Attached files

May 3, 2010

First Quarter 2010 Review

Peter S. Kraus

Chairman & Chief Executive Officer

David A. Steyn

Chief Operating Officer

John B. Howard

Chief Financial Officer

1Q10 Earnings Call Presentation

2

AllianceBernstein.com

Certain statements provided by management in this presentation are “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties, and other factors that

could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The most

significant of these factors include, but are not limited to, the following: the performance of financial markets, the investment

performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends,

future acquisitions, competitive conditions, and current and proposed government regulations, including changes in tax regulations

and rates and the manner in which the earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions readers to

carefully consider such factors. Further, such forward-looking statements speak only as of the date on which such statements are

made; AllianceBernstein undertakes no obligation to update any forward-looking statements to reflect events or circumstances after

the date of such statements. For further information regarding these forward-looking statements and the factors that could cause

actual results to differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for

the year ended December 31, 2009. Any or all of the forward-looking statements made in this presentation, Form 10-K, other

documents AllianceBernstein files with or furnishes to the SEC, and any other public statements issued by AllianceBernstein, may turn

out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and “Cautions Regarding Forward

-Looking Statements”, and those listed below, could also adversely affect AllianceBernstein’s financial condition, results of operations

and business prospects.

Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties, and other factors that

could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The most

significant of these factors include, but are not limited to, the following: the performance of financial markets, the investment

performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends,

future acquisitions, competitive conditions, and current and proposed government regulations, including changes in tax regulations

and rates and the manner in which the earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions readers to

carefully consider such factors. Further, such forward-looking statements speak only as of the date on which such statements are

made; AllianceBernstein undertakes no obligation to update any forward-looking statements to reflect events or circumstances after

the date of such statements. For further information regarding these forward-looking statements and the factors that could cause

actual results to differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for

the year ended December 31, 2009. Any or all of the forward-looking statements made in this presentation, Form 10-K, other

documents AllianceBernstein files with or furnishes to the SEC, and any other public statements issued by AllianceBernstein, may turn

out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and “Cautions Regarding Forward

-Looking Statements”, and those listed below, could also adversely affect AllianceBernstein’s financial condition, results of operations

and business prospects.

The forward-looking statements referred to in the preceding paragraph include statements regarding:

< The pipeline of new institutional mandates not yet funded: Before they are funded, institutional mandates do not represent

legally binding commitments to fund and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at

the times currently anticipated.

legally binding commitments to fund and, accordingly, the possibility exists that not all mandates will be funded in the amounts and at

the times currently anticipated.

< The expectation that our current AUM level, coupled with a lower expense base sets the stage for improved financial

results: Unanticipated events and factors, including pursuit of strategic initiatives, may expand AllianceBernstein’s expense base,

thus limiting the extent to which it benefits from any positive leverage in future periods. Growth in revenues will depend on the level of

assets under management, which in turn depends on factors such as the actual performance of the capital markets, the performance

of AllianceBernstein’s investment products and other factors beyond its control.

results: Unanticipated events and factors, including pursuit of strategic initiatives, may expand AllianceBernstein’s expense base,

thus limiting the extent to which it benefits from any positive leverage in future periods. Growth in revenues will depend on the level of

assets under management, which in turn depends on factors such as the actual performance of the capital markets, the performance

of AllianceBernstein’s investment products and other factors beyond its control.

Cautions Regarding Forward-Looking Statements

1Q10 Earnings Call Presentation

3

AllianceBernstein.com

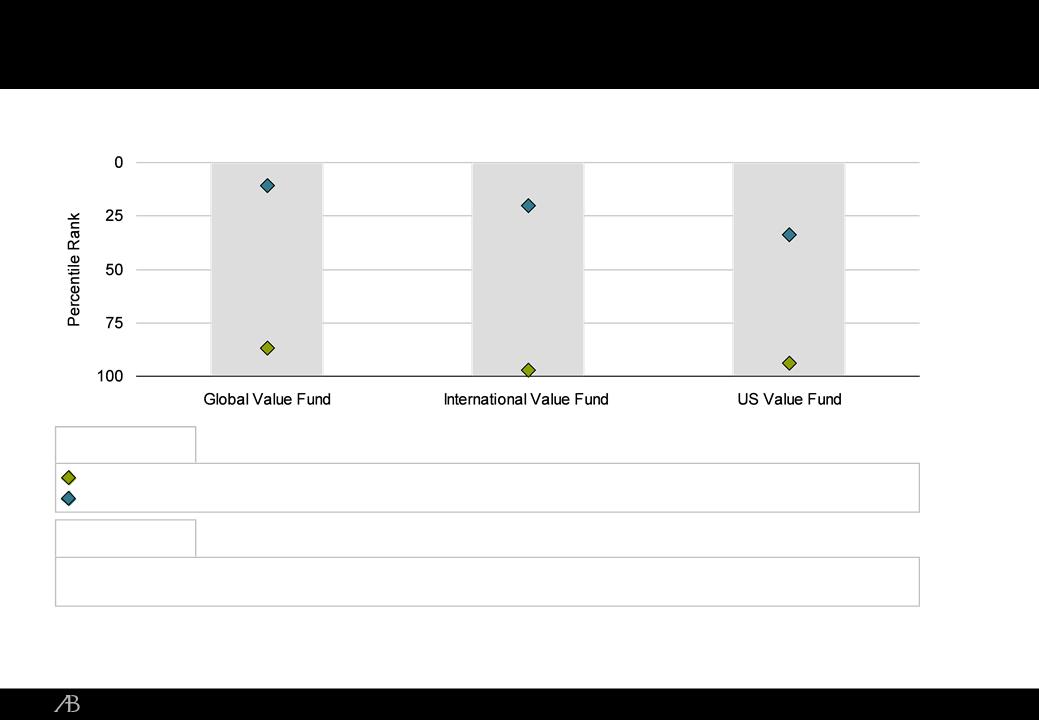

Cumulative Premium

vs. Benchmarks

vs. Benchmarks

As of March 31, 2010

Past Performance is no guarantee of future results. The returns and rankings presented are net of mutual fund A-share expense ratios. Peak-to-Trough time period is defined as October 9, 2007

through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. The Value Fund is part of the Bernstein Diversified Value (Russell 1000 Value). Global Value Fund

is in the Lipper Global Large-Cap Value Universe; International Value Fund is in the International Large Cap Value Funds Universe; Value Fund is in the Lipper Large Cap Value Funds Universe

through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. The Value Fund is part of the Bernstein Diversified Value (Russell 1000 Value). Global Value Fund

is in the Lipper Global Large-Cap Value Universe; International Value Fund is in the International Large Cap Value Funds Universe; Value Fund is in the Lipper Large Cap Value Funds Universe

