Attached files

|

PLEDGE AGREEMENT

|

PLEDGE AGREEMENT, dated as of 28th April 2010, (this “Agreement”) made among Flagstone Capital Management Luxembourg SICAF – FIS a company organized and existing under the laws of Luxembourg whose address of its registered or principal office is at 37 Val St. André, L-1128 Luxembourg (the “Pledgor”), and CITIBANK EUROPE PLC (the “Pledgee”).

PRELIMINARY STATEMENTS.

|

1.

|

FLAGSTONE REASSURANCE SUISSE, S.A., a company organized and existing under the laws of Switzerland, whose address of its registered or principal office is at Rue du College 1, CH-1920, Martigny, Switzerland (“Flagstone Re”) and the Pledgee have entered into one or more Master Agreements, Form 3/CEP, pursuant to which the Pledgee may, from time to time in its sole discretion, issue, or procure the issuance of, for the account of the Pledgor, letters of credit or similar or equivalent instruments (each a “Credit” and, collectively, the “Credits”).

|

|

2.

|

The Pledgor, as a subsidiary of Flagstone Re has agreed to secure the obligations of Flagstone Re to the Pledgee that result from time to time under each Master Agreement and in respect of the Credits issued thereunder, whether now existing or from time to time hereafter incurred or arising, as such obligations are more fully defined hereafter as the Secured Obligations.

|

|

3.

|

The Pledgor is the sole holder of the Securities Account (as defined below).

|

|

4.

|

The Pledgor has opened account numbers (together with any successor account opened and maintained for this purpose, the “Securities Account” or the “Pledged Account”) with JPMORGAN Bank Luxembourg S.A. (the “Approved Bank”) at its office at 6 Route de Trèves, L-2633 Senningerberg, Luxembourg.

|

|

5.

|

Pursuant to an Account Control Agreement dated 28th April 2010 and entered into between the Pledgee as secured party, the Pledgor as customer and the Approved Bank as bank (the “Account Control Agreement”), the Pledgee, the Pledgor and the Approved Bank are entering into such agreement to provide for the control of the Securities Account.

|

|

6.

|

The Pledgor and the Pledgee desire that the Pledged Collateral (as defined hereafter) shall at all times and pursuant to Clause 7(h) hereof, be equal to or exceed the Required Account Value (as defined below).

|

|

7.

|

Under a resolution dated 28th April 2010, the board of directors of the Pledgor is satisfied that entering into this Agreement serves the corporate purpose and is in the best corporate interest of the respective Pledgor.

|

|

8.

|

These recitals shall be an integral part of the Agreement and shall be referred to in the construction of it.

|

NOW, THEREFORE, in consideration of the premises and in order to induce the Pledgee to enter into transactions with and to provide services to the Pledgor and its subsidiaries pursuant to separate agreements or arrangements between such persons and the Pledgee, the parties hereto hereby agree as follows:

Section 1. Defined Terms:

|

(a)

|

Capitalized terms used herein shall have the respective meanings ascribed to them below:

|

|

(b)

|

Incorporated Definitions

|

The expressions defined in the Master Agreement are expressly and specifically incorporated into this Agreement and, accordingly, shall, except where context otherwise requires and save where otherwise defined in this Agreement, have the same meanings in this Agreement.

Section 1.1 Additional Definitions

In this Agreement the following terms shall have the following meaning:

|

"2005 Act"

|

means the Luxembourg Law of 5 August 2005 on Financial Collateral Arrangements.

|

||||

|

"Approved Bank"

|

means JPMORGAN Bank Luxembourg SA at its office at 6 Route de Trèves, L-2633 Senningerberg, Luxembourg.

|

||||

|

"Bank Notice"

|

means the notice of the existence of the Pledge and of the security interest created thereunder over the Collateral as referred to in paragraph 2.1(b), substantially in the form set out in Schedule A hereto.

|

||||

“Business Day” means a day (other than a Saturday or Sunday) on which the banks are generally open for business in Luxembourg and Dublin for the transaction of business of the nature required by this Agreement.

“Change of Control” is deemed to have occurred if:

(a) the Persons owning the Voting Interests of Pledgor as of the date hereof shall cease to own 51% or more of the Voting Interests of Pledgor; or

(b) Continuing Directors shall cease for any reason to constitute a majority of the board of directors of Pledgor.

“Collateral” means all claims and rights of any nature, which the Pledgor has or in the future may acquire in connection with the Securities Account, in particular means the Securities, the Future Securities and the Distributions.

“Continuing Directors” means the directors of Pledgor on the date hereof and each other director if, in each case, such other director’s nomination for election to the board of directors of Pledgor is recommended by at least a majority of the then Continuing Directors.

|

"Distributions"

|

means all dividends, interest and other monies payable in respect of the Securities and all other rights, benefits and proceeds in respect of or derived from the Securities (whether by way of redemption, bonus, preference, option rights, substitution, conversion or otherwise).

|

|

|

"Encumbrance"

|

means a mortgage, charge, sub-charge, assignment, pledge, lien (including a privilège) or other security interest of any kind securing any obligation of any person, or any other agreement or arrangement having a similar effect in respect of the Collateral.

|

“Event of Default” means a breach of, or default or event of default under, any Master Agreement or any failure of the Pledgor to perform any of its obligations under this Agreement or the Security Agreement, which failure shall continue unremedied for five (5) Business Days.

|

"Future Securities"

|

means all future securities, assets, rights, title, interest and claims the Pledgor has or will have in relation to the Pledged Account, and all amounts now or in the future credited or accrued on the Pledged Account, including, for the avoidance of doubt, cash and other rights and the property held therein or credited thereto and the proceeds and products thereof and property received, receivable or otherwise distributed in respect of the Pledged Account and the assets held therein and any assets from time to time subject, or expressed to be subject, to the Pledge created or expressed to be created by or pursuant to this Agreement or any part of those assets, including cash, assets or securities derived from the Securities (whether by way of redemption, liquidation, bonus, preference, option, substitution, conversion or otherwise) or from the proceeds thereof.

|

|

“Letter of Credit Value” means (a) in respect of each component of the Qualifying Collateral, (x) the market value of the relevant asset or (y) the cash value, in each case (i) subject to the provisions of Schedules 1 and 2 and multiplied by the percentage specified in the table set out in Schedule 1 under the column headed “Letter of Credit Value” for that type of asset or for cash; and if at any time there is more than one component part to the Qualifying Collateral, the Letter of Credit Value for the Qualifying Collateral shall be the sum of the Letter of Credit values for each component part of the Qualifying Collateral; or (b) such other amount calculated in such other manner as may be notified from time to time by Flagstone Re to the Pledgor.

