Attached files

| file | filename |

|---|---|

| EX-31.2 - QKL Stores Inc. | v179200_ex31-2.htm |

| EX-32.1 - QKL Stores Inc. | v179200_ex32-1.htm |

| EX-10.31 - EX-10.31 - QKL Stores Inc. | v179200_ex1031.htm |

| EX-31.1 - QKL Stores Inc. | v179200_ex31-1.htm |

| EX-4.5 - EX-4.5 - QKL Stores Inc. | v179200_ex10-29.htm |

| EX-10.29 - EX-10.29 - QKL Stores Inc. | v179200_ex10-31.htm |

| EX-4.6 - EX-4.6 - QKL Stores Inc. | v179200_ex10-30.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark

One)

|

þ

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934.

|

For

the fiscal year ended December 31, 2009

Or

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934.

|

For

the transition period from ________ to __________

Commission

file number 033-10893

QKL

STORES INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

75-2180652

|

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

Jingqi

Street

44

Dongfeng Xincun

Sartu

District

163311

Daqing, P.R. China

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (011) 86-459-460-7626

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $0.001 per share

|

NASDAQ Capital Market

|

Securities

registered pursuant to Section 12(g) of the

Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes o No

þ

Indicate

by check mark whether the registrant: (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past

90 days. Yes þ No

o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein,

and will not be contained, to the best of registrant’s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. þ

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting company þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Exchange

Act Rule 12b-2). Yes o No

þ

The

aggregate market value of the registrant’s common stock, $0.001 par value

per share, held by non-affiliates of the registrant on June 30, 2009, was

approximately $7,560,227 (based on the closing sales price of the registrant’s

common stock on that date ($4.20). Shares of the registrant’s common stock

held by each officer and director and each person known to the registrant to own

10% or more of the outstanding voting power of the registrant have been excluded

in that such persons may be deemed to be affiliates. This determination of

affiliate status is not a determination for other purposes.

APPLICABLE

ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE

YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports

required to be filed by Section 12, 13 or 15 of the Securities Exchange Act of

1934 subsequent to the distribution of securities under a plan confirmed by a

court.

Yes o No o

(APPLICABLE

ONLY TO CORPORATE REGISTRANTS)

Indicate

the number of shares outstanding of each of the registrant’s classes of common

stock, as of the latest practicable date. As of March 29, 2010 there

were 29,653,431 shares of common stock outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE: None

QKL

STORES, INC.

ANNUAL

REPORT ON FORM 10-K

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

TABLE OF

CONTENTS

|

PART

I

|

||||

|

ITEM

1

|

BUSINESS

|

1

|

||

|

ITEM

1A

|

RISK

RACTORS

|

22

|

||

|

ITEM

1B

|

UNRESOLVED

STAFF COMMENTS

|

35

|

||

|

ITEM

2

|

PROPERTIES

|

35

|

||

|

ITEM

3

|

LEGAL

PROCEEDINGS

|

39

|

||

|

ITEM

4

|

(REMOVED

AND RESERVED)

|

39

|

||

|

PART

II

|

|

|||

|

ITEM

5

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

40

|

||

|

ITEM

6

|

SELECTED

FINANCIAL DATA

|

41

|

||

|

ITEM

7

|

MAMANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

41

|

||

|

ITEM

7A

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

41

|

||

|

ITEM

8

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

42

|

||

|

ITEM

9

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

42

|

||

|

ITEM

9A

|

CONTROLS

AND PROCEDURES

|

42

|

||

|

ITEM

9B

|

OTHER

INFORMATION

|

43

|

||

|

PART

III

|

|

|||

|

ITEM

10

|

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

44

|

||

|

ITEM

11

|

EXECUTIVE

COMPENSATION

|

44

|

||

|

ITEM

12

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

44

|

||

|

ITEM

13

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

44

|

||

|

ITEM

14

|

PRINCIPAL

ACCOUNTANTING FEES AND SERVICES

|

44

|

||

|

PART

IV

|

||||

|

ITEM

15

|

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES

|

|

45

|

i

CAUTIONARY

STATEMENT

This

annual report contains forward-looking statements. Forward-looking statements

give our current expectations or forecasts of future events. You can identify

these statements by the fact that they do not relate strictly to historical or

current facts. Forward-looking statements involve risks and uncertainties.

Forward-looking statements include statements regarding, among other things, (a)

our projected sales, profitability and cash flows, (b) our growth strategies,

(c) anticipated trends in our industries, (d) our future financing plans and (e)

our anticipated needs for working capital. They are generally identifiable by

use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,”

“potential,” “projects,” “continuing,” “ongoing,” “expects,” “management

believes,” “we believe,” “we intend” or the negative of these words or other

variations on these words or comparable terminology. In particular, these

include statements relating to future actions, future performance, sales

efforts, expenses, the outcome of contingencies such as legal proceedings, and

financial results.

Any or

all of our forward-looking statements in this annual report may turn out to be

inaccurate. They can be affected by inaccurate assumptions we might make or by

known or unknown risks or uncertainties. Consequently, no forward-looking

statement can be guaranteed. Actual future results may vary materially as a

result of various factors, including, without limitation, the risks outlined

under “Risk Factors” and matters described in this annual report generally. In

light of these risks and uncertainties, there can be no assurance that the

forward-looking statements contained in this filing will in fact occur and you

should not place undue reliance on these forward-looking

statements.

PART

I

|

Item

1.

|

Business

|

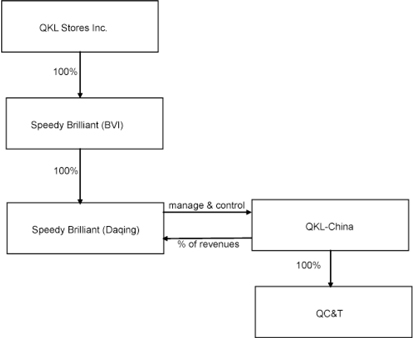

References

to “QKL-China” are to Daqing Qing Ke Long Chain Commerce & Trade Co., Ltd.,

a People’s Republic of China retail company that we control through a series of

contractural arrangements described in the section entitled “Our History and

Corporate Structure.” Unless otherwise specified or required by context,

references to “we,” “our,” “us” and the “Company” refer collectively to (i) QKL

Stores Inc. (formerly known as Forme Capital, Inc.), (ii) the subsidiaries of

QKL Stores Inc., which are Speedy Brilliant Group Limited, a British Virgin

Islands company (“Speedy Brilliant (BVI)”), which is wholly owned by QKL Stores

Inc., and Speedy Brilliant Commercial Consultancy Co., Ltd. (“Speedy Brilliant

(Daqing)”), which is wholly owned by Speedy Brilliant (BVI), (iii) QKL-China,

and (iv) Daqing Qinglongxin Commerce & Trade Co., Ltd. (“QC&T”), a

wholly owned subsidiary of QKL-China. For convenience, certain amounts in

Chinese Renminbi (“RMB”) have been converted to United States dollars at an

exchange rate of $1 = RMB 6.8282, the exchange rate on December 31, 2009.

References to “IGA” are to the Independent Grocers Alliance, an international

trade group and network of supermarkets that offers its members access to

industry information, bargaining advantages with suppliers, and other benefits

of affiliation with a large trade group. IGA reports that its member companies

operate in 40 countries worldwide and have total revenues of $21 billion per

year. Its website is www.IGA.com . References in this annual report to the “PRC”

or “China” are to the People’s Republic of China.

