Attached files

| file | filename |

|---|---|

| EX-32. - LIFE PARTNERS HOLDINGS INC | v184217_ex32.htm |

| EX-21 - LIFE PARTNERS HOLDINGS INC | v184217_ex21.htm |

| EX-3.4 - LIFE PARTNERS HOLDINGS INC | v184217_ex3-4.htm |

| EX-3.1 - LIFE PARTNERS HOLDINGS INC | v184217_ex3-1.htm |

| EX-3.3 - LIFE PARTNERS HOLDINGS INC | v184217_ex3-3.htm |

| EX-4.1 - LIFE PARTNERS HOLDINGS INC | v184217_ex4-1.htm |

| EX-3.2 - LIFE PARTNERS HOLDINGS INC | v184217_ex3-2.htm |

| EX-31.2 - LIFE PARTNERS HOLDINGS INC | v184217_ex31-2.htm |

| EX-31.1 - LIFE PARTNERS HOLDINGS INC | v184217_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

x

|

Annual

Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of

1934 (the “Exchange Act”)

|

For the

fiscal year ended: February 28, 2010

Commission

File Number: 0-7900

LIFE

PARTNERS HOLDINGS, INC.

(Name of

registrant in its charter)

|

Texas

(State

of incorporation)

|

74-2962475

(I.R.S.

Employer ID no.)

|

|

204

Woodhew Drive

Waco,

Texas

(Address of Principal Executive

Offices)

|

76712

(Zip

Code)

|

Registrant’s

telephone number, including area code: 254-751-7797

Securities

registered pursuant to Section 12(b) of the Exchange Act:

|

Common

Stock (par value $0.01 per share)

(Title

of Class)

|

NASDAQ

Global Select

(Name

of exchange on which registered)

|

Securities

registered pursuant to Section 12(g) of the Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the

Securities

Act. Yes

¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or

Section 15(d) of the Exchange Act. ¨

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or

for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for at least the past 90

days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files).

Yes ¨

No x

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer”, “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer x

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company ¨

|

Indicated

by check mark whether the registrant is a shell company (as defined in

Section 12b-2 of the Exchange Act).

Yes ¨ No

x

The

aggregate market value of the Common Stock held by non-affiliates of the

Registrant as of August 31, 2009, was $124,733,911, based on the last

reported sale price of $17.14 (adjusted for 2008 and 2009 splits) on that date

on the NASDAQ Global Select Market.

Shares of

Common Stock, $.01 par value, outstanding as of May 1, 2010: 14,859,016

(15,024,354 issued and outstanding less 165,338 treasury shares)

DOCUMENTS

INCORPORATED BY REFERENCE

Our

definitive proxy statement in connection with the Annual Meeting of Shareholders

to be filed with the Commission pursuant to Regulation 14A, is incorporated by

reference into Part III of this report.

2010

Form 10-K Annual Report

Table

of Contents

|

Item

|

Page No.

|

||

|

Part

I

|

|||

|

Special

Note Regarding Forward-Looking Statements

|

3

|

||

|

1.

|

Business

|

3

|

|

|

1A.

|

Risk

Factors

|

9

|

|

|

1B.

|

Unresolved

Staff Comments

|

12

|

|

|

2.

|

Properties

|

12

|

|

|

3.

|

Legal

Proceedings

|

12

|

|

|

4.

|

(Removed

and Reserved)

|

||

|

Part

II

|

|||

|

5.

|

Market

for Our Common Stock, Related Shareholder Matters and Our Purchases of Our

Equity Securities

|

13

|

|

|

6.

|

Selected

Financial Data

|

15

|

|

|

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

16

|

|

|

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

23

|

|

|

8.

|

Financial

Statements and Supplementary Data

|

24

|

|

|

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosures

|

24

|

|

|

9A.

|

Controls

and Procedures

|

25

|

|

|

9B.

|

Other

Information

|

28

|

|

|

Part

III

|

|||

|

10.

|

Directors,

Executive Officers and Corporate Governance

|

28

|

|

|

11.

|

Executive

Compensation

|

28

|

|

|

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Shareholder Matters

|

28

|

|

|

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

28

|

|

|

14.

|

Principal

Accountant Fees and Services

|

28

|

|

|

Part

IV

|

|||

|

15.

|

Exhibits

and Financial Statement Schedules

|

28

|

|

|

Signatures

|

29

|

||

|

Table

of Contents to Consolidated Financial Statements and Notes

|

30

|

||

|

Exhibit

Index

|

55

|

2

PART

I

Special

Note Regarding Forward-Looking Statements

Certain

statements in this annual report on Form 10-K for the fiscal year ended

February 28, 2010 (“fiscal 2010”), concerning our

business prospects or future financial performance, anticipated revenues,

expenses, profitability or other financial items, estimates as to size, growth

in or projected revenues from the life settlement market, developments in

industry regulations and the application of such regulations, and our

strategies, plans and objectives, together with other statements that are not

historical facts, are “forward-looking statements” as that term is defined under

the federal securities laws. All of these forward-looking statements

are based on information available to us on the date hereof, and we assume no

obligation to update any such forward-looking

statements. Forward-looking statements involve a number of risks,

uncertainties, and other factors, which could cause actual results to differ

materially from those stated in such statements. Factors that could

cause or contribute to such differences include, but are not limited to, those

discussed in this annual report on Form 10-K, particularly in the sections

entitled “Item 1A – Risk Factors” and “Item 7 – Management’s

Discussion and Analysis of Financial Condition and Results of

Operations”. We do not undertake any obligation to release publicly

any revisions to such forward-looking statements to reflect events or

uncertainties after the date hereof or reflect the occurrence of unanticipated

events.

Item

1. Business

Life

Partners

General. Life

Partners Holdings, Inc. (“we” or “Life Partners”) is a

specialty financial services company and the parent company of Life Partners,

Inc. (“LPI”). LPI is the

oldest and one of the most active companies in the United States engaged in the

secondary market for life insurance known generally as “life

settlements”. LPI facilitates the sale of life settlements between

sellers and purchasers, but does not take possession or control of the

policies. The purchasers acquire the life insurance policies at a

discount to their face value for investment purposes.

The Secondary Market for Life

Insurance Policies. LPI was incorporated in 1991 and has

conducted business under the registered service mark “Life Partners” since

1992. Our operating revenues are derived from fees for facilitating

life settlement transactions. Life settlement transactions involve

the sale of an existing life insurance policy to another party. By

selling the policy, the policyholder receives an immediate cash payment to use

as he or she wishes. The purchaser takes an ownership interest in the

policy at a discount to its face value and receives their ownership interest in

the death benefit under the policy when the insured dies.

We are a

specialty financial services company, providing purchasing services for life

settlements to our client base. We facilitate these transactions by

identifying, examining, and purchasing the policies as agent for the

purchasers. To meet market demand and maximize our value to our

clients, we have made significant investments in proprietary software and

processes that enable us to facilitate a higher volume of transactions while

maintaining our quality controls. Since our inception, we have

facilitated over 107,000 purchaser transactions involving over 6,200 policies

totaling over $2.3 billion in face value. We believe our

experience, infrastructure and intellectual capital provide us a unique market

position and will enable us to maintain sustainable growth within the life

settlement market.

