Attached files

| file | filename |

|---|---|

| 8-K - 8K INVESTOR PRESENTATION - JUNIPER PHARMACEUTICALS INC | form8k.htm |

1

Corporate Presentation April 2010

Frank Condella, Interim CEO

Larry Gyenes, CFO

2

This presentation contains forward-looking statements, which statements are indicated by the words “may,” “will,”

“plans,” “believes,” “expects,” “anticipates,” “potential,” and similar expressions. Such forward-looking statements

involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially

from those projected in the forward-looking statements.

“plans,” “believes,” “expects,” “anticipates,” “potential,” and similar expressions. Such forward-looking statements

involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially

from those projected in the forward-looking statements.

Factors that might cause future results to differ include, but are not limited to, the following: approval of the sale of the

assets and other matters contemplated by the Purchase and Collaboration Agreement with Watson Pharmaceuticals,

Inc. by Columbia's stockholders; the successful marketing of CRINONE® (progesterone gel) and STRIANT®

(testosterone buccal system) in the United States; the successful marketing of CRINONE by Merck Serono; the timely

and successful completion of the ongoing Phase III PREGNANT (PROCHIEVE Extending GestatioN A New Therapy)

Study of PROCHIEVE® 8% (progesterone gel) to reduce the risk of preterm birth in women with a short cervix in mid-

pregnancy; successful development of a next-generation vaginal progesterone product; success in obtaining

acceptance and approval of new products and new indications for current products by the United States Food and

Drug Administration and international regulatory agencies; the impact of competitive products and pricing; our ability

to obtain financing in order to fund our operations and repay our debt as it becomes due; the timely and successful

negotiation of partnerships or other transactions; the strength of the United States dollar relative to international

currencies, particularly the euro; competitive economic and regulatory factors in the pharmaceutical and healthcare

industry; general economic conditions; and other risks and uncertainties that may be detailed, from time-to-time, in

Columbia’s reports filed with the SEC.

assets and other matters contemplated by the Purchase and Collaboration Agreement with Watson Pharmaceuticals,

Inc. by Columbia's stockholders; the successful marketing of CRINONE® (progesterone gel) and STRIANT®

(testosterone buccal system) in the United States; the successful marketing of CRINONE by Merck Serono; the timely

and successful completion of the ongoing Phase III PREGNANT (PROCHIEVE Extending GestatioN A New Therapy)

Study of PROCHIEVE® 8% (progesterone gel) to reduce the risk of preterm birth in women with a short cervix in mid-

pregnancy; successful development of a next-generation vaginal progesterone product; success in obtaining

acceptance and approval of new products and new indications for current products by the United States Food and

Drug Administration and international regulatory agencies; the impact of competitive products and pricing; our ability

to obtain financing in order to fund our operations and repay our debt as it becomes due; the timely and successful

negotiation of partnerships or other transactions; the strength of the United States dollar relative to international

currencies, particularly the euro; competitive economic and regulatory factors in the pharmaceutical and healthcare

industry; general economic conditions; and other risks and uncertainties that may be detailed, from time-to-time, in

Columbia’s reports filed with the SEC.

Completion of the sale of the assets under the Purchase and Collaboration Agreement with Watson Pharmaceuticals,

Inc. is subject to various conditions to closing, and there can be no assurance those conditions will be satisfied or that

such sale or other transactions will be completed on the terms described in the Purchase and Collaboration

Agreement or other agreements related thereto or at all. All forward-looking statements contained herein are neither

promises nor guarantees. Columbia does not undertake any responsibility to revise or update any forward-looking

statements contained herein.

Inc. is subject to various conditions to closing, and there can be no assurance those conditions will be satisfied or that

such sale or other transactions will be completed on the terms described in the Purchase and Collaboration

Agreement or other agreements related thereto or at all. All forward-looking statements contained herein are neither

promises nor guarantees. Columbia does not undertake any responsibility to revise or update any forward-looking

statements contained herein.

3

} Specialty pharmaceutical company leveraging our

bioadhesive drug delivery system and clinical expertise

to develop proprietary products in women’s healthcare

bioadhesive drug delivery system and clinical expertise

to develop proprietary products in women’s healthcare

} CRINONE® 8% progesterone vaginal gel

◦ Sold worldwide for use in infertility treatments

} CRINONE/PROCHIEVE® 8% gel

◦ Currently in pivotal Phase III trial to reduce the risk of preterm

birth in women with short cervix

birth in women with short cervix

◦ Enrollment to complete in Q2 2010

◦ Data available around end of 2010

4

Frank C. Condella, Jr. -- Interim Chief Executive Officer /Board Member

• Chairman of SkyePharma ; Director of Fulcrum Pharma plc.

