Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-20997

SRI/SURGICAL EXPRESS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Florida | 59-3252632 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 12425 Race Track Road Tampa, Florida |

33626 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(813) 891-9550

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $.001 | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company “ in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Small reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant, based on the closing sale price of the common stock on June 30, 2009, as reported on the NASDAQ Global Market, was approximately $7,645,000. For purposes of this determination, the registrant excluded shares of common stock known to be held by officers, directors, and 10% shareholders, because those persons might be deemed affiliates. This determination of affiliate status is not necessarily conclusive for other purposes.

The registrant had 6,485,978 shares of common stock outstanding as of February 26, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated.

Portions of the Proxy Statement for the registrant’s 2010 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

FORM 10-K

YEAR ENDED DECEMBER 31, 2009

| Section |

Page | |||

| PART I |

||||

| Item 1. |

1 | |||

| Item 1A. |

8 | |||

| Item 1B. |

10 | |||

| Item 2. |

10 | |||

| Item 3. |

12 | |||

| Item 4. |

12 | |||

| PART II |

||||

| Item 5. |

13 | |||

| Item 6. |

14 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||

| Item 7A. |

24 | |||

| Item 8. |

25 | |||

| Item 9. |

Changes in and Disagreements With Accountants On Accounting and Financial Disclosure |

48 | ||

| Item 9A(T). |

48 | |||

| Item 9B. |

49 | |||

| PART III |

||||

| Item 10. |

50 | |||

| Item 11. |

50 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

50 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

50 | ||

| Item 14. |

50 | |||

| PART IV |

||||

| Item 15. |

51 | |||

| 55 | ||||

Table of Contents

PART I

| Item 1. | Business |

This Annual Report on Form 10-K, other documents that we publicly disseminate, and oral statements that are made on our behalf might contain both statements of historical fact and forward-looking statements. These forward-looking statements do not guarantee future performance, and our actual results could differ materially from those indicated by the forward-looking statements. Examples of forward-looking statements include: (i) projections of our revenue, earnings, capital structure, and other financial items, (ii) statements of our plans and objectives, (iii) statements of our expected future economic performance, and (iv) assumptions underlying our statements regarding SRI/Surgical Express, Inc. and our business. Among the factors that could cause or contribute to differences are those discussed below under the section entitled “Risk Factors”. We do not undertake to update our forward-looking statements.

The Company

SRI Surgical Express, Inc. (“SRI Surgical”, the “Company”, “we”, “us” or “our”) is a supplier and reprocessor of reusable surgical linen and instrumentation. Our slogan, Environmental Solutions, Delivered Daily® reflects SRI Surgical’s commitment to provide our healthcare clients with high quality reusable products, and the opportunity to reduce waste in the Operating Room (“OR”). Reducing waste in the OR begins with purchasing the appropriate reusable products that meet the needs of the clinical user, and minimize the use of disposable products in the surgical environment. We believe our reusable surgical gowns, drapes, table covers, towels, and instruments provide the opportunity for waste avoidance and environmental sustainability in the surgical arena. We start with products that have been manufactured specifically to be reusable and to be reprocessed. Our products are not single use products that are reprocessed for economic benefit.

SRI Surgical has ten reprocessing facilities that are regionally located across the United States. These facilities adhere to the standards of the United States Food and Drug Administration (“FDA”) regulated medical device manufacturing environment. We guarantee that our surgical linens will always be 100% inspected, repaired when necessary, and sterilized properly. No other company in the industry provides this type of service for their reusable surgical products.

SRI Surgical has a history of commitment to the environment. As well as providing our healthcare clients with environmentally friendly surgical linens and instruments, we have a demonstrated commitment to waste reduction in the communities that we serve, both as a healthcare service provider and a corporate citizen. SRI Surgical is a Charter Member of Practice Greenhealth, a networking organization for institutions in the healthcare community that have made a commitment to sustainable, eco-friendly practices. During 2009, we were awarded with Practice Greenhealth’s Champion for Change Award, which recognizes organizations that demonstrate successful accomplishments in ‘greening’ their organization as well as assisting healthcare clients in improving their environmental performance. SRI Surgical is also an EPA WasteWise Partner. The EPA WasteWise program targets the reduction of waste in the business environment. In 2009, we received the EPA’s Champion Award in the Design for the Environment Program’s Safer Detergents Stewardship Initiative (“SDSI”). In addition, SRI Surgical is also a member of the EPA’s Climate Leaders, a consortium of small business leaders that are measuring their greenhouse gas emissions and setting and achieving goals to reduce them. We are also a member of the EPA’s SmartWay program, which identifies products and services that reduce transportation-related emissions. During the year, we were recognized with the EPA’s Transport Award, which recognizes organizations that have made outstanding contributions to reducing climate change emissions and other air pollutants.

We also offer expert daily instrument processing at both our facilities (off-site) and our customers’ facilities (on-site). This innovative service provides customized, high-quality surgical instrument sets on a per-procedure fee basis. Sets processed at our FDA-regulated facilities have a consistently high level of quality built into every

1

Table of Contents

set. After each use, our highly trained instrument-processing technicians follow a thorough inspection and cleaning process to help ensure that the instruments are in proper working order. We ensure instrument availability and functionality, which offers our customers an opportunity to achieve high efficiency levels. In addition, we manage the instrumentation and supply chain of hospitals, surgery centers and operating rooms and their central sterilization facilities. In this setting, by using our expertise in implementing and managing FDA-regulated instrument processing facilities, we can deliver desired quality and performance levels that our customers seek.

Our integrated “closed-loop” process starts with daily delivery of reusable and disposable surgical supplies and instruments to healthcare providers. After use, we pick up the reusable textiles, basins, and instruments used in surgery and return them to our processing facilities. Used products arriving at our processing facilities are sorted, cleaned, inspected, packaged, sterilized, and shipped back to the healthcare providers. This “closed-loop” system eliminates the need for healthcare providers to stock on-hand inventory and greatly simplifies our customers’ surgical supply chain process. This process also allows healthcare providers to reduce medical waste disposal costs and increase the quality of products used by their staff and physicians. Additionally, with our daily just-in-time delivery model, our customers’ working capital requirements are favorably affected by their ability to carry less on-hand inventory of disposable products to support their surgical procedures.

We are well positioned to help healthcare providers reduce operating costs while improving the quality of care, so that they can respond to pressures created by the continued growth of managed care and reductions in procedure reimbursement. To reduce operating costs, we offer comprehensive procedure bundling solutions and outsourcing of surgical instrument processing. By providing surgical instruments of superior functionality and bundling solutions that allow surgical staff to shift focus from supply management to patient management, we help our customers significantly reduce operating and capital costs, increase revenue, and improve the quality of patient care.

We recently entered into a three-year reusable surgical products agreement with KP Select, Inc. the purchasing agent for the Kaiser Permanente Healthcare System (“Kaiser Permanente”). This agreement is effective March 1, 2010 and gives us the ability to contract with any Kaiser Permanente hospital for whom KP Select provides services and designates KP Select as their purchasing agent. Kaiser Permanente is a 48-hospital system located in the states of California, Ohio, Maryland, Oregon and Washington, and other states. This agreement allows us to assist Kaiser Permanente with their environmental awareness initiative, but does not commit Kaiser Permanente or its member hospitals to purchase any minimum quantity of products or services from us. We believe this agreement is a key element in our strategic growth initiatives.

