Attached files

| file | filename |

|---|---|

| EX-21 - TM Entertainment & Media, Inc. | v179137_ex21.htm |

| EX-32 - TM Entertainment & Media, Inc. | v179137_ex32.htm |

| EX-31.1 - TM Entertainment & Media, Inc. | v179137_ex31-1.htm |

| EX-31.2 - TM Entertainment & Media, Inc. | v179137_ex31-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

(mark

one)

|

||

|

OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For

the fiscal year ended December 31, 2009

OR

|

o

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d)

OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For

the transition period from __________ to __________

COMMISSION

FILE NO. 001-33746

CHINA

MEDIAEXPRESS HOLDINGS, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

DELAWARE

|

20-8951489

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

Room 2805, Central Plaza,

Wanchai Hong Kong

(Address

of principal executive offices)

+852-2827-6100

(Registrant’s telephone

number, including area code)

Securities

Registered Pursuant to Section 12(b) of the Act:

|

Common

Stock, Par Value $0.001 Per Share

|

NYSE

Amex

|

|

|

(Title

of Class)

|

(Name

of exchange on which registered)

|

Securities

Registered Pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Check

whether the issuer is not required to file reports pursuant to Section 13 or

15(d) of the Exchange Act.

Yes o No x

Check

whether the issuer (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the registrant was required to file such reports); and (2) has been subject

to such filing requirements for the past 90 days.

Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer” and “large accelerated filer” in Rule 12b-2 of the Exchange

Act.

|

Large

Accelerated Filer o

|

Accelerated

Filer x

|

Non-Accelerated

Filer o

|

Smaller

Reporting Company x

|

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes o No x

The

aggregate market value of the 10,255,000 voting and non-voting common equity

stock held by non-affiliates of the Registrant was approximately $79,476,250 as

of June 30, 2009, the last business day of the Registrant’s most recently

completed second fiscal quarter, based on the last sale price of the

registrant’s common stock on such date of $7.75 per share.

There

were a total of 32,909,845 shares of the registrant’s Common Stock, par

value $0.001 per share, outstanding as of March 9, 2010.

DOCUMENTS

INCORPORATED BY REFERENCE

(2) Portions

of the Registrant’s Proxy Statement relating to the Registrant’s 2009 Annual

Meeting of Shareholders, to be held on June 15, 2010, are incorporated by

reference into Part III of this Annual Report on Form 10-K where

indicated.

|

PART

I

|

2

|

|||

|

ITEM

1

|

Business

|

2

|

||

|

ITEM

1A.

|

Risk

Factors

|

31

|

||

|

ITEM

1B.

|

Unresolved

Staff Comments

|

52

|

||

|

ITEM

2

|

Properties

|

53

|

||

|

ITEM

3

|

Legal

Proceedings

|

53

|

||

|

ITEM

4

|

(Removed

and Reserved).

|

|||

|

PART

II

|

53

|

|||

|

ITEM

5

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and

Issuer

|

|||

|

Purchases

of Equity Securities

|

53

|

|||

|

ITEM

6

|

Selected

Financial Data

|

54

|

||

|

ITEM

7

|

Management’s

Discussion and Analysis of Financial Condition and Results

of

|

|||

|

Operations

|

54

|

|||

|

ITEM

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

68

|

||

|

ITEM

8

|

Financial

Statements and Supplementary Data

|

69

|

||

|

ITEM

9

|

Changes

in and Disagreements with Accountants on Accounting and

Financial

|

|||

|

Disclosures

|

69

|

|||

|

ITEM

9A.

|

Controls

and Procedures

|

70

|

||

|

ITEM

9B.

|

Other

Information.

|

71

|

||

|

PART

III

|

72

|

|||

|

ITEM

10

|

Directors,

Executive Officers and Corporate Governance

|

72

|

||

|

ITEM

11

|

Executive

Compensation

|

72

|

||

|

ITEM

12

|

Security

Ownership of Certain Beneficial Owners and Management and

Related

|

|

||

|

Stockholder

Matters

|

72

|

|||

|

ITEM

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

72

|

||

|

ITEM

14

|

Principal

Accountant Fees and Services

|

72

|

||

|

PART

IV

|

73

|

|||

|

ITEM

15

|

Exhibits,

Financial Statement Schedules

|

73

|

||

|

Index

to Consolidated Financial Statements

|

||||

|

Consolidated

Financial Statements

|

||||

i

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains forward-looking statements and information relating to China

MediaExpress Holdings, Inc., that are based on the beliefs of our management as

well as assumptions made by and information currently available to us. When used

in this report, the words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “plan” and similar expressions, as they relate to us or our

management, are intended to identify forward-looking statements. These

statements reflect our current view concerning future events and are subject to

risks, uncertainties and assumptions, including among many others: a general

economic downturn; a downturn in the securities markets; Securities and Exchange

Commission regulations which affect trading in the securities of “penny stocks,”

and other risks and uncertainties. Should any of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from those described in this report as anticipated,

estimated or expected. Except as required by law, we assume no obligation to

update any forward-looking statements publicly, or to update the reasons actual

results could differ materially from those anticipated in any forward-looking

statements, even if new information becomes available in the future. Important

factors that may cause actual results to differ from those projected include the

risk factors specified above. Notwithstanding the above, Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act expressly state

that the safe harbor for forward-looking statements does not apply to companies

that issue penny stock. Because we may from time to time be considered as an

issuer of penny stock, the safe harbor for forward-looking statements may not

apply to us at certain times.

All

statements other than statements of historical fact are statements that could be

deemed forward-looking statements, including statements regarding new and

existing products and opportunities; statements regarding market and industry

segment growth and demand and acceptance of new and existing products; any

projections of sales, earnings, revenue, margins or other financial items; any

statements of the plans, strategies and objectives of management for future

operations; any statements regarding future economic conditions or performance;

uncertainties related to conducting business in China; any statements of belief

or intention; any of the factors mentioned in the “Risk Factors” section of this

Form 10-K; and any statements or assumptions underlying any of the foregoing.

Also, forward-looking statements represent our estimates and assumptions only as

of the date of this report. You should read this report and the documents that

we reference in this report, or that we filed as exhibits to this report,

completely and with the understanding that our actual future results may be

materially different from what we expect.

Except as

required by law, we assume no obligation to update any forward-looking

statements publicly, or to update the reasons actual results could differ

materially from those anticipated in any forward-looking statements, even if new

information becomes available in the future.

