Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2009

oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________.

Commission file number 000-25765

CHINA FORESTRY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

87-0429748

|

|

|

(State or Other Jurisdiction of Incorporation of Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Room 517, No. 18 Building

Nangangjizhong District,

High-Tech Development Zone

Harbin, Heilongjiang Province,

The People’s Republic of China

|

(011) (86) 0451-87011257

|

|

|

(Address of principal executive offices) (ZIP Code)

|

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Act: None

|

|

|

Securities registered pursuant to Section12 (g) of the Act:Common Stock, $0.001 par value

|

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

Aggregate market value of the voting and non-voting common stock of the registrant held by non-affiliates of the registrant at December 31, 2009, computed by reference to the last reported sale price of $0.05 per share on June 30, 2009: $1,874,313.

Number of common shares outstanding at March 31, 2010: 56,000,000

2

TABLE OF CONTENTS

| PART I | ||

| Item 1. |

Business

|

4

|

| Item 2. |

Properties

|

14

|

| Item 3. |

Legal Proceedings

|

15

|

| Item 4. |

Removed and Reserved

|

15

|

| PART II | ||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities

|

16

|

| Item 6. |

Selected Financial Data

|

17

|

| Item 7. |

Management's Discussion and Analysis of Financial Condition and

Results of Operations

|

17

|

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk

|

21

|

| Item 8. |

Financial Statements and Supplementary Data

|

22

|

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure

|

33

|

| Item 9A. |

Controls and Procedures

|

34

|

| Item 9B. |

Other Information

|

35

|

| PART III | ||

| Item 10. |

Directors, Executive Officers and Corporate Governance

|

35

|

| Item 11. |

Executive Compensation

|

38

|

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

40

|

| Item 13. |

Certain Relationships, Related Transactions and Director Independence

|

41

|

| Item 14. |

Principal Accounting Fees and Services

|

41

|

| PART IV | ||

| Item 15. |

Exhibits, Financial Statement Schedules

|

42

|

| Signatures |

43

|

|

3

Forward-looking Statements

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable laws, including the securities laws of the United States, we do not intend to update any of the forward-looking statements so as to conform these statements to actual results.

As used in this annual report, the terms "we", "us", "our", “the Company”, and "China Forestry" mean China Forestry, Inc. and all of our subsidiaries, unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

Overview

History of Our Company

Patriot Investment Corporation, a Nevada corporation (“Patriot”), was originally incorporated on January 13, 1986. It has not had active business operations since inception and was considered a development stage company. In 1993, Patriot entered into an agreement with Bradley S. Shepherd in which Mr. Shepherd agreed to become an officer and director and use his best efforts to organize and update our books and records and to seek business opportunities for acquisition or participation.

On June 26, 2007, Patriot Investment Corporation simultaneously entered into, and closed, a Share Exchange Agreement (the “Exchange Agreement”) by and among the Company, Harbin SenRun Forestry Development Co., Ltd., a corporation organized and existing under the laws of the People’s Republic of China (“Harbin SenRun”), Bradley Shepherd, the President and majority shareholder of the Company (“Shepherd”), Everwin Development Ltd., a corporation organized under the laws of the British Virgin Islands (“Everwin”), and beneficial owner of 100% of the share capital of Jin Yuan Global Limited, Jin Yuan Global Limited, a corporation organized under the laws of the Hong Kong SAR of the People’s Republic of China (“Hong Kong Jin Yuan”), and the Jin Yuan Global Limited Trust, a Hong Kong trust created pursuant to a Declaration of Trust and a Trust and Indemnity Agreement dated March 10, 2007 (the “Jin Yuan Global Limited Trust”) (Everwin, Hong Kong Jin Yuan and the Jin Yuan Global Limited Trust being hereinafter referred to as the “SenRun Shareholders”). At the closing of the share exchange transaction contemplated under the Exchange Agreement (the “Share Exchange”), Everwin transferred all of its share capital of Hong Kong Jin Yuan together with the sum of $610,000 in cash, plus $25,000 in proceeds of a cash deposit that was retained by the Company, to the Company in exchange for an aggregate of 10,000,000 shares of Series A Convertible Preferred Stock, which preferred shares are convertible into 47,530,000 shares of common stock of the Company, thus causing Hong Kong Jin Yuan to become a wholly-owned subsidiary of the Company and Harbin SenRun to become an indirect wholly-owned subsidiary of the Company.

4

In addition, pursuant to the terms and conditions of the Exchange Agreement:

|

Ÿ

|

On the Closing Date, the Company declared a cash dividend to the holders of its common stock in an amount equal to $ 0.01227 per share to holders of record on July 6, 2007, representing the cash payment received from Everwin less the outstanding liabilities of the Company which were to be paid off before the cash dividend was made.

|

|

Ÿ

|

After the dividend payment date on July 16, 2007, Shepherd exchanged 44,751,500 of his shares of common stock of the Company for 221,500 shares of common stock of the Registrant, and Todd Gee exchanged 100,000 of his shares for 100,000 shares of common stock, with Mr. Shepherd ending up owning 507,500 shares of common stock and Mr. Gee ending up owning 100,000 shares of common stock.

|

|

Ÿ

|

Following Shepherd’s exchange of shares, Everwin converted its Series A Convertible Preferred Stock into 47,530,000 shares of common stock.

|

|

Ÿ

|

Demand and piggy-back registration rights were granted to Everwin and piggy-back registration rights were granted to Messrs. Shepherd and Gee with respect to shares of the Company’s restricted common stock acquired by them following the closing.

|

|

Ÿ

|

Everwin agreed for a period of one year following the closing that it will not cause or permit the Company to effect any reverse stock splits or register more than 6,000,000 shares of the Company’s common stock pursuant to a registration statement on Form S-8.

|

|

Ÿ

|

On the Closing Date, the current officers of the Company resigned from such positions and the persons designed by Everwin were appointed as the officers of the Company, notably Chunman Zhang as CEO, CFO and Treasurer and Degong Han as President and Secretary, and Todd Gee resigned as a director of the Company and a person designated by Everwin was appointed to fill the vacancy created by such resignation, notably Man Ha.

|

|

Ÿ

|

On the Closing Date, Shepherd resigned from his position as a director effective upon the expiration of the ten day notice period required by Rule 14f-1, at which time two persons designated by Everwin were appointed as directors of the Company, notably Degong Han and Kunlun Wang.

|

|

Ÿ

|

On the Closing Date, the Company paid and satisfied all of its “liabilities” as such term is defined by U.S. GAAP as of the closing.

|

|

Ÿ

|

On October 8, 2007, the Company announced the dismissal of Chunman Zhang from the offices of Chief Executive Officer, Chief Financial Officer and Treasurer, and the appointment of Yuan Tian as the Chief Executive Officer and Director and Man Ha as the Chief Financial Officer and Treasurer of the Company.

|

As of the date of the Exchange Agreement there were no material relationships between the Company or any of its affiliates and Everwin and the SenRun Shareholders, other than in respect of the Exchange Agreement.