“Lien” means any mortgage, pledge, attachment, lien, charge, claim, encumbrance, lease or security interest, easement, right of first or last refusal, right of first offer or other option or contingent purchase right.

|

"Luxembourg"

|

means the Grand Duchy of Luxembourg.

|

“Master Agreement” means each agreement on either the Form 3/CEP or otherwise (as from time to time amended, varied supplemented, novated or assigned) between the Pledgor (or by any person for or on behalf of the Pledgor), Flagstone Re and the Pledgee, pursuant to which the Pledgee has established, maintained, amended, renewed or substituted or arranged for the establishment, maintenance, amendment, renewal or substitution of a Credit.

|

"Payment Instruction"

|

means the instruction delivered to the Approved Bank, with a copy to the Pledgor, by or on behalf of the Pledgee of its intention to take enforcement action further to the occurrence of an Event of Default, substantially in the form set out in Schedule C hereto.

|

“Person” means any individual, corporation, partnership, joint venture, foundation, association, joint-stock company, trust, unincorporated organization, government or any political subdivision thereof or any agency or instrumentality of any thereof.

|

"Pledge"

|

means the first priority pledge (gage de premier rang) created under Section 2 The Pledge, of this Agreement.

|

“Pledged Collateral” shall mean any Qualifying Collateral and any cash, time deposits or other cash credit balance which may be maintained in the Security Account.

“Qualifying Collateral” has the meaning specified therefor in Section 7(h) hereof.

“Required Account Value” has the meaning specified therefor in Section 7(h) hereof.

“Secured Obligations” means all obligations of Flagstone Re now or hereafter existing under each Master Agreement (including all contingent obligations and unreimbursed or refinanced drawings with respect to Credit(s) issued or procured for issuance by the Pledgee for the Pledgor’s account) and this Agreement, whether direct or indirect, absolute or contingent, and whether for principal, interest, fees, expenses or otherwise and the payment of any and all expenses (including reasonable counsel fees and expenses) incurred by the Pledgee in enforcing any rights under this Agreement and the Master Agreements.

|

"Secured Parties"

|

means the Beneficiaries and any other person entitled to payment under Clause 1 of the Master Agreement and/or the Credit(s).

|

|

|

"Securities"

|

means the securities standing to the credit of the Securities Account.

|

|

|

"Securities Account"

|

means the Securities Account numbers (together with any successor account opened and maintained for this purpose), opened in the name of the Pledgor with the Approved Bank or any other account(s) replacing or substituting for this/these accounts for whatever reason.

|

“Voting Interests” of any Person means shares of capital stock issued by a corporation, or equivalent equity interests in any other Person, the holders of which are ordinarily, in the absence of contingencies, entitled to vote for the election of directors (or persons performing similar functions) of such Person, even if the right so to vote has been suspended by the happening of such a contingency.

|

Section 1.2

|

Interpretation and Construction

|

|

(a)

|

In this Agreement, unless the contrary intention appears, any reference to:

|

|

(i)

|

any document, agreement or other instrument is a reference to that document, agreement or other instrument as from time to time amended, modified, restated, novated, varied or supplemented;

|

|

(ii)

|

a provision of law is a reference to that provision as amended or re-enacted;

|

|

(iii)

|

a person includes its successors, transferees and assignees; and

|

|

(iv)

|

words denoting the plural shall include the singular and vice versa and words denoting one gender shall include another gender.

|

|

(b)

|

No provision of this Agreement shall be interpreted adversely against a party solely because that party was responsible for drafting that particular provision or because that party is relying on that particular provision.

|

|

(c)

|

This Agreement, as well as all other documents relating thereto, including notices, are and will be drawn up in English. In the event of any discrepancy between the English text of this Agreement or any agreement resulting from it or relating to it and any translation of it, the English language version shall prevail.

|

|

(d)

|

English language words used in this Agreement intend to describe Luxembourg legal concepts only and the consequences of the use of those words in English law or any other foreign law shall be disregarded.

|

|

(e)

|

Any Luxembourg legal concept referred to in this Agreement shall, in respect of any jurisdiction other than Luxembourg, be deemed to include such concept and have the meaning which in that jurisdiction most closely approximates the Luxembourg legal concept.

|

|

(f)

|

Any Schedule in this Agreement forms an integral part of this Agreement and any reference to this Agreement, unless otherwise specified, shall include a reference to the Schedule. In the event of any inconsistency or contradiction between the body of this Agreement and the Schedule, the provisions of the former shall prevail.

|

|

(g)

|

The titles and headings in this Agreement are inserted for ease of reference only and shall not affect the interpretation of the terms of this Agreement.

|

|

(h)

|

This Agreement is a Security Document. In the event of any inconsistency or contradiction between the provisions of this Agreement and the provisions of the Master Agreement, the provisions of the Master Agreement shall prevail (to the extent permitted by applicable law and to the extent the validity and enforceability of the Pledge is not affected).

|

|

Section 2:

|

The Pledge

|

2.1 Creation of the Pledge, Perfection

|

(a)

|

The Pledgor hereby assigns, transfers, provides and grants in favour of the Pledgee a first priority pledge (gage de premier rang) over its right, title and interest in the Collateral, as continuing security for the due performance and discharge of the Secured Obligations and the Pledgee accepts this Pledge in accordance with Articles 3 et seq. of the 2005 Act.

|

|

(b)

|

By delivering to the Approved Bank at the date of execution of this Agreement, by fax and by registered mail with acknowledgement of receipt, a notification of the existence of this Pledge and of the security interest created hereunder over the Collateral, with a copy thereof to the Pledgee, substantially in the form set out at Schedule A hereto, and by obtaining, on the date hereof, a duly executed acknowledgement and waiver, substantially in the form set out at Schedule B hereto from the Approved Bank, this Pledge can be held against the Approved Bank and against third parties (other than the Approved Bank).

|

|

(i)

|

The Collateral being composed of securities and financial instruments shall be marked as being pledged in favour of the Pledgee in the books of the Approved Bank by reference to the Pledged Account. Any future Collateral composed of securities and financial instruments shall be marked as pledged in favour of the Pledgee in the books of the Approved Bank as of the moment on which they are credited to the Pledged Account.

|

|

(c)

|

Upon execution of this Agreement, the Pledgor shall cause Approved Bank to proceed to any filings, publications and/or perfection formalities as may be required from time to time by Luxembourg law.

|

|

(d)

|

The Pledgor specifically agrees and acknowledges that the Secured Obligations will be deemed to include any and all Secured Obligations as may be so amended, modified, restated, novated, varied or supplemented from time to time, including without limitation:

|

|

(i)

|

any increase in any amount made available thereunder and/or any alteration and/or addition to the purposes for which any such amount, or increased amount, may be used;

|

|

(ii)

|

any amounts provided in substitution or in addition to the amounts originally made available;

|

|

(iii)

|

any rescheduling of the indebtedness incurred thereunder whether in isolation or in connection with any of the foregoing; and

|

|

(iv)

|

any combination of any of the foregoing in accordance with the terms thereof or, as the case may be, with the agreement of the relevant parties.

|

|

(e)

|

The Pledgee holds the benefit of this Agreement for the Secured Parties in accordance with the terms of the Master Agreement and with Article 2(4) of the 2005 Act.

|

|

2.2

|

Preservation of the Pledge

|

If and to the extent that at any time, and from time to time, in the reasonable opinion of the Pledgee, it shall be necessary or appropriate that further instruments be executed and/or further action be taken in order to create, preserve or perfect a valid first priority right of pledge over the Collateral, the Pledgor shall as soon as possible execute such further instruments or take such further action, at its expenses and in such manner and form as the Pledgee may reasonably require.

