Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d8k.htm |

| EX-99.1 - TRANSCRIPT OF ALCOA INC. FIRST QUARTER 2010 EARNINGS CALL - Howmet Aerospace Inc. | dex991.htm |

Alcoa

Logo Alcoa Logo

1

st

Quarter 2010 Earnings Conference

April 12, 2010

1

Exhibit

99.2 |

Alcoa

Logo Forward-Looking Statements

Today’s

discussion

may

include

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements relate to future events and expectations and involve known

and unknown risks and uncertainties. Alcoa’s actual results or actions

may differ materially from those projected in the forward-looking

statements. For a summary of the specific risk factors that could cause

results to differ materially from those expressed in the forward-looking

statements, please refer to Alcoa’s Form 10-K for the year ended

December 31, 2009, and other reports filed with the Securities and

Exchange Commission.

2 |

Alcoa

Logo Alcoa Logo

Chuck McLane

Executive Vice President and Chief Financial Officer

3 |

Alcoa

Logo 1

st

Quarter 2010

Financial Overview

Continued benefits from Cash Sustainability Initiatives

COGS % Sales of 82.1%, SGA % Sales of 4.9%

EBITDA

of

$596

million

–

highest

since

Q3’08

Loss

from

continuing

operations

of

$194

million,

or

$0.19

per

share

–

Restructuring

and

special

items

total

$295

million,

or

$0.29

per

share

–

Net loss of $201 million, or $0.20 per share

Realized aluminum price up 8%; realized alumina price up 13%

Debt

to

Capital

of

38.1%,

down

60

basis

points

–

Total debt reduced to $9.75 billion; Cash on hand of $1.3 billion

4 |

Alcoa

Logo Revenue Change by Market

0%

5%

(6%)

39%

34%

(21%)

(32%)

1%

(16%)

(10%)

(22%)

40%

(6%)

18%

58%

(36%)

(24%)

(18%)

48%

102%

1Q’10 Third Party Revenue

Sequential

Change

Year-Over-Year

Change

5

14%

5%

6%

2%

6%

2%

12%

5%

13%

35%

Aerospace

Automotive

B&C

Comm. Transport

Industrial Products

IGT

Packaging

Distribution/Other

Alumina

Primary Metals |

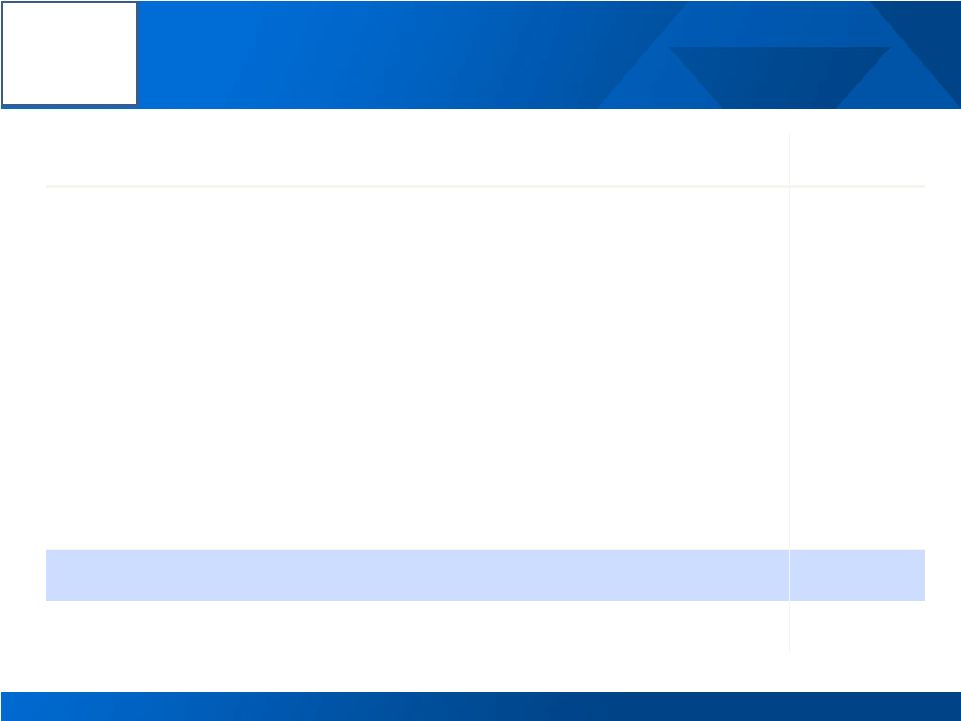

Alcoa

Logo Sequential Income Statement Summary

6

$ Millions

4Q’09

1Q’10

Change

Sales

$5,433

$4,887

($546)

Cost of Goods Sold

$4,905

$4,013

($892)

COGS % Sales

90.3%

82.1%

(8.2 % pts.)

Selling,

General Administrative, Other

$291

$239

($52)

SGA % Sales

5.4%

4.9%

(0.5 % pts.)

Restructuring and Other Charges

$69

$187

$118

Effective Tax Rate

34.8%

(95.5%)

N/A

Income (Loss) from Continuing Operations

($266)

($194)

$72

Income (Loss) from Discontinued Operations

($11)

($7)

$4 |

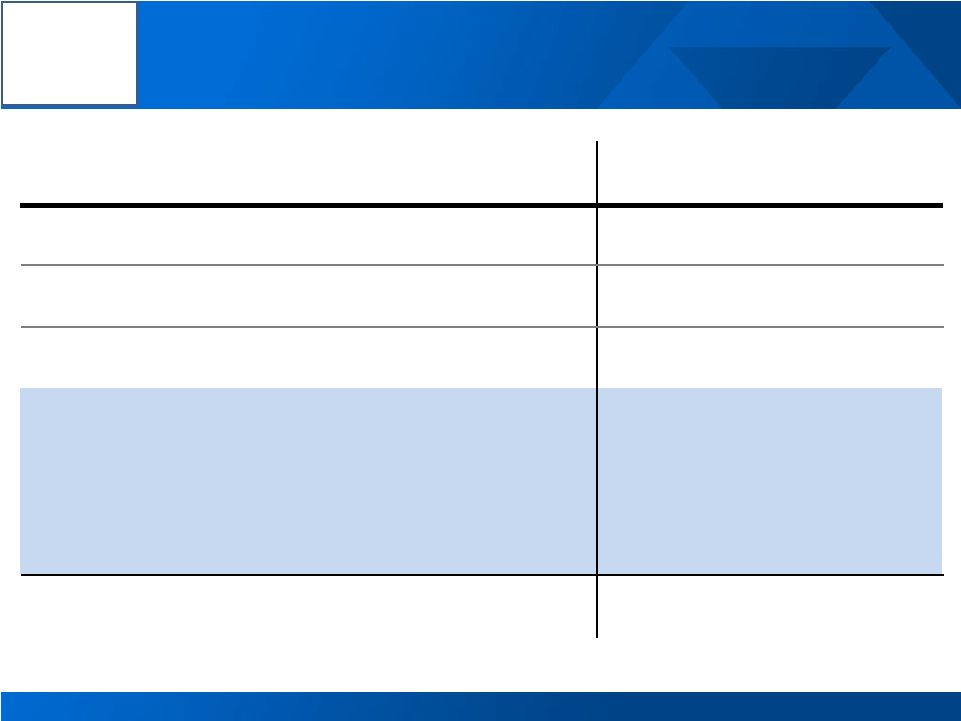

Alcoa

Logo 7

1

st

Quarter Restructuring and Special Items

*Restructuring Related includes ($119) million of restructuring in the corporate

segment and ($5) million of closure related inventory in COGS in the Alumina

and Primary metal segments

$ Millions

After-Tax & Non-

Controlling Interests

Earnings

Per Share

Income Statement

Classification

Segment

Restructuring Related*

($124)

