Attached files

2010

First-Quarter Earnings Results

April 22, 2010

Exhibit 99.3 |

2

Introduction

Unless otherwise stated, we will be talking about results in the

first quarter 2010 and comparing them with the same period in

2009

References to PMI volumes refer to shipment data

Industry volume and market shares are the latest data

available from a number of internal and external sources

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

Data tables showing adjustments to net revenues and

Operating Companies Income (OCI) for currency, acquisitions,

asset impairment and exit costs, adjustments to EPS, and

reconciliations to U.S. GAAP measures are at the end of

today’s web cast slides and are posted on our web site

|

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain statements that, to the

extent they do not relate strictly to historical or current facts, constitute

“forward-looking statements”

within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

based on current plans, estimates and expectations, and are not

guarantees of future performance. They are based on management’s

expectations that involve a number of business risks and uncertainties,

any of which could cause actual results to differ materially from those

expressed in or implied by the forward-looking statements. PMI

undertakes no obligation to publicly update or revise any forward-looking

statements, except in the normal course of its public disclosure

obligations. The risks and uncertainties relating to the forward-looking

statements in this presentation include those described under Item 1A.

“Risk Factors”

in PMI’s Form 10-K for the year ended December 31,

2009, filed with the Securities and Exchange Commission.

|

4

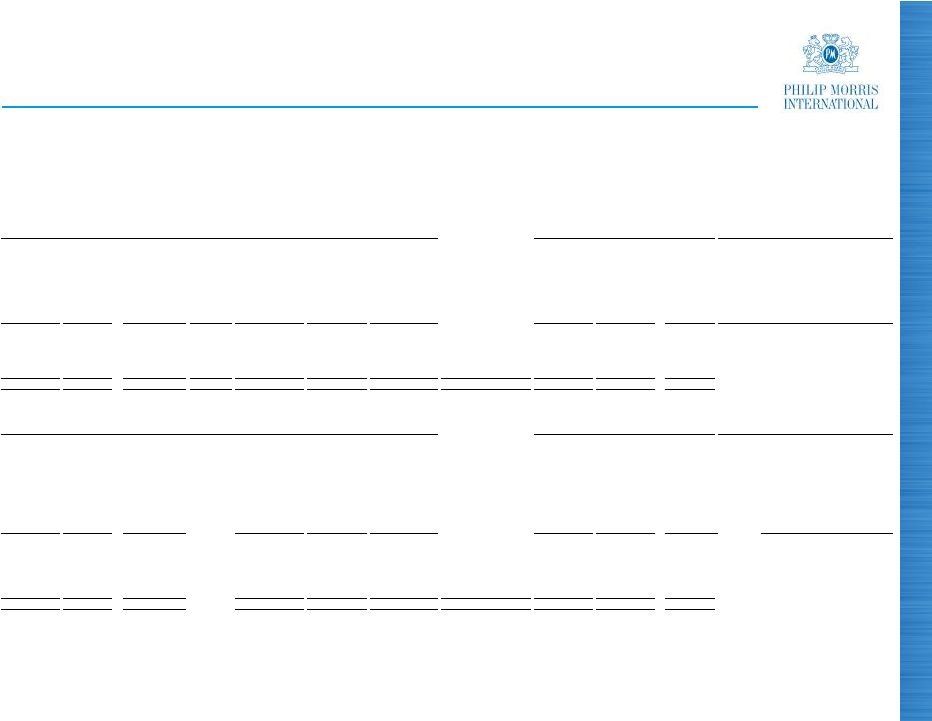

PMI Results

Strong financial performance in Q1, 2010

In line with or above all our constant currency mid to long-

term annual growth targets:

Growth

Targets

(c)

Q1,

2010

Results

(c)

Net Revenues

4 –

6%

+ 6.1%

Adjusted

OCI

(a)

6 –

8%

+ 8.6%

Adjusted

Diluted

EPS

(b)

10 –

12%

+13.5%

(a)

OCI stands for Operating Companies Income, which is defined as operating income

before general corporate expenses and the amortization of intangibles. Q1,

2010, OCI growth rate is on an adjusted basis which excludes asset impairment and exit costs

(b)

Adjusted diluted earnings per share

(c)

