Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CINCINNATI BELL INC | d8k.htm |

| EX-2.1 - EQUITY PURCHASE AGREEMENT DATED AS OF MAY 12, 2010 - CINCINNATI BELL INC | dex21.htm |

1

Cincinnati Bell

Investor Presentation

May 13, 2010

Exhibit 99.1 |

2

Safe Harbor

Certain

of

the

statements

and

predictions

contained

in

this

presentation

constitute

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act.

Statements

that

are

not

historical

facts,

including

statements

about

the

beliefs,

expectations

and

future

plans

and

strategies

of

the

Company,

are

forward-looking

statements.

These

include

any

statements

regarding:

future

revenue,

operating

income,

profit

percentages,

income

tax

refunds,

realization

of

deferred

tax

assets,

earnings

per

share

or

other

results

of

operations;

the

continuation

of

historical

trends;

the

sufficiency

of

cash

balances

and

cash

generated

from

operating

and

financing

activities

for

future

liquidity

and

capital

resource

needs;

the

effect

of

legal

and

regulatory

developments;

and

the

economy

in

general

or

the

future

of

the

communications

services

industries.

Actual

results

may

differ

materially

from

those

expressed

or

implied

in

forward-looking

statements.

The

following

important

factors,

among

other

things

could

cause

or

contribute

to

actual

results

being

materially

different

from

those

described

or

implied

by

such

forward-looking

statements

including,

but

not

limited

to:

changing

market

conditions

and

growth

rates

within

the

telecommunications

industry

or

generally

within

the

overall

economy;

changes

in

competition

in

markets

in

which

the

Company

operates;

pressures

on

the

pricing

of

the

Company’s

products

and

services;

advances

in

telecommunications

technology;

the

ability

to

generate

sufficient

cash

flow

to

fund

the

Company’s

business

plan,

repay

debt

and

interest

obligations,

and

maintain

our

networks;

the

ability

to

refinance

the

Company’s

indebtedness

when

required

on

commercially

reasonable

terms;

changes

in

the

telecommunications

regulatory

environment;

changes

in

the

demand

for

the

services

and

products

of

the

Company;

the

demand

for

particular

products

and

services

within

the

overall

mix

of

products

sold,

as

the

Company’s

products

and

services

have

varying

profit

margins;

the

Company’s

ability

to

introduce

new

service and product offerings on a timely and cost effective basis; work stoppages

caused by labor disputes; restrictions imposed under various credit

facilities and debt instruments; the Company’s ability to attract and retain highly qualified employees; the Company’s ability to access capital

markets and the successful execution of restructuring initiatives; changes in the

funded status of the Company’s retiree pension and healthcare plans;

disruption in operations caused by a health pandemic, such as the H1N1 influenza virus; changes in the Company’s relationships with current

large customers, a small number of whom account for a significant portion of

Company revenue; and disruption in the Company’s back-office

information

technology

systems,

including

its

billing

system.

More

information

on

potential

risks

and

uncertainties

is

available

in

recent

filings

with

the

Securities

and

Exchange

Commission,

including

Cincinnati

Bell’s

Form

10-K

reports,

Form

10-Q

reports

and

Form

8-K

reports.

The

forward-looking

statements included in this presentation represent estimates as of May 13, 2010. It

is anticipated that subsequent events and developments will or may cause

estimates to change. |

3

3

Non-GAAP Financial Measures

This presentation contains information about adjusted earnings before interest,

taxes, depreciation and amortization (Adjusted EBITDA). This is a

non-GAAP financial measure used by Cincinnati Bell management when

evaluating results of operations. Management believes this measure also

provides users of the financial statements with additional and useful

comparisons of current results of operations with past and future periods.

Non-GAAP financial measures should not be construed as being more

important than comparable GAAP measures. A detailed reconciliation of

Adjusted EBITDA (including the Company’s definition of these terms) to

comparable GAAP financial measures have been included in the tables appearing in

the Appendix to this presentation. |

4

Overview of Transaction

Cincinnati Bell is acquiring CyrusOne

for $525M (11.8x 2010E EBITDA)

Cincinnati Bell has obtained fully committed financing of $970M to:

•

Fund purchase price with 100% cash consideration

•

Refinance existing term loan with later maturity

•

Refinance existing revolver with new 4-year revolver

CyrusOne

will remain headquartered and operated out of Texas

•

Management team has been retained to generate future growth at the

company

The transaction is expected to close by the end of Q2 subject to

customary closing conditions and regulatory approvals

|

5

Data Center Investment Thesis

Attractive Industry Dynamics

•

Strong financial model

•

Recurring revenues with contracted

installed base, growing year to year

•

Success-based capital investment

•

Demand continues to outpace supply

•

Significant growth prospects

•

Increased internet usage

•

Increased regulation

•

Increased adoption of data center

outsourcing

Well Positioned Within Industry

•

Proven capabilities and track record

•

Existing in-market reputation with customers

•

“Early mover”

in an industry in its nascency

Natural Extension of Core Competencies

•

Expand geographically outside traditional

territory

•

Reduce

reliance

on

wireline

and

wireless

businesses in local markets

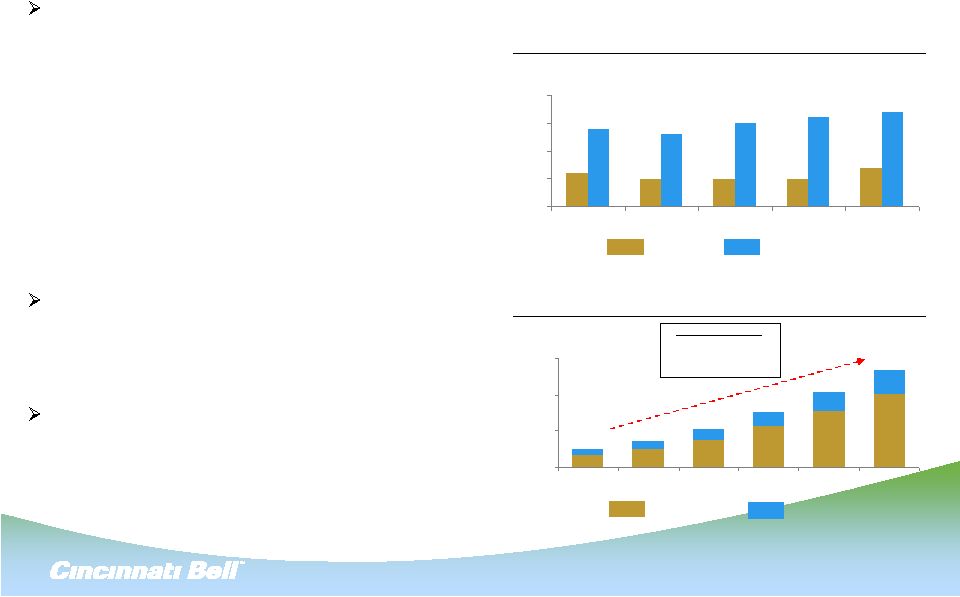

6%

5%

5%

5%

7%

14%

13%

15%

16%

17%

0

5

10

15

20

2008

2009

2010

2011

2012

Global Data Center Supply / Demand Growth Rates

Supply

Demand

(%)

Sources:

Tier 1 Research, Cisco VNI, 2009

Global IP Traffic Volume

PB per Month

40,571

31,211

22,768

15,465

10,488

7,037

12,833

10,022

7,722

5,805

4,258

3,103

0

20,000

40,000

60,000

2008

2009

2010

2011

2012

2013

10,140

14,746

21,270

30,490

41,233

53,404

‘08 –

‘13E CAGR:

Consumer

42%

Business

33%

Total

39%

Consumer

Business |

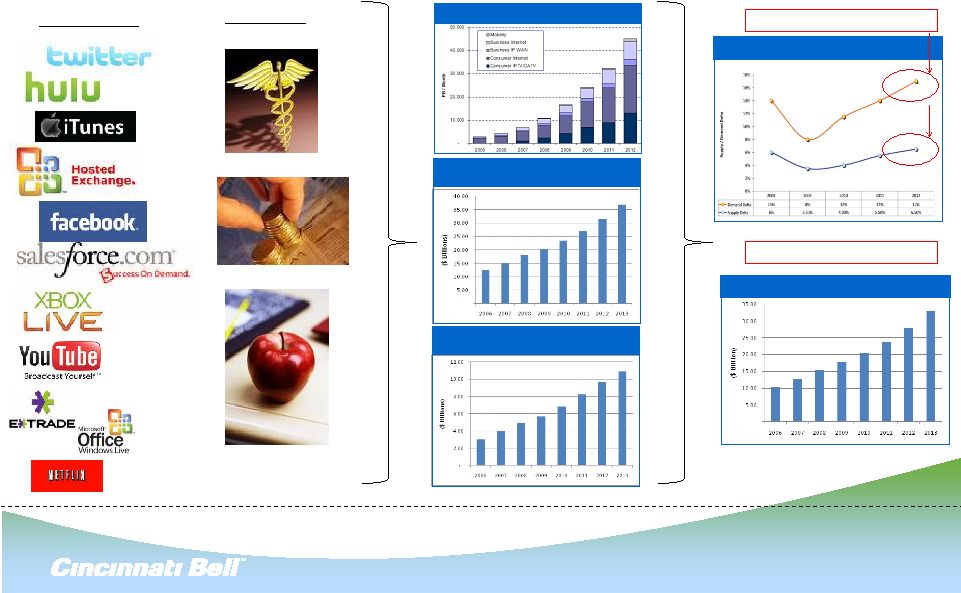

6

IP Traffic

Enterprise Internet

Services Revenue

Ethernet Revenue

Hosting Revenue

Drivers

Consumption

Demand

increase

which

fuels

Demand -

Broad Demand Drivers

Sources:

Gartner –

G00167790 April 2009

Tier 1 –

DC Supply/Demand 2009 Midyear

Can accord/Adams –

Equity Research June 2009

Global DC Supply and Demand

Increasing DC Demand vs. Supply

Applications

Industries

Increasing demand increases results |

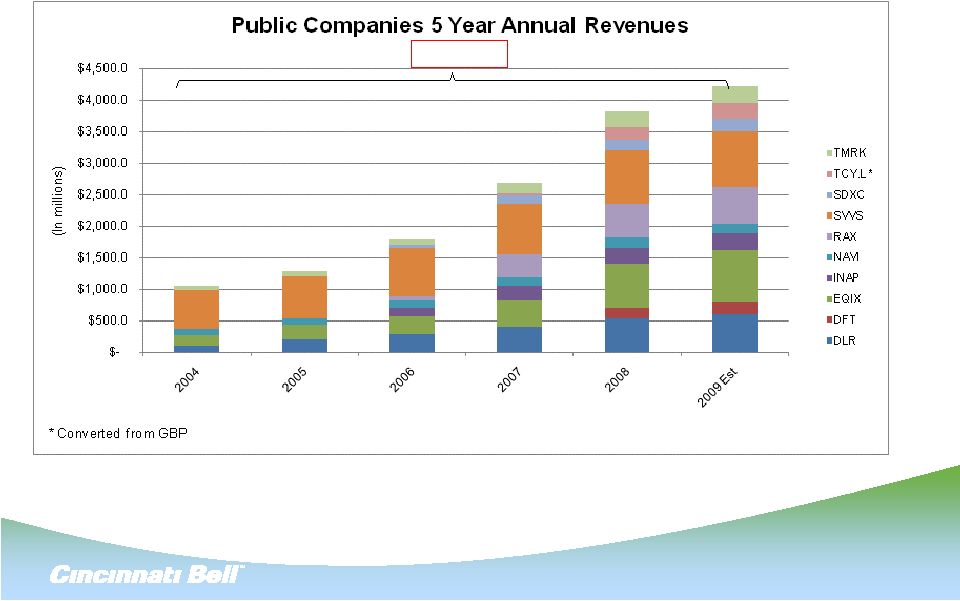

7

Competitors –

Competitors –

Total Revenue less than $5 Billion

Total Revenue less than $5 Billion

Source:

DH

Capital

–

Sept

2009

32% CAGR |

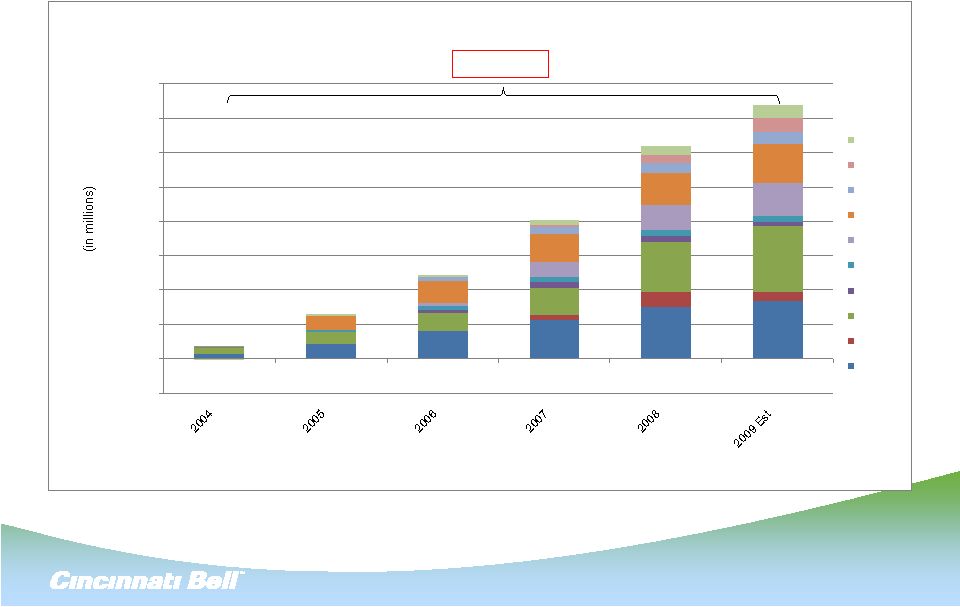

Public Companies 5 Year Annual EBITDA

-$200.0

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

$1,200.0

$1,400.0

$1,600.0

TMRK

TCY.L *

SDXC

SVVS

RAX

NAVI

INAP

EQIX

DFT

DLR

8

Competitors –

Competitors –

Total EBITDA less than $2 Billion

Total EBITDA less than $2 Billion

Source:

DH

Capital

–

Sept

2009

83% CAGR

*Converted from GBP |

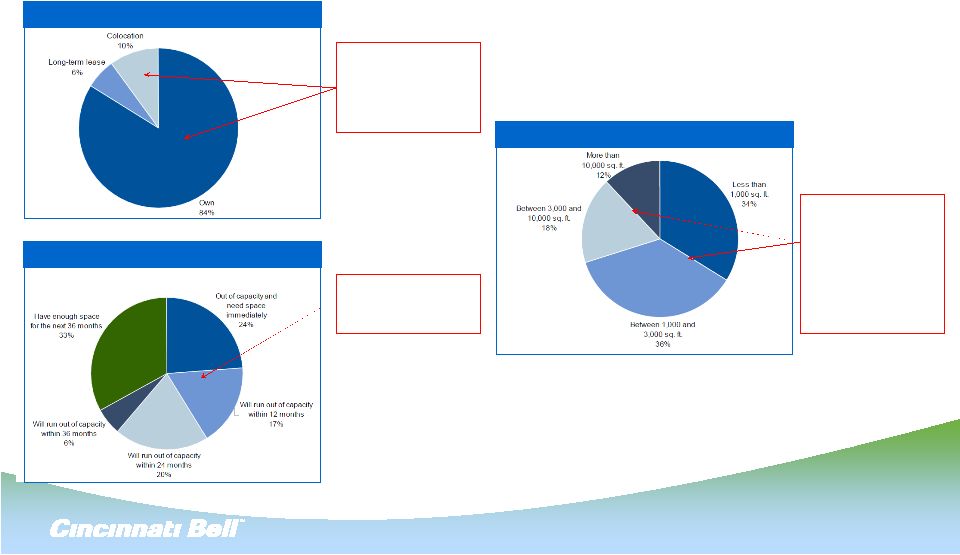

9

Demand –

Only 10% of market is outsourced and

most will run out of space in 3 years

Source: Gartner –

Jan 2009

How do you Obtain DC Space?

What is Your Expected Need?

How much Space will you Need?

Gartner DC Customer

Poll Shows Compelling Statistics

10% of companies

have outsource

relationship

84% currently do not

67% of companies

will need space

within 36 mo’s

70% of companies

will need at least 3K

Sq Ft of Space –

Mid

Range Companies

30% will need

greater than 3K –

Enterprise Range |

10

Leading Data Center Operator With Premium Data Center Facilities

–

Largest

and

most

prominent

Texas-based

carrier-neutral

colocation

provider

to

large

enterprises

–

Dominant

position

in

Texas,

with

7

best-in-class

facilities

in

Houston,

Dallas

and

Austin

markets

–

High

availability

(2N

power infrastructure)

/

high

power

density

(200+

watts

per

sq.

ft.)