On November 26, 2008, we entered into a five-year Supply and Co-Marketing Agreement (the “Co-Marketing Agreement”) with Cardinal Health 200, Inc. (“Cardinal” or “Cardinal Health”), an affiliate of Cardinal Health, Inc. Under the terms of the Co-Marketing Agreement, Cardinal is our exclusive supplier of disposable surgical packs, and provides for a new product offering, the Hybrid Preference Pack™, in which we combine our reusable surgical packs with Cardinal Health’s disposable surgical packs. We share profits from sales of the Hybrid Preference Pack™ based on an agreed-upon margin split. This new product couples the convenience of disposables with the waste-wise benefits of our reusable products. This environmentally friendly solution reduces packaging and medical waste, saves water and energy consumption, reduces chemical usage and provides just-in-time delivery and retrieval. In addition, the Co-Marketing Agreement appoints Cardinal the exclusive provider of our complete line of more than 400 disposable surgical kits.

The Co-Marketing Agreement allows us to focus on our strengths: reusable surgical products, instrumentation and management of central sterilization and supply chain activities. The Co-Marketing Agreement gives our environmentally friendly solution greater reach and visibility throughout the healthcare market. It brings together the strengths of two organizations that are market leaders in their segments for a more efficient and effective delivery of healthcare solutions.

2

Table of Contents

On February 3, 2010, SRI and Cardinal entered into an Amended and Restated Supply and Co-Marketing Agreement (the “Amended and Restated Supply Agreement”). We previously received disposable component products included in the Hybrid Preference Packs from Cardinal Health on a consignment basis and shared profits with Cardinal based on an agreed margin split from revenue actually received from sales of Hybrid Preference Packs. The Amended and Restated Supply Agreement provides, among other things, that we purchase from Cardinal Health the disposable component products included in the Hybrid Preference Packs instead of receiving them on a consignment basis. In addition, under the Amended and Restated Supply Agreement, we pay Cardinal Health for such components a fixed percentage of the price we charge our customers for such components. This amount payable to Cardinal Health under the Amended and Restated Supply Agreement will be reconciled quarterly to an agreed margin split based on revenue actually billed to Hybrid Preference Pack customers instead of revenue actually received from such customers. The term of the Co-Marketing Agreement remains unchanged.

Effective June 2009, we entered into a four-year national brand distribution agreement with Cardinal Health’s medical and surgical supply chain business. This agreement appoints Cardinal a non-exclusive, authorized distributor of our products. Cardinal Health includes our products on its master merchandise file and our products will be categorized as national brand. This agreement expands upon our current supply and co-marketing relationship with Cardinal Health’s Presource surgical kitting business and gives us access to a national distribution network that currently serves the Federal government as well as other healthcare providers not currently using our reusable product offering.

We closed our disposable products assembly facility in Plant City, Florida in January 2009. The cost of closing the assembly operations, which was substantially completed by the end of March 2009, was approximately $485,000. The costs that were incurred as part of the closure include, but are not limited to, retention, severance and rent expense. A payment from Cardinal under the Co-Marketing Agreement was used to offset these costs.

We maintain an internet website located at www.srisurgical.com. On our website we make available, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished to the Securities and Exchange Commission (“SEC”). This information is made available as soon as reasonably practicable after we electronically file with or furnish it to the SEC. Our Code of Ethics and Corporate Compliance Policies are also posted on our website. Information contained on our website, whether currently posted or posted in the future, is not part of this document or any documents incorporated by reference in this document.

Market

Since our introduction in the early 1990’s of reusable surgical gowns and drapes of exceptional quality for healthcare providers’ use, we have added custom disposable surgical packs to our product offering. In recent years, we have supplied and reprocessed high quality surgical instruments for our customers. Our ability to offer reusable surgical gowns and drapes, custom disposable surgical packs and reusable surgical instruments enables us to supply most everything our customers require for surgical procedures.

According to the American Hospital Association and Verispan, a healthcare consulting organization, the United States healthcare market includes approximately 5,800 acute care hospitals and 5,000 freestanding surgery centers.

The following market conditions and strategies provide continuing opportunities for us:

Continued Pressure on Providers to Contain Costs and Improve Profitability. With growth of managed care and a decrease in surgical service reimbursements, economic constraints require providers to continually increase their efficiency. To assist them in reducing their cost of operation, we offer products and services that help our customers eliminate inventory, reduce staff, capital expenditures and medical waste, and improve their overall supply chain efficiency.

3

Table of Contents

Increased Outsourcing of Provider Functions That Do Not Involve Patient Care. Providers with significant staff, capital and space dedicated to in-house processing of reusable surgical products and surgical instruments are outsourcing these functions to qualified outsourcing providers. By enabling our customers to outsource non-core functions, we allow them to increasingly focus on patient care.

Concern Regarding the Transmission of Infectious Diseases. The healthcare industry must manage the risk of infectious disease. These concerns increase the need for surgical barrier fabrics that protect surgeons and surgical staff from bloodborne pathogens. Industry response to these concerns led to the promulgation of the Association for the Advancement of Medical Instrumentation (“AAMI”) PB70 standard which establishes levels I, II, III and IV indicating increasing barrier protection. Using this standard as a guideline the FDA mandates that any company that markets their products according to the AAMI PB70 standard is required to submit a 510(k) prior to marketing the various levels. Our line of GreenGown™ gowns helps to prevent liquid and viral strike-through in critical areas during surgical procedures and is approved by the FDA for appropriate barrier labeling. Additionally, our FDA-regulated processes for decontamination and reprocessing of surgical instrumentation enable healthcare providers to better manage the risk of transmission of infectious diseases.

Concern Regarding the Handling and Disposal of Biohazardous Waste. The disposal of large volumes of infectious and hazardous waste generated by the healthcare industry continues to attract increased public awareness. Healthcare providers are under pressure to reduce their generation of biohazardous waste because of restrictions on incineration and limited access to dump sites. This market dynamic offers an advantage to companies that provide outsourced reusable alternatives to disposable surgical products.

Leverage Infrastructure with Increased Penetration in Markets. Our existing facilities combined currently have significant available capacity to access more of the national market. Distribution expansion, if prudently executed, could provide opportunity for business growth with incremental capital investment.

Activities by Hospitals, Hospital Groups and the Federal Government to Become Better Stewards of the Environment and to Create Facilities that Practice Environmental Sustainability. Increasing governmental pressure and public awareness are driving healthcare institutions, including government run institutions, to develop plans and implement policies to control their impact upon the communities in which they reside. The realization that the healthcare industry ranks second only to the food industry in waste generation is fueling increased interest in methods to control and eliminate waste through more aggressive efforts to reduce, reuse, and recycle. Through its Green Procurement Strategy (“DoD GPP”) the U.S. Department of Defense is implementing an agency-wide green procurement program designed to reduce resource consumption and solid waste generation. Green procurement includes, among other things, the acquisition of environmentally preferable products and services. Our reusable products are ideally suited to enable these institutions to respond aggressively by reducing waste through reuse of their surgical linens and basin sets. Additionally, our agreement with Cardinal’s distribution group allows us to reach more healthcare facilities that currently do not utilize our reusable product offering, including healthcare facilities operated by the U.S. Government. As part of that agreement, our products are listed on the Department of Defense’s distribution and pricing agreement (more commonly known as the “DAPA” list). Getting our products included on the DAPA list was a key initiative of ours in 2009. Having our products included on the DAPA list, through the agreement with Cardinal, allows government operated hospitals the ability to purchase our products.

