Attached files

| file | filename |

|---|---|

| EX-3.II - COMPANY BYLAWS - BEARD CO /OK | beardbylaws.htm |

| EX-10.22 - GEOHEDRAL LLC FINANCIALS - BEARD CO /OK | geoexh-123109.htm |

| EX-14 - COMPANY'S CODE OF ETHICS - BEARD CO /OK | beardcode-041510.htm |

| EX-21 - COMPANY SUBSIDIARIES - BEARD CO /OK | beardsubs-041510.htm |

| EX-10.11 - AMENDED AND RESTATED BUSINESS LOAN AGMT - BEARD CO /OK | beardkex1012-041510.htm |

| EX-2.10 - 1ST AMENDMENT TO ACQ AND JOINT DEVELOP AGMT - BEARD CO /OK | beard10kexh10-041510.htm |

| EX-10.13 - AMENDED AND RESTATED DEED OF TRUST - BEARD CO /OK | beardkexh1014-041510.htm |

| EX-31.1 - CEO CERTIFICATION - BEARD CO /OK | beard10kexh311-041510.htm |

| EX-31.2 - CFO CERTIFICATION - BEARD CO /OK | beard10kexh312-041510.htm |

| EX-32.2 - CFO CERTIFICATION - BEARD CO /OK | beard10kexh322-041510.htm |

| EX-32.1 - CEO CERTIFICATION - BEARD CO /OK | beard10kexh321-041510.htm |

| EX-2.9 - CANNON AGREEMENT - BEARD CO /OK | beardagmtcannon-041510.htm |

| EX-23.1 - CONSENT OF COLE & REED - BEARD CO /OK | beardcandrconsent-041510.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ________________

Commission file number 001-12396

THE BEARD COMPANY

(Exact name of registrant as specified in its charter)

|

Oklahoma

|

73-0970298

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Harvey Parkway

301 N.W. 63rd Street, Suite 400

Oklahoma City, Oklahoma

|

73116

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (405) 842-2333

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

(Name of each exchange on which registered

|

|

None

|

None

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.00033325 par value

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports, and (2) has been subject to such filing requirement for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form l0-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

(Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting common equity held by non-affiliates computed by reference to the last sale price of registrant’s common stock on the OTC Bulletin Board as of the close of business on June 30, 2009, was $18,269,000.

The number of shares outstanding of the registrant’s common stock as of March 31, 2010 was

Common Stock $.00033325 par value – 19,971,622.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant’s Proxy Statement for its 2010 Annual Meeting of Stockholders are incorporated by reference as to Part III, Items 10, 11, 12, 13 and 14.

THE BEARD COMPANY

FORM 10-K

For the Fiscal Year Ended December 31, 2009

|

TABLE OF CONTENTS

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

|

|

Item 1A.

|

Risk Factors

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

Item 2.

|

Properties

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

Item 4.

|

(Removed and Reserved)

|

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

Item 9B.

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

Item 11.

|

Executive Compensation

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

SIGNATURES

|

|

|

THE BEARD COMPANY

FORM 10-K

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

THIS REPORT INCLUDES “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF SECTION 27A OF THE SECURITIES ACT OF 1933, AS AMENDED, AND SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED. ALL STATEMENTS OTHER THAN STATEMENTS OF HISTORICAL FACTS INCLUDED OR INCORPORATED BY REFERENCE IN THIS REPORT, INCLUDING, WITHOUT LIMITATION, STATEMENTS REGARDING OUR FUTURE FINANCIAL POSITION, BUSINESS STRATEGY, BUDGETS, PROJECTED COSTS AND PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS, ARE FORWARD-LOOKING STATEMENTS. IN ADDITION, FORWARD-LOOKING STATEMENTS GENERALLY CAN BE IDENTIFIED BY THE USE OF FORWARD-LOOKING TERMINOLOGY SUCH AS “MAY,” “WILL,” “EXPECT,” “INTEND,” “PROJECT,” “ESTIMATE,” “ANTICIPATE,” “BELIEVE,” OR “CONTINUE” OR THE NEGATIVE THEREOF OR VARIATIONS THEREON OR SIMILAR TERMINOLOGY. ALTHOUGH WE BELIEVE THAT THE EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE, WE CAN GIVE NO ASSURANCE THAT SUCH EXPECTATIONS WILL PROVE TO HAVE BEEN CORRECT. IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM OUR EXPECTATIONS (“CAUTIONARY STATEMENTS”) ARE DISCLOSED UNDER “ITEM 1. BUSINESS (c) NARRATIVE DESCRIPTION OF OPERATING SEGMENTS,” “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” AND ELSEWHERE IN THIS REPORT. ALL SUBSEQUENT WRITTEN AND ORAL FORWARD-LOOKING STATEMENTS ATTRIBUTABLE TO US, OR PERSONS ACTING ON OUR BEHALF, ARE EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THE CAUTIONARY STATEMENTS. WE ASSUME NO DUTY TO UPDATE OR REVISE OUR FORWARD-LOOKING STATEMENTS BASED ON CHANGES IN INTERNAL ESTIMATES OR EXPECTATIONS OR OTHERWISE.

PART I

Item 1. Business.

(a) General development of business.

Organization. Registrant was organized as an Oklahoma corporation in 1974. Its two principal subsidiaries are Beard Oil Company (“BOC”), organized as a Delaware corporation in 1986, and Beard Technologies, Inc. (“BTI”), organized in 1990 as an Oklahoma corporation.

Disposition of Assets and Material Changes in Mode of Conducting Business. During 2009 two material changes occurred in our mode of conducting business: (i) we disposed of our remaining interest in the McElmo Dome CO2 Field in Colorado (see “CARBON DIOXIDE OPERATIONS”), which accounted for more than 99% of the CO2 Segment’s reserves and production and for 91% of revenues and 98% of the profits of our two profitable segments in 2008, and (ii) we finally settled the Visa litigation (see (“e-COMMERCE ACTIVITIES” and “Item 3. Legal Proceedings”) and the e-Commerce Segment ceased all efforts to pursue its proprietary internet payment methods and technologies with the exception of its Voucher Patent which generates a small annual royalty. As a result, beginning in 2010, our small remaining CO2 and license fee revenues and expenses will be reflected as “other revenues” and “other expenses” and our CO2 activities and e-Commerce activities will no longer be reflected as segments.

As a result of the above changes and the significant improvement in our liquidity and working capital (see a more detailed disclosure under “MD&A - Liquidity and capital resources –“Liquidity”, “Improvement in Working Capital” and “Change in Business Strategy”) positioned us to make investments in three areas which we believe have the potential for much greater returns on investment than we considered to be available in the carbon dioxide business.

3

General. Prior to October, 1993, The Beard Company (“Beard” or the “Company”), was primarily an oil and gas exploration company. During the late 1960’s we made the decision to diversify. In 1968 we started a hazardous waste management company, USPCI, Inc. (“USPCI”), which was partially spun off to shareholders in 1984. USPCI subsequently listed on the New York Stock Exchange in 1986. It was acquired by Union Pacific Corporation in 1987-1988 for $396 million ($111 million to BOC for its residual 28% interest, of which $60 million was distributed to shareholders).

Our operating activities are now comprised of four segments:

|

·

|

The oil and gas (“Oil & Gas”) Segment, which is in the business of producing oil and gas.

|

|

·

|

The coal reclamation (“Coal”) Segment, which is in the business of operating coal fines reclamation facilities in the U.S.;

|

|

·

|

The carbon dioxide (“CO2”) Segment, which has profitably produced CO2 gas since the early 1980’s;

|

|

·

|

The e-Commerce (“e-Commerce”) Segment, which was attempting to develop business opportunities to leverage starpay’s™ intellectual property portfolio of Internet payment methods and technologies prior to the Visa settlement in June of 2009.

|

We are also conducting minerals exploration and development through our investment in Geohedral LLC, a 25.68%-owned partnership organized in 2006 to explore for hard minerals in Alaska.

