Attached files

Building the Premier Middle-Market Investment Bank

Ronald J. Kruszewski

Chairman of the Board, President, and

CEO

Stifel

Financial Corp.

Presentation to Investors

April 26, 2010

Thomas W. Weisel

Chairman of the Board and CEO

Thomas Weisel

Partners

Exhibit 99.3 |

1

Forward-Looking Statements

Statements in this presentation that relate to Stifel Financial Corp., as well as Stifel, Nicolaus and

Company, Inc. and its other subsidiaries (collectively, “Stifel” or the

“Company”) and Thomas Weisel Partners Group, Inc. (“Thomas Weisel Partners”) future

plans, objectives, expectations, performance, events and the like may constitute

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Future events, risks and uncertainties, individually

or in the aggregate, could cause our actual results to differ materially from those expressed

or implied in these forward-looking statements. The material factors and assumptions

that could cause actual results to differ materially from current expectations include, without

limitation, the following: (1) the inability to close the merger in a timely manner; (2) the inability

to complete the merger due to the failure to obtain stockholder approval and adoption of the

merger agreement and approval of the merger or the failure to satisfy other conditions to

completion of the merger, including required regulatory and court approvals; (3) the failure of the transaction to

close for any other reason; (4) the possibility that the integration of Thomas Weisel Partners’

business and operations with those of Stifel may be more difficult and/or take longer than

anticipated, may be more costly than anticipated and may have unanticipated adverse results

relating to Thomas Weisel Partners’ or Stifel’s existing businesses; (5) the challenges of integrating

and retaining key employees; (6) the effect of the announcement of the transaction on Stifel’s,

Thomas Weisel Partners’ or the combined company’s respective business relationships,

operating results and business generally; (7) the possibility that the anticipated synergies

and cost savings of the merger will not be realized, or will not be realized within the expected time period;

(8) the possibility that the merger may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; (9) the challenges of maintaining and increasing

revenues on a combined company basis following the close of the merger; (10) diversion of

management’s attention from ongoing business concerns; (11) general competitive, economic, political

and market conditions and fluctuations; (12) actions taken or conditions imposed by the United States

and foreign governments; (13) adverse outcomes of pending or threatened litigation or

government investigations; (14) the impact of competition in the industries and in the specific

markets in which Stifel and Thomas Weisel Partners, respectively, operate; and (15) other factors

that may affect future results of the combined company described in the section entitled “Risk

Factors” in the proxy statement/prospectus to be mailed to Thomas Weisel Partners’

shareholders and in Stifel’s and Thomas Weisel Partners’ respective filings with the

U.S. Securities and Exchange Commission (“SEC”) that are available on the SEC’s web site located at

www.sec.gov, including the sections entitled “Risk Factors” in Stifel’s Form 10-K

for the fiscal year ended December 31, 2009, and “Risk Factors” in Thomas Weisel

Partners’ Form 10-K for the fiscal year ended December 31, 2009. Readers are strongly urged

to read the full cautionary statements contained in those materials. We assume no obligation to

update any forward-looking statements to reflect events that occur or circumstances that

exist after the date on which they were made. |

2

Additional Information and Where to Find It

In connection with the proposed merger, Stifel will be filing a registration statement on Form S-4

that will include a proxy statement of Thomas Weisel Partners that also constitutes a prospectus

of Stifel and other relevant documents relating to the acquisition of Thomas Weisel Partners

with the Securities and Exchange Commission (the “SEC”). Stifel and Thomas Weisel Partners shareholders

are urged to read the registration statement and any other relevant documents filed with the SEC,

including the proxy statement/prospectus that will be part of the registration statement,

because they will contain important information about Stifel, Thomas Weisel Partners and the

proposed transaction. The final proxy statement/prospectus will be mailed to shareholders of

Thomas Weisel Partners. Investors and security holders will be able to obtain free copies of the

registration statement and proxy statement/prospectus (when available) as well as other filed

documents containing information about Stifel and Thomas Weisel Partners, without charge, at

the SEC’s website (www.sec.gov). Free copies of Stifel’s SEC filings are also available on Stifel’s website

