Attached files

| file | filename |

|---|---|

| EX-32.1 - China Industrial Waste Management Inc. | v180840_ex32-1.htm |

| EX-32.2 - China Industrial Waste Management Inc. | v180840_ex32-2.htm |

| EX-31.2 - China Industrial Waste Management Inc. | v180840_ex31-2.htm |

| EX-31.1 - China Industrial Waste Management Inc. | v180840_ex31-1.htm |

| EX-21.1 - China Industrial Waste Management Inc. | v180840_ex21-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

x ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

For

the Fiscal Year Ended December 31,

2009

|

or

|

¨ TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

For

the transition period from ________________ to

__________________

|

Commission

File Number 002-95836-NY

CHINA INDUSTRIAL WASTE

MANAGEMENT, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

13-3250816

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

||

|

Dalian

Dongtai Industrial Waste Treatment Co.

No.

1 Huaihe West Road, E-T-D-Zone, Dalian, China

|

116600

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code 011-86-411-85811229

Securities

registered pursuant to Section 12(b) of the Act:

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes ¨

No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨

No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes þ

No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files).

Yes ¨

No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

þ

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company:

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

(Do

not check if smaller reporting company)

|

¨

|

Smaller

reporting company

|

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes ¨

No þ

State the

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common equity was

sold, or the average bid and asked prices of such common equity, as of the last

business day of the registrant's most recently completed second fiscal quarter.

$8,125,546.8 as of June 30, 2009.

Indicate

the number of shares outstanding of each of the registrant's classes of common

stock, as of the latest practicable date: 15,336,535 shares of common stock are

issued and outstanding as of March 31, 2010.

DOCUMENTS

INCORPORATED BY REFERENCE

List

hereunder the following documents if incorporated by reference and the Part of

the Form 10-K (e.g., Part I, Part II, etc.) into which the document is

incorporated: (1) Any annual report to security holders; (2) Any proxy or

information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or

(c) under the Securities Act of 1933. The listed documents should be

clearly described for identification purposes (e.g., annual report to security

holders for fiscal year ended December 24, 1980).

None.

FORWARD-LOOKING

STATEMENTS AND ASSOCIATED RISK

This report includes

"forward-looking statements." You can identify these statements by the fact that

they do not relate strictly to historical or current facts. These statements

contain such words as "may," "project," "might," "expect," "believe,"

"anticipate," "intend," "could," "would," "estimate," "continue," or "pursue,"

or the negative or other variations thereof or comparable terminology. In

particular, they include statements relating to, among other things, future

actions, new projects, strategies, future performance, the outcomes of

contingencies and our future financial results. These forward-looking statements

are based on current expectations and projections about future

events.

Investors are cautioned that

forward-looking statements are not guarantees of future performance or results

and involve risks and uncertainties that cannot be predicted or quantified and,

consequently, our actual performance may differ materially from those expressed

or implied by such forward-looking statements. Such risks and uncertainties

include, but are not limited to, the following factors, as well as other factors

described from time to time in our reports filed with the Securities and

Exchange Commission (including the sections entitled "Risk Factors" and

"Management's Discussion and Analysis of Financial Condition and Results of

Operations" contained therein): the timing and magnitude of technological

advances; the prospects for future acquisitions; the effects of political,

economic and social uncertainties regarding the governmental, economic and

political circumstances in the People’s Republic of China, the possibility that

a current customer could be acquired or otherwise be affected by a future event

that would diminish their waste management requirements; the competition in the

waste management industry and the impact of such competition on pricing,

revenues and margins; uncertainties surrounding budget reductions or changes in

funding priorities of existing government programs and the cost of attracting

and retaining highly skilled personnel; our projected sales, profitability, and

cash flows; our growth strategies; anticipated trends in our industries; our

future financing plans; and our anticipated needs for working

capital.

Forward-looking

statements speak only as of the date on which they are made, and, except to the

extent required by federal securities laws, we undertake no obligation to update

any forward-looking statement to reflect events or circumstances after the date

on which the statement is made or to reflect the occurrence of unanticipated

events. The Private Securities Litigation Reform Act of 1995, which provides a

“safe harbor” for similar statements by certain existing public companies, does

not apply to us because our stock is a “penny stock,” as defined under federal

securities laws.

CONVENTIONS

AND GENERAL MATTERS

The

official currency of the People’s Republic of China is the Chinese “Yuan” or

“Renminbi” (“yuan,” “Renminbi” or “RMB”). For the convenience of the reader,

amounts expressed in this report as RMB have been translated into United States

dollars (“US$” or “$”) at the rate quoted by the Federal Reserve System. The

Renminbi is not freely convertible into foreign currencies and the quotation of

exchange rates does not imply convertibility of Renminbi into U.S. Dollars or

other currencies. All foreign exchange transactions take place either through

the Bank of China or other banks authorized to buy and sell foreign currencies

at the exchange rates quoted by the People's Bank of China. No representation is

made that the Renminbi or U.S. Dollar amounts referred to herein could have been

or could be converted into U.S. Dollars or Renminbi, as the case may be, at the

PBOC Rate or at all.

The

"Company," "we," "us," "our" and similar words refer to China Industrial Waste

Management, Inc, and its direct and indirect, wholly-owned and partially-owned

subsidiaries.

All share

and per share information contained herein has been adjusted to reflect a 1 for

100 reverse stock split which occurred on May 12, 2006.

|

Page

No.

|

||

|

Forward

Looking Statements and Associated Risk

|

||

|

Conventions

and General Matters

|

||

|

Part

I

|

||

|

Item

1.

|

Business.

|

1

|

|

Item

1A.

|

Risk

Factors.

|

13

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

20

|

|

Item

2.

|

Properties.

|

20

|

|

Item

3.

|

Legal

Proceedings.

|

21

|

|

Item

4.

|

Removed

and Reserved.

|

21

|

|

Part

II

|

||

|

Item

5.

|

Market

for Registrant's Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

|

22

|

|

Item

6.

|

Selected

Financial Information.

|

23

|

|

Item

7.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations.

|

23

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosure About Market Risk.

|

31

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

31

|

|

Item

9.

|

Changes

In and Disagreements With Accountants on Accounting and Financial

Disclosure.

|

31

|

|

Item

9A.(T)

|

Controls

and Procedures.

|

31

|

|

Item

9B.

|

Other

Information.

|

32

|

|

Part

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

32

|

|

Item

11.

|

Executive

Compensation.

|

36

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

38

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

39

|

|

Item

14.

|

Principal

Accountant Fees and Services.

|

40

|

|

Part

IV

|

||

|

Item

15.

|

Exhibits,

Financial Statement Schedules.