In

keeping with standard practice and the practice of the National Bureau of

Statistics of China, references to “northeastern China” are to the three

northeastern provinces of Heilongjiang, Jilin and Liaoning. A map showing these

provinces is included in the section of this report entitled “Other

References.”

References

to QKL-China’s “registered capital” are to the equity of QKL-China, which under

PRC law is measured not in terms of shares owned but in terms of the amount of

capital that has been or will be contributed to a company by a particular

shareholder or all shareholders. The portion of a limited liability company’s

total capital contributed by a particular shareholder represents that

shareholder’s ownership of the company and the total amount of capital

contributed by all shareholders is the company’s total equity. Capital

contributions are made to a company by deposits into a dedicated account in the

company’s name, which the company may access in order to meet its financial

needs. When a company’s accountant certifies to PRC authorities that a capital

contribution has been made and the company has received the necessary government

permission to increase its contributed capital, the capital contribution is

registered with regulatory authorities and becomes a part of the company’s

“registered capital.”

1

Summary

We are a

regional supermarket chain that currently operates 34 supermarkets and two

department stores in northeastern China and Inner Mongolia. Our supermarkets

sell a broad selection of merchandise including groceries, fresh food and

non-food items. We have distribution center servicing our

supermarkets.

We are

the 1st supermarket

chain in northeastern China and Inner Mongolia that is a licensee of the

Independent Grocers Alliance, or IGA, a United States-based global grocery

network with aggregate retail sales of more than $21.0 billion per year. As a

licensee of IGA, we are able to engage in group bargaining with suppliers and

have access to more than 2,000 private IGA brands, including many that are

exclusive IGA brands.

Our total

revenues for the year ended December 31, 2009 was approximately $247.6 million,

an increase of $87.5 million, or 54.7%, compared to total revenues of $160.1

million for the year ended December 31, 2008. Our net income excluding changes

in fair value of warrants for the year ended December 31, 2009 was

approximately $10.8 million, an increase of $1.8 million, or 20.0%, from

approximately $9.0 million for the year ended December 31, 2008.

Our

Industry

We

operate in the supermarket industry in China, which is a part of the country’s

retail trade sector. We believe the retail market has benefited from compelling

industry fundamentals such as rapid economic growth, urbanization and increasing

disposable income.

China’s

economy has been experiencing consistent growth with nominal GDP growing from

approximately $1.9 trillion in 2004 to approximately $4.9 trillion in 2009. As a

result of China’s rapid economic growth, the urban population has increased

dramatically as people in rural and less developed areas migrate to cities in

search of better jobs and higher living standards. During the period between

2004 and 2009, the total urban population in China increased by approximately

79.0 million, or approximately 14.6%. This growth has been accompanied by rising

income levels of urban households where annual per capita disposable income

increased from $1,379 in 2004 to $2514 in 2009 a compound growth rate of 12.8%.

A growing middle class combined with an increasing affluence and purchasing

power has driven the rapid development of the retail sector and in turn driven a

large increase in consumer spending. Consumer spending has grown from $789

billion in 2004 to approximately $1.8 trillion in 2009, a compound growth rate

of approximately 18.4%.

Northeast

China has a population of 133 million, or approximately 9% of China’s

population. In December 2007, a major economic-development plan for northeastern

China, the “Plan for Revitalizing Northeast China,” was announced by an office

of the PRC’s State Counsel. We believe that the plan indicates a commitment by

the PRC government to make economic development of northeastern China a high

priority. We also believe that this development is likely to contribute to our

growth.

Company

History

On March

28, 2008, QKL Stores Inc. (formerly known as Forme Capital, Inc.) acquired

control of QKL-China through a “reverse merger” transaction. Upon completion of

the reverse merger transaction, QKL Stores Inc. ceased to be a shell company (as

that term is defined in Rule 12b-2 under the Securities Exchange Act of 1934

(the “Exchange Act”)).

Private

Placement Transaction

At the

same time as the closing of the reverse merger transaction, we closed a private

placement of securities, in which we sold 9,117,647 units to certain accredited

investors, for gross proceeds to us of $15.5 million, at a purchase price of

$1.70 per unit. Each unit consists of one share of Series A Preferred Stock

(each of which is convertible into one share of our common stock), one Series A

Warrant and one Series B Warrant (each of which is exercisable to purchase 0.625

of a share of common stock or, in the aggregate, are exercisable to purchase up

to a total of 11,397,058 shares of our common stock). The Series A Warrants have

an exercise price of $3.40 per share (subject to adjustment) and the Series B

Warrants have an exercise price of $4.25 per share (subject to adjustment). We

received $13.5 million as net proceeds from this private placement. The closing

of the private placement was conditioned on the closing of the reverse merger

transaction.

2

For more

information about the private placement you should read the section of this

report entitled “Our History and Corporate Structure.”

Public

Offering

In

November 2009 we raised an aggregate of $39.7 million in a public offering of

6,900,00 shares of our common stock at a price of $5.75 per share.

Name

Change

On June

18, 2008, we changed our name from Forme Capital, Inc. to QKL Stores Inc. On the

same date, our name change reflected on the Over-the-Counter Bulletin Board

(“OTCBB”) and our common stock began trading under the stock symbol QKLS.OB. On

October 21, 2009, our common stock was listed on NASDAQ under the symbol

“QKLS.”

Executive

Office

Our

executive offices are located at 44 Jingqi Street, Dongfeng Xincun, Sartu

District, Daqing, 163311 P.R.C. and our telephone number is (011)

86-459-4607626. Our corporate website is www.qklstoresinc.com .

Information contained on, or accessed through our website is not intended to

constitute and shall not be deemed to constitute part of this

report.

Overview

We are a

regional supermarket chain that currently operates 34 supermarkets and 2

department stores in the northeastern three provinces and Inner Mongolia. Our

supermarkets sell a broad selection of merchandise including groceries, fresh

food and non-food items. We currently have one distribution center servicing our

supermarkets.

We are

the first supermarket chains in northeastern China and Inner Mongolia that is a

licensee of the Independent Grocers Alliance, or IGA, a United States-based

global grocery network with aggregate retail sales of more than $21.0 billion

per year. As a licensee of IGA, we are able to engage in group bargaining with

suppliers and have access to more than 2,000 private IGA brands, including many

that are exclusive IGA brands.

Our

expansion strategy emphasizes growth through geographic expansion in

northeastern China and Inner Mongolia, where we believe local populations can

support profitable supermarket operations, and where we believe competition from

large foreign and national supermarket chains, which generally have resources

far greater than ours, is limited. Our strategies for profitable operations

include buy-side initiatives to reduce supply costs; focusing on merchandise

with higher margins, such as non-food items, foods we prepare ourselves and

private label merchandise; and increasing reliance on the benefits of membership

in the international trade group IGA.