4

Table of Contents

Customers

As of December 31, 2009, we served a customer base of approximately 425 hospitals and surgery centers located throughout the United States. Our strategy is to further expand upon the supply chain management needs of our current customer base, and grow our customer base by focusing on hospitals and surgery centers that are surgical procedure intensive.

We maintain short-term agreements to supply several group purchasing organizations (“GPOs”), including Novation, LLC, HealthTrust Purchasing Group, L.P., MedAssets, Inc., Broadlane, Inc. (for Tenet Healthcare Corporation or “Tenet”), Intermountain Health Services, Inc., Premier Purchasing Partners, L.P., and Hospital Corporation of America. Novation is the supply company for Voluntary Hospitals of America, Inc. and University Health System Consortium. HealthTrust Purchasing is a GPO representing over 1,400 hospitals and surgery centers. MedAssets is the largest independent healthcare purchasing group in the United States. Tenet owns and operates 55 acute care hospitals in 12 states. Intermountain Health Services, Inc. is a healthcare purchasing group that services 24 hospitals. Premier has more than 2,300 member hospitals and 64,000 other healthcare sites. Hospital Corporation of America represents 163 hospitals in 20 states. Through these relationships our products and services are potentially available to the vast majority of providers and surgery centers in our service areas. We continue to pursue additional GPO contracts that would allow us opportunities to further penetrate the healthcare market.

Products

Our principal reusable surgical products are GreenGown™ surgical gowns. We also offer reusable towels, surgical drapes, and stainless steel basin sets as part of our reusable surgical product line. We provide these products in a variety of configurations for a provider’s specific needs. A major benefit of our reusable system is reduced medical waste because of the elimination of disposable, single-use products.

Our GreenGown™ Premium Liquid Resistant Level III and Liquid Proof Level IV gowns are made of some of the most technologically advanced materials available, providing users with a highly breathable gown and excellent protection. This added protection is critical to healthcare providers given the continuing concerns of doctors, staff, and regulatory authorities regarding transmission of bloodborne pathogens, including HIV and hepatitis viruses. The Premium Liquid Resistant and Liquid Proof gowns are ideal for procedures with high bodily fluid volume and of longer duration. Our Standard Level II gown is made from an advanced micro-fiber polyester liquid resistant fabric, ensuring a high degree of comfort to the user, and is a cost-effective alternative to higher priced gowns. We believe this gown is ideal for procedures with minimal fluid exposure and of shorter duration. In November 2008, we obtained FDA 510(k) clearance to market our Level III and Level IV surgical gowns and our Level IV surgical drape, which is intended for use in healthcare facilities, as they are in compliance with AAMI PB70 standard. In May 2009, we obtained FDA 510(k) clearance to market our Level II surgical gowns, which is intended for use in healthcare facilities, as they are in compliance with AAMI PB70 standard.

We utilize RFID technology in our ten processing facilities. RFID technology is a method for identifying and tracking objects based on the use of a small tag that stores a unique code. We utilize “multi-read” RFID tags in our reusable surgical gowns and drapes, which allow us to replace the use of labor-intensive bar code scanning to track product usage. This technology offers us improved inventory control and monitoring of product quality. SRI Surgical holds a patent covering this process.

We contract with third-party vendors for cutting and sewing of gowns and drapes. We had a procurement agreement with Standard Textile Co., Inc. (“Standard Textile”) as our supply source for our reusable surgical products, which expired in August 2008. We continue to work with Standard Textile on a month to month basis and are currently in discussions with Standard Textile regarding a new agreement. We are also utilizing a secondary supplier.

5

Table of Contents

To complement our reusable surgical products, we offer disposable packs containing single-use disposable products, such as gauze, needles, syringes, and tubing. These packs are developed to a customer’s specifications, and in combination with our reusable line of surgical products, offer a cost-effective, high-quality alternative to custom procedure packs containing all disposable products. As mentioned above, in November 2008 we signed the Co-Marketing Agreement with Cardinal (see “Item 1. Business – the Company”). Under this agreement, Cardinal is appointed our sole vendor of disposable surgical packs. In addition, this agreement provides for a new product offering known as the Hybrid Preference Pack™. The Hybrid Preference Pack™ combines our reusable products with Cardinal’s disposable surgical packs. This combined product responds to hospital and surgery center green initiatives by providing environmentally preferred purchasing options that maximize value and minimize waste.

Our instrument-processing program, called AccuSetSM, offers our customers the benefit of consistently available surgical instruments processed at an FDA-regulated facility. Our thorough cleaning and inspection process assures that surgical instruments are functional and meet rigorous quality standards. We offer general, laparoscopic, orthopedic, arthroscopic, ophthalmic, neurological, ENT (ear, nose and throat) and L&D (labor and delivery) instrument processing at our facilities. We have introduced an overnight instrument processing program, ReadyCaseSM OnDemand. The program makes available to hospitals and surgery centers additional processing capabilities at our FDA-regulated facilities should they find themselves in sudden need. As of December 31, 2009, we serviced instrument programs at 77 hospitals.

We offer instruments as part of the AccuSetSM program pursuant to a Joint Marketing Agreement with Aesculap, Inc. (“Aesculap”), one of the oldest and largest worldwide suppliers of surgical instruments. In March 2003, we signed a 10-year Joint Marketing Agreement with Aesculap whereby Aesculap provides most of the surgical instruments our customers use in their procedures. Aesculap receives an agreed upon fee for each procedure based on the number and kinds of procedures performed with its instruments and the number and combination of instruments used for each procedure. We have also developed vendor relationships with many leading manufacturers of surgical instruments to procure instrumentation preferred by our customers and that Aesculap does not manufacture. These vendor relationships expand the range of solutions that we offer our customers. We expect our instrument-processing program will continue to grow and, as a result, we expect our instrument inventory will continue to grow.

ReadyCaseSM, our surgical supply and instrument delivery system, combines reusable products, disposable packs, surgical instruments, and physician preference items to provide most of the products required for a surgical procedure. The system allows our healthcare customers to develop and implement best practice protocols. We believe that ReadyCaseSM is the most complete case cart system available in the market. By delivering a high percentage of surgical products and instruments used in a procedure, ReadyCaseSM offers our customers the potential to reduce their supply chain management costs, improve their operational efficiency, and increase their revenue by improving throughput in their surgical area.

We also provide an outsource solution for our customers’ instrument processing and sterilization needs. Utilizing our expertise in managing FDA-regulated instrument processing facilities, we offer cost-effective management of hospital and surgery center instrumentation supply chain and central sterilization facilities.

Employees

As of December 31, 2009, we employed 834 people. Our employees are not covered by a collective bargaining agreement. We consider our employee relations to be good.

Competition

We compete primarily with sellers of disposable gowns, drapes, basins and custom packs. Our principal competitors are Cardinal Converters (a subsidiary of Cardinal Health, Inc.), Medline Industries, Inc., DeRoyal

6

Table of Contents

Industries, Inc., and Kimberly Clark Corporation. We also compete with third party instrument processors and the in-house processing capabilities of hospitals and surgery centers to provide surgical instruments and reusable products.

