Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MIRANT CORP | Financial_Report.xls |

| EX-31.2 - SECTION 302 CERTIFICATION OF CFO - MIRANT CORP | dex312.htm |

| EX-32.2 - SECTION 906 CERTIFICATION OF CFO - MIRANT CORP | dex322.htm |

| EX-32.1 - SECTION 906 CERTIFICATION OF CEO - MIRANT CORP | dex321.htm |

| EX-31.1 - SECTION 302 CERTIFICATION OF CEO - MIRANT CORP | dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-16107

Mirant Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-3538156 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 1155 Perimeter Center West, Suite 100, | 30338 | |

| Atlanta, Georgia | (Zip Code) | |

| (Address of Principal Executive Offices) | ||

(678) 579-5000

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

x | Accelerated Filer | ¨ | |||||||

| Non-accelerated Filer |

¨ | Smaller reporting company | ¨ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. x Yes ¨ No

As of May 3, 2010, there were 145,457,714 shares of the registrant’s Common Stock, $0.01 par value per share, outstanding.

Table of Contents

| Page | ||||

| Glossary of Certain Defined Terms | i-iii | |||

| Cautionary Statement Regarding Forward-Looking Information | 3 | |||

| PART I—FINANCIAL INFORMATION | ||||

| Item 1. | Interim Financial Statements (Unaudited): | |||

| Condensed Consolidated Statements of Operations | 6 | |||

| Condensed Consolidated Balance Sheets | 7 | |||

| Condensed Consolidated Statements of Stockholders’ Equity and Comprehensive Income | 8 | |||

| Condensed Consolidated Statements of Cash Flows | 9 | |||

| Notes to Condensed Consolidated Financial Statements (Unaudited) | 10 | |||

| Item 2. | Management’s Discussion and Analysis of Results of Operations and Financial Condition | 43 | ||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 69 | ||

| Item 4. | Controls and Procedures | 73 | ||

| PART II—OTHER INFORMATION | ||||

| Item 1. | Legal Proceedings | 74 | ||

| Item 1A. | Risk Factors | 74 | ||

| Item 2. | 75 | |||

| Item 5. | 76 | |||

| Item 6. | Exhibits | 77 | ||

2

Table of Contents

Glossary of Certain Defined Terms

Ancillary Services—Services that ensure reliability and support the transmission of electricity from generation sites to customer loads. Such services include regulation service, reserves and voltage support.

Bankruptcy Code—United States Bankruptcy Code.

Bankruptcy Court—United States Bankruptcy Court for the Northern District of Texas, Fort Worth Division.

Baseload Generating Units—Units that satisfy minimum baseload requirements of the system and produce electricity at an essentially constant rate and run continuously.

CAIR—Clean Air Interstate Rule.

CAISO—California Independent System Operator.

Cal PX—California Power Exchange.

Clean Air Act—Federal Clean Air Act.

Clean Water Act—Federal Water Pollution Control Act.

CO2—Carbon dioxide.

Company—Old Mirant prior to January 3, 2006, and New Mirant on or after January 3, 2006.

CPUC—California Public Utilities Commission.

Dark Spread—The difference between the price received for electricity generated compared to the market price of the coal required to produce the electricity.

DWR—California Department of Water Resources.

EBITDA—Earnings before interest, taxes, depreciation and amortization.

EOB—California Electricity Oversight Board.

EPA—United States Environmental Protection Agency.

EPC—Engineering, procurement and construction.

EPS—Earnings per share.

Exchange Act—Securities Exchange Act of 1934.

Exchange Ratio—Right of Mirant Corporation stockholders to receive 2.835 shares of common stock of RRI Energy, Inc.

FASB—Financial Accounting Standards Board.

FERC—Federal Energy Regulatory Commission.

GAAP—United States generally accepted accounting principles.

GenOn Energy—GenOn Energy, Inc.

Gross Margin—Operating revenue less cost of fuel, electricity and other products, excluding depreciation and amortization.

Hudson Valley Gas—Hudson Valley Gas Corporation.

Intermediate Generating Units—Units that meet system requirements that are greater than baseload and less than peaking.

i

Table of Contents

ISO—Independent System Operator.

ISO-NE—Independent System Operator-New England.

LIBOR—London InterBank Offered Rate.

MC Asset Recovery—MC Asset Recovery, LLC.

MDE—Maryland Department of the Environment.

Merger Agreement—An agreement and plan of merger into which Mirant Corporation entered with RRI Energy, Inc. and RRI Energy Holdings, Inc. on April 11, 2010.

Mirant—Old Mirant prior to January 3, 2006, and New Mirant on or after January 3, 2006.

Mirant Americas Energy Marketing—Mirant Americas Energy Marketing, LP.

Mirant Americas Generation—Mirant Americas Generation, LLC.

Mirant Bowline—Mirant Bowline, LLC.

Mirant California—Mirant California, LLC.

Mirant Canal—Mirant Canal, LLC.

Mirant Chalk Point—Mirant Chalk Point, LLC.

Mirant Delta—Mirant Delta, LLC.

Mirant Energy Trading—Mirant Energy Trading, LLC.

Mirant Lovett—Mirant Lovett, LLC, owner of the former Lovett generating facility, which was shut down on April 19, 2008, and has been demolished.

Mirant Marsh Landing—Mirant Marsh Landing, LLC.

Mirant MD Ash Management—Mirant MD Ash Management, LLC.

Mirant Mid-Atlantic—Mirant Mid-Atlantic, LLC and, except where the context indicates otherwise, its subsidiaries.

Mirant New York—Mirant New York, LLC.

Mirant North America—Mirant North America, LLC.

Mirant NY-Gen—Mirant NY-Gen, LLC sold by the Company in the second quarter of 2007.

Mirant Potomac River—Mirant Potomac River, LLC.

Mirant Potrero—Mirant Potrero, LLC.

MW—Megawatt.

MWh—Megawatt hour.

Net Capacity Factor—Actual production of electricity as a percentage of net dependable capacity to produce electricity.

New Mirant—Mirant Corporation on or after January 3, 2006.

NOL—Net operating loss.

NOV —Notice of violation.

NOx—Nitrogen oxides.

NSR—New source review.

ii

Table of Contents

NYISO—New York Independent System Operator.

NYMEX—New York Mercantile Exchange.

NYSDEC—New York State Department of Environmental Conservation.

NYSE—New York Stock Exchange.

Old Mirant—MC 2005, LLC, known as Mirant Corporation prior to January 3, 2006.

OTC—Over-the-Counter.

Ozone Season—The period between May 1 and September 30 of each year.

Peaking Generating Units—Units used to meet demand requirements during the periods of greatest or peak load on the system.

Pepco—Potomac Electric Power Company.

PG&E—Pacific Gas & Electric Company.

PJM—PJM Interconnection, LLC.

Plan—The plan of reorganization that was approved in conjunction with the Company’s emergence from bankruptcy protection on January 3, 2006.

PPA—Power purchase agreement.

Reserve Margin—Excess capacity over peak demand.

RGGI—Regional Greenhouse Gas Initiative.

RMR—Reliability-must-run.

RRI Energy—RRI Energy, Inc.

RTO—Regional Transmission Organization.

Scrubbers—Flue gas desulfurization emissions controls.

Securities Act—Securities Act of 1933, as amended.

Series A Warrants—Warrants issued on January 3, 2006, with an exercise price of $21.87 and expiration date of January 3, 2011.

Series B Warrants—Warrants issued on January 3, 2006, with an exercise price of $20.54 and expiration date of January 3, 2011.

SO2—Sulfur dioxide.

Spark Spread—The difference between the price received for electricity generated compared to the market price of the natural gas required to produce the electricity.

VaR—Value at risk.

VIE—Variable interest entity.

Virginia DEQ—Virginia Department of Environmental Quality.

Wrightsville—Wrightsville, Arkansas power generating facility sold by the Company in the third quarter of 2005.

iii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

In addition to historical information, the information presented in this Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve known and unknown risks and uncertainties and relate to future events, our future financial performance or our projected business results. In some cases, one can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “intend,” “seek,” “plan,” “think,” “anticipate,” “estimate,” “predict,” “target,” “potential” or “continue” or the negative of these terms or other comparable terminology.