We

completed the initial steps in the execution of our expansion plan in March

2008, when we raised financing through the combination of our reverse merger and

private placement. Under our expansion plan, we opened seven new stores in 2009

that have, in the aggregate, approximately 32,000 square meters of space and ten

new stores in 2008 that have, in the aggregate, approximately 42,000 square

meters of space. Six of the stores opened in 2008 were opened by us and four of

the stores were opened through the acquisition of existing businesses by us. In

2010, we plan to open hypermarkets and additional supermarkets department stores

having, in the aggregate, approximately 100,000 square meters of space and one

additional distribution center in the second quarter of 2010 that will have

approximately 19,600 square meters of space. We are also making improvements to

our logistics and information systems to support our supermarkets. We expect to

finance our expansion plan from funds generated from operations, bank loans and

proceeds from our fourth quarter 2009 public offering, and our long-term target

is to open 200 stores over the next five years, including hypermarkets,

supermarkets and department stores.

Our

Competitive Advantages

We

believe that our competitive advantages include our low prices, the quality of

our meat and produce, our breadth of products, and the location of our

stores.

3

The

location of our stores is also essential to our competitiveness, and our current

competition strategy focuses on locating our stores within the three provinces

of northeastern China and the eastern region of Inner Mongolia. Within those

areas, we try to locate our stores in small- and medium-sized cities/counties

where we expect to face limited competition from large foreign or national

supermarket chains.

In

addition to the competitive advantages described above, we believe we have

specific and distinct advantages over our domestic and foreign

competitors.

Compared

with local supermarkets, we believe we have the following

advantages:

|

|

§

|

Strong

relationships with local suppliers;

|

|

|

§

|

Membership

in the international trade group IGA, which provides access to purchasing

discounts for packaged goods and access to IGA’s exclusive

brands;

|

|

|

§

|

Superior

management, especially in inventory management, information management

systems, and sales and marketing

programs;

|

|

|

§

|

A

focus on human-resource management, including formal employee training

programs; and

|

|

|

§

|

A

management team with global experiences in the supermarket

industry.

|

Compared

with large foreign supermarkets, we believe we have the following

advantages:

|

|

§

|

A

familiarity with Chinese and local circumstances and culture, religion and

customs, and a corresponding understanding of local customer needs and

consumption patterns, which we believe are especially helpful in the areas

of raw food and meat sales;

|

|

|

§

|

Our

supermarkets are positioned within their respective markets as stores that

provide goods and services at low prices in a manner that is convenient to

our communities. By contrast, we believe that Wal-Mart and other foreign

retailers are perceived in Daqing and other medium-sized cities in

northeastern China as places for higher priced and more extravagant

purchases;

|

|

|

§

|

Strong

relationships with local suppliers;

and

|

|

|

§

|

Certain

advantages under Chinese law, such as the right to sell cigarettes, a

right foreign competitors do not

enjoy.

|

Business

Strategy

Our

strategy is to expand our current market share and to benefit from the

anticipated growth in China’s retail industry. Our operating strategy consists

of the following key elements:

|

|

§

|

Emphasizing

growth through geographic expansion in the three northeastern provinces

and Inner Mongolia where there is an emerging market for our retail

operations and where competition is

limited.

|

|

|

§

|

Reducing

cost of goods sold by (i) acquiring more merchandise directly from

manufacturers, cutting out middlemen and distributors, and otherwise

reducing supply costs, and (ii) building a larger distribution center to

enable us to purchase larger orders from vendors at lower prices, and

(iii) taking advantage of the purchasing power of collective ordering of

supplies through IGA.

|

|

|

§

|

Increasing

our profit margins by (i) offering and selling more self-prepared foods,

which have higher profit margins, including baked goods made in our

bakery, and cooked meats such as fried chicken legs and roast

chicken, (ii) offering and selling more private label goods,

which also have higher profit margins, and (iii) increasing non-food

section in newly opened stores to increase gross

margin.

|

4

In 2009

and 2008, we acquired approximately 12% and 10.0%, respectively, of our

merchandise directly from manufacturers (not including private label

merchandise). We estimate that approximately 6% of our total revenue in 2009 was

due to sales of self-prepared foods compared to approximately 5.5% of our total

revenue in 2008.

Our

strategy is to increase our sales of these cost-saving and higher-margin

categories of merchandise — direct-from-manufacturer, self-prepared food,

private label and IGA-related merchandises. In addition to emphasizing sales of

these categories, we also emphasize sales of other higher-margin items, such as

fashionable clothing and cosmetics, and seasonal items like gloves, coats,

sun-block and swimsuits, etc.

Our

Stores and Merchandise

Our

stores are spread throughout northeastern China and Inner Mongolia with a

concentration in Heilongjiang Province. The map below shows the location within

Heilongjiang province of all of our current locations. The right side of the map

depicts Heilongjiang Province; the left side depicts our stores and its

surrounding areas. The retail locations are indicated by a “QKL” mark; our

distribution center is indicated by a red truck icon.

Map

of locations — Heilongjiang Province and Municipality of Daqing

Our

Supermarkets

Our

supermarkets generated approximately 98.8% of our revenues in 2009 and 98.6% of

our revenue in 2008. Our current supermarkets have a total area of approximately

133,410 gross square meters, which includes all rental space as opposed to

85,688 square meters of retail space. All supermarkets share the same general

format and sell from the same inventory, however the larger stores carry a

greater variety of items than the smaller stores.

Our

supermarkets are designed to provide our customers with quality merchandise at a

low price and carry a broad selection of grocery, meat, produce, liquor and

tobacco, clothing, household items, small electronics, jewelry and general

merchandise.

5

Our

supermarkets carry merchandise divided into three major categories: grocery,

fresh food, and non-food items.

The table

below sets forth our total revenues for our sales of grocery, fresh food and

non-food items for the years ended December 31, 2007, 2008 and 2009

|

Percentage of Store sales for the Year

Ended December 31,

|

||||||||

|

2008

|

2009

|

|||||||

|

Grocery

|

32.3 | % | 33.6 | % | ||||

|

Fresh

food

|

50.5 | % | 47.5 | % | ||||

|

Non-food

items

|

17.2 | % | 18.9 | % | ||||

Grocery items

include:

|

|

§

|

Prepared

or packaged foods, including instant foods, canned foods, packaged rice

and wheat powder, and crackers and

chips;

|

|

|

§

|

Bulk

(unpackaged) grains including rice and ground

wheat;

|

|

|

§

|

Bottled

water and beverages;

|

|

|

§

|

Cigarettes;

and

|

|

|

§

|

Certain

non-food items such as cleaning products, cosmetics, and disposable

razors.

|

Fresh-food items

include:

|

|

§

|

Fresh

raw meat, which we cut and package;

|

|

|

§

|

Cooked

meats;

|

|

|

§

|

Fresh

seafood;

|

|

|

§

|

Fresh

bakery items, including breads, buns, dumplings, and other self-prepared

foods;

|

|

|

§

|

Fresh

noodles and pastas;

|

|

|

§

|

Fresh

milk, yogurt, and eggs (supplied fresh every day);

and

|

|

|

§

|

Packaged

dumplings (supplied fresh every

day).

|

Non-food items include all

non-food items, except cleaning and cosmetic items included in grocery;

specifically:

|

|

§

|

Clothing

and shoes;

|

|

|

§

|

Books

and stationery;

|

|

|

§

|

Bedding

and home furnishings;

|

|

|

§

|

Small

electronics and household use items like irons, electric shavers, hair

dryers, massage machines; and

|

|

|

§

|

Office

supplies, toys, sporting goods and other

items.

|

6

Our

target rate for loss due to spoilage and breakage of perishable and breakable

items is 0.4% of total revenue. This was also our approximate rate of loss for

spoilage and breakage in both 2008 and 2009.