All financial growth rates exclude currency. Net revenues and OCI growth rates also

exclude acquisitions Source: PMI Financials. See reconciliations to

U.S. GAAP measures at the end of this presentation |

5

PMI Results

Source: PMI Financials

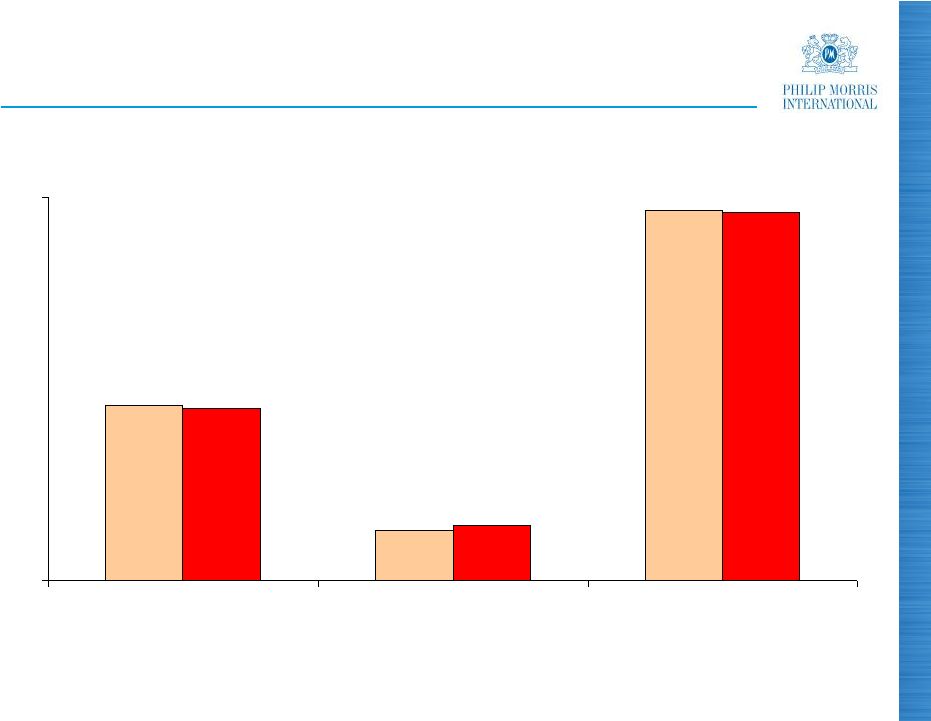

204.7

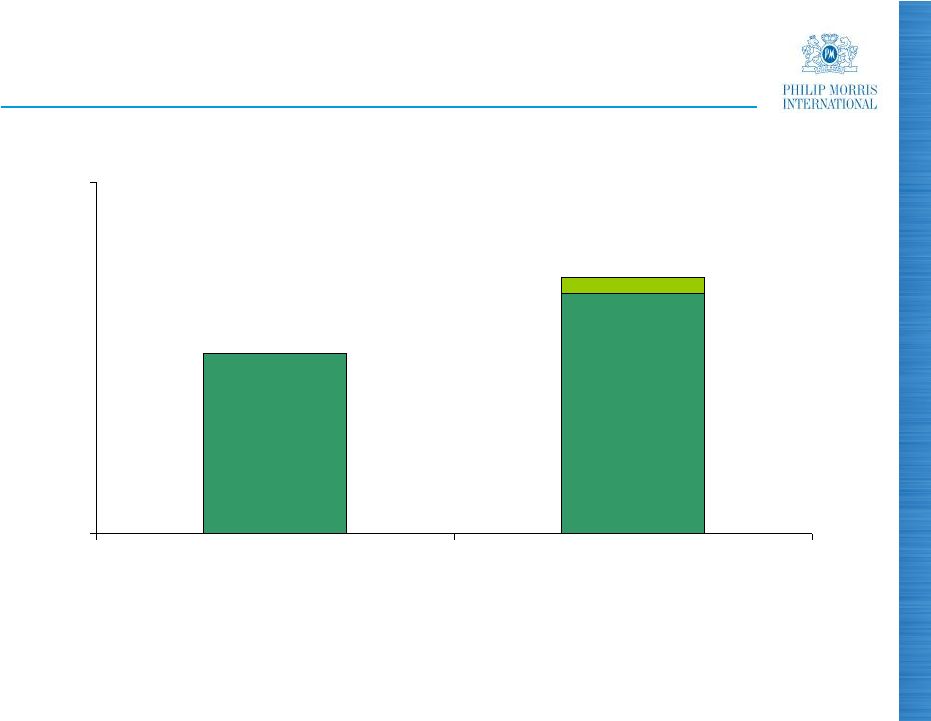

Q1, 2010 Results

(units billions)