Forward-looking statements are only predictions. Actual events or results may differ materially from any forward-looking statement as a result of various factors, which include:

| • | legislative and regulatory initiatives regarding deregulation, regulation or restructuring of the industry of generating, transmitting and distributing electricity (the “electricity industry”); changes in state, federal and other regulations affecting the electricity industry (including rate and other regulations); changes in, or changes in the application of, environmental and other laws and regulations to which we and our subsidiaries and affiliates are or could become subject; |

| • | failure of our plants to perform as expected, including outages for unscheduled maintenance or repair; |

| • | environmental regulations that restrict our ability or render it uneconomic to operate our business, including regulations related to the emission of CO2 and other greenhouse gases; |

| • | increased regulation that limits our access to adequate water supplies and landfill options needed to support power generation or that increases the costs of cooling water and handling, transporting and disposing off-site of ash and other byproducts; |

| • | changes in market conditions, including developments in the supply, demand, volume and pricing of electricity and other commodities in the energy markets, including efforts to reduce demand for electricity and to encourage the development of renewable sources of electricity, and the extent and timing of the entry of additional competition in our markets; |

| • | continued poor economic and financial market conditions, including impacts on financial institutions and other current and potential counterparties and negative impacts on liquidity in the power and fuel markets in which we hedge and transact; |

| • | increased credit standards, margin requirements, market volatility or other market conditions that could increase our obligations to post collateral beyond amounts that are expected, including additional collateral costs associated with OTC hedging activities as a result of proposed legislation governing derivative financial instruments; |

| • | our inability to access effectively the OTC and exchange-based commodity markets or changes in commodity market conditions and liquidity, including as a result of proposed legislation governing derivative financial instruments, which may affect our ability to engage in asset management, proprietary trading and fuel oil management activities as expected, or result in material gains or losses from open positions; |

| • | deterioration in the financial condition of our counterparties and the failure of such parties to pay amounts owed to us or to perform obligations or services due to us beyond collateral posted; |

3

Table of Contents

| • | hazards customary to the power generation industry and the possibility that we may not have adequate insurance to cover losses resulting from such hazards or the inability of our insurers to provide agreed upon coverage; |

| • | the expected timing and likelihood of completion of the proposed merger with RRI Energy, including the timing, receipt and terms and conditions of required stockholder, governmental and regulatory approvals that may reduce anticipated benefits or cause the parties to abandon the merger; the ability of the parties to arrange debt financing in an amount sufficient to fund the refinancing contemplated in, and on terms consistent with, the Merger Agreement; the diversion of management’s time and attention from our ongoing business during the time we are seeking to complete the merger; the ability to maintain relationships with employees, customers and suppliers; the ability to integrate successfully the businesses and realize cost savings and any other synergies; and the risk that credit ratings of the combined company or its subsidiaries may be different from what the companies expect; |

| • | price mitigation strategies employed by ISOs or RTOs that reduce our revenue and may result in a failure to compensate our generating units adequately for all of their costs; |

| • | changes in the rules used to calculate capacity, energy and ancillary services payments; |

| • | legal and political challenges to the rules used to calculate capacity, energy and ancillary services payments; |

| • | volatility in our gross margin as a result of our accounting for derivative financial instruments used in our asset management, proprietary trading and fuel oil management activities and volatility in our cash flow from operations resulting from working capital requirements, including collateral, to support our asset management, proprietary trading and fuel oil management activities; |

| • | our ability to enter into intermediate and long-term contracts to sell power and to obtain adequate supply and delivery of fuel for our generating facilities, at our required specifications and on terms and prices acceptable to us; |

| • | our failure to utilize new or advancements in power generation technologies; |

| • | the inability of our operating subsidiaries to generate sufficient cash flow to support our operations; |

| • | the potential limitation or loss of our income tax NOLs notwithstanding a continuation of our stockholder rights plan; |

| • | our ability to borrow additional funds and access capital markets; |

| • | strikes, union activity or labor unrest; |

| • | our ability to obtain or develop capable leaders and our ability to retain or replace the services of key employees; |

| • | weather and other natural phenomena, including hurricanes and earthquakes; |

| • | the cost and availability of emissions allowances; |

| • | curtailment of operations and reduced prices for electricity resulting from transmission constraints; |

| • | our ability to execute our business plan in California, including entering into new tolling arrangements for our existing generating facilities; |

4

Table of Contents

| • | our ability to execute our development plan in respect of our Marsh Landing generating facility, including obtaining the permits necessary for construction and operation of the generating facility, securing the necessary project financing for construction of the generating facility and completing the construction of the generating facility by mid-2013; |

| • | our relative lack of geographic diversification of revenue sources resulting in concentrated exposure to the Mid-Atlantic market; |

| • | the ability of lenders under Mirant North America’s revolving credit facility to perform their obligations; |

| • | war, terrorist activities, cyberterrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss; |

| • | our failure to provide a safe working environment for our employees and visitors thereby increasing our exposure to additional liability, loss of productive time, other costs and a damaged reputation; |

| • | our consolidated indebtedness and the possibility that we or our subsidiaries may incur additional indebtedness in the future; |

| • | restrictions on the ability of our subsidiaries to pay dividends, make distributions or otherwise transfer funds to us, including restrictions on Mirant North America contained in its financing agreements and restrictions on Mirant Mid-Atlantic contained in its leveraged lease documents, which may affect our ability to access the cash flows of those subsidiaries to make debt service and other payments; |

| • | our failure to comply with or monitor provisions of our loan agreements and debt may lead to a breach and, if not remedied, result in an event of default thereunder, which would limit access to needed capital and damage our reputation and relationships with financial institutions; and |

| • | the disposition of the pending litigation described in this Form 10-Q. |

Many of these risks, uncertainties and assumptions are beyond our ability to control or predict. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by cautionary statements contained throughout this report. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the date they are made.

Factors that Could Affect Future Performance

We undertake no obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this report.

In addition to the discussion of certain risks in Management’s Discussion and Analysis of Results of Operations and Financial Condition and the accompanying Notes to Mirant’s unaudited condensed consolidated financial statements, other factors that could affect our future performance (business, results of operations or financial condition and cash flows) are set forth in our 2009 Annual Report on Form 10-K and elsewhere in this Form 10-Q and are incorporated herein by reference.

Certain Terms

As used in this report, unless the context requires otherwise, “we,” “us,” “our,” the “Company” and “Mirant” refer to Old Mirant and its subsidiaries prior to January 3, 2006 and to New Mirant and its subsidiaries on or after January 3, 2006.

5

Table of Contents

MIRANT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three Months Ended March 31, |

||||||||

| 2010 | 2009 | |||||||

| (in millions, except per share data) |

||||||||

| Operating revenues (including unrealized gains of $363 million and $255 million, respectively) |

$ | 880 | $ | 878 | ||||

| Cost of fuel, electricity and other products (including unrealized losses of $11 million and $1 million, respectively) |

