Attached files

| file | filename |

|---|---|

| EX-31.2 - SEC/TREA CERTIFICATION - GRANT HARTFORD CORP | dg302cert.htm |

| EX-31.1 - CEO CERTIFICATION - GRANT HARTFORD CORP | es302cert.htm |

| EX-32.1 - OFFICER CERTIFICATION - GRANT HARTFORD CORP | esdg906cert.htm |

| EX-10.41 - MATTHEWS AMENDED EMPLOYMENT AGREEMENT - GRANT HARTFORD CORP | tmamendagree12510.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2009

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-155507

GRANT HARTFORD CORPORATION

(Exact name of registrant as specified in its charter)

|

Montana |

|

20-8690366 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

619 S.W. Higgins Suite O |

|

|

|

Missoula, Montana |

|

59803 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (406)531-3363

|

Title of each class |

|

Name of each exchange on which registered |

|

Common stock |

|

None |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in a definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes o No o

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer Yes o No o Accelerated filer Yes o No o

Non-accelerated filer (Do not check if a smaller reporting company) Yes o No o Smaller reporting company Yes x No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by non-affiliates was $2,476,530.40. The aggregate market value was computed by reference to the last sale price of the registrant's Common Stock through a private exempt offering pursuant to Section 4(2) of the Securities Act of 1933, as amended, on May 31, 2008.

Note.-If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

As of December 31, 2009, the Registrant had 21,450,195 shares of its no par value common stock issued and outstanding

DOCUMENTS INCORPORATED BY REFERENCE

None

ii

GRANT HARTFORD CORPORATION

FORM 10-K

For the fiscal year ended December 31, 2009

TABLE OF CONTENTS

PART I

| Page | ||

|

Business. |

6 |

PART II

|

Item 5. |

Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities. |

50 |

PART III

|

Directors, Executive Officers and Corporate Governance. |

60 |

PART IV

|

Exhibits, Financial Statement Schedules. |

72 |

|

|

72 |

iii

Unless the context otherwise requires, references in this Prospectus to "the company," "our company," "we," "our" and "us" means Grant Hartford Corporation. "$" refers to U.S. dollars.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, and the documents incorporated in it by reference, contains forward-looking statements that involve known and unknown risks and uncertainties. Examples of forward-looking statements include: projections of capital expenditures, competitive pressures, revenues, growth prospects, product development, financial resources and other financial matters. You can identify these and other forward-looking statements by the use of words such as "may," "will," "should," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "potential" or the negative of such terms, or other comparable terminology.

Our ability to predict the results of our operations or the effects of various events on our operating results is inherently uncertain. Therefore, we caution you to consider carefully the matters described under the caption "Risk Factors" and certain other matters discussed in this Prospectus, the documents incorporated by reference in this Prospectus, and other publicly available sources. These factors and many other factors beyond the control of our management could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by the forward-looking statements.

GLOSSARY OF TERMS

Airborne Magnetics - A technique of geophysical exploration of an area using an airborne magnetometer to survey that area. Syn. Aeromagnetic Prospecting

Anastomosing - Pertaining to a network of branching and rejoining fault or vein surfaces or surface traces.

Anhydrous - As a general term, a substance is said to be anhydrous if it contains no water.

Anticline - In structural geology, an anticline is a fold that is convex up and has its oldest beds at its core.

Assays - To analyze the proportions of metals in a mineralized material; to test a mineralized material for composition, purity, weight, or other properties of commercial interest.

Carbonates - A sediment formed by the organic or inorganic precipitation from aqueous solution of carbonates of calcium, magnesium, or iron; e.g., limestone and dolomite.

Consulting Geologist - A specialist employed in an advisory capacity. Normally, this person does not manage or direct any operation, and is at the service of the board rather than of the company's administrative and executive staff.

Core Drilling - Drilling that uses hollow diamond-studded drill bits on the end of the drill stem to produce lengths of cylindrical rock of varying diameter. It has the advantage over other drilling

1

methods of producing a solid core sample of the rock the drill has passed through, rather than chips, enabling more accurate determination and characterization of rock types, mineralized material, and structures encountered, and their orientations in three dimensions.

Core Holes - A boring by a diamond drill or other machine that is made for the purpose of obtaining core samples.

Deposits - Mineralized material deposit is used to designate a natural occurrence of a useful mineralized material, in sufficient extent and degree of concentration to invite exploitation.

Dolomite - Is the name of a sedimentary carbonate rock and a mineral, both composed of calcium magnesium carbonate found in crystals.

Drill Hole Records - A description of the borehole based on the daily logs from the driller and the samples and the report of the geologist.

Drilling - The operation of making deep holes with a drill for prospecting, exploration, or valuation.

Exploration - The search for mineralized material by (1) geological surveys; (2) geophysical prospecting (may be ground, aerial, or both); (3) boreholes and trial pits; or (4) surface or underground headings, drifts, or tunnels. Exploration aims at locating the presence of economically feasible mineralized material deposits and establishing their nature, shape, and grade, and the investigation may be divided into (1) preliminary and (2) final.

Exploratory Drilling - The drilling of boreholes from the surface or from underground workings, to seek and locate mineralized material and to establish geological structure.

Faulting - The process of fracturing and displacement that produces a fault.

Geochemistry - The branch of chemistry dealing with the chemical composition of the earth's crust and the chemical changes that occur there

Geology - Organized body of knowledge about the earth, including physical geology and historical geology, among others.

Geophysics - Physics of the Earth.

Grandiorite - Medium to coarse-grained rock that is one of the most abundant intrusive rocks. It contains quartz and is distinguished from granite by having more plagioclase feldspar than orthoclase feldspar; its other mineral constituents include hornblende, biotite, and augite. Granodiorite is similar to granite in appearance but darker.

Grinding Mill - A machine for the wet or dry fine crushing of rock or other material. The three main types are the ball, rod, and tube mills. The mill consists of a rotating cylindrical drum; the rock enters one hollow trunnion and the finished product leaves the other. Modern practice indicates ball mill feeds of 1/2 in, 3/4 in, and 1 in (1.27 cm, 1.91 cm, and 2.54 cm) for hard, medium, and soft rock respectively and the products range from 35 to 200 mesh and finer.

2

Gross Ton - The long ton of 2,240 avoirdupois pounds.

High-Grade - Said of a mineralized material reserve with a relatively high mineral content.

Grade - The element or metal content per unit of material.

Intercepts - That portion included between two points in a borehole, as between the point where the hole first encounters a specific rock or mineralized material and where the hole enters a different or underlying rock formation.

Intrusives - Of or pertaining to intrusion--both the processes and the rock so formed.

Log - The paper or electronic record of rock types and other geological and geotechnical information encountered during the drilling of a drill hole.

Metallurgy - The science and art of separating metals and metallic minerals from their ores by mechanical and chemical processes; the preparation of metalliferous materials from raw mineralized material.

Metallurgical Studies - Studies pertaining to the physical and chemical properties and behavior under varying conditions of rocks, minerals, mineralization and mineralized material, their metallic elements and intermetallic compounds, and their mixtures (alloys), and the processes required to optimize the extraction of particular metals.

Metamorphism - A process whereby rocks undergo physical or chemical changes or both to achieve equilibrium with conditions other than those under which they were originally formed (weathering arbitrarily excluded from meaning). Agents of metamorphism are heat, pressure, and chemically active fluids.

Mineralization - The process or processes by which a mineral is introduced into a rock, resulting in a valuable or potentially valuable deposit. It is a general term, incorporating various types; e.g., fissure filling, impregnation, and replacement.

Mining Claim - A mining claim is a parcel of land that has the possibility of containing a valuable mineralized material or proven/probable reserve in the soil or rock. A location is the act of appropriating such a parcel of land according to law or to certain established rules.

Old Workings - Mine working that has been abandoned, allowed to collapse, and perhaps sealed off. Unless proper safeguards are taken, old workings can be a source of danger to workings in production particularly if they are waterlogged and their plan position is uncertain.

Openpit Mine - A mine working or excavation open to the surface.

Openpit Mining - A form of operation designed to extract minerals that lie near the surface. Waste, or overburden, is first removed, and the mineral is broken and loaded, as in a stone quarry.

