Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - TENGION INC | dex231.htm |

| EX-23.2 - CONSENT - TENGION INC | dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 9, 2010.

Registration No. 333-164011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 6

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TENGION, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 2836 | 20-0214813 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2900 Potshop Lane, Suite 100

East Norriton, PA 19403

(610) 292-8364

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Steven Nichtberger, MD

President and Chief Executive Officer

Tengion, Inc.

2900 Potshop Lane, Suite 100

East Norriton, PA 19403

(610) 292-8364

Copies to:

| Kevin T. Collins, Esq. Martin C. Glass, Esq. Jason M. Casella, Esq. Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, NY 10018 Telephone: (212) 813-8800 Facsimile: (212) 355-3333 |

Joseph W. La Barge, Esq. Executive Director and Corporate Counsel Tengion, Inc. 2900 Potshop Lane, Suite 100 East Norriton, PA 19403 (610) 292-8364 |

David W. Pollak, Esq. David C. Schwartz, Esq. Morgan, Lewis & Bockius LLP 101 Park Avenue New York, NY 10178 Telephone: (212) 309-6000 Facsimile: (212) 309-6001 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to such Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated April 9, 2010

6,000,000 Shares

| TENGION, INC.

|

|

Common Stock

$5.00 per share

| •Tengion, Inc. is offering 6,000,000 shares.

•We anticipate that the initial public offering price will be $5.00 per share. |

•This is our initial public offering, and no public market currently exists for our shares.

•Trading symbol: Nasdaq Global Market—TNGN |

This investment involves risk. See “Risk Factors” beginning on page 11.

| Per Share | Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discount |

$ | $ | ||

| Proceeds, before expenses, to Tengion |

$ | $ | ||

Certain of our existing stockholders have indicated an interest in purchasing up to an aggregate of approximately $17.2 million in shares of common stock in this offering at the initial public offering price. The underwriters will receive an underwriting discount and commission of on the sale of shares of common stock to these existing stockholders.

The underwriters have a 30-day option to purchase up to 900,000 additional shares of common stock from us to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved of anyone’s investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Piper Jaffray | Leerink Swann | |

The date of this prospectus is , 2010

Table of Contents

Table of Contents

| Page | ||

| 1 | ||

| 11 | ||

| 31 | ||

| 32 | ||

| 33 | ||

| 34 | ||

| 35 | ||

| 37 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | |

| 57 | ||

| 85 | ||

| 114 | ||

| 116 | ||

| 118 | ||

| 123 | ||

| 125 | ||

| 128 | ||

| 128 | ||

| 128 | ||

| 129 | ||

| F-1 | ||

Unless otherwise stated, all references to “us,” “our,” “Tengion,” “we,” the “Company” and similar designations refer to Tengion, Inc. Tengion® and the Tengion logo® are our registered trademarks and Tengion Neo-Bladder Augment™, Tengion Neo-Urinary Conduit™, Tengion Neo-Bladder Replacement™, Tengion Neo-Vessel™ and Tengion Neo-Kidney™ are our trademarks. Other names are for informational purposes only and may be trademarks of their respective owners.

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. We have not authorized anyone to provide you with additional or different information. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Tengion

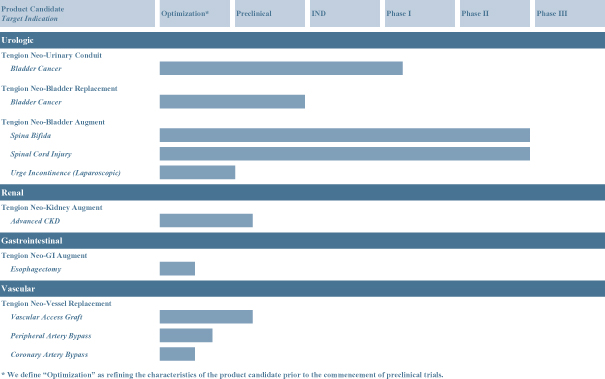

We believe we are the only regenerative medicine company focused on discovering, developing, manufacturing and commercializing a range of replacement organs and tissues, or neo-organs and neo-tissues. We currently create these functional neo-organs and neo-tissues using a patient’s own cells, or autologous cells, in conjunction with our Organ Regeneration Platform. We believe our proprietary product candidates harness the intrinsic regenerative pathways of the body to regenerate organs and tissues that are native-like, or substantially similar to native organs and tissues. We manufacture our product candidates in our scalable facilities using efficient and repeatable proprietary processes and we have implanted our neo-organs in clinical trials. We intend to develop our technology to address unmet medical needs in urologic, renal, gastrointestinal and vascular diseases.

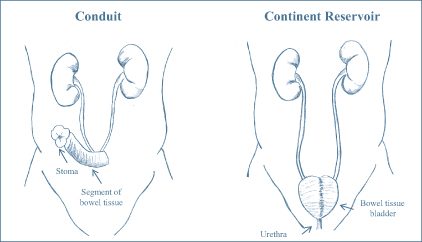

Our lead product candidate, the Neo-Urinary Conduit, is an autologous implant that catalyzes regeneration of native-like bladder tissue for bladder cancer patients requiring a urinary diversion following bladder removal, or cystectomy. This tubular conduit passively transports urine from the ureters, through a hole in the abdomen, or stoma, into a removable, disposable bag, or ostomy bag. We have an effective investigational new drug application, or IND, and in March 2010 we commenced a Phase I clinical trial for this product candidate in bladder cancer patients. We have also applied our technology in two Phase II clinical trials for our Neo-Bladder Augment for the treatment of neurogenic bladder, or dysfunctional bladder due to some form of neurological disease or condition. Our Neo-Urinary Conduit leverages recent advances in our technology platform that enable us to produce this product candidate more quickly and efficiently, and less expensively, than our Neo-Bladder Augment, enabling us to address larger market opportunities. Our product pipeline includes several candidates in early stage development, such as our Neo-Kidney Augment for patients with advanced chronic kidney disease, or CKD.

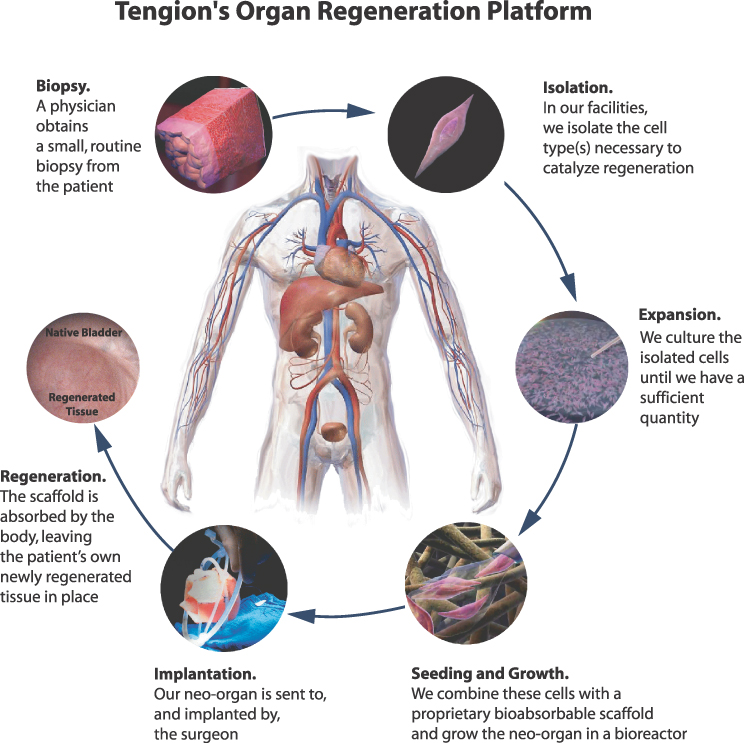

Our Organ Regeneration Platform

Our Organ Regeneration Platform is based on extensive work that began in the early 1990s at Children’s Hospital Boston and Massachusetts Institute of Technology, and continued at the Wake Forest Institute for Regenerative Medicine and our company. This platform, which utilizes intellectual property developed and owned by us and intellectual property licensed from Children’s Medical Center Corporation and Wake Forest University Health Sciences, involves the following steps:

