Attached files

| file | filename |

|---|---|

| 8-K - SUNOCO INC--FORM 8-K - SUNOCO INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - SUNOCO INC | dex991.htm |

1Q10

Earnings Conference Call April

29, 2010 Exhibit 99.2 |

2

Safe Harbor Statement

This slide presentation should be reviewed in conjunction with Sunoco’s First Quarter 2010 earnings

conference call held on April 29, 2010 at 5:30 p.m. ET. You may listen to the audio portion

of the conference call on the website or an audio recording will be available after the

call’s completion by calling 1-800-642-1687 and entering conference

ID#71298469.

Statements in this presentation that are not historical facts are forward-looking statements

intended to be covered by the safe harbor provisions of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements

are based upon assumptions by Sunoco concerning future conditions, any or all of which ultimately

may prove to be inaccurate, and upon the current knowledge, beliefs and expectations of Sunoco

management. These forward-looking statements are not guarantees of future

performance.

Forward-looking statements are inherently uncertain and involve significant risks and uncertainties

that could cause actual results to differ materially from those described during this

presentation. Such risks and uncertainties include economic, business, competitive and/or

regulatory factors affecting Sunoco's business, as well as uncertainties related to the outcomes

of pending or future litigation. In accordance with the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, Sunoco has included in its Annual Report on Form 10-K for

the year ended December 31, 2009, and in its subsequent Form 10-Q and Form 8-K filings,

cautionary language identifying important factors (though not necessarily all such factors) that

could cause future outcomes to differ materially from those set forth in the forward-looking

statements. For more information concerning these factors, see Sunoco's Securities and

Exchange Commission filings, available on Sunoco's website at www.SunocoInc.com. Sunoco expressly

disclaims any obligation to update or alter its forward-looking statements, whether as a result of

new information, future events or otherwise.

This presentation includes certain non-GAAP financial measures intended to supplement, not

substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to

GAAP financial measures are provided in the Appendix at the end of the presentation.

Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to

those measures provided in the Appendix, or on our website at www.SunocoInc.com.

|

3

Summary

1Q10 Results

Income before special items* of $17MM ($0.14/share)

Refining & Supply continues to be challenged by weak demand and

high global supply

Planned maintenance activity limited refineries’

throughput and

challenged margin realization during the quarter

Retail Marketing, Logistics and Coke businesses continue to deliver

solid and consistent results

Closed sale of Chemicals’

Polypropylene business in 1Q

Strategic Outlook

We remain focused on the fundamentals: running our refineries

safely and reliably at optimal capacity utilization, lowering our

breakeven cost per barrel, and improving margin capture, all of

which are designed to increase our cash generation from operations

Actions to improve balance sheet and strengthen our liquidity will

position us to take advantage of attractive growth opportunities

* For reconciliation to Total Income (Loss), see Slide 14.