207 | 271 | ||||||

| Gross Margin (excluding depreciation and amortization) |

673 | 607 | ||||||

| Operating Expenses: |

||||||||

| Operations and maintenance |

166 | 162 | ||||||

| Depreciation and amortization |

51 | 36 | ||||||

| Gain on sales of assets, net |

(2 | ) | (15 | ) | ||||

| Total operating expenses, net |

215 | 183 | ||||||

| Operating Income |

458 | 424 | ||||||

| Other Expense (Income), net: |

||||||||

| Interest expense |

50 | 38 | ||||||

| Interest income |

— | (2 | ) | |||||

| Other, net |

1 | — | ||||||

| Total other expense, net |

51 | 36 | ||||||

| Income Before Income Taxes |

407 | 388 | ||||||

| Provision for income taxes |

— | 8 | ||||||

| Net Income |

$ | 407 | $ | 380 | ||||

| Basic and Diluted EPS: |

||||||||

| Basic EPS |

$ | 2.81 | $ | 2.62 | ||||

| Diluted EPS |

$ | 2.79 | $ | 2.62 | ||||

| Weighted average shares outstanding |

145 | 145 | ||||||

| Effect of dilutive securities |

1 | — | ||||||

| Weighted average shares outstanding assuming dilution |

146 | 145 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

Table of Contents

MIRANT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| At March 31, 2010 |

At December 31, 2009 |

|||||||

| (in millions) | ||||||||

| ASSETS |

||||||||

| Current Assets: |

||||||||

| Cash and cash equivalents |

$ | 2,105 | $ | 1,953 | ||||

| Funds on deposit |

201 | 181 | ||||||

| Receivables, net |

367 | 412 | ||||||

| Derivative contract assets |

2,837 | 1,416 | ||||||

| Inventories |

247 | 241 | ||||||

| Prepaid expenses |

133 | 144 | ||||||

| Total current assets |

5,890 | 4,347 | ||||||

| Property, Plant and Equipment, net |

3,647 | 3,633 | ||||||

| Noncurrent Assets: |

||||||||

| Intangible assets, net |

169 | 171 | ||||||

| Derivative contract assets |

1,003 | 599 | ||||||

| Deferred income taxes |

539 | 376 | ||||||

| Prepaid rent |

280 | 304 | ||||||

| Other |

90 | 98 | ||||||

| Total noncurrent assets |

2,081 | 1,548 | ||||||

| Total Assets |

$ | 11,618 | $ | 9,528 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

| Current Liabilities: |

||||||||

| Current portion of long-term debt |

$ | 26 | $ | 75 | ||||

| Accounts payable and accrued liabilities |

816 | 718 | ||||||

| Derivative contract liabilities |

2,394 | 1,150 | ||||||

| Deferred income taxes |

539 | 376 | ||||||

| Other |

7 | 4 | ||||||

| Total current liabilities |

3,782 | 2,323 | ||||||

| Noncurrent Liabilities: |

||||||||

| Long-term debt, net of current portion |

2,538 | 2,556 | ||||||

| Derivative contract liabilities |

392 | 163 | ||||||

| Pension and postretirement obligations |

114 | 113 | ||||||

| Other |

69 | 58 | ||||||

| Total noncurrent liabilities |

3,113 | 2,890 | ||||||

| Commitments and Contingencies |

||||||||

| Stockholders’ Equity: |

||||||||

| Preferred stock, par value $.01 per share, authorized 100,000,000 shares, no shares issued at March 31, 2010 and December 31, 2009 |

— | — | ||||||

| Common stock, par value $.01 per share, authorized 1.5 billion shares, issued 311,866,593 shares and 311,230,486 shares at March 31, 2010 and December 31, 2009, respectively, and outstanding 145,404,164 shares and 144,946,815 shares at March 31, 2010 and December 31, 2009, respectively |

3 | 3 | ||||||

| Treasury stock, at cost, 166,462,429 shares and 166,283,671 shares at March 31, 2010 and December 31, 2009, respectively |

(5,336 | ) | (5,334 | ) | ||||

| Additional paid-in capital |

11,432 | 11,427 | ||||||

| Accumulated deficit |

(1,321 | ) | (1,728 | ) | ||||

| Accumulated other comprehensive loss |

(55 | ) | (53 | ) | ||||

| Total stockholders’ equity |

4,723 | 4,315 | ||||||

| Total Liabilities and Stockholders’ Equity |

$ | 11,618 | $ | 9,528 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

Table of Contents

MIRANT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME (UNAUDITED)

| Common Stock |

Treasury Stock |

Additional Paid-In Capital |

Accumulated Deficit |

Accumulated Other Comprehensive Loss |

Total Stockholders’ Equity |

|||||||||||||||||

| (in millions) | ||||||||||||||||||||||

| Balance, December 31, 2009 |

$ | 3 | $ | (5,334 | ) | $ | 11,427 | $ | (1,728 | ) | $ | (53 | ) | $ | 4,315 | |||||||

| Share repurchases |

— | (2 | ) | — | — | — | (2 | ) | ||||||||||||||

| Stock-based compensation |

— | — | 5 | — | — | 5 | ||||||||||||||||

| Total stockholders’ equity before other comprehensive income |

4,318 | |||||||||||||||||||||

| Net income |

— | — | — | 407 | — | 407 | ||||||||||||||||

| Pension and other postretirement benefits |

— | — | — | — | (2 | ) | (2 | ) | ||||||||||||||

| Total other comprehensive income |

405 | |||||||||||||||||||||

| Balance, March 31, 2010 |

$ | 3 | $ | (5,336 | ) | $ | 11,432 | $ | (1,321 | ) | $ | (55 | ) | $ | 4,723 | |||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

Table of Contents

MIRANT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Three Months Ended March 31, |

||||||||

| 2010 | 2009 | |||||||

| (in millions) | ||||||||

| Cash Flows from Operating Activities: |

||||||||

| Net income |

$ | 407 | $ | 380 | ||||

| Adjustments to reconcile net income and changes in other operating assets and liabilities to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

52 | 37 | ||||||

| Gain on sales of assets, net |

(2 | ) | (15 | ) | ||||

| Unrealized gains on derivative contracts, net |

(352 | ) | (254 | ) | ||||

| Stock-based compensation expense |

5 | 5 | ||||||

| Lower of cost or market inventory adjustments |

8 | 10 | ||||||

| Funds on deposit |

(14 | ) | (3 | ) | ||||

| Changes in other operating assets and liabilities |

198 | 111 | ||||||

| Total adjustments |

(105 | ) | (109 | ) | ||||

| Net cash provided by operating activities of continuing operations |

302 | 271 | ||||||

| Net cash provided by operating activities of discontinued operations |

2 | 2 | ||||||

| Net cash provided by operating activities |

304 | 273 | ||||||

| Cash Flows from Investing Activities: |

||||||||

| Capital expenditures |

(85 | ) | (171 | ) | ||||

| Proceeds from the sales of assets |

2 | 15 | ||||||

| Capital contributions |

— | (4 | ) | |||||

| Restricted deposit payments and other |

— | 1 | ||||||

| Net cash used in investing activities |

(83 | ) | (159 | ) | ||||

| Cash Flows from Financing Activities: |

||||||||

| Repayment of long-term debt |

(67 | ) | (39 | ) | ||||

| Share repurchases |

(2 | ) | (1 | ) | ||||

| Net cash used in financing activities |

(69 | ) | (40 | ) | ||||

| Net Increase in Cash and Cash Equivalents |

152 | 74 | ||||||

| Cash and Cash Equivalents, beginning of period |

1,953 | 1,831 | ||||||

| Cash and Cash Equivalents, end of period |

$ | 2,105 | $ | 1,905 | ||||

| Supplemental Cash Flow Disclosures: |

||||||||

| Cash paid for interest, net of amounts capitalized |

$ | 2 | $ | 1 | ||||

| Cash paid for claims and professional fees from bankruptcy |

$ | — | $ | 1 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

9

Table of Contents

MIRANT CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

A. Description of Business and Accounting and Reporting Policies

Mirant is a competitive energy company that produces and sells electricity in the United States. The Company owns or leases 10,076 MW of net electric generating capacity in the Mid-Atlantic and Northeast regions and in California. Mirant also operates an integrated asset management and energy marketing organization based in Atlanta, Georgia.

Proposed Merger with RRI Energy

On April 11, 2010, Mirant entered into the Merger Agreement with RRI Energy and RRI Energy Holdings, Inc. (“Merger Sub”), a direct and wholly-owned subsidiary of RRI Energy. Upon the terms and subject to the conditions set forth in the Merger Agreement, which has been unanimously approved by each of the boards of directors of Mirant and RRI Energy, Merger Sub will merge with and into Mirant, with Mirant continuing as the surviving corporation and a wholly-owned subsidiary of RRI Energy. The merger is intended to qualify as a tax-free reorganization under the Internal Revenue Code of 1986, as amended, so that none of RRI Energy, Merger Sub, Mirant or any of the Mirant stockholders generally will recognize any gain or loss in the transaction, except that Mirant stockholders will recognize gain with respect to cash received in lieu of fractional shares of RRI Energy common stock. Pursuant to the Merger Agreement, upon the closing of the merger, each issued and outstanding share of Mirant common stock, including grants of restricted common stock, will automatically be converted into shares of common stock of RRI Energy based on the Exchange Ratio. Additionally, upon the closing of the merger, RRI Energy will be renamed GenOn Energy. Mirant stock options and other equity awards will generally convert upon completion of the merger into stock options and equity awards with respect to RRI Energy common stock, after giving effect to the Exchange Ratio. As a result of the merger, Mirant stockholders will own approximately 54% of the equity of the combined company and RRI Energy stockholders will own approximately 46%.