| • | Isolation and expansion. We receive a small tissue sample, generally by routine biopsy, and isolate the necessary committed progenitor cells, which are relevant to a specific organ or tissue type. Committed progenitor cells have not yet developed into a single cell type and retain the ability to promote regeneration. We then use our proprietary cell growth process to grow, or expand, the progenitor cells. |

1

Table of Contents

| • | Seeding and growth. We place, or seed, these expanded cell populations on a bioabsorbable scaffold and put the seeded structure in a bioreactor, or a closed container used for enhancing biological growth under controlled conditions. |

| • | Implantation. The neo-organ or neo-tissue is shipped by a standard overnight courier service and implanted by a surgeon using standard surgical procedures. |

| • | Regeneration. Based on clinical and preclinical data, we believe that our implanted product candidates serve as templates for the body to regenerate native-like organs and tissues. Blood vessels and nerves grow into the implanted neo-organ or neo-tissue and the scaffold is gradually absorbed by the body. In preclinical tests, we have observed that the newly grown tissue integrates with its surroundings and becomes substantially indistinguishable over time from the native organ. Clinical results indicate that the body regulates the growth and development of the organ to ensure that it is not under- or over-developed. |

Our Strategy

Our goal is to become the leading regenerative medicine company focused on the development and commercialization of neo-organs and neo-tissues for a variety of diseases. To achieve this objective, we intend to:

| • | Rapidly advance our Neo-Urinary Conduit. |

| • | Leverage our Organ Regeneration Platform to develop additional neo-organs and neo-tissues, such as our Neo-Kidney Augment. |

| • | Become a fully integrated company with discovery, development, manufacturing and marketing capabilities. |

| • | Selectively pursue strategic partnerships to accelerate and maximize the potential of our product candidates and technology while preserving significant commercial rights. |

Initial Market Opportunities

Bladder Cancer. According to the National Cancer Institute, bladder cancer is the sixth most common form of cancer in the United States with approximately 10,000 cases per year of bladder cancer requiring bladder removal. Following bladder removal, patients require some form of urinary diversion. Most patients are currently treated by using a segment of bowel tissue to construct a conduit for urine to exit from the body into an ostomy bag. In its simplest form, the reconstruction involves creating a tubular structure out of bowel tissue and then connecting it to the ureters at one end and the skin at the other. The other diversionary option for patients is the creation of a continent reservoir out of bowel tissue.

Neurogenic Bladder. Current treatments for neurogenic bladder include medical management through a combination of medication and clean intermittent catheterization and, in advanced cases, surgery. Based upon our analysis of various hospital inpatient and discharge databases, we believe there are approximately 1,200 bladder augmentations using bowel tissue to augment the bladder, or enterocystoplasy, performed in the United States each year and approximately 1,100 in the European Union.

2

Table of Contents

Limitations of Current Therapies

While there is variation across procedures and patient types, there are risks and complications common to all procedures that rely on harvesting bowel tissue and placing it in the urinary tract.

| • | Bowel complications. Complications related to the bowel surgery typically consist of leaks, fistulas and obstructions. The loss of bowel tissue can also result in anemia and neurologic abnormalities. |

| • | Absorption issues. Use of bowel tissue often leads to electrolyte and metabolic imbalances, which can cause bone loss. |

| • | Infection. Persistent and recurrent infections are common in patients with bowel tissue reconstruction. |

| • | Mucus. Bowel tissue repositioned in the urinary tract secretes mucus into the urine. |

| • | Cancer. Malignancy, although rare, is a well-recognized complication following enterocystoplasty. |

Our Solutions

The Tengion Neo-Urinary Conduit

Our lead product candidate, the Neo-Urinary Conduit, is intended to replace the use of bowel tissue in bladder cancer patients requiring a non-continent urinary diversion after bladder removal. We expect that this product candidate will avoid complications such as urine absorption, infection and mucus secretion associated with the use of bowel tissue in the urinary tract, as well as the issues and complications that may arise from the surgical procedure involved in harvesting bowel tissue. Our Neo-Urinary Conduit is produced using smooth muscle cells from a routine fat biopsy and not cells from the diseased bladder, eliminating the risk of reintroducing cancerous cells from the bladder into the patient. We have an effective IND and in March 2010 we commenced a single-center Phase I clinical trial in bladder cancer patients. This trial is an open-label, single-arm study in up to five patients, which will allow optimization of the surgical procedure and post-surgical care in a controlled setting. While we have not explored later stage development with the Food and Drug Administration, or FDA, we believe that if this first study is successful, we may be able to move directly to a pivotal study as the next step in our regulatory pathway for our Neo-Urinary Conduit.

Principal observations of our Neo-Urinary Conduit in preclinical animal models have shown that:

| • | Implantation of our Neo-Urinary Conduit results in the formation of a functional conduit. |

| • | By three months post-implantation, the scaffold is replaced by native-like bladder tissue consisting of urothelium, submucosa and smooth muscle cells. |

| • | There is no evidence of abnormal cell growth, tissue development or immune response, or adverse systemic effects. |

| • | Our Neo-Urinary Conduit regenerates native-like bladder tissue with complete mucosal lining at the ureteral and skin junctions. |

These studies suggest that our Neo-Urinary Conduit may be safe and effective for treating patients who are undergoing cystectomy.

3

Table of Contents

Development of our Neo-Urinary Conduit came as a natural extension of our clinical development experience with our Organ Regeneration Platform in two Phase II studies for our Neo-Bladder Augment. We believe important improvements in our Organ Regeneration Platform, made concurrently with the development of our Neo-Bladder Augment, will simplify the development of our Neo-Urinary Conduit and enhance its commercialization prospects. Only one cell type, smooth muscle cells, is needed for our Neo-Urinary Conduit, compared to two cell types used in our Neo-Bladder Augment, simplifying the procedure and reducing both cost and production time by approximately 50%. We can now produce our Neo-Urinary Conduit in four weeks or less, enabling us to meet the typical clinical timeline for bladder cancer patients undergoing cystectomy. Patients receiving a conduit represent a market approximately ten times larger than that for neurogenic bladder augmentation. As a result, we are devoting a significant portion of our resources to completing the development of our Neo-Urinary Conduit.

