Attached files

| file | filename |

|---|---|

| EX-3.5 - BIOPHARM ASIA, INC. | ex3-5.htm |

| EX-31.1 - BIOPHARM ASIA, INC. | ex31-1.htm |

| EX-32.2 - BIOPHARM ASIA, INC. | ex32-2.htm |

| EX-31.2 - BIOPHARM ASIA, INC. | ex31-2.htm |

| EX-32.1 - BIOPHARM ASIA, INC. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE ANNUAL PERIOD ENDED DECEMBER 31, 2009

OR

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION FROM _______ TO ________.

COMMISSION FILE NUMBER: 000-25487

BIOPHARM ASIA, INC.

(Exact Name of Small Business Issuer as Specified in its Charter)

|

NEVADA

|

88-0409159

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

New Agriculture Development Park, Daquan Village,

Tonghua County, Jilin Province, P.R. China. 134115

(Address of principal executive offices) (Zip code)

Issuer's telephone number: 011-86-435-5211803

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 23, 2009, the last date prior to June 30, 2009 upon which shares of the registrant’s common stock were traded, the aggregate market value of the outstanding shares of the registrant's common stock held by non-affiliates (excluding shares held by Directors, officers and others holding more than 5% of the outstanding shares of the class) was $26,406,250, based upon a closing sale price of $3.25 as reported by Bloomberg Finance.

At March 25, 2010, the Registrant had outstanding 50,000,000 shares of common stock.

FORM 10-K

BIOPHARM ASIA, INC.

INDEX

|

Page

|

||

|

PART I

|

||

|

Item 1. Business

|

1

|

|

|

Item 1A. Risk Factors

|

9

|

|

|

Item 2. Properties

|

21

|

|

|

Item 3. Legal Proceedings

|

21

|

|

|

Item 4. Removed and Reserved

|

21

|

|

|

PART II

|

||

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

22

|

|

|

Item 6. Selected Financial Data

|

22

|

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

22

|

|

|

Item 7A. Qualitative and Quantitative Disclosures About Market Risk

|

26

|

|

|

Item 8. Financial Statements and Supplementary Data

|

26

|

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

26

|

|

|

Item 9A(T). Controls and Procedures

|

27

|

|

|

Item 9B. Other Information

|

29

|

|

|

PART III

|

||

|

Item 10. Directors, Executive Officers and Corporate Governance

|

30

|

|

|

Item 11. Executive Compensation

|

32

|

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

32

|

|

|

Item 13. Certain Relationships and Related Transactions.

|

33

|

|

|

Item 14. Principal Accountant Fees and Services

|

33

|

|

|

PART IV

|

||

|

Item 15. Exhibits and Financial Statement Schedules

|

35

|

|

|

Index to Consolidated Financial Statements

|

F-1

|

Special Note Regarding Forward Looking Information

This report contains forward-looking statements that reflect management's current views and expectations with respect to our business, strategies, future results and events, and financial performance. All statements made in this report other than statements of historical fact, including statements that address operating performance, events or developments that management expects or anticipates will or may occur in the future, including statements related to, cash flows, revenues, profitability, adequacy of funds from operations, statements expressing general optimism about future operating results and non-historical information, are forward-looking statements. In particular, the words "believe," "expect," "intend," "anticipate," "estimate," "plan," "may," "will," variations of such words and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements and their absence does not mean that the statement is not forward-looking. Readers should not place undue reliance on forward-looking statements which are based on management's current expectations and projections about future events, are not guarantees of future performance, and are subject to risks, uncertainties and assumptions. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those discussed in this report, particularly under the caption "Risk Factors." Except as required under the federal securities laws, we do not undertake any obligation to update the forward-looking statements in this report.

PART I

Item 1. Business

Introduction

BioPharm Asia, Inc. (the "Company" or “BioPharm”) is a holding corporation whose China-based operating subsidiaries, Tonghua Huachen Herbal Planting Company Limited ("HERB"), and Tonghua S&T Medical & Pharmacy Company Limited ("PHARMACY"), are primarily engaged in the planting and distribution of traditional herbal medicines and western medicines through 360 retail stores and through a distribution center to other chain stores, hospitals, neighborhood clinics and other channels.

HERB is an operating company engaged in planting, processing and selling herbs including, among others, Chinese Magnolia Vine, Ussuriensis Fritillary Bulb, Membranous Milk Vetch Root, Chinese Thorowax Root, Manchurian Wild Ginger, Ginseng, and Kudzurine Root in China. HERB owns 100% of the equity interests of Tonghua Huachen Pharmaceutical Company Limited ("HUACHEN"), a Chinese company founded in 1989, which also is engaged in the production and sale of herbal products, including, among others, Qiweixiaoke Capsule, Shengan Bujin Tablets, Tongqiaobiyan Tablets, Huatanpingchuan Tablets, Wujiarongxue Oral Liquid, and Methocarbamol Capsule.

PHARMACY is an operating company engaged in drug logistics and distribution in the People’s Republic of China (“PRC”) which as of December 31, 2009 owned and operated 360 retail drug stores. In addition, PHARMACY owns 100% of Yunnan Silin Pharmaceutical Company Limited ("SILIN"), a PRC company which is engaged in the sale of medicine products to hospitals and pharmacy shops, including the Company’s own retail outlets.

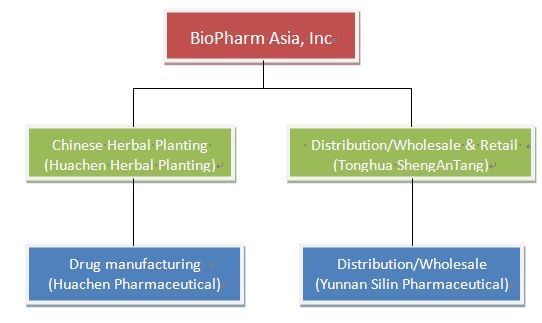

The following chart reflects our organizational structure as of the date of this Report.

BioPharm, Merger Sub, CNPH, CNPH HK, HERB, PHARMACY, HUACHEN, and SILIN are collectively referred to as the “Company,” “we,” “us,” and words of similar import, unless specific reference is made to a specific entity of the consolidated company.

Our Corporate History

We are a Nevada corporation incorporated on July 31, 2001 under the name Domain Registration, Corp.

On May 7, 2009, we acquired China Northern Pharmacy Holding Group Limited ("CNPH"), a British Virgin Islands corporation, through a merger in which our newly formed wholly owned subsidiary was merged into CNPH, the surviving corporation, pursuant to an Agreement and Plan of Merger dated as of April 30, 2009. CNPH is a holding company that had acquired on November 25, 2008 all of the outstanding stock of China Northern Pharmacy Holding Group Limited, a Hong Kong company ("CNPH HK"), which was incorporated on October 16, 2008. CNPH HK is a holding company that on November 21, 2008 acquired all of the equity interests of HERB and PHARMACY.