($0.12)

--

--

Discrete Tax Items

($112)

($0.11)

Taxes

Corporate

Special Items:

($59)

($0.06)

--

--

Mark

-to-Market Power Contracts

($31)

($0.03)

Other Income/Expense

Corporate

Power Outages

($17)

($0.02)

Revenue &

Cost

of Goods Sold

Alumina/Primary

Environmental Accrual

($11)

($0.01)

Cost of Goods Sold

Corporate

Total

($295)

($0.29) |

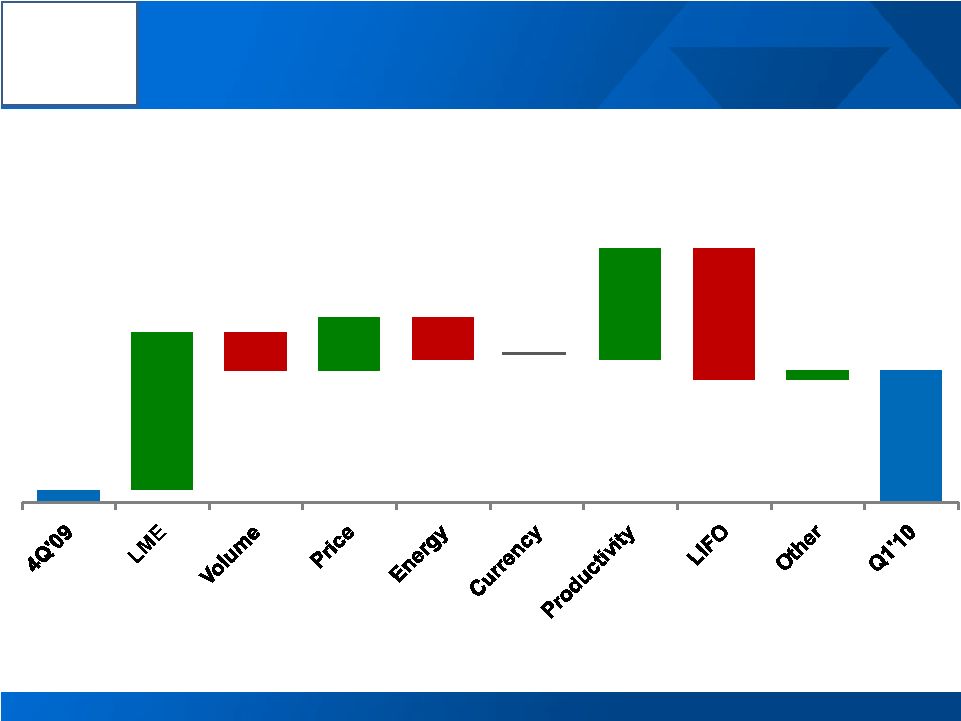

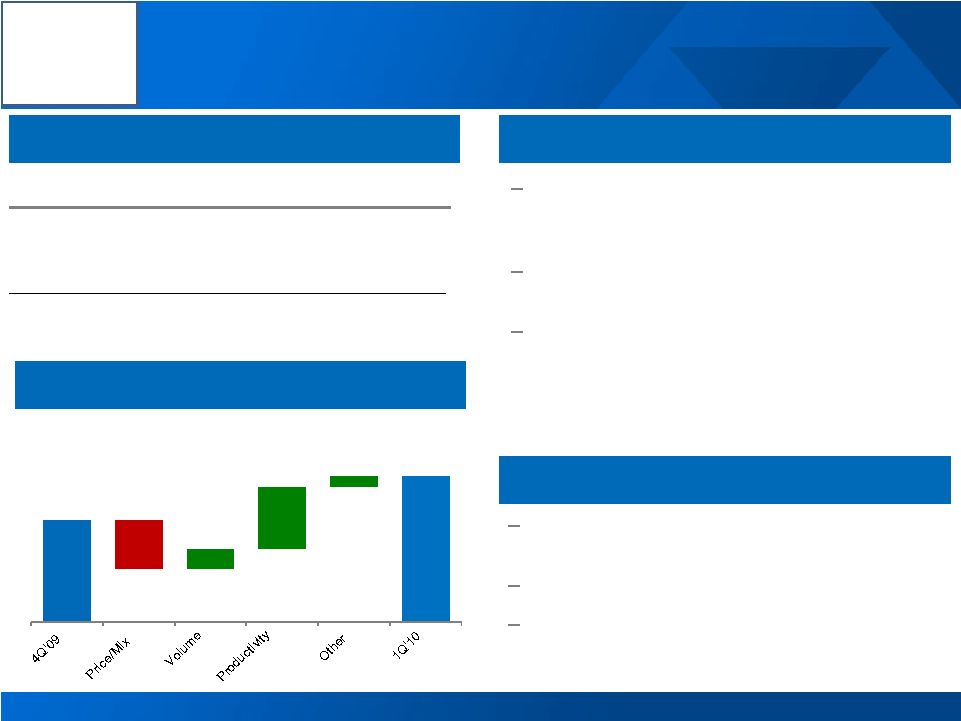

Alcoa

Logo 1

st

Quarter 2010 vs. 4th

Quarter 2009

Earnings Bridge

8

See appendix for reconciliation

$9

$121

($30)

$41

($33)

$0

$86

($101)

$8

$101

Income (Loss) from Continuing Operations excluding Restructuring & Other Special Items