|

4

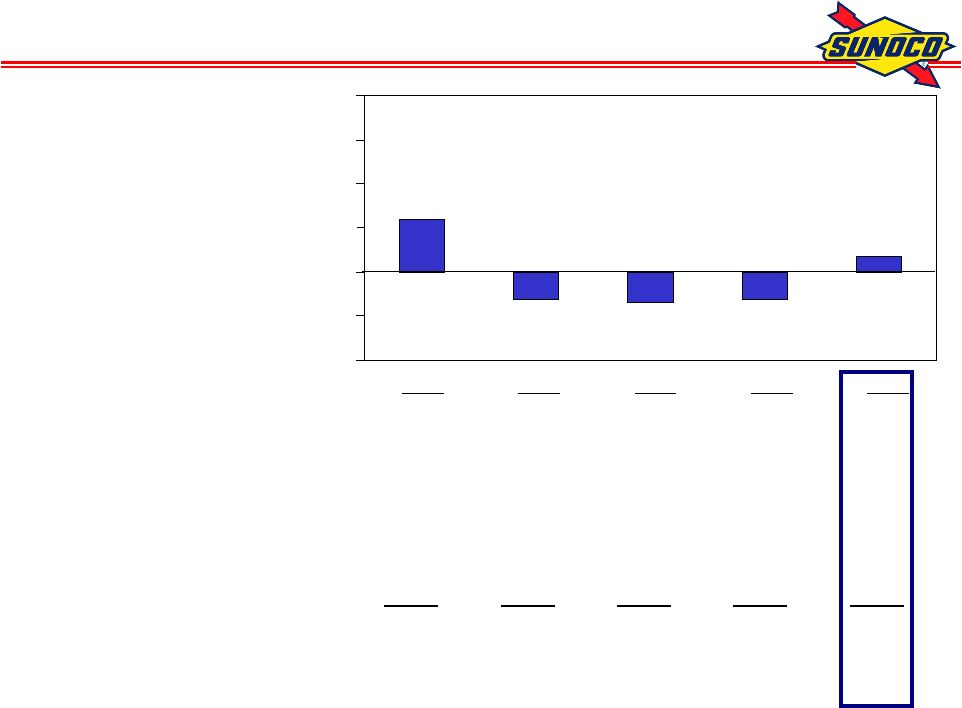

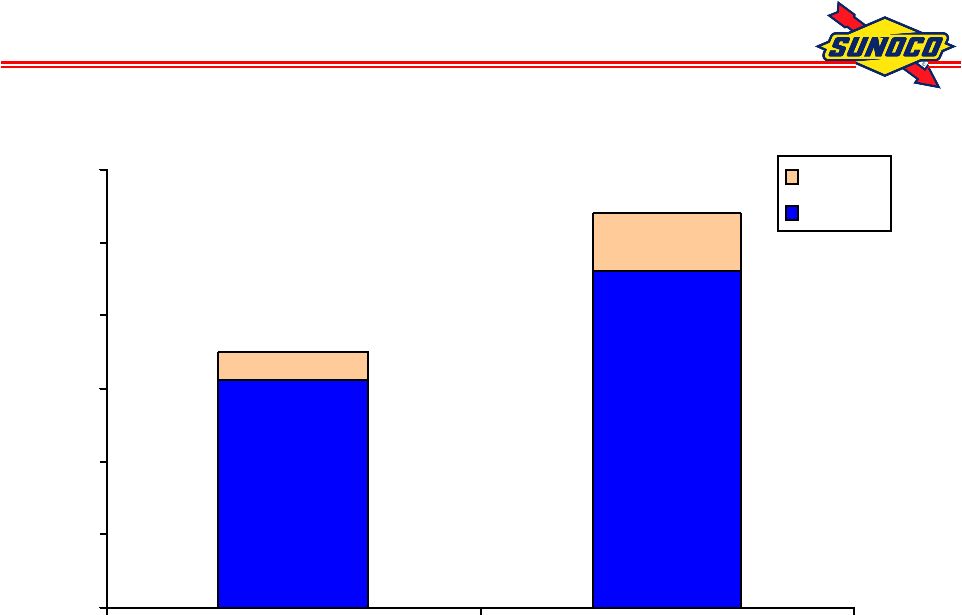

Income (Loss) Before Special Items*, MM$

59

(31)

(34)

(31)

17

($100)

($50)

$0

$50

$100

$150

$200

* For reconciliation to Total Income (Loss), see Slide 14.

1Q09

2Q09

3Q09

4Q09

1Q10

Refining & Supply:

Continuing Operations

14

(77)

(118)

(135)

(42)

Discontinued Tulsa Operations

9

(6)

-

-

-

Non-Refining

Continuing Operations

49

75

101

125

78

Discontinued Polypropylene Operations

8

3

1

2

21

Corp. & Net Fin.

(21)

(26)

(18)

(23)

(40)

Income (Loss), Before Special Items

59

(31)

(34)

(31)