The Tengion Neo-Bladder Replacement

We believe that our Neo-Bladder Replacement, similar to our Neo-Urinary Conduit, will enable patients to avoid the complications associated with removal of bowel tissue and its subsequent use as a bladder replacement. Our Neo-Bladder Replacement, when implanted in the body, is intended to serve as a template that recruits other cells to develop a regenerated bladder. Principal observations of our Neo-Bladder Replacement in large animal models were consistent with those of our Neo-Urinary Conduit, and also showed:

| • | All animals demonstrate continence upon removal of the catheter 21 days after surgery. |

| • | Implantation of our Neo-Bladder Replacement results in the formation of a compliant and functional bladder, with demonstrated nerve growth into the tissue. |

| • | The regenerated bladder achieves volumes typical of a native bladder and demonstrates an increase in capacity to accommodate animal growth. |

Based upon these preclinical studies, we believe our Neo-Bladder Replacement may provide patients with a functioning replacement bladder, thus enabling them to void urine with no need for a stoma or ostomy bag. We believe we have completed all preclinical development necessary to prepare an IND for our Neo-Bladder Replacement.

The Tengion Neo-Bladder Augment

Our Neo-Bladder Augment is intended to supplement the patient’s existing bladder and promote regeneration of healthy bladder tissue in patients suffering from neurogenic bladder. Based upon the long-term data obtained as part of an academic clinical experience published in The Lancet, a leading medical journal, and the results of our Phase II clinical trials, we believe our Neo-Bladder Augment may provide the benefits of enterocystoplasty without many of the associated complications. We currently create our Neo-Bladder Augment by seeding a combination of urothelium and smooth muscle cells cultured by our scientists from the patient’s bladder onto our proprietary bioabsorbable scaffold.

We have conducted two open-label, multi-center Phase II clinical trials of our Neo-Bladder Augment for the treatment of neurogenic bladder in pediatric and adult patients. These trials confirmed that we can translate the academic experience underlying our platform technology into standardized and repeatable processes that we believe are scalable to commercial manufacturing

4

Table of Contents

processes. Based upon our experience with our Neo-Urinary Conduit, we now have the ability to develop urologic neo-organs and neo-tissues using only smooth muscle cells. We intend to explore the application of this and other enhancements to our Neo-Bladder Augment.

In February 2009, the FDA placed our IND for our Neo-Bladder Augment on clinical hold as a result of certain serious adverse events. Two pediatric patients had experienced small bowel obstructions, one of whom had developed a bladder infection, and both of whom subsequently experienced a perforation of the bladder resulting in leakage of urine through the bladder wall. We submitted a complete response to the FDA in June 2009, noting among other things that these serious adverse events are known complications of enterocystoplasty, the current standard of care for these patients. The FDA released the clinical hold in July 2009 with no recommended changes to our protocol, product candidate or implantation procedure. A third serious adverse event, occurring in October 2009, involved an adult patient who experienced a bladder perforation resulting in leakage through the bladder wall during the insertion of a catheter into the bladder as part of an evaluation performed in our clinical study. We submitted a report of this event to the FDA in November 2009, noting that this serious adverse event is not an unexpected complication for these patients undergoing urodynamic procedures. The patients experiencing the first and third serious adverse events have fully recovered medically. The patient experiencing the bacterial infection continues, as of March 2010, to have an indwelling catheter, but has otherwise recovered medically.

Other Product Opportunities

We are leveraging our Organ Regeneration Platform to develop a range of additional neo-organs.

| • | Neo-Kidney Augment. Our Neo-Kidney Augment is designed to prevent or delay the need for dialysis or kidney transplant by improving renal function in patients with advanced chronic kidney disease, or CKD. We intend to use the patient’s kidney cells, procured by a needle biopsy, to create a product candidate that is implanted into the failing kidney and catalyzes the regeneration of functional kidney tissue. We have demonstrated the ability to prevent renal failure in animals and we have also isolated and characterized the necessary cells from healthy and diseased human kidneys, which we believe supports translation of this approach to human patients. We began a proof-of-concept study of our Neo-Kidney Augment in large animals earlier this year. |

| • | Neo-GI Augment. Our Neo-GI Augment is composed of smooth muscle cells seeded on our proprietary bioabsorbable scaffold, intended to be used as a tubular or patch implant. Our objective is to demonstrate that our product candidate regenerates native-like esophagus and intestinal tissues. |

| • | Neo-Vessel Replacement. Our Neo-Vessel Replacement is intended to regenerate a native-like blood vessel as an alternative to synthetic arterio-venous grafts and for use in other vascular applications. |

5

Table of Contents

Selected Risk Factors

Investing in our common stock involves substantial risk. Before participating in this offering, you should carefully consider all of the information in this prospectus, including risks discussed in “Risk Factors” beginning on page 11. Some of our most significant risks are:

| • | Our recurring losses from operations have raised substantial doubt regarding our ability to continue as a going concern. |

| • | We have a history of operating losses and we may not achieve or sustain profitability. As of December 31, 2009, we had an accumulated deficit of $181.6 million. We had net losses of $31.0 million, $42.4 million and $29.8 million in the years ended December 31, 2007, 2008 and 2009, respectively. |

| • | We have $22.3 million of outstanding debt as of December 31, 2009. This debt exposes us to risks that could adversely affect our business, operating results and financial condition. |

| • | If we do not successfully develop our product candidates and obtain the necessary marketing approvals to commercialize them, we will not generate sufficient revenues to continue our business operations. |

| • | Our product development programs are based on novel technologies and are inherently risky. |

| • | Our clinical trials may not be successful. |

| • | We cannot market and sell our product candidates in the United States or in other countries if we fail to obtain the necessary marketing approvals or licensure. |

| • | We have only limited experience manufacturing our product candidates. We may not be able to manufacture our product candidates in quantities sufficient for our clinical trials and/or any commercial launch of our product candidates. |

| • | If we are unable to obtain and maintain protection for our intellectual property, the value of our technology and product candidates will be adversely affected. |

6

Table of Contents

| Common stock offered | 6,000,000 shares of common stock (or 6,900,000 shares if the underwriters exercise their over-allotment option in full). | |

| Common stock to be outstanding after this offering | 12,353,536 shares of common stock (or 13,253,536 shares if the underwriters exercise their over-allotment option in full). | |

| Use of proceeds | We expect to use the net proceeds from this offering to fund our research and development activities, including clinical trials for our Neo-Urinary Conduit and preclinical research and development activities for our Neo-Kidney Augment, to maintain our manufacturing facilities, to service and repay our debt and for working capital and other general corporate purposes. | |

| Nasdaq Global Market symbol | TNGN | |

The number of shares of common stock to be outstanding after this offering is based on 6,353,536 shares outstanding as of December 31, 2009 and excludes:

| • | 712,373 shares of common stock issuable upon the exercise of options outstanding as of December 31, 2009 at a weighted average exercise price of $1.00 per share; |

| • | 114,342 shares of common stock issuable upon the exercise of warrants outstanding as of December 31, 2009 at a weighted average exercise price of $23.91 per share; and |

| • | 1,650,000 shares of our common stock reserved for future issuance under our 2010 Stock Incentive Plan. |

Except as otherwise indicated, all information in this prospectus assumes:

| • | the conversion of all outstanding shares of our redeemable convertible preferred stock, or preferred stock, into 5,651,955 shares of common stock; |

| • | no exercise of the underwriters’ over-allotment option; |

| • | our 1-for-14.5 reverse stock split effected on March 24, 2010; and |

| • | the filing of an amended and restated certificate of incorporation and the adoption of our amended and restated bylaws prior to the closing of the offering. |

7

Table of Contents

Certain of our existing stockholders have indicated an interest in purchasing up to an aggregate of approximately $17.2 million in shares of common stock in this offering at the initial public offering price. Because indications of interest are not binding agreements or commitments to purchase, these stockholders may elect not to purchase any shares in this offering.