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Exchange Agreement, which is filed as Exhibit 2.1 to a Form 8-K filed with the Commission on July 2, 2007, and is incorporated herein by reference.

We are a Nevada corporation. We are a fully-reporting 1934 Act company, with our common stock quoted on the Over the Counter Bulletin Board (OTCBB).

5

Everwin’s Acquisition of Hong Kong Jin Yuan; the Share Exchange

During January 2007, Mr. Degong Han, a citizen and resident of the People’s Republic of China and the majority shareholder of Harbin SenRun (“Han”), contributed 51% of the equity ownership of Harbin SenRun to Hong Kong Jin Yuan. Later, during March 2007, Han, who owned the remaining 49% equity interest in Harbin SenRun, executed the Jin Yuan Global Limited Trust, and transferred his ownership interest in trust and he became Trustee of the Trust. Simultaneously, the Trustee assigned to Hong Kong Jin Yuan the beneficial ownership interest in the Trust’s 49% ownership interest in Harbin SenRun. As a result of these transactions, Hong Kong Jin Yuan became the beneficial owner of a 100% interest in Harbin SenRun.

During May 2007, Everwin acquired 100% of the equity interest in Hong Kong Jin Yuan in exchange for shares of capital stock to be issued in the future by Everwin to the shareholders of Hong Kong Jin Yuan. As a result of these transactions, Everwin owns 100% of the equity interest in Hong Kong Jin Yuan, which, as mentioned above, owns 100% of the equity interest in Harbin SenRun. Mr. Man Ha, Chief Financial Officer of China Forestry, Inc., is the sole director, secretary and sole shareholder of Everwin.

Pursuant to the Share Exchange, 100% of the equity interest in Hong Kong Jin Yuan was contributed to the Company, together with $610,000 in cash, plus $25,000 in proceeds of a cash deposit that was retained by the Company, which made Hong Kong Jin Yuan a wholly owned subsidiary of the Company, and Harbin SenRun a wholly owned indirect subsidiary of the Company.

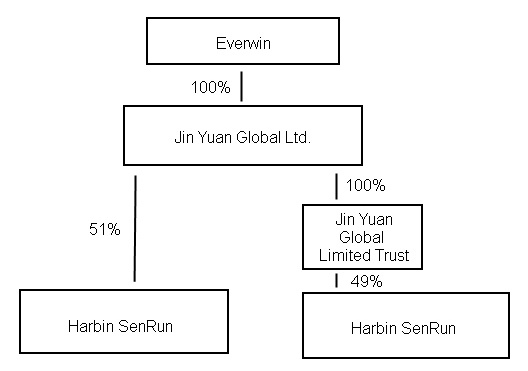

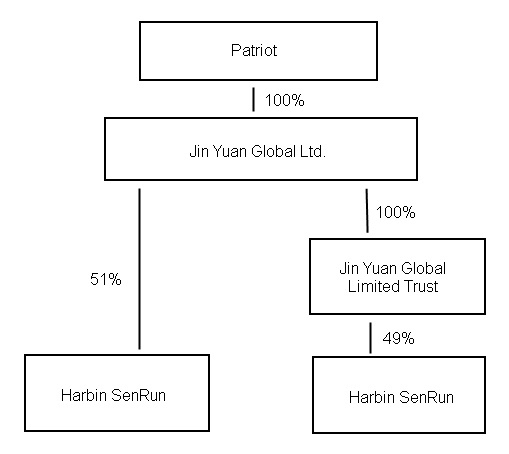

Organizational Charts

Set forth below is an organization chart of the entities that existed prior to the Share Exchange and contribution of 100% of the share capital of Hong Kong Jin Yuan by Everwin to Patriot, and an organizational chart showing the entities that existed after the Share Exchange and contribution of 100% of the share capital of Hong Kong Jin Yuan by Everwin to Patriot.

Before Share Exchange

6

After Share Exchange

Share Exchange

The Share Exchange. On June 26, 2007, the Company entered into the Exchange Agreement with Harbin SenRun, Shepherd, and the SenRun Shareholders. Upon closing of the Share Exchange on June 26, 2007, Everwin delivered 100% of the share capital in Hong Kong Jin Yuan to the Company together with $610,000 in cash, plus $25,000 in proceeds of a cash deposit that was retained by the Company, in exchange for 10,000,000 shares of Series A Convertible Preferred Stock of the Company which are convertible into 47,530,000 shares of common stock of the Company, resulting in Hong Kong Jin Yuan becoming a wholly-owned subsidiary of the Company, and Harbin SenRun becoming an indirect wholly-owned subsidiary of the Company. Each share of Series A Convertible Preferred Stock is entitled to 4.753 votes and is convertible into 4.753 shares of common stock of the Company.

As a result, 47,000,000 shares of the Company’s common stock were outstanding immediately prior to the closing of the Share Exchange, and, after giving effect to the cancellation and exchange of shares, and the conversion of the Series A Convertible Preferred Stock to common stock, 50,000,000 shares of the Company’s common stock will be outstanding after the closing of the Share Exchange. Of these shares, 1,862,500 shares of common stock represent the Company’s “float” prior to and after the Share Exchange. The 10,000,000 shares of Series A Common Stock and the 47,530,000 shares of common stock into which they are convertible were issued in reliance upon an exemption from registration pursuant to Regulation S under the Securities Act of 1933, as amended (the “Securities Act”). The 1,862,500 shares of common stock in the Company’s float will continue to represent the shares of the Company’s common stock held for resale without further registration by the holders thereof.

Neither the Company nor Everwin had any options or warrants to purchase shares of capital stock outstanding immediately prior to or following the Share Exchange.

7

Prior to the announcement by the Company relating to the entry into the Share Exchange, there were no material relationships between the Company, Everwin, Hong Kong Jin Yuan or Harbin SenRun, or any of their respective affiliates, directors or officers, or any associates of their respective officers or directors.

Changes Resulting from the Share Exchange. The Company has been carrying on Harbin SenRun’s business as its sole line of business. The Company relocated its executive offices to Room 517, No. 18 Building, Nangangjizhoing District, Hi-Tech Development Zone, Harbin, Heilongjiang, People’s Republic of China, and its telephone number is 86-0451-87011257.

Changes to the Officers and Board of Directors: At closing, the former officers of the Company resigned from such positions and the persons designated by Everwin were appointed to the following offices by Everwin, Chunman Zhang as CEO, CFO and Treasurer, and Degong Han as President and Secretary, were designated as officers of the Company. In addition, at closing Todd Gee resigned as a director of the Company and Man Ha was appointed to fill the vacancy created by such resignation. Further, Bradley Shepherd resigned from his position as a director effective July 6, 2007, at which time the board increased and Kunlun Wang and Degong Han were appointed directors. As mentioned above, on October 8, 2007, the Company announced the dismissal of Chunman Zhang from all of his offices, and the appointment of Yuan Tian to the position of Chief Executive Officer and Man Ha to the position of Chief Financial Officer and Treasurer.