(www.stifel.com), and free copies of Thomas Weisel Partners’ SEC filings are available on Thomas

Weisel Partners’ website (www.tweisel.com). Free copies of Stifel’s filings

also may be obtained by directing a request to Stifel’s Investor Relations by phone to

(314) 342-2000 or in writing to Stifel Financial Corp., Attention: Investor Relations, 501 North

Broadway, St. Louis, Missouri 63102. Free copies of Thomas Weisel Partners’ filings also

may be obtained by directing a request to Thomas Weisel Partners’ Investor Relations by

phone to 415-364-2500, in writing to Thomas Weisel Partners Group, Inc., Attention: Investor Relations, One

Montgomery Street, San Francisco, CA 94104, or by email to

investorrelations@tweisel.com. This communication shall not constitute an offer

to sell or the solicitation of an offer to buy securities, nor shall there be any sale of

securities in any jurisdiction in which such solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such jurisdiction.

Participants in the Solicitation

Stifel, Thomas Weisel Partners and their respective directors and executive officers may be deemed,

under SEC rules, to be participants in the solicitation of proxies from the shareholders of

Thomas Weisel Partners with respect to the proposed transaction. More detailed information

regarding the identity of the potential participants, and their direct or indirect interests, by securities holdings

or otherwise, will be set forth in the registration statement and proxy statement/prospectus and other

materials to be filed with the SEC in connection with the proposed transaction.

Information regarding Stifel’s directors and executive officers is also available in Stifel’s

definitive proxy statement for its 2010 Annual Meeting of Shareholders filed with the SEC on February

26, 2010. Information regarding Thomas Weisel Partners’ directors and executive

officers is also available in Thomas Weisel Partners’ definitive proxy statement for its

2009 Annual Meeting of Shareholders filed with the SEC on April 16, 2009. These documents are

available free of charge at the SEC’s web site at www.sec.gov and from Investor Relations

at Thomas Weisel Partners and Stifel Financial. |

3

Stifel

and TWP Today

Full-service, publicly traded investment bank (NYSE:SF)

More than 4,600 associates in 294 offices

Investment Banking

159 investment banking professionals

14 industry focused investment banking groups

Specialty groups provide coordinated financial sponsors

coverage and private placement expertise

Extensive advisory and capital raising experience

Stifel-advised M&A transactions continue to win industry

accolades

Research

61 senior research analysts

862 companies under coverage (excluding closed end funds)

Institutional Sales and Trading

159 equity sales & trading professionals

181 fixed income sales & trading professionals

Global Wealth Management

1,900 financial advisors with nearly $100B of AUM

Stifel

Bank & Trust -

$1.1 billion in assets at 12/31/09

Asset Management

Stifel

Capital Advisors, Washington Crossing, Choice

Investment Advisors & Missouri Valley Partners

Global growth-focused investment bank (Nasdaq: TWPG)

Approximately 450 associates in 4 countries and 12 offices

Investment Banking

106 investment banking professionals

Five growth verticals: Tech, Healthcare, Consumer, Mining &

Energy

Market leader in venture-backed IPOs

Book/Lead manage approximately 25% of equity deals

Completed multiple large (>$1B) M&A transactions

Research

32 senior research analysts

479 companies under research coverage (U.S. and Canada)

Institutional Sales and Trading

Powerful distribution in the U.S., CAN and Europe for North

American stocks

88 sales and trading professionals

Wealth Management

Approximately $5.5 billion in assets under advisement

Asset Management

Private equity; Venture; SMID-cap growth AUM totaling $1.6

billion |

4

Summary of Key Transaction Terms

Stifel

to acquire 100% of TWP’s

common stock in a tax-free exchange

Transaction

Consideration

Fixed exchange ratio of 0.1364 Stifel

shares for each TWPG share

No caps or collars

$7.60 per share based on an SF price of $55.74 (at 4/23/10)

