Attached files

| file | filename |

|---|---|

| 8-K - LUFKIN INDUSTRIES, INC 8K 4-7-2010 - LUFKIN INDUSTRIES INC | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - LUFKIN INDUSTRIES INC | ex99_1.htm |

LUFKIN INDUSTRIES, INC.

COMPANY INVESTMENT PROFILE

MARCH 2010

|

This Company Investment Profile is being produced by Lufkin in continuation of the Company’s goal to provide greater transparency and communication with its stakeholders. The Company’s objective with this Company Investment Profile is to differentiate itself by providing a more thorough understanding of its industry positioning, long-term vision, strategy and products. For more information on Lufkin, please visit us at www.Lufkin.com.

|

Corporate Headquarters

601 South Raguet

Lufkin, Texas 75902-0849

United States of America

For More Information, Please Contact Us

by Telephone, E-mail, or Visit Us Online:

936-634-2211

info@Lufkin.com

www.Lufkin.com

All Rights Reserved

|

Company Investment Profile

|

March 2010

|

| TABLE OF CONTENTS | ||||

|

I.

|

INVESTMENT HIGHLIGHTS

|

3

|

||

|

II.

|

COMPANY OVERVIEW

|

3

|

||

|

Oilfield Division

|

4

|

|||

|

Power Transmission Division

|

10

|

|||

|

III.

|

OPERATIONAL UPDATE AND NEAR-TERM OUTLOOK

|

15

|

||

|

Oilfield Division Outlook

|

15

|

|||

|

Power Transmission Division Outlook

|

16

|

|||

|

Management

|

17

|

|||

|

IV.

|

FINANCIAL OVERVIEW

|

19

|

||

|

Summary of 2009 Annual Results

|

19

|

|||

|

Annual 2009 Segment Performance

|

19

|

|||

|

Fourth Quarter 2009 Results

|

20

|

|||

|

Liquidity

|

22

|

|||

|

Consolidated Balance Sheets (Fiscal Year)

|

23

|

|||

|

Consolidated Statements of Earnings (Fiscal Year)

|

24

|

|||

|

Consolidated Statements of Cash Flows (Fiscal Year)

|

25

|

|||

|

V.

|

GLOSSARY

|

26

|

||

|

VI.

|

REFERENCES

|

28

|

||

| ©2010 Lufkin Industries, Inc. | Page 2 |

|

Company Investment Profile

|

March 2010

|

|

I. Investment Highlights

|

||

|

Lufkin Industries, Inc. (“Lufkin” or “The Company”) has the unique ability to bundle products, services and automation for the oil patch and diverse energy industries with high-quality engineering and sales support with high-precision manufacturing. Since its inception over a century ago, Lufkin has leveraged its financial strength and flexibility to grow its primary businesses in Oilfield and mechanical Power Transmission (PT) equipment and services organically and through strategic acquisitions.

|

||

|

Vertically Integrated Manufacturing, Technical and Engineering Capabilities. The Company’s two business segments are operationally integrated through engineering expertise and service offerings. The Company’s Oilfield Division has more than an 80-year history of fabricating, servicing and repairing surface pumping units, and the vertically integrated foundry reduces lead times, ensures product quality and furnishes casting technology that can improve product performance and reduce costs.

|

||

|

The PT Division designs, manufactures and repairs gearboxes and is an industry leader in high-speed turbo gearing. Its products are industry benchmarks for reliability and safety, largely owing to Lufkin’s superior engineering capabilities and manufacturing technology.

|

||

|

Lufkin is a leading supplier of high quality products for energy and industrial applications.

|

Strong Financial Position. A strong balance sheet with a cash balance of $100.9 million, as of December 31, 2009 and less than 1% total debt/total capitalization positions gives Lufkin the financial flexibility to pursue increasing growth opportunities in its oilfield equipment and services. Specifically, Lufkin is targeting international markets for its oilfield products and services, and emerging wind turbine farms and after-market repair for its gearbox products.

|

|

|

II. Company Overview

|

||

|

Incorporated in 1902, Lufkin Industries is a vertically integrated global leader in the manufacture, installation and service of artificial lift systems for oil and gas field applications. The Company is also a major manufacturer of highly engineered gearboxes that are used in a variety of industrial applications. Lufkin has a steadfast commitment to technology and engineering expertise, which allows it to consistently produce superior products and services. Its ability to handle all facets of the manufacturing process in-house as well as the complete integration of product design and production gives it excellent quality control capabilities.

|

||

|

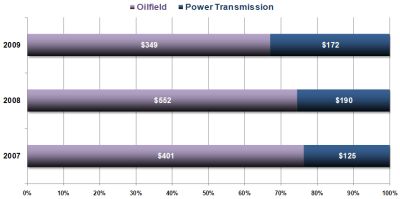

In both of its primary businesses, Oilfield and Power Transmission, the Company has a significant share of its markets. In 2009, Lufkin derived 67% of its total revenues from its Oilfield operations, or $349 million, and 33% or $172 million from Power Transmission. To serve these markets, Lufkin operates manufacturing facilities on three continents and has an international network of service centers, sales offices and sale representation affiliations in over 40 countries.

|

||

|

Lufkin’s Oilfield Division designs, manufactures, services and repairs artificial reciprocating rod-lift pumping equipment (“pumpjacks”) used primarily for oil and gas production. The Company also designs and manufactures automation systems that monitor and control artificial-lift pumps, which lowers production costs and optimizes well efficiency. Castings for new pumping units are

|

| ©2010 Lufkin Industries, Inc. | Page 3 |

|

Company Investment Profile

|

March 2010

|

|

produced by Lufkin’s iron foundry, which is part of the Oilfield Division. Traditionally known for its beam pumping units used in rod lift, the Company has expanded its product portfolio with the acquisition of International Lift Systems (“ILS”) in March 2009 to include gas lift and plunger lift systems and completion equipment.

|

||

|

Lufkin is also a leading supplier of mechanical power transmission products and services. Its Power Transmission Division designs, manufactures and services high-performance, precision gearboxes. Gearboxes are used in a multitude of industrial applications particularly in the oil and gas industry. These units vary widely in power and size, feature power ratings in excess of 125,000 HP and can weigh up to 250 tons.

|

||

|

In 1998, Lufkin acquired Comélor, a French company with an established reputation as a gear manufacturer serving a wide range of industries including iron and steel, metal processing, paper, cement, sugar, rubber, refrigeration, petrochemical, power generation, test facilities and others. Comélor, now known as Lufkin France, is also well known for its flexible gear couplings. It is the cornerstone of Lufkin’s European operations, which include complete sales and technical support, manufacturing, gear repair and field service.

|

||

|

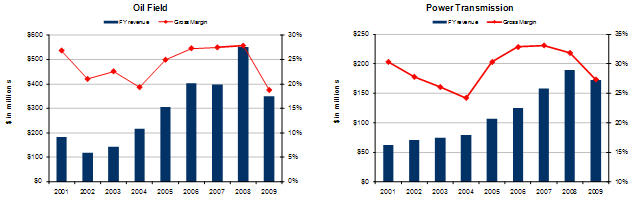

FIGURE 1: HISTORICAL REVENUE AND MARGIN GROWTH BY SEGMENT

|

||

|

||

|

Oilfield Division

|

||

|

Lufkin pumpjacks set the industry standard

|

The pumping units and related products that are manufactured by the Oilfield Division are primarily used to address the problem of low or declining reservoir pressure. As an oil or natural gas field is produced, the pressure in the reservoir declines and flow rates decrease. To maintain production at optimum rates and to maximize the recovery factor of a reservoir, artificial lift systems such as surface pumps, electric submersible pumps or gas lift are usually implemented. Estimated primary recovery rates, which encompass both the natural energy of the reservoir as well as artificial lift systems, range between 10% and 20% of the oil in place.

|

|

|

Lufkin's Oilfield pumping units are known throughout the world as the industry standard. The Company manufactures four basic types of pumping units: 1) air-balanced units, 2) beam balanced units, 3) crank balanced units, and 4) Mark II Unitorque units. The basic differences between the four types relate to the counterbalancing system. These pumping units are custom designed for the particular depth and producing characteristics of each well or

|

||

| ©2010 Lufkin Industries, Inc. | Page 4 |

|

Company Investment Profile

|

March 2010

|

|

reservoir, and they are extremely adaptable to meet various production demands. In addition to traditional oil well lifting applications, Lufkin’s pumping units are increasingly being used to lift water off of coalbed methane wells to reduce the static head and enhance gas recovery.