Overview

The Company was originally incorporated in Nevada on January 13, 1986. Since inception, it has not had active business operations and was considered a development stage company. In 1993, the Registrant entered into an agreement with Bradley S. Shepherd in which Mr. Shepherd agreed to become an officer and director and use his best efforts to organize and update the Company’s books and records and to seek business opportunities for acquisition or participation. The acquisition of the share capital of Hong Kong Jin Yuan was such an opportunity.

As a result of the Share Exchange, Hong Kong Jin Yuan became a wholly-owned subsidiary of the Company, Harbin SenRun became an indirect wholly-owned subsidiary of the Company, and the Company succeeded to the business of Harbin SenRun Forestry Development Co., Ltd., a producer of forest products with approximately 1,561 hectares of State forest assets located mainly over the Small Xing An Mountains, Jin Yin County, and the Harbin Wu Chang District of Heilongjiang Province of Northern China.

Harbin SenRun was founded in 2004. It currently has a workforce of 8 full time employees, mainly in sales, administration and in supporting services. It recruits temporary part-time workers to carry out felling, cutting and forestry plantation and protection.

Harbin SenRun engages in the business of conserving and managing forests and forest lands to provide a sustained supply of forest products, forest conditions, and other forest values desired by its position as a forest user. Its primary operations are felling trees and selling the logs.

8

Philosophy & Values

Since its inception, Harbin SenRun’s founders and management team have been committed to the philosophy of “the forest as an independent ecosystem,” and believe this focus will continue to help Harbin SenRun grow and develop as a strong and lasting enterprise.

Holding true to its values, Harbin SenRun treats the forest as a renewable resource, a sustainable resource, a storable resource, and a beneficial resource, yielding economic benefits, ecosystem benefits and social benefits. Management notes that the China forest products market grew by 13.68% in 2008 to reach a value of RMB 1,330 billion.

Description of Our Business

All references to the “Company,” “we,” “our” and “us” for periods prior to the closing of the Share Exchange refer to Harbin SenRun, and references to the “Company,” “we,” “our” and “us” for periods subsequent to the closing of the Share Exchange and Stock Purchase refer to the Registrant and its subsidiaries.

Company Overview

Forestry

Our forestry business manages 1,561 hectares of private commercial forestland in Heilongjiang Province, the People’s Republic of China. We have the right to use all of those hectares pursuant to a usage lease for a term of years from the provincial government. Our forest lands are as follows:

|

1.

|

Ping Yang He Forestry Center – The forest land locates near Small Xing An Mountains, Jin Yin County, Heilongjiang Province, with a total of 191 hectares. We have the woodland use right up to February 9, 2074.

|

|

2.

|

Jin Lien Forestry Center – The forest land locates near Harbin Wu Chang District of Heilongjiang Province, with a total of 571 hectares. We have the woodland use right up to September 8, 2056.

|

|

3.

|

Wei Xing Forestry Center – The forest land locates near Harbin Wu Chang District of Heilongjiang Province, with a total of 555 hectares. We have the woodland use right up to August 30, 2056.

|

|

4.

|

Mao Lin Forestry Center – The forest land locates near Harbin Wu Change District of Heilongjiang Province, with a total of 244 hectares. We have the woodland use right up to December 1, 2056

|

What we do

We grow and harvest trees, felling them and selling the logs to commercial customers. After harvest, we typically plant seedlings to reforest the harvested areas using the most effective regeneration method for the site and species. We monitor and care for the new trees as they grow to maturity. We seek to sustain and maximize the timber supply from our forestlands, while keeping the health of our environment a key priority.

9

The goal of our business is to maximize return by selling logs and stumpage to commercial customers. We focus on solid softwood and seek to improve forest productivity and returns, while managing the forests on a sustainable basis to meet both customer and public expectations.

How much we sell

There are no sales to customers in 2008 or 2009.

Where we are headed

Our strategies for achieving success include:

|

Ÿ

|

managing forests on a sustainable basis to meet customer and public expectations

|

|

Ÿ

|

reducing the time it takes to realize returns by practicing intensive forest management and focusing on the most advantageous markets

|

|

Ÿ

|

building long term relationships with our customers who rely on a consistent supply of high quality raw material

|

|

Ÿ

|

continuously reviewing our portfolio to create the greatest value for the company

|

10

Sales by Product Category

The Company sells logs, which is its sole product category at present; the log sales were $0 for the fiscal year ended December 31, 2009.

The Market for Logs

The World Log Market

Many countries in the world are starting programs to protect their domestic forest industries, reduce illegal logging, protect deforestation, all of which reduces supply. The reduction of supply has lead to increasing log prices in the world market, and this trend has continued over the last several years.

The Log Market in China

According to the International Tropical Timber Organization (“ITTO”), which was established in 1986 under the auspices of the United Nations, in 2008, China’s wood industry was strongly impacted by the international financial crisis. Based on statistics from China Customs, imports of logs dropped for the first time, while sawnwood imports continued to rise. A total of 29.57 million m³ of logs valued at USD5.182 billion were imported in 2008, down 20% by volume and 3% by value from 2007. These results, which have never been seen in the last ten years, largely resulted from low demand for international furniture and plywood. Another reason causing the reduction of imports was Russia’s increased export tariff, which led to a sharp drop in China’s imports of Russian logs.

On the other hand, China’s imports of sawnwood continued to increase. A total of 7 million m³ of sawnwood valued at USD2 billion was imported in 2008, up 9.6% by volume and 15% by volume, respectively, from 2007. This was mainly caused by rising prices over the period. With prices of logs increasing, some manufacturers used sawnwood as materials instead of logs.

In a February 11, 2010 update on FORDAQ.com, preliminary statistics in the report “2009 National Forestry Economy Performance” from China’s State Forestry Administration indicate that China’s forestry industry output in 2009 amounted to RMB1.58 trillion, up around 10% from 2008, but the pace of growth was slower than in 2008. The volumetric output of timber nationally in 2009 has been estimated at 69 million cubic meters, down 14% from the 81 million cubic meter output in 2008.

The forestry industry products are mainly composed of the felling and transport of timber and bamboo and the collection of forest products.

It appears that the continuous demand for high quality wood products is increasing the demand for logs in China. Further, we believe the rising standard of living in China will provide a higher demand for quality wood products for local consumption.

11

Competition

Log Sales

There are no strong competitors to the Company in the Heilongjiang Province. The Company believes that any logging operation that might compete with Harbin SenRun produces products that are lesser in quality than the Company’s products. Moreover, most of these competitors produce products that are considered lower grade than the Company’s products. The Company’s logs include alley woods (20%), the highly demanded charcoal wood material used for construction materials (35%), and thick woods (45%).

Cellulose Fibers (Pulp) and Paper

Although the Company does not sell cellulose fibers or paper at this point in time, the Company has identified competitors.

