Attached files

Pivotal Energy Development

Dana Grams

President

Dana Grams

President

2

2010 Analyst Meeting

Forward-Looking Statements

Certain expectations and projections regarding our future performance referenced in this presentation, in other reports or statements we file with the SEC or otherwise release to the public,

and on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are

forward-looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition,

economic performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions,

forward-looking statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may,"

"outlook," "plan," "potential," "predict," "project," "seek," "should," "target," "would," or similar expressions. Our expectations are not guarantees and are based on currently available

competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations

are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

and on our website, are forward-looking statements. Senior officers and other employees may also make verbal statements to analysts, investors, regulators, the media and others that are

forward-looking. Forward-looking statements involve matters that are not historical facts, such as statements regarding our future operations, prospects, strategies, financial condition,

economic performance (including growth and earnings), industry conditions and demand for our products and services. Because these statements involve anticipated events or conditions,

forward-looking statements often include words such as "anticipate," "assume," "believe," "can," "could," "estimate," "expect," "forecast," "future," "goal," "indicate," "intend," "may,"

"outlook," "plan," "potential," "predict," "project," "seek," "should," "target," "would," or similar expressions. Our expectations are not guarantees and are based on currently available

competitive, financial and economic data along with our operating plans. While we believe our expectations are reasonable in view of the currently available information, our expectations

are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations.

Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products; the impact of changes in state and federal

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy

industry consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified

vendors, unexpected change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business,

financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions,

including recent disruptions in the capital markets and lending environment and the current economic downturn; general economic conditions; uncertainties about environmental issues and

the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our business; the impact of natural disasters such

as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the Securities and Exchange Commission.

Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes.

legislation and regulation including changes related to climate change; actions taken by government agencies on rates and other matters; concentration of credit risk; utility and energy

industry consolidation; the impact on cost and timeliness of construction projects by government and other approvals, development project delays, adequacy of supply of diversified

vendors, unexpected change in project costs, including the cost of funds to finance these projects; the impact of acquisitions and divestitures; direct or indirect effects on our business,

financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors; interest rate fluctuations; financial market conditions,

including recent disruptions in the capital markets and lending environment and the current economic downturn; general economic conditions; uncertainties about environmental issues and

the related impact of such issues; the impact of changes in weather, including climate change, on the temperature-sensitive portions of our business; the impact of natural disasters such

as hurricanes on the supply and price of natural gas; acts of war or terrorism; and other factors which are provided in detail in our filings with the Securities and Exchange Commission.

Forward-looking statements are only as of the date they are made, and we do not undertake to update these statements to reflect subsequent changes.

Supplemental Information

Company management evaluates segment financial performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations and on

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated

level and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations.

operating margin. EBIT is a non-GAAP (accounting principles generally accepted in the United States of America) financial measure that includes operating income, other income and

expenses. Items that are not included in EBIT are financing costs, including debt and interest expense and income taxes. The company evaluates each of these items on a consolidated

level and believes EBIT is a useful measurement of our performance because it provides information that can be used to evaluate the effectiveness of our businesses from an operational

perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations.

Operating margin is a non-GAAP measure calculated as operating revenues minus cost of gas, excluding operation and maintenance expense, depreciation and amortization, and taxes

other than income taxes. These items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues

of the contribution resulting from customer growth, since cost of gas is generally passed directly through to customers.

other than income taxes. These items are included in the company's calculation of operating income. The company believes operating margin is a better indicator than operating revenues

of the contribution resulting from customer growth, since cost of gas is generally passed directly through to customers.

EBIT and operating margin should not be considered as alternatives to, or more meaningful indicators of, the company's operating performance than operating income or net income

attributable to AGL Resources Inc. as determined in accordance with GAAP. In addition, the company's EBIT and operating margin may not be comparable to similarly titled measures of

another company.

attributable to AGL Resources Inc. as determined in accordance with GAAP. In addition, the company's EBIT and operating margin may not be comparable to similarly titled measures of

another company.

Reconciliations of non-GAAP financial measures referenced in this presentation are available on the company’s Web site at www.aglresources.com.

