Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FIFTH THIRD BANCORP | d8k.htm |

Fifth Third Bank | All Rights Reserved

Annual Meeting of Fifth Third Shareholders

Kevin T. Kabat

Chairman, President & Chief Executive Officer

April 20, 2010

Please refer to earnings release dated January 21, 2010 and 10-K dated

February 26, 2010 for further information, including full results reported on a U.S.

GAAP basis

Exhibit 99.1 |

2

Fifth Third Bank | All Rights Reserved

Agenda

Overview

Economic backdrop

2009 performance summary and highlights

Capital and loan loss reserve analysis

Strategy for 2010 and beyond |

3

Fifth Third Bank | All Rights Reserved

Fifth Third today

* Fortune magazine, March 16, 2009

$113 billion assets

16 affiliates in 12 states

1,309 banking centers

2,358 ATMs

Fifth Third Bank has been

dedicated to serving the

needs of its retail and

commercial customers for

more than 150 years

Top 10 Superregional Bank

for 8 consecutive years*

Naples

Raleigh

Cincinnati

Florence

Louisville

Lexington

Nashville

Atlanta

Augusta

Orlando

Tampa

Naples

Raleigh

Charlotte

Huntington

Pittsburgh

Cleveland

Columbus

Toledo

Detroit

Grand Rapids

Traverse

City

Chicago

Evansville

Jacksonville

Indianapolis

St. Louis |

4

Fifth Third Bank | All Rights Reserved

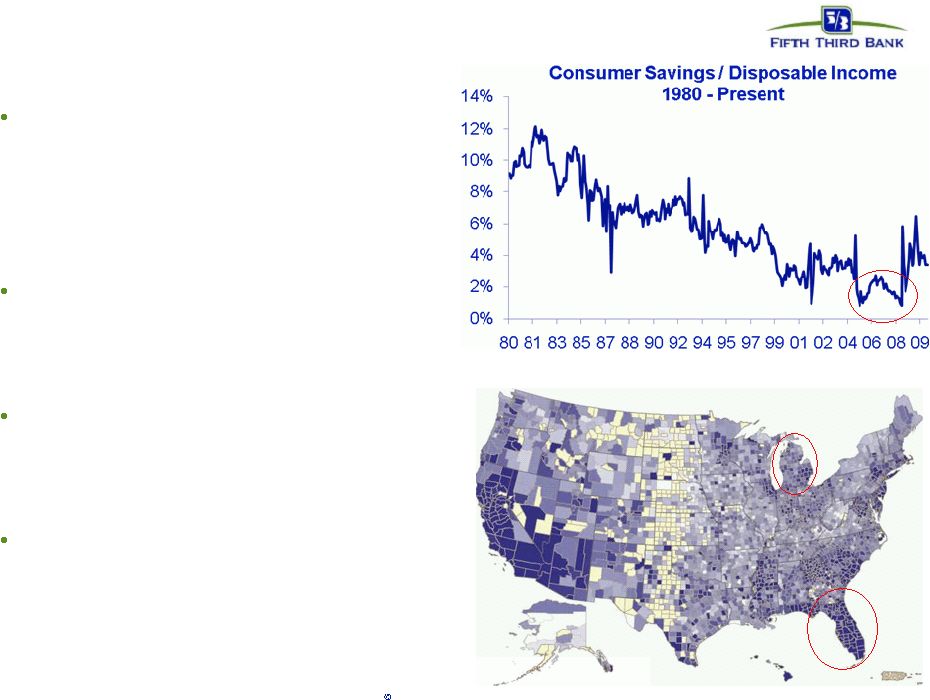

Operating environment update

Roots of the crisis

—

Global savings imbalances

—

The housing bubble

—

Higher than normal leverage in financial

system

—

Oversight failures

Government actions

—

TARP and CPP

—

The “stress test”

—

Ongoing intervention in housing market

Economy is improving

—

GDP growth

—

Housing market stabilization

—

Employment stabilizing

Outlook

—

Higher consumer savings rates

—

Loan demand remains measured

—

Limited role for non-bank lenders

90+

Delinquency

Mortgage

Heat

Map

–

Q409

Sources: Bureau of Economic Analysis, Federal Reserve Bank of New York

|

5

Fifth Third Bank | All Rights Reserved

GDP and Unemployment

Consumer Confidence and Retail Sales

Interest Rate Market

Macro economic indicators

Housing Market

Source: Bloomberg. |

6

Fifth Third Bank | All Rights Reserved

2009 results vs. peers

Range

Metric

Rank / 13

Peer average

Core Deposit growth^

8

9.7%

(1.8%)