The first one is Da Xing An Ling Sen Gong (Lin Ye) Ji Tuan Company Ltd., a company which is directly owned by the State Forestry Administration. This company manufactures and produces all forest products and some natural products, and is the manufacturing arm of the Central government. It has sales and distribution networks set up all over China. Its products cover the high-end as well as the low-end in terms of use and value. Logs, pulp and paper are primary offerings of the company.

A second competitor is Heilongjiang Yichun County Guang Ming Furniture Manufacturing Group. The group was organized in 1986 and now employs over 4,000 workers with 17 manufacturing facilities around Heilongjiang Province. Some of their wood products are exported to the overseas market.

A third competitor is BeiDaHuang ZhiYe. This company used to be a state owned enterprise which was set up in 1958, but in 2003 it was reorganized as a private company and its subsidiary was listed on the PRC stock market. Their pulp and paper manufacturing section has over 1,200 workers and annual output of over 14,000 tons of pulp and over 18,000 tons of paper.

A well known problem for a state owned or quasi-state owned enterprise in China is its inflexibility to react to market driven trends in production, manufacturing, timing of output, pricing and sales support. It is customary for employees of these companies not to embrace the risks associated with market driven changes and the globalization of the world market. In short, we believe they are not competitive with many smaller, more agile privately held companies.

Competitive Advantages and Strategy

Log sales

The Company believes that its product formulations, price points, lower costs, relationships, infrastructure, proven quality control standards, and reputation represent substantial competitive advantages. The Company is currently able to maintain a substantially lower cost structure than competitors based in the Heilongjiang Province. Furthermore, the Company believes its competitive advantage in China is protected by significant knowledge of government regulations, business practices, and strong relationships.

In comparison to Chinese competitors, the Company believes it possesses superior technological expertise, products, marketing knowledge, and global relationships.

12

Growth Strategy

The Company’s vision is to be an integrated forestry operation. Management intends to grow the Company’s business by pursuing the following strategies:

|

Ÿ

|

Grow capacity and capabilities in line with market demand increases

|

|

Ÿ

|

Enhance leading-edge technology through continuous innovation, research and study

|

|

Ÿ

|

Continue to improve operational efficiencies and use of nearly all resource by-products

|

|

Ÿ

|

Further expand into higher value-added segments of the forestry industry

|

|

Ÿ

|

Build a strong market reputation to foster and capture future growth in China

|

Existing Facilities in Heilongjiang Province

The Company uses tractors for collection of its logs, and trucks for delivery to customers. In the past, the Company rented trucks from the Forestry Bureau. In the future, the Company may purchase two tractors and three trucks. In addition, it may acquire ten more felling saws and other small sized equipment.

Sales and Marketing

Log sales

To date, the Company has developed relationships with current and future potential customers primarily through its small but effective sales force. The Company will continue to build on its success by expanding its sales force in China as may be appropriate. The Company’s sales strategy is designed to capitalize on its reputation, current industry trends and new market segments that have shown the most promise.

Intellectual Property

None.

13

Customers

Log sales

For the twelve month period from January 1, 2009 through December 31, 2009, the Company achieved revenues of $0, so the Company did not have any customers in 2009.

Regulation

According to “The State of the World’s Forests 2009” issued by the Food and Agriculture Organization of the United Nations, forest land in Asia and Pacific area occupies 18.6% of the world total forest land. The area has 136 million hectares of manmade forest, occupying half of the global manmade forest. One third of manmade forest in Asia and Pacific area locate in China and India for environmental protection.

The Company is subject to environmental regulation by both the PRC central government and by local government agencies. Since its inception, the Company has been in compliance with applicable regulations in all material respects.

The main statutes which govern matters related to forestry in China are set forth below:

|

1.

|

The Forest Law of the People’s Republic of China (the “Forest Law”) is the most important piece of legislation that regulates the forestry administrative management agencies at different levels and forest owners, managers and utilizers’ legal rights and responsibilities on ownership, management, protection, tree planting and forest felling.

|

|

2.

|

The Provisional Regulations on Forest Management provide for the major tasks of responsible forestry agencies and local forest land management and supervision agencies are implementing and executing relevant national and local laws, regulations and policies concerning forest land management.

|

|

3.

|

The Regulations on the Protection of Terrestrial Wildlife was enacted to provide better provisions for the protection of wild life.

|

Harbin SenRun has eight full time employees, mainly in sales, administration and supporting services. It recruits temporary part-time workers to carry out felling, cutting and forestry plantation and protection. Harbin SenRun believes it is in compliance with local prevailing wage, contractor licensing and insurance regulations, and has good relations with its employees.

Harbin SenRun’s headquarters are currently located on leased office space at Room 517, No. 18 Building, Nangangjizhoing District, Hi-Tech Development Zone, Harbin, Heilongjiang Province, People’s Republic of China.

In China, the ownership of land belongs to the PRC government, and private entities and individuals can acquire land use rights for a certain period of time. The land use right can be transferred according to the relevant law. According to the Forest Law, the woodland use right is transferable.

14

Harbin SenRun has the following 4 major Forestry Centers:

1. Ping Yang He Forestry Center

The forest land locates near Small Xing An Mountains, Jia Yin Country, Heilongjiang Province. The site area of the forest was approximately 191 hectares as recorded under the Forest Right Certificate.

We hold the forest land use right, woodland ownership right and woodland use right for a period of up to February 9, 2074 (approximately 65 years left).

There is a timber stand forest in which the trees are mainly for timber production. The major tree species are for timber product usage.

2. Jin Lien Forestry Center

The forest land locates near Harbin Wu Chang District of Heilongjiang Province. The site are of the forest was approximately 571 hectares as recorded in the Forest right Certificate.

We hold the forest land use right, woodland ownership right and woodland use right for a period of up to September 8, 2056 (approximately 47 years left).

This is a timber stand forest in which the trees are mainly for timber production. The major tree species were for timber product usage.

3. Wei Xing Forestry Center

The forest land locates near Harbin Wu Chang District of Heilongjiang Province. The site area of the forest was approximately 55 hectares as recorded under the Forest Right Certificate.

We hold the forest land use right, woodland ownership right and woodland use right for a period up to August 30, 2056 (approximately 47 years left).

This is a timber stand forest in which the trees are mainly for timber production. The major free species were Aspens, for timber product usage.

4. Mao Lin Forestry Center

The forest land locates near Harbin Wu Chan District of Heilongjiang Province. The site area of the forest was approximately 244 hectares as recorded under the Forest Right Certificate.

We hold the forest land use right, woodland ownership right and woodland use right for a period up to December 1, 2056 (approximately 47 years left).

This is a timber stand forest with the trees are used mainly for timber production. The major tree species are for timber product usage.

We know of no material, active or pending legal proceedings against us, our subsidiaries or our property, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholders are an adverse party or have a material interest adverse to us.

Item 4. Removed and Reserved

None.

15

|

Market for Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

Market Information

Our common stock is currently quoted on a limited basis on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “CHFY”. The quotation of our common stock on the OTCBB does not assure that a meaningful, consistent and liquid trading market currently exists. We cannot predict whether a more active market for our common stock will develop in the future. In the absence of an active trading market:

(1) Investors may have difficulty buying and selling or obtaining market quotations;

(2) Market visibility for our common stock may be limited; and

(3) A lack of visibility of our common stock may have a depressive effect on the market price for our common stock.