|

41

|

ITEM

1. BUSINESS.

Overview

China

Industrial Waste Management, Inc., through its 90%-owned subsidiary Dalian

Dongtai Industrial Waste Treatment Co., Ltd. (“Dalian Dongtai”) and other

indirect subsidiaries, is engaged in the collection, treatment, disposal and

recycling of industrial wastes, municipal sludge and sewage treatment, and

environmental protection engineer services principally in Dalian, China and

surrounding areas in Liaoning Province, China. The Company provides waste

disposal solutions to its more than 770 customers from facilities located in the

Economic and Technology Development Zone, Dalian, PRC. Dalian Dongtai treats,

disposes of and/or recycles many types of industrial wastes. Recycled waste

products are used by customers as raw materials to produce chemical and

metallurgy products. In addition, Dalian Dongtai and its subsidiaries treat or

dispose of industrial waste through incineration, landfill or water treatment;

as well as provide the following to its clients:

|

|

·

|

Environmental

protection services,

|

|

|

·

|

Technology

consultation,

|

|

|

·

|

Pollution

treatment services,

|

|

|

·

|

Waste

management design processing

services,

|

|

|

·

|

Waste

disposal solutions,

|

|

|

·

|

Waste

transportation services,

|

|

|

·

|

Onsite

waste management services, and

|

|

|

·

|

Environmental

pollution remediation services.

|

|

|

·

|

Municipal

sludge and seweage treatment

|

|

|

·

|

Sludge

treatment equipment design and manufacturing and technical

support

|

The

Company’s operations are conducted primarily in three areas as

follows:

|

|

·

|

Industrial

Solid Waste Treatment and Recycling: Dalian

Dongtai was the primary contributor to the Company’s revenue stream.

Dalian Zhuorui Resource Recycling Co., Ltd. (“Zhuorui”) intends to engage

in waste catalyst recycling to produce valuable metals and slag used for

cement. We expect Zhuorui to be operational in 2010. Hunan Hanyang

Environmental Protection Science & Technology Co., Ltd. (“Hunan

Hanyang”) was recently formed to own and operate a hazardous waste

treatment center in Hunan Province,

PRC.

|

|

|

·

|

Municipal

Sludge and Sewage: Dalian Dongtai Organic Waste Treatment Co., Ltd.

(“Dongtai Organic”) processes sludge by anaerobic fermentation to generate

biogas (methane). In 2010, Dongtai Organic received its initial revenues

from sludge treatment fees and sales of biogas (methane). In addition,

since June 2008, Dalian Dongtai Water Recycling Co. Ltd. (“Dongtai Water”)

has processed municipal sewage in the city of Dalian,

PRC.

|

|

|

·

|

Environmental

Protection and Equipment Engineering: Dalian Lipp Environmental

Energy Engineering & Technology Co., Ltd. (“Dalian Lipp”), a joint

venture with German Lipp, designs, manufactures, installs and provides

technical support for Lipp tanks, which are used for sludge treatment in

China.

|

1

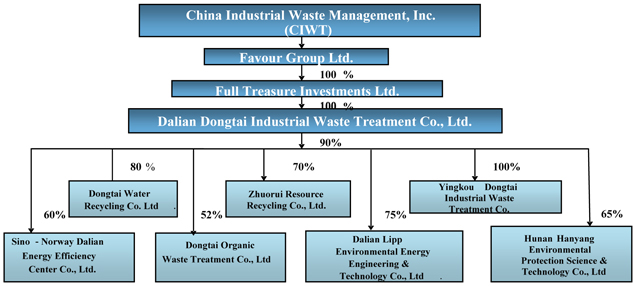

The

following diagram illustrates the Company’s current organizational

structure:

Industry Background and

Market Opportunities

Rapid

economic growth has resulted in China becoming the third largest economy in the

world. However, in the face of this economic surge, management believes

that economic losses attributable to environmental pollution are causing a 10%

offset to GDP growth in China.

In order

to address the PRC’s environmental issue, in early 2008 the State Environmental

Protection Administration (SEPA) was officially upgraded to become the Ministry

of Environmental Protection of China, reflecting the growing emphasis the PRC

Government places on environmental protection. In recent years a series of new

laws and regulations related to environmental protection have been implemented

in China. In addition, long-term plans for environmental protection have been

made by the government. During the Eleventh Five-year Plan (2006-2010), the PRC

government has established the following three primary environmental protection

goals:

|

|

·

|

Reduce

total pollutants by 10%;

|

|

|

·

|

Decrease

energy cost per unit of GDP by 20% (with a longer-term goal to decrease

carbon oxide cost per unit of GDP by 40-45% over 2005 levels by the end of

2020); and

|

|

|

·

|

Decrease

water cost per unit of industrial value by

30%.

|

Xie

Zhenhua, Vice-Chairman of National Development and Reform Commission stated that

the energy-saving and environmental protection industry has becoming a new

economic growth point of China and it is estimated that the GDP of the this

sector could reach RMB2800 billion (approximately $410 billion) in 2012.

Currently, there are approximately 30,000 companies engaged in the environmental

protection industry in China, employing a total of approximately 2 million

people. The number could reach RMB4,900 billion (approximately $717 billion) for

the Twelfeth Five-year Plan (2011-2015). During this period, environmental

protection investment and expenses on environmental pollution elimination

facility operation could rise to RMB 3,000 billion (approximately $439 billion)

and RMB 1,000 billion (approximately $146 billion),

respectively.

Management

believes that the environmental protection industry is taking shape in China,

and the industry has become a significant component of the overall economy.

Through the acquisition of operating subsidiaries, Dalian Dongtai has expanded

its operation into Municipal BOT (build-operate-transfer) projects such as

wastewater treatment, municipal sludge treatment, and environmental engineering.

At present, the environmental protection industry in China is rapidly growing,

and we expect that more centralized waste treatment and disposal facilities,

waste water treatment plants and municipal sludge treatment facilities will be

established throughout China. Therefore, management believes that the Company is

addressing a significant potential market and is well-positioned to perform a

pivotal role in the implementation of the PRC’s economic stimulus plan in 2009

and the Eleventh Five-year Plan in the long term.

2

Sources and Components of

Revenues

Our income is currently generated

from revenues from the following activities:

|

|

·

|

Industrial

Solid Waste Management. Revenue from industrial solid

waste management has two components, i.e., service fees from waste

treatment and disposal and revenues from sales of recycled commodities

such as cupric sulfate and organic solvent, and sales of valuable

materials.

|

|

|

·

|

Municipal

Sludge and Sewage Treatment. Revenue from municipal sewage treatment

is service fees for sewage

treatment, which

is paid by the local government based on

the amount of wastewater treated by the facility, contributed approximately

$1.02

million to revenues

in 2009.

|

We expect that sludge treatment

equipment design, manufacture and technical support will become a revenue

component in 2010.

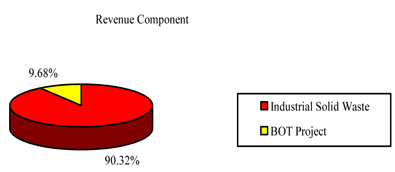

The following diagram illustrates the

relative contributions to

revenues of industrial solid waste management and municipal sewage

treatment:

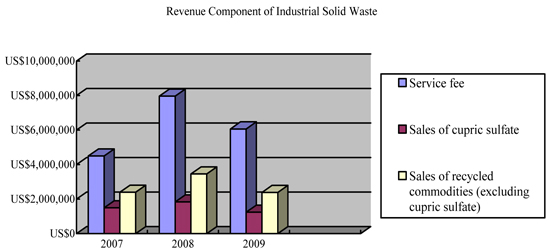

The

following diagram illustrates the relative contributions to revenues of the two

main streams of revenue from 2007 through 2009.

Notes:

(1) cupric sulfate is included in the sales of recycled commodities and it is

segmented because its sales account for more than 10% of total

revenue.