1

Pursuant to the terms of the merger, the shareholders of CNPH received 42,500,000 shares of our common stock, divided proportionally among the CNPH shareholders in accordance with their respective ownership interests in CNPH, in exchange for their shares in CNPH. As a result of the merger, the shareholders of CNPH acquired approximately 85% of our outstanding shares of common stock, effectively obtaining operational and management control of our company.

On July 26, 2009, we changed our name from Domain Registration Corp. to BioPharm Asia, Inc.

Our Business Segments

Our principal businesses are the planting, manufacturing, distribution and retail sale of a broad line of health care products. Based on the various operating activities, our reportable segments are:

|

·

|

HERB, herbal planting – planting, processing and selling herbs in China.

|

|

·

|

HUACHEN, drug manufacturing – the production and sale of herbal and pharmaceutical products to outsider distributors, as well as to SILIN, the Company’s distribution segment.

|

|

·

|

SILIN, distribution – the sale of healthcare products to hospitals, pharmacy shops, neighborhood clinics and the Company’s own pharmacy shops.

|

|

·

|

PHARMACY, retailing – the sale of healthcare products to end consumers.

|

Herbal Planting

The Company’s herbal planting segment cultivates herbs on approximately 495 acres in Jilin Province. These herbs, include, among others, Chinese Magnolia Vine Fruit, Membranous Milk Vetch Root, and Ginseng, and largely are sold to manufacturers of traditional Chinese medicines, as well as used for the Company’s production of such medicine. Approximately, 70-80% of the output of HERB’s plantations is sold to outside parties, with the remainder used by the Company’s other segments.

Competition

HERB's principal competitors include Wind City in Liaoning Province, which also plants Chinese Magnolia vine, and other pharmaceutical companies in Northeast China. The Company believes that its competitive advantages include geographical location, prevailing weather and environmental conditions, improved seed and the local government's tax-free preferential policy.

HERB employs 300 individuals, including more than 70 with professional specialties in various areas.

Drug Manufacturing

The Company manufactures a variety of traditional Chinese non-prescription drugs, the more significant being:

|

-

|

Qiweixiaoke Capsule,

|

|

-

|

Shengan Bujin Tablets,

|

|

-

|

Tongqiaobiyan Tablets,

|

|

-

|

Huatanpingchuan Tablets,

|

|

-

|

Wujiarongxue Oral Liquid,

|

|

-

|

Methocarbamol Capsule.

|

2

The output of the manufacturing segment is sold to drug and health care distributors, and distributed by the Company’s own distribution network. Approximately, 70-80% of the segment's products are sold to outside parties.

Competition

HUACHEN’s main competitor includes: Tonghua Wantong Pharmaceutical Company Limited, Sichuan Shuzhong Pharmaceutical Company Limited and Jilin JuRenTang Pharmaceutical Company Limited. HUACHEN’s products, Qiweixiaoke Capsule, used to treat diabetes, and Shengan Bujin Tablets, used to treat pulmonary tuberculosis, are not widely manufactured.

Distribution

SILIN, the Company’s distribution segment, provides a variety of pharmaceutical and healthcare products to hospitals, drug stores and other providers of such products. The Company’s distribution networks mainly include Jilin, Liaoning and Yunnan provinces. In addition to the distribution to outside channels, the Company utilizes its distribution network to provide products to its chain of retail drug stores. Approximately, 35-50% of the products distributed by SILIN goes to BioPharm’s retail stores. SILIN has 59 sales personnel.

Competition

The principal competitors of SILIN include Hunan Shuanghe Pharmaceutical Company, Shenyang Tengda Pharmaceutical Company and Jilin Drug Store. We believe SILIN has a competitive advantage due to its strong logistics and its large network coverage.

Retailing

Product Offerings

Our PHARMACY segment consists of 360 retail drug stores as of the end of 2009 which offer an array of pharmaceutical products as well as other goods. These products can be broadly classified into the following categories:

Prescription Drugs. Our retail stores offer approximately 300 prescription drugs. We accept prescriptions only from licensed health care providers and do not prescribe medications or otherwise practice medicine. Our in-store pharmacists verify the validity, accuracy and completeness of all prescription drug orders. We ask all prescription drug customers to provide us with information regarding drug allergies, current medical conditions and current medications. Sales of prescription drugs accounted for approximately 24% of our retail revenue in the year 2009.

OTC Drugs. We offer approximately 1,150 over-the-counter (“OTC”) drugs, including western medicines and traditional Chinese medicines, for the treatment of common illnesses. Sales of OTC drugs accounted for approximately 45% of our retail revenue in the year 2009.

Nutritional Supplements As disposable incomes rise, newly middle-class Chinese are purchasing nutritional supplements in record numbers, leading to an annual growth rate that we believe is over 20% in the domestic Chinese nutritional industry. Additionally, we believe that more and more Chinese who live in the countryside want to purchase nutritional supplements. We currently offer approximately 110 nutritional supplements, including a variety of healthcare supplements, vitamins, minerals and dietary products. We expect sales of nutritional supplements to increase more rapidly than those of drugs due to increasing wealth and disposable income of Chinese residents living in the country, and the Company intends to increase the variety of nutritional supplements available in its new retail stores in the country. Nutritional supplements normally generate higher gross margins than prescription and OTC drugs. Sales of nutritional supplements accounted for approximately 10% of our retail revenue in the year 2009.

3

Herbal Products. We offer various types of drinkable herbal remedies and packages of assorted herbs for making soup, which are used by consumers as health supplements. Herbal products typically have higher gross margins than prescription and OTC drugs. Sales of herbal products accounted for approximately 11% of our retail revenue in the year 2009.

Other Products. Other products sold by our retail drug stores include personal care products such as skin care, hair care and beauty products, family care products such as portable medical devices for family use, birth control and early pregnancy test products and convenience products, such as soft drinks, packaged snacks, and other consumables, cleaning agents and stationery. Other products offered also include seasonal and promotional items tailored to local consumer demand for convenience and quality. We believe offering these products increases customer visits by increasing the shopping convenience for our customers. Sales of other products accounted for about 10% of our retail revenue in the year 2009. Some of the OTC drugs, supplements and herbal products distributed in our pharmacies are manufactured by other segments of the Company.

The retail drug industry in China is highly fragmented, with few large chains. The main competitors of PHARMACY are the large number of retailers who are either individually owned or part of a relatively small chain, as well as hospital pharmacies and ordinary retail stores. Historically, hospital pharmacies have been the main channel of medicine sales in China, especially for those patients who are qualified for the socialized medicine policy, which means the local institutions will pay hospitalization costs, including the costs of prescription drugs, non-prescription drugs (over-the-counter medicines) and supplements like vitamin and mineral substances, which can be easily obtained in supermarkets and convenience stores.