|

||

|

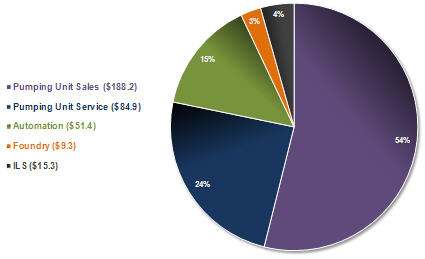

Pumping Unit Sales Generate Almost Two-Thirds of Oilfield Revenues. The Oilfield segment’s revenues are derived from four sources (Figure 2): Pumping Units, contributing about 54% to total segment revenues; Pumping Unit Services, which involves the refurbishment and repair of pumping units, supplies about 24% of revenues; Automation, which uses computer technology to optimize production, generates about 15% of segment revenues; ILS, which added revenues from gas lift and plunger lift services, contributed 4% to revenues; and Foundry, which not only supplies Lufkin with its own products but third parties as well, made up the remaining 3% of Lufkin’s Oilfield segment revenues, net of internal sales, in 2009.

|

||

|

FIGURE 2: 2009 OILFIELD REVENUES BY PRODUCT LINE ($ IN MILLIONS)

|

||

|

||

|

ILS ACQUISITION

|

||

|

On March 1, 2009, Lufkin completed the acquisition of International Lift Systems, LLC (“ILS”), a Louisiana-based limited liability company specializing in the manufacturing and servicing of gas lift, plunger lift and completion equipment for the oil and gas industry. Lufkin purchased ILS for $50 million, which represented a multiple of 7 times the EBITDA that ILS generated in 2008.

|

||

|

The ILS acquisition provided an entry into the offshore market, including deepwater plays, and was consistent with Lufkin’s long-term growth strategy of integrating strategic assets to leverage its position of industry leadership. Like Lufkin, ILS had a solid reputation for high-quality products, customer responsiveness and long-standing relationships with major independent and super-major integrated companies.

|

| ©2010 Lufkin Industries, Inc. | Page 5 |

|

Company Investment Profile

|

March 2010

|

|

AUTOMATION

|

||

Oilfield automation equipment reduces the total cost of operating and maintaining lift systems by remotely monitoring downhole reservoir conditions.

|

Automation systems have been the fastest growing product line at the Company and are a key component of its international growth strategy. Enhancing its Oilfield operations with automation services, Lufkin enables its customers to improve the efficiency and productivity of their wells. Lufkin Automation also provides customer support and services such as training programs and consultation.

|

|

|

Automation Services Enhance Operating Efficiencies for Customers. Oilfield automation equipment reduces the total cost of operating and maintaining lift systems by automating the operation of the pumping units with the use of sophisticated software, algorithms and instrumentation. Automation equipment monitors pump conditions below the surface to reduce production costs and enhance output. Variable speed drives can also be added to the automation equipment to further enhance operating efficiencies.

|

||

|

In addition to automating pumping units, Lufkin supplies state-of-the-art control equipment to automate water and/or CO2 injection and progressive cavity pump (“PCP”) wells. Lufkin’s systems offer automation control with advanced technological features that differentiate them from other products in the market.

|

||

|

MANUFACTURING

|

||

|

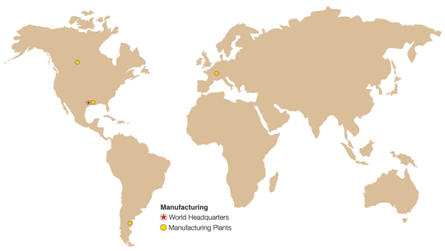

Lufkin has a well-established manufacturing position in the major oil producing areas of the world, which allows it to meet country-specific requirements and shorten lead times. In the U.S., the Company’s main manufacturing facilities are unionized, and the current labor contract associated with those facilities expires in October 2011. Pumping units are manufactured in Lufkin plants located in Texas, Canada and Argentina (Figure 3)

|

||

|

FIGURE 3: WORLDWIDE MANUFACUTURING LOCATIONS

|

||

|

| ©2010 Lufkin Industries, Inc. | Page 6 |

|

Company Investment Profile

|

March 2010

|

|

PUMPING UNIT SERVICE

|

||

Lufkin’s service capabilities provide on-site support of oilfield equipment. It offers these services to third parties as well.

|

||

|

Because of the competitive nature of the artificial lift market, customer service is an integral part of Lufkin’s strategy in winning and retaining customers. In this regard, Lufkin supports its pumping unit products business with a broad-based, well-trained service organization through which it installs, optimizes, repairs and maintains equipment in the field and provides on-site support of the pumping units. It offers these services to third parties as well as on its own equipment. Lufkin has service centers in the U.S., Canada, Argentina, Oman and Egypt. It also maintains warehouses around the world stocked with a full complement of original equipment manufacturer (OEM) spare parts available to maintain maximum uptime for oil and gas producers.

|

||

|

ECONOMICS OF A PUMPJACK

|

||

|

In mature oil fields, the pressure in the wellbore typically declines as the reservoir is depleted, and the wells can no longer flow oil and other liquids to the surface. In the vast majority of cases, the hydrocarbons must be “lifted” or extracted from the reservoir by the use of an artificial lift system. The Society of Petroleum Engineers estimates that more than 80% of the world’s oil wells use some kind of artificial lift equipment.

|

||

|

In the U.S.A., almost all oil wells need some form of artificial lift within months of completion, and many of these wells require artificial lift immediately upon completion. The reservoir pressure in many domestic fields is too low to “drive” the fluid to the surface, and with limited fluid volumes, sucker rod pumping can provide the necessary capacity. Gas wells, on the other hand, will usually flow for a number of years before they “load up” with liquids (usually water). Once the weight of the column of liquid (hydrostatic head) exceeds the reservoir pressure, the flow of gas will stop and some form of artificial lift is needed to remove the load. Often it takes removing only a few barrels of fluid to restore the well to production and extend the life of the well.

|

||

The Society of Petroleum Engineers estimates that more than 80% of the world’s oil wells use some kind of artificial lift equipment.

|

It is common for one pumping unit to remain on a well through the life of that well. Some of the economic factors that support that decision are steady fluid volumes, flexibility in the pumping unit to change stroke lengths and speeds to adjust to declining production. Just as importantly are the accounting requirements for partners in the well that can make it difficult to move, sell or re-size for declining production. A primary reason why an operator would change a pumping unit would be to accommodate increased volumes due to secondary or tertiary production (water floods, CO2, etc.). Once a well is depleted, the unit is usually moved to another well or sold as surplus.

|

|

|

If properly maintained, a pumpjack can last 20-30 years. While the pumpjack units themselves do not need to be replaced very often, when applicable, Lufkin has been replacing older-technology pumps with newer pumps or electric submersible pumps (“ESP”s) generating another source of revenue.

|

||

|

FOUNDRY

|

||

|

Lufkin entered the foundry industry in 1902 to initially service the repair needs of railroads and sawmills. Today, it is a critical part of the Company’s vertically integrated strategy. Its Company-owned foundry currently produces high-quality ductile and gray castings ranging in size from 100 pounds to 15

|

| ©2010 Lufkin Industries, Inc. | Page 7 |

|

Company Investment Profile

|

March 2010

|

|

Owning dedicated foundry capacity substantially reduces equipment production lead times.

|

tons for pumping units and external customers in the heavy equipment, valve and machine tool markets. Lufkin serves OEMs in various industries that manufacture goods such as valves, machine tools, pumps and compressors in addition to construction equipment and special machinery.

|

|

|

Having dedicated foundry capacity enhances Lufkin’s ability to reduce lead times to a minimum for production of oilfield and power transmission castings. This gives Lufkin a competitive advantage in responding to stringent customer delivery and quality requirements. Offering this level of service also enhances the Company’s ability to develop long-term relationships with its current and potential customer base.

|

||

|

However, the foundry does have significant fixed costs associated with its operations which can negatively affect margins when business slows down. Conversely, during boom times, the foundry improves efficiencies and reduces lead times.

