Attached files

| file | filename |

|---|---|

| EX-32 - GREAT ATLANTIC & PACIFIC TEA CO INC | ex32.htm |

| EX-13 - GREAT ATLANTIC & PACIFIC TEA CO INC | ex13.txt |

| EX-21 - GREAT ATLANTIC & PACIFIC TEA CO INC | ex21.htm |

| EX-23.1 - GREAT ATLANTIC & PACIFIC TEA CO INC | ex23_1.txt |

| EX-31.2 - GREAT ATLANTIC & PACIFIC TEA CO INC | ex31_2.htm |

| EX-31.1 - GREAT ATLANTIC & PACIFIC TEA CO INC | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[ X ] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 27, 2010

OR

OR

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to__________

Commission file number 1-4141

THE GREAT ATLANTIC & PACIFIC TEA COMPANY, INC.

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

Maryland |

13-1890974 |

||||||

(State or other

jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

||||||

2

Paragon Drive Montvale, New Jersey 07645 (Address of principal executive offices) |

|||||||

Registrant’s telephone number, including area code: |

201-573-9700 |

||||||

___________________________ |

|||||||

Securities registered pursuant to Section 12 (b) of the Act: |

|||||||

| Title of each class |

Name of each exchange on which registered |

||||||

|---|---|---|---|---|---|---|---|

Common Stock

— $1 par value |

New York Stock

Exchange |

||||||

9.375% Notes,

due August 1, 2039 |

New York Stock

Exchange |

||||||

Securities registered pursuant to Section 12 (g) of the Act: None |

|||||||

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the

Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes [ X ] No [ ]

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files. Yes [ ] No [ ]

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. [ ]

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

Large accelerated filer Accelerated filer X Non-accelerated filer Smaller reporting company

Large accelerated filer Accelerated filer X Non-accelerated filer Smaller reporting company

Indicate by check mark whether the

registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes [ ] No [X]

The aggregate market value of the

voting stock held by non-affiliates of the Registrant as of the close of business on September 5, 2009, the registrant’s most recently completed

second fiscal quarter, was $223,061,321.

The number of shares of common stock

outstanding as of the close of business on April 30, 2010 was 55,871,027.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part I,

Items 1, 1A and 3, and Part II, Items 5, 6, 7, 7A, 8 and 9A are incorporated by reference from the Registrant’s Fiscal 2009 Annual Report to

Stockholders. The information required by Part III, Items 10, 11, 12, 13, and 14 are incorporated by reference from the Registrant’s Proxy

Statement for the 2010 Annual Meeting of Stockholders.

1

PART I

ITEM 1 — Business

General

The Great Atlantic & Pacific Tea

Company, Inc. (“A&P”, “we”, “our”, “us” or “our Company”) is engaged in the retail food business.

We operated 429 stores averaging approximately 42,200 square feet per store as of February 27, 2010.

Operating under the trade names

A&P®, SuperFresh®, Waldbaum’s®, Super Foodmart®,

Food Basics®, The Food Emporium®, Best Cellars®, Best

Cellars at A&P®, Pathmark® and Pathmark Sav-A-Center®, we sell groceries, meat, fresh produce and other items commonly offered in

supermarkets and wine, beer and spirits in our Best Cellars® and Best Cellars at A&P® locations. In addition, many of our stores offer

bakeries, delicatessens, pharmacies, floral departments, fresh seafood and cheese departments and on-site banking. National, regional and local brands

are sold as well as a selection of our private label brands. In support of our retail operations, we sell private label products in our stores under

other brand names of our Company which include, without limitation, America’s Choice®, America’s Choice Gold®, Hartford

Reserve®, Smart Price, Green Way®, Via Roma®, Master Choice®, and Live Better Wellness®.

Building upon a broad base of

supermarkets, our Company has historically expanded and diversified within the retail food business through the acquisition of other supermarket chains

and the development of several alternative store types. We now operate our stores with merchandise, pricing and identities tailored to appeal to

different segments of the market, including buyers seeking gourmet and ethnic foods, a wide variety of premium quality private label goods and health

and beauty aids along with the array of traditional grocery products.

Our Internet address is

www.aptea.com. We make available free of charge through our Internet website our annual reports and the proxy statement for our annual meeting

of stockholders as soon as reasonably practicable after we electronically file such material with, or furnish them to, the Securities and Exchange

Commission. All of such materials are located at the “Investors” page. We also provide through our Internet website a hyperlink to the

Securities and Exchange Commission website, where the Company’s quarterly reports on Form 10-Q, current reports on Form 8-K, and Forms 3, 4 and 5

filed with respect to our equity securities under Section 16(a) of the Securities Exchange Act of 1934, as amended, may be accessed electronically. The

information found on our website shall not be deemed incorporated by reference by any general statement incorporating by reference this report into any

filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed

under the Acts.

Modernization of Facilities

During fiscal 2009, we spent

approximately $86 million for capital projects, which included 5 new stores, 6 store remodels and 4 store conversions. Our planned capital expenditures

for fiscal 2010 are expected to be in the range from $75 million to $100 million, and will relate primarily to our existing

supermarkets.

2

Sources of Supply

Our Company currently acquires a

majority of our saleable inventory from one supplier, C&S Wholesale Grocers, Inc. (“C&S”). Under our March 7, 2008 agreement with

C&S, C&S provides warehousing, logistics, procurement and purchasing services (the “Services”) in support of our Company’s

entire supply chain. This agreement expires on September 29, 2018. The agreement defines the parties’ respective responsibilities for the

procurement and purchase of merchandise intended for use or resale at our Company’s stores, as well as the parties’ respective remuneration

for warehousing and procurement/purchasing activities. In consideration for its services, C&S is paid an annual fee and has incentive income

opportunities based upon our cost savings and increases in retail sales volume. The agreement also provides that we will purchase virtually our entire

warehoused inventory from C&S.

Although there are a limited number of

distributors that can supply our stores, we believe that other suppliers could provide similar product on comparable terms.

Licenses and Trademarks

Our stores require a variety of

licenses and permits that are renewed on an annual basis. Payment of a fee is generally the only condition to maintaining such licenses and permits. We

maintain registered trademarks for nearly all of our store banner trade names and private label brand names. Trademarks are generally renewable on a 10

year cycle. We consider trademarks an important way to establish and protect our Company brands in a competitive environment.

Employees

As of February 27, 2010, we had

approximately 45,000 employees, of which 69% were employed on a part-time basis. Approximately 92% of our employees are covered by union contracts. Our

Company considers our present relations with employees to be satisfactory.

Competition

The supermarket business is highly

competitive throughout the marketing areas served by our Company and is generally characterized by low profit margins on sales with earnings primarily

dependent upon rapid inventory turnover, effective cost controls and the ability to achieve high sales volume. We compete for sales and store locations

with a number of national and regional chains, as well as with many independent and cooperative stores and markets.

Segment Information

The segment information required is

contained under the caption “Note 20 — Segments” in the Fiscal 2009 Annual Report to Stockholders and is herein incorporated by

reference.

3

ITEM 1A — Risk Factors

The Risk Factors required are disclosed

in the Fiscal 2009 Annual Report to Stockholders and are herein incorporated by reference.

