Attached files

| file | filename |

|---|---|

| EX-31.2 - OmniaLuo, Inc. | v179505_ex31-2.htm |

| EX-32.1 - OmniaLuo, Inc. | v179505_ex32-1.htm |

| EX-31.1 - OmniaLuo, Inc. | v179505_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended: December 31, 2009

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ____________ to _____________

Commission

File No. 000-52040

OMNIALUO,

INC.

(Name of

Small Business Issuer in Its Charter)

|

Delaware

|

88-1581779

|

|

|

(State

or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

Room

101, Building E6, Huaqiaocheng East Industrial Park,

|

||

|

Nanshan

District,

|

||

|

Shenzhen

518053, The People’s Republic of China

|

||

|

(Address of

Principal Executive Offices) (Zip

Code)

|

||

(+86)

755-8245-1808

(Registrant’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act: Common Stock, $0.01

par value

Name of

each exchange on which registered: N/A

Securities

registered under Section 12(g) of the Exchange Act: Common stock, $0.01 par

value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Check

whether the issuer is not required to file reports pursuant to Section 13 or

15(d) of the Exchange Act. ¨

Check

whether the issuer: (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or such shorter period that

the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes x No ¨

Check if

disclosure of delinquent filers in response to Item 405 of Regulation S-K is not

contained in this form, and no disclosure will be contained, to the best of

registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

definition of “accelerated filer, large accelerated filer and smaller reporting

company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer ¨ Accelerated

Filer ¨ Non-Accelerated Filer ¨ Smaller Reporting Company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No x

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates of the registrant (assuming for these purposes, but without

conceding, that all executive officers and directors and 10% stockholders are

“affiliates” of the registrant), based on the closing price of $0.17 per shares

of the registrant’s Common Stock on December 31, 2009, the last business day of

the registrant’s most recently completed fiscal year as reported by the OTC

Bulletin Board, was approximately $1,629,156.

The

number of shares outstanding of the issuer's common stock as of March 31, 2010

is 22,840,000.

Documents

incorporated by reference:

NONE.

- 1

-

OMNIALUO,

INC.

INDEX

|

Page

|

||

|

Part

I

|

3

|

|

|

Item

1

|

Business

|

3

|

|

Item1A

|

Risk

factors

|

19

|

|

Item

2

|

Properties

|

28

|

|

Item

3

|

Legal

proceedings

|

29

|

|

Item

4

|

Reserved

|

29

|

|

Part

II

|

29

|

|

|

Item

5

|

Market

for registrant’s common equity, related stockholder matters and issuer

purchases of equity securities

|

29

|

|

Item

7

|

Management’s

discussion and analysis of financial condition and results of

operations

|

30

|

|

Item

7A

|

Quantitative

and qualitative disclosures about market risk

|

40

|

|

Item

8

|

Financial

statements and supplementary data

|

40

|

|

Item

9

|

Reserved

|

40

|

|

Item

9A (T)

|

Controls

and procedures

|

40

|

|

Part

III

|

42

|

|

|

Item

10

|

Directors,

executive officers and corporate governance

|

[__]

|

|

Item

11

|

Executive

compensation

|

45

|

|

Item

12

|

Security

ownership of certain beneficial owners and management and related

stockholder matters

|

46

|

|

Item

13

|

Certain

relationships and related transactions, and director

independence

|

48

|

|

Item

14

|

Principal

accountant fees and services

|

49

|

|

Part

IV

|

||

|

Item

15

|

Exhibits

and financial statement schedules

|

50

|

|

Signatures

|

||

|

Exhibits

|

||

|

Report

of independent registered public accounting firm

|

[__]

|

|

|

Consolidated

Balance Sheets as of December 31, 2009 and 2008

|

[__]

|

|

|

Consolidated

Statements of Operations and Comprehensive (Loss) Income for the Years

Ended December 31, 2009 and 2008

|

[__]

|

|

|

Consolidated

Statements of Stockholders’ Equity for the Years Ended December 31, 2009

and 2008

|

[__]

|

|

|

Consolidated

Statements of Cash Flows for the Years Ended December 31, 2009 and

2008

|

[__]

|

|

|

Notes

to Consolidated Financial Statements

|

[__]

|

- 2

-

FORWARD-LOOKING

STATEMENTS

This

Annual Report on Form 10-K, including “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” contains forward-looking

statements that are based on the beliefs of our management, and involve risks

and uncertainties, as well as assumptions, that, if they ever materialize or

prove incorrect, could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. The words “believe,”

“expect,” “anticipate,” “project,” “targets,” “optimistic,” “intend,” “aim,”

“will” or similar expressions are intended to identify forward-looking

statements. All statements, other than statements of historical fact, are

statements that could be deemed forward-looking statements, including statements

regarding new and existing products, technologies and opportunities, statements

regarding market and industry segment growth and demand and acceptance of

new and existing products, any projections of sales, earnings, revenue, margins

or other financial items, any statements of the plans, strategies and objectives

of management for future operations, any statements regarding future

economic conditions or performance, uncertainties related to conducting business

in China, any statements of belief or intention, any of the factors mentioned in

the “Risk Factors” section of this Form 10-K, and any statements of

assumptions underlying any of the foregoing. All forward-looking statements

included in this report are based on information available to us on the date of

this report. We assume no obligation and do not intend to update these

forward-looking statements, except as required by law.

USE

OF CERTAIN DEFINED TERMS

In this

report, unless indicated otherwise, references to:

|

“OmniaLuo”

“the Company,” “we,” “us,” or “our” refer to the combined business of all

the entities that form our consolidated business

enterprise;

|

|

“China,”

“Chinese” and “PRC” refer to the People’s Republic of

China;

|

|

“BVI”

refers to the British Virgin

Islands;

|

|

“SEC”

refers to the United States Securities and Exchange

Commission;

|

|

“Securities

Act” refers to the Securities Act of 1933, as

amended;

|

|

“Exchange

Act” refers to the Securities Exchange Act of 1934, as

amended;

|

|

“RMB”

refers to Renminbi, the legal currency of China;

and

|

|

“U.S.

dollar,” “$”, “USD” and “US$” refer to the legal currency of the United

States.

|

PART

I

ITEM

1. BUSINESS

Corporate

History

We were

originally incorporated in the State of Delaware on March 7, 2001 under the name

Wentworth II, Inc. We were formed as a vehicle to pursue a business combination,

which we effected through our recent reverse acquisition of Omnia BVI (“Omnia

BVI”), a company organized under the law of British Virgin Islands through a

reverse acquisition as described below. We had no material

operations or revenue from operations prior to the reverse acquisition

described below. Our corporate name changed to OmniaLuo, Inc. in November 2007,

subsequent to the acquisition.

On

October 9, 2007, we entered into a share exchange agreement with Omnia BVI, the

shareholders of Omnia BVI and certain of our principal stockholders. Pursuant to

the share exchange agreement, we issued to the shareholders of Omnia BVI

16,800,000 shares of our common stock in exchange for all of the issued and

outstanding shares of Omnia BVI. As a result, Omnia BVI and its wholly-owned

subsidiary Shenzhen Oriental Fashion Co., Ltd., a company organized under the

laws of the PRC (“Oriental Fashion”) became our direct and indirect wholly-owned

subsidiaries, respectively, and the former shareholders of Omnia BVI became our

Company’s controlling stockholders. We amended our Certificate of Incorporation

in November 2007 to change our name from Wentworth II, Inc. to OmniaLuo,

Inc.