17

EPS (Diluted), Before Special Items

0.50

-0.27

-0.29

-0.27

0.14 |

5

1Q10 Special Items, MM$ after tax

($44) –

Loss related to the divestment of the discontinued

polypropylene operations

($20) –

Provision primarily related to contract losses in

connection with excess barge capacity resulting from the

shutdown of the Eagle Point refining operations

($7) –

Primarily related to pension settlement losses

($9) –

Unfavorable adjustment to deferred state income taxes

attributable to continuing phenol chemical operations

($80) |

6

Refining & Supply Summary* –

1Q10

1Q10 Loss from Continuing Operations of $42MM

Low utilization due to March turnarounds at Marcus Hook and Toledo

pressured margin realization and operating income due to fixed costs

Improved margin capture, in particular outside of the turnaround

periods

Delivering cost savings after closure of Eagle Point

Outlook

Market is expected to remain challenging with continued economic

weakness and additional global supply

We remain focused on the fundamentals

running our assets safely and reliably

optimizing our refining system to meet market demand

lower sustainable cost structure

improved margin capture

* Business Unit Income after tax. For reconciliation to Total Income (Loss), see

Slide 14. |

7

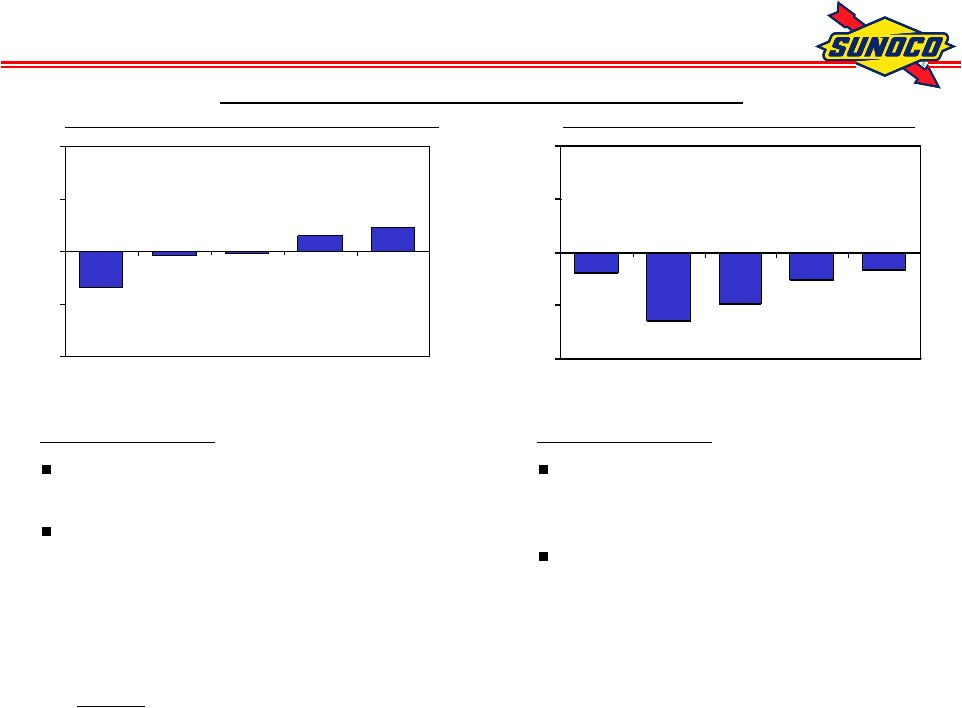

Realized Refining Margin vs. Benchmark, $/B

* Excludes discontinued Tulsa refining operations.

** R&S Weighted

Benchmark. For calculation, including changes effective with this quarter, see

Slide 22. 1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Refining

&

Supply

Realized Margin *

6.33

3.65

2.72

1.96

3.66

4.08

Weighted Benchmark **

5.71

6.05

4.57

3.59

4.98

5.67

Differential

0.62

(2.40)

(1.85)

(1.63)

(1.32)

(1.59)

Margin Capture Rate

111%

60%

60%

55%

73%

72%

Actual vs. Weighted Benchmark:

Crude

1.40

0.18

0.10

(0.61)

0.27

(0.92)

Product

(0.78)

(2.58)

(1.95)

(1.02)

(1.59)

(0.67)

Differential

0.62

(2.40)

(1.85)

(1.63)

(1.32)

(1.59) |

8

0.61

0.92

(0.10)

(0.18)

(1.40)

-4.00

-2.00

0.00

2.00

4.00

1Q09

2Q09

3Q09

4Q09

1Q10

Crude Cost vs. Weighted Benchmark

(0.67)

(1.02)

(1.95)

(2.58)

(0.78)

-4.00

-2.00

0.00

2.00

4.00

1Q09

2Q09

3Q09

4Q09

1Q10

Products vs. Weighted Benchmark

Refining Margin vs. Benchmark*, $/B

Total

Refining

&

Supply

(excluding

Tulsa)

* R&S Weighted

Benchmark. For calculation, see Slide 22.

