Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STATE STREET CORP | d8k.htm |

1

Well Positioned for the Future

Joseph L. Hooley

Chief Executive Officer

Edward J. Resch

Chief Financial Officer

INVESTOR AND ANALYST FORUM

5 May 2010

Exhibit 99.1 |

2

Reminder

This

presentation

contains

forward-looking

statements

as

defined

by

United

States

securities

laws,

including

statements

about

our

goals

and

expectations

regarding

our

business,

financial

condition,

results

of

operations

and

strategies,

the

financial

and

market

outlook,

governmental

and

regulatory

initiatives

and

developments,

and

the

business

environment.

Forward-looking

statements

are

often

identified

by

such

forward-looking

terminology

as

"plan,"

"expect,"

"look,"

"believe,"

"anticipate,"

"estimate,"

"seek,"

"may,"

"will,"

"trend,"

"target,”

“scenario,”

and

"goal,"

or

similar

statements

or

variations

of

such

terms.

These

statements

are

not

guarantees

of

future

performance,

are

inherently

uncertain,

are

based

on

current

assumptions

that

are

difficult

to

predict

and

involve

a

number

of

risks

and

uncertainties.

Therefore,

actual

outcomes

and

results

may

differ

materially

from

what

is

expressed

in

those

statements,

and

those

statements

should

not

be

relied

upon

as

representing

our

expectations

or

beliefs

as

of

any

date

subsequent

to

May

5,

2010.

Important

factors

that

may

affect

future

results

and

outcomes

include,

but

are

not

limited

to:

financial

market

disruptions

and

the

economic

recession,

whether

in

the

U.S.

or

internationally,

and

monetary

and

other

governmental

actions,

including

regulation,

taxes

and

fees,

designed

to

address

or

otherwise

be

responsive

to

such

disruptions

and

recession,

including

actions

taken

in

the

U.S.

and

internationally

to

address

the

financial

and

economic

disruptions

that

began

in

2007;

increases

in

the

volatility

of,

or

declines

in

the

levels

of,

our

net

interest

revenue

or

other

revenue

influenced

by

market

factors,

changes

in

the

composition

of

the

assets

on

our

consolidated

balance

sheet

and

the

possibility

that

we

may

be

required

to

change

the

manner

in

which

we

fund

those

assets;

the

financial

strength

and

continuing

viability

of

the

counterparties

with

which

we

or

our

customers

do

business

and

to

which

we

have

investment,

credit

or

financial

exposure;

the

liquidity

of

the

U.S.

and

international

securities

markets,

particularly

the

markets

for

fixed-income

securities,

and

the

liquidity

requirements

of

our

customers;

the

credit

quality,

credit

agency

ratings,

and

fair

values

of

the

securities

in

our

investment

securities

portfolio,

a

deterioration

or

downgrade

of

which

could

lead

to

other-than-temporary

impairment

of

the

respective

securities

and

the

recognition

of

an

impairment

loss

in

our

consolidated

statement

of

income;

the

maintenance

of

credit

agency

ratings

for

our

debt

and

depository

obligations

as

well

as

the

level

of

credibility

of

credit

agency

ratings;

the

ability

to

complete

our

announced

and

pending

acquisitions,

as

well

as

future

acquisitions,

divestitures

and

joint

ventures,

including

the

ability

to

obtain

regulatory

approvals,

the

ability

to

arrange

financing

as

required,

and

the

ability

to

satisfy

other

closing

conditions;

the

risks

that

acquired

businesses

will

not

be

integrated

successfully,

or

that

the

integration

will

take

longer

than

anticipated,

that

expected

synergies

will

not

be

achieved

or

unexpected

disynergies

will

be

experienced,

that

customer

and

deposit

retention

goals

will

not

be

met,

that

other

regulatory

or

operational

challenges

will

be

experienced

and

that

disruptions

from

the

transaction

will

harm

relationships

with

customers,

employees

or

regulators;

the

possibility

of

our

customers

incurring

substantial

losses

in

investment

pools

where

we

act

as

agent,

and

the

possibility

of

further

general

reductions

in

the

valuation

of

assets;

our

ability

to

attract

deposits

and

other

low-cost,

short-term

funding;

potential

changes

to

the

competitive

environment,

including

changes

due

to

the

effects

of

consolidation

and

perceptions

of

State

Street

as

a

suitable

service

provider

or

counterparty;

the

level

and

volatility

of

interest

rates

and

the

performance

and

volatility

of

securities,

credit,

currency

and

other

markets

in

the

U.S.

and

internationally;

our

ability

to

measure

the

fair

value

of

the

investment

securities

on

our

consolidated

balance

sheet;

the

results

of

litigation,

government

investigations

and

similar

disputes

or

proceedings;

the

enactment

of

new

legislation

and

changes

in

governmental

regulation

and

enforcement

that

affect

us

or

our

customers,

and

which

may

increase

our

costs

and

expose

us

to

risk

related

to

compliance;

adverse

publicity

or

other

reputational

harm;

the

performance

and

demand

for

the

products

and

services

we

offer,

including

the

level

and

timing

of

withdrawals

from

our

collective

investment

products;

our

ability

to

grow

revenue,

attract

and/or

retain

and

compensate

highly

skilled

people,

control

expenses

and

attract

the

capital

necessary

to

achieve

our

business

goals

and

comply

with

regulatory

requirements;

our

ability

to

control

operating

risks,

information

technology

systems

risks

and

outsourcing

risks,

and

our

ability

to

protect

our

intellectual

property

rights,

the

possibility

of

errors

in

the

quantitative

models

we

use

to

manage

our

business

and

the

possibility

that

our

controls

will

fail

or

be

circumvented;

the

potential

for

new

products

and

services

to

impose

additional

costs

on

us

and

expose

us

to

increased

operational

risk;

changes

in

accounting

standards

and

practices;

and

changes

in

tax

legislation

and

in

the

interpretation

of

existing

tax

laws

by

U.S.

and

non-U.S.

tax

authorities

that

impact

the

amount

of

taxes

due.

Other

important

factors

that

could

cause

actual

results

to

differ

materially

from

those

indicated

by

any

forward-looking

statements

are

set

forth

in

our

2009

Annual

Report

on

Form

10-K,

and

our

subsequent

SEC

filings.

We

encourage

investors

to

read

these

filings,

particularly

the

sections

on

Risk

Factors,

for

additional

information

with

respect

to

any

forward-looking

statements

and

prior

to

making

any

investment

decision.