Corporate Information

We were founded in July 2003 as a Delaware corporation. Our corporate offices are located at 2900 Potshop Lane, Suite 100, East Norriton, PA 19403, and our telephone number is (610) 292-8364. Our website address is www.tengion.com. Information on our website is not incorporated into this prospectus and should not be relied upon in determining whether to make an investment in our common stock.

8

Table of Contents

The following summary financial data should be read in conjunction with “Selected Financial Information and Other Data,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus. Our summary statement of operations data for the years ended December 31, 2007, 2008 and 2009, and for the period from July 10, 2003 (inception) through December 31, 2009 have been derived from our audited financial statements included elsewhere in this prospectus. The pro forma balance sheet data reflect the automatic conversion of all outstanding shares of preferred stock into common stock and the reclassification of the preferred stock warrant liability to stockholders’ equity (deficit) upon the completion of this offering.

The pro forma as adjusted balance sheet data reflect the pro forma balance sheet data at December 31, 2009 adjusted for the sale of 6,000,000 shares of our common stock in this offering at the initial offering price of $5.00 per share, after deducting the estimated underwriting discounts, commissions and offering expenses payable by us.

| Year Ended December 31, | July 2003 (inception) through December 31, |

|||||||||||||||

| 2007 | 2008 | 2009 | 2009 | |||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

$ | 22,335 | $ | 27,947 | $ | 17,948 | $ | 91,709 | ||||||||

| General and administrative |

5,290 | 7,467 | 5,527 | 28,670 | ||||||||||||

| Depreciation |

3,678 | 4,716 | 4,937 | 15,149 | ||||||||||||

| Operating loss |

(31,303 | ) | (40,130 | ) | (28,412 | ) | (135,528 | ) | ||||||||

| Interest income (expense) and change in value of preferred stock warrants, net |

315 | (2,263 | ) | (1,433 | ) | (1,668 | ) | |||||||||

| Net loss |

(30,988 | ) | (42,393 | ) | (29,845 | ) | $ | (137,196 | ) | |||||||

| Accretion of redeemable convertible preferred stock to redemption value |

(8,742 | ) | (11,754 | ) | (14,059 | ) | ||||||||||

| Net loss attributable to common stockholders |

$ | (39,730 | ) | $ | (54,147 | ) | $ | (43,904 | ) | |||||||

| Basic and diluted net loss attributable to common stockholders per share |

$ | (60.16 | ) | $ | (80.16 | ) | $ | (62.95 | ) | |||||||

| Weighted average common shares outstanding basic and diluted |

660,423 | 675,461 | 697,448 | |||||||||||||

| Unaudited pro forma net loss |

(29,845 | ) | ||||||||||||||

| Unaudited basic and diluted pro forma net loss per share |

$ | 4.70 | ||||||||||||||

| Unaudited basic and diluted pro forma weighted average common stock outstanding |

6,349,403 | |||||||||||||||

9

Table of Contents

| As of December 31, 2009 | ||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(1)(2) | ||||||||

| (Unaudited) | ||||||||||

| (in thousands) | ||||||||||

| Balance Sheet Data: |

||||||||||

| Cash, cash equivalents and short-term investments |

$ | 19,303 | $ | 19,303 | $ | 45,265 | ||||

| Working capital |

2,766 | 2,766 | 28,720 | |||||||

| Total assets |

37,238 | 37,238 | 62,095 | |||||||

| Long-term debt |

8,640 | 8,640 | 8,640 | |||||||

| Redeemable convertible preferred stock |

187,916 | — | — | |||||||

| Total stockholders equity (deficit) |

(178,074 | ) | 10,157 | 36,111 | ||||||

| (1) | On a pro forma basis to give effect to the automatic conversion of all outstanding shares of our redeemable convertible preferred stock into shares of our common stock and the reclassification of the preferred stock warrant liability to stockholders’ equity (deficit) upon the completion of this offering. |

| (2) | On a pro forma as adjusted basis to reflect the sale of 6,000,000 shares of our common stock in this offering at an assumed initial offering price to the public of $5.00 per share, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. A $1.00 increase (decrease) in the assumed initial public offering price of $5.00 per share would increase (decrease) additional cash, cash equivalents and short-term investments, working capital, total assets and total stockholders’ equity (deficit) by $6.0 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions. |

10

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in shares of our common stock. The occurrence of any of the following risks could harm our business, financial condition, results of operations or growth prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Financial Position and Need for Additional Capital

Our recurring losses from operations have raised substantial doubt regarding our ability to continue as a going concern.

Our recurring losses from operations raise substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2009 with respect to this uncertainty. This going concern opinion could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. Future reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. We are a development stage company and have not generated revenues or been profitable since inception, and it is possible we will never achieve profitability. We have devoted our resources to developing our Organ Regeneration Platform and certain product candidates, but such product candidates cannot be marketed until governmental approvals have been obtained. Accordingly, there is no current source of revenues much less profits, to sustain our present activities, and no revenues will likely be available until, and unless, our product candidates are approved by the FDA or comparable regulatory agencies in other countries and successfully marketed, either by us or a partner, an outcome which may not occur. If we successfully complete this offering, based upon our currently expected level of operating expenditures, we expect to be able to fund our operations to March 2011. This period could be shortened if there are any significant increases in planned spending on development programs or more rapid progress of development programs than anticipated. There is no assurance that other financing will be available when needed to allow us to continue as a going concern. The perception that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability to meet our contractual obligations.

We have a history of net losses and may not achieve or sustain profitability.

We have incurred losses in each year since our inception and expect to experience losses for the foreseeable future. As of December 31, 2009, we had an accumulated deficit of $181.6 million. We had net losses of $31.0 million, $42.4 million and $29.8 million in the years ended December 31, 2007, 2008 and 2009, respectively. These losses resulted principally from costs incurred in our clinical trials, research and development programs, construction of our research laboratories and commercial manufacturing facility and from our general and administrative expenses. These losses, among other things, have had and will continue to have an adverse effect on our stockholders’ equity, total assets and working capital.