USE

OF CERTAIN DEFINED TERMS

Except as

otherwise indicated by the context, references in this report to:

|

|

·

|

“we,”

“us,” “CME,” “the Company” or “our Company” are references to China

MediaExpress Holdings, Inc. and its

subsidiaries;

|

|

|

·

|

“China”

and “PRC” are a reference to the People’s Republic of

China;

|

|

|

·

|

“RMB”

is a reference to Renminbi, the legal currency of

China;

|

|

|

·

|

“U.S.

dollar,” “$” and “US$” are a reference to the legal currency of the United

States;

|

|

|

·

|

“SEC”

is a reference to the United States Securities and Exchange

Commission;

|

|

|

·

|

“Securities

Act” is a reference to Securities Act of 1933, as amended;

and

|

|

|

·

|

“Exchange

Act” is a reference to the Securities Exchange Act of 1934, as

amended;

|

1

PART

I

ITEM

1 Description of Business

Corporate

Structure and History

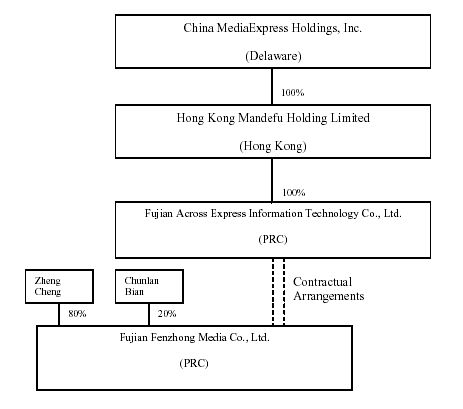

The

following diagram illustrates CME’s corporate structure as of the date of this

report:

We were

formerly a Delaware blank check company incorporated on May 1, 2007 under

the name TM Entertainment and Media, Inc. (“TM”) in order to serve as a vehicle

for the acquisition of an operating business in the entertainment, media,

digital and communications industries. On October 15, 2009, pursuant to the

terms of a Share Exchange Agreement, dated as of May 1, 2009, as amended on

September 30, 2009 (the “Share Exchange Agreement”), we acquired all of the

issued and outstanding capital stock of Hong Kong Mandefu Holding Limited (the

“HKMDF) and as a result, HKMDF became our direct wholly-owned subsidiary (the

“Transaction” or “Share Exchange). The Share Exchange represents a reverse

acquisition involving a public blank cheque company and has been accounted for

financial reporting purposes as the issuance of shares by HKMDF in exchange for

the assets and liabilities of the Company, accompanied by a

recapitalization. As a result of the Share Exchange, HKMDF is

the continuing entity for financial reporting purposes, and is deemed to be the

accounting acquirer. Accordingly, the accompanying consolidated

financial information of the Company prior to the Share Exchange reflects the

results, assets and liabilities of HKMDF whereas the assets and liabilities are

recorded at their carrying amounts. In addition, HKMDF’s shares and earnings per

share have been restated retroactively to reflect the share exchange ratio as at

the date of the Share Exchange in a manner similar to a

recapitalization.

2

HKMDF,

through contractual arrangements with Fujian Fenzhong Media Co., Ltd (the

“Fujian Fenzhong”), an entity majority owned by HKMDF’s former majority

shareholder, operates the largest television advertising network on inter-city

express buses in China. While HKMDF has no direct equity ownership in

Fujian Fenzhong, through the contractual agreements HKMDF receives the economic

benefits of Fujian Fenzhong’s operations.

Pursuant

to the Share Exchange Agreement, TM purchased 100% of the outstanding equity of

HKMDF and issued 20.915 million newly issued shares of common stock and

paid $10.0 million in three year, no interest promissory notes. Such

promissory notes were settled subsequent to December 31, 2009. In addition, the

former shareholders of HKMDF may earn up to an additional 15.0 million shares of

common stock subject to the achievement of the following net income targets for

2009, 2010 and 2011:

|

Year

|

Net

Income (RMB)

|

Net

Income (US$)(1)

|

Shares

|

|||

|

2009

|

287.0

million

|

$42.0

million

|

1.0

million

|

|||

|

2010

|

570.0

million

|

$83.5

million

|

7.0

million

|

|||

|

2011(2)

|

889.0

million

|

$130.2

million

|

7.0

million

|

|

(1)

|

Based

on current exchange rate of 6.83

RMB/US$.

|

|

(2)

|

If

CME’s adjusted net income for 2009, 2010 or 2011 does not equal or exceed

the targeted net income threshold for such fiscal year, the earn-out

shares in respect of such fiscal year will not be issued; provided,

however, that if CME’s adjusted net income in the fiscal year immediately

succeeding such non-achieving fiscal year exceeds the sum of (i) the

targeted net income threshold for such immediately succeeding fiscal year

(which, for the fiscal year ending December 31, 2012, the targeted net

income threshold shall be RMB1,155,700,000 ($169.2 million)) and (ii) the

shortfall amount for the non-achieving fiscal year, then the earn-out

shares in respect of such non-achieving fiscal year will be

issued.

|

In

addition, the Share Exchange Agreement required that a portion of the proceeds

received by CME upon the exercise of outstanding public warrants be paid to the

former shareholders of HKMDF up to a total of $20.9 million.

In

connection with the approval of the Transaction at the October 15, 2009 Special

Meeting of Stockholders of TM, we changed our name to “China MediaExpress

Holdings, Inc.”

Business

Summary

Overview

CME,

through contractual arrangements with Fujian Fenzhong, an entity majority owned

by CME’s majority shareholder, operates the largest television advertising

network on inter-city express buses in China. All references in this Report to

“CME’s advertising network”, “CME’s customers”, CME’s operations in general and

similar connotations, refer to Fujian Fenzhong, an entity which is controlled by

CME through contractual agreements and which operates the advertising network.

While CME has no direct equity ownership in Fujian Fenzhong, through the

contractual agreements CME controls the activities and receives the economic

benefits of Fujian Fenzhong’s operations. CME generates revenue by

selling advertising on its network of television displays installed on

inter-city express buses in China. As of July 31, 2008, CME’s advertising

network accounted for 81% of all inter-city express buses installed with hard

disk drive players, and 55% of all inter-city express buses installed with any

type of television display, according to CTR Market Research. CME commenced its

advertising services business in November 2003 as one of the first participants

in advertising on inter-city express buses in China. CME believes its early

entry into this business has enabled them to achieve an audience reach that is

highly attractive to advertisers.

3

CME’s

extensive and growing network covers inter-city express bus services originating

in China’s most prosperous regions. As of December 31, 2009, CME’s network

covered inter-city express bus services originating in fourteen regions,

including the five municipalities of Beijing, Shanghai, Guangzhou, Tianjin and

Chongqing and nine economically prosperous provinces, namely Guangdong, Jiangsu,

Fujian, Sichuan, Hubei, Anhui, Hebei, Shandong and Shanxi. These fourteen

regions in aggregate generated more than half of China’s gross domestic product,

or GDP, in 2007, according to the National Bureau of Statistics of China. CME’s

network is capable of reaching a substantial and growing audience. In the first

seven months of 2008, a monthly average of 53 million passengers traveled

on inter-city express buses within CME’s network, representing 57% of all

passengers traveling on inter-city express buses installed with television

displays in China, according to CTR Market Research. Many of the

cities connected in CME’s network are major transportation hubs, which serve as

points of transfer for large numbers of leisure, business and other travelers in

China to other modes of transportation. CME’s network also includes airport

buses connecting major cities to airports and tour buses traveling on routes

that connect major cities with popular tourist destinations in China. As of

December 31, 2009, CME’s network covered all of the transportation hubs

designated by the Ministry of Transport, and CME expects to further increase

this percentage as it continues to expand the geographic coverage of its

network. In addition to major transportation hubs, the network also covers small

to medium-sized cities in China, some of which rely on highway transportation as

the primary transportation option for connection outside these

cities.

