Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Colony Capital, Inc. | d8k.htm |

May 2010

EXHIBIT 99.1 |

1

Forward-Looking Statements

Some of the statements contained in this presentation constitute forward-looking statements within

the meaning of the federal securities laws. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In some cases, you can identify

forward-looking statements by the use of forward- Looking terminology such as

“may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or

the negative of these words and phrases or similar words or phrases which are predictions of or

indicate future events or trends and which do not relate solely to historical matters. You can

also identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this presentation reflect our current views about

future events and are subject to numerous known and unknown risks, uncertainties, assumptions

and changes in circumstances that may cause our actual results to differ significantly from those

expressed in any forward-looking statement. Statements regarding the following subjects, among

others, may be forward-looking: the use of proceeds from our initial public offering and

the concurrent private placement; our business and investment strategy; our projected operating

results; our ability to obtain financing arrangements; financing and advance rates for our target

assets; our expected leverage; general volatility of the securities markets in which we invest;

our expected investments; our expected co-investment allocations and related requirements; interest

rate mismatches between our target assets and our borrowings used to fund such investments; changes in

interest rates and the market value of our target assets; changes in prepayment rates on our

target assets; effects of hedging instruments on our target assets; rates of default or

decreased recovery rates on our target assets; the degree to which our hedging strategies may or may

not protect us from interest rate volatility; impact of changes in governmental regulations,

tax law and rates, and similar matters; our ability to maintain our qualification as a REIT for U.S.

federal income tax purposes; our ability to maintain our exemption from registration under the 1940

Act; availability of investment opportunities in mortgage-related and real

estate-related investments and other securities; availability of qualified personnel; estimates relating to our ability to

make distributions to our stockholders in the future; our understanding of our competition; and market

trends in our industry, interest rates, real estate values, the debt securities markets or the

general economy. While forward-looking statements reflect our good faith beliefs,

assumptions and expectations, they are not guarantees of future performance. Furthermore, we

disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or

factors, new information, data or methods, future events or other changes. For a further discussion of

these and other factors that could cause our future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2010 and subsequent filings with the SEC.

This presentation contains statistics and other data that has been obtained from or compiled from

information made available by third-party service providers. We have not independently

verified such statistics or data. Certain of the following slides present

information related to the prior performance of Colony Capital, LLC and its affiliates. This

information is provided for informational purposes only and is not intended to be indicative of future

results. Actual performance of Colony Financial, Inc. may vary materially.

|

2

Colony Financial, Inc. Overview

Colony Financial (NYSE: CLNY)

•

Commercial mortgage REIT focused on acquiring and originating commercial real estate

mortgage loans and real estate-related debt

•

Priced September 23, 2009 at $20.00/share

•

Total gross proceeds of $292.5 million

•

Externally managed by a subsidiary of Colony Capital, LLC

•

Sponsor investment of $10.75 million

•

1.50%

management

fee

on

committed

equity

(ramps

as

IPO

equity

is

deployed)

•

20% incentive fee above 8% trailing twelve-month ROI to investors (paid solely

in stock) $1.2 billion of total Colony Capital equity invested and committed,

primarily in distressed debt investments, since October 2009; $215 million

allocated to Colony Financial, Inc.

(1)

Approximately 78% of IPO Capital Invested / Committed To-Date

(1)

Assumes

an

estimated

$400mm

equity

stake

in

First

Republic

Bank,

including

$24

million

allocated

to

Colony

Financial,

Inc. |

3

Investment Highlights

*Past performance is not a guarantee of future results.

(1)

Includes investment-specific co-investment vehicles.

(2)

Internal

rates

of

return

(gross)

before

fees,

expenses,

and

general

partner’s

carried

interest,

calculated

using

a

“time-zero”

methodology

in

which

the

cash flows

of all investments (actual amounts of contributions and distributions) are based from the same

hypothetical starting date. (3)

Internal

rates

of

return

(net)

after

fees,

expenses,

and

general

partner’s

carried

interest,

calculated

using

a

“time-zero”

methodology

in

which

the

cash

flows

of

all investments (actual amounts of contributions and distributions) are based from the same

hypothetical starting date. Historic

Market

Opportunity

•

Long term opportunity to acquire and originate CRE debt with attractive risk-adjusted

returns

•

Hybrid financial institution/real estate company

•

REIT election for tax efficiency

Premier

Sponsor

•

Sponsored by Colony Capital –

a leading global real estate investment firm founded in

1991 by Thomas J. Barrack, Jr.