|

||

|

OILFIELD COMPETITIVE ADVANTAGE

|

||

|

The Company believes that it is one of the larger manufacturers of sucker rod pumping units in the world, and it can provide a full artificial lift system including the design, installation and field maintenance optimized by its proprietary software, SROD™.

|

||

|

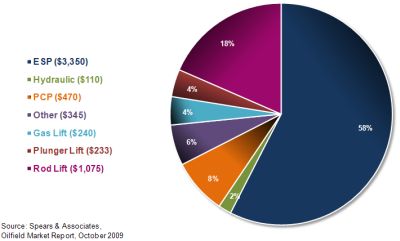

According to an October 2009 market report by Spears & Associates, rod lift sales reached an estimated $1.1 billion, or about 18% of the total $5.8 billion global artificial lift market in 2009 (Figure 4). Within the rod lift market, Lufkin held about a 30% market share based on its $325 million in revenues. Although the Spears report showed a 16% estimated decline in the 2009 global artificial lift market, the decline in sales appears to have since stabilized and their 2010 growth expectation will be for an 8% increase.

|

||

|

Since the economic downturn last year, customers have reduced capital spending and are satisfying drilling requirements with purchases of used equipment. The ongoing maintenance and repair of this equipment represent potential service opportunities for Lufkin, supported by its broad geographic network.

|

||

|

FIGURE 4: 2009 GLOBAL ARTIFICIAL LIFT MARKET ($ IN MILLIONS)

|

||

|

| ©2010 Lufkin Industries, Inc. | Page 8 |

|

Company Investment Profile

|

March 2010

|

|

Top Provider of Reliable Service and Outstanding Performance. Lufkin’s primary global competitor for new pumping units and automation equipment is Weatherford International, which is also the Company’s single largest competitor in the service market as well. Significant competitive pressure for services is also coming from small independent operators, and Chinese manufacturers are increasingly present in the pumping unit market.

|

||

|

A major differentiating factor for Lufkin relative to its competitors is the high reliability of its products and its ability to reduce manufacturing lead times for customized units. Prompt delivery of the pumpjacks allows its customers to maximize drilling and well completion in a timely manner. Moreover, Lufkin’s iron foundry supplies the Company with quality steel products at attractive prices, and also produces castings for third parties.

|

||

|

Other competitive advantages include Lufkin’s ability to bundle its equipment, automation and services. This reduces installation costs and downtime which in turn, improves cost efficiencies and optimizes oil and gas production for drilling operators. Also, the Company has a long history and extensive expertise in manufacturing a high-quality, custom-designed product that is known for dependable performance and outstanding reliability in the field.

|

||

|

OILFIELD GROWTH OPPORTUNITIES

|

||

|

Steadying oil prices in the second half of last year and expectations for an economic recovery this year drove a substantial rise in the oil-directed rig count in the U.S. during the 2009 fourth quarter. A continued recovery in the domestic rig count would draw down the glut of oil field equipment in customer inventories and increase the pace of new orders. Already in the fourth quarter of 2009, the Company saw a gradual rise in new orders, especially in North America, which led to a 20% sequential improvement in revenues from its Oilfield Division. If this trend should continue, its Oilfield Division expects to see incremental revenues from new orders gaining momentum over the next few quarters.

|

||

|

The Company will continue to expand the geographic reach of its traditional products as well as to introduce new and newly-acquired products through its global network of offices.

|

In the interim, Lufkin will continue to upgrade its service center network. In the U.S., it opened a new, more capable facility in Bakersfield, California that was fully operational in the 2009 fourth quarter. Construction is underway on a similar facility in Odessa, Texas, which should be completed in the first half of 2010. Also during 2009, the Company opened two new small service centers in Utah and North Dakota. In addition, Lufkin has begun the construction of a new automation-related facility in Houston.

|

|

|

Leveraging ILS Products in U.S. and Global Markets. Through its ILS acquisition, Lufkin is targeting new business opportunities in both the U.S. and international markets. Domestically, Lufkin plans to expand its ILS product applications in the Mid-Continent region, the Marcellus Shale and the Rockies, and internationally in Asia, Latin America and the Middle East. The Company will also continue to expand the geographic reach of its traditional products in addition to introducing new and newly acquired products through its global network of offices.

|

| ©2010 Lufkin Industries, Inc. | Page 9 |

|

Company Investment Profile

|

March 2010

|

|

Power Transmission Division

|

||

|

Lufkin also provides strong global after-sales support for any gear system, including non-Lufkin units.

|

||

|

Recognizing that the “heart” of a pumping unit is its gearbox, Lufkin leveraged its expertise in manufacturing gearboxes for its artificial lift systems and began producing gearboxes for industrial applications in 1939. For over 70 years, Lufkin has been a global leader in the design, manufacturing and servicing of high-performance, precision gear units for industrial applications. Its reputation for providing highly reliable equipment is complemented with a history of rapid, responsive customer service and engineering capabilities.

|

||

|

As a certified ISO 9001 company, Lufkin provides full product engineering and manufacturing services in Company-owned factories in both the U.S. and Europe. The design and manufacturing processes are integrated with the quality, performance and reliability that are essential in high-speed gearing applications. Lufkin also provides strong global after-sales support for any gear system, including non-Lufkin units. This is accomplished through a worldwide network of factory sales offices which can quickly respond to customer needs from any location at any time. Among its top customers are Dresser Rand, GE and National Oilwell Varco.

|

||

|

RMT ACQUISITION

|

||

|

As part of its strategic plan to enhance its capabilities and position the Company for growth as the economy recovers, Lufkin acquired Rotating Machinery Technology (RMT) in July of 2009. RMT is a New York-based company specializing in the manufacture of precision-designed bearings for high-speed turbo machinery, the repair of integrally geared turbo expanders and compressors, and the engineering analysis of rotor-bearing systems, primarily for the oil and gas and air separation industries. The acquisition placed the PT Division at the forefront of this important market and further enhances its reputation as the supplier of choice for critical duty gear drives. The synergy between PT and RMT provides worldwide cross-marketing opportunities.

|

||

|

LUFKIN engineers and manufactures high-performance precision gear drives for industrial applications in both the U.S. and Europe.

|

The purchase price was $8 million in cash, including the assumption of $1.8 million in long-term liabilities. Based on the $1.4 million in EBITDA generated by RMT in FY2008-09, the transaction was valued at a multiple of 5.7x. During its fiscal year ended June 30, 2009, RMT generated approximately $7.2 million of revenue and $1.4 million of adjusted EBITDA (unaudited).

|

|

|

POWER TRANSMISSION PRODUCTS

|

||

|

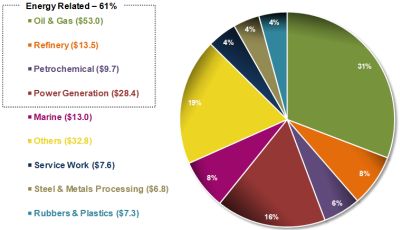

The Power Transmission Division’s products are highly engineered precision gear drives that are utilized in both speed-increasing and speed-reducing services across a wide spectrum of industrial and marine applications (Figure 5). The Division’s gear products are classed into two primary segments: high-speed turbo machinery units and low-speed high-torque units. Generally, high-speed gearboxes are speed increasing, i.e., they convert lower-speed, higher-torque input to higher-speed, lower-torque output; while low-speed gearboxes are torque increasing, converting higher-speed, lower-torque input to lower-speed, higher-torque output.

|

| ©2010 Lufkin Industries, Inc. | Page 10 |

|

Company Investment Profile

|

March 2010

|

|

FIGURE 5: 2009 LUFKIN POWER TRANSMISSION REVENUE BY PRODUCT LINE

|

||

|

($ in millions)

|

||

|

|

||

|

||

|

The primary market for the high-speed turbo gear products is the oil and gas industry, where the products are used on land and on offshore platforms for applications such as gas compression and oil production. Other strategic applications include electrical power generation, oil refining and petrochemicals manufacturing. The gearbox is used to transfer power from the primary mover such as an electric motor to the driven machine such as a centrifugal compressor or a pump. These units transmit powers above 120,000 HP and operate at speeds in excess of 50,000 rpm.