(2)

Represents revenues from sales of recycled commodities other than of cupric

sulfate.

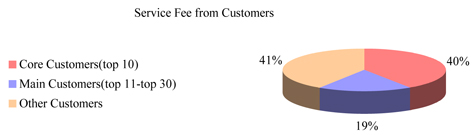

The

following chart illustrates the contributors to 2009 solid waste treatment

fees:

3

In fiscal

2009, we served approximately 777 customers. Our core customers (ten largest

customers) include Cannon Office Machine (Dalian), Toshiba (Dalian), STX

Shipbuilding (Dalian), Yisheng Dahua Petrochemicals Co., Ltd., PetroChina Fushun

Petrochemical, Dalian Pacific Electronic Co., Ltd., Dalian Pacific Multi-layer

PCB Co., Ltd and Bosch (Dalian). Core customers and main customers (the 20

largest customers after core customers) account for 4% of all customers and 59%

of total treatment fees, whereas 96% of all customers only contribute 41% to our

revenues generated from waste treatment fees.

The

current expansion project of Dalian Dongtai, which is one of fifty-five

hazardous waste treatment centers sponsored by the National Development and

Reform Commission, and one of two centers in Liaoning Province, commenced

construction at the end of July 2008. We have completed approximately 50% of

construction of the plant and on-site construction is expected to resume in

mid-April 2010 after the winter break. The Company expects the plant to be

operational in the fourth quarter of 2010. Management believes that with the

operation of the new centralized hazardous waste treatment center, coupled with

continued increase in international companies relocating to Dalian, Dalian

Dongtai is positioned to capitalize on this rapid environmental development in

Liaoning Province. We anticipate that revenues from our waste treatment, sales

of waste recovery and valuable material will experience a recovery from economic

downturn in 2010. We anticipate that revenue generated from waste water

treatment, which is based on waste water volume and paid by the local

government, will grow steadily as the amount of water which needs to be treated

increases in the future. Dongtai Organic is expected to contribute to the

Company’s revenue stream in 2010 through service fees for sludge processing and

sales of biogas (methane gas). Zhuorui, a catalyst recycling project, is

expected to be operational in late 2010 and contribute to revenues in future

periods.

Business

Activities

Industrial Solid Waste

Industrial

solid waste consists of (a) solid waste collection and treatment, (b) sales of

recycled commodities, (c) waste treatment and comprehensive reuse. A description

of each component is as follows:

Solid waste collection and

treatment: Dalian

Dongtai collects solid waste from customers, and charges processing fees based

upon the weight of the collected waste. Dalian Dongtai’s services include waste

collection and transportation, incineration, landfill, water treatment,

packaging, analysis, storage, labor, depreciation of facilities, maintenance,

chemicals, energy, management and taxes.

Sales of recycled commodities -cupric sulfate: Our subsidiary,

Dalian Dongtai, processes recovered products and converts them into cupric

sulfate in a form that is desirable for use by companies engaged in chemical

engineering, agriculture and mining. The sales price for cupric sulfate is

affected by the supply of raw materials, supplyer’s product life span, and

product structure and production status.

Sales of recycled commodities other

than of cupric

sulfate: General waste is

processed to produce valuable materials, which refers to material that can be

reused after sorting or treatment, such as waste metal and waste plastic. Dalian

Dongtai sorts and treats the valuable material contained in industrial waste,

and resells them based upon prevailing market prices. The following chart shows

the volume of valuable materials sold during fiscal year 2008 and

2009.

|

Category

|

Volume

|

||

|

2008

|

2009

|

||

|

1

|

Plastic

|

504

|

187

|

|

2

|

Waste

oil

|

2109

|

1367

|

|

3

|

Waste

iron

|

1297

|

1703

|

|

4

|

Waste

slag

|

1889

|

1146

|

|

5

|

Waste

circuit board

|

292

|

130

|

|

6

|

Valuable

Metals

|

417

|

425

|

|

7

|

Waste

paper

|

45

|

77

|

|

8

|

Other

|

568

|

379

|

|

9

|

Waste

Drum (big)

|

714

|

288

|

|

10

|

Waste

Drum(small)

|

473

|

327

|

|

Total

|

8308

|

6029

|

|

4

Waste catalyst treatment and

comprehensive reuse: Zhuorui was

incorporated in April 2006 and is engaged separation and purification of waste

catalysts treatment and comprehensive utilization of waste catalysts or similar

material.

In March

2009, Zhuorui commenced trial production of its waste catalyst processes. Due to

unfavorable market prices for Zhuorui’s final products, including chemical

compounds containing valuable metals, and imperfections detected during

trial production, the Company determined to suspend trial production in January

2010 in order to effect improvements to the technical flow prior to

market recovery. We expect that the improvement to the technical flow will also

enable Zhuorui to generate aluminum oxide as an additional by-product, and that

the addition of this byproduct will strengthen our revenues and profitability in

a manner that satisfies current emission standards established by

the government.

Dalian is

the national strategic oil storage and refining base. There are two large scale

oil refining companies in Dalian, i.e., West Pacific Petrochemical Company

(with a 10 million ton capacity) and Dalian Petrochemical Corporation (with a 20

million ton capacity). The total amount of waste catalyst produced by the two

companies is approximately 3,000 tons annually. Additionally, other refining

plants in northeast China are reconstructing their facilities to address

high-sulfur content oil. Upon completion of the reconstruction projects, the

annual generation volume of spent catalyst is expected to reach 8,000-10,000

tons.

Waste Treatment Systems: Dalian Dongtai operates

proprietary and non-proprietary systems for industrial solid waste treatment,

disposal and recycling, including:

|

|

·

|

Electric

Garbage Dismantling System

|

|

|

·

|

Organic

Solvent Distillation Recycling

System

|

|

|

·

|

Fluorescent

Tube Treatment System

|

|

|

·

|

Organic

Macromolecular Waste Destructive Distillation Cracking

System

|

|

|

·

|

Waste

Etchant Liquor Treatment System

|

|

|

·

|

Comprehensive

Treatment System for Industrial Waste

Water

|

|

|

·

|

Incineration

System for Solid Waste

|

|

|

·

|

Hazardous

Waste Landfill

|

|

|

·

|

Ordinary

Industrial Solid Waste Landfill

|

Electric Garbage

Dismantling System: Following classification and

dismantling of photocopier ink cartridges and electric components of certain

household appliances, the system can recover metal and plastics with high

efficiency and limit the amount of unrecyclable residual waste. The system also

includes recycling metals from household electric appliances such as TV picture

tubes, and treating the hazardous residual components such as phosphor and Freon

so that such residual waste is rendered innocuous. The system was built in 1997

and includes a large disintegrator, electronic scale, oven, vacuum cleaner,

decorticator and large goods elevator.

Organic Solvent

Distillation Recycling System:

Dalian Dongtai established the organic solvent distillation

recycling system in 1992. This system includes a raw material storage tank, a

rectifying tower, and a flashing tower. The system is capable of treating

organic solvents including triclene, acetone, ethyl acetate, isopropyl alcohol,

propylene glycol monomethyl ether methyl alcohol, methylbenzene, and

cyclohexanone.