Private

Label

Some of

the merchandise we sell in our supermarkets is made to our specifications by

manufacturers, using our QKL brand name. We refer to such merchandise as

“private label” merchandise. With private label merchandise, we entrust the

manufacturer to make the product and to select the name and design. Under our

agreements with the private label manufacturers, the private label manufacturers

cannot sell the product to any other company. Average profit margins from

private label products are typically 20%-30%, with certain products having a

profit margin of 30-50%, and are generally higher than profit margins for other

grocery items which are typically 12-13%.

Sales of

private label merchandise represented approximately 5.5 % and 5.0% of our total

sales revenue for 2009 and 2008, respectively. In June 2008, we established a

specialized department for designing and purchasing private label merchandise.

Six full-time employees currently work in this department. We plan to increase

the proportion of private label merchandise sold over the next several quarters.

Our goal is to increase private label sales to 20% of our total revenues in the

near future.

Our

Department Stores

As of the

date of this report, we operate two department stores through QKL-China’s

subsidiary, Daqing Qinglongxin Commerce & Trade Co., Ltd. (“QC&T”). Our

department stores generated 0.95% and 1.2% of our total revenues in 2009 and

2008, respectively. Our department stores are located in the same buildings as

our supermarkets and are licensed to sell all of the non-food products sold by

our supermarkets. Our department stores sell brand-name and luxury clothing and

accessories, cosmetics, small electronics, jewelry, books, home furnishings, and

bedding, and contain a movie theater and a traditional beauty

salon.

Our first

department store opened in September 2006 and is located in Ranghulu District of

Daqing. It has a total area of 12,000 square meters, including approximately

3,000 square meters occupied by our supermarket on the ground floor of the

building.

On

September 28, 2008, we opened a new supermarket store and a department store in

Taikang, a county in Heilongjiang Province located approximately 30 kilometers

from Daqing. It is the Company’s second unit comprised of a supermarket and

department store. It occupies roughly 10,000 square meters of leased space (the

supermarket is approximately 2,800 square meters and the department store is

nearly 7,200 square feet) in the commercial center of the city.

Our

department store business model is different from our supermarket business

model. The department stores operate on a concession and rent basis, with the

selling space occupied by retail partners who either sublet their space from, or

pay concession fees for use of the space to, QC&T. We do not own the

merchandise sold in the department stores, yet we do receive the proceeds of the

sales of merchandise in the department stores. The merchandise is owned by our

retail partners, we render the revenue we collected to them by deducting our

percentage of fees. In 2009 and 2008, approximately 67.9% and 66.2%,

respectively, of our department store revenue came from concession fees and

approximately 32.1% and 33.8%, respectively, came from rent.

Our

department store business model also differs from our supermarket business

model, in that our retail partners conduct their own purchasing operations (in

consultation with QC&T employees) and do not use our purchasing department.

Our retail partners receive their merchandise by delivery from distributors and

do not use our distribution center, delivery vehicles or logistics resources.

Each of the three above-ground floors in each of the department stores (but not

the ground floor, which houses a QKL-China supermarket) is occupied by a number

of stores, each operated by a retail partner. Each floor has one floor manager

who is employed by QC&T and who oversees the workings of that floor. The

employees charged with the logistical operation of the stores are employees of

our retail partners. Compared to our supermarket operations, our department

store operations are simpler and are less demanding of our resources, including

time, labor and purchasing effort.

Our

Distribution Centers

We

currently distribute grocery products to our supermarkets from our two

distribution centers located in Daqing, one for fresh food and one for grocery

and non-food merchandise. Approximately 45.0% of the merchandise sold in our

supermarkets are distributed through these facilities, which are located 1.5

kilometers and 5 kilometers from our headquarters. We plan to open a new

distribution center in the second quarter of 2010 located in Harbin, a city in

Heilongjiang Province, which will have approximately 19,600 square meters of

space and is approximately 180 kilometers from our headquarters in

Daqing.

7

Size

of Our Supermarkets

The table

below sets forth the size of our stores in net square meters, which includes

retail space as opposed to all rental space, and the average monthly sales per

square meter of each of our supermarkets during 2008 and 2009.

|

Store

Number

|

Store Name

|

Date Opened

|

Retail Space

Square

Meters

|

Average Monthly

Sales (In RMB)

per Square Meter,

2008

|

Average

Monthly Sales

(In RMB) per

Square Meter,

2009

|

|||||||||||

|

1

|

Xincun

Store

|

01/23/99

|

4,408 | 1,371 | 2,369 | |||||||||||

|

2

|

Longfeng

Store

|

06/18/00

|

1,499 | 2,920 | 3,222 | |||||||||||

|

3

|

Chengfeng

Store

|

05/12/01

|

2,706 | 1,644 | 1,523 | |||||||||||

|

4

|

Hengmao

Store

|

11/16/02

|

1,906 | 3,141 | 3,556 | |||||||||||

|

5

|

Yixi

Store

|

01/18/03

|

1,557 | 2,796 | 2,988 | |||||||||||

|

6

|

Wanbao

Store

|

04/26/03

|

1,290 | 1,453 | 1,764 | |||||||||||

|

7

|

Xizhai

Store (1)

