Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Tropicana Entertainment Inc. | a2197688zex-32.htm |

| EX-31.1 - EXHIBIT 31.1 - Tropicana Entertainment Inc. | a2197688zex-31_1.htm |

| EX-21.1 - EXHIBIT 21.1 - Tropicana Entertainment Inc. | a2197688zex-21_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Tropicana Entertainment Inc. | a2197688zex-31_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Financials

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

for the fiscal year ended December 31, 2009 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

for the transition period from to . |

||

Commission file number 000-53831 |

||

TROPICANA ENTERTAINMENT INC.

(Exact name of registrant as specified in its charter)

| Delaware | 27-0540158 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3930 Howard Hughes Parkway, 4th Floor, Las Vegas, Nevada 89169

(Address of principal executive offices, Zip Code)

Registrant's telephone number, including area code: 702-589-3900

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports). Yes o No ý

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ý No o

The aggregate market value of the common stock held by non-affiliates (all other persons other than executive officers or directors) of the registrant as of June 30, 2009 was $0.

As of March 19, 2010, there were 25,784,158 shares outstanding of the registrant's common stock.

Documents Incorporated by Reference

None.

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. Such statements contain words such as "may," "will," "might," "expect," "believe," "anticipate," "intend," "could," "would," "estimate," "project," "continue," "pursue," or the negative thereof or comparable terminology, and may include (without limitation) information regarding our expectations, hopes or intentions regarding the future, including but not limited to statements regarding the Predecessors' (as defined herein) reorganization in bankruptcy, our operating plans, our competition, financing, revenue, tax benefits, our beliefs regarding the sufficiency of our existing cash and credit sources, including our Exit Facility (as defined herein) and cash flows from operating activities to meet our projected expenditures (including operating and maintenance capital expenditures) and costs associated with certain of our projects over the next twelve months, estimated asset and liability values, risk of counterparty nonperformance and our legal strategies and the potential effect of pending legal claims on our business and financial condition. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in each such statement. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You should consider the areas of risk and uncertainty described above, as well as those discussed under "Item 1A—Risk Factors" in this Annual Report on Form 10-K. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Introduction

We are a Delaware corporation that was formed on May 11, 2009 to acquire certain assets of Tropicana Entertainment Holdings, LLC ("TEH"), and certain of its subsidiaries pursuant to their plan of reorganization under Chapter 11 of Title 11 of the United States Code (the "Bankruptcy Code"). The Company also acquired Columbia Properties Vicksburg, LLC ("CP Vicksburg"), JMBS Casino, LLC ("JMBS Casino") and CP Laughlin Realty ("Realty," and collectively with CP Vicksburg and JMBS Casino, the "Affiliate Guarantors"), all of whom were part of the same plan of reorganization as TEH and are referred to collectively in this Annual Report on Form 10-K, as the "Predecessors." The Predecessors' bankruptcies were jointly administered under the lead case In re: Tropicana Entertainment, LLC, Case No. 08-10856 in the United States Bankruptcy Court for the District of Delaware (the "Bankruptcy Court"). Except where the context suggests otherwise, the terms "we," "us," "our," and "the Company" refer to Tropicana Entertainment Inc. and its subsidiaries.

In addition, the Company acquired certain assets of Adamar of New Jersey, Inc. ("Adamar"), an unconsolidated subsidiary of TEH, pursuant to the Amended and Restated Purchase Agreement (defined below), including the Tropicana Casino and Resort—Atlantic City ("Tropicana AC"). Adamar was not a party to the Predecessors' bankruptcy. However, on April 29, 2009, Adamar, and its sole, wholly owned subsidiary, Manchester Mall, Inc. ("Manchester" and collectively, the "Tropicana AC Parties"), filed petitions for relief under Chapter 11 of the Bankruptcy Code in jointly administered cases under the lead case In re: Adamar of New Jersey, Inc., Case No. 09-20711 (JHW) (the "Adamar Bankruptcy Cases") before the United States Bankruptcy Court for the District of New Jersey (the "New Jersey Bankruptcy Court").

The reorganization of the Predecessors and the acquisition of Tropicana AC (together, the "Restructuring Transactions") were consummated and became effective on March 8, 2010 (the "Effective Date"), at which time, we acquired Adamar and several of the Predecessors' gaming properties and related assets. See "Item 1—Restructuring Transactions" for a further description of the

2

Restructuring Transactions. Prior to March 8, 2010 we conducted no business, other than in connection with the reorganization of the Predecessors and the acquisition of Tropicana AC, and had no material assets or liabilities.

General Background

The Company currently owns and operates a diversified, multi-jurisdictional collection of casino gaming properties. The nine properties we acquired through the Restructuring Transactions feature approximately 435,000 square feet of gaming space and 5,866 hotel rooms, serviced by approximately 7,300 full and part-time employees. The nine casino facilities we currently operate include three casinos in Nevada, three casinos in Mississippi and one casino in each of Indiana, Louisiana and New Jersey, as follows:

- •

- Tropicana Casino and Resort—Atlantic

City. Previously owned by Adamar and located along the Boardwalk in Atlantic City, New Jersey, this resort property features a hotel,

slot machines, table games and The Quarter, a 200,000-square-foot Las Vegas-style indoor dining, entertainment and retail center with a Havana-inspired theme.

- •

- Casino Aztar Evansville ("Casino Aztar"). Previously owned

by TEH and located on the Ohio River in Evansville, Indiana, this riverboat casino features two distinctive hotels, restaurants, slot machines and table games.

- •

- Tropicana Express Hotel and Casino ("Tropicana

Express"). Previously owned by TEH and located in Laughlin, Nevada, this resort property features a hotel, restaurants, slot machines

and table games.

- •

- River Palms Hotel and Casino ("River Palms"). Previously

owned by TEH and located in Laughlin, Nevada, this resort property features a hotel, restaurants, slot machines and table games.

- •

- MontBleu Casino ("MontBleu"). Previously owned by TEH and

located in South Lake Tahoe, Nevada, this resort property features a resort hotel, including restaurants and a spa, slot machines and table games.

- •

- Vicksburg Horizon Casino ("Vicksburg Horizon"). Previously

controlled by TEH through an Affiliate Guarantor and located in downtown Vicksburg, Mississippi, this riverboat casino features slot machines, a hotel and restaurants.

- •

- Lighthouse Point Casino ("Lighthouse Point"). Previously

owned by TEH (79%) and located in Greenville, Mississippi, this riverboat casino features slot machines.

- •

- Bayou Caddy's Jubilee Casino ("Jubilee"). Previously

controlled by TEH through an Affiliate Guarantor and located in Greenville, Mississippi, this riverboat casino features slot machines and table games.

- •

- Belle of Baton Rouge ("Belle of Baton Rouge"). Previously owned by TEH and located on the Mississippi River in the downtown historic district of Baton Rouge, Louisiana, this riverboat casino features slot machines, table games, restaurants and a hotel.

As discussed in "Item 1—Bankruptcy Proceedings," Tropicana Resort and Casino located in Las Vegas, Nevada, ("Tropicana LV") was subject to a separate plan of reorganization which was consummated on July 1, 2009, and consequently Tropicana LV is not part of the Company. In addition, Lake Tahoe Horizon Casino and Resort located in Lake Tahoe, Nevada, ("Tahoe Horizon") and formerly owned by TEH, is not part of the Company, as TEH assigned all rights and certain obligations related to the property in two phases, effective June 15, 2009 and October 16, 2009.

3

The Company's principal executive offices are located at 3930 Howard Hughes Parkway, 4th Floor, Las Vegas, Nevada 89169; its telephone number is (702) 589-3900.

Background

The Predecessors obtained their initial casino assets from Tropicana Casinos and Resorts, Inc., formerly known as Wimar Tahoe Corporation ("Wimar"), the parent company of TEH. Through 2006, Wimar had acquired interests in a number of casinos and resorts, including:

- •

- River Palms;

- •

- MontBleu;

- •

- Tahoe Horizon;

- •

- Lighthouse Point; and

- •

- Belle of Baton Rouge.

On May 19, 2006, Wimar entered into a definitive agreement and plan of merger with Aztar Corporation ("Aztar"), a publicly traded holding company that owned five casino properties, under which Wimar would acquire all of the stock of Aztar. On January 3, 2007, Wimar acquired all of Aztar for approximately $2.1 billion in cash (the "Aztar Acquisition").