Net Operating Loss Carryforwards. We have approximately $2.9 million of unused net operating losses ("NOL's") available for carryforward which expire in 2021 through 2027, plus approximately $3.45 million in tax depletion carryforwards. These carryforwards may be limited if we undergo a significant ownership change.

Effect of Recent Operations on Liquidity. Sustaining the operating activities of our unprofitable Coal and e-Commerce Segments, plus our parent company overhead, resulted in a serious outflow of cash during 2009. The sale of short-term notes and warrants during the first quarter of the year enabled us to manage our cash shortfall until the sale of our remaining interest in McElmo Dome and the subsequent settlement of the Visa litigation generated sufficient cash to satisfy our needs. The short-term notes were subsequently retired utilizing a portion of the proceeds from the McElmo Dome sale. In addition, we retired the remaining $440,000 of our convertible notes that had not previously been converted into common stock and our loan facility with a local bank. We paid $279,000 on the principal amount plus the accrued interest of $22,500 on the loan from The William M. Beard and Lu Beard 1988 Charitable Unitrust (the “Unitrust”), and negotiated a one year extension on the note and loan agreement. We were able to obtain a release on all collateral held by the parent company’s lenders, including the collateral held by the Unitrust. Although we had held preliminary discussions with our local bank about setting up a new loan facility, we determined that we had no need for such a facility at the time.

The steps we took in 2008 and 2009 (see a more detailed disclosure under: MD&A – Liquidity and capital resources---“Improvement in Working Capital” and “Change in Business Strategy”) significantly improved our liquidity and positioned us to make investments in three areas which we believe have the potential for much greater returns on investment than we considered to be available in the carbon dioxide business.

As a result of our improved liquidity we determined to focus our efforts on Oil & Gas, Coal, and minerals exploration and development through our Geohedral investment. Accordingly, we have taken the following steps to develop our business:

|

•

|

Invested $760,000 in Beard Dilworth, LLC (“BDLLC”) which raised another $1,025,000 from additional partners and positioned it to purchase the Dilworth Field. BDLLC then brought in working interest partners who have invested an additional $5,275,000 to finance the development of the field.

|

|

•

|

Increased our investment in Geohedral by an additional $1,040,000 in 2009, and as a result, increased our ownership in this partnership from 23.16% to 25.68%.

|

|

•

|

Provided the necessary funding to support BTI’s overhead requirements as it continued to pursue the various projects which it has under development.

|

4

We believe that all three of these investments (Dilworth, Geohedral, and the projects under development in the Coal Segment) hold considerable upside potential and that by making such investments we have positioned the Company for meaningful operating profits beginning next year as opposed to the operating losses we have generated in recent years.

Unless the context otherwise requires, references to us herein include our consolidated subsidiaries.

Additional Details

Details concerning projects currently under development by the Coal Segment are contained elsewhere in this Report. (See “Item 1. Business. (c) Narrative description of operating segments. COAL RECLAMATION ACTIVITIES - Projects Under Development” for additional details).

CONTINUING OPERATIONS

Oil and Gas Operations. Our oil and gas activities comprise the Oil & Gas Segment, consisting of the production of oil and gas which is conducted through BOC. Through our 40.58%-ownership of Beard Dilworth, LLC (“BDLLC”), which we formed in early 2009 to acquire the Dilworth Field in Oklahoma, we own a 10% interest before payout and a 14% interest after payout in the field. (See “INVESTMENTS---Beard Dilworth, LLC”). We also own non-operated working interests or overriding royalty interests in producing wells in Colorado and Wyoming, and hold undeveloped oil and gas leases in such states and in Mississippi.

Coal Reclamation Activities. Our coal reclamation activities, which are conducted by Beard Technologies, Inc. (“BTI”), comprise the Coal Segment. BTI is in the business of operating coal fines reclamation facilities in the U.S. and provides slurry pond core drilling services, fine coal laboratory analytical services and consulting services.

Carbon Dioxide Operations. Our carbon dioxide activities comprise the CO2 Segment, consisting of the production of CO2 gas which is conducted through Beard. In early 2009 we sold our remaining interest in the McElmo Dome Field in Colorado. Following the sale our only remaining interest consists of a small non-operated working and overriding royalty interest in a producing CO2 gas unit in Wyoming.

e-Commerce. Our e-Commerce activities, which have been conducted by starpay.com™, l.l.c. (“starpay”) and its parent, Advanced Internet Technologies, L.L.C. (“AIT”), comprise the e-Commerce Segment. starpay’s focus has centered on (i) developing licensing agreements and other fee based arrangements with companies implementing technology in conflict with its intellectual property, and (ii) bringing its litigation against Visa to a successful conclusion.

(b) Financial information about industry segments.

Financial information about industry segments is contained in the Statements of Operations and Note 15 of Notes to the Company's Financial Statements. See Part II, Item 8---Financial Statements and Supplementary Data.

(c) Narrative description of operating segments.

We currently have four operating segments: Oil & Gas, Coal, CO2, and e-Commerce. All of such activities, with the exception of our CO2 gas production activities, are conducted through subsidiaries. We, through our corporate staff, perform management, financial, consultative, administrative and other services for our subsidiaries.

OIL AND GAS OPERATIONS

The activities of the Oil and Gas Segment are conducted through our wholly-owned subsidiary, BOC, and our investment in 40.58%-owned Beard Dilworth, LLC (“BDLLC”), a limited liability company organized in Oklahoma in 2009. (See “INVESTMENTS---Beard Dilworth, LLC”). BOC is engaged in exploration for, development, production and sale of oil and gas. BOC was incorporated in Delaware in 1986 and is the successor to the original Beard Oil Company which was incorporated in Delaware in 1969 as the successor to the oil and gas business originally founded by a Beard family member in 1921.

5

Exploration Practices and Policy. Prior to BDLLC’s purchase of the Dilworth Field in Oklahoma (see below), BOC’s principal exploratory approach in recent years had been to acquire oil and gas leases from the U. S. government and various state governments on a “non-competitive” basis. and then to encourage other operators to drill on or in close proximity to our acreage by supporting their exploratory wells with acreage contributions. With the exception of one 80-acre tract adjacent to the Dilworth Field (the “Field”), all of the undeveloped acreage we hold is under such governmental leases. BOC has also entered into arrangements with major and independent operators who make certain exploratory commitments relative to our acreage for an interest in one or more of our leaseholds while we retain some form of reversionary working interest or overriding royalty interest and may also retain the right to participate in the drilling of development wells.

In April of 2009 BDLLC acquired the Field where BOC is finalizing the installation of a major waterflood which began producing in late December of 2009. The Field is expected to generate a significant amount of revenue and net income to us beginning in 2010, and will be the major focus of our operating activities in 2010 and 2011. As a result of the dissolution of BDLLC at the close of business on December 31, 2009, the Field is also expected to be the principal source of our revenues for the near term.

Although BOC is still acquiring, from time to time, oil and gas leases from the U. S. government and various state governments on a “non-competitive” basis, such acquisitions are no longer the principal thrust of our exploratory approach, and such acquisitions and our holdings of undeveloped acreage have ceased to be relevant or material to our oil and gas operations.

From time to time BOC also sells an interest in its undeveloped acreage and retains an overriding royalty. Such sale is commonly known as a “sublease”. In fiscal years 2009 and 2008, there were no revenues from sublease activities.

Sandy Lake Field. In 2004 BOC entered into a farmout agreement with Vista Resources (“Vista”) covering a 640-acre tract in Yuma County, Colorado. Vista drilled eight wells in the Niobrara Formation on the farmout lands in which BOC has a 22.5% working interest (19.6875% net revenue interest). All eight of the wells were completed as gas producers in the Niobrara Formation at a depth of approximately 2,800 feet. Our share of the production from these wells totaled $87,000 and $95,000 in 2009 and 2008, respectively.