ITEM 1B — Unresolved Staff Comments

None.

ITEM 2 — Properties

At February 27, 2010, we owned 56

properties consisting of the following:

Stores,

Not Including Stores in Owned Shopping Centers |

||||||

Land and

building owned |

13 | |||||

Building

owned and land leased |

22 | |||||

Total

stores |

35 | |||||

Shopping

Centers |

||||||

Land and

building owned |

6 | |||||

Building

owned and land leased |

1 | |||||

Total

shopping centers |

7 | |||||

Administrative and Other Properties |

||||||

Land and

building owned |

6 | |||||

Undeveloped

land |

8 | |||||

Total other

properties |

14 | |||||

Total

Properties |

56 |

Sixteen of these properties are pledged

under our Company’s Amended and Restated Credit agreements and our 11.375% Senior Secured Notes.

At February 27, 2010, we operated 429

retail stores, of which 42 were owned and 387 were leased. These stores are geographically located as follows:

Company

Stores: |

||||||

New

England States: |

||||||

Connecticut |

25 | |||||

Massachusetts |

1 | |||||

Total |

26 | |||||

Middle

Atlantic States: |

||||||

District of

Columbia |

1 | |||||

Delaware |

13 | |||||

Maryland |

27 | |||||

New

Jersey |

151 | |||||

New

York |

169 | |||||

Pennsylvania |

41 | |||||

Virginia |

1 | |||||

Total |

403 | |||||

Total

Stores |

429 |

4

The total area of all of our operated

retail stores is 18.1 million square feet averaging approximately 42,200 square feet per store. Excluding our Wine, Beer and Spirits stores and The

Food Emporium stores, which are generally smaller in size, the average store size is approximately 45,400 square feet. With the exception of our Wine,

Beer and Spirits stores, our stores built over the past several years and those planned in the future generally range in size from 40,000 to 60,000

square feet. The selling area of new stores ranges from approximately 60% to 75% of total square footage.

Our Company considers our stores,

warehouses, and other facilities adequate for our operations.

ITEM 3 — Legal Proceedings

The information required is contained

under the caption “Note 22 — Commitments and Contingencies” in the Fiscal 2009 Annual Report to Stockholders and is herein incorporated

by reference.

ITEM 4 — [Removed and Reserved]

PART II

ITEM 5 — Market for

Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The information required is contained

under the captions “Management’s Discussion and Analysis”, “Summary of Quarterly Results”, “Five Year Summary of Selected

Financial Data”, and “Stockholder Information” in the Fiscal 2009 Annual Report to Stockholders and is herein incorporated by

reference.

5

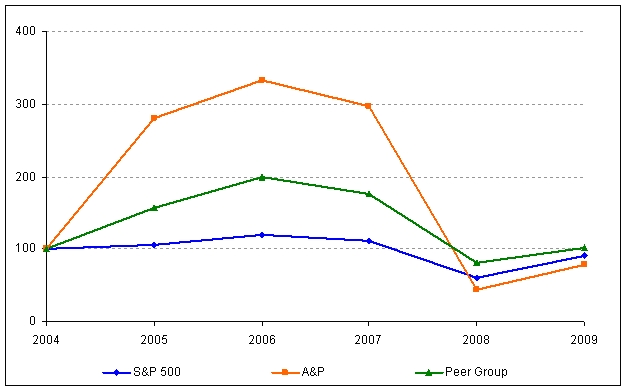

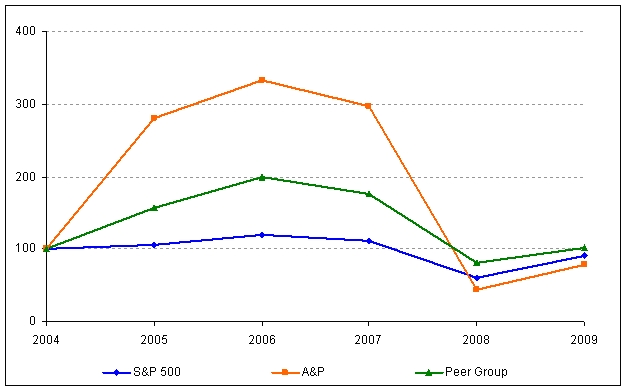

Stock Performance Graph

The following performance graph

compares the five-year cumulative total stockholder return (assuming reinvestment of dividends) of the Company’s Common Stock to the Standard

& Poor’s 500 Index and the Company’s Peer Group which consists of the Company, Supervalu Inc., Safeway, Inc. and The Kroger Co. The

“Peer Group” for the purposes of the Stock Performance Graph is a subset of, and should not be confused for, the peer group list of companies

used to benchmark executive compensation as discussed in the Proxy Statement for the Company’s 2009 Annual Meeting of Shareholders (“Proxy

Statement”). The performance graph assumes $100 is invested in the Company’s Common Stock, the Standard & Poor’s 500 Index and the

Company’s Peer Group on February 25, 2005, and that dividends paid during the period were reinvested to purchase additional shares. The

Company’s fiscal year ends the last Saturday in February.

| Last Business Day of Fiscal Year |

|

S&P 500 |

|

A&P |

|

Peer Group |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

$ |

$ |

$ |

||||||||||||

02/25/05 |

100 |

100 |

100 |

|||||||||||

02/24/06 |

106 |

281 |

157 |

|||||||||||

02/23/07 |

120 |

332 |

199 |

|||||||||||

02/22/08 |

112 |

297 |

176 |

|||||||||||

02/28/09 |

61 |

44 |

81 |

|||||||||||

02/27/10 |

91 |

78 |

102 |

|||||||||||

The performance graph above is being

furnished solely to accompany this Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K, and is not being filed for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, and is not to be incorporated by reference into any filing of our Company, whether made before

or after the date hereof, regardless of any general incorporation language in such filing.

6

ITEM 6 — Selected Financial Data

The information required is contained

under the caption “Five Year Summary of Selected Financial Data” in the Fiscal 2009 Annual Report to Stockholders and is herein incorporated

by reference.

ITEM 7 — Management’s Discussion and Analysis of

Financial Condition and Results of Operations

The information required is contained

under the caption “Management’s Discussion and Analysis” in the Fiscal 2009 Annual Report to Stockholders and is herein incorporated by

reference.

ITEM 7A — Quantitative and Qualitative Disclosures About

Market Risk

The information required is contained

in the section “Market Risk” under the caption “Management’s Discussion and Analysis” in the Fiscal 2009 Annual Report to

Stockholders and is herein incorporated by reference.

ITEM 8 — Financial Statements and Supplementary

Data

(a) |

Financial Statements: The financial statements required by this item and described in Part IV, Item 15 of this report are incorporated herein by reference to the Consolidated Financial Statements, related notes and supplementary data, in the fiscal 2009 Annual Report to Stockholders. Except for the sections included herein by reference, our Fiscal 2009 Annual Report to Stockholders is not deemed to be filed as part of this report. |

(b) |

Supplementary Data: The information required by this item is contained under the caption “Summary of Quarterly Results (Unaudited)” in the Fiscal 2009 Annual Report to Stockholders and is herein incorporated by reference. |

ITEM 9 — Changes in and Disagreements with Accountants on

Accounting and Financial

Disclosure

There were no changes in or

disagreements with accountants on accounting and financial disclosure during the fiscal year ended February 27, 2010.

