Attached files

U.S.

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For the

Year Ended December 31, 2009

Commission

File Number: 1-12401

WITS BASIN PRECIOUS MINERALS

INC.

(Exact

Name of Small Business Issuer as Specified in its Charter)

|

MINNESOTA

|

84-1236619

|

|

(State

or Other Jurisdiction of

|

(I.R.S.

Employer Identification Number)

|

|

Incorporation

or Organization)

|

900 IDS CENTER, 80 SOUTH

EIGHTH STREET, MINNEAPOLIS, MINNESOTA 55402-8773

(Address

of Principal Executive Offices)

Issuer’s

telephone number including area code: (612) 349-5277

Securities

registered under Section 12(b) of the Exchange Act: None

Securities

registered under Section 12(g) of the Exchange Act:

COMMON STOCK, $0.01 PAR

VALUE

Title of

Class

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

x

Indicate

by check mark if the Registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act. Yes ¨ No

x

Indicate

by check mark whether the issuer (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for

such shorter period that the Registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90

days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of

this chapter) during the preceding 12 months (or such shorter period that the

registrant was required to submit and post such files). Yes ¨ No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of Registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K ¨.

Indicate

by check mark whether the Registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

||

|

Non-accelerated

filer

|

¨

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act.) Yes ¨ No

x

The

Registrant’s revenues for its most recent fiscal year: None.

The

aggregate market value of the Registrant’s common stock held by non-affiliates

as of June 30, 2009 was approximately $12,500,000, based on the closing sale

price of $0.09 per share as reported on the OTCBB for the Company’s common stock

on June 30, 2009.

On April

13, 2010, there were 169,112,367 shares of common stock issued and outstanding,

which is the Registrant’s only class of voting stock.

Documents

Incorporated by Reference: None.

WITS

BASIN PRECIOUS MINERALS INC.

Annual

Report on Form 10-K

For the

Year Ended December 31, 2009

Table of

Contents

|

|

Page

|

|

|

PART

I

|

||

|

Item

1.

|

Description

of Business

|

4

|

|

Item

1A.

|

Risk

Factors

|

13

|

|

Item

2.

|

Description

of Properties

|

17

|

|

Item

3.

|

Legal

Proceedings

|

17

|

|

PART

II

|

||

|

Item

4.

|

Market

for Registrant’s Common Equity, Related Shareholder Matters and Issuer

Purchases of Equity Securities

|

18

|

|

Item

6.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

19

|

|

Item

7.

|

Financial

Statements and Supplementary Data

|

25

|

|

Item

8.

|

Changes

and Disagreements with Accountants on Accounting and Financial

Disclosure

|

25

|

|

Item

8A(T).

|

Controls

and Procedures

|

26

|

|

Item

8B.

|

Other

Information

|

28

|

|

PART

III

|

||

|

Item

9.

|

Directors,

Executive Officers and Corporate Governance

|

29

|

|

Item

10.

|

Executive

Compensation

|

30

|

|

Item

11.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Shareholder Matters

|

35

|

|

Item

12.

|

Certain

Relationships, Related Transactions and Director

Independence

|

36

|

|

Item

13.

|

Principal

Accountant Fees and Services

|

37

|

|

Item

14.

|

Exhibits

and Financial Statement Schedules

|

38

|

|

Signatures

|

45

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains both historical statements and statements

that are forward-looking in nature. Historical statements are based on events

that have already happened. Certain of these historical events provide some

basis to our management, with which assumptions are made relating to events that

are reasonably expected to happen in the future. Management also relies on

information and assumptions provided by certain third party operators of our

projects as well as assumptions made with the information currently available to

predict future events. These future event predictions, or forward-looking

statements, include (but are not limited to) statements related to the

uncertainty of the quantity or quality of probable ore reserves, the

fluctuations in the market price of such reserves, general trends in our

operations or financial results, plans, expectations, estimates and beliefs. You

can identify forward-looking statements by terminology such as “may,” “could,”

“should,” “anticipate,” “believe,” “estimate,” “continue,” “expect,” “intend,”

“plan,” “predict,” “potential” and similar expressions and their variants. These

forward-looking statements reflect our judgment as of the date of this Annual

Report with respect to future events, the outcome of which is subject to risks,

which may have a significant impact on our business, operating results and/or

financial condition. Readers are cautioned that these forward-looking statements

are inherently uncertain. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results or

outcomes may vary materially from those described herein. We undertake no

obligation to update forward-looking statements. The risks identified in PART I

Item 1A, among others, may impact forward-looking statements contained in this

Annual Report.

3

PART

I

ITEM

1. BUSINESS

OVERVIEW

Wits

Basin Precious Minerals Inc. (with its subsidiaries “we,” “us,” “our,” “Wits

Basin” or the “Company”) is a minerals exploration and development company based

in Minneapolis, Minnesota. As of December 31, 2009, we hold (i) a

majority equity interest of approximately 94% of Standard Gold, Inc. (f/k/a

Princeton Acquisitions, Inc.) which owns a past producing gold mine in Colorado

(the “Bates-Hunter Mine”), (ii) a 50% equity interest in China Global Mining

Resources (BVI) Ltd., which owns a producing iron ore mine and

processing plant in the People’s Republic of China, (the “PRC”), (iii) a 35%

equity interest in Kwagga Gold (Barbados) Limited, which holds prospecting

rights in South Africa (the “FSC Project”) and (iv) certain rights in the Vianey

Concession in Mexico. The following is a summary of these projects:

|

|

·

|

On

June 12, 2008, we transferred our right to purchase the Bates-Hunter Mine,

a prior producing gold mine located in Central City, Colorado, to a newly

created wholly owned subsidiary of ours, the Hunter Bates Mining

Corporation (the “Hunter Bates”). Concurrent with this transfer, Hunter

Bates completed the acquisition of the Bates-Hunter Mine. On September 29,

2009, Standard Gold, Inc., a Colorado corporation (“Standard Gold”)

(formerly known as Princeton Acquisitions, Inc., a public shell

corporation at the time) completed a reverse acquisition via a share

exchange with Hunter Bates and all of its shareholders, whereby the

holders of capital securities of Hunter Bates exchanged all of their

capital securities, on a share-for-share basis, into similar capital

securities of Standard Gold (the “Share Exchange”). Accordingly, the Share

Exchange represented a change in control (reverse merger) and Hunter Bates

became a wholly owned subsidiary of Standard Gold. We hold an aggregate of

21,513,544 shares of Standard Gold common stock (or approximately 94% of

the issued and outstanding shares of common stock) and thus, Standard Gold

is a majority owned subsidiary of ours. Standard Gold’s common stock is

quoted on the OTCBB under the symbol

“SDGR.”

|

|

|

·

|

On

March 17, 2009, we entered into a joint venture with London Mining, Plc, a

United Kingdom corporation (“London Mining”) for the purpose of acquiring

the processing plant of Nanjing Sudan Mining Co. Ltd (“Sudan”) and the

iron ore mine of Xiaonanshan Mining Co. Ltd (“Xiaonanshan”) (the Sudan and

Xiaonanshan collectively are referred to as the “PRC Properties”).