CME has

entered into long-term framework agreements with 45 bus operator partners for

terms ranging from five to eight years. Pursuant to these agreements, CME pays

the bus operators concession fees for the right to install its displays and

automated control systems inside their buses and display entertainment content

and advertisements. CME’s entertainment content is provided by third parties and

advertisements provided by its clients. CME obtains a wide range of free

entertainment content from Fujian SouthEastern Television Channel and Hunan

Satellite Television each month and purchases a limited amount of copyrighted

programs from the Audio and Video Publishing House of Fujian Province. As of

December 31, 2009, the number of inter-city express buses within CME’s network

is 20,161.

In

October 2007, CME entered into a five-year cooperation agreement with Transport

Television and Audio-Video Center, or TTAVC, an entity affiliated with the

Ministry of Transport of the People’s Republic of China, to be the sole

strategic alliance partner in the establishment of a nationwide in-vehicle

television system that displays copyrighted programs on buses traveling on

highways in China. The cooperation agreement also gave CME exclusive rights to

display advertisements on the system. In November 2007, TTAVC issued a notice

regarding the facilitation of implementation of the system contemplated under

the cooperation agreement to municipalities, provinces and transportation

enterprises in China. CME believes its status as the sole strategic alliance

partner designated by TTAVC and the exclusive rights to display advertisements

on the system has facilitated its historical expansion and is expected to

continue to provide them with a competitive advantage in the

future.

CME

believes its network is a highly effective advertising medium. The network is

capable of reaching audiences on inter-city express buses while they remain in a

comfortable and enclosed environment with minimal distraction. The majority of

the inter-city express buses within the network are equipped with leather seats

and air-conditioning, providing a comfortable environment which makes the

audiences more receptive to the content displayed on CME’s network. Inter- city

travel in China typically takes a number of hours. Audiences are therefore

exposed to the content displayed on its advertising platform for a significantly

longer period of time than on shorter-distance travel. In addition, CME’s

patented automated control systems ensure that the programs and advertisements

are displayed continuously throughout the journey.

CME has

grown significantly since it commenced its advertising services business in

November 2003. During the year ended December 31, 2009, more than 450

advertisers had purchased advertising time on CME’s network either through

advertising agents or directly from CME. Some of these clients have purchased

advertising time from CME for more than three years, including Hitachi, China

Telecom, Toyota, Siemens and China Pacific Life Insurance. CME has attracted

several well-known international and national brands to its advertising network,

including Coca Cola, Pepsi, Wahaha, KFC, Siemens, Hitachi, Haier, China Telecom,

China Mobile, Nokia, China Post, Procter & Gamble, Bank of China, China

Constructing Bank and China Pacific Life Insurance. While CME is unable to

determine the exact dollar amount paid by these individual advertisers who

purchase advertising through third party agencies, CME is able to determine,

based on the number of ads run for these advertisers, that these advertisers

comprise a significant portion the advertising on CME’s network. For the years

ended December 31, 2007, 2008 and 2009, CME generated total net revenue of

$25.8 million, $63.0 million and $95.9 million, respectively. During

the same periods, CME had net income of $7.0 million, $26.4 million

and $41.7 million, respectively.

4

Recent

Developments

On

December 29, 2009, the Company announced the redemption

of all the outstanding common share purchase warrants issued in the public

offering of TMI. In accordance with the Warrant Agreement governing

the warrants, the Company was entitled to redeem the public warrants because the

last sales price of its common shares was $11.50 or more for at least 20 trading

days within the 30 trading day period ending on December 23, 2009, and because

there was a current and effective registration statement covering the common

shares underlying the warrants. At the time of the notice, there were

8,355,000 public warrants issued and outstanding. Each warrant

entitled the holder to purchase from CME one share of the Company’s common stock

at an exercise price of $5.50.

On

January 12, 2010, Starr Cayman Investments II, LP (“Starr”), the Company and

certain subsidiaries and stockholders of the Company entered into a Securities

Purchase Agreement (the “Purchase Agreement”), pursuant to which Starr acquired

shares of Series A Convertible Preferred Stock (the “Preferred Stock”) and

warrants to purchase shares of common stock for an aggregate purchase price of

$30 million at a closing that occurred on January 28, 2010 (the

“Closing”). Concurrently, certain stockholders of the Company

transferred 150,000 shares of common stock to Starr for no additional cash

consideration. The warrants entitle the holder thereof to purchase up

to 1,545,455 shares of the Company’s Common Stock at an exercise price of $6.47

per share at any time and from time to time prior to January 28,

2015. Until 6 months after the Closing, Starr is not permitted to

transfer or otherwise dispose of its interest in the Preferred Stock, warrants

or such 150,000 shares of common stock or in any shares of common stock issued

upon conversion of the Preferred Stock or exercise of such warrants (other than

to certain permitted transferees or pursuant to certain other customary

exceptions).

So long

as Starr beneficially owns at least 3% of the Company’s Common Stock on a

fully-diluted and as-converted basis, the holders of at least a majority of the

shares of Series A Preferred Stock outstanding will be entitled to designate one

individual (the “Preferred Director”) to the Company’s board of directors (the

“Board”). For so long as Starr is entitled to designate the Preferred

Director, Starr will also have the right to appoint one director to each of the

boards of directors of certain subsidiaries of the

Company.

In

addition, for so long as Starr owns at least 3% of the Company’s Common Stock on

a fully-diluted and as-converted basis, the affirmative vote or consent of the

holders of at least a majority of the shares of Preferred Stock then outstanding

is necessary for effecting: (i) any amendment of the Certificate of

Incorporation or Certificate of Designations or Bylaws of the Company or any

subsidiary in a manner adverse to the rights, preferences or privileges of the

holders of the Series A Preferred Stock; (ii) increase or decrease the total

number of authorized shares of Series A Preferred Stock; or (iii) any material

amendment of the agreements pursuant to which the Company controls its operating

entities in the People’s Republic of China (“PRC”).

Each

Series A Preferred Stock is convertible into a number of shares of the Company’s

Common Stock in an amount equal to $30 divided by the then applicable conversion

price. The initial conversion price is $10 per share and is subject

to customary anti-dilution adjustments for issuances of shares of Common Stock

as a dividend or distribution on shares of the Common Stock. In

addition, each share of the Series A Preferred Stock shall be subject to

mandatory conversion at the then applicable conversion price into shares of

Common Stock upon the earliest to occur of the following: (i) the closing price

of the Company’s Common Stock is greater than or equal to $25 per share for a

period of 20 consecutive trading days over any 30 trading day period, (ii) the

Company’s market capitalization equals or exceeds $1.2 billion, or (iii) January

28, 2014.