$318 million of aggregate consideration (fully diluted shares includes restricted

stock units, net of taxes)

Management

Thomas Weisel

to join Stifel

as Co-Chairman with Ron Kruszewski

Combined senior leadership of both Stifel

and TWP in the Institutional Group (formerly Capital Markets)

Synergy

Opportunities

Closing

Conditions

Estimated annualized pre-tax cost efficiencies of $62 million, or

approximately 5% of combined 2009 expenses

Minimal client facing changes / Cost savings principally from redundancies

No revenue enhancements assumed

TWP shareholder approval

Regulatory approvals and other customary conditions

Board Seats

Thomas

Weisel

+

up

to

3

additional

TWP

Directors

to

join

Stifel

Board |

5

Transaction

Financials

($

in

000s,

except

per

share)

The transaction is

accretive to both

EPS

(2)

and Book Value

per share.

(1) Based

on

32.8

million

common

shares

as

of

12/31/09,

486,486

warrants

that

are

automatically

converted

during

a

change-in-control,

and

8.5

million

converted

RSUs

(net

of

taxes

and

including

3

million

gross

additional

RSUs

issued

by

TWPG

for

employee

retention).

(2) Based upon First Call consensus estimates. Assumes $62 million in

annual cost savings and excludes one-time charges. Transaction Value

Calculation TWP Book Value Analysis

SF Stock Price (4/23/10)

$55.74

As Reported Book Value (12/31/09)

Total Shareholders' Equity

$129,837

TWPG Stock Price (4/23/10)

$4.36

Basic Common Shares Outstanding

31,693

Fixed Exchange Ratio

0.1364x

Book Value Per Share

$4.10

Implied Price Per TWPG Share

$7.60

Adjusted Book Value (12/31/09)

Total Shareholders' Equity

$129,837

Implied

Aggregate

Consideration

Calculation

(1)

Deferred Tax Asset Valuation Allowance

68,802

Common Shares Outstanding

$249,649

Adjusted Total Shareholders' Equity

$198,639

Restricted Stock Units and Warrants

68,503

Implied Aggregate Consideration

$318,153

Adjusted Book Value Per TWP Share

$6.27

Pricing Multiples

TWP

Statistic

Implied

12/31/09

Multiple

Aggregate Consideration / LTM Revenues

$196,712

1.6x

Aggregate Consideration / LTM Net Revenues

$195,056

1.6x

Price Per TWPG Share / Book Value Per Share

$4.10

185.5%

Price Per TWPG Share / Adjusted Book Value Per Share

$6.27

121.3%

Price Per TWPG Share / 2011 Median Analyst Estimated EPS

$0.48

16.0x

Current Market Premium

$4.36

74.3% |

6

Why this Combination Makes Sense

Highly Complementary Investment Banking, Research and Sales and Trading Platforms

Additive, not

duplicative:

623

combined

offerings

completed

between

2005

-

2009

and

only

4

overlap

1,143

unique

U.S.

companies

under

research

coverage.

Only

8%

overlap

Expands institutional equity business both domestically and internationally

Fast Tracks

Stifel’s

Investment

Banking

Growth,

Which

Would

Otherwise

Take

Years

to

Achieve

Expands

Stifel's

Investment

Banking

business

in

key

growth

sectors

of

the

global

economy

Strengthens Stifel’s

profile within the venture capital community where TWP maintains key

relationships Enhances Stifel's

lead manager credentials

Geography: Expands

Stifel’s

west

coast

market

presence

&

provides

strong

market

entry

point

in

Canada

Enhances

and

Complements

Stifel’s

Existing

Business

Platform

Furthers Stifel’s

diversification plan: Pro forma revenue mix is approximately 50% / 50%

(Institutional Group and GWM)

