Attached files

| file | filename |

|---|---|

| EX-32.1 - Myecheck Inc. | v181132_ex32-1.htm |

| EX-31.2 - Myecheck Inc. | v181132_ex31-2.htm |

| EX-32.2 - Myecheck Inc. | v181132_ex32-2.htm |

| EX-31.1 - Myecheck Inc. | v181132_ex31-1.htm |

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

(Mark

One)

x ANNUAL REPORT UNDER

SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

Fiscal Period year ended December 31, 2009

o TRANSITION REPORT UNDER

SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

transition period from ______________ to ___________________

Commission

file number: 000 - 51977

MyECheck,

Inc.

(Exact

name of small business issuer as specified in its charter)

|

Nevada

|

20-1884354

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer Number)

|

1190

Suncast Lane, Suite 5

El Dorado

Hills, CA 95762

(Address

of principal executive offices)

(916)

932-0900

(Issuer's

telephone number)

Former

Address: 916 West Broadway Street, Vancouver, British Columbia, V5Z

1K7

Former

fiscal year: December 31

(Former

name, former address and former fiscal year, if changed since last

report)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.Yes

o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act.Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

o

|

Accelerated

filer

o

|

Non-accelerated

filer o

|

Smaller

reporting company

x

|

|

|

(Do

not check if a

|

||||

|

smaller

reporting company)

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No x

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

sold, or the average bid and asked price of such common equity, as of a

specified date within the past 60 days. (See definition of affiliate in Rule

12b-2 of the Exchange Act.)

Aggregate

market value of the voting and non-voting common equity held by non-affiliates

(29,448,521 shares)

computed by reference as of April 14, 2010 is $4,122,793.

State the

number of shares outstanding of each of the issuer's classes of common equity,

as of the latest practicable date.

As of

April 15, 2010 there are 70,864,772 common shares outstanding.

MyECheck,

Inc.

FORM

10-K

For the

Fiscal Year ended December 31, 2009

|

Part

I

|

||||

|

Item

1.

|

Description

of Business

|

4

|

||

|

Item

1A

|

Risk

Factors

|

|||

|

Item

2.

|

Description

of Property

|

12

|

||

|

Item

3.

|

Legal

Proceedings

|

12

|

||

|

Item

4.

|

Submission

of Matters to a vote of Security Holders

|

12

|

||

|

Part

II

|

||||

|

Item

5.

|

Market

for Common Equity and Related Stockholder Matters

|

12

|

||

|

Item

6

|

Selected

Financial Data

|

13

|

||

|

Item

7.

|

Management's

Discussion and Analysis or Plan of Operation

|

13

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

15

|

||

|

Item

8.

|

Financial

Statements

|

15

|

||

|

Item

9.

|

Changes

In and Disagreements with Accountants on Accounting and Financial

Disclosure

|

15

|

||

|

Item

9A.

|

Controls

and Procedures

|

15

|

||

|

Item

9B.

|

Other

Information

|

16

|

||

|

Part

III

|

||||

|

Item

10.

|

Directors,

Executive Officers, Promoters and Control Persons; Compliance with Section

16(a) of the Exchange Ac

|

16

|

||

|

Item

11.

|

Executive

Compensation

|

18

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

20

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions

|

21

|

||

|

Item

14.

|

Principal

Accountants Fees and Services

|

21

|

||

|

Item

15.

|

Exhibits

|

22

|

||

|

Signatures

|

23

|

|||

2

FORWARD

LOOKING STATEMENTS

CERTAIN

STATEMENTS IN THIS ANNUAL REPORT ON FORM 10-K, OR THE "REPORT," ARE

"FORWARD-LOOKING STATEMENTS." THESE FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE

NOT LIMITED TO, STATEMENTS ABOUT THE PLANS, OBJECTIVES, EXPECTATIONS AND

INTENTIONS OF MYECHECK, INC., A NEVADA CORPORATION AND OTHER STATEMENTS

CONTAINED IN THIS REPORT THAT ARE NOT HISTORICAL FACTS. FORWARD-LOOKING

STATEMENTS IN THIS REPORT OR HEREAFTER INCLUDED IN OTHER PUBLICLY AVAILABLE

DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, OR THE

"COMMISSION," REPORTS TO OUR SHAREHOLDERS AND OTHER PUBLICLY AVAILABLE

STATEMENTS ISSUED OR RELEASED BY US INVOLVE KNOWN AND UNKNOWN RISKS,

UNCERTAINTIES AND OTHER FACTORS WHICH COULD CAUSE OUR ACTUAL RESULTS,

PERFORMANCE (FINANCIAL OR OPERATING) OR ACHIEVEMENTS TO DIFFER FROM THE FUTURE

RESULTS, PERFORMANCE (FINANCIAL OR OPERATING) OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. SUCH FUTURE RESULTS ARE BASED UPON

MANAGEMENT'S BEST ESTIMATES BASED UPON CURRENT CONDITIONS AND THE MOST RECENT

RESULTS OF OPERATIONS. WHEN USED IN THIS REPORT, THE WORDS "EXPECT,"

"ANTICIPATE," "INTEND," "PLAN," "BELIEVE," "SEEK," "ESTIMATE" AND SIMILAR

EXPRESSIONS ARE GENERALLY INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS,

BECAUSE THESE FORWARD-LOOKING STATEMENTS INVOLVE RISKS AND UNCERTAINTIES. THERE

ARE IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM

THOSE EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS, INCLUDING OUR

PLANS, OBJECTIVES, EXPECTATIONS AND INTENTIONS AND OTHER FACTORS.

3

PART

I

Item 1.

Business

Business

Summary

MyECheck,

Inc. (“MyECheck” or the “Company”) is an early stage company engaged in the

payment processing industry; specifically MyECheck provides electronic check

image (“e-check”) services to merchants, payment services providers, banks and

other businesses. MyECheck was founded and incorporated in Delaware in October

2004 to capitalize on opportunities created by the passing of The Check Clearing

for the 21 st Century

Act (“Check 21”). MyECheck has commenced formal business operations and is

generating revenue.

MyECheck

was created to satisfy the demand for an alternative payment solution to credit

and debit cards for online commerce. MyECheck has developed and utilizes a

proprietary method of creating and clearing Remotely Created Check (“RCC”)

images on behalf of its e-commerce customers, having successfully implemented

its proprietary RCC service that enables companies to accept real-time check

payments from consumers and businesses online or over a telephone.

MyECheck

provides additional services to support its RCC service including fraud loss

prevention services. MyECheck also provides a number of services such as check

remittance processing and remote deposit capture (“RDC”) services for brick and

mortar companies, such as banks and retailers.

MyECheck

entered into a merger agreement with Sekoya Holdings Ltd., a Nevada corporation

in November 2007, amended and restated February 4, 2008. The merger was

effective March 14, 2008. Shareholders of Sekoya at the time of the merger would

own approximately 40% of the shares of the surviving company and shareholders of

MyECheck would own approximately 60% of the surviving company, with all parties

being diluted by additional financing to be completed following the Merger

(excluding 2,000,000 shares held in escrow as remedies for breaches of the

Merger Agreement).

Revenue

is generated from transaction fees charged to companies that contract with

MyECheck to utilize the Company’s services.