Loyal, Reputable Enterprise-Class Customer Base

–

98% of revenue base is recurring with monthly churn ~0.3%

–

Long-term “take-or-pay”

service agreements with average contract 3-5 years

–

Over 220 enterprise customers, including some of world’s largest

companies –

Particular

strength

and

market

share

in

oil

&

gas,

power,

energy

and

financial

verticals

Proven And Disciplined Business Model

–

Strong organic growth with ~50% of new sales coming from existing customers

–

Highly experienced and proven management team with over 100 years of relevant

experience Strong Financial Results

–

Last

Quarter

Annualized

(unaudited)

(1)

:

Revenue

$73M;

Adjusted

EBITDA

$42M

(Adjusted

EBITDA

margin 57%)

–

2009 Revenue of $58M and Adjusted EBITDA of $32M

–

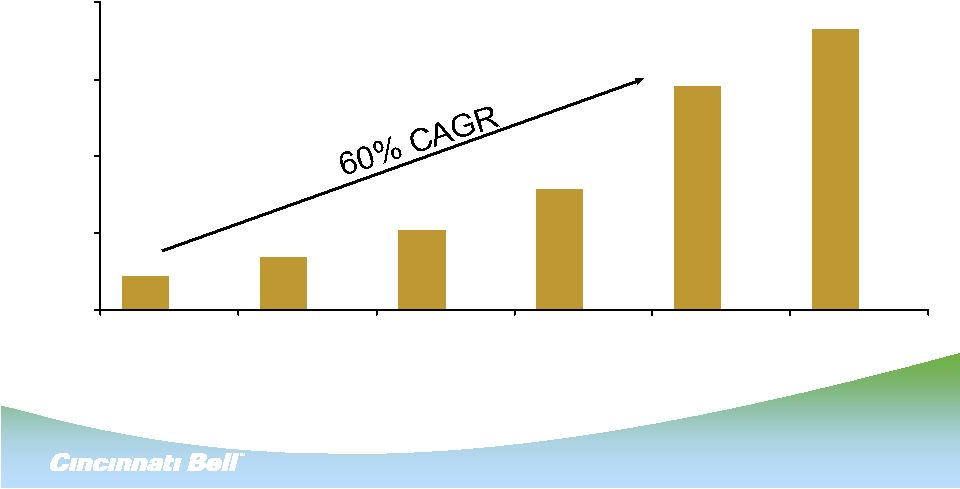

Annual revenue growth rate during past 4 years of approximately 60%

Overview of CyrusOne

(1) For the quarter ended March 31, 2010 |

11

Overview of Key Facilities

7 geographically diverse premium data centers throughout Texas (Houston, Dallas

& Austin) Tier III+ equivalent, SAS 70 Type II compliant data

centers 2N redundant power and carrier-neutral network connections

Engineered for dense power configurations (+200 watts/sq. ft)

Currently, 16.8 megawatts of critical load power capacity is in place and

deployable Hurricane

resistant

with

fire

detection,

protection,

suppression

and

alarms

24 x 365 NOCC and facilities staff provide for high security externally and

internally Modular

builds

–

most

expansions

are

less

than

three

years

old

Current utilization rate of ~76% on space and ~60% on power

Data Center Space (Sq. ft.) as of February 28, 2010

Houston

Dallas

Austin

Total

%

Sold Space

79,000

42,000

3,000

124,000

55%

Built-Out Space (Ready for Sale)

16,000

14,000

9,000

39,000

17%

Space Under Construction

11,000

–

–

11,000

5%

Available for Future Space

(1)

22,000

23,000

6,000

51,000

23%

Total Data Center Space

128,000

79,000

18,000

225,000

100%

Note:

(1) Excludes right of first refusal space |

12

Strong Revenue Growth

$9

$14

$21

$31

$58

$73

$0

$20

$40

$60

$80

2005A

2006A

2007A

2008A

2009A

LQA 3/31/10

($‘s in millions) |

13

13

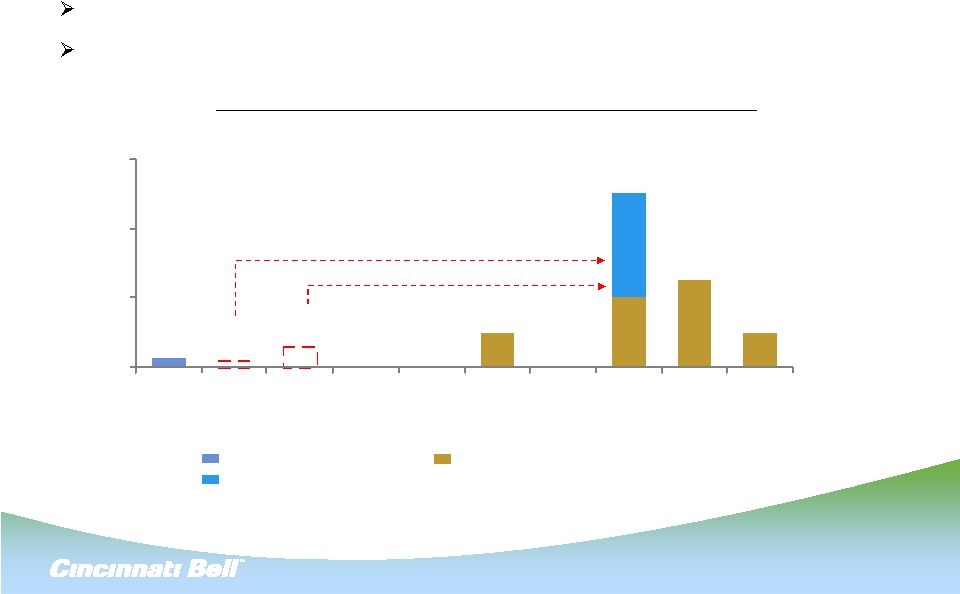

Ample Liquidity and No Near Term Maturities

No significant maturities until 2015

Pro forma LTM leverage increases to approx 5.1x

Note:

(1) Excludes undrawn

revolver and capital leases and other debt

Pro Forma Maturity Profile

(1)

$248

$248

$625

$500

$67

$51

$151

$760

0

500

1,000

1,500

'10

'11

'12

'13

'14

'15

'16

'17

'18Thereafter

($’s in millions)

Debt Maturity

Credit Facility

Receivables Purchase Facility |

14

CyrusOne

Management

Seasoned management team with over 100 years of relevant experience with a proven

track record of growing revenue and EBITDA

Name

Position

Years With CyrusOne

Relevant Experience

David Ferdman

President & CEO

9

17

Blake McLane

SVP, Strategic Development

5

15

Paul Marvin

VP, CFO

3

23

Kenneth Wolverton

VP, Data Center Operations

5

20

Dan Vasquez

VP, Technology

9

30

Total

31

105

Average

6

21 |

15

Customer Base and Contract Terms

Take-or-pay contracts with 3-5 year average

contract life and renewal periods

–

High renewal rates with monthly churn of

~0.3%

Blue chip customer base

–

220+ customers with 5 of the top 10 global

companies

High average monthly recurring revenues per

customer of approx $25K (as of 3/31/10)

% Total Recurring Revenue by Industry Vertical

Representative Customers

18%

11%

9%

4%

12%

6%

8%

13%

19%

Integrated Energy

Energy Utilities

Other

Mining

Technology

Upstream Oil & Gas

Oilfield Services

Financial

Healthcare |

16

Enhancing the Technology Solutions Business

Greater exposure to attractive industry

with significant growth prospects

Increasing geographical footprint beyond

traditional territory

–

Houston, Dallas and Austin

Diversify revenue stream beyond

wireline

and wireless businesses

1Q10 Square Footage

43

82

403

527

0

325

650

Standalone

Pro Forma

(000s)

Utilized

Available

446

609

90%

87%

Utilization %

$, in millions (unaudited)

