Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SENSUS USA INC | d8k.htm |

Deutsche Bank

2010 Alternative Energy, Utilities & Power Conference

May 12, 2010

1

Exhibit 99.1 |

Peter

Mainz-

CEO and President

Jeff Kyle-

CFO

Jim Hilty-

VP, Business Development

2 |

Safe

Harbor Statement The statements made during this presentation, other than

historical facts, are made in reliance on the safe- harbor provisions of

the Private Securities Litigation Reform Act of 1995. These statements involve risks

and uncertainties and are subject to change at any time. These statements reflect

the Company’s current expectations regarding its financial position,

revenues, cash flow and other operating results, business strategy,

financing plans, forecasted trends related to the markets in which the Company operates, legal

proceedings and similar matters. We cannot assure you that the expectations

expressed or implied in these forward-looking statements will turn out

to be accurate. Our actual results could be materially different from our

operations because of various risks. These risks include our susceptibility

to macroeconomic downturns in the United States and abroad, conditions in

the residential, commercial and industrial construction markets and in the

automotive industry, our dependence on new product development and intellectual

property, and our dependence on independent distributors and third-party

contract manufacturers, automotive vehicle production levels and schedules,

our substantial financial leverage, debt service and other cash

requirements, liquidity constraints and risks related to future growth and

expansion. Other important risk factors that could cause actual events or

results to differ from those contained or implied in

the forward-looking statements include, without limitation, our ability to

integrate acquired companies, general economic and business conditions,

competition, adverse changes in the regulatory or legislative environment in

which we operate, customer cancellations and other factors beyond the Company’s control.

We encourage you to review our annual report on Form 10-K, which discusses in

greater detail our results of operations for the most recently completed

fiscal year and consider the risks that relate to any of our

forward-looking statements.

3 |

Experience

Over a century of experience in providing advanced technologies to utility industry

Technology

Advanced technology and communications for data collection, control and metering

Global

Global footprint on five continents with operations and activities in many countries

Proven

4

A leader in innovative technology solutions that enable intelligent

use and conservation of critical energy and water resources.

Proven technology with 7 Million SmartPoint™ devices deployed at over 225

utilities |

About

Sensus •

Record $866 million of Net Sales

in FY2010; 9% 5 yr. CAGR

•

Record $128 million Adjusted

EBITDA*; 14.8% margin*

•

A market leader in the

•

NA Smart Grid market

•

Global Water market

•

NA Gas market

•

Nearly 4,000 employees

worldwide

•

Headquarters in Raleigh, N.C.

* See Appendix: Non-GAAP Measures

5 |

Market Environment

6 |

Today’s Reality

•

Energy and water -

under pressure

•

Utilities and consumers -

under pressure

•

Politicians and regulators -

under pressure

•

Aging infrastructure -

upgrade

•

Demand growth certain -

local and global

•

Electric cars, renewable/distributed generation

•

Need for control, conservation, cost efficiency

7 |

•

Technology is here, affordable to deliver

control, conservation, cost efficiency

•

Government seeding investments:

–

$787 billion ARRA stimulus package in US

–

Not limited to the US

•

Risk management is key

The Opportunities

8 |

Technology Transition Is Underway

•

Transition to AMI & Smart

Meters is underway

•

165 million (54%) of the

estimated 305 million

installed meters in NA have

been converted to some type

of automated metering

•

Early AMR installations must

be replaced to make them

AMI/Smart Grid compatible

•

2.7 billion global meter

installed base

Source:

“The Scott AMR Report: AMR Deployments in North America, 4th Quarter

2009”, IMS Research “The World Market for Utility Meters

– 2009 Edition”

and Management estimates.