About

Check 21

Check 21

was signed into law on October 28, 2003, and became effective on October 28,

2004. Check 21 is designed to foster innovation in the payments system and to

enhance its efficiency by reducing some of the legal impediments to check

truncation. The law facilitates check truncation by creating a new negotiable

instrument called a substitute check, which permits banks to truncate original

checks, to process check information electronically, and to deliver substitute

checks to banks that want to continue receiving paper checks. A substitute check

is the legal equivalent of the original check and includes all the information

contained on the original check. The law does not require banks to accept checks

in electronic form nor does it require banks to use the new authority granted by

the Act to create substitute checks.

Summary

History of MyECheck

MyECheck

started processing transactions on version one of its software platform in July

of 2005 and continued through March of 2006, after which it ceased processing in

order to further develop and refine its service offerings.

During

the period from March of 2006 through September 2007, MyECheck redesigned and

developed its software platform to better suit the demands of its prospective

customers and to ensure the accurate performance of the software.

4

MyECheck

has been sponsored by First Regional Bank, and successfully completed approval

and check image file (ANSI X9.37) testing with the Federal Reserve Bank in the

second quarter of 2007.

Version

two of its software platform was launched in September of 2007 and MyECheck has

been steadily ramping up transaction volume on the system since

then.

The

Services of MyECheck

MyECheck

offers comprehensive, easily implemented solutions that include real-time check

authorization, payment guarantee, check image creation and clearing and complete

online reporting. Set out below are services that MyECheck provides and intends

to provide as part of its business plan.

Remotely

Created Check Service

Internet

merchants and other companies wishing to accept payments online or over a

telephone (“Merchants”) can directly integrate with MyECheck’s payment engine.

Payor check data is collected by the Merchant either at the Merchant’s website

or over the telephone, and is transmitted in real-time to MyECheck for

processing.

MyECheck

uses patent pending technology to generate RCCs in accordance with the Federal

Reserve Check 21 specification. RCC images are formatted and are transmitted in

near real-time to banks, or more commonly directly to the Federal Reserve for

clearing on behalf of MyECheck’s partner bank(s).

MyECheck

believes that its RCC service overcomes many of the shortcomings of Automated

Clearing House (“ACH”) based e-check systems and cost-effectively provides

higher transaction success rates, faster funds clearing and fewer returned

items.

MyECheck

believes that it is positioned to capture a significant market share of the

alternative payments industry with a viable alternative payment method for

online payments. Compared to other online payment methods, MyECheck works with

more consumers, with the ability to guarantee payments at rates lower than

non-guaranteed card processing rates.

Check

Authorization Service

MyECheck

offers Check Authorization Service which enables merchants to verify consumer

provided data, check the status of the customer’s bank account, provide evidence

that the consumer has authorized the check and predict the likelihood of a check

being returned unpaid. Businesses that accept payments online through MyECheck

utilize this service to provide greater assurance that the check will clear.

Transactions can be approved or declined based upon the results of the Check

Authorization Service.

Check

Guarantee Service

MyECheck

co-markets with Check Guarantee Providers to offer Check Guarantee Service. The

Check Guarantee Provider warranties all approved checks and reimburses the Payee

for financial losses incurred as a result of returned checks. The Check

Guarantee Provider buys the returned checks that have been warranted from

merchants for the full face value of the returned checks. MyECheck merchants

utilize Check Guarantee Service so that they can ship products or provide

services immediately without having to wait for the check to clear. The Check

Guarantee Service also eliminates the need for Merchants to collect on returned

checks from their customers. The Check Guarantee Providers are independent third

parties whose services are offered to Merchants separately from the MyECheck

service. MyECheck is not compensated by, and does not compensate, Check

Guarantee Providers. MyECheck may in the future enter into compensated

arrangements with Check Guarantee Providers.

Remote

Deposit Capture and Remittance Processing

MyECheck

provides Remote Deposit Capture and Remittance Processing Solutions that enable

companies to scan paper checks at the brick and mortar point of sale or back

office, and remit check images to MyECheck for processing. MyECheck formats the

check images in accordance with the Federal Reserve Check 21 specification (ANSI

X9.37) and transmits the files in near real-time directly into the check

clearing system, as it does with its RCC image files. RDC reduces Merchant

handling and administrative costs, eliminates paper check transportation, speeds

clearing by an average of 2+ days and improves Merchant cash

flow.

5

International

Payment Service

Through

relationships with foreign financial services organizations, MyECheck is

planning to add international bank transfer payment services that will allow

MyECheck merchants to accept non-card associated bank transfers in local

currencies from the world’s largest global markets.

The

methodology expected to be employed with the international service would prevent

consumer initiated repudiation and charge-backs, eliminating most types of

international payments fraud. This service facilitates funds collection in over

50 countries and provides bank transfer remitting capabilities to bank accounts

in over 120 countries. The system currently supports 21 currencies and will

perform foreign exchange if required.

Merchant

Reporting

Through

our Merchant interface, MyECheck provides the following reports:

|

Detailed

transaction history

|

||

|

o

|

Successful

|

|

|

o

|

Failed

|

|

|

o

|

MyECheck

fees and settlement statements

|

|

In

addition to the above, pertinent information is returned at the end of each

transaction to facilitate reporting on the Merchant side.

Company

Competition

Other new

alternative payment brands have emerged and have experienced tremendous success

in recent months and years. Management believes that MyECheck services are in

many ways more viable, and possess greater revenue potential than other

alternative payment services that have emerged.

Most

other alternative payment services enable consumers to pay with either payment

cards or ACH based e-checks. One of the shortcomings of many of these payment

brands is that the consumer is redirected off of the merchant’s site in order to

complete the transaction.

The check

is the largest non-cash payment method in the US, demonstrating that people

often prefer to use checks over cards. In the past 5 years, the number of online

check transactions per quarter has grown from 742,660 to 318,484,650,

approximately a 428% growth rate. In spite of this, many online merchants and

businesses offer no alternative to cards, resulting in lost sales due to many

consumers’ inability or unwillingness to purchase cards.

MyECheck

provides access to more US consumers than any other payment method because it

can be used to clear checks from 100% of US checking accounts, including

business accounts and accounts where ACH does not work. MyECheck facilitates

faster funds clearing than cards or ACH providing same day or next day

availability of funds to the merchant’s bank. MyECheck also offers fraud control

tools including bank account verification, negative check-writer database

queries and payment guarantee at lower rates.

Because

MyECheck does not use the ACH network, transactions are not subject to National

Automated Clearing House Association (“NACHA”) regulation, including their

rules, fees and fines. MyECheck RCCs are governed by Uniform Commercial Code

(State check laws), and Check 21 law, which is more favorable to the Payee than

NACHA rules and facilitates higher returned item collection rates. The lower

number of returns and higher return collection rates translates to fewer losses,

lower fees for payment guarantee and higher profit margins for MyECheck

Merchants.

6

E-commerce

& Internet Industry

Worldwide,

more than one billion people are using the Internet. The number of American

homes and businesses with broadband access capabilities tops 50 million, and a

plethora of new services, entertainment options and time-saving solutions have

become widely available. The U.S. population is becoming more tech-savvy, with

at least 72% of American adults surfing the net on a regular basis. Confidence

in security for online transactions is on the rise, as is the ease of use of

most retail web sites.

Online

advertising, including paid search inclusion at sites like Google and Yahoo!,

has ballooned into a $10 billion business in the U.S. alone, threatening

traditional advertising venues of all types.