ITEM 9A — Controls and Procedures

Evaluation of Disclosure Controls and

Procedures

We have established and maintain

disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) that are designed to ensure that information required to

be

7

disclosed in our Company’s Exchange Act reports is recorded,

processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and

communicated to our Company’s management, including our President and Chief Executive Officer, and Senior Vice President, Chief Financial Officer

and Treasurer, as appropriate, to allow timely decisions regarding required disclosure.

We carried out an evaluation, under the

supervision and with the participation of our Company’s management, including our Company’s President and Chief Executive Officer along with

our Company’s Senior Vice President, Chief Financial Officer and Treasurer, of the effectiveness of the design and operation of our Company’s

disclosure controls and procedures pursuant to Exchange Act Rule 13a-15(b). Based upon the foregoing, as of the end of the period covered by this

report, our Company’s President and Chief Executive Officer along with our Company’s Senior Vice President, Chief Financial Officer and

Treasurer, concluded that our Company’s disclosure controls and procedures were effective at the reasonable assurance level.

The Company’s management does not

expect that its disclosure controls and procedures or its internal control over financial reporting will prevent all errors and all fraud. A control

system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are

met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered

relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all

control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments

in decision-making can be faulty, and breakdowns can occur because of simple errors or mistakes. Additionally, controls can be circumvented by the

individual acts of some person or by collusion of two or more people. The design of any system of controls also is based in part upon certain

assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all

potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies

or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur

and not be detected. Accordingly, the Company’s disclosure controls and procedures are designed to provide reasonable, not absolute, assurance

that the objectives of our disclosure control system are met and, as set forth above, the Company’s management has concluded, based on their

evaluation as of the end of the period, that our disclosure controls and procedures were sufficiently effective to provide reasonable assurance that

the objectives of our disclosure control system were met.

Incorporation by reference of Management’s Annual

Report on Internal Control over Financial Reporting

Management of The Great Atlantic

and Pacific Tea Company, Inc. has prepared an annual report on internal control over financial reporting (as such item is defined in Rules 13a-15(f)

and 15d-15(f) under the Exchange Act). Management’s report is included in our Company’s Fiscal 2009 Annual Report to Stockholders and is

herein incorporated by reference in this Annual Report on Form 10-K.

8

Incorporation by reference of Report of Independent

Registered Public Accounting Firm

The Report of Independent

Registered Public Accounting Firm is included in our Company’s Fiscal 2009 Annual Report to Stockholders and is herein incorporated by reference

in this Annual Report on Form 10-K.

Changes in Internal Control over Financial

Reporting

There has been no change

during the Company’s fiscal quarter ended February 27, 2010 in the Company’s internal control over financial reporting (as such item is

defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, the

Company’s internal control over financial reporting. The recent change in our Chief Executive Officer did not have a material effect on the

Company’s internal control over financial reporting.

ITEM 9B — Other Information

At a special meeting of the

Company’s stockholders held on December 15, 2009, the following matters were submitted for the consideration and vote of the Company’s

stockholders:

(a) |

a proposal to approve (as required pursuant to New York Stock Exchange Rule 312) the shares of the Company’s 8.0% Cumulative Convertible Preferred Stock, Series A-T and Series A-Y (the “Convertible Preferred Stock”) when voting together with the Common Stock becoming entitled to cast the full number of votes on an as-converted basis; and |

(b) |

a proposal to approve the issuance of the full amount of the Company’s Common Stock upon the exercise of conversion rights of the Convertible Preferred Stock. |

Of the 41,531,250.48 shares voted at

the special meeting, there were 37,547,681.54 shares voted “for” each proposal, 3,957,618.94 shares voted “against” each proposal,

and 25,950.00 abstentions. There were no broker non-votes.

PART III

ITEM 10 — Directors, Executive Officers and Corporate

Governance

The information required under this

item is incorporated herein by reference to our definitive Proxy Statement for our fiscal 2010 Annual Meeting of Stockholders, which shall be filed

with the SEC within 120 days after the end of our fiscal year, or June 27, 2010.

9

The executive officers of our Company

are as follows:

Name |

Age |

Current Position |

||||||||

Ron

Marshall |

54 |

President and

Chief Executive Officer |

||||||||

Brenda

Galgano |

41 |

Senior Vice

President, Chief Financial Officer & Treasurer |

||||||||

Christian

Haub |

45 |

Executive

Chairman |

||||||||

Andreas

Guldin |

48 |

Vice Chairman,

Chief Strategy Officer |

||||||||

Mark

Kramer |

60 |

Senior Vice

President, Operations |

||||||||

Christopher

McGarry |

43 |

Senior Vice

President, General Counsel & Secretary |

||||||||

Rebecca

Philbert |

48 |

Senior Vice

President, Merchandising and Supply & Logistics |

||||||||

Melissa

Sungela |

44 |

Vice President

and Corporate Controller |

||||||||

Mr. Marshall was appointed President

and Chief Executive Officer on February 8, 2010. Prior to joining the Company, Mr. Marshall served as President and Chief Executive Officer and a

Director of Borders Group, Inc. from January 2009 through January 2010. Mr. Marshall was Principal of Wildridge Capital Management, a private equity

firm that he founded in 2006. For eight years prior to founding Wildridge Capital Management, he was Chief Executive Officer of Nash Finch Company, a

$5 billion food distribution and retail organization. From 1994 to 1998, Mr. Marshall served as Executive Vice President and Chief Financial Officer of

Pathmark Stores, Inc., a supermarket retailer. Prior to that, Mr. Marshall served in senior management positions in a variety of retail companies,

including Dart Group Corporation’s Crown Books division and Barnes & Noble college bookstores.

Ms. Galgano, CPA, was appointed Senior

Vice President and Chief Financial Officer in November 2005 and in February 2010 was additionally appointed Treasurer. Ms. Galgano served as Senior

Vice President and Corporate Controller, from November 2004 to November 2005, Vice President, Corporate Controller from February 2002 to November 2004,

Assistant Corporate Controller from July 2000 to February 2002 and Director of Corporate Accounting from October 1999 to July 2000. Prior to joining

our Company, Ms. Galgano was with PricewaterhouseCoopers LLP as Senior Manager, Assurance and Business Advisory Services.

Mr. Haub was appointed Executive

Chairman in August 2005. He was elected a director in December 1991, and is Chair of the Executive Committee. Mr. Haub previously served as Chairman of

the Board and Chief Executive Officer; and as Chief Operating Officer of our Company from December 1993, becoming Co-Chief Executive Officer in April

1997, sole CEO in May 1998 and Chairman of the Board in May 2001. Mr. Haub also served as Interim President and CEO of the Company from October 20,

2009 to February 8, 2010 and also served as President from December 1993 through February 2002, and from November 2002 through November 2004. Mr. Haub

is a partner and Co-Chief Executive Officer of Tengelmann Warenhandelsgesellschaft KG, a partnership organized under the laws of the Federal Republic

of Germany (“Tengelmann”). Mr. Haub is on the Board of Directors of Metro, Inc., the Food Marketing Institute and on the Board of Trustees of

St. Joseph’s University in Philadelphia, Pennsylvania.