Builds the premier full service middle-market investment bank

TWP’s

Core Verticals Appear Poised to Benefit From a Market Rebound

Capital markets activity is returning to more normalized levels

TMT in cyclical lull since 2007

IPO market impacted by financial crisis and recession

VC-backed IPO market rebounding along with growth sector activity in

general M&A activity highly correlated to economic growth, poised to

accelerate; TWP has well documented M&A practice TWP's

Asset

Management

Business

Complements

Stifel's

Global

Wealth

Management

Division

Combined Senior Management Teams Reflect Strong Cultural Fit

Increased Revenue Opportunities and Cost Savings Create Opportunity for Enhanced

Profitability Note: TMT refers to technology, media and telecom.

|

7

Building the Premier Full Service Middle-Market Investment Bank

$2.0+ billion combined market capitalization

$1.5

billion

-

$1.6

billion

in

combined

2010E

revenues

(1)

$1.0 billion in combined equity capital as of 12/31/09

Coast-to-coast Institutional Equity and Fixed Income

Complementary product capabilities and investment banking coverage across broad

industry groups #1

U.S.

equity

research

platform

with

1,143

unique

companies

under

research

coverage

(2)

Growing

international

presence,

using

TWP

Canadian

presence

and

both

firms’

European

capabilities

~ 1,900 private client group financial advisors with over $100 billion in combined

client assets with a national presence

(1) Based upon First Call consensus estimates as of April 23, 2010.

(2) Source: Thomson Reuters for the combined company.

|

8

Core Verticals are Poised to Benefit from Rebounding Economy

Capital Markets Appear Headed Back to More Normalized Levels

TMT has historically been approximately 40% of TWP business and was down 75% over

the past two years

TWP core verticals are poised to accelerate from any market rebound

Note: TMT refers to technology, media and telecom.

Source:

Equidesk,

Private

Raise,

FPinfomart

and

TWP

Capital

Markets.

Transaction

fees

include

U.S.

and

Canadian

equity

transactions.

Excludes

IPOs

and

follow-ons

less

than

$15

million,

non-agented

PIPE’s

and

those

less

than

$10

million

and

CEF’s

and

includes

ADR’s.

TMT

refers

to

technology,

media

and

telecom.

North American Equity Capital Markets Transaction Fees ($ in M)

North American Equity Capital Markets Transaction Fees ($ in M)

1,188

1,244

2,040

598

878

1,253

1,200

257

750

656

961

677

861

1,528

2,086

1,800

384

678

841

437

4,634

5,763

6,843

2,553

5,168

405

192

1,262

1,627

1,159

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

2005

2006

2007

2008

2009

Tech/Media/Telecom

Healthcare

Consumer

Energy & Alt. Energy

Mining

Sectors ($ in millions)

2005

2006

2007

2008

2009

Avg. %

08+09

vs. 07

Tech/Media/Telecom

1,188

$

1,244

$

2,040

$

405

$

598

$

(75%)

Healthcare

878

1,253

1,200

257

750

(58%)

Consumer

656

961

677

192

861

(22%)

Energy & Alt. Energy

1,528

1,627

2,086

1,262

1,800

(27%)

Mining

384

678

841

437

1,159

(5%)