For

accounting purposes, the share exchange transaction was treated as a reverse

acquisition with Omnia BVI as the acquirer and the Company as the acquired

party. When we refer in this report to business and financial information for

periods prior to the consummation of the reverse acquisition, we are referring

to the business and financial information of Omnia BVI on a consolidated basis

unless the context suggests otherwise.

- 3

-

Concurrently

with the consummation of the reverse acquisition, we issued 4,920,000 shares of

the Company’s common stock and warrants to purchase an aggregate of 4,920,000

shares of the Company’s common stock for an aggregate purchase price of $6.15

million, to a total of 38 investors (of whom 29 were accredited investors and

nine were non-US residents who purchased shares and warrants in off-shore

transactions) in a private placement pursuant to Regulation D and a simultaneous

off-shore offering pursuant to Regulation S (collectively, the “2007 Private

Placement”). In connection with that private placement, we also issued warrants

to purchase 492,000 shares of the Company’s common stock to Keating Securities,

LLC (“Keating Securities”), as a financial advisory fee in partial consideration

of their services in connection with the private placement. Prior to

consummation of the reverse acquisition and 2007 Private Placement, we may be

deemed to have been an affiliate of Keating Securities by reason of the

ownership of shares of our common stock by principals and executives of Keating

Securities.

We

conduct all of our business operations through our indirectly wholly-owned

operating subsidiary Shenzhen Oriental Fashion Co., Ltd.

Description

of Business

Through

our operating subsidiary in China, Shenzhen Oriental Fashion Co., Ltd., we are

engaged in the business of designing, marketing, distributing and

selling women’s clothing, with an emphasis on fashionable business casual wear.

All our apparel is marketed under the brand names of OMNIALO and OMNIALUO

(collectively referred to herein as the “OMNIALUO Brands” or “OMNIALUO brand

names”) through a network of 108 retail stores across China. We offer a complete

line of business casual women’s wear, including bottoms, tops, and outerwear, as

well as accessories, under the OMNIALUO brand names.

There are

three different types of retail stores that carry the OMNIALUO brands: (i)

company-owned stores, which stores are owned exclusively by the Company and

carry only the OMNIALUO brands, (ii) independent distributor stores, which

stores are owned exclusively by third parties and carry the OMNIALUO brands

exclusively, and (iii) co-owned stores, which stores are owned jointly by the

Company and a third party, and carry the OMNIALUO brands exclusively. All three

types of stores are located throughout China. As of December 31, 2009 and 2008,

our network of retail stores across China consisted of 108 and 208 stores,

respectively. Out of the 208 stores we had as of December 31, 2008, there were

27 Company-owned stores, 31 co-owned stores and 150 independent

stores. Out of the 108 stores we had as of December 31, 2009, there

were 27 Company-owned stores, 8 co-owned stores and 73 independent distributor

stores.

Our

current target customers are “white-collar” and “pink-collar” urban females

between the ages of 25 to 35. In China, generally, “white-collar” individuals

are described as working professionals with after-tax annual income ranging from

$2,500 to $7,500 and “pink- collar” individuals are female working professionals

with after-tax annual income ranging from $7,500 to $22,500.

The

OMNIALUO brand of apparel has been awarded “China’s Best Women’s Wear Design” by

China Fashion Designers Association (“CFDA”) every year from 2002-2006. Ms.

Zheng Luo, a prominent designer in China, is our chief executive officer, chief

designer and the originator of the OMNIALUO brands. Ms. Zheng Luo was also the

founder and principal shareholder of Omnia BVI prior to our reverse acquisition

with Omnia BVI described above. Ms. Zheng Luo is currently our largest

individual shareholder. Ms. Zheng Luo has won numerous prestigious

awards and was recently named by Cosmopolitan Magazine the "2008 Chinese Fashion

Designer of the Year". Under the leadership of Ms. Zheng Luo OMNIALUO sets its

goal to become the Chinese brand equivalent of Ralph Lauren, Vera Wang and Anna

Sui. The OMNIALUO brands benefit significantly from Ms. Zheng Luo’s professional

reputation.

Development

of the OMNIALUO Brands and Formation of Omnia BVI and Oriental

Fashion

In 1996,

Ms. Zheng Luo created the OMNIALO brand and founded Green’s Apparel Co., Ltd.

(“Green’s Apparel”) in Shenzhen, China, in which she owned a 95% equity

interest. Green’s Apparel manufactured women’s clothing.

In 1997,

the OMNIALO trademark was registered with the Chinese National Trademark Bureau

in both Chinese and English. The registrant and initial owner of such trademark

was Green’s Apparel.

In March

2003, Shenzhen Oumeng Industrial Co., Ltd. (“Oumeng”) was established. Ms. Zheng

Luo was the CEO and 50% equity owner of Oumeng. Also in March 2003, Oumeng

purchased inventory from Green’s Apparel, consisting of women’s apparel. Green’s

Apparel has not conducted any business after the transfer of inventory to Oumeng

in March 2003, and upon such transfer, Oumeng entered into all contracts with

Green’s Apparel’s existing suppliers, manufacturers and distributors, and

acquired the OMNIALO trademark in August 2003. In addition to marketing and

selling products under the OMNIALUO name, Oumeng also engaged in various other

businesses such as marketing and selling other apparel, electronics,

kitchenware and hardware. Oumeng also managed C-Luo Intuition, a luxury,

made-to-order evening dress brand, which brand was previously owned by Ms. Zheng

Luo prior to the sale of such brand to an independent third party. By the end of

August 2006, OMNIALUO brand apparel, under the management of Oumeng, was being

distributed through 100 retail stores in China.

- 4

-

In early

2006, Ms. Zheng Luo determined that the growth and development of the OMNIALUO

brands and its associated women’s apparel products could best be achieved by the

formation of a new company which would focus on the design, marketing,

distribution and sale of women’s business casual wear, without the potential

distraction and costs of operating other businesses. Therefore, in August 2006,

Ms. Zheng Luo, together with several other individual shareholders, formed Omnia

BVI under the laws of the British Virgin Islands. Shortly thereafter, in

September 2006, Omnia BVI formed a wholly owned subsidiary, Shenzhen Oriental

Fashion Co., Ltd., under the laws of the PRC. All rights in the OMNIALO

trademark were transferred from Oumeng to Ms. Zheng Luo, and Ms. Zheng Luo

resigned from her CEO position at Oumeng to devote her effort to Oriental

Fashion and Omnia BVI on a full-time basis. Subsequently, in April 2007, Ms.

Zheng Luo and her sister Ms. Xiaoyin Luo transferred their ownership of Oumeng

to their mother, Ms. Yuhua Sun, and to Ms. Yujuan Sun, an unrelated

party.

Principal

Products and Pricing Strategy

Principal

Products

We offer

a complete line of business casual women’s wear including bottoms, tops and

outerwear as well as accessories. All apparel is marketed under the OMNIALUO

brands through a network of retail stores across China. Our main product line is

“fashionable business casual,” which is suitable for both business and casual

environments. Fashionable business casual is clothing that can be worn to work

as well as outside the office environment. In recent years, fashionable business

casual has gained significant market share in the fashion industry. We also have

a smaller “business casual” product line.