Completion of the merger is subject to various customary conditions, including, among others, (i) approval by RRI Energy stockholders of the issuance of RRI Energy common stock in the merger, (ii) adoption of the Merger Agreement by Mirant stockholders, (iii) effectiveness of the registration statement for the RRI Energy common stock to be issued in the merger, (iv) approval of the listing on the NYSE of the RRI Energy common stock to be issued in the merger, (v) expiration or termination of the applicable Hart-Scott-Rodino Act waiting period, (vi) receipt of all required regulatory approvals and (vii) consummation by GenOn Energy of debt financings in an amount sufficient to fund the refinancing transactions contemplated by, and on terms consistent with, the Merger Agreement.

Among the refinancing transactions noted above, the completion of the merger is conditioned on GenOn Energy consummating certain debt financing transactions, including securing a new revolving credit facility. The new GenOn Energy debt financing and revolving credit facility will be used, in part, to redeem the Mirant North America senior notes and to repay and terminate the Mirant North America term loan and revolving credit facility. See Note C for additional information on Mirant North America’s debt.

Both Mirant and RRI Energy are subject to restrictions on their ability to solicit alternative acquisition proposals, provide information and engage in discussions with third parties, except under limited circumstances to permit Mirant’s and RRI Energy’s boards of directors to comply with their fiduciary duties. The Merger Agreement contains certain termination rights for both

10

Table of Contents

Mirant and RRI Energy, and further provides that, upon termination of the Merger Agreement under specified circumstances, Mirant or RRI Energy may be required to pay the other a termination fee of either $37.15 million or $57.78 million. Further information concerning the proposed merger will be included in a joint proxy statement/prospectus contained in the registration statement on Form S-4 to be filed by RRI Energy with the SEC.

Provided neither has experienced an ownership change between December 31, 2009, and the closing date of the merger, each of Mirant and RRI Energy is expected separately to experience an ownership change, as defined in Section (“§”) 382 of the Internal Revenue Code of 1986, on the merger date as a consequence of the merger. Immediately following the merger, Mirant and RRI Energy will be members of the same consolidated federal income tax group. The ability of this consolidated tax group to deduct the pre-merger NOL carry forwards of Mirant and RRI Energy against the post-merger taxable income of the group will be substantially limited as a result of these ownership changes.

The merger is expected to be completed by the end of 2010. Prior to the completion of the merger, Mirant and RRI Energy will continue to operate as independent companies. Except for specific references to the proposed merger, the disclosures contained in this report on Form 10-Q relate solely to Mirant.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of Mirant and its wholly-owned subsidiaries have been prepared in accordance with GAAP for interim financial information and with the instructions for Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. For further information, refer to the consolidated financial statements and notes thereto included in the Company’s 2009 Annual Report on Form 10-K.

The accompanying unaudited condensed consolidated financial statements include the accounts of Mirant and its wholly-owned and controlled majority-owned subsidiaries. The consolidated financial statements have been prepared from records maintained by Mirant and its subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation. As of March 31, 2010, substantially all of Mirant’s subsidiaries are wholly-owned and located in the United States.

The preparation of the unaudited condensed consolidated financial statements in conformity with GAAP requires management to make various estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates. Certain prior period amounts have been reclassified to conform to the current period financial statement presentation.

The Company evaluates events that occur after its balance sheet date but before its financial statements are issued for potential recognition or disclosure. Based on the evaluation, the Company determined that there were no material subsequent events for recognition or disclosure other than those disclosed herein.

11

Table of Contents

MC Asset Recovery

MC Asset Recovery, although wholly-owned by Mirant, is governed by managers who are independent of Mirant and its other subsidiaries. MC Asset Recovery is considered a VIE because of the Company’s potential tax obligations which could arise from potential recoveries from legal actions that MC Asset Recovery is pursuing. Prior to January 1, 2010, under previous accounting guidance, Mirant was considered the primary beneficiary of MC Asset Recovery and included the VIE in the Company’s consolidated financial statements. Based on the revised guidance related to accounting for VIEs that became effective on January 1, 2010, the Company reassessed its relationship with MC Asset Recovery and determined that the Company is no longer deemed to be the primary beneficiary. The characteristics of a primary beneficiary, as defined in the accounting guidance are: (a) the entity must have the power to direct the activities or make decisions that most significantly affect the VIE’s economic performance and (b) the entity must have an obligation to absorb losses or receive benefits that could be significant to the VIE. As MC Asset Recovery is governed by an independent Board of Managers that has sole power and control over the decisions that affect MC Asset Recovery’s economic performance, the Company does not meet the characteristics of a primary beneficiary. Additionally, the Company no longer has any obligation to provide funding to MC Asset Recovery. However, under the Plan, the Company is responsible for the taxes owed, if any, on any net recoveries up to $175 million obtained by MC Asset Recovery. The Company currently retains any tax obligations arising from the next approximately $74 million of potential recoveries by MC Asset Recovery. As a result of the initial application of this accounting guidance, the Company deconsolidated MC Asset Recovery effective January 1, 2010, and adjusted prior periods to conform to the current presentation. See Note J for further discussion of MC Asset Recovery.

At March 31, 2010 and December 31, 2009, MC Asset Recovery had current assets and current liabilities of $38 million and $39 million, respectively, which are not included in the Company’s unaudited condensed consolidated balance sheets. For both the three months ended March 31, 2010 and 2009, MC Asset Recovery had operations and maintenance expense of less than $1 million, which is not included in the Company’s unaudited condensed consolidated statements of operations. The effect of deconsolidation on the unaudited condensed consolidated statement of cash flows for the three months ended March 31, 2009, was to present $4 million of operating costs of MC Asset Recovery which were funded by the Company, and had previously been appropriately included in operating activities, as an investing activity. The deconsolidation resulted in an increase in net cash provided by operating activities and an increase in net cash used in investing activities on the Company’s unaudited condensed consolidated statement of cash flows for that period. There was no effect on the Company’s unaudited condensed consolidated statement of cash flows for the three months ended March 31, 2010.

Inventories

Inventories consist primarily of fuel oil, coal, materials and supplies and purchased emissions allowances. Inventory is generally stated at the lower of cost or market value and is expensed on a weighted average cost basis. Fuel inventory is removed from the inventory account as it is used in the generation of electricity. Materials and supplies are removed from the inventory account when they are used for repairs, maintenance or capital projects. Purchased emissions allowances are removed from inventory and charged to cost of fuel, electricity and other products in the accompanying unaudited condensed consolidated statements of operations as they are utilized for emissions volumes.

12

Table of Contents

Inventories were comprised of the following (in millions):

| At March 31, 2010 |

At December 31, 2009 | |||||

| Fuel inventory: |

||||||

| Fuel oil |

$ | 128 | $ | 99 | ||

| Coal |

31 | 52 | ||||

| Other |

1 | 1 | ||||

| Materials and supplies |

67 | 66 | ||||

| Purchased emissions allowances |

20 | 23 | ||||

| Total inventories |

$ | 247 | $ | 241 | ||

Capitalization of Interest Cost

Mirant capitalizes interest on projects during their construction period. The Company determines which debt instruments represent a reasonable measure of the cost of financing construction in terms of interest costs incurred that otherwise could have been avoided. These debt instruments and associated interest costs are included in the calculation of the weighted average interest rate used for determining the capitalization rate. Once a project is placed in service, capitalized interest, as a component of the total cost of the construction, is amortized over the estimated useful life of the asset constructed.