The

forward-looking

statements

contained

in

this

presentation

speak

only

as

of

the

date

hereof,

May

5,

2010,

and

we

do

not

undertake

efforts

to

revise

those

forward-looking

statements

to

reflect

events

after

that

date. |

3

Well Positioned for the Future

Agenda

Key Trends

Competitive Positioning

Financial Review

Strategic Direction |

4

Well Positioned for the Future

Agenda

Key Trends

Competitive Positioning

Financial Review

Strategic Direction |

5

Worldwide Trends Support Our Strategy

Well Positioned for the Future

Key Trends

STRENGTH IN

CORE BUSINESSES

DRIVEN BY

•

Globalization

•

Retirement / Savings

•

Outsourcing

•

Consolidation

•

Increased Regulatory Oversight / Reform |

6

Well Positioned for the Future

Key Trends —

Globalization

1

Total assets include seven key European markets: UK, Netherlands, Germany,

Ireland/Luxembourg offshore assets, Italy, Switzerland and France. 2

ICI, 9/09

3

For Germany , France, UK, Netherlands, Switzerland, Towers Watson, 12/09; for

Italy, OECD data as of 12/08, applied 8.8% growth rate (Allianz International

Pensions Studies Western

4

CEA

European

Insurance,

applied

8%

growth

rate

(STT

estimate)

to

2008

figures

Insurance assets: Applied 8% growth rate to 2008 figures, to be updated

5

Source: BCG, 4/10

UK

Netherlands

Germany

Offshore

(Ireland/Lux.)

Italy

Switzerland

France

Pensions:

$4.0T

Insurance:

$8.3T

Collectives:

$6.5T

European

Collective,

Pension,

Insurance

markets:

$18.8

trillion

European Market Forecast to Grow 5.9% over next 3 years

5

11%

1%

5%

47%

4%

3%

29%

45%

25%

10%

2%

14%

4%

31%

6%

23%

8%

5%

27%

1

2

3

4 |

7

Well Positioned for the Future

Key Trends —

Globalization

$14.6T

2004

$18.8T

2009

$709.5B

2004

European Collective, Pension and

Insurance

Market

Growth

2004–2009

CAGR: 5.2%

State Street

European

AUC

Growth

2004–2009

CAGR: 21.4%

$1,867.9B

2009

1

2

1

Total assets include seven key European markets: UK, Netherlands, Germany, Ireland/Lux offshore

assets, Italy, Switzerland and France. Sources: ICI( 9/09), CEA 12/08), Watson Wyatt (12/09),

and State Street estimates. 2

AUC represents all European assets under custody. |

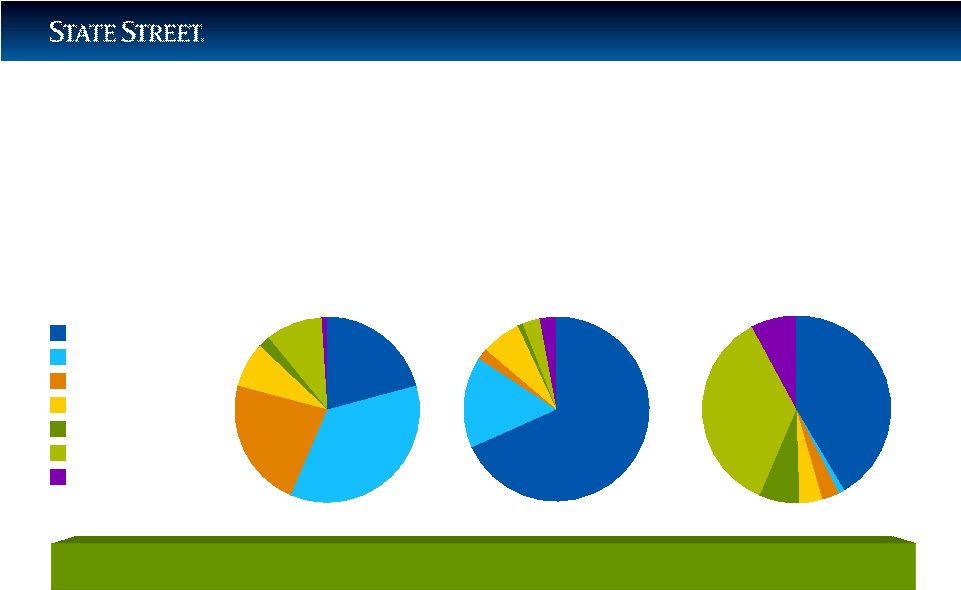

8

21%

35%

23%

8%

2%

10%

1%

Well Positioned for the Future

Key Trends —

Globalization

Asia-Pacific Collective, Pension and

Government-related

Markets:

$15.1

trillion

Pensions: $4.5T

Government

Related:

$7.4T

Collectives:

$3.2T

Japan

Australia

Hong Kong

South Korea

Taiwan

China

Singapore

68%

16%

2%

7%

1%

3%

3%

41%

1%

3%

4%

7%

36%

8%

Asia-Pacific Market Forecast to Grow 9.4% over next 3 years

4

2

3

1

1

Total assets include seven key markets: Japan, Australia, Hong Kong, South Korea, Taiwan, China

and Singapore. 2

Collectives as of September 2009

3

Government related: Japan includes Japan Post; Taiwan includes Chunghwa Post, formerly Taiwan Post

4

Source: BCG, 4/10

Sources: ICI (9/09), IMF (12/09), Cerulli Associates (12/08), Watson Wyatt (12/09), Monetary Authority

of Singapore MAS Survey, Singapore Central Provident Fund Board (12/08), Temasek Holdings,

HKSFC's Fund Management Activities Survey (12/08), Rainmaker (12/09), Korea National Pension Service, Korea Teacher Pension Fund; The

Bank of Korea, Korea Government Employee Pension Service (12/08); China National Council for Social

Security Fund (12/09), Central Bank of Republic of China (Taiwan) (9/09), Japan Post Bank

(12/09); State Street estimates |

9

Well Positioned for the Future

Key Trends —

Globalization

$8.8T

2004

$15.1T

2009

$294.4B

2004

Asia-Pacific Collective, Pension

and Government

Market

Growth

2004–2009

CAGR: 11.4%

State Street

Asia/Pacific

AUC

Growth 2004–2009

CAGR: 17.1%

$648.1B

2009

1

2

1

Total assets include seven key markets: Japan, Australia, Hong Kong, South Korea, Taiwan, China and

