Attached files

| file | filename |

|---|---|

| EX-21 - Sino Clean Energy Inc | v180449_ex21.htm |

| EX-31.1 - Sino Clean Energy Inc | v180449_ex31-1.htm |

| EX-32.1 - Sino Clean Energy Inc | v180449_ex32-1.htm |

| EX-31.2 - Sino Clean Energy Inc | v180449_ex31-2.htm |

| EX-10.16 - Sino Clean Energy Inc | v180449_ex10-16.htm |

WASHINGTON,

D.C. 20549

FORM

10-K

|

|

x

|

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended December 31, 2009

OR

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the transition period from

to

Commission

file number: 000-51753

SINO

CLEAN ENERGY INC.

(Exact

name of Registrant as specified in its charter)

|

Nevada

|

75-2882833

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

Room

1605, Suite B, Zhengxin Building

No.

5 Gaoxin 1st

Road, Gaoxin District

Xi’an,

Shaanxi Province, PRC

|

N/A

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s telephone number:

+86-29-82091099

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par

value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes þ No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will

not be contained herein, to the best of registrant’s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o

|

Smaller reporting

company þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes o No þ

As of

June 30, 2009, the aggregate market value of the voting stock held by

non-affiliates of the Registrant was approximately $11,596,908 based on a

closing price of $0.33 per share of common stock as reported on the

Over-the-Counter Bulletin Board on such date.

On March

31, 2010, we had 165,562,494 shares of common stock issued and

outstanding.

TO

ANNUAL REPORT ON FORM 10-K

FOR

YEAR ENDED DECEMBER 31, 2009

|

|

Page

|

||

|

PART

I

|

|

||

|

|

|||

|

Item

1.

|

Business

|

3

|

|

|

Item

1A.

|

Risk

Factors

|

12

|

|

|

Item

2.

|

Properties

|

26

|

|

|

Item

3.

|

Legal

Proceedings

|

26

|

|

|

PART

II

|

|

||

|

Item

4.

|

Market

for Registrant's Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

27

|

|

|

Item

5.

|

Selected

Financial Data

|

29

|

|

|

Item

6.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operation

|

29

|

|

|

Item

7.

|

Financial

Statements and Supplementary Data

|

F-1

|

|

|

Item

8.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

38

|

|

|

Item

8A(T).

|

Controls

and Procedures

|

39

|

|

|

Item

8B.

|

Other

Information

|

40

|

|

|

PART

III

|

|

||

|

Item

9.

|

Directors,

Executive Officers and Corporate Governance

|

40

|

|

|

Item

10.

|

Executive

Compensation

|

46

|

|

|

Item

11.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

51

|

|

|

Item

12.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

53

|

|

|

Item

13.

|

Principal

Accounting Fees and Services

|

54

|

|

|

PART

IV

|

|||

|

Item

14.

|

Exhibits,

Financial Statement Schedules

|

55

|

|

|

Signatures

|

59

|

2

CAUTION

REGARDING FORWARD-LOOKING INFORMATION

This

report contains forward-looking statements. All forward-looking statements are

inherently uncertain as they are based on current expectations and assumptions

concerning future events or future performance of the Company. Readers are

cautioned not to place undue reliance on these forward-looking statements, which

are only predictions and speak only as of the date hereof. Forward-looking

statements usually contain the words “estimate,” “anticipate,” “believe,”

“expect,” or similar expressions, and are subject to numerous known and unknown

risks and uncertainties. In evaluating such statements, prospective investors

should carefully review various risks and uncertainties identified in this

Report, including the matters set forth under the captions “Risk Factors” and in

the Company’s other SEC filings. These risks and uncertainties could cause the

Company’s actual results to differ materially from those indicated in the

forward-looking statements.

Although

forward-looking statements in this annual report on Form 10-K reflect the good

faith judgment of our management, such statements can only be based on facts and

factors currently known by us. Consequently, forward-looking statements are

inherently subject to risks and uncertainties, and actual results and outcomes

may differ materially from the results and outcomes discussed in or anticipated

by the forward-looking statements. Factors that could cause or contribute to

such differences in results and outcomes include, without limitation, those

specifically addressed under the heading “Risks Relating to Our Business” below,

as well as those discussed elsewhere in this annual report on Form 10-K. Readers

are urged not to place undue reliance on these forward-looking statements, which

speak only as of the date of this annual report on Form 10-K. We file reports

with the Securities and Exchange Commission (“SEC”). You can read and copy any

materials we file with the SEC at the SEC’s Public Reference Room, 100 F.

Street, NE, Washington, D.C. 20549 on official business days during the hours of

10 a.m. to 3 p.m. You can obtain additional information about the operation of

the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the

SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and

information statements, and other information regarding issuers that file

electronically with the SEC, including the Company.

We

undertake no obligation to revise or update any forward-looking statements in

order to reflect any event or circumstance that may arise after the date of this

annual report on Form 10-K. Readers are urged to carefully review and consider

the various disclosures made throughout the entirety of this annual report,

which attempt to advise interested parties of the risks and factors that may

affect our business, financial condition, results of operations and

prospects.

PART

I

ITEM

1. BUSINESS

Overview

Sino

Clean Energy Inc. (sometimes referred to in this annual report as “Company”,

“we” or “our”) is a holding company that, through its subsidiaries, is a

leading third party commercial producer and distributor of coal-water slurry

fuel (“CWSF”) in China. CWSF is a clean fuel that consists of fine coal

particles suspended in water. Our CWSF products are mainly used to

fuel boilers and furnaces to generate steam and heat for residential and

industrial applications. We sell our products in China and our

customers include industrial, commercial, residential and government

organizations. Our strong reputation in the CWSF industry in China, together

with our established track record for consistently delivering products in large

quantities, has enabled us to expand our customer base. We primarily

use washed coal to produce CWSF. We acquire the raw materials for each of our

production facilities primarily from three nearby coal mines. We have

established strong relationships with our suppliers and our ability to purchase

large quantities of raw materials has allowed us to achieve favorable pricing

and delivery terms.