The

holders of the Series A Preferred Stock are entitled to vote with the holders of

shares of Common Stock on all matters submitted to a vote of the stockholders of

the Company. The holders of the Series A Preferred Stock will be

entitled to the same number of votes as the number of shares of Common Stock

that the Series A Preferred Stock are then convertible into, subject to a cap

mandated by the closing price of the Common Stock on NYSE Amex LLC on January

12, 2010.

In

addition, for so long as Starr owns at least 3% of the Company’s Common Stock on

a fully-diluted and as-converted basis, Starr will have the right to purchase a

pro rata portion of any additional shares of capital stock proposed to be issued

by the Company, and will have the right to join certain stockholders in their

sale of capital stock of the Company on a pro rata basis, in each case in

proportion to Starr’s then current percentage of ownership of the issued and

outstanding shares of Common Stock, on a fully diluted, as-converted

basis. As long as Starr owns at least 3% of the issued and

outstanding shares of Common Stock, on a fully diluted, as-converted basis, it

will also have the right to require certain stockholders to purchase its

Preferred Stock and the Common Stock held by Starr or issued upon the conversion

of Preferred Stock or exercise of the Purchased Warrants upon the occurrence of

the Company’s failure to achieve audited consolidated net profits (“ACNP”) for

2009, 2010 or 2011 are less than $42 million, $55 million and $70 million,

respectively (each, a “Profits Target”) or to fulfill certain of its obligations

under the Purchase Agreement. The Performance Adjustment Amount

payable in any of 2009, 2010 or 2011 will be a fraction of $343,462,957 which is

proportionate to the amount by which the Company’s ACNP in such year falls short

of the then applicable Profits Target. The Performance Adjustment Amounts will

be payable in cash or stock, but only to the extent such stock, together with

the shares of Common Stock acquired or acquirable as a result of Starr’s

ownership of the Preferred Stock, the Purchased Warrants and the Transferred

Shares, will not exceed 19.9% of the total number of shares of Common Stock of

the Company issued and outstanding as of the date of the Purchase

Agreement. In the event that the stockholders subject to the

obligation to purchase Starr’s shares under the put right or to obligations

under the performance-based adjustment provisions do not comply therewith, Starr

will have the right to require such stockholders to sell up to all of the

Companys’ capital stock directly or indirectly held by them to a third party

pursuant to a managed sale process.

5

After the

Closing, the Company is obligated to, among other things, (i) within 3 months

effect the transfer of certain of the assets held in the PRC to other companies

controlled by it in the PRC and enter into licensing arrangements with respect

thereto, (ii) within 3 months amend the terms of the agreements pursuant to

which it controls its operating entities in the PRC to the reasonable

satisfaction of Starr, (iii) seek approval from the State Administration for

Radio and Television for the broadcasting of certain video programming not later

than December 31, 2010 and (iv) implement a program regarding compliance with

the US Foreign Corrupt Practices Act not later than April 30, 2010.

On

January 29, 2010, CME completed the redemption of its publicly-held warrants and

its publicly traded warrants and units ceased trading on the NYSE

Amex. Prior to the Redemption Date, a total of 8,659, 907 warrants

were exercised, or approximately 99.68% of all warrants held by the

public. The remaining 27,718 warrants were extinguished at redemption

and the holders of those warrants were paid the sum of $0.01 per

warrant. CME received total proceeds from all warrant exercises of

approximately $47 million, of which $20.9 million was paid to the former

shareholders of HKMDF in accordance with the terms of the Share Exchange

Agreement.

Corporate

Information

CME’s

principal executive offices are located at Room 2805, Central Plaza, Wanchai

Hong Kong. CME’s telephone number at this address is

(852) 2827-6100.

Industry

Advertising

on inter-city express buses represents a new and emerging segment of the

advertising market in China. CME believes the growth in demand for advertising

and continued development of the express bus sector in China will continue to

drive the growth of inter-city express bus advertising.

The

Advertising Market in China

One

of the Largest and Fastest Growing Advertising Markets

China has

the largest advertising market in Asia, excluding Japan, and is the fifth

largest advertising market in the world in 2007 by media expenditure. According

to ZenithOptimedia, advertising spending in China in 2007 was approximately

$15.4 billion, accounting for 15.6% of the total advertising spending in

the Asia-Pacific region. ZenithOptimedia also projected that the advertising

market in China will be one of the fastest growing advertising markets in the

world, at a CAGR of 12.8% from 2007 to 2011. By 2011, China is projected to

account for 19.6% of the total advertising spending in the Asia-Pacific

region.

The

growth of China’s advertising market is driven by a number of factors, including

the rapid and sustained economic growth and increases in disposable income and

consumption in China.

CME

believes the advertising market in China has significant potential for future

growth due to relatively low levels of advertising spending per capita and as a

percentage of GDP compared to more developed countries or regions.

The

following table sets forth the advertising spending per capita and as a

percentage of GDP in 2007 in China compared to more developed countries or

regions:

|

Advertising

Spending in 2007

|

||||||||

|

Per

Capita (US$)

|

As

a % of GDP

|

|||||||

|

China

|

$ | 11.62 | 0.5 | % | ||||

|

Hong

Kong

|

438.63 | 1.5 | % | |||||

|

South

Korea

|

206.71 | 1.0 | % | |||||

|

Japan

|

320.76 | 0.9 | % | |||||

|

Asia

Pacific (weighted average)

|

29.98 | 0.8 | % | |||||

|

United

States

|

586.11 | 1.3 | % | |||||

|

United

Kingdom

|

419.79 | 0.9 | % | |||||

Source:

ZenithOptimedia (December, 2008)

6

Advertising

Spending Driven by Rapid Growth in GDP and Disposable Income

The

growth of China’s advertising market is driven by a number of factors, including

the rapid and sustained growth of China’s GDP and increases in disposable income

and consumption of urban residents in China. According to the National Bureau of

Statistics of China, China was the third largest economy in the world in 2008

with a GDP of RMB30.1 trillion, which amounted to US$4.4 trillion. In

addition, the annual disposable income per capita in urban households increased

from RMB7,703 in 2002 to RMB15,781 in 2008, representing a CAGR of

12.7%.

Increasing

Significance of New Out-Of-Home Advertising Medium

The

advertising market in China can generally be divided into television, newspaper,

radio, magazine, Internet, cinema and out-of-home advertising media. Out-of-home

advertising is the third largest advertising medium in China after television

and newspapers, accounting for 16.7% of total advertising spending in 2007,

according to ZenithOptimedia. The percentage is larger than that of Europe, the

United States and some other countries in Asia Pacific. Total advertising

spending on out-of-home media in China was $2.6 billion in 2007, and is

projected to grow to $5.0 billion in 2011, representing a CAGR of 18.0%

from 2007 to 2011.

CME

believes out-of-home advertising networks are gaining increasing acceptance in

China. Out-of-home advertising networks offer advertisers alternative new media

to reach audiences more effectively and supplement traditional advertising media

such as television, magazine and radio, which may have more limited geographic

coverage. Moreover, due to the high cost of advertising on traditional

advertising media, in particular, during peak hours on television, out-of-home

advertising offers advertisers a more cost effective alternative.