The challenging healthcare environment in recent years has led to increasingly intense competition among suppliers and manufacturers of surgical products. As providers seek to reduce operating costs in response to pressure from governments, insurance companies, and health maintenance organizations, suppliers and manufacturers are being forced to compete on price, service, quality and delivery of innovative solutions that improve the healthcare supply chain. Because we believe competitive pressure will continue to intensify for the foreseeable future, we must position SRI Surgical to effectively compete based on our high-quality service and innovative outsourcing solutions.

Regulation

Substantially all of our products and services are subject to extensive government regulation in the United States by federal, state, and local governmental agencies, including the FDA, the Department of Transportation (“DOT”), and the Occupational Safety and Health Administration (“OSHA”).

Our reusable products are regulated as medical devices by the FDA, which regulates the development, production, distribution, and promotion of medical devices in the United States. Various states in which we do business also regulate medical devices. Pursuant to the Federal Food, Drug and Cosmetics Act (the “FDA Act”), our medical devices are subject to general controls regarding FDA inspections of our facilities, current Good Manufacturing Practices (“cGMP’s”), the Quality System Regulations (“QSR”), labeling, maintenance of records, and medical device reporting with the FDA. To the extent required, we have obtained FDA pre-market approval of our devices under Section 510(k) of regulations issued under the Code of Federal Regulations (“CFR”), which provides for FDA approval on an expedited basis for products shown to be substantially equivalent to devices already cleared by the FDA and currently legally marketable in the United States. Products must be produced in establishments registered with the FDA and manufactured in accordance with the QSR, as defined under the FDA Act. In addition, our medical devices must be initially listed with the FDA, and our labeling and promotional activities are subject to scrutiny by the FDA and, in certain instances, by the Federal Trade Commission. The Medical Device Reporting regulation obligates us to provide information to the FDA on serious injuries or deaths alleged to have been associated with the use of a product or in connection with certain product failures that could have caused serious injury or death. If we fail to comply with the applicable provisions of the FDA Act, the FDA may institute proceedings to detain or seize products, impose fines, enjoin future company activities, impose product labeling restrictions, or enforce product recalls or withdrawals from the market.

We and our hospital customers also must comply with regulations of OSHA, including the blood borne pathogen standards requiring “standard (universal) precautions” which must be observed to minimize exposure to blood and other bodily fluids. To comply with these requirements, our employees wear appropriate personal protective equipment when handling soiled linens and materials in the facility’s decontamination area. Properly used, our products allow our hospital customers to protect their employees in compliance with the OSHA regulations. Additionally, we must comply with local regulations governing the discharge of water used in our operations. We use locally licensed contractors to dispose of any biohazardous waste generated by our customers and received by us and therefore do not need to obtain permits for biohazardous waste disposal. We must comply with DOT and OSHA regulations governing the transportation of biohazardous materials, which include containing and labeling waste as well as reporting various discharges. We comply with these regulations by confining soiled products inside marked liquid proof bags for transport within secured and appropriately labeled transfer carts. A third-party contractor provides sterilization of our disposable accessory packs. The use of ethylene oxide by the contractor in the sterilization of our disposable accessory packs is subject to regulation by FDA, OSHA, and the Environmental Protection Agency.

7

Table of Contents

In addition, other federal, state and local regulatory authorities, including those enforcing laws which relate to the environment, fire hazard control, and working conditions, have jurisdiction to take actions that could have a material adverse effect on us. We make expenditures from time to time to comply with environmental regulations, but do not expect to make any material capital expenditures for environmental compliance during 2010. However, current environmental estimates could be modified as a result of changes in our plans, legal requirements or other factors.

| Item 1A. | Risk Factors |

The cautionary statements set forth below, as well as factors described elsewhere in this Annual Report on Form 10-K and in other SEC filings, discuss important factors that could cause actual results to differ materially from any forward-looking statements. We assume no obligation to update these forward-looking statements.

We may need additional capital in the future, which might not be available. Our business is capital intensive and requires annual expenditures for additional surgical products. Should we need or otherwise decide to raise additional funds, we may not be able to obtain financing on favorable terms, if at all. If we cannot raise funds, if needed, on acceptable terms, we may not be able to develop or enhance our products, take advantage of future opportunities, respond to competitive pressures or unanticipated requirements or otherwise support our operations. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”.

Failure to comply with certain covenants in our credit facility could adversely affect our ability to conduct our business. As of December 31, 2009, we had $10.1 million outstanding and $7.1 million available for borrowings under our credit facility with our lender (the “Credit Facility”). The Credit Facility contains operating and financial covenants which restrict, among other things, our ability to pay dividends, incur more debt, make loans and investments, encumber our assets, enter into a new business, or enter into certain merger, consolidation, or liquidation transactions.

In addition, the Credit Facility requires us to maintain certain financial ratios, including a minimum tangible net worth requirement and a fixed charge coverage ratio. We did not satisfy the tangible net worth covenant as of December 31, 2009. Our lender waived the requirement as of December 31, 2009 and amended the covenant for future periods. There can be no assurance that our lender will issue a waiver or grant an amendment in future periods, if we require one.

Our ability to comply with these covenants and financial ratios may be affected by events beyond our control. A breach of any of the covenants in the Credit Facility could result in an event of default, which, if not cured or waived, could have a material adverse effect on us. In the event of any default under the Credit Facility, we may be restricted from accessing our revolving credit line and the payment of all outstanding borrowings under the Credit Facility could be accelerated, together with accrued and unpaid interest and other fees. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”.

Recent turmoil in the credit markets and financial services industry could negatively impact our business, results of operations, financial condition or liquidity. The credit markets and the financial services industry have been experiencing a period of unprecedented turmoil and upheaval characterized by the bankruptcy, failure, collapse or sale of various financial institutions, an unprecedented level of intervention from the United States federal government and other foreign governments and tighter availability of credit. While the ultimate outcome of these events cannot be predicted, they could have a negative impact on our liquidity and financial condition if our ability to borrow money to finance operations or obtain credit from creditors were to be impaired.

Bank of America, N.A. is our lender under the Credit Facility. If Bank of America is adversely affected by the conditions of the U.S. and international capital markets, it may become unable to fund borrowings under its

8

Table of Contents

credit commitments to us or otherwise fulfill its obligations under the Credit Facility, which could have a material and adverse impact on our financial condition and our ability to borrow additional funds, if needed, for working capital, capital expenditures and other corporate purposes.

Our future growth is dependent on the sales process and market acceptance of our products and services. Our future performance depends on our ability to maintain and increase revenues from new and existing customers. Our sales process to acquire new customers is typically extended in duration, because of industry factors such as the approval process in hospitals for purchases from new suppliers, the duration of existing supply contracts, and implementation delays pending termination of a hospital’s previous supply relationships. Our future performance also depends on the market accepting our product and service offerings, which emphasize the supply of reusable surgical products to a market that predominantly uses disposable products. We are also regularly developing new instrument processing programs. We are subject to a risk that the market will not broadly accept these product offerings, which would adversely affect our revenues and operating results.

The Supply and Co-Marketing Agreement with Cardinal may not be successful. We signed a five-year Co-Marketing Agreement, as amended, with an affiliate of Cardinal Health, Inc. See “Item 1. Business – The Company”. The Co-Marketing Agreement appoints Cardinal as our exclusive supplier of disposable products and provides for co-marketing of an environmentally friendly healthcare solution, the Hybrid Preference Pack™, a reusable and disposable products pack. The Co-Marketing Agreement requires us to make additional investments in personnel, equipment and programs. If our Hybrid Preference Pack™ initiative is not accepted by the marketplace, it would materially and adversely affect us.