The following table sets forth the range of high and low prices of our common stock as quoted on the OTCBB during the periods indicated. The prices reported represent prices between dealers, do not include markups, markdowns or commissions and do not necessarily represent actual transactions.

|

High

|

Low

|

||||||||

|

2009

|

First Quarter

|

$ | 0.07 | $ | 0.015 | ||||

|

|

Second Quarter

|

$ | 0.035 | $ | 0.015 | ||||

|

|

Third Quarter

|

$ | 0.07 | $ | 0.03 | ||||

|

|

Fourth Quarter

|

$ | 0.1 | $ | 0.015 | ||||

|

|

|

||||||||

|

2008

|

First Quarter

|

$ | 1.01 | $ | 0. 11 | ||||

|

|

Second Quarter

|

$ | 0.62 | $ | 0. 12 | ||||

|

|

Third Quarter

|

$ | N/A | $ | N/A | ||||

|

|

Fourth Quarter

|

$ | 0.95 | $ | 0.03 | ||||

The transfer agent for our common stock is Interwest Transfer Co., Inc., 1981 East 4800 South, Ste 100, Salt Lake City, UT 84111, Attn Melinda Orth; Tel: (801) 272-9294.

From January 1 to April 1, 2010, the highest and lowest prices of our common shares on the OTC Bulletin Board were $0.09 per share and $0.04 per share. On April 1, 2010, the closing price of our common stock on the OTC Bulletin Board on the last day it traded before the filing of this Annual Report was $0.04 per share.

Holders

As of December 31, 2009, there were 143 holders of record of 56,000,000 outstanding shares of common stock of the Company, which does not include shareholders who own our shares in so-called “street name.”

16

Dividends

Holders of our common stock are entitled to dividends if declared by the Board of Directors out of funds legally available therefore. As of December 31, 2009 no cash dividends have been declared.

Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our results of operation, financial condition, contractual and legal restrictions and other factors the board of directors deem relevant.

As of December 31, 2009, we did not have any equity compensation plans.

We have not made any previously unreported sales of unregistered securities from January 1, 2009 to December 31, 2009.

Recent Purchases of Equity Securities by us and our Affiliated Purchasers

We have not repurchased any of our common stock and have no publicly announced repurchase plans or programs as of December 31, 2009.

Not applicable.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This report contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including, "could" "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this Annual Report.

17

Results of Operations

|

Year Ended December 31,

|

|

2009

|

|

|

2008

|

|

||

|

Net Sales Revenue:

|

|

$

|

0

|

|

|

$

|

0

|

|

|

General and Administrative Expenses:

|

|

$

|

113,178

|

|

|

$

|

1,162,532

|

|

|

Income (Loss) Before Taxes:

|

|

$

|

(113,178)

|

|

|

$

|

(1,162,532)

|

|

|

Net Income (Loss):

|

|

$

|

(113,178)

|

|

|

$

|

(1,162,532)

|

|

Operating Revenue

There was no revenue in 2009 or 2008 as a result of failing to acquire the wood-cutting quota from the local government department of Tieli Bureau of Forestry and there was no production in 2009 and 2008. The Company is currently in the process of getting the wood-cutting quota from the government.

Loss before taxes decreased by $1,049,354 for the twelve-month period ended December 31, 2009, compared to the same corresponding period in year 2008. The loss before taxes was predominantly caused by failing to acquire a log-cutting quota from the local Bureau of Forestry. The local Tieli Bureau of Forestry was undertaking an organization reform and did not issue any wood-cutting quota to local timberlands in 2009 and 2008. The decrease in loss is due to China Forestry having issued 6,000,000 common shares in 2008 for services to outside consultants and recording $1,090,500 of expenses based on the fair value of the common stock at the time the service agreements were signed. There were no such expenses incurred during 2009.

Since the Company did not get any sales revenue from selling logs in 2009, the percentage of total operating revenues and consolidated gross profit margins cannot be measured in 2009.

Selling, General and Administrative Expenses

Selling, general and administrative expenses decreased by approximately $1,049,354 to $113,178 for the year ended December 31, 2009 from $1,162,532 for the same corresponding period in 2008. The decrease was mainly due to the stock based compensation paid to consultants in 2008 and there were no such expense incurred during 2009.

Net Loss

Net loss was approximately $113,178 for the year ended December 31, 2009, as compared to a net loss of $1,162,532 for the same period in 2008. The decrease in net loss was the result of the stock based compensation paid to consultants in 2008 and there were no such expenses incurred in 2009.

Liquidity and Capital Resources

Our financial statements have been prepared on a going concern basis, which implies we will continue to realize our assets and discharge our liabilities in the normal course of business. Our ability to continue as a going concern is ultimately contingent upon our ability to attain profitable operations through the successful development of our business plan. As shown in the accompanying consolidated financial statements, we have incurred an accumulated deficit of $1,354,354 as of December 31, 2009 through our limited operations. We have working capital deficits and negative operating cash flows. These conditions raise substantial doubt as to our ability to continue as a going concern. We are actively pursuing additional funding and a potential merger or acquisition candidate and strategic partners, which would enhance owners’ investment. These financial statements do not include any adjustments related to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event we cannot continue as a going concern.

18

As of December 31, 2009, cash and cash equivalents totaled $1,599. This cash position was the result of a combination of cash at the beginning of the period in the amount of $2,652 and net cash provided by financing activities in the amount of $89,771, offset by net cash used in operating activities in the amount of $88,817.

We believe that said level of financial resources is a significant factor for our future development and accordingly may choose at any time to raise capital through private debt or equity financing to strengthen our financial position, facilitate growth and provide us with additional flexibility to take advantage of business opportunities.

China Forestry has not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. China forestry has not entered into any derivative contracts that are indexed to China Forestry’s shares and classified as equity or that are not reflected in China Forestry’s financial statements. Furthermore, the company does not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. China Forestry does not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to the Company or engages in leasing, hedging or research and development services with the Company.

Inflation

China Forestry believes that inflation has not had a material effect on its operations to date.

Critical Accounting Policies

The discussion and analysis of China Forestry’s financial condition presented in this section are based upon the audited financial statements of the company, which have been prepared in accordance with the generally accepted accounting principles in the United States. During the preparation of the financial statements, the company was required to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, the company evaluates its estimates and judgments, including those related to investments, fixed assets, income taxes and other contingencies. The company bases its estimates on historical experience and on various other assumptions that it believes are reasonable under current conditions. Actual results may differ from these estimates under different assumptions or conditions.

In response to the SEC’s Release No. 33-8040, “Cautionary Advice Regarding Disclosure About Critical Accounting Policy,” China Forestry identified the most critical accounting principles upon which its financial status depends. The company determined that those critical accounting principles are related to the use of estimates, revenue recognition, and income tax and impairment of long-lived assets. The company presents these accounting policies in the relevant sections in this management’s discussion and analysis, including the Recently Issued Accounting Pronouncements discussed below.