Pursuant to that certain Amended and Restated Subscription Agreement,

dated March 17, 2009 by and between London Mining and the Company, London

Mining purchased 100 ordinary A Shares of China Global Mining Resources

(BVI) Ltd, a British Virgin Islands corporation and at the time a wholly

owned subsidiary of ours (“CGMR (BVI)”) for $38.75 million, which A Shares

constitute a 50% equity interest in CGMR (BVI). We hold the remaining 50%

equity interest in the form of 100 ordinary B Shares. The A Shares carry a

preference with respect to return of capital and distributions (A Shares

are entitled to 99%) until London Mining receives an aggregate of $44.5

million in return of capital or distributions and certain other conditions

are met. On March 17, 2009, CGMR (BVI), through its wholly owned

subsidiary China Global Mining Resources Limited, a Hong Kong corporation

(“CGMR HK”), acquired the PRC Properties. At that time, we deconsolidated

CGMR (BVI) as a subsidiary of

ours.

|

4

|

|

·

|

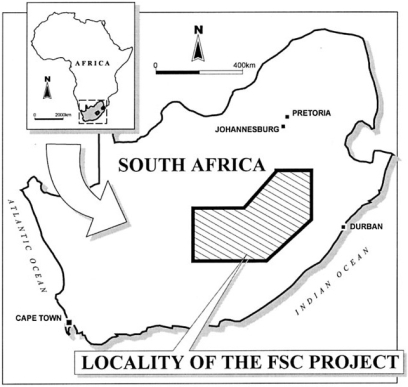

We

hold a 35% equity interest in Kwagga Gold (Barbados) Limited (“Kwagga

Barbados”), which, through its wholly owned subsidiary Kwagga Gold

(Proprietary) Limited, a South African entity (“Kwagga Pty”), holds

mineral exploration rights in South Africa. This project is referred to as

the “FSC Project” and is located adjacent to the historic Witwatersrand

Basin. From October 2003 through August 2005, we completed only two

range-finding drillholes (our $2,100,000 investment to acquire the 35%

equity was utilized to fund the drillholes) and we have not performed any

further exploration activities since. On December 12, 2007, we entered

into an agreement with AfriOre International (Barbados) Limited

(“AfriOre”), the holder of the other 65% of Kwagga Barbados, whereby we

may acquire all of AfriOre’s interest of Kwagga Barbados, which agreement

required completion on or before June 30, 2009. Documentation has been

submitted to obtain the consent of South Africa’s Minister of Minerals and

Energy, who oversees the Department of Minerals and Energy (the “DME”) to

allow for the sale of the controlling interest in Kwagga Pty to a U.S.

company, all of which is still under review. We have a verbal agreement

from AfriOre regarding an extension to obtain consent from the DME. Other

than limited maintenance of the prospecting rights, no other activities

will be conducted until consent is issued by the

DME.

|

|

|

·

|

In

October 2007, we executed an amendment to a formal joint venture agreement

with Journey Resources Corp., a corporation formed under the laws of the

Province of British Columbia (“Journey”), and Minerales Jazz S.A. De C.V.,

a corporation duly organized pursuant to the laws of Mexico and a wholly

owned subsidiary of Journey. Pursuant to the terms of the amendment, we

own a 50% undivided beneficial interest in “located mineral claims” in the

property known as the Vianey Mine Concession located in the State of

Guerrero, Mexico (“Vianey”). Based on our further due diligence on the

Vianey, we have determined that it is necessary to increase the size of

the land package in order for this project to be a viable exploration

endeavor. Inquiries and communications have been disseminated to the

adjacent properties, regarding possible purchase of land, rights or some

type of further joint venture to accomplish an increased footprint. Due to

the limited possibility of return on capital and since we do not

anticipate providing any significant funding for the foreseeable future,

we have deemed this project immaterial to our project

portfolio. If any significant event should occur relating to

the Vianey after the date of this report, we will report it accordingly,

otherwise this project will not be commented on in the

future.

|

As of

December 31, 2009, we possess only a few pieces of equipment and we employ

insufficient numbers of personnel necessary to actually explore and/or mine for

minerals. Therefore, we are substantially dependent on the third party

contractors we engage to perform such operations. As of the date of this Annual

Report, we do not claim to have any mineral reserves at the Bates-Hunter Mine,

the FSC Project or the Vianey.

OUR

HISTORY

We were

originally incorporated under Colorado law in December 1992 under the name

Meteor Industries, Inc. In conjunction with our April 2001 merger

with activeIQ Technologies Inc, we reincorporated under Minnesota law and

changed our name to Active IQ Technologies, Inc. In June 2003, following our

transaction to acquire the rights to the FSC Project, we changed our name to

Wits Basin Precious Minerals Inc., in order to further associate our corporate

name with our new business model of minerals exploration.

Effective

May 1, 2003, we became an exploration stage company due to the sale of our prior

business models and we will continue reporting as an exploration stage company

until such time as one of our exploration projects provides recordable revenues

or we otherwise complete an acquisition or joint venture with business models

that have operating revenues.

5

OUR EXPLORATION

PROJECTS

BATES-HUNTER

MINE

Overview

On

January 21, 2005, Wits Basin acquired an option to purchase all of the

outstanding capital stock of the Hunter Gold Mining Corp. (a corporation

incorporated under the laws of British Columbia, Canada) who held all of the

assets of the Bates-Hunter Mine. On July 21, 2006, Wits Basin

executed a stock purchase agreement to supersede the option agreement. On

September 20, 2006, Wits Basin executed an Asset Purchase Agreement to

purchase the Bates-Hunter Mine on different economic terms than previously

agreed upon in the stock purchase agreement or option. On June 12, 2008, Wits

Basin entered into a fifth amendment to the Asset Purchase Agreement to, among

other changes, reflect its assignment of its rights in the Asset Purchase

Agreement to Hunter Bates and thereby allowing Hunter Bates to complete the

acquisition of the Bates-Hunter Mine. The acquisition of the assets (which

included land, buildings, equipment, mining claims and permits) of the

Bates-Hunter Mine was completed on June 12, 2008.

The Asset

Purchase Agreement was financed through a limited recourse promissory note of

Hunter Bates payable to Mr. Otten in the principal amount of Cdn$6,750,000

($6,736,785 US as of June 12, 2008) and the issuance of 3,620,000 shares of Wits

Basin common stock with a fair value of $0.205 per share (the closing sale price

on June 11, 2008) totaling $742,100. Furthermore, the Asset Purchase Agreement

requires the following additional compensation: (i) a 2% net smelter return

royalty on all future production, with no limit; (ii) a 1% net smelter return

royalty (up to a maximum payment of $1,500,000); and (iii) a fee of $300,000 to

be paid in cash. Wits Basin incurred acquisition costs of $380,698.

The

Bates-Hunter Mine is located about 35 miles west of Denver, Colorado and is

located within the city limits of Central City. The Central City mining district

lies on the east slope of the Front Range where elevations range from 8,000 feet

in the east to 9,750 feet in the west. Local topography consists of gently

rolling hills with local relief of as much as 1,000 feet.

The mine

site is located in the middle of a residential district within the city limits

of Central City and is generally zoned for mining or industrial use. The

Bates-Hunter Mine shaft is equipped with an 85 foot tall steel headframe and a

single drum hoist using a one inch diameter rope to hoist a two ton skip from

approximately 1,000 feet deep. A water treatment plant has been constructed

adjacent to the mine headframe. This is a significant asset given the mine site

location and current gold prices.

Geology

The

regional geology of the Central City district is not “simple” but the economic

geology is classically simple. The Precambrian granites and gniesses in the area

were intensely fractured during a faulting event resulting in the emplacement of

many closely spaced and roughly parallel veins. The veins are the result of

fracture filling by fluids that impregnated a portion of the surrounding

gneisses and granites with lower grade gold concentrations “milling ore” and

usually leaving a high grade “pay streak” of high grade gold sulphides within a

quartz vein in the fracture. There are two vein systems present, one striking

east-west and the other striking sub parallel to the more predominant east-west

set. These veins hosted almost all of the gold in the camp. The veins vary from

2 to 20 feet in width and dip nearly vertical. Where two veins intersect, the

intersection usually widens considerably and the grade also increases, sometimes

to bonanza grades. In the Timmins camp, this same feature was described as a

“blow out” and resulted in similar grade and thickness increases. The Bates vein

in the area of the Bates-Hunter Mine has been reported to have both sets of

veins and extremely rich “ore” where the two veins intersected. These veins

persist to depth and consist of gold rich sulphides that include some

significant base metal credits for copper and silver.