Composite. Source: Lipper and AllianceBernstein

Lipper Percentile Ranks

Peak-to-Trough (12.1)% (10.3)% (3.7)%

Trough-to-Present 14.4% 12.4% (2.5)%

(MSCI World)

(MSCI EAFE)

(Russell 1000 Value)

Cumulative Premium

vs. Peer Average

vs. Peer Average

Peak-to-Trough (9.4)% (8.5)% (6.3)%

Trough-to-Present 18.8% 11.8% 3.3%

87

97

94

11

20

34

Restoring Competitive Performance

1Q10 Earnings Call Presentation

4

AllianceBernstein.com

As of March 31, 2010

Past Performance is no guarantee of future results. The returns and rankings presented are net of mutual fund A-share total expense ratios. Peak-to-Trough time period is defined as October 9,

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Growth Fund is part of the Alliance Global Research Growth composite and is

measured against the Lipper Global Large Cap Growth Category; International Growth Fund is part of the Alliance International Research Growth All Country composite and is part of the Lipper

International Large Cap Growth Category. Small/Mid Cap Growth Fund is part of the Mid Cap Growth Category. Source: Lipper and AllianceBernstein

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Growth Fund is part of the Alliance Global Research Growth composite and is

measured against the Lipper Global Large Cap Growth Category; International Growth Fund is part of the Alliance International Research Growth All Country composite and is part of the Lipper

International Large Cap Growth Category. Small/Mid Cap Growth Fund is part of the Mid Cap Growth Category. Source: Lipper and AllianceBernstein

Lipper Percentile Ranks

Cumulative Premium

vs. Benchmarks

vs. Benchmarks

Peak-to-Trough (7.8)% (4.4)% (4.3)%

Trough-to-Present (5.0)% 5.0% (5.7)%

Cumulative Premium

vs. Peer Average

vs. Peer Average

Peak-to-Trough (8.1)% (4.0)% (4.9)%

Trough-to-Present (0.2)% 8.3% 7.5%

(MSCI World)

(MSCI AC World ex US)

(Russell 2500 Growth)

97

79

89

39

16

25

Restoring Competitive Performance

1Q10 Earnings Call Presentation

5

AllianceBernstein.com

As of March 31, 2010

*33% Barclays Capital US High Yield 2% Constrained Index, 33% JPMorgan EMBI Global, 33% JPMorgan GBI-EM

Past Performance is no guarantee of future results. The returns and rankings presented are net of mutual fund A-share total expense ratios. Peak-to-Trough time period is defined as October 9,

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Bond Fund is part of Lipper Global Income Funds Category; High Income Fund is part

of Lipper High-Current Yield Funds Category; Intermediate Diversified Municipal Bond Fund is part of Lipper Intermediate Municipal Debt Funds Category. Source: Lipper and AllianceBernstein

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Bond Fund is part of Lipper Global Income Funds Category; High Income Fund is part

of Lipper High-Current Yield Funds Category; Intermediate Diversified Municipal Bond Fund is part of Lipper Intermediate Municipal Debt Funds Category. Source: Lipper and AllianceBernstein

Lipper Percentile Ranks

Cumulative Premium

vs. Benchmarks

vs. Benchmarks

Peak-to-Trough (19.9)% (8.8)% (4.2)%

Trough-to-Present 24.3% 21.7% (0.3)%

Cumulative Premium

vs. Peer Average

vs. Peer Average

Peak-to-Trough (4.6)% 0.7% 3.2%

Trough-to-Present 9.7% 20.0% (2.8)%

(Barclays Global Aggregate

(USD hedged) Index)

(Composite Benchmark*)

(Barclays 5Yr GO Municipal Bond Index)

70

52

88

21

5

14

Restoring Competitive Performance

1Q10 Earnings Call Presentation

6

AllianceBernstein.com

(1) Approximately $86 billion of Blend Strategies AUM are reported in their respective services.

(2) Includes index, structured, asset allocation services and other non-actively managed AUM.

In US dollars billions

Total: ($20.2) ($24.0) ($12.9) ($16.8) ($6.4)

(2)

Net Flows By Investment Service(1)

1Q10 Earnings Call Presentation

7

AllianceBernstein.com

In US dollars billions

Total: ($20.2) ($24.0) ($12.9) ($16.8) ($6.4)

Net Flows By Distribution Channel

1Q10 Earnings Call Presentation

8

AllianceBernstein.com

Billions

< Net outflows improved by 59% sequentially due to a 25% decline in gross outflows

< Sales activity continued to rebound— second consecutive quarter with increased client relationships

< Risk-aversion continued to abate, based on new-account asset mix

< Launched a dynamic approach to managing portfolio risk: adopted by over 2,000 clients since late February

Percentages are calculated using AUM rounded to the nearest million.

Private Client Highlights

1Q10 Earnings Call Presentation

9

AllianceBernstein.com

Billions

< Net flows were positive, improving by $2.9 billion sequentially

< Gross sales were up 34% sequentially

< Mutual fund net inflows for 4th consecutive quarter, fueled primarily by non-US sales and new product launches

=1Q10 included two significant fund launches with a major Asian distributor

=Business in Asia experienced solid growth, driven by new products and distributor relationships

=Mutual fund net flows in US improved as sales increased, but still negative

< 66% of mutual funds (asset-weighted) were in top 50% of peer groups for 1Q10 and one year; 72% for 10 years

Percentages are calculated using AUM rounded to the nearest million.

