Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE DATED APRIL 7, 2010 - General Motors Co | dex991.htm |

| 8-K - FORM 8-K - General Motors Co | d8k.htm |

General Motors Company April 7, 2010 Exhibit 99.2 |

Forward Looking Statements 1 In this presentation and in related comments by our management, our use of the words “expect,” “anticipate,” “possible,” “potential,”

“believe,” “intend,” “target,” “may,”

“would,” “could,” “should,” “project,” “projected,” “positioned” or similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors might include: our ability to comply with the requirements of our credit agreements with the U.S. Treasury and EDC and to repay those agreements as planned; our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; our ability to maintain adequate liquidity and financing sources and an appropriate level of debt, including as required to fund our planning significant investment in new technology, and our ability to realize successful vehicle applications of new technology. Our most recent annual report on Form 10-K provides information about these and other factors, which may be revised or supplemented in future reports to the SEC on Form 10-Q or 8-K. |

Vision

Statement 2 Design, Build & Sell the World’s Best Vehicles |

Key

2010 CY Launches 3 2011 Chevy Cruze GMNA 2011 Opel Meriva GME GMIO 2011 Buick Regal 2011 Chevy Volt 2011 Opel Astra Wagon 2011 Chevy Orlando 2011 Chevy Sail 2011 Chevy Spark 2011 Buick Excelle Coming Soon |

Rebuild First Class Relationships 4 Customers Dealers Communities Union Partners Suppliers Employees |

Summary of 2009 Results 5 Q4 July 10 – Dec 31 Global Revenue $32.3B $57.5B EBIT $(4.0)B $(4.8)B Total Net Income/(Loss) $(3.4)B $(4.3)B Net cash provided/(used) operating activities (1.9) 1.0 Memo: Total net income/(loss) excludes preferred dividends Return to profitability a key priority |

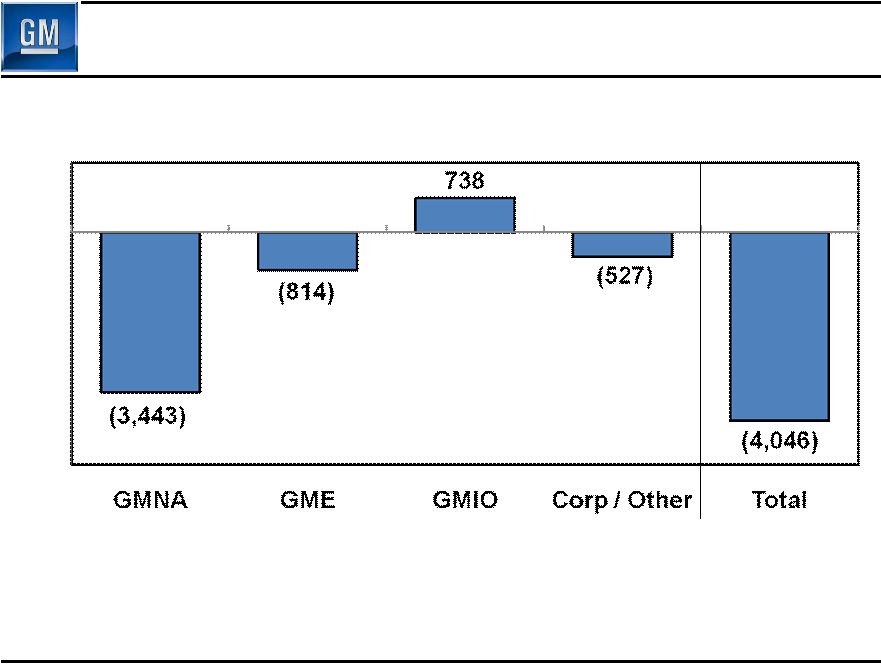

Q4

2009 EBIT 6 Q4 2008 (3,403) (1,855) (1,074) (2,321) (8,653) Memo: Old GM EBIT ($M) |

Sustainable Financial Strength ($B) Old GM Dec 31, 2008 New GM Dec 31, 2009 Cash & marketable securities * 14.2 36.2 Key Obligations: Debt 45.9 15.8 Preferred Stock n/a 7.0 Underfunded Pensions 25.6 27.5 Underfunded OPEB 32.9 9.6 Total Key Obligations 104.4 59.9 7 * Includes UST & Canadian HC Trust Restricted Cash |

Integrity & Reliability in Public Reporting • Requirement resulting from 363 transaction • Resets the basis for accounting to fair value as of July 10 and results in a new entity for financial reporting purposes • Substantially all of GM’s assets and liabilities recorded at fair value as of July 10, similar to purchase accounting – Adjustments recorded to ledgers & subledgers – More than 1 million asset records adjusted • Initiative was a major undertaking 8 Fresh-start accounting a key milestone for going public |