Global Meter Installed Base (units in millions)

1,277

976

442

2,695

9 |

Our

communication platform is dedicated, reliable, secure –

Minimum infrastructure; FCC licensed protected radio spectrum

–

Standards compliant; Upgradeable in place, over-the-air

Our SmartPoint™

devices are field proven…at scale

–

7 million installed & communicating over the last 3 years

–

2 million for Southern Company

–

225 individual projects electric, water, gas & combination utilities

Our solid track record

–

Long history and experience with global utilities

–

Leading NA smart grid market position

–

Leading global water market position

–

Solid and proven business model

–

Global footprint

–

Commitment to technology innovation and R&D investment

Sensus

Advantages

10 |

Electric Vehicles

Netmetering &

Distributed Storage

Charging Station

Distributed

Generation

(Wind/Solar/Other)

Meters

Electricity / Water / Gas

Demand Response

Programs

Programmable Thermostats

Water Heaters & Switches

Distribution

Automation

(Substation Equipment)

Utility

Backend

Sensus Smart Grid Solution

11 |

Building the Smart Grid…Today

•

225 Smart Grid projects completed

or in-process

•

37 States

•

2 Canadian Provinces

•

2 European countries

•

7 million SmartPoint™

devices

installed

•

11 million SmartPoint™

devices

when all current projects complete

12 |

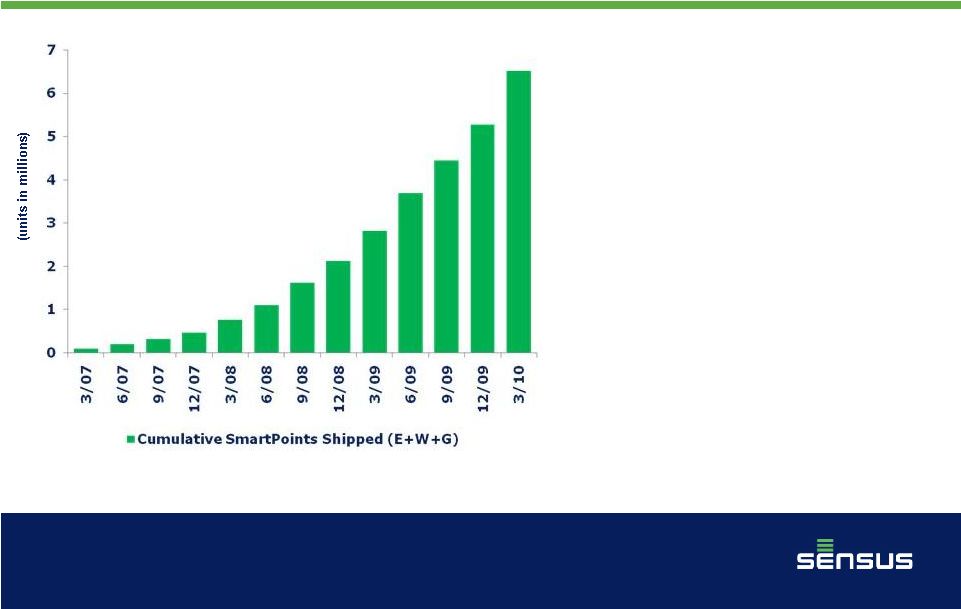

Sensus

SmartPoint™Deployments

•

Dramatic growth in electric

Sensus

SmartPoint

TM

device

deployments

•

Electric growth driven by 2-way

Smart Grid deployments, not

basic AMR

•

Electric AMI market share

increased from 3% to 23% in

two years

•

Water market transitioning from

basic AMR to 2-way smart

metering

Source:

The

Scott

Report:

AMR

Deployments

in

North

America

and

Sensus

13 |

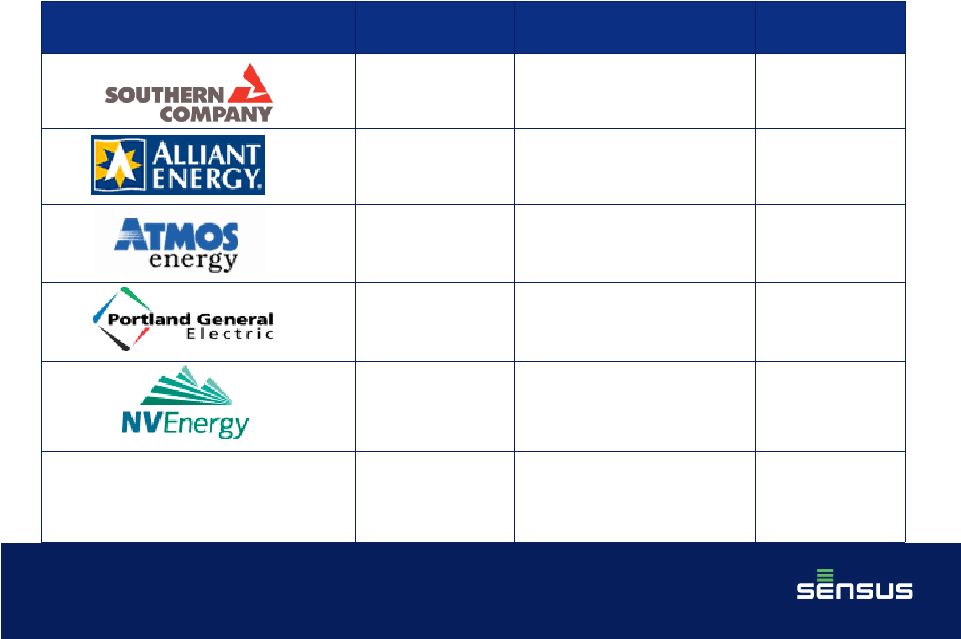

Major

Utilities Selecting Sensus Utilities

Customers

Served

AMI Endpoints

Duration

4.3 million

4.3 million Electric

15 years

1.4 million

1.0 million Electric

0.4 million Gas

15 years

3.0 million

0.3 million Gas

20 years

0.9 million

0.9 million Electric

12 years

2.4 million

1.3 million Electric

0.2 million Gas

20 years

London Hydro

Smart Grid Consortium

Ontario,

Canada

(representing 35 utilities)

1.8 million

1.2 million Electric

15 years

14 |

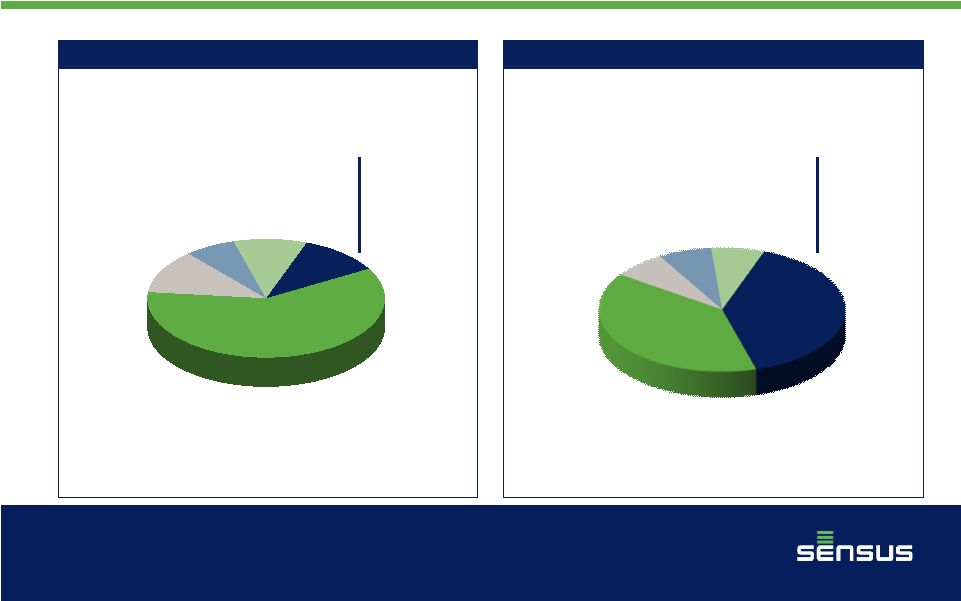

A

Global Water Metering Leader Global Market

Market Size: $2.3 billion

•

Scarcity of water and conservation

initiatives are global factors

•

Key markets of North America (22%

share) and Europe (25% share) are driven

by water meter replacement programs

•

Technology is a driver both for residential

and commercial & industrial applications

–

2-Way water communications network

–

iPERL™

water management device

•

Global market coverage

Source:

IMS Research Report 2008; management estimates.

Note:

Market shares based on revenue.