To maintain and improve its competitive position, PHARMACY (i) utilizes the benefits of being a chain of stores, including purchasing efficiencies and cost advantages, brand identification, and cooperation between medical care providers and pharmacies to achieve the advantages of hospital pharmacies; (ii) is actively marketing supplements and enlarging the market share of supplements; (iii) takes advantage of store location, choosing locations in peripheral areas, like suburbs and the countryside, where there are fewer competitors. Currently, the bulk of PHARMACY’s stores are located in suburban and rural markets.

PHARMACY employs 1,478 individuals at its headquarters and its chain stores, including 38 executives and 1,440 in sales.

Government Regulation

As a grower, manufacturer, distributor and retailer of pharmaceutical products, we are subject to extensive regulation and oversight by different levels of the food and drug administration in China, in particular, the State Food and Drug Administration, (“SFDA”). PRC law regarding the Administration of Pharmaceutical Products provides the basic legal framework for the administration of the production and sale of pharmaceutical products in China and governs the manufacturing, distributing, packaging, pricing and advertising of pharmaceutical products in China. The corresponding implementation regulations set out detailed rules with respect to the administration of pharmaceuticals in China. We are also subject to other PRC laws and regulations that are applicable to business operators, retailers and foreign-invested companies.

4

Distribution of Pharmaceutical Products

A distributor of pharmaceutical products must obtain a distribution permit from the relevant provincial or designated municipal or county-level food and drug administration. The granting of such a permit is subject to an inspection of the distributor's facilities, warehouses, hygienic environment, quality control systems, personnel and equipment. The distribution permit is valid for five years, and the holder must apply for renewal of the permit within six months prior to its expiration. In addition, a pharmaceutical product distributor needs to obtain a business license from the relevant administration for industry and commerce prior to commencing its business. All of our entities engaged in retail pharmaceutical business have obtained necessary pharmaceutical distribution permits, and we do not expect any significant difficulties when renewing these permits and/or certifications.

In addition, under the Supervision and Administration Rules on Pharmaceutical Product Distribution promulgated by the SFDA, a pharmaceutical product distributor is responsible for its procurement and sales activities and is liable for the actions of its employees or agents in connection with their conduct of distribution on behalf of the distributor.

Good Supply Practice (“GSP”) Standards

GSP standards regulate wholesale and retail pharmaceutical product distributors to ensure the quality of distribution of pharmaceutical products in China. The current applicable GSP standards require pharmaceutical product distributors to implement strict controls on the distribution of medicines, including standards regarding staff qualifications, distribution premises, warehouses, inspection equipment and facilities, management and quality control. These GSP certificates currently have expiration dates of nearly five years. We do not expect any significant difficulties in renewing these certifications upon their expiration.

Prescription Administration

Under the Rules on Administration of Prescriptions promulgated by the SFDA, doctors are required to include the chemical ingredients or generic description of the medicines they prescribe in their prescription and are not allowed to include brand names in their prescriptions. This regulation is designed to provide consumers with choices among different pharmaceutical products that contain the same chemical ingredients.

Advertisement of Pharmaceutical Products

To prevent misleading advertising of pharmaceutical products, the State Administration for Industry and Commerce, (“SAIC”) and the SFDA jointly promulgated the Standards for Examination and Publication of Advertisements of Pharmaceutical Products and Rules for Examination of Advertisement of Pharmaceutical Products in March 2007. Under these regulations, there are prohibitions on the advertising of certain pharmaceutical products, and advertisement of prescription pharmaceutical products may only be made in authorized medical magazines. In addition, approval must be obtained from the provincial level of the food and drug administration before a pharmaceutical product may be advertised. Such approval, once obtained, is valid for one year.

Product Liability and Consumer Protection

Product liability claims may arise if products sold have any harmful effect on the consumers. The injured party may claim for damages or compensation. The General Principles of the Civil Law of the PRC, which became effective in January 1987, state that manufacturers and sellers of defective products causing property damage or injury shall incur civil liabilities for such damage or injuries.

The Product Quality Law of the PRC was enacted in 1993 and amended in 2000 to strengthen the quality control of products and protect consumers' rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses and imposition of fines, and in severe circumstances, may be subject to criminal liability.

The Law of the PRC on the Protection of the Rights and Interests of Consumers became effective January 1, 1994 to protect consumers' rights when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers. In extreme situations, pharmaceutical product manufacturers and distributors may be subject to criminal liability if their goods or services lead to death or injuries of customers or other third parties.

5

Price Controls

The retail prices of some pharmaceutical products sold in China, primarily those included in the national and provincial medical insurance catalogs and those pharmaceutical products whose production or distribution are deemed to constitute monopolies, are subject to price controls in the form of fixed prices or price ceilings. Manufacturers or distributors cannot freely set or change the retail price for any price-controlled product above the applicable price ceiling or deviate from the applicable fixed price imposed by the PRC government. The prices of medicines that are not subject to price controls are determined freely at the discretion of the respective pharmaceutical companies, subject to notification to the provincial pricing authorities.

The retail prices of medicines that are subject to price controls are administered by the Price Control Office of the National Development and Reform Commission, (“NDRC”), and provincial and regional price control authorities. The retail price, once set, also effectively determines the wholesale price of that medicine. From time to time, the NDRC publishes and updates a list of medicines that are subject to price controls. Fixed prices and price ceilings on medicines are determined based on profit margins that the relevant government authorities deem reasonable, the type and quality of the medicine, its production costs, prices of substitute medicines and the extent of the manufacturer's compliance with the applicable GMP standards. The NDRC directly regulates the pricing of a portion of the medicines on the list, and delegates to provincial and regional price control authorities the authority to regulate the pricing of the rest of the medicines on the list.

Provincial and regional price control authorities have discretion to authorize price adjustments based on the local conditions and the level of local economic development. Currently, approximately 1,500 pharmaceutical products, or approximately 10% of the pharmaceutical products available in China, are subject to price control. Of those, the price controls for the retail prices of approximately 600 pharmaceutical products are administered by the NDRC and the rest are administered by provincial and regional price control authorities.

Only the manufacturer of a medicine may apply for an increase in the retail price of the medicine, and it must either apply to the provincial price control authorities in the province where it is incorporated, if the medicine is provincially regulated, or to the NDRC, if the medicine is NDRC regulated. For a provincially regulated medicine, in cases where provincial price control authorities approve an application, manufacturers must file the newly approved price with the NDRC for record and thereafter the newly approved price will become binding and enforceable across China.

The NDRC may grant premium pricing status to certain pharmaceutical products that are under price control. The NDRC may set the retail prices of pharmaceutical products that have obtained premium pricing status at a level that is significantly higher than comparable products.