Since

2003 this system has been listed and promoted as a "national key environmental

project" by the State Environmental Protection Administration for three

consecutive years. As a result of employing this system Dalian Dongtai is also

listed as the technology-supporting unit of the "National Technology Achievement

Promotion Project". This system won the second prize for Dalian Technology

Innovations in December 2000. Dalian Dongtai has established strict procedures

for the disposal or treatment of toxic and hazardous chemical waste. No

environmental pollution accident has occurred since the establishment of Dalian

Dongtai. Dalian Dongtai has established relationships with over 40 enterprises

in dealing with their toxic chemical waste.

Fluorescent Tube

Treatment System: Dalian Dongtai has developed a

waste fluorescent tube treatment system. The system is able to safely dispose of

fluorescent lighting tubes which contain harmful substances such as mercury. The

system breaks the tubes under negative pressure, and absorbs and washes the

harmful components such as mercury. The glass fragments and metal residue

resulting from the treatment can then be recycled.

Organic

Macromolecular Waste Destructive Distillation Cracking

System: Canon Dalian Business Machines Co., Ltd.

is an enterprise established in Dalian by Canon (China) Co. Ltd. primarily to

produce laser printer ink cartridges. Treatment of the residual powdered ink in

used cartridges was problematic, so Dalian Dongtai developed a unique waste

powdered ink destructive distillation pyrolysis treatment technique for Canon.

This system can transform the waste powdered ink into fuel with a high calorific

value. The residue can also be used to produce cement. The system was built in

1995 and is composed of destructive distillation cracking oven, heat exchange

device and air storage tank. The system is able to treat powdered ink from

photocopiers and printers, and organic macromolecular materials such as

polystyrene, polypropylene resin, polycarbonate, rubber materials, and oil

sludge.

5

Waste Etchant

Liquor Treatment System: This system includes a

material delivery device, reaction vessels, and press filters. The system can

process etchant containing waste copper element and generate cupric sulfate

through neutralization, acidification, and metathesis.

Industrial Waste

Comprehensive Treatment System: The system

includes a treatment tank, an oil removal tank, a reaction tank, a precipitation

tank, a neutralization tank, an absorption tank, filtering device. It is able to

treat the ablution resulting from removing oil from the surface of metal, and

grinding and cutting fluids resulting from machining.

Solid Waste

Incineration System: The inappropriate handling

of hazardous chemicals can trigger serious environment pollution. Dalian Dongtai

has built an incineration system which includes a two-stage incineration stove,

a residual heat recovery system and a residual gas discharge system which

renders the gas innocuous. The major wastes that can be processed through the

system include: waste organic solvents, waste oil, waste glue liquor, and

combustible solid industrial garbage. The automatic operating system meets PRC

national standards.

Hazardous Waste

Landfill: The landfill has been built in

accordance with PRC national construction standards. It has a double HDPE

impermeable layer lining and percolating water collection system. After

stabilization and solidification, the toxic and hazardous waste to be deposited

in the landfill receives treatment rendering it innocuous. The system is able to

handle a wide variety of waste residue containing heavy metal and incinerate

residues. The project covers an area of 112,350 square feet.

Landfill for

Ordinary Industrial Solid Waste:

The landfill for ordinary industrial solid waste has been built according

to PRC national standards. It is equipped with a single layer anti-seepage

pretreatment system and a collection system of percolating water. The landfill

can process ordinary industrial Class 1 and Class 2 wastes.

Municipal

Sludge and

Municipal Sewage

Treatment:

We

conduct our municipal sludge and municipal sewage treatment operations as BOT

(build operate transfer) projects. In a typical BOT project, the municipal

government will invite candidates to bid on the project. The winner of the bid

is generally the bidder which offers the best combination of price and

construction and operating model for the project. The winning bidder must assume

the responsibility for financing the construction of the BOT project and, in

return, is granted the right to operate the facility for 20-25 years following

completion of construction. In connection with the project, the municipal

government becomes responsible for the payment of service fee to the operator of

the facility.

Dongtai

Organic was incorporated in March 2007 to operate a BOT municipal sludge

treatment and disposal facility in Dalian, PRC for a period of 20 years. In

addition to sludge treatment fees, Dongtai Organic expects to generate revenues

from sales of biogas, a byproduct of the sludge treatment process. At the time

of incorporation, we acquired a 49% interest in Dongtai Organic, and on December

16, 2009, Dalian Dongtai acquired an additional 3% equity interest, thereby

increasing its ownership of Dongtai Organic to 52%. Designed capacity of this

sludge treatment plant is 600 tons/day and it is anticipated to reach its full

capacity within one or two years. In January 2010 Dongtai Organic received its

initial sludge processing fee and made its first sales of biogas (methane

gas).The Company intends to continue to seek acquisition candidates in the

sludge treatment business in other cities of China.

Dongtai

Water was incorporated in July 2006, at which time Dalian Dongtai acquired an

18% equity interest in Dongtai Water. On July 16, 2007 Dalian

Dongtai purchased an additional 62% of the equity of Dongtai

Water. Dongtai Water is a BOT project, designed to process municipal waste

water generated from a portion of Dalian city. The first stage of construction

of the plant has been completed and is operating to specification and design

parameters, with Class A discharging water and a capacity of approximately

30,000 tons/day. This plant has been operating since June 2008.Completion of

construction of the Xiajiahe plant is planned to be executed in three stages.

Phase Two is expected to be completed in 2-3 years and will increase treatment

capacity to 60,000 tons/day. Dongtai Water continues to evaluate necessary

expansion capacity for Phase Three. Dongtai Water also intends to continue its

research and development focused on the reuse of reclaimed water.

Design and Installation of

Environmental Protection Equipment and Renewable Energy

Equipment:

On

October 18, 2007, Dongtai entered into a Contract for Joint Venture Using

Foreign Investment with Roland Lipp, Karin Lipp-Mayer and Minghuan Shan to

establish a joint venture limited liability company in the People’s Republic of

China. The joint venture entity, known as Dalian Lipp Environmental Energy

Engineering & Technology Co., Ltd. (“Dalian Lipp”), intends to target

organic waste treatment and waste water treatment market, and engage in sales of

its proprietary fermentation reactor, sewage tank and post-sale technical

service. The Company plans to pursue localization of equipment design and

manufacturing during 2010. We do not anticipate that Dalian Lipp will generate

revenues from operations until September 2010. Dalian Dongtai owns a 75%

interest in Dalian Lipp.