July

10 Reorg & Fresh-Start 9 July 10 Reorganization • $83B reduction in liabilities extinguished through 363 sale & issued common equity, warrants & preferred stock fair valued at $20B • $8B reduction in OPEB related to Revised UAW Settlement Agreement • $4B reduction in pension and OPEB resulting from July 10 implementation of modification to benefit plans July 10 Fresh-Start • Recognition of $30B goodwill • Recognition of $16B intangible assets • $19B balance in property, plant & equipment which is an $18B reduction • $8B balance in equity & cost based investments |

Commitments to Stakeholders • Original government loans of $8.4B – Paid $2.4B to UST & $0.4B to EDC through Mar 31 – Outstanding balance to be repaid in full by June at the latest 10 |

New

Leadership Team 11 12 of 13 EC members new to company or in new positions since July 2009 (Tom Stephens appointed to current position May 2009) Ed Whitacre Chairman & CEO Tom Stephens Tom Stephens Vice Chairman Vice Chairman Global Prod. Ops Global Prod. Ops Steve Girsky Vice Chairman Corp. Strategy & Bus. Dev. Chris Liddell Chris Liddell Vice Chairman Vice Chairman CFO CFO Nick Reilly Nick Reilly President President Europe Europe Mark Reuss President North America Tim Lee Tim Lee President President International Ops. International Ops. Mary Barra V.P. Human Resources Mike Millikin V.P. Legal Terry Kline Terry Kline V.P. Information V.P. Information Technology Technology John Montford Senior Advisor Gov’t Relations Selim Selim Bingol Bingol V.P. Comm V.P. Comm . . Bob Lutz Bob Lutz Vice Chairman Vice Chairman |

General Motors Company Select Supplemental Financial Information |

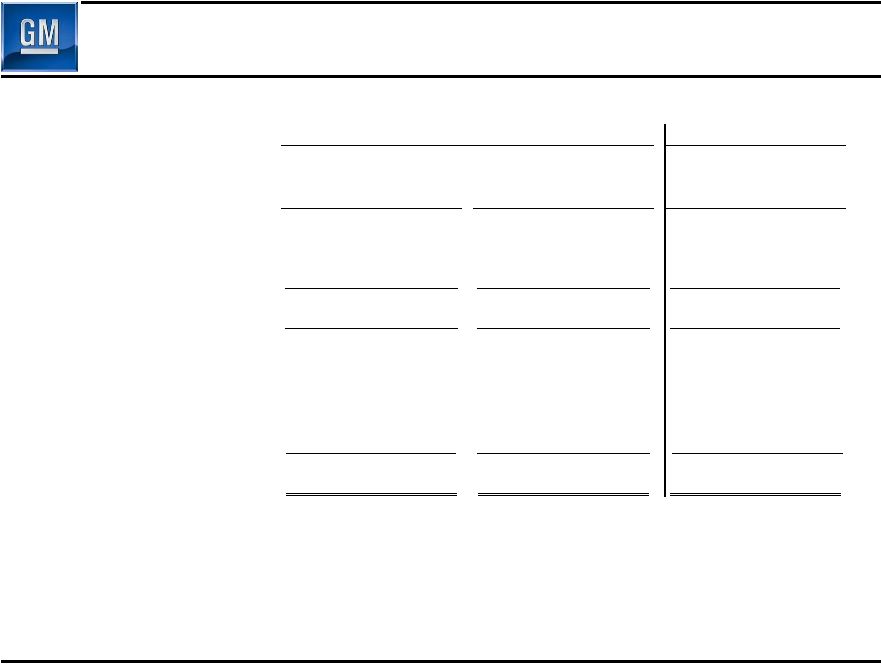

EBIT

Reconciliation 13 Predecessor July 10, 2009 October 1, 2009 October 1, 2008 Through Through Through December 31, 2009 December 31, 2009 December 31, 2008 Operating segments (EBIT) GMNA $

(4,820) GMIO 1,198 GME (805) Total operating segments (4,427) Corporate and eliminations (360) Income (loss) attributable to stockholders before interest and income taxes (4,787) Interest income 184 Interest expense 694 Income tax expense (benefits) (1,000) Net income (loss) attributable to stockholders $

(4,297) $

(3,443) 738

(814) (3,519) (527) (4,046) 75 329 (861) $

(3,439) $

(3,403) (1,074) (1,855) (6,332) (2,321) (8,653) 102 308 737 $

(9,596) Successor

|