Sales of Nutritional Supplements and other Food Products

According to the PRC Food Hygiene Law and Rules on Food Hygiene Certification, a distributor of nutritional supplements and other food products such as SILIN must obtain a food hygiene certificate from relevant provincial or local health regulatory authorities. The grant of such certificate is subject to an inspection of the distributor's facilities, warehouses, hygienic environment, quality control systems, personnel and equipment. The food hygiene certificate is valid for four years, and the holder must apply for renewal of the certificate within six months prior to its expiration.

Trademarks

The PRC Trademark Law and the PRC Trademark Implementing Regulations provide the basic legal framework for the regulation of trademarks in China, and the SAIC is responsible for the registration and administration of trademarks throughout the country. The PRC has adopted a "first-to-file" principle with respect to trademarks.

6

PRC law provides that each of the following acts constitutes infringement of the exclusive right to use a registered trademark:

|

Ÿ

|

use of a trademark that is identical with or similar to a registered trademark in respect of the same or similar commodities without the authorization of the trademark registrant;

|

|

Ÿ

|

sale of commodities infringing upon the exclusive right to use the trademark;

|

|

Ÿ

|

counterfeiting or making, without authorization, representations of a registered trademark of another person, or sale of such representations of a registered trademark;

|

|

Ÿ

|

changing a registered trademark and selling products on which the altered registered trademark is used without the consent of the trademark registrant; and

|

|

Ÿ

|

otherwise infringing upon the exclusive right of another person to use a registered trademark.

|

In the PRC, a trademark owner who believes the trademark is being infringed has three options:

|

Ÿ

|

The trademark owner can provide his trademark registration certificate and other relevant evidence to the state or local Administration for Industry and Commerce, (“AIC”), which can, in its discretion, launch an investigation. The AIC may take actions such as ordering the infringer to immediately cease the infringing behavior, seizing and destroying any infringing products and representations of the trademark in question, closing the facilities used to manufacture the infringing products or imposing a fine. If the trademark owner is dissatisfied with the AIC's decision, he may, within 15 days of receiving such decision, institute civil proceedings in court.

|

|

Ÿ

|

The trademark owner may institute civil proceedings directly in court. Civil remedies for trademark infringement include:

|

|

-

|

injunctions;

|

|

-

|

requiring the infringer to take steps to mitigate the damage (i.e., publish notices in newspapers); and

|

|

-

|

damages (i.e. compensation for the economic loss and injury to reputation as a result of trademark infringement suffered by the trademark owner).

|

The amount of compensation is calculated according to either the gains acquired by the infringer from the infringement, or the losses suffered by the trademark owner, including expenses incurred by the trademark owner to claim and litigate such infringement. If it is difficult to determine the gains acquired by the infringer from the infringement, or the losses suffered by the trademark owner, the court may elect to award compensation of not more than RMB500,000.

|

Ÿ

|

If the trademark infringement is so serious as to constitute a crime, the trademark owner may file a complaint with the police and the infringer is subject to investigation for criminal liability in accordance with PRC law.

|

Foreign Exchange Regulation

Pursuant to the Foreign Currency Administration Rules promulgated in 1996 and amended in 1997 and various regulations issued by the SAFE, and other relevant PRC government authorities, the Renminbi is freely convertible only to the extent of current account items, such as trade-related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investments, require the prior approval from the SAFE or its local counterpart for conversion of Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside the PRC.

Payments for transactions that take place within the PRC must be made in Renminbi. Unless otherwise approved, PRC companies must repatriate foreign currency payments received from abroad. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by the SAFE or its local counterpart. Unless otherwise approved, domestic enterprises must convert all of their foreign currency receipts into Renminbi.

Dividend Distribution

The principal laws, rules and regulations governing dividends paid by our PRC operating subsidiaries include the Company Law of the PRC (1993), as amended in 2006, Wholly Foreign Owned Enterprise Law (1986), as amended in 2000, and Wholly Foreign Owned Enterprise (or Law Implementation Rules (1990)), as amended in 2001. Under these laws and regulations, each of our consolidated PRC entities, including wholly foreign owned enterprises, (“WFOE’s”), and domestic companies in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our consolidated PRC entities, including WFOE’s and domestic companies, is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its statutory surplus reserve fund until the accumulative amount of such reserve reaches 50% of its respective registered capital. These reserves are not distributable as cash dividends.

7

Taxation

Under the Enterprise Income Tax Law, (“EIT Law”), effective January 1, 2008, China adopted a uniform tax rate of 25% for all enterprises (including foreign-invested enterprises) and revoked the tax exemption, reduction and preferential treatments applicable to foreign-invested enterprises. However, there is a transition period for enterprises, whether foreign-invested or domestic, that prior to the effective date were receiving preferential tax treatments granted by relevant tax authorities. Enterprises that were subject to an enterprise income tax rate lower than 25% may continue to enjoy the lower rate and gradually transition to the new tax rate within five years after the effective date of the EIT Law. Enterprises that were entitled to exemptions or reductions from the standard income tax rate for a fixed term may continue to enjoy such treatment until the fixed term expires. However, the two-year exemption from enterprise income tax for foreign-invested enterprise begins from January 1, 2008 instead of from when such enterprise first becomes profitable. Preferential tax treatments will continue to be granted to industries and projects that are strongly supported and encouraged by the state, and enterprises otherwise classified as "new and high technology enterprises strongly supported by the state" will be entitled to a 15% enterprise income tax rate even though the EIT Law does not define this term.

Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors

On August 8, 2006, six PRC regulatory agencies, including the Chinese Securities Regulatory Commission, (“CSRC”), promulgated a rule entitled Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the new M&A rule, to regulate foreign investment in PRC domestic enterprises. The new M&A rule provides that the Ministry of Commerce must be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise and any of the following situations exists: (i) the transaction involves an important industry in China; (ii) the transaction may affect national "economic security"; or (iii) the PRC domestic enterprise has a well-known trademark or historical Chinese trade name in China. The new M&A rule also contains a provision requiring overseas SPVs, formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. On September 21, 2006, the CSRC issued a clarification that sets forth the criteria and process for obtaining any required approval from the CSRC.

To date, the application of this new M&A rule is unclear.

Government Support of the Drugstore Industry. The PRC government has supported the growth of the drugstore industry with a series of initiatives.

|

Ÿ

|

Anti-Corruption. The substantial majority of hospitals in China are owned and operated by the government, and revenue from hospital pharmacies constitutes a significant portion of hospitals' revenue. Hospitals procure their supplies of pharmaceutical products in bulk from manufacturers or distributors of pharmaceutical products, and generally decide whether to include a particular medicine on their formulary based upon a number of factors, including doctors' preference in prescribing the medicine, the cost of the medicine, the perceived efficacy of the medicine and the hospital's budget. Decisions by hospitals regarding whether to include a particular medicine in their pharmacies could be affected by corrupt practices, including illegal kickbacks and other benefits offered by manufacturers or distributors of pharmaceutical products. These corrupt practices may also affect doctors' decisions regarding which types of medicine to prescribe.

|

The PRC government has strengthened its anti-corruption measures and has organized a series of government-sponsored anti-corruption campaigns in recent years. In particular, China amended its criminal code in 2006, increasing the penalties for corrupt business practices. The amendment of the criminal code is expected to make pharmaceutical product suppliers compete for the hospitals' business on fair and equal terms, and thus is expected to result in more growth opportunities for drugstores that are not affiliated with hospitals.