|

||

|

The low-speed product family includes custom and standard drives for such industries as steel and aluminum mills, rubber mills, plastics mixing and extrusion, sugar mills, marine propulsion, cement mills and mining. Units for some of these specialized services can exceed 250 tons in size.

|

||

|

POWER TRANSMISSION INDUSTRIAL APPLICATIONS

|

||

|

Power Generation

|

||

|

The power generation industry demands products that provide high performance under extreme operating conditions. The mechanical reliability of each gear unit is critical in power generation. All Lufkin high-speed gear units are manufactured from high-quality materials, and each is inspected and tested before being shipped to the customer. Lufkin’s gearboxes are often used in conjunction with both steam and gas turbines to drive cogeneration power plants. The use of steam as a byproduct of gas-fired power production allows industrial users to recover and utilize their waste heat, which is advantageous as environmental and economic concerns mount. Other Lufkin applications in this sector include gearboxes used in hydropower generation, an increasingly important source of renewable energy.

|

||

|

Oil and Gas Production

|

||

|

For oil and gas exploration and production companies, equipment manufacturers have developed efficient and reliable operational systems that are designed to avoid expensive interruptions during the hydrocarbon extraction process. In this context, one-speed and two-speed Power Swivel gearboxes have been designed to combine the functions of powering and lifting

|

| ©2010 Lufkin Industries, Inc. | Page 11 |

|

Company Investment Profile

|

March 2010

|

|

for drill string operations. These products can withstand very high mechanical stresses and meet impact strength requirements at lower pressures. This solution is particularly effective for directional drilling and on offshore drilling platforms. Lufkin guarantees the reliability of its components, which is particularly reassuring to offshore producers who typically operate during bad weather conditions and in adverse environments. Turbo gear units are frequently used in reinjection, compression and pipeline transmission applications, as well as with liquefied natural gas (LNG) production.

|

||

|

Rubber Mixers

|

||

|

Lufkin has set the standard for high-precision mixer drives and reducers. These gears are primarily used in rubber processing applications such as tire manufacture. Lufkin custom designs gears with various features to meet a variety of product specifications. A comprehensive product line of reducers for batch mixers suited to the customer’s needs ranges in size from 80 liters to the biggest 620-liter batch mixer drives, on which the output shaft centers and the friction ratio are customized.

|

||

|

Steel and Aluminum Industries

|

||

|

All of Lufkin’s gear drives that are used in steel and aluminum industry applications are specifically designed and produced to withstand the intense heat, moisture and heavy shock loads present in the typical mill environment. For this industry, Lufkin designs and manufactures speed reducers that are known for their high quality and reliability, and comply with standards established by the user or to satisfy the most stringent industry requirements. These drives are typically customized to meet the requirements of a specific application. Thousands of units of various sizes, some as heavy as 100 tons, have been in service for decades. Certain units provide motion-in-materials handling (traveling cranes, transfer cars, ladle tilters), while other units drive special machines (continuous casters for steel, aluminum and other metals, rolling and finishing mills, presses, straighteners, shears, coilers, drawing and wire drawing benches).

|

||

|

Marine Propulsion

|

||

|

Marine industry service demands intense power, dependable performance and exceptional mechanical integrity from a propulsion system. Lufkin manufactures propulsion drives targeted for the work boat industry, which includes inland river tow boats, offshore supply vessels, tugs, barges, ferries, and medium-size bulk and liquid carrier ships. The rate of bulk cargo shipping on inland rivers has been driven by increasing traffic congestion on highways, higher fuel prices, and better efficiencies using bulk transport, and demand for offshore work boats has been driven by the need to support oil and gas production platforms which are operating in ever-deeper waters.

|

||

|

Extrusion Applications

|

||

|

In industries where products have to be manufactured by extrusion, Lufkin’s gear units are known for their reliable service and outstanding performance. The extrusion process typically involves pushing or squeezing a raw molten material such as metal, rubber or plastic, through a tool known as a die using a mechanical or hydraulic press. Through a heating and cooling process, the raw material can be reshaped into plastics, metal cylinders, aluminum cans, weather stripping, adhesive tape and many other products. Lufkin supplies special gear units with or without an integral thrust bearing, which are used in

|

| ©2010 Lufkin Industries, Inc. | Page 12 |

|

Company Investment Profile

|

March 2010

|

|

the early stages of the extrusion process. Its integral thrust bearing gear units are used in a variety of applications in the plastics and rubber industries. Lufkin is recognized for its expertise in the highly complex designs required for high volume dual-screw extruders.

|

|||||

|

Gear Repair

|

|||||

|

Lufkin operates six facilities dedicated to the repair and refurbishment of all brands and makes of gears.

|

One of the challenges facing operators of high-performance, precision power is to maximize performance and minimize downtime. Lufkin specializes in the repair, refurbishment, and re-rate of all types of gear drives. Repair work is performed in dedicated facilities to accommodate the fast turnaround times required. The gear repair business is headquartered in an 80,000-square-foot facility that is devoted solely to the aftermarket repair, rebuild and overhaul needs of the end-user market. Service and engineering personnel evaluate the equipment to identify what is needed to return the units back to service as quickly and efficiently as possible. Lufkin also operates four satellite service centers in North America and one in Europe. A team of 30 highly skilled field service technicians provides global support for Lufkin’s customers worldwide.

|

||||

|

Other Applications

|

|||||

|

Lufkin can furnish customer baseplates and common lubrication systems for drive trains involving a gearbox and customer-furnished equipment. Lufkin also manufactures a wide range of customized units for a variety of industries and applications.

|

|||||

|

·

|

Axial compressors

|

·

|

ID fans

|

||

|

·

|

Centrifugal compressors

|

·

|

Generators

|

||

|

·

|

Process compressors

|

·

|

High-speed balance stands

|

||

|

·

|

Reciprocating compressors

|

·

|

Integrally geared compressor drives

|

||

|

·

|

Refrigeration compressors

|

·

|

Sugar cane mills

|

||

|

·

|

Rotary compressors

|

·

|

Sugar cane shredders

|

||

|

·

|

Blowers

|

·

|

Turbo expanders

|

||

|

·

|

Centrifugal pumps

|

·

|

Gas turbine accessory drives

|

||

|

·

|

Reciprocating pumps

|

||||

Quality is controlled in each phase of the production process, and Lufkin controls each facet of design and production through its integrated operations.

|

The industry is requiring gears that are capable of higher power levels, higher speeds, better efficiencies, longer life and improved reliability. Lufkin has responded to this demand with a new generation of products and has developed the technologies required to design and manufacture these gear units.

|

||||

|

Incorporating the latest technology with its in-house manufacturing processes, Lufkin’s entire production process is carefully integrated and monitored to ensure optimum performance and accuracy. Processes such as carburizing of gears and CBN finish grinding of the gear teeth enable Lufkin to produce units with the durability and precision required in all high-speed applications. Using advanced technology such as 3-D design software, Lufkin ensures that all high-speed gear drives meet the most exacting customer specifications.

|

|||||

|

Lufkin’s expertise goes beyond the design, manufacturing and testing of high-speed precision gear units. It also provides comprehensive field diagnosis and services as well as all types of gear repair for not only its own products but also those manufactured by other companies. Lufkin has the capability to completely rebuild any manufacturer’s gear drive. If repair is not practical, it will replace the gearset with new Lufkin gears. It can also design a

|

|||||

| ©2010 Lufkin Industries, Inc. | Page 13 |

|

Company Investment Profile

|

March 2010

|

|

replacement gearbox, utilizing existing couplings and lube systems. Replacement equipment typically results in increased ratings and improved performance and reliability. Lufkin also has full testing capability for new and rebuilt units.

|

||

|

PT COMPETITIVE ADVANTAGE

|

||

|

In all of the applications for gearboxes, an equipment failure and/or downtime can be disruptive and extremely costly to the end user. Lufkin combines its world-class expertise in engineering, metallurgy and manufacturing technology to produce equipment that will deliver reliability, superior performance, and lengthy service life. Moreover, Lufkin offers the logistical advantage of design, manufacturing, and product performance testing capability in both Europe and the U.S. It is the only turbo gear manufacturer able to offer this full range of global support, including after-market service.