For the three months ended March 31, 2010 and 2009, the Company incurred the following interest costs (in millions):

| Three Months Ended March 31, |

||||||||

| 2010 | 2009 | |||||||

| Total interest costs |

$ | 52 | $ | 53 | ||||

| Capitalized and included in property, plant and equipment, net |

(2 | ) | (15 | ) | ||||

| Interest expense |

$ | 50 | $ | 38 | ||||

The amounts of capitalized interest above include interest accrued. For the three months ended March 31, 2010 and 2009, cash paid for interest was $2 million and $3 million, respectively, of which $0 and $2 million, respectively, were capitalized.

Development Costs

Mirant capitalizes project development costs for generating facilities once it is probable that the project will be completed. These costs include professional fees, permits and other third party costs directly associated with the development of a new project. The capitalized costs are depreciated over the life of the asset or charged to operating expense if the completion of the project is no longer probable. Project development costs are expensed when incurred until the probable threshold is met.

Recently Adopted Accounting Guidance

On June 12, 2009, the FASB issued guidance which requires the Company to perform an analysis to determine whether the Company’s variable interest gives it a controlling financial interest in a VIE. This analysis should identify the primary beneficiary of a VIE. This guidance also requires ongoing reassessments of whether an enterprise is the primary beneficiary of a VIE and enhances the disclosures to provide more information regarding the Company’s involvement

13

Table of Contents

in a VIE. This guidance is effective for fiscal years beginning after November 15, 2009. The Company adopted this accounting guidance on January 1, 2010, and as a result, deconsolidated MC Asset Recovery. See Note J for further details on MC Asset Recovery.

On January 21, 2010, the FASB issued guidance that enhances the disclosures for fair value measurements. The guidance requires the Company to disclose separately the amount of significant transfers between Level 1 and Level 2 of the fair value hierarchy, the reasons for the significant transfers, the valuation techniques and inputs used and the classes of assets and liabilities accounted for at fair value on a recurring basis. The Company adopted this accounting guidance for the quarter ended March 31, 2010. See Note B for additional information on fair value measurements.

On February 25, 2010, the FASB issued guidance that amends its requirement for public companies to disclose the date through which the Company has evaluated subsequent events and whether that date represents the date the financial statements were issued or were available to be issued. The Company adopted the subsequent event disclosure requirements for the quarter ended March 31, 2010, and the adoption had no effect on the Company’s unaudited condensed consolidated statements of operations, financial position or cash flows. The Company continues to evaluate subsequent events through the date when the financial statements are issued.

New Accounting Guidance Not Yet Adopted at March 31, 2010

On January 21, 2010, the FASB issued guidance that requires a reconciliation for Level 3 fair value measurements, including presenting separately the amount of purchases, issuances and settlements on a gross basis. The Company currently discloses the amount of purchases, issuances and settlements on a net basis within its roll forward of Level 3 fair value measurements in Note B. These disclosure requirements are effective for fiscal years beginning after December 15, 2010. The Company will present these disclosures in its Form 10-Q for the quarter ended March 31, 2011.

B. Financial Instruments

Derivative Financial Instruments

In connection with the business of generating electricity, the Company is exposed to energy commodity price risk associated with the acquisition of fuel and emissions allowances needed to generate electricity, the price of electricity produced and sold and the fair value of fuel inventories. In addition, the open positions in the Company’s trading activities, comprised of proprietary trading and fuel oil management activities, expose it to risks associated with changes in energy commodity prices. The Company, through its asset management activities, enters into a variety of exchange-traded and OTC energy and energy-related derivative financial instruments, such as forward contracts, futures contracts, option contracts and financial swap agreements to manage exposure to commodity price risks. These contracts have varying terms and durations, which range from a few days to years, depending on the instrument. The Company’s proprietary trading activities also utilize similar derivative financial instruments in markets where the Company has a physical presence to attempt to generate incremental gross margin. The Company’s fuel oil management activities use derivative financial instruments to hedge economically the fair value of the Company’s physical fuel oil inventories and to optimize the approximately three million barrels of storage capacity that the Company owns or leases.

Changes in the fair value and settlements of derivative financial instruments used to hedge electricity economically are reflected in operating revenue, and changes in the fair value and settlements of derivative financial instruments used to hedge fuel economically are reflected in cost of fuel, electricity and other products in the accompanying unaudited condensed consolidated

14

Table of Contents

statements of operations. Most of the Company’s long-term coal agreements are not required to be recorded at fair value because of the Company’s election of normal purchases treatment under the accounting guidance for derivative financial instruments. As such, these contracts are not included in derivative contract assets and liabilities in the accompanying unaudited condensed consolidated balance sheets and are not included in the tables below. Changes in the fair value and settlements of derivative contracts for trading activities, comprised of proprietary trading and fuel oil management, are recorded on a net basis as operating revenue in the accompanying unaudited condensed consolidated statements of operations. As of March 31, 2010, the Company does not have any derivative financial instruments for which hedge accounting has been elected and option contracts comprise less than 1% of the Company’s net derivative contract assets.

The Company also considers risks associated with interest rates, counterparty credit and Mirant’s own non-performance risk when valuing its derivative financial instruments. The nominal value of the derivative contract assets and liabilities is discounted to account for time value using a LIBOR forward interest rate curve based on the tenor of the Company’s transactions being valued.

The following table presents the fair value of each class of derivative financial instruments related to commodity price risk (in millions):

| Fair Value at | ||||||||||

| Commodity Derivative Contracts |

Balance Sheet Location | March 31, 2010 |

December 31, 2009 |

|||||||

| Asset management: |

||||||||||

| Power |

Derivative contract assets | $ | 1,836 | $ | 1,178 | |||||

| Fuel |

Derivative contract assets | 27 | 26 | |||||||

| Total asset management |

1,863 | 1,204 | ||||||||

| Trading activities |

Derivative contract assets | 1,977 | 811 | |||||||

| Total derivative contract assets |

3,840 | 2,015 | ||||||||

| Asset management: |

||||||||||

| Power |

Derivative contract liabilities | (793 | ) | (488 | ) | |||||

| Fuel |

Derivative contract liabilities | (26 | ) | (15 | ) | |||||

| Total asset management |

(819 | ) | (503 | ) | ||||||

| Trading activities |

Derivative contract liabilities | (1,967 | ) | (810 | ) | |||||

| Total derivative contract liabilities |

(2,786 | ) | (1,313 | ) | ||||||

| Asset management, net: |

||||||||||

| Power |

1,043 | 690 | ||||||||

| Fuel |

1 | 11 | ||||||||

| Total asset management |

1,044 | 701 | ||||||||

| Trading activities, net |

10 | 1 | ||||||||

| Total derivative contracts, net |

$ | 1,054 | $ | 702 | ||||||

15

Table of Contents

The following tables present the net gains (losses) for derivative financial instruments recognized in income in the unaudited condensed consolidated statements of operations (in millions):

| Location of Net Gains (Losses) Recognized in Income |

Amount of Net Gains

(Losses) Recognized in Income for the Three Months Ended March 31, 2010 |

|||||||||||||

| Commodity Derivative Contracts |

Realized | Unrealized | Total | |||||||||||

| Asset management |

Operating revenues | $ | 85 | $ | 353 | $ | 438 | |||||||

| Trading activities |

Operating revenues | 19 | 10 | 29 | ||||||||||

| Asset management |

Cost of fuel, electricity and other products | (15 | ) | (11 | ) | (26 | ) | |||||||

| Total |

$ | 89 | $ | 352 | $ | 441 | ||||||||

| Location of Net Gains (Losses) Recognized in Income |

Amount of Net Gains

(Losses) Recognized in Income for the Three Months Ended March 31, 2009 |

|||||||||||||

| Commodity Derivative Contracts |

Realized | Unrealized | Total | |||||||||||

| Asset management |

Operating revenues | $ | 136 | $ | 270 | $ | 406 | |||||||

| Trading activities |

Operating revenues | 28 | (15 | ) | 13 | |||||||||

| Asset management |

Cost of fuel, electricity and other products | (16 | ) | (1 | ) | (17 | ) | |||||||

| Total |

$ | 148 | $ | 254 | $ | 402 | ||||||||

The following table presents the notional quantity on long (short) positions for derivative financial instruments on a gross and net basis at March 31, 2010 (in equivalent MWh):

| Notional Quantity | |||||||||

| Derivative Contract Assets |

Derivative Contract Liabilities |

Net Derivative Contracts |

|||||||

| (in millions) | |||||||||

| Commodity Type: |

|||||||||

|

Power1 |

(173 | ) | 133 | (40 | ) | ||||

| Natural gas |

(75 | ) | 75 | — | |||||

| Fuel oil |

3 | (3 | ) | — | |||||

| Coal |

2 | 1 | 3 | ||||||

| Total |

(243 | ) | 206 | (37 | ) | ||||

| 1 | Includes MWh equivalent of natural gas transactions used to hedge power economically. |