|

06/28/03

|

3,118 | 2,295 | 2,065 | |||||||||||

|

8

|

Zhaoyuan

Store

|

03/29/08

|

2,246 | 479 | 1,723 | |||||||||||

|

9

|

Zhaodong

Store

|

12/07/03

|

1,669 | 3,151 | 2,995 | |||||||||||

|

10

|

Wanli

Store

|

04/18/04

|

1,541 | 1,468 | 1,884 | |||||||||||

|

11

|

Hubin

Store

|

12/25/04

|

1,163 | 1,049 | 1,931 | |||||||||||

|

12

|

Donghu

Store

|

09/24/05

|

2,315 | 1,855 | 2,589 | |||||||||||

|

13

|

Yichun

Store

|

01/23/06

|

3,160 | 1,522 | 1,345 | |||||||||||

|

14

|

Jixi

Store

|

09/17/06

|

2,500 | 1,939 | 1,954 | |||||||||||

|

15

|

Acheng

Store

|

05/20/06

|

4,035 | 2,436 | 1,887 | |||||||||||

|

16

|

Lusejiayuan

Store

|

04/30/06

|

760 | 1,108 | 2,341 | |||||||||||

|

17

|

Jixi

Store 2

|

03/29/07

|

1,720 | 1,955 | 1,639 | |||||||||||

|

18

|

Yixi

Store 2

|

09/09/06

|

866 | 664 | 2,180 | |||||||||||

|

19

|

Harbin

Store

|

12/27/06

|

2,370 | 1,245 | 1,719 | |||||||||||

|

20

|

Central

Street Store

|

09/27/08

|

4,968 | 2,781 | 2,222 | |||||||||||

|

21

|

Suihua

Store

|

07/12/08

|

1,883 | 1,223 | 2,392 | |||||||||||

|

22

|

Taikang

Store

|

09/14/08

|

1,560 | 3,313 | 2,501 | |||||||||||

|

23

|

Zhaodong

Dashijie

|

05/27/09

|

2,587 | — | 2,599 | |||||||||||

|

24

|

Lindian

|

04/01/09

|

2,196 | — | 2,358 | |||||||||||

|

25

|

Boli

Store

|

12/21/08

|

4,045 | 433 | 1,107 | |||||||||||

|

26

|

Xinguangtiandi

Store

|

04/28/09

|

2,066 | — | 1,921 | |||||||||||

|

27

|

Hailaer

Store

|

12/28/08

|

4,606 | 3,113 | 1,377 | |||||||||||

|

28

|

Anda

Store

|

11/22/08

|

1,595 | 2,962 | 2,877 | |||||||||||

|

29

|

Fuyu

Store

|

11/29/08

|

1,630 | 3,303 | 2,227 | |||||||||||

|

30

|

Nehe

Store

|

11/11/08

|

1,774 | 2,801 | 2,308 | |||||||||||

|

31

|

Shidai

Lijing Store

|

06/21/03

|

101 | 616 | 701 | |||||||||||

|

33

|

Zhalaiteqi

Store

|

12/13/09

|

1,727 | — | 2,766 | |||||||||||

|

34

|

Tongjiang

Store

|

9/30/09

|

2,115 | — | 1,958 | |||||||||||

|

35

|

Datong

Store

|

11/07/09

|

2,590 | — | 1,820 | |||||||||||

|

36

|

Nongan

Store

|

12/20/09

|

4,987 | — | 2,715 | |||||||||||

|

Average

|

2,240 | 1,835 | 2,158 | |||||||||||||

|

(1)

|

This

store has been temporarily closed for refurbishment and will re-open in

the 4 th

quarter of 2010.

|

8

Recent

Developments

Supermarket

Store Openings

Tongjiang

Store

On

September 30, 2009, we opened one new supermarket in Tongjiang, a border city

next to Russia in Heilongjiang province, approximately 800 kilometers from

Daqing. The new store occupies approximately 4,000 square meters in a large

shopping center in the commercial area in Tongjiang. More than 40,000 people in

the rural area plus additional people from surrounding suburban areas may shop

in our new store. The store carries more than 13,000 products in fresh food,

groceries and nonfood items. Since the store only open for one day during the

third quarter, meaningful sales data is not available yet.

Lindian

Store

On April

1, 2009, we opened a new supermarket store in Lindian, a city in Heilongjiang

Province, approximately 140 kilometers from Daqing. The new store occupies

approximately 5,000 square meters in the commercial center of

Lindian.

The

county of Lindian has a population of approximately 80,000. Based on our own

independent research, we believe there are no other large supermarket stores in

Lindian.

Zhaodong

Dashijie Store

On May

27, 2009, we opened a new supermarket store in Zhaodong, a city in Heilongjiang

Province, approximately 115 kilometers from Daqing. The new store occupies

approximately 6,000 square meters in the commercial center of Zhaodong. It is

the second store the Company opened in Zhaodong city.

The city

of Zhaodong has a population of approximately 230,000.

Datong

Store

On

November 7, 2009 we opened a new supermarket store in Datong, Heilongjiang

Province. Datong District is rich in oil and natural gas and is

surrounded by farmlands with abundant agriculture. With no competing

stores in the area, the Company’s modern supermarket will address the population

of approximately 85,000 people. The Datong store occupies an area of

4,340 square meters and carries a wide variety of grocery, fresh food and

non-food products.

Zhalaiteqi

Store

On

December 13th, 2009

the company opened a new supermarket store in the city of Zhalaiteqi, Inner

Mongolia, which has a population of approximately 40,000. As the

first modern supermarket in Zhalaiteqi, the store occupies an area of 2,880

square meters and carries items across all three of the Company’s core

categories.

Nong’an

Store

On

December 20, 2009 we opened a new supermaret in Nong’an County, Jilin, a city

with a population of approximately one million residents. Nong’an

County is one of the largest counties in China in terms grain

production. The Nong’an store occupies an area of 7,485 square meters

and carries a wide variety of grocery, food and non-food items.

Acquisitions

of Existing Businesses

Xinguangtiandi

Store

On

September 30, 2008, we entered into an agreement with Daqing Xinguangtiandi

Shopping Center Co., Ltd. to acquire the business and all of the assets of a

supermarket store located in the Xinguangtiandi shopping center in Daqing. The

assets included the lease, the inventory and all licenses held. The

Xinguangtiandi store occupies approximately 3,700 square meters in a commercial

shopping center in Daqing. The purchase price of RMB 13.8 million (approximately

$2.0 million) was paid in two installments: a deposit of RMB 100,000

(approximately $14,590) was paid prior to October 15, 2008 and the remaining

balance was paid on December 2, 2008, the date of the completion of the transfer

of the seller’s assets and the relevant government registration procedures

regarding the change of the ownership.

9

We

reopened the Xinguangtiandi Store on April 30, 2009.

Renovations

Xizhai

Store

We

temporarily closed our Xizhai store in Daqing on June 1, 2009 due to a

renovation of the building by the landlord. After the renovation the size of the

store will be increased to 7,000 square meters. We anticipate that

the store will be reopened before the end of 2010.

Our

Equipment

The

equipment we use in operating our business includes standard equipment for our

industry, such as display cases, freezers and ovens, delivery trucks, and the

computer hardware and software used in our electronic information, inventory and

logistics system. All of our equipment is owned outright by us and was acquired

by cash purchase.

Advertising

and Publicity

We

advertise in many ways, including direct-marketing circulars (bi-weekly, weekly

and 3 days on weekends), local newspaper advertisements and coupons, membership

cards and member promotions, and general promotions such as discounts and prize

lotteries.

Our

marketing and advertising activities are conducted by our marketing department,

which has ten employees. The department’s responsibility covers a wide range of

issues, including our brand strategy and brand promotion, sales promotion,

design of advertising materials, design of décor of stores, and management of

our club membership. They are also engaged in market and price investigation. We

base our advertising on our analysis and observations of the market and our

competitors. The head of the marketing department works closely with the

purchasing department in determining purchasing and sales patterns.

Under

contracts we have with our suppliers, our suppliers are responsible for the

costs of most of the discounts and promotions

Customers

and Pricing

Our

pricing strategy is to offer merchandise of a quality comparable to that of our

competitors and at a competitive price.

In

general, all customers pay the same price for our merchandise. However, the

following discounts are available to some customers as part of our promotional

marketing strategy.

|

|

§

|

We

have a program where bulk buyers may receive discounts by negotiation,

which currently has over 650,000 members. These discounts are typically up

to 2.0% of our retail price, depending on what our annual gross margin

targets allow. Sales to these customers represented less than 2% of our

total revenues for 2009 and less than 2.0% of our total revenues for

2008.

|

|

|

§

|

Membership

card holders may receive discounts on select products during promotional

periods. Sales to these customers represented 36.8% of our

total revenues in 2009 and 25.9% of our total revenues for

2008.

|

The rest

of our customers, including large customers such as school cafeterias, pay our

standard price.

10

Payment

methods for customers include cash, bank cards, and two kinds of store cards:

cash cards, which can be charged in advance and used as cash, and membership

cards, which can deposit money in, accumulate points and provide discounts for

membership products.