•

32

private

investment

vehicles

(1)

/

$16.1

billion

of

equity

raised

over

19-year

history

•

Experienced and tenured executive team with over 200 employees in 13 offices across

10 countries with in-house asset management and servicing capabilities

Relevant

Experience

•

Deep experience underwriting and investing in CRE debt dating back to RTC era

•

28%

gross

(2)

/

21%

net

(3)

internal

rate

of

return

(“IRR”)

on

all

realized

debt

investments

since 1991 involving 24 transactions and 4,674 assets*

•

Colony Capital investing through its private distressed real estate credit fund since

July 2008

Robust

Pipeline

•

CLNY continues to source attractive deal flow and our pipeline is ramping

•

Invested, or committed to invest 78% of our net IPO proceeds in first three quarters of

operation

•

Colony Capital’s global platform provides a significant advantage

Recent investments in Europe, sourced via regional offices

Co-investments with private funds allow us to access bigger deals

CLNY’s

allocation right increases from 33% to 50% upon expiry of CDCF’s

investment

period (July 2010) |

Thomas J. Barrack,

Jr. (Chairman)

Richard Saltzman

(President)

Executive Committee

(8 Members)

Investor

Relations

Executive, Legal

and Administrative

Finance and

Accounting

Acquisitions

Asset

Management

Colony Capital, LLC

•

13 offices in 10 countries

•

Over 200 employees

•

Since inception invested in ~10,000

assets acquired for ~$45 billion

Global Footprint

Santa Monica •

Boston •

New York •

London •

Madrid •

Paris •

Rome •

Beirut •

Beijing •

Hong Kong •

Seoul •

Taipei •

Tokyo

4

Note: Above includes Colony Realty Partners, LLC, Colony Capital SAS, and other affiliates of Colony

Capital LLC. |

5

Special

servicers

Key Relationships Cultivated Over Decades

Differentiated Deal Sourcing Sets Us Apart from Our Competition

BORROWERS

•

Private

investors

•

Real estate

operating

companies

•

Real estate

funds

•

REITs

•

Developers

•

Homebuilders

PROPRIETARY

DEAL

FLOW

FINANCIAL INSTITUTIONS

•

Commercial

banks

•

Pension

funds

•

Life insurance

companies

•

Specialty

finance

companies

•

Hedge funds

•

Investment

banks

GOVERNMENT

•

FDIC

•

OTS

•

Treasury

•

OCC

•

FRB

•

HUD

Differentiated

Deal Sourcing

•

Strong relationships with the government (including FDIC), banks

and other

financial institutions, public and private real estate companies

•

Ability to make secondary CRE loan acquisitions including NPLs

/ Loan-to-Own and

to originate new loans

•

Recent experience acquiring loan portfolios from FDIC

•

Global platform has already yielded two deals in Europe |

6

Colony Investment Track Record

Colony Capital’s experience

•

Colony Capital has invested in over 10,000 assets with acquisition value of

approximately $45 billion

•

Since 1991, $16.1 billion equity raised and invested in real estate debt and equity

During the RTC era, Colony Fund I executed $1.7 billion of transactions with

government agencies and financial institutions comprising 1,093 assets

•

Colony Capital was founded in 1991 with the acquisition of assets from the RTC

•

Continued

to

build

reputation

investing

in

distressed

CRE

assets

during

the

’90s

•

Successful

resolution

of

these

portfolios

yielded

34%

gross

(6)

and

28%

net

(7)

IRR*

Exceptional performance on realized debt investment strategies

Vehicle

IPO Pricing Date

Number of

Investments

Equity Invested &

Committed

Net IPO

Proceeds

Colony Financial, Inc.

2009

12

$215

$275

(1)

Realized Real Estate-Related

Debt Investments

Fund Closing

Date

(2)

Number of

Assets

(3)

Equity

Invested

(4)

Total

Capitalization

(4)(5)

Gross

IRR

(6)

Net

IRR

(7)

Debt Investments*

(8)

1991-

2003

4,674

$430

$2,251

28%

21%

*The performance and other data is not a guarantee or prediction of the returns that we may achieve in

the future. (1)

Gross proceeds of the IPO and private placement of $292.5mm, net of transaction costs and underwriting

fees (cash and deferred). (2)

Represents year of initial deployment of equity.

(3)

Number of Assets includes distinct mortgages and properties which are part of the investments; with

respect to corporate entity investments in which Colony Capital has majority ownership or

substantial control rights, includes all real estate assets controlled through such entities; other

corporate entity investments are tabulated as a single asset. (4)

Excludes capital called for fund-level fees and expenses.

(5)

Total Capitalization is determined as of the closing of the investment and includes all equity called

and all debt funded or contractually committed to be funded by the collective investments herein.

(6)

Internal rates of return (gross) before fees, expenses, and general partner’s carried interest,

calculated using a “time-zero” methodology in which the cash flows of all investments (actual amounts of

contributions and distributions) are based from the same hypothetical starting date. Investors

participating in all Colony Fund I investments achieved a time-weighted gross internal rate of return of

58% (calculated using actual dates and amounts of contributions and distributions).