Singapore. Sources: ICI (9/09), IMF (12/09), Cerulli Associates (12/08), Watson Wyatt (12/09), Monetary Authority

of Singapore MAS Survey, Singapore Central Provident Fund Board (12/08), Temasek Holdings,

HKSFC's Fund Management Activities Survey (12/08), Rainmaker (12/09), Korea National Pension Service, Korea Teacher Pension Fund; The

Bank of Korea, Korea Government Employee Pension Service (12/08); China National Council for Social

Security Fund (12/09), Central Bank of Republic of China (Taiwan) (9/09), Japan Post Bank

(12/09); State Street estimates 2

AUC represents all Asia/Pacific assets under custody. |

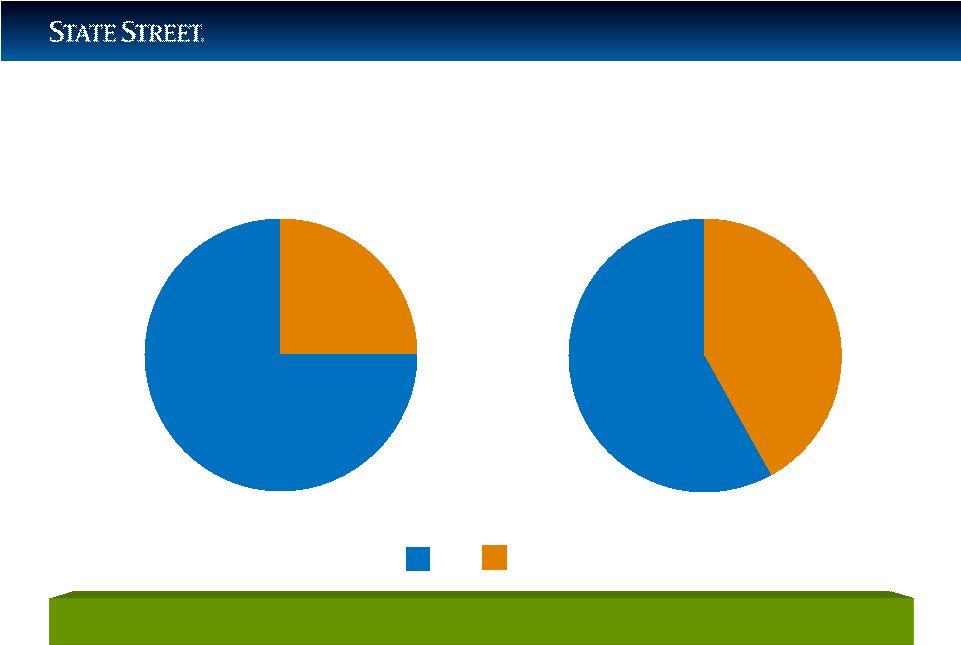

10

Well Positioned for the Future

Key Trends —

Globalization at State Street

Expect to Double Non-US Revenue over 5 Years

2

23%

77%

41%

59%

Revenue

1999

Pro Forma

2009

US

Non-US

1

1

Excludes impact of discount accretion ($621 million); reported 2009 non-US revenue for State

Street was $2.878 billion (36%); pro forma 2009 is adjusted for estimated impact of

ISPSS and Mourant

2

Assumes F/X rates stay constant. |

11

Well Positioned for the Future

Key Trends —

Globalization at State Street

1

39% of State Street’s employees worked outside of the US as of December

31, 2009; pro forma 2009 is adjusted for 1,425 employees from ISPSS and Mourant.

State Street has Strong Presence in Non-US Locations

Employees

12%

88%

44%

56%

1999

Pro

Forma

2009

US

Non-US

1 |

12

Well Positioned for the Future

Key Trends —

Retirement Savings

•

DC Plans are a Growing Segment for US Retirement Savings

US Defined Contribution Assets include 401(K), 403(b) and 457 plans; Source ICI, as

of 9/30/09. 0

1,000

2,000

3,000

4,000

5,000

'99

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

CAGR

’02–’07

’08 vs. ‘09

12%

15%

US Defined Contribution Assets

$M USD |

13

Well Positioned for the Future

Key Trends —

Outsourcing

1

Pension & Investment,/Watson Wyatt World 500, 12/28/09.

2

As of 4/01/10

3

Preqin, 6/09

4

Hedge Fund Research, 3/31/10

5

McKinsey, 7/09

INVESTMENT MANAGER

OPERATIONS

OUTSOURCING

•

State Street is leading provider with more than $7 trillion of AUA in

this market that is sized at approximately $53 trillion

PRIVATE EQUITY

ADMINISTRATION

•

With the Mourant

acquisition, State Street is the largest servicer of

private equity in the world with $255 billion of AUA

in a market

sized at $2.3 trillion

HEDGE FUND

SERVICING

•

State Street services more than $300 billion of AUA in hedge fund

assets —

the second largest servicer in the world in a $1.7 trillion

market

4

growing

at

an

estimated

19%

CAGR

over

the

next

4

years

5

FUND ACCOUNTING

AND ADMINISTRATION

•

Market-leading position

•

Integrated, global, multi-currency system

1

3

2 |

14

Well Positioned for the Future

Key Trends —

Outsourcing

INVESTMENT

MANAGEMENT

SOLUTIONS

•

Customized strategic and tactical asset allocation solutions

through flexible and efficient portfolio implementation across and

within global asset classes

TRANSITION

MANAGEMENT

•

Provide transparent, efficient transitions and allocation

management for pension plans; managed transitions with total

assets of $173 billion in 1,006 transitions in 2009

ELECTRONIC

TRADING

•

Continued growth expected

•

Acquired Currenex, a fast-paced, high-speed trading solution to

compliment FX Connect |

15

Well Positioned for the Future

Key Trends —

Consolidation

11

of

the

Top

20

Custodians

Each

Have

Less

Than

$3

Trillion

in

Assets

1

GlobalCustody.net, adjusted for acquisition of ISPSS and BHF.