Cautionary Statements and Supplemental Information

3

2010 Analyst Meeting

Nymex Monthly Continuation

May 6, 2010

May 6, 2010

Nymex Forward Curve

May 6, 2010

Nymex Monthly Volatility 1990-2010

April 5, 2010

Fundamentals of the Marketplace

4

2010 Analyst Meeting

Proposed USGC LNG Terminals

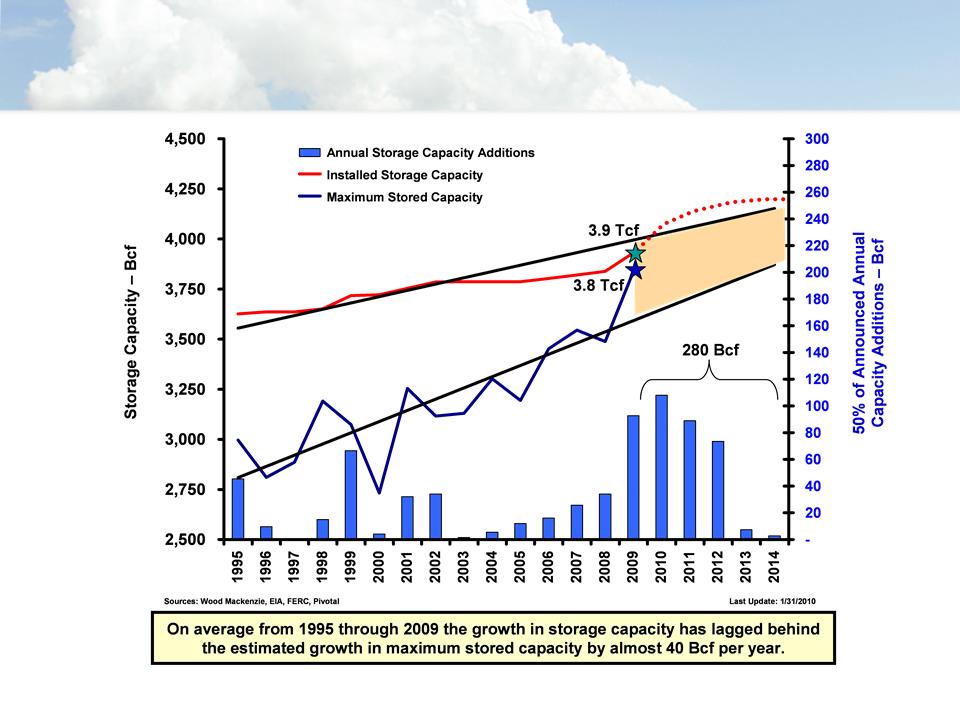

Natural Gas Storage Capacity Supply - Demand

Balance

Balance

U.S. Domestic Shale Production

Extended Economic Slowdown Environmental Policy Domination

Domestic Energy Policy Moderate Policies

U.S. LNG Imports under Alternative Scenarios

Extended Economic Slowdown Environmental Policy Domination

Domestic Energy Policy Moderate Policies

Fundamentals of the Marketplace

5

2010 Analyst Meeting

Fundamentals of the Marketplace

• Market is cyclical

• Supply basins are shifting

– Canada and Gulf of Mexico in decline

– Shale and tight sands increasing

• Deliverability characteristics of new unconventional production are more

challenging

challenging

• Infrastructure need is real (pipeline, treating, processing, storage)