Apparel

under the OMNIALUO brands is made of high quality materials, and many pieces

contain intricate and delicate craftwork. The designs are made to accentuate a

woman’s figure while providing a unique cut and stitching to the material, which

provide a slimming look. The majority of materials used are composed of tatting

and knitwear. Tatting and knitwear are soft fabrics and allow women’s skin to

“breathe” thus providing comfort in addition to style.

OMNIALUO

brand apparel and our chief designer, Ms. Zheng Luo, have consistently won top

fashion design awards in China since 2002. Most recently, Ms. Zheng Luo was

recognized by the Cosmopolitan Magazine as the “China Designer of the Year” in

2008.

With

respect to accessories, we released our accessories products in the third

quarter of 2007 and plan to release expanded new accessories products in the

next several fiscal quarters. Accessories have been identified as an important

product line for us and we have dedicated research and development efforts to

the creation of accessories. We believe that customers in China are interested

in purchasing a complete outfit, which includes clothing, accessories, and

shoes. As such, the availability of accessories coordinated with the clothing

line can effectively increase a customer’s total spending.

In the

fourth quarter of 2007, we started designing and developing “Omnialuo

Collections” to target “golden collar” female professionals in China. The

garments are generally priced from US$250 to US$400. We plan to produce only 100

to 200 pieces per style, so as to create a sense of exclusivity. We initially

introduced “Omnialuo Collections” to the market on a small scale in the fourth

quarter of 2007, we fully launched the product line in the third quarter of

2008.

Pricing

Our

design, marketing, and sales divisions are responsible for pricing our products.

The design, marketing, and sales divisions make internal evaluations of apparel

based on predicted market acceptance and then price the items accordingly. The

final price also takes into consideration competitive apparel price

levels.

Current

Pricing Strategy

The

retail price range of our products is between $40 to $300 per item, with the

majority of items priced between $60 and $150. In China, this price range is

considered the middle to upper-middle price range. The CGIR (or China Garment

Industry Report) released by CFDA (or China Fashion Designer Association) in

2006 forecasts that this middle to upper-middle price range will be the fastest

growing segment in the next five years, with an annual growth rate more than

25%.

Our full

retail price of apparel is typically five to six times our actual production

cost. For example, if a shirt costs $15 in raw materials and manufacturing, full

retail price will be $83, or 5.5 times production cost. However, only “new

arrival” apparel sells at full retail price. The “new arrival” period usually

lasts for two months. After such time, various discounts and promotions reduce

the actual selling price to between 60% to 80% of the full retail price, which

is equivalent to 3 to 4 times production cost.

In China,

the average selling price for similar apparel after the new arrival period is

60% to 70% of the full retail price. Our average is better than this average, as

we do not discount our products as much as other manufacturers, in part to

support our image as a premium brand. Our independent distributors do have some

latitude to deviate from our discount policies, but our experience to date is

that we provide greater discounts than do our independent

distributors.

- 5

-

New

Pricing Strategy

Over the

course of the next three years, we will be implementing our new pricing strategy

to increase the full retail price to eight to ten times our production cost, and

increase our average selling price to six to eight times our production cost. We

do not expect the price increase to result in a net reduction in sales as we

believe that (i) the price increase is in line with industry trends, and (ii)

our enhanced advertising campaign will raise brand recognition, thereby

increasing sales. The current average gross profit margin across all ranges of

our products is 50% and we expect to improve this gross profit margin to 55%

within the next three years.

Customers

In China,

professional women are generally divided into three categories, “white-collar”,

“pink-collar” and “golden-collar” (when accounting for purchasing-power

parity, the lifestyle of a household with annual income of $12,500 in China is

similar to the lifestyle of a household earning $40,000 annually in the United

States). (Source: National Bureau of Statistics of China; McKinsey Global

Institute Analysis 2006. Both the individual income and household income

referred to here are on an after-tax basis.)

Pink-collar

workers usually work in high-paying industries such as finance, consulting,

legal services, or assume senior positions in government agencies. Our business

casual collections as well as our fashionable business casual collection appeal

to pink-collar women.

White

collar workers usually work in junior or middle positions in an office

environment. This includes positions such as secretaries, administrators,

operators, IT staff, accounting staff and junior saleswomen. Usually, there is

no strict dress code for “white-collar” professionals in the office.

“White-collar” professionals can wear “relaxed” business style apparel instead

of business suits in their workplaces. In this sense, our fashionable business

casual can be worn by “white-collar” females both in and out of the work

environment.

“Golden-collar”

refers to the class of professionals with annual incomes over $22,500. They

typically hold executive positions in corporations or operate their own

businesses. “Golden-collar” females usually like to wear luxury brands. Our

brands will eventually target “golden-collar” females as well.

Our

current target customers are “white-collar” and “pink-collar” urban females

between the ages of 25 to 35. In China, “pink-collar” refers to women who

typically earn $7,500 to $22,500 annually “White-collar” refers to women who

typically earn $2,500 to $ 7,500 annually.

Our plan

has been to expand our target demographic to 35 to 45 year-old females by

offering premium and mature styles of apparel. Since 2007, our designs in the

spring/summer wear collection have reflected these new styles. Tapping into the

35 to 45 year-old female market is also intended to develop a large group of

loyal customers as well as increase revenues and profits. In China, the

wealthiest consumers are the 25 to 45 year-old group, much younger than the

highest earning group (45-54 years old) in the United States (McKinsey &

Company’s proprietary 2004 personal-financial-services surveys in China). A

study by Women’s Wear Daily (“In the Crosshairs”, an article written by Lisa

Movius, published in Women’s Wear Daily on March 22, 2005) indicated that

urban females aged between 25 to 35 in China demonstrate the highest

consumption needs in apparel, spending more than 20% of their disposable income

on clothing compared to the national average of 8% to 10%. Our strategy of

focusing on the 25 to 45 year-old urban female segment is intended to

capitalize on this consumption pattern.

Distribution

Network and Methods

Our

products are sold in the following types of stores: (i) company-owned stores,

which stores are owned exclusively by the Company, (ii) co-owned stores, which

stores are owned jointly by the Company and a third party, and (iii) independent

distributor stores, stores are owned exclusively by third parties. All three

types of stores carry the OMNIALUO brands exclusively. We refer to company-owned

stores and co-owned stores collectively as retail stores. All three

types of stores are located throughout China. We also run special, limited-time

outlet sales in major malls to sell excess inventories at the end of each

season. We currently do not have franchisees or franchised stores.

- 6

-

The table

below summarizes the characteristics of our major distribution channels and the

number of stores we had as of December 31, 2009:

|

Sales

Channel

|

Sub

Channel

|

Location

|

Objective

|

Characteristics

|

*Store

Level

Net

Profit

Margin

|

||||||

|

Company-owned

Stores

(27)

|

Flagship

Stores

|

Major

shopping malls in Tier 1 cities

|

Showcase

brand and attract customers and distributors

|

Capital

outlay: High

Inventory

risk: High

Operating

expenses: medium

|

Medium-low

|

||||||

|

Standard

Stores

|

Key

shopping malls in highly competitive Tier 1 & Tier 2

cities

|

Test

market to gauge customer interest and increase sales

|

Capital

outlay: High

Inventory

risk: Medium

Operating

expenses: Medium

|

Medium

|

|||||||

|

Co-owned

Stores (8)

|

Co-owned

Stores

|

Tier

1 & Tier 2 cities

|

Maximize

sales and profit

|

Capital

outlay: Medium

Inventory

risk: High

Operating

expenses: Medium

|

Medium-high

|

||||||

|

Independent

Distributor Stores (73)

|

Independent

Distributor Stores

|

Tier

1, Tier 2 & Tier 3 cities

|

Maximize

sales and profit

|

Capital

outlay: Low

Inventory

risk: Low

Operating

expenses: Low

|

High

|

*

In calculating the store level net profit margin, we take into consideration

related store expenses billed to us, including decoration, rent, payroll, mall

management fees, and utilities.