• Formerly CEO of SkyePharma; IVAX Corporation; Faulding Pharmaceutical Co.;

Hoffman-La Roche.

Hoffman-La Roche.

Robert S. Mills -- President and Chief Operating Officer

• Formerly SVP, manufacturing Operations, Watson Pharmaceuticals;

Alphapharma, Inc.; Aventis, SA

Alphapharma, Inc.; Aventis, SA

Lawrence A. Gyenes -- Senior Vice President, Chief Financial Officer and Treasurer

• Formerly CFO at Acusphere; Zila; Savient & Reliant; 15 years at Searle

Michael McGrane -- Senior Vice President, General Counsel and Secretary

• Formerly General Counsel, The Liposome Co.; Novartis Consumer Health

•George W. Creasy, MD -- Vice President, Clinical Research and Development

• Formerly spent 16 years Johnson & Johnson; Fellow of the American College of

Obstetricians and Gynecologists.

Obstetricians and Gynecologists.

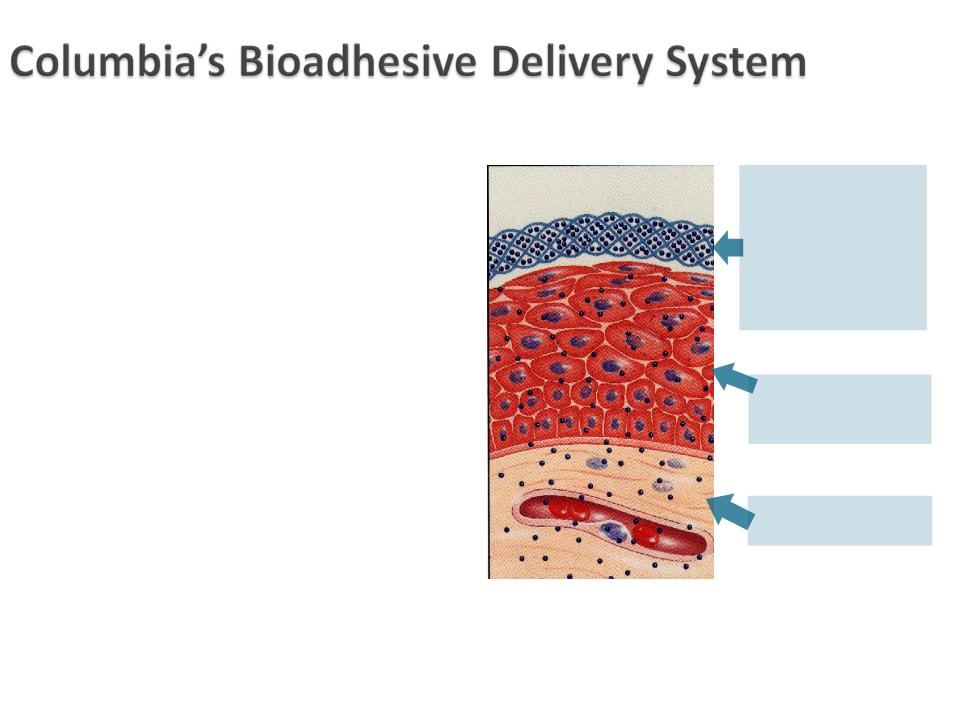

} Technology that uses bioadhesion to

administer medication to patients in a

targeted fashion

administer medication to patients in a

targeted fashion

} Polycarbophil-based, non-immunogenic

(hypo-allergenic) polymer

(hypo-allergenic) polymer

} Adheres to mucosal surface and discharged

upon normal cell turnover

upon normal cell turnover

◦ Oral mucosa for up to 24 hours

◦ Vaginal epithelium for 72+ hours

} Enables controlled and sustained drug

release

release

} Able to deliver broad range of compounds

to address numerous therapeutic areas

to address numerous therapeutic areas

Polycarbophil: a water-

swellable, water-

insoluble polymer with

numerous negative

charges that

swellable, water-

insoluble polymer with

numerous negative

charges that

permit hydrogen

bonding with the cell

surface

bonding with the cell

surface

Active entrapped in the

cross-linked polymer

polycarbophil

cross-linked polymer

polycarbophil

Sustained release of

active to tissue

active to tissue

6

*2008 net revenues include $2.9 million in previously deferred revenue for

STRIANT licensing fees from Ardana as a results of its bankruptcy in Q2 2008.