(2.3)%

0.7%

Cigarette Volume

Excl. Acquisitions

Actual

% Growth

Q1, 2010 vs. Q1, 2009 |

6

Business Outlook

Economic environment

Adult consumer behavior

Excise taxation

Competitiveness |

7

Economic Environment

Emerging markets in Asia continue to grow

Improved outlook in Latin America

Some signs of stabilization in Eastern Europe

Economic conditions in EU remain difficult |

8

Adult Consumer Behavior

Growing premium volume in several emerging markets,

such as Algeria, Argentina, Indonesia and Mexico

Consumer downtrading moderating in Russia

Price sensitivity remains high in EU markets

Improvement in employment levels key to global

resumption in consumer uptrading

Illicit trade attracting price sensitive consumers |

9

Excise Taxation

Most governments are continuing to pursue a policy of

reasonable increases

Excise tax structures are globally improving |

10

New EU Excise Tax Directive

Premised on gradual tax increases

Three important structural improvements:

-

Increase in maximum specific-to-total ratio from 55% to 76.5%

-

Gradual reduction in gap between tax rates on fine cut and

cigarettes

-

Elimination of previous 100% of MPPC cap on Minimum Excise

Tax

Visibility through 2018

Source: European Union Commission |

11

Excise Taxation

Most governments are continuing to pursue a policy of

reasonable increases

Excise tax structures are globally improving

Large disruptive excise tax increases in January 2010 in

Romania and Turkey:

-

Double-digit industry volume declines

-

Significant increase in illicit trade in both markets

Source: PMI Financials |

12

Excise Taxation

Most governments are continuing to pursue a policy of

reasonable increases

Excise tax structures are globally improving

Large disruptive excise tax increases in January 2010 in

Romania and Turkey

Greek Government decreased the Minimum Excise Tax,

at the same time as it increased the ad-valorem excise

tax rate:

-

Consumer downtrading expected as price gaps widen

-

Main impact starting in the second quarter

Consequently, government revenue targets may not be

met and we hope a more appropriate approach will be

taken going forward

Source: PMI Financials |

13

Excise Taxation

Most governments are continuing to pursue a policy of

reasonable increases

Excise tax structures are globally improving

Large disruptive excise tax increases in January 2010 in

Romania and Turkey

Greek Government decreased the Minimum Excise Tax,

at the same time as they increased the ad-valorem excise

tax rate

70 Yen / pack excise tax increase in Japan to take place

in October 2010:

-

Impact on industry volume very difficult to predict

-

PMI obtained approval to increase prices by 20 Yen / pack this

June but has decided not to implement this price move

Source: Government of Japan |

14

PMI Competitiveness

PMI continues to grow share across wide range of

developed and emerging markets

Markets where PMI’s smoker share among Legal Age

(min. 18) –

24 year olds is at least 5 share points higher

than among Legal Age (min. 18) –

64 year olds include:

-

OECD: Austria, Belgium, France, Hungary, Japan, Korea,

Netherlands, Poland, Portugal, Slovakia, Spain

-

Non-OECD: Argentina, Brazil, Egypt, Lebanon, Qatar, Slovenia,

Ukraine

Source:

A.C.

Nielsen,

PMI

Estimates

and

PMI

Market

Research

–

Consumer

and

Segment

Tracking

(CAST) |

15

Marlboro

Volume

Strong performance in Q1, 2010, with total volume down

just 0.6% and up 1.4% excluding Romania and Turkey

Asia: volume up 7.4%

Latin America & Canada: volume up 1.5%

Source: PMI Financials |

16

Marlboro

Volume

Strong performance in Q1, 2010, with total volume down

just 0.6% and up 1.4% excluding Romania and Turkey

Asia: volume up 7.4%

Latin America & Canada: volume up 1.5%

EEMA: volume down 1.2%, in spite of strong performance

in North Africa and improved duty-free sales

EU: volume down 6.2%, due to consumer downtrading in

Germany and Spain and overall industry volume decline

Non-EU markets account for over 60% of global Marlboro

volume

Source: PMI Financials |

17

Marlboro

Innovation

Roll-out of new architecture

Innovative line extensions:

-

Marlboro Filter Plus

(2.8% share in Kuwait)

-

Marlboro Gold Touch

(1.4% share in Italy)