We expect to continue to incur significant operating expenses and anticipate that our expenses and losses will increase in the foreseeable future as we seek to further develop our product candidates, technology and manufacturing capabilities. Our expenses are expected to relate to the following:

| • | conducting our Phase I clinical trial for our Neo-Urinary Conduit for patients with bladder cancer who require removal of their bladder; |

| • | continuing our preclinical development of our Neo-Bladder Replacement for bladder cancer patients requiring removal of their bladder and desiring a continent urinary diversion; |

| • | continuing research and development efforts relating to our Neo-Kidney Augment; |

11

Table of Contents

| • | advancing our Neo-Bladder Augment; |

| • | researching and developing our Neo-GI Augment, Neo-Vessel Replacement and other product candidates; |

| • | maintaining, expanding, protecting and enforcing our intellectual property portfolio and assets and potentially challenging the intellectual property of others; |

| • | validating, certifying and staffing our commercial manufacturing facility if and when our product candidates advance into later-stage clinical trials; |

| • | expanding our manufacturing capabilities to support commercialization of our current and future product candidates; and |

| • | servicing and repaying indebtedness. |

The extent of our future operating losses is highly uncertain, and we may never achieve or sustain profitability. If we are unable to achieve and then maintain profitability, the market value of our common stock will decline and you could lose all or part of your investment.

In order to fund our operations, we will need to raise significant amounts of capital. We may not be able to raise additional capital when necessary or on acceptable terms to us, if at all.

Our future capital requirements will depend on many factors, including:

| • | the scope and results of our clinical trials, particularly regarding the number of patients required and the required duration of follow up for our clinical trials in support of our product candidates; |

| • | the time, complexity and costs involved in obtaining marketing approvals for our product candidates, which could take longer and be more costly than obtaining approval for a new conventional drug candidate, given the FDA’s limited experience with clinical trials and marketing approval for products derived from a patient’s own cells; |

| • | the scope and results of our research and preclinical development programs; |

| • | the costs of operating our research and development facility to support our research and early clinical activities; |

| • | the costs of validating, certifying and staffing our manufacturing facility to support later-stage clinical trials and also in anticipation of commercialization activities, if any; |

| • | the costs of maintaining, expanding, protecting and enforcing our intellectual property portfolio, including potential dispute and litigation costs and any associated liabilities and potentially challenging the intellectual property of others; |

| • | the costs of entering new markets outside the United States; and |

| • | the level of debt service payments we are obligated to make. |

As a result of these factors, among others, we will need to seek additional funding prior to our being able to generate positive cash flow from operations. We would likely seek funding through public or private sales of our securities, commercial loan facilities, or some combination of both. We also might seek funding through collaborative arrangements. Additional funding may not be available to us on acceptable terms, or at all. If we obtain capital through collaborative arrangements, these arrangements could require us to relinquish some rights to our technologies or product candidates. If we raise capital through the sale of equity, or securities convertible into equity, dilution to our then-existing stockholders would result. If we obtain funding through the incurrence of debt, we would likely become subject to covenants restricting our business activities, and holders of debt instruments would have rights and privileges senior to those of our equity investors. In addition, servicing the interest and repayment

12

Table of Contents

obligations under our current and future borrowings would divert funds that would otherwise be available to support research and development, clinical or commercialization activities.

If we are unable to obtain adequate financing on a timely basis, we may be required to delay, reduce the scope of or eliminate one or more of our development programs, and reduce our personnel, any of which could have a material adverse effect on our business, financial condition and results of operations.

We have a substantial amount of debt that exposes us to risks that could adversely affect our business, operating results and financial condition.

We have approximately $22.3 million of debt outstanding as of December 31, 2009 which is secured by liens on substantially all of our assets. We expect that the annual principal and interest payments on our outstanding debt will be approximately $15.4 million, $9.0 million and $0.2 million in 2010, 2011 and 2012, respectively. The level and nature of our indebtedness could, among other things:

| • | make it difficult for us to obtain any necessary financing in the future; |

| • | limit our flexibility in planning for or reacting to changes in our business; |

| • | reduce funds available for use in our operations; |

| • | impair our ability to incur additional debt because of financial and other restrictive covenants or the liens on our assets which secure our current debt; |

| • | hinder our ability to raise equity capital because in the event of a liquidation of the business, debt holders receive a priority before equity holders; |

| • | make us more vulnerable in the event of a downturn in our business; or |

| • | place us at a possible competitive disadvantage relative to less leveraged competitors and competitors that have better access to capital resources. |

Unless we raise substantial additional capital or generate substantial revenue from a license or strategic partnership involving one of our product candidates, we may not be able to service or repay our debt when it becomes due, in which case our lenders could seek to accelerate payment of all unpaid principal and foreclose on our assets. Any such event would have a material adverse effect on our business, operating results and financial condition.

Our short operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

We are a development stage company. We commenced operations in July 2003. Our operations to date have been limited to organizing and staffing our company, acquiring and developing our technology and undertaking preclinical studies and clinical trials of our product candidates. We have not demonstrated an ability to successfully complete large-scale clinical trials, obtain marketing approvals for product registration, manufacture a commercial-scale product or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. As a result, we have a limited operating history from which you can evaluate our business and prospects.

13

Table of Contents

In addition, as a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known or unknown factors. If we are successful in obtaining marketing approval for any of our product candidates, we will need to transition from a company with a research focus to a company capable of supporting commercial activities. We may not be successful in such a transition.

If we fail to properly manage our growth, our business could be adversely affected.

We have substantially increased the scale of our operations since our inception in 2003. We anticipate further increasing the scale of our operations as we develop our product candidates. If we are unable to manage our growth effectively, our operations and financial condition could be adversely affected. The management of our growth will depend, among other things, upon our ability to improve our

operational, financial and management controls, reporting systems and procedures. Furthermore, we may have to make investments in and hire and train additional personnel for our operations and manufacturing, which would result in additional burdens on our systems and resources and require additional capital expenditures.

If we do not successfully develop our product candidates and obtain the necessary marketing approvals to commercialize them, we will not generate sufficient revenues to continue our business operations.

In order to obtain marketing approval of our product candidates so that we can generate revenues once they are commercialized, we must conduct extensive preclinical studies and clinical trials to demonstrate that our product candidates are safe and effective and obtain and maintain approval of our manufacturing facilities. Our early stage product candidates, including our Neo-Urinary Conduit, for which we have an effective IND and for which we have commenced a single-center Phase I clinical trial, may fail to perform as we expect. Moreover, our Neo-Urinary Conduit and our other product candidates may ultimately fail to demonstrate the necessary safety and efficacy for marketing approval. We will need to conduct additional research and development, and devote significant additional financial resources and personnel to develop commercially viable products and obtain the necessary marketing approvals, and if we fail to do successfully, we may cease operations altogether.

Risks Related to the Development of Our Product Candidates

Our product development programs are based on novel technologies and are inherently risky.

We are subject to the risks of failure inherent in the development of products based on new technologies. The novel nature of our Organ Regeneration Platform creates significant challenges with respect to product development and optimization, manufacturing, government regulation and approval, third-party reimbursement and market acceptance. For example, the FDA has relatively limited experience with the development and regulation of autologous neo-organs and neo-tissues and, therefore, the pathway to marketing approval for our product candidates may accordingly be more complex, lengthy and uncertain than for a more conventional new drug candidate. The FDA may not approve our product candidates or may approve them with certain restrictions that may limit our ability to market our product candidates, and our product candidates may not be successfully commercialized, if at all.

Our clinical trials may not be successful.