Big Porcupine Field. BOC also has a 4.5% overriding royalty interest in 12 wells which produce coal bed methane gas from the Mesaverde Formation from a 317-acre tract in Campbell County, Wyoming. The wells were drilled by Peabody Natural Gas, LLC on a lease BOC sold to them in 2000 on which BOC retained an overriding royalty interest. Our share of production from these wells totaled less than $1,000 and $8,000 in 2009 and 2008, respectively. According to the operator the wells have been shut-in since January or February of 2009 and are not likely to be re-opened.

Due to the limited pipeline capacity in the Rocky Mountain area, the price we have received for the gas we have sold to date has been lower than normally received in other areas of the U.S.

In addition to the acreage we own in the above fields, BOC owns undeveloped leases covering 41 acres in Colorado, 4,510 acres in Mississippi and 2,945 acres in Wyoming, a total of 7,496 acres.

Principal Products and Services. The principal products produced by our Oil & Gas Segment are oil and gas which accounted for the following percentage of total consolidated revenues from continuing operations for each of the last two fiscal years:

|

Fiscal Year

Ended

|

Percent of

Consolidated

Revenues from

Continuing

Operations

|

||

|

12/31/09

|

29.7%

|

||

|

12/31/08

|

7.2%

|

||

6

Sources and Availability of Raw Materials. BOC is involved in an extractive enterprise which does not require the consumption of raw materials other than fuel, water and drilling mud and chemicals which are utilized by the drilling rigs employed to drill the wells in which it has an interest. Such materials are normally available to the drilling contractors employed by the operator, although the cost thereof may vary considerably between wells.

Seasonality. The Oil & Gas Segment’s operations are considered to be seasonal since any drilling activities conducted in the winter may be hindered or impaired by adverse weather conditions.

Working Capital Items. The Oil & Gas Segment does not carry significant amounts of inventory nor does it provide extended payment terms to its customers. Prior to the dissolution of BDLLC at year-end 2009, the segment’s working capital was considered adequate to conduct its operations, since its modus operandi had been to let third parties pay for all of the costs of the wells in which it participates unless proven locations are involved and borrowings can be arranged to finance such drilling operations. Beginning in 2010 BOC will be carrying larger accounts receivable and will require more working capital in view of its activities in the Dilworth Field. (See “INVESTMENTS---Beard Dilworth, LLC”).

Dependence of the Segment on a Single Customer. The Oil & Gas Segment did not have any customers which accounted for 10% or more of Registrant’s consolidated revenues during the last two years. Accordingly, the loss of a single customer would not have a material adverse effect on us and our subsidiaries taken as a whole.

Market Conditions. Oil and gas production generally is sold at the wellhead to various pipeline companies. Market demand (and the resulting prices received for crude oil and natural gas) can be affected by weather conditions, economic conditions, import quotas, the availability and cost of alternative fuels, and the proximity to, and capacity of, natural gas pipelines and other systems of transportation.

Prior to the dissolution of BDLLC, ((See “INVESTMENTS---Beard Dilworth, LLC”), the Oil & Gas Segment (ignoring its interest in BDLLC) had no oil production. Our natural gas production was being sold on a “spot” basis to the only pipeline markets available in the two fields in which our other properties are located. And, since both of our other properties were non-operated, we had no control over the price we were receiving. The price we received in Colorado ranged from $3.51 to $4.76 per Mcf in 2009, and from $3.66 to $6.24 per Mcf in 2008; in Wyoming the price we received ranged from $1.41 to $1.73 per Mcf in 2009, and from $1.09 to $4.62 per Mcf in 2008.

Regulation. We are subject to extensive federal, state and local laws and regulations that affect our oil and gas operations including, among other things, state regulation of production, and federal regulation of oil and/or gas sold in interstate and intrastate commerce, all of which factors are beyond our control.

♦ Effect of Compliance with Environmental Regulations on Capital Expenditures. We are subject to extensive federal, state and local laws and regulations governing the protection of the environment. These laws and regulations may, among other things:

▪ require the acquisition of various permits before drilling or production commences;

▪ require the installation of expensive pollution control equipment;

▪ require safety-related procedures and personal protective equipment to be used during operations;

▪ restrict the types, quantities and concentrations of various substances that can be released into the environment;

|

|

▪ suspend, limit, prohibit or require approval before construction, drilling and other activities; and require remedial measures to mitigate pollution from historical and ongoing operations, such as the closure of pits and plugging and abandonment of wells.

|

Governmental authorities have the power to enforce compliance with these laws and regulations, as well as other laws and regulations that may be adopted in the future. We estimate that the cost of compliance by BOC in 2008 and 2009 required capital expenditures of less than $10,000, and that our share of the cost of compliance within BDLLC required capital expenditures of approximately $170,000 in 2009.

7

♦ Effect of Compliance with Environmental Regulations on Insurance Costs. In order to mitigate our environmental exposure, we carry sudden and accidental pollution coverage under our general liability insurance policy which covers us and all working interest owners. We also carry underground resources coverage in connection with any properties we operate.

Competition. We encounter competition from other independent operators and from major oil and gas companies in acquiring properties suitable for exploration. Virtually all of these competitors have financial resources and staffs substantially larger then ours. Our ability to discover reserves in the future depends in part on our ability to select suitable prospects for future exploration. Because of our cash constraints our ability to develop new reserves in the near term will likely be limited to projects that we can successfully promote and for which we can raise the necessary financing.

COAL RECLAMATION ACTIVITIES

Background of Beard Technologies, Inc. In early 1990 we acquired more than 80% of Energy International Corporation (“EI”), a research and development firm specializing in coal-related technologies. We sold EI in 1994, retaining certain assets which we contributed to a wholly-owned subsidiary, BTI.

The MCN Projects. Beginning in April of 1998, BTI operated six pond recovery/Section 29 briquetting projects for a subsidiary of MCN Energy Group, Inc. (“MCN”). At the time this made BTI, to the best of our knowledge, the largest operator of coal recovery plants in the world. MCN became concerned that the plants might not qualify for the Section 29 tax credits that were critical to the economics of the plants, and took a special charge of $133,782,000 at year-end 1998 to completely write off the projects. In January of 1999 MCN terminated the contracts with BTI. This had a severe negative impact on BTI’s subsequent income and cash flow. The contracts later qualified for the tax credits.

Effect of Natural Gas Prices on Coal Demand. The increase in natural gas prices from 2004 to 2007 had a major impact upon the electric power generating industry which began to focus on building new generating capacity utilizing coal-fired rather than gas-fired plants. Gas prices have declined in recent months in view of the slowdown in the world economy; oil prices have recently moved up. Nonetheless, the price of coal when compared to the price of gas on a Btu basis remains attractive. It appears that coal, which accounts for over 50% of the nation’s power generating capacity, will remain the principal fuel source for electric power production in the United States for a number of years.

The recent decline in gas prices has caused a corresponding slackening of demand for most coal products. However, there is increasing pressure from the “green” movement for regulatory agencies to more quickly reclaim or re-mine abandoned slurry impoundments. This has sparked renewed interest among pond owners and coal operators to move forward with pond recovery projects. Many of these recovery projects had been sitting on the back burner for a number of years because of marginal coal prices and stagnant demand.

We believe this is an ideal set of circumstances for BTI, which in recent years has been totally focused on pond recovery. During the last 10 years, BTI has called on numerous coal producers and utilities, particularly those having ponds which it believes have large reserves of recoverable coal fines. We have a great deal of expertise in the complicated business of coal pond recovery. We believe that we are one of the two industry leaders and that most coal operators contact us first when they are interested in having a pond recovered.

Recent Activities; Projects Under Development. BTI devoted all of its efforts in 2009 to project development. Currently, it has several projects under development, most of which are located in the Central Appalachian Coal Basin. It also has a number of other projects in the pipeline for follow up once these projects have come to a resolution. Because all of the projects under development are subject to obtaining the necessary financing, we cannot assure you that any of them will proceed.