|

Section 3

|

Collateral Requirements

|

3.1 The Pledgor undertakes to:

|

|

(a)

|

ensure that at all times the Letter of Credit Value of the Securities Account is equal to or exceeds the aggregate outstanding amount of the Secured Obligations;

|

|

|

(b)

|

from time to time, pay or transfer to the Approved Bank (by way of increment to the Securities Account) money and securities so that at all times the Letter of Credit Value of the Securities Account is equal to or exceeds the aggregate outstanding amount of the Secured Obligations; and

|

|

|

(c)

|

ensure that at all times each component part of the Securities Account shall satisfy the Pledgee’s requirements. Final determination as to whether the Pledgee’s requirements have been satisfied shall be at the sole discretion of the Pledgee.

|

|

Section 4

|

Scope of the Pledge

|

|

4.1

|

Continuing Security

|

This Pledge shall be a continuing security for the due performance of the Secured Obligations, shall remain in full force and effect until expressly released in accordance with Section 13 (Discharge of the Pledge), and shall in particular not be discharged by reason of the circumstance that there is at any time no Secured Obligation currently owing from the Pledgor to the Pledgee, nor shall the Pledge be discharged by any intermediate payment or satisfaction of any part of the Secured Obligations or by any settlement of accounts.

|

4.2

|

No Discharge

|

|

(a)

|

To the extent allowed by applicable law, neither the obligations of the Pledgor under this Agreement nor the Pledge will be affected by an act, omission, matter or thing which, but for this Section 4 (Scope of the Pledge), would reduce, release or prejudice any of the Pledgor's obligations under the Pledge and/or this Agreement (without limitation and whether or not known to it) including:

|

|

(i)

|

any time, indulgence, waiver or consent granted to, or composition with, the Pledgor or any other person;

|

|

(ii)

|

the release of the Pledgor or any other person under the terms of any composition or arrangement with any creditor of any member of the Pledgor's group;

|

|

(iii)

|

the taking, variation, compromise, exchange, renewal or release of, or refusal or neglect to perfect, take up or enforce any rights against, or security over assets of, the Pledgor or other person or any non-presentation or non-observance of any formality or other requirement in respect of any instrument or any failure to realise the full value of any security;

|

|

(iv)

|

the application of any payment received from the Pledgor or for its account towards obligations of the Pledgor other than the Secured Obligations;

|

|

(v)

|

the booking of funds into any sub-accounts within the Securities Account, the withdrawal or deposit of any amounts from or into the Collateral;

|

|

(vi)

|

any incapacity or lack of power, authority or legal personality of or dissolution or change in the members or status of the Pledgor or any other person;

|

|

(vii)

|

any amendment (however fundamental) or replacement of the Master Agreement and/or the Credit(s) or any other document or security;

|

|

(viii)

|

any unenforceability, illegality or invalidity of any obligation of any person under the Master Agreement and/or the Credit(s); or

|

|

(ix)

|

situation of illiquidity (cessation de paiements) and absence of access to credit (credit ébranlé) within the meaning of Article 437 of the Luxembourg Commercial Code, insolvency proceedings (faillite) within the meaning of Articles 437 ff. of the Luxembourg Commercial Code or any other insolvency proceedings pursuant to the Council Regulation (EC) N° 1346/2000 of 29 May 2000 on insolvency proceedings controlled management (gestion contrôlée) within the meaning of the grand ducal regulation of 24 May 1935 on controlled management, voluntary arrangement with creditors (concordat préventif de faillite) within the meaning of the law of 14 April 1886 on arrangements to prevent insolvency, as amended, suspension of payments (sursis de paiement) within the meaning of Articles 593 ff. of the Luxembourg Commercial Code or voluntary or compulsory winding-up pursuant to the law of 10 August 1915 on commercial companies, as amended, regulatory winding-up pursuant to the law of 13 February 2007 on specialized investment funds (“SIF”), as amended or withdrawal of the official list of specialized investment funds provided for in Article 43(1) of the law of 13 February 2007 on SIF.

|

|

(b)

|

The Pledgor expressly acknowledges and recognizes the right of any Secured Party to enter into any agreements, arrangements and amicable settlements, with or without remission of the Secured Obligations, without the Pledgor's rights under this Pledge being in any manner altered or prejudiced.

|

|

Section 5

|

Use of Securities Account

|

|

5.1

|

Operation of the Securities Account

|

|

(a)

|

The Pledgor shall be entitled to continue to freely operate the Securities Account, subject only to the restrictions expressly set out in this Agreement, the Master Agreement or Account Control Agreement, until a Payment Instruction has been delivered to the Approved Bank.

|

|

(b)

|

Immediately upon the delivery of a Payment Instruction, the Pledgor shall not be entitled to withdraw or otherwise transfer any Collateral or credit balance standing from time to time on the Securities Account, unless otherwise agreed by the Pledgee.

|

|

5.2

|

Collection Mandate

|

As soon as a Payment Instruction has been delivered, any principal amount, interest or other moneys or property hereby pledged which may be received by the Pledgor shall be held in the name and for the account of the Pledgee and paid or delivered to the Pledgee, as soon as reasonably practicable, for application against the Secured Obligations.

|

Section 6

|

Voting Interests and Distributions

|

|

6.1

|

Voting Interests

|

|

(a)

|

Until an Event of Default occurs and is continuing, the Pledgor shall be entitled to exercise all Voting Interests attached to the Collateral. However, the Pledgor shall not exercise or direct the exercise of the Voting Interests attached to the Collateral, give any consent, waiver or ratification, or take any action in a manner which, in the reasonable opinion of the Pledgee, would materially and adversely affect the validity or enforceability of this Pledge or would cause an Event of Default to occur.

|

|

(b)

|

After the occurrence and during the continuance of an Event or Default, the Pledgor shall not, without the prior written consent of the Pledgee, exercise any Voting Interests in relation to the Collateral. Therefore, as soon as practicable after such occurrence and during the continuance of Event of Default, the Pledgor shall seek instructions on the exercise of the Voting Interests attached to the Collateral and act upon such instructions. The Pledgee may, after having given notice to the Pledgor and the Company, declare that it will, with effect from such notice, exercise the Voting Interests in the Collateral and preclude the Pledgor from doing so.

|

|

(c)

|

In any case, the Pledgor shall give the Pledgee reasonable notice of all shareholder’s meetings in relation to the Securities and the agenda of such meetings. The Pledgor shall not in any way waive the right (whether statutory or in accordance with the relevant articles of incorporation) to any notice period in respect of the convening of general shareholder’s meetings.

|

|

6.2

|

Distributions

|

|

(a)

|

Until an Event of Default occurs and is continuing, the Pledgor shall be entitled to directly receive and apply all Distributions, whether or not they have been declared or have accrued prior to enforcement in accordance with Section 11 (Enforcement of the Pledge), except to the extent such Distributions are prohibited under the Master Agreement or applicable law.

|

|

(b)

|

Following the occurrence and during the continuance of an Event of Default, any dividends shall be paid exclusively to the Pledgee, which shall apply the same towards the Secured Obligations in accordance with the terms of the Master Agreement.