In recent

years, the pricing of our merchandise has changed as the price of our supplies

has changed. For example, in 2007, the price of pork rose significantly and

store prices rose correspondingly, until they were partially offset by

government subsidies. The price of imported products, primarily including wine,

beer and liquor, has changed as the RMB exchange rate has changed. We do not

believe any price changes have had a significant effect on our business to

date.

Suppliers

Our 10

largest suppliers of merchandise in 2009 were, from largest to

smallest:

|

|

§

|

Fengyou

Wang (Vegetable Vendor);

|

|

|

§

|

Fan

Huang (Fruit Vendor);

|

|

|

§

|

Daqing

Huayao Economic and Trade Company;

|

|

|

§

|

Heilongjiang

Longjiangfu food and oil Ltd.;

|

|

|

§

|

Lianxiang

Li (Meat Vendor);

|

|

|

§

|

Daqing

Hongtaiyuan Economic and Trade

Ltd.;

|

|

|

§

|

Harbin

Pepsi Cola Co., Ltd.;

|

|

|

§

|

Daqing

Tianyi Food, Ltd.;

|

|

|

§

|

Heilongjiang

Cigarettes Company, Daqing Branch;

and

|

|

|

§

|

Harbin

Hongyang Economic and Trade, Ltd.

|

Customers

have the right under PRC law to return defective or spoiled products to us for a

full refund. Pursuant to the same law, our suppliers are required to fully

reimburse us for these returns.

Choosing

Suppliers

We

typically have two or more suppliers for each product we sell. Even for special

brands, including western beverages, we have several distributors from whom we

can order. We choose among competing suppliers on the basis of price and the

strategic needs of our business.

Shipping

from Suppliers

We

receive most of our merchandise from suppliers, which are often large

distribution companies, which deliver goods by their own trucks sent either to

our distribution center (in the case of grocery and non-food items) or directly

to our stores (in the case of fresh food items).

We

receive some merchandise direct from agricultural producers or manufacturers,

which arrive by train or truck and ships to a convenient location where we

transfer it to our delivery trucks. Our Daqing distribution centers also receive

train shipments directly through train tracks on the premises.

11

Distribution

to Our Supermarkets and Department Stores

For

distribution from our distribution centers to our supermarkets, we use our own

trucks to deliver merchandise in the Daqing area. We hire third-party

shipping companies to deliver goods to stores more distant from

Daqing. We follow a delivery schedule determined by our electronic

information, inventory and logistics system.

Distribution

to our department stores is arranged by our retail partners, as described under

“Our Department Stores” above.

Pricing

and Terms of Payment to Suppliers

We have

three kinds of payment arrangements with our suppliers: cash payment,

pre-payment and payment in arrears. The terms of these arrangements are

negotiated individually with each supplier and formalized in written

contracts.

Employees

As of

December 31, 2009, we had approximately 3,877 employees, all of whom are

full-time employees. Approximately 3,516 of our employees work in operations and

approximately 361 work in management. We have signed standard labor employment

contracts with all our employees, including our executive officers, with a

standard term of two to five years, and we have an employee manual that sets

forth relevant policies. We also hire temporary employees, typically for a term

of three months.

Under

each of our employment contracts, we are required to comply with applicable

labor laws and are obligated to:

|

|

§

|

Provide

a safe and sanitary working

environment;

|

|

|

§

|

Provide

regular breaks for employees;

|

|

|

§

|

Comply

with mandated limits on each employee’s weekly working

hours;

|

|

|

§

|

Obey

applicable minimum wage standards;

|

|

|

§

|

Provide

necessary training for technical or specialized

tasks;

|

|

|

§

|

Make

required payments to retirement, unemployment and medical insurance

plans;

|

|

|

§

|

Provide

30 days’ notice of termination to an employee, except in special

circumstances; and

|

|

|

§

|

Terminate

an employee’s employment only for certain reasons, specifically, if the

employee:

|

|

|

§

|

Proves

unsuitable for employment during a probation

period;

|

|

|

§

|

Seriously

neglects employment duties, causing harm to our

interests;

|

|

|

§

|

Forces

us to terminate or amend a labor contract against our will by means of

deception, coercion or taking advantage of difficulties experienced by

us;

|

|

|

§

|

Simultaneously

enters an employment relationship with another employer that seriously

affects the employee’s ability to complete the tasks of the Company, or

refuses to remedy the situation after we point out the

problem;

|

|

|

§

|

Seriously

violates our disciplinary policy;

or

|

|

|

§

|

Is

guilty of criminal acts and/or is subject to criminal

prosecution.

|

12

Employee

benefits include five state-mandated insurance plans:

|

|

§

|

Retirement

insurance: We withhold a portion of each employee’s

monthly salary, which is determined by the provincial government, and is

generally 8.0%, and contribute to a pooled fund an additional amount

determined by law, up to approximately 20.0% of the employee’s monthly

salary.

|

|

|

§

|

Medical

insurance: We withhold approximately 2.0% of each

employee’s salary and contribute to a pooled fund an additional amount

totaling approximately 8.0% of total payroll

expense.

|

|

|

§

|

Unemployment

insurance: We withhold approximately 1.0% of each

employee’s salary and contribute to a pooled fund an additional amount

totaling approximately 2.0% of total payroll

expense.

|

|

|

§

|

Worker’s comp.

insurance: We pay 5% of base amount salary of RMB 1,140

for each employee and contribute to a pooled fund. We don’t withhold

employees’ salary for it;

|

|

|

§

|

Maternity

insurance: We pay 0.7% of base amount of RMB 1,140 for

each employee and contribute to a pooled fund. We don’t withhold

employees’ salary for it.

|

In 2009

our average compensation per employee per month was RMB1,372 (approximately

$201) compared to RMB 1,084 (approximately $156) in 2008. We also pay benefits

in the form of social security insurance fees for each of our

employees.

We have a

system of human resource performance review and incentive policies that allow

personnel reviews to be carried out monthly, quarterly or annually.

Training

We have a

business school and training center at our headquarters in Daqing, which

includes a lecture hall where we provide professional advancement and management

courses, training in company policies and compliance with regulations, and

lectures by outside members of the business community.

There are

also monthly meetings with all the store managers, led by our CEO or COO. There

are regional training conferences once per week, which provide opportunities for

sharing experiences and improving our business performance, as well as for

developing the skills and judgment of our store managers.

Intellectual

Property

We have

registered the name “Qingkelong” as a trademark in the PRC, details of which are

set forth below:

|

Trademark

|

Certificate No.

|

Category

|

Owner

|

Valid Term

|

||||

|

Qingkelong

|

No.

1995020

|

No.

35: “sales promotion (for others)”

|

Qingkelong

|

4/7/03

–

4/6/13

|

Insurance

Vehicle

Insurance

We have a

standard commercial vehicle insurance policy in place for all of our delivery

trucks.

Comprehensive

(“All-Risk”) Property Insurance

A number

of comprehensive property insurance policies are held by us covering losses to

our retail stores and distribution center. Our “all-risk” policies range in

coverage amounts from RMB 270,000 (approximately $39,455) to RMB 51.6 million

(approximately $7.5 million) at related premiums that range between RMB 51,639

(approximately $7,546) to RMB 270 (approximately $39), respectively, for the

one-year periods they cover.