($ millions) |

Alcoa

Logo Sensitivity Summary

9

+/-

$100/MT = +/-

$200 million

LME Aluminum Annual Net Income Sensitivity

Currency Annual Net Income Sensitivity

+/-

10% versus USD

Australian $

+/-

$75 million

Brazilian $

+/-

$50 million

Euro €

+/-

$40 million

Canadian $

+/-

$35 million |

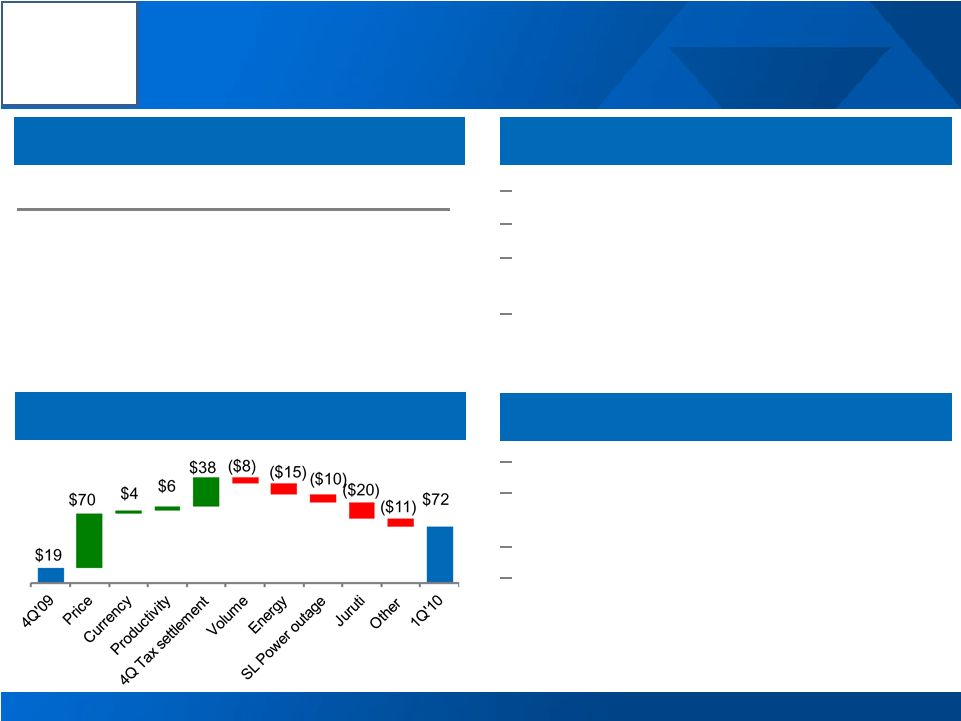

Alcoa

Logo Alumina

1

st

Quarter Highlights

2

nd

Quarter Outlook

1

st

Quarter Business Conditions

10

1Q 09

4Q 09

1Q 10

Production (kmt)

3,445

3,897

3,866

3

rd

Party Shipments (kmt)

1,737

2,716

2,126

3

rd

Party Revenue ($MM)

430

760

638

ATOI ($MM)

35

19

72

Realized 3rd party Alumina price up 13%

Cash sustainability initiative benefits

Sao Luis power outage negatively impacted cost by

$10 million

Higher

Juruti

costs

of

$20

million

Pricing to follow two month lag on LME

Continued benefits from cash sustainability

initiatives

Potential labor disruptions in Australia

Production projected to increase by 100 KMT

1

st

Quarter Performance Bridge

$ Millions |

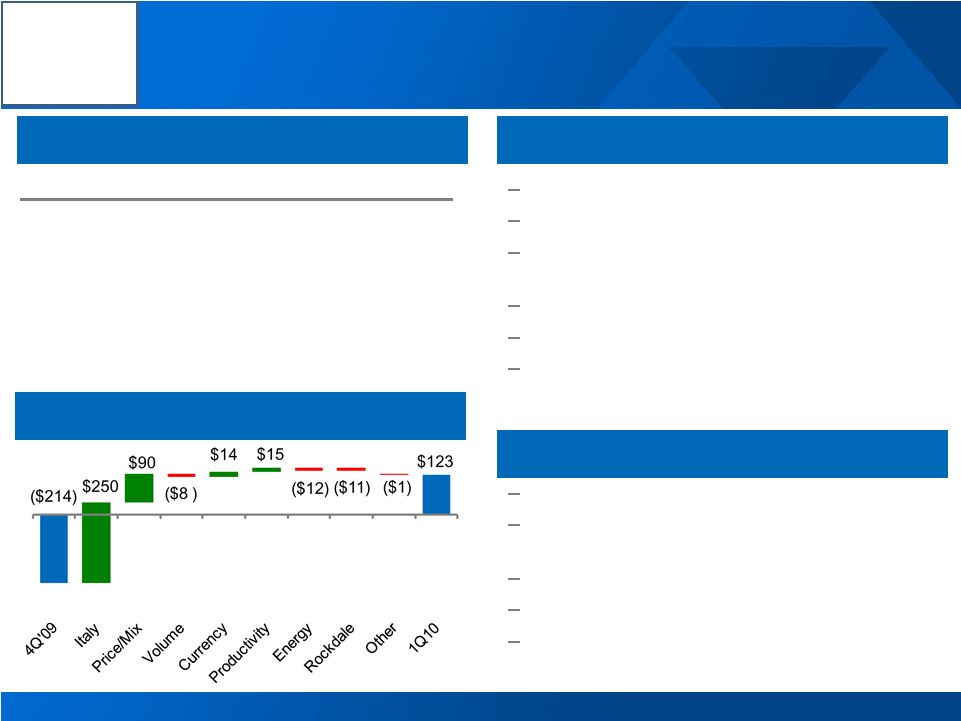

Alcoa

Logo Primary Metals

1

st

Quarter Highlights

1

st

Quarter Business Conditions

2

nd

Quarter Outlook

11

1Q 09

4Q 09

1Q 10

Production (kmt)

880

897

889

3

rd

Party Shipments (kmt)

683

878

695

3

rd

Party Revenue ($MM)

844

1,900

1,702

3

rd

Party Price ($/MT)

1,567

2,155

2,331

ATOI ($MM)

(212)

(214)