Dr. Guldin was appointed Vice Chairman

and Chief Strategy Officer effective October 15, 2009. He previously served as Executive Managing Director, Strategy & Development from May 1, 2007

to October 15, 2009. He was elected to the Board of Directors in May 2007. Prior to joining the Company, he was Senior Executive Vice President

(Corporate Finance) and Co-Chief Financial Officer

10

of Tengelmann Warenhandelsgesellschaft KG. Prior to joining

Tengelmann, Mr. Guldin served as a member of the Executive Management Team and Chief Financial Officer at E. Breuninger GmbH & Co. (Germany), a

prestigious department store and fashion retailer in Germany. Before that he worked for several years as a Senior

Consultant and Project Leader at PA Consulting and CSC Index, Germany.

Mr. Kramer was appointed Senior Vice

President, Operations in April 2010. Prior to joining our Company, Mr. Kramer was with Rite Aid Corporation from February 2009 to April 2010, where he served as

Group Vice President, Operations. Prior to that Mr. Kramer held various positions for Pathmark Stores, Inc., including Executive Vice President,

Operations from April 2004 to December 2007.

Mr. McGarry was appointed Senior Vice

President, General Counsel and Secretary on October 7, 2009. Mr. McGarry joined the Company in March 2006 as Vice President of Legal Services and from

July 2006 to October 2009, also served as Legal Compliance Officer and Assistant Secretary for the Company. Prior to joining the Company, Mr. McGarry

was General Counsel from 2003 to 2005 for Exel, Inc., successor-in-interest to Tibbett & Britten Group Americas, a major international logistics

service provider for the food and beverage, fashion and other consumer product sectors. For the period from 1992 to 1998, and from 2001 to 2003, Mr.

McGarry was a Partner and attorney in various New Jersey based law firms. From 1998 to 2001, Mr. McGarry served as Assistant General Counsel, Director

of Real Estate and Corporate Secretary for The Grand Union Company.

Ms. Philbert was appointed Senior Vice

President, Merchandising, in December 2006 and in February 2007 was additionally appointed Senior Vice President, Supply & Logistics. Prior to

joining our Company, Ms Philbert worked for Safeway, Inc. from 1981 to 2006, where she most recently served as Corporate Vice President and Senior

Lead, Lifestyle Store Development. Prior to that, Ms. Philbert served as Corporate Vice President Deli and Foodservice & Starbucks and prior to

that Corporate Vice President of Marketing.

Ms. Sungela, CPA, was appointed Vice

President and Corporate Controller in November 2005. Ms. Sungela served as Vice President and Assistant Corporate Controller from June 2004 to November

2005. Prior to joining our Company, Ms. Sungela was North American Controller for Amersham Biosciences, a part of GE Healthcare, from April 2002 to

June 2004. Previously, Ms. Sungela served as Director of Accounting Policy for Honeywell, from June 1998 to January 2002.

Code of Business Conduct and Ethics

Our Company has adopted a Code of

Business Conduct and Ethics applicable to all employees. This Code is applicable to Senior Executives including the Chief Executive Officer, Chief

Financial Officer and Treasurer and Chief Accounting Officer of our Company. A&P’s Code of Business Conduct and Ethics is available on the

Company’s Website at www.aptea.com under “Corporate Governance.” Our Company intends to post on its website any amendments to, or

waivers from, its Code of Business Conduct and Ethics applicable to Senior Financial Executives. The Code of Business Conduct and Ethics is available

in print to any shareholder or other interested party upon written request to the Legal Compliance Officer, 2 Paragon Drive, Montvale, New Jersey 07645

or by calling (201) 571-4355.

11

ITEM 11 — Executive Compensation

The information required regarding our

director and executive compensation and certain corporate governance matters is contained under the captions, “The Board of Directors of the

Company,” “Executive Compensation” and “Report of Management Development and Compensation Committee,” respectively, in the

Proxy Statement, to be filed on or before June 27, 2010, and is herein incorporated by reference.

ITEM 12 — Security Ownership of Certain Beneficial Owners

and Management and Related Stockholder Matters

The information required by this item

is contained in our Proxy Statement under the heading “Security Ownership of Certain Beneficial Owners and Management,” and is herein

incorporated by reference.

As of April 30, 2010, there were approximately 5,468 stockholders of record of our common stock.

Securities authorized for issuance

under equity compensation plans are summarized below:

| As of February 27, 2010 |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number of securities to be issued upon exercise of outstanding options and rights |

Weighted average exercise price of outstanding options and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities (reflected in first column) |

|||||||||||||

Equity

compensation plans approved by security holders: |

|||||||||||||||

1994 Stock

Option Plan for officers and key employees* |

52,550 | $ | 4.30 | - | |||||||||||

1994 Stock

Option Plan for Board of Directors** |

17,503 | 9.75 | - | ||||||||||||

1998 Long

Term Incentive and Share Award Plan*** |

1,334,938 | 24.04 | - | ||||||||||||

2008 Long

Term Incentive and Share Award Plan |

3,306,451 | 4.37 | 2,401,625 | ||||||||||||

Pathmark

Rollover Options |

483,012 | 31.38 | - | ||||||||||||

Total

Outstanding as of February 27, 2010 |

5,194,454 | $ | 23.25 | 2,401,625 | |||||||||||

Equity Compensation Plans

Not approved by security holders:

Not approved by security holders:

None.

* |

On March 17, 2004, the plan expired. |

** |

On July 14, 2004, the plan was replaced with the 2004 Non-Employee Director Compensation Plan |

*** |

On July 14, 2008, the plan expired. |

12

ITEM 13 — Certain Relationships and Related Transactions

and Director Independence

The information required by this item

is contained in our Proxy Statement under the heading “Certain Relationships and Transactions” and “The Board of Directors of the

Company,” and is herein incorporated by reference.

ITEM 14 — Principal Accounting Fees and

Services

The information required by this item

is contained in our Proxy Statement under the heading “Independent Registered Public Accounting Firm,” and is herein incorporated by

reference.