In the corporate reorganization completed by Wimar concurrently with the Aztar Acquisition, (i) Aztar became a wholly owned subsidiary of TEH, and (ii) Wimar contributed River Palms, MontBleu, Tahoe Horizon, Lighthouse Point and Belle of Baton Rouge to TEH. Through the Aztar Acquisition, TEH added to its gaming business Tropicana LV, Tropicana AC, Casino Aztar and Tropicana Express. A fifth casino, purchased as part of the Aztar Acquisition and located in Missouri, was sold by the Predecessors in June 2007.

The Aztar Acquisition was funded with several sources of financing, including a senior secured credit facility comprised of a $1.53 billion senior secured term loan ("TE Loan") and a $180 million senior secured revolving credit facility ("TE Revolver" together with the TE Loan, the "TE Senior Secured Credit Facility") by and between Tropicana Entertainment, LLC ("TE") (a direct wholly owned subsidiary of TEH) and the lenders thereto (the "OpCo Lenders"). The TE Senior Secured Credit Facility was guaranteed by certain subsidiaries of TE as well as by the Affiliate Guarantors.

In addition, the Aztar Acquisition was funded with the net proceeds of an issuance by TE and Tropicana Finance Corp. (a direct wholly owned subsidiary of TE) on December 28, 2006 of $960.0 million aggregate principal amount of 95/8% Senior Subordinated Notes due 2014 which were subsequently exchanged for substantially identical registered notes (the "TE Notes"). The TE Notes were guaranteed by certain subsidiaries of TEH as well as by the Affiliate Guarantors.

The Aztar Acquisition was also financed with a $440 million senior secured loan (the "LandCo Credit Facility") by and between the lenders thereto (the "LandCo Lenders"), Tropicana LV as borrower, and Adamar of Nevada Corporation, Hotel Ramada of Nevada Corporation, Tropicana Development Company, LLC, Tropicana Enterprises, Tropicana Las Vegas Holdings, LLC and Tropicana Real Estate Company, LLC as guarantors (the "LandCo Guarantors", and together with Tropicana LV, the "LandCo Debtors"). The LandCo Debtors' obligations under the LandCo Credit Facility were secured by a perfected first priority security interest in substantially all of the assets of the LandCo Debtors.

4

Bankruptcy Proceedings

Background

The Predecessors assumed and incurred approximately $3.1 billion of debt as part of the Aztar Acquisition consisting of the TE Senior Secured Credit Facility, the TE Notes and the LandCo Credit Facility. Almost immediately after the Aztar Acquisition closed in January 2007, a downturn in the economy adversely impacted the Predecessors' operations in three principal respects. First, consumers cut back on their traveling and gambling, which caused a material and unprecedented drop in the Predecessors' revenue and operating cash flows (as well as those of many of the Predecessors' competitors in the gaming industry). Second, the value of real estate, one of the Predecessors' primary assets, eroded across the country, sharply reducing the market value of the Predecessors' total assets. Third, the nation's credit markets drastically tightened, severely limiting the Predecessors' access to additional capital, especially given that the Predecessors' collateral package was largely based on real estate, as well as severely limiting the Predecessors' lenders' willingness to refinance the Predecessors' existing indebtedness. This affected all aspects of the Predecessors' availability of financing.

New Jersey License Denial

Prior to the closing of the Aztar Acquisition, the New Jersey Casino Control Commission (the "NJ Commission") granted TEH interim authorization to own and operate Tropicana AC through its subsidiary, Adamar. As a condition to the grant of interim authorization, TEH was required to place the equity securities of Adamar in a trust (the "ICA Trust" or "Trust"). Thereafter, TEH, their officers, owner and other qualifiers continued with the lengthy process of obtaining a ruling from the NJ Commission that TEH was qualified to be a holding company of Adamar. Contemporaneous with the pursuit by TEH of a qualification ruling, Adamar filed its application with the NJ Commission to renew its casino license.

On December 12, 2007, the NJ Commission denied the application of TEH to be found qualified to be a holding company of Adamar, thus activating the ICA Trust. The activation of the ICA Trust vested the Trustee of the ICA Trust (the "Trustee") with all powers, authority and duties necessary to the unencumbered exercise of all rights incident to the ownership of the equity securities of Adamar. Because TEH was found not qualified, the NJ Commission also denied the application of Adamar for renewal of its casino license (the "New Jersey License Denial"). On that same day, and by way of a formal commission order issued on December 19, 2007, the NJ Commission imposed a conservatorship on Adamar and appointed the Trustee to be the conservator and take over and into his possession and control all the property and business of Adamar relating to Tropicana AC, including the possession and control of the resort's cash flow. No other properties or casinos were subject to the New Jersey License Denial.

In conformance with statutory requirements, the NJ Commission authorized the Trustee to endeavor to sell, assign, convey or otherwise dispose of Tropicana AC subject to any and all valid liens, claims and encumbrances, to a person who is appropriately licensed or qualified or able to obtain interim authorization from the NJ Commission to acquire Tropicana AC. Despite the efforts of the Trustee, no acceptable third-party offer was made to acquire Tropicana AC.

Indiana License Development

Following the New Jersey License Denial, the Indiana Gaming Commission staff asserted that TEH's failure to renew the New Jersey license imperiled TEH's license to operate Casino Aztar. As a result of these assertions, TEH entered into an agreement to sell Casino Aztar on an expedited basis (the "Casino Aztar Sale") and Aztar Indiana Gaming Company, LLC, the owner of Casino Aztar, further consented to enter into an agreement called the "Durable Power of Attorney for the Designation and Appointment of Attorney-in-Fact for the Purposes of Conducting Riverboat Gambling

5

Operations and Related Activities" on March 29, 2008 (the "Evansville Power of Attorney"), under which an independent third party, Mr. Robert Dingman (later succeeded by Trinity Hill Group, LLC, the entity that employs Mr. Dingman) was appointed as attorney-in-fact (the "Evansville Attorney in Fact") of Casino Aztar. Pursuant to the Evansville Power of Attorney, the Evansville Attorney in Fact had certain managerial powers over Casino Aztar until the Effective Date. The Casino Aztar Sale was not consummated as a result of the prospective buyer's inability to finance its acquisition. The action of the Indiana Gaming Commission however, did not result in the Predecessors' loss of casino license or access to cash flows.

Bankruptcy Filing—Predecessors

As discussed above, at the time of the New Jersey License Denial, the Predecessors and Adamar's operating results were under significant financial pressure given the depressed state of the gaming industry and the increased leverage resulting from the Aztar Acquisition. That pressure was exacerbated by the Predecessors' subsequent loss of control over, and cash flows from, Adamar, and by the appointment of the Evansville Attorney in Fact. These events ultimately culminated in the Delaware bankruptcy filing. On May 5, 2008 (the "Petition Date"), the Predecessors filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in order to preserve their assets and the value of their estates.

On the Petition Date, each of the Predecessors (except Greenville Riverboat LLC, which does business as Lighthouse Point and was not a guarantor of the TE Notes) commenced the Chapter 11 cases (the "Chapter 11 Cases"). On May 6, 2008, the Bankruptcy Court entered an order jointly administering the Chapter 11 Cases pursuant to Bankruptcy Rule 1015(b). As the Predecessors progressed toward an exit from the Chapter 11 Cases, the Predecessors determined that, given their capital structure and the claims arising thereunder, as well as the nature of their business operations, two separate plans of reorganization were warranted. Accordingly, the Predecessors proposed two separate plans of reorganization, one for Tropicana LV and related debtors and assets (the "Tropicana LV Plan") and one for the Predecessors' other casino gaming properties (the "Plan of Reorganization" or the "Plan"). The Tropicana LV Plan was confirmed on May 5, 2009 and consummated on July 1, 2009, and as a result, Tropicana LV was no longer owned or operated by the Predecessors and is not owned by or a part of the Company.

Pursuant to the Tropicana LV Plan, on July 1, 2009, the assets related to Tropicana LV were acquired by an unrelated company, owned by the LandCo Lenders. A litigation trust (the "Litigation Trust") was also created, to which the Predecessors contributed certain claims against their former equity owner, Mr. William Yung, certain entities controlled by Mr. Yung and against the JMBS Casino Trust. The Litigation Trust recently began pursuit of these claims through an adversary proceeding filed as part of the Chapter 11 Cases. Beneficial interests in the Litigation Trust represent the right to receive a portion of any net proceeds that are collected pursuant to the claims against Mr. Yung. On the Effective Date, the Predecessors' beneficial interests terminated, and beneficial interests representing the Predecessors' prior share of the Litigation Trust will be distributed pro rata to the general unsecured creditors of the Predecessors once those claims are reconciled.