Express

Bus Travel in China

The

overall economic growth and development of highway systems in China have

resulted in increased leisure and business travel among cities in China through

highways. According to the National Bureau of Statistics, the total number of

passengers traveling on highways reached 22.1 billion in 2008, representing

a 7.6% growth from 2007.

Express

bus travel is a primary means of transportation in China due to various reasons,

including the more comprehensive coverage of highway networks compared to other

modes of transportation and relatively low private vehicle ownership in China.

Many cities in China are highly dependent on highway transportation and many

small and medium-sized cities in China rely on highways as the primary means of

transportation outside cities and towns. Inter-city buses on highways also offer

the advantages of lower cost, higher frequency and point-to-point convenience

relative to rail and air travel, an additional factor which explains the

prevalence and continued growth of this mode of inter-city transportation.

According to the Ministry of Transport, as of July 31, 2008, there were

over 43,000 inter-city express buses with a seating capacity of more than

27 passengers in China. The average monthly passenger traffic on inter-city

express buses totaled over 158 million in the seven months ended

July 31, 2008. In addition to its large size and continued growth, the

express bus market is highly fragmented, with a large number of small-scale

operators operating services primarily within certain provinces or regions. At

present, there are few large operators with nationwide networks.

China

intends to outlay significant expenditures on highway infrastructure

construction to promote balanced development in urban and rural areas in China.

CME believes the sustained economic growth and a more comprehensive, efficient

and convenient highway system will continue to drive express bus travel in

China.

Advertising

on Inter-City Express Buses in China

Advertising

on inter-city express buses represents a new and emerging segment of the

advertising market in China, and can be considered part of the out-of-home

advertising market. Given the high fragmentation of the express bus market, few

bus operators possess the scale to operate a sizable advertising services

business by themselves. The large advertising network operators on inter-city

express buses therefore tend to be independent advertising companies who have

entered into concession agreements with numerous bus operators to display

advertising inside their buses. The advertising market on inter-city express

buses is itself also highly fragmented, with only a few large players known to

possess significant market share in China. According to the Ministry of

Transport, as at July 31, 2008, over 90,000 television displays were

installed on inter-city express buses in China. Out of these, over 37,000

television displays utilized hard disk drive players, and the remainder used DVD

players, CF cards and other audio-visual technologies. CME believes hard disk

drives represent the most effective technology at present to operate television

advertising on inter-city express buses.

7

As an

advertising medium, CME believes advertising on inter-city express buses

possesses the following characteristics:

|

|

·

|

Effective audience

reach. The large number of passengers on inter-city

express buses in China provide advertisers with a large and growing target

audience. The displays installed on inter-city express buses are often the

only form of media provided in such environments. Passengers are more

willing to watch the programs on the displays and the accompanying

advertisements.

|

|

|

·

|

Cost

effectiveness. Advertising placed on inter-city express

buses, where a large number of people congregate, can reach consumers at a

lower cost than most other traditional media advertising, such as on

television at home.

|

|

|

·

|

Attractive target

demographics. Most of the passengers traveling on

inter-city express buses belong to China’s emerging middle class, with

higher than average income and purchasing power. Many of the passengers

are business travelers, including distributors who own their businesses in

small- and medium-sized cities and frequently travel to larger cities to

engage in wholesale procurement and trading. These passengers have strong

purchasing and decision-making power for their businesses, presenting

wholesale and long-term business opportunities to advertisers in addition

to retail sales. The volume and the quality of such target audience are

attractive to advertisers for the promotion of their products and

services.

|

|

|

·

|

Increasing

acceptance. CME believes that television advertising

networks on inter-city express buses have gained increasing acceptance

among three major groups: express bus operators, highway travelers and

advertisers. CME believes many express bus operators have chosen to

partner with digital media companies to reduce their operational costs,

and improve the overall passenger experience. Digital media networks

provide passengers with informative and entertaining content or otherwise

provide an outlet to fill idle time, which may help to enhance the overall

passenger experience and add value to the services provided by express bus

operators. CME believes advertisers have increasingly chosen digital media

advertising on inter-city express buses due to their high receptivity

among passengers and ability to reach large audiences with favorable

demographics in a cost effective

manner.

|

Competitive

Strengths

The

largest television advertising network on inter-city express buses with an early

entrant advantage in China

CME

believes it operates the largest television advertising network on inter-city

express buses in China. According to CTR Market Research, as of July 31,

2008, CME’s advertising network accounted for 81% of all inter-city express

buses installed with hard disk drive players and 55% of all inter-city express

buses installed with any type of television display. In the first seven months

of 2008, a monthly average of over 53 million passengers traveled on

inter-city express buses within CME’s network, representing 85% and 57%,

respectively, of the passenger traffic on inter-city express buses installed

with hard disk drive players and with any type of television display,

respectively. CME believes its large-scale network capable of reaching a

sizeable audience traveling within economically prosperous regions in China

presents an attractive proposition to advertisers.

The

ability to maintain and enhance CME’s leading market position

CME

believes it has the following competitive strengths that would allow it to

maintain and enhance its position as the largest television advertising network

on inter-city express buses in China:

|

|

·

|

Early entrant

advantage. CME commenced its advertising services

business in November 2003 and was amongst the first companies to engage in

digital television advertising on inter-city express buses in China. CME

rapidly established a sizeable nationwide network, occupying a significant

market share. CME’s early entry into the

market

has also enabled it to accumulate a significant amount of knowledge and

experience in this nascent segment of the advertising

industry.

|

8

|

|

·

|

Long-term agreements with a

large number of bus operators. CME has entered into

long-term framework agreements with a large number of bus operators,

enabling it to occupy a significant market share and to create significant

entry barriers for potential competitors. CME has entered into long-term

framework agreements with 40 inter-city express bus operators for terms

ranging from five to eight years. As of July 31, 2008, the number of buses

within CME’s network accounted for 81% of all inter-city express buses

installed with hard disk drive players and 55% of all inter-city express

buses installed with any type of television display, according to CTR

Market Research.

|

|

|

·

|

Scale of

operations. CME believes it has achieved the scale of

operations that is not only attractive to advertisers but also allow it to

capitalize on cost synergies. CME’s network with over 16,000 inter-city

express buses covers all four municipalities and seven economically

prosperous provinces in China. The large number of inter-city express

buses in CME’s network in economically prosperous regions in China has

enabled it to attract a significant number of clients. During 2009, more

than 450 advertisers directly or indirectly purchased advertising time on

CME’s network.

|

|

|

·

|

The sole strategic partner

designated by an entity affiliated with the Ministry of

Transport. In October 2007, CME entered into a five-year

cooperation agreement with an entity affiliated with the Ministry of

Transport of the People’s Republic of China to be the sole strategic

partner in the establishment of a nationwide in-vehicle television system

displaying copyrighted programs on buses traveling on highways in China.