Company-owned

Stores

Company-owned

stores are retail stores owned 100% by us and which sell the OMNIALUO Brand

exclusively. We manage the daily operations of these stores, and pay all

operating expenses, including decoration, rent, payroll, and utilities. All

company-owned stores are located either within shopping malls or in independent

stores located on the street. There are two types of company-owned stores,

(1) flagship stores, and (2) standard stores. Flagship stores are high-profile

stores, located in key shopping malls of first-tier cities, such as Shanghai,

Beijing, and Shenzhen. These stores are extravagantly decorated,

display a number of luxurious items and offer the complete OMNIALUO Brand

product line. The cost of opening and operating flagship stores is high, thus

making them the least profitable among all store types. Standard stores are well

decorated, however, they are less extravagant than the flagship stores, and

are operated in major shopping malls of the first-tier and second-tier

cities. These stores are fashionably decorated and offer the most

complete product lines. These stores serve to showcase and promote the

OMNIALUO brands. In addition, the Company-owned stores are used to monitor

market trends and our products’ performance. Company-owned stores have the

lowest profitability among all our distribution channels. Nonetheless, we

believe that shopping malls are the best location for our stores as

according to the CGIR, in 2005, shopping malls and department stores represented

more than 55% of apparel sales in urban cities in China.

Co-owned

Stores

Co-owned

stores are owned jointly by us and a third party and sell the OMNIALUO Brand

exclusively. All co-owned stores are located in key shopping malls in first-tier

and second-tier cities. We are obligated to share revenues with the shopping

malls in which our stores are located. In some instances there are minimum

revenue payments to the landlord, or a threshold before revenue is split, or

both. On average, we must turn over 20% of the profits from each store to

the shopping mall in which such store is located. The co-ownership partner

receives 30% of the revenue from co-owned stores, after deducting the 20% due to

the shopping mall. Operating expenses are split evenly between us and the

co-ownership partners, however, 70% of the up-front investment is made by us. We

retain full ownership of the inventory delivered to the

co-owned stores. Co-owned stores serve as good complements to

Company-owned stores and independent distributor stores with a relatively high

net profit margin of 40%-50%.

As of

December 31, 2009 and 2008, we operated 35 and 58 retail stores, respectively,

of which there were 27 and 27 company-owned stores, respectively, in key

shopping malls in the first-tier and second-tier cities (see below under “Location of Retail Stores -

Markets” ), and 8 and 31 co-owned stores, respectively, in key shopping

malls located in first-tier and second-tier cities. The two types of stores

collectively accounted for approximately 34.9 of our total revenue in 2009 and

approximately 44.4% of our total revenue in 2008.

Independent Distributor

Stores

Independent

distributor stores are owned 100% by a third party and sell the OMNIALUO Brand

exclusively. Our products are sold to independent distributor stores at 35-40%

of the full retail price. We average approximately 50-55% net profit margin on

sales to the independent distributors. No items are sold on consignment. The

independent distributor stores make a 30% down payment upon ordering and pay the

balance before any shipment is sent. Hence, the independent distributor store

model generates a high profit margin for us, with no upfront investment, minimal

inventory risk and minimal cash flow shortage.

- 7

-

Independent

distributor stores are the most important distribution channel for our sales. As

of December 31, 2008 and December 31, 2009, we had 150 and 73 independent

distributor stores, respectively, across China. The independent distributor

stores represented approximately 55.6% of our total revenues in 2008, and

represent approximately 65.1% of our total revenues in 2009. Our future success

is to a large extent dependent on increasing the number of the independent

distributor stores.

During

2009, there was one customer who contributed 10% or more to the Company’s

consolidated revenue: Wuxi Langyi(24.78%). During 2008, there was no

customer who contributed 10% or more to the Company’s consolidated

revenue.

Outlets & Special Sales

Promotions

Periodically,

we run outlet sales in major malls to dispose of excess inventory at the end of

each season. We earn a small profit from the outlet channel.

Dedicated

Support for Independent Distributors and Co-ownership Partners

We

provide assistance to our independent distributors and co-ownership partners. By

helping the independent distributors and co-ownership partners operate

efficiently and profitably, and rewarding independent distributors and

co-ownership partners that meet or exceed sales targets, we hope to encourage

successful distributors and co-ownership partners to open more stores. Many of

our top ten distributors have multiple independent or co-ownership

stores.

We

provide assistance to our independent distributors and co-ownership partners in

the following areas of operations.

(i) Setting

up: retail site selection, construction, provision of our retail infrastructure,

image conformity and organization of the operational systems.

(ii) Training:

continuing support on visual display, customer service and store

administration.

(iv) Advertisement

and promotion: coordinating system-wide advertising and promotional activities

to increase independent distributors’ and co-partners’ sales and profits. Beyond

discounts, promotional activities consist of loyalty clubs and members’ only

events, store and Company anniversary promotions, limited editions, gift items

and sales promotions coordinated with other suppliers of

accessories.

(v) Inventory

liquidation: helping independent distributors to move excess inventory by

exchanging inventories among stores and selling through outlets.

(vii) Financial

analysis and support: Our finance department can analyze each store’s financial

situation and recommend specific performance adjustments. It also administers

incentive systems to reward successful independent distributors and maintain the

highest standards of quality control.

Growth

Plan for Distribution Channels

Since our

formation in the third quarter of 2006, one of our growth strategies is to open

new stores, especially independent distributor stores and co-owned stores which

generally have higher margins than company-owned stores. As of November 12,

2008, we had 245 stores altogether. However, as a result of the global economic

recession and the presumed temporary but nonetheless marked decrease in Chinese

consumer spending, particularly in the fourth quarter 2008, we were forced to

close certain stores that did not make their pre-determined sales requirements.

We believe that it was necessary to remove non-performers from an otherwise

strong network of retail outlets. While formerly on pace to meets our goal of

250 stores by year-end 2008, it became necessary in the fourth quarter to cease

pursuit of this goal and trim store count for the long-term good of the Company.

As such, we closed 37stores by December 31, 2008.

In

January 2009, additional stores that did not meet performance requirements were

subsequently closed. As of January 31, 2009, we had 178 stores in total,

including 27 company-owned stores, 31 co-owned stores, and 120 independent

distributor stores. In February 2009, we closed another 13 stores that did not

meet performance requirements. As of February 28, 2009, we had 165 stores in

total, including 27 company-owned stores, 31 co-owned stores and 107 independent

distributor stores. We continued to close non-performing stores in the remaining

period of 2009 in order to better face global economic crisis. As of September

30, 2009 we had 135 stores in total, including 27 company-owned stores, 15

co-owned stores, and 93 independent distributor stores. As of December 31, 2009,

we had 108 stores in total, including 27 company-owned stores, 8 co-owned stores

and 73 independent distributor stores. The total store count is still subject to

change based on prevailing market conditions. Nevertheless, we believe that

there has been indication that the deterioration of the Chinese consumer market

has slowed down in recent months. If the market condition improves, we expect

that no more stores will be closed except those that need to be replaced by new

stores. Our goal is to have 150 stores in total by the end of 2010.

