Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TTM TECHNOLOGIES INC | f8k_050510.htm |

| EX-99 - EXHIBIT 99.1 - TTM TECHNOLOGIES INC | exh_991.htm |

EXHIBIT 99.2

Global Presence / Local Knowledge

2010 First Quarter Earnings Call & Update

May 6, 2010

2

2

Safe Harbor

During the course of this call, the company will make forward-looking statements subject

to known and unknown risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to, fluctuations in quarterly and annual operating

results, the volatility and cyclicality of various industries that the company serves and the

impact of the current economic crisis and other risks described in TTM’s most recent

SEC filings. The company assumes no obligation to update the information provided in

this conference call.

to known and unknown risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to, fluctuations in quarterly and annual operating

results, the volatility and cyclicality of various industries that the company serves and the

impact of the current economic crisis and other risks described in TTM’s most recent

SEC filings. The company assumes no obligation to update the information provided in

this conference call.

The company also will present non-GAAP financial information in this call. For a

reconciliation of TTM’s non-GAAP financial information to the equivalent measures under

GAAP, please refer to the company’s press release, which was filed with the SEC and

which is posted on TTM’s website.

reconciliation of TTM’s non-GAAP financial information to the equivalent measures under

GAAP, please refer to the company’s press release, which was filed with the SEC and

which is posted on TTM’s website.

Global Presence / Local Knowledge

3

Q1 Overview

Kent Alder, CEO & President

4

Strategic Overview

4

A stronger, world-class PCB

manufacturer with the scale,

production capabilities,

market breadth and

expanded customer service

ability to lead in today’s

competitive global PCB

marketplace.

manufacturer with the scale,

production capabilities,

market breadth and

expanded customer service

ability to lead in today’s

competitive global PCB

marketplace.