8

|

Ÿ

|

Pharmaceutical Product Labeling and Prescription Management. The PRC State Food and Drug Administration, or SFDA, promulgated pharmaceutical product labeling regulations in March 2006, which require that pharmaceutical product labels state the generic ingredients of the pharmaceutical products and which bar the registration of any brand name for any pharmaceutical product which does not contain active ingredients. In addition, doctors are not permitted to include brand names in their prescriptions and required to specify the chemical ingredients of the medicines they prescribe in their prescription. These requirements are expected to have the following positive impacts on the business of non-hospital drugstores:

|

|

Ÿ

|

help curb corrupt practices by pharmaceutical product manufacturers and doctors;

|

|

Ÿ

|

ensure that patients are given better information on the medicines they purchase; and

|

|

Ÿ

|

weaken the hospitals' monopoly on prescriptions and prescription pharmaceutical products.

|

|

Ÿ

|

Advertising of Pharmaceutical Products. The PRC government has adopted a series of measures regulating the advertising of pharmaceutical products. Consumers typically become familiar with a medicine through advertising and word-of-mouth recommendations by pharmacy salespeople. With increased restrictions on advertising of pharmaceutical products, pharmaceutical product manufacturers are expected to increasingly rely on retail pharmacies to build brand familiarity among the general public.

|

|

Ÿ

|

Equal Opportunity for Non-Hospital Drugstores. The PRC Ministry of Health has promulgated prescription regulations requiring hospitals to allow prescriptions to be filled at non-hospital drugstores. The implementation of this regulation is expected to increase drug sales, especially prescription drug sales, in drugstores chains and independent drugstores that are not affiliated with hospitals.

|

|

Ÿ

|

Increased Availability of Funding Under the National Medical Insurance Program. The PRC government has increased the availability of funding under the national medical insurance program and included more pharmaceutical products in the China's national medical insurance scheme.

|

|

Ÿ

|

Enhanced Quality Requirements for the Operations of Pharmacies. China has strengthened its enforcement of good supply practice, or GSP, standards since adopting it at the end of December 2004. As a result, many smaller drugstore chains or independently operated drugstores may find it difficult to meet these enhanced quality requirements for the operations of pharmacies.

|

ITEM 1A. RISK FACTORS

The purchase of our common stock involves a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and other information and our consolidated financial statements and related notes included elsewhere in this report. If any of the following events actually occurs, our financial condition or operating results may be materially and adversely affected, our business may be severely impaired, and the price of our common stock may decline, perhaps significantly. This means you could lose all or a part of your investment.

Risks Related to Our Business

We may not be able to timely identify or otherwise effectively respond to changing customer preferences, and we may fail to optimize our product offering and inventory position.

The drugstore industry in China is rapidly evolving and is subject to rapidly changing customer preferences that are difficult to predict. Our success as both a retailer and a distributor depends on our ability to anticipate and identify customer preferences and adapt our product selection to these preferences. In particular, we must optimize our product selection and inventory positions based on sales trends. We cannot assure you that our product selection, especially our selections of nutritional supplements and food products, will accurately reflect customer preferences at any given time. If we fail to anticipate accurately either the market for our products or customers' purchasing habits or fail to respond to customers' changing preferences promptly and effectively, we may not be able to adapt our product selection to customer preferences or make appropriate adjustments to our inventory positions, which could significantly reduce our revenue and have a material adverse effect on our business, financial condition and results of operations.

9

Our private label products may not achieve or maintain broad market acceptance.

We believe that whether we can succeed in gaining and maintaining broad market acceptance of our private label products depends on many factors, including:

|

Ÿ

|

our ability to maintain competitive product pricing;

|

|

Ÿ

|

our ability to maintain the cost competitiveness of our private label products;

|

|

Ÿ

|

the effectiveness of our sales and marketing efforts;

|

|

Ÿ

|

our ability to provide consistent and high quality customer experiences;

|

|

Ÿ

|

publicity or public perception concerning our company, our brand, our products or our competitors or competing products;

|

|

Ÿ

|

whether or not customers develop habits of routinely purchasing and using our private label products; and

|

|

Ÿ

|

our ability to anticipate, identify and respond to changing customer preferences.

|

If we fail to achieve or maintain broad market acceptance for our private label products, or if products introduced by our competitors are more favorably received than our private label products, or if we fail to respond to customers' changing preferences promptly and effectively, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Our success depends on our ability to establish effective advertising, marketing and promotional programs, including pricing strategies implemented in response to competitive pressures and/or to drive demand for our products. Our advertisements are designed to promote our brand, our corporate image and the prices of products available for sale in our stores. Our pricing strategies and value proposition must be appropriate for our target customers. If we are not able to maintain and increase the awareness of our brand, products and services, or if our competitors are more active or more successful in their activities, we may not be able to attract and retain customers and our reputation may also suffer. We expect to incur substantial expenses in our marketing and promotional efforts to both attract and retain customers. However, our marketing and promotional activities may be less successful than we anticipate, and may not be effective at building our brand awareness and customer base. We also cannot assure you that our current and planned spending on marketing activities will be adequate to support our future growth. Failure to successfully execute our advertising, marketing and promotional programs may result in material decreases in our revenue and profitability.

Failure to maintain appropriate inventory levels could increase our inventory holding costs or cause us to lose sales, either of which could have a material adverse effect on our business, financial condition and results of operations.

We need to maintain sufficient inventory levels to operate our business successfully as well as meet our customers' expectations. However, we must also guard against the risk of accumulating excess inventory. We are exposed to such inventory risks as a result of our increased offering of private label products, rapid changes in product life cycles, changing consumer preferences, uncertainty of success of product launches, seasonality, and manufacturer backorders and other vendor-related problems. We cannot assure you that we can accurately predict these trends and events and avoid over-stocking or under-stocking products. In addition, demand for products could change significantly between the time product inventory is ordered and the time it is available for sale. When we begin selling a new product, it is particularly difficult to forecast product demand accurately. The purchase of certain types of inventory may require significant lead-time. As we carry a broad selection of products and maintain significant inventory levels for a substantial portion of our merchandise, we may be unable to sell such inventory in sufficient quantities or during the relevant selling seasons. Carrying too much inventory would increase our inventory holding costs or lead to unsold stock, and failure to have inventory in stock when a customer orders it could cause us to lose that order or lose that customer, either of which could have a material adverse effect on our business, financial condition and results of operations.