We rely on key suppliers. We rely on Aesculap as our major source of supply of instruments for our instrument processing programs. Any failure of Aesculap to furnish instruments for any reason could materially and adversely affect our ability to service these programs until we secured one or more alternative suppliers. We had a procurement agreement with Standard Textile as our supply source for our reusable surgical products through August 2008. We are currently working with Standard Textile on a month-to-month basis until a new agreement can be reached. We are also utilizing a secondary supplier. If Standard Textile were unable to perform or if we are unable to reach an agreement with Standard Textile or another supplier on favorable terms, we would be materially and adversely affected.

In November 2008, we entered into a Co-Marketing Agreement with Cardinal. The Co-Marketing Agreement appoints Cardinal the exclusive supplier of disposable products for our customers. If the agreement does not provide the results we expect under its terms, we would be materially and adversely affected.

The loss of a significant customer or purchasing organization could adversely affect our operating results. During the year ended December 31, 2009, hospitals belonging to three group purchasing organizations (“GPOs”), Novation, LLC, HealthTrust Purchasing Group, L.P. and MedAssets, Inc. accounted for approximately 62% of our sales. One customer, a healthcare provider, accounted for approximately 10% of our revenues in 2009. Our business with these GPOs is pursuant to short-term agreements, which are subject to renewal from time to time through competitive processes. Although each GPO member hospital currently makes its purchasing decisions on an individual basis, the loss of a substantial portion of the GPO hospitals’ business would adversely affect our revenues and results of operations.

Intense competition in the markets in which we operate could adversely affect us. Our business is highly competitive. Competitors include a number of distributors and manufacturers, as well as the in-house reprocessing operations of hospitals. Certain of our existing and potential competitors possess substantially greater resources than we possess. Some of our competitors, including Cardinal Converters (a subsidiary of Cardinal Health, Inc.) and Medline Industries, Inc., serve as the sole supplier of a wide assortment of products to a significant number of hospitals. While we have a substantial array of surgical products, many of our competitors have a greater number of products for the entire hospital, which in some instances is a competitive disadvantage for us. There is no assurance that we will be able to compete effectively with existing or potential competitors. See “Item 1. Business-Competition.”

9

Table of Contents

The loss of key executives and employees could adversely affect us. Our success depends upon the contributions of executives and key employees. The loss of executives and certain key employees in sales, operations and marketing could have a significant adverse effect on our ability to penetrate our markets, operate efficiently, and develop and sell new products and services. We also believe our success will depend in large part upon our ability to attract and retain additional highly skilled personnel.

Our ability to effectively grow depends on our ability to improve our operational systems. We have expanded our operations since inception and may continue to expand to pursue existing and potential market opportunities. This growth places a significant demand on management, financial and operational resources. To manage growth effectively, we must implement and improve our operational systems, procedures and controls on a timely basis and continue to invest in the operational infrastructure of our business.

Our product liability insurance may not be sufficient to cover all claims. The use of medical devices such as surgical instruments entails an inherent risk of product liability or other claims initiated by patients or hospitals. Any of those claims in excess of our insurance coverage or not covered by insurance could adversely affect our results of operations.

Changes in federal or state regulations could materially adversely affect us. Significant aspects of our business are subject to federal, state and local statutes and regulations governing, among other things, medical waste-disposal and workplace health and safety. In addition, most of the products furnished or sold by us are subject to regulation as medical devices by the FDA, as well as by other federal, state and local agencies. Our facilities are subject to quality systems inspections by FDA officials. The FDA has the power to enjoin future violations, seize adulterated or misbranded devices, and require the manufacturer to remove products from the market, and publicize relevant facts. Federal, state or local governments might impose additional restrictions or adopt interpretations of existing laws that could materially adversely affect us. See “Item 1. Business – Regulation.”

Failure to maintain adequate internal systems and effective internal controls over financial reporting and information systems could adversely affect us. As more fully described in Item 9A(T), Controls and Procedures, in the third quarter of 2009,we identified losses of reusable surgical products that were not previously captured by our tracking systems, and determined this deficiency was a material weakness in our internal controls over financial reporting. We implemented initiatives to remediate this material weakness in our internal controls as of September 30, 2009. Correction of any further “significant deficiencies” or “material weaknesses” (as defined under the Public Company Accounting Oversight Board guidelines) could require additional remedial measures, which could be costly and time-consuming. If a significant deficiency or material weakness exists at any year-end (including a material weakness identified prior to year-end for which there is an insufficient period of time to evaluate and confirm the effectiveness of the corrections or related new procedures), our management will be unable to report favorably as to the effectiveness of our internal control over financial reporting or information systems, which could adversely affect us.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

We operate ten reusable processing facilities that range in size between 30,000 and 63,500 square feet in Baltimore, Chattanooga, Cincinnati, Dallas, Houston, Los Angeles, Raleigh, Salt Lake City, Stockton, and Tampa. Each facility has standardized processes and equipment, including computerized and fully automated heavy-duty washers, dryers, and sterilizers to achieve consistent decontamination and sterilization of reusable surgical products and instruments. We follow the Quality System Regulations at each facility, and regularly implement at all facilities efficiencies that have been developed and tested at another location.

10

Table of Contents

We maintain service centers in Detroit, Louisville, Miami and Oklahoma City to facilitate distribution of our products to our customers.

We operated a disposable accessory products facility in Plant City, Florida, where we assembled and packaged single-use surgical products into customized disposable accessory packs. We transported these disposable accessory packs to a third-party facility for sterilization before they were sent to our processing facilities for final delivery. As part of the Co-Marketing Agreement we signed with Cardinal Health in November 2008, we agreed to close the Plant City facility which was substantially completed in March 2009. As a result, we source our disposable products through Cardinal Health.

We own our Chattanooga, Cincinnati, Houston, and Stockton processing facilities and our corporate headquarters; we lease the remaining processing facilities, service centers, and the disposable accessory products facility.

We believe that our existing facilities adequately serve our current requirements. The table below summarizes our properties and the major markets they serve as of December 31, 2009:

| Square Footage (Approx.) |

Lease Expiration |

Selected Markets Served | ||||

| Processing Facilities: |

||||||

| Baltimore, Maryland |

58,700 | May 31, 2012 (Options to 2022) |

Baltimore, Philadelphia, Richmond, New Jersey | |||

| Chattanooga, Tennessee |

50,000 | Owned | Atlanta, Birmingham, Nashville, Mississippi | |||

| Cincinnati, Ohio |

50,000 | Owned | Columbus, Cincinnati, Louisville, Lexington, Detroit, Cleveland | |||

| Dallas, Texas |

31,000 | March 31, 2013 | Dallas, Oklahoma City, Tulsa | |||

| Houston, Texas |

30,000 | Owned | Houston, San Antonio, Austin | |||

| Los Angeles, California |

30,400 | November 30, 2012 | San Diego, Los Angeles | |||

| Raleigh, North Carolina |

63,500 | March 31, 2012 (Options to 2022) |

South Carolina, North Carolina | |||

| Salt Lake City, Utah |

31,800 | July 6, 2012 | Utah, Idaho | |||

| Stockton, California |

57,000 | Owned | Sacramento, San Francisco, Oakland | |||

| Tampa, Florida |

63,000 | January 23, 2012 (Options to 2032) |

Florida, Georgia | |||

| Service Centers: |

||||||

| Detroit, Michigan |

7,300 | November 30, 2012 | ||||

| Louisville, Kentucky |

10,000 | December 31, 2010 | ||||

| Miami, Florida |

4,000 | January 31, 2011 | ||||

| Oklahoma City, Oklahoma |

3,600 | February 28, 2012 | ||||

| Disposable Products: |

||||||

| Plant City, Florida |

40,800 | February 28, 2010 (Notice given to terminate lease on April 7, 2009) |

||||

| Corporate Office: |

||||||

| Tampa, Florida |

42,000 | Owned |

||||

11

Table of Contents

| Item 3. | Legal Proceedings |

From time to time, we are subject to legal proceedings that arise in the ordinary course of our business. We do not believe these proceedings, individually or in the aggregate, will have a material adverse effect on our financial position, results of operations, or cash flows.