19

Timberlands. We carried timberland at historical cost less accumulated amortization. Since private ownership of timberland is not allowed in the People’s Republic of China, the Company acquired the user right of timberland from the government. We capitalized the acquisition costs of the user right and allocated that cost to the timberland. The user right is good for from 50 to 70 years and with the user right, the timber on the timberland is under the Company’s ownership. Amortization of the use right on timberland is primarily determined using the straight-line method over the life of usage right.

We review the carrying value of our long-lived assets annually or whenever events or changes in circumstances indicate that the historical-cost carrying value of an asset may no longer be appropriate. We assess recoverability of the asset by comparing the undiscounted future net cash flows expected to result from the asset to its carrying value. If the carrying value exceeds the undiscounted future net cash flows of the asset, an impairment loss is measured and recognized. An impairment loss is measured as the difference between the net book value and the fair value of the long-lived asset. Fair value is estimated based upon either discounted cash flow analysis or estimated salvage value.

We capitalized reforestation costs incurred in developing viable seedling plantations (up to two years from planting), such as site preparation, seedlings, planting, fertilization, insect and wildlife control, thinning and herbicide application. We expensed all other costs, such as property taxes and costs of forest management personnel, as incurred. Once the seedling plantation was viable, we expensed all costs to maintain the viable plantations, such as fertilization, herbicide application, insect and wildlife control, and thinning, as incurred. We capitalized costs incurred to initially build roads as land improvements, and we expensed as incurred costs to maintain these roads.

Income Taxes. China Forestry has adopted Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (SFAS 109). SFAS 109 requires the recognition of deferred income tax liabilities and assets for the expected future tax consequences of temporary differences between income tax basis and financial reporting basis of assets and liabilities. Provision for income taxes consist of taxes currently due plus deferred taxes. Since China forestry had no operations within the United States there is no provision for US income taxes and there are no deferred tax amounts as of December 31, 2008. The charge for taxation is based on the results for the year as adjusted for items, which are non-assessable or disallowed. It is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences, and deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which deductible temporary differences can be utilized. Deferred tax is calculated at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it related to items credited or charged directly to equity, in which case the deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when they related to income taxes levied by the same taxation authority and the Company intends to settle current tax assets and liabilities on a net basis.

20

Credit Risk

Financial instruments that subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company maintains its cash and cash equivalents with high-quality institutions. Deposits held with banks may exceed the amount of insurance provided on such deposits. Generally these deposits may be redeemed upon demand and therefore bear minimal risk.

Foreign Exchange Risk

The value of the Renminbi against the U.S. dollar and other currencies is affected by, among other things, changes in China’s political and economic conditions. Since July 2005, the Renminbi has no longer been pegged to the U.S. Dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the Renminbi may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future, PRC authorities may lift restrictions on fluctuations in the Renminbi exchange rate and lessen intervention in the foreign exchange market.

Because all of our earnings and cash assets are denominated in Renminbi, but our reporting currency is the U.S. dollar, fluctuations in the exchange rate between the U.S. dollar and the Renminbi will affect our balance sheet and our earnings per share in U.S. dollars. In addition, appreciation or depreciation in the value of the Renminbi relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue in the future that will be exchanged into U.S. dollars and earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Most of the transactions of the Company are settled in Renminbi and U.S. dollars. In the opinion of the directors, the Company is not exposed to significant foreign currency risk.

Inflation

Inflationary factors, such as increases in the cost of raw materials and overhead costs, could impair our operating results. Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of sales revenue if the selling prices of our products do not increase with these increased costs.

Company’s Operations are All in China

All of our operations are conducted in China and are subject to various political, economic, and other risks and uncertainties inherent in conducting business in China.

The Company has significant investments in the PRC. The operating results of the Company may be adversely affected by changes in the political and social conditions in the PRC and by changes in Chinese government policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things. There can be no assurance; however, those changes in political and other conditions will not result in any adverse impact.

21

Item 8. Financial Statements and Supplementary Data

CHINA FORESTRY, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2009

|

Page(s)

|

||||

|

Consolidated Balance Sheets as of December 31, 2009 and 2008

|

24 | |||

|

Consolidated Statements of Operations and Comprehensive Income for the Years Ended December 31, 2009 and 2008

|

25 | |||

|

Consolidated Statements of Cash Flows for the Years Ended December 31, 2009 and 2008

|

26 | |||

|

Consolidated Statements of Changes in Stockholders’ Equity for the Years Ended December 31, 2009 and 2008

|

27 | |||

|

Notes to the Consolidated Financial Statements

|

28 - 32 | |||

22

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

China Forestry, Inc. and Subsidiaries

(formerly Patriot Investment Corp)

Harbin, Heilongiang Province, People’s Republic of China

We have audited the accompanying consolidated balance sheets of China Forestry, Inc. (the “Company”), as of December 31, 2009 and 2008 and the related statements of operations, changes in stockholders’ equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2009 and 2008 and the consolidated results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, The Company has suffered recurring losses from operations, which raises substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters are described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

April 7, 2010

23

CHINA FORESTRY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

As of December 31, 2009 and 2008

|

December 31,

|

December 31,

|

|||||||

|

2009

|

2008

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash

|

$ | 1,599 | $ | 2,652 | ||||

|

Prepaid expenses

|

- | 2,006 | ||||||

|

Total Current Assets

|

1,599 | 4,658 | ||||||

|

Timberlands - net (Note3)

|

829,445 | 845,047 | ||||||

|

Total Assets

|

$ | 831,044 | $ | 849,705 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 10,126 | $ | 5,463 | ||||

|

Due to shareholders

|

154,628 | 64,889 | ||||||

|

Total Current Liabilities

|

164,754 | 70,352 | ||||||

|

Shareholders' Equity

|

||||||||

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized;

|

||||||||

|

0 shares issued and outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value; 200,000,000shares authorized,

|

||||||||

|

56,000,000 and 56,000,000 shares issued and outstanding

|

56,000 | 56,000 | ||||||

|

Additional Paid-in Capital

|

1,938,764 | 1,938,764 | ||||||

|

Accumulated Deficit

|

(1,384,354 | ) | (1,271,176 | ) | ||||

|

Accumulated comprehensive income

|

55,880 | 55,765 | ||||||

|

Shareholders' Equity

|

666,290 | 779,353 | ||||||

|

Total Liabilities and Shareholders' Equity

|

$ | 831,044 | $ | 849,705 | ||||

See accompanying notes to the Consolidated Financial Statements.