|

||

|

PT GROWTH OPPORTUNITIES

|

||

|

Growth in the Power Transmission business is driven by Lufkin’s expansion of its service capabilities internationally. This global expansion leverages Lufkin’s operational skills that it has demonstrated in its core markets. Its strategies for continued growth are focused on further expanding its global footprint and in particular, growing its sales organization across Europe, Asia and the Middle East. This is complemented by its existing manufacturing and engineering organizations that have enabled Lufkin to offer superior products with the shortest lead times in the industry. Its unique position as the only turbo gear manufacturer with manufacturing design and performance testing facilities in North America and Europe offers full product support in both the Eastern and Western Hemispheres.

|

||

|

Expand RMT’s Global Engineering Expertise. The strategic acquisition of RMT was an example of Lufkin’s long-term objective of integrating assets and alliances with its existing resources and services. RMT, which was already a key supplier to Lufkin Industries, had established a global reputation for delivering high-quality, innovative and precision products and services to customers. Its existing CEO and senior management joined the merged company, providing experience and expertise in the areas of bearing design and rotor dynamics. Going forward, the addition of the RMT operations will enhance Lufkin’s engineering capabilities and after-market support to its customers.

|

||

|

Pursue Renewable and Alternative Energy Markets. Another area of increasing interest and growth opportunity lies in alternative energy. Around the globe, governments are increasing funding for infrastructure and alternative energy projects, which may create opportunities for power transmission products, and the current U.S. administration is very supportive of generating energy from renewable and alternative sources. Approximately $3 billion of federal funding has been allocated by the Obama administration to clean coal technology, which is a process that requires high-performance gears to inject and compress the CO2 underground.

|

| ©2010 Lufkin Industries, Inc. | Page 14 |

|

Company Investment Profile

|

March 2010

|

|

III. Operational Update and Near-Term Outlook

|

||

|

During 2009, the market was challenging for energy service companies such as Lufkin primarily because prices for products and services were declining faster than costs. Up until September 2009, delays and cancellations in oil and gas projects had affected demand for pumping units and gearboxes. However, there has been a steady increase in the land drilling rig count since that time, and in the 2009 fourth quarter, the number of rigs drilling for oil in the U.S. reached the highest level in about 16 years. As a result, the cancellation of pumping unit orders has stopped, and quotation activity for both Lufkin’s Oilfield and Power Transmission products and services has increased since mid-September 2009 and has continued through the first of this year.

|

||

|

Focused on Strategic Expansion and Acquisition Opportunities. While the worst appears to be over, Lufkin will continue to focus on cost reductions and to develop its long-term expansion and acquisition strategy. Also, management remains committed to the lean manufacturing program it undertook in 2008, and expects to realize cost efficiencies throughout 2010 as a result of this initiative. Over the medium and long term, the Company believes that there are positive growth trends for artificial lift equipment, and it will continue to look at opportunities in additional artificial lift product lines. Its acquisition of ILS last year was consistent with this strategy. Also, the Company will continue to look for strategic acquisitions, such as the RMT transaction in July 2009, which would enhance its capabilities and long-term growth opportunities in mechanical power transmission. This will include targeting business opportunities both inside and outside of the energy sector.

|

||

|

In addition to the two acquisitions it made during 2009, the Company plans to continue to invest organically in its businesses, and to fund its budget internally with operating cash flows. Capital expenditures for 2010 are projected to remain in the range of 2009 spending levels, and will primarily target expanding geographical and product lines and replacing equipment for efficiency improvements. In addition, the Company will continue to review international expansion opportunities.

|

||

Demand for artificial lift equipment primarily depends on the level of new onshore oil well and workover drilling activity.

|

Lufkin’s focus on international markets remains the core of its strategy for growth, along with its ongoing investment in developing technologies that bring more value to its customers. As existing oil and gas fields mature, the market will require an increasing use for artificial lift, especially in the South American, Russian and Middle Eastern markets. The Company’s culture and people are also keys to its success, differentiating Lufkin from its competitors. To that end, Lufkin plans to continue to add intelligent, capable, customer- oriented people to ensure that it has the resources and depth of talent to build for the future, even in the most challenging of times.

|

|

|

Oilfield Division Outlook

|

||

|

Demand for artificial lift equipment primarily depends on the level of new onshore oil well and workover drilling activity as well as drilling and general field maintenance budgets and the depth and fluid conditions of the wells. Higher drilling activity, the activation of idle wells, and the upgrading of existing wells is driven by the available cash flow of Lufkin’s customers, which is directly tied to energy prices. Approximately 60% of Lufkin’s Oilfield business is leveraged to crude oil.

|

| ©2010 Lufkin Industries, Inc. | Page 15 |

|

Company Investment Profile

|

March 2010

|

|

During the difficult energy market and global economy in 2009, many exploration and production (E&P) companies reduced their drilling programs and capital budgets to remain cash-flow positive. As a result, certain drilling projects and workover programs were cancelled or delayed, particularly in North America. While oil prices appear to have stabilized in the mid-to-high $70 per barrel range, natural gas prices have remained relatively weak, which continues to impact the overall cash flows of E&P companies and thus, their ability to fund new oil drilling projects. The recovery of the drilling market will depend on the E&P companies’ long-term perceptions of the level and stability of the price of oil.

|

||

|

Recently, there are some encouraging signs that indicate that the worst of this market cycle may be over.

|

Recently, however, industry data suggests an increase in upstream capital spending, and the Company expects to see an increase in new orders from the E&P companies as they begin to launch their budgeted projects. Lufkin has already seen a significant improvement in new bookings in its Oilfield Division over the past two quarters from the lows hit in the first quarter of 2009, which is also an encouraging trend. This growth was mainly the result of stronger activity in the U.S., particularly in the Bakken Shale, Permian Basin and the heavy oil fields in California. Lufkin expects to see a gradual pickup in Gulf of Mexico activity as well, which is a market served by ILS.

|

|

|

Internationally, demand for pumping units, oil field services and automation equipment continues to increase.

|

Internationally, demand for pumping units, oil field services and automation equipment is expected to increase during the first half of 2010. Recently, Latin America has been Lufkin’s most active market. The Company is working to develop the service and spare parts markets in Colombia and is expanding its range of products and services in Brazil and Mexico. Growing its international presence will continue to be a strong focus for Lufkin in 2010: Its strategy is to expand the geographic reach of its traditional products, as well as introduce new and newly acquired products through its global network of offices.

|

|

|

Although weak in 2009, the automation segment is also showing signs of improvement. Automation sales were impacted by sluggish demand from major oil company customers, but the fourth quarter revenues showed a 73% increase over the third quarter. Most of the demand came from customers operating in the Rocky Mountains. Outside of the U.S., the Company has recently been receiving requests for bids from customers in the former Soviet Union. Overall, Lufkin expects its automation segment to do well in the first half of 2010.

|

||

|

Power Transmission Division Outlook

|

||

Looking ahead, the proposal activity and project list for PT productions and services bodes well for 2010.

|

The Power Transmission (PT) Division services many diverse markets, each of which has its own unique set of drivers. Demand for Lufkin’s gearboxes is tied to energy-related markets such as refining, petrochemical, drilling, coal, marine and power generation; therefore, lower energy prices during 2009 reduced demand for Power Transmission products and services.

|

|

|

Generally, Power Transmission products are components used in large-scale projects that tend to have longer lead times, and therefore, bookings are not as volatile as in Lufkin’s Oilfield equipment business. However, customer spending on new equipment can lag when global industrial capacity utilizations are low, as was the case in 2009. The lingering impact of the decline in energy prices and restricted credit markets continued to affect the timing and status of many large infrastructure projects in the 2009 fourth

|

| ©2010 Lufkin Industries, Inc. | Page 16 |

|

Company Investment Profile

|

March 2010

|

|

quarter. The lower activity levels affected both revenues and margins in this division.

|

||

|

Looking ahead, the proposal activity and target projects list bodes well for 2010. The recovery in crude oil prices is driving an improvement in the economics of big LNG projects, which could result in new business for RMT this year. The Company is also seeing a slight upturn in orders from the petrochemicals and refining sectors, particularly for its aftermarket business. Overseas, its Lufkin France operation has received new orders for complex gear drives that will go into cooling pumps in nuclear power applications in Asia, and has recently won orders for gear units to produce power in hydroelectric plants in South America and Eastern Europe.