3

Probable (Indicated) Reserves - Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

Proven (Measured) Reserves - Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; garde and/or quality are computed from the results of detailed sampling and (a) the sites for inspection, sampling and measurement are

spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

Proven/Probable Reserve Block - A section of a proven/probable reserve body, usually rectangular, that is used for estimates of overall tonnage and quality.

Proven/Probable Reserve Body - A mass of proven/probable reserve with defined geometry.

Outcrop - The part of a rock formation that appears at the surface of the ground.

Output - The quantity of coal or mineralized material raised from a mine and expressed as being so many tons per shift, per week, or per year.

Planimeter - An instrument for measuring the area of any plane figure by passing a tracer around its boundary line.

Prefeasibility Study (PFS) - A preliminary assessment of the economic viability of mining a deposit. A PFS forms the basis for justifying further investigations including a full Feasibility Study. It usually follows a successful exploration campaign, and summarizes all geological, engineering, environmental, legal and economic information accumulated to date on the project.

Proterozoic Era - Younger of the two divisions of Precambrian time, from 2.5 billion to 542 million years ago. Proterozoic rocks have been identified on all the continents and often constitute important sources of metallic mineralized material, notably of iron, gold, copper, uranium, and nickel.

Quartzites - Metamorphic rock commonly formed by metamorphism of sandstone and composed of quartz. No rock cleavage. Breaks through sand grains in contrast to sandstone, which breaks around grains.

Reclamation - Restoration of mined land to original contour, use, or condition.

Recovery - The percentage of valuable constituent derived from a mineralized material, or of coal from a coal seam; a measure of mining or extraction efficiency.

Refining - The purification of crude metallic products.

4

Reverse Circulation - The circulation of bit-coolant and cuttings-removal liquids, drilling fluid, mud, air, or gas down the borehole outside the drill rods and upward inside the drill rods.

Sample - A section of core or a specific quantity of drill cuttings that represents the whole from which it was removed.

Sedimentary - Formed by the deposition of sediment (e.g., a sedimentary clay), or pertaining to the process of sedimentation (e.g., sedimeentary volcanism).

Shales - Fine-grained, detrital sedimentary rock made up of silt- and clay-sized particles. Contains clay mineralized material as well as particles of quartz, feldspar, calcite, dolomite, and other mineralized material. Distinguished from mudstone by presence of fissility.

Skarn - An old Swedish mining term for silicate gangue (amphibole, pyroxene, garnet, etc.) of certain iron mineralized material and sulfide deposits of Archean age, particularly those that have replaced limestone and dolomite. Its meaning has been generally expanded to include lime-bearing silicates, of any geologic age, derived from nearly pure limestone and dolomite with the introduction of large amounts of Si, Al, Fe, and Mg. In American usage, the term is more or less synonymous with tactite.

Strike - Direction of line formed by intersection of a rock surface with a horizontal plane. Strike is always perpendicular to direction of dip.

Stripping Ratio - The unit amount of spoil or overburden that must be removed to gain access to a unit amount of mineralized material, generally expressed in cubic yards of overburden to raw tons of mineralized material.

SURPAC (GENCOM) - is a comprehensive system for mineralized material evaluation, open pit and underground mine design, mine planning and production, used by geologists, engineers and surveyors daily.

Tailings - The finely ground material that remains after all economically recoverable metals or proven/probable reserves of economic interest has been removed from the deposit through milling and processing. Tailings may or may nor contain economically recoverable metals or proven/probable reserves.

Tailing Pond - Area closed at lower end by constraining wall or dam to which mill effluents are run. Clear water may be returned after settlement in dam, via penstock (s) and piping.

Target - The point a borehole or exploration work is intended to reach.

Troy Ounce - One-twelfth of a pound of 5,760 grains (troy pound), or 480 grains. A troy ounce equals 20 pennyweights, 1.09714 avoirdupois oz, or 31.1035 g. It is used in all assay returns for gold, silver, and platinum-group metals.

Vein - A fissure, fault or crack in host rock, of varying dimensions, filled by mineralized material that have travelled upwards from a deeper source.

5

Veinlet - A narrow, fine stringer or filament of mineralized material that occurs in a discontinuous pattern in the host rock.

Waste Rock - Barren or submarginal rock that has been mined, but is not of sufficient value to warrant treatment and is therefore removed ahead of the milling processes.

Zone - A volume of rock that has mineralized material, or encompasses a particular feature, such as a fault, shear or mineralized material body.

PART I

Item 1. Business.

General

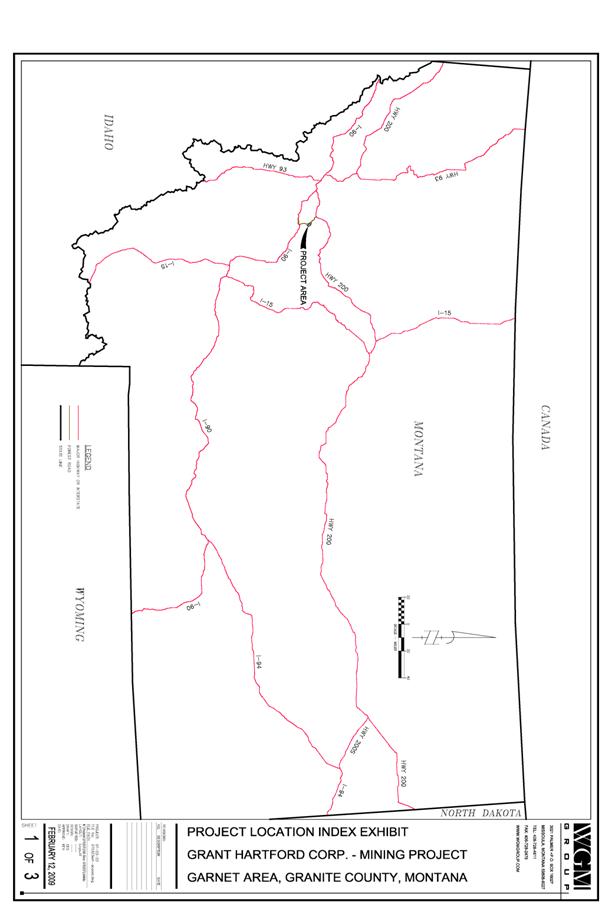

Grant Hartford Corporation ("GHC", "We", "Us" or the "Company") was incorporated on March 15, 2007, under the laws of the State of Montana. Our Company is a mineral exploration, development and production company, that is currently in the exploration stage of historically designated mineralized material on the Garnet Mineral Property, located in Missoula, Montana. On June 15, 2007, we acquired an option to purchase a 100% interest in the mineral rights (excluding surface rights) to 23 patented mining claims and to purchase 122 unpatented mining claims from Commonwealth Resources, L.L.C.

Commonwealth Resources L.L.C. provided the Company with historical data on the claims area dating back to 1865 and data from exploration programs conducted in the late 1980's and early 1990's. Drill logs and reports containing drilling results from the drilling program conducted by Pegasus Gold Corporation ("Pegasus") between 1990 and 1992 indicated the existence of low grade mineralized material that was drilled sufficiently to establish continuity between drill holes. Pegasus also encountered a number of high grade mineralized material intercepts. Pegasus Gold Corporation allowed its option to the Garnet Mineral Property to lapse in 1993 and subsequently filed bankruptcy. The various grades and widths of high grade mineralized material veins found by Pegasus lend themselves to further exploration by the Company that could result in the determination of the existence of underground proven/ probable gold reserves.

During the third and fourth quarters of 2008, GHC began a definition drilling program consisting of 54 reverse circulation drill holes, totaling 13,203 feet, which examined three vein systems located on the Garnet Mineral Property. The Company designated drill targets based on results of the exploration conducted by Pegasus between December, 1989 and December, 1992, which consisted of 147 reverse circulation holes, totaling 47,646 feet, six core holes, totaling 1,710 feet, and 4,110 samples including soil, trench, channel, rock chip, dump, underground, and stream sediment samples. Other exploration activities completed by Pegasus include geochemical soil analysis, induced polarization, VLF and air magnetometer surveys, surface and underground mapping and sampling, historic dump surveys, and trench and grab sampling.