The cooperation agreement gave CME exclusive rights to display

advertisements on the system. In November 2007, this entity issued a

notice regarding the facilitation of implementation of the system

contemplated under the cooperation agreement to municipalities, provinces

and transportation enterprises in

China.

|

A

highly effective and efficient advertising network

CME

believes its network is a highly effective and efficient. According to a survey

conducted by CTR Market Research in July 2008 on bus services originating in

eight major cities, on average, 81% of all passengers said they had watched the

television displays on CME’s network, and almost 80% said they regularly watched

the displays on the network. CME believes the effectiveness of its advertising

network is demonstrated by the following characteristics:

|

|

·

|

Enclosed and comfortable

environment with minimal distraction. The majority of

the inter-city express buses within CME’s network are equipped with

leather seats and air-conditioning, providing a comfortable environment

which makes the audiences more receptive to the content displayed.

Passengers are required by law to be seated during journeys on

expressways, thereby enabling passengers to view the content displayed on

CME’s network with little view

obstruction.

|

|

|

·

|

Inter-city travel increases

length of exposure. Inter-city travel in China typically

takes a number of hours. Audiences are therefore exposed to the content

displayed on CME’s network for a significantly longer period of time than

on shorter-distance travel. According to a survey conducted by CTR Market

Research in July 2008 on bus services originating in eight major cities,

the average duration of a journey on buses within CME’s network took two

and a half hours. As CME displays advertisements in ten-minute blocks

after every 30 minutes of entertainment content, the audiences can

potentially view the same advertisement up to three times per journey. CME

believes repeated exposure to the same advertisement significantly

increases its effectiveness.

|

|

|

·

|

CME’s patented automated

control systems ensure uninterrupted display. CME’s

patented automated control systems are designed to ensure the automatic

initiation of the entertainment content and advertisements on the displays

whenever the driver opens the doors of the buses, and ensure continuous

display throughout the journey. This prevents interruption due to actions

of bus drivers or passengers during the

journey.

|

9

The

audience reach of CME’s network

CME

believes its network allows its clients to launch campaigns for both products

with mass appeal as well as campaigns targeting specific geographies and

audience profiles. Clients who wish to promote widely consumed products such as

food and beverage are able to reach a large number of passengers through CME’s

network. Clients wishing to promote luxury or high-end products and services may

focus their advertising on airport shuttle buses, or in selected municipalities

and provinces with more affluent travelers.

In

addition, CME believes many advertisers are drawn to its network because of the

penetration of small to medium-sized cities in China. Due to the penetration of

CME’s network, advertisers are able to target wholesalers and distributors in

small to medium-sized cities who travel frequently to larger cities to engage in

wholesale procurement and trading. Many wholesalers and distributors rely on

inter-city express buses as their primary means of transportation between

cities. The ability to target such distributors further enhances the appeal of

CME’s advertising network.

CME

believes that the effectiveness and extensive coverage of its network will

continue to allow it to maintain its existing clients, enhance client loyalty

and attract new clients.

A

highly price competitive advertising medium

The CPM,

or cost of reaching a thousand viewers, of advertising on CME’s network is

significantly lower than that of other advertising media, including local

television channels and other out-of-home advertising media. According to CTR

Market Research, as of July 31, 2008, the CPM for every 15 seconds of

advertising on CME’s network in eight major cities represented only a small

fraction of the CPM for advertising on local television channels in those

cities. CME believes the low CPM of advertising on its network presents a highly

compelling proposition to advertisers, and presents potential room for future

increases in its rates.

|

City

|

CPM

of Advertising on CME’s Network

|

CPM

of Advertising on Local Television Channels

|

||||||

|

(In

RMB for every 15 seconds)

|

||||||||

|

Shanghai

|

3.61 | 140 | ||||||

|

Guangzhou

|

3.22 | 114 | ||||||

|

Xiamen

|

3.06 | 255 | ||||||

|

Fuzhou

|

2.61 | 268 | ||||||

|

Nanjing

|

2.58 | 153 | ||||||

|

Changzhou

|

2.58 | 317 | ||||||

|

Tianjin

|

2.56 | 59 | ||||||

|

Beijing

|

2.14 | 133 | ||||||

Source:

CTR Market Research as of July 31, 2008

Strong

Value Proposition

CME

believes its success has resulted from its strong value proposition to various

parties involved in its business, including its clients, the inter-city express

bus operators participating in its network, and the content providers of

entertainment programs. CME provides its clients with an alternative advertising

medium that it believes is more effective and price competitive than other

advertising media. In addition, CME provide its bus operator partners with a

source of incremental revenue from concession fees, and a source of

entertainment for their passengers which enhances their service, without the

need for them to invest in and incur ongoing costs of operating the displays.

Moreover, CME’s extensive network in China offers its content providers an

alternative channel to effectively promote their brand to a wider audience

otherwise more difficult or expensive to reach through conventional distribution

channels. CME believes its strong value proposition to various parties involved

in its business will enable it to sustain its long-term business

growth.

10

Strong

Management Team with Extensive Experience

CME has

an experienced management team. In particular, Zheng Cheng, its founder,

chairman and chief executive officer has over ten years’ experience in business

management. He demonstrated his entrepreneurship and business leadership by

starting up CME’s business in November 2003 and having successfully grown CME’s

business to become the largest digital television advertising network operator

on inter-city express buses in China with a strong client base and significant

financial growth in less than five years. He also secured CME’s status as the

sole strategic alliance partner of TTAVC and initiated the invention,

application and registration of patent protection for its automated control

systems. In order to successfully manage and expand CME’s business in an

efficient and cost effective manner, he exerted significant efforts in the

refinement of its management system and business process. Fujian Fenzhong

received recognition in December, 2007 by the China Advertising Association, an

independent industry association, as a first-class media advertising enterprise

in China. CME believes its certification demonstrates its ability to pass

stringent evaluation standards, including its scale of operation, quality of

human resources, quality of services and influence in the industry. In addition,

on January 17, 2008, Fujian Fenzhong received ISO 9001:2000 certification

according to the standards of China National Accreditation Service and

International Accreditation Forum. CME believes such ISO certification

demonstrates its ability to meet international standards in its management

system. In addition to Mr. Cheng, CME’s management’s team includes Jacky

Wai Kei Lam, its Chief Financial Officer, Jian Yu, its Chief Operating Officer,

Jinlong Du, its Chief Marketing Officer, Biaoxing Chen, its

Chief Technology Officer, Weisheng Liu, its Chief Administration Officer

and Zhuofeng Zheng, its financial controller. CME believes a well

established management system allows it to operate its business to the

satisfaction of clients in an efficient and cost effective manner.