FACTORS

•

Global footprint and scale essential

•

Ongoing need for investment in technology

•

Competing demands for capital

•

Distribution: Access to global clients

Industry Will Consolidate With Major Providers

1 |

16

Well Positioned for the Future

Key Trends —

Consolidation

DEUTSCHE BANK’S GSS

Established State Street’s leadership position in Europe

IFS

Added hedge fund servicing capability

CURRENEX

Expanded electronic high-speed trading capability

PALMERI

Accelerated State Street’s leadership in private equity servicing

INVESTORS FINANCIAL

Expanded share of mutual fund and hedge fund servicing markets

Excellent Track Record in Executing Accretive Acquisitions

|

17

Well Positioned for the Future

Key Trends —

Consolidation

INTESA SANPAOLO’S

SECURITIES

SERVICES

1

•

Enhances European servicing capability

•

Acquiring

custody, fund administration, depository bank

and banca

corrispondente

•

Paying

€1.28B

2

in

cash

•

Goal to retain 90% of revenue of ~€293M

•

~€343

in

custody

assets

3

•

~€11B in cash deposits

4

•

Removing ~€60M in costs over 5 years

•

Incurring ~€80M (pre-tax) in merger and integrations costs

•

Expect to be modestly accretive (excluding M & I costs)

•

Will have capital ratios at closing approximately at the

levels as of 9/30/09

1

Expected to close in Q2 2010 subject to regulatory approvals and other closing conditions.

2

State Street expects to support the acquired ISPSS balance sheet with approximately €560

million of additional capital at the closing. 3

Average for first half of 2009.

4

At 6/30/09. |

18

Well Positioned for the Future

Key Trends —

Consolidation

MOURANT

INTERNATIONAL

FINANCE

ADMINISTRATION

•

State

Street

is

now

1

:

–

No.1 in alternative asset servicing globally

–

No.1 in private equity servicing globally

–

No.1 in real estate asset servicing globally

–

No. 2 in hedge fund servicing globally

•

Cash purchase

•

Annualized revenue of about $100 million

•

Mostly non-US assets

•

Provides cross-sell opportunities

•

Expected to be slightly accretive in 2010 (excluding M & I costs)

1

Incorporating Mourant data with data from HFM Week, April 2009; ICFA Alternative Fund Administration

Survey, April/May 2009 |

19

Well Positioned for the Future

Agenda

Key Trends

Competitive Positioning

Financial Review

Strategic Direction |

20

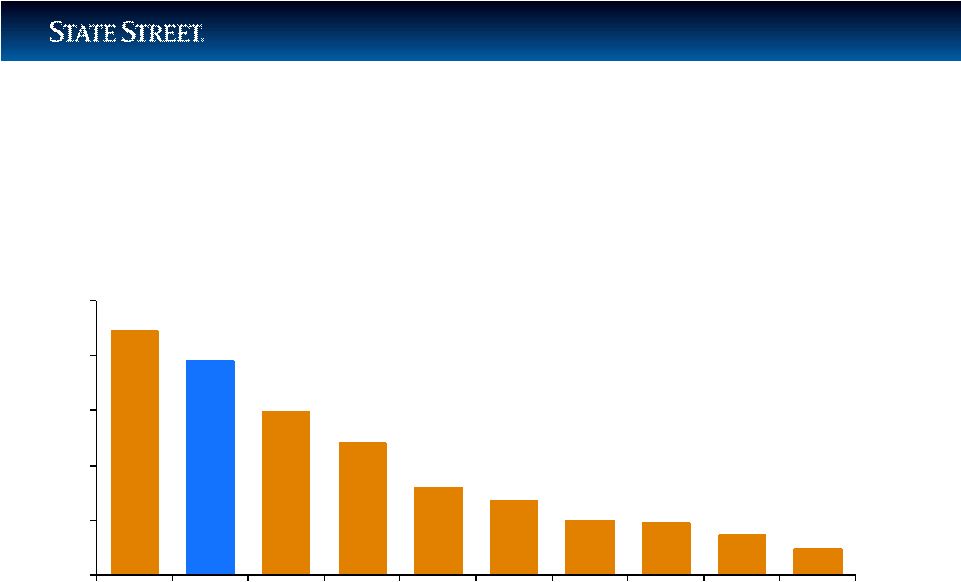

(USD $T)

1

Source: Global Custody.net, 12/31/2009

2

Includes assets of approximately $670 billion in assets from ISPSS and

Mourant 3

AUC Only

Source: Company filings, as of 12/31/09; globalcustody.net

Well Positioned for the Future

Competitive Positioning —

Assets Under Custody/Administration

22.3

19.5

14.9

12.1

8.0

6.8

5.0

4.8

3.7

2.4

$0

$5

$10

$15

$20

$25

BK

STT

JPM

Citi

HSBC

BNP

Soc Gen

CACEIS

NTRS

RBCD

3

3

3

Total

Worldwide

Custody

Assets:

$104

trillion

1

2 |

21

1

Data also includes UIT Accounting.