(7)

Internal rates of return (net) after fees, expenses, and general partner’s carried

interest, calculated using a “time-zero” methodology in which the cash flows of all investments (actual amounts of

contributions and distributions) are based from the same hypothetical starting date. Investors

participating in all Colony Fund I investments achieved a time-weighted net internal rate of return of 46%

(calculated using actual dates and amounts of contributions and distributions).

(8)

This table shows certain performance data relating to all realized real-estate related debt

investments, as of December 31, 2009, made

by

investment funds sponsored by Colony Capital or its affiliates, and does not include investments made

by Colony Financial, Inc. |

7

Investment Strategy

•

Origination and purchase of well structured

and re-underwritten first mortgage commercial

loans

•

Acquire at discount from banks, CRE funds

and other finance companies

•

FDIC dispositions of CRE assets from failed

banks, often at large discounts to face value

•

Value-added strategies including loan-to-own,

discounted payoffs and loan modifications

•

U.S. Life Insurance

Loan Portfolio

•

DB FDIC Portfolio

•

Class A Manhattan

Office

•

Colonial Loan

•

U.S. Commercial Bank

Loan Portfolio

•

German Portfolio

•

Priming Loans / DIP lending / Rescue Capital

•

B-notes and Mezzanine Loans

•

Minority Equity Positions in Banks

•

Construction / Rehab loans

•

CMBS / CRE CDO

•

WLH Secured Loan

•

First Republic Bank

•

WLH Land Acquisition

First Mortgage

Loans

&

FDIC Portfolios

Other /

Special

Situations

Targeted

Strategy

Description

Recent Colony

Investments |

8

CLNY Current Portfolio

(dollars in millions)