|

|

(c)

|

In the event that any return on the Collateral which, under the above paragraphs, is to be paid or delivered to the Pledgee, shall entitle the Pledgor to a tax credit on account of withholding taxes, the Pledgor shall forthwith upon the declaration of such return, pay to the Pledgee an amount equivalent to such tax credit and such amount shall be deemed to be a return on the Collateral for purposes of this sub-section 6.2 (Distributions).

|

|

(d)

|

This Pledge shall not in any way be affected by any stamping, regrouping, splitting or renewal of the Collateral, or by any similar operation, and the securities resulting from any such operation shall be part of the Collateral.

|

|

6.3

|

Power of Attorney

|

The Pledgor agrees to do whatever is necessary in order to ensure that the exercise of the Voting Interests under this Section 6 (Voting Interests and Distributions) is facilitated for the Pledgee or any other person designated by the Pledgee and the Pledgor shall promptly execute and/or deliver to the Pledgee, at the Pledgor's cost, such forms of proxy as the Pledgee or such other person may require for the purpose of protecting, exercising and/or enforcing its rights hereunder.

|

Section 7

|

Covenants and Warranties

|

|

7.1

|

Representations and Warranties

|

The Pledgor represents and warrants to the Pledgee as at the date hereof that:

|

(a)

|

the Pledgor has been duly incorporated and validly exists under its laws of Luxembourg and the copies of the (restated) articles of association of the Pledgor delivered to the Pledgee are complete, correct and up-to-date;

|

|

(b)

|

the Pledgor has the power, authority and capacity to enter into this Agreement and to exercise its rights and perform its obligations hereunder and all corporate and other actions required to authorise the execution and performance of this Agreement have been duly taken;

|

|

(c)

|

the Pledgor's board of directors has taken all necessary steps to enable it to assign, transfer, pledge or grant as security the Collateral and the granting of the Pledge falls within the corporate purpose and is in the best corporate interest and corporate benefit of the Pledgor;

|

|

(d)

|

this Agreement has been duly executed and delivered by the Pledgor and creates a valid, perfected and enforceable first priority right of pledge over the Collateral and the proceeds thereof (subject to paragraph 7.3 (e)) and constitutes legal, valid and binding obligations of the Pledgor, enforceable in accordance with its terms;

|

|

(e)

|

save for this Pledge, no Encumbrance, however created or arising (unless arising by operation of law) exists over the Collateral and the Pledge creates a valid first ranking security over the Collateral in favour of the Pledgee;

|

|

(f)

|

immediately prior to the execution of this Agreement it was, and it will be, the absolute beneficial owner of and has, and will have, full right and title to the Collateral free and clear of any Encumbrances (unless arising by operation of law) and none of the Collateral secured under this Agreement is subject to any prohibition in respect of the taking of security in respect thereof;

|

|

(g)

|

it is and will be the sole holder of the Securities Account and the Securities Account is the only Securities Account held by it in Luxembourg as at the date of this Agreement, being the "relevant account" for purposes of the 2005 Act;

|

|

(h)

|

the Pledgor shall cause the assets of the type specified in Schedule 1 (the “Qualifying Collateral”) to be pledged as Collateral so that at all times the Letter of Credit Value of such securities equal to or exceeds the aggregate outstanding amount of the Secured Obligations, equal or exceed an amount equal to the aggregate amount of the then outstanding Credits together with any unreimbursed or refinanced drawings thereunder (the “Required Account Value”); and without limiting the foregoing, if at any time the Pledgor is not in compliance with the requirements of this subclause (h), the Pledgor shall within one Business Day cause additional Qualifying Collateral to be held as Collateral pursuant to clause Cause 2 hereunder to equal or exceed the Required Account Value.

|

|

(i)

|

upon request of the Pledgee, it will provide the Pledgee with copies of any administrative records and all information and supporting documentation relating to the Collateral or the Securities Account;

|

|

(j)

|

it will instruct the Approved Bank to (i) provide to the Pledgee, on a monthly basis, the account statements of the Securities Account, and (ii) transmit any other report or document relating to the Collateral and the Securities Account to the Pledgee upon request of the Pledgee;

|

|

(k)

|

it will not voluntarily require any clearance system to re-materialise the Securities;

|

|

(l)

|

if the Securities cease to be held through the Approved Bank in the Securities Account and such Securities are instead held within any other clearance system, it shall, if so reasonably requested by the Pledgee procure that it instructs such other clearance system to transfer such Securities to an account of the Pledgee or its nominee with that clearance system, and takes whatever reasonable action the Pledgee may request for the dematerialisation or re-materialisation of such Securities held in a clearance system.

|

|

7.2

|

Negative Covenants

|

|

(a)

|

Subject to the terms of the Master Agreement,and as long as this Agreement remains in force, the Pledgor shall not (nor shall the Pledgor agree to) create or permit to subsist any Encumbrance over any of the Collateral or any part thereof (irrespective of whether ranking before or behind the Pledge), other than this Pledge without the Pledgee's prior written approval.

|

|

(b)

|

The Pledgor has not taken any winding-up resolution, has not been declared bankrupt and has not applied for general settlement or composition with creditors (concordat préventif de faillite), controlled management (gestion contrôlée) or moratorium or reprieve from payment (sursis de paiement), and is not subject to any similar proceedings affecting the rights of creditors generally.

|

|

7.3

|

Positive Covenants

|

The Pledgor covenants and undertakes with the Pledgee as follows:

|

(a)

|

to give or procure to be given to the Pledgee such opinions, certificates, information and evidence (and in such form) as the Pledgee may reasonably request for the purpose of the discharge or exercise of the duties, powers, authorities and discretions vested in it under this Agreement or by operation of law;

|

|

(b)

|

at all times to observe and perform its obligations and rights in respect of the Collateral, not do, or permit to be done, anything which could prejudice the Pledge and not, without the prior written consent of the Pledgee, perform any act which may result in a reduction of the value of the Collateral;

|

|

(c)

|

in the event of a seizure or attachment by a third party of any of the Collateral which the Pledgor is aware of, at its own expense, to

|

|

(ii)

|

promptly notify the Pledgee and send it or its attorneys a copy of the relevant attachment or seizure documentation as well as all other documents required under applicable law, signed to the extent required by this Pledgor, for challenging the attachment or seizure (if possible);

|

|

(iii)

|

notify the third party or the attorneys acting on behalf of this third party in writing of the Pledgee's interest in the Collateral; and

|

|

(iv)

|

take such measures (including necessary legal action) as may reasonably be required or requested by the Pledgee to protect the Pledgee's interest in the Collateral;

|

|

(d)

|

to take the action required under Section 2.1(b) to perfect the Pledge;

|

|

(e)

|

to obtain from the Approved Bank a waiver, subordination or release of its first ranking pledge (if any) over the Collateral, existing by operation of the Approved Bank's general business conditions, such waiver, subordination or release to be provided to the Pledgee in the form set out in Schedule B hereto no later than two (2) Business Days following the signing of this Agreement; and

|

|

(f)

|

to notify the Pledgee as soon as possible of any event or circumstance which would reasonably be expected to have a material adverse effect on the validity or enforceability of this Agreement.