PART IV

ITEM 15 — Exhibits and Financial Statement

Schedules

(a) Documents filed as part of this

report:

1) |

Financial Statements: The following Consolidated Financial Statements, related Notes and Report of Independent Registered Public Accounting Firm are included in the fiscal 2009 Annual Report to Stockholders and are incorporated by reference into Item 8 of Part II of this Annual Report on Form 10-K. |

Consolidated Statements of

Operations

Consolidated Statements of Stockholders’ Equity (Deficit) and Comprehensive Loss

Consolidated Balance Sheets

Consolidated Statements of Cash Flows

Notes to Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm

Consolidated Statements of Stockholders’ Equity (Deficit) and Comprehensive Loss

Consolidated Balance Sheets

Consolidated Statements of Cash Flows

Notes to Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm

2. |

Financial Statement Schedule: |

| Schedule II Valuation and Qualifying Accounts and Reserves |

| All other schedules are omitted because they are not required or do not apply, or the required information is included elsewhere in the Consolidated Financial Statements or Notes thereto. |

3. |

Exhibits: |

| The following are filed as Exhibits to this Report: |

EXHIBIT

NO. |

DESCRIPTION |

|||||

2.1 |

Stock Purchase

Agreement, dated as of July 19, 2005, by and among The Great Atlantic & Pacific Tea Company, Inc., A&P Luxembourg S.a.r.l., Metro Inc. and

4296711 Canada Inc. (incorporated herein by reference to Exhibit 2.1 to Form 8-K filed on July 22, 2005) |

|||||

13

3.1 |

Articles of

Incorporation of The Great Atlantic & Pacific Tea Company, Inc., as amended and restated (incorporated herein by reference to Exhibit 3.1 to Form

8-K filed on July 1, 2008) |

|||||

3.2 |

By-Laws of The

Great Atlantic & Pacific Tea Company, Inc., as amended and restated on August 4, 2009 (incorporated herein by reference to Exhibit 3.1 to Form 8-K

filed on August 5, 2009) |

|||||

4.1 |

Indenture, dated

as of January 1, 1991, between The Great Atlantic & Pacific Tea Company, Inc. and JPMorgan Chase Bank (formerly The Chase Manhattan Bank as

successor by merger to Manufacturers Hanover Trust Company), as trustee (the “Indenture”) (incorporated herein by reference to Exhibit 4.1 to

Form 8-K, filed on January 1, 1991) |

|||||

4.2 |

Second

Supplemental Indenture, dated as of December 20, 2001, to the Indenture between The Great Atlantic & Pacific Tea Company, Inc. and JPMorgan Chase

Bank, relating to the 9 1/8% Senior Notes due 2011 (incorporated herein by reference to Exhibit 4.1 to Form 8-K filed on December 20,

2001) |

|||||

4.3 |

Successor Bond

Trustee (incorporated herein by reference to Exhibit 4.4 to Form 10-K filed on May 9, 2003) |

|||||

4.4 |

Third

Supplemental Indenture, dated as of August 23, 2005, to the Indenture between The Great Atlantic & Pacific Tea Company, Inc. and Wilmington Trust

Company (as successor to JPMorgan Chase Bank) (incorporated herein by reference to Exhibit 4.1 to Form 8-K filed on August 23, 2005) |

|||||

4.5 |

Fourth

Supplemental Indenture, dated as of August 23, 2005, to the Indenture between The Great Atlantic & Pacific Tea Company, Inc. and Wilmington Trust

Company (as successor to JPMorgan Chase Bank) (incorporated herein by reference to Exhibit 4.2 to Form 8-K filed on August 23, 2005) |

|||||

4.6 |

Indenture, dated

as of December 18, 2007, among The Great Atlantic & Pacific Tea Company, Inc. and Wilmington Trust Company, as Trustee (incorporated herein by

reference to Exhibit 4.1 to Form 8-K filed on December 17, 2007) |

|||||

4.7 |

First

Supplemental Indenture, dated as of December 18, 2007, among The Great Atlantic & Pacific Tea Company, Inc. and Wilmington Trust Company, as

Trustee, relating to the 5.125% Senior Convertible Notes due 2011 (incorporated herein by reference to Exhibit 4.2 to Form 8-K filed on December 17,

2007) |

|||||

14

4.8 |

Second

Supplemental Indenture, dated as of December 18, 2007, among The Great Atlantic & Pacific Tea Company, Inc. and Wilmington Trust Company, as

Trustee, relating to the 6.75% Senior Convertible Notes due 2011 (incorporated herein by reference to Exhibit 4.4 to Form 8-K filed on December 17,

2007) |

|||||

4.9 |

Form of Global

5.125% Senior Convertible Note due 2011 (incorporated herein by reference to Exhibit 4.3 to Form 8-K filed on December 17, 2007) |

|||||

4.10 |

Form of Global

6.75% Senior Convertible Note due 2012 (incorporated herein by reference to Exhibit 4.5 to Form 8-K filed on December 17, 2007) |

|||||

4.11 |

Articles

Supplementary of 8% Cumulative Convertible Preferred Stock Series A-T, A-Y, B-T and B-Y of The Great Atlantic & Pacific Tea Company, Inc.

(incorporated herein by reference to Exhibit 4.1 to Form 8-K filed on August 5, 2009) |

|||||

4.12 |

Indenture, dated

as of August 4. 2009, among The Great Atlantic & Pacific Tea Company, Inc., the guarantors named therein and Wilmington Trust Company, as trustee

(incorporated herein by reference to Exhibit 4.3 to Form 8-K filed on August 5, 2009) |

|||||

4.13 |

Form of 11.375%

Senior Secured Notes due 2015 (incorporated herein by reference to Exhibit 4.4 to Form 8-K filed on August 5, 2009) |

|||||

4.14 |

Amended and

Restated Tengelmann Stockholder Agreement, dated as of August 4, 2009, by and between The Great Atlantic & Pacific Tea Company, Inc. and Tengelmann

Warenhandelgesellschaft KG (incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on August 5, 2009) |

|||||

4.15 |

Amended and

Restated Yucaipa Stockholder Agreement, dated as of August 4, 2009, by and among The Great Atlantic & Pacific Tea Company, Inc., Yucaipa American

Alliance Fund II, LP, Yucaipa American Alliance (Parallel) Fund II, LP, Yucaipa Corporate Initiatives Fund I, LP, Yucaipa American Alliance Fund I, LP

and Yucaipa American Alliance (Parallel) Fund I, LP and Yucaipa American Alliance Fund II, LLC, as Stockholder Representative (incorporated herein by

reference to Exhibit 10.2 to Form 8-K filed on August 5, 2009) |

|||||

4.16 |

Registration

Rights Agreement, dated as of August 4, 2009, among The Great Atlantic & Pacific Tea Company, Inc., the guarantors named therein and Banc of

America Securities LLC (incorporated herein by reference to Exhibit 10.3 to Form 8-K filed on August 5, 2009) |

|||||

10.1 |

Executive

Employment Agreement, made and entered into as of the 15th day of August, 2005, by and

between The Great Atlantic & Pacific Tea Company, Inc. and Mr. Eric Claus (incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on

September 9, 2005) and a technical amendment (incorporated herein by reference to Exhibit 10.1 to Form 10-K filed on May 9, 2006) |

|||||

15

10.2 |

Employment

Agreement, made and entered into as of the 16th day of June, 2003, by and between The Great

Atlantic & Pacific Tea Company, Inc. and Brenda Galgano (incorporated herein by reference to Exhibit 10.9 to Form 10-Q filed on October 17,

2003) |

|||||

10.3 |

Employment

Agreement, made and entered into as of the 25th day of January, 2006, by and between The

Great Atlantic & Pacific Tea Company, Inc. and Jennifer MacLeod (incorporated herein by reference to Exhibit 10.13 to Form 10-K filed on May 9,

2006) |

|||||

10.4 |

Employment

Agreement, made and entered into as of the 1st day of March, 2005, by and between The Great