24

CHINA FORESTRY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the years ended December 31, 2009 and 2008

|

Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Revenues

|

$ | - | $ | - | ||||

|

Expenses

|

||||||||

|

General and administrative expenses

|

113,178 | 1,162,532 | ||||||

|

Net Loss

|

$ | (113,178 | ) | $ | (1,162,532 | ) | ||

|

Other comprehensive income-Foreign exchange gain (loss)

|

115 | 51,410 | ||||||

|

Comprehensive loss

|

$ | (113,063 | ) | $ | (1,111,122 | ) | ||

|

Net Loss per share - basic and diluted

|

$ | (0.00 | ) | $ | (0.02 | ) | ||

|

Weighted average shares outstanding - basic and diluted

|

56,000,000 | 52,219,178 | ||||||

See accompanying notes to the Consolidated Financial Statements.

25

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the years ended December 31, 2009 and 2008

|

Year Ended

|

||||||||

|

Dec 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

Operating Activities:

|

||||||||

|

Net income (loss)

|

$ | (113,178 | ) | $ | (1,162,532 | ) | ||

|

Adjustments to reconcile income (loss) to net cash provided by (used in) operations:

|

||||||||

|

Amortization

|

17,702 | 17,454 | ||||||

|

Stock Based Compensation

|

- | 1,090,500 | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

(Increase)/decrease in prepaid expenses

|

2,010 | 4,403 | ||||||

|

Increase/(decrease) in accounts payable and accrued expenses

|

4,649 | 1,292 | ||||||

|

Net cash provided by (used in) operating activities

|

(88,817 | ) | (48,883 | ) | ||||

|

Financing Activities

|

||||||||

|

Advances from related parties

|

89,771 | 49,266 | ||||||

|

Net cash provided by financing activities

|

89,771 | 49,266 | ||||||

|

Effect of exchange rate changes on cash

|

(2,007 | ) | (391 | ) | ||||

|

Increase(decrease) in cash

|

(1,053 | ) | (8 | ) | ||||

|

Cash at beginning of period

|

2,652 | 2,660 | ||||||

|

Cash at end of period

|

$ | 1,599 | $ | 2,652 | ||||

|

Supplemental Cash Flow Information:

|

||||||||

|

Interest and taxes paid during the year

|

$ | - | $ | - | ||||

See accompanying notes to the Consolidated Financial Statements.

26

CHINA FORESTRY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the years ended December 31, 2009 and 2008

|

|

Preferred Stock

|

Common Stock

|

Addition

|

|

Retained

|

|

||||||||||||||||||||||||||

|

|

Shares

|

Par (0.001)

|

Shares

|

Par (0.001)

|

Paid in Capital

|

OCI

|

Earnings

|

Total

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Balances, December 31, 2006

|

- | - | - | - | (427 | ) | 5,817 | (5,489 | ) | (99 | ) | |||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||

|

Preferred shares issued under merger

|

10,000,000 | 10,000 | - | - | - | - | - | - | ||||||||||||||||||||||||

|

Common shares issued under merger

|

2,470,000 | 2,470 | 633,004 | - | - | 635,474 | ||||||||||||||||||||||||||

|

Conversion of preferred to common

|

(10,000,000 | ) | (10,000 | ) | 47,530,000 | 47,530 | (47,530 | ) | - | - | - | |||||||||||||||||||||

|

Special distribution

|

- | - | - | - | (635,475 | ) | - | - | (635,475 | ) | ||||||||||||||||||||||

|

Contribution of shareholder debt to equity

|

- | - | - | - | 846,382 | - | - | 846,382 | ||||||||||||||||||||||||

|

Cash Contributions

|

- | - | - | - | 58,310 | - | - | 58,310 | ||||||||||||||||||||||||

|

Currency translation

|

(1,461 | ) | (1,461 | ) | ||||||||||||||||||||||||||||

|

Net income

|

- | - | - | - | - | - | (103,155 | ) | (103,155 | ) | ||||||||||||||||||||||

|

Balances, December 31 , 2007

|

- | $ | - | 50,000,000 | $ | 50,000 | $ | 854,264 | $ | 4,356 | $ | (108,644 | ) | $ | 799,976 | |||||||||||||||||

|

Share Based compensation

|

- | - | 6,000,000 | 6,000 | 1,084,500 | - | - | 1,090,500 | ||||||||||||||||||||||||

|

Currency translation

|

- | - | - | - | - | 51,409 | - | 51,409 | ||||||||||||||||||||||||

|

Net income (Loss)

|

- | - | - | - | - | - | (1,162,532 | ) | (1,162,532 | ) | ||||||||||||||||||||||

|

Balances, December 31 , 2008

|

- | - | 56,000,000 | 56,000 | 1,938,764 | $ | 55,765 | $ | (1,271,176 | ) | $ | 779,353 | ||||||||||||||||||||

|

Currency translation

|

- | - | - | - | - | 115 | - | 115 | ||||||||||||||||||||||||

|

Net income (Loss)

|

- | - | - | - | - | - | (113,178 | ) | (113,178 | ) | ||||||||||||||||||||||

|

Balances, December 31 , 2009

|

- | $ | - | 56,000,000 | $ | 56,000 | $ | 1,938,764 | 55, 880 | (1,384,354 | ) | 666,290 | ||||||||||||||||||||

See accompanying notes to the Consolidated Financial Statements.

27

CHINA FORESTRY AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

Note 1 - ORGANIZATION AND BUSINESS BACKGROUND

Patriot Investment Corp., (the “Company” or “Patriot”) was incorporated under the law of the State of Nevada on January 13, 1986. The Company is principally engaged in the growing and harvesting of timber and manufacture and marketing of lumber in the People’s Republic of China (“PRC”) through its holding and subsidiaries, Everwin Development Limited (“Everwin”) and Jin Yuan Global Limited (“Jin Yuan”).

Everwin was incorporated on April 25, 2007 in British Virgin Islands (“BVI”) under the BVI Business Companies Act, 2004. Jin Yuan was incorporated as a Hong Kong limited liability company on November 22, 2006. On May 25, 2007, Jin Yuan transferred its sole share to Everwin. Both Everwin and Jin Yuan were formed to facilitate a merger between a US company and a PRC business entity.

Harbin Senrun Forestry Development Limited (“Senrun”) was incorporated as a company with a limited liability in People’s Republic of China on August 2, 2004. Senrun is located in Harbin, Heilongjiang and principally engaged in the growing and harvesting of timber and the manufacture and marketing of lumber. All Senrun’s business is currently in PRC.

On January 10, 2007, Jin Yuan acquired 51% of the equity ownership in Senrun.

On March 10, 2007, Mr. Han Degong (the “Trustee”), citizen of the PRC, who owns a 49% equity ownership interest in Senrun, executed Trust and Indemnity Agreements with Jin Yuan Global Limited, pursuant which the Trustee assigned to Jin Yuan Global Limited all of the beneficial interest in the Trustee’s equity ownership in the Company. These arrangements have been undertaken solely to satisfy the PRC regulations, which prohibits foreign companies from owning or operating the forestry business in the PRC. Through the transaction and agreement described in preceding paragraphs, Senrun is deemed a 100% subsidiary of Jin Yuan.