- 8

-

We

believe our focus in expanding independent distributor stores and co-owned

stores is generally feasible because we structure our independent distributor

stores and co-owned stores to require low startup costs. We are also prepared to

launch advertising campaigns and market promotions to boost our brand

recognition, when necessary, in conjunction with our expansion plan. We launched

advertising campaigns and market promotions of OmniaLuo in October 2007 that

continued into 2009. The advertising campaign features Ms. Zheng Luo and the

OMNIALUO brands in major fashion magazines in China such as Vogue, Harper’s

Bazaar and Cosmopolitan. We believe that the increased publicity will enhance

our brand image and result in increased interest from independent distributors

and co-partners.

Franchising

We will

be eligible to enter into franchise arrangements one year after our application

for a retail license is approved. However, we have no existing plans to enter

into such arrangements.

Location

of Our Stores - Markets

There is

significant regional disparity in China with respect to per capita GDP. China is

divided into five regions, the Eastern, Southern, Western, Northern and Central

regions. Eastern and Southern China are the richest regions and historically

represent approximately 36% of China’s population and approximately 56% of

China’s GDP.

In the

Eastern and Southern regions, the population had an average per capita GDP of

$2,400, above the national average of $1,000 in 2005 (National Bureau of

Statistics of China, 2006). In the Northern region, the per capita GDP averaged

$2,100, in the Central region, the per capita GDP averaged $1,100 and in the

Western region the per capita GDP averaged $680.

Our

OMNIALUO Brand apparel has been well-received in the Southern region, and also

has a certain level of market penetration in the Eastern and Central regions. We

are currently making efforts to strengthen our foothold in existing markets,

increase our sales in the Eastern and Southern regions, and develop a market in

the Northern region.

Cities in

China where Retail Stores are Located

Our

products are marketed and sold in cities in China that have the highest levels

of average disposable income. For marketing purposes, we classify cities into

five groups as follows:

|

|

(i)

|

First-tier

cities are cosmopolitan cities located in the center of each of the five

geographic regions. Shanghai and Hangzhou (Eastern China), Shenzhen and

Guangzhou (Southern China), Xi’an, Chengdu, and Chongqing (Western China),

Beijing and Shenyang (Northern China), and Wuhan and Changsha (Central

China) are first-tier cities.

|

|

|

(ii)

|

Second-tier

cities are typically provincial capitals excluding the cities in tier one.

In China, there are approximately 25 second-tier

cities.

|

|

|

(iii)

|

Third-tier

cities are major towns outside the provincial capitals. In China, there

are over 265 third-tier cities, of which 50 have populations of over 1

million.

|

|

|

(iv)

|

Fourth-tier

cities are small cities distributed in hundreds of small

counties.

|

|

|

(v)

|

Fifth-tier

cities are small cities in rural and remote

areas.

|

The

cities in the first three tiers account for less than 40% of the population in

China but more than 70% of the national disposable income.

- 9

-

Our

products are currently sold in first-, second- and third-tier cities. The tables

below provide geographical distribution of our sales channels as of December 31,

2008.

|

Company-Owned Stores and Co-Owned Stores

|

||||

|

Region

|

Main City

|

Number of Stores

|

||

|

Eastern

China

|

Shanghai

|

4

|

||

|

Other

|

0

|

|||

|

Southern

China

|

Shenzhen

|

11

|

||

|

Guangzhou

|

5

|

|||

|

Other

|

2

|

|||

|

Fujian

|

3

|

|||

|

Western

China

|

Kunming

|

4

|

||

|

Central

China

|

Wuhan

|

6

|

||

|

Northern

China

|

Shenyang,

Harbin, Beijing, Jinzhou, Qingdao

|

0

|

||

|

Total

|

35

|

|||

|

Independent Distributor Stores

|

||||

|

Region

|

Total Number of Stores

|

Number of Distributors

|

||

|

Eastern

China

|

27

|

23

|

||

|

Southern

China

|

37

|

16

|

||

|

Central

China

|

17

|

11

|

||

|

Western

China

|

16

|

12

|

||

|

Northern

China

|

11

|

11

|

||

|

Total

|

108

|

73

|

||

Product

Design, Research and Development

Designers

One of

our main strengths is our artistic design team led by Ms. Zheng Luo, who is our

chief designer, founder and chief executive officer. Ms. Zheng Luo is a

prominent designer in China’s fashion industry. Our design team

consists of 14 designers, many of whom have been working with Ms. Zheng Luo for

several years. Ms. Zheng Luo’s ability to retain her design team provides for

consistent designs and greater brand loyalty.

Ms. Zheng

Luo and the OMNIALUO brands have been featured frequently in various popular

fashion magazines such as

Harper’s Bazaar, L’Official, Marie Claire, Vogue, Jessica and Cosmopolitan. Ms. Zheng Luo

has also been interviewed by many leading domestic and international media,

including China Central Television (“CCTV”), the largest TV network in China,

Hong Kong Phoenix TV, French Fashion TV, Italian Orbit TV, Vogue UK and

Washington Daily. In 2003, Ms. Luo was invited to present her design and hold a

fashion show for Fashion China Seminar in the Museum of Louvre. In

September 2008, Ms Luo, as the only designer invited from China, held a fashion

show at the New York Fashion Week. Recently, Ms. Zheng Luo was

acknowledged by the Cosmopolitan Magazine as the “China Designer of the Year”

for 2008.

Ms. Zheng

Luo’s designs have been worn by several Chinese media celebrities. In 2006, the

well-known Chinese movie star Ms. Ziyi Zhang, who starred in films such as

Memoirs of a Geisha, House of Flying Daggers , and Hero, wore one of her evening

dresses while attending a celebrity charity banquet. Ms. Luo’s fashion show

held in Beijing in November 2006 was attended by, among other notable attendees,

Ms. Bingbing Fan, who ranked as the 7th most famous person in China according to

Forbes . Ms Bingbing Fan wore Ms. Zheng Luo’s design to that Beijing

show.

We

conduct active training programs for our designers. Each of our designers

attends, on average, more than 10 training sessions ever year and visits the

Hong Kong SAR and other major cities in China regularly to see the latest

fashion trends and understand local tastes. Training sessions take various

forms, including attendance of fashion shows, fashion salons and fashion

seminars.

- 10

-

The table

below lists some of the awards Ms. Zheng Luo, her team members and the OMNIALUO

brand have received.