CME

Strategies

CME’s

objectives are to strengthen its position as the largest digital television

advertising network on inter-city express buses in China and continue to achieve

rapid growth. CME intends to achieve these objectives by implementing the

following strategies:

Expand

the Coverage and Penetration of its Advertising Network on Inter-City Express

Buses

CME

intends to expand the coverage and penetration of its out-of-home digital

televisions advertising network on inter-city express buses to further grow its

revenue. CME intends to achieve this through the following means:

|

|

·

|

Increase the number of

inter-city express buses within its network. CME intends

to enter into new long-term framework agreements with other express bus

operators not already participating in its advertising network. Such

efforts would enable CME to have a more comprehensive coverage and deeper

penetration into small and medium-sized cities in

China.

|

|

|

·

|

Expand the geographic converge

of its network. CME intends to expand into new regions

to increase the geographic coverage of its network. For example, CME

expects to enter into new provinces and regions in the future, including

Shandong, Zhejiang, Hunan, Heilongjiang, Jilin, Liaoning, Yunnan, Guangxi,

Shanxi. To further increase the penetration of its network, CME intends to

increase the coverage of its advertising network to county level cities in

various provinces in China highly dependent on highway transportation for

connection outside these cities. CME believes the breadth and penetration

of its advertising network with nationwide coverage would provide its

clients with a wider and more diverse distribution network for their

advertisements.

|

|

|

·

|

Increase coverage of routes

connecting prosperous coastal cities. CME intends to

expand the fleet of inter-city express buses traveling in economically

prosperous coastal cities and provinces, including those traveling to and

from airports and tour buses, to enhance the reach of its network to more

affluent and business travelers with strong purchasing

power.

|

11

Broaden

Revenue Sources

CME aims

to seek to broaden its revenue sources to further augment its potential revenue

growth through providing additional advertising channels to advertisers and new

services to passengers:

|

|

·

|

Separately package advertising

time slots on airport shuttle buses, tour buses and buses servicing the

commute between supermarkets and residential communities for sale to its

clients. CME intends to separate advertising time slots

on buses based on the purpose of travels for sale to its clients. This

will enable advertisers to effectively target more specific audience

profiles. For example, advertisers who wish to promote luxury and high-end

products and services may focus their advertisings on airport shuttle

buses, or in selected municipalities and provinces with more affluent

travelers. To further increase the number of airport shuttle buses

carrying its network, CME intends to enter into contracts with bus

operators that connect Beijing, Tianjin and Xiamen with the airports

servicing these metropolitan areas. Advertisers in the hotel, dining and

travel and leisure industries are able to purchase advertising time slots

on tour buses carrying CME’s network. Advertisers with their products for

sale on supermarket shelves are able to purchase advertising time slots on

buses that service the commute between supermarkets and residential

communities. CME believes the development of these separate networks would

enable it to broaden its revenue sources and generate incremental

revenue.

|

|

|

·

|

Generate revenue from the

display of soft advertisements packaged as entertainment

content. CME seeks to generate revenue from displaying

entertainment programs which are effectively soft advertisements, for a

variety of products and services. Examples of such advertisements include

travel programs featuring hotels, restaurants and tourist destinations,

and fashion shows featuring lines of clothing being the subject of

promotion.

|

|

|

·

|

Establish stationary

advertising media. CME intends to establish stationary

advertising media at inter-city express bus terminals to complement its

business. These include digital billboards or liquid emitting diodes, or

LEDs, installed at bus terminals to target passengers during their waiting

time. CME expects this expansion would increase the value of its network

by increasing the size of the audience reachable and by extending the

exposure for advertisers. In addition to providing an additional source of

revenue, CME believes this initiative would increase demand for its

services and enable it to charge higher

rates.

|

|

|

·

|

Offer new services to

advertisers and passengers. CME intends to feature

hotels, spa resorts, local restaurants on its network while displaying the

logo, telephone numbers and other contact information of relevant service

providers and charge advertising fees. In addition, CME plans to handle

bookings through call centers or short messages for the convenience of

passengers who are attracted to relevant services featured on its network.

CME plans to share revenue resulting from bookings through call centers or

short messages with relevant service providers participating in its

value-added service programs. CME may also seek to provide drinks

sponsored by advertisers or offer other merchandise for sale on the

inter-city express buses carrying its

network.

|

Increase

CME’s Average Advertising Rates

CME aims

to maximize its average advertising rates through the following

means:

|

|

·

|

Sell first few minutes of the

advertising time slots at higher rates. Advertisers

generally consider the first few minutes of each advertising time slot to

be more effective than the remaining few minutes toward the end of the

advertising time slot. As a result, CME intends to separately package the

first few minutes of each advertising time slot for sale at a higher

price, which CME believes would increase its average advertising

rates.

|

|

|

·

|

Expand the coverage and

penetration of its advertising network. CME believes

expanded coverage and penetration of its advertising network would

increase the effectiveness and attractiveness of its network to

advertisers, thereby enabling it to increase its average advertising

rates.

|

|

|

·

|

Capture increased advertising

spending on its advertising network from its

clients. CME intends to compete for a larger portion of

its clients’ advertising budget relative to other media. CME believes

increased demand for advertising time on its network will enable it to

charge higher average advertising rates. CME’s network is capable of

reaching a large audience in transit who are otherwise more difficult or

expensive to reach through conventional media. Currently, the CPM of

advertising on CME’s network is significantly lower than that in other

advertising media, including both traditional and new out-of-home media.

Compared to other out-of-home advertising networks with coverage limited

to buildings, airplanes, airports or public transportation of a particular

city, CME’s network has a wider geographic coverage with lower CPM. In

light of the characteristics of its advertising network, CME believes it

will be able to capture an increasingly larger portion of its clients’

advertising budgets while charging higher advertising rates, as the

acceptance of its advertising medium continues to

grow.

|

12

|

|

·

|

Enhance the effectiveness of

its advertising network. CME intends to continue to

improve the environment in inter-city express buses by installing

additional digital television displays on each bus and offering a wider

range of content attractive to the target audience. CME believes such

enhancements will make its advertising network more effective and

attractive to advertisers and advertising

agencies.

|

|

|

·

|

Attract national and

international brand name advertisers to purchase its advertising

time. CME believes the effectiveness of its network

would continue to attract more international and national brand name

advertisers to purchase advertising time slots from it through advertising

agencies or directly. CME believes increased demand from advertising

agency clients and direct clients would enable it to charge higher average

selling price. CME also intends to penetrate further the local advertising

markets by appealing to local advertisers who typically utilized other

types of advertising media.

|

Seek

and Maintain Strategic Partnerships and Merger and Acquisition

Opportunities

CME

intends to continue to maintain and pursue strong relationships with government

authorities in China in charge of regulating the industries related to its

business. CME seeks to maintain communication channels with the Ministry of

Transport to facilitate the delivery of its services and implementation of the

government’s policy initiatives with respect to the display of copyrighted

programs on inter-city express buses. CME seeks to leverage its government

relationships and industry connections to increase the penetration of its

services in its existing and prospective advertising network.

CME aims

to continue expanding the scale of its advertising network and the type of media

platforms it employs through strategic relationships and mergers and

acquisitions. CME seeks to enter into strategic relationships or merger and

acquisition agreements with local companies capable of delivering customized,

time-specific and local-oriented content. CME believes strategic partnership and

merger and acquisition opportunities would allow it to utilize their resources

to facilitate local penetration.