6

Previous Exploration

Efforts

The

following is based on the information from a report titled “Exploration and

Development Plan for the Bates-Hunter Project,” prepared by Glenn R. O’Gorman,

P. Eng., dated March 1, 2004.

Lode gold

was first discovered in Colorado in 1859 by John H. Gregory. The

first veins discovered were the Gregory and the Bates. This discovery started a

gold rush into the area with thousands of people trying to stake their

claims. The Central City mining district is the most important mining

district in the Front Range mineral belt. Since 1859, more than

4,000,000 ounces of gold have been mined from this district. Over 25% of this

production has come from the area immediately surrounding the Bates-Hunter

Project. Although the Bates vein was one of the richest and most

productive in the early history of the area, it was never consolidated and mined

to any great depth.

The

majority of production on the claims occurred during the period prior to

1900. Technology at that time was very primitive in comparison to

today's standards. Hand steel and hand tramming was the technology of the day.

The above limitations coupled with limited claim sizes generally restricted

mining to the top few hundred feet on any one claim.

During

the early 1900’s cyanidation and flotation recovery technologies were developed

along with better hoists and compressed air operated drills. Consolidation of

land was a problem. Production rates were still limited due to the lack of

mechanized mucking and tramming equipment. Issues that were major obstacles

prior to the 1900’s and 1930’s are easily overcome with modern

technology.

Colorado

legislated their own peculiar mining problem by limiting claim sizes to 500 feet

in length by 50 feet wide and incorporated the Apex Law into the system as

well. A typical claim was 100 to 200 feet long in the early days.

This resulted in making it extremely difficult for any one owner to consolidate

a large group of claims and benefit from economies of scale. The W.W.II

Production Limiting Order # 208 effectively shut down gold mining in the area

and throughout Colorado and the United States in mid 1942.

Historical

production records indicate that at least 350,000 ounces of gold were recovered

from about half of the Bates Vein alone to shallow depths averaging about 500

feet below surface.

GSR

Goldsearch Resources drilled two reverse circulation holes on the property in

1990. The first hole did not intersect the Bates Vein. However, the second

drilled beneath the Bates-Hunter shaft bottom intersected the Bates Vein at

about 900 feet below surface. The drill cuttings graded 0.48 oz. Au/ton over 10

feet. This drillhole intersected three additional veins as well with significant

gold assays.

Through

August 2008, over 12,000 feet of drilling was accomplished, which provided

detailed data, which has been added to the existing 3-D map of the region.

Several narrow intervals of potential ore grade gold values were intersected,

which require further exploration efforts to delineate any

valuation.

Our Exploration

Plans

With what

has been compiled so far, including surface drill results, underground and

surface geologic mapping and sampling, assay testing, detailed surface surveys

of mineral claims and outcropping veins, research of structural geology of the

vein systems and computer modeling with three-dimensional software, Standard

Gold is continuing to define what possible next steps can be implemented and

what those steps will require in funding. No further exploration activities will

be conducted at the Bates-Hunter Mine until such time as Standard Gold can

obtain sufficient funds. Standard Gold has taken measures to secure the property

while it remains inactive.

7

KWAGGA

GOLD (BARBADOS) LIMITED AND THE FSC PROJECT

Overview

By

September 2004, we invested $2,100,000 to acquire a 35% equity interest in

Kwagga Gold (Barbados) Limited (“Kwagga Barbados”), which, through its wholly

owned subsidiary Kwagga Gold (Proprietary) Limited, holds mineral exploration

rights in South Africa (pursuant to an August 27, 2004 “Shareholders

Agreement”). We refer to this as the “FSC Project” and it is located

adjacent to the historic Witwatersrand Basin. In December 2007, we entered into

a new agreement, the “Sale of Shares Agreement” with AfriOre International

(Barbados) Limited (“AfriOre”), the holder of the other 65% of Kwagga Barbados,

whereby we have the option to acquire all of AfriOre’s interest in Kwagga

Barbados. Our ownership in Kwagga Barbados was facilitated through a transaction

with Hawk Uranium Inc. (“Hawk”) in 2003. H. Vance White, an officer and director

of Hawk served on our board of directors until July 10, 2009.

In order

for us to acquire the remaining 65% interest pursuant to the Sale of Shares

Agreement, all of the following must occur: (1) South Africa’s Minister of

Minerals and Energy, who oversees the Department of Minerals and Energy (the

“DME”), must consent in writing to the change in the controlling interest in

Kwagga (Proprietary) as per South African law; (2) we must incur exploration

expenditures in the aggregate amount of at least $1.4 million; and (3) we must

pay to AfriOre an amount equal to $1.162 million within three months following

the final date of the completion of the required $1.4 million exploration

expenditures. The closing of this transaction will occur three business days

following the receipt of the DME consent (provided certain other conditions have

then been satisfied), at which time we will acquire the remaining 65% interest

and simultaneously grant to AfriOre a security interest in that 65% interest as

collateral for the performance of our obligations under the Sale of Shares

Agreement. Such security interest will not be released by AfriOre until such

time as we incur the exploration expenditures described above and make the

$1.162 million payment to AfriOre. As additional consideration for entering into

the Sale of Shares Agreement, AfriOre will be entitled to a 2% gross royalty on

all sales of gold and any other minerals by us relating to the FSC Project. We

may buy back 1% of the 2% gross royalty for a one-time cash payment of $2

million upon delivery of a bankable feasibility study.

Should

consent be issued by the DME, then the 2004 Shareholders Agreement will be

superseded by the Sale of Shares Agreement. Under the terms of the Sale of

Shares Agreement, as amended, consent was to be obtained by the DME on or before

June 30, 2009. We have continued its verbal discussion with AfriOre regarding an

extension of the termination date of the Sale of Shares Agreement. Should

consent be denied by the DME or should AfriOre not provide any further

extensions of the termination date, then the Sale of Shares Agreement will lapse

and the 2004 Shareholders Agreement shall remain in full force and effect.

Furthermore, we have been in communications with the DME with respect to our

application for such consent.

In

November 2008, AfriOre informed us that they would not be providing any

additional funding and that it was our responsibility to maintain the permits

and land claims of the FSC Project. Therefore, in November 2008, we entered into

a bridge financing arrangement with Hawk, whereby Hawk made a loan to the

Company of $60,000 in consideration of a 90-day promissory note in order to

provide temporary funding to Kwagga. We recorded these proceeds as an investment

in Kwagga and will recognize 100% of the expenses (attributable to a loss in

subsidiary) related to such permit and land claim maintenance

expenditures. The Hawk loan was satisfied on December 24,

2009.

Previous Exploration

Efforts

The

geological model was developed by AfriOre, affiliates of AfriOre and academic

geologists from Witwatersrand University.

In

October 2003, AfriOre commissioned the first drillhole, which was completed on

June 8, 2004. This drillhole, BH47, was drilled in the western structural block

to a depth of 2,984 meters (approximately 9,800 feet) and intersected a well

developed succession of lower Proterozoic rocks before it was terminated in a

zone of shearing. Although BH47 was not successful in intersecting

any gold bearing mineralization reefs to the depths drilled, it did confirm the

existence of the overlying cover rock stratigraphies, similar to those in the

main Witwatersrand Basin, thereby confirming the initial geological

model.