123

Realized pricing up 8%

Positive currency impact of $14 million

Non-recurrence of Q4 ‘09 non-cash charge

related to Italy power decision

Productivity improvement of $15 million

Higher power costs, particularly in Italy

Rockdale outage negatively affected quarter by

$ 11 million

Pricing to follow 15-day lag

Continued benefits from cash sustainability

initiatives

Rockdale power station running below capacity

US labor negotiations

Production equal to first quarter

1

st

Quarter Performance Bridge

$ Millions |

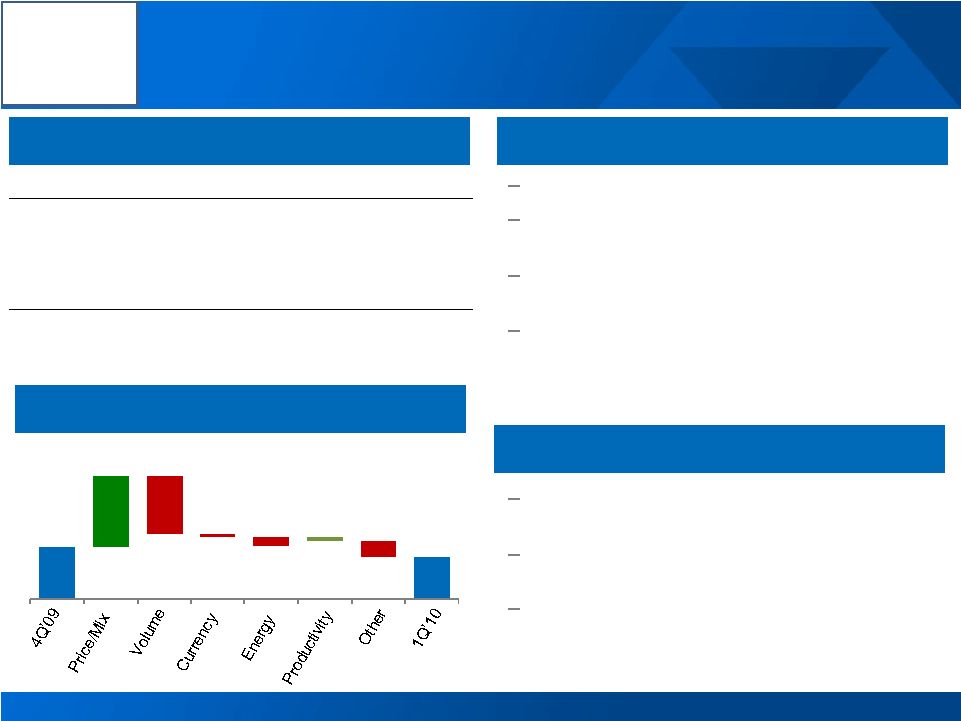

Alcoa

Logo Flat Rolled Products

12

2

Quarter

Outlook

1

Quarter

Business

Conditions

1

Quarter

Highlights

ATOI $ Millions

1Q 09

4Q 09

1Q 10

Global Rolled Products,

excl Russia, China & Other

3

63

47

Russia, China & Other

(64)

(26)

(17)

Total ATOI

(61)

37

30

Improved mix and pricing across every region

Decision to curtail sales in RPD drove lower

volumes

Gains from cash sustainability initiatives –

overhead reduction of 8% sequentially

Higher energy costs in North America and Russia

Continued benefits from cash sustainability

initiatives

Modest improvement in aerospace and industrial

markets

North American RPD volumes remain at low

levels

1

Quarter

Performance

Bridge

$ Millions

st

st

st

nd

$37

$50

( $41)

($2)

( $6)

$3

($11)

$30 |

Alcoa

Logo Engineered Products and Solutions

1

st

Quarter Business Conditions

2

nd

Quarter Outlook

1

st

Quarter Highlights

13

ATOI % Sales equal to year ago quarter despite

$200M decline in sales driven by strong

performance in cash sustainability initiatives

Volume improvements in Commercial Transport

and Industrial Products markets

Continued downward pressure in IGT and

Building and Construction markets

Continued benefits from cash sustainability

initiatives

Market conditions show slight improvement

Aerospace destocking slowly coming to an end

$ Millions

1Q 09

4Q 09

1Q 10

3

rd

Party Revenue

1,270

1,097

1,074

ATOI

95

57

81

ATOI % of Revenue

7.5%

5.2%

7.5%

1

st

Quarter Performance Bridge

$ Millions

$57

($26)

$12

$34

$6

$81 |

Alcoa

Logo 1

st

Quarter 2010 Cash Flow Overview

14

See appendix for free cash flow reconciliation

($ Millions)

1Q'09

4Q'09

1Q'10

Net Loss

(487)

($268)

($179)

DD&A

283

369

358

Change in Working Capital

351

522

(336)

Pension Contributions

(34)

(26)

(22)

Taxes / Other Adjustments

(384)

527

378

Cash From Operations

(271)

$1,124

$199

Dividends to Shareholders

(137)

(30)

(32)

Change in Debt

(305)

(286)

(42)

Dividends to Noncontrolling Interest

(77)

(47)

(72)

Contributions from Noncontrolling Interest

159

153

27

Other Financing Activities

863

0

(61)

Cash From Financing Activities

503

($210)

($180)

Capital Expenditures

(471)

(363)

(221)

Other Investing Activities

607

(137)

13

Cash From Investing Activities

136

(500)