Retail Highlights

1Q10 Earnings Call Presentation

10

AllianceBernstein.com

< Net outflows improved by 45% compared to 4Q09 and 36% compared to 1Q09 due to decreased gross outflows

< Pipeline of awarded but unfunded mandates increased by 42% sequentially to $5.2 billion from $3.6 billion

< Consultant relations improving; e.g. consultant advocacy key to recent large Global Fixed income mandate award

< Fixed Income success continues:

= Strong performance continued to drive sales of Global Fixed Income services to non-US clients

= Completed final round of PPIP capital raise, exceeding the $1.1 billion original capacity allocation

< Japan Strategic Value named Best Japan Equity service in AsianInvestor 2010 Investment Performance Awards

Billions

Percentages are calculated using AUM rounded to the nearest million.

Institutions Highlights

1Q10 Earnings Call Presentation

11

AllianceBernstein.com

*Source: Management estimate

< 1Q10 revenue up 5% year-over-year and 2% sequentially; Europe up strong double-digits and U.S. down

slightly year-over-year

slightly year-over-year

< Although the industry backdrop remains sluggish, we believe SCB continued to gain share*, driven by

investments in research, new trading services, and geographic footprint

investments in research, new trading services, and geographic footprint

< Research and trading capabilities received recognition:

= Bernstein was again ranked #1 on all key metrics of research quality in a leading independent survey of US

institutional investors

institutional investors

= Sanford C. Bernstein ranked #2 among North American brokers in obtaining the best prices for customers

in an independent, third-party survey of institutional clients

in an independent, third-party survey of institutional clients

< 2010 strategic initiatives remain on track:

= Maintain/expand research preeminence

= Grow US and European share

= Build out Asia research platform

= Expand and grow service set: equity derivatives, European electronic platform, ECM

= Increase collaboration between sellside and Private Client sales team

Bernstein Research Services Highlights

1Q10 Earnings Call Presentation

12

AllianceBernstein.com

4,369

4,761

4,654

4,544

4,276

Five Quarter Headcount Trend

1Q10 Earnings Call Presentation

13

AllianceBernstein.com

In US dollars millions (excluding per-Unit amounts)

*Operating Margin = (Operating Income less Net Income/plus Net Loss of Consolidated Entities Attributable to Non-Controlling Interests) / Net Revenues.

Percentages are calculated using revenues and expenses rounded to the nearest thousand.

(1) Final Federated trail payment to be recorded in second quarter of 2010 and is expected to be lower than in 1Q10

(2) Higher Venture Capital Fund losses in 1Q10

(3) 1Q10 GAAP results include a real estate sublease charge of $12 million, or $0.04 per Unit

|

|

1Q

2010 |

1Q

2009 |

Percent

Change |

|

4Q

2009 |

Percent

Change |

|

Net Revenues

|

$725

|

$598

|

21%

|

|

$782

|

-7%

|

|

Operating Expenses

|

585

|

564

|

4%

|

|

582

|

1%

|

|

Operating Income

|

140

|

34

|

314%

|

|

200

|

-30%

|

|

Non-Operating Income(1)

|

4

|

6

|

-28%

|

|

5

|

-1%

|

|

Income Before Income Taxes

|

144

|

40

|

261%

|

|

205

|

-29%

|

|

Income Taxes

|

13

|

8

|

52%

|

|

14

|

-6%

|

|

Net Income

|

131

|

32

|

317%

|

|

191

|

-31%

|

|

Net (Income) Loss of Consolidated Entities

Attributable to Non-Controlling Interests(2) |

17

|

5

|

214%

|

|

1

|

n/m

|

|

Net Income Attributable to AllianceBernstein Unitholders

|

$148

|

$37

|

302%

|

|

$192

|

-23%

|

|

AllianceBernstein L.P. Diluted Net Income per Unit(3)

|

$0.53

|

$0.14

|

279%

|

|

$0.70

|

-24%

|

|

Operating Margin*

|

21.6%

|

6.5%

|

|

|

25.7%

|

|

|

AllianceBernstein Holding L.P. Diluted Net Income per Unit(3)

|

$0.46

|

$0.07

|

557%

|

|

$0.62

|

-26%

|

First Quarter 2010 Net Income

1Q10 Earnings Call Presentation

14

AllianceBernstein.com

Percentages are calculated using revenues and expenses rounded to the nearest thousand.

In US dollars millions

(1) Y/Y: 1Q10 Deferred Comp gains vs. 1Q09 losses and higher Venture Capital Fund losses in 1Q10

Q/Q: Higher Venture Capital Fund losses and lower Deferred Comp gains in 1Q10

(2) Other Revenues primarily comprised of shareholder servicing fees and dividend and interest income

|

Revenues |

1Q

2010 |

1Q

2009 |

Percent

Change |

|

4Q

2009 |

Percent

Change |

|

Base Fees

|

$509

|

$433

|

18%

|

|

$527

|

-3%

|

|

Performance Fees

|

3

|

12

|

-78%

|

|

16

|

-84%

|

|

Bernstein Research

|

111

|

106

|

5%

|

|

109

|

2%

|

|

Distribution

|

80

|

58

|

38%

|

|

81

|

-1%

|

|

Investment Gains (Losses)(1)

|

-8

|

-41

|

-81%

|

|

14

|

n/m

|

|

Other Revenues(2)

|

31

|

32

|

-4%

|

|

36

|

-15%

|

|

Total Revenues

|

726

|

600

|

21%

|

|

783

|

-7%

|

|

Less: Interest Expense

|

1

|

2

|

-59%

|

|

1

|

43%

|

|

Net Revenues

|

$725

|

$598

|

21%

|

|

$782

|

-7%

|

First Quarter 2010 Revenues

1Q10 Earnings Call Presentation

15

AllianceBernstein.com

Percentages are calculated using AUM rounded to the nearest million and revenues to the nearest thousand.