Restructuring

largely complete

largely complete

Combination with

Meadville complete

Meadville complete

5

5

Q1 2010 Highlights

1) Gross margin improved from 18.5 percent to 19.5 percent

– Revenue of $138.2 million came in at the upper end of guidance range

– 2009 strategic restructuring working as planned

2) Cash generation of $7.2 million in the quarter

– Cash and cash equivalents, restricted cash and short term investments

increased from $215.7 million in the fourth quarter to $222.9 million in

the first quarter

increased from $215.7 million in the fourth quarter to $222.9 million in

the first quarter

3) Improved market conditions

– Commercial market supported firmer pricing especially in quick-turn

– Aerospace & Defense pricing higher due to product mix

6

$ in millions

Q1 2010 Segment Results

7

7

Q1 2010 End Market Update

• Aerospace & Defense

– Broad base of diverse programs provide stability

and growth

and growth

– Second quarter forecast stable

• Networking/Communications

– Percentages down due to increased orders

shipped at the end of Q4

shipped at the end of Q4

– Second quarter forecast up due to more normal

ordering patterns and end market strength

ordering patterns and end market strength

|

End Market

|

4Q09

|

1Q10

|

|

Aerospace & Defense

|

42%

|

42%

|

|

Networking /

Communications |

38%

|

33%

|

|

Computing / Storage /

Peripherals |

10%

|

13%

|

|

Medical / Industrial /

Instrument / Other |

10%

|

12%

|

End Markets

• Medical / Industrial / Instrumentation / Other

– Increased on overall segment strength led by Medical and Instrumentation

– Second quarter up on continued broad based strength

• Computing / Storage / Peripherals

– Improvement due to increased orders from a large server and storage customer

– Sustain first quarter revenue level in the second quarter

8

8

Q1 2010 Customer & Order Update

|

Top 5

1Q10 |

31%

|

BAE, Cisco, Hamilton Sundstrand,

Huawei, Raytheon |

|

Top 5

4Q09 |

34%

|

Cisco, Huawei, Juniper Networks,

Northrop Grumman, Raytheon |

Top 5 OEM Customers

alphabetical order

|

Commercial

|

5 - 10

weeks |

6 - 10

weeks |

Stable

|

|

Aerospace &

Defense |

5 - 8

weeks* |

5 - 8

weeks* |

Stable

|

Lead Times

4Q09

1Q10

* Some A&D products require 14-20 weeks lead time

TTM and IPC Book to Bill

Status

• No single customer represented 10 percent or more

of sales during 4Q09 and 1Q10

|

TTM

|

1.05

|

1.08

|

1.12

|

|

IPC

|

1.06

|

1.09

|

1.10

|

4Q09

1Q10

3Q09

• Stable to slightly longer lead time at commercial

plants

plants

• Lead time unchanged for Aerospace & Defense plants

• Strong book to bill reflects improving market

conditions

Global Presence / Local Knowledge

9

Financial Overview

Steve Richards, CFO

10

10

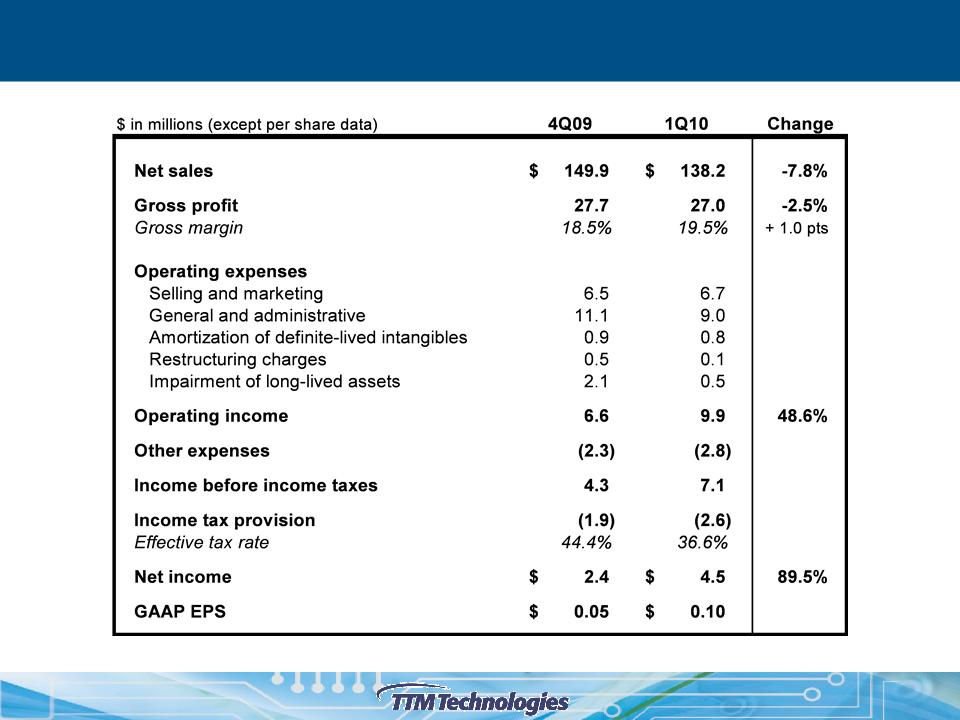

Income Statement - Q1 vs. Q4

11

11

Non-GAAP Results - Q1 vs. Q4

1 Non-GAAP net income & EPS, EDITDA and adjusted EBITDA in this slide are defined in our 1Q 2010 press release

Global Presence / Local Knowledge

12

Meadville Update

13

Aerospace /

Defense

• No. 1 North American

supplier

supplier

• Rigid Flex and specialty

PCB products

PCB products

• Backplane and

subassembly

subassembly

Time

• Dedicated ultra-short

lead time capability

(<24 hours available)

lead time capability

(<24 hours available)

• Dedicated, highly

flexible, ramp-to-

volume production in

<10 days

flexible, ramp-to-

volume production in

<10 days

• High-mix complex

technology production

with standard

technology production

with standard

delivery

Financial Strength

• Focus on operational

excellence

excellence

• Superior asset management

and strong balance sheet

and strong balance sheet

• Strong cash flow generation

• Successful integration of

strategic acquisitions

strategic acquisitions

Technology

• High performance,

technologically complex

PCBs

technologically complex

PCBs

• Advanced manufacturing

processes & technology

expertise

processes & technology

expertise

• Industry-leading average

layer count of 20+ at

Chippewa Falls facility

layer count of 20+ at

Chippewa Falls facility

Industry-Leading

Execution and

Financial Results

Execution and

Financial Results

Global Presence -

Asian Capacity

• High volume capability

• Capture incremental business

from existing customers

from existing customers

• Seamless transition of prototype

to volume production

to volume production

• Footprint to supply growing

Asian demand

Asian demand

• Established financial model with

leading growth and margin profile

leading growth and margin profile

• Excellent management team with

extensive China manufacturing

expertise

extensive China manufacturing

expertise

• Strong cultural fit - with similar

business philosophies

business philosophies

• Advanced technology capabilities -

best fit with TTM

best fit with TTM

• Specialized facility strategy

• Complementary customer base

consisting of Tier 1 OEMs

consisting of Tier 1 OEMs

• Diversified end-market mix

• Cost effective platform with

significant China manufacturing

capacity

significant China manufacturing

capacity

TTM’s Asian M&A Criteria

Meadville

PCB Position

PCB Position

TTM Strategy

14

R&D

Growth

Maturity

NPI

Total Solution Capabilities

• Engineering support

• Prototype

• Low volume / High mix

• Medium volume / Ramp

• Volume production

Product Life Cycle

Advanced

Technology &

Service Excellence

Technology &

Service Excellence

Total Customer Solution

15

Organization Structure

TTM Corporate

Headquarters

Santa Ana, CA U.S.A.