Closed Transactions

Date

Acquired

CLNY

Description

Invested

Committed

Total

% Owned

U.S. Life Insurance Loan

Portfolio

Dec-09

$49.7

$ –

$49.7

37.9%

25 performing, fixed rate first mortgages secured by commercial

real estate

WLH Secured Loan

Oct-09

48.0

–

48.0

24.0%

Senior secured term loan secured by first mortgages on

residential land and security interests in cash and other assets

DB FDIC Portfolio

Jan-10

33.0

1.7

34.7

33.3%

Approximately 1,200 performing and non-performing loans

secured mostly by commercial real estate

First Republic Bank

Pending

–

24.0

24.0

TBD

Equity stake in approximately $20 billion retail bank

Class A Manhattan Office

Mar-10

15.0

–

15.0

33.3%

First mortgage pari-passu

participation interest secured by Class

A midtown Manhattan office building

Spanish REOC/Colonial

Loan

Nov-09

12.0

1.3

13.3

5.1%

Syndicated senior secured loan to a Spanish commercial real

estate company

West Village Townhomes/

Photography Loan

Mar-10

9.9

–

9.9

33.3%

Recourse Loan Secured by first liens on two West Village

Manhattan townhomes and a photography catalogue

U.S. Commercial Bank Loan

Portfolio

Dec-09

6.7

–

6.7

33.3%

10 Performing and one delinquent, fixed rate first mortgages

secured by commercial real estate

German Loan Portfolio

Dec-09

5.3

–

5.3

33.3%

94 primarily first mortgage non-performing commercial real estate

loans

WLH Land Acquisition

Dec-09

3.4

–

3.4

24.0%

Approximately 1,100 residential lots in a sale/easement

Westlake Village Loan

Oct-09

2.5

–

2.5

33.3%

First mortgage commercial loan

AAA CMBS Financed with

TALF

Oct-09

2.0

–

2.0

32.7%

AAA CMBS security financed with five-year TALF

TOTAL

–

Closed

&

Pending

$187.5

$27.0

$214.5 |

9

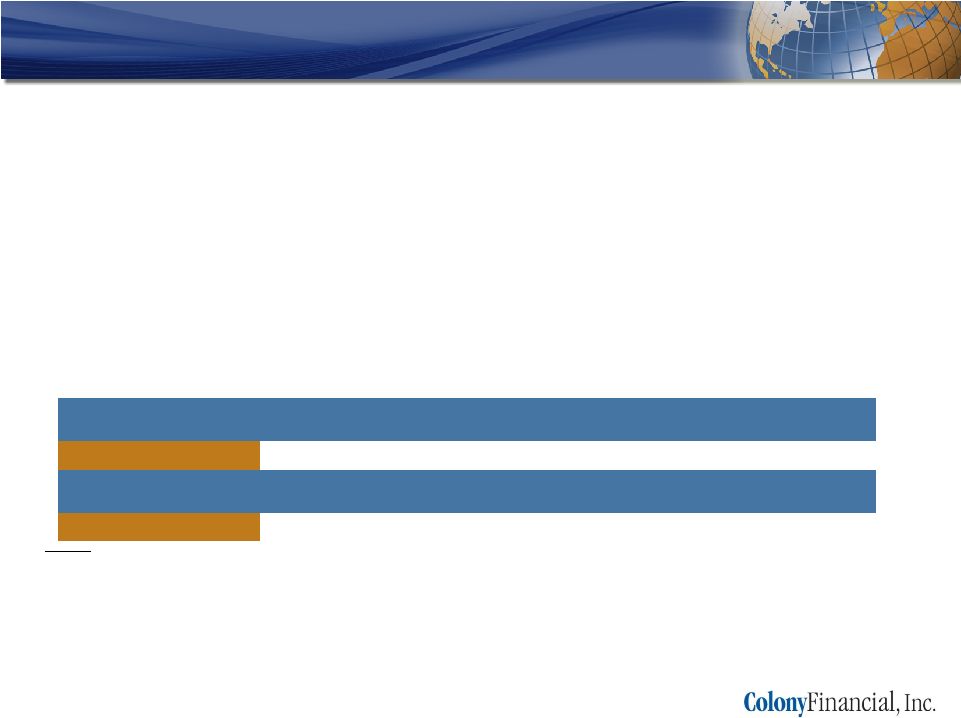

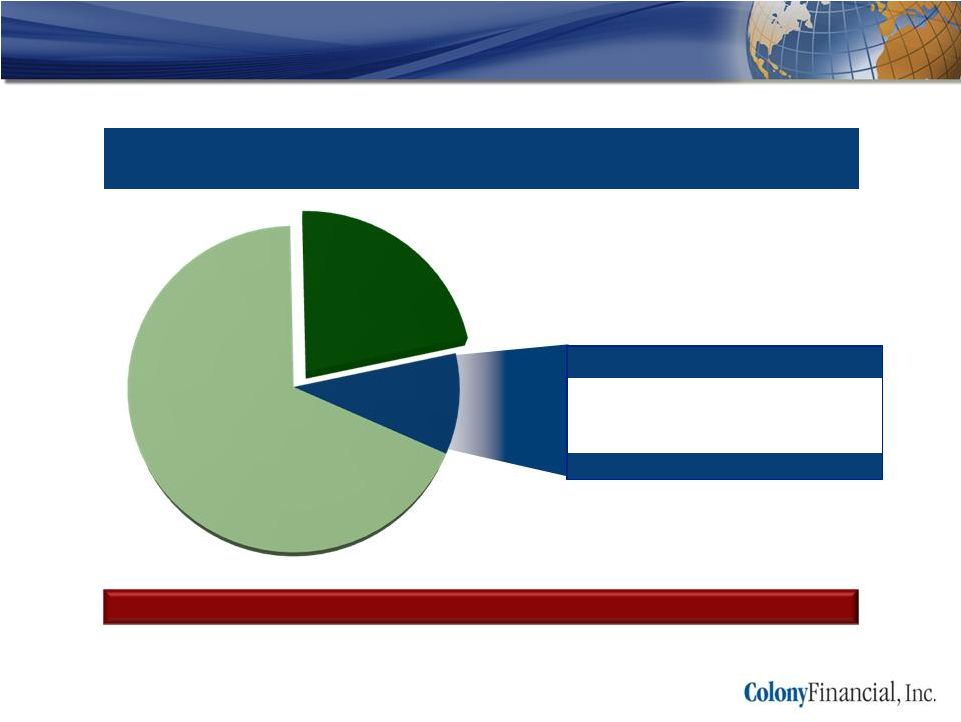

CLNY Capital Commitments

Unfunded Commitments

First Republic Bank

DB FDIC Portfolio

Spanish REOC/Colonial Loan

$24

2

1

Total Commitments

$27

INVESTED

$188; 68%

COMMITTED

NOT

UTILIZED

$27; 10%

AVAILABLE

$61; 22%

$275 Net Proceeds after Deferred Underwriting Fees

78% Called and Committed

(dollars in millions)

$61 million of uncommitted capital; 22% of total net proceeds |

10

U.S. Life Insurance Loan Portfolio

Investment Description

•

Dec-09 purchase of 25 first lien commercial

loans for $131 million from Nationwide Life

Insurance Company (25% discount to portfolio

UPB of $175 million)

•

All loans are current and performing

•

Assets located nationwide with largest

concentration in PA (21% of UPB), NC (12%),

CA,

IL,

MI,

MO,

NV,

and

UT

(7-9%

each)

–

47%

retail,

28% office, 22% industrial, 3% hotel

•

Portfolio generates average interest yield of 8.3% and cash yield of 10.2% including

principal amortization on purchase price basis

>

On average, loans in portfolio have been current for 35 months and have a remaining

term of 85 months

Current Status

•

$2.2 million collections since acquisition, representing a 10% annualized cash

yield, on target with underwriting

•

Expected that majority of loans will perform to maturity with some loans resolving

early through discounted payoff or foreclosure |

11

WLH Secured Loan

Investment Overview

•

Oct-09 $206 million senior first mortgage loan secured by real estate and $71

million of pledged cash

•

WLH has built over 100,000 homes since 1956

>

WLH owns 11,829 lots, homes and models

•

14% coupon and 3% origination fee; 5-year term (matures Oct-14)