Fair Value Hierarchy

Based on the observability of the inputs used in the valuation techniques for fair value measurement, the Company is required to classify recorded fair value measurements according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The fair value measurement inputs the Company uses vary from readily observable prices for exchange-traded instruments to price curves that cannot be validated through external pricing sources. The Company’s financial assets and liabilities carried at fair value in the unaudited condensed consolidated financial statements are classified in three categories based on the inputs used.

16

Table of Contents

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls must be determined based on the lowest level input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the asset or liability.

The Company’s transactions in Level 1 of the fair value hierarchy primarily consist of natural gas and crude oil futures traded on the NYMEX and swaps cleared against the NYMEX prices. The Company’s transactions in Level 2 of the fair value hierarchy primarily include non-exchange-traded derivatives such as OTC forwards, swaps and options. The Company’s transactions in Level 3 of the fair value hierarchy primarily consist of financial power swaps in less liquid locations and long-term coal agreements that do not qualify for normal purchases treatment. The Company did not have any transfers between Levels 1 and 2 for the three months ended March 31, 2010.

The following tables set forth by level within the fair value hierarchy the Company’s financial assets and liabilities that were accounted for at fair value on a recurring basis as of March 31, 2010, by class and tenor, respectively. At March 31, 2010, the Company’s only financial assets and liabilities measured at fair value on a recurring basis are derivative financial instruments.

17

Table of Contents

The following table presents financial assets and liabilities accounted for at fair value on a recurring basis as of March 31, 2010, on a gross and net basis by class (in millions):

| Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Other Unobservable Inputs (Level 3) |

Total | |||||||||||||

| Assets: |

||||||||||||||||

| Commodity contracts—asset management: |

||||||||||||||||

| Power |

$ | 9 | $ | 1,803 | $ | 24 | $ | 1,836 | ||||||||

| Fuel |

8 | 5 | 14 | 27 | ||||||||||||

| Total commodity contracts—asset management |

17 | 1,808 | 38 | 1,863 | ||||||||||||

| Commodity contracts—trading activities |

966 | 951 | 60 | 1,977 | ||||||||||||

| Total derivative contract assets |

983 | 2,759 | 98 | 3,840 | ||||||||||||

| Liabilities: |

||||||||||||||||

| Commodity contracts—asset management: |

||||||||||||||||

| Power |

(43 | ) | (744 | ) | (6 | ) | (793 | ) | ||||||||

| Fuel |

(25 | ) | (1 | ) | — | (26 | ) | |||||||||

| Total commodity contracts—asset management |

(68 | ) | (745 | ) | (6 | ) | (819 | ) | ||||||||

| Commodity contracts—trading activities |

(961 | ) | (990 | ) | (16 | ) | (1,967 | ) | ||||||||

| Total derivative contract liabilities |

(1,029 | ) | (1,735 | ) | (22 | ) | (2,786 | ) | ||||||||

| Net: |

||||||||||||||||

| Commodity contracts—asset management: |

||||||||||||||||

| Power |

(34 | ) | 1,059 | 18 | 1,043 | |||||||||||

| Fuel |

(17 | ) | 4 | 14 | 1 | |||||||||||

| Total commodity contracts—asset management |

(51 | ) | 1,063 | 32 | 1,044 | |||||||||||

| Commodity contracts—trading activities, net |

5 | (39 | ) | 44 | 10 | |||||||||||

| Total derivative contract assets and liabilities, net |

$ | (46 | ) | $ | 1,024 | $ | 76 | $ | 1,054 | |||||||

18

Table of Contents

The following table presents financial assets and liabilities accounted for at fair value on a recurring basis as of December 31, 2009, on a gross and net basis by class (in millions):

| Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Other Unobservable Inputs (Level 3) |

Total | |||||||||||||

| Assets: |

||||||||||||||||

| Commodity contracts—asset management: |

||||||||||||||||

| Power |

$ | 2 | $ | 1,162 | $ | 14 | $ | 1,178 | ||||||||

| Fuel |

11 | 8 | 7 | 26 | ||||||||||||

| Total commodity contracts—asset management |

13 | 1,170 | 21 | 1,204 | ||||||||||||

| Commodity contracts—trading activities |

374 | 415 | 22 | 811 | ||||||||||||

| Total derivative contract assets |

387 | 1,585 | 43 | 2,015 | ||||||||||||

| Liabilities: |

||||||||||||||||

| Commodity contracts—asset management: |

||||||||||||||||

| Power |

(11 | ) | (475 | ) | (2 | ) | (488 | ) | ||||||||

| Fuel |

(14 | ) | (1 | ) | — | (15 | ) | |||||||||

| Total commodity contracts—asset management |

(25 | ) | (476 | ) | (2 | ) | (503 | ) | ||||||||

| Commodity contracts—trading activities |

(368 | ) | (433 | ) | (9 | ) | (810 | ) | ||||||||

| Total derivative contract liabilities |

(393 | ) | (909 | ) | (11 | ) | (1,313 | ) | ||||||||

| Net: |

||||||||||||||||

| Commodity contracts—asset management: |

||||||||||||||||

| Power |

(9 | ) | 687 | 12 | 690 | |||||||||||

| Fuel |

(3 | ) | 7 | 7 | 11 | |||||||||||

| Total commodity contracts—asset management |

(12 | ) | 694 | 19 | 701 | |||||||||||

| Commodity contracts—trading activities, net |

6 | (18 | ) | 13 | 1 | |||||||||||

| Total derivative contract assets and liabilities, net |

$ | (6 | ) | $ | 676 | $ | 32 | $ | 702 | |||||||

The following table presents net financial assets and liabilities accounted for at fair value on a recurring basis as of March 31, 2010, by tenor (in millions):

| Commodity Contracts | ||||||||||

| Asset Management |

Trading Activities |

Total | ||||||||

| 2010 |

$ | 349 | $ | 6 | $ | 355 | ||||

| 2011 |

230 | 9 | 239 | |||||||

| 2012 |

164 | (5 | ) | 159 | ||||||

| 2013 |

153 | — | 153 | |||||||

| 2014 |

148 | — | 148 | |||||||

| Thereafter |

— | — | — | |||||||

| Total |

$ | 1,044 | $ | 10 | $ | 1,054 | ||||

19

Table of Contents

The volumetric weighted average maturity, or weighted average tenor, of the asset management derivative contract portfolio at March 31, 2010 and December 31, 2009, was approximately 21 months and 22 months, respectively. The volumetric weighted average maturity, or weighted average tenor, of the trading derivative contract portfolio at March 31, 2010 and December 31, 2009, was approximately 11 months and 9 months, respectively.