10

We depend on the continued service of, and on the ability to attract, motivate and retain, a sufficient number of qualified and skilled staff, especially regional managers and in-store pharmacists for our stores.

Our ability to continue expanding our retail drugstore chain and deliver high quality products and customer service depends on our ability to attract and retain qualified and skilled staff, especially regional managers and in-store pharmacists. In particular, the applicable PRC regulations require at least one qualified pharmacist to be stationed in every drugstore to instruct or advise customers on prescription drugs. Over the years, a significant shortage of pharmacists has developed due to increasing demand within the drugstore industry as well as demand from other businesses in the healthcare industry. We cannot assure you that we will be able to attract, hire and retain sufficient numbers of skilled regional managers and in-store pharmacists necessary to continue to develop and grow our business. The inability to attract and retain a sufficient number of skilled regional managers and in-store pharmacists could limit our ability to open additional stores, increase revenue or deliver high quality customer service. In addition, competition for these individuals could cause us to offer higher compensation and other benefits in order to attract and retain them, which could materially and adversely affect our financial condition and results of operations.

Our brand name, trade names, trademarks, trade secrets and other intellectual property are valuable assets. If we are unable to protect them from infringement, our business prospects may be harmed.

As sales of our private label products increasingly account for a substantial portion of our revenue, we consider our brand name, trade names and trademarks to be valuable assets. Under PRC law, we have the exclusive right to use a trademark for products or services for which such trademark has been registered with the PRC Trademark Office of State Administration for Industry and Commerce, or the SAIC. However, we may be unable to secure the trademark registration for which we applied. In addition, our efforts to defend our trademarks may be unsuccessful against competitors or other violating entities and we may not have adequate remedies for any such violation.

Moreover, we may be unable to prevent third parties from using our brand name or trademarks without authorization. Unauthorized use of our brand name or trademarks by third parties may adversely affect our business and reputation, including the perceived quality and reliability of our products.

We also rely on trade secrets to protect our know-how and other proprietary information, including pricing, purchasing, promotional strategies, customer lists and/or suppliers lists. However, trade secrets are difficult to protect. While we use reasonable efforts to protect our trade secrets, our employees, consultants, contractors or advisors may unintentionally or willfully disclose our information to competitors. In addition, confidentiality agreements, if any, executed by the foregoing persons may not be enforceable or provide meaningful protection for our trade secrets or other proprietary information in the event of unauthorized use or disclosure. If we were to claim that a third party had illegally obtained and was using our trade secrets, our enforcement efforts could be expensive and time-consuming, and the outcome is unpredictable. In addition, if our competitors independently develop information that is equivalent to our trade secrets or other proprietary information, it will be even more difficult for us to enforce our rights and our business and prospects could be harmed.

Litigation may be necessary in the future to enforce our intellectual property rights or to determine the validity and scope of the intellectual property rights of others. However, because the validity, enforceability and scope of protection of intellectual property rights in the PRC are uncertain and still evolving, we may not be successful in prosecuting these cases. In addition, any litigation or proceeding or other efforts to protect our intellectual property rights could result in substantial costs and diversion of our resources and could seriously harm our business and operating results. Furthermore, the degree of future protection of our proprietary rights is uncertain and may not adequately protect our rights or permit us to gain or keep our competitive advantage. If we are unable to protect our trade names, trademarks, trade secrets and other propriety information from infringement, our business, financial condition and results of operations may be materially and adversely affected.

We may be exposed to intellectual property infringement and other claims by third parties which, if successful, could disrupt our business and have a material adverse effect on our financial condition and results of operations.

Our success depends, in large part, on our ability to use our proprietary information and know-how without infringing third party intellectual property rights. As we increase our sales of private label products, and as litigation becomes more common in China, we face a higher risk of being the subject of claims for intellectual property infringement, invalidity or indemnification relating to other parties' proprietary rights. Our current or potential competitors, many of which have substantial resources, may have or may obtain intellectual property protection that will prevent, limit or interfere with our ability to make, use or sell our products in China. Moreover, the defense of intellectual property suits, including trademark infringement suits, and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our management personnel.

11

As a retailer of pharmaceutical and other healthcare products, we are exposed to inherent risks relating to product liability and personal injury claims.

Pharmacies are exposed to risks inherent in the packaging and distribution of pharmaceutical and other healthcare products, such as with respect to improper filling of prescriptions, labeling of prescriptions, adequacy of warnings and unintentional distribution of counterfeit drugs. Furthermore, the applicable laws, rules and regulations require our in-store pharmacists to offer counseling, without additional charge, to our customers about medication, dosage, delivery systems, common side effects and other information the in-store pharmacists deem significant. Our in-store pharmacists may also have a duty to warn customers regarding any potential negative effects of a prescription drug if the warning could reduce or negate these effects and we may be liable for claims arising from advice given by our in-store pharmacists. In addition, product liability claims may be asserted against us with respect to any of the products we sell and as a retailer, we are required to pay for damages for any successful product liability claim against us, although we may have the right under applicable PRC laws, rules and regulations to recover from the relevant manufacturer for compensation we made to our customers in connection with a product liability claim. We may also be obligated to recall affected products. Any product liability claim or product recall may result in adverse publicity regarding us and the products we sell, which would harm our reputation. If we are found liable for product liability claims, we could be required to pay substantial monetary damages. Furthermore, even if we successfully defend ourselves against this type of claim, we could be required to spend significant management, financial and other resources, which could disrupt our business, and our reputation as well as our brand name may also suffer. We, like many other similar companies in China, do not carry product liability insurance. As a result, any imposition of product liability could materially harm our business, financial condition and results of operations. In addition, we do not have any business interruption insurance due the limited coverage of any business interruption insurance in China, and as a result, any business disruption or natural disaster could severely disrupt our business and operations and significantly decrease our revenue and profitability.

Our operating results are difficult to predict, and we may experience significant fluctuations in our operating results.

Our operating results may fluctuate significantly. As a result, you may not be able to rely on period to period comparisons of our operating results as an indication of our future performance. Factors causing these fluctuations include, among others:

|

Ÿ

|

our ability to maintain and increase sales to existing customers, attract new customers and satisfy our customers' demands;

|

|

Ÿ

|

the frequency of customer visits to our drugstores and the quantity and mix of products our customers purchase;

|

|

Ÿ

|

the prices we charge for our products or changes in our pricing strategies or the pricing strategies of our competitors;

|

|

Ÿ

|

timing and costs of marketing and promotional programs organized by us and/or our suppliers, including the extent to which we or our suppliers offer promotional discounts to our customers;

|

|

Ÿ

|

our ability to acquire merchandise, manage inventory and fulfill orders;

|

|

Ÿ

|

technical difficulties, system downtime or interruptions of our ERP system, which we use for product selection, procurement, pricing, distribution and retail management processes;

|

|

Ÿ

|

the introduction by our competitors of new products or services;

|

|

Ÿ

|

the effects of strategic alliances, potential acquisitions and other business combinations, and our ability to successfully and timely integrate them into our business;

|

|

Ÿ

|

changes in government regulations with respect to pharmaceutical and retail industries; and

|

|

Ÿ

|

economic and geopolitical conditions in China and elsewhere.

|

In addition, a significant percentage of our operating expenses is fixed in the short term. As a result, a delay in generating or recognizing revenue for any reason could result in substantial operating losses.