In US dollars

(1) Y/Y: Fees from closed All Asset Deep Value Fund in 1Q09

Q/Q: Hedge Fund fees in 4Q09

|

|

1Q

2010 |

1Q

2009 |

Percent

Change |

|

4Q

2009 |

Percent

Change |

|

Ending AUM ($ Billions)

|

$501

|

$411

|

22%

|

|

$496

|

1%

|

|

Average AUM ($ Billions)

|

$490

|

$424

|

16%

|

|

$494

|

-1%

|

|

|

|

|

|

|

|

|

|

By Fee Type ($ Millions):

|

|

|

|

|

|

|

|

Base Fees

|

$509

|

$433

|

18%

|

|

$527

|

-3%

|

|

Performance Fees(1)

|

3

|

12

|

-78%

|

|

16

|

-84%

|

|

Total

|

$512

|

$445

|

15%

|

|

$543

|

-6%

|

|

|

|

|

|

|

|

|

|

Base Fees By Channel ($ Millions):

|

|

|

|

|

|

|

|

Institutions

|

$196

|

$185

|

7%

|

|

$212

|

-7%

|

|

Retail

|

$152

|

$111

|

37%

|

|

$154

|

-1%

|

|

Private Client

|

$161

|

$137

|

17%

|

|

$161

|

-

|

|

Total

|

$509

|

$433

|

18%

|

|

$527

|

-3%

|

First Quarter 2010 Advisory Fees

1Q10 Earnings Call Presentation

16

AllianceBernstein.com

*“Other” includes Interest and Amortization of Intangibles.

Percentages are calculated using expenses rounded to the nearest thousand.

In US dollars millions

(1) Approximately $8 million, $8 million and $6 million in Bernstein Research Services transaction costs were reclassified from General and Administrative to

Promotion and Servicing expenses for 1Q10, 1Q09 and 4Q09, respectively

Promotion and Servicing expenses for 1Q10, 1Q09 and 4Q09, respectively

(2) Y/Y: Improved Foreign Exchange P&L ($7M) offset by higher real estate sublease charges ($12M in 1Q10 vs. $7M in 1Q09)

Q/Q: 1Q10 includes $12M real estate sublease charge

|

Expenses |

1Q

2010 |

1Q

2009 |

Percent

Change |

|

|

4Q

2009 |

Percent

Change |

|

|

Compensation &

Benefits |

$319

|

$314

|

2%

|

< Slide 17

|

|

$323

|

-1%

|

< Slide 17

|

|

Promotion &

Servicing(1) |

122

|

105

|

16%

|

< Higher distribution plan

expenses |

|

128

|

-5%

|

< Lower distribution plan and

travel-related expenses |

|

General &

Administrative(1)(2) |

138

|

139

|

-1%

|

|

|

125

|

11%

|

|

|

Other*

|

6

|

6

|

-

|

|

|

6

|

-

|

|

|

Total

|

$585

|

$564

|

4%

|

|

|

$582

|

1%

|

|

First Quarter 2010 Operating Expenses

1Q10 Earnings Call Presentation

17

AllianceBernstein.com

Percentages are calculated using expenses rounded to the nearest thousand.

In US dollars millions

|

|

1Q

2010 |

1Q

2009 |

Percent

Change |

|

4Q

2009 |

Percent

Change |

|

Base Compensation(1)

|

$105

|

$127

|

-17%

|

|

$115

|

-9%

|

|

Incentive Compensation

|

|

|

|

|

|

|

|

Cash

|

68

|

69

|

-1%

|

|

71

|

-4%

|

|

Deferred Compensation(2)

|

58

|

33

|

76%

|

|

62

|

-7%

|

|

Total

|

126

|

102

|

24%

|

|

133

|

-5%

|

|

Commissions

|

52

|

52

|

-

|

|

47

|

12%

|

|

Fringes & Other(3)

|

36

|

33

|

8%

|

|

28

|

27%

|

|

Total

|

$319

|

$314

|

2%

|

|

$323

|

-1%

|

(1) Base compensation decreased due to lower severance and base salaries; severance charges were $5M, $21M and $12M for 1Q10, 1Q09 and 4Q09,

respectively

respectively

(2) Y/Y: Increase due to change in amortization of mark-to-market on deferred compensation mutual fund awards and higher amortization of

AllianceBernstein Unit awards (see slide 34 for detail)

AllianceBernstein Unit awards (see slide 34 for detail)

(3) Sequential increase in Fringes and Other due primarily to higher payroll taxes in 1Q10, resulting from annual reset of employer tax caps

First Quarter 2010 Compensation & Benefits

1Q10 Earnings Call Presentation

18

AllianceBernstein.com

Percentages are calculated using income, earnings and expenses rounded to the nearest thousand.

In US dollars millions (except per Unit amounts)

|

|

1Q

2010 |

1Q

2009 |

Percent

Change |

|

4Q

2009 |

Percent

Change |

|

AllianceBernstein

|

|

|

|

|

|

|

|

Net Income Attributable to AllianceBernstein

|

$148

|

$37

|

302%

|

|

$192

|

-23%

|

|

Weighted Average Equity Ownership Interest

|

36.6%

|

34.2%

|

|

|

35.0%

|

|

|

AllianceBernstein Holding

|

|

|

|

|

|

|

|

Equity in Net Income

Attributable to AllianceBernstein |

$54

|

$13

|

330%

|

|

$67

|

-19%

|

|

Income Taxes

|

7

|

6

|

18%

|

|

7

|

-

|

|

Net Income

|

$47

|

$7

|

601%

|

|

$60

|

-21%

|

|

Diluted Net Income Per Unit

|

$0.46

|

$0.07

|

557%

|

|

$0.62

|

-26%

|

|

Distributions Per Unit

|

$0.46

|

$0.07

|

557%

|

|

$0.62

|

-26%

|

AllianceBernstein Holding Financial Results

1Q10 Earnings Call Presentation

19

AllianceBernstein.com

Q & A

1Q10 Earnings Call Presentation

20

AllianceBernstein.com

Appendix

1Q10 Earnings Call Presentation

21

AllianceBernstein.com

International Value

US Diversified Value

Benchmark MSCI World (Cap, UH, net) MSCI EAFE (Cap, UH, net) Russell 1000 Value

1Q10

CY2009

CY2008

CY2007

CY2006

CY2005

Institutional Equity Composites vs. Benchmarks

Percent

Performance is preliminary.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of composites is presented after investment management fees.