3

We act as

a purchasing agent for life settlement purchasers. In performing

these services, we identify, qualify and purchase policies on behalf of our

clients that match their buying parameters and return

expectations. Because we are obliged to work within these parameters,

we must make offers that are competitive from the seller’s point of view, but

still fit within the buying parameters of our clients. This

success-based compensation formula ensures that we bring value to both parties

to the transaction and that both purchaser and seller are

satisfied. We locate potential policy owners through a network of

life settlement brokers and, to a lesser extent, through insurance, financial

and estate planning professionals, through personal referrals and through

Internet and print media advertising. Brokers are typically

compensated based on a percentage of the face value of the policy sold and this

amount is negotiated between the policyholder and the broker. This

compensation is paid upon the closing of a settlement. Estate

planning professionals and financial planners typically operate on a

fee-for-service basis, which is paid directly by their client. We

have long-term relationships with many of the country’s life settlement brokers

and, for those that we transact business with, believe that these brokers adhere

to applicable regulatory requirements when conducting their

business. Broker referrals accounted for 99% of our total business as

measured by policy face value in each of fiscal 2010, 2009 and

2008. In fiscal 2010, only one broker made referrals whose policy

face values represented over 10% of our total business. Referrals

from this broker accounted for 15% of our total business. In fiscal

2009, we had three brokers with 10% or more of our total business and they

accounted for 44% of our total business. In fiscal 2008, we had three

brokers with 10% or more of our total business and they accounted for 69% of our

total business. We are encountering more brokers in the market and believe

that greater competition among brokers has reduced our supply concentration

risk.

We

categorize our purchasers of life settlements as either institutional or

retail. Institutional purchasers are typically investment funds

designed to acquire and hold life settlements. From the beginning of

fiscal 2008, we have acted as the purchasing agent for one institutional

fund, in which we have a $6.5 million investment as of February 28,

2010. The institutional fund has acquired policies through us having

a face value of $278 million. The institutional fund accounted

for 1%, 8% and 7% of our total revenues in fiscal 2010, 2009 and 2008,

respectively.

We have

pursued the sponsorship of two funds ourselves. In fiscal 2008, we

initiated a fund to raise from $20 million to $100 million to acquire policies,

but were not successful in obtaining sufficient subscriptions to close the

fund. The fund was structured as a limited partnership and we offered

the interests ourselves and through placing brokers in a private

placement. In fiscal 2010, we initiated a second fund to raise $10

million. This fund is also structured as a limited partnership, and

we are offering the interests ourselves and through placing brokers to a small

number of qualified investor in a private placement. The fund has not

closed and we cannot ensure that we will raise the required

capital. We have pursued the sponsorship of funds believing that

these funds will expand our retail efforts by affording purchasers an

alternative to the current retail model in which purchasers acquire direct

interests in policies. We believe that securities brokers are

accustomed to seeing investment products in a fund structure and their

familiarity with funds structures may increase broker interest. We

also believe the fund structure will aid market penetration by enabling us to

sell in states that treat life settlement transactions as securities, which

limits or blocks our ability to sell in those states.

The

majority of our clients are high net worth individuals, which we refer to as

retail purchasers. Our retail purchasers generally come to us through

a network of financial planners, whom we call licensees. We developed

this network through referrals and have long-standing relationships with most of

these financial planners. Although the financial planners can be

compensated through fee-based consultations paid by the purchaser, we compensate

most of the financial planners based on the amount invested. The

compensation of financial planners is paid in cash upon the closing date of the

transaction.

4

To

purchase a life settlement, a prospective retail purchaser typically submits a

purchaser application containing personal information such as the purchaser’s

name and address as well as affirmative representations establishing the

purchaser as financially sophisticated. A purchaser will also submit

an agency agreement and special power of attorney, which appoints us as a

limited agent of the purchaser to act on his or her behalf in purchasing a life

settlement. Unless specifically waived by a purchaser, the agency

agreement limits our authority to policies issued by an insurance carrier having

an A.M. Best Company rating of B+ or better and to policies beyond their

contestable period (generally two years or older). For most of the

policies that we broker on behalf of our clients, the insureds have a life

expectancy of between 48 months and 60 months, although we can identify policies

with longer life expectancies or other purchasing parameters if requested by our

clients. As we identify and qualify policies, we distribute insurance

and current medical status information on these policies (with the insured’s

name and other identifying information redacted) throughout our financial

planner network. We also make available to each purchaser, through

their financial planner, standard disclosures discussing the nature and risks of

making a life settlement purchase. Purchasers can then, in

consultation with their financial planner or other professionals, select one or

more policies, specify the portion of the policy or policies to be purchased and

submit a reservation electronically. To diversify their positions,

retail purchasers generally buy fractional interests in one or more policies and

not an entire policy, while institutional purchasers tend to purchase entire

policies. Prior to reserving an interest, purchasers mail or wire

funds for acquisition of the policies to an escrow agent and mail or

electronically deliver a policy funding agreement to us. The policy

funding agreement identifies the policy or policies to be purchased, the

acquisition price, the administrative services provided, and the escrow

arrangements for receipt and disbursement of funds.

For the

protection of the seller’s ownership interest and the purchaser’s monetary

interest, all transactions are closed through an outside escrow

agent. The escrow agent will close a purchase when it receives from

each purchaser executed policy funding agreements and the acquisition price for

a policy, verifies that the policy is in full force and effect and that no

security interest has attached to the policy, and receives a transfer of policy

ownership form acknowledged by the insurance company. The escrow

agent then pays the seller the offer price (net of fees and

costs). We send confirmation of the transaction to the purchaser as

well as a copy of the assignment documents.

After

closing the transaction, we generally hold title to the policy as nominee for

the purchaser. Responsibility for policy premium costs passes to the

purchaser, who typically funds the premium costs from the deposits with the

escrow agent. We strictly maintain the confidentiality of an

insured’s personal information in accordance with regulations promulgated by the

Texas Department of Insurance and other applicable state laws. A

purchaser will receive evidence of the transfer of ownership of the policy

(which identifies the insured), but will not receive contact information for the

insured, which is available only to licensed life settlement companies like

us. We perform certain ministerial functions, such as monitoring the

insured’s health status and notifying the escrow agent upon the insured’s

death. We also notify purchasers in instances in which the premium

escrow account has been exhausted so that the purchaser can replenish the

account to keep the policy from lapsing.

Conflicts of

Interest. Our business model can pose conflicts of interest,

which may arise when we purchase policies for our own account while purchasing

policies for others. Conflicts could arise between retail and

institutional purchasers if we were to favor one over the other. A

financial incentive to favor one over the other could exist if the compensation

that we earn is higher with one type of purchaser than the other or, in the case

of institutional purchasers, if we have a financial interest in the

institutional purchaser. We have pursued the sponsorship of funds

that would acquire policies. If we were to close a sponsored fund,

the fund would purchase interests in policies alongside with and on similar

terms as our retail clients and would not have a conflict of

interest. However, it is possible that retail clients and funds might

compete with institutional purchasers for policies and would pose conflicts of

interest.