Management

believes that new methods of taking advantage of efficiencies created by the

Internet are becoming widely accepted as access to high-speed broadband Internet

connections become commonplace. Users of the Internet (both business and

consumer) are multiplying around the globe, and many companies are earning

substantial profits in serving those users.

The

migration to more efficient payment mechanisms is affected by innovations,

incentives, and regulation. While advances in technology have yielded numerous

payment method alternatives, many have not been widely adopted. Numerous payment

innovations have not been widely adopted because many payment system

participants lacked sufficient incentives to change consumer

behavior.

Gaining

market adoption is a major challenge in the migration to efficient payment

mechanisms. This can be particularly difficult considering the deep emotional

attachment of consumers to more traditional payment forms, e.g., checks, in the

United States. There are incentives that make U.S. consumers and businesses more

likely to adopt less efficient and less secure payment instruments, such as

credit and signature-based debit cards.

Weak

authentication procedures are a main factor driving fraud. The legal and

regulatory framework protects consumers differently based on the payment

instrument used to make purchases.

According

to a survey published June 29, 2006, approximately 74% of consumers would be

willing to spend about $960 more per year on music, games, subscriptions, and

other digital content online if they could use a form of payment that’s safer

and more convenient than a credit or debit card. Given current estimates of

active consumers online, that adds up to $14.4 billion in forgone sales annually

for Internet-based content sellers, according to Javelin Strategy &

Research.

Aside

from those who say they would buy more if given alternatives, some 72% of online

consumers said they have abandoned a purchase when it came time to make payment.

The major finding of the poll is that the availability of secure and convenient

payment options beyond traditional credit and debit cards can drive significant

incremental purchases, subscriptions, and transactions.

Although

many new payment schemes exist today with many more on the horizon, the vast

majority of these systems continue to be based upon the two fundamental payment

methods, credit and debit.

Successful

solutions such as PayPal and more recently BillMeLater offer a slight twist to

the traditional payment mechanism of credit cards. PayPal for example, whose

primary merchant customers are small retailers who typically are not large

enough to qualify for their own merchant account at a bank, offers consumer

payment options consisting of either credit cards or bank debit through the ACH

network.

BillMeLater

is a credit based system whereby the consumer applies for and, if approved, is

granted a line of credit at the time of the transaction.

All other

e-check (online electronic check) solutions are based upon the ACH (automated

clearing house) system. ACH transactions are bank electronic funds transfers

whereby the consumer’s bank account is debited and the recipients account is

credited. ACH transactions work reasonably well in most instances, however the

system does suffer from some shortcomings which have impacted

adoption.

ACH

transactions are governed by NACHA, (the National Automated Clearing House

Association), which imposes a substantial number of rules and regulations upon

the transactions and their users. Compliance with the many, and continuously

updating, NACHA operating rules can be complicated for Merchants.

ACH

transactions take several days to clear through the system. During the clearing

period the recipient has no way to determine if the transaction is even going

clear or if it will result in an administrative return. ACH has more than 60

reasons why a transaction can fail. Many times it is because the consumer’s bank

has chosen not to participate in ACH, or hasn’t performed the correct system

integration.

7

Checks

continue to be the number one non-cash payment method in the US, with the value

of checks processed annually around one hundred trillion dollars. Up to 45% of

adults either have no payment cards or have no available credit on their cards,

meaning that as many as 80 Million US adults have no ability to buy online at

the many websites that only accept cards.

Many

online merchants are dissatisfied with credit card and ACH solutions, and many

online industries such as travel and brokerage have no check solution at all.

Management believes this provides MyECheck with a significant market

opening.

Employees

and Contractors

As of

January 1, 2010, MyECheck had 4 full time employees and 6 independent

contractors.

Leases

The

Company leases its corporate office under a non-cancelable rental agreement

through December 2009. Monthly payments at the inception of the lease terms were

$8,576 and increase

4% annually. During 2009, the Company extended the non-cancelable

operating lease. This lease expires on February 28,

2012.

Regulation

MyECheck

is not currently subject to direct federal, state or local regulation, and laws

or regulations applicable to access to or commerce on the Internet, other than

regulations applicable to businesses generally. MyECheck provides transaction

processing services and does not conduct transactions or hold or transfer cash

itself. However, there can be no assurances that MyECheck will not be subject to

such regulation in the future.

Cost

of Compliance with Environmental Regulation

MyECheck

currently has no costs associated with compliance with environmental

regulations. However, there can be no assurances that MyECheck will not incur

such costs in the future.

Software

Development

In April

2006, MyECheck entered into an open ended software development agreement with R

Systems International Ltd., a software product development company, and that

agreement continues to be in effect. MyECheck also develops some of its software

in-house and utilizes an independent contractor. During the past four years,

research and development costs associated with the development of the software

have been approximately $183,000.

MyECheck

own proprietary software and intellectual property, and licenses patented

technology from the Company founder Edward R Starrs.

Business

Partners

MyECheck

has entered into a Processor Agreement with First Regional Bank. First Regional

Bancorp (NASDAQ: FRGB) is a bank holding company headquartered in Century City,

California. Its subsidiary, First Regional Bank, specializes in providing

businesses and professionals with the management expertise of a major bank and

the personalized service of an independent. First Regional Bank offers the

latest technology combined with a higher level of service, responsiveness and

cost savings not found at other institutions.

First

Regional Bank has sponsored MyECheck at the Federal Reserve Bank, and MyECheck

is permitted to use First Regional Bank’s FedLine account to electronically

access the Federal Reserve check clearing system.

During

2008 and 2009, the Company expanded its relationships with larger customers and

as a result of their banking requirements, the Company implemented processing of

Check 21 files directly to the bank instead of entering into agreements to use

their bank’s FedLine account to

electronically access the Federal Reserve check clearing system. As

more banks have implemented Check 21 clearing processes with the Federal

Reserve, the need to use a bank’s FedLine to process transactions directly to

the Federal Reserve has diminished.

On

January 29, 2010, the Company’s sponsoring bank, First Regional Bank, was closed

by the Federal Deposit Insurance Corporation (FDIC). The new bank

acquiring the old bank from the FDIC obtained all rights to accept or reject

former contracts. The new bank elected to reject the Company’s agreement

with the old bank. The Company is in the process of moving its customers

to one of its other processing banks.

MyECheck

has entered into an Agreement with Cardinal Commerce Corporation, a global

leader in enabling authenticated payments, secure transactions and alternative

payment brands for both eCommerce and mobile commerce. CardinalCommerce enables

payment brands such as Verified by Visa, MasterCard SecureCode, PayPal, eBillme,

Bill Me Later, Google Checkout, MyECheck, and NetCash (with Western Union and

NACHA Secure Vault Payments coming soon) to a network of over 30,000 merchants

and thousands of Banks.

The

Cardinal mobile platform leverages its merchant network, bank network and

payment brands by linking them with end users’ mobile phones through an

integrated mobile platform. Cardinal's proprietary and easily deployable

technology provides consumers, merchants, card issuers, and processors the

ability to conduct authenticated Internet, wireless and m obile transactions

safely and securely. Headquartered in Cleveland, Ohio, with facilities in the

United States, Europe and Africa, CardinalCommerce services a global customer

base.