Value Equity: Relative Performance

1Q10 Earnings Call Presentation

22

AllianceBernstein.com

International Large Cap Growth

Benchmark Russell 1000 Growth MSCI World (Cap, UH, net) MSCI EAFE (Cap, UH, net)

Institutional Equity Composites vs. Benchmarks

Percent

Performance is preliminary.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of composites is presented after investment management fees.

1Q10

CY2009

CY2008

CY2007

CY2006

CY2005

Growth Equity: Relative Performance

1Q10 Earnings Call Presentation

23

AllianceBernstein.com

International Blend

Global Blend

Institutional Blend Strategies Composites vs. Benchmarks

Percent

Benchmark MSCI World (Cap, UH, net) MSCI EAFE (Cap, UH, net) MSCI EM (Cap, UH, net)

Performance is preliminary.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of composites is presented after investment management fees.

Blend Strategies: Relative Performance

1Q10

CY2009

CY2008

CY2007

CY2006

CY2005

1Q10 Earnings Call Presentation

24

AllianceBernstein.com

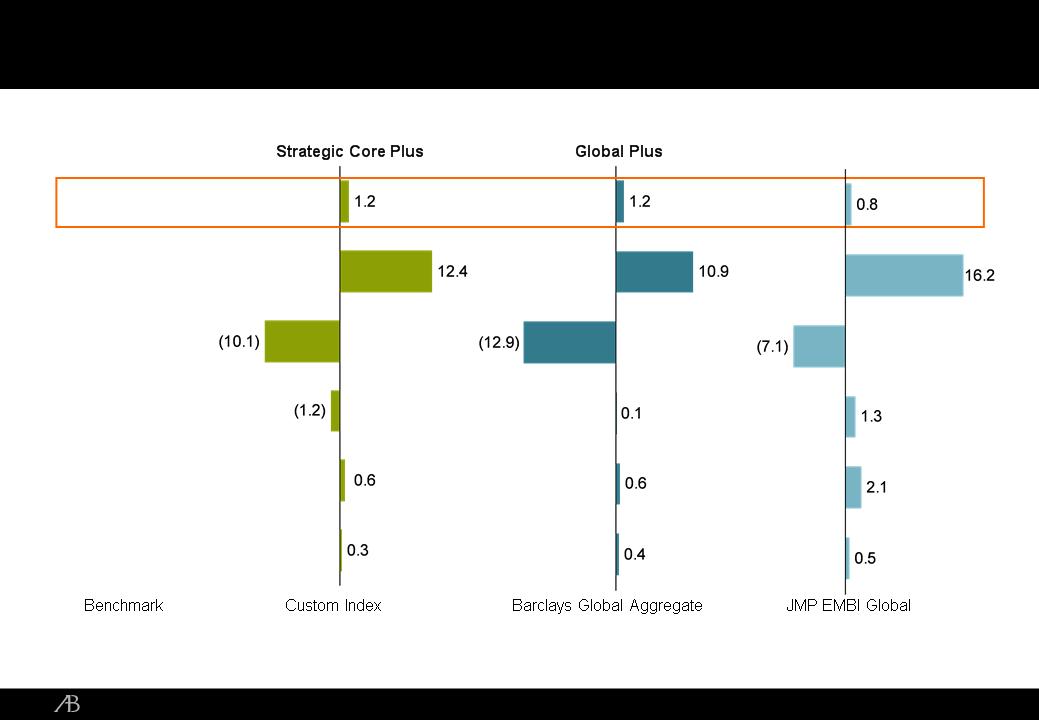

Institutional Fixed Income Composites vs. Benchmarks

Percent

Bond Index (Unhedged)

Performance is preliminary.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of composites is presented after investment management fees.

Emerging Market Debt

1Q10

CY2009

CY2008

CY2007

CY2006

CY2005

Fixed Income: Relative Performance

1Q10 Earnings Call Presentation

25

AllianceBernstein.com

Performance is preliminary.

As of March 31, 2010

Investment performance of composites is presented after investment management fees. Periods of more than one year are annualized.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Institutional Equity Composites vs. Benchmarks

Institutional Value Equity: Relative Performance

1Q10 Earnings Call Presentation

26

AllianceBernstein.com

Performance is preliminary.

As of March 31, 2010

Investment performance of composites is presented after investment management fees. Periods of more than one year are annualized.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Institutional Equity Composites vs. Benchmarks

Institutional Growth Equity: Relative Performance

1Q10 Earnings Call Presentation

27

AllianceBernstein.com

Performance is preliminary.

As of March 31, 2010

Investment performance of composites is presented after investment management fees. Periods of more than one year are annualized.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Institutional Blend Strategies Equity Composites vs. Benchmarks

|

|

|

Periods Ended March 31, 2010

|

|

|||

|

Service

|

1Q

2010 |

One

Year |

Three

Years |

Five

Years |

10

Years |

Benchmark

|

|

Global Blend Strategies

|

(1.4)

|

0.6

|

(5.8)

|

(2.8)

|

N/A

|

MSCI World

|

|

International Blend Strategies

|

(0.6)

|

(1.9)

|

(3.0)

|

(2.1)

|

N/A

|

MSCI EAFE

|

|

US Blend Strategies

|

(0.5)

|

0.8

|

(1.8)

|

(0.8)

|

N/A

|

S&P 500

|

|

Emerging Markets Blend Strategies

|

(0.6)

|

7.5

|

(2.3)

|

(2.4)

|

N/A

|

MSCI EM

|

Institutional Blend Strategies: Relative Performance

1Q10 Earnings Call Presentation

28

AllianceBernstein.com

Performance is preliminary.

As of March 31, 2010

Investment performance of composites is presented after investment management fees. Periods of more than one year are annualized.

*The benchmarks listed are the current benchmarks for the investments service—certain benchmarks have evolved over time and therefore are time blended.

The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Institutional Fixed Income Composites vs. Benchmarks*

Institutional Fixed Income: Relative Performance

1Q10 Earnings Call Presentation

29

AllianceBernstein.com

Performance is preliminary.