We

believe that several factors mitigate the conflicts. We work to

ensure the neutral pricing of policies, that is, that policies are priced

according to the value and risk presented. If pricing is neutral,

there is no financial reason for favoring one policy over

another. One factor in policy pricing is assessing life expectancy,

which is determined in our model by an independent medical

doctor. Once we have the life expectancy, we apply a pricing formula

to determine the purchase price. Further, most sellers are

represented by experienced brokers, who know the market for

settlements. Another factor that reduces the impact of conflicts is

that policies are typically sold in pieces rather than in

whole. Thus, several purchasers participate side-by-side in a single

policy, which diminishes the risk that one purchaser might be favored over

another purchaser. The methods by which purchasers select policies

also reduce the potential for conflicts. Retail purchasers choose the

policies in which they wish to participate from the available policies posted on

our website. Institutional purchasers will typically set the

parameters of policies that they wish to acquire.

5

We also

avoid conflicts since we rarely compete against our retail or institutional

purchasers in acquiring policies. We purchased the bulk of the

policies for our own account as part of settlement agreements or tertiary

purchases, in which we acquired previously purchased policies because they were

no longer suitable for the purchasers. These were not opportunities

offered to our retail or institutional purchasers and thus we were not competing

with our purchasers. In the fiscal years 2010, 2009 and 2008, we

acquired 974 interests in policies for our own account, all but one of which was

a part of a settlement or a tertiary purchase. In the fiscal years

2010, 2009 and 2008, we also invested in one institutional fund, for which we

served as a purchasing agent. The fund has completed its acquisitions

of policies and is no longer purchasing. We supplied approximately

39% of the policies purchased by the fund, and its purchases from us were never

more than 8% of our revenues in any one year. Our compensation from

the fund was less than the compensation we typically earned on retail

purchases.

The Life Settlement Market and

Competition. Life settlements provide a secondary market for

existing life insurance policies that the owner no longer needs or wants and

that insure a person whose life expectancy can be reasonably

estimated. From the early 2000s through 2007, the market for life

settlements grew substantially from both the demand and the supply sides of the

transaction with an increase in the average face amount of policies presented

for sale. The larger amount of capital required to meet the higher

acquisition costs of the average life settlement led us to seek relationships

with institutional purchasers in addition to expanding our base of retail

clients and increasing the minimum investment amount. We have devoted

substantial marketing and client development resources to attracting both

individual and institutional purchasers, both directly and through their

advisors. The number of retail purchasers and the amount of their

average investment has increased over the last three fiscal years, providing us

with a significant market advantage by enabling us to reach the diversification

goals of our clients as well as giving us greater flexibility in purchasing

policies. Institutional purchasers have played a less significant

role in our business. In the fiscal years 2010, 2009 and 2008, we had

one institutional purchaser that accounted for 1%, 8%, and 7% of our revenues,

respectively. We believe that this market segment has potential,

however, and continue to seek institutional opportunities.

In a 2009

report, the insurance research group, Conning & Co. (the “Conning report”), estimated

that the life settlement industry completed $12 billion in face value of

transactions in 2007 and $11.8 billion in 2008. Based on our own

research from other providers, publicly reported data and estimates based on

historical data, we estimate the total amount of face value of transactions

completed by the life settlement industry in 2009 was $7.3

billion. The Conning report attributed the decline in market size

from 2007 to 2008 to the disruption of the credit markets in 2008. As

noted in the Conning report, estimates of market size are only approximations,

since precise market data is not available publicly. We are the only

publicly held company operating exclusively in this market. Some

competitors file publicly available transaction activity with state insurance

commissions. However, not every company may report its transactions

and the accuracy of the information relies on the veracity of the filings made

by each company.

Based on

our estimate of a $7.3 billion market in 2009, our market share is approximately

7%. Although the overall life settlement market contracted, which may

be attributable to the distress of the credit markets, our business model does

not use leverage and thus our market share grew from 6% in 2008 to 7% in 2009 as

there was less competition for quality policies. We believe the life

settlement market is highly diversified among market participants. We

estimate that our largest industry competitor currently has about 19% of the

total market share. Excluding ourselves and this large competitor,

the remaining 74% of the market is divided among approximately 30 other market

participants, of which only five have between 5 and 10% each of the total market

share. Unlike some of our competitors, which rely on the credit

markets and may have more restrictive purchasing parameters or a single provider

of investment capital, our retail oriented model has a broad base of over 25,000

clients. We believe this diversified model makes us more competitive

in the market and provides us with greater funding flexibility. We

also believe that this model provides a stronger platform for our sustainable

growth as a company. Markets are segmented by length of life

expectancy and policy face value. The amount of competition in these

markets varies according to the demand for such policies.

6

While we

believe the life settlement market overall will remain flat or increase slightly

during the next year, we believe our market share will continue to increase due

to a number of factors. First, market demand from our purchaser base

remains strong for these transactions. Unlike much of our

competition, we are not adversely affected by any restraint on

credit. The continued general economic uncertainty has led many

purchasers to seek alternative investment strategies that diversify their

portfolios and avoid economically sensitive investments. Life

settlements provide diversification and produce returns that are not correlated

to stock and bond market fluctuations, depressed real estate markets or the

currently uncertain credit market. We believe that interest from

retail and institutional purchasers will grow throughout the next fiscal

year.

A second

contributing factor as to why we believe our share of the life settlement market

may continue to increase is the solid supply of higher face value

policies. Because of increased education among financial

professionals and advisors, there is a growing awareness among policy owners of

the value that can be realized from life settlements. The growing

awareness has expanded the supply of eligible policies, especially policies with

higher face values. We believe much of our increased business over

the last three years is due to the steady supply of higher face value policies,

and we believe this trend will continue. We intend to increase our

market share by growing our client base and utilizing our substantial

intellectual capital and infrastructure to provide superior value to both

policyholders and our clients. Among our core competencies is the

ability to process and close transactions quickly and more efficiently than our

competitors. We believe our ability to deploy our assets into the

market in this manner will enable us to continue to increase our market

share.

Limited

access to capital, the insurance industry’s addition of pre-death cash benefits,

law enforcement pressure on companies operating illegally, and increasing

government regulation have contributed to a stabilization in the number and

sophistication of life settlement companies, both those purchasing for their own

accounts and those, like us, who act as agents for our clients. We

estimate the number of life settlement companies that are consistently active in

purchasing for their own account or as agents for purchasers has declined to

seven. We believe this reduction in the number of competitors results

from the withdrawal of companies that relied heavily on leverage and a single or

preferred client model in the face of tightened credit markets. In

contrast, our business model uses no leverage and is a multi-client

model. As credit markets tightened in 2008 and 2009, the number of

companies remaining in the market allowed us to see more policies and to be more

selective in the policies we chose. As a result, we were able to

realize higher revenues per settlement (policy) in each of fiscal 2008, 2009,

and 2010.