The Company's plan of operation for 2009 was to conduct focused exploration activities in the area Pegasus explored and drilled in order to continue establishing drill hole continuity and to

6

proceed with a pre-feasibility or scoping study in order to determine the existence of proven/probable reserves. The Company retained the engineering firm CDM of Helena, MT to assist in proceeding with and completing the pre-feasibility or scoping study.

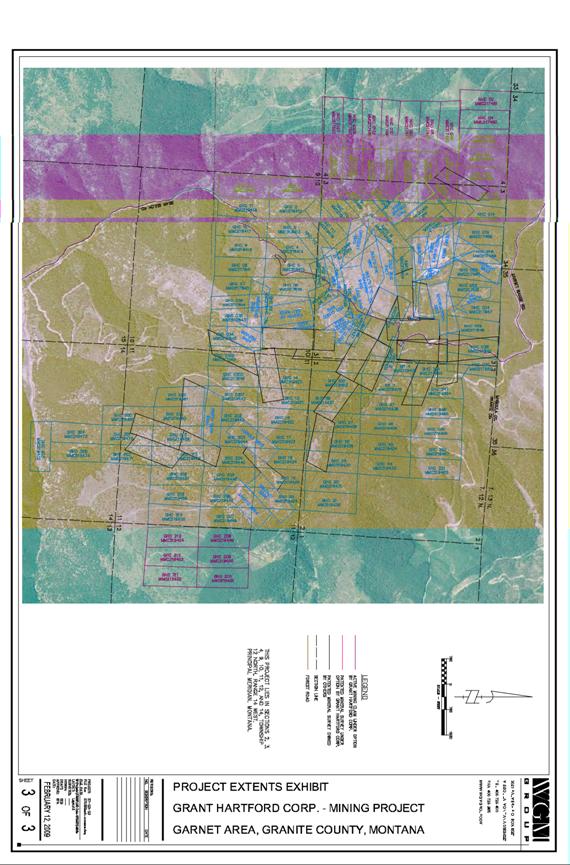

The 2009 exploration drill program targeted the completion of 150 reverse circulation drill holes in order to further define underground and pit mineralized material located in the Nancy Hanks and Dewey mineral claims. A total of 111 reverse circulation drill holes, totaling 37,763 feet, were completed during the 2009 exploration program. Of these, 62 holes totaling 21,840 feet, were drilled in the greater Nancy Hanks Pit area. Total drill footage for 2009 is nearly 3 times the footage drilled by GHC in 2008. In addition to the Nancy Hanks Pit area, the program included exploration of the Willie Vein System and began definition of the Tostman and Tiger deposits in the greater project area. This drilling in addition to GHC's 2008 drill results and previous drill programs are being used to create both pit and underground mineralized material models using Vulcan 3-D modeling software.

One of the most significant advances in our exploration activities in 2009 was the acquisition of Maptek's Vulcan 3-D geologic modeling software and the input of all previous drill results and data. Other activities included the implementation of a geophysics program conducted on the Willie vein system, creation of a "geologic team" to expand our knowledge of the Garnet District, updating surface geologic maps, metallurgical test work for mill planning, various placer exploration activities, Lidar mapping and creation of high resolution topographic maps and aerial photos, and continued compilation of historic maps and data for future exploration and mine planning.

Acquisition of the patented and unpatented mineral claims.

We have acquired an exclusive option to purchase the mineral interests to 23 patented mineral claims and 122 unpatented mineral claims located within the Garnet Mining District of Granite County, Montana from Commonwealth Resources, L.L.C. Commonwealth Resources, L.L.C., is owned by Aaron Charlton, Rodney K. Haynes, Kim L. Charlton and Eric Sauve. Aaron Charlton and Eric Sauve are related parties to our Company, Grant Hartford Corporation. The owner of record of 122 unpatented claims is Commonwealth Resources, L.L.C. Commonwealth Resources, LLC holds these 122 unpatented and 23 patented claims pursuant to the terms of the Grant Hartford Option Agreement for our Company. Commonwealth Resources, L.L.C. retained the services of WGM Survey Co. of Missoula, Montana to physically stake and record ownership in these 122 unpatented mineral claims with Granite County, Montana and the Bureau of Land Management. The owner of record on 22 of the 23 patented mineral claims is Commonwealth Resources, L.L.C. The owner of record of one (1) patented claim, the Free Coin, is River Terrace Estates, Inc. Commonwealth Resources, L.L.C. entered into a Mining Lease between River Terrace Estates, Inc. and Commonwealth Resources, L.L.C. which provides for a lease and option to purchase the Free Coin patented mining claim. This Mining Lease has been partially assigned to Grant Hartford Corporation both by the terms of the Grant Hartford Option Agreement between Commonwealth Resources, L.L.C. and the Company and through a Partial Assignment of Amended Mining Lease, which assigned to GHC the leasehold interest in the Amended Mining lease and the right to acquire it, upon exercise of the purchase option defined in the Lease and Amended Lease, the mineral rights in and to the mining claim. The material terms of the Free

7

Coin patented mining claim transaction are further set forth in the "Material Terms of Related Party Agreements" section of this Form 10-K on page 9.

The 122 unpatented mineral claims are administered by the United States Bureau of Land Management ("BLM") under the provisions provided for by the 1872 Mining Law. Commonwealth Resources, L.L.C.'s interest in these 122 unpatented mineral claims will continue into perpetuity provided that Commonwealth Resources, L.L.C. pays a $125 maintenance fee each year on each mineral claim in compliance with the Bureau of Land Management regulations pertaining to unpatented mining claims. The required amount of expenditure for Commonwealth Resources, L.L.C. to hold these 122 claims is $15,250 per year. The maintenance figure is set by the BLM and can be altered only in its sole discretion.

The 23 patented mining claims are fee simple properties. Commonwealth Resources, L.L.C.'s interest in these 22 patented mineral claims will continue in perpetuity, provided that Commonwealth Resources, L.L.C. pays the assessed property taxes for each respective mining claim to Granite County, Montana. The current required tax expenditure for Commonwealth Resources, L.L.C. to hold these 22 patented claims is $1,362 per year. Commonwealth Resources, L.L.C.'s interest in the Free Coin patented mineral claim will continue for a period of seven (7) years beginning on March 29, 2007, provided that Commonwealth Resources, L.L.C. complies with the material terms of the Amended Mining Lease, which are set forth in the "Material Terms of Related Party Agreements" section of this Form 10-K on page 9.

Four of the patented mineral claims owned by Commonwealth Resources, L.L.C. have a mortgage lien that is non-interest-bearing, in the amount of $300,000 payable to Intrepid Technologies Inc. of Idaho Falls, ID. Those four claims are the Nancy Hanks, (ms#5365), Dewey-Midnight, (ms#9833), Tiger, (ms#5361), and Placer Claim 751, (ms#751).

Three of the patented mining claims owned by Commonwealth Resources, L.L.C. have a trust indenture, interest bearing at 12% per annum, in the amount of $84,735.31 payable to Herbert B. Hanich, DVW, Profit Sharing Plan. Those three claims are the Fourth of July (ms#5453), North Star (ms#9404), and the Harold (ms#5812).

We entered into the Grant Hartford Option Agreement, which conveys an exclusive option to purchase the mineral rights to the 23 patented mining claims and an exclusive option to purchase the 122 unpatented mining claims from Commonwealth Resources, L.L.C. Pursuant to this contract, we have the right to explore for minerals, develop potential mining targets, and enter into limited gold production. The terms of this Grant Hartford Option Agreement required the issuance by us of 19,000,000 shares of our common stock, annual Option payments by us of $190,000 during the first five (5) year period and $400,000 during the final two (2) year period of the Grant Hartford Option Agreement, and an annual access lease payment of $60,000 for the entire period of the Grant Hartford Option Agreement. The agreement was executed on June 15, 2007 for a term of seven (7) years. We may exercise our option to purchase the mineral deeds to the patented claims and the unpatented claims at any time for a cash payment to Commonwealth Resources, L.L.C. of $7,000,000. The material terms of the Grant Hartford Option Agreement are further set forth in the "Material Terms of Related Party Agreements" section of this Form 10-K on page 9.