|

||

|

Opportunities Outside of Conventional Energy Markets. The Company continues to see opportunities in alternative energy segments as well as in more traditional power generation sectors such as load gears for gas and steam turbine generator sets. Among its traditional customers, several refineries and petrochemical plants have scheduled maintenance turnarounds, which will benefit Lufkin’s field service and gear repair business.

|

||

Lufkin has begun expanding its PT business into wind power, in which it will repair malfunctioning and damaged gearboxes.

|

Lufkin’s strong tie to the oil and gas industry has the potential to yield significant additional growth and diversification benefits in the alternative energy markets, where it has begun expanding into wind power. The Company is in the process of renovating a building at its Lufkin, Texas plant that will serve as a repair facility for wind turbine machinery, where it will handle repairs on malfunctioning and damaged gearboxes. Because the gearbox of a wind turbine generator must transfer the low-speed, high-torque power generated by its rotor blades into high-speed, low-torque power to produce electricity, its proper functioning is critical, and reliability will always be a pivotal issue.

|

|

|

Thus, the repair of wind turbine gearboxes is an important task. High-quality replacement parts and depth of expertise in quickly diagnosing and addressing problems—differentiating factors that Lufkin possesses—can enhance reliability and result in longer uptime, which are both valuable benefits for wind turbine operators. Another competitive advantage is Lufkin’s proximity to the largest concentrations of wind turbines in the world. With its repair facilities in Texas and France, and its four service centers, Lufkin is strategically located to all major wind farm installations in North America and Western Europe. Texas is now the largest producer of wind energy in the U.S., and the market for wind turbine gearbox repair has begun to rebound.

|

||

|

Management

|

||

|

All of the executive officers of the firm, with the exception of one, have been employed by the Company for more than 10 years.

|

||

|

John F. (Jay) Glick, President and Chief Executive Officer. Mr. Glick was elected Chief Executive Officer effective March 1, 2008 upon the retirement of the former CEO. He also currently serves as President of the Company effective August 2, 2007. Mr. Glick had previously served as Vice President and General Manager of Lufkin’s Oilfield Division from April 2007 until August 2007; he also held the position of Vice President and General Manager of Lufkin’s Power Transmission Division from September 1994 until April 2007. Prior to joining Lufkin, Mr. Glick had a 20-year career with Cameron and was Director of Manufacturing for the United Kingdom and Ireland.

|

| ©2010 Lufkin Industries, Inc. | Page 17 |

|

Company Investment Profile

|

March 2010

|

|

Christopher L. Boone, Vice President, Treasurer, and Chief Financial Officer. In 2008, Mr. Boone was appointed as Vice President/Treasurer/Chief Financial Officer upon the retirement of the former CFO. Mr. Boone previously served as Corporate Controller and has been employed by the Company since 1993.

|

||

|

Mark E. Crews, Vice President, Oilfield. Mr. Crews has been employed by the Company since January 2008. Prior to joining Lufkin, Mr. Crews was employed by Cameron International Corporation in Houston, as Vice President, Technology.

|

||

|

Terry L. Orr, Vice President, Power Transmission. Mr. Orr has been employed by the Company since August 1976. Prior to becoming the Company’s Vice President of the Power Transmission Division, Mr. Orr served as the Company’s Director of Sales and Marketing for the Power Transmission Division from December 1996 until September 2007.

|

||

|

Paul G. Perez, Vice President, General Counsel / Secretary. Mr. Perez has been with the Company since July 1993. Prior to becoming the Company’s vice President and General Counsel / Secretary, Mr. Perez served as Director of Human Resources, and also served at Cameron before joining Lufkin.

|

||

|

Scott H. Semlinger, Vice President, Manufacturing Technology. Mr. Semlinger joined the Company in December 1975. He has served as Vice President of Manufacturing Technology since April 2007. He previously served in a variety of management positions, including Vice President and General Manager of the Trailer Division and the Foundry Division, Vice President of Oilfield Manufacturing / Foundry, Senior Vice President and Vice President of the MachineryDivision.

|

| ©2010 Lufkin Industries, Inc. | Page 18 |

|

Company Investment Profile

|

March 2010

|

|

IV. Financial Overview

|

||

|

Summary of 2009 Annual Results

|

||

|

During the year 2009, the prevailing weak U.S. market combined with pricing pressure for oil field equipment negatively affected Lufkin’s annual results. Total revenues fell by 29.7% to $521.4 million in 2009 from $741.2 million in 2008. The difficult commodity environment also caused bookings to decline across all product lines.

|

||

|

Gross margin for 2009 decreased to 21.7% from 28.8%, primarily due to the large revenue decline, which resulted in lower fixed cost coverage and market pricing pressure. As a percentage of sales, selling, general and administrative expenses increased to 14.4% during 2009 compared to 9.7% during 2008, reflecting mainly the large decline in total revenues. During the year, the Company booked a pre-tax $6 million litigation reserve related to a 2005 discrimination lawsuit ($0.26 per diluted share impact).

|

||

|

The Company reported annual 2009 net earnings from continuing operations of $22.5 million, or $1.51 per diluted share, compared to 2008 net earnings from continuing operations of $88.0 million, or $5.91 per diluted share. As a percent of revenues, net income in 2009 was 4.2% compared to 11.9% in 2008, before adjusting for the special items mentioned above. Adjusted 2009 GAAP earnings per share (EPS) were $1.77 versus $6.16 in 2008. Adjusted net earnings from continuing operations were 5.0% of total revenues versus 12.4% in 2008.

|

||

|

Annual 2009 Segment Performance

|

||

|

Over the last three years, Lufkin’s sales mix has shifted towards its Power Transmission segment, with the most pronounced change coming in 2009 (Figure 6). Looking at the segment performance during the year ending December 31, 2009, annual revenues from Oilfield sales decreased 36.7% to $349.2 million (Figure 7) but the Power Transmission segment fared slightly better, experiencing a 9.1% decline in annual revenues (Figure 8).

|

||

|

FIGURE 6: REVENUE CONTRIBUTION BY SEGMENT ($ IN MILLIONS)

|

||

|

| ©2010 Lufkin Industries, Inc. | Page 19 |

|

Company Investment Profile

|

March 2010

|

|

FIGURE 7: ANNUAL OILFIELD REVENUE BY PRODUCT LINE

|

|||||||

|

Annual Oilfield Segment Revenues ($mm)

|

|||||||

| 2009 | 2008 | ||||||

|

New Pumping Units

|

$ |

188.2

|

$ |

342.1

|

|||

|

Pumping Unit Service

|

84.9

|

103.0

|

|||||

|

Automation

|

51.4

|

82.4

|

|||||

|

Commercial Castings

|

9.3

|

24.4

|

|||||

|

ILS

|

15.3

|

-

|

|||||

|

Total

|

$ |

349.2

|

$ |

551.8

|

|||

|

New pumping unit sales fell 45% to $188.2 million, primarily due to lower U.S. demand and pricing pressure. Pumping unit service sales declined 17.6% to $84.9 million during 2009, reflecting the weak U.S. market. Automation sales of $51.4 million were down 37.5%, compared to $82.4 as a result of lower sales in the U.S and pricing pressure. Commercial casting sales of $9.3 million during 2009 were down $15.1 million, or 61.6 due to lower sales to the machine tool market. Sales from Lufkin ILS contributed $15.3 million during 2009.

|

|||||||

|

In response to lower energy prices, U.S. and international customers deferred or cancelled drilling programs which led to lower orders for new pumping units. As a result, Oilfield’s backlog decreased to $43.3 million as of December 31, 2009, from $188.1 million at December 31, 2008.