3

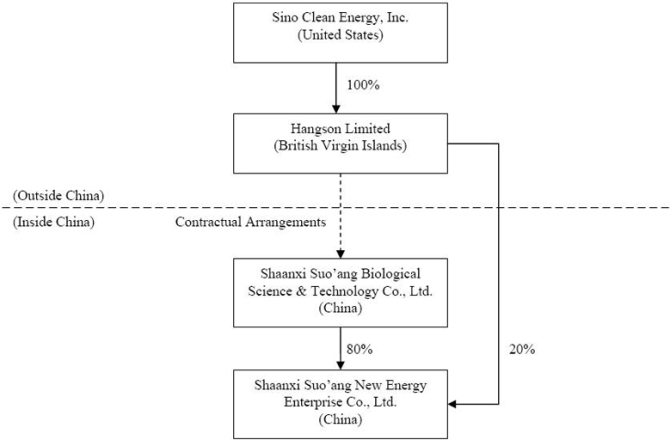

Until

November 12, 2009, all of our business operations were conducted through Shaanxi

Suo’ang Biological Science & Technology Co., Ltd., a PRC company (“Suo’ang

BST”) that we controlled through contractual arrangements designed to comply

with the law of People’s Republic of China (“PRC” or “China”) and Suo’ang BST’s

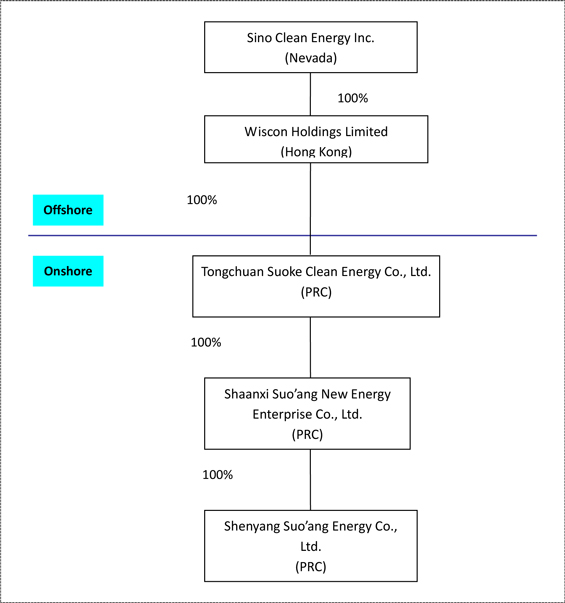

PRC subsidiary, Shaanxi Suo’ang New Energy Enterprise Co., Ltd. (“Suo’ang New

Energy”). Beginning in June 2009, we effected a reorganization of our

corporate structure in order to make Suo’ang New Energy wholly

owned. Pursuant to such reorganization, our business is now operated

by Suo’ang New Energy through our indirect wholly-owned subsidiary Tongchuan

Suoke Clean Energy Co., Ltd., a PRC limited liability company (“Suoke Clean Energy”),

which is incorporated under PRC law and wholly owned by Wiscon Holdings Limited,

a Hong Kong company

(“Wiscon”), our directly owned Hong Kong subsidiary/holding company,

which was incorporated in 2006 and acquired by us in June 2009. On

September 27, 2009, we received approval from the Tongchuan Bureau of Commerce

for the transfer of all of Suo’ang New Energy’s equity interests to Suoke Clean

Energy. With the approval, Suo’ang New Energy has become a “domestic

PRC enterprise wholly-owned by a wholly-foreign owned

enterprise.” Registration of the approval with the Tongchuan

Administration of Industry and Commerce, the final step in completing this

reorganization, was completed on November 12, 2009. On October 12,

2009, Suo’ang New Energy established Shenyang Sou’ang Energy Co., Ltd., a

wholly-owned PRC subsidiary(“Shenyang Energy”), to

conduct the CWSF business in Shenyang, Liaoning Province.

Corporate

Organization and History

We were

originally incorporated in Texas as “Discount Mortgage Services, Inc.” on July

11, 2000. In September 2001, we purchased Endo Networks, Inc., a Canadian

software developer, and changed our name to “Endo Networks, Inc.” on November 5,

2001. We re-domiciled to the State of Nevada on December 13, 2001.

On

October 20, 2006 we consummated a share exchange transaction with Hangson, a

British Virgin Islands company, the stockholders of Hangson and a majority of

our stockholders. We issued a total of 26,000,000 shares of our

common stock to the Hangson Stockholders and a consultant in the transaction, in

exchange for 100% of the common stock of Hangson. As a result of the

transaction we became engaged in the CWSF business, through the operations of

Suo’ang BST and Suo’ang New Energy. On January 4, 2007, we changed

our name from “Endo Networks, Inc.” to “China West Coal Energy Inc.”, and then

on August 15, 2007, we changed our name again to our present name, “Sino Clean

Energy Inc.” to better reflect the direction and business of the

Company

Hangson

did not conduct any substantive business operations of its own, but from August

2006 to June 30, 2009, controlled Suo’ang BST, a PRC company and Suo’ang BST’s

80%-owned subsidiary Suo’ang New Energy. From June 30, 2008 to

November 12, 2009 Hangson owned 20% of Suo’ang New Energy. Hangson

controlled Suo’ang BST through a series of contractual arrangement.

Beginning

in June 2009, we effected a reorganization of our corporate structure in order

to make Suo’ang New Energy a wholly-owned subsidiary (the “2009

Reorganization”). On June 30, 2009, we were a party to a series of

agreements (collectively the “Transfer Agreements”) transferring the contractual

arrangements, through which Hangson controlled Suo’ang BST, to Suoke Clean

Energy.

On

September 15, 2009, Suo’ang BST and Hangson entered into a share transfer

agreement with Suoke Clean Energy pursuant to which Suo’ang BST and Hangson

transferred 100% of the equity interests in Suo’ang New Energy to Suoke Clean

Energy. On September 27, 2009, the Tongchuan Bureau of Commerce

approved the transfer of all of Suo’ang New Energy’s equity interests to Suoke

Clean Energy. Registration of the approval of the equity transfer

with the Tongchuan Administration of Industry and Commerce, which was a

condition to the closing of the Share Transfer, was completed on November 12,

2009. As a result of receiving the required approval and registration

the share transfer transaction was closed and we were able, through Suoke Clean

Energy to own 100%of the equity interests of Suo’ang New

Energy. On October 12, 2009, Suo’ang New Energy established a

wholly-owned subsidiary to conduct the CWSF business in Shenyang, Liaoning

Province.

4

On

December 31, 2009, we entered into a series of termination agreements to

terminate the contractual arrangements by and among Suoke Clean Energy, Suo’ang

BST and certain stockholders of Suo’ang BST. We no longer needed to

keep such contractual arrangements in place due to the fact that Suo’ang BST was

no longer engaged in any substantial business operations. In connection with the

termination agreements, certain assets held by Suo’ang BST, such as, office

equipment, vehicles, bank deposits, accounts receivable, were transferred to

Suoke Clean Energy. Employees of Suo’ang BST signed new employment contracts

with Suoke Clean Energy. All rights and obligations under certain business

operation agreements and technology cooperation contracts between

Suo’ang BST and third parties were assigned to Suo’ang New Energy.

On

December 31, 2009, Hangson transferred all of its equity interests in Wiscon to

us. Since Hangson had no substantive operations of its own after the

transfer and termination of the contractual arrangements, we dissolved Hangson

on December 31, 2009.

Wiscon Holdings

Limited

Wiscon is

a limited liability company incorporated in Hong Kong under the Companies

Ordinance on September 4, 2006 and Hangson acquired all of its issued and

outstanding equity interests on June 30, 2009. On December 31, 2009, Hangson

transferred all of its equity interests in Wiscon to Sino Clean Energy Inc. As a

result, Wiscon became a direct wholly-owned subsidiary of Sino Clean Energy

Inc.