Improved Drilling and Lab Capabilities. BTI has made substantial investments to improve its slurry pond core drilling equipment and its fine coal laboratory analytical services capabilities. In addition to supporting its own pond recovery project evaluations, BTI now offers state of the art drilling and analytical services to commercial clients who are independently investigating their own projects.

8

Principal Products and Services. The principal services supplied by our Coal Segment are:

▪ Slurry pond drilling services:

|

|

♦ BTI personnel have perfected their Vibracore technique using a unique all-terrain, amphibious drill rig that can reach even the hardest-to-reach areas of impoundments.

|

|

|

♦ Experience with its own pond recovery operations has given BTI a vast knowledge of slurry deposition patterns, enabling it to design a drilling program best suited to a pond’s characteristics.

|

♦ Provide mapping/location and drill logs of the Vibracore samples.

▪ Laboratory services:

|

|

♦ Utilizes its in-house, world-class fine coal laboratory that employs state-of-the-art equipment to evaluate washability, flotation, and particle size analysis.

|

|

|

♦ Perform reserve evaluation for pond recovery projects.

|

|

|

♦ Perform quality control testing for active recovery operations.

|

|

|

▪ Pond recovery project design and evaluation. BTI has been involved in the slurry pond recovery industry since its infancy in the early 1990’s. BTI’s expertise includes:

|

|

|

♦ Technical and economic impoundment evaluations.

|

|

|

♦ Slurry pond mining plans.

|

|

|

♦ Recovery plant design and construction.

|

|

|

♦ Pond recovery operations as Owner/Operator or as Contractor.

|

Sources and Availability of Raw Materials. There are numerous coal impoundments scattered throughout the eastern third of the U.S. which contain sizeable reserves of coal fines which we believe can be recovered on an economic basis while at the same time solving an environmental problem.

Dependence of the Segment on a Single Customer. The Coal Segment accounted for the following percentages of our consolidated revenues from continuing operations for each of the last two years.

|

Fiscal Year

Ended

|

Percent of

Consolidated

Revenues from

Continuing

Operations

|

|

|

12/31/09

|

7.6%

|

|

|

12/31/08

|

1.5%

|

|

We are unable to predict whether we will become dependent on a single customer in the future until the additional projects under development by the segment are negotiated and finalized.

Facilities. In October and November of 2008. BTI moved its office and laboratory facilities to facilities which it purchased and subsequently remodeled. The facilities are situated on a 13.82 acre parcel of land near Somerset, Pennsylvania, and include the following:

|

·

|

“A” frame, two and one half story house with an attached two car garage and apartment; currently being used as office facilities with a reception area, kitchen, copy room, conference area, engineering and file / storage area.

|

|

·

|

Seven (7) bay garage with rough dimension of 110’ X 40’ X 16’ high with an attached garage / barn at 40’ X 80’ X 12’ high. The garage / barn area has been converted into the coal laboratory, two of the seven bays are being used to store laboratory equipment, tools and the sampling truck, trailer and Argo sampling rig. Future plans are to convert the seven bay area into a two-story office/laboratory facility for BTI.

|

9

The property meets BTI’s needs for its current operations, has sufficient building area to expand the future office facilities if required, and also has ample additional property to install other facilities that may be required. If the existing property should be found of inadequate size for future expansion, additional property is available and adjacent to the present property.

Market Demand and Competition. The coal reclamation industry is highly competitive, and the Coal Segment must compete against larger companies, as well as several small independent concerns. Competition is largely on the basis of technological expertise and customer service.

Seasonality. The coal reclamation business is somewhat seasonal due to the tendency for field activity to be reduced in cold and/or bad weather.

Environmental Matters. Compliance with Federal, state and local laws regarding discharge of materials into the environment or otherwise relating to protection of the environment are of primary concern to the segment, and the cost of addressing such concerns are factored into the cost of each project. The cost of compliance varies by project and cannot be estimated until all of the contract provisions have been finalized. See “Regulation---Environmental and Worker Safety Matters.”

Financial Information. Financial information about the Coal Segment is set forth in the Financial Statements. See Part II, Item 8---Financial Statements and Supplementary Data.

CARBON DIOXIDE OPERATIONS

General. Our carbon dioxide (CO2) gas operations are conducted by the parent company which, prior to March of 2009, owned working and overriding royalty interests in two CO2 gas producing units.

Carbon Dioxide (CO2) Properties

McElmo Dome. The McElmo Dome field in Dolores and Montezuma Counties in western Colorado is a 240,000-acre unit which produces CO2 gas.

At the beginning of 2008 we owned a 0.53814206% working interest (0.4526611% net revenue interest) and an overriding royalty interest equivalent to a 0.0920289% net revenue interest in the Unit, giving us a total 0.5446900% net revenue interest. Effective February 1, 2008 we sold 35% of our ownership interests to third parties, reducing our working interest in the Unit to approximately 0.34979234% (0.2942297% net revenue interest) and an overriding royalty interest equivalent to approximately a 0.0598188% net revenue interest, giving us a total of approximately a 0.3540485% net revenue interest in the Unit. Such interests reflected our Unit interest excluding any participation in the Goodman Point expansion. (See note (2) to the accompanying financial statements: “Additional Details - McElmo Dome Sale”).

10

Deliveries of CO2 gas are transported through a 502-mile, 30-inch diameter pipeline to the Permian Basin in West Texas where such gas is utilized primarily for injection into mature oil fields. Kinder Morgan CO2 Company, L.P. (“KM”) serves as operator of the unit. There are 54 producing wells, ranging from 7,634 feet to 8,026 feet in depth, that produce from the Leadville formation. The wells produced a combined total of 972 million cubic feet per day in 2006. McElmo Dome is believed to be the largest producing CO2 field in the world. The Four Corners Geological Society in 1983 estimated that the field contained 17 trillion cubic feet (“TCF”) of CO2. The gas is approximately 98% CO2. The field underwent a $100,000,000 expansion in 2008-2009, known as the Goodman Point Expansion, in which we elected not to participate.

In 2009, we sold 264,000 Mcf (thousand cubic feet) attributable to our working and overriding royalty interests at an average price of $1.11 per Mcf. In 2008, we sold 867,000 Mcf (thousand cubic feet) attributable to our working and overriding royalty interests at an average price of $1.55 per Mcf.

CO2 production from the field averaged 980 million cubic feet per day in 2008. We were advised by the operator that at year-end 2008 the field was capable of producing approximately 1.1 billion cubic feet per day. As a result of the McElmo Dome sale, no production information was available to us at year-end 2009.

KM estimated that there were 9.0 TCF of remaining reserves at year-end 2006. The field produced 0.707 TCF in 2007 and 2008, leaving an estimated 8.3 TCF of remaining reserves at year-end 2008 (29 BCF to our net interest), based upon KM’s estimate of reserves (latest information available to us).

At December 31, 2008, our interest in the McElmo Dome Field was subject to deed of trust liens in the amount of approximately (i) $1,000,000* in favor of a local bank, (ii) $390,000 in favor of a holder of our 2009 Notes and (iii) $2,250,000 in favor of a related party. Such liens were released when we sold our remaining interest in the Field in 2009.

_______

*Reflects the maximum amount available under the line of credit. Borrowings totaled $800,000 at December 31, 2008.

Sales of Our Interest in the Field. In March of 2008 we closed on the sale of 35% of our interest in McElmo Dome for $3,500,000. On April 14, 2009, we entered into an agreement to sell our remaining interest in the field for $5,200,000. We received a $1,300,000 down payment upon execution of the agreement and received the $3,737,000 balance (after certain adjustments) of the consideration on May 7, 2009. The sale was effective March 1, 2009. (See note (2) to the accompanying financial statements – “Additional Details” and “McElmo Dome Sale” for complete details concerning the two transactions and the use of proceeds therefrom).