8

The

second drillhole, BH48 (which was completed in August 2005) was drilled to a

depth of 2,559 meters (approximately 8,400 feet) and intersected over 600 meters

of quartzites, below cover rocks which included a relatively thin succession of

Transvaal Supergroup sedimentary rocks (160 meters) and Ventersdorp Supergroup

lavas (132 meters) below the Karoo Supergroup rocks. The quartzites have been

positively identified as Witwatersrand rocks, both through stratigraphic

correlation and age dating analysis. Although the age dating determinations

indicated an age of the quartzites in accordance with that of the Witwatersrand

Supergroup, expert consultants engaged by AfriOre correlated the quartzites with

the West Rand Group of the Witwatersrand Supergroup. Also identified in BH48

were a number of bands of pyrite mineralization which, while returning assays

results with negligible amounts of gold, nevertheless were consistent with

similar features encountered throughout the rocks in the main Witwatersrand

Basin.

Our Exploration

Plans

The FSC

Project is significant because for the first time all the historical data

previously held by independent sources has been acquired and interpreted

together. Part of the data that AfriOre has acquired and compiled from

independent sources includes:

|

|

·

|

Government

aeromagnetic and gravimetric data.

|

|

|

·

|

An

AfriOre commissioned detailed aeromagnetic survey covering 1531 km2.

|

|

|

·

|

66

regional drillholes of which 37 define the greater FSC basin and 7

intersected Witwatersrand rocks within the FSC

basin.

|

|

|

·

|

785

line kilometers of seismic

data.

|

9

Six

potential sites for proposed future drilling have been identified for

consideration. Based on inquiries made in December 2008, preliminary estimates

for drilling a single 2,000 meter drillhole was estimated at $750,000. Also, it

has been recommended that additional seismic and drillhole information be

purchased from a third party to enhance the interpretation of the potential six

exploration sites. Any of these costs would qualify for our minimum exploration

expenditures of $1,400,000 required under the Sale of Shares Agreement.

Therefore, in order to move this project to its next phase of exploration, we

would need to raise at least $2,562,000 in dedicated funds. We will continue to

seek financing arrangements from sources that have interests in the gold fields

of South Africa in order to move this project to its next phase.

VIANEY

MINE CONCESSION

In

October 2007, we executed an amendment to the formal joint venture agreement

with Journey Resources Corp., a corporation formed under the laws of the

Province of British Columbia (“Journey”) and Minerales Jazz S.A. De C.V., a

corporation duly organized pursuant to the laws of Mexico and a wholly owned

subsidiary of Journey. Pursuant to the terms of the amendment, we own a 50%

undivided beneficial interest in “located mineral claims” in the property known

as the Vianey Mine Concession located in the State of Guerrero, Mexico

(“Vianey”). Through September 2007, we paid an aggregate of $600,000

and issued an aggregate of 2.6 million shares of our unregistered common stock

(valued at $685,000) to Journey for our interest. The book value of our interest

in Vianey was $0 at December 31, 2007. We recorded no expenditures during 2009

on this project.

Based on

our further due diligence on the Vianey, we have determined that it is necessary

to increase the size of the land package in order for this project to be a

viable exploration endeavor. Inquiries and communications have been disseminated

to the adjacent properties, regarding possible purchase of land, rights or some

type of further joint venture to accomplish an increased footprint. Journey

remains the operator of the project and has other specific tasks to be

performed.

Due to

the limited possibility of return on capital and since we do not anticipate

providing any significant funding for the foreseeable future, we have deemed

this project immaterial to our project portfolio. If any significant

event should occur relating to the Vianey after the date of this report, we will

report it accordingly, otherwise this project will not be commented on in the

future.

TRANSACTIONS

IN THE PEOPLE’S REPUBLIC OF CHINA

During

2007, we made a direct $5 million investment through one of our wholly owned

subsidiaries to the sellers of the iron ore PRC Properties (the processing plant

of Nanjing Sudan Mining Co. Ltd and the iron ore mine of Xiaonanshan Mining Co.

Ltd), which secured our right to purchase these assets and provided the sellers

with working capital. The original heads of agreement, that certain Equity and

Asset Transfer Heads of Agreement, dated May 4, 2007, went through a series of

amendments and assignments. As of December 31, 2008, we only held the rights to

acquire these iron ore mining properties and, therefore, we continued to record

the $5 million as an advanced payment for the eventual purchase of the iron ore

properties until such time as we had some type of resolution.

On

December 17, 2008, we created a new British Virgin Islands corporation and

wholly owned subsidiary of ours under the name of China Global Mining Resources

(BVI) Limited (“CGMR (BVI)”) to serve as the joint venture entity proposed with

London Mining. On December 23, 2008, we sold our 100% equity ownership of China

Global Mining Resources Limited, a Hong Kong corporation (“CGMR HK”) to CGMR

(BVI) for $4.8 million, whereby CGMR HK became a wholly owned subsidiary of CGMR

(BVI). CGMR HK was assigned all of our rights to acquire the PRC Properties. Due

to this sale occurring between two commonly controlled entities, no gain ($4.8

million) was recorded by the Company. We still owned 100% of both CGMR’s as of

December 31, 2008.

10

On March

17, 2009, we entered into an amended and restated subscription agreement with

London Mining (the “LM Subscription Agreement”), whereby they acquired a 50%

equity interest in CGMR (BVI) by paying an aggregate of $38.75 million for 100 A

Shares. We hold the remaining 50% equity interest in CGMR (BVI) in the form of

100 ordinary B Shares. All shares have equal voting rights and the board of

directors was split equally between the two equity owners as well.

Contemporaneously, CGMR (BVI) (through CGMR HK) completed the acquisition of the

PRC Properties. Pursuant to the LM Subscription Agreement, we entered into a

shareholders’ agreement with London Mining (the “LM Shareholders’ Agreement”)

setting forth certain preferences of the A Shares and governance terms

applicable to CGMR (BVI). The A Shares carry a preference with

respect to return of capital and distributions until such time as an aggregate

of $44.5 million (which includes the subscription amount of $38.75 million and

$5.75 million in the form of a loan made to us) is returned or distributed to

the holders of the A Shares (the “Repayment”). The A Shares preference entitles

the holders of the A Shares to 99% of the distributions of CGMR (BVI) until

Repayment, while the B Shares that we hold will receive a 1% distribution until

such time London Mining’s investment is returned. After Repayment, London Mining

will be entitled to 60% of the distributions and the Company 40% until the PRC

Properties achieve an annual production output of 850,000 tons of iron ore. Upon

achievement of such production, the respective holders of the A Shares and the B

Shares, each as a class, will be entitled to 50% of the distributions.

Additionally, London Mining is entitled under the LM Shareholders’ Agreement to

a management fee in the amount of $5.5 million for the first year following the

acquisition, and $4.5 million annually thereafter until Repayment. In

the event Repayment occurs within three years, we may be entitled to receive a

portion of the aggregate management fee paid to London Mining. Under

the LM Shareholders’ Agreement, we will be required to indemnify London Mining

in the event certain events occur prior to Repayment, including (i) certain

payments made under the consulting agreement with Mr. Lu (the seller of the PRC

Properties) that are to be deferred, (ii) failure to complete the acquisition of

the Matang iron ore deposit located in the Anhui Province of the PRC, (iii)

payments incurred in developing Matang in accordance with the business plan

relating to the operation of the PRC Properties, or (iv) a material deviation

from the business plan relating to the operation of the PRC Properties. Our

indemnification, if any, would be satisfied by the transfer of a number of our B

Shares, having a fair market value equal to the indemnified amount as determined

under the LM Shareholders’ Agreement. The LM Shareholders’ Agreement further

provides for transfer restrictions agreed between the parties, including rights

of first refusal, drag along and tag along rights.