>

Interest only with full recourse to WLH

•

Debt proceeds used by WLH to increase near-term corporate liquidity, accelerate

development and sale of selected projects, extinguish revolver debt and

acquire new assets at distressed pricing

Current Status

•

Loan

performing

and

WLH’s

performance

has

tracked

Colony

underwriting

>

Since funding, WLH acquired 862 finished lots for $87 million ($101k/lot)

>

Sales pace and pricing has exceeded underwriting projections

>

$118

million

of

pledged

cash

as

of

3/31/09

serves

as

significant

war

chest

for

future acquisitions and buffer for scheduled interest payments

•

WLH received $102 million of tax refunds in 2010 due to extension of NOL carryback;

cash included in collateral |

12

DB FDIC Portfolio

Investment Overview

•

Jan-10 portfolio acquisition of approximately 1,200 loans with aggregate unpaid

principal balance of approximately $1.0 billion for 44% of face value

•

Deutsche Bank served as advisor to FDIC on sale of 40% managing member equity

interest in newly formed limited liability company created to hold acquired loans, with

FDIC retaining remaining 60% equity interest

•

Majority of portfolio comprised of non-performing and sub-performing loans secured by

first priority liens on CRE assets and land

>

Primarily in California, Nevada, Arizona, Georgia and Florida

>

High concentration of loans secured by land and retail assets

•

FDIC

provided

highly

favorable

financing

($233

million

–

50%

LTV)

at

0%

interest

rate;

cash flow sweep after fees and expenses, no covenants

Current Status

•

All loans boarded onto loan servicing and asset management systems

•

Asset managers establishing and executing business plans on asset by asset basis

>

Borrowers contacted and discussions underway regarding modifications; legal

strategies being pursued where applicable

>

Resolutions (23 loans) and other collections since closing totaling $23 million in first

75 days |

13

First Republic Bank (“FRB”)

Investment Description

•

Oct-09, Colony-led consortium, with General Atlantic, signed agreement to

acquire First Republic Bank from Bank of America Corporation

(“BofA”) •

Unique opportunity to acquire a $20 billion best-in-class relationship bank

led by Jim H. Herbert, II and Katherine August-deWilde

>

Approximately $19 billion of loans and $17 billion of deposits

Current Status

•

Expected closing in Q2 2010

•

Regulatory approvals in process

•

Operating and financial transition underway

>

BofA and FRB teams began transition Nov-09 and continue to work toward smooth

divestiture

>

4Q09 results (first quarter since signing) slightly ahead of underwriting

|

14

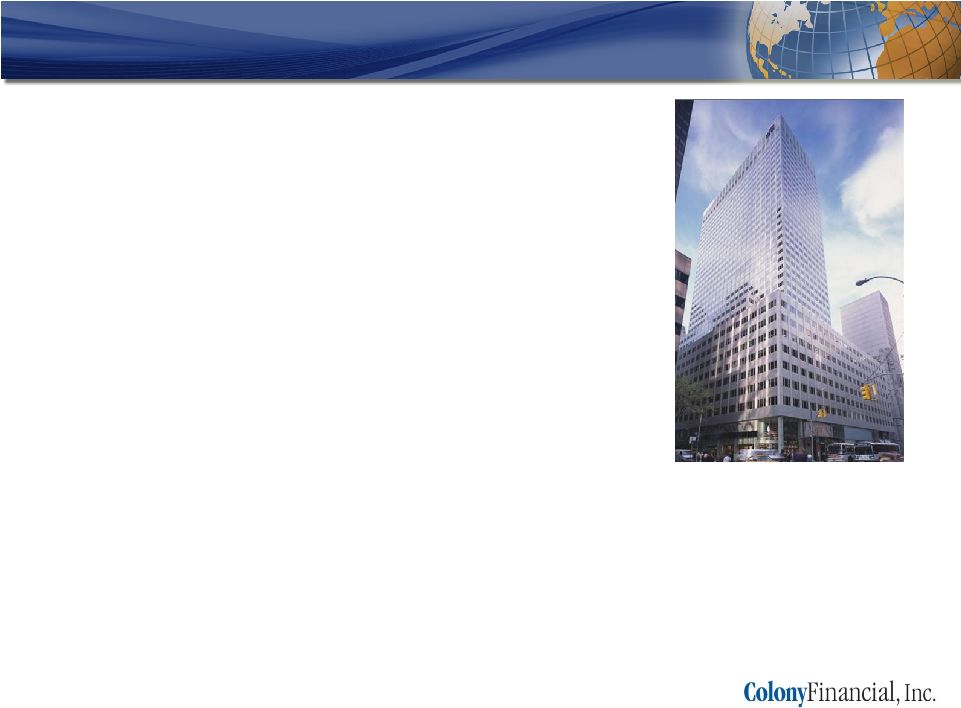

Class A Manhattan Loan Participation

Investment Description

•

$45

million

acquisition

of

pari-passu

participation

in

$1.2 billion first mortgage on mid-town Manhattan

office building (32% discount to UPB of $66 million)