In 2009,

MyECheck announced a partnership with Morse Data Corporation. Morse Data’s

InOrder solution is a leading enterprise management system for multi-channel

merchants, fulfillment service providers and publishers. Easily deployed as an

off-the-shelf system, InOrder accommodates all sales channels, including web,

phone, fax, EDI, POS and catalog sales in real time for immediate and accurate

inventory and order processing.

8

MyECheck

also announced that it had signed an agreement with Regal Entertainment Group,

the world’s largest motion picture exhibitor. Regal patrons are able to

purchase discount movie tickets and gift cards by securely entering their

checking account details on the Regal website. The MyECheck service works with

every checking account in the United States, including all business accounts,

enabling more Regal patrons to purchase online.

Additionally,

MyECheck announced it had entered into a definitive agreement with Simplifile,

the leading provider of electronic recording services. The agreement

facilitates the MyECheck Remotely Created Check solution into the Simplifile

e-recording service which allows Simplifile customers to make payments for

recording and submission fees using an online check imaging

process.

MyECheck

also announced several other new merchants during the course of 2009.

MyECheck

is substantially reliant on these agreements for its business. If MyECheck

develops a broader base of customers and vendor relationships, that reliance may

decrease, but there can be no assurances as to the timing or extent of such

growth.

On

November 17, 2008, the Company announced that it had signed the California State

Teachers’ Retirement Fund (CalSTRS) as a customer. CalSTRS primary

responsibility is to provide retirement related benefits and services to

teachers in public schools and community colleges. It administers retirement,

disability and survivor benefits for California's 813,000 public school

educators and their families from the state's 1,400 school districts, county

offices of education and community college districts.

The

Merger Agreement

MyECheck,

Inc., a Delaware corporation (“MEC”) and Sekoya Holdings, Limited (a Nevada

corporation) entered into a Merger Agreement in November 2007, which was amended

and restated as of February 4, 2008, and was filed as an exhibit to the Report

on Form 8-K filed on February 7, 2008 (the Report on Form 8-K and Merger

Agreement are incorporated herein by reference). The merger was effective March

14, 2008.

A total

of 2,000,000 shares otherwise issuable to MEC’s shareholders have been held back

(the “Escrow Shares”) for purposes of compensating MEC and its officers,

directors, employees, agents and affiliates should they sustain any loss due to

a breach of Company’s representations, warranties, covenants or agreements

contained in the Merger Agreement or any related document (a “Loss”).

Item

1A: Risk Factors

MYECHECK

IS A HIGH RISK, START-UP COMPANY AND, AS SUCH, THERE IS UNCERTAINTY REGARDING

WHETHER IT WILL SUCCESSFULLY EXECUTE OUR BUSINESS PLAN, GENERATE ENOUGH REVENUE

TO SUPPORT OPERATIONS, RECEIVE ANY INVESTMENT, OR ENGAGE ANY NEW

CUSTOMERS.

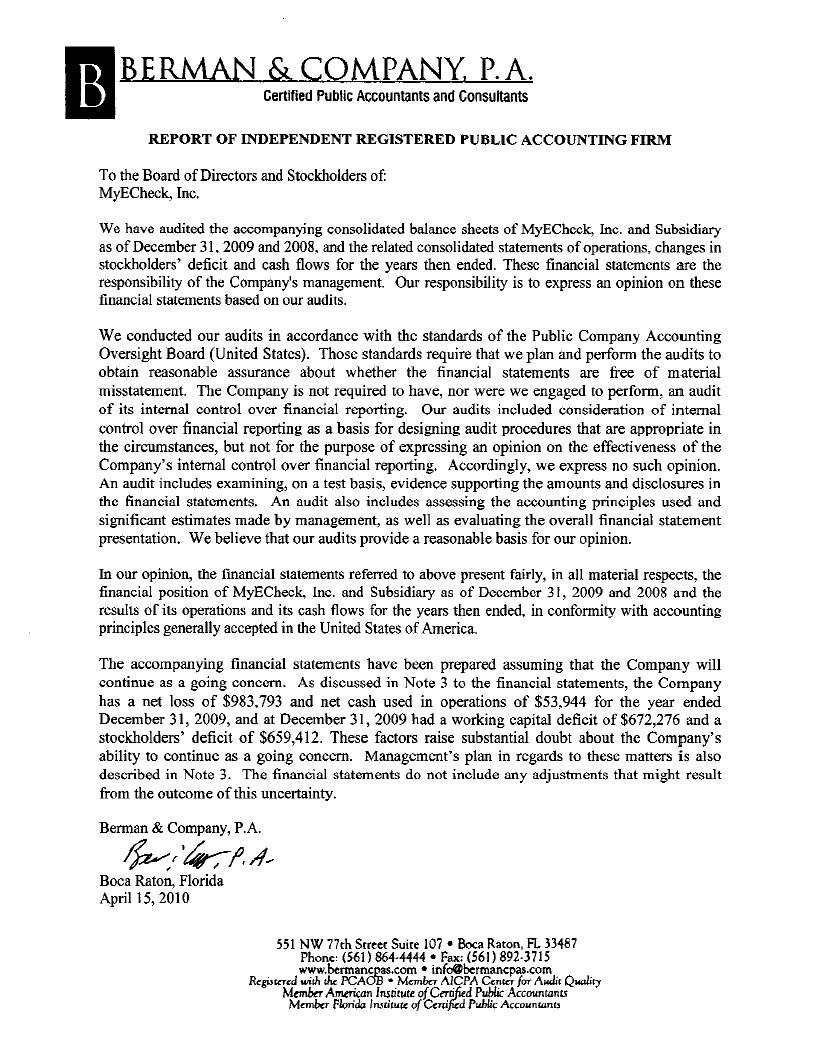

“Going

concern” opinion by auditors

The

report of the auditors accompany the Company’s financial statements included

herein notes that the Company has a net loss of $983,793 and net cash

used in operations of $53,944 for the year ended December 31, 2009, a

working capital deficit of $672,276, an accumulated deficit of $3,354,113 and a

stockholders’ deficit of $659,412 at December 31, 2009. As a result of these

factors, the auditors noted that there was “substantial doubt” about the

Company’s ability to continue as a going concern.

The

ability of the Company to continue as a going concern is dependent on

Management's plans, which include the raising of capital through debt and/or

equity markets. The Company will require additional funding during

the next twelve months to finance the growth of its current and expected

operations and achieve strategic objectives. Additionally, the Company will need

to continually generate revenues through its current business operations in

order to generate enough cash flow to fund operations through

2010. The Company is also dependent on maintaining their positive

approval status with the Federal Reserve. If the Company were to lose

this approval, their ability to provide services would be affected

negatively. The Company is also dependent on bank sponsorship when

processing transactions directly with the Federal Reserve. If the Company

were to lose bank sponsorship, their ability to provide services would be

affected negatively. On January 29, 2010, the Company’s sponsoring bank was

closed by the Federal Deposit Insurance Corporation (FDIC). The new bank

acquiring the old bank from the FDIC obtained all rights to accept or reject

former contracts. The new bank elected to reject the Company’s agreement

with the old bank. The Company is in the process of moving its customers

to one of its other processing banks.

Product

Risk

There are

no assurances that MyECheck will continue to be able to provide its services.

Changes in laws or interpretation of existing laws may pose significant risk and

may prevent MyECheck from providing its service. MyECheck is dependent on a bank

relationship and there are assurances that MyECheck will be able to maintain its

current bank relationships, or develop new bank relationships.