Source: The NASDAQ Stock Market Inc., Data Products, as of 2/1/10

Well Positioned for the Future

Competitive

Positioning

—

US

Mutual

Funds

Number of Funds Priced Daily

0

2,000

4,000

6,000

8,000

10,000

STT

BK

PFPC

JPM

First Trust

Citi

Fidelity

US Bancorp

Van Kampen

Princor

41%

6%

5%

5%

4%

4%

4%

3%

2%

2%

1 |

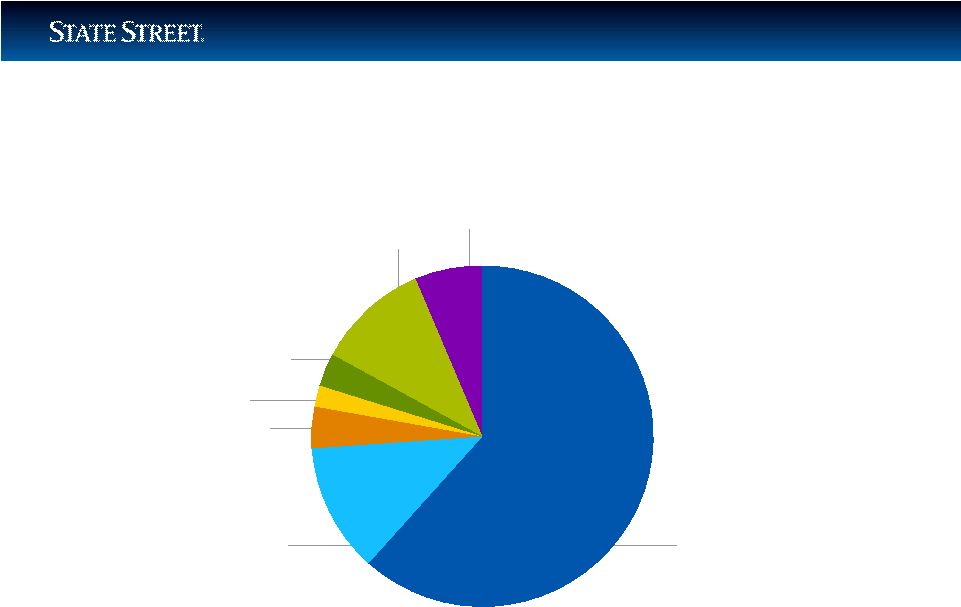

22

Well Positioned for the Future

Competitive Positioning —

Investment Manager Operations Outsourcing

STT

62%

BK

12%

JPM

4%

HSBC

2%

NTRS

3%

RBCD

11%

BBH

6%

Source: Scrip Issue Global Report, (3/10) |

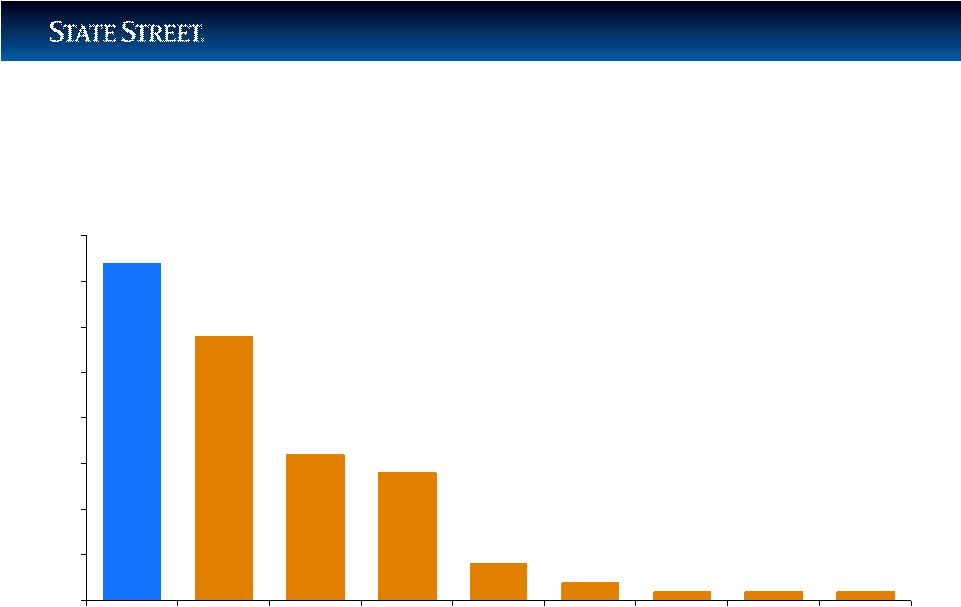

23

3.7

2.9

1.6

1.4

0.4

0.2

0.1

0.1

0.1

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

STT

BNY

NTRS

JPM

RBCD

Citi

SocGen

HSBC

BBH

(USD $T)

Well Positioned for the Future

Competitive

Positioning

—

Pension

Fund

Assets

1

Data is self reported to Scrip Issue Global Report (3/10)

1 |

24

Well Positioned for the Future

Competitive Positioning —

Alternative Assets Under Administration

USD $B

$0

$100

$200

$300

$400

$500

$600

STT

Citco

Citi

HSBC

BK

Fortis

SEI

GS

UBS

JPM

Real Estate

Private Equity Assets

Hedge Fund Assets

596

491

329

283

217

182

168

164

159

151

Sources: HFM Week 13th Biannual Assets Under Administration

Survey, November 2009; STT AUA as of 12/31/09, adjusted for Mourant; ICFA Alternative Fund Administration

Survey April/May 2009; 2009 Global Custodian Private Equity Fund Administrators Survey; Prequin

12/31/08. |

25

Well Positioned for the Future

Competitive

Positioning

—

US

ETF

Assets

Under

Management

373

189

92

46

24

12

9

8

6

6

$0

$50

$100

$150

$200

$250

$300

$350

$400

BLK

SSgA

Vanguard

Invesco

ProShares

Van Eck

BK

US Comm

Funds

Wisdom

Tree

Rydex

USD $B

Source: National Stock Exchange as of 12/31/09 |

26

(USD $B)

345

253

206

152

122.

$0

$50

$100

$150

$200

$250

$300

$350

BLK

SSgA

Northern Trust

Vanguard

BNY Mellon

Source: Pensions & Investments as of December 31, 2008

Includes US Institutional, tax-exempt assets managed internally (assets managed

passively on behalf of non-US entities are not represented) Well Positioned

for the Future Competitive

Positioning

—

Top

Managers

of

US-Domiciled

Indexed

Equities

and Fixed Income |

27

Well Positioned for the Future

Competitive

Positioning

—

Recent

Recognition

No. 1 Manager

of Worldwide

Institutional Assets

Pensions & Investments,

2009 Money Managers Survey

Custodian of the Year

2010 Global Pensions Awards

Top Rated in Pre-Trade,

Post-Trade, Organization

and Support

Plansponsor, 2009 Transition

Management Survey

No. 1 Global Custodian

for Clients with $10B+

in Assets

Global Custodian

2009 Global Custody Survey

No. 1 Global Mutual

Fund Administrator

Global Custodian

2009 Mutual Fund

Administration Survey

Most Recognized

ETF Brand

exchangetradedfunds.com

2009 Global ETF Awards

Global Private Equity Fund

Administrator of the Year

International Custody and

Fund Administration

2009

Global Awards

Global Securities Lender

of the Year

International Custody and

Fund Administration

2009

Global Awards

No. 1 in Flow Research

Euromoney

2009 FX Survey |

28

Well Positioned for Growth

Competitive

Positioning

—

Strength

in

Winning

New

Business

•

$1.1 trillion in assets to be serviced won in 2009

•

In 2009 top 100 clients used 13.8 products

•

$319 billion in assets to be serviced won YTD (4/15/10)

•

Strong pipeline in both asset management and asset servicing

•

More than 200 of 300 of the largest investment managers

in the world are our clients

70% Win Ratio on Competitive Bids in 2009

1

As measured by Assets Under Management

1 |

29

Well Positioned for the Future

Long-Term

Operating-Basis

Financial

Goals

Key Trends and Competitive Position Support Long-term Goals

1

For a description of operating-basis presentation, see Appendix.

Operating-basis EPS Growth of 10% –

15%

Operating-basis ROE of 14% –

17%

Operating-basis Revenue Growth of 8% –

12%

1 |

30

Well Positioned for the Future

Long-Term Financial Goals —

Operating-basis

Revenue

Growth

Model

1

For a description of operating-basis presentation, see Appendix.