As of March 31, 2010

Investment performance of composites is presented after investment management fees. Periods of more than one year are annualized.

*The Fully Diversified 60% stocks/40% bonds (simulation) is meant to be illustrative of the value generated by the "total solution" approach AllianceBernstein encourages for most clients: a

diversified allocation across investment portfolios of varying types aimed at optimizing return and volatility over time. The Bernstein Fully Diversified Portfolio is composed of specific proportions of

each of the products that follow, which were included in the simulation as of the following dates: Strategic Value—January 1, 1983; Strategic Growth—January 1, 1983 (ACM Large Cap Growth

used as a proxy for Strategic Growth through January 1, 2001; Strategic Growth used thereafter); Intermediate Municipal Bond Composite—January 1, 1983; Bernstein Tax-Managed International

Fund—July 1, 1992; Emerging Markets Fund—January 1, 1996; AllianceBernstein Institutional REIT Fund—July 1, 2001. The AllianceBernstein Institutional REIT Fund was removed from the

simulation on December 31, 2008. The portfolio was rebalanced quarterly through December 31, 2005; monthly thereafter. Simulated performance results have certain inherent limitations. The

results may not reflect the impact that certain material economic and market factors might have had on actual decision making if they were reflective of a managed account. No representation is

being made that any account will, or is likely to, achieve profits or losses similar to those described herein.

diversified allocation across investment portfolios of varying types aimed at optimizing return and volatility over time. The Bernstein Fully Diversified Portfolio is composed of specific proportions of

each of the products that follow, which were included in the simulation as of the following dates: Strategic Value—January 1, 1983; Strategic Growth—January 1, 1983 (ACM Large Cap Growth

used as a proxy for Strategic Growth through January 1, 2001; Strategic Growth used thereafter); Intermediate Municipal Bond Composite—January 1, 1983; Bernstein Tax-Managed International

Fund—July 1, 1992; Emerging Markets Fund—January 1, 1996; AllianceBernstein Institutional REIT Fund—July 1, 2001. The AllianceBernstein Institutional REIT Fund was removed from the

simulation on December 31, 2008. The portfolio was rebalanced quarterly through December 31, 2005; monthly thereafter. Simulated performance results have certain inherent limitations. The

results may not reflect the impact that certain material economic and market factors might have had on actual decision making if they were reflective of a managed account. No representation is

being made that any account will, or is likely to, achieve profits or losses similar to those described herein.

Source: Standard and Poor’s, Morgan Stanley, Lipper and AllianceBernstein

|

|

|

Periods Ended March 31, 2010

|

|||

|

Service

|

1Q

2010 |

One

Year |

Three

Years |

Five

Years |

10

Years |

|

Fully Diversified Simulation*

|

2.7

|

32.0

|

(3.3)

|

2.8

|

3.3

|

|

S&P 500

|

5.4

|

49.8

|

(4.2)

|

1.9

|

(0.7)

|

|

|

|

|

|

|

|

|

MSCI World (net)

|

3.2

|

52.4

|

(5.4)

|

2.9

|

(0.0)

|

|

|

|

|

|

|

|

|

Lipper Short/Int Blended Muni Fund

Avg |

0.7

|

6.2

|

3.4

|

3.3

|

3.9

|

|

|

Private Client: Absolute Performance

1Q10 Earnings Call Presentation

30

AllianceBernstein.com

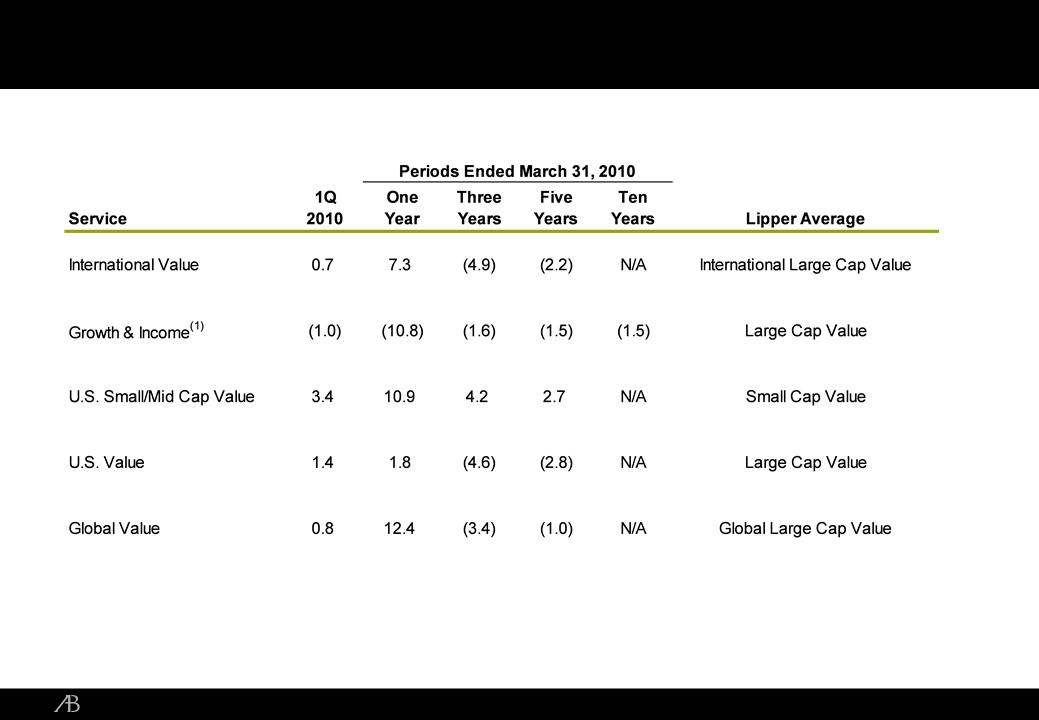

Retail Mutual Funds vs. Lipper Averages

NOTE: The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of mutual funds is presented after investment management fees.

(1) Performance figures other than 1Q2010 and One Year are positively affected by class action settlement proceeds.

Source: AllianceBernstein and Lipper. Mutual Fund and Lipper performance data through 3/31/10.