Awards

to Ms. Zheng Luo

|

2008

|

Best

Woman Fashion Designer of the Year, awarded by Cosmopolitan

Magazine

|

|

|

2007

|

One

of the Top 10 Outstanding Designers, awarded by CFDA

|

|

|

2006

|

Golden

Peak Award in Beijing’s Fashion Show, awarded by China Fashion Designers

Association (CFDA, the highest authority in China’s fashion

industry)

Golden

Peak is viewed as the most prestigious award in the Chinese fashion

industry. Each year this award is given by the CFDA to one single designer

in recognition of his/her overall outstanding achievements in the fashion

design industry. Only “The Best Women’s Wear Designer” recipients in the

preceding years are qualified to be nominated for the Golden Peak

Award.

|

|

|

2005

|

Lycra

in Style Designer Award, awarded by Harper’s

Bazaar

|

|

|

2005

|

The

Best Women’s Wear Designer, awarded by CFDA

This

award, granted by CFDA, is regarded as second only to the Golden Peak

Award. Ms. Zheng Luo winning the “Best Women’s Wear Designer” award in

China is comparable to Calvin Klein’s chief designer, Francisco Costa’s

winning the Women’s Wear Designer of the Year in 2006 in the United

States.

|

|

|

2005

|

One

of the Top 10 Young Designers in China, awarded by CFDA

|

|

|

2004

|

The

Best Women’ Wear Designer, awarded by CFDA

|

|

|

2004

|

The

Outstanding Designer in Asia, trophy awarded by Moet &

Chandon

|

|

|

2003

|

The

NAUTICA Originality Foundation Platinum Prize, awarded by

Nautica

Ms.

Zheng Luo, selected from among more than 1,000 other Chinese designers,

won the Nautica prize, a prize awarded to the most talented Chinese

designer in 2003.

|

|

|

2003

|

Invited

to the Fashion China Seminar held in Paris’ Louvre Museum.

Ms.

Zheng Luo, together with five other talented Chinese designers, was

invited to present a China-focused fashion show at the Louvre

Museum.

|

|

|

2002

|

One

of the Top Ten Fashion Designers in CHINA, awarded by

CFDA

|

|

|

2002

|

#1

among Top Ten Designers, awarded by CFDA

|

|

|

Awards

to the OMNIALUO Brand

|

||

|

2006

|

China

Best Women’s Wear Design, awarded by CFDA

|

|

|

2005

|

China

Best Women’s Wear Design, awarded by CFDA

|

|

|

2004

|

China

Best Women’s Wear Design, awarded by CFDA

|

|

|

2003

|

China

Best Women’s Wear Design, awarded by CFDA

|

|

|

2002

|

China

Best Women’s Wear Design, awarded by CFDA

|

|

|

Awards

to Other Company Design Professionals

|

||

|

2006

|

Ms.

Yi Zhou was awarded one of the top ten designers in Guangdong Province by

CFDA

|

|

Product

Design Process

New

collections in the Chinese fashion industry are usually introduced twice each

year, one collection for Spring/Summer and one collection for

Fall/Winter.

In order

to stay on top of the latest fashion trends, starting in late 2006 we began

introducing new collections at trade shows or fashion shows four times a year.

Specifically, we now introduce our (i) spring collection in November, (ii)

summer collection in March, (iii) fall collection in May, and (iv) winter

collection in August.

- 11

-

We

typically receive, on average, 80% of our orders during these trade events. This

percentage is expected to be lower going forward due to our enhanced marketing

efforts outside of the trade events and we expect to obtain more orders from

other distributors who do not participate in the trade events. We completed the

implementation of a new information management system for product order

placements, to enhance our overall business process management, in Company-owned

and co-owned stores in 2007. We have also selected 20 independent distributors

for implementation of the system.

Our

design team currently develops more than 1,600 new products per year, but only

releases about 550 new products after careful selection of what to release to

the market. We constantly focus on improving the design and quality of the

garments we produce.

The

design process for each season requires approximately fifty to sixty days from

conceptualization to finalization, and can be roughly divided into three stages,

planning, design and sample making. The design process of one season will start

while that of the preceding season is still in progress.

|

|

(i)

|

Planning.

In the planning stage, our design team forecasts the upcoming seasons’

fashion trends for Chinese women’s apparel. The goal is to integrate the

latest North American fashion trends with the Chinese woman’s aesthetic

sense. The design teams then develop four themes per collection. After

deciding on the main themes, the design team decides how many product

lines to introduce under each theme. The planning stage lasts

approximately 20 days.

|

|

|

(ii)

|

Design.

In the design stage, our designers collect original fabrics and

accessories. The designers then prepare drawings for the individual items

in each product line. The design process takes approximately 30 to 40

days.

|

|

|

(iii)

|

Sample

Making. Sample making is the last stage of the design process where

pattern making, cutting, sewing, fitting and revision take place and

usually lasts for approximately 2

days.

|

Procurement,

Suppliers, Manufacturing, and Quality Control

Procurement

We have a

purchasing department currently comprised of five employees. This department is

engaged in all procurement activities, such as specification and sample testing,

production capability verification, order placement, contract management, and

price and quantity negotiations. Final pricing for all orders are approved

by both our chief executive officer Ms. Zheng Luo and our vice

president.

We do not

use independent agents in our procurement activities. We believe that our

in-house personnel are better equipped to focus on and represent our interests,

to respond to our needs and, are more likely to build long-term relationships

with key vendors. We believe that these relationships will improve our access to

raw materials at favorable prices over the long-term.

The

entire process from searching for suppliers to reaching a procurement agreement

usually takes one week. In most cases, it takes 20 to 30 days to receive the

purchased raw materials. In case inventory is lower than required, we remedy

shortfalls by purchasing from the same suppliers to ensure the consistency of

quality. Manufacturers’ delivery dates are generally specified by contract to

ensure that products will be available in our warehouses when we need them. We

believe we have good relationships with our suppliers and, generally, there

are adequate sources to enable us to produce sufficient supply of apparel in a

timely manner. Once we purchase the material, those materials are delivered to

independent manufacturers for further processing and/or decoration.

Suppliers

The raw

materials required by us can be divided into two categories: (i) tatting and

knitwear, and (ii) woolen and leather-made garments. For tatting and knitwear

made garments, we purchase raw materials which are delivered to independent

manufacturers for further processing. For woolen and leather-made garments, we

purchase ready-to-wear clothes which require further design work and are also

delivered to independent manufactures for further processing and

decoration.

We

currently purchase a variety of materials from more than fifty vendors. We

believe that there is a sufficient number of suppliers for such materials in the

market. In 2009, Yi Sheng Fabric was the only supplier that accounted for more

than 5% of our total raw material and finished goods purchases. No supplier

accounted for more than 5% of our total raw material and finished goods

purchases in 2008.

- 12

-

Outsourced

Manufacturing

We do not

operate any manufacturing facilities, and we do not currently have any plans to

do so. Our apparel is produced by independent manufacturers that are selected,

monitored and coordinated by our quality control department to assure conformity

to our quality standards. We believe that the use of independent manufacturers

increases our production flexibility, enables us to focus on higher margin

business, and, at the same time substantially reduces capital expenditures and

avoids the costs of maintaining a large production workforce. We maintain

ownership of the raw materials and finished goods while such items are at our

independent manufacturers.

We

believe that our long-term, reliable and cooperative relationships with many of

our manufacturers provide a competitive advantage over many of our competitors.

Our merchandise is produced by approximately 15 independent manufacturers

located in Guangdong Province, China with close proximity to our headquarters in

Shenzhen, China. Xin Cai, one of the 15 contract manufacturers,

currently produces approximately 10.8%

of our annual manufactured garments in terms of dollar amount.

Although

there are no long-term agreements between us and any of our contractors or

suppliers, we believe our relationships with our suppliers and contract

manufacturers are excellent. In addition, we receive preferential treatment from

Yin Hu as the products manufactured by Yin Hu for us usually account for

over 90% of Yin Hu's production capacity. Yin Hu was 80% owned by Ms. Zheng

Luo, our founder and chief executive officer, until January 2007, at which time

she transferred her entire interest in Yin Hu to unrelated third

parties.