15

16% |

Financial Overview

16 |

Fiscal Year End March 31

(US$ in millions)

FY 2009

FY 2010

Percent

Change

Net Sales

$792

$866

+ 9.3%

Gross Profit

$199

$247

+ 24.1%

Gross Profit %

25.1%

28.5%

R&D Investment / Net Sales %

3.9%

4.8%

Adjusted EBITDA *

$102

$128

+ 25.5%

Adjusted EBITDA % *

12.9%

14.8%

Backlog

$124

$134

+ 8.1%

Average Sales Cycle (days)**

26

15

+ 42.3%

Financial Highlights

* See Appendix: Non-GAAP Measures

** Sales Cycle = Days Sales + Days Inventory -

Days Payable

17 |

Water Metering

39%

Gas Metering

7%

Precision

Die Casting

7%

Clamps &

Couplings

7%

Clamps & Couplings

10%

Precision

Die Casting

7%

Gas Metering

12%

Water Metering

60%

Evolution of Net Sales

Fiscal Year 2004 Net Sales

Fiscal Year 2010 Net Sales

Conservation Solutions

11%

$59M

Conservation Solutions

40%

$348M up 490%

Net Sales: $529M

Net Sales: $866M

(Fiscal year ended March 31)

18 |

Global

Reach Over 40 facilities on five continents and nearly 4,000 people

Text

$611M

$15M

$28M

$169M

$43M

19

Net Sales by Geography |

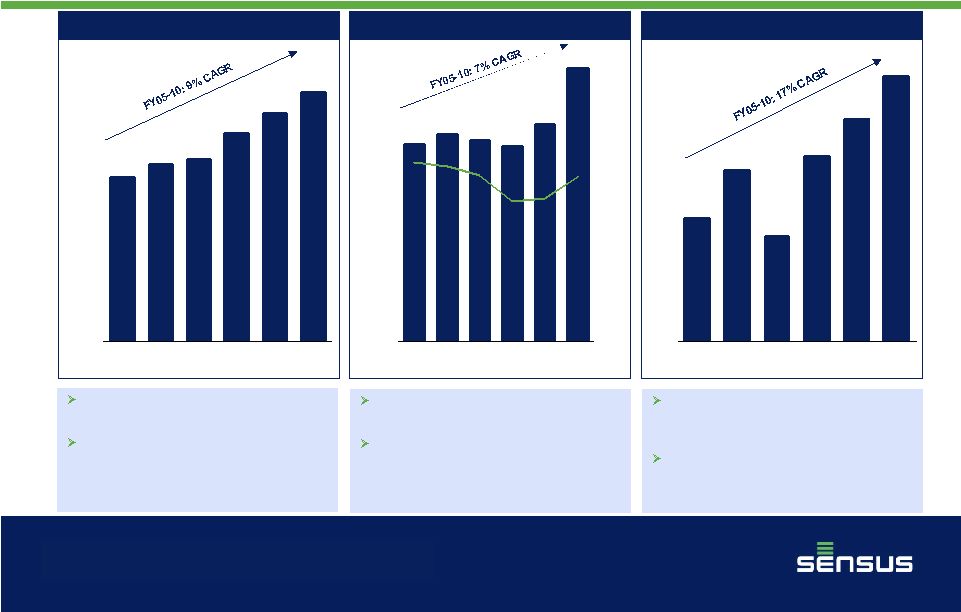

$92

$97

$94

$91

$102

$128

16%

16%

15%

13%

13%

15%

0%

5%

10%

15%

20%

25%

$0

$20

$40

$60

$80

$100

$120

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

$34

$47

$29

$51

$61

$73

$0

$10

$20

$30

$40

$50

$60

$70

$80

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

$572

$614

$631

$722

$792

$866

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

FY

2005

FY

2006

FY

2007

FY

2008

FY

2009

FY

2010

Strong Financial Track Record

Net Sales

(1)

Net cash provided by operating activities as reported in the

Company SEC filings.

Adjusted EBITDA margins improving as

leverage and scale drive operating results.

R&D investment rate increase approximately

25% from 2008 levels to 4.8% of net sales as

technology is introduced across the Utility

Infrastructure Systems product portfolios.

2008

Sensus

launches

FlexNet™

systems

and enters AMI Electric markets.

2009 revenue traction attained as market

share expands rapidly to 23% with 7 million

SmartPoint™

devices shipped within just over

2 years.