2

Assumes 7% average annual growth in global equities.

Market growth

1% –

2%

New clients

2% –

3%

Additional sales to existing clients

4% –

5%

Acquisitions

1% –

2%

8% –

12%

1

2 |

31

Edward J. Resch

Chief Financial Officer

FINANCIAL REVIEW |

32

Well Positioned for the Future

Financial Review

Balance Sheet and Capital Position: A Strong Foundation

Market-driven Revenue: NIR/NIM, Securities Finance,

Foreign Exchange

Operating Performance in 2010: Growth in a

Challenging Environment |

33

Well Positioned for the Future

Financial Review

Balance Sheet and Capital Position: A Strong Foundation

Market-driven Revenue: NIR/NIM, Securities Finance,

Foreign Exchange

Operating Performance in 2010: Growth in a

Challenging Environment |

34

Well Positioned for the Future

Financial Review —

Balance Sheet and Capital Position:

A Strong Foundation

Currently Well Positioned

BALANCE

SHEET AS OF

3/31/10

•

Total Balance Sheet: $154 billion

–

“Normalized”

Balance Sheet: $135 billion

–

Duration gap: approximately 0.31 years

•

Investment Portfolio of $93 billion

–

Duration: approximately 1.27 years

–

Solid credit profile

–

Unrealized after-tax loss: $1.4 billion, down 77% from 12/31/08

•

Liabilities

–

Customer driven

–

Integral to custody relationship

•

Strong Capital Ratios |

35

Well Positioned for the Future

Financial Review —

Balance Sheet and Capital Position:

A Strong Foundation

Maintaining Flexibility Pending Regulatory Guidance

1

For a description of the capital ratios, including certain related reconciliations,

please see Appendix. CAPITAL

MANAGEMENT

•

Successfully executed TCE improvement plan in 2009

•

Capital ratios are well in excess of regulatory requirements for

“well capitalized”

•

State Street’s target ratios

1

:

–

Leverage: 5.25% to 5.75%

–

TCE: 4.25% to 4.75%

•

Sources of capital

–

Net earnings

–

Equity from employee compensation programs

•

Uses of capital

–

Reinstating dividend a priority

–

Organic growth opportunities

–

Repurchase of shares |

36

1

Except as noted in note 4 below, minimum “Well Capitalized”

as defined by Federal regulators.

2

Estimated including acquisition of ISPSS; earnings based on First Call analyst

consensus estimate and estimated impact on earnings of discount accretion.

3

Minimum “Well Capitalized,”

as defined by Federal regulators, applies to State Street Bank and Trust only.

4

Target ratio as defined by State Street.

5

Ratio as defined by Moody’s Investors Service, Inc.

For a description of the capital ratios, including certain related reconciliations,

please see Appendix. Well Positioned for the Future

Financial

Review

—

Balance

Sheet

and

Capital

Position:

A Strong Foundation

Strong Capital Generation and Strategic Deployment

“Well

State Street Corp.

Capitalized”

1

Q2 ’10 E

2

Q1 ’10

Q4 ’09

Tier 1 Leverage

5%

3

7.2%

9.0%

8.5%

Tier 1 Capital

6%

15.6%

18.1%

17.7%

Tier 1 Common Ratio

13.6%

15.9%

15.6%

Total Capital

10%

17.0%

19.5%

19.1%

Tangible Common Equity

4.25% –

4.75%

4

5.5%

7.5%

6.6%

TCE/RWA

5

11.7%

14.1%

12.8% |

37

Well Positioned for the Future

Financial Review

Balance Sheet and Capital Position: A Strong Foundation

Market-driven Revenue: NIR/NIM, Securities Finance,

Foreign Exchange

Operating Performance in 2010: Solid Growth in a

Challenging Environment

•

2010 Scenarios for Net Interest Margin:

–

Flatter Curve

–

Most Likely

–

Higher Rates

•

A View of Structural NIM

•

Securities Finance

•

Foreign Exchange |

38

Well Positioned for the Future

Financial Review —

Market-driven Revenue:

NIR/NIM, Securities Finance, Foreign Exchange

ASSUMPTIONS (INCLUDING ISPSS)

•

Balance sheet about $150 billion

•

Duration gap about 0.50 years

MOST LIKELY ECONOMIC SCENARIO

•

Slow, steady recovery

•

House price stabilization

•

Slow improvement in unemployment

•

S & P 500 at 1125 on average for the year

2010

SCENARIOS

FOR

NET

INTEREST

MARGIN

1

1

Excluding discount accretion and related tax-equivalent adjustments; for a

reconciliation to GAAP, see Appendix. 2

Federal Funds

Flatter

Curve

Most Likely

Higher

Rates

FF²

2010 (avg.)

0.25%

0.25%

0.60%

FF²

year-end

0.25%

0.25%

1.00%

Yield curve

Flattens

Steep

Steep

FF²

to 2-year (avg.)

0.50%

1.25%

1.20%

FF²

to 10-year (avg.)

2.75%

3.80%

3.75%

2010 NIM (in bps) (avg.)

140–150

150–160

150–160 |

39

Well Positioned for the Future

Financial

Review

—

Market-driven

Revenue:

NIR/NIM, Securities Finance, Foreign Exchange

1

Excludes discount accretion

Yield in %

NIM in bps

Historical Trends in Yield Curve, FF Rate and STT’s

NIM

NIM ¹

Fed Funds

FF to 5-Year Treasury Spread |

40

Well Positioned for the Future

Financial Review —

Market-driven Revenue:

NIR/NIM, Securities Finance, Foreign Exchange

MARKET FACTORS

•

Level of rates —

FF to 3%

•

Shape of the curve —

FF to 5-year

is 100-125 bps

•

Asset spreads —

Not to widen from

current level

•

Pace of rate change —

Measured pace

of increase

CONTROLLABLE FACTORS

•

Credit quality —

Continue AAA/AA focus

•

Interest –rate risk —

Approximate duration

of 0.5 years

•

Asset strategy —

Maintain current

investment strategy

•

Capital —

Maintain current capital level

OUTLOOK FOR NORMALIZED NET INTEREST MARGIN

Expect Normalized NIM to Settle in Range of 1.75% –

1.85%

1

Federal Funds

1

1 |

41

Well Positioned for the Future

Financial Review —

Market-driven

Revenue:

NIR, Securities Finance,

Foreign Exchange REVENUE TRENDS IN SECURITIES FINANCE

1

Based on data from Data Explorers Universe as of period end.

