinton Draper

|

15,000 | 15,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Sanpete

Capital

c/o

Klint Draper

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Troy

L. Wood

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Eclipse

Investments, LLC

c/o

James Malmstrom

|

50,000 | 50,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

CW

Acquisitions, Inc.

c/o

David Welch

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Nathanael

Cotton

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Joe

Cotton

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Deborah

& Steven Hall

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Linda

D. Horrocks

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Peter

Morkel

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Todd

Harvey

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

3CG,

LLC

c/o

Lamont Faber

|

17,500 | 17,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

William

E. Davis

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Noah

Rosales

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Darlene

Morre

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Merrill

Moore

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % |

18

|

Holly

E. Wheat

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ber

Cubs Investments, LLC

c/o

Scott Bevensen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Scott

Christensen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Debra

Wright

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jennifer

Hansen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Uptown

Auto, LLC

c/o

David Welch

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Joe

Cotton Jr.

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

Weingarten

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Marvin

T. Hofff

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

William

R. May Jr.

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Richard

& Cynthia Seeley

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

RGF

Investments, LLC

c/o

Richard A. Seeley

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

R. Rosanbalm

&

Linda C. Webb

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jared

Perry

|

22,500 | 22,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Liselot

Bergen

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Robert

& Marion Jacobsen

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ana

Duran

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Phillip

Chase

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ann

Gregg

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Bryce

Pearson

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Lorilee

Richardson

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Anthony

& Angela Monson

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Llyod

S. Weber

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Thayne

Dave Wilde

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

Mansfield

|

20,000 | 20,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Ironfish

Creative LLC

c/o

Richard Manulkin

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Jason

Crosland

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Stephen

Young

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

C. Jonas

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

The

Lebrecht Group, APLC

c/o

Brian A. Lebrecht (2)

|

551,500 | 551,500 | 1.7 | % | -0- | 0.0 | % | |||||||||||||

|

Michael

Southworth

|

1,250,000 | 1,250,000 | 3.9 | % | -0- | 0.0 | % | |||||||||||||

|

Ace

Wealth Man LLC

c/o

Edward Lowry

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Valorie

Wolf

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

HS

Utah Properties, LLC

c/o

Hal P. Shearer

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Joni

Barry

|

7,500 | 7,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Paul

& Susan Wolf

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Marc

Fenwick

|

17,500 | 17,500 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Roger

E. Kent

|

16,000 | 16,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Thomas

M. Malin, Jr.

|

10,000 | 10,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

American

Pension Services,

Inc. (Admin

for David W.

Christensen

Roth IRA 949)

c/o

Dean H. Becker

|

25,000 | 25,000 | <1 | % | -0- | 0.0 | % | |||||||||||||

|

Total

|

4,433,500 | 4,433,500 | 13.7 | % | -0- | 0.0 | % |

19

|

|

(1)

|

Based on 32,396,000 shares

outstanding.

|

|

|

(2)

|

The

Lebrecht Group, APLC serves as our legal counsel in connection with this

offering.

|

PLAN

OF DISTRIBUTION

We anticipate that a market maker will

apply to have our common stock traded on the over-the-counter bulletin board at

some point in the future, but there is no guarantee this will