6

Facilities of Dalian Dongtai and its subsidiaries

:

The

following table describes the capacity of the various facilities used by the

Company, both currently and following the completion of planned

expansion:

To

satisfy a surging demand for industrial solid waste disposal and treatment, in

July 2008 Dalian Dongtai commenced construction of an expansion project

designed to increase capacity of its treatment facility to 114,000 tons annually

– twice that of existing capacity. The total investment for the

expansion project is estimated at about $16 million, 30% of which

(approximately $4,831,625) will be subsidized by the central government. Of this

amount, $1.46 million has been released to the Company and the balance will

be disbursed in accordance with construction progress.

|

|

|

|

Capacity*

|

|||||

|

Nature of Service

|

Type of Facility

|

Description

|

Existing

|

Post-

Expansion

|

||||

|

Incinerator

|

Incineration

Treatment

|

3,300

t/a

|

9,000

t/a

|

|||||

|

Solid

Waste Treatment

|

Landfill

|

Disposal

of Waste by Landfill

|

13,000

t

|

40,000

t

|

||||

|

and

Disposal

|

Effulent

Treatment System

|

Handling

of Various Industrial Effluent

|

18,000

t/a

|

25,000

t/a

|

||||

|

Etchant

Utilization System

|

Generation

of Cupric sulfate from Etchant

|

2,000

t/a

|

—

|

|||||

|

Resource

Recovery

|

Waste

Solvent Recovery System

|

Production

of Industrial-Class Organic Solvent Products with Waste

Solvent

|

1,000

t/a

|

3,000

t/a

|

||||

|

Valuable

Metal Recovery System

|

Yielding

of Valuable Alloy or Metal Oxide Products

|

5,000

t/a

|

10,000t/a

|

|||||

|

Collection

and Sales of

Valuable

Material

|

Waste

Sorting and Filtrating System

|

—

|

10,000

t/a

|

—

|

||||

|

Municipal

Sewage,

Municipal

|

Sewage

Treatment Plant Operation (BOT)

|

Municipal

Sewage Treatment Plant Operation and Management

|

30,000

t/d

|

100,000

t/d

|

||||

|

Sludge

Treatment

|

Municipal

Sludge Treatment Plant Operation (BOT Project)

|

Municipal

Sludge Plant Operation and Management

|

400

t/d

|

600

t/d

|

||||

|

Environmental

Protection

Equipment

Manufacturing

|

|

Manufacturing

and Sales of Lipp Tank

|

|

Sludge

Fermentation-Tank and Auxiliary

Equipment Manufacturing

|

|

—

|

|

—

|

|

*

|

Key:

t = tons; t/d = tons per day; t/a = tons

annually.

|

|

a)

|

Dalian Dongtai Industrial Waste Treatment, Co., Ltd. commenced the construction of its expansion project in July 2008. The total investment for the project was estimated to be US$16 million, 30 percent of which (approximately $4,831,625) is expected to be subsidized by the central government. To date, US$1.46 million has been released to the Company and the balance is expected to be disbursed consistent with construction progress. Upon completion of the project, Dalian Dongtai’s industrial solid waste treatment capacity is anticipated to increase to 114,000 tons per annum, or twice its existing capacity. |

|

b)

|

Dalian Dongtai acquired a 65% interest in Hunan Hanyang on September 18, 2009. Hunan Hanyang has entered into a BOT Agreement with the Bureau of Environmental Protection of Hunan Province, pursuant to which Hunan Hanyang has the right to construct and operate the Hazardous Waste Treatment Center of Changsha City, Hunan Province (the "Center") for 25 years upon completion of construction. The Center is included in the Chinese government's National Construction Planning of Hazardous Waste and Medical Waste Disposal Facilities. The total investment in this project is expected to reach approximately $27 million, $3.1 million of which has been received in the form of a government subsidy, representing the first installment of a total expected government subsidy of $16.1 million. |

|

c)

|

In

accordance with Dongtai Organic's franchise agreement with the local

government, Dongtai

Organic is entitled to process all of the sludge generated from sewage

treatment plants in the urban area of Dalian City. The project generates

revenues from two sources: (i) fees which are based on the volume of

sludge processed and (ii) fees from the sale of biogas (natural gas) to

the Dalian Gas Company. In the first quarter of 2010, Dongtai Organic

received its first payment of $120,000 from the sale of biogas (natural

gas) and its first payment of $185,000 for processing municipal sludge in

Dalian City.

|

|

d)

|

In order to strengthen its influence in the sludge treatment field, on August 31, 2009 and September 1, 2009, Dalian Dongtai acted as a co-organizer of the "Sino-German Workshop in Response to Climate Change Application of Sludge Treatment Technologies and Potential CDM Projects" in Dalian, China. The Workshop was organized by the Ministry of Housing and Urban-Rural Development of the Peoples' Republic of China and the German Federal Environmental Department of Nature Conservation and Nuclear Safety. At the workshop, experts from China and Germany introduced current practices for sludge treatment in both countries as well as further developments in the context of Clean Development Mechanisms. |

7

|

e)

|

Dongtai Organic’s sludge-energy approach was broadcasted during the recent United Nations Climate Change Conference in Copenhagen, Denmark. The Company’s Dalian Sludge Treatment Facility was featured on the China Central Television (CCTV) English Channel on December 20, 2009 as an example of how the clean coastal city of Dalian is helping fulfill the PRC government's pledge to reduce greenhouse gas emissions by treating sludge at our local Dalian Sludge Treatment Facility. |

|

f)

|

In

recognition of his contributions to the economy of Dalian City, a major

seaport and industrial center in Northeast China, the prestigious "Top Ten

People in Dalian's Economy" award was bestowed on Mr. Jinqing Dong, the

Company's founder and Chief Executive Officer, in January 2010. This award

has historically been bestowed on leaders in industry, academia and

politics, and include those who play a key role in Dalian's success as a

city that has grown into an important industrial center. The award was

presented by the city's senior officers in Dalian's Radio and TV

Broadcasting Hall.

|

Market

Industrial solid

waste

Major

sources of industrial waste in the Dalian area include industrial enterprises,

scientific research institutions and university laboratories. Dalian Dongtai

believes that the total amount of waste generated and collected in the greater

Dalian area has grown significantly in recent years - from approximately 11,000

tons in 2001, to approximately 53,980 tons in 2009. Approximately 60% of Dalian

Dongtai’s revenue for the year ended December 31, 2009 were from waste

collection, treatment and disposal services, and the balance of Dalian Dongtai’s

revenue are related to recycling operations.

Dalian

Dongtai acquired a 65% interest in Hunan Hanyang on September 18, 2009.

Hunan Hanyang has entered into a BOT Agreement with the Bureau of Environmental

Protection of Hunan Province, pursuant to which Hunan Hanyang has the right to

construct and operate the Hazardous Waste Treatment Center of Changsha City,

Hunan Province (the "Center") for 25 years upon completion of construction. The

Center is one of fifty-five hazardous waste treatment centers included in the

Chinese government's National Construction Planning of Hazardous Waste and

Medical Waste Disposal Facilities. Hunan Hanyang is also authorized to perform

collection, disposal and treatment of hazardous waste generated from 10 cities

including Changsha, Zhuzhou, Changde, Yiyang, Xiangtan, Yueyang, Zhangjiakou,

Huaihua, Loudi and Xiangxi in northern Hunan Province during the franchising

period. For example, due to the increasing labor cost in coastal cities, more

and more manufacturing companies such as circuit board manufacturers,

automobile-related industries, are moving to inland provinces including Hunan

Province.. There are no existing hazardous waste disposal and treatment

facilities in Hunan Province.

Municipal sludge and sewage

treatment

The

central government has determined to increase the urban sewage treatment rate to

60% by 2010.By that time, sludge generated from sewage treatment plants over the

county is expected to reach 30 million tons per year. Only a few metropolitan

cities such as Beijing, Shanghai and Guangzhou have sludge treatment facilities.