Atlantic & Pacific Tea Company, Inc. and William J. Moss (incorporated herein by reference to Exhibit 10.13 to Form 10-K filed on May 10,

2005) |

|||||

10.5 |

Employment

Agreement, made and entered into as of the 11th day of December, 2006, by and between The

Great Atlantic & Pacific Tea Company, Inc. and Rebecca Philbert (incorporated herein by reference to Exhibit 10.15 to Form 10-K filed on April 25,

2007) |

|||||

10.6 |

Offer letter,

made as of the 21st day of November, 2006 and entered into as of the 11th day of December, 2006, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Rebecca Philbert, (incorporated herein by reference to Exhibit 10.8 to Form 10-K filed on May 8, 2008) |

|||||

10.7 |

Employment

Agreement, made and entered into as of the 4th day of January, 2006, by and between The

Great Atlantic & Pacific Tea Company, Inc. and Melissa E. Sungela (incorporated herein by reference to Exhibit 10.17 to Form 10-Q filed on January

6, 2006) |

|||||

10.8 |

Employment

Agreement, made and entered into as of the 12th day of September, 2005, by and between The

Great Atlantic & Pacific Tea Company, Inc. and Paul Wiseman (incorporated herein by reference to Exhibit 10.17 to Form 10-Q filed on October 18,

2005) |

|||||

10.9 |

Employment

Agreement, made and entered into as of the 2nd day of December, 2004, by and between The

Great Atlantic & Pacific Tea Company, Inc. and Allan Richards (incorporated herein by reference to Exhibit 10.18 to Form 10-Q filed on October 18,

2005) |

|||||

10.10 |

Employment

Agreement, made and entered into as of the 22nd day of January, 2010, by and between The

Great Atlantic & Pacific Tea Company, Inc. and Ronald Marshall (incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on January 28,

2010) |

|||||

16

10.11 |

Form of Amendment

to Employment Agreement dated December 16, 2008 (incorporated herein by reference to Exhibit 10.13 to Form 10-K/A filed on July 23,

2009) |

|||||

10.12 |

Form of Amendment

to Employment Agreement dated June 16, 2009 (incorporated herein by reference to Exhibit 10.2 to Form 10-Q filed on July 23, 2009) |

|||||

10.13 |

Supplemental

Executive Retirement Plan effective as of September 1, 1997 (incorporated herein by reference to Exhibit 10.B to Form 10-K filed on May 27,

1998) |

|||||

10.14 |

Supplemental

Retirement and Benefit Restoration Plan effective as of January 1, 2001 (incorporated herein by reference to Exhibit 10(j) to Form 10-K filed on May

23, 2001) |

|||||

10.15 |

1994 Stock Option

Plan (incorporated herein by reference to Exhibit 10(e) to Form 10-K filed on May 24, 1995) |

|||||

10.16 |

1998 Long Term

Incentive and Share Award Plan (incorporated herein by reference to Appendix B to the Proxy Statement dated May 25, 2006) |

|||||

10.17 |

2008 Long Term

Incentive and Share Award Plan (incorporated herein by reference to Exhibit 10.1 of Form 8-K filed on July 1, 2008) |

|||||

10.18 |

Form of Stock

Option Grant (incorporated herein by reference to Exhibit 10.20 to Form 10-K filed on May 10, 2005) |

|||||

10.19 |

The Great

Atlantic & Pacific Tea Company, Inc. 1994 Stock Option Plan for Non-Employee Directors (incorporated herein by reference to Exhibit 10(f) to Form

10-K filed on May 24, 1995) |

|||||

10.20 |

The Great

Atlantic & Pacific Tea Company, Inc. 2004 Non-Employee Director Compensation effective as of July 14, 2004 (incorporated herein by reference to

Appendix C to the Proxy Statement dated May 25, 2006) |

|||||

10.21 |

Description of

Management Incentive Plan (incorporated herein by reference to Exhibit 10.30 to Form 10-K filed on May 9, 2006) |

|||||

10.22 |

Asset Purchase

Agreement, dated as of June 27, 2005, by and between The Great Atlantic & Pacific Tea Company, Inc., Ocean Logistics LLC and C&S Wholesale

Grocers, Inc. (incorporated herein by reference to Exhibit 10.38 to Form 10-Q/A filed on June 25, 2007) |

|||||

17

10.23 |

Supply Agreement,

dated as of June 27, 2005, by and between The Great Atlantic & Pacific Tea Company, Inc. and C&S Wholesale Grocers, Inc. (incorporated herein

by reference to Exhibit 10.39 to Form 10-Q/A filed on June 25, 2007) |

|||||

10.24 |

Information

Technology Transition Services Agreement by and between The Great Atlantic and Pacific Tea Company, Limited (“A&P Canada”) and Metro,

Inc. entered into on August 15, 2005 (incorporated herein by reference to Exhibit 10.40 to Form 10-Q filed on October 18, 2005) |

|||||

10.25 |

Investor

Agreement by and between A&P Luxembourg S.a.r.l., a wholly owned subsidiary of The Great Atlantic & Pacific Tea Company, Inc. and Metro, Inc.

entered into on August 15, 2005 (incorporated herein by reference to Exhibit 10.41 to Form 10-Q filed on October 18, 2005) |

|||||

10.26 |

Employment

Agreement, made and entered into as of the 1st day of May, 2007, by and between The Great

Atlantic & Pacific Tea Company, Inc. and Andreas Guldin (incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on May 7,

2007) |

|||||

10.27 |

Amended and

Restated Credit Agreement dated as of December 27, 2007, among The Great Atlantic & Pacific Tea Company, Inc., and the other Borrowers party

thereto, as Borrowers and the Lenders party thereto, and Bank of America, N.A., as Administrative Agent and Collateral Agent and Banc of America

Securities LLC as Lead Arranger (incorporated herein by reference to Exhibit 10.45 to Form 10-Q filed on January 8, 2008) |

|||||

10.28 |

First Amendment

to Amended and Restated Credit Agreement dated as of April 4, 2008 among The Great Atlantic & Pacific Tea Company, Inc., and the other Borrowers

party thereto, as Borrowers and the Lenders party thereto, and Bank of America, N.A., as Administrative Agent and Collateral Agent (incorporated herein

by reference to Exhibit 10.36 to Form 10-K/A filed on July 23, 2009) |

|||||

10.29 |

Confirmation of

Issuer Warrant Transaction for 2011 Notes, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Bank of

America, N.A. (incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on December 18, 2007) |

|||||

10.30 |

Amendment to

Confirmation of Issuer Warrant Transaction (2011), dated as of December 17, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Bank of America, N.A. (incorporated herein by reference to Exhibit 10.3 to Form 8-K filed on December 21, 2007) |

|||||

10.31 |

Confirmation of

Issuer Warrant Transaction for 2012 Notes, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Bank of

America, N.A. (incorporated herein by reference to Exhibit 10.2 to Form 8-K filed on December 18, 2007) |

|||||

18

10.32 |

Amendment to

Confirmation of Issuer Warrant Transaction (2012), dated as of December 17, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Bank of America, N.A. (incorporated herein by reference to Exhibit 10.4 to Form 8-K filed on December 21, 2007) |

|||||

10.33 |

Confirmation of

Issuer Warrant Transaction for 2011 Notes dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Lehman