8

Material Terms of Related Party Agreements

The Grant Hartford Option Agreement

Mr. Eric Sauve, as President, CEO, CFO and Director of Grant Hartford Corporation ("GHC") negotiated the terms of the Grant Hartford Option Agreement ("Option Agreement") with Commonwealth Resources, L.L.C. in March, 2007. Mr. Aaron Charlton, the Managing Member of Commonwealth Resources, L.L.C., negotiated on behalf of Commonwealth Resources, L.L.C. The parties determined the material terms of the Option Agreement during a 25 day contemplative period, beginning on February 25, 2007 and ending on March 22, 2007, and by relying upon several factors, including but not limited to, the presence of extensive historical data on the mineral property, such as the "Garnet Project Summary" by Eric Stimson, of Pegasus Gold Corporation and the "Mineral Property Valuation" by John C. Brower, PhD, and a previous option agreement to the mining property and claims with Pegasus Gold Corp. The fore mentioned, Pegasus Gold Corporation, allowed its option to the Garnet Mineral Property to lapse in 1993 and subsequently filed for bankruptcy. In the Garnet Mining History and Geology sections of this Form 10-K, located on Pages 15 and 16, the Company uses selected geological descriptions from Dr. John Brower's "Mineral Property Valuation of the Garnet and Copper Cliff Mining District in Garnet and Missoula Counties." However, Dr. Brower's has declined to provide his consent to use this information to Grant Hartford Corporation, due to the age of the report, which is dated September 1999, and the fact that a third party entity commissioned Dr. Brower to prepare the report, thus he does not own the report. Grant Hartford hereby adopts these geological conclusions as our own and directs investors to review Risk Factor 10, "Non-Consent to Use Geological Reports," on page 35 of this Form 10-K. On March 22, 2007, GHC and Commonwealth Resources, L.L.C. entered into a Letter of Intent and on June 15, 2007, GHC and Commonwealth Resources, L.L.C. finalized the Option Agreement, whereby GHC would acquire an option to purchase the mineral rights to 122 unpatented and 23 patented mining claims from Commonwealth Resources, L.L.C.. The material terms whereby GHC obtained the option to purchase the Garnet Mining District mineral deeds from GHC are as follows: GHC is allowed a seven (7) year period whereby Commonwealth Resources, L.L.C. will hold the mineral rights to the property exclusively for the benefit of GHC. In order to retain the exclusive option to purchase the mineral rights for this seven (7) year period, GHC is responsible for the Bureau of Land Management assessment fees, which currently total $125.00 for each of the 122 unpatented mining claim, for a total annual payment of $15,250.00, the property taxes on each of the 23 patented mining claims, for a total annual payment of $1,362, an annual surface access lease payment of $60,000, an annual option payment of $190,000, which increases to $400,000 in year six (6) and seven (7) of the Option Agreement, the issuance of 19,000,000 shares of GHC's no par value common stock, pursuant to the Amendment to Grant Hartford Option Agreement dated January 24, 2008, and the payment of a 5% net smelter return on any ore processed during the option period within fifteen (15) days of the close of each calendar month. GHC has paid a total of $50,875.74 on behalf of Commonwealth Resources, L.L.C. in Bureau of Land Management Assessment Fees and property taxes through December 31, 2009. GHC paid Commonwealth Resources, L.L.C. a total of $957,522.21 in annual option payments and annual surface access lease payments through December 31, 2009. GHC has also issued 19,000,000 shares of the Company's no par value common stock to Commonwealth Resources, L.L.C. at $0.125 per share for a total consideration valued at $2,375,000. At the time the 19,000,000 shares of the

9

Company's no par value common stock were issued, the shares represented 89.6% of the Company's issued and outstanding common stock.

A breach of the Option Agreement occurs when any obligation under the Option Agreement or the Lease is not performed. Ten (10) days from the date of the defaulting incident, Commonwealth Resources, L.L.C. may deliver the notice of default to GHC. GHC then has twenty (20) days from the date of service to cure the default before the Option Agreement is terminated. Upon termination GHC shall: ensure sufficient assessment work has been filed to hold unpatented claims through the assessment year commencing September 1 of that calendar year; GHC has 60 days to deliver: existing drill core samples, pulps, and copies of formal reports, and GHC must represent and warrant the accuracy and completeness of this data; GHC has 180 days to remove any of GHC's property that was placed on the site by GHC, excluding that property that must be left pursuant to the Option Agreement or Lease; and GHC has 180 days to replace any structures moved from the property.

Notice of Option to Purchase Mineral Interests

On September 25, 2008, a Notice of Option to Purchase Mineral Interests was filed with the Granite Clerk and Recorder, whereby Commonwealth Resources, L.L.C. conveyed upon GHC the right to purchase the mineral rights pertaining to the subject mining claims at any time prior to June 15, 2014, provided GHC performs all obligations as required pursuant to the material terms of the Grant Hartford Option Agreement ("Option Agreement"). The material terms as stated in the Option Agreement are as follows: The option may be exercised at any time prior to 11:59pm, June 14, 2014. GHC may enter and shall have immediate possession of the property containing the optioned mineral rights, excluding historical structures. GHC may use the property to: carry out its operations; install buildings, plants, machinery, equipment, tools, appliances and supplies; and remove up to 100 tons per day of rock, ores, minerals and metals, whereby 5% of the net smelter return on any ore processed will be paid to Commonwealth Resources, L.L.C. within fifteen (15) days of the close of each calendar month. In the event Commonwealth Resources, L.L.C.'s title is deficient, GHC may remedy the deficiency and deduct the costs and related expenses of said deficiency from the final purchase price of the Garnet Mining District mineral deeds. In order to avoid default, GHC shall complete the following material terms: Pay an annual option payment of $190,000 to Commonwealth Resources, L.L.C. on June 15 of each calendar year until June 15, 2011, whereby the option payment increases to $400,000 for the final two year period. GHC is required to issue 19,000,000 shares of GHC's no par value common stock, pursuant to an Amendment to Grant Hartford Option Agreement dated January 24, 2008; fully and timely pay all real estate taxes and assessments on the patented claims; create and provide to Commonwealth Resources, L.L.C., a work program, which may be abandoned if it is not warranted, based on the results of previous work. GHC will hold Commonwealth Resources, L.L.C. harmless from rehabilitation or reclamation of the property. At the time of completion of operations, GHC must return structures to their original site, or another agreed upon site on the property. GHC must provide work program results to Commonwealth Resources, L.L.C. GHC must secure and maintain adequate insurance on the property and for the workers. Additional mineral claims may be purchase by GHC within the area of interest for the mutual benefit of both parties. GHC must fully perform the material terms of the Mineral Lease, which is entitled Non-Exclusive Surface Lease Agreement ("Lease"), which was entered into by the parties on June

10

15, 2007. The material terms of the Lease are as follows: The Lease runs co-extensively with the Option Agreement and expires at GHC's acquisition of the mineral rights. At that time the parties shall enter into a new lease on the property, under mutually agreeable terms and for rent of not less than the current Lease. GHC may use any structure on the property as listed in Schedule B of the Lease. Any structure constructed, remodeled, or renovated on the property is to run with the land and is to remain there for the benefit of Commonwealth Resources, L.L.C. GHC is required to maintain fire and extended coverage on all structures in use on the property and must maintain the exteriors and interiors of those structures. An annual rent payment of $60,000 per year is required, which, upon thirty (30) day notice, may convert to monthly or quarterly payments upon mutual agreement between the parties. In addition, GHC must pay all the taxes and assessments on the patented claims and pay all assessments and conduct all work required to keep unpatented mining claims in good standing with the US Department of Interior, Bureau of Land Management and State of Montana, or any political subdivision thereof. GHC shall hold Commonwealth Resources, L.L.C. harmless from liability damages or claims of damages and GHC must carry suitable liability insurance.