5

Current

Corporate Structure

Prior to

the 2009 Reorganization, our corporate structure was as follows:

6

As a

result of the 2009 Reorganization, our current organizational structure is as

below:

Our

Products

Coal

water mixture, or CWSF, is a viscous, heavy liquid fuel that is produced by

mixing grounded coal, water and chemical additives. CWSF can be

stored, pumped and burned as a substitute for oil or gas in properly modified

furnaces or boilers. In general, CWSF is cheaper than, but has

combustion thermal efficiency similar to, oil or gas. CWSF burns cleaner than

coal, and is free of coal dust or the danger of spontaneous combustion during

transportation and storage.

7

China is

a large producer and consumer of coal and will remain so for the foreseeable

future. To address environmental concerns from the use of coal, the Chinese

central government in August 1995 formulated the “9th Five-Year Plan for Clean

Coal Technology in China and a Development Program to 2010,” which

emphasizes the need to strengthen research and development of clean coal

technologies and to promote commercialization of proven clean coal

technologies. CWSF is one such proven technology which already has the

support and endorsement of a number of local governments throughout China. For

example, the municipal government of Tongchuan, where our plant is located,

adopted resolutions on June 27, 2008 requiring all existing coal furnaces within

city limits to be replaced by CWSF furnaces or other clean energy furnaces

by 2012, and requiring all new furnaces to use CWSF as fuel effective

immediately. The city has established a working group headed by both the deputy

mayor and the director of the local environmental protection bureau to promote

CWSF, and has designated RMB six million of its annual budget from 2008 to

2012 for subsidies and grants to facilitate the switch from coal to

CWSF. Other cities that are actively promoting CWSF include Dongguan

in Guangdong Province, one of China’s manufacturing bases, and Nanchang, the

provincial capital of Jiangxi Province. Both cities have adopted resolutions

(Dongguan in May 26, 2008 and Nanchang in August 19, 2008) similar to those of

Tongchuan that first encourage and then mandate the switch from coal to CWSF.

Additionally, both of these cities seek to establish and foster a CWSF

production industry within their borders.

Suo’ang

BST began studying market demands for CWSF and the feasibility of a CWSF

business in 2004. On May 8, 2006, Suo’ang BST established Suo’ang New Energy as

a subsidiary for the purpose of engaging in the research, development,

production and sale of CWM. Suo’ang BST entered into its first sales

contracts for CWSF in January 2007, and commenced CWSF production in July

2007.

Our

Production Plant

Our CWSF

production plant is located in the city of Tongchuan, north of Xi’an, the

ancient capital of China and the provincial capital of Shaanxi Province. We

produce CWSF by mixing coal with water and certain chemical additives as

follows:

8

The plant

was completed in July 2007 with an annual production capacity of 100,000 metric

tons (“tonnes”). Recently, we completed the installation of a fluid acoustic

energy CWSF system, which we purchased from Zhejiang Jinggong Group, an

unrelated third party vendor. The system’s technology simplifies the mixing

process of the ingredients of CWSF, thereby reducing the overall amount of raw

materials required while increasing the production volume as compared

to the traditional production method. The system’s technology also prevents

sedimentation that can result from long-distanced transportation of CWSF under

the traditional production method, which can impact its combustion and heating

proficiencies. The system is now operational.

Our

Customers

CWSF is

sold and distributed directly to our customers. Suo’ang New Energy entered into

its first sales contracts for CWSF in January 2007, and as of December 31, 2009,

we had over 30 customers, one of which is in Shenyang and accounted for

approximately 14% of our total sale. None of our other customers accounted for

more than 10% of our total sales.

We sell

CWSF on a per tonne basis, and our sales are net of applicable sales taxes.

Customers generally enter into one-year supply contracts with Suo’ang New

Energy, pursuant to which they make monthly payments of the total sales in an

agreed amount. As we are dependent on one major customer, Shenyang

Haizhong, for a substantial portion of our revenues, nonrenewal or termination

of our contract with this customer would have a materially adverse effect on our

revenues. In the event that our major customer does not renew or terminates

our contract, there can be no assurance that we will be able to obtain another

supply contract similar in scope. Additionally, there can be no assurance that

our business will not remain largely dependent on a limited customer base

accounting for a substantial portion of our revenues.

Suo’ang

New Energy also acts as an agent for Qingdao Haizhong Industry Inc., an

unrelated third-party manufacturer of boilers that are compatible with our CWSF,

and receives commission for sales of such boilers.

As CWSF

is still a relatively new industry, we look for opportunities to participate in

energy-related tradeshows and government-sponsored events to promote CWSF

generally and our Company specifically. We regularly give on-site presentations

at our plant to visiting dignitaries at the request of the Tongchuan Municipal

Government. We participated in the “Popularizing CWSF and Enhancing Energy

Conservation and Pollutants Reduction Conference ” held in Xi’an on March 27,

2008 and the first “Clean Fuel Popularization Conference” sponsored by Shaanxi

Province Environmental Protection Bureau on March 13, 2008. In April

2009, we participated in the Investment & Trade Forum for Cooperation

between Eastern & Western China in Xi’an.

Competition

We are

the third largest CWSF producer in China, as measured by CWSF production

capacity, with an early-mover advantage and strong business

relationships. We believe that we are able to differentiate ourselves

from our competitors by building track records and reputation for high quality

of product and services, by securing long-term customer contracts in each of the

target markets, and by selectively expanding into new regional

markets.

Currently there are 40 to

50 active CWSF suppliers in the Chinese CWSF market. Most CWSF suppliers had a

commercialized sales volume of lower than 100,000 tons in 2008 and in

2009.

9

Competition

is mainly based on establishing a large and stable customer base, building

capacity near large customers, maintaining good, long-term relationship with

large customers, and gaining more market share as most suppliers are not

competing on a regional level.

The CWSF

industry is still at an early stage in China and we have thus far experienced

limited competition from domestic CWSF producers.

China

represents a potentially lucrative market for international competitors, many of

whom may seek to enter the PRC market. We believe that there are currently no

foreign competitors with a material presence in the CWSF industry in

China.

Sources

and Availability of Raw Materials and Our Principal Suppliers

CWSF is

made from coal, water and additives. We provide additive suppliers with coal

samples and additive suppliers in turn change and adjust the formula in

accordance with our instructions.

Coal is

the primary raw material used to produce CWSF and accounted for approximately

82% of our cost of goods sold as of December 31, 2009.

We source

raw materials from nearby coal suppliers for each of our production facilities.

Coal is widely available in China and we maintain long-term relationships with

three key suppliers. To minimize purchasing and logistics costs, we

source coal from suppliers as close as possible to our production

facilities. We generally enter into one-year contracts with these

suppliers that set forth the purchase volume but not the pricing terms. We

determine raw material prices based on arm’s-length negotiations with our

suppliers shortly prior to delivery with reference to market

prices. Our reputation as a dependable counterparty enables us to

obtain a stable and low-cost supply of raw material coal for our production

facilities. Our long-standing supplier relationships provide us with a

competitive advantage in China, and we intend to broaden these relationships to

parallel our efforts to increase the scale of our production facilities, thereby

maintaining a diverse supplier network while leveraging our purchasing power to

obtain favorable pricing and delivery terms.