Although

we are one of the larger life settlement companies (based on face value of

policies settled), competition within the life settlement market is active among

the few companies in this sector and we will continue to experience competition

for qualified policies to purchase. This competition will have an

effect on the prices we pay for policies, the amount of brokerage and referral

fees we pay, and the prices we set for the acquisition of

policies. We believe the overall market for life settlements will

increase as more seniors become aware of their option to liquidate an unwanted

policy through a life settlement. In light of our experience in the

market and our estimates concerning competition and supply and demand for

policies, we believe our total business volume for life settlements will

increase in fiscal 2011.

The

following table shows the number of life settlement contracts (policies) we have

transacted, the aggregate face values and purchase prices of those contracts,

and the revenues we derived, for our last three fiscal years:

7

|

Fiscal 2010

|

Fiscal 2009

|

Fiscal 2008

|

||||||||||

|

Number

of settlements (policies)

|

201 | 196 | 200 | |||||||||

|

Face

value of policies

|

$ | 590,189,000 | $ | 693,715,000 | $ | 415,293,000 | ||||||

|

Average

revenue per settlement

|

$ | 562,171 | $ | 528,645 | $ | 363,046 | ||||||

|

Total

net revenues derived (1)

|

$ | 62,019,160 | $ | 54,420,577 | $ | 36,822,734 | ||||||

(1) The

revenues derived are exclusive of brokerage and referral

fees.

Industry

Regulation and Taxation

General. When the

life settlement market was first established, it was sparsely

regulated. Due in part to well-publicized abuses within the industry,

the federal government and various states moved to regulate the market in the

mid-1990s. These regulations generally took two forms. One

sought to apply consumer protection-type regulations to the

market. This application was designed to protect policyholders and

purchasers. Another sought to apply securities regulations to the

market, in an effort to protect purchasers. Various states have also

used their insurance regulations to guard against insurance fraud within the

industry.

Consumer Protection

Licensing. The consumer protection-type regulations arose

largely from the draft of a model law and regulations promulgated by the

National Association of Insurance Commissioners (“NAIC”). At least

40 states have now adopted some version of this model law or another form of

regulation governing life settlement companies in some way. These

laws generally require the licensing of providers and brokers, require the

filing and approval of settlement agreements and disclosure statements, describe

the content of disclosures that must be made to insureds and sellers, describe

various periodic reporting requirements for settlement companies and prohibit

certain business practices deemed to be abusive. Some of these laws

fix minimum payment levels that a purchaser must pay a selling insured based on

the insured’s life expectancy. The minimum payment requirements

generally apply when the insured is terminally ill or has a short life

expectancy (42 months or less). In our settlement transactions, we

typically deal with policies having life expectancies of 48 months or longer and

thus these requirements do not usually affect our settlement

transactions.

Licensing. Many

states require the licensing of life settlement brokers and providers, mandate

disclosures to sellers or purchasers or both, require periodic reporting

requirements, and set forth prohibited business practices. We are

licensed as a viatical and life settlement company by the Texas Department of

Insurance. Under the Texas requirements, we must file our transaction

documents with the state for approval, make certain disclosures to insureds and

sellers, offer a 15-day right of rescission to the seller, file certain annual

reports with the state, and abstain from unfair business

practices. Because all of our transactions are completed in Texas,

the Department of Insurance has jurisdiction to investigate complaints from any

insured or seller, regardless of the state in which that insured or seller

lives. Consequently, we believe Texas offers protection to all

insureds or policyholders that we transact business with (including those living

in states that have no licensing requirement). However, other states

have their own licensing requirements in order to purchase policies from policy

owners in those states and we comply with those requirements as

well. In addition to Texas, we are licensed to engage in life

settlement transactions with policy owners residing in the following states:

Arkansas, Connecticut, Illinois, Maryland, Mississippi, Nevada, New Jersey,

North Carolina, Oklahoma, Pennsylvania, Tennessee and Virginia. We

also have a license application pending in the state of New

York. Many other states have clearly identified exemptions from

licensing requirements, which permit us to purchase from policy owners in those

states according to those exemptions. Information about us is

available through the Texas Department of Insurance or on its website

at: https://apps.tdi.state.tx.us/pcci/pcci

_show_profile.jsp?tdiNum=8967842&company

Name=Life%20Partners,%20Inc.&sysTypeCode=PA.

8

Securities

Regulations. Some states and the Securities and Exchange

Commission have attempted to treat life settlements as securities under federal

or state securities laws. We have structured our settlement

transactions to reduce the risk that they would be treated as securities under

state or Federal securities law, and the Federal Circuit Court for the District

of Columbia has ruled that our settlement transactions are not securities under

the Federal securities laws. Many state securities laws have

exceptions or registration exemptions that may enable our settlement

transactions in those states. Nonetheless, we have encountered claims

from some states asserting that our transactions are securities under state

law. We have amicably settled these claims and have worked with

regulators to establish clear guidelines for accepting clients from these

states.

We

believe that a combination of consumer protection-type laws and existing

insurance regulations provide an appropriate framework for regulation of the

industry. As a practical matter, the widespread application of

securities laws would burden us and senior Americans attempting to sell their

policies with little or no benefit to purchasers. Each of our

purchasers has represented themselves to be financially sophisticated, high net

worth individuals or institutions, which have considerably less need for the

protections afforded by the securities laws. At this point, due to

the manner in which we structure our settlements and the availability, in some

instances, of exceptions and exemptions under securities laws, such laws have

not limited our business model to a significant extent. But we cannot

give assurance that our business would not be materially and adversely impacted

by securities-based regulation.

Insurance

Regulation. As a life settlement company, we facilitate the

transfer of ownership in life insurance policies, but do not participate in the

issuance of policies. Further, we do not issue any type of

contemporaneous agreement to purchase a policy at the time the policy is

issued. As such, we are not required to be licensed as an insurance

company or insurance broker. We do deal, however, with insurance

companies and professionals in our business and are affected indirectly by the

regulations covering them. The insurance industry is highly

regulated, and these regulations affect us in numerous ways. We must

understand the regulations as they apply to policy terms and provisions and the

entitlement to, and collectability of, policy benefits. We rely upon

the protections against fraudulent conduct that these regulations offer, and we

rely upon the licensing of companies and individuals with whom we do

business.

Employees

As of

February 28, 2010, we had 62 direct employees, none of whom are represented

by a labor union, as well as 6,392 licensees who act as independent contractors

and refer clients to us for the purchase of life settlements. We

continuously review benefits and other matters of interest to our employees and

consider our employee relations to be satisfactory.

More

about Life Partners

Our

executive offices are located at 204 Woodhew Drive, Waco, Texas 76712 and our

telephone number is 254-751-7797. Our corporate information website

is www.lphi.com. We make available without charge our annual report

on Form 10-K, our quarterly reports on Form 10-Q, current reports on

Form 8-K, and amendments to these reports shortly after we file these

reports with the SEC. Our informational website for potential sellers

and purchasers is www.lifepartnersinc.com.