It is anticipated that there will be a surge in treatment demand for sludge and

other degradable wastes in next 10 years. For example, in Liaoning Province

there are currently 42 sewage treatment plants processing 4 million tons of

waste water every day. All sewage treatment plants in Liaoning Province are

expected to generate, in the aggregate, 1 million tons of sludge per year

(approximately 2,800 tons/day). Our treatment plant in Dalian that is operated

by Dongtai Organic is the only sludge treatment plant in Liaoning Province. We

believe that the shortage of sludge treatment facilities in Liaoning Province is

a microcosm of the problem that exists throughout China.

Engineering

Sewage

sludge is an end product of the waste water treatment process. In the face of a

new surge of waste water treatment plant construction triggered by the economic

stimulus plan in 2009, the increasing amount of sewage sludge will pose an

increasing threat to environmental conservation in China. In order to cope with

the issue, the Ministry of Environmental Protection is placing controls on

sludge treatment. The central government has determined to increase the urban

sewage treatment rate to 60% by 2010, when it is expected that all of these

sewage treatment plants will generate approximately 30 million tons of sludge

every year, as a result of which it appears that a significant market for sewage

sludge treatment is taking shape in China. Dalian Lipp, targeting degradable

organic waste treatment market, is positioned to seize opportunities in the

field of sewage sludge treatment, and treatment of organic waste such as kitchen

waste and animal ejection.

8

China has recovered from the global economic downturn and it is generally believed it will maintain the growth rate that was seen prior to 2009. Management is confident that the Company will benefit from the opportunities which are emerging from the construction of infrastructure for environmental pollution control, and will gain further growth based on the balanced business structure.

Customers

Dalian

Dongtai performs solid waste disposal services for more than 770 companies,

including multinational companies (or their PRC affiliates) such as Canon,

Pfizer, Toshiba, Toto, Posco-CFM Coated Steel, Fuji, Wepec, Ryobi, TDK, YKK, and

Panasonic. For the year ended December 31, 2009, Dalian Dongtai’s 10 largest

waste disposal customers accounted for approximately 40% of Dalian Dongtai’s

waste processing revenues. The three largest waste treatment customers during

2009 were Dalian Pacific Multi-layer PCB Co., Ltd., Dalian Pacific Electronics

Co., Ltd. and Yisheng Dahua Petrochemicals Co., Ltd. No customer accounted for

10% or more of Dalian Dongtai’s 2009 revenues for waste treatment.

Dalian

Dongtai’s ten largest customers of recycled commodities (excluding curpric

sulfate) accounted for approximately 66% of Dalian Dongtai’s sales of recycled

commodities in 2009. Dalian Dongtai’s ten largest customers for cupric sulfate

accounted for approximately 95% of Dalian Dongtai’s sales of cupric sulfate in

2008.

The local

PRC government is the sole customer of Dongtai Water and Dongtai Organic.

Dongtai Water became operational in June 2008. Dongtai Organic is expected to

contribute to revenues in 2010.

Technology and Intellectual

Property

Dalian

Dongtai has established the Dongtai Industrial Waste Disposal Technology Center

in conjunction with the Dalian University Institute for Ecoplanning and

Development. The center currently has 22 professional engineers and 9 analysts.

In collaboration with experts from Canada and U.S. - based RPP International

Consulting Company, the Center is focused on research related to eco-planning

theory and policy, professional training, ecological efficiency evaluation and

simulation analysis.

Since its

establishment, Dalian Dongtai has closely cooperated with scientific research

communities and universities, such as Dalian Institute of Chemical

Physics, the Chinese Academy of Sciences (Beijing) Mechanics Institute,

Tsinghua University and Dalian University of Technology. Dongtai also

participated in compiling the National Waste Disposal Criteria along with over

50 international enterprises such as China Electronics Engineering Design

Institute, Intel (China) Co., Ltd., Motorola (China) Co., Ltd, and Dell (China)

Co., Ltd.

In

addition, Dalian Dongtai's research and development team specializes in

environmental engineering, chemical engineering, water supply and drainage

systems, surface treatment, biological engineering, metallurgy, machinery,

electronics, and computer science. The Company provides significant input into

the research of methods of industrial solid waste treatment and comprehensive

waste utilization. Dalian Dongtai’s recognition for its scientific achievements

in business operations includes the following:

|

|

·

|

Dalian

Dongtai was awarded second prize of Dalian Technology Innovation for its

Comprehensive Utilization and Disposal of Waste Organic Solvents system.

The system has been listed as the "National Key Practical Technology

for Environmental Protection" by the Ministry of Science and Technology

and the State Administration of Environmental Protection of the

PRC;

|

|

|

·

|

The

Destructive Distillation Thermal Cracking of Powdered

Ink;

|

|

|

·

|

The

Safety Landfill of Hazardous Waste;

|

|

|

·

|

Pyrolysis

Incineration Stove;

|

|

|

·

|

The

Innocuous Treatment of Cyanide;

|

|

|

·

|

The

Comprehensive Utilization of the Waste Etchant Liquor from PCB

industry;

|

|

|

·

|

The

Comprehensive Utilization and Disposal of Waste Catalyst. This system won

the third prize of Dalian Technology Innovation and has been listed as the

"National Key Practical Technology for Environmental Protection" by the

State Administration of Environmental Protection of the PRC. It was

supported by the Innovation Funds for Small-and-Medium Sized Scientific

and Technological Enterprises of the Ministry of Science and

Technology;

|

|

|

·

|

The

Treatment of PCB Industry's Waste Liquid containing heavy

metal;

|

|

|

·

|

The

Disposal of Medical Refuse;

|

|

|

·

|

The

Disposal of Waste Batteries;

|

9

|

|

·

|

The

Innocuous Treatment of Arsenic

Compound;

|

|

|

·

|

The

Wet Oxidation of High Concentration Organic

Waste;

|

|

|

·

|

The

Disposal of Ordinary Industrial Waste;

and

|

|

|

·

|

The

Comprehensive Utilization and Innocuous Treatment of Electronic

Waste.

|

Dalian

Dongtai has been granted five patents covering waste disposal systems and

techniques by the PRC Patent Office. The following table identifies and

describes those patents:

|

Status

|

Description

|

Patent Number

|

Grant Date

|

Expiry Date

|

||||

|

Granted

|

The

Disposal of Powdered Ink Waste from Copy Machines

|

ZL

01 1 27963.X

|

7/7/04

|

7/20/21

|

||||

|

Granted

|

Consecutive

Destructive Distillation Stove

|

ZL

200420069745.5

|

7/13/05

|

7/9/14

|

||||

|

Granted

|

Plasma

Fusion Pyrolysis Device

|

ZL

200420069742.1

|

7/20/05

|

7/9/14

|

||||

|

Granted

|

The

Disposal of Waste Catalyst

|

ZL

200410021093.2

|

1/17/07

|

1/20/24

|

||||

|

Granted

|

|

Method

and Equipment For High-Efficiency Solid-Liquid Separation Under High

Pressure

|

|

ZL

200610046723.0

|

|

11/12/08

|

|

5/26/26

|

Research and

Development

The

Company considers research and development a key contributing factor to

maintaining competitive edge over its peers. Dalian Dongtai typically spends 5%

of its revenues on research and development activities. Projects which are the

subject of research and development include:

|

|

·

|

Dalian

Dongtai is conducting a joint research with Dalian-Onoda Cement Company

Ltd., a Japan company, on waste processing technology with cement kiln

with the objective of reducing the amount of waste going into land fills

and incinerators by utilizing waste as the raw material for cement

production.

|

|

|

·

|

We

are developing a technology to utilize salt contained in the waste water

through the evaporation and condensation

process.

|

|

|

·

|

We

are developing a process to combine combustible liquid and solid waste to

produce a renewable fuel.

|

|

|

·

|

We

are developing a process to utilize oily sludge generated from refineries

through anhydration.

|

|

|

·

|

Dongtai

Organic is actively seeking opportunities to process other degradable

wastes, such as kitchen waste. A combination of sludge and kitchen waste

can increase the volume of biogas and hence increase Dongtai Organic’s

profitability.

|

For each

of the two years ended December 31, 2009 and 2008 we expended $ 513,631 and

$561,885, respectively, on research and development activities.