-

Marlboro Black Menthol

(1.3% share in Japan)

Incremental volume and

reinforcement of equity of

the overall Marlboro

franchise

Note: All market share data refers to first quarter to date, 2010

Source: A.C. Nielsen, PMI estimates and Tobacco Institute of Japan

|

18

Superior Brand Portfolio

Mid-Price

Premium &

Above

Local Heritage

International

Low-Price |

19

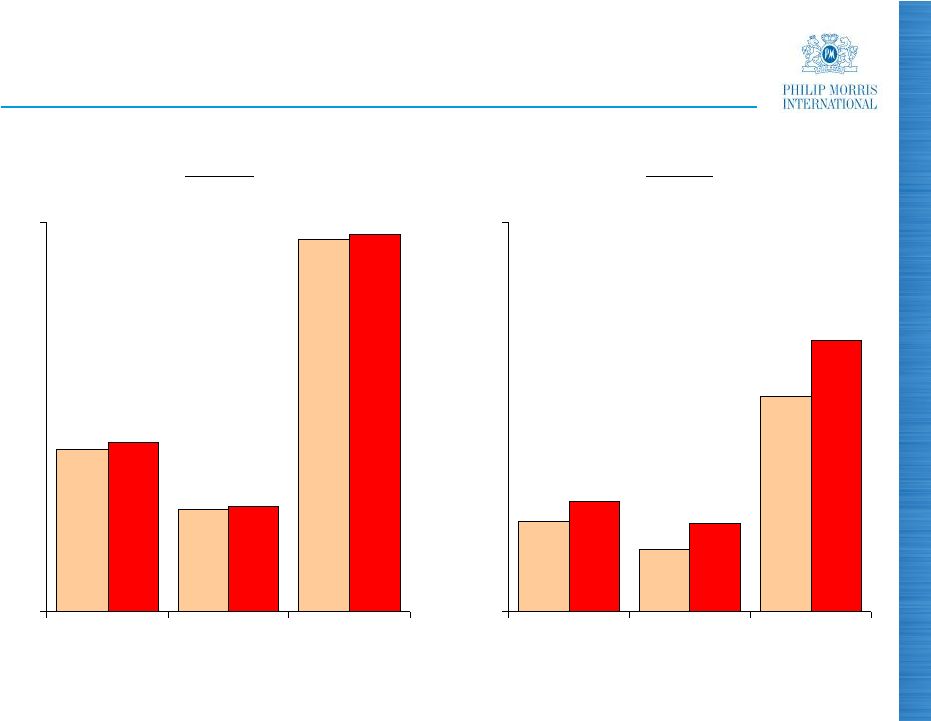

18.3

5.2

38.6

18.0

5.7

38.4

0

40

Total PMI

PMI Market Share Developments: EU Region

Source: PMI Estimates

(%) |

20

5.8

4.0

13.8

7.0

5.7

17.4

0

25

Total PMI

10.4

6.5

23.9

10.8

6.7

24.2

0

25

Total PMI

PMI Market Share Developments: Asia Region

Source:

Tobacco

Institute

of

Japan

and

Hankook

Research

(%)

(%)

Japan

Korea |

21

PMI Market Share Developments: Russia

PMI share up 0.5pp to 25.6% in Q1, 2010

Bond

Street

key

driver

of

PMI

share

gains

and

fastest-

growing brand on the market

Parliament

in

above

premium

segment

is

stable

Chesterfield

in mid-price segment is gaining share

Source: A.C. Nielsen |

22

PMI Share Developments: Emerging Markets

(0.1)

29.0

Indonesia

(a)

0.9

74.5

Argentina

N.A.

c.90 (March)

Philippines

0.4

69.6

Mexico

(1.5)

40.9

Turkey

0.4pp

36.2

Ukraine

Variance

Q1, 2010

vs. Q1, 2009

Q1, 2010

Market Shares

a)

Latest available data for the quarter through end February

Source: A.C. Nielsen and PMI estimates |

23

Pricing

In last six months, PMI has implemented price increases

notably in:

Pricing variance was $449 million in Q1, 2010

Argentina

Canada

Dominican Rep.