(208) |

We

Are Focused on Achieving Our 2010 Goals 15

Procurement reduction of $2.5 billion

Overhead reduction of $500 million

Capital expenditures of $1.25 billion

Days Working Capital reduction of 2 days

Driving Positive Free Cash Flow |

Alcoa

Logo Alcoa Logo

Klaus Kleinfeld

President and Chief Executive Officer

16 |

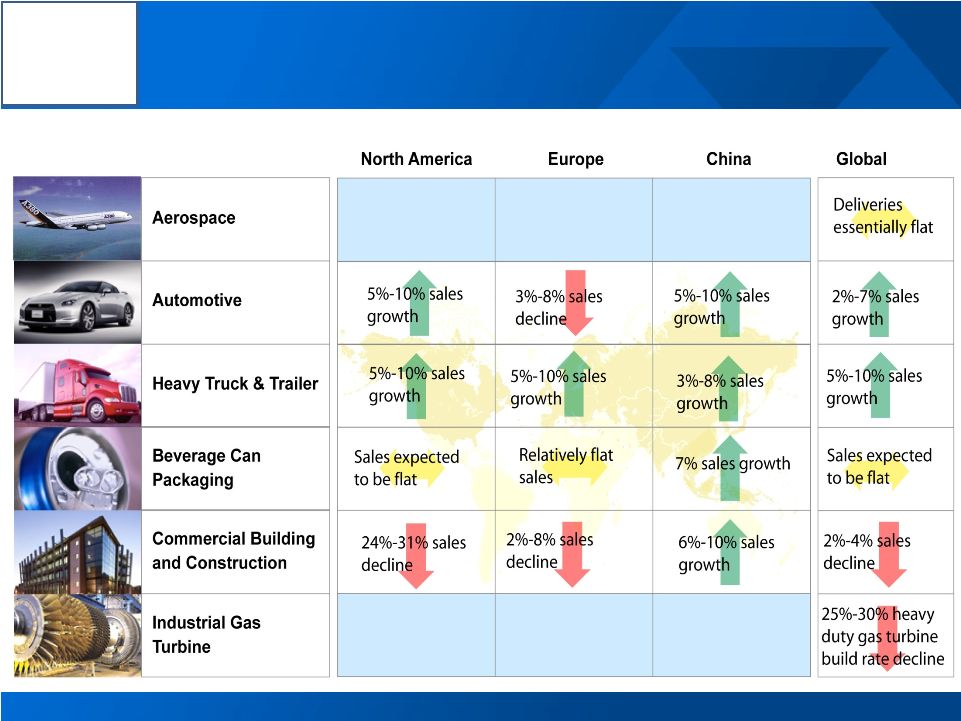

Alcoa

Logo Market Conditions in 2010

Alcoa End Markets: Current Assessment of 2010 vs. 2009 Conditions

Source: Alcoa analysis

17 |

Alcoa

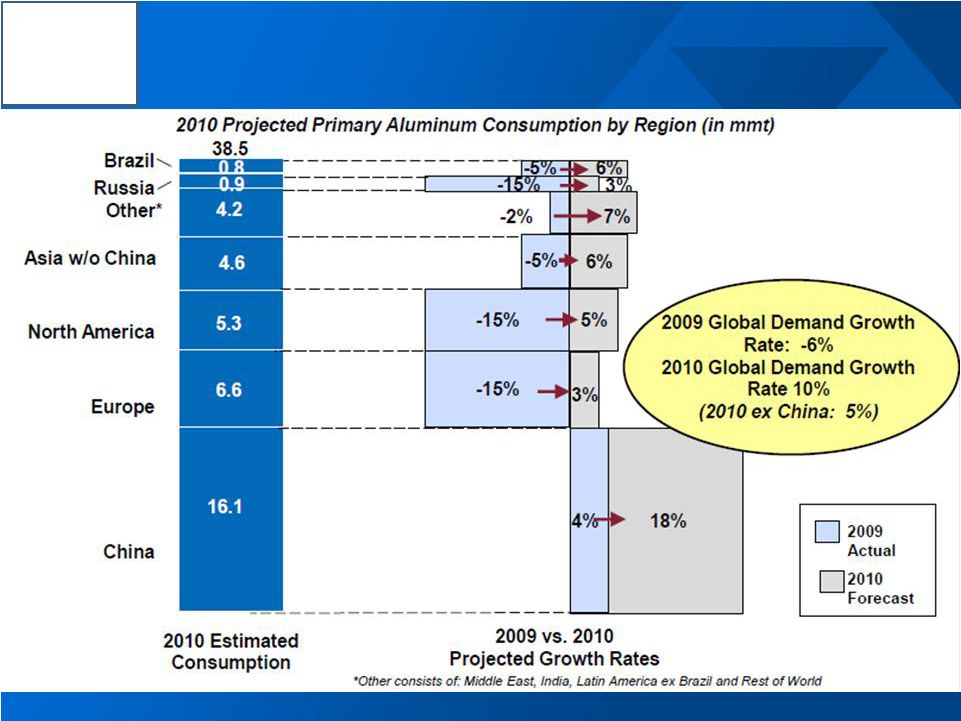

Logo Global Physical Demand to Rise 10% in 2010

18 |

Alcoa

Logo Inventories Flat As Stable Demand Drives Premiums Higher

Source: Bloomberg, IAI

Global inventory days of consumption and regional premiums

45%

118%

266%

66 days of

consumption

LME at 47

days

Non-LME at

19 days

$135 / MT

$136 / MT

$124 / MT

19

0

10

20

30

40

50

60

70

80

LME

Shanghai

Japan Port

Producer

0%

50%

100%

150%

200%

250%

300%

350%

400%

Midwest

Japan

Europe

Regional Premium (1-Year Change) |

Alcoa

Logo 2010 Annualized Run Rate

23,150

2010 Restarts or Curtailments

(365)

2010 Brown/Greenfield Expansion

745

Total Supply

23,530

Demand

(22,500)

Exports to China, Net

(200)

Net Surplus

830

China

Western World

2010 Primary Aluminum Surplus Is Manageable

(in kmt)

2010 Annualized Run Rate

16,100

2010 Restarts or Curtailments

0

2010 Brown//Greenfield Expansion

200

Total Supply

16,300

Demand

(16,100)

Imports from West, Net

200

Net Surplus

400

Source: Alcoa estimates, Brook Hunt, CRU, CNIA, IAI

20

Surplus

Surplus |

Alcoa

Logo 2010E Alumina Supply / Demand Balance (in kmt)

Source: Alcoa estimates, CRU, CNIA, IAI

2010 Global Alumina in Balance

China

Western World

21

2010 Annualized Run Rate

27,000

Imports from Western World

5,400

Supply

32,400

Demand

(32,400)

(Deficit) / Surplus

0

2010 Annualized Run Rate

51,000

Exports to China

(5,400)

Supply

45,600

Demand

(45,400)

(Deficit) / Surplus

200

Balanced |

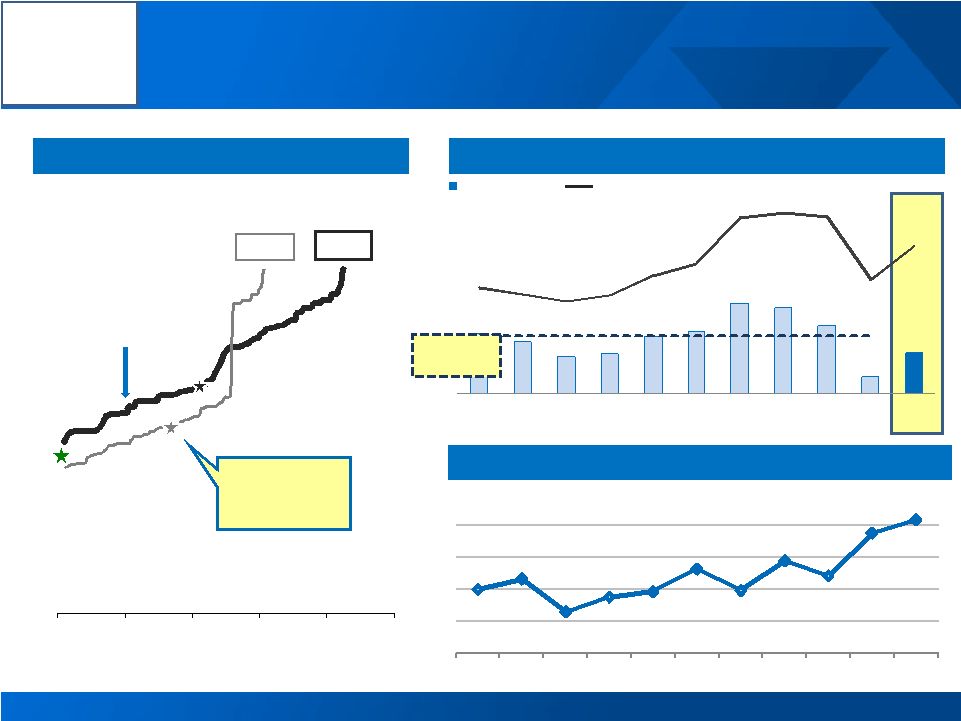

Alcoa

Logo 72

62

44

48

68

75

110

104

81

20

49

1,549

1,447

1,350

1,433

1,719

1,900

2,570

2,641

2,572

1,664

2,136

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Q1'10

0

20,000

40,000

60,000

80,000

100,000

Cumulative Production KMT

Significant Value Creation From The Alumina Leader

Alumina financial and strategic overview

Global Refining Cost Curve

LME

EBITDA/MT

Ma’aden

1st Percentile

Online 2014

EBITDA per Metric Ton

22

Source : CRU; Alcoa Analysis

50

th

Percentile = $232/MT

~50% increase

in midpoint

since 2000

Average =

~$70/MT

50

th

Percentile = $140MT

[Alcoa Logo]