We will only obtain marketing approval to commercialize a product candidate if we can demonstrate to the satisfaction of the FDA or the applicable non-United States regulatory authority, in clinical trials, that the product candidate is safe and effective, and otherwise meets the appropriate standards required for approval for a particular indication. Clinical trials are lengthy, complex and extremely expensive processes with uncertain results. A failure of one or more of our clinical trials may occur at any stage of testing. To date, we have conducted two Phase II clinical trials for our Neo-Bladder Augment, involving 16 pediatric and adult patients. During these trials, three patients experienced serious adverse events that at the time of their occurrence were deemed by the respective clinical investigator to be clinically significant and probably related to our product candidate or implantation procedure. Each of the serious adverse events involved perforation of the bladder, which is a known complication in patients undergoing enterocystoplasty, the

14

Table of Contents

current standard of care for these patients. A bladder perforation results in urine leakage through the bladder wall. We believe the underlying cause of these bladder perforations varied from patient to patient, and may be related to complications that can occur in this patient population including abscesses, bacterial infections, small bowel obstructions or invasive urologic procedures. As a result of these serious adverse events, the FDA placed our IND related to these clinical trials on hold. We submitted a complete response in June 2009 and the FDA released the clinical hold in July 2009 with no recommended changes to our protocol, product candidate or implantation procedure. There can be no assurance, however, that we will not experience similar serious adverse events with other patients in our Neo-Bladder Augment clinical trials or in our Phase I clinical trial for our Neo-Urinary Conduit.

We have limited experience in conducting and managing the preclinical development activities and clinical trials necessary to obtain marketing approvals necessary for marketing our product candidates, including approval by the FDA.

Our efforts to develop all of our product candidates are at an early stage. We may be unable to progress our product candidates that are undergoing preclinical testing into clinical trials. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and favorable initial results from a clinical trial do not necessarily predict final results. The indications of use for which we are pursuing development may have clinical effectiveness endpoints that have not previously been reviewed or validated by the FDA, which may complicate or delay our effort to ultimately obtain FDA approval. We cannot assure you that our clinical trials will ultimately be successful.

We have not obtained marketing approval or commercialized any of our product candidates. We may not successfully design or implement clinical trials required for marketing approval to market our product candidates. We might not be able to demonstrate that our product candidates meet the appropriate standards for marketing approval, particularly as our technology may be the first of its kind to be reviewed by the FDA. If we are not successful in conducting and managing our preclinical development activities or clinical trials or obtaining marketing approvals, we might not be able to commercialize our product candidates, or might be significantly delayed in doing so, which will materially harm our business.

We may find it difficult to enroll patients in our clinical trials.

Our initial product candidates are designed to treat diseases that affect relatively few patients. This could make it difficult for us to enroll the number of patients that may be required for the clinical trials we would be required to conduct in order to obtain marketing approval for our product candidates.

In addition, we may have difficulty finding eligible patients to participate in clinical trials because a patient may require a concomitant surgical procedure that would prevent them from receiving our product candidates, may be using alternative therapies, or the extent of a patient’s overall medical condition may render such patient ineligible to participate in our trials. Our inability to enroll a sufficient number of patients for any of our current or future clinical trials would result in significant delays and could require us to abandon one or more clinical trials altogether.

If we are not able to retain qualified management and scientific personnel, we may fail to develop our technologies and product candidates.

Our future success depends to a significant extent on the skills, experience and efforts of the principal members of our scientific and management personnel. These members include Steven Nichtberger, MD, our President and CEO, and Timothy Bertram, DVM, PhD, our Senior Vice President, Science and Technology. The loss of either or both of these individuals could harm our business and might significantly delay or prevent the achievement of research, development or business objectives. Competition for personnel is intense. We may find it difficult to retain qualified management and scientific personnel. For example, two of our executive officers voluntarily left our company in 2009 to pursue other opportunities. We may be unable to retain our current personnel or attract or integrate other qualified management and scientific personnel in the future.

15

Table of Contents

We rely on third parties to conduct certain preclinical development activities and our clinical trials, and those third parties may not perform satisfactorily.

We do not conduct in our facilities certain preclinical development activities of our product candidates, such as preclinical studies in animals, nor do we conduct clinical trials for our product candidates ourselves. We rely on, or work in conjunction with, third parties, such as contract research organizations, medical institutions and clinical investigators, to perform these functions. Our reliance on these third parties for preclinical and clinical development studies reduces our control over these activities. We are responsible for ensuring that each of our preclinical development activities and our clinical trials is conducted in accordance with the applicable U.S. federal and state laws and foreign regulations, general investigational plan and protocols. However, other than our contracts with these third parties, we have no direct control over these researchers or contractors, as they are not our employees. Moreover, the FDA requires us to comply with standards, commonly referred to as Good Clinical Practices, or GCP, for conducting, recording and reporting the results of our clinical trials to assure that data and reported results are credible and accurate and that the rights, safety and confidentiality of trial participants are protected. Our reliance on third parties that we do not control does not relieve us of these responsibilities and requirements. Furthermore, these third parties also may have relationships with other entities, some of which may be our competitors. If these third parties do not successfully carry out their contractual duties, meet expected deadlines or conduct our preclinical development activities or our clinical trials in accordance with regulatory requirements or our stated protocols, we will not be able to obtain, or may be delayed in obtaining, marketing approvals for our product candidates and will not be able to, or may be delayed in our efforts to, successfully commercialize our product candidates. These third parties may be warned, suspended or otherwise sanctioned by the FDA or other government or regulatory authorities for failing to meet the applicable requirements imposed on such third parties. As a result, the third parties may not be able to fulfill their contractual obligations, and the results obtained from the preclinical and clinical research using their services may not be accepted by the FDA to support the marketing approval of our product candidates. If the third parties or their employees become debarred by the FDA, we cannot use the research data derived from their services to support the marketing approval of our product candidates. Finally, these third parties may be bought by other entities, change their business plans or strategies or they may go out of business, thereby preventing them from meeting their contractual obligations to us.

We may not be able to secure and maintain relationships with research institutions and clinical investigators that are capable of conducting and have access to necessary patient populations for the conduct our clinical trials.

We rely on research institutions and clinical investigators to conduct our clinical trials. Our reliance upon research institutions, including hospitals and clinics, provides us with less control over the timing and cost of clinical trials and the ability to recruit subjects. If we are unable to reach agreement with suitable research institutions and clinical investigators on acceptable terms, or if any resulting agreement is terminated because, for example, the research institution and/or clinical investigators lose their licenses or permits necessary to conduct our clinical trials, we may be unable to quickly replace the research institution and/or clinical investigator with another qualified research institution and/or clinical investigator on acceptable terms. We may not be able to secure and maintain agreement with suitable research institutions to conduct our clinical trials.

Compliance with governmental regulations regarding the treatment of animals used in research could increase our operating costs, which would adversely affect the commercialization of our technology.

The Animal Welfare Act, or AWA, is the federal law that covers the treatment of certain animals used in research. Currently, the AWA imposes a wide variety of specific regulations that govern the humane handling, care, treatment and transportation of certain animals by producers and users of research animals, most notably relating to personnel, facilities, sanitation, cage size, feeding, watering and shipping conditions. Third parties with whom we contract are subject to registration, inspections and

16

Table of Contents

reporting requirements. Furthermore, some states have their own regulations, including general anti- cruelty legislation, which establish certain standards in handling animals. If we or any of our contractors fail to comply with regulations concerning the treatment of animals used in research, we may be subject to fines and penalties and adverse publicity, and our operations could be adversely affected.