1Q10 Comments:

Higher transportation costs vs

benchmark and 4Q09

LIFO reserve for year-to-date

inventory draw at higher quarter-end

crude prices

1Q10 Comments:

Negative due to non-benchmark

products and effects of turnaround

(ratability and yield gains)

Versus 4Q09, improved realizations

on benchmark products and

chemicals offset by impact of

turnaround, LIFO reserves & non-

benchmark products |

9

Non-Refining Business Income* -

1Q10

Retail Marketing –

Earnings of $21MM

Margins consistent with 4Q09, still challenged due to rising

wholesale prices; seasonal drop in demand and further

affected by winter storms in Northeast

Logistics –

Earnings of $17MM

Largely contributions from Sunoco Logistics Partners L.P.

(NYSE: SXL); lower than 1Q09 related primarily to lower

income from crude marketing activities

Coke –

Earnings of $37MM

Consistent with 4Q09 earnings, excluding the $41MM one

time tax credit associated with start-up of Granite City

Maintain full year guidance of net income between $125MM

-$140MM

* Business Unit Income after tax. For reconciliation to Total Income (Loss), see

Slide 14. |

10

SunCoke Update

Granite City Start Up

The ramp up during 1Q10 was slower than planned

Needed performance improvements have been identified and are being

implemented Impact to

income

guidance

expected

to

be

offset

by

benefits

from

higher

coal

prices

extending out further than planned and lower costs

Middletown Plant Update

Construction

began

in

early

April

2010

with

coke

production

expected

in

2

nd

half

2011

Total capital spend projected at $380MM, including capitalized interest

of approximately $25MM

Jewell Mining Expansion Planned

Expand production from Jewell mines by 500,000 tons per year (increase of

40%) Will be producing at annualized rate of 1.75MM tons by late 2012

Total capital spend estimated to be approximately $25MM through 2014

Expansion provides an opportunity for income growth

Will also be updating coal reserve study |

11

SUN

SXL

(ex SXL)

Sunoco

Cash flow from Operations*

7

494

501

Capital Program

(27)

(132)

(159)

Free Cash Flow

(20)

362

342

Divestments

-

8

8

Dividends to Sunoco Shareholders

-

(18)

(18)

Distributions & Other

(23)

(5)

(28)

SXL Dividends to Sunoco

(24)

24

-

Net Proceeds from Sale of LP units

-

145

145

Modification of SXL IDRs

(201)

201

-

Net Cash Flow before Net Debt Activity

(268)

717

449

Net Debt Activity

268

(282)

(14)

Net Increase in Cash & Cash Equivalents

-

435

435

1Q10

1Q10 Cash Flow, MM$

* Includes $394 MM income tax refund. |

12

Net Debt-to-Capital Ratio, %

34%

41%

16%

32%

Consolidated

Sunoco (ex-SXL)

*

Proforma.

**

Sunoco Revolver Covenant basis. For calculation, see Slide 18.

12/31/09

3/31/10

Sunoco (ex-SXL)*

32%

16%

SXL

50%

63%

Consolidated**

41%

34%

Sunoco Net Debt

1,223

498

SXL Net Debt

866

1,139

Total Net Debt

2,089

1,637 |

13

Key Takeaways

We will maintain our focus on delivering value to

shareholders and achieving our aspiration of becoming

the preferred provider of transportation fuels in our

markets

We took early proactive steps to make us stronger, leaner

and more competitive

We remain focused on the fundamentals

Running our refineries safely, reliably & at optimal capacity

utilization Cost reduction & capital discipline

Improving margin capture

Actions to improve balance sheet and liquidity position us to

take advantage of attractive growth opportunities in Logistics,

Coke and Retail Marketing |

Appendix |

15

Earnings Profile, MM$ after tax

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Refining & Supply

Continuting Operations

14

(77)

(118)

(135)

(316)

(42)

Discontinued Tulsa Operations

9

(6)