A breach of the Lease includes the following: If GHC fails to pay all taxes and assessments, or conduct all work on the subject claims; uses the property in a way not set forth in the Lease; fails to pay the rent payment; commits or suffers any waste that is committed in or upon the property; makes a general assignment for the benefit of creditors; makes an insolvent assignment; or files a voluntary petition for bankruptcy. In the event GHC fails to pay all taxes and assessments and perform all work on the subject claims; Commonwealth Resources, L.L.C. shall have the right, without notice, to make payments or perform the work required. This default may be cured by GHC if the Company reimburses Commonwealth Resources, L.L.C. for the full costs for completing the requirements in a timely manner. Otherwise termination of the agreement requires written notice of default to be delivered to GHC no sooner than 10 days from the defaulting event. GHC then has thirty (30) days from delivery of the default notice to cure the default in its entirety. If said cure is not completed within the thirty (30) day time period, Commonwealth Resources, L.L.C. may reenter the property, take possession and cancel the Lease, whereby GHC forfeits all rents paid and is responsible for any damages suffered by Commonwealth Resources, L.L.C. as a result of the default.

A breach of the Option Agreement occurs when any obligation under the Option Agreement or the Lease is not performed. Ten (10) days from the date of the defaulting incident, Commonwealth Resources, L.L.C. may deliver the notice of default to GHC. GHC then has twenty (20) days from the date of service to cure the default before the Option Agreement is terminated. Upon termination GHC shall: ensure sufficient assessment work has been filed to hold unpatented claims through the assessment year commencing September 1 of that calendar year; GHC has 60 days to deliver: existing drill core samples, pulps, and copies of formal reports, and GHC must represent and warrant the accuracy and completeness of this data; GHC has 180 days to remove any of GHC's property that was placed on the site by GHC, excluding that property that must be left pursuant to the Option Agreement or Lease; and GHC has 180 days to replace any structures moved from the property.

Non-Exclusive Surface Lease Agreement

GHC must fully perform the material terms of the Mineral Lease, which is titled Non-Exclusive

11

Surface Lease Agreement ("Lease"), and was entered into by the parties on June 15, 2007. The material terms of the Lease are as follows: The Lease runs co-extensively with the Option Agreement and expires at GHC's acquisition of the mineral rights. At that time the parties shall enter into a new lease of the property, under mutually agreeable terms and for rent of not less than the current Lease. GHC may use any structure on the property as listed in Schedule B of the Lease. Any structure constructed, remodeled, or renovated on the property is to run with the land and is to remain there for the benefit of Commonwealth Resources, L.L.C. GHC is required to maintain fire and extended coverage on all structures in use on the property and must maintain the exteriors and interiors of those structures. An annual rent payment of $60,000 per year is required, which, upon thirty (30) day notice, may convert to monthly or quarterly payments upon mutual agreement between the parties. In addition, GHC must pay all the taxes and assessments on the patented claims and pay all assessments and conduct all work required to keep unpatented mining claims in good standing with the US Department of Interior, Bureau of Land Management and State of Montana, or any political subdivision thereof. GHC shall hold Commonwealth Resources, L.L.C. harmless from liability damages or claims of damages and GHC must carry suitable liability insurance.

A breach of the Lease includes the following: If GHC fails to pay all taxes and assessments, or conduct all work on the subject claims; uses the property in a way not set forth in the Lease; fails to pay the rent payment; commits or suffers any waste that is committed in or upon the property; makes a general assignment for the benefit of creditors; makes an insolvent assignment; or files a voluntary petition for bankruptcy. In the event GHC fails to pay all taxes and assessments and perform all work on the subject claims; Commonwealth Resources, L.L.C. shall have the right, without notice, to make payments or perform the work required. This default may be cured by GHC if the Company reimburses Commonwealth Resources, L.L.C. for the full costs for completing the requirements in a timely manner. Otherwise termination of the agreement requires written notice of default to be delivered to GHC no sooner than 10 days from the defaulting event. GHC then has thirty (30) days from delivery of the default notice to cure the default in its entirety. If said cure is not completed within the thirty (30) day time period, Commonwealth Resources, L.L.C. may reenter the property, take possession and cancel the Lease, whereby GHC forfeits all rents paid and is responsible for any damages suffered by Commonwealth Resources, L.L.C. as a result of the default.

Amended Mining Lease / Partial Assignment of Amended Mining Lease and Acknowledgment

The owner of record of one (1) patented claim, the Free Coin, is River Terrace Estates, Inc. An Amended Mining Lease between River Terrace Estates, Inc. and Commonwealth Resources, L.L.C. provides for a lease and option to purchase the Free Coin patented mining claim. This Mining Lease has been partially assigned to Grant Hartford Corporation both by the terms of the Grant Hartford Option Agreement between Commonwealth Resources, L.L.C. and the Company and through a Partial Assignment of Amended Mining Lease, which assigned to GHC the leasehold interest in the Amended Mining lease and the right to acquire, upon exercise of the purchase option defined in the Lease and Amended Lease, the mineral rights in and to the mining claim. The terms and nature of this Mining Lease, amended on or about February 20, 2009, are as follows: River Terrace Estates, Inc. leases Free Coin Quartz Lode, Mineral Survey No. 4652, Patent No. 28062 containing 13.86 acres, more or less, to Commonwealth Resources, L.L.C. for a

12

period of seven years from March 29, 2007, subject to Commonwealth Resources, L.L.C.'s option to purchase. Commonwealth Resources, L.L.C. shall have the exclusive right to enter upon and have possession of the mining claims for the purpose of testing, exploring, developing, and operating the mining claims as unpatented mining claims and extracting from and selling, with the exception of the portion attributable to River Terrace Estates, Inc., any minerals found thereon and therein, specifically including, but not limited to, gold, silver, copper, gemstones and other minerals or gems. The places where any testing, exploring, developing and operating of the claim shall be done, and the extent thereof, shall be left entirely to the discretion of Commonwealth Resources, L.L.C., provided however, that Commonwealth Resources, L.L.C. shall perform all work on said premises in a good and miner-like manner so as to preserve the premises as a workable lode mining claim. The following are the material terms of the option to purchase the subject mining claim: Commonwealth Resources, L.L.C. shall pay an annual rent payment of $500; Commonwealth Resources, L.L.C. shall pay a 3% net smelter return on all minerals extracted from the claim during the seven years immediately succeeding the date of the Amended Mining Lease; Commonwealth Resources, L.L.C. shall pay any real property, or any other taxes assessed or levied against mining claims, Commonwealth Resources, L.L.C.'s property, or structures on the mining claim; Commonwealth Resources, L.L.C. shall pay all costs for the operation of said premises; Commonwealth Resources, L.L.C. will not allow a lien of any kind to be imposed or enforced against the premises; and Commonwealth Resources, L.L.C. will maintain appropriate insurance policies, including general liability and auto-related liability. A default on the option to purchase the subject mining claims consists of a violation of any provision of the Mining Lease, culminating in River Terrace Estates, Inc. delivering a written notice of violation and 120 day notice of termination of Mining Lease to Commonwealth Resources, L.L.C. Commonwealth Resources, L.L.C. has 120 days from receipt of said notice to cure the default; otherwise River Terrace Estates, Inc. may take possession of the premises. The following are the material terms of the purchase agreement of the subject mining claim: Commonwealth Resources, L.L.C. shall give its notice of intention to purchase the mineral claim within seven (7) years from March 29, 2007. The purchase price for the subject mining claim shall be $60,000, plus 12% bonus per annum, computed from the date of the Mining Lease to the date of the final closing payment, not to be more than ninety (90) days after the notice to exercise the option is given to River Terrace Estates, Inc.