On May 30, 2008, the Bankruptcy Court entered final orders approving an adequate protection package, authorizing the Predecessors to use the OpCo Lenders' cash collateral in the operation of the business and to borrow up to $67 million in post-petition, debtor-in-possession financing (the "DIP Credit Facility") secured by superpriority liens on certain of the Predecessors' assets. Availability under the DIP Credit Facility was subsequently increased to $80 million in October 2008. The DIP Credit Facility was provided by a group of lenders led by Silver Point Finance, LLC, one of the OpCo Lenders. The proceeds of the DIP Credit Facility together with cash generated from daily operations and cash on hand were used to fund post-petition operating expenses, including supplier obligations and employee wages, salaries and benefits. The DIP Credit Facility was repaid on the Effective Date.

6

The Bankruptcy Court confirmed the Predecessors' Plan of Reorganization on May 5, 2009 (the "Confirmation Date"). The Plan was consummated and became effective on March 8, 2010, which was when all conditions to effectiveness were satisfied, including, among other things, that all gaming regulatory approvals and consents required for the Plan's effectiveness were obtained. The Plan enabled the Predecessors' casinos to emerge from bankruptcy under an improved capital structure, while still being able to continue operations in the ordinary course of business.

Bankruptcy Filing—Adamar

Despite the efforts of the Trustee, no acceptable third-party offer was made to acquire Tropicana AC. Accordingly, the Trustee began a dialogue with the steering committee of the OpCo Lenders (the "Steering Committee"). At a meeting of the NJ Commission conducted on February 18, 2009, the Steering Committee advised the NJ Commission that the OpCo Lenders were willing to make a credit bid (the "Credit Bid") to acquire Tropicana AC, meaning that the OpCo Lenders would offer to exchange a portion of the OpCo Credit Facility (as defined in the Plan) for ownership of Tropicana AC. Thereafter, the Steering Committee, the Trustee and Predecessors negotiated the terms of an asset purchase agreement (the "Asset Purchase Agreement").

On April 29, 2009, the NJ Commission approved the final form of the Asset Purchase Agreement and the NJ Commission gave the Trustee permission to cause Adamar to file for bankruptcy protection and pursue an auction sale of Tropicana AC pursuant to 11 U.S.C. §363 utilizing the Asset Purchase Agreement as the first bid to acquire the Tropicana AC (the "Sale"). On April 29, 2009, the Asset Purchase Agreement was executed. Pursuant to the Plan, the portion of the TE Senior Secured Credit Facility used to make the Credit Bid would not be cancelled but would instead, pursuant to the Plan, remain outstanding on the Effective Date for purposes of the Credit Bid.

On April 29, 2009, the Tropicana AC Parties filed the Adamar Bankruptcy Cases. On June 12, 2009, the New Jersey Bankruptcy Court entered an order that, among other things, approved the sale by Adamar of all of the property owned or controlled by Adamar relating to Tropicana AC to the OpCo Lenders, free and clear of all claims, encumbrances (as defined in the June 12, 2009 order of the New Jersey Bankruptcy Court) and interests (other than assumed liabilities and permitted encumbrances identified in the Asset Purchase Agreement) pursuant to the terms of the Asset Purchase Agreement (the "New Jersey Sale Order").

On August 26, 2009, the NJ Commission ruled that we were permitted to apply to the NJ Commission to become a holding company of a subsidiary which would acquire Tropicana AC pursuant to the terms of the Asset Purchase Agreement.

As a result of the NJ Commission's August 26, 2009 ruling, which cleared the way for Tropicana AC to be owned by a subsidiary of ours, the parties to the Asset Purchase Agreement agreed to amend and restate the Asset Purchase Agreement to provide that, among other things, Tropicana AC would be acquired by Tropicana Atlantic City Corp. ("Trop AC Corp."), a subsidiary of ours, pursuant to the terms of the amended and restated Asset Purchase Agreement (the "Amended and Restated Purchase Agreement"), a modified New Jersey Sale Order and the Plan. The New Jersey Bankruptcy Court entered an order approving the Amended and Restated Purchase agreement on October 29, 2009 (the "NJ Sale Order"). The Bankruptcy Court entered an order approving the Amended and Restated Purchase Agreement on November 4, 2009 (the "Delaware Sale Order"). On November 19, 2009 the NJ Commission approved the terms of the Amended and Restated Purchase Agreement, approved Adamar entering into the Amended and Restated Purchase Agreement, and approved the Plan of Reorganization as amended to accommodate changes as a consequence of the parties entering into the Amended and Restated Purchase Agreement.

The Tropicana AC Parties operated as debtors-in-possession pending the Sale. No plan of reorganization was proposed in the Adamar Bankruptcy Cases due to the Sale. The Sale was

7

consummated and became effective on March 8, 2010, at which time we acquired Tropicana AC and the OpCo Lenders each received their pro rata portion of 12,901,947 shares of our Common Stock in exchange for their Credit Bid (the "Tropicana AC Shares"). Carl C. Icahn, through several of its affiliates, became the beneficial owner of approximately 47.5% the TE Senior Secured Credit Facility, and as such, received approximately 47.5% of the Tropicana AC Shares on the Effective Date.

Restructuring Transactions

Pursuant to the Plan, prior to and on the Effective Date, certain of the Restructuring Transactions were consummated and the Company acquired from the Predecessors certain subsidiaries of TEH (but, as previously indicated, did not acquire Tropicana LV, Tahoe Horizon, and related assets), the Affiliate Guarantors, and the assets of certain Predecessors, in exchange for (a) the issuance of shares of our common stock (the "Common Stock"), interests in the Litigation Trust and warrants to purchase an additional 3,750,000 shares of our Common Stock (the "Ordinary Warrants") and (b) the assumption of certain liabilities of TEH, its subsidiaries subject to the Restructuring Transactions and the Affiliate Guarantors incurred after the Petition Date, to the extent not paid on or prior to the Effective Date (other than income tax liabilities). The Ordinary Warrants have a four year and six month term, and have an exercise price of $52.44 per share. Also, pursuant to the Amended and Restated Purchase Agreement, on the Effective Date, the Company acquired the assets of Tropicana AC and certain subsidiaries.

On the Effective Date, the OpCo Lenders were issued 12,098,053 shares of Common Stock, in addition to the 12,901,947 Tropicana AC Shares they received in connection with the Sale, while holders of the TE Notes and holders of general unsecured claims will receive upon reconciliation of the amounts of their respective claims, Ordinary Warrants and beneficial interests in the Litigation Trust in exchange for all of their claims against the Predecessors. As a result, the OpCo Lenders became the stockholders of the Company on the Effective Date. Carl C. Icahn, through several of his affiliates, became the beneficial owner of approximately 47.5% of our shares of Common Stock and as of March 8, 2010 ultimately controlled approximately 47.5% of our outstanding Common Stock. No other stockholder beneficially owns more than 5% of the outstanding shares of our Common Stock.

In addition, under the Plan of Reorganization as amended, the Company entered into a senior secured credit facility in the aggregate amount of $150 million (the "Exit Facility"). The Exit Facility consists of (i) a $130 million senior secured term loan credit facility issued at a discount of 7% (the "Term Loan Facility") and (ii) a $20 million senior secured revolving credit facility (the "Revolving Facility"). The agreement governing the Exit Facility also obligated the Company to issue 1,312,500 warrants to purchase our Common Stock at a strike price of a $0.01 to participating lenders on the Effective Date (the "Penny Warrants" and, together with the "Ordinary Warrants," the "Warrants"). The Exit Facility was entered into on December 29, 2009 and the Term Loan Facility was fully drawn on the Effective Date. The proceeds of the Term Loan Facility were used to repay certain indebtedness, including the DIP Credit Facility, to pay Bankruptcy Court-approved administrative claims and expenses, to provide for working capital, to pay fees and expenses related to the Exit Facility and for other general corporate purposes. Entities affiliated with Mr. Icahn are lenders under the Exit Facility and hold over 50% of the loans extended under the Exit Facility. In addition, an entity affiliated with Mr. Icahn is the administrative agent and collateral agent under the Exit Facility. On March 9, 2010, affiliates of Mr. Icahn that participated as Exit Facility lenders exercised their Penny Warrants which raised Mr. Icahn's ultimate control over our Common Stock on that date to 49.1% of the shares issued and outstanding.