Item

1A. Risk Factors

In

addition to other information in this annual report on Form 10-K, the

following risk factors should be carefully considered in evaluating us and our

business. Such factors significantly affect or could significantly

affect our business, operating results or financial condition. This

annual report on Form 10-K contains forward-looking statements that have

been made pursuant to the provisions of the Private Securities Litigation Reform

Act of 1995. Actual results could differ materially from those

projected in the forward-looking statements as a result of the risk factors set

forth below and elsewhere in this annual report on

Form 10-K.

9

Growth

in the life settlement market may be affected by several factors

Growth of

the life settlement market and our expansion within the market may be affected

by a variety of factors, including:

|

|

·

|

The

inability to identify sufficient numbers of qualified policies to meet

demand;

|

|

|

·

|

The

inability to convince potential sellers of the benefits of life

settlements;

|

|

|

·

|

The

inability to attract sufficient qualified

purchasers;

|

|

|

·

|

Competition

from other life settlement

companies;

|

|

|

·

|

The

occurrence of illegal or abusive business practices resulting in negative

publicity about the market; and

|

|

|

·

|

The

adoption of overly burdensome governmental

regulation.

|

In

addition, the life settlement market may evolve in ways we have not anticipated

and we may be unable to respond in a timely or cost-effective

manner. If the life settlement market fails to grow as quickly as or

in the directions we have anticipated, our business, financial condition and

results of operations would be materially adversely affected as it relates to

our large-scale growth.

Our

success depends on maintaining relationships within our referral

networks

We rely

primarily upon brokers to refer potential sellers of policies to us and upon

financial professionals, known as licensees, to refer retail purchasers to

us. These relationships are essential to our operations and we must

maintain these relationships to be successful. We do not have fixed

contractual arrangements with life settlement brokers and they are free to do

business with our competitors. Our network of licensees is much

broader, but no less important. Our ability to build and maintain

relationships with our licensees will depend upon our closing rates, the value

we bring to our retail clients and the level of compensation we pay to the

referring professional. The compensation paid to the referring

professional will affect the offer price to the seller and the compensation we

receive. We must balance these interests successfully to build our referring

network and attain greater profitability.

Our

purchasers depend on our ability to predict life expectancies and set

appropriate prices; if our investment returns are not competitive, we may lose

purchasers

A

purchaser’s investment return from a life settlement depends on three factors:

the difference between the policy face amount and purchaser’s cost basis

(consisting of the acquisition cost and premiums paid to maintain the policy),

the length of the holding period, and the demise of the insured. We

price settlements based on the policy face amount, the anticipated life

expectancy of an insured and policy maintenance costs. Life

expectancies are estimated generally from standard medical and actuarial data

based on the historical experiences of similarly situated

persons. The data is based necessarily on averages involving

mortality and morbidity statistics. The outcome of a single

settlement may vary significantly from the statistical average. It is

impossible to predict any one insured’s life expectancy exactly. To

mitigate the risk that an insured will outlive his or her predicted life

expectancy, we price life settlements to yield competitive returns even if this

life expectancy prediction is exceeded by several years. In addition,

life settlement purchasers must be able to bear a non-liquid investment for an

indeterminate period.

10

If we

underestimate the average life expectancies and price our transactions too high,

our purchasers will realize smaller returns, demand may fall, and purchasers may

invest their funds elsewhere. In addition, amounts escrowed for

premiums may be insufficient to keep the policy in force, requiring purchasers

to invest further proceeds to pay these additional premiums. If we

overestimate the average life expectancies, the settlement prices we offer will

fall below market levels, supply will decrease, and sellers may engage in

business with our competitors or pursue other alternatives. Our

ability to accurately predict life expectancies and price accordingly is

affected by a number of factors, including:

|

|

·

|

The

accuracy of our life expectancy estimations, which must sufficiently

account for factors including an insured’s age, medical condition, life

habits (such as smoking), and geographic

location;

|

|

|

·

|

Our

ability to anticipate and adjust for trends, such as advances in medical

treatments, that affect life expectancy data;

and

|

|

|

·

|

Our

ability to balance competing interests when pricing settlements, such as

the amounts paid to policy sellers, the acquisition costs paid by

purchasers, and the compensation paid to ourselves and our referral

networks.

|

To

support our pricing systems, we use both in-house and outside specialists,

including medical doctors and published actuarial data. We cannot

assure purchasers that, despite our experience in settlement pricing, we will

not err by underestimating or overestimating average life expectancies or

miscalculating reserve amounts for future premiums. If we do so, we

could lose purchasers or policy sellers, and those losses could have a material

adverse effect on our business, financial condition, and results of

operations.

Government

regulation could negatively impact our business

We are

licensed and regulated by the Texas Department of Insurance as a viatical and

life settlement company and hold licenses as a life settlement provider in other

states as well. State laws requiring the licensing of life settlement

providers govern many aspects of our conduct, operations, advertising and

disclosures. The laws may vary from state to state, however, and our

activities and those of brokers with whom we do business can be affected by

changes in these laws or different interpretations of these laws. In

addition, some states and the Securities and Exchange Commission treat certain

life settlements as securities under state and federal securities

laws. We have legal precedent holding that our settlements are not

securities under the Federal securities laws. Possible exceptions or

registration exemptions may be available to us under many state securities

laws. As a result, we do not believe that the application of state or

Federal securities laws will have a material adverse effect on our

operations. Nonetheless, we have encountered claims from states that

our transactions are securities under state law and subject to

registration. We have settled all of these claims amicably and with

clear direction as to how we may accept clients from these

states. However, we cannot assure you that other securities

regulators or private individuals will not attempt to apply the securities laws

to our settlements or that defending such attempts would not have a material

adverse effect on our business. Further, changes in laws or

governmental regulation could affect our brokers or clients, which could have a

material adverse effect on our business.

Our

Chairman and Chief Executive Officer beneficially owns 50% of our common stock

and, as a result, can exercise significant influence over us

Under SEC

regulations, Mr. Brian D. Pardo, our Chairman and Chief Executive Officer, is

considered the beneficial owner of approximately 50% of our common stock,

largely as the result of exercising voting power by proxy over shares held by

The Pardo Family Trust. He will be able to control most matters

requiring approval by our shareholders, including the election of directors and

approval of significant corporate transactions. His voting control

affects indirectly the process for nominating directors, since theoretically he

could nominate and elect directors without board involvement. This

concentration of ownership may also have the effect of delaying or preventing a

change in control of Life Partners, which in turn could have a material adverse

effect on the market price of our common stock or prevent our shareholders from

realizing a premium over the market price for their shares of common stock.

11

Item

1B. Unresolved Staff Comments

We have

not received within 180 days before February 28, 2010, written comments from the

Securities and Exchange Commission regarding our periodic or current reports

under the Securities and Exchange Act of 1934, as amended, that remain

unresolved.