The

following table sets forth a summary, for the periods indicated, of the

aggregate amounts of coal used in our operations:

|

Year ended December 31,

|

||||||||

|

2008

|

2009

|

|||||||

|

(in

tons)

|

||||||||

|

Coal

|

10,8824.34 | 321,958.89 | ||||||

For 2008

and 2009, we have four coal suppliers. Our two largest coal suppliers accounted

for 85 % and 12 % of coal purchase, respectively. Suppliers are generally paid

upon delivery with a varying level of deposit.

Intellectual

Properties and Licenses

We

currently do not own any intellectual property rights. We may, however,

enter into confidentiality, non-compete and invention assignment agreements with

our employees and consultants and nondisclosure agreements with third

parties. While CWSF and its manufacturing process is not patented or

patentable, nevertheless, we may at times be involved in litigation based on

allegations of infringement or other violations of intellectual property

rights. Furthermore, the application of laws governing intellectual

property rights in the PRC is uncertain and evolving and could involve

substantial risks to us.

10

Government

Approval and Regulation of Our Principal Products or Services

The

Environmental Protection Law of the PRC governs us and our CWSF

products. The Environmental Protection Law, promulgated by the

National People’s Congress on December 26, 1989, is the cardinal law for

environmental protection in China. The law establishes the basic principle for

coordinated advancement of economic growth, social progress and environmental

protection, and defines the rights and duties of governments at all levels.

Local environmental protection bureaus may set stricter local standards than the

national standards and enterprises are required to comply with the stricter of

the two sets of standards. The Environmental Protection Law requires any entity

operating a facility that produces pollutants or other hazards to incorporate

environmental protection measures into its operations and to establish an

environmental protection responsibility system, which must adopt effective

measures to control and properly dispose of waste gases, waste water, waste

residue, dust or other waste materials.

Violators

of the Environmental Protection Law and various environmental regulations may be

subject to warnings, payment of damages and fines. Any entity undertaking

construction work or manufacturing activities before the pollution and waste

control and processing facilities are inspected and approved by the relevant

environmental protection bureau may be ordered to suspend production or

operations and may be fined. The violators of relevant environment protection

laws and regulations may be exposed to criminal liability if violations result

in severe loss of property, personal injuries or death.

In

addition, China is a signatory to the 1992 United Nations Framework Convention

on Climate Change and the 1997 Kyoto Protocol, which are intended to limit

emissions of greenhouse gases. Efforts to control greenhouse gas emission in

China could result in reduced use of coal if power generators switch to sources

of fuel with lower carbon dioxide emissions, which in turn could reduce the

revenues of our business and have a material adverse effect on our results of

operations.

The

Company endeavors to ensure the safe and lawful operation of its facilities in

manufacturing and distribution of CWSF and believes it is in compliance in all

material respects with applicable PRC laws and regulations.

No

enterprise may start production at its facilities until it receives approval

from the Ministry of Commerce to begin operations. Suo’ang New Energy and

Shenyang Energy currently have the requisite approval and licenses from the

Ministry of Commerce in order to operate our production facilities.

Research

and Development

Our CWSF

manufacturing technology was developed in-house by our research and development

department. Our research and development team comprises of three (3)

professionals, one of whom is an external expert. We have engaged two

university institutes for CWSF research projects and we plan to continue our

research and development efforts to strengthen our leading position in the CWSF

market in China. We are currently developing new specialty CWSF

products and we have also conducted research on and implemented new CWSF

production methods by adopting new additives.

We have

entered into two technology cooperation agreements with School of Chemistry and

Chemical Engineering of Shaanxi Normal University (“Normal University”) and

School of Energy and Power Engineering of Xi’an Jiao Tong University (“Jiao Tong

University”) in 2009. Normal University agreed to develop two types

of CWSF additive for the Company prior to March 31, 2012; the total amount of

development fee was RMB2,000,000. We entrusted Jiao Tong University

to develop three types of special CWSF prior to September 30, 2010; the total

amount of development fee was RMB3,000,000. Both agreements indicate that any

intellectual property arising from such developments shall belong to

us.

11

Our

research and development efforts have generated technological improvements that

have been instrumental in lowering our production costs and increasing our

operational efficiency. We believe our emphasis on research and

development, innovation, and continuous improvement will enable us to maintain

and expand our leading position in the industry.

Costs

and Effects of Compliance with Environmental Laws

We had no

environmental compliance costs in 2009 and 2008, as our use of washed coal,

which is our primary raw material, and our manufacturing process are not deemed

to generate pollutant emissions or discharges under applicable PRC environmental

regulations.

Employees

As of

December 31, 2009, we had 138 employees, all of which were full time employees.

During our peak season, generally from October through March, we hire

approximately 40 additional temporary employees. In 2008, we had 68 employees,

all of which were full time employees.

The

following table shows a breakdown of our employees by functions:

|

Functions

|

Number

of

employees

|

||

|

Manufacturing

|

68

|

||

|

Sales

and Marketing

|

15

|

||

|

General

Administration, Purchasing

|

52

|

||

|

Research

& Development

|

3

|

||

|

Total

|

138

|

None of

these employees are represented by any collective bargaining agreements. We have

not experienced a work stoppage. Management believes our employees have loyalty

to the Company.

ITEM

1A. RISK FACTORS

You

should carefully consider the risks described below together with all of the

other information included in this report before making an investment decision

with regard to our securities. The statements contained in or incorporated into

this offering that are not historic facts are forward-looking statements that

are subject to risks and uncertainties that could cause actual results to differ

materially from those set forth in or implied by forward-looking statements. If

any of the following risks actually occurs, our business, financial condition or

results of operations could be harmed. In that case, the trading price of our

common stock could decline, and you may lose all or part of your

investment.

12

Risks

Associated With Our Business

Our

limited operating history makes it difficult to evaluate our future prospects

and results of operations.

We have a

relatively limited operating history. We commenced operations of our

CWSF business in 2007. Accordingly, you should consider our future

prospects in light of the risks and uncertainties experienced by early stage

companies in evolving industries such as the coal products and alternative

energy industry in China. Our limited history for producing CWSF may not serve

as an adequate basis to judge our future prospectus and results of operations.

Our operations are subject to all of the risks, challenges, complications and

delays frequently encountered in connection with the operation of any new

business, as well as those risks that are specific to the CWSF industry.

Investors should evaluate us in light of the problems and uncertainties

frequently encountered by companies attempting to develop markets for new

products, and technologies. Despite best efforts, we may never overcome these

obstacles to financial success.

Our

production and sale of CWSF is dependent upon the implementation of our business

plan, as well as our ability to enter into agreements with third parties for the

provision of coal on terms that will be commercially viable for us. There can be

no assurance that our efforts will be successful or result in sales or profit.

If we fail to execute on our business plan, there could be a material adverse

effect on our operations.

If

we require additional financing to execute our business plan, we may not be able

to find such financing on satisfactory terms or at all.