On June 26, 2007, under the terms of the Share Exchange Agreement, Everwin exchanged all share capital of Jin Yuan together with the sum of $635,000 for the Company’s 10,000,000 restricted shares of Series A Convertible Preferred Stock, $.001par value. The Company’s 10,000,000 shares of Preferred Stock were converted into 47,530,000 shares of the Company’s common stock.

As a result of Share Exchange Agreement, the transaction was treated for accounting purposes as a recapitalization and reverse merger by the accounting acquirer (Senrun).

The consolidated balance sheet consists of the net assets of the accounting acquirer at historical cost; and the consolidated statements of operations include the operations of the accounting acquirer for the years presented

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of China Forestry, Inc. and its wholly-owned subsidiaries, Everwin Development Limited and Jin Yuan Global Limited. All significant inter-company accounts and balances have been eliminated in consolidation.

28

Basis of Presentation

These accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Use of Estimates

In preparing these consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the year reported. Actual results may differ from these estimates.

Foreign Currency Translation

The functional currency of the Company is the Renminbi (“RMB”). The accompanying financial statements have been expressed in United States dollars, the reporting currency of the Company. In accordance with ASC 830 (Statement of Financial Accounting Standards No. 52), "Foreign Currency Translation", foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates as of the balance sheet date. The statements of operations are translated using a weighted average rate for the period. Translation adjustments are reflected as accumulated comprehensive income in shareholders’ equity.

Concentrations of credit risk

Financial instruments that subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company maintains its cash and cash equivalents with high-quality institutions. Deposits held with banks may exceed the amount of insurance provided on such deposits. Generally these deposits may be redeemed upon demand and therefore bear minimal risk.

Country risk

The Company has significant investments in the PRC. The operating results of the Company may be adversely affected by changes in the political and social conditions in the PRC and by changes in Chinese government policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things. There can be no assurance; however, those changes in political and other conditions will not result in any adverse impact.

Basic and Diluted Net Loss per Share

The basic net loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net loss per common share is computed by dividing the net loss adjusted on an "as if converted" basis, by the weighted average number of common shares outstanding plus potential dilutive securities. For the years ended December 31, 2009 and 2008, there were no potential dilutive securities and therefore no diluted net loss per common share was calculated.

Revenue Recognition

Revenues are recognized when products are shipped to customers, both title and the risks and rewards of ownership are transferred or services have been rendered and accepted, and collectability is reasonably assured.

29

Cash and Cash Equivalents

Cash and cash equivalents include all highly liquid investments with original maturities of three months or less.

Timberland

The Company carried timberland at historical cost less accumulated amortization. Since private ownership of timberland is not allowed in the People’s Republic of China, the Company acquired the user right of timberland from the government. We capitalized the acquisition costs of the user right and allocated that cost to the timberland. The user right is good for from 50 to 70 years and with the user right, the timber on the timberland is under the Company’s ownership. Amortization of the use right on timberland is primarily determined using the straight-line method over the life of usage right.

The Company reviews the carrying value of its long-lived assets annually or whenever events or changes in circumstances indicate that the historical-cost carrying value of an asset may no longer be appropriate. The Company assesses recoverability of the asset by comparing the undiscounted future net cash flows expected to result from the asset to its carrying value. If the carrying value exceeds the undiscounted future net cash flows of the asset, an impairment loss is measured and recognized. An impairment loss is measured as the difference between the net book value and the fair value of the long-lived asset. Fair value is estimated based upon either discounted cash flow analysis or estimated salvage value.

The Company capitalized reforestation costs incurred in developing viable seedling plantations (up to two years from planting), such as site preparation, seedlings, planting, fertilization, insect and wildlife control, thinning and herbicide application. We expensed all other costs, such as property taxes and costs of forest management personnel, as incurred. Once the seedling plantation was viable, we expensed all costs to maintain the viable plantations, such as fertilization, herbicide application, insect and wildlife control, and thinning, as incurred. We capitalized costs incurred to initially build roads as land improvements, and we expensed as incurred costs to maintain these roads.

Income Tax

Income tax expense is based on reported income before income taxes. Deferred income taxes reflect the effect of temporary differences between assets and liabilities that are recognized for financial reporting purposes and the amounts that are recognized for income tax purposes. In accordance with ASC 740 (Statement of Financial Accounting Standards (SFAS) No. 109), "Accounting for Income Taxes," these deferred taxes are measured by applying currently enacted tax laws.

The Company did not provide any current or deferred income tax provision or benefit for any period presented to date because there is no income from operations, with only minor timing differences with regard to the depreciation of fixed assets. Management has determined that any deferred tax asset or liability is inconsequential, and not material to the financial statements.

Restricted Retained Earnings

Pursuant to the laws applicable to the PRC, PRC entities must make appropriations from after-tax profit to the non-distributable “statutory surplus reserve fund”. Subject to certain cumulative limits, the “statutory surplus reserve fund” requires annual appropriations of 10% of after-tax profit until the aggregated appropriations reach 50% of the registered capital (as determined under accounting principles generally accepted in the PRC ("PRC GAAP") at each year-end). For foreign invested enterprises and joint ventures in the PRC, annual appropriations should be made to the “reserve fund”. For foreign invested enterprises, the annual appropriation for the “reserve fund” cannot be less than 10% of after-tax profits until the aggregated appropriations reach 50% of the registered capital (as determined under PRC GAAP at each year-end). The Company did not make any appropriations to the reserve funds mentioned above due to lack of profit after tax since commencement of operations.

30

New Accounting Pronouncements

There were various accounting standards and interpretations issued during 2009 and 2008, none of which are expected to have a material impact on the Company’s consolidated financial position, operations or cash flows.

NOTE 2 - GOING CONCERN

The Company’s ability to continue as a going concern is ultimately contingent upon its ability to attain profitable operations through the successful development of its business plan. As shown in the accompanying consolidated financial statements, the Company has incurred an accumulated deficit of $1,384,354 as of December 31, 2009 through its limited operations. These conditions raise substantial doubt as to the Company's ability to continue as a going concern. The Company is actively pursuing additional funding and a potential merger or acquisition candidate and strategic partners, which would enhance owners’ investment. The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 3 - TIMBERLANDS

Timberlands consist of the following as of December 31, 2009:

|

Location

|

Usage Right Effective Period

|

|

Amount

|

|

||

|

Ping Yang He Forestry Center*

|

02/09/2004 - 02/09/2074

|

|

$

|

0

|

|

|

|

Jiu Lien Forestry Center

|

09/08/2006 - 09/08/2056

|

|

|

358,557

|

|

|

|

Wei Xing Forestry Center

|

08/30/2006 - 08/30/2056

|

|

|

342,175

|

|

|

|

Mao Lin Forestry Center

|

12/01/2006 - 12/01/2056

|

|

|

184,786

|

|

|

|

Total Cost

|

|

|

885,518

|

|

||

|

Less: Accumulated Amortization

|

|

|

(56,073

|

)

|

||

|

Net Timberlands

|

|

$

|

829,445

|

|

||

*Ping Yang He Forestry Center was contributed by the shareholder valued at zero, due to there was no cost associated with this contributed asset.