Quality

Control

We

monitor the quality of fabrics ordered and inspect samples of each product

before production begins. We also perform random quality control checks during

and after production before the garments leave our manufacturers. Our quality

control personnel visit all independent manufacturers’ facilities at least three

times a week. Final inspections occur when the garments are received in our

warehouse. After that, we distribute finished garments to retail stores

nation-wide. We employ two full-time quality control personnel, as well as an

additional three inspectors at our warehouse. Our quality control program is

designed to ensure that our products meet our high quality standards and that we

deliver high quality products to retail stores. As we further expand our stores

and increase our sales, we plan to hire more quality control

personnel.

Information

Management Systems

Since

January 2007, we have been implementing a new information management system.

This system is intended to enable us to procure raw materials on an economic

purchase order basis, keep track of raw materials stock on a real time basis and

monitor the production process. This system is intended to improve production

efficiency and reduce purchasing and storage costs. We have applied the

distribution function of the new system to our Company-owned stores and some of

our co-owned stores. By implementing the distribution function, we are able to

check our apparel stock in different categories, different sizes and colors on a

real-time basis. For example, if one company-owned store is in need of certain

inventory, we are able to immediately communicate to the other company-owned

store with excess inventory in that category and ensure a prompt

redistribution of inventory among both stores within one or two days. This new

distribution function is expected to reduce lost sales arising from inventory

shortages in particular stores and better allocate resources among different

stores across different regions. Currently, we are satisfied with the

implementation results of the new distribution function in the Company-owned

stores and our co-owned stores. We have started to extend the application of the

new system to selected independent distributor stores. As of December 31,

2009, 55 independent distributors are qualified to have access to the new

system, which accounted for more than half of our total independent distributors

stores at the end of 2009.

Inventory

We

generally receive the bulk of our orders from retail stores in trade or fashion

shows and usually fulfill these orders within three months. The orders are

non-cancelable, requiring in the case of orders from independent distributors a

30% down payment upon the order placement, with full payment due before delivery

of the goods. Once orders are placed, retail stores are allowed to exchange 10%

of the merchandise ordered for the first time but no exchanges are allowed in

subsequent orders for the same products.

Backlog

On

December 31, 2009, our backlog of unfilled firm orders for delivery was

approximately $2.5 million, compared with a backlog of unfilled firm orders for

delivery of approximately $4.0 million as of December 31, 2008. We believe that

our backlog at any specific point in time is not necessarily indicative of sales

and business results in the near future.

Employees

All of

our employees are employees of our wholly owned PRC operating subsidiary,

Oriental Fashion. As of December 31, 2009, we had approximately 150 full-time

employees. We consider our employee relationships to be satisfactory. We plan to

increase the number and level of our skilled executive management

executives.

- 13

-

Intellectual

Property

The

Company has two trademarks, OMNIALO and OMNIALUO, that are registered in the

PRC. Starting from November 17, 2009, such trademarks have also been registered

in the United States.

Omnialo. Oriental Fashion has

acquired rights of use to the Chinese and English OMNIALO trademarks, which were

assigned to it for nominal cost by Ms. Zheng Luo, until October 6, 2017. The

transfer of ownership of the trademarks has been approved by the Trademark

Office of State Administration for Industry and Commerce (the “Trademark

Office”). Ms. Zheng Luo has licensed use of these trademarks to Oriental

Fashion. These trademarks originally expired in September 2007 (for the Chinese

trademark) and October 2007 (for the English trademark), and applications

to extend their registration until 2013 were filed and were approved in

September 2007, resulting in new expiration dates of September 2017 (for the

Chinese trademark) and October 2017 (for the English trademark). Both Oumeng and

Ms. Zheng Luo have entered into agreements with Oriental Fashion agreeing not to

use the OMNIALO trademarks in the future.

Omnialuo. Oriental Fashion

has licensed, at nominal cost, rights of use to the Chinese and English OMNIALUO

trademarks, the registration of which Ms. Zheng Luo had initially applied for in

March 2005. These applications were approved by the trademark office on January

19, 2009. Ms. Zheng Luo transferred the Chinese and English OMNIALUO trademarks

to Oriental Fashion at nominal cost subsequent to registration of the OMNIALUO

trademarks by the Trademark Office. Both Oumeng and Ms. Zheng Luo have entered

into agreements with Oriental Fashion agreeing not to use the OMNIALUO

trademarks in the future.

Competition

The

women’s apparel market is highly fragmented in China. It is estimated by the

China Garment Industry Report that in 2005, the top ten women’s wear brands,

including international brands and domestic ones, totaled only 13.36% of the

total market. The market is extremely sensitive to fashion swings and

diversified consumer preferences.

Honoring

commitments made the World Trade Organization agreements, on December 11, 2004,

the Chinese government lifted all restrictions imposed on foreign enterprises

regarding their entry into China. Foreign retailers are allowed to establish

wholly owned foreign enterprises in China with no restrictions on registered

capital. Further, foreign retailers are allowed to open stores in any geographic

areas in China. Therefore, in addition to domestic competition, the Company is

subject to increasing competition from international brands.

Among our

competitors are well established domestic brands such as Moiselle and Pink Mary

and well established international brands such as Ports 1961 and others, most of

which have the same demographic focus as us. Many of our domestic competitors,

and most or all of our international competitors, are significantly larger

and have substantially greater distribution and marketing capabilities, capital

resources and brand recognition. We believe we can effectively compete with

other brands based on our attention to Chinese customers’ aesthetic tastes,

reflected through our design and use of materials, and the role in and

commitment to the Company of our chief designer, founder and principal

stockholder, Ms. Zheng Luo.

Growth

Strategy

We plan

to grow our sales and net profit margin based on the following

strategies:

Selectively

Expand Distribution Channels

Since our

formation in the third quarter of 2006, one of our growth strategies is to open

new stores, especially independent distributor stores and co-owned stores which

generally have higher margins than company-owned stores. As of November 12,

2008, we had 245 stores altogether. However, as a result of the global economic

recession and the presumed temporary but nonetheless marked decrease in Chinese

consumer spending, particularly in the fourth quarter 2008, we were forced to

close certain stores that did not make their pre-determined sales requirements.

We believe that it was necessary to remove non-performers from an otherwise

strong network of retail outlets. While formerly on pace to meets our goal of

250 stores by year-end 2008, it became necessary in the fourth quarter to cease

pursuit of this goal and trim store count for the long-term good of the Company.

As such, we closed 37stores by December 31, 2008. In 2009, we continued to close

non-performing stores in order to better better face global economic crisis. As

of December 31, 2009, we had 108 stores in total, including 27 company-owned

stores, 8 co-owned stores and 73 independent distributor stores. The total store

count is still subject to change based on prevailing market conditions.

Nevertheless, we believe that there has been indication that the deterioration

of the Chinese consumer market has slowed down in recent months. If the market

condition improves, we expect that no more stores will be closed except those

that need to be replaced by new stores. Our goal is to have 150 stores in total

by the end of 2010.