>

Represents 5.4% of first mortgage, which consists

of $930 million of CMBS and $286 million of

non-securitized

pari-passu

first

mortgage

notes

>

6.4% coupon; 9.5% cash yield at acquisition;

matures Feb-17

>

1.4 million SF Class A building built in 1957

>

Acquisition basis of $585/SF (vs. $858/SF face value)

•

Current occupancy of 86%

>

In-place rents of $64/SF well below recent lease comps

>

Office building acquired by owners Feb-07 for $936/SF

Current Status

•

Loan transferred to special servicing Mar-10 as necessary step to allow for restructuring

discussions

–

note

is

current

and

performing

•

Anticipated restructure to occur at or prior to depletion of interest reserve (late 2010 /

early 2011) |

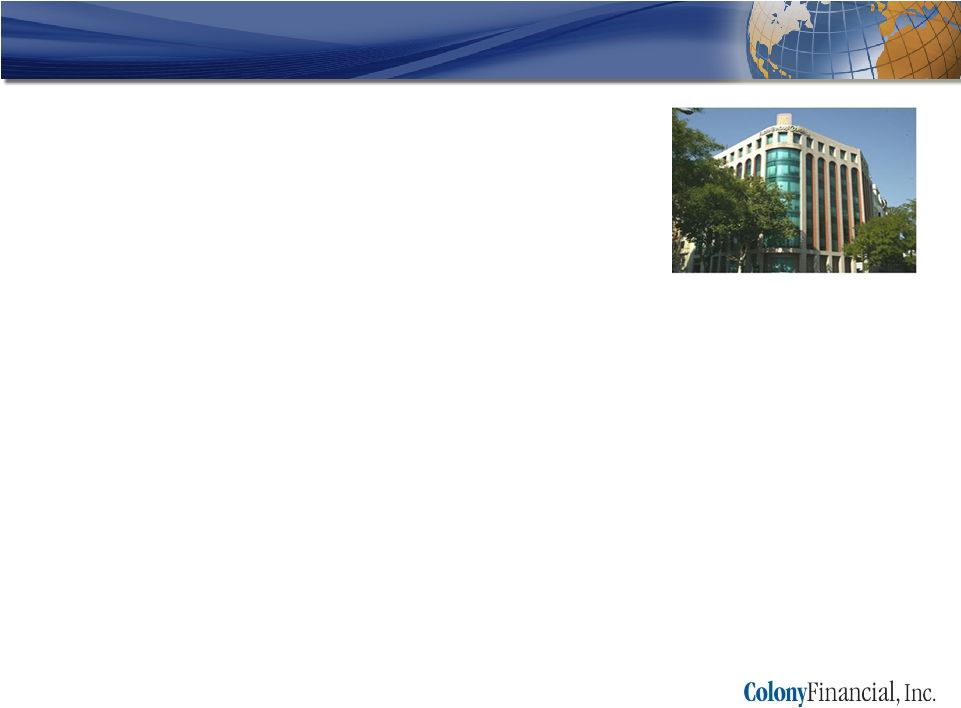

15

Spanish REOC/Colonial Loan

Investment Description

•

Dec-09 acquisition of €903 million (face amount)

share

of

syndicated

loan

to

Inmobiliaria

Colonial,

S.A.

for

€329

million

(64%

discount)

–

18%

share

of company’s total debt

>

Joint venture with Orion Capital Managers

and Mount Kellett

•

Timing of acquisition coincided with Colonial’s

negotiations with lenders to recapitalize its over-leveraged balance sheet (LTV > 100%

and ICR < 0.8x)

•

Colonial (SM: COL) is one of the largest publicly-traded real estate companies in Spain

with prime office building portfolio in Madrid, Barcelona, and Paris (through 53.4% share

in Société

Foncière

Lyonnaise)

•

Company portfolio consists of €4.8 billion in quality real estate assets:

>

€3.6 billion rental assets generating €150 million annual revenues

>

€1.2 billion for over 2 million m2 of building rights in quality land bank, residential

developments and commercial projects (non-yielding)

Investment Thesis

•

Opportunity

to

acquire

debt

backed

by

quality

real

estate

assets

at

significant

discount

to face value, with further opportunity to enhance position via restructuring

•

Pending recapitalization entails segregating performing and non-performing debt into

separate

tranches

and

converting

a

portion

of

debt

to

equity

via

issuance

of

new

shares |

16

West Village Townhomes/ Photography Loan

Investment Description

•

Mar-10 origination of 5-year, $30.4 million

recourse loan to world-renowned

photographer (Annie Leibovitz)