Agreement with Garnet Range Resources, LLC and Grant Hartford Corporation

Our Company is a mineral exploration, development and production company and during its normal course of business Grant Hartford Corporation sub-contracts all drilling and earth moving tasks required to complete our drill programs on the Garnet Mineral Property. In June, 2009, Grant Hartford Corporation recognized unforeseen circumstances in the Company's current arrangements to rent and operate the heavy equipment necessary to perform its exploration activities. In order to fulfill this need, the Company entered into a non-exclusive Agreement with Garnet Range Resources, LLC ("Garnet"), on July 6, 2009. The non-exclusive agreement was for an open ended term, wherein Garnet is to provide support services to Grant Hartford in the form of the operation of heavy equipment, provision of labor and coordination of project management with respect to exploring the mining claims located on the Garnet Mineral Property, which is Optioned by Grant Hartford Corporation. Garnet Range Resources, LLC is owned by two individuals, Eric Sauve and Joyce Charlton, each owns fifty percent (50%) of Garnet's membership interests. Eric

13

Sauve is the President, CEO & Director of Grant Hartford Corporation, a related party to the Company, and Joyce Charlton is the spouse of Aaron Charlton, Senior Consultant and a related party to Grant Hartford Corporation. The material terms of the Agreement are as follows: GHC agrees to rent a Caterpillar D8H Dozer #46A18817 and a PC400LC Komatsu Excavator #A85031 from Garnet. The rental agreement shall include an operator, all maintenance, repair and support of the equipment, payment of taxes, insurance and all operating expenses, including fuel, which shall be the responsibility of Garnet. Changes to the Agreement shall be made by Appendix to the Agreement. Garnet shall deliver monthly invoices, itemizing the services rendered during that period. GHC shall pay within ten (10) calendar days of receipt of Garnet's invoice. Any disputed amount that is not resolved within twenty (20) days of invoice must be paid to a mutually agreed upon third party until resolution. Garnet shall be solely responsible for employing personnel and paying any costs associated with the personnel. Garnet holds GHC harmless from liability. Garnet and GHC are each to have $1,000,000 insurance policies to cover their own liability. Failure of either party to perform any of said party's obligations under the Agreement shall constitute a default. In the event the default continues for five (5) days, written notice shall be given to the defaulting party. The default may be cured within twenty (20) days of service of written notice. In the event the default is not cured within the twenty (20) day period, the contract shall terminate. Governing law shall be the State of Montana.

Vehicle Lease Agreement with Garnet Range Resources, LLC.

On July 1, 2009, Grant Hartford Corporation entered into a vehicle lease agreement with Garnet Range Resources, LLC ("Garnet"), a Montana limited liability company that is owned by two individuals, Eric Sauve and Joyce Charlton, each owns fifty percent (50%) of Garnet's membership interests. Eric Sauve is the President, CEO and Director of Grant Hartford Corporation, a related party to the Company, and Joyce Charlton is the spouse of Aaron Charlton, Senior Consultant and a related party to Grant Hartford Corporation. The material terms of the Agreement are as follows: Garnet shall provide GHC the use of an automobile for a period of 2 years beginning April 22, 2009 to April 21, 2011. GHC shall pay Garnet, in advance, the sum of $4,500 for the use of the vehicle for the 2 year period. GHC shall have comprehensive insurance coverage on the vehicle. GHC shall be responsible for all repairs, licensing, fuel and any other costs associated with the vehicle during the lease period.

Garnet Historical Owners and Operators

The historical owners of the Garnet mineral property were: Pegasus Gold Corporation ("Pegasus"), which was a mid size gold producing Company in the 1980's and mid 1990's that optioned the Garnet Property from Garnet Mining Inc. and Cordoba Corporation, which were owned and controlled by Aaron Charlton, between 1989 and 1993. Pegasus Gold Corporation allowed its option to the Garnet Mineral Property to lapse in 1993 and subsequently filed bankruptcy. Pegasus Gold Corporation is not affiliated with GHC or Commonwealth Resources, L.L.C. Trans-Global Resources, N.L., which was an exploration company listed on the ASX and NASDAQ had a 56% interest in the Garnet Property from 1991 to 1993. Mr. Aaron Charlton, a related party to GHC, was the Chairman of Trans-Global Resources, N.L. Western Energy Corporation, a mining exploration subsidiary of the Montana based power utility, Montana Power

14

Company, conducted exploration of the Garnet Property from 1987 to 1989. American Mining Corporation owned and conducted exploration on the Garnet property between 1966 and 1971. The President of the American Mining Corporation was James Charlton, the deceased father of Aaron Charlton and Kim L. Charlton. Anaconda Corporation was a major mining company that explored the Garnet Property in the 1960's. Each of the above mentioned companies compiled geological data from exploration on the Garnet Project. This data is being used by GHC to confirm drilling targets. None of the above mentioned companies has any current relationship, claim or affiliation to the Garnet Project, Grant Hartford Corporation, or Commonwealth Resources, L.L.C. None of the above companies have any current relationships or affiliations with related parties to the Company, with the exception of Aaron Charlton who was formerly the Chairman of Trans-Global Resources, N.L., Garnet Mining, Inc. and Cordoba Corporation and who is the son of James Charlton, the former President of American Mining Corporation.

Garnet Geology

In order to provide a brief overview and description of the rock formations and mineralization, present on the Garnet Mineral Property, and of which Grant Hartford Corporation is currently exploring, the following excerpts from the "Garnet Project Summary, December 1992," as prepared by Pegasus Gold Corporation ("Garnet Project Summary") are included below. Pegasus Gold Corporation allowed its option to the Garnet Mineral Property to lapse in 1993 and subsequently filed bankruptcy.

|

|

"Near the Garnet mining district, the northwest-plunging Deep Creek anticline is intruded on its northern flank by granodiorite of the Garnet Range stock. The formations in contact with the granodiorite include silty quartzites of the upper Proterozoic Garnet Range Quartzite (Missoula Group), vitreous Cambrian Flathead Quartzite, shales and silty carbonates of the Cambrian Wolsey Shale, dolomites and gray limestone of the Cambrian Meagher Limestone, poorly exposed Cambrian Park Shale, light colored dolomite and limestone of the Cambrian Pilgrim Formation, thin-bedded limestones and calcareous shales of the Cambrian Red Lion and Devonian Maywood Formations (mapped as a single unit), and black, carbonaceous limestones and dolomites of the Devonian Jefferson Formation." |

|

|

|

|

|

"Within a thousand feet of the granodiorite, contact metamorphism is well developed in the sedimentary rocks. Limestones are recrystallized to coarsely crystalline marbles, carbonaceous limestones and dolomites are bleached white with some recrystallized graphite observed, impure carbonates and silty shales are commonly converted to anhydrous skarn assemblages (principally garnet-epidote-diopside), and silty quartzites contain prominent clots of biotite-andalusite-cordierite, creating the distinctive spotted hornfels that district miners called "birdseye porphyry"." |

|

|

|

|

|

"Most of the intrusive contacts mapped in the district are north-dipping and conformable to bedding. North-dipping sills are abundant within a thousand feet of the plutonic contact. However, the stock itself is probably not conformable. Regional aeromagnetic maps indicate that a thin shelf of sedimentary rock extends for more |

15

|

|

than a mile away from the contact. Granitic rocks are probably present at shallow depths beneath the sedimentary rocks before dropping off abruptly at the edge of the stock. The many sills in this shelf of sedimentary rock probably contributed to the widespread contact metamorphism observed in the district." |

|

|

|

|

|

Mineralized material-bearing "quartz vein zones dip from 30 to 50 degrees northward in the Garnet district, and from 30 to 45 degrees southward at Coloma. These veins were responsible for an estimated 150,000 ounces of gold production from the Garnet and Coloma mines, as well as for much of the estimated 500,000 ounces of placer gold from nearby creeks" which were obtained during the pre-1942 historical mining period of the region. |

Four major vein systems are present in the Garnet District. All four strike generally east-west, and dip at shallow to moderate angles toward the north. The most northerly of these is the Nancy Hanks system which includes the International, Shamrock, Dewey, and Nancy Hanks veins. These veins occur within the granodiorite, or along the contact with marbles and shales of the Jefferson, Red Lion, and Maywood Formations. The vein systems are anastomosing networks of north-dipping veins and veinlets, with abundant subhorizontal ladder veinlets cutting the granodiorite between the main veins. The veins and veinlets are predominantly milky white or clear quartz with minor calcite and/or ankerite. Up to 2% pyrite can be found in the veins, but trace amounts are more typical. Away from the major veins, the granodiorite is strongly propylitized for a few inches up to several feet with minor amounts of disseminated pyrite. Trace amounts of quartz veinlets are sometimes responsible for" mineralized material drill intercepts.