CME’s

Advertising Network

CME

displays entertainment programs and advertisements on inter-city express buses

carrying its network. Inter-city express buses refer to buses traveling directly

in between cities through expressways in China with a seating capacity of more

than 27 passengers per bus. Typically, two to three digital television displays

are installed on each inter-city express bus participating in CME’s network. As

of June 30, 2009, CME’s digital television advertising network consisted of

over 16,000 express buses and over 34,000 digital television displays. For the

seven months ended July 31, 2008, on average 53 million passengers

traveled on inter-city express buses within CME’s network every

month.

According

to reports CME commissioned from CTR Market Research, CME had an approximate 85%

share of passenger traffic on inter-city express buses installed with hard disk

drive players, and an approximate 57% share of passenger traffic on inter-city

express buses installed with all types of display technologies in China. The

following table sets forth CME’s market share for inter-city express buses

installed with hard disk drive players, and inter-city express buses installed

with all types of display technologies, in terms of the number of buses, the

number of displays and passenger traffic, as of July 31, 2008.

|

As

of July 31, 2008

|

Inter-City

Express Buses Installed with Hard Disk Drive Players

|

Inter-City

Express Buses Installed with all Types of Television Display

Technologies

|

||||||

|

CME’s

share in terms of number of buses

|

81 | % | 55 | % | ||||

|

CME’s

share in terms of number of screens

|

82 | % | 57 | % | ||||

|

CME’s

share in terms of passenger traffic

|

85 | % | 57 | % | ||||

13

Source:

CTR Market Research

As of

December 31, 2009, CME’s network covered inter-city express bus services

originating in fourteen regions, including the five municipalities of Beijing,

Shanghai, Guangzhou, Tianjin and Chongqing and nine economically prosperous

provinces, namely Guangdong, Jiangsu, Fujian, Sichuan, Hubei, Anhui, Hebei,

Shandong and Shanxi] These fourteen regions in aggregate generated

more than half of China’s GDP in 2007, according to the National Bureau of

Statistics of China. Many of the cities connected in CME’s network are major

transportation hubs, which serve as points of transfer for large numbers of

leisure, business and other travelers in China to other modes of transportation.

CME’s network also includes airport buses connecting major cities to airports

and tour buses traveling on routes that connect major cities with popular

tourist destinations in China.

CME’s

Advertising Services

CME

displays entertainment programs interspersed with advertisements, with a

ten-minute block of advertising shown after every thirty minutes of

entertainment programming. The entertainment programs enable CME to capture the

attention of the passengers to increase the effectiveness of advertisements

displayed on its platform. The passengers traveling on inter-city express buses

included in CME’s advertising network are the target audience of its

clients.

The

advertisements displayed on CME’s network are provided by its clients

approximately seven days prior to their display on CME’s network. The design and

production of advertisements displayed on CME’s network are undertaken by

independent third party professional advertising agencies. CME inspects the

content of the advertisements for purposes of compliance with applicable laws

and regulations and reserves the right to request a revision of content it

believes may be in violation of applicable laws and regulations and to reject

the display of such advertisements if the content is not revised or if the

content may still be, in CME’s view, in violation of applicable laws and

regulations after revision. CME’s in-house production department combines the

entertainment programs provided by CME’s content suppliers with advertisements

provided by CME’s clients for display on CME’s platform.

Audience

Profile

According

to the surveys conducted by the CTR Market Research in selected cities, namely,

Shanghai, Beijing, Guangzhou, Tianjin, Nanjing, Fuzhou, Xiamen and Changzhou, in

July 2008, the audience of CME’s network have the following overall

characteristics:

|

|

·

|

the

average age is 30 years old;

|

|

|

·

|

the

average household income is over RMB5,800 per month and the average

individual income is over RMB3,300 per

month;

|

|

|

·

|

the

primary purposes of travel include business, travel and leisure and

visiting families and friends;

|

|

|

·

|

over

50% of the target audiences have received a diploma, college degree or

higher education;

|

|

|

·

|

over

40% of the target audiences are professionals, managers, executives and

business owners; and

|

|

|

·

|

over

40% of the target audiences are frequent travelers that take inter-city

express buses for more than once a

month.

|

CME

believes its network is highly attractive to advertisers because they are

capable or reaching large amounts of relatively young, income generating,

well-educated and successful passengers who travel frequently on inter-city

express buses in China.

14

Clients

CME

derives all of its revenue from selling advertising time slots to its clients.

CME generates revenue from two types of clients: advertising agencies which

purchase advertising time slots from it and resell such time to advertisers and

advertising clients which directly purchase advertising time slots from CME. CME

generates a majority of its revenue from selling advertising time slots to

advertising agencies which in turn sell such time to advertisers. For the year

ended December 31, 2009, CME derived 78.6% of its revenue from selling

advertising time slots to advertising agencies and the remaining 21.4% of its

revenue directly from advertisers. During the same period, CME’s top ten clients

and the single largest client accounted for 45.0% and 6.9%, respectively, of its

total revenue.

Sales

and Marketing

As of

December 31, 2009, CME employed an advertising sales force of 65 employees.

CME’s sales force focuses their efforts on studying CME’s clients’ sales and

marketing strategies, analyzing their needs and providing tailored advertising

solutions to suit their needs. CME also utilizes its network to promote its own

brand and business.

To

provide assurance to its clients that CME performs its contractual obligations

by displaying their advertisements on CME’s network according to CME’s

contracts, CME commissions CTR Market Research each month to conduct independent

verification studies. In this connection, CTR Market Research dispatches

personnel to take the inter-city express buses carrying CME’s network to conduct

random inspections of CME’s advertising services without its knowledge and

compiles reports based on the findings they gathered. CME provides such reports

to its clients on a monthly basis.

Advertising

Contracts

CME

typically enters into one-year contracts with its advertising agency clients.

CME’s advertising agency clients usually enter into contracts with it at the

beginning of the year and purchase a specified amount of advertising time for

the entire year.

The key

terms of one-year contracts with advertising agency clients

include:

|

|

·

|

the

average advertising rate for every thirty

seconds;

|

|

|

·

|

the

number of minutes the advertisements will be displayed each month;

and

|

|

|

·

|

the

aggregate advertising fees payable in that

year.

|

CME has

also entered into long-term framework agreements with two of its advertising

agency clients for a term of three years starting from January 1, 2008 to

December 31, 2010. In addition to the contract terms typically included in

the contracts with advertising agency clients, the long-term framework

agreements also specify the permissible range of annual increase in the average

selling prices, which is between a minimum of 20% and a maximum of

50%.

CME

usually enters into six-month or short-term contracts with its direct

advertising clients. Such short-term contracts are intended to give the clients

flexibility to purchase advertising time slots or increase orders for CME’s

advertising time slots as the clients introduce new products or services or when

they augment their marketing efforts during peak seasons. The key terms of such

short-term contracts include:

|