The Plan of Reorganization, as amended, also provided for, among other things:

- •

- the termination of all indebtedness under the TE Senior Secured Credit Facility, except for a portion of indebtedness that was terminated upon the consummation of the Amended and

8

- •

- the cancellation of all TE Notes;

- •

- the cancellation of approximately $150.0 million of other pre-petition indebtedness;

- •

- payment in full of the DIP Credit Facility;

- •

- payment in full of all Allowed Administrative Claims (as defined in the Plan);

- •

- payment in full of all Allowed Priority Tax Claims (as defined in the Plan);

- •

- payment in full of all Allowed Other Priority Claims (as defined in the Plan); and

- •

- reinstatement, payment in full, or satisfaction in full by return of collateral of all Allowed Other Secured Claims (as defined in the Plan).

Restated Purchase Agreement, pursuant to the Credit Bid, the NJ Sale Order and the Delaware Sale Order;

The Restructuring Transactions contemplated by the Plan involved the following steps. Certain of the Predecessors formed the Company, New Tropicana Holdings, Inc. ("New Tropicana Holdings"), a Delaware corporation, New Tropicana OpCo, Inc. ("New Tropicana OpCo"), a Delaware corporation, and Trop AC Corp. Trop AC Corp formed a wholly owned subsidiary, Tropicana AC Sub, a New Jersey corporation. Capitalized terms used in this section not otherwise defined have the meaning set for in the Plan.

- •

- New Tropicana Holdings entered into a subscription agreement with and became a wholly owned subsidiary of TEH; New

Tropicana OpCo entered into a subscription agreement with, and became a wholly owned subsidiary of New Tropicana Holdings;

- •

- New Tropicana OpCo formed two wholly owned Nevada limited liability companies ("LLCs") ("New St. Louis Riverboat

LLC" and "New Jazz Enterprises LLC");

- •

- Jazz Enterprises, Inc. ("Jazz Enterprises"), Tropicana Express, Inc. and Aztar Indiana Gaming Corporation ("Aztar

IN Gaming Corp," and "Aztar IN Gaming LLC" after such conversion) merged into, and in the case of Ramada New Jersey Holdings Corporation ("Ramada Holdings") merged into, from corporations to limited

liability companies ("LLCs") by operation of state law (unless otherwise noted herein, references to entities will include the same defined term before and after the conversion to LLCs);

- •

- Aztar distributed 1% of the LLC interests of Tropicana Express, Inc. to TE;

- •

- TE formed St. Louis Riverboat LLC, a Missouri LLC; and

- •

- St. Louis Riverboat Entertainment, Inc. ("St. Louis Riverboat") merged with and into St. Louis Riverboat LLC.

Prior to the Effective Date, the following actions occurred:

- •

- CP Baton Rouge Casino, LLC ("Baton Rouge") contributed all of its assets (other than the LLC interests of Jazz Enterprises and Centroplex Centre Convention Hotel LLC ("Centroplex"), stock of Argosy of Louisiana, Inc. ("Argosy"), receivables due from other Debtors ("Intercompany Receivables"), and Insider Causes of Action) to Jazz Enterprises; Argosy contributed all of its assets (other than the partnership interest in Catfish Queen Partnership in Commendam ("Catfish Queen"), Intercompany Receivables, and Insider Causes of Action) to Catfish Queen; and TEH contributed all of its assets (other than the LLC interests of Tropicana

On the Effective Date, the following actions occurred in the following order:

9

- •

- Aztar contributed all of its assets (other than the stock of Ramada New Jersey Holdings Corporation, Aztar Development

Corporation, and Aztar MO Gaming Corporation; the LLC interests of Aztar IN Gaming LLC, Tropicana Express, Inc., and Tropicana Las Vegas Holdings LLC; Intercompany

Receivables; and Insider Causes of Action) to Tropicana Express, Inc.; Aztar MO Gaming Corporation and Aztar IN Gaming LLC contributed all of their assets (other than the LLC interests

of Aztar Riverboat Holding Company LLC ("Aztar Riverboat Holding"), Intercompany Receivables, and Insider Causes of Action) to Aztar Riverboat Holding; and Tropicana Entertainment Intermediate

Holdings LLC contributed all of its assets (other than the LLC interests of TE, Intercompany Receivables, and Insider Causes of Action) to TE;

- •

- TE contributed all of its assets (other than the stock of Aztar and Tropicana Finance Corp.; the LLC interests of

Greenville Riverboat LLC ("Greenville"), Baton Rouge, Tahoe Horizon, LLC ("Tahoe Horizon"), St. Louis Riverboat, Columbia Properties Tahoe, LLC ("MontBleu"), Columbia

Properties Laughlin, LLC ("CP Laughlin"), CP St. Louis Casino, LLC ("CP St. Louis Casino") and Tropicana Express, Inc.; Intercompany Receivables; and Insider Causes

of Action) to Tahoe Horizon;

- •

- Aztar Riverboat Holding assumed all of the liabilities of Aztar Indiana Gaming Company, LLC ("Aztar IN Gaming

Company") that were subject to compromise under the Plan; and Argosy and Jazz Enterprises assumed (in proportion to their partnership interests in Catfish Queen) all of the liabilities of Catfish

Queen that were subject to compromise under the Plan;

- •

- Baton Rouge assumed all of the liabilities of Centroplex that were subject to compromise under the Plan; and Aztar MO

Gaming Corporation and Aztar IN Gaming LLC assumed (in proportion to their ownership of Aztar Riverboat Holding) all of the liabilities of Aztar Riverboat Holding that were subject to

compromise under the Plan (including those assumed by Aztar Riverboat Holding pursuant to the previous paragraph);

- •

- TE assumed all of the liabilities of Tahoe Horizon, MontBleu, and CP Laughlin that were subject to compromise under the

Plan; Aztar and TE assumed (in proportion to their ownership of Tropicana Express, Inc.) all of the liabilities of Tropicana Express, Inc. that were subject to compromise under the Plan;

- •

- The Company made a capital contribution of its Common Stock to New Tropicana Holdings, a portion of which was then

contributed to New Tropicana OpCo;

- •

- The Company made a capital contribution of its Common Stock to Trop AC Corp., and Trop AC Corp. made a capital

contribution of the Company's Common Stock to Trop AC Sub;

- •

- New Tropicana OpCo immediately contributed the Company's Common Stock to New St. Louis Riverboat LLC and to

New Jazz Enterprises LLC;

- •

- TE transferred all of its Intercompany Interest in Greenville and 100% of the Intercompany Interests of Tahoe Horizon,

MontBleu, CP Laughlin, and CP St. Louis Casino to New Tropicana OpCo in exchange for the Company's Common Stock;

- •

- TE transferred all of its Intercompany Interest in Tropicana Express, Inc. to New Tropicana Holdings in exchange

for the Company's Common Stock;

- •

- Aztar transferred all of its Intercompany Interests in Tropicana Express, Inc. to New Tropicana OpCo in exchange for the Company's Common Stock;

Entertainment Intermediate Holdings, LLC, Intercompany Receivables, and Insider Causes of Action) to Tropicana Entertainment Intermediate Holdings, LLC;

10

- •

- St. Louis Riverboat transferred 100% of its assets to New St. Louis Riverboat LLC in exchange for the

Company's Common Stock and the assumption by New St. Louis Riverboat LLC of certain of the operating liabilities of St. Louis Riverboat;

- •

- Baton Rouge transferred 100% of the Intercompany Interests of Centroplex to New Tropicana OpCo in exchange for the

Company's Common Stock;

- •

- Jazz Enterprises transferred 100% of its assets (other than Intercompany Receivables and Insider Causes of Action) to New

Jazz Enterprises LLC in exchange for the Company's Common Stock and the assumption by New Jazz Enterprises LLC of certain of the operating liabilities of Jazz Enterprises;

- •

- Argosy transferred 1% of the Intercompany Interests in Catfish Queen to New Tropicana Holdings and any remaining

Intercompany Interests in Catfish Queen that it held to New Tropicana OpCo, both in exchange for the Company's Common Stock;