Public perception of ethical and social issues may limit or discourage the type of research we conduct.

Our clinical trials involve people, and we and third parties with whom we contract also do research involving animals. Governmental authorities could, for public health or other purposes, limit the use of human or animal research or prohibit the practice of our technology. Public attitudes may be influenced by claims that our technology or that regenerative medicine generally is unsafe for use in research or is unethical and akin to cloning. In addition, animal rights activists could protest or make threats against our facilities, which may result in property damage and subsequently delay our research. Ethical and other concerns about our methods, particularly our use of human subjects in clinical trials or the use of animal testing, could adversely affect our market acceptance.

Risks Related to the Manufacturing of Our Product Candidates

We have only limited experience manufacturing our product candidates. We may not be able to manufacture our product candidates in quantities sufficient for our clinical trials and/or any commercial launch of our product candidates.

We may encounter difficulties in the production of our product candidates. Construction of neo-organs and neo-tissues from autologous live human cells involves strict adherence to complex manufacturing and storage protocols and procedures. Early stage clinical manufacturing is conducted in our pilot facility and, while we have supported clinical manufacturing from this location, future difficulties may arise which limit our production capability and delay progress in our clinical trials. We have built a commercial-scale manufacturing facility, which is based on our pilot manufacturing facility and processes used in that facility, which we believe will support late phase clinical trials and the initial commercial launch of our product candidates. As a result of our business decision to focus our resources on our Neo-Urinary Conduit, activities that were under way to prepare this facility to commence manufacturing operations were temporarily halted in March 2009 and we are currently maintaining the facility in a condition that will enable us to complete these activities and commence manufacturing operations. We expect completion of these activities, including recertification and hiring additional staff, will cost approximately $1.0 million. Any unexpected difficulty in completing these activities would increase cost or delay late-stage clinical or commercial manufacturing.

We may encounter technical or logistical difficulties as we seek to commence, and subsequently increase, production at our commercial-scale manufacturing facility. These difficulties could increase our costs or cause delays in the production of our product candidates necessary for any Phase III clinical trial and/or any anticipated commercial launch of our product candidates, any of which could damage our reputation and harm our business. Moreover, we have limited experience in manufacturing our product candidates for human patients and we are not aware of any party that manufactures products similar to ours. As a result, if we are not able to successfully manufacture our product candidates, we may be unable to utilize the manufacturing services of a third-party manufacturer.

The current manufacture of our product candidates involves the use of regulated animal tissues, and future product candidates may also use animal-sourced materials.

We currently utilize several bovine-derived products, such as growth media, in the manufacture of our Neo-Urinary Conduit and Neo-Bladder Augment. Bovine-sourced materials are strictly regulated in the United States and other jurisdictions due to their capacity to transmit the prion disease Bovine Spongiform Encephalopathy, or BSE, which manifests itself in humans as Creutzfeldt-Jakob Disease. Although we obtain our supply of bovine-based materials from closed herds in jurisdictions that are not currently known to carry BSE, there can be no assurance that these herds will remain BSE-free or that a

17

Table of Contents

future outbreak or presence of other unintended and potentially hazardous agents would not adversely affect our product candidates or patients that may receive them. Further, our future product candidates may involve the use of bovine-sourced or other animal-based materials, which could increase the risk of transmission of other diseases carried by such animals.

If a natural or man-made disaster strikes our manufacturing facility, we would be unable to manufacture our product candidates for a substantial amount of time, which would harm our business.

Our manufacturing facility and manufacturing equipment would be difficult to replace and could require substantial replacement lead-time and additional funds if we lost use of either the facility or equipment. Our facility may be affected by natural disasters, such as floods. We do not currently have commercial-scale back-up capacity, so in the event our facility or equipment was affected by man-made or natural disasters, we would be unable to manufacture any of our product candidates until such time as our facility could be repaired or rebuilt. Although we currently maintain global property insurance with property limits of $27.0 million and business interruption insurance coverage of $5.4 million for damage to our property and the disruption of our business from fire and other casualties, such insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, or at all.

Our business involves the use of hazardous materials that could expose us to environmental and other liability.

Our research and development processes and our operations involve the controlled storage, use and disposal of hazardous materials including, but not limited to, biological hazardous materials. We are subject to federal, state and local regulations governing the use, manufacture, storage, handling and disposal of these materials and waste products. Although we believe that our safety procedures for handling and disposing of these hazardous materials comply with the standards prescribed by law and regulation, the risk of accidental contamination or injury from hazardous materials cannot be completely eliminated. In the event of an accident, we could be held liable for any damages that result, and any liability could exceed the limits or fall outside the coverage of our insurance. Moreover, we may not be able to maintain insurance to cover these risks on acceptable terms, or at all. We could also be required to incur significant costs to comply with current or future laws and regulations relating to hazardous materials. We currently maintain insurance coverage that is consistent with similar companies in our stage of development. In addition to global property insurance, we maintain general liability insurance coverage of $2.0 million with an excess liability insurance of $4.0 million, and workers’ compensation coverage of $0.5 million per incident.

Risks Related to Marketing Approval and Other Government Regulations

We cannot market and sell our product candidates in the United States or in other countries if we fail to obtain the necessary marketing approvals or licensure.

We cannot sell our product candidates until regulatory agencies grant marketing approval, or licensure. The process of obtaining such marketing approval is lengthy, expensive and uncertain. It is likely to take many years to obtain the required marketing approvals for our product candidates or we may never gain the necessary approvals. Any difficulties that we encounter in obtaining marketing approval may have a substantial adverse impact on our operations and cause our stock price to decline significantly. Any adverse events in our clinical trials for one of our product candidates could negatively impact the clinical trials and approval process for our other product candidates.

To obtain marketing approvals in the United States for our product candidates, we must, among other requirements, complete carefully controlled and well-designed clinical trials sufficient to demonstrate to the FDA that the product candidate is safe and effective for each indication for which we seek approval. Several factors could prevent completion or cause significant delay of these trials, including an inability to enroll the required number of patients or failure to obtain FDA approval to commence a clinical trial. Negative or inconclusive results from or adverse events during a preclinical safety study or clinical trial

18

Table of Contents

could cause the preclinical study or clinical trial to be repeated or a program to be terminated, even if other studies or trials relating to the program are successful. The FDA can place a clinical trial on hold if, among other reasons, it finds that patients enrolled in the trial are or would be exposed to an unreasonable and significant risk of illness or injury. If safety concerns develop, we, an Institutional Review Board, or IRB, or the FDA could stop our trials before completion. The populations for which we are developing our product candidates may have other medical complications that would affect their experience in our trials and would affect their experience with our product candidates, if approved. A serious adverse event is an event that results in significant medical consequences, such as hospitalization or prolonged hospitalization, disability or death, and if unexpected must be reported to the FDA. We cannot assure you that other safety concerns regarding our product candidates will not develop. For example, in February 2009, the FDA placed our IND for our Neo-Bladder Augment on clinical hold following certain serious adverse events that occurred with respect to patients in our Phase II clinical trials. We submitted a complete response in June 2009 and the FDA released the clinical hold in July 2009, with no recommended changes to our protocol, product candidate or implantation procedure.