The

revenues from the sales of CWSF may not be adequate to support the expansion of

our business. We may still need substantial additional funds to build and

maintain new production facilities, pursue research and development activities,

obtain necessary regulatory approvals and market our business. While we may seek

additional funds through public or private equity or debt financing, strategic

transactions and/or from other sources, there are no assurances that future

funding will be available on favorable terms or at all. If additional funding is

not obtained, we may need to reduce, defer or cancel any plans of expansion,

including overhead expenditures, to the extent necessary. The failure to fund

our capital requirements as they arise would have a material adverse effect on

our business, financial condition and results of operations.

Our

business and results of operations are dependent on the PRC coal markets, which

may be cyclical.

As all of

our revenue is derived from sales of CWSF, our business and operating

results are substantially dependent on the domestic supply of coal, especially

washed coal. The PRC coal market is cyclical and exhibits fluctuation in supply

and demand from year to year and is subject to numerous factors beyond our

control, including, but not limited to, the economic conditions in the PRC, the

global economic conditions and fluctuations in industries with high demand for

coal, such as the power and steel industries. Fluctuations in supply and demand

for coal have effects on coal prices which, in turn, affect our operating and

financial performance. The demand for coal is primarily affected by the overall

economic development and the demand for coal from the electricity generation,

steel and construction industries. The supply of coal, on the other hand, is

primarily affected by the geographical location of the coal supplies, the volume

of coal produced by domestic and international coal suppliers, and the quality

and price of competing sources of coal. Alternative fuels such as natural gas,

oil and nuclear power, alternative energy sources such as hydroelectric power,

and international shipping costs also have effects on the market demand for

coal. Excess demand for coal may have an adverse effect on coal prices which

would, in turn, cause a decline in our profitability. A significant increase in

domestic coal prices could also materially and adversely affect our business and

results of operations.

13

We

rely on a limited number of third-party suppliers for our supply of coal and the

loss of any such supplier could have a material adverse effect on our

operations.

We are

dependent upon our relationships with local third parties for our supply of

coal. Five suppliers provided 100% of the coal we used to produce

CWSF in 2007, 2008 and 2009 and our single largest supplier provided 70%, 93%,

and 85%, respectively. Suppliers are generally paid upon delivery

with a varying level of deposit up to 2 months and we generally enter into

one-year contracts with our suppliers. While we expect to increase

the number of suppliers we use as our business expands, if any of these

suppliers, and in particular our largest supplier, terminate their supply

relationship with us we may be unable to procure sufficient amounts of coal to

fulfill our demand. If we are unable to obtain adequate quantities of

coal to meet the demand for our CWSF product, our customers could seek to

purchase products from other suppliers, which could have a material adverse

effect on our revenues.

In

the past we have derived a significant portion of our sales from a few large

customers. If we were to lose any such customers, our business,

operating results and financial condition could be materially and adversely

affected

Our

customer base has been highly concentrated. As of December 31, 2009,

we had 27 customers all within Shaanxi Province. In 2007, 2008 and

2009, our five largest customers contributed 94%, 59% and 37.36% of our total

revenues, respectively, while our largest customer contributed 31%, 14% and 14%

of our total revenues, respectively. Our total number of customers is

still relatively concentrated and limited, and any adverse developments to any

one of their business operations could have an adverse impact on our business,

operating results and financial condition.

Our

business and prospects will be adversely affected if we are not able to compete

effectively.

We face

competition in all areas of our business. While we have no direct competitor for

CWSF in Shaanxi Province where we are based, there are other CWSF producers in

other areas of China that may look to expand their business into our market.

Additionally, we must compete against producers of other forms of energy such as

coal, natural gas and oil, which may have broader market acceptance. Some of our

competitors may have greater financial, marketing, distribution

and technological resources than we have, and they may have more

well-known brand names in the marketplace. If we are unable to

compete effectively against our competitors, this may have a material adverse

impact on our results of operations.

We

depend on our key executives, and our business and growth may be severely

disrupted if we lose their services.

Our

future success depends substantially on the continued services of our key

executives. In particular, we are highly dependent upon Mr. Baowen Ren, our

chairman, chief executive officer and president, who has established

relationships within the industries we operate. If we lose the services of one

or more of our current executive officers, we may not be able to replace them

readily, if at all, with suitable or qualified candidates, and may incur

additional expenses to recruit and retain new officers with industry experience

similar to our current officers, which could severely disrupt our business and

growth. In addition, if any of our executives joins a competitor or forms a

competing company, we may lose some of our suppliers or customers. Furthermore,

as we expect to continue to expand our operations and develop new products, we

will need to continue attracting and retaining experienced management and key

research and development personnel.

Competition

for qualified candidates could cause us to offer higher compensation and other

benefits in order to attract and retain them, which could have a material

adverse effect on our financial condition and results of operations. We may also

be unable to attract or retain the personnel necessary to achieve our business

objectives, and any failure in this regard could severely disrupt our business

and growth.

14

Our

business will suffer if we cannot obtain, maintain or renew necessary permits or

licenses.

All PRC

enterprises in the CWSF industry are required to obtain from various PRC

governmental authorities certain permits and licenses, including, without

limitation, a business license. We have obtained permits and licenses required

for the production and distribution of CWSF. Failure to obtain all necessary

approvals/permits may subject us to various penalties, such as fines or being

required to vacate from the facilities where we currently operate our

business.

These

permits and licenses are subject to periodic renewal and/or reassessment by the

relevant PRC government authorities and the standards of compliance required in

relation thereto may from time to time be subject to change. We intend to apply

for renewal and/or reassessment of such permits and licenses when required by

applicable laws and regulations, however, we cannot assure you that we can

obtain, maintain or renew the permits and licenses or accomplish the

reassessment of such permits and licenses in a timely manner. Any changes in

compliance standards, or any new laws or regulations that may prohibit or render

it more restrictive for us to conduct our business or increase our compliance

costs may adversely affect our operations or profitability. Any failure by us to

obtain, maintain or renew the licenses, permits and approvals, may have a

material adverse effect on the operation of our business. In addition, we may

not be able to carry on business without such permits and licenses being renewed

and/or reassessed.

We

may suffer losses resulting from industry-related accidents and lack of

insurance.

Our

manufacturing facilities may be affected by water, gas, fire or structural

problems. As a result, we, like other coal-based products companies, may

experience accidents that will cause property damage and personal injuries.

Although we have implemented safety measures for our production facilities and

provided on-the-job training for our employees, there can be no assurance that

accidents will not occur in the future. Additionally, the risk of accidental

contamination or injury from handling and disposing of our product cannot be

completely eliminated. In the event of an accident, we could be held liable for

resulting damages.

Although

some of our production line equipments and vehicles are covered by property

insurance, we do not currently maintain fire, casualty or other property

insurance covering our properties, equipment or inventories. In

addition, we do not maintain any business interruption insurance

or any third party liability insurance to cover claims related to personal

injury, property or environmental damage arising from accidents on our

properties, other than third party liability insurance with respect to vehicles.

Any uninsured losses and liabilities incurred by us could exceed our resources

and have a material adverse effect on our financial condition and results of

operations.

Our

operations are subject to a number of risks relating to the PRC.