Alcoa

25

th

Percentile

2000

2009

Tight Market, Rising Cost = Higher Alumina % LME

Alcoa

3

rd

Party

Alumina

Sales

%

LME

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010 |

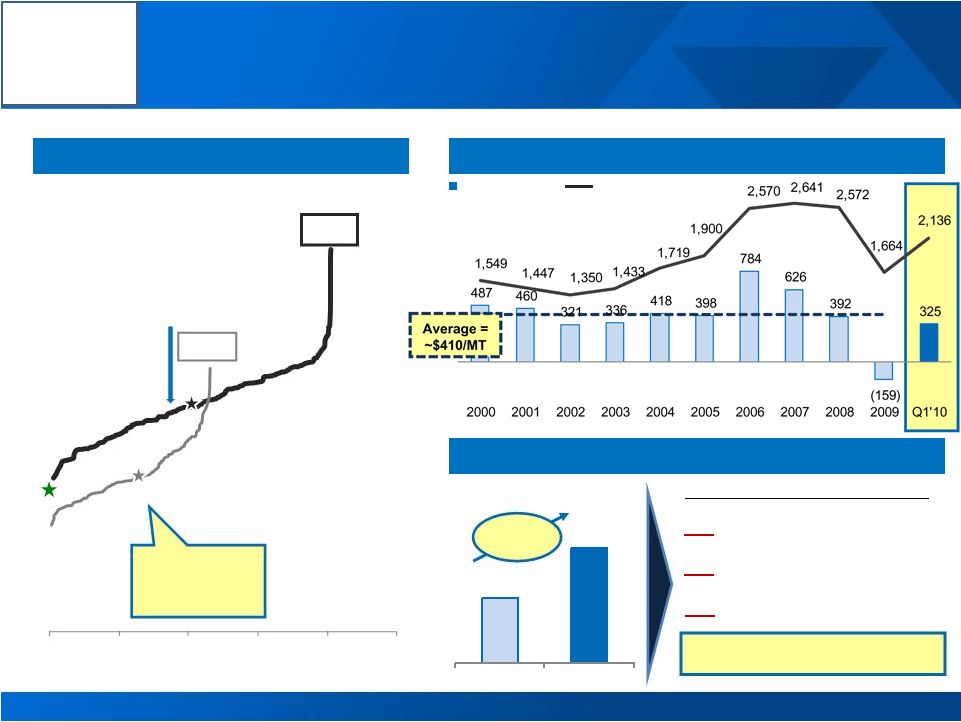

Streamlined Primary Metals Poised to Drive EBITDA

Primary Metals financial and strategic overview

Global Primary Cost Curve

EBITDA per Metric Ton

LME

EBITDA/MT

23

Future Capacity Growth Challenged

Aluminum Demand (MMT)

Requires 2.3 MMT per Year

3x

Ma’aden Smelters per Year

4x

Sao Luis Expansions per Year

20

New Gas Turbines per Year

50 Percentile = $1,755/MT

50 Percentile = $1,183/MT

2009

Ma’aden

1st Percentile

Online 2013

45 Percentile

Source : CRU; Alcoa Analysis

0

10,000

20,000

30,000

40,000

50,000

Cumulative Production KMT

38.5

68.0

2010

2018

~50% increase

in midpoint

since 2000

6%

CAGR

~$30 Billion per Year

2000

Alcoa Logo

th

th

th

[Alcoa Logo]