STRIANT licensing fees from Ardana as a results of its bankruptcy in Q2 2008.

*

7

|

Millions

|

2007

|

2008

|

2009

|

|

Net revenues

|

$29.6

|

$36.2*

|

$32.2

|

|

Cost of revenues

|

(9.0)

|

(10.9)

|

(9.2)

|

|

Gross Profit

|

20.6

|

25.3

|

23.0

|

|

Selling & distribution

|

10.1

|

12.7

|

12.0

|

|

General & administrative

|

7.8

|

8.6

|

10.6

|

|

Research & development

|

5.8

|

6.2

|

8.6

|

|

Amortization of licensing right

|

5.0

|

5.0

|

5.0

|

|

Loss from operations

|

(8.1)

|

(7.3)

|

(13.2)

|

|

Interest expense

|

(7.9)

|

(7.9)

|

(8.9)

|

|

Net loss

|

(14.3)

|

(14.1)

|

(21.9)

|

|

Earnings (loss) per share

|

$(0.28)

|

$(0.27)

|

$(0.39)

|

*2008 net revenues include $2.9 million in previously deferred revenue for

STRIANT licensing fees from Ardana as a results of its bankruptcy in Q2 2008.

STRIANT licensing fees from Ardana as a results of its bankruptcy in Q2 2008.

8

|

Nasdaq: CBRX

|

|

|

Recent market price (4/6/2010)

|

$1.04

|

|

Market capitalization

|

$68.2 million

|

|

Cash and equivalents (12/31/2009)

|

$14.8 million

|

|

Debt obligations

|

|

|

PharmaBio royalty loan due 11/30/2010 (extendable one year)