We are

also subject to a number of risks relating to the PRC, including the

following:

|

·

|

The

PRC government currently supports the development and operation of clean

coal technology such as CWSF. If the PRC government changes its current

policies that are currently beneficial to us, we may face significant

constraints on our flexibility and ability to expand our business

operations or to maximize our

profitability;

|

|

·

|

Under

current PRC regulatory requirements, projects for the development of CWSF

require approval of the PRC government. If we are required to undertake

any such projects for our growth or for cost reduction and we do not

obtain the necessary approval on a timely basis or at all, our financial

condition and operating performances could be adversely

affected;

|

15

|

·

|

The

PRC government has been reforming, and is expected to continue to reform

its economic system. Many of the reforms are unprecedented or

experimental, and are expected to be refined and improved. Other

political, economic and social factors can also lead to further

readjustment of the reform measures. This refining and readjustment

process may not always have a positive effect on our operations. Our

operating results may be adversely affected by changes in China’s economic

and social conditions and by changes in policies of the PRC government

such as changes in laws and regulations (or the interpretation thereof),

imposition of additional restrictions on currency conversion and reduction

in tariff protection and other import

restrictions;

|

|

·

|

Since

1994, the conversion of RMB into foreign currencies, including Hong Kong

and U.S. dollars, has been based on rates set by the People’s Bank of

China, or PBOC, which are set daily based on the previous day’s PRC

interbank foreign exchange market rate and current exchange rates on the

world financial markets. Since 1994, the official exchange rate for the

conversion of RMB to U.S. dollars has generally been stable. On July

21, 2005, however, PBOC announced a reform of its exchange rate system.

Under the reform, RMB is no longer effectively linked to US dollars but

instead is allowed to trade in a tight 0.3% band against a basket of

foreign currencies. Any devaluation of the RMB may adversely affect

the value of our shares and dividends payable thereon as we receive our

revenues and denominate our profits in RMB. Our financial condition and

operating performance may also be affected by changes in the value of

certain currencies other than RMB in which our earnings and obligations

are denominated. In particular, a devaluation of the RMB is likely to

increase the portion of our cash flow required to satisfy any foreign

currency-denominated obligations;

and

|

|

·

|

Since

1997, many new laws and regulations covering general economic matters have

been promulgated in the PRC. Despite this activity to develop the legal

system, the PRC’s system of laws is not yet complete. Even where adequate

law exists, enforcement of existing laws or contracts based on existing

law may be uncertain and sporadic, and it may be difficult to obtain swift

and equitable enforcement or to obtain enforcement of a judgment by a

court of another jurisdiction. The relative inexperience of PRC’s

judiciary in many cases creates additional uncertainty as to the outcome

of any litigation. In addition, interpretation of statutes and regulations

may be subject to government policies reflecting domestic political

changes.

|

Competitors

may develop and market products that are less expensive, more effective or

safer, making CWSF obsolete or uncompetitive.

Some of

our competitors and potential competitors may have greater product development

capabilities and financial, scientific, marketing and human resources than we

do. Technological competition from other alternative energy companies is intense

and is expected to increase. Other companies have developed

technologies that could be the basis for competitive products. Some of these

products may be more effective and are less costly than CWSF. Over time, CWSF

may become obsolete or uncompetitive, which would have a material adverse effect

on our results of operations.

The

commercial success of CWSF depends on the degree of its market acceptance among

industrial and civil heating customers and if CWSF does not attain market

acceptance, our operations and profitability would be adversely

affected.

Despite

the central government’s push for clean-coal technology and the support for CWSF

amongst a number of municipal governments, CWSF may ultimately not gain wide

market acceptance in the PRC. The degree of market acceptance of any product

depends on a number of factors, including establishment and demonstration of its

efficacy and safety, cost-effectiveness, advantages over alternative products,

and marketing and distribution support for the product. Limited information

regarding these factors is available in connection with CWSF or competitive

products.

16

To

establish wide market acceptance of CWSF, we will require a marketing and sales

force with appropriate technical expertise and supporting distribution

capabilities, as well as continuing governmental support for the use of CWSF. We

may not be able to establish sales, marketing and distribution capabilities or

enter into arrangements with third parties on acceptable terms, and our ability

to influence governmental support is limited. If CWSF does not gain wide market

acceptance, our ability to continue to generate or increase revenue may be

limited.

If

we were successfully sued for product liability, we could face substantial

liabilities that may exceed our resources.

We may be

held liable if our product causes injury or is found unsuitable during product

testing, manufacturing, marketing, sale or use. We currently do not have product

liability insurance. We are not insured with respect to this liability. If we

choose to obtain product liability insurance but cannot obtain sufficient

insurance coverage at an acceptable cost or otherwise protect against potential

product liability claims, the commercialization of our product may be prevented

or inhibited. If we are sued for any injury caused by our product, our

liability could exceed our total assets.

We

may be unable to maintain an effective system of internal control over financial

reporting, and as a result we may be unable to accurately report our financial

results.

Our

reporting obligations as a public company place a significant strain on our

management, operational and financial resources and systems. If we fail to

maintain an effective system of internal control over financial reporting, we

could experience delays or inaccuracies in our reporting of financial

information, or non-compliance with the Securities and Exchange Commission, or

the SEC, reporting and other regulatory requirements. This could subject us to

regulatory scrutiny and result in a loss of public confidence in our management,

which could, among other things, adversely affect our stock price.

Our

business may be harmed because we do not carry any business insurance

coverage.

The

insurance industry in the PRC is still at an early stage of development.

Insurance companies in the PRC offer limited business insurance products. We do

not have any business liability or disruption insurance coverage for our

operations. Any business disruption, litigation or natural disaster may result

in our incurring substantial costs and the diversion of our

resources.

Our

success depends on attracting and retaining qualified personnel.

We depend

on a core team of management and operational personnel. The loss of any of these

individuals could prevent us from achieving our business objectives. Our future

success will depend in large part on our continued ability to attract and retain

other highly qualified management and operational personnel, as well as

personnel with expertise in our field and industry. We face competition for

personnel from other companies, universities, public and private research

institutions, government entities and other organizations. If our recruitment

and retention efforts are unsuccessful, our business operations could

suffer.

Downturn

in the global economy may slow domestic growth in China, which, in turn, may

effect our business.

Due to

the global downturn in the financial markets, China may not be able to maintain

its recent growth rates mainly due to the decreased demand for China’s

exported good in countries that are in recessions. Although we do not

presently export any of our products, our earnings may become unstable if

China’s domestic growth slows significantly and the domestic demand for energy

declines.

17

Risk

Related to the Alternative Energy Industry

A

drop in the retail price of conventional energy or other alternative energy may

have a negative effect on our business.

A

customer’s decision to purchase CWSF will be primarily driven by the return on

investment resulting from the energy savings from CWSF. Any fluctuations in

economic and market conditions that impact the viability of conventional and

other alternative energy sources, such as decreases in the prices of oil and

other fossil fuels could cause the demand for CWSF to decline and have a

material adverse affect on our business and results of operations. Although we

believe that current levels of retail energy prices support a reasonable return

on investment for CWSF, there can be no assurance that future retail pricing of

conventional energy and other alternative energy will remain at such

levels.