Fiscal Year Ended March 31 (US$ in millions)

Adjusted EBITDA *

Operating Cash Flow

(1)

Continued drive on balance sheet efficiency

through working capital initiatives. Days sales

cycle improved over 100% since 2008.

Maintained investments in infrastructure and

software to support market strategies and

commitments.

* See Appendix: Non-GAAP Measures

20 |

Sensus

is “Smart Grid-Ready”

Today

•

Financially strong provider of time-tested technology and

communications to global water, gas and electric utilities

•

No matter what the alternative energy source is, it must be measured,

managed and controlled

•

Increasing water scarcity will drive efficiency and conservation

•

“Future-proof,”

flexible and proven AMI/Smart Grid solutions

•

Cover all types of utilities, population densities and terrain

•

7 million Sensus

SmartPoint™

devices installed to date

•

Our Goal: Sensus

in every home and business

21 |

What

Does Success Look Like? •

Proven technology solutions and

ongoing innovation

•

Trusted partner whose system

flexibility and ongoing innovations

reduce risk

•

Cost efficiency

•

Execution

22 |

Success Looks Like Sensus!

23 |

Thank You

For more information visit: www.sensus.com

24 |

Appendices

25 |

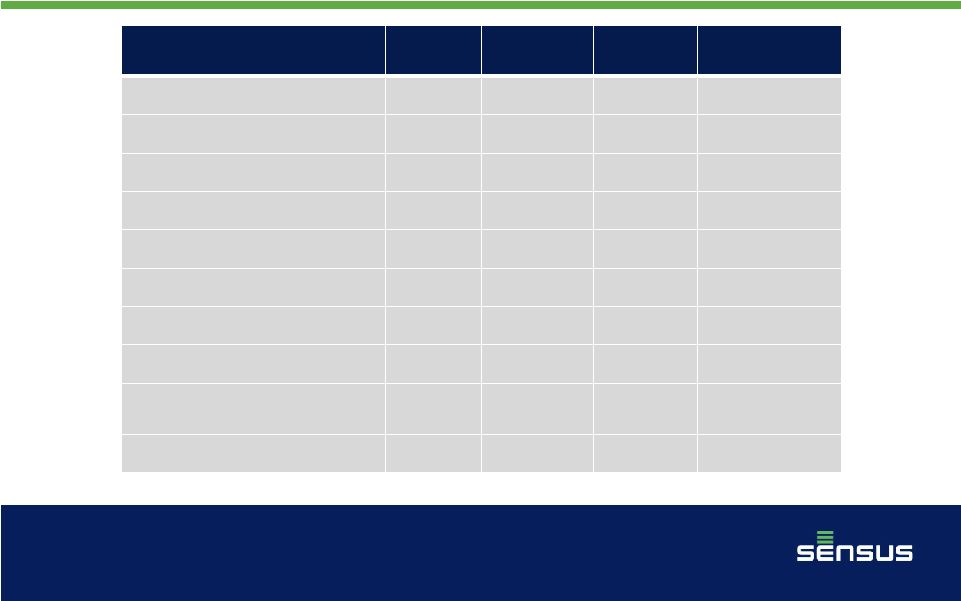

Appendix: Financial Position

Fiscal Year End March 31

(US$ in millions )

FY 2008

FY 2009

FY 2010

FY % of

Capitalization

Cash

$ 38

$ 38

$ 59

Short-term loans

$ 6

$ 5

$ 5

1%

Term loans

$174

$159

$186

26%

Sr. Subordinated Notes

$275

$275

$275

38%

Total Debt

$455

$439

$466

65%

Paid-in Capital

$243

$245

$252

35%

Total Book Capitalization

$698

$684

$718

100%

Adjusted

EBITDA

*

(1)

$ 91

$102

$128

Adjusted EBITDA * / Interest

expense, net

(1)

2.4x

3.1x

2.9x

Net Debt / Adjusted EBITDA*

4.5x

3.7x

3.4x

* See Appendix: Non-GAAP Measures

26

(1)

As defined in the credit facility agreements. |

Appendix: Non-GAAP Measures

•

To enhance the comparability and usefulness of its financial

information, the Company provides certain non-GAAP measures to

describe more fully the results of its underlying business.