|

$16.4 million

|

|

Subordinated 8% convertible notes due 12/31/2011

(convertible @ $5.25) |

$40.0 million

|

9

10

$300+ Million Total Market Opportunity

11

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

$16,000,000

$18,000,000

2006

2007

2008

2009

CRINONE 8%

12

} Brigham and Women’s study compared CRINONE vs. IM

progesterone in 440 women

progesterone in 440 women

◦ Similar pregnancy rates and outcomes

◦ CRINONE was significantly better tolerated than IM progesterone

◦ Added CRINONE to protocol in preferred position

} Berger analysis compared the efficacy of luteal

supplementation with 3 different progesterone preparations

in women aged 35-40 undergoing IVF-FET

supplementation with 3 different progesterone preparations

in women aged 35-40 undergoing IVF-FET

◦ Clinical pregnancy rates were comparable

◦ Once daily CRINONE may improve compliance

} Toner study found bleeding is rare in IVF patients who

become pregnant when treated with CRINONE + estrogen

become pregnant when treated with CRINONE + estrogen

13

14

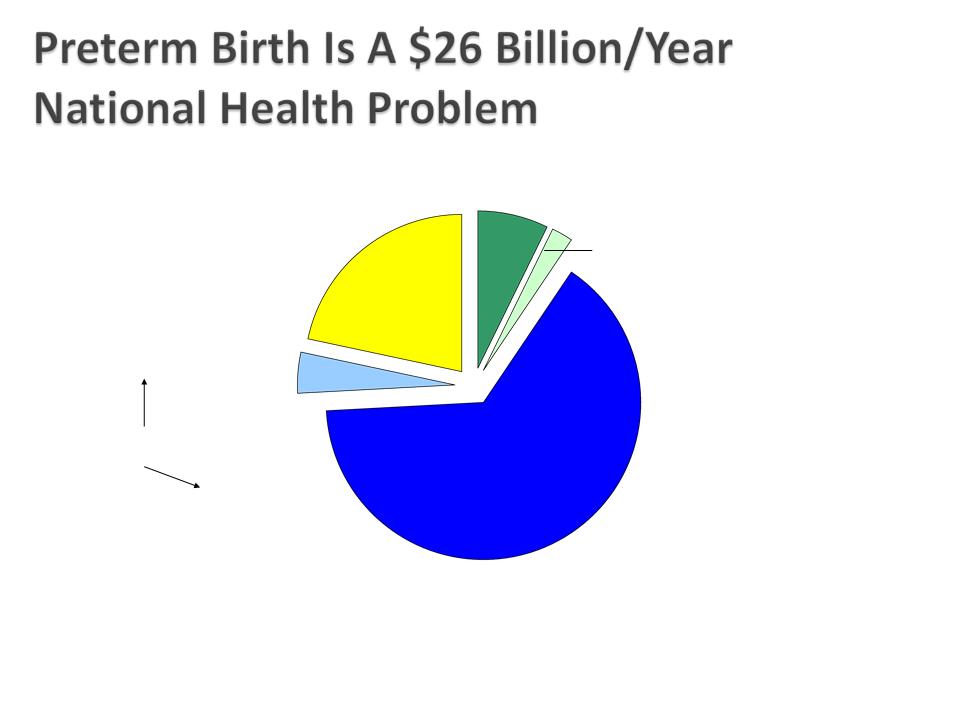

} Studies have shown that “short cervix” is the most

powerful predictor of preterm birth

powerful predictor of preterm birth

} Cervical length should be measured in pregnant women

at mid-pregnancy

at mid-pregnancy

} A cervix of <3.0cm at 18-22 weeks is considered “short”

} Progesterone is the most promising treatment to reduce

risk of PTB and improve infant outcomes in women with

a short cervix

risk of PTB and improve infant outcomes in women with

a short cervix

Behrman RE et al. In: Behrman RE, Butler AS, eds. Preterm Birth: Causes, Consequences, and Prevention.

Washington, DC: The National Academies Press; 2006:329-354.

Washington, DC: The National Academies Press; 2006:329-354.

Lost household and

market productivity

market productivity

$5.7 billion

Maternal delivery costs

$1.9 billion

Children’s early intervention

services

services

$611 million

Infant Costs

Special education services

$1.1 billion

Medical care services

$16.9 billion

~$51,600 Per Preterm Infant

16

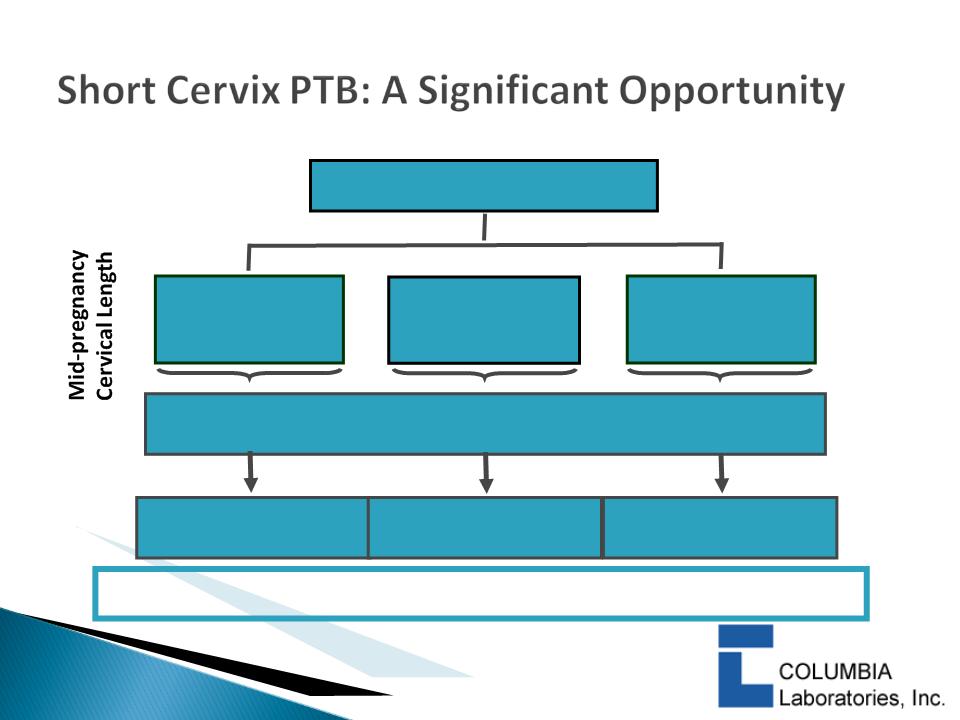

$1.7+ Billion Total U.S. Market Opportunity

$225+ million market

potential

potential

4.3 Million Births Annually

>2.5 - 3.0 cm

(20%)

(20%)

$1.1+ billion

market potential

> 2.0 - 2.5 cm

(6%)

(6%)

1.0 - 2.0 cm

(4%)

(4%)