Brothers OTC Derivatives Inc. (incorporated herein by reference to Exhibit 10.3 to Form 8-K filed on December 18, 2007) |

|||||

10.34 |

Amendment to

Confirmation of Issuer Warrant Transaction (2011) dated as of December 17, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Lehman Brothers OTC Derivatives Inc. (incorporated herein by reference to Exhibit 10.5 to Form 8-K filed on December 21, 2007) |

|||||

10.35 |

Confirmation of

Issuer Warrant Transaction for 2012 Notes dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Lehman

Brothers OTC Derivatives Inc. (incorporated herein by reference to Exhibit 10.4 to Form 8-K filed on December 18, 2007) |

|||||

10.36 |

Amendment to

Confirmation of Issuer Warrant Transaction (2012) dated as of December 17, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Lehman Brothers OTC Derivatives Inc. (incorporated herein by reference to Exhibit 10.6 to Form 8-K filed on December 21, 2007) |

|||||

10.37 |

Confirmation of

Convertible Bond Hedge Transaction for 2011 Notes, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Bank

of America, N.A. (incorporated herein by reference to Exhibit 10.5 to Form 8-K filed on December 18, 2007) |

|||||

10.38 |

Confirmation of

Convertible Bond Hedge Transaction for 2012 Notes, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Bank

of America, N.A. (incorporated herein by reference to Exhibit 10.6 to Form 8-K filed on December 18, 2007) |

|||||

10.39 |

Confirmation of

Convertible Bond Hedge Transaction for 2011 Notes, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Lehman Brothers OTC Derivatives Inc. (incorporated herein by reference to Exhibit 10.7 to Form 8-K filed on December 18, 2007) |

|||||

10.40 |

Confirmation of

Convertible Bond Hedge Transaction for 2012 Notes, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and

Lehman Brothers OTC Derivatives Inc. (incorporated herein by reference to Exhibit 10.8 to Form 8-K filed on December 18, 2007) |

|||||

19

10.41 |

Share Lending

Agreement, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc. and Bank of America, N.A. (incorporated herein by

reference to Exhibit 10.9 to Form 8-K filed on December 18, 2007) |

|||||

10.42 |

Amendment No. 1

to Share Lending Agreement dated as of December 18, 2007, between The Great Atlantic & Pacific Tea Company, Inc. and Bank of America, N.A.

(incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on December 21, 2007) |

|||||

10.43 |

Share Lending

Agreement, dated December 12, 2007, by and between The Great Atlantic & Pacific Tea Company, Inc., Lehman Brothers International (Europe) Limited

and Lehman Brothers Inc. (incorporated herein by reference to Exhibit 10.10 to Form 8-K filed on December 18, 2007) |

|||||

10.44 |

Amendment No. 1

to Share Lending Agreement dated as of December 18, 2007, among The Great Atlantic & Pacific Tea Company, Inc. and Lehman Brothers International

(Europe) Limited, as borrower, and Lehman Brothers Inc., as borrowing agent (incorporated herein by reference to Exhibit 10.2 to Form 8-K filed on

December 21, 2007) |

|||||

10.45 |

Warehousing,

Distribution and Related Services Agreement dated March 7, 2008 by and between The Great Atlantic & Pacific Tea Company, Inc. and C&S Wholesale

Grocers, Inc. (incorporated herein by reference to Exhibit 10.50 to Form 10-Q filed on July 21, 2008)*** |

|||||

10.46 |

Intercreditor

Agreement, dated as of August 4, 2009, among Bank of America, N.A., as First Lien Agent, Wilmington Trust Company, as Second Lien Agent, The Great

Atlantic & Pacific Tea Company, Inc. and the subsidiaries of The Great Atlantic & Pacific Tea Company, Inc. party thereto (incorporated herein

by reference to Exhibit 10.4 to Form 8-K filed on August 5, 2009) |

|||||

10.47 |

Form of Director

Indemnification Agreement (incorporated herein by reference to Exhibit 10.5 to Form 8-K filed on August 5, 2009) |

|||||

10.48 |

Security

Agreement, dated as of August 4, 2009, among The Great Atlantic & Pacific Tea Company, Inc., the subsidiaries from time to time party thereto, and

Wilmington Trust Company, as collateral agent (incorporated herein by reference to Exhibit 10.6 to Form 8-K filed on August 5, 2009) |

|||||

10.49 |

Investment

Agreement, dated as of July 23, 2009, by and among The Great Atlantic & Pacific Tea Company, Inc., Erivan Karl Haub, Christian Wilhelm Erich Haub,

Karl-Erivan Warder Haub, Georg Rudolf Otto Haub and Emil Capital Partners, LLC, as investor’s representative, and the other signatories thereto

(incorporated herein by reference to Exhibit 10.1 to Form 8-K filed on July 24, 2009) |

|||||

20

10.50 |

Investment

Agreement, dated as of July 23, 2009, by and among The Great Atlantic & Pacific Tea Company, Inc., Yucaipa American Alliance Fund II, LP and

Yucaipa American Alliance (Parallel) Fund II, LP and, solely with respect to Section 3.02 and 3.05, Yucaipa Corporate Initiatives Fund I, LP, Yucaipa

American Alliance Fund I, LP and Yucaipa American Alliance (Parallel) Fund I, LP, and, solely with respect to Section 5.05, Yucaipa American Alliance

Fund II, LLC as investors’ representative (incorporated herein by reference to Exhibit 10.2 to Form 8-K filed on July 24, 2009) |

|||||

10.51 |

Second Amendment

to the Amended and Restated Credit Agreement, dated July 23, 2009, by and among The Great Atlantic & Pacific Tea Company, Inc. and the other

Borrowers party thereto, as Borrowers, and the Lenders party thereto, and Bank of America, N.A., as Administrative Agent and Collateral Agent

(incorporated herein by reference to Exhibit 10.2 to Form 8-K filed on July 24, 2009) |

|||||

11** |

Statement re

computation of per share earnings |

|||||

13* |

Fiscal 2009

Annual Report to Stockholders |

|||||

18 |

Preferability

Letter Issued by PricewaterhouseCoopers LLP (incorporated herein by reference to Exhibit 18 to Form 10-Q filed on July 29, 2004) |

|||||

21* |

Subsidiaries of

Registrant |

|||||

23.1* |

Consent of

Independent Registered Public Accounting Firm from PricewaterhouseCoopers LLP |

|||||

31.1* |

Certification of

the Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|||||

31.2* |

Certification of

the Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|||||

32* |

Certification

Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|||||

* |

Filed with this

10-K |

|||||

** |

Information

required to be presented in Exhibit 11 is included in Exhibit 13 under Note 18 — Earnings per Share, prepared in accordance with the accounting

guidance for earnings per share. |

|||||

*** |

Portions of this

exhibit have been omitted pursuant to a request for confidential treatment. |

|||||

21

Report of Independent Registered Public Accounting Firm

on

Financial Statement Schedule

Financial Statement Schedule

To the Stockholders and Board of Directors of

The Great Atlantic & Pacific Tea Company, Inc.:

The Great Atlantic & Pacific Tea Company, Inc.:

Our audits of the consolidated financial statements and of the

effectiveness of internal control over financial reporting referred to in our report dated May 6, 2010 appearing in the Fiscal 2009 Annual Report to

Shareholders of The Great Atlantic & Pacific Tea Company, Inc. (which report and consolidated financial statements are incorporated by reference in

this Annual Report on Form 10-K) also included an audit of the financial statement schedule listed in Item 15(a)(2) of this Form 10-K. In our opinion,

this financial statement schedule presents fairly, in all material respects, the information set forth therein when read in conjunction with the

related consolidated financial statements.