13

Public

Liability Insurance

Each of

our stores carries a public liability insurance policy, covering losses relating

to claims of loss or damage due to injuries occurring on our premises. Our

public liability policies typically have a coverage amount of RMB 2 million

(approximately $292,261) and a premium of RMB 3,000 (approximately $438), with

the exception of our Acheng store, which has a coverage amount of RMB 7.2

million (approximately $1.1 million) and a premium of RMB 7,212 (approximately

$1,054), for the one-year periods they cover.

Research

and Development Activities

We are

not presently engaged in any research and development activities. However, for

self-prepared products (e.g. baked goods), our fresh foods department and bakery

department perform continuing market investigations in order to determine how

other companies are making prepared foods and whether we can improve on those

methods. Our cooking personnel and head chef work with the purchasing department

to develop formulas for use in our stores.

Government

Regulation of Our Operations

Our

operations are subject to a wide range of regulations covering every aspect of

our business. The most significant of these regulations are set forth below. In

each case, we have passed the most recent required inspections and have received

appropriate and up-to-date licenses, certificates and authorizations, as set

forth in the next subsection of this annual report.

|

|

§

|

Circular

of State Administration of Industry and Commerce Concerning the Relevant

Issues for the Administration of Registration of Chain Stores in effect on

May 30, 1997, which sets forth the conditions for the establishment for

chain stores and branches, and the procedures for applying for a business

license.

|

|

|

§

|

Circular

Concerning the Relevant Issues on the Management of Specific Goods by

Chain Stores (collectively promulgated by PRC State Economic and Trade

Commission, Ministry of Domestic Trade, Ministry of Culture, Ministry of

Posts and Telecommunication, General Administration of Press and

Publication, State Administration for Industry and Commerce and State

Tobacco Monopoly Bureau) in effect on June 25, 1997, which provides that

chain stores must obtain a license from relevant government authorities

for the management of specific goods, such as tobacco, pharmaceutical

products, food products and audio-video

products..

|

|

|

§

|

Relevant

Opinions on the Promotion for the Development of Chain Stores, promulgated

by PRC State Commission for Economic Restructuring and State Economic and

Trade Commission, in effect on September 27, 2002, which provides relevant

opinions on the promotion for the development of chain stores, such as

simplifying the administrative approval

procedures.

|

Approvals,

Licenses and Certificates

We

require a number of approvals, licenses and certificates in order to operate our

business. We believe we are in compliance in all material respects with all laws

relevant to the operation of our business.

Competition

Competitive

Environment

The

supermarket industry in China is intensely competitive, with many companies,

both local and foreign, competing as retailers of food, groceries and other

merchandise, using a variety of business strategies.

Our main

competitors are local, regional and national chain supermarkets, and national

and foreign chain retailers operating “big box” or hypermarket stores of the

kind made famous by Wal-Mart and Carrefour.. We also face competition from

traditional street markets and markets where customers can purchase live poultry

and fish, convenience stores, tobacco and liquor retailers, restaurants,

specialty retailers and large drugstore chains.

14

We do not

believe we currently face significant direct competition from China’s large

national supermarket chains as we have decided not to compete in the areas in

which they focus their operations, which are China’s biggest cities and

surrounding suburbs-Shanghai, Shenzhen, Guangzhou, Beijing, and Chongqing-all

areas outside of northeastern China and Inner Mongolia. Instead, we have decided

to focus on China’s less-populated “second tier” and “third tier” cities and

surrounding areas in northeastern China and Inner Mongolia, which we believe

provide ample opportunity for expansion.

Among the

large foreign supermarket chains currently doing business in China, we believe

that Wal-Mart is currently the only significant direct competitor to one of our

stores. This is also primarily due to our choice of store locations. Although

Carrefour, Metro, Tesco and other foreign companies also operate in China and

compete with local supermarkets in their locations, they do not have a

significant number of stores in northeastern China or Inner Mongolia, where our

stores are located. In addition, our expansion plan targets small and

medium-sized cities and counties, which we believe are not being targeted by

these large international retailers. We believe that these plans will allow us

to avoid intense competition from these retailers.

Our

Competitors — Domestic Supermarkets

We

believe that the two supermarket companies listed below are our most significant

direct domestic competitors based in China:

|

|

§

|

Dashang Supermarkets is

a national supermarket/department store chain consisting of approximately

70 supermarkets/department stores located in 30 cities across China. Its

headquarters are located in Dalian City, Liaoning Province. The chain is

managed by Dashang Group Co., Ltd., one of China’s largest retailers,

which operates more than 60 medium- to large-sized retail outlets,

including department stores, shopping malls and specialty stores. We

believe that, as of the date of this annual report, approximately nine of

our stores compete directly with one Dashang supermarket/department store,

which is about 20 kilometers away from our headquarter in

Daqing.

|

|

|

§

|

Huachen Supermarkets is

a local supermarket chain consisting of approximately 10 supermarkets. Its

headquarters are located in Suihua City, Heilognijiang Province. Five of

its stores are in the same city or county as ours competing directly with

our stores.

|

Our

Competitors — Foreign Supermarkets

Wal-Mart is the world’s

largest retailer and has more than 200 stores and 70,000 employees in China. Of

its China stores, nearly 100 are in its supermarket or hypermarket format, three

are in its Sam’s Club format, two are in its neighborhood market format, and

approximately 100 are operated under the name of its partially-owned PRC

affiliate, Trust-Mart. We believe that approximately six of our stores compete

directly with one Wal-Mart store, which is about 200 meters from one of our

Xincun Store.

National

and foreign retailers have greater resources and a greater geographic range than

we do, and their stores are often bigger (hypermarkets often have an area of

14,000 square meters of retail space, compared to the average 2,240 square

meters of retail space of our stores), which may enable them to offer a greater

variety of products. This may give them advantages in terms of pricing, ability

to expand, advertising budgets, efficiencies in distribution, bargaining power,

and other areas.

OUR

HISTORY AND CORPORATE STRUCTURE

Organizational

History of QKL Stores Inc.

Prior to

June 18, 2008, QKL Stores Inc. was known as Forme Capital, Inc.

Forme

Capital, Inc. (“Forme”) was incorporated in Delaware on December 2, 1986. Prior

to 1989, Forme’s only activity was the creation and spinning off to its

stockholders of nine blind pool companies, or companies with no specified

business plan. From 1989 to 1998, Forme was a real estate company. From 1999 to

2000, Forme invested in fine art. From 2000 to 2007, Forme had no operations or

substantial assets. Accordingly, Forme was deemed to be a “blank check” or shell

company, that is, a development-stage company that has no significant non-cash

assets and either has no specific business plan or purpose or has indicated that

its business plan is to engage in a merger or other acquisition with an

unidentified company.

15

On

November 13, 2007, Forme filed an Amended and Restated Certificate of

Incorporation to change the number of shares of stock that it was authorized to

issue to 100,000,000 shares of common stock, par value $0.001 per share, and

100,000,000 shares of preferred stock, par value $0.01 per share. The change

became effective on December 5, 2007.

We have

no operations or substantial assets other than those of QKL-China, over which we

acquired control in the reverse merger transaction discussed below. Prior to the

reverse merger transaction, our business plan was to seek out and obtain

candidates with which we could merge or whose operations or assets could be

acquired through the issuance of common stock and possibly debt.