Net CO2 Production. The following table sets forth our net CO2 production from McElmo Dome for each of the last two fiscal years:

| Fiscal Year Ended |

Net CO2

Production

(Mcf)

|

|

|

12/31/09

|

264,000

|

|

|

12/31/08

|

867,000

|

|

11

Average Sales Price and Production Cost. The following table sets forth our average sales price per unit of CO2 produced and the average lifting cost (lease operating expenses and production taxes) per unit of production for the last two fiscal years:

|

Fiscal Year

Ended

|

Average Sales

Price Per Mcf

of CO2

|

Average Lifting

Cost Per Mcf

of CO2

|

||

|

12/31/09

|

$1.11

|

$0.05*

|

||

|

12/31/08

|

$1.55

|

$0.19*

|

*Increase in average lifting costs due primarily to additional severance and ad valorem taxes for 2008. The properties were sold before ad valorem taxes were paid in 2009.

Market Demand and Competition. Our principal market for CO2 is for injection into mature oil fields in the Permian Basin. Our primary competitors for the sale of CO2 include suppliers that have an ownership interest in McElmo Dome, Bravo Dome and Sheep Mountain CO2 reserves, and Petro-Source Carbon Company, which gathers waste CO2 from natural gas production in the Val Verde Basin of West Texas. There is no assurance that new CO2 sources will not be discovered or developed, which could compete with us or that new methodologies for enhanced oil recovery will not replace CO2 flooding.

Dependence of the Segment on a Single Customer. The CO2 Segment accounted for the following percentages of our consolidated revenues from continuing operations for each of the last two years. Our CO2 revenues are received from two operators who market the CO2 gas to numerous end users on behalf of the interest owners who elect to participate in such sales. In 2008, approximately 99% of our revenues from the sale of CO2 gas was derived from KM and Trinity and approximately 1% was derived from Exxon Mobil. In 2009, approximately 95% of our revenues from the sale of CO2 gas was derived from KM and Trinity and approximately 5% was derived from Exxon Mobil.

|

Fiscal Year Ended

|

Percent of

Consolidated

Revenues from

Continuing

Operations

|

|

|

12/31/09

|

62.1%

|

|

|

12/31/08

|

91.0%

|

Under the existing operating agreements, so long as any CO2 gas was being produced and sold from the field, we had the right to sell our undivided share of the production to either KM or Exxon Mobil and also had the right to sell such production to other users. We believed that the loss of either KM, Trinity or Exxon Mobil as a customer would have a material adverse effect on the segment and on us. Following the sale of our remaining interest in McElmo Dome, the revenues from our remaining CO2 interest in Wyoming (see below) were not material.

Productive Wells. Our principal CO2 properties are held through our ownership of interests in oil and gas leases which produce CO2 gas. As of December 31, 2009, we had sold all of our working and overriding royalty interests in the McElmo Dome Unit in Colorado. Our sole remaining CO2 interest consists of a small overriding royalty interest in the Fogarty Creek Field in Wyoming. Such interest accounted for less than 1% of our CO2 revenue and operating profits in the CO2 Segment in 2008.

Financial Information. Financial information about our CO2 gas operations is contained in our Financial Statements. See Part II, Item 8---Financial Statements and Supplementary Data.

12

e-COMMERCE ACTIVITIES

Formation of starpay.com™, inc. (now starpay.com, l.l.c.). In 1999 four patent applications were filed embodying the features of a new secure payment system for Internet transactions and we formed starpay.com, inc. (“starpay”) to pursue the development of the payment system. In 2000, starpay filed two additional patent applications which considerably broadened the scope and the potential of its patent claims. In 2001 starpay became starpay.com, l.l.c.

In May of 2003 we formed Advanced Internet Technologies, L.L.C. (“AIT”). The members of starpay.com, l.l.c. contributed their entire membership interests in starpay to AIT for equivalent membership interests in AIT. starpay became a wholly-owned subsidiary of AIT with Marc Messner, Beard’s VP-Corporate Development and the inventor of starpay’s technology, serving as its Sole Manager. Current ownership in AIT is as follows: Beard (71%); Messner (15%); patent attorney (7%); Web site company (7%).

The starpay Technology. Our secure payment methods and technologies addressed payer and transaction authentication in many forms. These included, but are not limited to, performing a payer query for authentication and transaction consent verification, as well as, chaining split transactions into an integrated verifiable unique transaction authenticating the user and the transaction attributes in the process.

Other features of starpay’s technology included a patent-pending system that incorporated the innovative use of the ubiquitous compact disc or smart card as a security and transaction-enabling device. The enabling device, user’s identifier and/or PIN must all be present to enable a payment transaction on the Internet. This technology was an additional layer of security that might or might not be applied to starpay’s proprietary process flow models.

License Agreement. In November of 2001 VIMachine, Inc. (“VIMachine”), the owner of U.S. Patent 5,903,878, “Method and Apparatus for Electronic Commerce” (the “VIMachine Patent”) granted to starpay the exclusive marketing rights, with respect to certain clients (the “Clients”) which starpay had identified to VIMachine, for security software and related products and applications. starpay believed the VIMachine Patent would provide numerous opportunities to generate related licensing agreements in the electronic authentication and payment transaction fields.

In March 2002 starpay’s marketing rights with respect to its Clients were broadened to include the right to litigate on behalf of VIMachine all patent claims in relation to the VIMachine Patent and related foreign applications or patents. Any settlement and/or judgment resulting from starpay’s prosecution of the VIMachine Patent claims starpay along with VIMachine filed a suit in the U. S. District Court for the Northern District of Texas, Dallas Division was to be shared 50/50 or 25/75 between starpay and VIMachine (depending upon who the infringing party might be) following reimbursement to starpay (from the settlement and/or judgment monies) for litigation related expenses incurred, including defense of any counterclaims.

Visa Litigation. In May of 2003 against Visa International Service Association and Visa USA, Inc., both d/b/a Visa (Case No. CIV:3-03-CV0976-L). As of June 1, 2009 the parties agreed to settle the Case. We received $832,000 as our share of the Settlement and distributed $7,000 thereof to starpay’s partners. Accordingly, this matter is now closed. See “Item 3. Legal Proceedings---Visa Litigation” for additional details.

Issuance of Initial Patent; Exclusive License Agreement. On April 9, 2002, the U.S. Patent and Trademark Office issued U.S. Patent No. 6,370,514 (the “Voucher Patent”) to starpay on its patent application titled “Method for Marketing and Redeeming Vouchers for use in Online Purchases.” All claims submitted in this application were allowed. The Voucher Patent will expire on August 2, 2019.

13

On March 28, 2003, starpay finalized a Patent License Agreement with Universal Certificate Group LLC (“UCG”), a private company based in New York City. UCG has developed a universal online gift certificate that is accepted as payment at hundreds of online stores through its subsidiary, GiveAnything.com, LLC. The Agreement, which remains in effect for the term of the patent, grants to UCG the exclusive, worldwide license to use, improve, enhance or sublicense the Voucher Patent. Under the Agreement, starpay received a license fee payable annually for three years plus a royalty payable semi-annually during the patent term. The $25,000 license fee which starpay received in 2005 was its final license fee under the Agreement. starpay also shares in any license fees or royalties paid to UCG for any sublicenses. UCG has the exclusive right to institute any suit for infringement under the Agreement. starpay has the right to jointly participate in any suit, in which case any damages obtained will be shared according to the fees and expenses borne by each party. UCG has the option to terminate the Agreement at any time without liability.

starpay’s Strategy and Current Opportunities. starpay’s plan had been to develop licensing agreements and other fee based arrangements with companies implementing technology in conflict with our intellectual property. However, its licensing efforts were placed on hold pending the resolution of the Visa litigation. As a result of the Visa settlement, the e-Commerce Segment ceased all efforts to pursue the development of any proprietary internet payment methods and technologies with the exception of its Voucher Patent which generates a small annual royalty. (See “Item 3. Legal Proceedings---Visa Litigation”).

Facilities. starpay occupies a small portion of the office space occupied by us at our corporate headquarters located in Oklahoma City, Oklahoma.