| Item 4. | Reserved |

12

Table of Contents

PART II

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Common Stock Information

Our common stock trades publicly on The NASDAQ Stock Market LLC (NASDAQ Global Market) (the “NASDAQ”) under the symbol “STRC”. On February 26, 2010, there were approximately 39 holders of record of our common stock. The table below sets forth the high and low sales prices for our common stock for fiscal years 2008 and 2009, as reported on the NASDAQ.

Common Stock Price Range

| Year ended December 31, 2008 |

High | Low | ||||

| First quarter |

$ | 6.44 | $ | 3.52 | ||

| Second quarter |

$ | 4.69 | $ | 3.00 | ||

| Third quarter |

$ | 4.10 | $ | 3.30 | ||

| Fourth quarter |

$ | 3.96 | $ | 0.59 | ||

| Year ended December 31, 2009 |

||||||

| First quarter |

$ | 1.80 | $ | 0.76 | ||

| Second quarter |

$ | 1.58 | $ | 1.00 | ||

| Third quarter |

$ | 2.82 | $ | 1.30 | ||

| Fourth quarter |

$ | 3.40 | $ | 1.50 | ||

We have never declared or paid cash dividends on our common stock and do not anticipate paying dividends on our common stock in the foreseeable future. Additionally, financial covenants in our credit facility prohibit the payment of cash dividends. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” and “Notes to Financial Statements”.

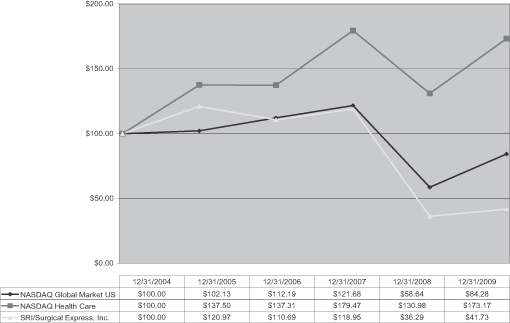

Stock Performance Graph

The following graph shows a comparison of our cumulative total shareholder return, NASDAQ Global Market (U.S.), and the NASDAQ Health Care Index. This graph assumes that $100 was invested on December 31, 2004 in our common stock and in the other indices and in each case, assumes reinvestment of all dividends. Historic stock price performance does not necessarily indicate future stock price performance.

13

Table of Contents

| Item 6. | Selected Financial Data |

The following table contains certain selected financial data that have been derived from our audited financial statements. The data should be read in conjunction with the Financial Statements and Notes thereto incorporated into Item 8 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated into Item 7.

| Years Ended December 31, | |||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

| (In thousands, except per share data) | |||||||||||||||||||

| Statement of operations data: |

|||||||||||||||||||

| Revenues |

$ | 98,453 | $ | 97,028 | $ | 94,201 | $ | 93,831 | $ | 91,734 | |||||||||

| Cost of revenues |

78,355 | 75,599 | 73,947 | 71,534 | 68,554 | ||||||||||||||

| Gross profit |

20,098 | 21,429 | 20,254 | 22,297 | 23,180 | ||||||||||||||

| Distribution expenses |

6,933 | 7,227 | 6,394 | 6,327 | 6,261 | ||||||||||||||

| Selling and administrative expenses |

16,607 | 16,289 | 17,775 | 17,574 | 15,092 | ||||||||||||||

| Income (loss) from operations |

(3,442 | ) | (2,087 | ) | (3,915 | ) | (1,604 | ) | 1,827 | ||||||||||

| Interest expense |

619 | 1,077 | 1,385 | 1,206 | 1,197 | ||||||||||||||

| Other income |

(367 | ) | (396 | ) | (342 | ) | — | — | |||||||||||

| Income (loss) before income taxes |

(3,694 | ) | (2,768 | ) | (4,958 | ) | (2,810 | ) | 630 | ||||||||||

| Income tax expense (benefit) |

82 | (212 | ) | (1,765 | ) | (857 | ) | 237 | |||||||||||

| Net income (loss) |

$ | (3,776 | ) | $ | (2,556 | ) | $ | (3,193 | ) | $ | (1,953 | ) | $ | 393 | |||||

| Basic earnings (loss) per common share: |

|||||||||||||||||||

| Earnings (loss) per common share |

$ | (0.58 | ) | $ | (0.40 | ) | $ | (0.50 | ) | $ | (0.31 | ) | $ | 0.06 | |||||

| Basic earnings (loss) per diluted share: |

|||||||||||||||||||

| Earnings (loss) per diluted share |

$ | (0.58 | ) | $ | (0.40 | ) | $ | (0.50 | ) | $ | (0.31 | ) | $ | 0.06 | |||||

| Weighted average common shares outstanding: |

|||||||||||||||||||

| Basic |

6,464 | 6,434 | 6,399 | 6,338 | 6,277 | ||||||||||||||

| Diluted |

6,464 | 6,434 | 6,399 | 6,338 | 6,311 | ||||||||||||||

| Balance sheet data (at end of period): |

|||||||||||||||||||

| Reusable surgical products, net |

$ | 18,151 | $ | 20,577 | $ | 19,416 | $ | 20,954 | $ | 22,416 | |||||||||

| Total assets |

62,928 | 69,746 | 71,968 | 74,354 | 76,432 | ||||||||||||||

| Notes payable |

6,124 | 8,434 | 2,493 | 2,497 | 3,229 | ||||||||||||||

| Mortgages payable |

4,013 | 4,228 | 4,286 | 4,524 | 4,763 | ||||||||||||||

| Bonds payable |

520 | 520 | 7,060 | 7,720 | 8,380 | ||||||||||||||

| Obligation under capital lease |

— | — | — | — | 6 | ||||||||||||||

| Total liabilities |

23,063 | 26,764 | 27,342 | 27,636 | 28,349 | ||||||||||||||

| Shareholders’ equity |

39,865 | 42,982 | 44,626 | 46,718 | 48,083 | ||||||||||||||

14

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis should be read with our financial statements and Notes included elsewhere in this Annual Report on Form 10-K. This discussion and analysis contains trend analysis and might contain forward-looking statements. These statements are based on current expectations and actual results might differ materially. Among the factors that could cause actual results to vary are those described in the “Overview” section below and in Item 1A. – Risk Factors.

Overview

We provide daily processing, assembly and delivery of reusable and disposable surgical products and instruments through our state-of-the-art, FDA-regulated service centers. Our integrated “closed-loop” process starts with daily delivery of reusable and disposable surgical supplies and instruments to healthcare providers. After use, we pick up the reusable textiles, basins and instruments used in surgery and return them to our processing facilities. Used products arriving at our processing facilities are sorted, cleaned, inspected, packaged, sterilized and shipped back to the healthcare providers. We also manage the instrumentation and supply chain of hospitals, surgery centers and operating rooms and their central sterilization facilities.