18.1%

9.8%

Tier 1 ratio*

1

11.1%

8.4%

13.3%

13.3%

Tier 1 common ratio*

7

7.0%

5.5%

8.5%

7.0%

5

6.2%

4.3%

8.1%

6.5%

Tangible common equity ratio

1

3.10%

Net Interest Margin*

7

3.47%

2.72%

4.31%

3.55%

2

Core PPNR / Average Loans*

(annualized)

5

2.7%

1.4%

4.8%

2.9%

1

3

4

5

6

7

1.69%

4.88%

4.88%

Reserves / loans

2

78%

8

51%

130%

116%

Reserves / NPAs

4

113%

9

65%

163%

132%

Reserves / annualized NCOs

Peers include: BBT, CMA, HBAN, KEY, MI, MTB, PNC, RF, STI, USB, WFC, ZION. Source:

SNL and company reports ^ Excludes

core

deposit

increases

resulting

from

acquisitions

in

2009

*4Q09 data. Growth year-over-year.

NPAs

exclude HFS portion and covered loans for all banks. |

7

Fifth Third Bank | All Rights Reserved

Deposit share momentum

Source: FDIC, SNL Financial; branches included are full service retail / brick and

mortar; data excludes headquarters branches with over $250 million in deposits.

•

Continued focus on

customer satisfaction

and building full

relationships has

given strong

momentum to the

retail network

•

Fifth Third grew

deposits in 15 of 16

affiliate markets in

2009

–

Modest attrition in

North Carolina

acquisition market

•

Fifth Third grew

deposit market share

in 75% of affiliate

markets in 2009

Affiliate

5/3 Deposit

(08-09)

5/3 Market Share

Name

Deposit

($)

(%)

Share

2009

2008

Chicago

788,601

9.8%

4.0%

3.8%

Northeastern Ohio

606,708

17.0%

4.2%

3.8%

South Florida

579,342

21.1%

3.1%

2.8%

Eastern Michigan

418,525

11.9%

5.4%

5.0%

Central Florida

338,091

28.9%

3.0%

2.5%

Tampa

334,080

24.5%

3.5%

3.1%

Central Ohio

213,971

5.6%

11.1%

11.2%

Cincinnati

212,656

2.2%

21.5%

21.9%

Southern Indiana

195,169

8.6%

4.1%

4.0%

Louisville

194,593

13.0%

8.9%

8.2%

Northwestern Ohio

177,122

7.5%

16.2%

15.4%

Western Michigan

149,252

2.1%

18.4%

18.4%

Tennessee

142,615

12.8%

3.5%

3.3%

Central Indiana

139,354

4.7%

8.4%

8.3%

Central Kentucky

2,608

0.3%

8.1%

8.7%

North Carolina

(113,631)

(4.4%)

4.8%

5.3% |

8

Fifth Third Bank | All Rights Reserved

Third Party customer experience recognition

University of Michigan American Customer Satisfaction Index (ACSI)*

Fifth Third Bank was tied for first (Wachovia) in the latest ACSI ranking. We were

significantly higher than all of the other measured banks, including JP

Morgan Chase, Bank of America, Wells Fargo and Citigroup

Forrester

Fifth

Third

finished

second

among

large

banks

in

customer

experience

(CXPi

2010)

Fifth Third ranked #1 for correlation between a positive customer experience and

repurchase plans (2008)

Gallup

Achieved top quartile customer loyalty in 2009

Achieved top quartile customer satisfaction in 2008

JD Power

Fifth Third ranked 6

among our peer group (up from 13

in 2007)

Fifth Third ranked 8

among the top 20 banks (up from 16

in 2007)

Convergys

Fifth Third ranked 3

among peer group and 5

overall in 2009 Convergys Retail Bank

study

th

th

th

th

rd

th

*

Fifth

Third

Bank

engaged

the

American

Customer

Satisfaction

Index

(ACSI)

in

custom

research

projects

surveying

Fifth

Third

Bank

customers.

In

the

surveys,

ACSI

used

the

same statistical methodology as the independently measured banks, Bank of America,

Chase, Wells Fargo, and Citigroup |

9

Fifth Third Bank | All Rights Reserved

4Q09 credit results

Source:

SNL

and

company

reports.

NPAs

exclude

loans

held-for-sale

and

covered

assets.

Year-over-year NCO growth versus peers

Peer average: 122%

NPA ratio versus peers

Year-over-year NPA growth versus peers

Peer average: 100%

Net charge-off ratio versus peers |

10

Fifth Third Bank | All Rights Reserved

Strong reserve position

Coverage ratios are strong relative to peers

Source: SNL and company reports. NPAs/NPLs

exclude held-for-sale portion for all banks and covered assets for BBT,

USB, and ZION. 1.