Item

2. Properties

Our

corporate offices are located at 204 Woodhew Drive in Waco, Texas. We

own two buildings on adjacent lots at this location and our offices occupy both

buildings, which together total 24,000 square feet. One building was

built in 1985 and the other in 1986.

Item

3. Legal Proceedings

During

the fiscal years ended February 28, 2010, 2009, and February 29, 2008,

we incurred settlement expenses of $3,615,726, $1,382,140 and $173,954,

respectively, for the resolution of litigation or potential

litigation. In fiscal 2010, the biggest settlements were for the

Maxim and State of Texas cases discussed below. We also settled a

case in Florida for $770,000. In some instances, we have repurchased

interests in policies to settle claims. In these cases, only the

excess (if any) of the settlement payment over the investment cost of the

repurchased policy interest is charged to settlement expense. The

balance is recorded on our balance sheet as an asset under “Investments in

policies” and the cash expenditure is recorded on our cash flow statement under

“Purchase of policies for investment purposes and capitalized

premiums”.

On April

12, 2010, we entered into a settlement agreement with Maxim Group, LLC, an

investment firm, to settle all claims in a civil action filed in

2007. Under the settlement, we agreed to deliver to Maxim 56,230

shares of our common stock, which were held in treasury, and which were valued

for settlement purposes at $1.25 million ($22.23 per share). The

fairness of this share delivery was affirmed by the court in a fairness hearing,

which was conducted on April 13, 2010. The court’s affirmation

enabled the shares to qualify for exemption from registration under Section

3(a)(10) of the Securities Act of 1933, as amended. The cost of

settlement was accrued in our consolidated financial statements as of February

28, 2010. The settlement cost had no effect on our cash position as

of February 28, 2010. The delivered treasury shares will be

shown as issued and outstanding in the fiscal quarter ending May 31,

2010.

On April

24, 2001, the state of Texas initiated a suit against LPI for alleged violations

of the Texas Deceptive Trade Practices Act (“DTPA”). The State

claimed that the contracts LPI used with purchasers before 1998 did not clearly

state that the purchasers were responsible for paying premiums to keep life

insurance policies purchased in force and that LPI had violated the DTPA by

requesting premiums from purchasers. LPI contended that the

purchasers of the policy interests were responsible to pay premiums, as they

were the owners of the policies. The trial court issued a summary

judgment in favor of LPI, which was appealed by the State. After a

lengthy appeals process, the matter was remanded back to the trial court and the

LPI and the State agreed to settle the matter by entering into an Assurance of

Voluntary Compliance (“AVC”) agreement, which was

filed with the court on April 1, 2010. Under the AVC, both parties

stipulate that the action relates only to certain contracts used with Texas

purchasers before 1998. The AVC further stipulates that the Attorney

General did not allege that LPI miscalculated escrow accounts or that it

committed any crime, fraud, misappropriation or malfeasance regarding escrow

accounts. Under the terms of the AVC, LPI agrees not to request any

further premium payments from the Texas purchasers identified in the AVC, to pay

future premiums on their behalf, estimated at $32,162 annually, and to pay

settlement costs totaling $300,000. By entering into the AVC, both

parties agree to release and discharge each other from any and all claims for

damages or other relief arising out of the action and we consider this matter to

be completely resolved and settled.

12

On May 6,

2010, we settled an administrative case with the Virginia State Corporation

Commission, which provides for a “safe harbor” of procedures and disclosures

that will permit us to accept Virginia residents as purchasers within a clearly

defined regulatory structure. The estimated cost of this settlement

of $170,000 was accrued in our consolidated financial statements as of February

28, 2010.

We are

subject to other legal proceedings in the ordinary course of

business. When we determine that an unfavorable outcome is probable

and the amount of the loss can be reasonably estimated, we reserve for such

losses. Except as discussed above: (i) management

has not concluded that it is probable that a loss has been incurred in any of

our pending litigation; (ii) management is unable to estimate the possible

loss or range of loss that could result from an unfavorable outcome of any

pending litigation; and (iii) accordingly, management has not provided any

amounts in the consolidated financial statements for unfavorable outcomes, if

any.

It is

possible that our consolidated results of operations, cash flows or financial

position could be materially affected in a particular fiscal quarter or fiscal

year by an unfavorable outcome or settlement of any pending

litigation. Nevertheless, although litigation is subject to

uncertainty, management believes and we have been so advised by counsel handling

the respective cases, that we have a number of valid claims and defenses in all

pending litigation to which we are a party, as well as valid bases for appeal of

adverse verdicts against us. All such cases are, and will continue to

be, vigorously defended and all valid counterclaims pursued. However,

we may enter into settlement discussions in particular cases if we believe it is

in the best interests of our shareholders to do so.

Market

Information

Our

common stock is traded on the Nasdaq Global Select Market under the symbol

LPHI. On April 30, 2010, there were approximately 93 shareholders of

record of our Common Stock. Most of our common stock is held

beneficially in “street name” through various securities brokers, dealers and

registered clearing agencies. We believe that there are approximately

8,920 beneficial owners of shares of our common stock who hold in street

name.

The

following table reflects the high and low sales prices of our common stock for

each quarterly period during the last two fiscal years (adjusted for February 6,

2009 stock split):

13

|

High

|

Low

|

Cash

Dividends

|

||||||||||

|

Year

Ended 2/28/09

|

||||||||||||

|

First

Quarter

|

$ | 17.56 | $ | 9.66 | $ | .0700 | ||||||

|

Second

Quarter

|

$ | 23.33 | $ | 14.69 | $ | .0700 | ||||||

|

Third

Quarter

|

$ | 33.81 | $ | 17.06 | $ | .0800 | ||||||

|

Fourth

Quarter

|

$ | 36.06 | $ | 14.89 | $ | .0700 | ||||||

|

Year

Ended 2/28/10

|

||||||||||||

|

First

Quarter

|

$ | 20.33 | $ | 13.92 | $ | .3200 | ||||||

|

Second

Quarter

|

$ | 21.77 | $ | 13.61 | $ | .2500 | ||||||

|

Third

Quarter

|

$ | 19.50 | $ | 15.65 | $ | .2500 | ||||||

|

Fourth

Quarter

|

$ | 22.58 | $ | 18.59 | $ | .2500 | ||||||

On May 3,

2010, the last reported sale price of our common stock on The Nasdaq Global

Select Market was $23.39 per share. Our total share volume for April

2010 was 2,398,200 shares compared to 3,968,900 shares for the same period last

year.

Dividends

We paid

common stock dividends of $1.07 per share in fiscal 2010 and $0.29 per share in

fiscal 2009. The dividend declared by the Board of Directors has been

at least $0.05 per share in each quarter since March 1, 2005.