|

|||||||

|

FIGURE 8: ANNUAL POWER TRANSMISSION REVENUE BY PRODUCT LINE

|

|||||||

|

Annual Power Transmission Segment Revenues ($mm)

|

|||||||

| 2009 | 2008 | ||||||

|

New Unit Sales

|

$ |

131.8

|

$ |

144.9

|

|||

|

Repair & service

|

38.4

|

44.5

|

|||||

|

RMT

|

2.0

|

-

|

|||||

|

Total

|

$ |

172.2

|

$ |

189.4

|

|||

|

Sales for the Company’s Power Transmission segment decreased to $172.2 million, or by 9.1%, for the year ended December 31, 2009 compared to the prior year, primarily driven by a 9.0% decline in new unit sales. Repair and service sales fell 13.7% to $38.4 million as customers deferred spending on maintenance projects due to poor economic conditions. Sales from Lufkin RMT, which was purchased in mid-2009, contributed $2.0 million during 2009. Decreased bookings of new units for the energy-related and marine markets led to a decline in Power Transmission’s backlog which was $97.0 million at December 31, 2009 compared to $129.3 million at December 31, 2008.

|

|||||||

|

Fourth Quarter 2009 Results

|

|||||||

|

For the 2009 fourth quarter, Lufkin announced earnings from continuing operations of $3.6 million, or $0.24 per share compared to $1.77 per share, in the fourth quarter of last year, when the Company was enjoying record levels of business in both of its divisions. The 2009 fourth quarter results were negatively affected by uncertainties surrounding the near-term oil and gas market and the pace of the U.S. economic recovery.

|

|||||||

|

For the combined company, new order bookings in the 2009 fourth quarter were $133 million, up almost 50% from the third quarter and only slightly

|

|||||||

| ©2010 Lufkin Industries, Inc. | Page 20 |

|

Company Investment Profile

|

March 2010

|

|

below the new bookings for the fourth quarter a year ago. Total company backlog at December 31, 2009 was $140.2 million compared to $133.8 million at the end of the 2009 third quarter and $317.5 million in the fourth quarter of last year (Figure 9).

|

||

|

FIGURE 9: ORDER BACKLOG HISTORY COMPARISON ($ IN MILLIONS)

|

||

|

||

|

Pricing remains challenging, and until more idle capacity is returned to production in the oil services sector, management expects pricing pressures to continue. International activity should improve through the first half of 2010, and although Canada has shown increased activity, pricing will probably remain difficult due to foreign product competition. Although Power Transmission bookings showed improvement in January 2010, this may not be indicative of a long-term improvement.

|

||

|

Early Signs of Stabilization in Oilfield Market. On a sequential basis, Oilfield revenues for the fourth quarter of 2009 increased more than 20% to $88.8 million. Although this was down 50% from a year ago, the rebound during the quarter may have been indicative of a recovery in the market off the lows during 2009. Comparing the quarterly performance with the same period last year, the decline in revenues was led by a 62% drop in new pumping unit sales, primarily in North America, mainly reflecting a slow response from major oil company customers. This also impacted sales revenues for pumping unit services and automation products which declined 23% and 45%, respectively, during the quarter. ILS, which was purchased in the first quarter of 2009, contributed $4.4 million to the quarter, a 5.1% decrease from the third quarter of 2009.

|

||

|

Bookings in the Oilfield Division were up 70% sequentially from the third quarter of 2009 to $96.1 million, and were more than five times the level of the first quarter. Approximately 60% of those bookings were for U.S. projects, with the remaining 40% for international. Steadying oil prices in the second half of last year, and expectations for the economic recovery this year, drove a substantial rise in the oil-directed rig count in the U.S. during the fourth quarter, and this is gradually driving an increase in new orders. Domestic strength has been greatest in the Bakken, the Permian Basin, and the heavy oil fields in California. Although the natural gas market remains weak, about 70% to 75% of the Company’s Oilfield revenue is leveraged to oil. Internationally, bookings increased sequentially in Latin America and the Eastern Hemisphere, and there was seasonal strength in Canada.

|

| ©2010 Lufkin Industries, Inc. | Page 21 |

|

Company Investment Profile

|

March 2010

|

|

Power Transmission Orders Lag Recovery. During the 2009 fourth quarter, Power Transmission sales revenues fell approximately 29% to $38 million from the same period a year ago. The decline in revenues was primarily due to large orders for oil and gas projects that continued to be delayed. Gross margin showed a 10% sequential decrease (a 14% year-over-year decrease) due to lower activity levels as well as a less favorable product mix. Through the fourth quarter as well as the month of January 2010, Power Transmission worked reduced hours at U.S. manufacturing plants to adjust to the lower demand.

|

||

|

Bookings in the Power Transmission Division at the end of the 2009 fourth quarter rose 13% sequentially to $37 million from the third quarter of 2009 but were down 23% from a year ago.

|

||

|

Liquidity

|

||

|

Lufkin’s healthy balance sheet, which carries minimal debt, should provide the financial flexibility to make continued capital investments in expanding manufacturing capacity and its service network in addition to seeking accretive acquisitions. The Company’s three-year, unsecured credit facility of $40 million with a domestic bank expires on December 31, 2010, and as of December 31, 2009, Lufkin had $24.0 million of available borrowing capacity after deducting outstanding letters of credit of $16.0 million. At the end of the 2009 fourth quarter, Lufkin had long term debt of $1.5 million, secured by collateral consisting of its equipment, inventory and accounts receivable, and has current debt of $1.4 million on notes it assumed as part of the ILS acquisition.

|

||

|

During the 2009 fourth quarter, Lufkin spent $12.2 million on capital projects and spent $39.8 million for the full year. The Company projects 2010 capital expenditures will meet or exceed 2009 levels.

|

| ©2010 Lufkin Industries, Inc. | Page 22 |

|

Company Investment Profile

|

March 2010

|

Consolidated Balance Sheets

(Fiscal Year)

|

December 31, 2009 and 2008

|

||||||||

|

(Thousands of dollars, except share and per share data)

|

||||||||

|

2009

|

2008

|

|||||||

|

Assets

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 100,858 | $ | 107,756 | ||||

|

Receivables, net

|

92,506 | 139,144 | ||||||

|

Income tax receivable

|

4,303 | 978 | ||||||

|

Inventories

|

110,605 | 128,627 | ||||||

|

Deferred income tax assets

|

5,198 | 4,941 | ||||||

|

Other current assets

|

4,351 | 3,674 | ||||||

|

Current assets from discontinued operations

|

811 | 618 | ||||||

|

Total current assets

|

318,632 | 385,738 | ||||||

|

Property, plant and equipment, net

|

159,770 | 130,079 | ||||||

|

Goodwill, net

|

45,001 | 11,862 | ||||||

|

Other assets, net

|

18,187 | 2,546 | ||||||

|

Long-term assets from discontinued operations

|

- | 493 | ||||||

|

Total assets

|

$ | 541,590 | $ | 530,718 | ||||

|

Liabilities and Shareholders' Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 19,993 | $ | 38,543 | ||||

|

Current portion of long-term debt

|

1,372 | - | ||||||

|

Accrued liabilities:

|

||||||||

|

Payroll and benefits

|

9,568 | 14,046 | ||||||

|

Warranty expenses

|

4,220 | 3,586 | ||||||

|

Taxes payable

|

4,562 | 5,894 | ||||||

|

Other

|

24,147 | 25,340 | ||||||

|

Current liabilities from discontinued operations

|

1,026 | 1,404 | ||||||

|

Total current liabilities

|

64,888 | 88,813 | ||||||

|

Long-term debt

|

1,516 | - | ||||||

|

Deferred income tax liabilities

|

10,950 | 9,219 | ||||||

|

Postretirement benefits

|

7,874 | 7,070 | ||||||

|

Other liabilities

|

20,647 | 11,618 | ||||||

|

Commitments and contingencies

|

- | - | ||||||

|

Long-term liabilities from discontinued operations

|

37 | 61 | ||||||

|

Shareholders' equity:

|

||||||||

|

Common stock, $1.00 par value per share; 60,000,000 shares authorized; 15,808,588 and 15,791,963 shares issued , respectively

|

15,809 | 15,792 | ||||||

|

Capital in excess par

|

70,508 | 63,014 | ||||||

|

Retained earnings

|

421,908 | 414,748 | ||||||

|

Treasury stock, 923,168 and 931,168 shares, respectively, at cost

|

(34,621 | ) | (34,917 | ) | ||||

|

Accumulated other comprehensive income (loss)

|

(37,926 | ) | (44,700 | ) | ||||

|

Total shareholders' equity

|

435,678 | 413,937 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 541,590 | $ | 530,718 | ||||

| ©2010 Lufkin Industries, Inc. | Page 23 |

|

Company Investment Profile

|

March 2010

|

Consolidated Statements of Earnings

(Fiscal Year)

|

Years ended December 31, 2009, 2008 and 2007

|

||||||||||||

|

(Thousands of dollars, except per share data)