Total

4,634

$

5,763

$

6,843

$

2,553

$

5,168

$

(44%) |

9

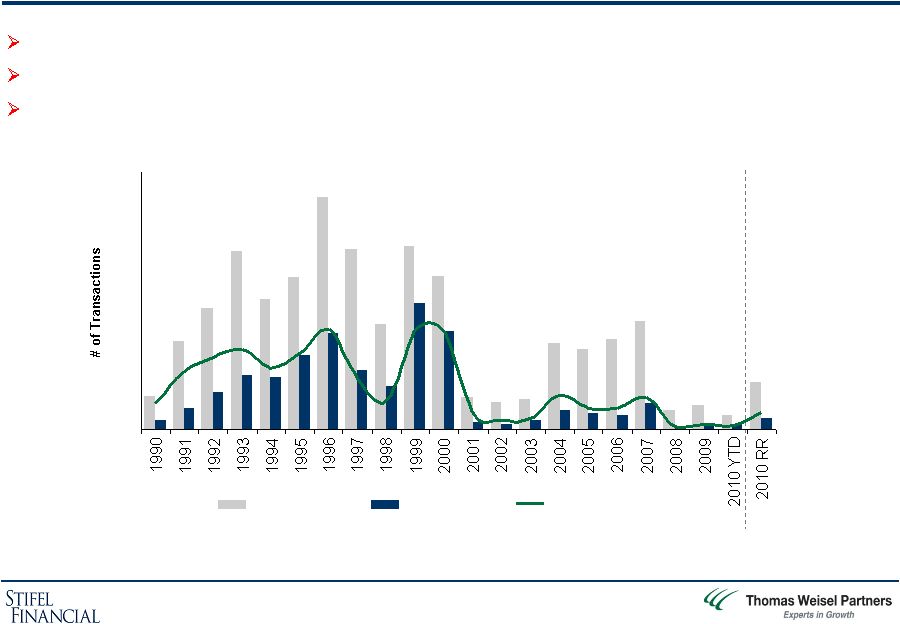

U.S. IPO Market is Cyclical; Pronounced in Growth Sectors

Market turned at the beginning of 2003, 2010 shows similar trends

Average # IPOs between (’01-’03) were 80/year compared with 247/year

between (’04-’07) Average # TMT IPOs between

(’01-’03) were 18/year compared with 51/year between (’04-’07)

Note: TMT

refers

to

technology,

media

and

telecommunications.

Source:

Dealogic,

FactSet,

ThomsonOne

and

TWP

Capital

Markets.

89

241

331

484

354

415

631

490

285

499

418

86

74

79

233

217

245

294

52

65

40

129

24

57

101

147

142

203

259

162

114

345

268

19

14

21

51

42

40

72

6

13

9

29

0

100

200

300

400

500

600

700

# Total

U.S.

IPOs

# U.S.

TMT

IPOs

# Venture-backed IPOs |

10

Technology

M&A

Environment

–

Announced

U.S.

Targets

M&A Activity, Highly Correlated to U.S. GDP, Appears Poised to Accelerate

Note:

Includes

Securities

Data

Corporation

designated

Technology

Industries

(e.g.

Computer

Related,

Electronics,

IT

Services,

Semiconductors,

Software).

Announced

transactions

with

disclosed

values

of

$20

million or more involving U.S. targets only. Excludes spinoffs and repurchases and

withdrawn transactions. Source: Securities Data Corp/Thomson One. $33

$53

$5

$7

$7

$6

$18

$28

$34

$49

$106

$166

$345

$73

$42

$57

$34

$94

$112

$126

$68

$0

$50

$100

$150

$200

$250

$300

$350

$400

'90

'91

'92

'93

'94

'95

'96

'97

'98

'99

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

0

100

200

300

400

500

600

700

800

Volume $B

Deals

Deals

Volume

RR |

11

$14,485

$18,820

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

1

$33,305

108

88

0

50

100

150

200

1

196

Dramatically Increases Investment Banking Footprint

Number

of

Offerings

2005

–

2009

M&A

Transactions

2005

–

2009

# of Transactions

$ Volume (M)

Source:

Dealogic,

Capital

IQ,

TWP

internal

and

SF

internal.

Stifel’s

transactions

include

the

Capital

Markets

Division

of

Legg

Mason

Wood

Walker,

Inc.

(acquired

on

December

1,

2005)

and

Ryan

Beck

&

Co.,

Inc.

(acquired

on

February

28,

2007)

and

their

respective

affiliates.

TWP’s

transactions

include

Westwind

transactions.

(1)

Total

is

adjusted

for

4

overlapping

transactions.

Average 5-Year Lead Managed Transaction %

SF:

16.5% TWP: 24.5%

SF

TWP

Enhances scope and scale with low level of overlap rarely available

321

306

0

100

200

300

400

500

600

700

1

623

(1) |

12

Highly Complementary Investment Banking Industry Coverage

Capital Markets Activity Between 2005 -

2009

(1)

Source:

Dealogic,

Stifel

internal

and

TWP

internal.