9

Market

Risk

There are

no assurances that the market demand for MyECheck’s services exist, or will

continue to exist in the future. The Internet and high technology industries are

rapidly evolving and changing, and new products or services may be introduced

that may make MyECheck’s services less viable or obsolete.

Reliance

on Key Employees

At least

in its early stage, the Company's business depends to a large extent on

retaining the services of its founder, Mr. Edward R Starrs (Chairman of the

Board of Directors and Chief Executive Officer), as well as MyECheck’s Chief

technical Officer Mr. R. Stephen Blandford and MyECheck’s Chief Financial

Officer Mr. James R Heidinger. The Company's operations could be materially

adversely affected if, for any reason, one or more of the above officers ceases

to be active in MyECheck's management.

Financial

Risk

There are

no assurances that MyECheck will always have sufficient money to continue

operations.

Competitive

Risk

There are

no assurances that MyECheck will be able to effectively compete against larger,

better funded competitors. Although MyECheck is apparently first to market with

its RCC service, competing services may be developed that may offer more

advantages, cost less or may have higher sales and marketing

success.

Dependence

on the Internet

Because

MyECheck’s products and services are provided directly over the Internet, the

future success of MyECheck will depend in large part on whether the Internet

proves to be a viable commercial marketplace. Whether because of inadequate

development of the necessary infrastructure or as a result of fraud, or any

other cause, if customers lack confidence in sourcing products over the

Internet, MyECheck’s business, operating results and financial condition will be

materially adversely affected.

Rapid

Technologic Change; Dependence on New Product Development

The

Internet market in which MyECheck intends to compete is characterized by rapid

and significant technological developments, frequent new product introductions

and enhancements, continually evolving business expectations and swift changes.

To compete effectively in such markets, MyECheck must continually improve and

enhance its products and services and develop new technologies and services that

incorporate technological advances, satisfy increasing customer expectations and

compete effectively on the basis of performance and price. MyECheck’s success

will also depend substantially upon its ability to anticipate, and to adapt its

products and services to its collaborative partner’s preferences. There can be

no assurance that technological developments will not render some of MyECheck's

products and services obsolete, or that MyECheck will be able to respond with

improved or new products, services, and technology that satisfy evolving

customers’ expectations. Failure by MyECheck to acquire, develop or introduce

new products, services, and enhancements in a timely manner could have a

material adverse effect on MyECheck’s business, financial condition and

operations. Also, to the extent one or more of MyECheck's competitors introduces

products and services that better address a customer’s needs, MyECheck’s

business would be materially adversely affected.

Delays

in New Product and Service Development and Introduction

The

process of developing products and services such as those offered by MyECheck

may prove to be extremely complex and it is highly likely that MyECheck will

experience delays in developing and introducing new products and services in the

future. If MyECheck is unable to develop and introduce new products, services or

enhancements to existing products and services in a timely manner in response to

changing market conditions or customer requirements, MyECheck's business,

operating results and financial conditions would be materially adversely

affected. Also, announcements of currently planned or other new products and

services may cause customers to delay their subscription decisions in

anticipation of such products and services, which could have a material adverse

effect on MyECheck's business, operating results and financial condition,

especially if the introduction of such products and services is

delayed.

10

Flaws

and Defects in Products and Services

Products

and services as complex as those offered by MyECheck may contain undetected

flaws or defects when first introduced or as new versions are released. Any

inaccuracy or defects may result in adverse products and service reviews and a

loss or delay in market acceptance. There can be no assurance that flaws or

defects will not be found in MyECheck’s products and services. If found, flaws

and defects would have a material adverse effect upon MyECheck’s business

operations and financial condition.

Management

of Potential Growth

MyECheck's

ability to manage its future growth, if any, will require it to continue to

implement and improve its operational, financial and management information

systems and control and to hire and train new employees, including management

and technical personnel, and also to motivate and manage its new employees and

to integrate them into its overall operations and culture. Although the

management team has successfully grown other companies, there can be no

assurance that MyECheck will be able to perform such actions successfully.

MyECheck's failure to manage growth effectively would have a material adverse

effect on MyECheck’s results of operations and its ability to execute its

business strategy.

Lack

of a Public Market

There has

not been a regular trading public market for MyECheck’s shares there are no

assurances that a regular trading market will develop in the near term or that,

if developed, it will be sustained. In the event a regular public trading market

does not develop, any investment in MyECheck’s Common Stock would be highly

illiquid. Accordingly, investors in MyECheck may not be able to readily sell

their shares.

There

are risks in trading in “microcap” stocks, including shares of the

Company

The

Securities and Exchange Commission has advised investors to use caution in

investing in shares of “microcap” companies, which would include the

Company. http://www.sec.gov/investor/pubs/microcapstock.htm. The

Company encourages investors to consider the information provided by the SEC

prior to making an investment in the Company’s stock.

Dividends

MyECheck

has not paid any dividends or made distributions to its investors and is not

likely to do so in the foreseeable future. MyECheck presently intends to retain

earnings for use in its business. Additionally, MyECheck may fund a portion of

its future expansion through debt financing, and a condition of such financing

may prohibit the payment of dividends while the debt is outstanding. Therefore,

management's goal is to build value by increasing the size of the business and

not by paying dividends.

Competition

With the

ever-growing popularity of the Internet and as computer hardware (i.e., servers)

and creating/maintaining virtual private networks becomes more affordable, other

on-line services may appear or are already established which will try to create

an electronic link to provide similar products and services that MyECheck

offers. Some of those businesses may have far greater financial and marketing

resources, operating experience and name recognition than MyECheck. Potential

competitors include PayPal, Google Checkout, BillMeLater and others. All these

companies take different approaches to processing electronic transactions and to

the best of MyECheck's knowledge, none of them currently offer services of the

same type as MyECheck. Notwithstanding, these potential competitors, as well as

the entry of more competitors offering similar services, could have a material

adverse effect upon MyECheck's business, operating results and financial

condition.

Reliance

on license with affiliated party

The

Company has entered into a memorandum of understanding with Ed Starrs, its

founder and CEO, under which the Company will become the sole licensee of a

newly granted patent for check processing technology. No royalties

will be due for the patent for one year, and future royalties are subject to

negotiation by the Company and Mr. Starrs. The Company believes that

it will obtain a competitive advantage from the ability to access the patent.

Failure to agree on future terms of the license could have a material adverse

impact on the Company.

11

Item

1B. Unresolved Staff Comments.

Not

applicable

Item

2: Description of Property

MyECheck’s

operates its executive offices from approximately 3,300 square feet of Class A

office space in a business park located in El Dorado Hills, CA. Certain

contractors operate from their homes located in various regions throughout the

country. MyECheck’s primary operational data center is located in a tier IV data

center in Sacramento, CA. Our telephone number is (916) 932-0900.

Item

3: Legal Proceedings

MyECheck

may from time to time be involved in various claims, lawsuits, and disputes with

third parties, actions involving allegations of discrimination, intellectual

property infringement, or breach of contract actions incidental to the operation

of its business. However, litigation is subject to inherent uncertainties, and

an adverse result in these or other matters may arise from time to time that may

harm its business. MyECheck is currently not aware of any such legal proceedings

or claims that they believe will have, individually or in the aggregate, a

material adverse affect on its business, financial condition or operating

results.