Subject

to the provisions of the LM Shareholders’ Agreement, the Company has a 50%

equity interest, equal voting rights and an equal representation on the

board. Therefore, the Company can exercise influence over the

operations and financial policies of the joint venture but does not exercise

control.

CGMR

(BVI)’s current activities relate to processes that will optimize the extraction

levels at the Xiaonanshan iron ore open mine and to increase recoveries and

concentrate grade at the Sudan processing plant. Furthermore, CGMR (BVI) has

undertaken a program to define the existing resource and to acquire further deep

mining rights at Xiaonanshan, to provide payments to the seller in accordance

with the original acquisition agreement and is investigating its options in

order to raise the funding necessary to assist in acquiring certain adjacent

operations in order to form the basis for future expansion plans.

Effective

with the consummation of the joint venture, the $5 million advance was not

considered a partial payment on the iron ore properties purchase price but

rather an advance still due back from the sellers. This accounting treatment,

however, was subject to different interpretation by the joint venture partners

and therefore, for the year ended December 31, 2009, the Company impaired the $5

million to $0.

INDUSTRY

BACKGROUND

The

exploration for and development of mineral deposits involves significant capital

requirements. While the discovery of an ore body may result in substantial

rewards, few properties are ultimately developed into producing

mines. Some of the factors involved in determining whether a mineral

exploration project will be successful include, without limitation:

|

|

·

|

competition;

|

|

|

·

|

financing

costs;

|

|

|

·

|

availability

of capital;

|

|

|

·

|

proximity

to infrastructure;

|

11

|

|

·

|

the

particular attributes of the deposit, such as its size and

grade;

|

|

|

·

|

political

risks, particularly in some emerging third world countries;

and

|

|

|

·

|

governmental

regulations, particularly regulations relating to prices, taxes,

royalties, infrastructure, land use, importing and exporting of gold,

environmental protection matters, property title, rights and options of

use, and license and permitting

obligations.

|

All of

which leads to a speculative endeavor of very high risk. Even with the formation

of new theories and new methods of analysis, unless the minerals are simply

lying exposed on the surface of the ground, exploration will continue to be a

“hit or miss” process.

PRODUCTS AND

SERVICES

As of

December 31, 2009, we hold (i) an equity interest of approximately 94% of

Standard Gold, Inc. (f/k/a Princeton Acquisitions, Inc.) which owns a past

producing gold mine in Colorado (Bates-Hunter Mine), (ii) a 50% equity interest

in China Global Mining Resources (BVI) Ltd., which owns a producing iron ore

mine and processing plant in the PRC, (iii) a 35% equity interest in Kwagga Gold

(Barbados) Limited, which holds prospecting rights in South Africa (FSC Project)

and (iv) certain rights in the Vianey Concession in Mexico.

EXPLORATION AND DEVELOPMENT

EXPENSES

If we

acquire a project that has no revenue, exploration expenses will be charged to

expense as incurred.

EMPLOYEES

As of

December 31, 2009, we employ three individuals under the Wits Basin parent

corporation – our chief executive officer, our president and our chief financial

officer. Standard Gold (a majority owned subsidiary) employs one mine related

employee at the Bates-Hunter Mine. None of our employees are represented by a

labor union and we consider our employee relations to be good.

FINANCIAL INFORMATION IN

INDUSTRY SEGMENTS

During

the year ended December 31, 2009, our continuing operations included one

reportable segment: that of minerals exploration.

AVAILABLE

INFORMATION

We make

available free of charge, through our Internet web site www.witsbasin.com, our

annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, and amendments to those reports filed or furnished pursuant to Section

13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we

electronically file such material, or furnish it to the Securities and Exchange

Commission. You can also request a free copy of the above filings by writing or

calling us at:

Wits

Basin Precious Minerals Inc.

Attention:

Mark D. Dacko, Secretary

900 IDS

Center, 80 South 8th

Street

Minneapolis,

Minnesota 55402-8773

(612)

349-5277

12

ITEM 1A. RISK

FACTORS

RISKS

RELATING TO OUR COMMON STOCK

TRADING

OF OUR COMMON STOCK IS LIMITED.

Trading

of our common stock is conducted on the National Association of Securities

Dealers’ Over-the-Counter Bulletin Board, or “OTC Bulletin Board.” This has an

adverse effect on the liquidity of our common stock, not only in terms of the

number of shares that can be bought and sold at a given price, but also through

delays in the timing of transactions and reduction in security analysts’ and the

media’s coverage of us. This may result in lower prices for our common stock

than might otherwise be obtained and could also result in a larger spread

between the bid and asked prices for our common stock.

BECAUSE

IT IS A “PENNY STOCK” IT CAN BE DIFFICULT TO SELL SHARES OF OUR COMMON

STOCK.

Our

common stock is a “penny stock.” Broker-dealers who sell penny stocks must

provide purchasers of these stocks with a standardized risk disclosure document

prepared by the SEC. This document provides information about penny stocks and

the nature and level of risks involved in investing in the penny stock market. A

broker must also give a purchaser, orally or in writing, bid and offer

quotations and information regarding broker and salesperson compensation, make a

written determination that the penny stock is a suitable investment for the

purchaser, and obtain the purchaser’s written agreement to the purchase. The

penny stock rules may make it difficult for you to sell your shares of our

stock. Because of the rules, there is less trading in penny stocks. Also, many

brokers choose not to participate in penny stock

transactions. Accordingly, you may not always be able to sell our

shares of common stock publicly at times and prices that you feel are

appropriate.

A

SIGNIFICANT NUMBER OF SHARES OF OUR COMMON STOCK ARE HELD IN RESERVE FOR VARIOUS

AGREEMENTS AND THEIR ISSUANCE COULD DEPRESS THE PRICE OF OUR

SECURITIES.

The

issuance of a substantial number of shares of our common stock in the public

market could adversely affect the market price for our common stock and make it

more difficult for you to sell our securities at times and prices that you feel

are appropriate. As of April 13, 2010, we had 169,112,367 shares of common stock

issued and outstanding. Furthermore, we have reserved for issuance (i)

15,643,500 shares of common stock issuable upon the exercise of outstanding

stock options, (ii) 78,046,403 shares of common stock issuable upon the exercise

of outstanding warrants and (iii) an aggregate of 29,513,304 shares of common

stock issuable under outstanding convertible debt agreements.

RISKS

RELATING TO OUR FINANCIAL CONDITION

WE

CURRENTLY DO NOT HAVE ENOUGH CASH TO FUND OPERATIONS, DEBT REDUCTION OR

POTENTIAL ACQUISITIONS DURING 2010.

As of

April 14, 2010, we had only approximately $113,000 of cash and cash equivalents

on hand. Since we do not expect to generate any revenue from

operations in 2010, we will be required to raise additional capital in financing

transactions in order to satisfy our expected cash expenditures. Included in the

expected cash expenditures is approximately $13,500,000 in debt that will become

due during 2010, assuming some or all of such debt is not converted into equity

prior to such date. Accordingly, we will require additional funds during

2010.

13

We

continue to seek additional opportunities relating to our mining operations, and

our ability to seek out such opportunities, perform due diligence, and, if

successful, acquire such properties or opportunities requires additional

capital. We expect to raise such additional capital by selling shares of our

capital stock or by borrowing money. However, we currently have only a limited

number of available shares of common stock authorized for issuance, and will

require shareholder approval to increase our authorized capitalization to raise

such additional capital. Additionally, such additional capital may not be

available to us at acceptable terms or at all. Further, if we

increase our capitalization and sell additional shares of our capital stock,

your ownership position in our Company will be subject to

dilution. In the event that we are unable to obtain additional

capital, we may be forced to cease our search for additional business

opportunities, reduce our operating expenditures or to cease operations

altogether.