- •

- Aztar IN Gaming LLC transferred 1% of the Intercompany Interests in Aztar Riverboat Holding to New Tropicana

Holdings and 69% of the Intercompany Interests in Aztar Riverboat Holding to New Tropicana OpCo, both in exchange for the Company's Common Stock; Aztar MO Gaming Corporation transferred the remaining

30% of such Intercompany Interests to New Tropicana OpCo in exchange for the Company's Common Stock;

- •

- TE, Baton Rouge, Argosy, Jazz Enterprises, St. Louis Riverboat, Aztar, Aztar MO Gaming Corporation, and Aztar IN

Gaming LLC distributed the Company's Common Stock that such Entities received from New Tropicana OpCo and New Tropicana Holdings to Holders of Claims entitled to receive the Company's Common Stock in

accordance with the Plan in partial payment of such Claims;

- •

- The OpCo debtors contributed the Insider Causes of Action to the Litigation Trust for the benefit of Holders of Claims

entitled to receive the Litigation Trust Proceeds in accordance with the Plan in partial payment of such Claims;

- •

- Existing Interests in JMBS Casino LLC, Columbia Properties Vicksburg LLC, and CP Laughlin Realty LLC were cancelled and

new LLC interests in each LLC were issued to New Tropicana OpCo;

- •

- Any remaining Claims subject to compromise were cancelled pursuant to the Plan;

- •

- Adamar and Manchester sold to the Company, and the Company directed Adamar and Manchester to transfer, assign, convey and

deliver to Trop AC Corp. all of the Adamar Assets in exchange for the Company's Common Stock and assumption of certain liabilities; Ramada Holdings sold, transfer, assigned conveyed and delivered to

Trop AC Sub all of the Ramada Holdings Assets in exchange for the Company's Common Stock and the assumption of certain liabilities; Atlantic Deauville Inc. and Adamar Garage Corporation sold,

transferred, assigned, conveyed, and delivered to Trop AC Sub all of the atlantic assets in exchange for the Company's Common Stock and the assumption of certain liabilities; and Ramada

New Jersey, Inc. sold, transferred, assigned, conveyed, and delivered to Trop AC Sub all of the Ramada Assets in exchange for the Company's Common Stock and the assumption of certain

liabilities, in each case pursuant to and in accordance with the terms of the Amended and Restated Purchase Agreement; and

- •

- Adamar, Manchester, Ramada Holdings, Atlantic Deauville Inc., Adamar Garage Corporation, and Ramada New Jersey, Inc. sold, transferred, and delivered (and directed the Company and Trop AC Sub to deliver, and the Company and Trop AC Sub delivered) to the Holders of Allowed OpCo Credit Facility Claims, the Company's Common Stock pursuant to and in accordance with the terms of the Amended and Restated Purchase Agreement.

11

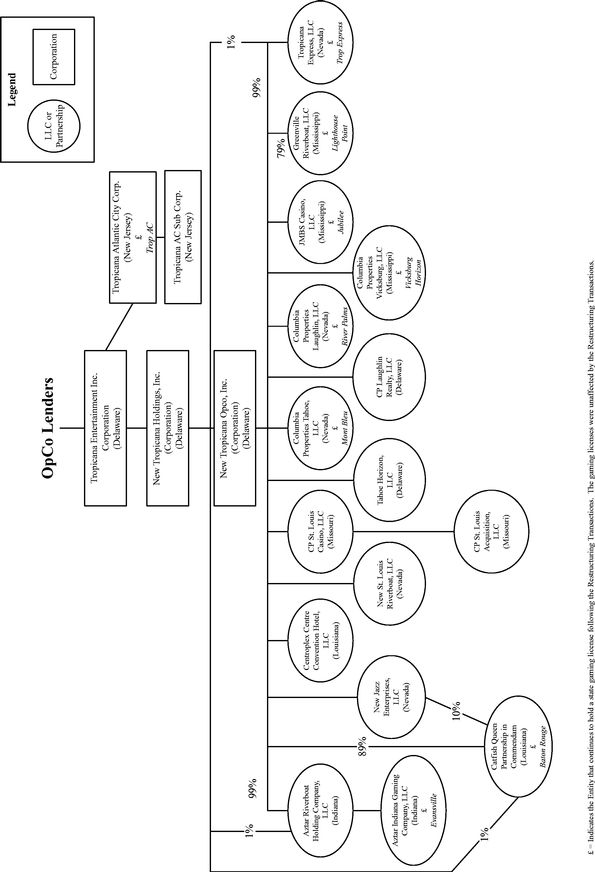

Pursuant to the Restructuring Transactions our corporate structure is as follows:

12

Properties and Segments

The Predecessors and Adamar viewed each city in which their casino properties are located as an operating segment and reported their results of operations separately for each city in which their casino properties were located. The following describes each property that we acquired by their segment. For a discussion of the historical financial results of the Predecessors and Adamar by operating segment, see "Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations."

Atlantic City, New Jersey

Tropicana AC

Tropicana AC is situated on a 14-acre site with approximately 660 feet of ocean frontage along the Boardwalk in Atlantic City, New Jersey. The property features 2,129 hotel rooms and suites, approximately 3,158 slot machines, 135 table games, 35 poker tables and 13 restaurants and bars. The property also features The Quarter, a Havana-themed, more than 200,000 square foot, Las Vegas-style indoor entertainment and retail center, including 15 restaurants, 25 shops and an IMAX theatre. Other amenities include a 2,000-seat showroom, a full service spa and salon, a health club and indoor pool, a beach and pool bar and approximately 120,000 square feet of meeting and convention space.

Competition

Tropicana AC primarily competes with casino and gaming facilities located in New Jersey, Pennsylvania, New York, Maryland and Delaware. The following is a brief summary of competition in these five states.

Atlantic City Market. The Atlantic City market primarily serves the New York-Philadelphia-Baltimore-Washington, D.C. corridor with nearly 30 million adults living within a three-hour driving radius. The Atlantic City market is currently the second largest gaming market in the United States, after Las Vegas.

Competition in Atlantic City is intense and continues to increase. Currently, the 11 casino hotels located in Atlantic City, including Tropicana AC, compete with each other on the basis of customer service, quality and extent of amenities and promotional offers. For this reason, Adamar and its competitors have historically incurred substantial capital expenditures to compete effectively.

During 2008, certain of Adamar's competitors in Atlantic City completed significant room expansion projects and added other new amenities to their facilities. Trump Entertainment Resorts completed the construction of a new, 782-room hotel tower at the Taj Mahal, the Chairman Tower in October 2008. Revel Entertainment Group ("Revel") continues development on a 20-acre, oceanfront site next to the Showboat Casino Hotel. Revel has announced that it plans to construct an approximate $2 billion mega resort which was originally expected to open in late 2010. While Revel has obtained interim financing allowing it to commence certain work at the site, it has not yet received financing for its complete project. It recently announced that it would slow construction on the project until it can secure long-term financing. At this time we cannot ascertain when and if Revel's project will be completed.

We believe that there are several other sites on the Boardwalk, in the marina district and possibly at Bader Field, a former airport located in Atlantic City, if that area is zoned for gaming, where casino hotels could be built in the future. Additionally, various applications for casino licenses have been filed and announcements with respect thereto have been made from time to time in these areas. Legislation was recently introduced in New Jersey that would lower the requirement for Atlantic City casino/hotel developments to a minimum of 200 rooms from the previous minimum of 500 rooms and lower the required gaming space to 20,000 square feet from the current minimum of 60,000 square feet. These

13

smaller, cheaper casinos could revitalize the gaming market in Atlantic City, however, the increased competition and new, modern casino experience could have a detrimental effect on the performance of existing facilities.

In April 2004, the Atlantic City casinos executed an agreement with the New Jersey Sports and Exposition Authority ("NJSEA") which owns and operates two of the four New Jersey horse race tracks, including the Meadowlands race track. The agreement provides that annual payments made by the casinos to the NJSEA in each of 2004 through 2008 in order to subsidize horse racing would establish a moratorium on the conduct of casino gaming, including video lottery terminals ("VLTs") at any New Jersey race track until January 2009.

In August 2008, the Atlantic City casinos executed a new agreement with the NJSEA (the "2008 NJSEA Subsidy Agreement"). The 2008 NJSEA Subsidy Agreement provides that substantial annual payments made by the casinos to the NJSEA in 2008 through 2011 in order to subsidize horse racing would establish a moratorium on the conduct of casino gaming, including VLTs at any New Jersey race track until December 31, 2011.