|

The Pledgor undertakes to the Pledgee that the covenants and warranties in this Section 7 (Covenants and Warranties) shall at all times remain true and correct [and are deemed to be repeated, as required under the Master Agreement, on each date until full discharge of the Pledge in accordance with Section 13 (Discharge of the Pledge) with reference to the facts and circumstances then existing.

|

Section 8

|

Further Assurances

|

|

(a)

|

In connection with this Agreement and all transactions contemplated hereby, each party shall execute and deliver all such additional documents and instruments, and perform such additional acts, as any other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

|

|

(b)

|

In particular, without limiting the generality of the foregoing, the Pledgor shall promptly do whatever the Pledgee reasonably requires, after the occurrence and during the continuance of an Event of Default, to facilitate the enforcement of the Pledge or the exercise of any other rights vested in the Pledgee, including, but not limited to, executing any transfer, conveyance, charge, assignment or assurance of the Collateral (whether to the Pledgee or its nominees), making any registration and giving any notice, order or direction.

|

|

(c)

|

All approvals and consents of any party hereto shall be in writing.

|

|

Section 9

|

Immediate Recourse, Waiver

|

|

(a)

|

The Pledgor waives, to the fullest extent allowed by applicable law, any right or benefit, present or future, it may have of first requiring the Pledgee to proceed against or claim payment from any person or entity or enforce any guarantee or security granted by any other person or entity before enforcing this Agreement and/or any rights hereunder (including for purposes of Article 1285 of the Luxembourg Civil Code), and any right or benefit, present or future, it may have under Article 2037 of the Luxembourg Civil Code.

|

|

(b)

|

To the fullest extent allowed by applicable law, the Pledgor waives any right, action or claim it may have under the Pledge against any person securing or guaranteeing the Secured Obligations, including, in particular, the Pledgor's rights of recourse under Articles 2028 et seq. of the Luxembourg Civil Code, any right to subrogation or any other similar right, action or claim under any applicable law (including ancillary relief or provisional measures such as saisie-arrêt conservatoire) or by way of set-off. The Pledgor acknowledges that this waiver is of the essence for the Secured Parties and shall, to the extent required, continue in full force and effect notwithstanding any termination of the Agreement or any discharge of the Pledge under Section 13 (Discharge of the Pledge).

|

|

Section 10

|

Additional Security

|

This Agreement shall be in addition to and shall not in any way be prejudiced by or dependent on any collateral or other security now or hereafter held by the Pledgee as security for the Secured Obligations or any Encumbrance to which they may be entitled. The rights of the Pledgee and the Secured Parties hereunder are in addition to and not exclusive of those provided by law.

|

Section 11

|

Enforcement of the Pledge

|

|

11.1

|

Remedies

|

|

(a)

|

Immediately upon the occurrence and during the continuance of an Event of Default, the Pledgee shall be entitled to enforce the Pledge, in its absolute discretion, after having delivered a Payment Instruction substantially in the form set out at Schedule C hereto, and exercise any right in any manner as the Pledgee, acting reasonably, shall determine to the widest extent permitted by Luxembourg law in accordance with Article 11 of the Collateral Act, but without limiting any other rights or remedies otherwise available to the Pledgee.

|

|

(b)

|

In particular, and to the extent allowed under Luxembourg law, the Pledgee shall be entitled to:

|

|

(i)

|

seize or otherwise take possession of the then issued Collateral at its fair market value, as determined by an independent auditor (réviseur d’entreprises) of good repute and acting reasonably (at the cost of the Pledgor), without the need of prior court authorization or any prior notice (mise en demeure); or

|

|

(ii)

|

apply for a court order transferring title to the Collateral to the Pledgee or any other person designated by the Pledgee in discharge of the Secured Obligations following a valuation of the Collateral by a court appointed expert, take control of any Distributions to which the Pledgee is entitled and to apply any money paid to the Pledgee to the satisfaction and set-off against all or any part of the Secured Obligations, without the need of any prior notice (mise en demeure); or

|

|

(iii)

|

in respect of such Collateral that constitute securities not listed or quoted on a stock exchange in Luxembourg or any other jurisdiction, without the need of prior court authorization or any prior notice (mise en demeure)

|

|

(A)

|

sell the Collateral or have the Collateral sold in realization upon mutual agreement in a private transaction at arm's length (conditions commerciales normales); or

|

|

(B)

|

sell the Collateral on a stock exchange determined by the Pledgee or by public auction held by an official designated by the Pledgee, to take control of any proceeds to which the Pledgee is entitled and to apply any money paid to the Pledgee to the satisfaction and set-off against all or any part of the Secured Obligations; or

|

|

(iv)

|

in respect of securities listed or quoted on the official list of a stock exchange in Luxembourg or any other jurisdiction, to cause the sale thereof at such stock exchange at the prevailing market value as quoted on the principal market for such Shares as the opening price on the day of appropriation, without the need of prior court authorization or any prior notice (mise en demeure). The parties agree that the list price at such stock exchange may not necessarily represent the value of the Shares and that the Pledgee may sell the securities at any price it considers, at normal commercial conditions, to be reasonable.

|

|

(c)

|

In particular, the Pledgee shall be entitled to apply any balance standing to the credit of the Securities Account to the satisfaction of and set-off against the Secured Obligations, and to take control of any proceeds to which the Pledgee is entitled, without the need of prior court authorisation or any prior notice.

|

|

(d)

|

To the extent necessary, in case of enforcement of the Pledge in accordance with Article 11 of the Collateral Act, the Pledgor hereby expressly and irrevocably waives any right, claim or objection deriving from any restriction applicable to the transfer of the Collateral.

|

|

(e)

|

No action, choice or omission in this respect, or partial enforcement, shall in any manner reduce, release or prejudice any of the Pledgor's obligations under the Pledge and/ or this Agreement. The Pledge shall continue in full force and effect until enforcement, discharge or termination, as the case may be, of this Agreement.

|

|

11.2

|

Application of Proceeds

|

|

(a)

|

The proceeds of any enforcement, sale or other disposition of any part of the Collateral and, in general, all moneys received by the Pledgee in accordance with this Agreement shall, subject to the rights of creditors mandatorily preferred by law applying to companies generally, be applied in accordance with the relevant provisions of the Master Agreement.

|

|

(b)

|

The Pledgor shall remain liable for any shortfall between the amount of these proceeds and the Secured Obligations and expressly waives the benefit of Articles 1253 and 1256 of the Luxembourg Civil Code.

|

|

Section 12

|

Disclaimer of Liability

|

The Pledgee shall not be liable to the Pledgor for any costs, losses, liabilities or expenses (including legal fees, taxes and duties) relating to the enforcement of the Pledge or for any act, default, omission or misconduct of the Pledgee, or its officers, employees or agents in connection with this Agreement and any Credits and relating to the enforcement of the Pledge and to the Collateral save (i) where the same arises as a result of gross negligence (faute grave) or wilful misconduct (dol, faute lourde), and (ii) for any surplus remaining following any enforcement, sale or other disposition of any part of the Collateral under Section 11 (Enforcement of the Pledge).