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Sales

|

$ | 521,359 | $ | 741,194 | $ | 555,806 | ||||||

|

Cost of sales

|

408,815 | 527,120 | 393,538 | |||||||||

|

Gross profit

|

112,544 | 214,074 | 162,268 | |||||||||

|

Selling, general and administrative expenses

|

75,120 | 71,974 | 57,582 | |||||||||

|

Litigation reserve

|

6,000 | 6,000 | - | |||||||||

|

Operating income

|

31,424 | 136,100 | 104,686 | |||||||||

|

Interest income

|

899 | 1,737 | 3,751 | |||||||||

|

Interest expense

|

(650 | ) | (193 | ) | (273 | ) | ||||||

|

Other income (expense), net

|

1,339 | (1,232 | ) | 1,294 | ||||||||

|

Earnings from continuing operations before income tax provision

|

33,012 | 136,412 | 109,458 | |||||||||

|

Income tax provision

|

10,533 | 48,387 | 37,673 | |||||||||

|

Earnings from continuing operations

|

22,479 | 88,025 | 71,785 | |||||||||

|

(Loss) earnings from discontinued operations, net of tax

|

(453 | ) | 214 | 2,426 | ||||||||

|

Net earnings

|

$ | 22,026 | $ | 88,239 | $ | 74,211 | ||||||

|

Basic earnings per share

|

||||||||||||

|

Earnings from continuing operations

|

$ | 1.51 | $ | 5.96 | $ | 4.82 | ||||||

|

(Loss) earnings from discontinued operations

|

(0.03 | ) | 0.01 | 0.16 | ||||||||

|

Net earnings

|

$ | 1.48 | $ | 5.97 | $ | 4.98 | ||||||

|

Diluted earnings per share

|

||||||||||||

|

Earnings from continuing operations

|

$ | 1.51 | $ | 5.91 | $ | 4.76 | ||||||

|

(Loss) earnings from discontinued operations

|

(0.03 | ) | 0.01 | 0.16 | ||||||||

|

Net earnings

|

$ | 1.48 | $ | 5.92 | $ | 4.92 | ||||||

| ©2010 Lufkin Industries, Inc. | Page 24 |

|

Company Investment Profile

|

March 2010

|

Consolidated Statements of Cash Flows

(Fiscal Year)

|

Years ended December 31, 2009, 2008 and 2007

|

||||||||||||

|

(Thousands of dollars)

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Cash flows form operating activities:

|

||||||||||||

|

Net earnings

|

$ | 22,026 | $ | 88,239 | $ | 74,211 | ||||||

|

Adjustments to reconcile net earnings to cash provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

18,457 | 15,699 | 14,008 | |||||||||

|

(Recovery) provision for losses on receivables

|

(1,840 | ) | 2,508 | 11 | ||||||||

|

LIFO (income) expense

|

(2,964 | ) | 7,742 | 1,905 | ||||||||

|

Deferred income tax (benefit)/provision

|

(913 | ) | (3 | ) | 7,250 | |||||||

|

Excess tax benefit from share-based compensation

|

(259 | ) | (4,140 | ) | (3,031 | ) | ||||||

|

Share-based compensation expense

|

2,943 | 3,584 | 3,682 | |||||||||

|

Pension expense (income)

|

10,665 | (1,274 | ) | (3,257 | ) | |||||||

|

Postretirement expense (income)

|

539 | (48 | ) | (400 | ) | |||||||

|

(Gain) loss on disposition of property, plant and equipment

|

(354 | ) | 27 | (636 | ) | |||||||

|

Loss (income) from discontinued operations

|

453 | (214 | ) | (2,426 | ) | |||||||

|

Changes in:

|

||||||||||||

|

Receivables, net

|

58,461 | (52,554 | ) | (2,928 | ) | |||||||

|

Income tax receivable

|

(3,248 | ) | 1,409 | (4,573 | ) | |||||||

|

Inventories

|

28,650 | (46,151 | ) | (15,596 | ) | |||||||

|

Other current assets

|

(1,376 | ) | (2,144 | ) | 177 | |||||||

|

Accounts payable

|

(22,878 | ) | 24,201 | 7,788 | ||||||||

|

Accrued liabilities

|

(6,531 | ) | 12,060 | 13,532 | ||||||||

|

Net cash provided by continuing operations

|

101,831 | 48,941 | 89,717 | |||||||||

|

Net cash (used in) provided by discontinued operations

|

- | (1,813 | ) | 593 | ||||||||

|

Net cash provided by operating activities

|

101,831 | 47,128 | 90,310 | |||||||||

|

Cash flows from investing activites:

|

||||||||||||

|

Additions to property, plant and equipment

|

(39,825 | ) | (29,552 | ) | (18,815 | ) | ||||||

|

Proceeds from disposition of property, plant and equipment

|

923 | 219 | 1,383 | |||||||||

|

(Increase) decrease in other assets

|

(1,216 | ) | 579 | (64 | ) | |||||||

|

Acquisition of other companies

|

(51,658 | ) | - | - | ||||||||

|

Net cash used in continuing operations

|

(91,776 | ) | (28,754 | ) | (17,496 | ) | ||||||

|

Net cash provided by (used in) discontinued operations

|

- | 1,813 | (593 | ) | ||||||||

|

Net cash used in investing activities

|

(91,776 | ) | (26,941 | ) | (18,089 | ) | ||||||

|

Cash flows from financing activites:

|

||||||||||||

|

Payments of notes payable

|

(3,426 | ) | - | - | ||||||||

|

Dividends paid

|

(14,866 | ) | (14,806 | ) | (13,094 | ) | ||||||

|

Excess tax benefit from share-based compensation

|

259 | 4,140 | 3,031 | |||||||||

|

Proceeds from exercise of stock options

|

612 | 8,295 | 3,467 | |||||||||

|

Purchases of treasury stock

|

11 | (4,623 | ) | (27,497 | ) | |||||||

|

Net cash used in financing activities

|

(17,410 | ) | (6,994 | ) | (34,093 | ) | ||||||

|

Effect of translation on cash and cash equivalents

|

457 | (1,185 | ) | (177 | ) | |||||||

|

Net (decrease) increase in cash and cash equivalents

|

(6,898 | ) | 12,008 | 37,951 | ||||||||

|

Cash and cash equivalents at beginning of period

|

107,756 | 95,748 | 57,797 | |||||||||

|

Cash and cash equivalents at end of period

|

$ | 100,858 | $ | 107,756 | $ | 95,748 | ||||||

| ©2010 Lufkin Industries, Inc. | Page 25 |

|

Company Investment Profile

|

March 2010

|

|

V. Glossary

|

||

|

Artificial Lift

|

The use of artificial means, such as a mechanical device (rod pump or velocity string), to increase the flow of liquids, such as crude oil or water, from a production well. Artificial lift is needed in wells when there is insufficient pressure in the reservoir to lift the produced fluids to the surface, but often used in naturally flowing wells to increase the flow rate.

|

|

|

Bearings

|

Highly engineered, precision-made components enabling machinery to move at extremely high speeds and carry remarkable loads with ease and efficiency due to the reduced friction of incorporating a “rolling” component such as metal balls or rollers versus direct contact between two surfaces. Bearings must be able to offer high precision, reliability and durability, as well as the ability to rotate at high speeds with minimal noise and vibration. Parts that twist, turn or move frequently require a bearing.

|

|

|

Carburizing

|

A heat treatment process in which iron or steel is heated in the presence of a gaseous, liquid, solid or plasma source of carbon with a lower melting point, liberating the carbon as it decomposes. Once cooled, the outer surface of the metal will have higher carbon content, making it harder and giving the metal increased wear resistance; however, the inner core will retain its soft and tough properties, yielding better fatigue/tensile characteristics.

|

|

|

Couplings

|

Power transmission couplings join two shafts together at their ends for the purpose of transmitting power. Couplings are widely used for the modification of stiffness and damping (reducing vibration) in power transmission systems, both in torsion or twisting motions and in other directions (misalignment compensation).

|

|

|

ESP

|