We cannot ascertain at this time the effects that any new projects could have on the Atlantic City gaming market. However, future developments and expansions could have a material adverse effect on our business and operations.

Pennsylvania. In July 2004, the Pennsylvania legislature enacted the Race Horse Development and Gaming Act which authorizes the Pennsylvania Gaming Control Board to permit a total of up to 61,000 slot machines in up to fourteen different licensed locations in Pennsylvania, seven at racetracks (each with up to 5,000 slot machines), five at slot parlors (two in Philadelphia, one in Pittsburgh and two elsewhere, each with up to 5,000 slot machines) and two at established resorts (each with up to 500 slot machines). Three of the racetrack sites, Pocono Downs, Philadelphia Park and Chester Downs and three slot parlors, two in Philadelphia and one in Bethlehem, are located in the market area of Tropicana AC. Slot machine operations commenced in late 2006 at the racetracks and, as of December 31, 2009, approximately 11,500 slot machines were operating at these locations. Sands Casino Resort Bethlehem recently opened in May 2009 with approximately 3,250 slot machines. In October 2009, Sugar House Casino commenced construction of its $310 million casino in Philadelphia to include 1,700 slot machines which is anticipated to be completed in August 2010. The other Philadelphia slot parlor is expected to be managed by Wynn Resorts, Limited pursuant to a letter of intent and is subject to approval by the Pennsylvania Gaming Control Board prior to commencing construction. Competition from the Pennsylvania area slot machine facilities that are currently operational has adversely impacted Atlantic City casinos, including Tropicana AC.

In addition, Pennsylvania approved the legalization of live table games in January 2010. The Pennsylvania Gaming Control Board is in the process of creating a regulatory framework with regard to table games and has estimated that it will take six to nine months before table games can become operational. We believe that the legalization of live table games in Pennsylvania and the potential opening of additional slot parlors could further adversely impact Atlantic City casinos, including Tropicana AC.

New York. Pursuant to legislation enacted in 2001, the Division of the Lottery of the State of New York is authorized to permit the installation of VLTs at various horse racing facilities in New York. During 2004, VLT operations commenced at four upstate and western New York racetracks and at a racetrack in Sullivan County, which operates 1,500 VLTs and is considerably closer (approximately 95 miles) to Manhattan. The VLT facility at Yonkers Raceway ("Yonkers") opened in late 2006 and now operates 5,300 VLTs. In addition, several casino operators are currently bidding for a license to operate a proposed 4,500 VLT facility at Aqueduct Racetrack ("Aqueduct"); however, the State of New York has not selected the winning bidder. Once construction begins on the facility, it is expected to take approximately 12 to 14 months to complete. At this time, we cannot ascertain when and if

14

construction will begin. Additionally, at various times there have been discussions about allowing VLTs at the Belmont racetrack ("Belmont"). These Yonkers, Aqueduct and Belmont locations are less than fifteen miles from Manhattan.

The 2001 legislation also authorized the Governor of New York to negotiate compacts authorizing the operation of up to six Native American casino facilities including slot machine gaming. A compact negotiated in 2002 authorized three such facilities located in the western part of New York and outside of Adamar's primary market area. The remaining three Native American casinos, if developed, are required by law to be located in either Sullivan County or Ulster County, adjoining counties less than 100 miles northwest of Manhattan. Competition from the VLT facilities at Aqueduct Racetrack and Yonkers Raceway and from potential Native American casinos as may be authorized and operated in Sullivan or Ulster County could adversely impact Atlantic City casinos, including Tropicana AC.

Maryland. In November 2008, Maryland voters passed a referendum to allow 15,000 slot machines at five locations across that state. The State of Maryland set a February 2009 deadline for bids to operate the five locations and received only four qualified bids to operate slot machines and no one bid for the fifth location. In the initial bids received, potential operators bid for 6,550 of the total potential slot machines available. In September 2009, the first location to win approval was the Ocean Downs Racetrack, which is expected to include 600 slot machines that are anticipated to be in operation by Memorial Day 2010. In October 2009, a second location was approved in Cecil County, which will be developed and managed by Penn National Gaming ("Penn"). Penn has announced plans to build a $97.5 million facility including 1,500 slot machines and is expected to be open by late 2010. Proposals for the two remaining bids, including the two largest casinos envisioned by the state in Anne Arundel County and Baltimore, continue to face obstacles that could delay operations past planned openings in 2011. We believe these facilities in Maryland could adversely impact Atlantic City casinos, including Tropicana AC.

Delaware. Tropicana AC competes with Delaware primarily for gaming customers from the Southern New Jersey, Southern Pennsylvania and Delaware regions. In May 2009, Delaware approved sports betting, which is currently limited to parlay wagering on National Football League games, where bettors must win bets on multiple games. In addition, live table game legislation was introduced when the Delaware General Assembly reconvened in January 2010. While Atlantic City's casinos currently offer table games, they are currently not permitted to offer sports betting. We believe the introduction of the limited sports betting in Delaware and the legalization of live table games could adversely impact Atlantic City casinos, including Tropicana AC.

Tropicana AC has relied on marketing and promotional efforts to compete in the Atlantic City market, and the Adamar Bankruptcy Cases may have a material adverse effect on these efforts going forward.

Evansville, Indiana

Casino Aztar

Casino Aztar is a large casino hotel and entertainment complex located on over 20 acres along the Ohio River in Evansville, the third largest city in the state of Indiana. The property was the first of 13 casinos to be licensed in the state of Indiana and commenced operations in 1995.

The property's casino operations are located on the three-deck "City of Evansville" riverboat, a replica of the historic 130-year old Robert E. Lee side-wheel steamboat. The casino features approximately 38,360 square feet of casino space, 894 slot machines, 34 table games and 12 poker tables. The property also features two distinctive hotels with a total of 347 hotel rooms. The Casino Aztar Hotel includes 251 guest rooms and suites, one restaurant, conference rooms and banquet facilities. The Le Merigot, a boutique 96-room hotel with an upscale martini lounge opened in

15

December 2006. The 44,000-square-foot pavilion adjacent to the riverboat features three restaurants, an entertainment lounge, a gift shop, a café and players club. The District at Casino Aztar, a $33 million entertainment complex that opened in late 2006, includes seven waterfront acres, two restaurants, a large park area located in front of the pavilion used by Aztar and the community for events and the Le Merigot Hotel. The property also includes a seven-story parking garage and surface parking with a combined total of 2,100 parking spaces.

A 1.4 million adult population living within a 90-mile radius of the Casino Aztar provides a stable, local customer base. Over 60% of the Casino Aztar's business is generated from customers within a 50-mile radius. Customers are primarily drawn from local tri-state area of southern Indiana, southeastern Illinois, northwestern Kentucky and northern Tennessee.

Competition

As the only casino within a 90-mile radius of Evansville, Casino Aztar enjoys a prime location. Its nearest direct competitor, French Lick Casino is located 91 miles to the northeast. Other competitors include: Horseshoe Southern Indiana located 111 miles east; Harrah's Metropolis located 142 miles southwest; Harrah's St. Louis located 172 miles northwest; Indiana Live located 217 miles northeast; and Hoosier Park located 267 miles northeast. To a lesser extent, Casino Aztar also competes with a satellite off-track betting facility, Indiana Downs, located near Indianapolis, Indiana.

Legislation to bring casino gambling to neighboring Kentucky has been intermittently introduced dating back to 1988 and now Kentucky is bordered by five states with legalized gaming, which may put additional pressure on Kentucky legislators to legalize gaming. State leaders have debated for years whether Kentucky, a state with a long tradition of betting on horse races, can offer casino-style gambling at racetracks. In June 2009, the Governor of Kentucky called lawmakers into a special session to address significant projected state budget deficits and added a proposal to legalize slot machines at racetracks. House lawmakers voted to approve the proposal but the legislation was rejected by the Senate Appropriations and Revenue Committee. The efforts to enact enabling legislation in Kentucky are expected to intensify in 2010 following the approval of four casinos by Ohio voters in the November 3, 2009 election. Ellis Park, a thoroughbred racetrack in Henderson, Kentucky is located approximately eight driving miles south of Casino Aztar. The racetrack traditionally conducts live racing from July 4th to September 1st every year. The racetrack has recently faced financial challenges and whether Ellis Park can vie for slot machines is still unclear. The financial results of Casino Aztar could be adversely affected if gaming is legalized in Kentucky in the future.