$340+ million market

potential

potential

16 weeks X $83.31 week =

$1,333 per patient

17

} Phase III clinical trial

◦ Double-blind, placebo controlled

◦ 450 pregnant women with cervical length 1.0-2.0cm

◦ ~40 centers (U.S. and abroad)

◦ Primary endpoint: a reduction in preterm births at ≤32 6/7

weeks vs. placebo

weeks vs. placebo

◦ Improved infant outcomes important secondary endpoint

} NIH participation

◦ Validates science and design of trial

18

} Currently enrolled 426 patients as of 4/7/10

} Complete patient enrollment Q2 2010

} Last infant is born Q4 2010

} Report study outcomes Y/E 2010

} File with FDA* 2011

} FDA decision* 2011/2012**

*Assuming positive outcome

**PDUFA limits review time to 10 months; could shorten

to 6 months if granted priority review

to 6 months if granted priority review

19

progesterone

placebo

33 investigators

n=116 (58 Prochieve, 58 Placebo)

As Cervical Length Decreases, The Benefit Of

Treatment Increases

Treatment Increases

Baseline Cervical Length ≤ 3.0 cm

Baseline Cervical Length < 2.8 cm

progesterone

placebo

22 Investigators

N=46 (19 Prochieve, 27 Placebo)

Fishers Exact Test

at <32 weeks*:

at <32 weeks*:

(p = 0.014)

At ≤ 32 Weeks No Preterm Births Were Seen With Prochieve® Vs. 29.6% On Placebo

The Kaplan-Meier method was

used for calculation; (Wilcoxon

P = 0.043).

used for calculation; (Wilcoxon

P = 0.043).

DeFranco et al, Ultrasound Obstet

Gynecol 2007; 30: 697-705

Gynecol 2007; 30: 697-705

20

p=0.016

p=0.077

p=0.16

DeFranco et al, Ultrasound Obstet

Gynecol 2007; 30: 697-705

Gynecol 2007; 30: 697-705

21

DeFranco et al,

Ultrasound Obstet

Gynecol 2007; 30:

697-705

Ultrasound Obstet

Gynecol 2007; 30:

697-705

p=0.013

p=0.026

p=0.05

22

} Progesterone delivery patent à 2013

◦ U.S. Patent No. 5,543,150

◦ Development of a generic would be challenging due to:

– Clinical endpoints (not blood levels) are required to demonstrate bio-

equivalence for a generic gel

equivalence for a generic gel

– A clinical endpoint requires a non-inferiority study in hard-to-treat

infertility subjects

infertility subjects

} Second generation formulation à 2019

◦ U.S. Patent No. 6,248,358

◦ Designed to replace current gel product

◦ Would have certain user benefits over current formulation

◦ Clinical study necessary in approved indications for FDA approval

23

} Progesterone delivery patent à 2013

} Next generation formulation à 2019

} PTB/Short Cervix (patent pending) à 2028

◦ Patent Application No. US-2008/0188829-A1

◦ Claims a method to:

– Identify pregnant women with a short cervix

– Prevent PTB by administering progesterone to minimize the shortening or

effacing of the cervix

effacing of the cervix

– Administer progesterone by any route

– Deliver in a broad range of doses

◦ Includes both natural progesterone & synthetic progestins

◦ Patent applications filed worldwide

24

25

} Watson Pharmaceuticals

◦ Global specialty pharmaceutical company

◦ Branded business focused on Urology & Women’s Health

◦ ~$500 million in branded revenues

◦ $4 billion market capitalization

◦ Field force of 350 calling on OB/GYNs and urologists, plus

specialists focusing on infertility clinics

specialists focusing on infertility clinics

26

} Watson to acquire:

◦ Substantially all of CBRX progesterone assets

◦ 11.2 million shares CBRX common stock

} Watson assumes responsibility for all U.S. sales,

marketing & distribution activities for CRINONE

in infertility

marketing & distribution activities for CRINONE

in infertility

} CBRX continues manufacturing & supply chain

management

management

27

} Watson & CBRX will collaborate on:

◦ Completion of the PREGNANT Study

– CBRX out-of pocket costs capped at $7 million

spent beginning 1/1/2010

spent beginning 1/1/2010

◦ Development of next-generation vaginal

progesterone products for infertility and preterm

birth

progesterone products for infertility and preterm

birth

– Watson will fund development once the

transaction closes

transaction closes

28

} Watson will pay CBRX:

◦ $47 million upfront

◦ Escalating royalties from 10 to 20%

◦ Up to $45.5 million upon CBRX successful completion

of several milestones

of several milestones

} With initial proceeds, CBRX to:

◦ Pre-pay $16 million PharmaBio debt

◦ Retire 100% of the $40 million of 8% convertible notes

29

} Transaction subject to stockholder approval

◦ Needs >50% of voting power in favor

} Preliminary Proxy to SEC on March 19; to stockholders in

April/May

April/May

} Special meeting will be held - likely in May/June

} Columbia’s Board of Directors unanimously recommends

a vote in favor of this transaction

a vote in favor of this transaction

30

} Use new data to drive sales growth of CRINONE in

infertility

infertility

} Close Watson transaction by June

◦ Retire debt in associated transaction

◦ Transition U.S. sales and marketing

◦ Reduce infrastructure costs

} Complete PREGNANT Study

◦ If data is positive, pursue FDA approval of CRINONE/PROCHIEVE for

reducing the risk of preterm birth in women with short cervix

reducing the risk of preterm birth in women with short cervix

} Collaborate with Watson to develop second generation

product to protect long-term royalty stream

product to protect long-term royalty stream

} Establish alternate promotion arrangement for STRIANT

31

• A modest 12% increase in product sales to $17 million

would match the 2009 product contribution margin

would match the 2009 product contribution margin

• The above excludes Merck Serono revenues which

contributed another $9 million in revenues and $6 million in

contribution margin in 2009

contributed another $9 million in revenues and $6 million in

contribution margin in 2009

32

} Collaborate with WPI to maximize preterm birth

opportunity and value for CBRX shareholders

opportunity and value for CBRX shareholders

} Apply proven proprietary drug delivery systems to

develop new products for women’s health needs

develop new products for women’s health needs

} Selectively pursue development opportunities in other

therapeutic areas utilizing platform technologies

therapeutic areas utilizing platform technologies

◦ Expand use of progressive hydration technology for extended

release products

release products

◦ Pursue label expansion for Striant

33

|

Product

|

Indication

|

Clinical Stage

|

|

Crinone/Prochieve 8%

Vaginal Gel

|

Reduce risk of preterm birth in women

with a short cervix in mid-pregnancy |

Pivotal Phase III

|

|

Crinone/Prochieve 8%

Next generation

|

ART (Infertility)

|

Phase I

|

|

Crinone/Prochieve 8%

Next generation

|

Preterm Birth

|

Phase I

|

|

Carbamide Peroxide

Vaginal Tablet

|

Bacterial vaginosis

|

Pre-clinical

|

|

Infertility Product

Subcutaneous

|

Non-progesterone ART

|

Phase I/II

|

|

Testosterone

Vaginal delivery

|

Fibroid reduction

|

Phase I

|

|

Anesthetic

Vaginal Gel

|

Chronic Pelvic Pain (CPP)

|

Phase II

|

34

} Carbamide peroxide for bacterial vaginosis

} In-house development program

◦ Formulation & pre-clinical: approx. 9 months

◦ IND filing

◦ Phase I safety study: approx. 9 months

◦ Phase II proof of concept study: approx. 9 months

◦ Total expected cost: $2.5 million

} Partner for Phase III

35

} Debt reduced; balance sheet strengthened

} Ongoing revenue: potential milestones, royalties from Watson &

Merck Serono, sales of Striant

Merck Serono, sales of Striant

} Reduced operating expenses

} Sufficient cash for operations, completing PREGNANT Study and FDA

filing

filing

} Positive cash flow from preterm birth trial success, filing, and launch

} Lifecycle management program increases likelihood of long term

revenue stream

revenue stream

} CBRX funds new development projects through proof of concept,

then partnered

then partnered

36

} Focused today on:

◦ Building CRINONE sales to infertility market

◦ Developing CRINONE/PROCHIEVE for preterm birth indication

} With stockholder approval of WPI transaction:

◦ CBRX emerges debt free, with a stronger balance sheet

◦ Ongoing royalty revenues from WPI & Merck-Serono, potential milestone

payments, STRIANT sales

payments, STRIANT sales

◦ Significantly lower operating expenses

◦ Burn rate decreases to ~ $1 million per quarter through the completion

of the PREGNANT Study

of the PREGNANT Study

◦ If PREGNANT Study is successful, CBRX will be cash flow & earnings

positive on an annual basis from that point forward

positive on an annual basis from that point forward

37

Corporate Presentation April 2010

Frank Condella, Interim CEO

Larry Gyenes, CFO