REVENUE DRIVEN

BY COMBINATION

OF VOLUMES,

SPREAD, AND

DURATION OF

PORTFOLIO

VOLUMES

•

Assets on loan at about $400B for past 5 quarters with NYSE short

interest below historic levels

–

Believe volumes are at or near a trough for this cycle

•

Expect volumes to improve as economic recovery continues

•

From Q1 ’07 to Q1 ’10 our market share increased from 21% to more

than 28%

1

SPREAD

•

3-month LIBOR to FF spread widened (Q4 ’08) to unprecedented levels

and then tightened (Q1 ’10)

•

Expect modest improvement in spreads in 2H ’10

PORTFOLIO DURATION

•

Reduced to 21 days (Q1 ’10) from 35 days (Q1 ’07) as asset owners

sought higher levels of liquidity

•

Expect duration to increase as liquidity requirements lessen

|

42

Well Positioned for the Future

Financial Review —

Market-driven

Revenue:

NIR, Securities Finance,

Foreign Exchange REVENUE TRENDS IN FOREIGN EXCHANGE

April Volumes Increased Above Q1 Monthly Average

1

STT’s

customer-weighted volatilities.

REVENUE DRIVEN

BY COMBINATION

OF VOLUMES AND

VOLATILITY

VOLUMES

•

Q1 ’10 volumes annualized ($2.9TN) tracking above 2009 level, but not at

level of 2007 and 2008 ($3.4 TN on avg.)

•

Expect increased cross-border flows to drive improvement in F/X

environment and volumes

VOLATILITY

•

Average annual volatility in ’08 and ’09

(1.36%

avg.)¹

significantly

above

level of Q1 ’10 (0.99%)¹

•

Expect Q1 ’10 level to be maintained or improved slightly as Central Banks

respond to levels of economic activity globally

|

43

Well Positioned for the Future

Financial Review

•

Q1 2010 Performance

•

Core Business Strength

•

Expense Initiatives

Balance Sheet and Capital Position: A Strong Foundation

Market-driven Revenue: NIR/NIM, Securities Finance,

Foreign Exchange

Operating Performance in 2010: Growth in a

Challenging Environment |

44

Continuing to Perform in Challenging Times

Well Positioned for the Future

Financial Review —

Operating Performance in 2010:

Growth in a Challenging Environment

Results¹

for 3 Months Ended

$ in millions, except per share data

3/31/10

12/31/09

% Change

Operating-basis revenue

$2,116

$2,082

1.6%

Operating-basis expenses

$1,566

$1,556

0.6%

Operating-basis EPS

$0.75

$0.71

5.6%

Operating-basis ROE

10.0%

9.9%

Positive operating leverage²

100 bps

1

Results presented on an operating basis, including fully taxable-equivalent

revenue; for a description of operating-basis presentation and related reconciliations, please see Appendix.

2

Positive operating leverage is defined as the excess rate of growth of total

revenue over the rate of growth of total expenses, each determined on an operating basis. |

45

Well Positioned for the Future

Financial Review —

Operating Performance in

2010: Growth in a

Challenging Environment OPERATING

MODEL

IMPROVEMENT

•

Aggressively managing expenses in response to current

environment

•

Restructured workforce in 2009

•

Implementing LEAN (begun in 2009)

•

Utilizing operations in Poland, China and India

•

Advancing technology to decrease unit cost factors

•

Optimizing global real estate footprint |

46

Well Positioned for the Future

Agenda

Key Trends

Competitive Positioning

Financial Review

Strategic Direction |

47

Well Positioned for the Future

Strategic Direction

FOCUSED ON

•

Doubling non-US revenues over the next five years

•

Accelerating market share globally through organic growth

and acquisition

•

Driving industry innovation for clients by maintaining technology

investment at 20% –

25% of operating expenses

•

Strengthening industry-leading operating model

•

Achieving positive operating leverage on annual basis

•

Enhancing risk management capabilities across organization

|

48

Well Positioned for the Future

Summary —

Expectations Fueling Confidence in 2010 Outlook

•

Strength in servicing fee revenue

•

Successful integration of acquisitions

•

Modest improvement in management fee revenue

•

NIM in range of 150–160 bps

•

Gradual improvement in F/X and Securities Finance in 2H

•

Expense control commitments

•

No further net securities gains, OTTI, or LLP budgeted

Expect Operating-Basis EPS to be Slightly Above 2009 Level of $3.32

|

49

Well Positioned for the Future

Summary

•

Well positioned against global

growth trends

•

Excellent competitive position

•

Worldwide client relationships

•

Strong capital position

Committed to Delivering Shareholder Value

Committed to Long-Term Financial Goals

•

Expanding core business

•

Proven track record integrating

acquisitions

•

Talented global employee base

•

Disciplined expense management |

50 |

STATE STREET CORPORATION

TANGIBLE COMMON EQUITY AND TIER 1 COMMON RATIOS

As of Period End

The ratio of tangible common equity to adjusted tangible assets, or TCE ratio, is calculated by dividing consolidated total common shareholders’ equity by consolidated total assets, after reducing both amounts by goodwill and other intangible assets net of related deferred taxes. Total assets reflected in the TCE ratio also exclude cash balances on deposit at the Federal Reserve Bank and other central banks in excess of required reserves. The TCE ratio is not required by GAAP or by bank regulations, but is a metric used by management to evaluate the adequacy of State Street’s capital levels. Since there is no authoritative requirement to calculate the TCE ratio, our TCE ratio is not necessarily comparable to similar capital measures disclosed or used by other companies in the financial services industry. Tangible common equity and adjusted tangible assets are non-GAAP financial measures and should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP.

The tier 1 risk-based common, or tier 1 common, ratio is calculated by dividing tier 1 capital less non-common elements, including qualifying trust preferred securities, by total risk-weighted assets, which assets are calculated in accordance with applicable bank regulatory requirements. The tier 1 common ratio is not required by GAAP or on a recurring basis by bank regulations. However, this ratio was used by the Federal Reserve in connection with its stress test administered to the 19 largest U.S. bank holding companies under the Supervisory Capital Assessment Program, the results of which were announced in May 2009. Although we understand that the Federal Reserve does not intend to prospectively require calculation of the tier 1 common ratio, due to the recent timing of the Supervisory Capital Assessment Program, management is currently monitoring this ratio, along with the other capital ratios, in evaluating State Street’s capital levels and believes that, at this time, the ratio may be of interest to investors.