Casino Aztar has relied on branding and marketing efforts to compete in this market, and the recent Chapter 11 Cases may have a material adverse effect on these efforts going forward.

Laughlin, Nevada

Tropicana Express

Tropicana Express is located on an approximately 31-acre site on Casino Drive, Laughlin's principal thoroughfare, with a train theme prevalent throughout the property. Tropicana Express features approximately 969 slot machines, 20 table games, 6 poker tables, a race and sports book and 1,495 hotel rooms. Non-gaming amenities include a train-shaped, heated outdoor swimming pool, seven restaurants, three full service bars, an entertainment lounge with live music, a premium lounge for high-end players, a 800 seat multi-purpose show room and concert hall, meeting space, retail stores, an arcade and a covered parking structure. The property recently remodeled 1,200 hotel rooms, including premium bedding and linen, which we believe positioned those hotel rooms as the highest quality standard room product in the Laughlin market.

16

River Palms

River Palms is located on an approximately 35-acre site also on Casino Drive, with approximately 1,300 feet of frontage on the Colorado River. River Palms features approximately 777 slot machines, 13 table games, a 200 seat bingo room and a sports book. Non-gaming amenities include 1,000 hotel rooms, 10,500 square feet of meeting and convention space, an outdoor pool, a full service spa and beauty salon, a fitness center, three restaurants, three full service bars, a nightclub/comedy club, two entertainment lounges with live music and a covered parking structure.

Competition

The Tropicana Express and River Palms compete primarily with other Laughlin hotels and casinos located along the Colorado River based on a mix of casino games, personal service, payout ratios, price of hotel rooms, restaurant value and promotions. Tropicana Express and River Palms also compete with casinos in nearby locations, including the Mojave tribe's casino situated eight miles south of Laughlin, Native American casinos in Arizona and California, and numerous casinos in Las Vegas.

During 2008, one of our direct competitors in the Laughlin market, Aquarius Casino Resort ("Aquarius"), completed a large capital improvement program. Completed capital improvements to the Aquarius include renovations to the casino and common areas, new slot machines, new signage and renovations to suites and standard hotel rooms.

The Laughlin area is situated in an unincorporated portion of Clark County and is located in the southerly portion of the State of Nevada. Laughlin is located along the west side of the Colorado River, which forms the boundary between Nevada and Arizona. Las Vegas is located approximately 97 miles to the north via U.S. Highway 95. Los Angeles is approximately 300 miles west with access being provided by Interstate 40 and Interstate 15. Flagstaff, Arizona is approximately 180 miles east via Interstate 40 while Phoenix, Arizona is approximately 185 miles southeast of Laughlin. The Laughlin market is a value-oriented destination for travelers seeking an alternative to the fast-paced Las Vegas experience. The Laughlin properties target the customer in this market seeking great value, a breadth of amenities and friendly service in their gaming, lodging, dining and entertainment experiences.

Tropicana Express and River Palms have relied on marketing and promotional efforts to compete in this market, and the Chapter 11 Cases may have a material adverse effect on these efforts going forward.

Lake Tahoe, Nevada

MontBleu

MontBleu is situated on approximately 21 acres in South Lake Tahoe, across Highway 50 from the Edgewood Golf Club. In May 2006, an extensive re-branding and refurbishment of the property's casino, lobby, retail facilities, restaurants and nightclubs was completed. The property features a 437-room hotel tower and approximately 45,000 square feet of casino space, with approximately 611 slot machines, 25 table games and 6 poker tables, as well as a race and sports book. The property also offers guests a choice of three restaurants and various non-gaming amenities, including retail shops, two nightclubs, a 1,500-seat showroom, approximately 14,000 square feet of meeting and convention space, a parking garage, a full service health spa and workout area, an indoor heated lagoon style pool with whirlpool, and a wedding chapel that seats up to 120. MontBleu draws customers primarily from the northern California and northern Nevada markets.

Competition

The South Lake Tahoe area consists of five casino properties including MontBleu and Tahoe Horizon. Two Harrah's casino properties, Harvey's Resort Hotel and Harrah's Casino Hotel, are the

17

largest competitors in this market. The fifth property, The Lakeside Inn, is primarily a casino catering to local residents with an attached motor lodge catering to overnight visitors There are also three other casinos on the North Shore of Lake Tahoe, which are approximately 25 miles from the South Lake Tahoe market. There are also numerous casinos in located in Reno, Nevada, which is approximately 60 miles from South Lake Tahoe and several in the Carson City, Nevada, market which is approximately 30 miles from South Lake Tahoe. In addition, gaming revenues in the South Lake Tahoe area are directly and adversely affected by the ongoing proliferation of Native American gaming in northern California. Native American casinos, including the Cache Creek in Brooks, Jackson Ranchero in Jackson, Thunder Valley Casino in Auburn and Red Hawk Casino located on Highway 50 in Placerville, the corridor from the San Francisco/Oakland Bay Area leading into Lake Tahoe, vigorously compete with would-be South Lake Tahoe visitors from northern California and the Pacific Northwest.

MontBleu has relied on marketing and promotional efforts to compete in this market, and the Chapter 11 Cases may have a material adverse effect on these efforts going forward.

Vicksburg, Mississippi

Vicksburg Horizon

Vicksburg Horizon is situated in downtown Vicksburg, Mississippi, in close proximity to the Vicksburg Memorial Battlefield Park and within walking distance to the Vicksburg Convention Center. The property features a 297-foot multi-level, antebellum style, dockside riverboat casino housing approximately 382 slot machines. Additional amenities include 117 hotel rooms, a restaurant featuring a comfortable setting and freshly prepared meals with a Southern touch, two covered parking garages as well as additional parking. Vicksburg Horizon attracts both local patrons and patrons primarily from the Jackson, Mississippi, and Monroe, Louisiana areas.

Competition

Vicksburg Horizon currently competes with four other gaming operations located in Vicksburg, Mississippi. In May 2008, Ameristar Vicksburg completed a casino expansion that added 25,500 square feet of gaming space and a new 1,000-space parking garage. The Ameristar Vicksburg expansion also included a new VIP lounge that opened in July 2008 and two additional restaurants, which opened in September 2008. In October 2008, a new competitor, Riverwalk Casino opened a $100 million casino-hotel in Vicksburg. The Riverwalk facility has a 25,000 square-foot casino, featuring 900 gaming positions and 80 hotel rooms. These new facilities have adversely impacted the financial performance of Vicksburg Horizon and the other facilities operating in the market.

Several potential gaming sites still exist in or near Vicksburg and from time to time potential competitors have proposed the development of additional casinos. In 2005, the Mississippi Gaming Commission granted preliminary approval for a sixth casino license in the Vicksburg market. One developer has proposed building a $200 million casino facility that would include a 250-room hotel, parking garage and other non-gaming amenities. As originally announced, construction of this project was to begin in early 2006, but development has not yet begun and no new date has been announced.

The Vicksburg market also faces regional competition from two casinos owned by a Native American tribe near Philadelphia, Mississippi, located about 70 miles east of Jackson and 115 miles east of Vicksburg. Vicksburg is also subject to competition from four casinos and one slots-only racetrack in Shreveport and Bossier City, Louisiana, located approximately 175 miles from Vicksburg, as well as casinos located along the Mississippi Gulf Coast.

In addition, proposals have been made from time to time to develop other Native American casinos in Louisiana and Mississippi, some of which could be competitive with the Vicksburg market if completed.

18

Vicksburg Horizon has relied on marketing and promotional efforts to compete in this market, and the Chapter 11 Cases may have a material adverse effect on these efforts going forward.

Greenville, Mississippi

Lighthouse Point

Lighthouse Point is a 210-foot, three-deck, dockside riverboat located in Greenville, approximately 90 miles from Vicksburg, Mississippi. A $4 million renovation was completed in January 2008. The riverboat features a casino on all three floors housing approximately 557 slot machines. The property also includes a dockside facility with a buffet, a deli on the second floor, a bar on each floor and 370 onsite surface parking spaces. Lighthouse Point draws the majority of its customers within a 30-mile radius of Greenville and to a lesser extent Little Rock, Arkansas.