Performance

Graph

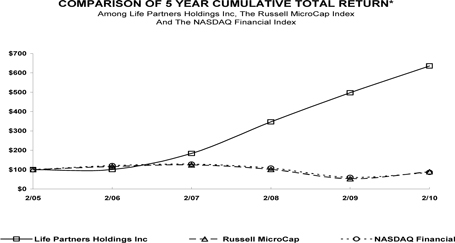

The line

graph below compares the cumulative total shareholder return on our Common Stock

for the last five fiscal years with cumulative total return on the Russell

MicroCap Index and the Nasdaq Financial Index. This graph assumes a

$100 investment in each of Life Partners Holdings, Inc., the Russell Microcap

Index and the Nasdaq Financial Index at the close of trading on

February 28, 2005, and also assumes the reinvestment of all

dividends. The points represent fiscal year-end levels based on the

last trading day in each fiscal year. Return information is

historical and not necessarily indicative of future performance.

14

|

As of February 28/29,

|

||||||||||||||||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|||||||||||||||||||

|

Life

Partners

|

$ | 100 | $ | 101 | $ | 184 | $ | 347 | $ | 497 | $ | 635 | ||||||||||||

|

Russell

Microcap Index

|

$ | 100 | $ | 116 | $ | 124 | $ | 101 | $ | 53 | $ | 89 | ||||||||||||

|

Nasdaq

Financial Index

|

$ | 100 | $ | 121 | $ | 128 | $ | 108 | $ | 60 | $ | 86 | ||||||||||||

We

selected these indices because they include companies with similar market

capitalizations to ours. We believe these are the most appropriate

comparisons since we are the only publicly traded company operating exclusively

in the life settlement industry and have no comparable industry “peer”

group.

The

performance graph above is being furnished solely to accompany this Annual

Report on Form 10-K pursuant to Item 201(e) of Regulation S-K, is not being

filed for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended, and is not to be incorporated by reference into any of our filings,

whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

Recent

Sales of Unregistered Securities

In April

2007, we issued 78,125 shares upon exercise of a stock option at $3.84 per share

($300,000 total). The shares were issued to a single individual in

reliance on the exemption afforded by Section 4(2) under the Securities Act

and under a similar private offering exemption under the applicable state

securities laws.

Securities

Authorized for Issuance under Equity Compensation Plans

We have

no outstanding options or shares subject to options or other purchase rights

authorized, but not outstanding.

Our

Purchases of Our Equity Securities

We made

no purchases of our equity securities during our fiscal year ended

February 28, 2010.

The

following table sets forth certain information concerning our consolidated

financial condition, operating results, and key operating ratios for the dates

and periods indicated. This information does not purport to be

complete, and should be read in conjunction with “Management's Discussion and

Analysis of Financial Condition and Results of Operations” and our Consolidated

Financial Statements and Notes thereto.

|

Year

Ended February 28/29,

(millions, except per share

information)

|

||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Operating

Results

|

||||||||||||||||||||

|

Revenues

|

$ | 113.0 | $ | 103.6 | $ | 72.6 | $ | 29.8 | $ | 20.1 | ||||||||||

|

Income

from Operations

|

$ | 47.4 | $ | 40.5 | $ | 27.3 | $ | 4.1 | $ | 1.2 | ||||||||||

|

Pre-tax

Income

|

$ | 47.7 | $ | 42.2 | $ | 28.8 | $ | 4.9 | $ | 2.2 | ||||||||||

|

Net

Income

|

$ | 29.4 | $ | 27.2 | $ | 18.8 | $ | 3.4 | $ | 1.1 | ||||||||||

15

|

Year

Ended February 28/29,

(millions, except per share

information)

|

||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

Balance

Sheet Data at Fiscal Year End

|

||||||||||||||||||||

|

Current

Assets

|

$ | 37.9 | $ | 29.2 | $ | 20.9 | $ | 8.7 | $ | 4.3 | ||||||||||

|

Current

Liabilities

|

$ | 12.3 | $ | 7.6 | $ | 8.0 | $ | 8.5 | $ | 6.0 | ||||||||||

|

Working

Capital

|

$ | 25.6 | $ | 21.6 | $ | 12.9 | $ | .2 | $ | (1.7 | ) | |||||||||

|

Total

Assets

|

$ | 72.7 | $ | 52.4 | $ | 31.9 | $ | 16.6 | $ | 12.0 | ||||||||||

|

Total

Liabilities

|

$ | 12.9 | $ | 8.4 | $ | 9.1 | $ | 8.9 | $ | 6.8 | ||||||||||

|

Shareholders’

Equity

|

$ | 59.8 | $ | 44.0 | $ | 22.8 | $ | 7.7 | $ | 5.2 | ||||||||||

|

Return

on Assets

|

47.0 | % | 64.5 | % | 77.4 | % | 23.5 | % | 10.3 | % | ||||||||||

|

Return

on Equity

|

56.7 | % | 81.3 | % | 123.1 | % | 51.9 | % | 19.9 | % | ||||||||||

|

Per

Share Data(1)

|

||||||||||||||||||||

|

Earnings

Per Share

|

$ | 1.98 | $ | 1.83 | $ | 1.25 | $ | 0.23 | $ | 0.08 | ||||||||||

|

Dividends

Per Share

|

$ | 1.07 | $ | 0.29 | $ | 0.25 | $ | 0.21 | $ | 0.20 | ||||||||||

|

Financial

Ratios

|

||||||||||||||||||||

|

Current

Ratio

|

3.1

: 1

|

3.8

: 1

|

2.6

: 1

|

1.0

: 1

|

0.7

: 1

|

|||||||||||||||

|

Quick

Ratio

|

3.1

: 1

|

3.8

: 1

|

2.6

: 1

|

1.0

: 1

|

0.7

: 1

|

|||||||||||||||

(1)

Earnings per share data is restated for the fiscal 2008 and 2009 stock

splits.

Item

7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations

Special

Note: Certain statements set forth below under this caption constitute

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. See Special Note Regarding

Forward-Looking Statements for additional factors relating to such

statements.

We

provide the following discussion to assist in understanding our financial

position as of February 28, 2010, and results of operations for the years

ended February 28, 2010, 2009, and February 29, 2008. As

you read this discussion, refer to our Consolidated Financial Statements and

Notes thereto. We analyze and explain the differences between periods

in the material line items of these statements.

Critical

Accounting Estimates, Assumptions and Policies

Our

discussion and analysis of financial condition and results of operations are

based on our Consolidated Financial Statements that were prepared in accordance

with accounting principles generally accepted in the United States of

America. To guide our preparation, we follow accounting policies,

some of which represent critical accounting policies as defined by the

SEC. The SEC defines critical accounting policies as those that are

both most important to the portrayal of a company’s financial condition and

results and require management’s most difficult, subjective, or complex

judgment, often as a result of the need to make estimates about the effect of

matters that are inherently uncertain and may change in subsequent

periods. Certain accounting estimates involve significant judgments,

assumptions and estimates by management that may have a material impact on the

carrying value of certain assets and liabilities, disclosures of contingent

liabilities, and the reported amounts of income and expenses during the

reporting period that management considers to be critical accounting

estimates. The judgments, assumptions and estimates used by

management are based on historical experience, management’s experience,

knowledge of the accounts and other factors that are believed to be

reasonable. Because of the nature of the judgments and assumptions

made by management, actual results may differ materially from these judgments

and estimates, which could have a material impact on the carrying values of our

assets and liabilities and the results of our operations. Areas

affected by our estimates and assumptions are identified below.