Existing

regulations and changes to such regulations may present technical, regulatory

and economic barriers to the purchase and use of CWSF, which may significantly

affect the demand for our products.

CWSF is

subject to oversight and regulations in accordance with national and local

ordinances and regulations relating to safety, environmental protection, and

related matters. We are responsible for knowing such ordinances and regulations,

and must comply with these varying standards. Any new government regulations or

utility policies pertaining to our product may result in significant additional

expenses to us and our customers and, as a result, could cause a significant

reduction in demand for our product.

The

market for CWSF is emerging and rapidly evolving, and its future success remains

uncertain. If CWSF is not suitable for widespread adoption or sufficient demand

for CWSF does not develop or takes longer to develop than we anticipate, our

sales would not significantly increase and we would be unable to achieve or

sustain profitability. In addition, demand for CWSF in the markets and

geographic regions where we operate may not develop or may develop more slowly

than we anticipate. Many factors will influence the widespread adoption of CWSF

and demand for our products, including:

|

·

|

cost-effectiveness

of CWSF as compared with conventional and other alternative energy

products and technologies;

|

|

·

|

performance

and reliability of CWSF as compared with conventional and other

alternative energy products and

technologies;

|

|

·

|

capital

expenditures by customers used to buy CWSF boilers tend to decrease if the

PRC or global economy slows down;

and

|

|

·

|

availability

of government subsidies and

incentives.

|

Risks

Related to Doing Business in China

Our

business operations are conducted entirely in the PRC. Because of China’s

economy and its laws, regulations and policies are different from those

typically found in western countries and are continually changing, we will face

risks including those summarized below.

Adverse

changes in economic and political policies of the PRC government could have a

material adverse effect on the overall economic growth of China, which could

adversely affect our business.

Substantially

all of our business operations are conducted in China. Accordingly,

our results of operations, financial condition and prospects are subject to a

significant degree to economic, political and legal developments in

China. China’s economy differs from the economies of most developed

countries in many respects, including with respect to the amount of government

involvement, level of development, growth rate, control of foreign exchange and

allocation of resources. While the PRC economy has experienced significant

growth in the past 20 years, growth has been uneven across different

regions and among various economic sectors of China. The PRC government has

implemented various measures to encourage economic development and guide the

allocation of resources. Some of these measures benefit the overall PRC economy,

but may also have a negative effect on us. For example, our financial

condition and results of operations may be adversely affected by government

control over capital investments or changes in tax regulations that are

applicable to us. Since early 2004, the PRC government has implemented

certain measures to control the pace of economic growth. Such measures may

cause a decrease in the level of economic activity in China, which, in turn,

could adversely affect our results of operations and financial

condition.

18

Uncertainties

with respect to the PRC legal system could adversely affect us.

Our

operations in China are governed by PRC laws and regulations. We are

generally subject to laws and regulations in China. The PRC

legal system is based on written statutes. Prior court decisions may be cited

for reference but have limited precedential value.

However,

China has not developed a fully integrated legal system and recently enacted

laws and regulations may not sufficiently cover all aspects of economic

activities in China. In particular, because these laws and

regulations are relatively new, and because of the limited volume of published

decisions and their nonbinding nature, the interpretation and enforcement of

these laws and regulations involve uncertainties. In addition, the

PRC legal system is based in part on government policies and internal rules

(some of which are not published on a timely basis or at all) that may have a

retroactive effect. As a result, we may not be aware of our violation

of these policies and rules until some time after the violation. In

addition, any litigation in China may be protracted and result in substantial

costs and diversion of resources and management attention.

We

must comply with the Foreign Corrupt Practices Act.

We are

required to comply with the United States Foreign Corrupt Practices Act, which

prohibits U.S. companies from engaging in bribery or other prohibited payments

to foreign officials for the purpose of obtaining or retaining business. Foreign

companies, including some of our competitors, are not subject to these

prohibitions. Certain of our customers are PRC government entities and our

dealings with them are likely to be considered to be with government officials

for these purposes. Corruption, extortion, bribery, pay-offs, theft and other

fraudulent practices occur from time-to-time in mainland China. If our

competitors engage in these practices, they may receive preferential treatment

from personnel of some companies, giving our competitors an advantage in

securing business or from government officials who might give them priority in

obtaining new licenses, which would put us at a disadvantage. We could suffer

severe penalties if our employees or other agents were found to have engaged in

such practices.

The

payment of dividends in the PRC is subject to limitations. We may not be able to

pay dividends to our stockholders.

We

conduct all of our business through our subsidiaries incorporated in the PRC. We

rely on dividends paid by these consolidated subsidiaries for our cash needs,

including the funds necessary to pay any dividends and other cash distributions

to our stockholders, to service any debt we may incur and to pay our operating

expenses. The payment of dividends by entities established in the PRC is subject

to limitations. Regulations in the PRC currently permit payment of dividends

only out of accumulated profits as determined in accordance with accounting

standards and regulations in the PRC, subject to certain statutory procedural

requirements. Each of our PRC subsidiaries, including wholly foreign owned

enterprises is also required to set aside at least 10.0% of their after-tax

profit based on PRC accounting standards each year to their general reserves or

statutory reserve fund until the aggregate amount of such reserves reaches 50.0%

of their respective registered capital. Our statutory reserves are not

distributable as loans, advances or cash dividends. In addition, if any of our

PRC subsidiaries incurs debt on its own behalf in the future, the instruments

governing the debt may restrict its ability to pay dividends or make other

distributions to us. Any limitations on the ability of our PRC subsidiaries to

transfer funds to us could materially and adversely limit our ability to grow,

make investments or acquisitions that could be beneficial to our business, pay

dividends and otherwise fund and conduct our business.

19

Adverse

changes in political and economic policies of the PRC government could have a

material adverse effect on the overall economic growth of China, which could

materially and adversely affect our business.

All of

our operations are conducted in China and all of our sales are made in China.

Accordingly, our business, financial condition, results of operations and

prospects are affected significantly by economic, political and legal

developments in China. The PRC economy differs from the economies of most

developed countries in many respects, including:

|

|

·

|

the

amount of government involvement;

|

|

|

·

|

the

level of development;

|

|

|

·

|

the

growth rate;

|

|

|

·

|

the

control of foreign exchange; and

|

|

|

·

|

the

allocation of resources.

|

While the

PRC economy has grown significantly since the late 1970s, the growth has been

uneven, both geographically and among various sectors of the economy. The PRC

government has implemented various measures to encourage economic growth and

guide the allocation of resources. Some of these measures benefit the overall

PRC economy, but may also have a negative effect on us. For example, our

financial condition and results of operations may be adversely affected by

government control over capital investments or changes in tax regulations that

are applicable to us.