Market Demand and Competition. Following the Visa settlement the segment suspended its efforts to market the Voucher Patent, so market demand and competition are no longer relevant.

Dependence of the Segment on a Single Customer. The e-Commerce Segment accounted for the following percentages of the Company's consolidated revenues from continuing operations for each of the last two years.

|

Fiscal Year

Ended

|

Percent of

Consolidated

Revenues from

Continuing

Operations

|

|

|

12/31/09

|

0.06%

|

|

|

12/31/08

|

0.03%

|

|

The segment presently has only one customer, a licensee. However, the licensee has only generated one sublicense and does not appear to be pursuing any others. We believe that the loss of the segment’s present customer would not have a material adverse effect on the segment since the segment would then be in a position to pursue licenses directly with other parties. The loss of the present customer would not have a material adverse effect on us.

Financial Information. Financial information about the e-Commerce Segment is set forth in the Financial Statements. See Part II, Item 8---Financial Statements and Supplementary Data.

INVESTMENTS

Geohedral LLC. In 2006, we joined with three other partners in forming Geohedral LLC (“Geohedral”) to stake claims encompassing a series of black sand ridges which Geohedral believes contain significant quantities of magnetite (iron ore) and ilmenite (iron titanium oxide ore), and meaningful quantities of gold, silver and other precious metals (the “BlackSands Area”). Geohedral raised $3,155,000 in 2008 to pay the cost of staking and filing claims covering approximately 49,000 acres along the shore of the Gulf of Alaska near the town of Yakutat in southern Alaska. A few of the claims were rejected by the U.S. Forest Service; the balance of the claims, covering approximately 48,000 acres, were approved.

14

Later that year Geohedral raised an additional $1,640,000. (including $380,000 from us) which covered the cost of drilling 10 core holes ranging in depth from 65 feet to 125 feet (with seven holes in the 95 to 100 foot range) before they had to suspend coring due to adverse weather conditions. These cores were then assayed by an independent laboratory.

In 2009 Geohedral raised an additional $2,546,700 to stake and file additional claims covering approximately 16,000 acres, and pay the annual rentals due in the fall of 2009. The new area, known as Tanis Mesa, adjoins the BlackSands Area. We participated fully in this cash call, and also purchased an additional interest, increasing our ownership in Geohedral from 23.16% up to 25.68%. In 2009 we invested $1,040,000 in the partnership (including $441,000 for the purchased interest).

In the summer of 2009 Geohedral conducted an exploration program, supervised by the independent mining and engineering firm (the “Firm”) retained to supervise the exploration at the Yakutat project, on the Tanis Mesa property. The program consisted of drilling two core holes and digging five pits for sampling. The samples were submitted to an independent laboratory for assay testing. While the preliminary results were encouraging, to date they have not been confirmed by a third party lab. The fine nature of the mineral content (we are dealing with very fine particles of material) at Tanis Mesa has required us to seek further advice and input from our consultants.

Currently, Geohedral is focused on assay verification of the magnetite and ilmenite as well as the precious metals in the BlackSands Area. They have already received some positive assay results in support of the qualitative nature of the mineral content encountered in this area. The lab selection process is being led by the Firm, which has selected a lab they believe is capable of testing for magnetite and ilmenite as well as precious metals. Geohedral is working diligently with the Firm to arrive at the appropriate strategy needed to verify the potential for this property.

Based upon the price paid for interests in Geohedral in connection with its 2009 cash call, we believe that our interest in the partnership significantly exceeds our carrying cost of $222,000 on December 31, 2009.

Recent Development:

We continue to be optimistic about the potential of the project. The market appears to be heating up for smaller mining companies holding significant assetsA.

_______

AReuters release dated 4/11/10 – “BAY STREET - Big miners go shopping for production assets.”

Beard Dilworth, LLC. In April of 2009 we organized Beard Dilworth, LLC (“BDLLC”), a 40.58%-owned subsidiary, which set out to raise $7,000,000 to fund the purchase and development of the Dilworth Field (the “Field”), which is situated on an anticline on the Nemaha Ridge in Township 28 North, Range 1 East in Kay County, Oklahoma, BDLLC was able to raise $1,725,000 (including $700,000 from us) during April, which enabled it to purchase the Field at a Sheriff’s Sale on April 17, 2009 for a purchase price of $1,695,000.

The project had been brought to us by the company (the “Promoter”) that had owned the Field when it went into receivership in 2008. BDLLC took on the project subject to the commitment that (i) $7,000,000 would be raised for the purchase and development of the Field and (ii) that the Promoter would receive a 50% reversionary interest in the Field after payout (“APO”), defined as the time at which BDLLC and its partners had received a 3.5-to-1 return ($24,500,000) on their investment. It was also agreed by all parties that BDLLC would receive a 10% reversionary interest in the Field after the 3.5-to-1 payout for raising the $7,000,000.

15

In July of 2009, we announced that BDLLC had raised an additional $5,275,000 to fund the development of the Field, increasing the amount raised by BDLLC to fund the purchase and development of the Field to the required $7,000,000. The development funding was provided by RSE Energy, LLC - 80%, True Energy Exploration, LLC - 10%, and Royal Energy, LLC - 10% (collectively referred to as the “Group),” who took their ownership directly as working interests in the Field rather than as partners in BDLLC. Closing for the development program occurred on June 30, 2009. The BDLLC investors, who put up $1,725,000 to fund the purchase, and the Group that put up the $5,275,000 to fund the development, will each receive a 3.5-to-1 return before payout (“BPO”). As of December 31, 2009, BDLLC was dissolved and its former owners (including us) also became working interest owners in the Field. After payout (“APO”) of the $24,500,000, the former owners of BDLLC will own 9.86% of the Field (including 4.00% owned by us), the Group will own 30.14%, we will have a reversionary interest of 10%*, and the Promoter will have a 50% reversionary interest.

_______

*We will actually own a 10% interest BPO by virtue of our original $700,000 investment in BDLLC, and 14% APO as a result of our 10% reversionary interest plus our 4% APO interest in the Field.

During the last half of 2009, Beard Oil Company (“BOC”), the Field operator, drilled and completed three small bore production wells, two large bore production wells, and one new salt water disposal well (“SWDW”). Two SWDW’s already in place in the Field that were not part of BDLLC’s initial purchase were purchased for $1,000,000 BOC started injecting water into the Arbuckle Formation in late December of 2009.

It has been estimated that the Field has produced more than 70 million barrels of oil since the discovery well in the Field was completed in 1911. One of the country’s leading engineering firms has estimated that the Field should be capable of producing up to an additional 4.4 million barrels of oil from the Arbuckle Formation (encountered at a depth of approximately 3,500 feet) by utilizing high volume extraction (“HVE”) technology. The secondary recovery program that is underway is estimated to have a field-wide production potential of several million barrels of oil. The targeted rate of fluid recovery is approximately 228,000 barrels of fluid per day with an anticipated hydrocarbon yield of 1.1%.

Approximately 93% of the Field infrastructure was in place at year-end 2009, at which point BDLLC was in the first stage of its injection program. We anticipate reaching the second stage during the second quarter of this year, when we expect to have seven wells producing from the Arbuckle and achieve an average injection rate of 185,000 barrels of fluid per day. We expect the HVE program will be fully operational by year-end 2010 with nine producing wells and three SWDW’s, and an anticipated hydrocarbon yield of 1.1%. As a result of the dissolution of BDLLC at the close of business on December 21, 2009, we own a 10% working interest (W.I.) before payout (BPO) and a 14% W.I. after payout (APO).

Excluding the salt water disposal wells, we own a 10% working interest in 9 wells (0.9 net wells to us) in the HVE program at December 31, 2009. developed acreage in the field approximated 1,000 gross acres (100 acres net to us).

Our independent reserve engineer, Ivan D. Allred, Jr., estimated that the Field contained proved developed reserves, net to our interest, of approximately 370,000 barrels of oil and 1,500,000 mcf of natural gas at December 31, 2009. We will incur significant production costs on the HVE program. The present value of future cash flows at 10% on the Field, net to our interest, approximated $9.5 million at December 31, 2009.