WE

HAVE VERY LIMITED ASSETS IN OPERATION.

After we

sold all of our prior business models in 2003, we became an exploration stage

company and do not anticipate having any revenues from operations until an

economic mineral deposit is put into production or unless we complete other

acquisitions or joint ventures with business models that produce such revenues.

As of April 13, 2010, we hold (i) an equity interest of approximately 94% of

Standard Gold, Inc. (f/k/a Princeton Acquisitions, Inc.) which owns a past

producing gold mine in Colorado (Bates-Hunter Mine), (ii) a 35% equity interest

in Kwagga Gold (Barbados) Limited, which holds prospecting rights in South

Africa (FSC Project) and (iii) certain rights in the Vianey Concession in

Mexico. None of these properties may ever produce any significant mineral

deposits.

With

respect to our equity interest in CGMR (BVI), due to the disproportionate

distributions stipulated in the LM Shareholders’ Agreement, our proportional 1%

return on CGMR (BVI) assets utilized in the operations at the mine and

processing plant, provides little return to the Company at this time and there

can be no guarantees that it may ever result in significant returns to the

Company.

WE

ANTICIPATE INCURRING LOSSES FOR THE FORESEEABLE FUTURE.

Since

becoming an exploration stage company in May 2003 through December 31, 2009, we

have incurred an aggregate net loss of $67,654,919. We expect

operating losses to continue for the foreseeable future and may never be able to

operate profitably.

OUR

INDEPENDENT AUDITORS HAVE SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A

GOING CONCERN.

We have

had net losses for each of the years ended December 31, 2009 and 2008, and we

have an accumulated deficit as of December 31, 2009. Since the financial

statements for each of these periods were prepared assuming that we would

continue as a going concern, in the view of our independent auditors, these

conditions raise substantial doubt about our ability to continue as a going

concern. Furthermore, since we do not expect to generate any significant

revenues from operations for the foreseeable future, our ability to continue as

a going concern is dependent on our ability to raise the required additional

capital or debt financing to meet short and long-term operating requirements. We

believe that private placements of equity capital and debt financing may be

adequate to fund our long-term operating requirements. We may also encounter

business endeavors that require significant cash commitments or unanticipated

problems or expenses that could result in a requirement for additional cash. If

we raise additional funds through the issuance of equity or convertible debt

securities, the percentage ownership of our current shareholders could be

reduced, and such securities might have rights, preferences or privileges senior

to our common stock. Additional financing may not be available upon acceptable

terms, or at all. If adequate funds are not available or are not

available on acceptable terms, we may not be able to take advantage of

prospective business endeavors or opportunities, which could significantly and

materially restrict our operations. We are continuing to pursue external

financing alternatives to improve our working capital position. If we are unable

to obtain the necessary capital, we may have to cease

operations.

14

CERTAIN

OF OUR AGREEMENTS REQUIRE PAYMENTS IN FOREIGN CURRENCIES AND ARE SUBJECT TO

EXCHANGE RATE FLUCTUATIONS.

Certain

of our acquisition agreements (including certain of those we hold in our

subsidiaries) and other agreements we have entered require payments in foreign

currencies, including the Canadian Dollar and the South African Rand. It is

possible that we will enter into other agreements for future acquisitions or

work relating to our various mining interests that will require payment in

currencies other than the U.S. Dollar. Fluctuations in exchange rates, in

particular between the U.S. Dollar and other currencies, can affect the actual

amounts of these payments and potentially may be in excess of the amounts we

have budgeted for payment of these fees and other payments.

RISKS

RELATING TO OUR BUSINESS

WE

WILL REQUIRE ADDITIONAL FINANCING TO CONTINUE TO FUND OUR CURRENT EXPLORATION

PROJECT INTERESTS OR TO ACQUIRE INTERESTS IN OTHER EXPLORATION

PROJECTS.

Substantial

additional financing will be needed in order to fund beyond the current

exploration programs underway or to potentially complete further acquisitions or

complete other acquisitions or joint ventures with other business

models. Our means of acquiring investment capital is limited to

private equity and debt transactions. We have no significant sources of

currently available funds to engage in additional exploration and

development. Without significant additional capital, we will be

unable to fund exploration of our current property interests or acquire

interests in other mineral exploration projects that may become available. See

“—Risks Relating to Our Financial Condition – We Currently Do Not Have Enough

Cash to Fund Operations During 2010.”

OUR

PERFORMANCE MAY BE SUBJECT TO FLUCTUATIONS IN MINERAL PRICES.

The

profitability of the exploration projects could be significantly affected by

changes in the market price of minerals. Demand for minerals can be influenced

by economic conditions, attractiveness as an investment vehicle and the relative

strength of the U.S. Dollar and local investment currencies. Other factors

include the level of interest rates, exchange rates, inflation and political

stability. The aggregate effect of these factors is impossible to predict with

accuracy.

In

particular, mine production and the willingness of third parties such as central

banks to sell or lease gold affects the supply of gold. Worldwide production

levels also affect mineral prices. In addition, the price of gold, silver and

iron ore have on occasion been subject to very rapid short-term changes due to

speculative activities. Fluctuations in gold prices may adversely affect the

value of any discoveries made at the sites with which we are

involved.

MINERAL

EXPLORATION IS EXTREMELY COMPETITIVE.

There is

a limited supply of desirable mineral properties available for claim staking,

lease or other acquisition in the areas where we contemplate participating in

exploration activities. We compete with numerous other companies and

individuals, including competitors with greater financial, technical and other

resources than we possess, in the search for and the acquisition of attractive

mineral properties. Our ability to acquire properties in the future will depend

not only on our ability to develop our present properties, but also on our

ability to select and acquire suitable producing properties or prospects for

future mineral exploration. We may not be able to compete successfully with our

competitors in acquiring such properties or prospects.

15

THE

NATURE OF MINERAL EXPLORATION IS INHERENTLY RISKY.

The

exploration for and development of mineral deposits involves significant

financial risks, which even experience and knowledge may not eliminate,

regardless of the amount of careful evaluation applied to the process. Very few

properties are ultimately developed into producing mines. Whether a

gold or other mineral deposit will become commercially viable depends on a

number of factors, including:

|

|

·

|

financing

costs;

|

|

|

·

|

proximity

to infrastructure;

|

|

|

·

|

the

particular attributes of the deposit, such as its size and grade;

and

|

|

|

·

|

governmental

regulations, including regulations relating to prices, taxes, royalties,

infrastructure, land use, importing and exporting and environmental

protection.

|

The

outcome of any of these factors may prevent us from receiving an adequate return

on invested capital.

CERTAIN

OF OUR DIRECTORS AND OFFICERS MAY HAVE CONFLICTS OF INTEREST WITH REGARD TO

CERTAIN TRANSACTIONS TO WHICH WE OR OUR AFFILIATES MAY BE PARTIES.

Stephen

D. King, our Chief Executive Officer, is a director of CGMR (BVI) and Dr. Clyde

Smith, our President, is a representative on the CGMR (BVI) Management

Committee. Additionally, Messrs. King and Smith serve as paid

consultants to CGMR (BVI). As a result of Messrs. King and Smith’s affiliation

with CGMR (BVI) and its subsidiaries, conflicts of interest may arise with the

Company.

THE

OPERATORS OF OUR EXPLORATION PROJECTS MAY NOT HAVE ALL NECESSARY TITLE TO THE

MINING EXPLORATION RIGHTS.