Retail Value Equity: Relative Performance

1Q10 Earnings Call Presentation

31

AllianceBernstein.com

Retail Mutual Funds vs. Lipper Averages

NOTE: The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of mutual funds is presented after investment management fees.

Investment performance of mutual funds is presented after investment management fees.

(1) Performance figures other than 1Q2010 and One Year are positively affected by class action settlement proceeds.

Source: AllianceBernstein, Morningstar, and Lipper. Mutual Fund, Morningstar, and Lipper performance data through 3/31/10.

Retail Growth Equity: Relative Performance

1Q10 Earnings Call Presentation

32

AllianceBernstein.com

Retail Fixed Income Funds vs. Peer Group Averages

NOTE: The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of mutual funds is presented after investment management fees.

Source: AllianceBernstein, Morningstar, and Lipper. Mutual Fund, Morningstar, and Lipper performance data through 3/31/10.

Retail Fixed Income: Relative Performance

1Q10 Earnings Call Presentation

33

AllianceBernstein.com

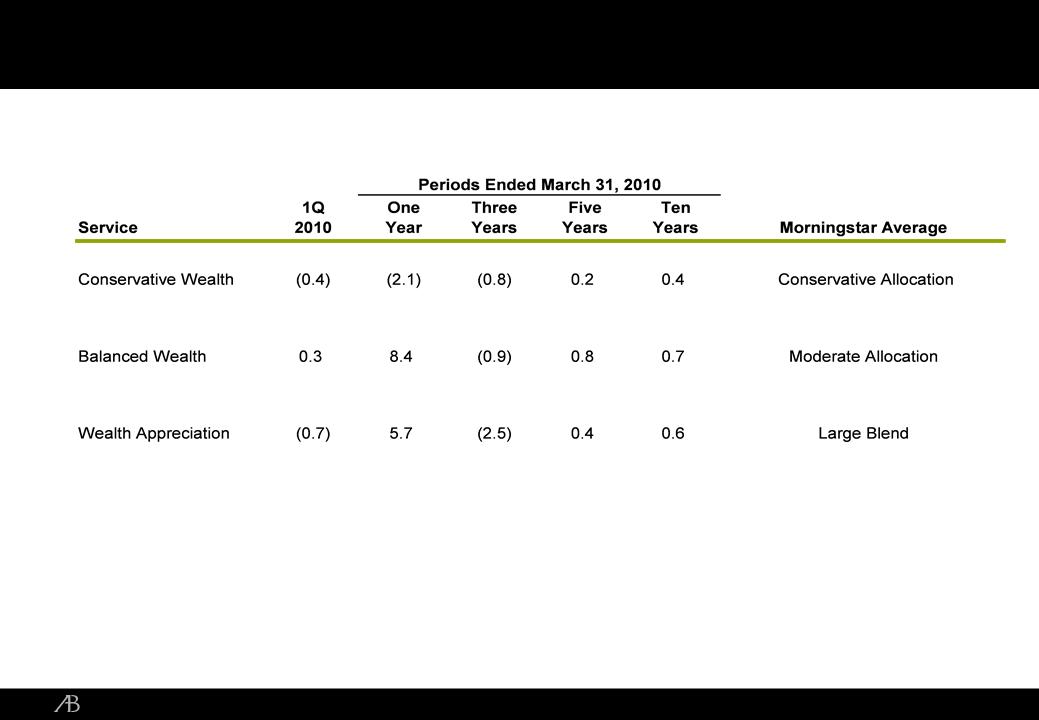

Retail Mutual Funds vs. Morningstar Averages

NOTE: The information in this table is provided solely for use in connection with this presentation, and is not directed toward existing or potential investment advisory clients of AllianceBernstein.

Investment performance of mutual funds is presented after investment management fees.

Source: AllianceBernstein and Morningstar. Mutual fund and Morningstar performance data through 3/31/10.

Wealth Strategies: Relative Performance

1Q10 Earnings Call Presentation

34

AllianceBernstein.com

In US dollars millions

|

|

4Q

2008 |

1Q

2009 |

2Q

2009 |

3Q

2009 |

4Q

2009 |

1Q

2010 |

|

Revenues

|

|

|

|

|

|

|

|

Investment Gains (Losses)

|

($131)

|

($28)

|

$63

|

$71

|

$15

|

$11

|

|

Dividends

|

7

|

1

|

2

|

1

|

4

|

1

|

|

Total Revenues

|

($124)

|

($27)

|

$65

|

$72

|

$19

|

$12

|

|

Expenses

|

|

|

|

|

|

|

|

Amortization of Original Awards

|

$59

|

$45

|

$39

|

$40

|

$36

|

$31

|

|

Amortization of MTM - Prior Periods

|

(20)

|

(17)

|

(16)

|

(11)

|

(6)

|

(4)

|

|

Amortization of MTM - Current Quarter

|

(60)

|

(12)

|

25

|

28

|

8

|

4

|

|

% of Investment Gains (Losses)

|

46%

|

43%

|

40%

|

39%

|

53%

|

36%

|

|

Dividends

|

7

|

1

|

1

|

1

|

4

|

1

|

|

Sub-Total of Mutual Fund Expenses

|

(14)

|

17

|

49

|

58

|

42

|

32

|

|

Amortization of AB Units

|

16

|

11

|

10

|

11

|

19

|

23

|

|

Other

|

2

|

5

|

3

|

4

|

1

|

3

|

|

Total expenses

|

$4

|

$33

|

$62

|

$73

|

$62

|

$58

|

|

Net P&L impact of Mutual Fund Grants

|

($110)

|

($44)

|

$16

|

$14

|

($23)

|

($20)

|

Six-Quarter Deferred Compensation Net P&L Trend

1Q10 Earnings Call Presentation

35

AllianceBernstein.com

In US dollars millions

|

Assets

|

Mar 31, 2010

|

Dec 31, 2009

|

|

Cash and cash equivalents

|

$584

|

$614

|

|

Cash and securities, segregated

|

1,005

|

985

|

|

Receivables, net

|

1,185

|

1,099

|

|

Investments:

|

|

|

|

Deferred compensation - related

|

372

|

401

|

|

Other

|

407

|

374

|

|

Goodwill, net

|

2,893

|

2,893

|

|

Intangible assets, net

|

219

|

224

|

|

Deferred sales commissions, net

|

87

|

90

|

|

Other (incl. furniture & equipment, net)

|

534

|

535

|

|

Total Assets

|

$7,286

|

$7,215

|

|

|

|

|

|

Liabilities and Capital

|

|

|

|

Liabilities:

|

|

|

|

Payables

|

$1,776

|

$1,670

|

|

Accounts payable and accrued expenses

|

335

|

278

|

|

Accrued compensation and benefits

|

341

|

316

|

|

Debt

|

206

|

249

|

|

Total Liabilities

|

2,658

|

2,513

|

|

|

|

|

|

Partners' capital attributable to AllianceBernstein Unitholders

|

4,474

|

4,530

|

|

Non-controlling interests in consolidated entities

|

154

|

172

|

|

Total Capital

|

4,628

|

4,702

|

|

Total Liabilities and Capital

|

$7,286

|

$7,215

|

Consolidated Balance Sheet

1Q10 Earnings Call Presentation

36

AllianceBernstein.com

In US dollars millions

|

|

Three Months Ended

|

|

|

|

Mar 31, 2010

|

Mar 31, 2009

|

|

Cash Flows From Operating Activities:

|

|

|

|

Net Income

|

$131

|

$32

|

|

Non-cash items:

|

|

|

|

Amortization of deferred sales commissions

|

12

|

15

|

|

Amortization of non-cash deferred compensation

|

26

|

16

|

|

Depreciation and other amortization

|

21

|

21

|

|

Unrealized gains on deferred compensation - related investments

|

(24)

|

(16)

|

|

Unrealized loss on consolidated venture capital fund

|

21

|

6

|

|

Other

|

5

|

2

|

|

Changes in assets and liabilities

|

26

|

(29)

|

|

Net cash provided by operating activities

|

218

|

47

|

|

Cash Flows From Investing Activities:

|

|

|

|

Purchases of investments

|

-

|

(2)

|

|

Proceeds from sales of investments

|

-

|

2

|

|

Additions to furniture, equipment and leasehold improvements

|

(1)

|

(29)

|

|

Net cash used in investing activities

|

(1)

|

(29)

|

|

Cash Flows From Financing Activities:

|

|

|

|

(Repayment) issuance of commercial paper, net

|

(43)

|

11

|

|

Proceeds from bank loans, net

|

-

|

66

|

|

Increase (decrease) in overdrafts payable

|

24

|

(14)

|

|

Distributions to General Partner and unitholders

|

(194)

|

(99)

|

|

Purchases of Holding Units to fund deferred compensation awards, net

|

(24)

|

(1)

|

|

Other

|

5

|

7

|

|

Net cash used in financing activities

|

(232)

|

(30)

|

|

Effect of exchange rate changes on cash and cash equivalents

|

(15)

|

(2)

|

|

Net decrease in cash and cash equivalents

|

(30)

|

(14)

|

|

Cash and cash equivalents at the beginning of period

|

614

|

553

|

|

Cash and cash equivalents at the end of period

|

$584

|

$539

|

Consolidated Statement of Cash Flows

1Q10 Earnings Call Presentation

37

AllianceBernstein.com

In US dollars billions

|

|

Institutions

|

Retail

|

Private Client

|

Total

|

|

Beginning of Period

|

$300.0

|

$120.7

|

$74.8

|

$495.5

|

|

Sales/New accounts

|

3.5

|

10.5

|

2.1

|

16.1

|

|

Redemptions/Terminations

|

(9.9)

|

(6.3)

|

(1.5)

|

(17.7)

|

|

Cash flow

|

(2.2)

|

(1.4)

|

(0.8)

|

(4.4)

|

|

Unreinvested dividends

|

-

|

(0.3)

|

(0.1)

|

(0.4)

|

|

Net Flows

|

(8.6)

|

2.5

|

(0.3)

|

(6.4)

|

|

Investment Performance

|

5.6

|

4.6

|

2.0

|

12.2

|

|

End of Period

|

$297.0

|

$127.8

|

$76.5

|

$501.3

|

|

% Total at end of period

|

59%

|

26%

|

15%

|

100%

|

|

% Change from beg of period

|

-1%

|

6%

|

2%

|

1%

|

Three-months ended 3/31/10 AUM Rollforward by Distribution Channel

1Q10 Earnings Call Presentation

38

AllianceBernstein.com

In US dollars billions

|

|

Value

Equity |

Growth

Equity |

Fixed

Income |

Other

|

Total

|

|

Beginning of Period

|

$171.2

|

$94.1

|

$184.3

|

$45.9

|

$495.5

|

|

Sales/New accounts

|

2.3

|

2.5

|

10.4

|

0.9

|

16.1

|

|

Redemptions/Terminations

|

(6.7)

|

(6.0)

|

(4.9)

|

(0.1)

|

(17.7)

|

|

Cash flow

|

(2.9)

|

(1.4)

|

0.1

|

(0.2)

|

(4.4)

|

|

Unreinvested dividends

|

-

|

-

|

(0.4)

|

-

|

(0.4)

|

|

Net Flows

|

(7.3)

|

(4.9)

|

5.2

|

0.6

|

(6.4)

|

|

Investment Performance

|

5.5

|

2.0

|

2.8

|

1.9

|

12.2

|

|

End of Period(2)

|

$169.4

|

$91.2

|

$192.3

|

$48.4

|

$501.3

|

|

% Total at end of period

|

34%

|

18%

|

38%

|

10%

|

100%

|

|

% Change from beg of period

|

-1%

|

-3%

|

4%

|

5%

|

1%

|

(1) Includes index, structured, asset allocation services and other non-actively managed AUM.

(2) Approximately $86 billion in Blend Strategies AUM are reported in their respective services.

(1)

Three-months ended 3/31/10 AUM Rollforward by Investment Service

1Q10 Earnings Call Presentation

39

AllianceBernstein.com

In US dollars billions

As of March 31, 2010

Retail

Private Client

$297.0 $127.8 $76.5

AUM by Region