During

2005, a lawsuit was filed against the Company in the State of California,

claiming the Company was using the technology created by the plaintiff. On March

31, 2010, the Company settled the case with the plaintiff with a payment of

275,000 shares of the Company’s stock. The stock was valued at

$46,750 ($0.17/share), based upon the quoted closing trading price. Since the

potential loss on settlement existed at December 31, 2009, the Company accrued

the settlement as the amount was known prior to the issuance of these financial

statements.

Item

4: Submission of Matters to a Vote of Security Holders

There

were no matters submitted to a vote of security holders during the fiscal period

ended December 31, 2009.

PART

II

Item

5: Market for Common Equity, Related Stockholder Matters and Small Business

Issuer Purchases of Equity Securities

The

Company's Common stock is presently listed on the OTC Bulletin Board under the

symbol "MYEC". Our common stock has been listed on the OTC Bulletin Board since

October 2006. There is currently no significant trading in our common

stock and there has been little active

trading since our common stock has been listed on the OTC Bulletin Board. Prior

to the merger, any trading in the Company’s shares did not represent trading

based on the current operations or business of the Company.

As of

December 31, 2009, the approximate number of holders of Common Stock of the

Company is 54.

Since

our inception date, our boards of directors have not declared any dividend

payments to the shareholders. The declaration and payment of dividends to

holders of our common stock by us, if any, are subject to the discretion of our

board of directors. Our board of directors will take into account such matters

as general economic and business conditions, our strategic plans, our financial

results and condition, contractual, legal and regulatory restrictions on the

payment of dividends by us, and such other factors as our board of directors may

consider to be relevant.

The

company has never issued securities for any equity compensation

plan.

On March

14, 2008, as a result of the Merger, the former shareholders of MEC became

shareholders of approximately 60% of the Company’s outstanding common

stock. The transaction was exempt from registration under

Section 4(1) of the Securities Act of 1933.

MyECheck

has entered into subscription agreements with Youngal Group Ltd. and Anshan

Finance Ltd. (together the “Investors”) who have agreed, in the aggregate, to

purchase 4,000,000 shares of MyECheck’s common stock following the

Effective Time of the Merger. The shares were issued in reliance upon an

exemption from the registration requirements of the Securities Act of 1933

provided by Regulation S. A total of 4,000,000 shares have been

issued under those subscription agreements, but the Investors did not fully

perform.

12

Item

6: Selected Financial Data

Omitted

per Item 301 (c) of Regulation S-K.

Item

7. Management's Discussion and Analysis or Plan of

Operation

The

following discussion contains certain forward-looking statements that are

subject to business and economic risks and uncertainties, and MyECheck's actual

results could differ materially from those forward-looking statements. The

following discussion regarding the financial statements of MyECheck should be

read in conjunction with the financial statements and notes

thereto.

MyECheck's

prior full fiscal year ending December 31, 2007 is not indicative of MyECheck's

current business plan and operations. Incorporated in October 2004, MyECheck

currently has limited revenues and is deemed an early stage Company. This plan

of operation will focus on MyECheck's business plan and operations current.

There can be no assurance that MyECheck will generate positive cash flow and

there can be no assurances as to the level of revenues, if any, MyECheck may

actually achieve from its operations.

Implementation

Plan

Following

is an outline of MyECheck's plan to build a widely used payment system. The

success of MyECheck depends on a number of factors including the careful

selection and active participation of qualified Value Added Resellers (“VARs”)

and Payment Service Providers (“PSPs”). The VARs / PSPs commitment to MyECheck

will depend on the commercial viability of MyECheck’s solutions and web-based

services.

MyECheck

targets internet payment gateways and payments software and service providers

for partnership and reseller opportunities. Early emphasis has been on building

sales channels through partnerships. MyECheck has experienced early success in

partnerships with Cardinal Commerce and is in discussions and other major

PSPs.

In

addition to its in-house direct sales department, MyECheck has engaged a number

of specialized independent sales agents such as Sheffield Resource Network and

others, who leverage their existing contacts for direct sales.

MyECheck

has an active PR program and issues press releases on a regular basis which

generate in-bound leads and interest from industry press. Company management

conducts interviews with national press. MyECheck attends and exhibits at

industry trade shows, conferences and other networking events.

MyECheck

in-house sales force and independent sales agents also use email and cold

calling marketing techniques, focusing on the industry’s largest target

companies. MyECheck is currently in discussion with large Independent Sales

Organizations (ISOs) regarding partnership and representation

opportunities.

In

addition to the effective marketing and distribution of MyECheck’s services,

MyECheck’s infrastructure must be able to support a significant increase in

transaction volume. MyECheck plans to enhance its infrastructure by adding a new

data center and new hardware in anticipation of increased transaction volume.

MyECheck plans to continue to scale it’s infrastructure in advance of the

need.

Critical

Accounting Policies

Our

financial statements and related public financial information are based on the

application of accounting principles generally accepted in the United States

(“GAAP”). GAAP requires the use of estimates; assumptions, judgments and

subjective interpretations of accounting principles that have an impact on the

assets, liabilities, revenues and expense amounts reported. These estimates can

also affect supplemental information contained in our external disclosures

including information regarding contingencies, risk and financial condition. We

believe our use of estimates and underlying accounting assumptions adhere to

GAAP and are consistently and conservatively applied. We base our estimates on

historical experience and on various other assumptions that we believe to be

reasonable under the circumstances. Actual results may differ materially from

these estimates under different assumptions or conditions. We continue to

monitor significant estimates made during the preparation of our financial

statements.

Our

significant accounting policies are summarized in Note 2 of our financial

statements. While all these significant accounting policies impact our financial

condition and results of operations, we view certain of these policies as

critical. Policies determined to be critical are those policies that have the

most significant impact on our financial statements and require management to

use a greater degree of judgment and estimates. Actual results may differ from

those estimates. Our management believes that given current facts and

circumstances, it is unlikely that applying any other reasonable judgments or

estimate methodologies would cause effect on our consolidated results of

operations, financial position or liquidity for the periods presented in this

report.

We

believe the following critical accounting policies and procedures, among others,

affect our more significant judgments and estimates used in the preparation of

our consolidated financial statements:

13

Revenue

recognition

The

Company records revenue when all of the following have occurred; (1) persuasive

evidence of an arrangement exists, (2) product delivery has occurred, (3) the

sales price to the customer is fixed or determinable, and (4) collectibility is

reasonably assured.

The

Company earns revenue from services, which has included the

following: electronic check processing, financial verification,

identity verification and check guarantee services. The services are performed

under the terms of a contract with a customer, which states the services to be

utilized and the terms and fixed price for all services under

contract. The price of these services may be a fixed fee per

transaction and/or a percentage of the transaction processed depending on the

service.

Revenue

from electronic check processing is derived from fees collected from merchants

to convert merchant customer check data into an electronic image of a paper

draft, which allows the Company to deposit the funds to the merchant’s bank

through image clearing with the Federal Reserve on behalf of the

bank. The Company recognizes the revenue related to electronic check

processing fees when the services are performed.

Revenue

from financial verification is derived from fees collected from merchants to

process requests to validate financial verifications to an outside service

provider under contract with the Company. This revenue is recognized

when the transaction is processed, since the Company has no further

obligations.

Revenue

from check guarantee services is derived from fees collected from merchants to

process transaction to an outside service provider under contract with the

Company. This revenue is recognized when the transaction is

processed, since the Company has no further obligations.