• LNG will come - rapidly expanding global LNG infrastructure

– Variability contributes to price volatility

• Power generation will grow and favors natural gas

• Industrial demand will rebound with economic improvement

• Demand peak continues to grow

• “Green” power fluctuations exaggerates natural gas peaks

• Politics (carbon policies) may dictate size of natural gas market

• The natural gas market will grow

• Storage is a necessity in managing supply / market imbalances

– Operational

– Price mitigator

6

2010 Analyst Meeting

Storage Additions Lag Behind Use

7

2010 Analyst Meeting

Beaumont

Disposal

Line

Line

• Two caverns of 12 Bcf working gas capacity

• Injection/Withdrawal - 300/600 MMcf/d

• 14,205 Hp of compression

• 6 pipeline interconnections

– Kinder Morgan, Centana, Golden Pass,

Houston Pipe Line, Texas Eastern, Florida Gas

• 9 miles of twin 24-inch pipeline

• In service - Cavern 1: 3Q 2010, Cavern 2: 2012

Golden Triangle Program Overview

8

2010 Analyst Meeting

Golden Triangle Storage

• Pipeline

– 80% complete

– Passed FERC inspection

– Completing bores and directional drills

• Meter Stations

– 30% complete

– June-August expected completion dates

• Compressors

– 65% complete

– Expected in-service date of July 2010

9

2010 Analyst Meeting

Three Dimensional Sonar Picture

1250 Ft

Empire State

Building

Building

Golden Triangle Cavern Progress

Cavern 1

• Leaching continues at rates ~3,900 gpm

• Cavern size estimated to be 8.0 MM barrels by

August 1st

August 1st

• Leaching scheduled to end June 1st -

conversion activities to commence

conversion activities to commence

• Sonar completed February 2010; Results

indicated a good cavern shape

indicated a good cavern shape

Cavern 2

• Cavern 2 continues to be monitored during

shutdown until leaching operations start-up

again in June

shutdown until leaching operations start-up

again in June

• Commercial service for Cavern 2 on schedule

to begin 2Q 2012

to begin 2Q 2012

10

2010 Analyst Meeting

Cavern

Creation

• Always full

of water as

it grows

of water as

it grows

Salt

Surface

Open

Brine Out

Fresh Water In

Cavern

Creation

• Always full

of water as

it grows

of water as

it grows

Salt

Surface

Open

Brine Out

Fresh Water In

Cavern

Creation

• Always full of

water as it

grows

water as it

grows

• Conversion to

commercial

operations -

gas displaces

water

commercial

operations -

gas displaces

water

Salt

Surface

Gas In and Out

Open

Brine Out

Cavern

Creation

• Always full of

water as it

grows

water as it

grows

• Conversion to

commercial

operations -

gas displaces

water

commercial

operations -

gas displaces

water

Salt

Surface

Gas In and Out

Brine Out

Transition to Commercial Operations

11

2010 Analyst Meeting

Today

Project risk is

significantly

eliminated

significantly

eliminated

Golden Triangle Storage Schedule

12

2010 Analyst Meeting

Compressors

MCC Building

Compressor Piping &

Conduit

Conduit

Gas Coolers

Golden Triangle Construction

13

2010 Analyst Meeting

Cavern 2 Wellhead

24” Header Pipeline

Pipeline Route-of-Way

Golden Triangle Construction

14

2010 Analyst Meeting

: 10.0 MMDth

: 7.5 MMDth

: 2

: 360 MDth/Day

: 600 MDth/Day

: 9

: 15 miles dual 16”

Existing

Configuration

: 37 MMDth

: 17 - 28 MMDth

: 4

: 660 MMcf per Day

: 1,320 MMcf per Day

: 12

: Additional Pipeline

Maximum

Expanded

Configuration

Jefferson Island Expansion

• Total Capacity

• Working Gas

• Number of Caverns

• Max Injection Capability

• Max Withdrawal Capability

• Interconnects

• Header System

15

2010 Analyst Meeting

• Settled mineral lease dispute with State of

Louisiana via operating agreement

Louisiana via operating agreement

• Entered “Stage Gate One” of Asset

Development Process

Development Process

• Expect to submit permit applications

• Permits anticipated, prep for construction,

detailed engineering

detailed engineering

• Expected start-up of operations, Cavern 3

• Cavern 1 expected expansion

• Cavern 2 expected expansion

Jefferson Island Timeline

December 2009

January 2010

June 2010

2011

2014

2015

16

2010 Analyst Meeting

Jefferson Island Program Overview

Project A

– Obtain permits for

Cavern 3 & 4

Cavern 3 & 4

– Complete raw water and

disposal well facility

disposal well facility

– Upgrade leach plant

– Solution mine Cavern 3

adding 6 Bcf working

gas

adding 6 Bcf working

gas

Project B

– Expand Caverns 1 & 2,

adding 3.5 Bcf of

working gas capacity

adding 3.5 Bcf of

working gas capacity

– Replace wellheads and

leaching strings

leaching strings

17

2010 Analyst Meeting

Where We Are Going

• Proceeding with measured expansions

• Geographic diversity

• Increase optionality

• Long-term portfolio value

18

2010 Analyst Meeting

AGL Resources Advantages

• Long-term player

• Well-capitalized

• Good locations

• Speed to market

• Low-cost expansion opportunities

• Strong customer focus

• Experienced management team / sustainable

organization

organization

19

2010 Analyst Meeting

Opportunities Just Beginning

• Storage fundamentals remain strong

– Natural gas market is growing

– Significant barriers now exist to develop new storage

• Uncertainty remains challenging

– Credit markets - Commodity price

– Inflation - Market participates

– Interest rates - Renewable energy sources

– Demand - Carbon / greenhouse gas legislation

– Supply sources

• Next cycle will come

• Long-term view