Subsequent Development

In April of 2010, management opted to purchase and install two horizontal pumping systems at a total cost of approximately $550.000 ($55,000 to us) on the newly drilled SWDW to enable it to achieve its projected rate of disposal capacity. We anticipate the pumps will be operational by June, 2010.

16

REGULATION

General. We are subject to extensive regulation by federal, state, local, and foreign governmental authorities. Our operations in the United States are subject to political developments that we cannot accurately predict. Adverse political developments and changes in current laws and regulations affecting us could dramatically impact the profitability of our current and intended operations. More stringent regulations affecting our oil and gas operations and our coal reclamation activities could adversely impact the profitability of such operations and the availability of those projects in the future.

Environmental and Worker Safety Matters. Federal, state, and local laws concerning the protection of the environment, human health, worker safety, natural resources, and wildlife affect virtually all of our operations, especially our coal reclamation and environmental remediation activities. These laws affect our profitability and increase the Company’s exposure to third party claims.

It is not possible to reliably estimate the amount or timing of our future expenditures relating to environmental matters because of continually changing laws and regulations, and the nature of our businesses. We cannot accurately predict the scope of environmental or worker safety legislation or regulations that will be enacted. Our cost to comply with newly enacted legislation or regulations affecting our business operations may require us to make material expenditures to comply with these laws. We do not presently include environmental exposures with regard to our coal reclamation activities in our insurance coverage. Should we become involved with coal reclamation projects having environmental exposure, we believe we will have no difficulty in obtaining environmental coverage adequate to satisfy our probable environmental liabilities. As of this date, we are not aware of any environmental liability or claim that could reasonably be expected to have a material adverse effect upon our present financial condition.

Both our Oil & Gas activities and our Coal activities expose us to compliance with applicable environmental and worker safety laws and regulations. (See also: OIL AND GAS OPERATIONS – “Market Conditions”, “Regulation”, and “Effect of Compliance with Environmental Regulations on Capital Expenditures” and “Pollution Insurance Coverage” and COAL RECLAMATION ACTIVITIES – “Environmental Matters.”

OTHER CORPORATE ACTIVITIES

Other Assets. During the last 10 years we have disposed of most of the assets related to the operations which we discontinued in 1999, 2001 and 2007. However, we still have a few remaining assets and investments which we are in the process of liquidating as opportunities materialize. At year-end 2009 such assets consisted primarily of the residue of an iodine extraction plant and related equipment, drilling rig components and related equipment, wastewater storage tanks and a real estate limited partnership in which we are a limited partner. All of such assets are reflected on our books for less than their anticipated realizable value, which we estimate in total would not exceed $40,000. As excess funds become available from such liquidations they will be utilized for working capital, reinvested in our ongoing business activities or redeployed into newly targeted opportunities.

Office and Other Leases. We lease office space in Oklahoma City, Oklahoma, aggregating 6,645 square feet under a lease expiring September 30, 2013, at a current annual rental of $110,000. In addition, BTI leases a minor amount of warehouse space for storage at other locations as required to serve its needs.

Employees. As of December 31, 2009, we employed 14 full time employees and two part time employees in our continuing operations, including nine full time employees and two part time employees on the corporate staff.

Item 1A. Risk Factors.

Not applicable.

17

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

See Item 1(c) and Notes 7 and 19 to our financial statements included in Item 8 of this report for information regarding our properties.

Item 3. Legal Proceedings.

Neither we nor any of our subsidiaries are engaged in any litigation or governmental proceedings which we believe will have a material adverse effect upon the results of operations or financial condition of any of such companies.

Visa Litigation. In May of 2003 our 71%-owned subsidiary, starpay.com, l.l.c., along with VIMachine, Inc. filed a suit in the U. S. District Court for the Northern District of Texas, Dallas Division against Visa International Service Association and Visa USA, Inc., both d/b/a Visa (Case No. CIV:3-03-CV0976-L). As of June 1, 2009 the parties agreed to settle the Case. An Agreement executed by the parties was to have become effective when the Stipulated Order of Dismissal had been filed with the Court. As of July 17, 2009 the Order had not been filed. The Company felt that further delays in filing a Form 8-K reflecting execution of the Agreement and receipt of the Settlement funds would not be appropriate, and accordingly filed an 8-K reflecting such items on that date. We received $832,000 as our share of the Settlement and distributed $7,000 thereof to starpay’s partners. Accordingly, this matter is now closed.

Item 4. (Removed and Reserved).

PART II

Item 5. Market for the Registrant's Common Equity and Related Stockholder Matters.

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters.

(a) Market information.

Our common stock trades on the OTC Bulletin Board (“OTCBB”) under the ticker symbol BRCO. The following table sets forth the range of reported high and low bid quotations A for such shares on the OTCBB for each full quarterly period within the two most recent fiscal years:

|

2009A

|

High

|

Low

|

|

Fourth quarter

|

$9.32

|

$4.25

|

|

Third quarter

|

6.50

|

1.005

|

|

Second quarter

|

2.10

|

1.18

|

|

First quarter

|

2.60

|

1.00

|

|

2008A

|

High

|

Low

|

|

Fourth quarter

|

$2.70

|

$1.275

|

|

Third quarter

|

3.95

|

0.55

|

|

Second quarter

|

1.25

|

0.255

|

|

First quarter

|

0.415

|

0.13

|

_____

AThe reported quotations were obtained from the OTCBB Web Site. Such quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. The quotations reflect the high best bid and low best bid for each quarter. One market maker has frequently quoted a bid of $0.01 per share, and at other times a bid of $.0001 per share, and such bids are not considered to reflect a realistic bid for the shares.

BAll prices have been adjusted to reflect the 2-for-1 stock split effected on November 2, 2009.

18

(b) Holders.

As of March 31, 2010, the Company had 424 record holders of common stock.

(c) Dividends.

To date, we have not paid any cash dividends. The payment of cash dividends in the future will depend upon our financial condition, capital requirements and earnings. We intend to employ our earnings, if any, primarily in our coal reclamation activities and in paying down our debt, and do not expect to pay cash dividends for the foreseeable future. The Certificate of Designations of our Preferred Stock does not preclude the payment of cash dividends. The Certificate provides that, in the event we pay a dividend or other distribution of any kind, holders of the Preferred Stock will be entitled to receive the same dividend or distribution based upon the shares into which their Preferred Stock would be convertible on the record date for such dividend or distribution.

(d) Securities authorized for issuance under equity compensation plansA.

|

Plan category

|

Number of securities to

be issued upon exercise

of outstanding options, warrants and rights

(a)

|

Weighted average

exercise price of

outstanding

options, warrants

and rights

(b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|

|

Equity compensation

plans approved by security holders

|

2003-2 DSC PlanB - 566,278

2006 SO PlanD - 174,200

|

$3.05C

$1.865

|

None

None

|

|

|

Equity compensation plans not approved by security holders

|

Individual)

Compensation) - 80,000E

Arrangements) 27,000F

2006 SO PlanD 16,000

|

$1.775

$1.50

$5.575

|

None

None

184,000

|

|

|

Total

|

All Plans - 863,478

|

$2.69

|

109,959

|

|

_______

AThe numbers shown in the above table are as of December 31, 2009.

BThe 2003-2 Deferred Stock Compensation Plan, as amended (the “DSC Plan”), which authorized 1,600,000 shares to be issued, was approved by the stockholders at the 2004 Annual Stockholders’ Meeting. At the time the DSC Plan was terminated on November 17, 2005, a total of 1,595.623.88 Stock Units had been credited to the Participants’ Stock Unit Accounts based upon the Participants’ deferral of $425,100 of Fees or Compensation. At year-end 2009, a total of 1,029,338 shares had been distributed to the Participants, 7.88. fractional shares had been cashed out, and 566,278 shares remained to be distributed to Participants who had elected the equal annual installments distribution method.