We expect

that Kwagga (Barbados), Kwagga (Proprietary), Journey and CGMR (BVI) will have

good and proper right, title and interest in and to the respective mining

exploration rights they currently own, have optioned or intend to acquire and

that they will explore and develop. Such rights may be subject to prior

unregistered agreements or interests or undetected claims or interests, which

could materially impair our ability to participate in the development of our

projects. The failure to comply with all applicable laws and regulations,

including failure to pay taxes and to carry out and file assessment work, may

invalidate title to portions of the properties where the exploration rights are

held.

LAWS

GOVERNING MINERAL RIGHTS OWNERSHIP HAVE CHANGED IN SOUTH AFRICA.

The South

African mining industry has undergone a series of significant changes

culminating in the enactment of the Mineral and Petroleum Resources Development

Act No. 28 of 2002 (“the Act”) on May 1, 2004. The Act legislates the abolition

of private mineral rights in South Africa and replaces them with a system of

state licensing based on the patrimony over minerals, as is the case with the

bulk of minerals in other established mining jurisdictions such as Canada and

Australia.

Holders

of old-order mining rights are required to apply for conversion of their old

order rights into new order mining rights in terms of the Act. Once a new order

right is granted, security of tenure is guaranteed for a period of up to 30

years, subject to ongoing compliance with the conditions under which the right

has been granted. A mining right may be renewed for further periods of up to 30

years at a time, subject to fulfillment of certain conditions. We will be

required to apply for new order rights before we can further explore in South

Africa and at this time, can not estimate the costs involved to

proceed.

DUE

TO LEGISLATION ENACTED IN SOUTH AFRICA, KWAGGA (PROPRIETARY) WILL BE REQUIRED TO

SELL A SUBSTANTIAL AMOUNT OF ITS STOCK, WHICH WOULD DILUTE OUR EQUITY POSITION

IN KWAGGA.

In

accordance with the Broad-Based Socio-Economic Empowerment Charter for the South

African mining industry, Kwagga (Proprietary) must sell 26% of its capital stock

at fair market value to a Black Economic Empowerment investor by

2014. Any investment by such a group will dilute our ownership of

Kwagga (Proprietary) and, accordingly, the right to receive profits generated

from the FSC Project, if any.

16

DOING

BUSINESS IN CHINA

The

Chinese economy differs from the economies of most developed countries in many

respects, including:

|

|

·

|

the

amount of government involvement;

|

|

|

·

|

the

level of development;

|

|

|

·

|

the

growth rate;

|

|

|

·

|

the

control of foreign exchange; and

|

|

|

·

|

the

allocation of resources.

|

The PRC

government has implemented various measures to encourage economic growth and

guide the allocation of resources. Some of these measures benefit the overall

Chinese economy, but may also have a negative effect on us and CGMR (BVI). For

example, CGMR (BVI)’s ability to make distributions may be adversely affected by

government control over capital investments or changes in applicable tax

regulations. The PRC government also exercises significant control over Chinese

economic growth through the allocation of resources, controlling payment of

foreign currency-denominated obligations, setting monetary policy and providing

preferential treatment to particular industries or companies.

RESTRICTIONS

ON CURRENCY EXCHANGE MAY LIMIT OUR ABILITY TO RECEIVE AND USE ANY REVENUES

EFFECTIVELY.

Foreign

exchange transactions by companies under China’s capital account continue to be

subject to significant foreign exchange controls and require the approval of PRC

governmental authorities. There may be restrictions for us to receive any funds

from the PRC iron ore joint venture.

ITEM

2. PROPERTIES

Our

corporate office is located at 900 IDS Center, 80 South Eighth Street,

Minneapolis, Minnesota 55402-8773, in which we occupy approximately 160 square

feet of office space, together with the use of related adjacent common areas,

pursuant to a lease agreement that expires May 31, 2010, which requires monthly

payments of $1,261. We believe that our current corporate facilities

are adequate for our current needs.

On June

12, 2008, Hunter Bates completed the acquisition of the Bates-Hunter Mine

located in Central City, Colorado, which includes a water treatment plant,

headframe building and the land, financed through a limited recourse promissory

note. Hunter Bates incurs no rent expenses at the mine site, but does incur the

basic heat, light and water operating expenses. We do not claim to have any

mineral reserves at the Bates-Hunter Mine and further development is contingent

upon available funds.

ITEM 3. LEGAL

PROCEEDINGS

We are

not currently involved in any material legal proceedings out of the ordinary

course of our business.

17

PART

II

ITEM 4. MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES

PRICE RANGE OF COMMON

STOCK

Our

common stock is quoted on the OTCBB under the symbol “WITM.” As of

April 13, 2010 the last closing bid price of our common stock as reported by

OTCBB was $0.07 per share. The following table sets forth for the periods

indicating the range of high and low bid prices of our common

stock:

|

Period

|

High

|

Low

|

||||||

|

Quarter

Ended March 31, 2008

|

$ | 0.33 | $ | 0.18 | ||||

|

Quarter

Ended June 30, 2008

|

$ | 0.25 | $ | 0.14 | ||||

|

Quarter

Ended September 30, 2008

|

$ | 0.21 | $ | 0.10 | ||||

|

Quarter

Ended December 31, 2008

|

$ | 0.15 | $ | 0.05 | ||||

|

Quarter

Ended March 31, 2009

|

$ | 0.13 | $ | 0.05 | ||||

|

Quarter

Ended June 30, 2009

|

$ | 0.10 | $ | 0.05 | ||||

|

Quarter

Ended September 30, 2009

|

$ | 0.08 | $ | 0.03 | ||||

|

Quarter

Ended December 31, 2009

|

$ | 0.09 | $ | 0.07 | ||||

|

Quarter

Ended March 31, 2010

|

$ | 0.09 | $ | 0.05 | ||||

The

quotations from the OTCBB above reflect inter-dealer prices, without retail

mark-up, mark-down or commission and may not reflect actual

transactions.

RECORD

HOLDERS

As of

April 13, 2010, there were approximately 195 record holders of our common stock,

excluding shareholders holding securities in “street name.” Based on securities

position listings, we believe that there are approximately 3,100 beneficial

holders of our common stock in “street name.”

DIVIDENDS

We have

never paid cash dividends on our common stock and have no present intention of

doing so in the foreseeable future. Rather, we intend to retain all future

earnings to provide for the growth of our Company. Payment of cash dividends in

the future, if any, will depend, among other things, upon our future earnings,

requirements for capital improvements and financial condition.

RECENT SALES OF UNREGISTERED

SECURITIES

In

addition to the sales of unregistered securities that we reported in Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K during fiscal year ended

2009, we made the following sales of unregistered securities during the quarter

ended December 31, 2009.

In

November 2009, we issued 1,100,000 shares of our common stock to an affiliated

foreign consultant for services related to the CGMR (BVI) joint venture. The

fair value was $99,000.

18

In

December 2009, in consideration of an extension on the maturity date from a note

holder, we issued 300,000 shares of common stock. The fair value was

$20,661.

During

November and December 2009, we received notices to convert $128,645 of principal

of the Platinum Long Term Growth V, LLC 10% Senior Secured Convertible

Promissory Note into 2,195,329 shares of our common stock, conversion rates

ranging from $0.0573 to $0.0595 per share.

From

October to December 2009, through a private placement, we accepted subscriptions

for 6,300,000 shares of our common stock at a price of $0.05 per share and

received gross proceeds of $315,000 less offering costs of $31,821. As

additional consideration, the Company entered into a private option with each

subscriber, such that for each 200,000 shares of Wits Basin common stock they

purchased in the private placement, they hold an option to purchase from Wits

Basin 20,000 units (“Standard Gold Units”) of Standard Gold, at a price of $0.50

per Standard Gold Unit. Each Standard Gold Unit consists of one share of

Standard Gold common stock and a warrant to purchase a share of Standard Gold

common stock at an exercise price of $1.00 per share. Wits Basin

purchased 630,000 Standard Gold Units from Standard Gold and is holding the

Standard Gold Units in reserve should the option holders exercise their

option.