-

-

3

-

Retail Marketing

6

10

49

21

86

21

Chemicals

Continuting Operations

(12)

(3)

(2)

4

(13)

3

Discontinued Polypropylene Operations

8

3

1

2

14

21

Logistics

30

26

19

22

97

17

Coke

25

42

35

78

180

37

Corporate Expenses

(11)

(15)

(6)

(6)

(38)

(23)

Net Financing Expenses & Other

(10)

(11)

(12)

(17)

(50)

(17)

Income(Loss) Before Special Items

59

(31)

(34)

(31)

(37)

17

Special Items

(47)

(24)

(278)

57

(292)

(80)

Total Income (Loss)

12

(55)

(312)

26

(329)

(63)

EPS (Diluted), Income (Loss)

Before Special Items

0.50

(0.27)

(0.29)

(0.27)

(0.32)

0.14

EPS (Diluted), Income (Loss)

0.10

(0.47)

(2.67)

0.22

(2.81)

(0.53)

|

16

Key Indicators

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Realized Margin Indicators

Refining & Supply, $/B*

6.33

3.65

2.72

1.96

3.66

4.08

Retail Marketing, cpg

Gasoline

6.4

7.0

13.0

8.8

8.9

8.9

Distillate

24.5

12.0

11.7

7.9

14.8

8.0

Chemicals, cpp**

6.6

8.2

7.3

9.7

8.0

9.9

Market Indicators

Dated Brent Crude Oil, $/B

44.40

58.79

68.27

74.56

61.51

76.24

Natural Gas, $/DT

4.48

3.81

3.44

4.92

4.16

5.04

* Excludes discontinued Tulsa refining operations.

** Excludes discontinued polypropylene operations. |

17

Key Volume Indicators -

Refining & Supply

* Excludes discontinued Tulsa refining operations.

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Total Refining & Supply *

Crude Throughputs, MB/D

627

644

613

617

625

533

% Capacity

76

78

74

85

78

79

Net Prod. Available for Sale, MB/D

689

720

669

682

690

591

Net Prod. Available for Sale, MMB

62

66

62

62

252

53 |

18

Key Volume Indicators –

Non-Refining

* Excludes discontinued polypropylene operations.

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Retail Marketing

Gasoline Sales, MM gal

1,066

1,147

1,140

1,108

4,461

1,026

Middle Distillate Sales, MM gal

138

116

114

95

463

91

Total Sales, MM gal

1,204

1,263

1,254

1,203

4,924

1,117

Gasoline and Diesel Throughput

143

153

156

153

151

147

(Company-owned or leased outlets)

(M gal/Site/Month)

Merchandise Sales (M$/Store/Month)

78

92

104

91

91

88

Chemicals*

Phenol and Related Sales, MM#

407

427

483

457

1,774

449

Coke

Production, M tons:

United States

681

694

715

778

2,868

841

Brazil

280

282

321

383

1,266

413 |

19

Financial Ratios, MM$ except ratios

*

Represents Partners’

Capital for SXL and Shareholders’

Equity for Sunoco.

**

The

Net

Debt

/

Capital

ratio

is

used

by

Sunoco

management

in

its

internal

financial

analysis

and

by

investors

and

creditors in the assessment of Sunoco’s financial position.

*** Capital excludes noncontrolling

interests.

Proforma

Proforma

SUN

SUN

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

Debt

868

1,596

2,464

1,141

1,306

2,447

Plus: Debt Guarantees

-

2

2

-

2

2

Less: Cash

(2)

(375)

(377)

(2)

(810)

(812)

Net Debt

866

1,223

2,089

1,139

498

1,637

Equity*

862

2,557

2,557

657

2,712

2,712

SXL Noncontrolling

Interest

-

-

488

-

-

414

Capital

1,728

3,780

5,134

1,796

3,210

4,763

Net Debt / Capital (Sunoco

Revolver Covenant Basis)**

50%

32%

41%

63%

16%

34%

Debt / Capital (GAAP Basis) ***

49%

47%

12/31/2009

3/31/2010 |

20

0.0

0.5

1.0

1.5

2.0

2.5

3.0

12/31/2009

3/31/2010

SXL

Sunoco

1.7

Liquidity*, B$

* Includes

$0.4B

and

$0.8B

at

12/31/09

and

3/31/10

of

cash

and

cash

equivalents.