Garnet Mining History

The following is a brief history of previous operations, including, insofar as known, the names and dates of previous operators: Between 1896 and 1942, geological reports indicate that the Nancy Hanks, Lead King, Dewey, International and Tiger mines were active on the Garnet property. The year of 1942 marked the beginning of World War II, causing mining to cease until the 1960's when Anaconda Corporation began its exploration programs on portions of the Garnet Property. From 1966 to 1971, American Mining Corporation owned and conducted its own exploration on the Garnet Property. Western Energy Corporation, a mining exploration subsidiary of the Montana based power utility, Montana Power Company, conducted exploration of the Garnet Property from 1987 to 1989. Pegasus Gold Corp. ("Pegasus"), which was a mid size gold producing Company in the 1980's and mid 1990's, optioned the Garnet Property between 1989 and 1993. Pegasus Gold Corporation allowed its option to the Garnet Mineral Property to lapse in 1993 and subsequently filed bankruptcy. Trans-Global Resources, N.L., which was an exploration company listed on the ASX and NASDAQ had a 56% interest of the Garnet Property from 1991 to 1993.

In Pegasus' exploration of the Garnet Property they identified mineralized material in two of Grant Hartford Corporation's mining claims that are under option through Commonwealth Resources,

16

L.L.C. Subsequently, the Company used these previous exploration results from the Nancy Hanks and Dewey patented claims, as a basis for our current exploration plans. Several of the following excerpts and summarizations from the "Garnet Project Summary, December 1992," prepared by Pegasus Gold Corporation ("1992 Report") and the "Mineral Property Valuation, Garnet and Copper Cliff Mining Districts," prepared by John C. Brower, Ph.D. (1999 Report) are provided and outline the Pegasus operations on the Garnet Property. Dr. Brower has declined to provide his consent to use this information to Grant Hartford Corporation, due to the age of the report, which is dated September 1999, and the fact that a third party entity commissioned Dr. Brower to prepare the report, thus he does not own the report. Grant Hartford hereby adopts these geological conclusions as our own and directs investors to review Risk Factor 10, "Non-Consent to Use Geological Reports," on page 35 of this Form 10-K.

|

|

"Between December, 1989, and December 1992, Pegasus Gold conducted an exploration program covering over 22 square miles and employing airborne magnetics and resistivity, ground, magnetics, IP, and resistivity surveys. Drill targets were defined using geologic mapping, [and] rock, soil and trench geochemistry. Fourteen targets were drill tested with 147 reverse circulation holes (47,601 feet), and six core holes (1,710 feet)." This exploration program designated mineralized material located in "the Nancy Hanks deposit using 16 north-south cross sections," and reported "tonnages for 129 polygonal blocks on these cross sections as defined by intercepts in 43 reverse circulation drill holes, nine trenches, and three core holes." These calculations resulted in designated mineralized material of 3.2 million tons, with an average grade of 0.04 ounces AU per ton." |

|

|

|

|

|

The 1999 Report further discusses the Pegasus exploration plan and states that the "...Dewey/Nancy Hanks and Cascade zones were constructed by Pegasus, showing drill holes and intercepts of" mineralized material and other geology. Pegasus completed their calculations "manually by drawing polygons on the cross sections, and with polygon cross sectional areas determined by use of planimeters. Polygons were then extended halfway to the adjacent cross section to determine volume and tonnage." Pegasus created Ninety-three blocks on ten cross sections. |

|

|

|

|

|

"The approach employed by Pegasus is suitable as a first approximation, early indication type of estimate, to determine whether enough gross grade and tonnage is present to merit further work, but is far too generalized for feasibility decisions. More sophisticated analytical techniques using computer models (bellow) can reveal ore grades and gross tonnages that differ significantly from first approximations. They can be substantially higher or lower, due to more selective designation of what is ore and what is waste, which can subsequently expand or contract mineable zones." The 1999 Report goes on to suggest that John C. Brower used "the drill hole data from Pegasus in computer mine modeling, namely the commonly used proprietary programs SURPAC and THREE-D. SURPAC to generate a mine block model, in this case with user defined mine blocks 100 feet square and 50 feet high. Modeling utilized 62 drill holes in the Dewey/Nancy Hanks area and 17 in the Magone & Anderson, with an average |

17

|

|

spacing of 250 feet apart." The 1999 Report's "prefeasibility model was based on a 6-year mine life, followed by two years of reclamation," and prescribed the removal of 6,972,000 short tons of designated mineralized material which had an average grade of "0.086 troy ounces per short ton." |

These results from the Pegasus Exploration Plan, which were further interpreted by the 1999 Report, are the basis for Grant Hartford Corporation's initial exploration plans and give rise to our plans for expanding exploration on the property and proceeding with a pre-feasibility or scoping study in order to determine the existence of proven/ probable reserves on the Garnet Mineral Property.

2008 Operations

J. Robert Flesher, Vice-President Geology and Mining, for GHC, prepared the "Nancy Hanks Project Geology And Drilling Report for 2008," wherein the results for the Company's 2008 exploration program were detailed. During the second half of 2008, the Grant Hartford Corporation began a definition drilling program consisting of 54 reverse circulation drill holes (12,497.5 feet), examining three mineralized material systems. Drill targets were based on results from exploration conducted by Pegasus between December, 1989 and December, 1992 and many historical records, maps, and other geologic reports. Pegasus completed 147 reverse circulation holes (47,601 feet) and six core holes (1,710 feet). Combined, the total drill footage available for reserve calculation and mine planning is 31,808.5 feet.

The Company's exploration program for 2008 successfully intercepted multiple high-grade mineralized material zones. We discovered and expanded mineralized material zones indentified by Pegasus in the East Dewey and North Dewey zones. Drilling on the Nancy Hanks deposit confirmed mineralized material as identified by Pegasus with open boundaries in several directions. A new mineralized material zone, at the 200 foot level in the area of Nancy Hanks pit, was discovered which is open in three directions. The Company plans to begin inputting the 2008 exploration program data and the Pegasus drill data into the Vulcan Sub-Surface 3-D Modeling Software ("Vulcan") in order to provide the Company with an updated open pit mineralized material calculation and an underground high-grade mineralized material calculation.

2009 Operations

The Company's 2008 exploration program was designed to quantify, through the use of definition drilling, both open pit and underground mine mineralized material targets identified by the previous Pegasus exploration program. It was the Company's intent to use this information to proceed with prefeasibility or scoping studies in 2009 in order to determine the updated existence of proven/probable reserves.

18

GHC's 2009 exploration program was designed to expand on the 2008 drill results and the results of Pegasus' exploration project (1989-1992). The Pegasus exploration project identified 16 different areas of high grade mineralized material. Numerous historical reports, production records, and maps were also used to determine the most promising targets.

Due to the encouraging results obtained in the first three zones drilled in 2008, no drilling was conducted on any of the other targets suggested by Pegasus. All three 2008 targets were found in the Nancy Hanks/Dewey vein systems. The 2009 exploration program continued to define the Nancy Hanks area and expand the exploration to 3 additional high grade targets containing mineralized material indicated by limited drilling conducted by Pegasus. These include the Willie Vein, the Tiger Vein, and the Tostman mineralized zone. GHC completed 111 holes totaling 37,763 feet in 2009. Plans called for confirmation of these high-grade intercepts, tightening drill spacing for more accurate reserve estimation, moving more mineralized material into a potential proven/probable reserve category, and evaluating the high-grade intercepts for underground extraction.

The Nancy Hanks project area has had a significant amount of exploration conducted in the low grade, open pit mineralized zone. The Vulcan 3D modeling software has produced a preliminary mineralized material resource estimate and additional modeling is currently being conducted to further define a potential proven/probable reserve estimate. The Company anticipates combining this estimate with our 2010 exploration activities in order to complete the definitive proven/probable resource estimate contained in this portion of the project. As a safe guard against historical results, two confirmation holes were drilled along side two sets of twin core/reverse circulation holes completed by Pegasus and results closely mirrored previous results.

Additional high grade vein systems beneath the Nancy Hanks pit area are being modeled with the Vulcan 3-D modeling software, however the preliminary block model results indicate high grade mineralized material to warrant additional exploration. These high-grade veins are open ended and down dip laterally and appear to be getting wider and higher grade at depth. Current drill results indicate this vein structure potentially continues to down dip and recent geological models imply this is in the direction of the mineralized material source. This vein system appears to be a continuation of the structures mined historically during the early Nancy Hanks and Dewey production period between 1896 and 1942. The Company anticipates further defining these vein structures in our 2010 exploration program and adding them to our definitive proven/probable resource estimate in our proposed pre-feasibility study.