The pathway to marketing approval for our product candidates may be more complex and lengthy than for approval of a conventional new drug or biologic. Similarly, to obtain approval to market our product candidates outside of the United States, we will need to submit clinical data concerning our product candidates and receive marketing approval from governmental agencies, which in certain countries includes approval of the price we intend to charge for our product. We may encounter delays or rejections if changes occur in regulatory agency policies, or if reports from preclinical and clinical testing on similar technology or products raise safety and/or efficacy concerns, during the period in which we develop a product candidate or during the period required for review of any application for marketing approval. If we are not able to obtain marketing approvals for use of our product candidates under development, we will not be able to commercialize such products and, therefore, may not be able to generate sufficient revenues to support our business.

The FDA may impose requirements on our clinical trials that are difficult to comply with, which could harm our business.

The requirements the FDA may impose on clinical trials for our product candidates are uncertain. As a result, we cannot assure you that we will be able to comply with such requirements. For example, the FDA may require endpoints in our late-stage clinical trials that are different from or in addition to the endpoints in our early-stage clinical trials or the endpoints which we may propose. The endpoints or other study elements, including sample size, the FDA requires may make it less likely that our Phase III clinical trials are successful or may delay completion of the trials. If we are unable to comply with the FDA’s requirements, we will not be able to get approval for our product candidates and our business will suffer.

If we are not able to conduct our clinical trials properly and on schedule, marketing approval by the FDA and other regulatory authorities may be delayed or denied.

Our clinical trials may be delayed or terminated for many reasons, including, but not limited to, if:

| • | the FDA does not grant permission to proceed or places the trial on clinical hold; |

| • | subjects do not enroll or remain in our trials at the rate we expect; |

| • | we fail to manufacture necessary amounts of product candidate; |

| • | either of our manufacturing facilities is ordered by the FDA or other government or regulatory authorities to temporarily or permanently shut down due to violations of current Good Manufacturing Practice, or cGMP, or other applicable requirements, or infections or cross-contaminations of product candidates in the manufacturing process; |

| • | subjects choose an alternative treatment for the indications for which we are developing our product candidates, or participate in competing clinical trials; |

| • | subjects experience an unacceptable rate or severity of adverse side effects; |

19

Table of Contents

| • | reports from preclinical or clinical testing on similar technologies and products raise safety and/or efficacy concerns; |

| • | third-party clinical investigators lose their license or permits necessary to perform our clinical trials, do not perform our clinical trials on our anticipated schedule or consistent with the clinical trial protocol, Good Clinical Practice and regulatory requirements, or other third parties do not perform data collection and analysis in a timely or accurate manner; |

| • | inspections of clinical trial sites by the FDA or IRBs find regulatory violations that require us to undertake corrective action, suspend or terminate one or more sites, or prohibit us from using some or all of the data in support of our marketing applications; |

| • | third-party contractors become debarred or suspended or otherwise penalized by FDA or other government or regulatory authorities for violations of regulatory requirements, in which case we may need to find a substitute contractor, and we may not be able to use some or any of the data produced by such contractors in support of our marketing applications; or |

| • | one or more IRBs refuses to approve, suspends or terminates the trial at an investigational site, precludes enrollment of additional subjects, or withdraws its approval of the trial. |

If we are unable to conduct our clinical trials properly and on schedule, the FDA may delay or deny marketing approval.

Final marketing approval of our product candidates by the FDA or other regulatory authorities for commercial use may be delayed, limited, or denied, any of which would adversely affect our ability to generate operating revenues.

Any of the following factors, if one or more were to occur, could cause final marketing approval for our product candidates to be delayed, limited or denied:

| • | our product candidates could fail to demonstrate safety and efficacy in preclinical or clinical testing; |

| • | the manufacturing processes for our product candidates could fail to consistently demonstrate their safety and purity; |

| • | the FDA could disagree with the clinical endpoints we propose for our clinical trials and refuse to allow us to conduct clinical trials utilizing clinical endpoints we believe are appropriate; |

| • | it could take many years to complete the testing of our product candidates, and failure can occur at any stage of the process; |

| • | negative results or adverse side effects during a clinical trial could cause us to delay or terminate development efforts for a product candidate; |

| • | the FDA could seek the advice of an Advisory Committee of physician and patient representatives that may view the risks of our product candidates as outweighing the benefits; |

| • | the FDA could require us to expand the size and scope of the clinical trials; or |

| • | the FDA could impose post-marketing restrictions. |

Our development costs will increase if we have material delays in our clinical trials, or if we are required to modify, suspend, terminate or repeat a clinical trial. If marketing approval for our product candidates is delayed, limited or denied, our ability to market products, and our ability to generate product sales, would be adversely affected.

20

Table of Contents

Any product for which we obtain marketing approval could be subject to restrictions or withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our product candidates, when and if any of them are approved.

Any product for which we obtain marketing approval, along with the manufacturing processes, post-approval clinical data, labeling, advertising and promotional activities for such product, will be subject to continual requirements of and review by the FDA and comparable regulatory authorities, including through periodic inspections. These requirements include, but are not limited to, submissions of safety and other post-marketing information and reports, registration requirements, cGMP and Quality System Regulation, or QSR, requirements relating to quality control, quality assurance and corresponding maintenance of records and documents. Even if marketing approval of a product is granted, the approval may be subject to limitations on the indicated uses for which the product may be marketed or to other conditions of approval, or may contain requirements for costly and time consuming post-marketing testing and surveillance to monitor the safety or efficacy of the product. Discovery after approval of previously unknown problems with our product candidates or manufacturing processes, or failure to comply with regulatory requirements, may result in actions such as:

| • | restrictions on such products’ manufacturers or manufacturing processes; |

| • | restrictions on the marketing or distribution of a product, including refusals to permit the import or export of products; |

| • | warning letters or untitled letters; |

| • | warning labels on the products; |

| • | withdrawal of the products from the market; |

| • | refusal to approve pending applications or supplements to approved applications that we submit; |

| • | suspension of any ongoing clinical trials; |

| • | recall of products; |

| • | fines, restitution or disgorgement of profits or revenue; |

| • | suspension or withdrawal of marketing approvals; |

| • | product seizure; |

| • | injunctions; or |

| • | imposition of civil or criminal penalties. |

In addition, if any of our product candidates are approved, our product labeling, advertising and promotion would be subject to regulatory requirements and continuing regulatory review. The FDA strictly regulates the promotional claims that may be made about prescription products. In particular, a product may not be promoted for uses that are not approved by the FDA as reflected in the product’s approved labeling. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant sanctions.

Current or future legislation may make it more difficult and costly for us to obtain marketing approval of our product candidates.

In 2007, the Food and Drug Administration Amendments Act of 2007, or the FDAAA, became law. This legislation grants significant new powers to the FDA, many of which are aimed at assuring the safety of drugs and biologics after approval. For example, FDAAA granted the FDA new authority to impose

21

Table of Contents