The PRC

economy has been transitioning from a planned economy to a more market-oriented

economy. Although the PRC government has in recent years implemented measures

emphasizing the utilization of market forces for economic reform, the reduction

of state ownership of productive assets and the establishment of sound corporate

governance in business enterprises, a substantial portion of the productive

assets in China is still owned by the PRC government. The continued control of

these assets and other aspects of the national economy by the PRC government

could materially and adversely affect our business. The PRC government also

exercises significant control over economic growth in China through the

allocation of resources, controlling payment of foreign currency-denominated

obligations, setting monetary policy and providing preferential treatment to

particular industries or companies. Efforts by the PRC government to slow the

pace of growth of the PRC economy could result in decreased capital expenditure

by energy users, which in turn could reduce demand for our

products.

Any

adverse change in the economic conditions or government policies in China could

have a material adverse effect on the overall economic growth and the level of

energy investments and expenditures in China, which in turn could lead to a

reduction in demand for our products and consequently have a material adverse

effect on our business and prospects.

The

PRC economic cycle may negatively impact our operating results.

The rapid

growth of the PRC economy before 2008 generally led to higher levels of

inflation. The PRC economy has more recently experienced a slowing of its growth

rate. A number of factors have contributed to this slow-down, including

appreciation of the Renminbi, or RMB, the currency of China, which has adversely

affected China’s exports. In addition, the slow-down has been exacerbated by the

recent global crisis in the financial services and credit markets, which has

resulted in significant volatility and dislocation in the global capital

markets. It is uncertain how long the global crisis in the financial services

and credit markets will continue and the significance of the adverse impact it

may have on the global economy in general, or the Chinese economy in particular.

Slowing economic growth in China could result in slowing growth and demand for

our services which could reduce our revenues. In the event of a recovery in the

PRC, renewed high growth levels may again lead to inflation. Government attempts

to control inflation may adversely affect the business climate and growth of

private enterprise. In addition, our profitability may be adversely affected if

prices for our products rise at a rate that is insufficient to compensate for

the rise in inflation.

20

You

may experience difficulties in effecting service of legal process, enforcing

foreign judgments or bringing original actions in China based on United States

or other foreign laws against us and our management.

All of

the assets of Suoke Clean Energy, Suo’ang New Energy and Shenyang Energy are

located in, and all of our senior executive officers reside within, China. As a

result, it may not be possible to effect service of process within the United

States or elsewhere outside China upon our senior executive officers and

directors not residing in the United States, including with respect to matters

arising under U.S. federal securities laws or applicable state securities laws.

Moreover, our Chinese counsel has advised us that China does not have treaties

with the United States or many other countries providing for the reciprocal

recognition and enforcement of judgment of courts. As a result, our public

stockholders may have substantial difficulty in protecting their interests

through actions against our management or directors than would stockholders of a

corporation with assets and management members located in the United

States.

Governmental

control of currency conversion may affect the value of your

investment.

The PRC

government imposes controls on the convertibility of RMB into foreign currencies

and, in certain cases, the remittance of currency out of China. We receive all

of our revenues in RMB. Shortages in the availability of foreign

currency may restrict the ability of our PRC subsidiaries and our affiliated

entity to remit sufficient foreign currency to pay dividends or other payments

to us. Under existing PRC foreign exchange regulations, payments of

current account items, including profit distributions, interest payments and

expenditures from trade-related transactions, can be made in foreign currencies

without prior approval from the PRC State Administration of Foreign Exchange by

complying with certain procedural requirements. However, approval

from appropriate government authorities is required where RMB is to be converted

into foreign currency and remitted out of China to pay capital expenses such as

the repayment of bank loans denominated in foreign currencies.

Fluctuation

in the value of RMB may have a material adverse effect on your

investment.

The value

of RMB against the U.S. dollar and other currencies may fluctuate and is

affected by, among other things, changes in political and economic

conditions. Our revenues and costs are mostly denominated in RMB,

while a significant portion of our financial assets are denominated in U.S.

dollars. Any significant fluctuation in value of RMB may materially and

adversely affect our cash flows, revenues, earnings and financial position, and

the value of, and any dividends payable on, our stock in U.S.

dollars. For example, an appreciation of RMB against the U.S. dollar

would make any new RMB denominated investments or expenditures more costly to

us, to the extent that we need to convert U.S. dollars into RMB for such

purposes.

We

face risks related to health epidemics and outbreak of contagious

disease.

Our

business could be materially and adversely affected by the effects of H1N1 flu

(swine flu), avian flu, severe acute respiratory syndrome or other epidemics or

outbreaks. In April 2009, an outbreak of H1N1 flu (swine flu) first occurred in

Mexico and quickly spread to other countries, including the U.S. and the PRC. In

the last decade, the PRC has suffered health epidemics related to the outbreak

of avian influenza and severe acute respiratory syndrome. Any prolonged

occurrence or recurrence of H1N1 flu (swine flu), avian flu, severe acute

respiratory syndrome or other adverse public health developments in the PRC may

have a material adverse effect on our business and operations. These health

epidemics could result in severe travel restrictions and closures that would

restrict our ability to ship our products. Potential outbreaks could also lead

to temporary closure of our production facilities, our suppliers’ facilities

and/or our end-user customers’ facilities, leading to reduced production,

delayed or cancelled orders, and decrease in demand for our products. Any future

health epidemic or outbreaks that could disrupt our operations and/or restrict

our shipping abilities may have a material adverse effect on our business and

results of operations.

21

Risks

Related to an Investment in Our Securities

The full

conversion of certain outstanding convertible notes and the full exercise of

certain outstanding warrants could result in the substantial dilution of the

company in terms of a particular percentage ownership in the company as well as

the book value of common stock. The sale of a large amount of common stock

received upon conversion of the notes and exercise of the warrants on the public

market, or the perception that such sales could occur, could substantially

depress the prevailing market prices for our stock.

There are

over 9 million warrants outstanding from the financings that closed in September

2008. Additionally, the convertible notes that we issued in July 2009 may

currently be converted into approximately 61 million shares of common stock, and

there are also over 34 million warrants that we issued in connection with the

convertible notes. In the event of conversion or exercise of these securities,

as their conversion and exercise prices are less than the then current market

price for our common stock, a stockholder will suffer substantial dilution of

his, her or its investment in terms of the percentage ownership in us as well as

the book value of the shares of common stock held.

To

date, we have not paid any cash dividends and no cash dividends are expected to

be paid in the foreseeable future.

We do not

anticipate paying cash dividends on our common stock in the foreseeable future

and we may not have sufficient funds legally available to pay dividends. Even if

the funds are legally available for distribution, we may nevertheless decide not

to pay any dividends. We intend to retain all earnings for our

operations.

Our

common stock are thinly traded and, you may be unable to sell at or near ask

prices or at all if you need to sell your shares to raise money or otherwise

desire to liquidate your shares.

. Our

common stock has historically been sporadically or “thinly-traded” on the OTCBB,

meaning that the number of persons interested in purchasing our common stock at

or near bid prices at any given time may be relatively small or

non-existent. This situation is attributable to a number of factors,

including the fact that we are a small company which is relatively unknown to

stock analysts, stock brokers, institutional investors and others in the

investment community that generate or influence sales volume, and that even if

we came to the attention of such persons, they tend to be risk-averse and would

be reluctant to follow an unproven company such as ours or purchase or recommend