Alcoa |

Alcoa

Logo Rolled Products Positioned to Substantially Improve Returns

–

Russian can sheet mill fully operational in 2010

–

China Bohai

mill on schedule for full ramp-up by 2011

–

Lowest

conversion

cost

Ma’aden

mill

on-line

in

2013

–

Strengthened positions in aerospace, can sheet,

lithographic sheet

–

Exited global foil business

–

Headcount reduced by 5,000 FTEs since 2008

–

Overhead $140 million lower than 2008

Global Flat Rolled Products financial and strategic overview

2009 3

rd

Party Sales by Market

Segment EBITDA & EBITDA % Sales

Strategic Position

24

573

541

495

479

531

620

536

498

254

224

107

EBITDA $Millions

EBITDA % Sales

11%

11%

11%

10%

9%

9%

6%

5%

3%

4%

7%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Q1'10

Distribution

10%

Automotive

4%

B&C

5%

Commercial

Transport

3%

Industrial

/Other

13%

Aerospace

12%

Packaging

53%

75%

Utilization |

Alcoa

Logo EPS Strong Platform for Profitable Growth

–

Focused the portfolio on strategic segments

–

85% of sales are from #1 or #2 market leaders

–

$440 million of productivity improvement in 2009

–

Aerospace destocking is improving

–

Significant profit accelerators for the future

–

787/A380

–

Joint Strike Fighter

–

Heavy Truck market recovery

–

Rapidly integrated 2 fastener acquisitions

Engineered Products & Solutions financial and strategic overview

2009 3

rd

Party Sales by Market

Segment EBITDA & EBITDA % Sales

Strategic Position

25

368

436

287

356

495

536

676

783

922

630

152

EBITDA $Millions

EBITDA % Sales

11%

11%

8%

9%

12%

11%

12%

13%

15%

13%

14%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Q1'10

Aerospace

47%

IGT

14%

B&C

20%

Commercial

Transport

4%

Automotive

10%

Other

5%

70%

Utilization

65%

Utilization |

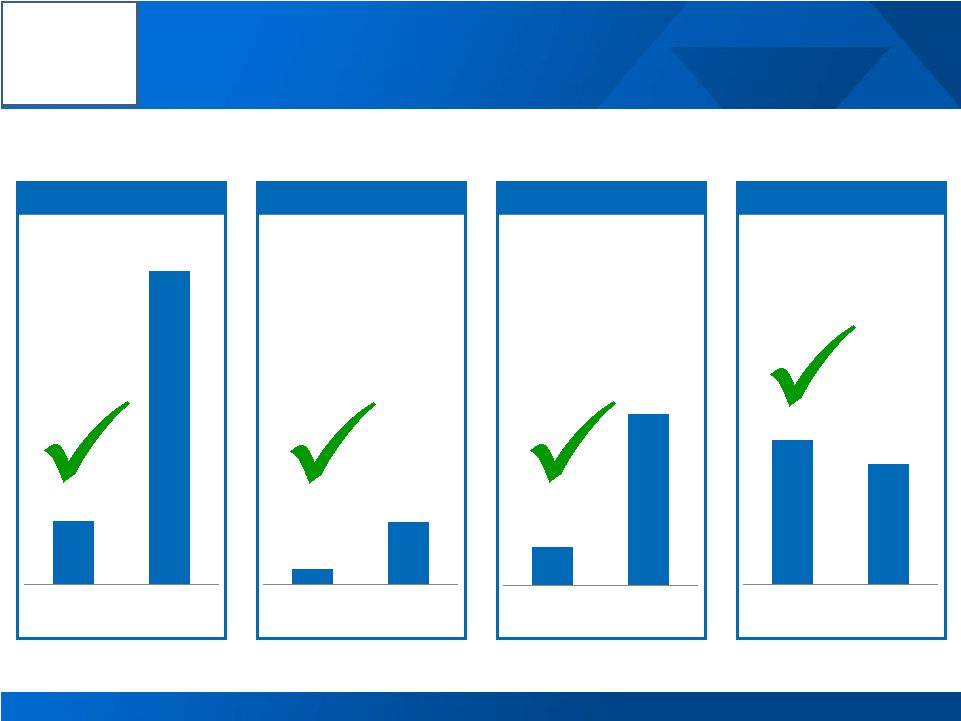

Alcoa

Logo Aggressively Pursuing 2010 Operational Targets

26

Procurement

Overhead

$500

Total Capex*

$1,250

Working Capital

35

2010 Cash Sustainability Operational Targets and Actual Performance

$ Millions

$127

$281

42

$ Millions

$ Millions

Days Working Capital

$2,500

$505

2010

YTD

2010

Target

2010

YTD

2010

Target

2010

YTD

2010

Target

2010

YTD

2010

Target

*Total Capex includes investments in Ma’aden project

|

Alcoa

Logo Alcoa Driving Near-term and Long-term Shareholder Value

27

–

End-markets improving

–

Aluminum

demand

to

rise

10%

in 2010

–

Global alumina

supply/demand in balance

–

Global primary metal surplus

of 12 days

–

Overhead cost reduction

target of $500 million

–

Procurement cost reduction

target of $2.5 billion

–

Divested underperforming

businesses

–

Strengthened balance sheet

Environment Stabilized

Exceeding Goals

Growing Profitably

–

Global alumina leader

leveraging lowest cost

production base

–

Global aluminum leader

reducing cost position

–

Alcoa Rolled Products leading

profitability revitalization

–

EPS expanding market

leadership and competitive

distance

Momentum

Execution

Growth |

Alcoa

Logo Matthew E. Garth

Director, Investor Relations

A

390 Park Avenue

New York, NY 10022-4608

Telephone: (212) 836-2674

www.alcoa.com

Additional Information

28 |

Alcoa

Logo A

Alcoa Logo |

Alcoa

Logo Effective Tax Rate

Effective tax rate, excluding discrete tax items is a non-GAAP financial measure.

Management believes that the Effective tax rate, excluding discrete tax items is

meaningful to investors because it provides a view of Alcoa’s operational tax rate.

30

$ Millions

1Q’09

(Loss) income from continuing operations before income taxes

($88)

Provision for income taxes

$84

Effective

tax

rate

as

reported

(95.5%)

Discrete

tax

provisions:

Medicare Part D

-

$79

Transaction-related and other items

-

$33

Subtotal -

Discrete tax (benefits) provisions

$112

(Benefit)

Provision

for

income

taxes

excluding

discrete

tax

(benefits)

provisions

($28)

Effective tax rate excluding discrete tax (benefits) provisions

31.8% |

Alcoa

Logo Reconciliation of ATOI to Consolidated Net (Loss) Income

Attributable to Alcoa

31

(in millions)

1Q09

2Q09

3Q09

4Q09

2009

1Q10

Total segment ATOI

$

(143)

$

(132)

$

142

$ (101)

$

(234)

$ 306

Unallocated amounts (net of tax):

Impact of LIFO

29

39

80

87

235

(14)

Interest income

1

8

(1)

4

12

3

Interest expense

(74)

(75)

(78)

(79)

(306)

(77)

Noncontrolling interests

(10)

5

(47)

(9)

(61)

(22)

Corporate expense

(71)

(70)

(71)

(92)

(304)

(67)

Restructuring and other charges

(46)

(56)

(3)

(50)

(155)

(122)

Discontinued operations

(17)

(142)

4

(11)

(166)

(7)

Other

(166)

(31)

51

(26)

(172)

(201)

Consolidated net (loss) income attributable to

Alcoa

$ (497)

$ (454)

$ 77

$ (277)

$ (1,151)

$ (201)

|

Alcoa

Logo Reconciliation of Alcoa EBITDA

32

(in millions)

Quarter ended

March 31,

2010

Net loss attributable to Alcoa

$ (201)

Add:

Net income attributable to noncontrolling interests

22

Loss from discontinued operations

7

Provision for income taxes

84

Other expenses, net

21

Interest expense

118

Restructuring and other charges

187

Provision for depreciation, depletion, and

amortization

358

Earnings before interest, taxes, and depreciation

and amortization (EBITDA)

$ 596

Alcoa’s definition of EBITDA is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following items: Cost of goods

sold; Selling, general administrative, and other expenses; Research and development expenses;

and Provision for depreciation, depletion, and amortization. EBITDA is a non- GAAP

financial measure. Management believes that this measure is meaningful to investors because EBITDA provides

additional information with respect to Alcoa’s operating performance and the Company’s

ability to meet its financial obligations. The EBITDA presented may not be comparable to

similarly titled measures of other companies. |

Alcoa

Logo Reconciliation of Adjusted Income

33

(in millions)

Quarter ended

December 31,

2009

March 31,

2010

Net

loss attributable

to Alcoa

$ (277)

$ (201)

Loss

from

discontinued

operations

(11)

(7)

Loss

from continuing

operations

attributable to Alcoa

(266)

(194)

Restructuring and

other charges

49

119

Discrete tax items*

(82)

112

Special items**

308

64

Income

from

continuing

operations

attributable to Alcoa

–

as adjusted

$

9

$ 101

Income from continuing operations attributable to Alcoa – as adjusted is a non-GAAP

financial measure. Management believes that this measure is meaningful to investors because

management reviews the operating results of Alcoa excluding the impacts of restructuring and other

charges, discrete tax items, and special items. There can be no assurances that

additional restructuring and other charges, discrete tax items, and special items will not occur in

future periods. To compensate for this limitation, management believes that it is

appropriate to consider both Loss from continuing operations attributable to Alcoa determined under

GAAP as well as Income from continuing operations attributable to Alcoa – as

adjusted.