Jubilee

Jubilee also is located in Greenville, in close proximity to Lighthouse Point. A $4 million renovation was completed in November 2007. The 240-foot, three-deck dockside riverboat features a casino on two floors housing approximately 485 slot machines and 7 table games, with the third floor available for concerts and special events. The property also includes a deli on the first floor and a bar on each floor. A 500-space surface parking lot is located offsite with an additional 200 parking spaces available onsite when the water level is low. The property also owns and operates the Greenville Inn & Suites, a 41 room suite hotel located less than a mile away which offers free shuttle service to and from the Jubilee and Lighthouse Point. Jubilee draws the majority of its customers within a 30 mile radius of Greenville and to a lesser extent the Little Rock, Arkansas, area.

Competition

Jubilee, Lighthouse Point and privately owned Harlow's Casino are currently the only licensed riverboat gaming facilities in the Greenville market. Harlow's Casino opened in November 2007 with a total project cost of $70 million, and features approximately 1,000 gaming positions and 105 hotel rooms. This new facility has adversely impacted the financial performance of the Greenville properties.

To a lesser extent, the Greenville market also competes with the Vicksburg market which is 90 miles to the south and the Tunica, Mississippi market which is 115 miles to the northeast.

Lighthouse Point and Jubilee have relied on marketing and promotional efforts to compete in this market, and the Chapter 11 Cases may have a material adverse effect on these efforts going forward.

Baton Rouge, Louisiana

Belle of Baton Rouge

Belle of Baton Rouge is located on the Mississippi River in the downtown historic district of Baton Rouge, across from the River Center, a 70,000 square foot convention center. The three-deck, dockside riverboat casino features approximately 907 slot machines, 22 table games and 6 poker tables. Non-gaming amenities include 300 hotel rooms, 14,000 square feet of meeting and convention space, an outdoor pool, a fitness center, three restaurants, a sports bar, an entertainment venue and a 50,000-square-foot glass atrium enclosing a lush tropical lobby. A new 326 space parking garage opened in June 2008, creating a convenient parking facility. The City of Baton Rouge is also contemplating three new hotels at the River Center to open in 2011, which we believe would drive additional traffic to the property. Baton Rouge is located 75 miles north of New Orleans and is believed to rival New Orleans as the largest city in Louisiana. The city has experienced significant growth in recent years, particularly after Hurricane Katrina struck the nearby New Orleans region in 2005. Approximately 90% of the Belle of Baton Rouge customer base resides within a 45 mile radius of the property.

19

Competition

Belle of Baton Rouge is currently one of two licensed dockside riverboat gaming facilities operating in Baton Rouge. The other riverboat facility, Hollywood Casino Baton Rouge, is owned by Penn.

Belle of Baton Rouge also faces competition from land-based and riverboat casinos throughout Louisiana and on the Mississippi Gulf Coast, from casinos on Native American lands and from non-casino gaming opportunities within Louisiana. It faces competition from eleven casinos on the Mississippi Gulf Coast, which is approximately 120 miles east of Baton Rouge; many of these casinos are destination resorts that attract customers from the Baton Rouge area. Subsequent to Hurricane Katrina, Mississippi Gulf Coast casinos have been allowed to operate as land-based facilities. In addition to the Hollywood Casino Baton Rouge, Belle of Baton Rouge also faces competition from two locations in New Orleans, which is approximately 75 miles from Baton Rouge, in the form of two major riverboat casinos and one land-based casino. In addition, there are also three Native American casinos in Louisiana. The two closest Native American casinos are land-based facilities located approximately 45 miles southwest and approximately 65 miles northwest of Baton Rouge. Belle of Baton Rouge also faces competition from a racetrack located approximately 55 miles from Baton Rouge operating approximately 1,500 gaming machines. Approximately 3,000 video poker machines located in truck stops, restaurants, bars and off-track betting facilities located in certain surrounding parishes provide additional competition.

Another gaming operator, Pinnacle Entertainment ("Pinnacle") received approval from the Louisiana Gaming Control Board ("LGCB") for a third riverboat casino in Baton Rouge that was subject to a local option referendum subsequently approved by East Baton Rouge Parish voters in February 2008. In October 2008, the LGCB approved the architectural plans for Pinnacle's planned $250 million Baton Rouge casino-hotel resort, Riviere Place. Riviere Place will be located on 575 acres of land approximately eight miles southeast of downtown Baton Rouge, and is expected to have 1,300 slot machines and 50 table games. The project is currently in the design phase and construction is expected to commence in May 2010 with a projected opening in late 2011. Pinnacle has also announced plans to renovate its Boomtown New Orleans property and expand its L'Auberge du Lac property, in Lake Charles, Louisiana, adding hotel room capacity and a second riverboat casino. If the projects receive the remaining local approvals and entitlements, and if Pinnacle proceeds with the construction of the Riviere Place, it may have a material adverse effect on Belle of Baton Rouge.

Belle of Baton Rouge has relied on marketing and promotional activities to compete effectively in this market, and the Chapter 11 Cases may have a material adverse effect on these efforts going forward.

Competition in General

We own land-based and riverboat casino facilities in a number of United States casino entertainment jurisdictions. We compete with numerous casinos and casino hotels of varying quality and size in the market areas where their properties are located and with other forms of legalized gaming in the United States, including state-sponsored lotteries, racetracks, jai alai, off-track wagering, video lottery and video poker terminals and card parlors. We also compete with other non-gaming resorts and vacation areas, and with various other entertainment businesses. The casino entertainment business is characterized by competitors that vary considerably by their size, quality of facilities, number of operations, brand identities, marketing and growth strategies, financial strength and capabilities, level of amenities, management talent and geographic diversity.

In most markets, we compete directly with other casino facilities operating in the immediate and surrounding market areas. In some markets, we face competition from nearby markets in addition to direct competition within their market areas.

20

With new markets opening for development and decreased spending on leisure activities, in addition to overall economic conditions, competition in existing markets has intensified. Many casino operators have invested in expanding existing facilities, developing new facilities, and acquiring established facilities in existing markets. This expansion of existing casino entertainment properties, the increase in the number of properties and the aggressive marketing strategies of many of our competitors has increased competition in many markets in which we compete, and this intense competition is expected to continue. Our properties, on the other hand, have been largely unable to invest in the upkeep and expansion of their properties due to limitations on capital expenditures resulting from the Chapter 11 Cases. Our ability to invest in our properties going forward may continue to be constrained, and going forward we may not be able to compete effectively with casinos that have been modernized or recently expanded.

Our operating results can be adversely affected by costs associated with advertising and promotions and complimentary services to patrons, the amount and timing of which may be affected by the policies of our properties' competitors and their efforts to keep pace with them. Going forward, if our operating revenues are insufficient to allow us to match the promotions of competitors, the number of our casino patrons may decline, which may have a material adverse effect on our financial performance. In addition, some of our competitors have significantly greater financial resources than we do, and as a result we may not be able to successfully compete with them in the future.

Our ability to successfully compete is dependent upon our ability to manage our costs and develop and implement strong and effective marketing campaigns both at the individual properties and across our business and invest in, and upgrade, the facilities we own. To the extent we are unable to successfully develop and implement these types of marketing initiatives and invest in and upgrade our facilities, we may not be successful in competing in our markets, which may have a material adverse effect on our financial position.

The Slot Machine Industry in General

Slot machine revenue represents a substantial portion of our revenue. It is important that we maintain and upgrade our slot machines and systems to keep them competitive with other casinos and attractive to gaming customers. In the past, slot machine sales were dominated by International Gaming Technology ("IGT"), which commanded approximately 75% of the market. A few other companies competed for the remaining 25%. In recent years the slot machine manufacturing industry has become significantly more competitive. It is estimated that IGT is currently shipping less than 50% of all new slot machines while its floor presence in casinos has fallen from approximately 75% to 50%. Three other public gaming manufacturing companies (WMS Industries Inc., Bally Technologies, Inc. and Aristocrat Leisure Limited) have increased floor presence and have significant market share. These companies all have very competitive and successful slot offerings. In addition to these three competitors, there are other providers such as the Atronic Group, Konami Digital Entertainment, Inc., Aruze Corp. and AC Coin & Slot that develop and manufacture slot machines. Currently, we have business relationships with all the slot machine manufacturers or their sales representatives. See "Item 1A—Risk Factors—The concentration and evolution of the slot machine manufacturing industry could impose additional costs on our operations."

Trademarks