Level 3 Disclosures

The following tables present a roll forward of fair values of net assets and liabilities categorized in Level 3 for the three months ended March 31, 2010 and 2009, and the amount included in income for the three months ended March 31, 2010 and 2009 (in millions):

| Commodity Contracts | |||||||||||

| Asset Management |

Trading Activities |

Total | |||||||||

| Fair value of assets and liabilities categorized in Level 3 at January 1, 2010 |

$ | 19 | $ | 13 | $ | 32 | |||||

| Total gains or losses (realized/unrealized): |

|||||||||||

| Included in income of existing contracts (or changes in net assets or liabilities)1 |

(11 | ) | 21 | 10 | |||||||

| Purchases, issuances and settlements2 |

(13 | ) | 10 | (3 | ) | ||||||

| Transfers out of Level 33 |

37 | — | 37 | ||||||||

| Fair value of assets and liabilities categorized in Level 3 at March 31, 2010 |

$ | 32 | $ | 44 | $ | 76 | |||||

| Commodity Contracts | |||||||||

| Asset Management |

Trading Activities |

Total | |||||||

| Fair value of assets and liabilities categorized in Level 3 at January 1, 2009 |

$ | 24 | $ | 22 | $ | 46 | |||

| Total gains (realized/unrealized): |

|||||||||

| Included in income of existing contracts (or changes in net assets or liabilities)1 |

6 | 2 | 8 | ||||||

| Purchases, issuances and settlements2 |

9 | 9 | 18 | ||||||

| Transfers in and/or out of Level 33 |

— | — | — | ||||||

| Fair value of assets and liabilities categorized in Level 3 at March 31, 2009 |

$ | 39 | $ | 33 | $ | 72 | |||

| 1 | Reflects the total gains or losses on contracts included in Level 3 at the beginning of each quarterly reporting period and at the end of each quarterly reporting period, and contracts entered into during each quarterly reporting period that remain at the end of each quarterly reporting period. |

| 2 | Represents the total cash settlements of contracts during each quarterly reporting period that existed at the beginning of each quarterly reporting period. |

| 3 | Denotes the total contracts that existed at the beginning of each quarterly reporting period and were still held at the end of each quarterly reporting period that were either previously categorized as a higher level for which the inputs to the model became unobservable or assets and liabilities that were previously classified as Level 3 for which the lowest significant input became observable during each quarterly reporting period. Amounts reflect fair value as of the end of each quarterly reporting period. |

20

Table of Contents

| Three Months Ended March 31, 2010 | |||||||||

| Operating Revenues |

Cost of Fuel |

Total | |||||||

| Gains included in income |

$ | 38 | $ | 6 | $ | 44 | |||

| Gains included in income (or changes in net assets) attributable to the change in unrealized gains or losses relating to assets still held at March 31, 2010 |

$ | 38 | $ | 6 | $ | 44 | |||

| Three Months Ended March 31, 2009 | |||||||||

| Operating Revenues |

Cost of Fuel |

Total | |||||||

| Gains included in income |

$ | 26 | $ | — | $ | 26 | |||

| Gains included in income (or changes in net assets) attributable to the change in unrealized gains or losses relating to assets still held at March 31, 2009 |

$ | 28 | $ | — | $ | 28 | |||

Counterparty Credit Concentration Risk

The Company is exposed to the default risk of the counterparties with which the Company transacts. The Company manages its credit risk by entering into master netting agreements and requiring counterparties to post cash collateral or other credit enhancements based on the net exposure and the credit standing of the counterparty. The Company also has non-collateralized power hedges entered into by Mirant Mid-Atlantic. These transactions are senior unsecured obligations of Mirant Mid-Atlantic and the counterparties and do not require either party to post cash collateral for initial margin or for securing exposure as a result of changes in power or natural gas prices. The Company’s credit reserve on its derivative contract assets was $17 million and $13 million at March 31, 2010 and December 31, 2009, respectively.

At March 31, 2010 and December 31, 2009, approximately $3 million and $12 million, respectively, of cash collateral posted to the Company by counterparties under master netting agreements were included in accounts payable and accrued liabilities on the unaudited condensed consolidated balance sheets.

21

Table of Contents

The Company also monitors counterparty credit concentration risk on both an individual basis and a group counterparty basis. The following tables highlight the credit quality and the balance sheet settlement exposures related to these activities (dollars in millions):

| At March 31, 2010 | |||||||||||||||

| Credit Rating Equivalent |

Gross Exposure Before Collateral1 |

Net Exposure Before Collateral2 |

Collateral3 | Exposure Net of Collateral |

% of Net Exposure |

||||||||||

| Clearing and Exchange |

$ | 2,048 | $ | 183 | $ | 183 | $ | — | — | ||||||

| Investment Grade: |

|||||||||||||||

| Financial institutions |

1,301 | 844 | 3 | 841 | 84 | % | |||||||||

| Energy companies |

724 | 164 | 35 | 129 | 13 | % | |||||||||

| Other |

2 | 1 | — | 1 | — | ||||||||||

| Non-investment Grade: |

|||||||||||||||

| Financial institutions |

— | — | — | — | — | ||||||||||

| Energy companies |

8 | 8 | — | 8 | 1 | % | |||||||||

| Other |

— | — | — | — | — | ||||||||||

| No External Ratings: |

|||||||||||||||

| Internally-rated investment grade |

20 | 14 | — | 14 | 1 | % | |||||||||

| Internally-rated non-investment grade |

8 | 8 | — | 8 | 1 | % | |||||||||

| Not internally rated |

— | — | — | — | — | ||||||||||

| Total |

$ | 4,111 | $ | 1,222 | $ | 221 | $ | 1,001 | 100 | % | |||||

| At December 31, 2009 | |||||||||||||||

| Credit Rating Equivalent |

Gross Exposure Before Collateral1 |

Net Exposure Before Collateral2 |

Collateral3 | Exposure Net of Collateral |

% of Net Exposure |

||||||||||

| Clearing and Exchange |

$ | 790 | $ | 96 | $ | 96 | $ | — | — | ||||||

| Investment Grade: |

|||||||||||||||

| Financial institutions |

997 | 646 | 12 | 634 | 81 | % | |||||||||

| Energy companies |

497 | 125 | 13 | 112 | 14 | % | |||||||||

| Other |

— | — | — | — | — | ||||||||||

| Non-investment Grade: |

|||||||||||||||

| Financial institutions |

— | — | — | — | — | ||||||||||

| Energy companies |

— | — | — | — | — | ||||||||||

| Other |

— | — | — | — | — | ||||||||||

| No External Ratings: |

|||||||||||||||

| Internally-rated investment grade |

34 | 27 | — | 27 | 4 | % | |||||||||

| Internally-rated non-investment grade |

8 | 8 | — | 8 | 1 | % | |||||||||

| Not internally rated |

— | — | — | — | — | ||||||||||

| Total |

$ | 2,326 | $ | 902 | $ | 121 | $ | 781 | 100 | % | |||||

| 1 | Gross exposure before collateral represents credit exposure, including realized and unrealized transactions, before applying the terms of master netting agreements with counterparties and netting of transactions with clearing brokers and exchanges. The table excludes amounts related to contracts classified as normal purchases/normal sales and non-derivative contractual commitments that are not recorded at fair value in the unaudited condensed consolidated balance sheets, except for any related accounts receivable. Such contractual commitments contain credit and economic risk if a counterparty does not perform. Non-performance could have a material adverse effect on the future results of operations, financial condition and cash flows. |

| 2 | Net exposure before collateral represents the credit exposure, including both realized and unrealized transactions, after applying the terms of master netting agreements. |

| 3 | Collateral includes cash and letters of credit received from counterparties. |

22

Table of Contents

The Company had aggregate credit exposure to three investment grade counterparties that each represented an exposure of more than 10% of total credit exposure, net of collateral and that totaled $617 million and $495 million at March 31, 2010 and December 31, 2009, respectively.

Mirant Credit Risk

The Company’s standard industry contracts contain credit-risk-related contingent features such as ratings-related thresholds whereby the Company would be required to post additional cash collateral or letters of credit as a result of a credit event, including a downgrade. Additionally, some of the Company’s contracts contain adequate assurance language, which is generally subjective in nature, but would most likely require the Company to post additional cash collateral or letters of credit as a result of a credit event, including a downgrade. However, as a result of the Company’s current credit rating, the Company is typically required to post collateral in the normal course of business to offset completely its net liability positions, after applying the terms of master netting agreements. At March 31, 2010, the fair value of the Company’s financial instruments with credit-risk-related contingent features in a net liability position was approximately $65 million for which the Company has posted collateral of $59 million, including cash and letters of credit, to offset substantially the position.