We

believe our focus in expanding independent distributor stores and co-owned

stores is generally feasible because we structure our independent distributor

stores and co-owned stores to require low startup costs. We are also prepared to

launch advertising campaigns and market promotions to boost our brand

recognition, when necessary, in conjunction with our expansion plan. We launched

advertising campaigns and market promotions of OmniaLuo in October 2007 that

continued into 2009. The advertising campaign features Ms. Zheng Luo and the

OMNIALUO brands in major fashion magazines in China such as Vogue, Harper’s

Bazaar and Cosmopolitan. We believe that the increased publicity will enhance

our brand image and result in increased interest from independent distributors

and co-partners.

- 14

-

Develop New Merchandise

Categories

Accessories

have been identified as an important future product line for the OMNIALUO Brand.

The new expanded accessories product line was released in the third quarter of

2007. In addition, in the first quarter of 2009, we applied to the Trademark

Office for a new trademark, OM WEEKEND. The products with this

trademark will target female professionals in China who are 18-30 years old. We

intend for OM WEEKEND and OMNIALUO to develop into a more perfect brand

system, which we will then take “up market”.

Expand our Market Vertically and

Horizontally

We aim to

continue to target the 25 to 35 year old female demographic and vertically

extend into the 35 to 45 age group by offering premium and mature styled

apparel. The 35 to 45 year old female age group generally has higher brand

loyalty and purchasing power. Penetrating this age group is intended to develop

a large group of loyal customers and increase our profits. We will also seek to

expand our market horizontally by increasing our visibility in northern China by

offering apparel tailored to the local consumers’ dressing tastes. This is being

implemented by our designers who have an understanding of local northern China

preferences. These designs were included in our spring/summer 2009 product line

that was released in December 2008.

Regulatory

Matters

Franchise

Regulation

We will

be eligible to enter into franchise arrangements one year after our application

for a retail license is approved. However, we have no existing plans to enter

into such arrangements. Should we enter into such arrangements, we would be

required to comply with certain legal requirements, including owning at least

two Company-owned or co-owned stores in China for more than one year, having the

ability to provide long-term training services to the franchisee, having a goods

supply system that is stable and that can guarantee quality, and having a good

reputation in business operations, and we would be required to submit an

application to the relevant Chinese authorities. Should we chose to

enter into franchise arrangements, we believe there would be little difficulty

in meeting these requirements.

Elimination of Restrictions on

International Competitors in China

Honoring

commitments in WTO agreements, on December 11, 2004, the Chinese government

lifted all restrictions imposed on foreign enterprises regarding their entry

into the retail market in China. Foreign retailers are allowed to establish a

wholly owned foreign enterprise in China with no restrictions on registered

capital. Further, foreign retailers are allowed to open any number of stores in

any geographic areas in China. This opens the door for substantial competition

from a number of larger international apparel retailing brands and companies.

See “Competition” above.

Industry

Overview

Economy in China

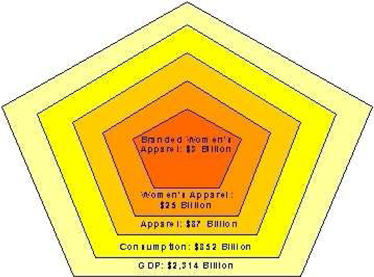

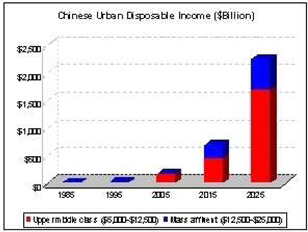

According

to the China Garment Industry Report, China has sustained 9%+ GDP growth for the

last 25 years and is likely to continue at 7% GDP growth in the next five years.

In 2005, China achieved a GDP of $2,314 billion and total consumption of $852

billion. The report further revealed that the Chinese people, in general, spend

8% to 10% of their disposable income on garments, and that the garment industry

in China saw overall sales of $87 billion. The report forecasted that the

garment industry in China will continue at more than a 20% annual growth rate

for the next 5 years.

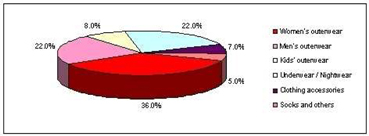

Segments

The

garment industry in China can be divided into seven major categories, which are

women’s outerwear, men’s outerwear, kids’ outerwear, knitwear,

underwear/nightwear, accessories, and socks. Women’s outerwear is the biggest

sector in the Chinese garment industry and accounted for approximately 36% of

garment industry sales by dollar amount in 2005. In contrast, men’s

outerwear only represented approximately 22% of industry sales in the same

period. Underwear/nightwear is also a significant sector in garment industry in

China.

The below

diagram illustrates the percentage of sales for each garment category in 2005 in

China. Overall garment industry sales in China in 2005 were $87 billion (Source:

Chinese Garment Industry Report, 2005-2006).

- 15

-

Concentration

Rates of

concentration differ from one garment sector to another. Men’s wear in China was

the most concentrated sector, with the top 10 sellers (both international brands

and Chinese domestic ones) occupying approximately 50% of collective sales in

men’s wear. Kids’ wear follows as the second most concentrated sector, with the

top 10 sellers representing approximately 35% of overall sales of kids’

wear. Women’s wear is the most fragmented sector, with then top ten sellers

only accounting for approximately 13.36% of sales. The garment industry is not

experiencing a major consolidation. Instead, it is undergoing a reshuffling with

quality brands, existing or new, taking market share from low quality and

non-branded products.

Distribution

Channels

In China,

urban dwellers do most of their shopping in shopping malls or department stores

because they feel brands displayed in big stores are more trustworthy with high

quality guarantees. CGIR indicated that, in 2005, 55% of garment purchases were

made in shopping malls or department stores, 23% in specialty stores such as

franchised stores, 13% in grocery stores, 6% in outlets and the remaining 3% in

other channels.

The

diagram below illustrated the percentage of Garment Sales in China by

Distribution Channels in 2005. Overall garment industry sales in 2005 in China

were $87 billion. (Source: Chinese Garment Industry Report,

2005-2006.)

Structural

Changes

The

Chinese apparel industry has experienced three stages. Before 1990, apparel was

purchased primarily for functional purpose and people were very price conscious

when making purchase decisions. From 1990 to 1999, people were shifting their

attention from being mainly price conscious to being more quality aware; they

liked to purchase clothes which were comfortable and durable. Since 1999,

people are increasingly brand aware and more inclined to purchase quality

brand apparel. This is especially true for young and middle aged urban females

who like to wear personalized and distinctive brands to appear

unique.

Market

Analysis

Market Segments

The

Chinese women’s apparel market can be segmented into different categories by

price, age, and style as indicated in the following tables.

- 16

-

|

Price Category

|

Full Retail

Price Range

|

Customer’s Social

Status

|

Customers’ Annual

Income

|

Family’s Social

Class

|

Family’s Annual

Household Income

|

|||||||||

|

Low

price

|

$

|

<

37

|

Blue-Collar

|

$

|

<

1,500

|

Poor

|

$

|

<

$3,125

|

||||||

|

Lower-middle

price

|

$

|

37-$75

|

Blue-White

Collar

|

$

|

1,500-$2,500

|

Lower-Middle

Class

|

$

|

3,125-$5,000

|

||||||

|

Middle

price

|

$

|

75-$125

|

White-collar

|

$

|

2,500

- $7,500

|

Upper-middle

Class

|

$

|

5,000-$12,500

|

||||||

|

Upper-middle

price

|

$

|

125-$188

|

Pink-collar

|

$

|

7,500-$22,500

|

Mass

Affluent

|

$