Operating

Strategy

Our

business strategy is designed to increase revenues and earnings through

profitable growth and improving returns on invested capital. The components of

our strategy include:

|

|

·

|

Maintaining

commercialization of industrial solid waste treatment as our core business

and maintaining a balanced business structure of the three business lines;

;

|

|

|

·

|

Expansion

into municipal sludge treatment BOT projects with the goal of 30-40% of

our revenues being provided by sludge

treatment;

|

|

|

·

|

Promoting

the installation of sludge treatment tanks in other cities to seize the

market opportunity in the surge of sludge

treatment;

|

|

|

·

|

Managing

our businesses locally with a strong operating focus and emphasis on

customer service;

|

|

|

·

|

Entering

into new geographic markets in China;

and

|

|

|

·

|

Maintaining

our financial capacity and effective administrative systems and controls

to support on-going operations and future growth. We are evaluating growth

in our solid waste treatment operations through opportunities to cooperate

with prominent domestic or overseas partners and attempts to integrate

customer groups (for example, the refinery industry), to realize resource

optimization.

|

|

|

·

|

We

also plan to seek new BOT projects and acquire interests in existing

projects.

|

10

Government

Regulation

The

industrial waste treatment business is still in its nascent stages in China.

There are only a few coastal cities and several major cities in industrialized

regions that have built or even plan to build industrial waste treatment

facilities.

The

industry has high barriers to entry due to the central government's strict

licensing requirements. Both the Ministry of Environment Protection and local

bureaus of environmental protection license and regulate companies engaged in

waste disposal and treatment. The requirements for licensing have become more

stringent and applicants must demonstrate, among other things, that they have a

sufficient operating history and a sufficient number of professional

technicians, as well as compliance with national and local environmental

standards.

The State

has also adopted Measures for the Administration of Permit for Operation of

Dangerous Wastes (“Measures”). The Measures are intended to strengthen

supervision and administration of activities relating to the collection, storage

and disposal of dangerous wastes, and preventing dangerous wastes from polluting

the environment.

Dalian

Dongtai has been awarded an Environmental Protection Facility Operation License

by the Ministry of Environment Protection. In addition, pursuant to the

Measures, Dalian Dongtai has received a Permit for the Operation of Dangerous

Wastes by the provincial Bureau of Environmental Protection. In addition, Dalian

Dongtai’s license provides that it is exclusively responsible for the collection

and processing of industrial waste in Dalian and the surrounding areas of

Liaoning Province.

The

Company believes that it currently complies with all licensing requirements

relating to its business operations. However, there is no assurance that the

central or provincial governments will not adopt new regulations or licensing

requirements that will make it more difficult for Dalian Dongtai to operate in

the environmental protection industry.

Competition

There are

several large companies in China that engage in providing solid waste recycling

services, the recovery and treatment of waste materials, the production and sale

of recycled products, the operation of environmental protection facilities (BOT)

and/or the manufacture of environmental protection equipment. In addition to

Dalian Dongtai, these companies include Shenzhen Dongjiang Environmental Co.,

Ltd., Tianjin Hejia Veolia Environmental Service Co., Ltd., Hangzhou Dadi

Environmental Protection Co., Ltd., and Shanghai Solid Waste Disposal Center.

Dalian Dongtai and Shenzen Dongjiang provide the most extensive array of these

services. Dalian Dongtai believes it is the only company offering a full range

of services in Dalian and Liaoning Province.

Within

Liaoning Province, our principal competitors are Liaoning Zhen Xing, a

state-owned environmental concern, primarily serving Shenyang and the

surrounding area, and Liaoning Muchang Solid Waste Disposal Co., Ltd., a private

solid waste disposal company also serving Shenyang and the surrounding area.

Within Dalian, our principal competitor is Dalian Pingan Environmental

Protection, a smaller-capacity, private enterprise, primarily dealing with

limited categories of hazardous waste.

We

believe that we enjoy a competitive advantage over other companies engaged in

the environmental protection industry, for reasons including:

|

|

·

|

Reputation – Dalian Dongtai has

established itself as the leading environmental protection company in

Liaoning Province, and an industry leader in all of China. Government

officials consult Dalian Dongtai when drafting environmental protection

legislation. Dalian Dongtai’s expanded facility has been included in the

current national centralized hazardous waste disposal facility plan

established by the National Development and Reform

Commission.

|

|

|

·

|

Broad and

Diversified Customer Base – Dalian Dongtai has a

diverse customer base including some 650 companies engaged in private

enterprises, municipal institutions and universities, including Canon,

Pfizer, Toshiba and Panasonic (or their respective PRC affiliates).

Management anticipates that as additional large multinational companies

locate in Liaoning Province, Dalian Dongtai will be their first choice to

provide environmental services. Dalian Dongtai holds both national and

provincial operating permits.

|

|

|

·

|

Long-term

Stable Relationships

– Dalian Dongtai has an 19-year operating history and is committed

to maintaining its customers by providing high quality products and

services. Some of Dalian Dongtai’s customers, including Canon, Goodyear

and Pfizer, or their PRC affiliates, have established strategic

partnership with Dalian Dongtai since it commenced operations in

1991.

|

11

|

|

·

|

Comprehensive

Services –

Dalian Dongtai provides a comprehensive array of services including solid

waste treatment, waste collection and transportation, environmental

protection services, storage to landfill and on-site management. The broad

range of services we offer allows us to customize a package of services to

meet the needs of the large clients that we

service.

|

|

|

·

|

Advanced

Technologies –

Dalian Dongtai designs and develops proprietary processes and

technologies for use in providing its services. It has been awarded four

patents in the PRC covering solid waste disposal and treatment processes,

and two additional patent applications are pending. Dalian Dongtai, in

conjunction with the Dalian University Institute for Eco-planning and

Development, has established and operates the Dongtai Industrial Waste

Disposal Technology Center. Dalian Dongtai also cooperates with experts in

Canada and the United States to conduct research concerning eco-planning

theory and policy, ecological efficiency evaluation and related

activities, with the support of the Dalian University of

Technology.

|

|

|

·

|

Experienced

Management –

Dalian Dongtai’s senior management has extensive experience in

environmental protection. Mr. Dong Jinqing, our Chief Executive Officer,

founded Dalian Dongtai in 1991, and has over 19 years experience in the

field of environmental protection. Dalian Dongtai was one of the first

companies to be granted a permit for the operation of environmental

protection equipment by the State Environmental Protection Administration,

and license to operate hazardous waste treatment and disposal facilities

by the Liaoning Environmental Protection

Bureau.

|

In

addition to the competitive advantages we believe we enjoy, there are barriers

to entering the solid waste and environmental services market,

including:

|

|

·

|

Substantial

capital investment required;

|

|

|

·

|

Retaining

qualified management is difficult;

|

|

|

·

|

Difficulties

in developing a customer base;

|

|

|

·

|

Government

licenses and permits; and

|

|

|

·

|

Advanced

technologies are difficult to

develop.

|

.