Stock-based

compensation

Generally,

all forms of share-based payments, including stock option grants, restricted

stock grants and stock appreciation rights are measured at their fair value on

the awards’ grant date, based on the estimated number of awards that are

ultimately expected to vest. Share-based compensation awards issued to

non-employees for services rendered are recorded at either the fair value of the

services rendered or the fair value of the share-based payment, whichever is

more readily determinable. The expense resulting from share-based payments are

recorded in general and administrative expense in the consolidated statement of

operations.

Derivative

Financial Instruments

Fair

value accounting requires bifurcation of embedded derivative instruments such as

conversion features in convertible debt or equity instruments, and measurement

of their fair value for accounting purposes. In determining the appropriate fair

value, the Company uses the Black-Scholes option-pricing model. In assessing the

convertible debt instruments, management determines if the convertible debt host

instrument is conventional convertible debt and further if there is a beneficial

conversion feature requiring measurement. If the instrument is not considered

conventional convertible debt, the Company will continue its evaluation process

of these instruments as derivative financial instruments.

Once

determined, derivative liabilities are adjusted to reflect fair value at each

reporting period end, with any increase or decrease in the fair value being

recorded in results of operations as an adjustment to fair value of derivatives.

In addition, the fair value of freestanding derivative instruments such as

warrants, are also valued using the Black-Scholes option-pricing

model.

Income

Taxes

The

Company accounts for income taxes in accordance with accounting guidance now

codified as FASB ASC Topic 740, “Income Taxes,” which requires that the Company

recognize deferred tax liabilities and assets based on the differences between

the financial statement carrying amounts and the tax bases of assets and

liabilities, using enacted tax rates in effect in the years the differences are

expected to reverse. Deferred income tax benefit (expense) results from the

change in net deferred tax assets or deferred tax liabilities. A valuation

allowance is recorded when it is more likely than not that some or all deferred

tax assets will not be realized.

Accounting

guidance now codified as FASB ASC Topic 740-20, “Income Taxes – Intraperiod Tax

Allocation,” clarifies the accounting for uncertainties in income taxes

recognized in accordance with FASB ASC Topic 740-20 by prescribing guidance for

the recognition, de-recognition and measurement in financial statements of

income tax positions taken in previously filed tax returns or tax positions

expected to be taken in tax returns, including a decision whether to file or not

to file in a particular jurisdiction. FASB ASC Topic 740-20 requires that any

liability created for unrecognized tax benefits is disclosed. The application of

FASB ASC Topic 740-20 may also affect the tax bases of assets and liabilities

and therefore may change or create deferred tax liabilities or assets. The

Company would recognize interest and penalties related to unrecognized tax

benefits in income tax expense. At December 31, 2009 and 2008, respectively, the

Company did not record any liabilities for uncertain tax positions.

Earnings

per Share

In

accordance with accounting guidance now codified as FASB ASC Topic 260,

“Earnings per Share,” basic earnings (loss) per share is computed by

dividing net income (loss) by weighted average number of shares of common stock

outstanding during each period. Diluted earnings (loss) per share is

computed by dividing net income (loss) by the weighted average number of shares

of common stock, common stock equivalents and potentially dilutive securities

outstanding during the period.

14

Off-Balance Sheet

Arrangements

We do not

have any off-balance sheet arrangements, financings, or other relationships with

unconsolidated entities or other persons, also known as “special purpose

entities” (SPEs).

Operating

Lease

The

Company leased its corporate office under a non-cancelable rental agreement from

May 2005 through December 2009. During 2009, the Company extended the

non-cancelable operating lease. This lease expires on February 28,

2012.

Liquidity

As of

December 31, 2009, MyECheck had cash on hand amounting to $7,255. MyECheck is

currently operating cash flow negative and its operating expenses exceed its

operating income.

There are

currently no commitments for capital expenditures.

There are

trends in sales that would have a material affect on MyECheck. In recent months

there has been a marked increase in the number of applications for MyECheck’s

services. Management expects this trend to continue throughout 2010, however

there can be no assurances that the current trend will continue.

There are

currently no guarantees or other off balance sheet arrangements.

Revenue

from operations during the year ended December 31, 2009 was $725,331. During the

year ended December 31, 2008, revenue from operations was $548,159.

MyECheck

started processing transactions on version one of its software platform in July

of 2005 and continued through March of 2006, after which it ceased processing in

order to further develop and refine its service offerings. During the period

from March of 2006 through September 2007, MyECheck redesigned and developed its

software platform to better suit the demands of its prospective customers and to

ensure the accurate performance of the software. MyECheck launched revenue

generating operations on version two of its software platform in September

2007.

The

Company’s auditors have issued a “going concern” qualification to their opinion

on the Company’s financial statements. The Company expects to require

additional capital infusions during

2010 and may not survive without such capital

infusions.

Item

7A: Quantitative and Qualitative Disclosures About Market Risk

Omitted

per Item 305(e) of Regulation S-K.

Item

8: Financial Statements

The

consolidated financial statements required to be filed pursuant to this Item 8

begin on page F-1 of this report.

Item

9: Changes In Disagreements With Accountants on Accounting and Financial

Disclosure

Berman

& Company, P.A., the Company’s Independent Registered Public Accounting

Firm (the “Firm”), have been the only auditor since inception and there

have been no disagreements between MyECheck and the Firm.

Item

9A: Controls and Procedures

Our Chief

Executive Officer and Chief Financial Officer (the "Certifying Officers") are

responsible for establishing and maintaining disclosure controls and procedures

for the Company. The Certifying Officers have designed such disclosure controls

and procedures to ensure that material information is made known to them,

particularly during the period in which this report was prepared. The Certifying

Officers have evaluated the effectiveness of the Company's disclosure controls

and procedures within 90 days of the date of this report and believe that the

Company's disclosure controls and procedures are effective based on the required

evaluation. There have been no significant changes in internal controls or in

other factors that could significantly affect internal controls subsequent to

the date of their evaluation, including any corrective actions with regard to

significant deficiencies and material weaknesses.

15

Internal

control over financial reporting is a process to provide reasonable assurance

regarding the reliability of consolidated financial reporting and the

preparation of financial statements for external purposes in accordance with

U.S. generally accepted accounting principles. There has been no change in the

Company’s internal control over financial reporting during the year ended

December 31, 2009 that has materially affected, or is reasonably likely to

materially affect, the Company’s internal control over financial

reporting.

The

Company’s management, including the Company’s CEO and CFO, does not expect that

the Company’s disclosure controls and procedures or the Company’s internal

controls will prevent all errors and all fraud. A control system, no matter how

well conceived and operated, can provide only reasonable, not absolute,

assurance that the objectives of the control system are met. Further, the design

of a control system must reflect the fact that there are resource constraints,

and the benefits of controls must be considered relative to their costs. Because

of the inherent limitations in all control systems, no evaluation of the

controls can provide absolute assurance that all control issues and instances of

fraud, if any, within the Company have been detected.

Management

conducted an evaluation of the effectiveness of our internal control over

financial reporting based on the framework in Internal Control - Integrated

Framework issued by the Committee of Sponsoring Organizations of the Treadway

Commission. Based on this evaluation, management concluded that the company’s

internal control over financial reporting was effective as of December 31,

2009.