In addition, at March 31, 2010 and December 31, 2009, the Company had approximately $1 million and $25 million, respectively, of cash collateral posted with counterparties under master netting agreements that was included in funds on deposit on the unaudited condensed consolidated balance sheets.

Fair Values of Other Financial Instruments

Other financial instruments recorded at fair value include cash and interest-bearing cash equivalents. The following methods are used by Mirant to estimate the fair value of financial instruments that are not otherwise carried at fair value on the accompanying unaudited condensed consolidated balance sheets:

Notes and Other Receivables. The fair value of Mirant’s notes receivable are estimated using interest rates it would receive currently for similar types of arrangements.

Long- and Short-Term Debt. The fair value of Mirant’s long- and short-term debt is estimated using quoted market prices, when available.

The carrying amounts and fair values of Mirant’s financial instruments are as follows (in millions):

| At March 31, 2010 | At December 31, 2009 | |||||||||||

| Carrying Amount |

Fair Value | Carrying Amount |

Fair Value | |||||||||

| Assets: |

||||||||||||

| Notes and other receivables |

$ | 1 | $ | 1 | $ | 2 | $ | 2 | ||||

| Liabilities: |

||||||||||||

| Long- and short-term debt |

$ | 2,564 | $ | 2,496 | $ | 2,631 | $ | 2,559 | ||||

23

Table of Contents

C. Long-Term Debt

Long-term debt was as follows (dollars in millions):

| At March 31, 2010 |

At December 31, 2009 |

Interest Rate | Secured/ Unsecured | |||||||||

| Long-term debt: |

||||||||||||

| Mirant Americas Generation: |

||||||||||||

| Senior notes: |

||||||||||||

| Due May 2011 |

$ | 535 | $ | 535 | 8.30% | Unsecured | ||||||

| Due October 2021 |

450 | 450 | 8.50% | Unsecured | ||||||||

| Due May 2031 |

400 | 400 | 9.125% | Unsecured | ||||||||

| Unamortized debt premiums (discounts), net |

(3 | ) | (3 | ) | ||||||||

| Mirant North America: |

||||||||||||

| Senior secured term loan, due 2010 to 2013 |

307 | 373 | LIBOR + 1.75%1 | Secured | ||||||||

| Senior notes, due December 2013 |

850 | 850 | 7.375% | Unsecured | ||||||||

| Capital leases, due 2010 to 2015 |

25 | 26 | 7.375% -8.19% | |||||||||

| Total |

2,564 | 2,631 | ||||||||||

| Less: current portion of long-term debt |

(26 | ) | (75 | ) | ||||||||

| Total long-term debt, net of current portion |

$ | 2,538 | $ | 2,556 | ||||||||

| 1 | The weighted average interest rate for the periods ended March 31, 2010 and December 31, 2009, was 1.98% and 2.13%, respectively. |

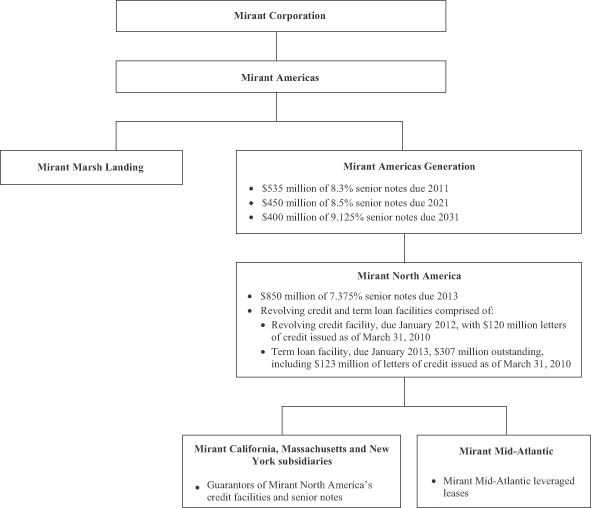

Mirant Americas Generation Senior Notes

The senior notes are senior unsecured obligations of Mirant Americas Generation having no recourse to any subsidiary or affiliate of Mirant Americas Generation.

Mirant North America Senior Secured Credit Facilities

Mirant North America, a wholly-owned subsidiary of Mirant Americas Generation, entered into senior secured credit facilities in January 2006, which are comprised of a senior secured term loan due January 2013 and a senior secured revolving credit facility due January 2012. The senior secured term loan had an initial principal balance of $700 million, which has amortized to $307 million as of March 31, 2010. At the closing, $200 million drawn under the senior secured term loan was deposited into a cash collateral account to support the issuance of up to $200 million of letters of credit. During 2008, Mirant North America transferred to the senior secured revolving credit facility approximately $78 million of letters of credit previously supported by the cash collateral account and withdrew approximately $78 million from the cash collateral account, thereby reducing the cash collateral account to approximately $122 million. At March 31, 2010, the cash collateral balance was approximately $124 million as a result of interest earned on the invested cash balances. At March 31, 2010, there were approximately $120 million of letters of credit outstanding under the senior secured revolving credit facility and $123 million of letters of credit outstanding under the senior secured term loan cash collateral account. At March 31, 2010, $635 million was available under the senior secured revolving credit facility and less than $1 million was available under the senior secured term loan for cash draws or for the issuance of letters of credit. Although the senior secured revolving credit facility has lender commitments of $800 million, availability thereunder reflects a $45 million effective reduction as a result of the bankruptcy filing of Lehman Commercial Paper, Inc., a lender under the facility.

24

Table of Contents

In addition to quarterly principal installments, which are currently $0.8 million, Mirant North America is required to make annual principal prepayments under the senior secured term loan equal to a specified percentage of its excess free cash flow, which is based on adjusted EBITDA less capital expenditures and as further defined in the loan agreement. On March 10, 2010, Mirant North America made a mandatory principal prepayment of approximately $66 million on the term loan. At March 31, 2010, the current estimate of the mandatory principal prepayment of the term loan in March 2011 is approximately $18 million. This amount has been reclassified from long-term debt to current portion of long-term debt at March 31, 2010.

The senior secured credit facilities are senior secured obligations of Mirant North America. In addition, certain subsidiaries of Mirant North America (not including Mirant Mid-Atlantic or Mirant Energy Trading) have jointly and severally guaranteed, as senior secured obligations, the senior secured credit facilities. The senior secured credit facilities have no recourse to any other Mirant entities.

See Note A for a discussion of the contemplated repayment of the term loan and repayment and termination of the revolving credit facility in connection with the consummation of the proposed merger with RRI Energy.

Mirant North America Senior Notes

The senior notes due in 2013 are senior unsecured obligations of Mirant North America. In addition, certain subsidiaries of Mirant North America (not including Mirant Mid-Atlantic or Mirant Energy Trading) have jointly and severally guaranteed, as senior unsecured obligations, the senior notes. The Mirant North America senior notes have no recourse to any other Mirant entities, including Mirant Americas Generation.

See Note A for a discussion of the contemplated redemption of the senior notes in connection with the consummation of the proposed merger with RRI Energy.

D. Guarantees and Letters of Credit

Mirant generally conducts its business through various operating subsidiaries which enter into contracts as a routine part of their business activities. In certain instances, the contractual obligations of such subsidiaries are guaranteed by, or otherwise supported by, Mirant or another of its subsidiaries, including by letters of credit issued under the credit facilities of Mirant North America.

In addition, Mirant and its subsidiaries enter into various contracts that include indemnification and guarantee provisions. Examples of these contracts include financing and lease arrangements, purchase and sale agreements, commodity purchase and sale agreements, construction agreements and agreements with vendors. Although the primary obligation of Mirant or a subsidiary under such contracts is to pay money or render performance, such contracts may include obligations to indemnify the counterparty for damages arising from the breach thereof and, in certain instances, other existing or potential liabilities. In many cases, the Company’s maximum potential liability cannot be estimated because some of the underlying agreements contain no limits on potential liability.