|

Section 13

|

Discharge of the Pledge

|

|

13.1

|

Release

|

|

(a)

|

Subject to sub-section 13.2 (Retention of Security), upon expiry of the period beginning on the date of this Agreement and ending on the date upon which the Pledgee /Administrative Agent/Security Agent (acting reasonably) is satisfied that all Secured Obligations shall have been unconditionally and irrevocably paid and discharged in full, the Pledgee shall promptly at the request and expense of the Pledgor release the Collateral from the Pledge.

|

|

(b)

|

This Pledge shall be discharged by, and only by, the express release thereof granted by the Pledgee in writing.

|

|

(c)

|

The Pledgee shall give such instructions and directions as the Pledgor may reasonably require in order to perfect such release.

|

|

13.2

|

Retention of Security

|

|

(a)

|

Any release of this Pledge shall be null and void and without effect if any payment received by the Pledgee or by the Secured Parties and applied towards satisfaction of all or part of the Secured Obligations (i) is avoided or declared invalid as against the creditors of the maker of such payment, or (ii) becomes repayable by the Pledgee or by the Secured Parties to a third party, or (iii) proves not to have been effectively received by the Pledgee [or by the Secured Parties].

|

|

(b)

|

If any payment by the Pledgor or any discharge given by the Pledgee (whether in respect of any of the Secured Obligations or any security for the Secured Obligations or otherwise) is avoided or reduced for whatever reason:

|

|

(i)

|

the liability of the Pledgor shall continue as if the payment, discharge, avoidance or reduction had not occurred; and

|

|

(ii)

|

the Pledgee shall, to the extent permitted by applicable law, be entitled to recover the value or amount of that security or payment from the Pledgor, as if the payment, discharge, avoidance or reduction had not occurred, it being understood that the Pledgor shall promptly do whatever the Pledgee requires for such purpose, without prejudice to the Pledgor’s other obligations under this Agreement.

|

|

Section 14

|

Power of Attorney

|

|

14.1

|

Appointment

|

The Pledgor, by way of security, irrevocably and severally appoints the Pledgee and any of its delegates or sub-delegates to be its attorney (mandataire) to take any action which the Pledgor is entitled or obliged to take in relation to the Collateral under this Agreement, [and upon prior notice to the Pledgor, in accordance with the Master Agreement],

|

(i)

|

after the occurrence and during the continuance of an Event of Default, which has not been waived; and

|

|

(ii)

|

at any time, if the Pledgor has failed to do anything required to be done by it according to the terms of this Agreement, including in relation to the perfection of the Pledge, and has not remedied such failure within 5 (five) Business Days from a request to remedy such failure;

|

it being understood that the enforcement of the Pledge must be carried out in accordance with Section 11 (Enforcement of the Pledge).

|

14.2

|

Ratification

|

The Pledgor ratifies and confirms whatever any attorney does or purports to do under its appointment under this Section 14 (Power of Attorney) except where such attorney is acting with wilful misconduct or negligently, or in breach of the terms of the Master Agreement, or in violation of the corporate interest of the Pledgor.

|

Section 15

|

Notices

|

Unless otherwise provided in the Master Agreement, any notice, request, demand or other communication to be made by one person to another under or in connection with this Agreement shall be sent by facsimile (confirmed by simple letter or registered letter, return receipt requested, if necessary) and delivered or addressed to the addressee at its address below (or any other address it may subsequently notify in writing to the other parties):

if to the Pledgor, to:

Address: Flagstone Capital Management Luxembourg SICAF - FIS

37 Val St André

L-1128 Luxembourg

Attention: [CONTACT PERSON]

Facsimile: [FAX]

With a copy (which shall not constitute notice) to:

if to the Pledgee, to:

|

Address:

|

Citibank Europe PLC

|

Insurance Letter of Credit Department

2nd Floor, 1 North Wall Quay,

Dublin 1

|

|

Republic of Ireland

|

Attention: Peadar Mac Canna

Facsimile: + 353 1 6222741

If to the Approved Bank, to:

Address: JP Morgan Bank Luxembourg S.A.

6 Route de Trèves, L-2633 Senningerberg,

Luxembourg

Attention: [CONTACT PERSON]

Facsimile: [FAX]

The date on which a notice by mail shall be deemed validly given shall be the date of its effective receipt by the addressee, i.e. the date appearing on the acknowledgment of receipt. Any notice given by facsimile shall be deemed validly given on the date appearing on the confirmation of transmission of the said facsimile.

|

Section 16

|

Further Provisions

|

|

16.1

|

Evidence of Indebtedness

|

In any action, proceedings or claim relating to this Agreement, or to the Pledge contained in this Agreement, a statement (which shall contain information in reasonable detail in support thereof) as to any amount due by the Pledgor in respect of the Secured Obligations, which is certified as being correct by an authorised officer of the Pledgee shall, save in the case of manifest or proven error and until evidence of the contrary, be conclusive prima facie evidence that such amount is in fact due and payable.

|

16.2

|

Several Obligations

|

The obligations of each party are several and no party shall be responsible or liable for the acts or omissions of any other party.

|

16.3

|

Delegation of Powers

|

The Pledgee shall be entitled, at any time and as often as may be expedient, to delegate all or any of the powers and discretion vested in it by this Agreement in such manner, upon such terms and to such person as the Pledgee in its absolute discretion may think fit.

|

16.4

|

Currency Conversion

|

For the purpose of or pending the release of this Pledge in accordance with Section 13 (Discharge of the Pledge), and in particular for the purpose of the satisfaction of and set-off against all or any part of the Secured Obligations under Section 11 (Enforcement of the Pledge), the Pledgee may convert any monies collected or applied by it under this Agreement from one currency to another as the Pledgee in its absolute discretion may think fit and any such conversion shall be undertaken at the prevailing spot rate of exchange for the time being, obtaining such other currency with the first currency as determined by the Pledgee in its discretion, acting reasonably, except to the extent such conversion is required to be made in accordance with the provisions of the Master Agreement.

|

16.5

|

Illegality, Severability

|

|

(a)

|

Any provision of this Agreement which is invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting, impairing or invalidating the remaining provisions hereof, and any such invalidity, illegality or unenforceability in any jurisdiction shall not render invalid, illegal or unenforceable such provision in any other jurisdiction. To the extent permitted by applicable law, the Pledgor waives any provision of law which renders any provisions hereof invalid, illegal or unenforceable in any respect.

|

|

(b)

|

In the event of any such invalidity, illegality or unenforceability in any jurisdiction, the parties hereto shall negotiate in good faith with a view to agreeing on the substitution and replacement of any such provision by a provision that is legal, valid, binding and enforceable in such jurisdiction, and that, to the extent practicable, most nearly approximates its economic effects and effects the parties original intentions and purpose upon entering into this Agreement.

|

|

16.6

|

Costs and Expenses

|

All the Pledgee's reasonable documented costs and expenses (including legal fees, taxes and duties) incurred in connection with the preparation, negotiation and signing of this Agreement shall be borne by the Pledgor in accordance the relevant provisions of the Letters of Credit. The obligation to reimburse such reasonable costs and expenses shall be part of the Secured Obligations.