Notwithstanding

our competitive advantages and the barriers to entering the marketplace, there

is no assurance that we will remain a competitive force in our industry, or that

we will operate on a profitable basis.

Employees

As of

December 31, 2009 Dalian Dongtai and its subsidiaries employs 446 registered

full-time employees. The following table depicts the allocation of these

employees.

|

Company

|

Senior Management

|

Technicians and

Engineers

|

No. of Employees

|

|||

|

Dalian

Dongtai

|

10

|

24

|

256

|

|||

|

Dongtai

Water

|

2

|

2

|

19

|

|||

|

Dongtai

Organic

|

3

|

4

|

48

|

|||

|

Zhuorui

|

5

|

11

|

95

|

|||

|

Dalian

Lipp

|

1

|

None

|

7

|

|||

|

Yingkou

|

1

|

None

|

2

|

|||

|

Sino-Norway

EEC

|

1

|

None

|

5

|

|||

|

Hunan

Hanyang

|

3

|

None

|

12

|

|||

|

Total

|

|

24

|

|

41

|

|

446

|

The

Company has not experienced any work stoppages and it considers relations with

its employees to be good. The Company anticipates hiring additional employees as

it expands industrial waste treatment and disposal, and initiates new

project.

Company

History

The

Company was originally incorporated as a Delaware corporation in 1987 under the

name of Egan Systems, Inc. In late 1987, the Company acquired ENVYR Corporation

as a wholly owned subsidiary and established its headquarters in Raleigh, North

Carolina. From 1987 to 2003, the Company was primarily engaged in the business

of developing, selling and supporting computer software products, particularly

products related to the COBOL computer language.

12

In

October 2003, the Company acquired a group of 35 mining claims from Goldtech

Mining Corporation, a Washington Corporation. In November, 2003, the Company

acquired the remaining mining claims of Goldtech Mining Corporation. In

connection with the acquisitions, the Company changed its name to Goldtech

Mining Corporation and re-domiciled to the State of Nevada.

Following

these acquisitions, the Company operated in two lines of business: (a) the

exploration and development of potential mining properties, and (b) the

development, marketing and support of computer software products and services.

In September 2004, the Company sold its computer business and adopted a business

plan to focus exclusively on its mining exploration business. By September 2005,

the Company had ceased active mining operations as a result of its loss of

contractual mining rights in Spain.

In 2005

the Board of Directors of the Company decided to pursue other business

opportunities. In November 2005, the Company acquired a 90% indirect ownership

interest (through a wholly owned Delaware subsidiary known as DonTech Waste

Services Inc., which was originally known as Dalian Acquisition Corp.) in Dalian

Dongtai, in a reverse merger transaction. Dalian Dongtai had been founded on

January 9, 1991 as a limited liability company under the PRC laws, with a total

registered capital of $250,000.

As a

result of the reverse merger, Dalian Dongtai became a joint venture with foreign

investment under the laws of the PRC, with a total registered capital of $2.3

million. The formation of the joint venture was approved by Dalian Industry and

Commerce Bureau, and the term of the joint venture is 12 years. A new

business license was issued to Dalain Dongtai on October 10, 2005, and the

registered capital has been fully paid as of April 2007.

On

September 18, 2008, the Company formed Favour Group Ltd. as a British Virgin

Islands corporation and a wholly-owned subsidiary of China Industrial Waste

Management, Inc. Simultaneously the Company formed Full Treasure Investments

Ltd. as a Hong Kong corporation and wholly-owned subsidiary of Favour Group Ltd.

Favour Group Ltd. and Full Treasure Investments, Ltd. were established to

facilitate the Company’s banking relationships.

In March

2009, Dontech Waste Services Inc. was merged with and into the Company and

Dalian Dongtai became a direct 90%-owned subsidiary of China Industrial Waste

Management, Inc.

ITEM

1A. RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the risks described below and the other information contained

in this Annual Report on Form 10-K before deciding to invest in our common

stock.

Risks Related to our

Business

Our

failure to compete effectively may adversely affect our ability to generate

revenue.

We

compete primarily on the basis of our ability to secure contracts with

industrial companies, and local government entities in Dalian, China and

surrounding areas for waste processing and disposal or for the purchase by us of

waste material which we recycle. There can be no assurance that such contracts

will be available to us in new areas as we attempt to expand or that our

competitors will negotiate more favorable arrangements with our current

customers. We expect that we will be required to continue to invest in building

waste treatment and disposal infrastructure. Our competitors may have better

resources and better strategies to raise capital which could have a material

adverse effect on our business, results of operations and financial

condition.

We

rely on our governmental permits rights to operate our business in Dalian, China

and the loss of the permits would have a material adverse impact on our

business.

Only

those companies who have been granted a special operating license issued by the

national and local governments are permitted to engage in the industrial waste

treatment and disposal business in China. Dalian Dongtai's expansion

project has been listed as one of the fifty-five items

of the Hazardous Waste and Medical Waste Treatment Facility

Construction Program approved by State Environmental Protection Administration.

The national and local governments have strict requirements regarding the

technology which must be employed and the qualifications and training of

management of the licensee which must be maintained. Either the national or

local government could determine at any time that we do not meet the strict

requirements of technology or management and revoke our permit to engage in the

industrial waste business in China. The termination of our licenses to operate

would have a material adverse impact on our revenue and business.

13

If

we fail to introduce new services or our existing services are not accepted by

potential customers we may not gain or may lose market share.

Our

continued growth is dependent upon our ability to generate increased revenue

from our existing customers, obtain new customers and raise capital from outside

sources. We believe that in order to continue to capture additional market share

and generate additional revenue, we will have to raise more capital to fund the

construction and installation of additional facilities and to obtain additional

equipment to collect, process and dispose of industrial waste and recycle waste

for our existing and future customers. For example, we anticipate that we will

require approximately RMB40 million (approximately $5.85 million) in order to

fund the balance of construction of an expansion project to upgrade Dalian

Dongtai’s existing waste processing facilities, as well as approximately

additional RMB14 million (approximately $2 million) to satisfy the operational

requirements of Zhuorui. We anticipate that the total funding requirement

(including the foregoing expenditures) that we will be needed to finance the

construction and installation of additional facilities and to obtain additional

equipment for Dalian Dongtai to accommodate a sharp increase in demand for its

waste management services and more stringent regulatory criteria in

environmental management, as well as to strengthen our presence outside of

Dalian, China, through investment and/or acquisition is approximately RMB100

million (approximately $15 million). We anticipate that such funding will be

provided through a variety of sources including bank loans, equity financing and

net cash flow generated from operations.

It is

likely that we will also seek participation in additional BOT projects or form

joint venture projects, although no such projects have been identified by us at