Specifically, the Company utilizes the measure of Adjusted EBITDA,

which is defined as follows:

–

Adjusted

EBITDA

is

defined

as

consolidated

earnings

before

interest expense, depreciation and amortization, and income

taxes plus (a) restructuring costs, (b) management fees and (c)

acquisition-related costs, and adjusted for other nonrecurring

items.

•

Refer to the Company’s press release on Form 8-K dated May 7,

2010 for further discussion of non-GAAP measures.

27 |

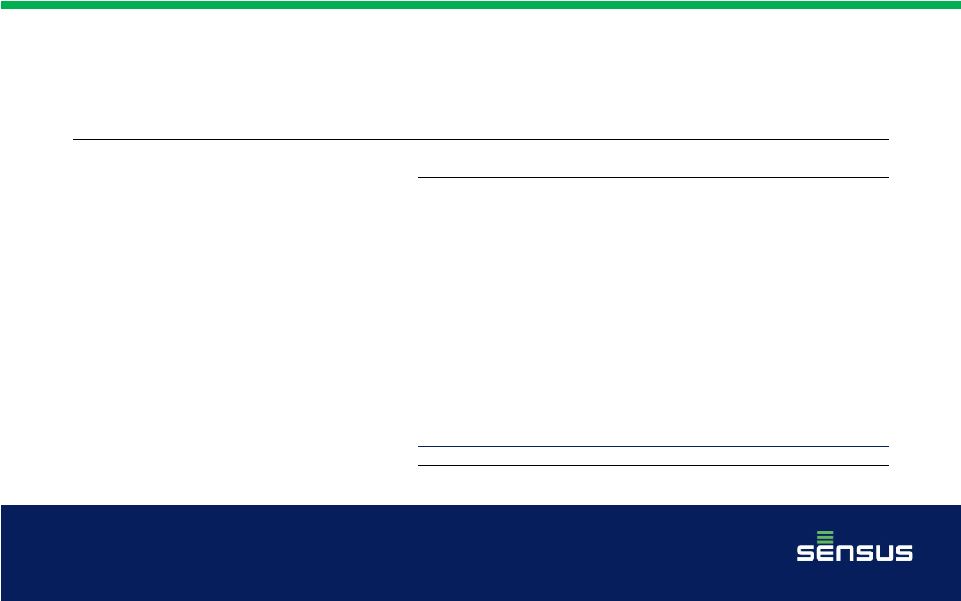

Appendix: Non-GAAP Measures

A reconciliation of Adjusted EBITDA to consolidated net loss follows:

FY

FY

FY

FY

FY

FY

Ended

Ended

Ended

Ended

Ended

Ended

($ in millions)

3/31/2010

3/31/2009

3/31/2008

3/31/2007

3/31/2006

3/31/2005

Net sales

$ 865.6 $

791.9 $ 722.0

$ 631.4

$ 613.9

$ 569.8

Adjusted Gross Profit

$ 247.2 $

199.4 $ 186.9

$ 177.7

$ 186.4

$ 170.8

Consolidated net loss

$ (5.0)

$ (16.0)

$ (6.4)

$ (8.4)

$ (3.2)

$ (5.0)

Depreciation and amortization

45.5

46.6

47.7

48.1

42.4

39.8

Interest expense, net

43.6

39.9

41.8

42.4

39.3

36.7

Income tax provision (benefit)

7.7

0.7

(1.4)

0.5

8.2

8.3

Restructuring costs

25.9

9.9

7.0

8.5

7.2

8.1

Management fees

3.3

3.1

2.6

2.6

2.3

2.1

Acquisition-related costs

1.2

-

-

0.1

-

-

Loss on debt extinguishment

5.9

-

-

-

-

-

Other non-recurring items

-

3.3

-

-

1.1

0.9

Goodwill impairment

-

14.4

-

-

-

-

(Gain) loss from discontinued operations

-

-

-

(0.1)

-

0.8

Adjusted EBITDA (excluding discontinued operations)

$ 128.1 $

101.9 $ 91.3

$ 93.7

$ 97.3

$ 91.7

28 |