Mexico

Australia

Indonesia

Malaysia

Pakistan

Romania

Russia

Saudi Arabia

Turkey

Ukraine

France

Greece

Italy

Poland

Spain

UK

LA & Canada

Asia

EEMA

EU

Source: PMI Financials |

24

PMI Results

Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of

this presentation 6.5

Q1, 2010 Results

($ billions)

6.1%

16.1%

Net Revenues

Excl. Currency

and Acquisitions

Actual

% Growth

Q1, 2010 vs. Q1, 2009 |

25

PMI Results

(a)

Excludes asset impairment and exit costs

Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of

this presentation 2.8

6.5

Q1, 2010 Results

($ billions)

8.6 %

17.0%

Adjusted OCI

(a)

6.1%

16.1%

Net Revenues

Excl. Currency

and Acquisitions

Actual

% Growth

Q1, 2010 vs. Q1, 2009 |

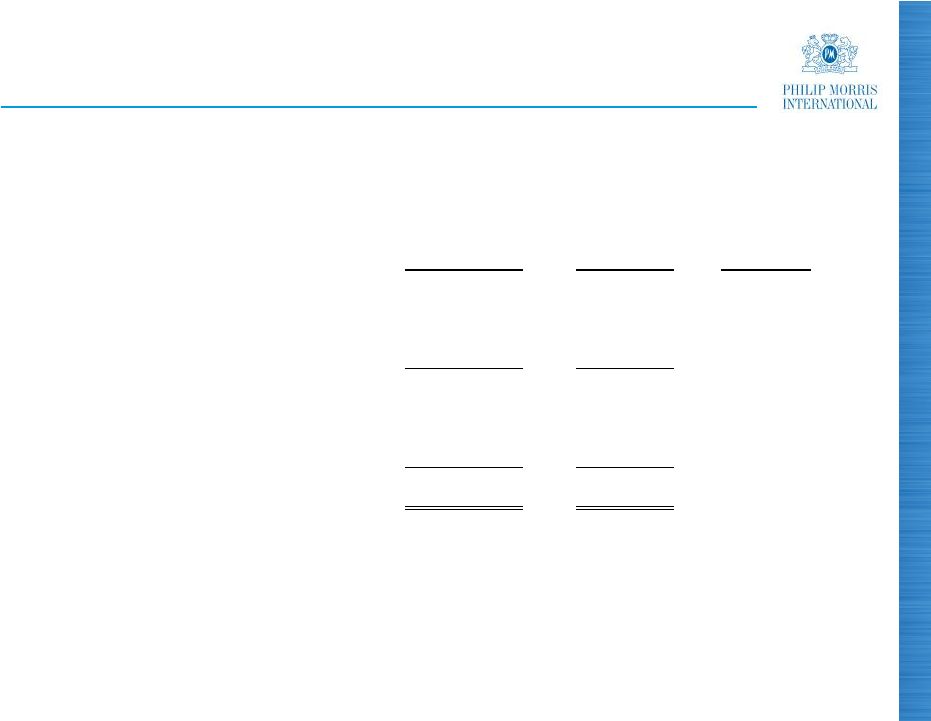

26

Adjusted OCI Margins

(a)

0.4

42.7

42.3

Total PMI

2.9

30.2

27.3

LA & Canada

(3.8)

37.8

41.6

Asia

4.6

45.0

40.4

EEMA

0.3pp

49.0%

48.7%

EU

Variance

Q1

2010

Q1

2009

(a)

Excluding currency impact

Note: Margins are calculated as adjusted OCI, divided by net revenues, excluding

excise taxes Source: PMI

Financials.

See

reconciliation

to

U.S.

GAAP

measures

at

the

end

of

this

presentation |

27

Productivity and Costs

$200 million tobacco leaf cost increase forecast for 2010

Will be largely offset by productivity savings in

manufacturing

On track to realize $500 million of productivity and cost

savings in 2010 and $1.5 billion on a cumulative basis for

the period 2008-2010

Source: PMI Financials |

28

PMI Results

0.90

Q1, 2010

Results ($)

13.5%

21.6%

Adjusted

Diluted

EPS

(a)

Excl. Currency

Actual

% Growth

Q1, 2010 vs. Q1, 2009

(a)