|

16.7

|

Rights Cumulative, Waivers

|

|

(a)

|

The respective rights and remedies of the parties provided in this Agreement are cumulative and may be exercised as often as considered appropriate and are in addition to any respective rights or remedies provided by general law.

|

|

(b)

|

The respective rights of the parties hereto shall not be capable of being waived or varied otherwise than by express waiver or variation in writing; and, in particular, any failure to exercise or any delay in exercising any such rights shall not operate as a variation or waiver of that or any other such right; any defective or partial exercise of such rights shall not preclude any other or further exercise of that or any other such right; and no act or course of conduct or negotiation on their part or on their behalf shall in any way preclude them from exercising any such right or constitute a suspension or any variation of any such right.

|

|

16.8

|

Transferability

|

|

(a)

|

This Agreement shall be binding upon and shall inure to the benefit of the Pledgor and the Pledgee and their respective successors and permitted assigns and references in this Agreement to any of them shall be construed accordingly.

|

|

(b)

|

The Pledgor shall not be entitled to assign, novate, encumber or transfer any of its rights or benefits and obligations under this Agreement without the prior written consent of the Pledgee in accordance with the Master Agreement.

|

|

(c)

|

The rights and obligations of the Pledgee hereunder shall automatically and without any further action being necessary be transferred to any new Pledgee appointed in relation to the Secured Obligations. In case more than one Pledgee is appointed in relation to all or part of the Secured Obligations each Pledgee shall automatically and without any further action being necessary be entitled to exercise the rights granted hereby in relation to the part of the Secured Obligations in respect of which it has been appointed, always subject, however, to the provisions of this Agreement. For the avoidance of doubt, the right granted under this paragraph (c) shall exclusively benefit the Pledgee.

|

|

16.9

|

Reservation, Transfer of Rights

|

The parties reserve, for purposes of Articles 1278 et seq. of the Luxembourg Civil Code and except as otherwise stated in the Master Agreement, the Pledge granted hereby and the security interest created under it. The Pledge shall continue in full force and effect to the benefit of any Secured Party, notwithstanding any assignment, amendment, novation or transfer of any kind in favour of any transferee by the Pledgee of all or any part of the Secured Obligations, or any further consent or formality.

|

16.10

|

Entire Agreement, Amendments

|

This Agreement and the matters referred to herein constitute the entire Agreement between Pledgor and Pledgee and supersede and cancel all prior representations, alleged warranties, statements, negotiations, drafts, undertakings, letters, acceptances, agreements, understandings, contracts and communications, whether oral or written, with respect to or in connection with the subject matter hereof. This Agreement may only be amended or changed by a written instrument signed by or on behalf of all parties [having obtained the requisite approval, if any, in accordance with the provisions of the Master Agreement.

|

16.11

|

Counterparts

|

This Agreement may be executed in any number of counterparts (whether by delivery of an original of such executed counterparts or by facsimile transmission of such executed counterparts), all of which will be deemed to be an original and such counterparts taken together will constitute one agreement and any of the parties hereto may execute this Agreement by signing any such counterpart.

|

Section 17

|

Governing Law and Jurisdiction

|

|

(a)

|

This Agreement and any non-contractual obligations arising out of or in connection with it shall be governed by and construed in accordance with the laws of Luxembourg.

|

|

(b)

|

Each party hereto hereby agrees for the benefit of the other parties that the courts of Luxembourg, judicial district of Luxembourg-City, are to have the non-exclusive jurisdiction to settle any claims, disputes or matters (the "Proceedings") arising out of or in connection with this Agreement (including a dispute relating to any non-contractual obligations arising out of or in connection with it) and that accordingly any suit, action or proceeding arising out of or in connection with this Agreement (including any Proceedings relating to any non-contractual obligations arising out of or in connection with this Agreement) may be brought in such courts.

|

|

(c)

|

The submission to the jurisdiction of the courts of Luxembourg shall not (and shall not be construed so as to) limit the right of the Pledgee to initiate Proceedings in any other court which may otherwise have jurisdiction, including, without limitation, the courts having jurisdiction by reason of any party's domicile. Legal Proceedings by any party in any one or more jurisdictions shall not preclude legal Proceedings by it in any other jurisdiction, whether by way of substantive action, ancillary relief, enforcement or otherwise.

|

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered by its officer thereunto duly authorized as of the date first above written.

Flagstone Capital Management Luxembourg SICAF - FIS

BY:

______________________________________

CITIBANK EUROPE PLC

BY:

______________________________________

Name:

Title:

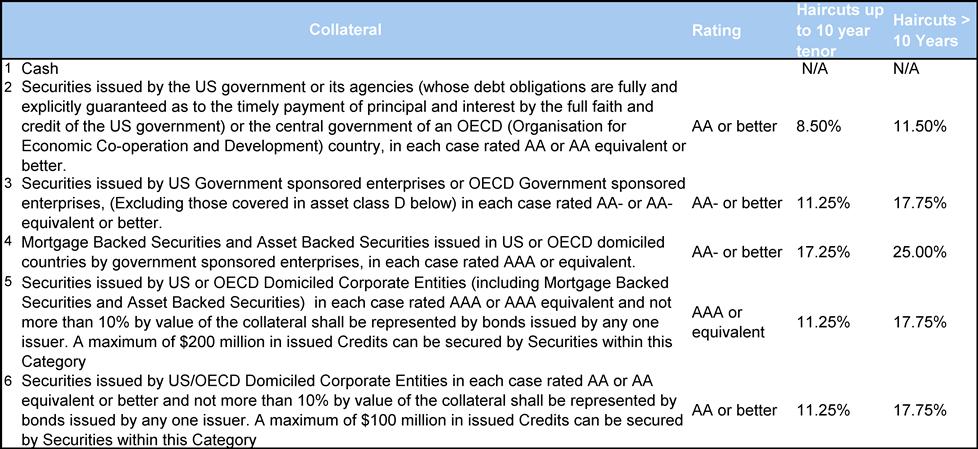

SCHEDULE 1

Letter of Credit Value and Pledgee's Requirements for “Qualifying Collateral”

SCHEDULE 2

Currency Margins

|

1.

|

Where the Qualifying Collateral or a portion thereof is denominated in the same currency as a Credit (the "Credit Currency"), the Qualifying Collateral or such portion thereof shall have a value of 100% of its value in the relative Credit Currency; and for this purpose the Pledgee shall notionally match each Credit with the Collateral or a portion thereof denominated in the relative Credit Currency.

|

|

2.

|

Where the Qualifying Collateral or a portion thereof is denominated in a currency other than the relative Credit Currency, both the Letter of Credit Value (or, where only a portion of the Qualifying Collateral is in the relative Credit Currency, the balance of the Letter of Credit Value remaining unmatched) and the Qualifying Collateral or such portion thereof shall be notionally converted into a common base currency (as the Pledgee may in its discretion determine); and following such notional conversion the Qualifying Collateral or such portion thereof shall suffer a deduction of the Relevant Percentage, to cover exchange movements that may from time to time affect the value of the underlying unmatched Qualifying Collateral or a portion thereof and the contingent obligations to which it relates.

|

|

3.

|

The "Relevant Percentage" means:

|

|

|

(a)

|

where the Qualifying Collateral or a portion is denominated in U.S. dollars, Canadian dollars or English Pounds Sterling, Euro 10%;

|

|

|

(b)

|

where the Qualifying Collateral or a portion thereof is denominated in Swiss Francs or Japanese yen, 15%; and

|

|

|

(c)

|

where the Qualifying Collateral or a portion thereof is denominated in any other currency, 25%.

|

|

4.

|

For the purposes of each notional conversion to be effected hereunder the provisions of Section 16.4 shall apply mutatis mutandis.

|

SCHEDULE A

FORM OF BANK NOTICE

(LETTERHEAD OF THE PLEDGOR)

To: [….]