CSince the exercise price of the Stock Units in the DSC Plan is determined by the Fair Market Value of the shares on their date of distribution, we have arbitrarily used the last sale price of $3.05 per share on March 31, 2010 as the weighted-average exercise price of the outstanding Stock Units since the value on the distribution dates is not determinable.

DThe 2006 Stock Option Plan (the “SO Plan”) originally authorized the issuance of 200,000 shares of common stock. On October 16, 2009, the Directors authorized an increase in the number of shares available under the SO Plan from 200,000 to 400,000. On that same date an employee was granted a 20,000 share option when only 4,000 shares remained available that had previously been approved by shareholders. The remaining 16,000 grant will be ratified once the increase in number of shares available under the SO Plan has been approved at the 2010 Shareholder Meeting.

EReflects a 5-year option, expiring in November of 2013, to purchase 80,000 shares of common stock issued to a consultant.

FReflects 2-year warrants, expiring in February and March of 2011, to purchase 27,000 shares of common stock issued to parties who purchased $68,530 of short-term notes maturing between May and September of 2009. All of the notes have now been repaid.

19

(e) Performance graph.

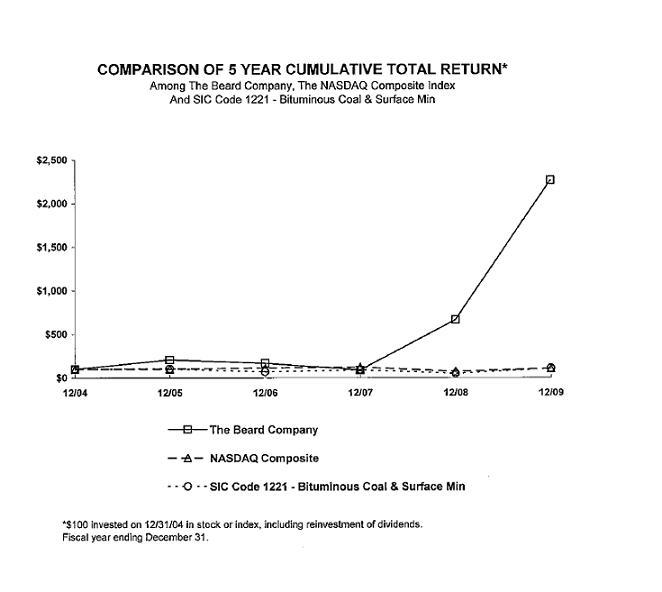

The following performance graph compares our cumulative total stockholder return on our common stock against the cumulative total return of the NASDAQ Market Index and the SIC Code Index of the Bituminous Coal, Surface Mining Industry compiled by Morningstar, Inc. for the period from December 31, 2004 through December 31, 2009. The performance graph assumes that the value of the investment in our stock and each index was $100 on December 31, 2004, and that any dividends were reinvested. We have never paid dividends on our common stock.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN AMONG THE BEARD COMPANY,

NASDAQ MARKET INDEX AND SIC CODE INDEX

NASDAQ COMPOSITE INDEX AND SIC CODE 1221 INDEX -

BITUMINOUS COAL & SURFACE MINING

|

---------------------------------------FISCAL YEAR ENDED---------------------------------

|

||||||

|

COMPANY/INDEX/MARKET

|

12/31/04

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

|

The Beard Company

|

100.00

|

208.33 | 168.33 | 91.67 | 666.67 | 2,266.67 |

|

Bituminous Coal, Surface Mining Industry Index

|

100.00

|

101.41 | 114.05 | 124.05 | 73.57 | 106.10 |

|

NASDAQ Market Index

|

100.00

|

105.20 | 69.27 | 93.17 | 48.53 | 108.80 |

The Industry Index chosen consists of the following companies: Alliance Holdings GP LP, Alliance Resource Partners, Arch Coal, Inc., Consol Energy, Inc., Foundation Coal Holdings, International Coal Group Inc., James River Coal Company, National Coal Corp., Peabody Energy Corp., Penn Virginia GP Holdings, Westmoreland Coal Co. and Yanzhou Coal Mining Co.

20

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion addresses the significant factors affecting our results of operations, financial condition, liquidity and capital resources. Such discussion should be read in conjunction with our financial statements including the related notes.

Overview

General. In 2009 we operated within the following operating segments: (1) the oil and gas (“Oil & Gas”) Segment, (2) the coal reclamation (“Coal”) Segment, (3) the carbon dioxide (“CO2”) Segment, and (4) the e-Commerce Segment.

The Oil & Gas Segment consists of the production of oil and gas. The Coal Segment is in the business of operating coal fines reclamation facilities in the U.S. and provides slurry pond core drilling services, fine coal laboratory analytical services and consulting services. The CO2 Segment consists of the production of CO2 gas. Following the Visa settlement in June of 2009, the e-Commerce Segment ceased its attempts to develop business opportunities to leverage starpay’s intellectual property portfolio of Internet payment methods. We are also conducting minerals exploration and development through our investment in Geohedral, LLC, a partnership organized in 2006 to explore for hard minerals in Alaska.

In 2009 our continuing operations reflected earnings of $2,872,000 compared to earnings of $3,311,000 in 2008.

Beginning in 1999 we started discontinuing the operations of those segments that were not meeting their targeted profit objectives and which did not appear to have significant growth potential. This ultimately led to the discontinuance of five of our unprofitable segments. Such discontinued operations reflected losses of $1,000 in 2009 and $947,000 in 2008. See “Discontinued Operations” below.

We are focusing our primary attention on the Oil & Gas and Coal Segments, which we believe have important potential for growth and profitability, together with our investment in Geohedral LLC, which we believe has significant upside potential.

We have a few remaining assets and other investments that we intend to liquidate as opportunities materialize.

Operating results for the Coal Segment for 2009 and 2008 continued to be impacted by the lack of a coal contract generating operating profits. The segment recorded operating losses of $476,000 in 2008 and $594,000 in 2009. The segment is expected to achieve profitability once the Alden recovery plant is up and running. There is no assurance that the financing for the project will be secured.

Operating profit for the CO2 Segment in 2009 decreased $860,000 to $302,000, or 74%, from 2008, primarily as a result of the sale, effective March 1, 2009, of our remaining 65% interest in the McElmo Dome Field, our principal revenue producing asset in the segment. The operating loss of the e-Commerce Segment decreased $68,000 to $55,000 for 2009 compared to $123,000 for 2008. We no longer allocated certain SG&A expenses, notably the manager’s salary and related items, to the segment following the settlement of the Visa litigation in June of 2009. The Oil & Gas Segment recorded an operating profit of $46,000 for 2009 compared to $25,000 for 2008 due primarily to our receiving $62,000 for operating the wells in the Dilworth Field in which we had an interest through our 40.58% ownership of BDLLC. At December 31, 2009, BDLLC was dissolved and the assets and liabilities were distributed proportionately to its partners. Our Coal Segment’s operating loss increased by $118,000---from $476,000 in 2008 to $594,000 in 2009---as a result of increases in expenses, primarily costs related to projects under development in the segment. The operating loss from corporate activities at the parent company increased $224,000, or 19%, from $1,122,000 in 2008 to $1,346,000 in 2009 primarily as the result of allocating $190,000 less in SG&A costs to other entities in the consolidated group. Results from continuing operations reflected a decrease of $439,000, from earnings of $3,311,000 in 2008 to earnings of $2,872,000 in 2009, primarily as a result of the $1,113,000 increase in operating losses, a $329,000 increase in losses from unconsolidated affiliates and a $149,000 impairment in the carrying value of our investment in Geohedral. These losses were partially offset by a $418,000 reduction in interest expense and the $832,000 gain on the settlement in the Visa litigation. Gain on the sale of investments was $4,894,000 in 2009 compared to $3,329,000 in 2008. The year 2008 also benefitted from a $1,671,000 gain on the disposition of controlling interests in subsidiaries with no comparable event in 2009.

21