Excludes asset impairment and exit costs

Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of

this presentation |

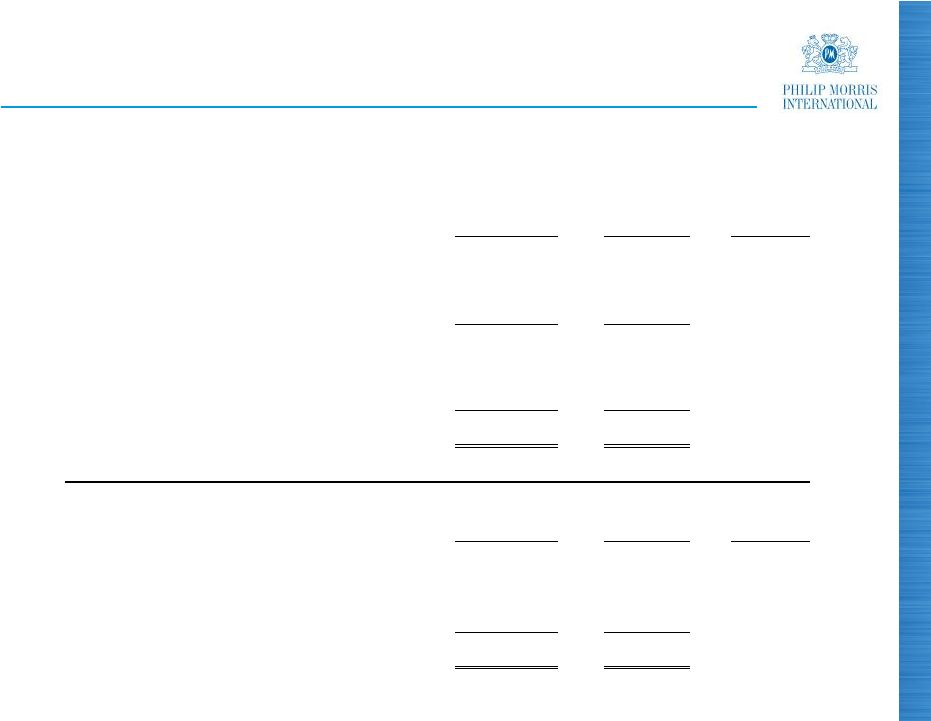

29

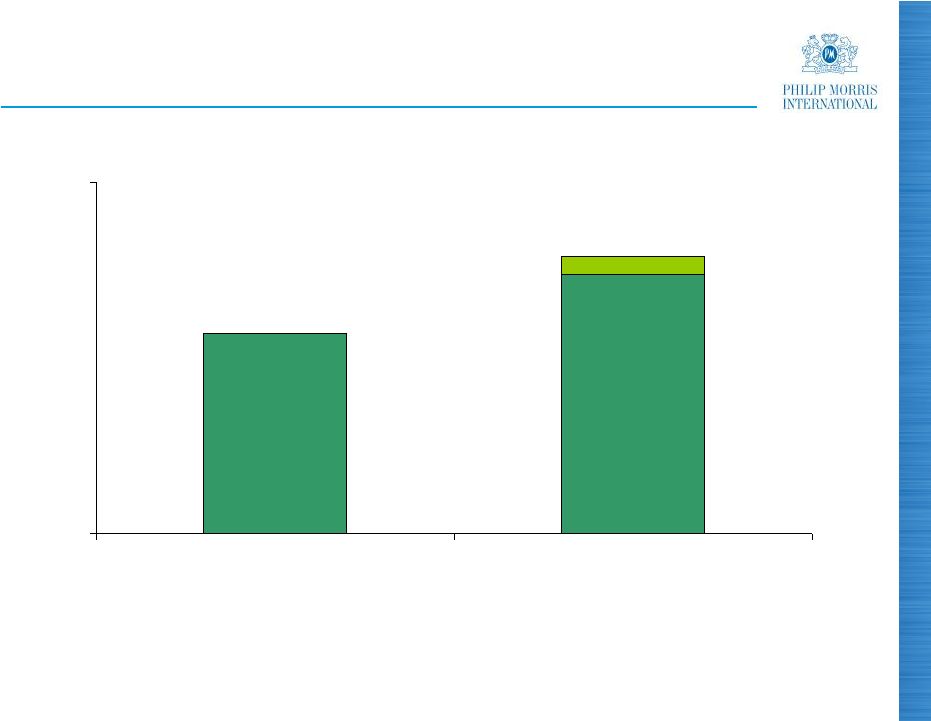

1,427

1,974

0

2,500

Q1

Q1

Source: PMI Financials. See reconciliations to U.S. GAAP measures at the end of

this presentation Operating Cash Flow

($ millions) |

30

Operating Cash Flow

Increase in operating cash flow in Q1, 2010, driven mainly

by:

Higher net earnings

Stricter forestalling regulations

Working capital improvement program

Source: PMI Financials |

31

1,282

1,824

0

2,500

Q1

Q1

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures. Source: PMI Financials. See reconciliations to U.S. GAAP

measures at the end of this presentation Free Cash Flow

(a)

($ millions) |

32

Corporate Financing

$1.0 billion 10 year bond with 4.5% coupon issued in

March 2010

$2.5 billion three-year bank revolver established to

replace two facilities maturing this year

Over $14 billion in well-laddered bonds in three currencies

issued since spin with attractive average cost of 5.5%

Total available and undrawn bank revolver credit is now

$5.2 billion

Continued strong A2 / A / A long-term credit ratings

Access to tier 1 commercial paper market

Source: PMI Financials |

33

Shareholder Returns

$1.8 billion spent in Q1, 2010, to purchase 36.1 million

shares

$257 million remained on current share repurchase plan,

which will be completed by end April

New share repurchase program of $12 billion May 2010

through April 2013

Dividend yield on 19 April 2010 was an attractive 4.5%

Source: PMI Financials |

34

Summary

Strong financial results

Pricing power remains intact

Superior brand portfolio

Innovation success

Market share gains

Tremendous cash flow

Some road bumps from excise taxation

Improved economic outlook

Good business momentum

Impact of Japan excise tax increase uncertain |

35

2010 EPS Guidance

PMI is reaffirming its 2010 reported diluted EPS guidance

of $3.75 -

$3.85

Guidance represents a reported diluted EPS growth rate

of 16% to 19%

Exchange rates more favorable today than in February

More cautious stance being taken on Japan in light of

recent developments

On a constant currency basis, reported diluted EPS

guidance growth rate is 10% to 13% |

Questions & Answers

2010 First-Quarter

Earnings Results |

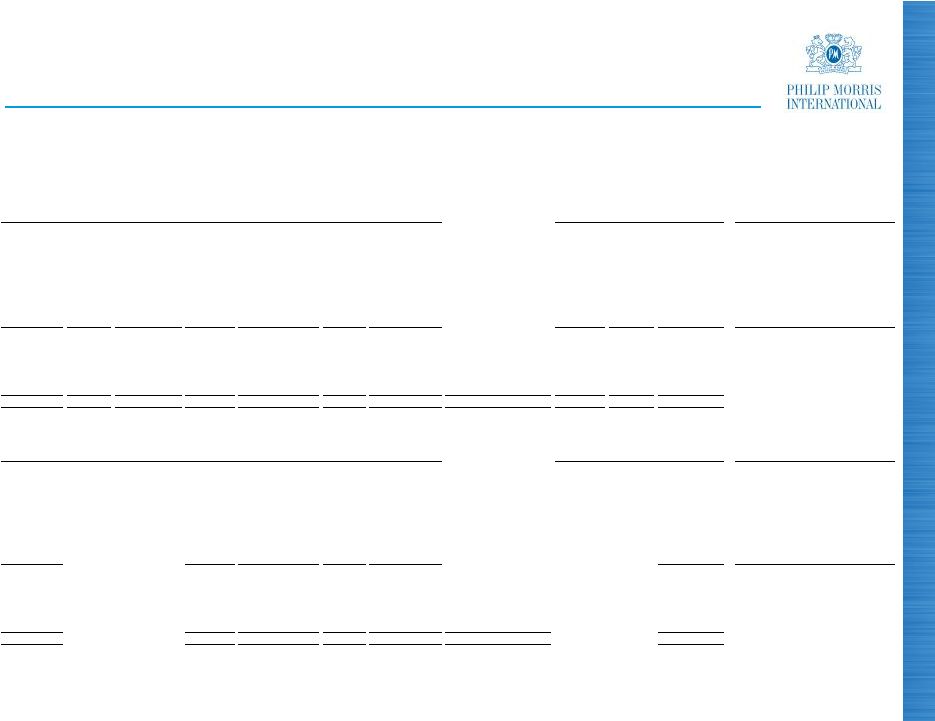

37

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for Impact of Currency and Acquisitions

For the Quarters Ended March 31,

(in millions)

(Unaudited)