We believe our facilities are strategically situated to capitalize on future market opportunities. These facilities have significant available capacity to access more of the national market.

We derive our revenue from the sale and servicing of reusable and disposable surgical products and instruments and the management of our customers’ supply chain and central sterilization functions. Reusable products include linens (gowns, towels and drapes) and basins (stainless steel cups, carafes, trays and basins). Disposable accessory packs supplement the reusable products with highly customizable components. We sell our products and services through a direct sales force located throughout most of the major markets in the United States. Our revenue growth is primarily determined by the number of customers, the number and type of surgical procedures that we service for each customer, and pricing for our various types of surgical packs and procedures. Revenues are recognized as the agreed upon products and services are delivered, generally daily. We incur most of our cost of revenues from processing the reusable surgical products and instruments at our processing facilities. In November 2008, we signed a five-year Co-Marketing Agreement with Cardinal under which both companies will market an environmentally friendly combined reusable and disposable surgical pack. In addition, we appointed Cardinal as our exclusive provider of disposable surgical products. We amended and restated the Co-Marketing Agreement in February 2010. See “Item 1. Business – The Company.”

Most of our surgical instrument supply arrangements with customers use instruments owned by Aesculap, which receives an agreed upon fee for each procedure based on the number and kinds of procedures performed with its instruments and the number and combination of instruments used for each procedure. This arrangement allows us to limit our cost of capital for instrument programs. In addition to the Aesculap-owned instruments, we purchase surgical instruments from other vendors to service customers who have requirements that Aesculap cannot fulfill. We expect instrument revenues will continue to grow and, as a result, we expect our instrument inventory will continue to grow.

Our profitability is primarily determined by our revenues, the efficiency with which we deliver products and services to customers, and our ability to control our costs. We incurred operating and net losses in 2009, as our revenues were short of our expectations and we experienced lower margins. Although sales to customers who predominantly purchase reusable textiles increased this year and we continue to see growth in other products sold with our ReadyCaseSM case cart management system (combining instruments, reusable textiles and disposable products), we continue to encounter compressed margins, primarily as a result of industry pricing trends and higher levels of reusable surgical product loss recognized during the year. Our Tampa facility incurred higher than normal levels of loss during the year and as a result of an information systems error, we recognized additional loss in the third quarter associated with earlier years which was not known by us at January 1, 2009.

15

Table of Contents

Our principal strategic opportunity to improve our operating results is to capitalize on our service capabilities and considerable infrastructure by leveraging our current relationships with existing customers and adding new customers. We continue to focus on introducing our current and potential new customers to our physician-specific ReadyCaseSM case cart management system, which has been our principal source of new sales. In addition, the Co-Marketing Agreement we entered into with Cardinal Health gives us the opportunity to focus on our strengths: reusable surgical products, instrumentation, and management of central sterilization and supply chain activities. The agreement gives our environmentally friendly solution greater reach and visibility throughout the healthcare market. It brings together the strengths of two organizations that are leaders in their segments for a more efficient and effective delivery of healthcare solutions. See “Item 1. Business – The Company.”

Critical Accounting Policies and Estimates

The preparation of our financial statements and related disclosures in conformity with accounting principles generally accepted in the United States of America requires management to make judgments, assumptions, and estimates that affect the amounts reported in our financial statements and accompanying notes. On an ongoing basis, we evaluate our estimates and assumptions based upon historical experience and various other factors and circumstances. We believe that these estimates and assumptions are reasonable under the circumstances; however, actual results may vary from these estimates and assumptions. Note B to our financial statements describes the significant accounting policies and methods that we use in preparing our financial statements. We identified the following critical accounting policies that affect the more significant judgments, assumptions and estimates used in preparing our financial statements.

Allowance for Doubtful Accounts. Our allowance for doubtful accounts is based on our assessment of the collectability of specific customer accounts, the overall aging of the balances and the financial stability of the customer. The use of different estimates or assumptions could produce different allowance balances. If a major customer’s creditworthiness deteriorates or customer defaults run at a rate higher than historical experience, we would be required to increase this allowance, which could adversely affect our results of operations.

Reserves for Shrinkage, Obsolescence, and Scrap for Reusable Surgical Products and Instruments. We determine our reserves for shrinkage and obsolescence of our reusable surgical products and instruments based on historical experience. Any linen products not scanned by our RFID system for a 210-day period are considered lost and written off. We determine our reserve for scrap based upon quality assurance standards and historical evidence. We periodically verify the quantity of other reusable surgical products by counting and by applying observed turn rates. A third party, Aesculap, owns most of the surgical instruments that we use. We base our reserve for owned surgical instrument losses on our assessment of our historical loss experience, including periodic physical counts. Using different estimates or assumptions could produce different reserve balances for our reusable products and instruments. We review this reserve quarterly. If actual shrinkage, obsolescence or scrap differs from our estimates, our reserve would increase or decrease accordingly, which could adversely affect our results of operations.

Reserves for Shrinkage and Obsolescence for Inventories. We determine our reserves for shrinkage and obsolescence of our inventories based on historical data, including the results of cycle counts performed during the year and the evaluation of the aging of our disposable surgical products. Using different estimates or assumptions could produce different reserve balances. We review this reserve quarterly. If actual losses differ from our estimates, our reserve would increase or decrease accordingly, which could adversely affect our results of operations.

Amortization of Reusable Surgical Products and Instruments. Our reusable surgical products are stated at cost. We amortize linens and basins on a basis similar to the units of production method. Estimated useful lives for each product are based on the estimated total number of available uses for each product. The expected total available usage for our linen products using the three principal fabrics (accounting for approximately 74% of the reusable surgical products) is 75, 100, and 125 uses, based on several factors, including our actual historical

16

Table of Contents

experience with these products. We believe our RFID technology enables us to evaluate the useful lives of linen products more often. Basins are amortized on a straight-line basis over their estimated useful life, up to 20 years. We amortize owned surgical instruments on the straight-line method based on a four-year useful life. If our actual use experience with these products is shorter than these assumptions, our amortization rates for reusable products and instruments would increase, which could adversely affect our results of operations.

Health Insurance Reserves. We offer employee benefit programs including health insurance to eligible employees. We retain a liability up to $95,000 annually for each health insurance claim. Our policy has an estimated annual aggregate liability limit of $3.4 million. We accrue health insurance costs using estimates to approximate the liability for reported claims and claims incurred but not reported. Using different estimates or assumptions could produce different reserve balances. If actual claim results exceed our estimates, our health insurance reserve would increase, which could adversely affect our results of operations.

Workers’ Compensation Insurance Reserve. Our workers’ compensation insurance program is a large dollar deductible, self-funded plan. We retain a liability of $250,000 for each claim occurrence. Our policy has an annual aggregate liability limit of $1.5 million. We base our reserve on historical claims experience and reported claims. We accrue workers’ compensation insurance costs using estimates to approximate the liability for reported claims and claims incurred but not reported. We review this reserve quarterly. If actual claims differ from our estimates, the reserve would increase or decrease accordingly, which could adversely affect our results of operations.