U.S. / Shanghai

Assembly Business

Assembly Business

(1 plant in U.S.,

1 plant in China)

U.S. PCB

Business

Business

(6 plants in U.S.)

Asian PCB

Business

(7 plants in China,

1 plant in Hong Kong)

Existing TTM

management team

management team

Existing Meadville

management team

management team

16

Revenue

by

End-Market

End-Market

TTM

Pro Forma

Meadville PCB

TTM

Pro Forma

Meadville PCB

Source: Company filings. Revenue for the calendar year 2009 period

The combination creates a leading global manufacturer with a highly diversified revenue mix

Notes:

Americas includes United States, Canada, Central and South America. Greater China includes China, Hong Kong and Taiwan. Asia includes Asian countries excluding Greater China

EMEA includes Europe, Middle East and Africa

Diversifying Revenue Base

Revenue

by

Geography

17

17

Accretion and Synergies

Accretion estimate

• Transaction expected to be accretive in the third quarter of 2010

Revenue synergies

• Qualification process varies by customer

• Asian facilities ran at 75 to 95 percent of capacity in the first quarter

• Expanding capacity to accommodate growth

• 2010 potential from “simple qualification” customers

• Targeting “comprehensive qualification” customers for late 2010 and 2011

Cost synergies

• Minimal duplicative public company costs

• Better negotiations on direct materials due to larger scale of combined

operations

operations

• Transfer of best practices

18

Update on Board & Stockholders

• Ownership of shares

– 36.3 million shares issued: 26.2 million to Tang family and 10.1 million to

minority shareholders

minority shareholders

– Meadville’s minority investors request to sell approximately 1.3 million

shares of TTM stock

shares of TTM stock

– Tang family, TTM’s largest minority shareholder, to retain 33 to 35

percent stake in TTM

percent stake in TTM

• Trading restrictions

– Tang family agreement prohibits sale of shares for 18 months; credit

agreement requires Tangs to hold 20 percent stake in TTM

agreement requires Tangs to hold 20 percent stake in TTM

• Expansion of board

– Addition of Tom Tang, Managing Director of Asia Pacific Region

– Three new Government Security Committee members

19

19

2009 Pro Forma Combined Income Statement

1 Pro forma adjustments are disclosed in the Form 8-K/A filed with the SEC on April 26, 2010

20

Transaction Summary

• Final purchase price

– $114 million in cash

– 36.3 million shares of TTM stock

• Closing market value of $329 million assuming closing market price of $9.06

per share on April 8, 2010

per share on April 8, 2010

– Assumed $433 million of Meadville debt

– Total: $876 million

• EBITDA multiple

– $876 million / $114.6 million adjusted EBITDA = 7.6 implied multiple

• Leverage ratio

– Including TTM’s convertible debt of $175 million, initial leverage ratio is

about 3.3 times combined 2009 EBITDA

about 3.3 times combined 2009 EBITDA

– Goal is to be under 3 times EBITDA within first year following deal close

21

21

First Quarter Review - Meadville

• Performance updates

– Revenue was $159 million in the first quarter. Forecasting higher

revenue in the second quarter

revenue in the second quarter

– Material costs increasing - negotiating price increases with customers to

offset

offset

– Book to bill for the first quarter was strong at 1.2

• End markets

– In general, end markets remained steady with fourth quarter 2009 as a

percent of sales

percent of sales

– The Computing end market benefited from a new product launch by a

major customer

major customer

• Capacity expansion

– Planned enhancements to physical plant capacity are in progress and

should be production ready by third quarter 2010

should be production ready by third quarter 2010

– This increase in overall capacity is anticipated to raise quarterly revenue

by 10 to 14 percent by first quarter 2011

by 10 to 14 percent by first quarter 2011

22

22

Q2 2010 Guidance

|

Revenue

|

$290 - $310

|

|

GAAP EPS

|

$0.03 - $0.12

|

|

Non-GAAP EPS

|

$0.16 - $0.25

|

($millions)

EPS based on approximately 76.5 million shares

• U.S. revenue expected to rise by 5 percent at plants with commercial focus and remain

steady at Aerospace/Defense plants; Backplane Assembly revenue expected to decrease

by about 10 percent due to Hayward facility closure

steady at Aerospace/Defense plants; Backplane Assembly revenue expected to decrease

by about 10 percent due to Hayward facility closure

• Asian operations should experience revenue growth in computing, cell phones

• Purchase accounting will raise COGS by about $4.5 million for inventory mark-up

• Forecast reflects $7.7 million in transaction costs, primarily payments to advisor