Includes

all

equity

and

preferred

offerings.

Note:

Overlapping

transactions

include:

Orbitz

Worldwide

(OWW),

AeroVironment

(AVAV),

TRX

(TRXI)

and

NutriSystem

(NTRI).

Of

the

623

combined

offerings

completed

between

2005

-

2009

ONLY

4

overlap

(1)

# Offerings

Offering Value

Industry

Stifel

TWP

Combined

Overlap

($B)

%

Stifel

Core

Competencies

FIG

99

12

111

0

33.1

$

27.4%

Real Estate

109

10

119

0

21.7

18.0%

U.S. Energy and Natural Resources

34

0

34

0

5.5

4.6%

Aerospace Defense & Government Services

7

4

10

1

4.7

3.9%

Industrials

21

2

23

0

3.8

3.2%

Transportation

3

3

6

0

1.8

1.5%

Education

7

1

8

0

1.3

1.1%

Subtotal

280

32

311

1

72.0

$

59.7%

TWP

Core

Competencies

Technology, Media & Telecommunications

9

96

104

1

20.1

16.7%

Canadian Energy & Natural Resources

11

100

111

0

13.6

11.3%

Healthcare

15

51

66

0

8.5

7.0%

Consumer

6

27

31

2

6.4

5.3%

Subtotal

41

274

312

3

48.6

$

40.3%

Total

321

306

623

4

120.6

$

100.0% |

13

Highly

Complementary

Investment

Banking

Industry

Coverage

Completed M&A Transactions Between 2005 -

2009

(1)

For disclosed deal values only.

Source: Capital IQ.

# Transactions

Transaction Value

(1)

Industry

Stifel

TWP

Combined

($B)

%

Stifel

Core

Competencies

Real Estate

4

0

4

8.6

$

25.9%

Financial Institutions

36

3

39

5.5

16.6%

Industrials

13

4

17

0.5

1.4%

Aerospace, Defense & Government Services

4

0

4

0.3

1.0%

U.S. Energy & Natural Resources

1

0

1

0.1

0.4%

Education

4

0

4

0.1

0.2%

Transportation

5

0

5

NA

NA

Subtotal

67

7

74

15.1

$

45.4%

TWP

Core

Competencies

Technology, Media & Telecommunications

26

41

67

8.6

47.4%

Healthcare

2

13

15

6.1

18.3%

Canadian Energy & Natural Resources

2

16

18

2.0

6.0%

Consumer

11

11

22

1.5

4.4%

Subtotal

41

81

122

18.2

$

54.6%

Total

108

88

196

33.3

$

100.0% |

14

Creates the Largest U.S. Equity Research Platform

Pro Forma U.S. Research

Coverage Pro Forma

U.S. Research Coverage

(1) Source:

Thomson

Reuters

rankings

and

research

coverage

as

of

4/23/10

for

Stifel

and

TWP.

Rankings

exclude 87 closed end funds for Stifel. 100 equities in total

overlap. (2) Small Cap includes

market caps less than $1.0 billion USD. 1,143 unique U.S. companies under

coverage. Only 8% overlap

(1)

93 senior research analysts

#1 U.S. equities coverage

#1 U.S. Small Cap. equities coverage

(2)

Cover approximately 50% of the S&P 500

Combination gets Stifel

to market weight for 3 critical growth

engines of the U.S. economy: Technology, Healthcare and

Energy

U.S.

U.S.

Research

Research

Coverage

Coverage

(1)

(1)

Rank

Firm

# Companies

Stifel

(pro forma, ex.

overlap)

1,143

1.

JPMorgan

1,064

2.

BofA

Merrill Lynch

961

3.

Barclays Capital

914

4.

Stifel

862

24.

TWP

381

Small

Small

Cap.

Cap.