•

Secured by first liens on two prime West

Village

Manhattan townhomes and photography catalogue

Current Status

•

Interest rate 14% per year, of which up to 4%

can accrue in first 12 months at borrower's option;

2% origination fee

>

Low

36%

LTV

based

upon

real

estate

appraisal

value

and

wholesale

liquidation

value of unique photography catalogue including 100,000 prints and over one million

negatives

•

Colony will participate in free cash flow from borrower's catalogue and photography

business during life of loan and minimum of two years thereafter |

17

U.S. Commercial Bank Loan Portfolio

Investment Description

•

Dec-09

purchase

of

11

largely

performing,

first

lien

commercial

real

estate

mortgages

from JPMorgan Chase for $20 million (40% discount to portfolio UPB of $33 million)

>

Ten performing loans represent 93% of UPB

•

All

assets

located

in

South

Florida

–

77%

retail

and

23%

office

•

On Colony’s purchase price basis, portfolio generates average interest yield of 10.2%

and cash yield of 11.7% including principal amortization

>

On average, loans in portfolio have been current for 24 months and have a remaining

term of 108 months

Current Status

•

93% of portfolio current and performing as expected

>

One loan currently under Forbearance Agreement, but paying interest current

•

Collections since acquisition total $0.4 million, representing an annualized cash yield of

11%, on target with underwriting

•

Expected that majority of loans will perform to maturity with some loans resolving early

through discounted payoff or foreclosure |

18

German Loan Portfolio

Investment Description

•

Dec-09 acquisition of NPL portfolio from

Bankaktiengesellschaft

AG, the “bad bank”

repository for a network of German cooperative

banks, for €10 million (net of €1.8 million interim

collections); 84% discount to portfolio UPB of

€61 million

>

94 primarily first mortgage, non-performing

real estate loans located 72% in Western Germany and 28% in former East German

states

>

Collateral includes 48% residential, 29% commercial, 18% land, and 5% mixed use

assets

Current Status

•

Six

loans

fully

resolved

as

of

YE09;

together

with

receipts

from

unresolved

loans,

total

collections are ahead of underwriting projections

Strategic Execution

•

Resolve

remaining

portfolio

by

4Q12

via

loan

modifications,

loan

sales,

discounted

payoffs

and

foreclosures |

19

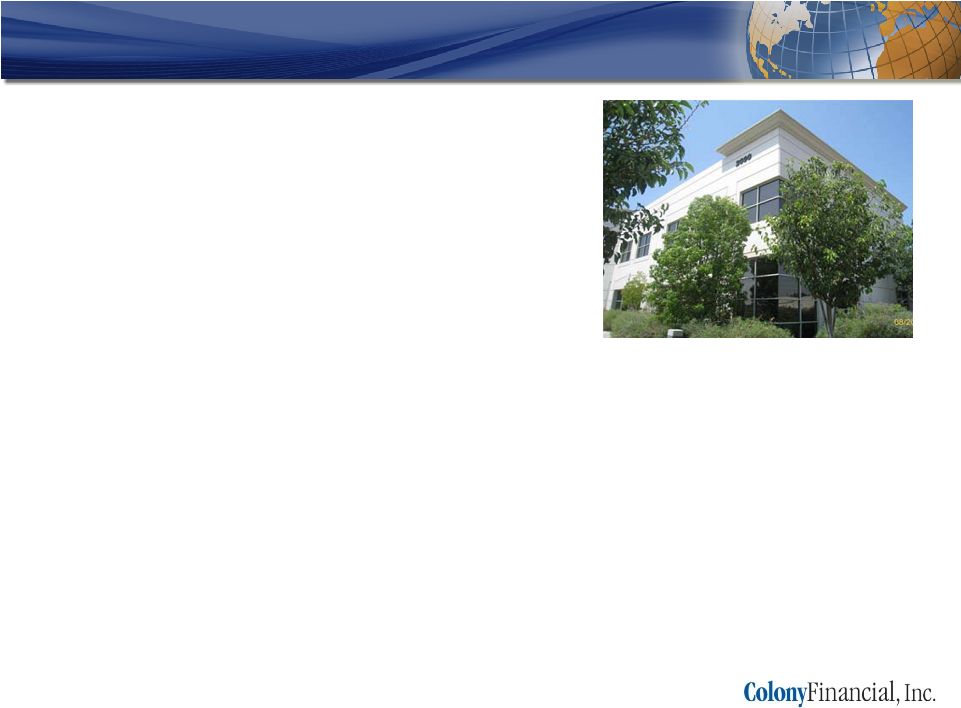

Westlake Village Loan

Investment Description

•

Oct-09 purchase of performing real estate

loan on 60,000 SF office building located in

Westlake Village, CA for $7.6 million from

BofA

(32% discount to $11.3 million UPB)

>

Implied basis of $128/SF, approximately

58% of replacement cost

•

Loan generates average interest yield of 8%

on purchase price basis

•

Loan matures in 2017

Current Status

•

Building

maintains

100%

occupancy

with

four

tenants:

The

Walking

Company,

Loan

Tool Box, Yoga Works, LLC, and Amalgamated Pixels Inc.