16

We

recognize income at the time a settlement closes and the purchaser has obligated

itself to make the purchase. We defer $100 per life settlement to

cover minor monitoring services provided subsequent to the settlement

date. We amortize this deferred cost over the anticipated life

expectancy of the insureds.

We

sometimes make short-term advances to facilitate a life settlement

transaction. These amounts are included in “Accounts

receivable – trade”, and are collected as the life settlement transactions

close. All amounts are considered collectible as we are repaid the

advance before any of the other parties involved in the transaction receive

funds.

We follow

the guidance contained in ASC 325-30, Investments in Insurance

Contracts, to account for our investments in life settlement

contracts. ASC 325-30 states that a purchaser may elect to account

for its investments in life settlement contracts using either the investment

method or the fair value method. The election is made on an

instrument-by instrument basis and is irrevocable. Under the

investment method, a purchaser recognizes the initial investment at the purchase

price plus all initial direct costs. Continuing costs (e.g., policy

premiums and direct external costs, if any) to keep the policy in force are

capitalized. Under the fair value method, a purchaser recognizes the

initial investment at the purchase price. In subsequent periods, the

purchaser re-measures the investment at fair value in its entirety at each

reporting period and recognizes changes in fair value earnings (or other

performance indicators for entities that do not report earnings) in the period

in which the changes occur. We elected to value our investments in

life settlement contracts using the investment method. As of

February 28, 2010, our investments in life settlements held for our own

account were carried at $16,460,353.

We

establish litigation and policy analysis loss accruals based on our best

estimates as to the ultimate outcome of contingent liabilities. This

loss analysis is necessary to properly match current expenses to currently

recognized revenues and to recognize that there is a certain amount of liability

associated with litigation and policy losses. Through these accruals,

we recognize the estimated cost to settle pending litigation as an

expense. These estimates are reviewed on a quarterly basis and

adjusted to management’s best estimate of the anticipated liability on a

case-by-case basis. A high degree of judgment is required in

determining these estimated accrual amounts since the outcomes are affected by

numerous factors, many of which are beyond our control. As a result,

there is a risk that the estimates of future litigation and policy analysis loss

costs could differ from our currently estimated amounts. Any

difference between estimates and actual final outcomes could have a material

impact on our financial statements.

We must

make estimates of the collectability of accounts and notes receivable and

premium advances. The accounts associated with these areas are

critical to recognizing the correct amount of revenue and expenses in the proper

period. Within the last quarter of fiscal 2010, issues have been

resolved which have enabled us to better estimate the collectability of premium

advances. The agreement with the State of Texas allowed us to

specifically identify a class of investors for whom we made premium advances,

and which, under the terms of the agreement, will be

uncollectible. Our historical success of collecting premium advances

has enabled us to build a body of evidence by which we can demonstrate full

collectability of the remaining balance of advanced premiums.

17

We review

the carrying value of our property and equipment for impairment whenever events

and circumstances indicate that the carrying value of an asset may not be

recoverable from the estimated future cash flows expected to result from its use

and eventual disposition. In cases where undiscounted expected future

cash flows are less than the carrying value, an impairment loss is recognized

equal to an amount by which the carrying value exceeds the fair value of

assets. The factors considered by management in performing this

assessment includes current operating results, trends and prospects, the manner

in which the property is used, and the effects of obsolescence, demand,

competition and other economic factors. Based on this assessment,

there was no impairment during fiscal years 2010, 2009 and 2008.

We must

evaluate the useful lives of our property and equipment to assure that an

adequate amount of depreciation is being charged to

operations. Useful lives are based generally on specific knowledge of

an asset’s life in combination with the Internal Revenue Service rules and

guidelines for depreciable lives for specific types of assets.

We are

required to estimate our income taxes. This process involves

estimating our current tax exposure together with assessing temporary

differences resulting from differing treatment of items for tax and accounting

purposes. These differences result in deferred tax assets and

liabilities. We must then assess the likelihood that our deferred tax

assets will be recovered from future taxable income, and, to the extent we

believe that recovery is not likely, we must establish a valuation

allowance. To the extent we establish a valuation allowance or

increase this allowance in a period, we must include a tax provision or reduce

our tax benefit in the statements of income. We use our judgment to

determine our provision or benefit for income taxes, deferred tax assets and

liabilities and any valuation allowance recorded against our net deferred tax

assets.

We cannot

predict what future laws and regulations might be passed that could have a

material effect on our results of operations. We assess the impact of

significant changes in laws and regulations on a regular basis and update the

assumptions and estimates used to prepare our financial statements when we deem

it necessary.

We have

not made any material changes to our critical accounting estimates or

assumptions or the judgments affecting the application of those estimates or

assumptions. We discuss our significant accounting policies,

including those policies that are not critical, in Note 2 of our

Consolidated Financial Statements.

New

Accounting Pronouncements

Recent

accounting pronouncements have been issued including ASC 320, 810, 815, 820,

825, 855, 958-320 and ASC 946-10-15-2 (ASU 2009-12). For a discussion

of these pronouncements, refer to Footnote 3 of our Consolidated Financial

Statements.

Life

Partners

We are

the world’s oldest and only publicly traded company operating exclusively in the

life settlement industry. Our revenues are primarily derived from

fees associated with facilitating life settlement transactions.

18

Comparison

of Years Ended February 28, 2010, 2009, and February 29,

2008

We had

net income of $29,426,278 for the year ended February 28, 2010 (“fiscal 2010”), compared to

net income of $27,159,116 for the year ended February 28, 2009 (“fiscal 2009”), and

$18,756,271 for the year ended February 29, 2008 (“fiscal 2008”). The

8.3% increase in net income in fiscal 2010 is attributable primarily to a 9.1%

increase in revenues and our ability to increase our operating margins by

remaining highly selective in our purchasing strategies, resulting in a 14.0%

increase in revenues net of brokerage and licensee fees. The increase

in revenues, net of brokerage fees, together with the large decrease in the

allowance account for premium advances, resulted in an increase in income from

operations of 17.1%. The 44.8% increase in net income in fiscal 2009

was attributable to a 42.7% increase in revenues and a 47.8% increase in

revenues net of brokerage and licensee fees. The large increase in

revenues, net of brokerage fees, resulted in an increase in income from

operations of 48.6%. Legal and professional costs were $1,311,637,

$1,839,782 and $1,660,176 in fiscal 2010, 2009 and 2008, respectively, and after

executive and employee bonuses and payroll, comprised the largest single general

and administrative expense. The legal and professional costs were

attributable primarily to legal costs associated with the administrative case by

the state of Virginia, our audit and tax preparation fees, our SEC filings, the

lawsuit with the state of Texas, defending ourselves in the arbitration against

a former investment banking firm, and other legal matters as they

arise. See Item 3,

Legal Proceedings.

Revenues – Revenues increased