To the attention of:

|

|

(ADDRESS)

|

Cc: [PLEDGEE]

To the attention of:

(ADDRESS)

|

|

[DATE]

|

BY REGISTERED MAIL WITH ACKNOWLEDGEMENT OF RECEIPT

Ladies and Gentlemen,

Re.: Pledge of Securities Account

We refer to the Securities Account with number [●] and maintained by us in your books (the “Securities Account”).

We hereby give you notice that under a Securities Account Pledge Agreement dated on or about [●] (the "Pledge Agreement"), we have pledged as a first ranking security to […] (the "Pledgee"), all title, interest, benefit, claims and rights of any nature, present and future in connection with and to our Securities Account (including all securities deposited or standing from time to the account, in whatever form).

We further request you to waive any right of pledge, right of set-off, lien, right of retention, right of combination of accounts or any similar right you may have against us or the Securities Account, whether arising by way of contract, general terms and conditions or law.

To the extent necessary, we release you from your professional secrecy obligation for any information transmitted to the Pledgee under and in accordance with the Pledge Agreement and more generally from any liability with regard to any damage whatsoever (direct or indirect) which you may incur owing to the transmission of such information.

We kindly ask you to return the attached acknowledgement form, duly executed, to our above address, with a copy to the Pledgee.

Kind regards,

The Pledgor

[…]

By:

Name:

Title:

Enclosures

SCHEDULE B

FORM OF ACKNOWLEDGEMENT AND WAIVER

(LETTERHEAD OF THE APPROVED BANK)

To: […]

To the attention of:

(ADDRESS)

|

|

[DATE]

|

Ladies and Gentlemen,

Re.: Pledge of Securities Account

Dear Sirs,

At the request of the Pledgor we confirm and agree that :

|

(i)

|

we have received the notice of pledge dated […] (the Notice) and relating to the first ranking pledge (gage de premier rang) created pursuant to a securities account pledge agreement (the Securities Account Pledge Agreement) dated […] between […] as the Pledgor and […] as the Pledgee over the securities account opened in the books of our Approved Bank with number […] in the name of the Pledgor (the Securities or Pledged Account), together with a copy of the Pledge Agreement and acknowledge our quality of third party holder of the Collateral (tiers détenteur de gage);

|

|

(ii)

|

we waive and release particularly for the benefit of the Pledgee, any present and future liens, encumbrance, claims, security interest, right of set-off or right of retention over the Collateral and the Pledged Account in our favour; [except that we shall retain a lien on any Pledged Collateral in the Pledged Account for the payment of our fees and for the payment of any Pledged Collateral credited to the Pledged Account for which payment or reimbursement to us has not been made or received]

|

|

(iii)

|

we have not previously received any other notice of pledge, charge, assignment or other in respect of the Pledged Account;

|

|

(iv)

|

in accordance with the provisions of the Luxembourg act on Financial Collateral Arrangements dated 5 August, 2005, as amended from time to time, the Collateral constituting securities and financial instruments shall be marked as being pledged in favour of the Pledgee in the books of our Approved Bank by reference to the Pledged Account which is an account opened for the sole purpose of holding the Collateral pledged in favour of the Pledgee. Any future Collateral constituting securities and financial instruments shall be marked as pledged in favour of the Pledgee in the books of the Approved Bank as of the moment on which they are credited to the Pledged Account;

|

|

(v)

|

we shall have only the duties and responsibilities expressly set forth in writing herein and in our standard account documentation and terms and conditions as in effect from time to time, all of which shall apply to the Pledged Account to the extent not inconsistent with the terms of the present acknowledgement and, for the avoidance of doubt, we would like to point out that we thus have no obligation of any kind to provide information, to control, monitor or block the Pledged Account other than in accordance with the terms set forth in this acknowledgement;

|

|

(vi)

|

we shall (i) provide to the Pledgee, on a monthly basis, the account statements of the Pledged Account, and (ii) transmit any other report or document relating to the Collateral and the Pledged Account to the Pledgee upon request of the Pledgee;

|

|

(vii)

|

we expressly acknowledge that the Pledgor will be free to dispose of the Collateral until the occurrence of an Event of Default notified to us by the Pledgee. If the Pledgee notifies to us by registered or hand delivery mail that an Event of Default has occurred and that the Pledgor can no longer dispose of the Collateral (the Blocking Notice), we will block all the Collateral and the Pledged Account and we shall not execute anymore the instructions given by the Pledgor;

|

We shall block all the Collateral and the Pledged Account within a reasonable time limit on a best effort basis after the effective receipt of a copy of the Blocking Notice sent by the Pledgee to us at […] Luxembourg by hand delivery or registered mail with acknowledgement of receipt at the attention of Département Juridique (Facsimile: […]).

This acknowledgement as well as the Pledge Agreement are governed by, and shall be construed in accordance with, Luxembourg law.

Yours sincerely,

[…]

By:

Name:

Title:

SCHEDULE C

FORM OF PAYMENT INSTRUCTION

(LETTERHEAD OF THE PLEDGEE)

To: [APPROVED BANK]

To the attention of:

(ADDRESS)

From: [PLEDGEE]

To the attention of:

(ADDRESS)

Cc: [PLEDGOR]

To the attention of:

(ADDRESS)

|

|

[DATE]

|

BY REGISTERED MAIL WITH ACKNOWLEDGEMENT OF RECEIPT

Ladies and Gentlemen,

We refer to the Bank Notice addressed to you by [PLEDGOR] dated [·], a copy of which is attached hereto. Terms defined in such Bank Notice shall have the same meaning when used in this notice.

We herewith notify you in our capacity as Pledgee that, with immediate effect, the authority granted to [PLEDGOR] in connection with the Securities Account or any other account replacing or substituting for this account for whatever reason (as described in the Bank Notice) has been revoked. With respect to Securities Account No [●] we kindly request you to

|

(i)

|

block this Securities Account as soon as possible;

|

|

(ii)

|

not accept or execute any instructions by [Pledgor] or any other person acting on behalf of or in the name of [Pledgor] in respect of such Securities Account; and

|

|

(iii)

|

notify the Pledgee once the blocking of the Securities Account has become effective.

|

We, as the Pledgee, are authorised to collect the amounts standing to the credit of the Securities Account and to take any other action necessary to enforce the Pledge in accordance with the terms of the Bank Notice and the Pledge Agreement.

Please transfer EUR [·] to [Account Number].

The Pledgee

|

|

[●]

|

By:

Name:

Title:

Enclosure