The table set forth below presents the calculations of State Street's ratios of tangible common equity to total tangible assets and tier 1 common capital to total risk-weighted assets.

| (Dollars in millions) |

March 31, 2010 |

December 31, 2009 |

September 30, 2009 |

|||||||||||

| Consolidated Total Assets |

$ | 153,971 | $ | 157,946 | $ | 163,277 | ||||||||

| Less: |

||||||||||||||

| Goodwill |

4,515 | 4,550 | 4,554 | |||||||||||

| Other intangible assets |

1,768 | 1,810 | 1,845 | |||||||||||

| Excess reserves held at central banks |

19,235 | 21,731 | 22,125 | |||||||||||

| Adjusted assets |

128,453 | 129,855 | 134,753 | |||||||||||

| Plus: |

||||||||||||||

| Deferred tax liability |

515 | 521 | 524 | |||||||||||

| Total tangible assets |

A | $ | 128,968 | $ | 130,376 | $ | 135,277 | |||||||

| Consolidated Total Common Shareholders' Equity |

$ | 15,410 | $ | 14,491 | $ | 13,440 | ||||||||

| Less: |

||||||||||||||

| Goodwill |

4,515 | 4,550 | 4,554 | |||||||||||

| Intangible assets |

1,768 | 1,810 | 1,845 | |||||||||||

| Adjusted equity |

9,127 | 8,131 | 7,041 | |||||||||||

| Plus deferred tax liability |

515 | 521 | 524 | |||||||||||

| Total tangible common equity |

B | $ | 9,642 | $ | 8,652 | $ | 7,565 | |||||||

| Tangible common equity ratio |

B/A | 7.5 | % | 6.6 | % | 5.6 | % | |||||||

| Ratio of tangible common equity to total risk-weighted assets |

B/D | 14.1 | % | 12.8 | % | 10.2 | % | |||||||

| Tier 1 capital |

$ | 12,335 | $ | 12,005 | $ | 11,271 | ||||||||

| Less trust preferred securities |

1,450 | 1,450 | 1,450 | |||||||||||

| Tier 1 common capital |

C | $ | 10,885 | $ | 10,555 | $ | 9,821 | |||||||

| Total risk-weighted assets |

D | 68,247 | 67,691 | 73,823 | ||||||||||

| Ratio of tier 1 common capital to total risk-weighted assets |

C/D | 15.9 | % | 15.6 | % | 13.3 | % | |||||||

STATE STREET CORPORATION

RECONCILIATION OF REPORTED RESULTS TO OPERATING-BASIS RESULTS

We measure and compare certain financial information on a non-GAAP, or “operating” basis because we believe that such information supports meaningful comparisons from period to period and the analysis of comparable financial trends with respect to our normal ongoing business operations. We believe that operating-basis financial information, which reports revenue from non-taxable sources on a fully taxable-equivalent basis and excludes the impact of revenue and expenses outside of the normal course of our business, facilitates an investor’s understanding and analysis of State Street’s underlying performance and trends in addition to reported financial information, which is prepared in accordance with GAAP. The following table reconciles financial information prepared in accordance with GAAP to operating-basis financial information.

| (Dollars in millions, except per share amounts) |

Quarter Ended December 31, 2009 | Quarter Ended March 31, 2010 | % Change | ||||||||||||||||||||||||

| Reported Results |

Adjustments | Operating Results |

Reported Results |

Adjustments | Operating Results |

Q4 2009 vs Q1 2010 |

|||||||||||||||||||||

| Total fee revenue |

$ | 1,526 | $ | 1,526 | $ | 1,540 | $ | 1,540 | 0.9 | ||||||||||||||||||

| Net interest revenue |

697 | $ | (198 | )(1) | 499 | 661 | $ | (180 | )(4) | 481 | (3.6 | ) | |||||||||||||||

| Gains related to investment securities, net |

57 | — | 57 | 95 | — | 95 | |||||||||||||||||||||

| Total revenue |

2,280 | (198 | ) | 2,082 | 2,296 | (180 | ) | 2,116 | 1.6 | ||||||||||||||||||

| Provision for loan losses |

35 | — | 35 | 15 | — | 15 | |||||||||||||||||||||

| Total expenses |

1,565 | (9 | )(2) | 1,556 | 1,579 | (13 | )(2) | 1,566 | 0.6 | ||||||||||||||||||

| Income before income tax expense |

680 | (189 | ) | 491 | 702 | (167 | ) | 535 | |||||||||||||||||||

| Income tax expense |

182 | (76 | )(3) | 106 | 207 | (75 | )(6) | 132 | |||||||||||||||||||

| Tax-equivalent adjustment |

— | 32 | (5) | 32 | — | 32 | (5) | 32 | |||||||||||||||||||

| Net income available to common shareholders |

$ | 498 | $ | (145 | ) | $ | 353 | $ | 495 | $ | (124 | ) | $ | 371 | 5.1 | ||||||||||||

| Diluted earnings per common share |

$ | 1.00 | $ | (.29 | ) | $ | .71 | $ | .99 | $ | (.24 | )$ | .75 | 5.6 | |||||||||||||

| Average diluted common shares outstanding (in thousands) |

497,615 | 497,615 | 497,615 | 498,056 | 498,056 | 498,056 | |||||||||||||||||||||

| Return on common equity |

14.0 | % | (4.1 | )% | 9.9 | % | 13.4 | % | (3.4 | )% | 10.0 | % | |||||||||||||||

| (1) | Represents tax-equivalent adjustment of $32 million, which is not included in reported results, net of $230 million of discount accretion for the period, related to a portion of the aggregate difference between the fair value and the par value of the asset-backed commercial paper conduits' investment securities on the date of consolidation of the conduits onto the balance sheet. |

| (2) | Represents merger and integration costs recorded in connection with acquisitions. |

| (3) | Represents $15 million of aggregate income tax benefit related to merger and integration costs and the provision for legal exposure associated with certain fixed-income strategies managed by SSgA, net of $91 million of income tax expense related to discount accretion. |

| (4) | Represents tax-equivalent adjustment of $32 million, which is not included in reported results, net of $212 million of discount accretion for the period, primarily related to a portion of the aggregate difference between the fair value and the par value of the asset-backed commercial paper conduits' investment securities on the date of consolidation of the conduits onto the balance sheet. |

| (5) | Represents tax-equivalent adjustment, which is not included in reported results. |

| (6) | Represents $8 million of income tax benefit related to the merger and integration costs net of $83 million of income tax expense related to discount accretion. |