U.S

U.S

Research

Research

Coverage

Coverage

(1)(2)

(1)(2)

Rank

Firm

# Companies

Stifel

(pro forma, ex.

overlap)

423

1.

Stifel

386

2.

Virtua

Research

339

3.

Sidoti

& Company

332

4.

Raymond James

284

23.

TWP

137

Consumer

15%

Energy

15%

Technology

18%

Financials

17%

Healthcare

10%

Transport.

4%

AD&GS

4%

Media

6%

Educ.

1%

REITs

8%

Bus. Svcs.

2% |

15

Enhances a Top Tier Sales and Trading

Platform

Powerful combined research presence, with excellent sales and trading relationships

across regions

#11 YTD AutEx

volume among investment banks on a combined basis

Strong content, combined with excellent electronic trading team and products

TWP

relationships

with

growth

managers,

combined

with

Stifel

coverage

depth

with

both

growth

and value investors

Combines sales and trading groups

Leverages

Stifel’s

Fixed

Income

capabilities

with

TWP

client

base |

16

Enhances Global Wealth Management

Global Wealth Management

1,900 financial advisors

TWP advisors bring deep access to Silicon Valley clients

Private Equity Group

Global Growth Partners: $890 million growth-oriented fund of funds

Healthcare Venture Partners: $122 million device-focused venture capital

fund Venture Partners: $253 million early-stage venture capital

fund Strategic Opportunities Fund: $82 million venture strategic

opportunities/venture capital fund Stifel

Capital

Advisors:

Over

$7

billion

of

assets

under

management

(1)

Investment Management

Manages

small

and

mid-cap

growth

equity

portfolios

for

institutions

and

high

net

worth

individuals

Bank & Trust

Provides lending products and services to private client customers and corporate

clients (1)

Assets under management reflect assets managed by Stifel Capital Advisors' affiliate, FSI Capital

Holdings, LLC and its subsidiaries. Assets under management are calculated based on the aggregate principal balance

of assets as of March 3, 2010. The calculation of assets under management may differ from the

calculation of other asset managers, and as a result this measure may not be comparable to similar measures presented

by other asset managers. Had assets under management been calculated using the method used for purposes

of calculating asset management fees the result would be less than the measure reported herein. |

17

Coast to Coast Institutional Group Presence

Global Wealth

Management

Global Wealth

Management

Combined Institutional Group

Presence Combined

Institutional Group Presence

TWPG

SF

TWPG

SF |

18

Stifel’s

Track Record in Integrating

Transactions:

Low Risk Opportunity

Successfully integrated Legg’s sales and trading, research and investment

banking

platforms

to

Stifel’s

platform

Majority of Legg Mason Investment Banking Managing Directors remain with

Stifel

today

Achieved cost savings objectives

Remains core of Institutional Capital Markets business

Closed December 1, 2005

Successfully integrated Ryan Beck’s private client group and investment

banking

platforms

to

Stifel’s

platform

Achieved cost savings objectives

Closed February 28, 2007

Successfully

integrated

UBS’

private

client

group

platform

to

Stifel’s

platform

Revenue production in-line with expectations

Achieving synergy objectives

Last closing October 16, 2009

(56 branches from

UBS Financial

Services)

(Capital Markets Division) |

19

Driving Value for Stakeholders

Clients

Greater access to resources of both firms

Senior management and leadership provides broader platform to attract and retain

talent Strong cultural fit between firms

Expands services across Institutional Group and Global Wealth Management

platforms Broader industry focus

Deeper talent pool for serving clients

Complementary investment banking and research platforms with almost no overlap

provide continuity of client facing personnel

Continued investment in Investment Banking fully leverages firm strengths

Stifel

remains

over

40%

owned

by

“insiders”

on

a

fully

diluted

basis,

creating

direct

alignment

of

interest with shareholders

Increased revenue opportunities and cost savings create opportunity for enhanced

profitability Proven successful integrators

Building the Premier Growth-Focused Middle-Market Investment Bank

Associates

Shareholders |