The

Reverse Merger Transaction

On March

28, 2008, we completed a number of related transactions through which we

acquired control of QKL-China: (i) a restructuring transaction which granted

control of QKL-China to another PRC entity, Speedy Brilliant (Daqing), and (ii)

a share exchange transaction, which transferred ownership and control of Speedy

Brilliant (Daqing) to us.

We refer

to the restructuring transaction and the share exchange transaction together as

the “reverse merger transaction.” The purpose of the reverse merger was to

acquire control of QKL-China. We did not acquire QKL-China directly by either

issuing stock or paying cash for QKL-China (or for Speedy Brilliant (Daqing))

because under PRC law it is uncertain whether a share exchange would be legal,

and the terms of a cash purchase would not have been favorable. Speedy Brilliant

(Daqing) did not acquire QKL-China directly, by either issuing its own stock or

paying cash for QKL-China, because under PRC law it is uncertain whether such a

share exchange would be legal, and the terms of a cash purchase would not have

been favorable to Speedy Brilliant (Daqing).

We

instead chose to acquire control of QKL-China through the contractual

arrangements described below because alternative methods of acquisition —

specifically, the acquisition of QKL — China outright either by share exchange

or by cash payment — was not available or advisable as described above.

Acquisition of QKL-China by share exchange was not available to Speedy Brilliant

(Daqing) because (i) Speedy Brilliant (Daqing) is wholly owned by Speedy

Brilliant (BVI), a British Virgin Islands company, and is therefore a wholly

foreign-owned entity under PRC law, (ii) wholly foreign-owned entities are,

under PRC law, treated as foreign entities for relevant regulatory purposes, and

(iii) under PRC laws that became effective on September 8, 2006, it is uncertain

both what procedures must be used in order for a foreign entity to acquire a PRC

entity by share exchange and whether such an acquisition would have binding

legal effect in the PRC. Acquisition of QKL-China for cash was not advisable for

Speedy Brilliant (Daqing) because the terms of such a cash acquisition,

including (i) a purchase price for QKL-China determined under PRC law and (ii)

the terms of a financing transaction in which we would raise the funds to pay

the purchase price, would not have been favorable to Speedy Brilliant

(Daqing).

PRC

Restructuring Agreements

The PRC

restructuring transaction was effected by the execution of five agreements

between Speedy Brilliant (Daqing), on the one hand, and QKL-China (and in some

cases the shareholders of QKL-China), on the other hand. Those five agreements

and their consequences are described below.

Consigned

Management Agreement

The

Consigned Management Agreement among Speedy Brilliant (Daqing), QKL-China and

all of the shareholders of QKL-China, provides that Speedy Brilliant (Daqing)

will provide financial, business management and human resources management

services to QKL-China that will enable Speedy Brilliant (Daqing) to control

QKL-China’s operations, assets and cash flow, and in exchange, QKL-China will

pay a management fee to Speedy Brilliant (Daqing) equal to 4.5% of QKL-China’s

annual revenue. The management fee for each year is due by January 31 of the

following year. The agreement will remain effective until Speedy Brilliant

(Daqing) or its designees have acquired 100% of the equity interests of

QKL-China or substantially all of the assets of QKL-China.

Technology

Service Agreement

The

Technology Service Agreement among Speedy Brilliant (Daqing), QKL-China and all

of the shareholders of QKL-China, provides that Speedy Brilliant (Daqing) will

provide technology services, including the selection and maintenance of

QKL-China’s computer hardware and software systems and training of QKL-China

employees in the use of those systems, and in exchange QKL-China will pay a

technology service fee to Speedy Brilliant (Daqing) equal to 1.5% of QKL-China’s

annual revenue. The technology service fee for each year is due by January 31 of

the following year. The agreement will remain effective until Speedy Brilliant

(Daqing) or its designees have acquired 100% of the equity interests of

QKL-China or substantially all of the assets of QKL-China.

16

Loan

Agreement

The Loan

Agreement among Speedy Brilliant (Daqing) and all of the shareholders of

QKL-China, provides that Speedy Brilliant (Daqing) will make a loan in the

aggregate principal amount of RMB 77 million (approximately $11.2 million) to

the shareholders of QKL-China, each shareholder receiving a share of the loan

proceeds proportional to its shareholding in QKL-China, and in exchange each

shareholder agreed (i) to contribute all of its proceeds from the loan to the

registered capital of QKL-China in order to increase the registered capital of

QKL-China, (ii) to cause QKL-China to complete the process of registering the

increase in its registered capital with PRC regulatory authorities within 30

days after receiving the loan, and (iii) to pledge their equity to Speedy

Brilliant (Daqing) under the Equity Pledge Agreement described

below.

The loan

is repayable by the shareholders at the option of Speedy Brilliant

(Daqing) either by the transfer of QKL-China’s equity to Speedy Brilliant

(Daqing) or through proceeds indirectly from the transfer of QKL-China assets to

Speedy Brilliant (Daqing). The loan does not bear interest, except that if (x)

Speedy Brilliant (Daqing) is able to purchase the equity or assets of QKL-China,

and (y) the lowest allowable purchase price for that equity or those assets

under PRC law is greater than the principal amount of the loan, then, insofar as

it is allowable under PRC law, interest will be deemed to have accrued on the

loan in an amount equal to the difference between the lowest allowable purchase

price for QKL-China and the principal amount of the loan. The effect of this

interest provision is that, if and when permitted under PRC law, Speedy

Brilliant (Daqing) may acquire all of the equity or assets of QKL-China by

forgiving the loan, without making any further payment. If the principal amount

of the loan is greater than the lowest allowable purchase price for the equity

or assets of QKL-China under PRC law, then Speedy Brilliant (Daqing) would

exempt the shareholders from paying the difference between the two amounts. The

effect of this provision is that (insofar as allowable under PRC law) the

shareholders of QKL-China may satisfy their repayment obligations under the loan

by transferring all of QKL-China’s equity or assets to Speedy Brilliant

(Daqing), without making any further payment.

The Loan

Agreement also contains promises from the shareholders of QKL-China that during

the term of the agreement they will elect as directors of QKL-China only

candidates nominated by Speedy Brilliant (Daqing), and they will use their best

efforts to ensure that QKL-China does not take certain actions without the prior

written consent of Speedy Brilliant (Daqing), including (i) supplementing or

amending the articles of association or rules of QKL-China, or of any subsidiary

controlled or wholly owned by it, (ii) increasing or decreasing its registered

capital or shareholding structure, (iii) transferring, mortgaging or disposing

of any interests in its assets or income, or encumbering its assets or income in

a way that would affect Speedy Brilliant (Daqing)’s security interest unless

required for QKL-China’s normal business operations, (iv) incurring or

succeeding to any debts and liabilities, (v) entering into any material contract

(exceeding RMB 5.0 million, or approximately $0.7 million, in value); (vi)

providing any loan or guarantee to any third party; (vii) acquiring or

consolidating with any third party, or investing in any third party; and (viii)

distributing any dividends to the shareholders in any manner. In addition, the

Loan Agreement provides that at Speedy Brilliant (Daqing)’s request, QKL-China

will promptly distribute all distributable dividends to its

shareholders.

The funds

that Speedy Brilliant (Daqing) used to make the loan came from the proceeds

received by us, its indirect parent company, in the private placement

transaction completed in March 2008.

Exclusive

Purchase Option Agreement