Pro Forma

Tech Sol

CyrusOne

Combined

LQA 3/31/2010

Revenue

286

$

73

$

360

$

Adj EBITDA

52

42

94

Margin %

18%

57%

26% |

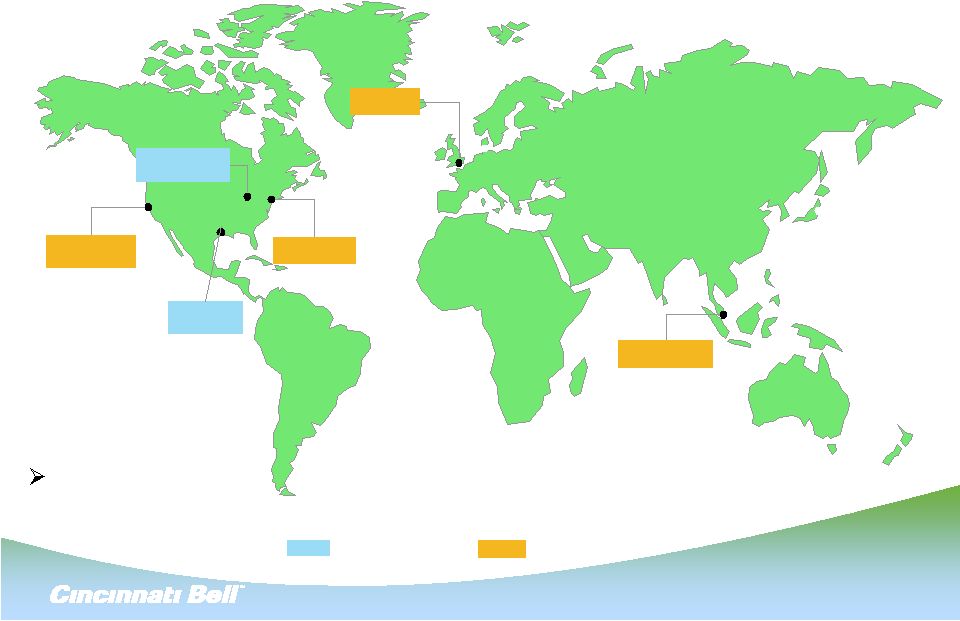

17

Sizable Footprint with Significant Upside Opportunities

Markets Served

Data

Facilities

Center

Top 50

# Firms > 500

Fortune 1000

Entity

Market

(#)

Capacity

MSA Rank

(1)

employees

(1)

Company HQ

(2)

CBTS

Cincinnati, OH

6

426,000

24

1,831

15

CyrusOne

Houston, TX

3

95,000

6

2,795

55

CyrusOne

Dallas, TX

2

56,000

4

3,386

45

CyrusOne

Austin, TX

2

12,000

35

1,644

3

CBTS

Chicago, IL

1

7,000

3

3,794

58

CBTS

Other markets

3

13,000

n/a

-

-

17

609,000

13,450

(1)

Population and rankings as of 2009; firms as of 2006

(2)

Fortune, April 2009

Majority of data center capacity located in the Top 25 Metropolitan

Statistical Areas

Approximately 13,000 firms with more than 500 employees

|

18

Cincinnati

Texas

Singapore

London

New York

Bay Area

Building a Strong Platform to Launch Global Growth

Significant Fortune 500 customers in Cincinnati and Texas markets provide

platform for future customer driven global expansion

Existing Markets

Future Markets |

19

Strategic Summary

Significant demand drivers

CyrusOne

is proven leader in the industry

Significant opportunity in combined enterprise customer base

Achieving scale economies and fueling growth by access to internally

generated capital

Expand relationships with several other Fortune 500 customers

Pro Forma Data Center Customer Base |

20

Question and Answers

*

*

*

* |

21

Appendix –

Non-GAAP Reconciliations

*

*

*

* |

22

Non-GAAP Financial Measure

Use of Non-GAAP Financial Measures

This presentation contains information about adjusted earnings before

interest, taxes, depreciation and amortization (Adjusted EBITDA). This is a

non-GAAP financial measure used by Cincinnati Bell management when

evaluating results of operations. Management believes this measure

also provides users of the financial statements with additional and useful

comparisons of current results of operations with past and future

periods. A non-GAAP financial measure should not be construed as

being more important

than

a

comparable

GAAP

measure.

The

following

slide

reconciles

this non-GAAP measure to a comparable GAAP measure.

Adjusted EBITDA

provides a useful measure of operational performance.

The company defines Adjusted EBITDA as GAAP operating income plus

depreciation, amortization, restructuring charges, asset impairments, and

other special items. Adjusted EBITDA should not be considered as an

alternative

to

comparable

GAAP

measures

of

profitability

and

may

not

be

comparable with the measure as defined by other companies.

|

23

Reconciliation of Operating Income to Adjusted EBITDA

CBTS

CyrusOne

Operating Income (GAAP) for the first quarter 2010

7

$

7

$

Add:

Depreciation and amortization

6

4

Adjusted EBITDA (Non-GAAP) for the first quarter 2010

13

$

11

$

Annualized Adjusted EBITDA based on the first quarter 2010

52

$

42

$

Twelve

months

ended

Dec., 31

2009

CyrusOne

Operating Income (GAAP) for the year ended Dec. 31, 2009

23

$

Add:

Depreciation and amortization

9

Adjusted EBITDA (Non-GAAP) for the year ended Dec. 31, 2009

32

$

Three months ended

March 31, 2010

($ in millions, unaudited) |