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding Excise

Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported

Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

6,748

$

4,564

$

2,184

$

178

$

2,006

$

3

$

2,003

$

European Union

6,050

$

4,063

$

1,987

$

9.9 %

1.0 %

0.8 %

3,356

1,610

1,746

52

1,694

26

1,668

EEMA

2,831

1,379

1,452

20.2 %

16.7 %

14.9 %

3,562

1,689

1,873

172

1,701

75

1,626

Asia

2,857

1,267

1,590

17.8 %

7.0 %

2.3 %

1,921

1,228

693

51

642

-

642

Latin America & Canada

1,548

980

568

22.0 %

13.0 %

13.0 %

15,587

$

9,091

$

6,496

$

453

$

6,043

$

104

$

5,939

$

PMI Total

13,286

$

7,689

$

5,597

$

16.1 %

8.0 %

6.1 %

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,062

$

80

$

982

$

2

$

980

$

European Union

967

$

9.8 %

1.6 %

1.3 %

770

8

762

9

753

EEMA

586

31.4 %

30.0 %

28.5 %

724

81

643

(5)

648

Asia

661

9.5 %

(2.7)%

(2.0)%

217

23

194

-

194

Latin America & Canada

155

40.0 %

25.2 %

25.2 %

2,773

$

192

$

2,581

$

6

$

2,575

$

PMI Total

2,369

$

17.1 %

8.9 %

8.7 %

2010

2009

% Change in Reported Operating

Companies Income

2010

2009

% Change in Reported Net

Revenues excluding Excise Taxes |

38

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin Excluding Currency and Acquisitions For the Quarters Ended March

31, (in millions)

(Unaudited)

(1) For the calculation of net revenues excluding excise taxes and currency, refer

to previous slide. Reported

Operating

Companies

Income

Less

Asset

Impairment

& Exit

Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,062

$

-

$

1,062

$

80

$

982

$

2

$

980

$

European Union

967

$

(1)

$

968

$

9.7 %

1.4 %

1.2 %

770

-

770

8

762

9

753

EEMA

586

-

586

31.4 %

30.0 %

28.5 %

724

-

724

81

643

(5)

648

Asia

661

-

661

9.5 %

(2.7)%

(2.0)%

217

-

217

23

194

-

194

Latin America & Canada

155

-

155

40.0 %

25.2 %

25.2 %

2,773

$

-

$

2,773

$

192

$

2,581

$

6

$

2,575

$

PMI Total

2,369

$

(1)

$

2,370

$

17.0 %

8.9 %

8.6 %

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net

Revenues

excluding

Excise

Taxes &

Currency

(1)

Adjusted

Operating

Companies

Income Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

(1)

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding

Excise

Taxes

(1)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

982

$

2,006

$

49.0 %

980

$

2,003

$

48.9 %

European Union

968

$

1,987

$

48.7 %

0.3

0.2

762

1,694

45.0 %

753

1,668

45.1 %

EEMA

586

1,452

40.4 %

4.6

4.7

643

1,701

37.8 %

648

1,626

39.9 %

Asia

661

1,590

41.6 %

(3.8)

(1.7)

194

642

30.2 %

194

642

30.2 %

Latin America & Canada

155

568

27.3 %

2.9

2.9

2,581

$

6,043

$

42.7 %

2,575

$

5,939

$

43.4 %

PMI Total

2,370

$

5,597

$

42.3 %

0.4

1.1

% Change in Adjusted Operating

Companies Income

2009

2010

2009

2010 |

39

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, Excluding Currency For the Quarters Ended March 31,

(Unaudited)

2010

2009

% Change

Reported Diluted EPS

0.90

$

0.74

$

21.6%

Less:

Asset impairment and exit costs

-

-

Adjusted Diluted EPS

0.90

$

0.74

$

21.6%

Less:

Currency Impact

0.06

Adjusted Diluted EPS, Excluding Currency

0.84

$

0.74

$

13.5% |

40

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

Reconciliation of Operating Cash Flow to Operating Cash Flow, excluding

Currency For the Quarters Ended March 31,

(in millions)

(Unaudited)

(a) Operating Cash Flow

2010

2009

% Change

Net cash provided by operating activities

(a)

1,974

$

1,427

$

38.3 %

Less:

Capital expenditures

150

145

Free cash flow

1,824

$

1,282

$

42.3 %

Less:

Currency impact

116

Free cash flow, excluding currency

1,708

$

1,282

$

33.2 %

2010

2009

% Change

Net cash provided by operating activities

(a)

1,974

$

1,427

$

38.3 %

Less:

Currency impact

130

Net cash provided by operating activities, excluding currency

1,844

$

1,427

$

29.2 % |

2010

First-Quarter Earnings Results April 22, 2010

|