>

The Walking Company recently filed bankruptcy; lease terms temporarily revised and

tenant performing as agreed

•

$0.3 million collections since acquisition, representing an annualized cash yield of 8%,

on track with underwriting

•

Pursue opportunities for early exit while achieving return projections |

20

AAA CMBS Financed with TALF

Investment Overview

•

Acquired $40.0 million of a AAA-rated CMBS security for approximately $37.9 million

•

Obtained approximately $31.9 million of financing from the Term Asset-Backed Securities

Loan Facility, or TALF for a five-year term, which resulted in a total equity investment of

approximately $6.0 million

•

CLNY’s pro rata share of the equity investment was approximately $2.0 million, which

represents a 32.7% ownership interest

•

Security has a coupon of 5.29%

•

TALF financing financing carries an interest rate of 3.64%

•

The leveraged current cash yield is approximately 15.7% based on the equity investment

|

21

Deal Pipeline

Pipeline is expanding at accelerating rate

•

FDIC portfolio sales

•

Financial institution asset sales

•

Discounted payoff financings

•

First mortgage originations

•

Real estate operating company

recapitalizations

•

DIP financings

•

CMBS / CRE CDO

Fundamentals continue to drive ramp-up of deal flow

•

702 banks and $403 billion of assets

are

on

FDIC

Troubled

Banks

List

(2)

•

140 banks failed in 2009 with approximately

$170

billion

of

assets

(2)

•

Top 100 banks hold $1.05 trillion of CRE loans /

$80.5

billion

of

Non-Performing

Loans

(1)

LARGE

EXISTING

DEAL

PIPELINE

(1) Commercial Mortgage Alert as of January 15, 2010.

(2) FDIC as of December 31, 2009. |

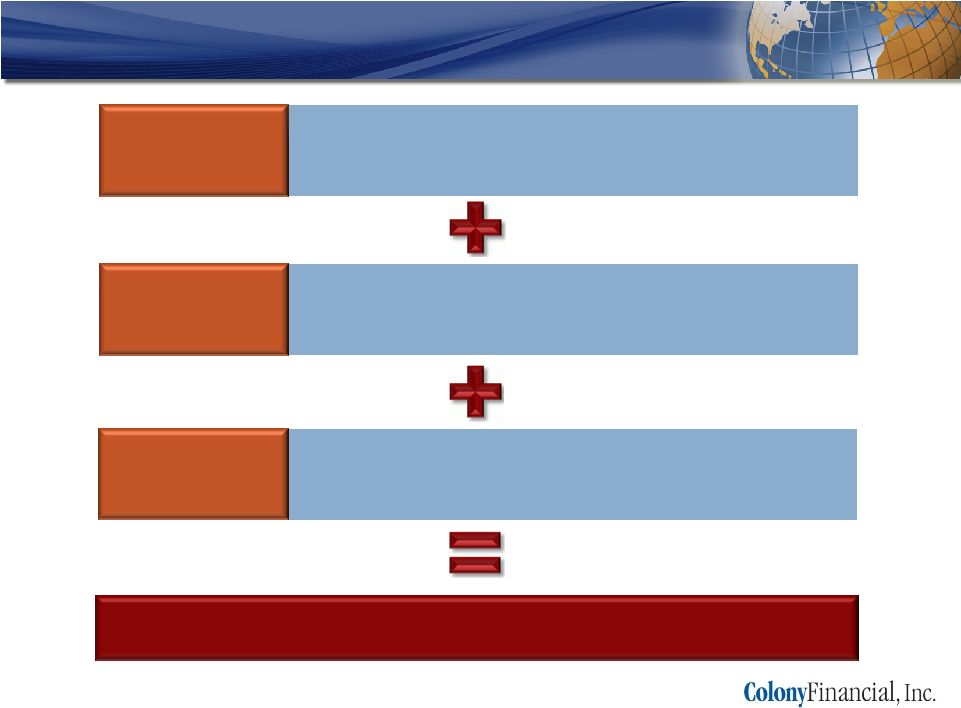

22

Investment Opportunity

Attractive risk-adjusted returns are available through

re-underwritten secondary and newly originated CRE

loans

and other debt investments

PROVEN

STRATEGY

Financial industry and CRE market correction underway

and expected to create a protracted period of distress

analogous to the early 1990s

THE RIGHT

TIME

DISTINGUISHED

TEAM

Experienced sponsor with operational platform and

successful CRE debt investment track record dating back

to RTC era

Unique Investment Opportunity in a CRE Finance Company

with Strong Sponsorship |