As discussed in Notes 1 and 10 to the consolidated financial

statements, the Company changed the manner in which it accounts for convertible debt with cash settlement features during fiscal 2009.

Florham Park, New Jersey

May 6, 2010

May 6, 2010

22

Schedule II

The Great Atlantic & Pacific Tea Company,

Inc.

Valuation and Qualifying Accounts and Reserves

Years Ended February 23, 2008, February 28, 2009 and February 27, 2010

(in thousands)

Years Ended February 23, 2008, February 28, 2009 and February 27, 2010

(in thousands)

| Allowance for Bad Debts for Year Ended |

Beginning Balance |

Additions Charged to Costs & Expenses |

Additions Charged to Other Accounts |

Deductions (1) |

Adjustments |

Ending Balance |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Feb. 23,

2008 |

$ | 4,514 | 2,059 | - | (993 | ) | 284 | (3) | $ | 5,864 | ||||||||||||||||

Feb. 28,

2009 |

5,864 | 1,263 | 2,910 | (4) | (1,574 | ) | - | 8,463 | ||||||||||||||||||

Feb. 27,

2010 |

8,463 | 1,433 | - | (1,168 | ) | - | 8,728 | |||||||||||||||||||

| Stock Loss Reserve for Year Ended |

Beginning Balance |

Additions Charged to Costs & Expenses |

Additions Charged to Other Accounts |

Deductions |

Adjustments |

Ending Balance |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Feb. 23,

2008 |

$ | 12,762 | 1,455 | - | - | 1,500 | (3) | $ | 15,717 | |||||||||||||||||

Feb. 28,

2009 |

15,717 | 8,525 | - | - | - | 24,242 | ||||||||||||||||||||

Feb. 27,

2010 |

24,242 | (5,293 | ) | - | - | - | 18,949 | |||||||||||||||||||

| LIFO Reserve for Year Ended |

Beginning Balance |

Additions Charged to Costs & Expenses |

Additions Charged to Other Accounts |

Deductions |

Adjustments |

Ending Balance |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Feb. 23,

2008 |

$ | - | 2,310 | - | - | - | $ | 2,310 | ||||||||||||||||||

Feb. 28,

2009 |

2,310 | 7,817 | - | - | - | 10,127 | ||||||||||||||||||||

Feb. 27,

2010 |

10,127 | (842 | ) | - | - | - | 9,285 | |||||||||||||||||||

| Deferred Tax Valuation Allowance for Year Ended |

Beginning Balance |

Additions Charged to Costs & Expenses |

Additions Charged to Other Accounts |

Deductions (2) |

Adjustments |

Ending Balance |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Feb. 23, 2008

(5) |

$ | 74,355 | 67,169 | 152,514 | (6) | (250,392 | ) | - | $ | 43,646 | ||||||||||||||||

Feb. 28, 2009

(5) |

43,646 | 71,240 | 91,622 | (7) | - | - | 206,508 | |||||||||||||||||||

Feb. 27, 2010

(5) |

206,508 | 327,796 | 33,349 | (8) | - | - | 567,653 | |||||||||||||||||||

23

(1) |

Deductions to Allowance for Bad Debts represent write-offs of accounts receivable balances. |

(2) |

For the year ended February 23, 2008, the deduction represents the reduction in the Deferred Tax Valuation Allowance and reserves acquired in connection with our purchase of Pathmark Stores, Inc. |

(3) |

For the year ended February 23, 2008, the adjustments represent reserves acquired in connection with our purchase of Pathmark Stores, Inc. |

(4) |

Primarily represents additional reserves recorded as part of purchase accounting for Pathmark Stores, Inc. |

(5) |

Prior period amounts were adjusted due to our retrospective adoption of the new accounting guidance for convertible debt with cash settlement features during fiscal 2009. |

(6) |

Primarily represents the impact of the adoption of FIN 48, “Accounting for Uncertain Tax Positions.” |

(7) |

Primarily relates to purchase accounting adjustments relating to our acquisition of Pathmark, and pension and postretirement charges to “Other comprehensive income.” |

(8) |

Primarily relates to pension and postretirement charges to “Other comprehensive income.” |

24

SIGNATURES

Pursuant to the requirements of Section

13 or 15 (d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

The Great

Atlantic & Pacific Tea Company, Inc. (registrant) |

|||||||||||

Date: May 6,

2010 |

By: /s/

Brenda M. Galgano Brenda M. Galgano, Senior Vice President, Chief Financial Officer |

||||||||||

Pursuant to the requirements of the

Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant in the capacities and as of the

date indicated.

/s/ Ron

Marshall Ron Marshall |

President

and Chief Executive Officer |

Date: May 6,

2010 |

||||||||

/s/ Brenda M.

Galgano Brenda M. Galgano |

Senior

Vice President, Chief Financial Officer and Treasurer |

Date: May 6,

2010 |

||||||||

/s/ Christian

W.E. Haub Christian W.E. Haub |

Executive

Chairman and Director |

Date: May 6,

2010 |

||||||||

/s/ Andreas

Guldin Andreas Guldin |

Vice

Chairman, Chief Strategy Officer and Director |

Date: May 6,

2010 |

||||||||

/s/ Melissa E.

Sungela Melissa E. Sungela |

Vice

President, Corporate Controller |

Date: May 6,

2010 |

||||||||

/s/ John D.

Barline John D. Barline |

Director |

Date: May 6,

2010 |

||||||||

/s/

Jens-Jürgen Böckel Jens-Jürgen Böckel |

Director |

Date: May 6,

2010 |

||||||||

/s/ Frederic

F. Brace Frederic F. Brace |

Director |

Date: May 6,

2010 |

||||||||

/s/ Bobbie A.

Gaunt Bobbie A. Gaunt |

Director |

Date: May 6,

2010 |

||||||||

/s/ Dan P.

Kourkoumelis Dan P. Kourkoumelis |

Director |

Date: May 6,

2010 |

||||||||

/s/ Edward

Lewis Edward Lewis |

Director |

Date: May 6,

2010 |

||||||||

/s/ Gregory

Mays Gregory Mays |

Director |

Date: May 6,

2010 |

||||||||

/s/ Maureen B.

Tart-Bezer Maureen B. Tart-Bezer |

Director |

Date: May 6,

2010 |

||||||||

/s/ Terrence

J. Wallock Terrence J. Wallock |

Director |

Date: May 6,

2010 |

||||||||

25