Except as

noted above, sales of the securities identified above were made pursuant to

privately negotiated transactions that did not involve a public offering of

securities and, accordingly, we believe that these transactions were exempt from

the registration requirements of the Securities Act pursuant to Section 4(2)

thereof and rules promulgated thereunder. Based on representations from the

above-referenced investors, we have determined that such investors were

“accredited investors” (as defined by Rule 501 under the Securities Act) and

were acquiring the shares for investment and not distribution, and that they

could bear the risks of the investment and could hold the securities for an

indefinite period of time. The investors received written disclosures that the

securities had not been registered under the Securities Act and that any resale

must be made pursuant to a registration or an available exemption from such

registration. All of the foregoing securities are deemed restricted securities

for purposes of the Securities Act.

ITEM 6.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The

following discussion should be read in conjunction with the Financial Statements

of the Company and notes thereto included elsewhere in this Annual

Report. See “—Financial Statements.”

Readers

are cautioned that the following discussion contains certain forward-looking

statements and should be read in conjunction with the “Special Note Regarding

Forward-Looking Statements” appearing at the beginning of this Annual

Report.

As of

December 31, 2009, we hold (i) an equity interest of approximately 94% of

Standard Gold, Inc. (f/k/a Princeton Acquisitions, Inc.) which owns a past

producing gold mine in Colorado (Bates-Hunter Mine), (ii) a 50% equity interest

in China Global Mining Resources (BVI) Ltd., which owns a producing iron ore

mine and processing plant in the PRC, (iii) a 35% equity interest in Kwagga Gold

(Barbados) Limited, which holds prospecting rights in South Africa (FSC Project)

and (iv) certain rights in the Vianey Concession in Mexico.

19

Bates-Hunter

Mine

On June

12, 2008, we transferred our right to purchase the Bates-Hunter Mine, a prior

producing gold mine located in Central City, Colorado, to a newly created wholly

owned subsidiary of ours, the Hunter Bates Mining Corporation (the “Hunter

Bates”). Concurrent with this transfer, Hunter Bates completed the acquisition

of the Bates-Hunter Mine. On September 29, 2009, Standard Gold, Inc., a Colorado

corporation (“Standard Gold”) (formerly known as Princeton Acquisitions, Inc., a

public shell corporation at the time) completed a reverse acquisition via a

share exchange with Hunter Bates and all of its shareholders, whereby the

holders of capital securities of Hunter Bates exchanged all of their capital

securities, on a share-for-share basis, into similar capital securities of

Standard Gold (the “Share Exchange”). Accordingly, the Share Exchange

represented a change in control (reverse merger) and Hunter Bates became a

wholly owned subsidiary of Standard Gold. We hold an aggregate of 21,513,544

shares of Standard Gold common stock (or approximately 94% of the issued and

outstanding shares of common stock) and thus, Standard Gold is a majority owned

subsidiary of ours. Standard Gold’s common stock is quoted on the OTCBB under

the symbol “SDGR.”

Through

August 2008, a total of approximately 12,000 feet of surface drilling has been

accomplished on the Bates-Hunter Mine properties, which provided detailed data,

which has been added to our existing 3-D map of the region. With the surface

drilling program completed in August 2008, no further exploration activities

will be conducted at the Bates-Hunter Mine until such time as sufficient funds

have been acquired to resume exploration activities.

China Global Mining

Resources

On March

17, 2009, we entered into a joint venture with London Mining, Plc, a United

Kingdom corporation (“London Mining”) for the purpose of acquiring the

processing plant of Nanjing Sudan Mining Co. Ltd (“Sudan”) and the iron ore mine

of Xiaonanshan Mining Co. Ltd (“Xiaonanshan”) (the Sudan and Xiaonanshan

collectively are referred to as the “PRC Properties”). Pursuant to that certain

Amended and Restated Subscription Agreement, dated March 17, 2009 by and between

London Mining and the Company, London Mining purchased 100 ordinary A Shares of

China Global Mining Resources (BVI) Ltd, a British Virgin Islands corporation

and at the time a wholly owned subsidiary of ours (“CGMR (BVI)”) for $38.75

million, which A Shares constitute a 50% equity interest in CGMR (BVI). We hold

the remaining 50% equity interest in the form of 100 ordinary B Shares. The A

Shares carry a preference with respect to return of capital and distributions

until London Mining receives an aggregate of $44.5 million in return of capital

or distributions and certain other conditions are met. On March 17, 2009, CGMR

(BVI), through its wholly owned subsidiary China Global Mining Resources

Limited, a Hong Kong corporation (“CGMR HK”), acquired the PRC Properties. Due

to the disproportionate distributions stipulated in the joint venture agreement

and since the joint venture is struggling to have enough cash flow to make the

required payments to the seller under the original terms of the purchase

agreement, our proportional 1% interest has been impaired to $0 as of December

31, 2009.

CGMR

(BVI)’s current activities relate to improving processes that will optimize the

extraction levels at the Xiaonanshan iron ore open mine and to increase

recoveries and concentrate grade at the Sudan processing plant. In the year

ending 2009, the joint venture mined over 1 million tonnes of ore (since April

2009) and produced approximately 273,000 tonnes of magnetite concentrate at an

average grade of 62% Fe. Furthermore, CGMR (BVI) has undertaken a program to

define the existing resource and to acquire further deep mining rights at

Xiaonanshan, to provide payments to the seller in accordance with the original

acquisition agreement and is investigating its options in order to raise the

funding necessary to assist in acquiring certain adjacent operations in order to

form the basis for future expansion plans.

Kwagga Gold

(Barbados)

We hold a

35% equity interest in Kwagga Gold (Barbados) Limited (“Kwagga Barbados”),

which, through its wholly owned subsidiary Kwagga Gold (Proprietary) Limited, a

South African entity (“Kwagga Pty”), holds mineral exploration rights in South

Africa. This project is referred to as the “FSC Project” and is located adjacent

to the historic Witwatersrand Basin. From October 2003 through August 2005, we

completed only two range-finding drillholes (our $2,100,000 investment to

acquire the 35% equity was utilized to fund the drillholes) and we have not

performed any further exploration activities since. On December 12, 2007, we

entered into an agreement with AfriOre International (Barbados) Limited

(“AfriOre”), the holder of the other 65% of Kwagga Barbados, whereby we may

acquire all of AfriOre’s interest of Kwagga Barbados. We have submitted

documentation to obtain the consent of South Africa’s Minister of Minerals and

Energy, who oversees the Department of Minerals and Energy (the “DME”) to allow

for the sale of the controlling interest in Kwagga Pty to a U.S. company, which

is still under review. Other than limited maintenance of the prospecting rights,

no other activities will be conducted until consent is issued by the DME.

Furthermore, we have been in communications with the DME with respect to our

application for such consent.

20

Vianey Mine

Concession

In

October 2007, we executed an amendment to a formal joint venture agreement with

Journey Resources Corp., a corporation formed under the laws of the Province of

British Columbia (“Journey”), and Minerales Jazz S.A. De C.V., a corporation

duly organized pursuant to the laws of Mexico and a wholly owned subsidiary of

Journey. Pursuant to the terms of the amendment, we own a 50% undivided

beneficial interest in “located mineral claims” in the property known as the

Vianey Mine Concession located in the State of Guerrero, Mexico (“Vianey”).

Based on our further due diligence on the Vianey, we have determined that it is

necessary to increase the size of the land package in order for this project to

be a viable exploration endeavor. Inquiries and communications have been