Income Taxes. Our effective tax rate is based on our losses and statutory tax rates in the various jurisdictions in which we operate. Significant judgment is required in determining our effective tax rate and evaluating our tax positions. Income taxes have been provided using the asset and liability method in accordance with ASC Topic 740, Income Taxes, (“ASC 740”). In accordance with ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in the tax rate is recognized in operations in the period that includes the enactment date of the rate change. The tax benefits must be reduced by a valuation allowance in certain circumstances. Realization of the deferred tax benefits is dependent on generating sufficient taxable income prior to the expiration of any net operating loss carry-forwards. We periodically review deferred tax assets for recoverability, and provide valuation allowances as necessary.

Stock-Based Compensation. In accordance with the ASC Topic 718, Share-Based Payments”, (“ASC 718”) and the Security and Exchange Commission Staff Accounting Bulletin No. 107 (“SAB 107”), we recognize stock-based compensation expense in our consolidated statements of operations. We have elected to use the binomial model to determine the fair value of our issued options. Option pricing models require the input of subjective assumptions, including the expected life of the option, the price volatility of the underlying stock, expected interest rates and forfeitures. If actual results differ significantly from our assumptions, stock-based compensation could increase or decrease. For further discussion of our stock-based compensation, see Note B-Summary of Significant Accounting Policies – Stock-Based Compensation and Note J – Stock Options to the financial statements.

Fair Value Accounting. In September 2006, the Financial Accounting Standards Board (the “FASB”) issued an accounting standard that now resides in ASC Topic 820, Fair Value Measurements and Disclosures, (“ASC 820”), ASC 820 defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. ASC 820 creates a fair value hierarchy, which prioritizes the inputs to be used in determining fair value. The three hierarchy levels are based upon the assumptions (inputs) used to price the assets or liabilities. Level 1 provides the most reliable measure of fair value, such as quoted market prices in active markets for identical assets and liabilities. Level 2 includes observable inputs other than those

17

Table of Contents

included in Level 1. For example, quoted market prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets. Level 3 generally requires significant management judgment as the inputs reflect management’s own assumptions used in pricing the asset or liability. Companies are required to disclose relevant fair value information in their financial statements that allows users to assess inputs used to measure fair value, and the effect of those measurements on earnings for the periods presented. Companies are also required to separately reconcile the beginning and ending balances for each major category of assets and liabilities. ASC 820 is effective for financial statements issued for fiscal years beginning after November 15, 2007; however, the FASB delayed the effective date of ASC 820 for one year for certain nonfinancial assets and liabilities that are not remeasured at fair value on a recurring basis. Examples of nonfinancial assets and liabilities include property and equipment, goodwill and intangible assets that are not amortized. There were no financial instruments recognized at fair value in our financial statements requiring the application of ASC 820 for the year ended December 31, 2009.

In April 2007, the FASB issued an accounting standard that is contained in ASC Topic 825, Financial Instruments, (“ASC 825”). ASC 825 permits an entity to measure certain financial assets and financial liabilities at fair value where entities will report unrealized gains and losses in earnings at each subsequent reporting date. The standard allows entities to elect fair value application on an instrument-by-instrument basis with certain exceptions. The fair value option election is irrevocable in most cases. The new standard establishes presentation and disclosure requirements and assets and liabilities that are measured at fair value must be displayed on the face of the balance sheet. The adoption of ASC 825 did not have a material impact on our financial statements.

Recently Issued Accounting Standards

In June 2009, the Financial Accounting Standards Board (“FASB”) issued a standard that established the FASB Accounting Standards Codification™ (“ASC”) and amended the hierarchy of generally accepted accounting principles (“GAAP”) such that the ASC became the single source of authoritative nongovernmental U.S. GAAP. The ASC did not change current U.S. GAAP, but was intended to simplify user access to all authoritative U.S. GAAP by providing all the authoritative literature related to a particular topic in one place. All previously existing accounting standard documents were superseded and all other accounting literature not included in the ASC is considered non-authoritative. New accounting standards issued subsequent to June 30, 2009 are communicated by the FASB through Accounting Standards Updates (“ASU”). For the Company, the ASC was effective July 1, 2009. This standard did not have an impact on the our results of operations or financial condition. However, throughout the notes to the financial statements references that were previously made to various former authoritative U.S. GAAP pronouncements have been changed to coincide with the appropriate section of the ASC.

In August 2009, the FASB issued ASU No. 2009-05, Measuring Liabilities at Fair Value, which provides additional guidance on how companies should measure liabilities at fair value under ASC 820. The ASU clarifies that the quoted price for an identical liability should be used. However, if such information is not available, an entity may use, the quoted price of an identical liability when traded as an asset, quoted prices for similar liabilities or similar liabilities traded as assets, or another valuation technique (such as the market or income approach). The ASU also indicates that the fair value of a liability is not adjusted to reflect the impact of contractual restrictions that prevent its transfer and indicates circumstances in which quoted prices for an identical liability or quoted price for an identical liability traded as an asset may be considered level 1 fair value measurements. This ASU is effective for us on October 1, 2009. This standard did not have an impact on the our results of operations or financial condition.

In January 2010, the FASB issued ASU No. 2010-6, Improving Disclosures About Fair Value Measurements, that amends existing disclosure requirements under ASC 820 by adding required disclosures about items transferring into and out of levels 1 and 2 in the fair value hierarchy; adding separate disclosures about purchase, sales, issuances, and settlements relative to level 3 measurements; and clarifying, among other things, the existing fair value disclosures about the level of disaggregation. This ASU is effective for us for the

18

Table of Contents

first quarter of 2010, except for the requirement to provide level 3 activities of purchases, sales, issuances, and settlements on a gross basis, which is effective beginning the first quarter of 2011. Since this standard impacts disclosure requirements only and we do not have any items that meet the classification as Level 2 or Level 3 items, its adoption will not have a material impact on our results of operations or financial condition.

Results of Operations

We operate on a 52-53 week fiscal year ending the Sunday nearest December 31st. The financial statements are reflected as of December 31, 2009, 2008, and 2007 for presentation purposes only. The actual end of each period was January 3, 2010, December 28, 2008, and December 30, 2007, respectively. There are 53 weeks in 2009 and 52 weeks in 2008 and 2007.

The following table sets forth for the periods shown the percentage of revenues represented by certain items reflected in our statements of operations:

| Years Ended December 31, | |||||||||

| 2009 | 2008 | 2007 | |||||||

| Revenues |

100.0 | % | 100.0 | % | 100.0 | % | |||

| Cost of revenues |

79.6 | 77.9 | 78.5 | ||||||

| Gross profit |

20.4 | 22.1 | 21.5 | ||||||

| Distribution expenses |

7.0 | 7.4 | 6.8 | ||||||

| Selling and administrative expenses |

16.9 | 16.8 | 18.9 | ||||||

| Loss from operations |

(3.5 | ) | (2.1 | ) | (4.2 | ) | |||

| Interest expense |

0.6 | 1.1 | 1.5 | ||||||

| Other income |

(0.4 | ) | (0.4 | ) | (0.4 | ) | |||

| Loss before income taxes |

(3.7 | ) | (2.8 | ) | (5.3 | ) | |||

| Income tax provision (benefit) |

0.1 | (0.2 | ) | (1.9 | ) | ||||

| Net loss |

(3.8 | )% | (2.6 | )% | (3.4 | )% | |||

Year ended December 31, 2009 compared to year ended December 31, 2008

Revenues