Berman

& Company, P.A., the Company’s independent registered public accounting

firm, has not issued an attestation report on the effectiveness of the Company’s

internal controls over financial reporting since we are not yet required to

comply with this provision of Section 404(B) of the Sarbanes-Oxley

Act.

Changes

in Internal Control over Financial Reporting

There

were no changes in the Company’s internal control over financial reporting

during the year ended December 31, 2009, that have materially affected, or are

reasonably likely to materially affect, the Company’s internal control over

financial reporting.

Item

9B: Other Information

None

Item

10: Directors, Executive Officers, Promoters and Control Persons; Compliance

with Section 16(a) of the Exchange Act

There is

no involvement by any of Director, Executive Officer or Control Person in

bankruptcy, criminal proceeding, injunctions, or violation of securities law in

the past 5 years.

The

following table sets forth the names and ages of the current directors and

executive officers of MyECheck, the principal offices and positions with

MyECheck held by each person and the date such person became a director or

executive officer of MyECheck. The executive officers of MyECheck are elected

annually by the Board of Directors. The directors serve one year terms until

their successors are elected. The executive officers serve terms of one year or

until their death, resignation or removal by the Board of Directors. There are

no family relationships between any of the directors and executive officers. In

addition, there was no arrangement or understanding between any executive

officer and any other person pursuant to which any person was selected as an

executive officer.

The

directors and executive officers of MyECheck are as follows:

|

Name

|

Age

|

Position(s)

|

Date

Appointed

|

|||

|

Edward

Robert Starrs

|

49

|

President

|

October

29, 2004

|

|||

|

Chief

Executive Officer

|

||||||

|

Chairman

of the Board

|

||||||

|

Director

|

||||||

|

Robert

Stephen Blandford

|

50

|

Vice

President of Technology

|

October

29, 2004

|

|||

|

Chief

Technology Officer

|

||||||

|

Secretary

|

||||||

|

Director

|

||||||

|

James

Ronald Heidinger

|

53

|

Vice

President of Finance

|

May

15, 2006

|

|||

|

Chief

Financial Officer

|

||||||

|

Treasurer

|

||||||

|

Director

|

16

Edward R

Starrs

Mr.

Starrs has more than 20 years experience as an international business executive

with management experience in multiple industries. He has been an officer and

director of MyECheck since its formation in 2004. Previously, Mr. Starrs was

President of Starnet Systems International, Inc., a wholly owned subsidiary of a

public company that was processing more than $2 billion annually in Internet

transactions.

Mr.

Starrs owned and operated several successful companies including, ERS Marketing,

Inc., where he produced over $20 million in contracts for his clients, and Bay

Distributing, Inc. a major distributor of over 800 product categories to Fortune

500 accounts.

From

January, 2002 through October, 2004, Mr. Starrs was President of Digency, Inc.,

an online payment processing company engaged in credit card and eCheck

transaction processing for Internet Merchants.

Starrs

has also held senior management positions with Fortune 100 companies including

McCaw Communications, Inc. (AT&T), and AMF, Inc., the world’s largest

sporting goods conglomerate.

R Stephen

Blandford

Mr.

Blandford possesses more than 15 years experience as a Senior Information

Technology Professional including serving as CTO for companies in the online

entertainment and gaming industries.

Mr.

Blandford’s professional experience includes i2 Corp, MXM Media, Maxum

Entertainment Group, Perspective Technologies, WinStreak and

others.

From

January 2002 through October 2004, Mr. Blandford was Chief Technology Officer

for Digency, Inc., an online payment processing company engaged in credit card

and eCheck transaction processing for Internet Merchants.

Mr.

Blandford has expertise in the design and implementation of Java streaming media

solutions for multiple platforms, using Coldfusion, PHP, & SQL DBs. For more

than a decade Blandford has architected systems featuring virtually every

emerging technology.

James

Heidinger, BS, CPA

During

the period from 2000 through 2005, Mr. Heidinger served as Chief Financial

Officer for ORBA Financial Management, an investment and insurance sales and

marketing firm licensed in all 50 states. With over 450 independent

registered representatives and premium and investment sales of over $750

million, ORBA is the top production leader for Western Reserve Life and

InterSecurities, both subsidiaries of AEGON NV, the third largest

international insurance firm in the world and a major investor in ORBA Financial

Management.

Previously,

Mr. Heidinger was recruited to create and implement a corporate accounting

system, provide financial statements, perform a systems conversion and set up a

cash management system for Cucina Holdings, Inc. a $50 million food and beverage

manufacturer, wholesaler and retailer. Its branded names include Java City

Coffee, Caravali Coffees and La Petite Boulangerie.

17

Audit

Committee Financial Expert

We do not

have an audit committee financial expert as we believe the cost related to

retaining a financial expert at this time is prohibitive. Further, because we

are only beginning our commercial operations, at the present time, we believe

the services of a financial expert are not warranted.

Conflicts

of Interest

The only

conflict that we foresee is that our officers and directors devote time to

projects that do not involve us.

SECTION

16(A) BENEFICIAL OWNER REPORTING COMPLIANCE

Section

16(a) of the Securities and Exchange Act of 1934 requires that the Company's

directors, executive officers, and persons who own more than 10% of registered

class of the Company's equity securities, or file with the Securities and

Exchange Commission (SEC), initial reports of ownership and report of changes in

ownership of common stock and other equity securities of the Company. Officers,

directors, and greater than 10% beneficial owners are required by SEC regulation

to furnish the Company with copies of all Section 16(a) reports they

file.

Code of

Ethics

The

Company has adopted code of ethics for all of the employees, directors and

officers.

Item

11: Executive Compensation

On

January 1, 2007, MyECheck entered into a three year Employment Agreement with

Mr. Edward R Starrs, MyECheck's President and Chief Executive Officer, whereby

MyECheck will pay Mr. Starrs an annual salary of $240,000. The Agreement also

requires MyECheck to provide, at its expense, complete health insurance coverage

for Mr. Starrs and his children.

MyECheck

pays. R Stephen Blandford, MyECheck's Vice President of Technology and Chief

Technology Officer, an annual salary of $90,000 and provides health insurance

coverage for Mr. Blandford .

MyECheck

pays Mr. James R Heidinger, MyECheck's Vice President of Finance and Chief

Financial Officer, an annual salary of $135,000 and provides complete health

insurance coverage for Mr. Heidinger.

MyECheck

does not provide compensation for its directors.

18

The

following table sets forth the total compensation MyECheck pays its

Officers.

|

Annual

Compensation

|

Long-Term

Compensation

|

||||||||||||||||

|

Awards

|

Pay-outs

|

||||||||||||||||

|

Name

and

Principal

Position

|

Year

|

Salary($)

|

Bonus($)

|

Other

Annual

Compensation

($)

|

Restricted

Stock

Award(s)

($)

|

Securities

Underlying

Options/SARs

(#)

|

LTIP

Payouts

|

All

Other

Compensation

($)

|

|||||||||

|

Edward

R Starrs

|

2009

|

240,000

|

0

|

19,317

|

128,356

|

0

|

0

|

0

|

|||||||||

|

(Chairman

& CEO)

|

|||||||||||||||||

|

R

Stephen Blandford

|

2009

|

90,000

|

0

|

6,816

|

99,960

|

0

|

0

|

0

|

|||||||||

|

(Chief

Technology Officer, Director)

|

|||||||||||||||||

|

James

R Heidinger

|

2009