Moreover, our business is subject to seasonal variations in demand. In particular, traditional retail seasonality affects the sales of certain pharmaceuticals and other non-pharmaceutical products. Sales of our pharmaceutical products benefit in the fourth quarter from the winter cold and flu season, and are lower in the first quarter of each year because Chinese New Year falls into the first quarter of each year and our customers generally pay fewer visits to drugstores during this period. In addition, sales of some health and beauty products are driven, to some extent, by seasonal purchasing patterns and seasonal product changes. Failure to manage the increased sales effectively in the high sale season, and to manage increases in inventory in anticipation of sales increases could have a material adverse effect on our financial condition, results of operations and cash flow.

12

Many of the factors discussed above are beyond our control, making our quarterly results difficult to predict, which could cause the trading price of our common stock to decline below investor expectations. You should not rely on our operating results for prior periods as an indication of our future results.

We may not be able to manage our expansion of operations effectively and failure to do so could strain our management, operational and other resources, which could materially and adversely affect our business and growth potential.

We have grown rapidly since our inception and we anticipate continued expansion of our business to address growth in demand for our products and services, as well as to capture new market opportunities. The continued growth of our business has resulted in, and will continue to result in, substantial demands on our management, operational and other resources. In particular, the management of our growth will require, among other things:

|

Ÿ

|

our ability to continue to identify new store locations and lease new store facilities at acceptable prices;

|

|

Ÿ

|

our ability to optimize product offerings and increase sales of private label products;

|

|

Ÿ

|

our ability to control procurement costs and optimize product pricing;

|

|

Ÿ

|

our ability to control operating expenses and achieve a high level of efficiency, including, in particular, our ability to manage the amount of time required to open new stores and for stores to become profitable, to maintain sufficient inventory levels and to manage warehousing, buying and distribution costs;

|

|

Ÿ

|

information technology system enhancement, including the installation of our ERP system;

|

|

Ÿ

|

strengthening of financial and management controls;

|

|

Ÿ

|

increased marketing, sales and sales support activities; and

|

|

Ÿ

|

hiring and training of new personnel, including in-store pharmacists and regional managers.

|

If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

Future acquisitions are expected to be a part of our growth strategy, and could expose us to significant business risks.

One of our strategies is to grow our business through acquisitions, especially in areas where local regulations prohibit the opening of new drugstores within certain distances of an existing drugstore, and in areas that are close to our distribution centers in order to gain operational efficiencies in distribution and leverage our information technology infrastructure over a broader store base. However, we cannot assure you that we will be able to identify and secure suitable acquisition opportunities. Our ability to consummate and integrate effectively any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources and, to the extent necessary, our ability to obtain financing on satisfactory terms for larger acquisitions, if at all.

Moreover, if an acquisition candidate is identified, the third parties with whom we seek to cooperate may not select us as a potential partner or we may not be able to enter into arrangements on commercially reasonable terms or at all. The negotiation and completion of potential acquisitions, whether or not ultimately consummated, could also require significant diversion of management's time and resources and potential disruption of our existing business. Furthermore, we cannot assure you that the expected synergies from future acquisitions will actually materialize. In addition, future acquisitions could result in the incurrence of additional indebtedness, costs, and contingent liabilities. Future acquisitions may also expose us to potential risks, including risks associated with:

|

Ÿ

|

the integration of new operations, services and personnel;

|

|

Ÿ

|

unforeseen or hidden liabilities;

|

|

Ÿ

|

the diversion of financial or other resources from our existing businesses;

|

|

Ÿ

|

our inability to generate sufficient revenue to recover costs and expenses of the acquisitions; and

|

|

Ÿ

|

the potential loss of, or harm to, relationships with employees or customers.

|

13

Any of the above could significantly disrupt our ability to manage our business and materially and adversely affect our business, financial condition and results of operations.

We depend substantially on the continuing efforts of our executive officers, and our business and prospects may be severely disrupted if we lose their services.

Our future success is dependent on the continued services of the key members of our management team. The implementation of our business strategy and our future success depend in large part on our continued ability to attract and retain highly qualified management personnel. We face competition for personnel from other drugstore chains, retail chains, supermarkets, convenience stores, pharmaceutical companies and other organizations. Competition for these individuals could cause us to offer higher compensation and other benefits in order to attract and retain them, which could materially and adversely affect our financial condition and results of operations. We may be unable to attract or retain the personnel required to achieve our business objectives and failure to do so could severely disrupt our business and prospects. The process of hiring suitably qualified personnel is also often lengthy. If our recruitment and retention efforts are unsuccessful in the future, it may be more difficult for us to execute our business strategy.

We may need additional capital and may not be able to obtain it at acceptable terms or at all, which could adversely affect our liquidity and financial position.

We may need to raise additional funds if our expenditures exceed our current expectations due to changed business conditions or other future developments, or to finance our acquisition strategy. Our future liquidity needs and other business reasons could require us to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities or securities convertible or exchangeable into our equity securities would result in additional dilution to you. The incurrence of additional indebtedness would result in increased debt service obligations and could result in operating and financing covenants that restrict our operational flexibility.

Our ability to raise additional funds in the future is subject to a variety of uncertainties, including:

|

Ÿ

|

our future financial condition, results of operations and cash flows;

|

|

Ÿ

|

general market conditions for capital-raising activities by pharmaceutical companies; and

|

|

Ÿ

|

economic, political and other conditions in China and elsewhere.

|

We may be unable to obtain additional capital in a timely manner or on commercially acceptable terms or at all. Furthermore, the terms and amount of any additional capital raised through issuances of equity securities may result in significant shareholder dilution.

Risks Related to Our Industry

We face significant competition, and if we do not compete successfully against existing and new competitors, our revenue and profitability would be materially and adversely affected.