FITB

4.88%

2.

KEY

4.31%

3.

HBAN

4.03%

4.

ZION

3.81%

5.

RF

3.43%

6.

MI

3.36%

7.

PNC

3.22%

8.

WFC

3.13%

9.

STI

2.74%

10.

USB

2.66%

11.

BBT

2.51%

12.

CMA

2.34%

13.

MTB

1.71%

Peer Average

3.11%

Reserves / Total loans

Industry leading reserve level |

Strong capital position

Source: SNL and company reports.

(TCE + reserves) / Loans

Tangible common equity ratio

Peer average: 6.2%

Peer average: 12.0%

Tier 1 common ratio

Peer average: 7.1%

Peer average w/

TARP: 11.2%

Peer average

w/o TARP: 8.9%

Tier 1 capital ratio (with and without TARP)

8.6%

11.1%

10.5%

11.5%

11.5%

12.0%

12.5%

13.0%

12.8%

13.3%

Strong capital ratios relative to peers, particularly considering reserve

levels 11

Fifth Third Bank | All Rights Reserved |

12

Fifth Third Bank | All Rights Reserved

Strong relative stock performance

From June 2008 capital actions to date

(110%)

(90%)

(70%)

(50%)

(30%)

(10%)

10%

30%

50%

70%

90%

110%

6/08

7/08

8/08

9/08

10/08

11/08

12/08

1/09

2/09

3/09

4/09

5/09

6/09

7/09

8/09

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

FITB 59%

SP Banks 6%

BKX (9%)

TARP

investment

FTPS

announcement

SCAP

results

Source: Bloomberg, 06/18/08 –

04/16/10.

June 2008

capital

actions

FITB

stock price

$9.26

FITB

stock price

$14.20 |

13

Fifth Third Bank | All Rights Reserved

Strong relative stock performance

From last year’s Annual Shareholder Meeting to date

(50%)

0%

50%

100%

150%

200%

250%

300%

4/09

5/09

6/09

7/09

8/09

9/09

10/09

11/09

12/09

1/10

2/10

3/10

4/10

FITB 259%

SP Banks 65%

BKX 61%

Source:

Bloomberg,

04/21/09

–

04/16/10.

FITB

stock price

$3.65

FITB

stock price

$14.20

SCAP

results |

14

Fifth Third Bank | All Rights Reserved

Focus areas for 2010 and beyond |

|

16

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report may contain statements that we believe are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175

promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and

Rule 3b-6 promulgated thereunder. These statements relate to our financial condition, results of operations, plans, objectives, future

performance or business. They usually can be identified by the use of forward-looking language

such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as

“believes,” “plans,” “trend,” “objective,”

“continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,”

“should,” “could,” “might,” “can,” or similar verbs. You

should not place undue reliance on these statements, as they are subject to risks and

uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K. When considering

these forward-looking statements, you should keep in mind these risks and uncertainties, as well

as any cautionary statements we may make. Moreover, you should treat these statements as

speaking only as of the date they are made and based only on information then actually known to

us. There are a number of important factors that could cause future results to differ

materially from historical performance and these forward- looking statements. Factors that

might cause such a difference include, but are not limited to: (1) general economic conditions and

weakening in the economy, specifically the real estate market, either nationally or in the states in

which Fifth Third, one or more acquired entities and/or the combined company do business, are

less favorable than expected; (2) deteriorating credit quality; (3) political developments,

wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4) changes in

the interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and

sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to

maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining

capital requirements may limit Fifth Third’s operations and potential growth; (8) changes and

trends in capital markets; (9) problems encountered by larger or similar financial institutions

may adversely affect the banking industry and/or Fifth Third (10) competitive pressures among

depository institutions increase significantly; (11) effects of critical accounting policies and judgments; (12) changes in

accounting policies or procedures as may be required by the Financial Accounting Standards Board

(FASB) or other regulatory agencies; (13) legislative or regulatory changes or actions, or

significant litigation, adversely affect Fifth Third, one or more acquired entities and/or the

combined company or the businesses in which Fifth Third, one or more acquired entities and/or the combined company are engaged;

(14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth

Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to

receive dividends from its subsidiaries; (18) potentially dilutive effect of future acquisitions on current

shareholders’ ownership of Fifth Third; (19) effects of accounting or financial results of one or

more acquired entities; (20) difficulties in separating Fifth Third Processing Solutions from

Fifth Third; (21) loss of income from any sale or potential sale of businesses that could have

an adverse effect on Fifth Third’s earnings and future growth;(22) ability to secure confidential information through the use of

computer systems and telecommunications networks; and (23) the impact of reputational risk created by

these developments on such matters as business generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking

statements. |