* Discrete tax items include the following: charges for a change in the tax treatment of federal

subsidies received related to prescription drug benefits provided under certain retiree health benefit plans ($79),

unbenefitted losses in Russia, China, and Italy ($22) (will be offset in future 2010 quarters),

interest due to the IRS related to a previously deferred gain associated with the 2007 formation of the former soft

alloy extrusions joint venture ($6), and a change in the anticipated sale structure of the

Transportation Products Europe business ($5) for the quarter ended March 31, 2010; and a benefit for the reorganization

of an equity investment in Canada (-$71), a charge for the write-off of deferred tax assets

related to operations in Italy ($41), a benefit for a tax rate change in Iceland (-$31), and a benefit for the reversal of a

valuation allowance on net operating losses in Norway (-$21) for the quarter ended December 31,

2009. ** Special items include the following: charges related to unfavorable mark-to-market changes

in derivative contracts ($31), power outages at the Rockdale, TX and São Luís, Brazil facilities ($17), an additional

environmental accrual for the Grasse River remediation in Massena, NY ($11), and the write off of

inventory related to the permanent closures of certain U.S. facilities ($5) for the quarter ended March 31, 2010;

and charges related to a recent European Commission’s ruling on electricity pricing for smelters

in Italy ($250), a tax settlement related to an equity investment in Brazil ($24), an estimated loss on excess

power at our Intalco smelter ($19), and an environmental accrual for smelters in Italy ($15) for the

quarter ended December 31, 2009. |

Alcoa

Logo Reconciliation of Alumina EBITDA

34

($ in millions)

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

1Q10

Alumina

After-tax operating

income (ATOI)

$ 585

$ 471

$ 315

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$

112

$ 72

Add:

Depreciation,

depletion, and

amortization

163

144

139

147

153

172

192

267

268

292

92

Equity (income)

loss

(3)

(1)

(1)

–

(1)

–

2

(1)

(7)

(8)

(2)

Income taxes

279

184

130

161

240

246

428

340

277

(22)

27

Other

(12)

(17)

(14)

(55)

(46)

(8)

(6)

2

(26)

(92)

1

Earnings

before

interest, taxes,

depreciation, and

amortization

(EBITDA)

$

1,012

$

781

$

569

$

668

$

978

$

1,092

$

1,666

$

1,564

$

1,239

$

282

$

190

Production

(thousand metric

tons) (kmt)

13,968

12,527

13,027

13,841

14,343

14,598

15,128

15,084

15,256

14,265

3,866

EBITDA/Production

($ per metric ton)

72

62

44

48

68

75

110

104

81

20

49

Alcoa’s definition of EBITDA is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following items: Cost of goods

sold; Selling, general administrative, and other expenses; Research and development expenses; and

Provision for depreciation, depletion, and amortization. The Other line in the table

above includes gains/losses on asset sales and other nonoperating items. EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to

investors because EBITDA provides additional information with respect to Alcoa’s operating

performance and the Company’s ability to meet its financial obligations. The EBITDA

presented may not be comparable to similarly titled measures of other companies.

|

Alcoa

Logo Reconciliation of Primary Metals EBITDA

35

($ in millions)

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

1Q10

Primary Metals

After-tax operating

income (ATOI)

$ 1,000

$ 905

$ 650

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 123

Add:

Depreciation,

depletion, and

amortization

311

327

300

310

326

368

395

410

503

560

147

Equity (income)

loss

(50)

(52)

(44)

(55)

(58)

12

(82)

(57)

(2)

26

–

Income taxes

505

434

266

256

314

307

726

542

172

(365)

18

Other

(41)

(8)

(47)

12

20

(96)

(13)

(27)

(32)

(176)

1

Earnings before

interest, taxes,

depreciation, and

amortization

(EBITDA)

$ 1,725

$

1,606

$

1,125

$

1,180

$

1,410

$

1,413

$ 2,786

$ 2,313

$

1,572

$ (567)

$

289

Production

(thousand metric

tons) (kmt)

3,539

3,488

3,500

3,508

3,376

3,554

3,552

3,693

4,007

3,564

889

EBITDA/Production

($ per metric ton)

487

460

321

336

418

398

784

626

392

(159)

325

Alcoa’s definition of EBITDA is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following items: Cost of goods

sold; Selling, general administrative, and other expenses; Research and development expenses; and

Provision for depreciation, depletion, and amortization. The Other line in the table

above includes gains/losses on asset sales and other nonoperating items. EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to

investors because EBITDA provides additional information with respect to Alcoa’s operating

performance and the Company’s ability to meet its financial obligations. The EBITDA

presented may not be comparable to similarly titled measures of other companies.

|

Alcoa

Logo Reconciliation of Flat-Rolled Products EBITDA

36

($ in millions)

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

1Q10

Flat-Rolled

Products

After-tax operating

income (ATOI)

$ 296

$ 253

$ 225

$ 222

$ 254

$ 278

$ 233

$ 178

$

(3)

$ (49)

$ 30

Add:

Depreciation,

depletion, and

amortization

153

167

184

190

200

220

223

227

216

227

59

Equity (income)

loss

(3)

2

4

1

1

–

2

–

–

–

–

Income taxes

126

124

90

71

75

121

58

92

35

48

18

Other

1

(5)

(8)

(5)

1

1

20

1

6

(2)

–

Earnings before

interest, taxes,

depreciation, and

amortization

(EBITDA)

$ 573

$

541

$

495

$

479

$

531

$

620

$ 536

$ 498

$

254

$ 224

$

107

Total sales

$ 5,167

$ 4,868

$ 4,571

$ 4,768

$ 6,042

$ 7,081

$ 8,610

$ 9,597

$ 9,184

$ 6,182

$ 1,481

EBITDA/Total

sales

11%

11%

11%

10%

9%

9%

6%

5%

3%

4%

7%

Alcoa’s definition of EBITDA is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold;

Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and

amortization. The Other line in the table above includes gains/losses on asset sales and other

nonoperating items. EBITDA is a non-GAAP financial measure. Management believes that this

measure is meaningful to investors because EBITDA provides additional information with respect to Alcoa’s operating performance

and the Company’s ability to meet its financial obligations. The EBITDA presented may not be

comparable to similarly titled measures of other companies. |

Alcoa

Logo Reconciliation of Engineered Products and Solutions EBITDA

37

($ in millions)

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

1Q10

Engineered

Products

and

Solutions

After-tax operating

income (ATOI)

$ 125

$ 189

$ 63

$ 124

$ 156

$ 271

$ 365

$ 435

$ 533

$ 315

$ 81

Add:

Depreciation,

depletion, and

amortization

165

186

150

166

168

160

152

163

165

177

41

Equity (income)

loss

(1)

–

–

–

–

–

6

–

–

(2)

(1)

Income taxes

79

61

39

55

65

116

155

192

222

139

31

Other

–

–

35

11

106

(11)

(2)

(7)

2

1

–

Earnings before

interest, taxes,

depreciation, and

amortization

(EBITDA)

$ 368

$

436

$

287

$

356

$

495

$

536

$ 676

$ 783

$

922

$ 630

$

152

Total sales

$ 3,386

$ 4,141

$ 3,492

$ 3,905

$ 4,283

$ 4,773

$ 5,428

$ 5,834

$ 6,199

$ 4,689

$ 1,074

EBITDA/Total

sales

11%

11%

8%

9%

12%

11%

12%

13%

15%

13%

14%

Alcoa’s definition of EBITDA is net margin plus an add-back for depreciation, depletion, and

amortization. Net margin is equivalent to Sales minus the following items: Cost of goods

sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The

Other line in the table above includes gains/losses on asset sales and other nonoperating items.

EBITDA is a non-GAAP financial measure. Management believes that this measure is

meaningful to investors because EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its

financial obligations. The EBITDA presented may not be comparable to

similarly titled measures of other companies. |