2.7 |

21

Refining & Supply –

Products Manufactured

* Excludes discontinued Tulsa refining operations.

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Total Refining & Supply *

Net Production, MB/D

689.1

720.2

669.2

681.7

689.9

590.5

Gasoline

51%

51%

52%

53%

52%

52%

Middle Distillates

34%

32%

33%

32%

32%

34%

Residual Fuel

9%

9%

9%

8%

9%

6%

Petrochemicals

3%

4%

4%

4%

4%

4%

Other

8%

9%

7%

8%

8%

9%

Less Refinery Fuel

-5%

-5%

-5%

-5%

-5%

-5% |

22

Refining & Supply -

Gasoline and Distillate Production

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Total Refining & Supply *

Gasoline Production, MB/D

350.0

370.3

346.0

365.5

357.9

306.3

RFG

46%

46%

55%

45%

48%

47%

Conventional

54%

54%

45%

55%

52%

53%

Distillate Production, MB/D

233.4

229.5

219.3

219.3

225.3

202.4

On-Road Diesel Fuel

47%

53%

56%

52%

52%

53%

Heating Oil / Off-Road Diesel

30%

22%

23%

25%

25%

28%

Jet Fuel

20%

23%

19%

21%

21%

17%

Kerosene/Other

3%

2%

2%

2%

2%

2%

* Excludes discontinued Tulsa refining operations. |

23

Sunoco Refining Weighted Benchmark Margin, $/B

Toledo

4-3-1

Benchmark

4 WTI Crude: NYMEX Futures Close + $2.00 for transportation*

3 Unleaded Gasoline: Chicago Pipeline Platt’s Low

1 Distillate: 50% ULSD Chicago Pipeline Platt’s Low

50% Jet Gulf Coast Pipe Platt’s Low**

Northeast

6-3-2-1

Value-Added

Benchmark

6 Dated Brent Crude: Platt’s Mid + $2.25 for transportation*

3 Gasoline: 50% Unleaded RBOB NY Harbor Barge Platt's Low

50% Unleaded Regular Gasoline NY Harbor Barge Platt's Low

2 Distillate: 55% ULSD/LSD NY Harbor Barge Platt's Low

20% Jet/Kero NY Harbor Barge Platt's Low

25% No.2 Fuel Oil NY Harbor Barge Platt's Low

1 No. 6 0.3% Sulfur High Pour Resid: NY Harbor Barge Platt’s Low

1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Northeast 6-3-2-1

Value-Added Benchmark

5.32

5.23

4.10

3.85

4.62

6.09

Toledo 4-3-1

Benchmark

7.28

9.36

6.41

2.56

6.40

3.99

Note: The weighted benchmark has been updated for two items to be more reflective of

market and operations: *The crude transportation cost within the weighted

benchmark is now $2.20/B, $1/B higher than the previous benchmark calculated from a new

Northeast crude transportation benchmark of $2.25/B and a new Toledo crude

transportation benchmark of $2/B. All periods have been

restated for this new crude transportation cost benchmark.

**The

Toledo

benchmark

was

also

updated

effective

1/1/2010

to

include

the

US

Gulf

Coast

Jet

Platts

Low

marker

as

50%

of

the

distillate

benchmark, with

ULSD

Chicago

Platts

Low

comprising

the

other

50%.

The

distillate

benchmark

previously

was

comprised

of

100%

ULSD

Chicago Platts

Low. Prior to 2010, the benchmarks were not restated for this change due to

immateriality. 1Q09

2Q09

3Q09

4Q09

FY09

1Q10

Northeast 6-3-2-1

at 80% weight

4.26

4.18

3.28

3.08

3.70

4.87

Toledo 4-3-1

at 20% weight

1.45

1.87

1.29

0.51

1.28

0.80

R&S Weighted Benchmark

5.71

6.05

4.57

3.59

4.98

5.67 |

24

For More Information

Media releases and SEC filings are available

on

our

website

at

www.SunocoInc.com

Contact for more information:

Clare McGrory

(215) 977-6764 |