The drugstore industry in China is highly competitive, and we expect competition to intensify in the future. Our primary competitors include other drugstore chains and independent drugstores. We also increasingly face competition from discount stores, convenience stores and supermarkets as we increase our offering of non-drug convenience products and services. We compete for customers and revenue primarily on the basis of store location, merchandise selection, our private label offerings, price, services that we offer and our brand name. We believe that the continued consolidation of the drugstore industry and continued new store openings by chain store operators will increase competitive pressures in the industry. As a result, we expect to face additional competition in terms of finding suitable new store locations if we expand into these cities. Moreover, we may be subject to additional competition from new entrants to the drugstore industry in China. If the PRC government removes the barriers and allows foreign companies to operate majority-owned retail drugstore business in China, we could face increased competition from foreign companies. Some of our larger competitors may enjoy competitive advantages, such as

14

|

Ÿ

|

greater financial and other resources;

|

|

Ÿ

|

larger variety of products;

|

|

Ÿ

|

more extensive and advanced supply chain management systems;

|

|

Ÿ

|

greater pricing flexibility;

|

|

Ÿ

|

larger economies of scale and purchasing power;

|

|

Ÿ

|

more extensive advertising and marketing efforts;

|

|

Ÿ

|

greater knowledge of local market conditions;

|

|

Ÿ

|

stronger brand recognition; and

|

|

Ÿ

|

larger sales and distribution networks.

|

As a result, we may be unable to offer products comparable to, or more desirable than, those offered by our competitors, market our products as effectively as our competitors or otherwise respond successfully to competitive pressures. In addition, our competitors may be able to offer larger discounts on competing products, and we may not be able to profitably match those discounts. Furthermore, our competitors may offer products that are more attractive to our customers or that render our products uncompetitive. In addition, the timing of the introduction of competing products into the market could affect the market acceptance and market share of our products. Our failure to compete successfully could materially and adversely affect our business, financial condition, results of operation and prospects.

Changes in economic conditions and consumer confidence in China may influence the retail industry, consumer preferences and spending patterns.

Our business and revenue growth primarily depend on the size of the retail market of pharmaceutical products in China. As a result, our revenue and profitability may be negatively affected by changes in national, regional or local economic conditions and consumer confidence in China. In particular, as we expand the number of our retail stores in metropolitan markets, where living standards and consumer purchasing power are relatively high, we become more susceptible to changes in economic conditions, consumer confidence and customer preferences of the Chinese population. External factors beyond our control that affect consumer confidence include unemployment rates, levels of personal disposable income, national, regional or local economic conditions and acts of war or terrorism. Changes in economic conditions and consumer confidence could adversely affect consumer preferences, purchasing power and spending patterns.

In addition, acts of war or terrorism may cause damage to our facilities, disrupt the supply of the products and services we offer in our stores or adversely impact consumer demand. Any of these factors could have a material adverse effect on our business, financial condition and results of operations.

The retail prices of some of our products are subject to control, including periodic downward adjustment, by PRC governmental authorities.

An increasing percentage of our pharmaceutical products, primarily those included in the national and provincial Medical Insurance Catalogues, are subject to price controls in the form of fixed retail prices or retail price ceilings. In addition, the retail prices of these products are also subject to periodic downward adjustments as the PRC governmental authorities seek to make pharmaceutical products more affordable to the general public. Any future price controls or government mandated price reductions may have a material adverse affect on our financial condition and results of operations, including significantly reducing our revenue and profitability.

Our retail operations require a number of permits and licenses in order to carry on their business.

Drugstores in China are required to obtain certain permits and licenses from various PRC governmental authorities, including GSP certification. We are also required to obtain food hygiene certificates for the distribution of nutritional supplements and food products. We cannot assure you that we have obtained or maintained all required licenses, permits and certifications to carry on our business at all times, and from time to time we may have not been in compliance with all such required licenses, permits and certifications.

Moreover, these licenses, permits and certifications are subject to periodic renewal and/or reassessment by the relevant PRC governmental authorities and the standards of such renewal or reassessment may change from time to time. We intend to apply for the renewal of these licenses, permits and certifications when required by applicable laws and regulations. Any failure by us to obtain and maintain all licenses, permits and certifications necessary to carry on our business at any time could have a material adverse effect on our business, financial condition and results of operations. In addition, any inability to renew these licenses, permits and certifications could severely disrupt our business, and prevent us from continuing to carry on our business. Any changes in the standards used by governmental authorities in considering whether to renew or reassess our business licenses, permits and certifications, as well as any enactment of new regulations that may restrict the conduct of our business, may also decrease our revenue and/or increase our costs and materially reduce our profitability and prospects. Furthermore, if the interpretation or implementation of existing laws and regulations changes or new regulations come into effect requiring us to obtain any additional licenses, permits or certifications that were previously not required to operate our existing businesses, we cannot assure you that we will successfully obtain such licenses, permits or certifications.

15

The continued penetration of counterfeit products into the retail market in China may damage our brand and reputation and have a material adverse effect on our business, financial condition, results of operations and prospects.

There has been continued penetration of counterfeit products into the pharmaceutical retail market in China. Counterfeit products are generally sold at lower prices than the authentic products due to their low production costs, and in some cases are very similar in appearance to the authentic products. Counterfeit pharmaceuticals may or may not have the same chemical content as their authentic counterparts, and are typically manufactured without proper licenses or approvals as well as fraudulently mislabeled with respect to their content and/or manufacturer. Although the PRC government has been increasingly active in combating counterfeit pharmaceutical and other products, there is not yet an effective counterfeit pharmaceutical product regulation control and enforcement system in China. Although we have implemented a series of quality control procedures in our procurement process, we cannot assure you that we would not sell counterfeit pharmaceutical products inadvertently. Any unintentional sale of counterfeit products may subject us to negative publicity, fines and other administrative penalties or even result in litigation against us. Moreover, the continued proliferation of counterfeit products and other products may reinforce the negative image of retailers among consumers in China, may severely harm the reputation and brand name of companies like us, and adversely impact the sales of our own manufactured products and those that we distribute. The continued proliferation of counterfeit products in China could have a material adverse effect on our business, financial condition, results of operations and prospects.

Risks Related to Our Corporate Structure

Transactions among our affiliates are subject to scrutiny by the PRC tax authorities and a finding that we or any of our consolidated entities owe additional taxes could have a material adverse impact on our net income and the value of an investment in our common stock.

Under PRC law, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. If any of the transactions we have entered into among our consolidated entities are challenged by the PRC tax authorities to be not on an arm's-length basis, or to result in an unreasonable reduction in our PRC tax obligations, the PRC tax authorities have the authority to disallow our tax deduction claims, adjust the profits and losses of our respective PRC consolidated entities and assess late payment fees and other penalties. Our net income may be materially reduced if our tax liabilities increase or if we are otherwise assessed late payment fees or other penalties.

Risks Related to Doing Business in China

Adverse changes in political and economic policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products and materially and adversely affect our competitive position.

All of our business operations are conducted in China and all of our sales are made in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including:

|

Ÿ

|

the degree of government involvement;

|

|

Ÿ

|

the level of development;

|

|

Ÿ

|

the growth rate;

|

|

Ÿ

|

the control of foreign exchange;

|

|

Ÿ

|

access to financing; and

|

|

Ÿ

|

the allocation of resources.

|

16

While the Chinese economy has grown significantly in the past 25 years, the growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us.