Nancy Hanks Pit Area Drill Hole Highlights

|

Drill Hole |

From |

To |

Interval |

Grade OPT Au |

|

GHN41-09 |

290 |

320 |

30' |

.409 |

|

-including |

295 |

300 |

5' |

1.775 |

|

GHN52-09 |

345 |

500 |

155' |

.095 |

|

GHN56-09 |

330 |

360 |

30' |

.246 |

|

GHD98-09 |

185 |

205 |

20' |

.384 |

|

-including |

190 |

195 |

5' |

1.212 |

|

GHD99-09 |

115 |

120 |

5' |

1.700 |

|

GHD99-09 |

160 |

170 |

10' |

.331 |

19

The Willie Vein System had 30 reverse circulation drill holes completed totaling 9,333 feet in 2009 and the results have been entered into the Vulcan 3-D modeling software to create a preliminary mineralized material estimate that is nearly 400 feet along strike containing 72,000 tons at 0.226 OPT Au. This drill program was based on 2 drill holes completed by Pegasus totaling 615 feet which intercepted a high grade quartz vein structure contained in the Garnet Range Quartzite. Plans to further delineate this structure were a top priority for 2009 and drill results confirmed the existence of a mineralized quartz vein within a bleached quartzite structure. Vein structures were intercepted in nearly every hole completed here. This vein is from five to fifteen feet thick and appears to be relatively uniform and continues to down dip and laterally. Down dip intercepts appear to be getting wider and higher grade. This vein system is open in 2 directions and GHC anticipates additional exploration will continue on the Willie during the 2010 exploration program to further define the mineralized material vein system.

Willie Vein Drill Hole Highlights

|

Drill Hole |

From |

To |

Intercept |

Grade OPT Au |

|

GHW6-09 |

145 |

165 |

20' |

.255 |

|

-including |

145 |

150 |

5' |

.695 |

|

GHW62-09 |

345 |

355 |

10' |

.239 |

|

GHW64-09 |

305 |

358 |

53' |

.366 |

|

-including |

325 |

335 |

10' |

1.273 |

|

GHW66-09 |

270 |

390 |

20' |

.158 |

|

-including |

285 |

290 |

5' |

.342 |

The Tostman mineralized zone is located approximately 1,800 feet west of the Nancy Hanks pit area. This deposit was drilled by Pegasus, who encountered both lower grade pit type material as well as higher grade underground veins. The geology here is very similar to the Nancy Hanks pit area and this mineralized zone is contained in altered Garnet Range granodiorite adjacent to the contact zone with the sedimentary sequences. This is typical of many of the historic mines located in the Garnet Mining District. Grant Hartford included the Tostman in the 2009 exploration plan to further define this deposit, confirm the data reported by Pegasus, and begin modeling to create initial proven/ probable reserve estimates. During 2009, GHC drilled 10 holes on the Tostman deposit totaling 3,800 feet and was able to confirm much of the data presented by Pegasus. Several high grade veins were encountered as well as intervals of lower grade mineralization. The 2009 drill data has been modeled using the Vulcan 3-D modeling software in order to determine a preliminary proven/ probable reserve estimate, however additional drilling will be conducted during the 2010 exploration program, which will further define this deposit as it is open in three directions.

Tostman Deposit Drill Hole Highlights

|

Drill Hole |

From |

To |

Intercept |

Grade OPT Au |

|

GHC57-09 |

320 |

325 |

5' |

.262 |

|

GHC58-09 |

275 |

280 |

5' |

.294 |

|

GHC59-09 |

120 |

125 |

5' |

.290 |

|

GHC106-09 |

335 |

360 |

25' |

.175 |

|

-including |

335 |

340 |

5' |

.582 |

The Tiger vein system is contained in an altered sedimentary sequence just south of the Nancy

20

Hanks Pit area. This contact area is highly altered from the adjacent intrusive stock and contains marble and altered limestones with intrusive granodiorite sills deposited along bedding planes. This vein was mined historically and mineralized material is contained in an oxidized vein approximately ten feet in thickness. Nine holes were completed on the Tiger claim in 2009 totaling 2,790 feet. Of these nine holes, only four targeted the vein structure. The remaining 5 holes were water/condemnation holes which were sampled, but no significant mineralization was observed. We plan to complete additional drilling to the east of our 2009 program during our 2010 exploration program, which we anticipate will determine the extent of this vein structure.

Tiger Vein Drill Hole Highlights

|

Drill Hole |

From |

To |

Intercept |

Grade OPT Au |

|

GHT96-09 |

120 |

130 |

10' |

.268 |

|

-including |

120 |

125 |

5' |

.444 |

2009 Additional Exploration Activities

In addition to the 2009 exploration program, the Company also accomplished the following activities during 2009.

Vulcan Sub-Surface 3-D Modeling Software Program

GHC purchased the Vulcan Sub-Surface 3-D geologic modeling software ("Vulcan") early in 2009. All historic and current drill data has been input for drill planning and mine planning. GHC enlisted WGM of Missoula, MT to conduct a Lidar air survey of the project area. This survey has a tolerance of 2' or less and has provided the Company with an extremely accurate and current topography, along with aerial photography of the Garnet Mineral Property that has been imported to Vulcan. Many of the historic mine workings, roads, and various other features in the area have been digitized and imported into Vulcan. These historic workings help indicate the potential location of mineralized material bodies, in addition to mine planning activities. Using all available data, Vulcan is being used to create mineralized material zones of interest for further exploration and definition during the 2010 exploration program, reserve reports, mine planning, and geologic mapping.

Geophysics

GHC worked with Echotech of Missoula, MT to evaluate the data gathered by Pegasus. It was determined that the data was not very useful to us as more modern techniques give much better information. A down hole geophysics program was conducted on the Willie vein system and geophysical data is currently being processed and will be imported into Vulcan for analysis and use in exploration planning.

Geological Team

The Company organized a Geological Team during the 2009 exploration program which will serve to increase our knowledge and ability to handle the Garnet Mineral Property's increasing geological needs. The Geological Team has brought a wide range of knowledge together allowing the Company to more efficiently accomplish its exploration activities on the Garnet

21

Mineral Property. Dr. Sears has conducted numerous geological mapping activities in the greater Garnet Mining District and his work will provide a unique and beneficial source of geological information for our exploration activities on the Garnet Mineral Property. In order to fully utilize our Geological Team, we anticipate adding additional Vulcan licenses useable by other members of our Geological Team during the 2010 exploration season.

Team members include:

J. Robert Flesher - Vice President of Geology and Mining for GHC

Dr. James Sears - Director for GHC and a Professor of Geology at the University of Montana

Jeff Switzer - Field Geologist and recent geology graduate from the University of Montana. Mr. Switer

was a student of Dr. Sears'

Sarah Clark - Field Geologist and recent geology graduate from the University of Montana. Ms. Clark

was a student of Dr. Sears'

Joe Faubian - CDM consulting geologist

Metallurgical Testing

Samples were created from drill cuttings from various mineralized material zones and grade ranges in 2009 exploration program. These tests were conducted by Dawson Labs, of Salt Lake City, Utah and are currently being used for mill design and planning.

Mine planning

Mine planning activities were on-going during the 2009 exploration program. Underground extraction plans were created for the Willie vein model by Small Mine Development, of Boise, Idaho. Small Mine Development is an underground mine contractor and has extensive experience in underground mining techniques. During the 2010 exploration program, we anticipate Small Mine Development's creation of an underground mining plan for the high grade veins in the vicinity of the Nancy Hanks Pit area. Open pit planning is in the preliminary stages and will expand as the 2010 exploration program progresses throughout the year.

There are no production or milling operations on the property, as of today. There is no electric power on the property. Any future mining or milling operation will require either power lines to reach the property or the generation of power on site. The Company has retained CDM Engineering of Helena, MT to conduct a cost estimate for power requirements.

Mapping

Geological mapping has become a top priority for GHC and Dr. Sears completed a significant amount of surface mapping during the2009 exploration program. More accurate definition of the contact zone will continue to be updated throughout 2010. This information will help us target potentially undiscovered deposits which may lie in proximity to the contact zones currently under active exploration. A thorough knowledge of the geological conditions of the district will greatly increase our potential for successful exploration activities.

22

Conclusion of the Company's 2009 Drilling Activities