Attached files

| file | filename |

|---|---|

| EX-32.2 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex32-2.htm |

| EX-31.1 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex31-1.htm |

| EX-32.1 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex32-1.htm |

| EX-14.1 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex14-1.htm |

| EX-31.2 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex31-2.htm |

| EX-10.41 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex10-41.htm |

| EX-10.18 - III TO I MARITIME PARTNERS CAYMAN I LP | v178943_ex10-18.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

x ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2009

¨ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period

from to

Commission

File Number 000-53656

III to

I Maritime Partners Cayman I, L.P.

(Exact

name of registrant as specified in its charter)

|

Cayman

Islands

|

98-0516465

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

5580

Peterson Lane

Suite

155

Dallas,

Texas

|

75240

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

(972)

392-5400

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

To

be so registered

|

Name

of each exchange on which

each

class is to be registered

|

|

None

|

None

|

Securities

registered pursuant to Section 12(g) of the Act:

|

Class

A Limited Partner Units

|

|

(Title

of Class)

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past

90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act).

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated

filer ¨

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes ¨ No x

No market

currently exists for the limited and general partnership interests of the

registrant.

Documents

incorporated by reference: None.

INDEX

|

Page

Number

|

||||

|

Forward-Looking

Statements

|

3

|

|||

|

Part

I

|

||||

|

Item

1.

|

Business

|

4

|

||

|

Item

1A.

|

Risk

Factors

|

18

|

||

|

Item

2.

|

Properties

|

34

|

||

|

Item

3.

|

Legal

Proceedings

|

34

|

||

|

Part

II

|

||||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

34

|

||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

36

|

||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

58

|

||

|

Report

of Independent Registered Public Accounting Firm

|

59

|

|||

|

Consolidated

Balance Sheets as of December 31, 2009 and 2008

|

60

|

|||

|

Consolidated

Statements of Operations for years ended December 31, 2009 and

2008

|

61

|

|||

|

Consolidated

Statements of Partners’ Equity for the years ended December 31, 2009 and

2008

|

62

|

|||

|

Consolidated

Statements of Cash Flows for the years ended December 31, 2009 and

2008

|

63

|

|||

|

Consolidated

Statements of Comprehensive Income (Loss) for the years ended December 31,

2009 and 2008

|

64

|

|||

|

Notes

to Consolidated Financial Statements

|

65

|

|||

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

87

|

||

|

Item

9A(T).

|

Controls

and Procedures

|

87

|

||

|

Item

9B.

|

Other

Information

|

87

|

||

|

Part

III

|

||||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

87

|

||

|

Item

11.

|

Executive

Compensation

|

88

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

90

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

91

|

||

|

Item

14.

|

Principal

Accounting Fees and Services

|

96

|

||

|

Part

IV

|

||||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

96

|

2

Forward-Looking

Statements

Certain

statements contained or incorporated by reference in this Form 10-K including

without limitation statements containing the words “believe,” “anticipate,”

“attainable,” “forecast,” “will,” “may,” “expect(ation),” “envision,” “project,”

“budget,” “objective,” “goal,” “target(ing),” “estimate,” “could,” “should,”

“would,” “conceivable,” “intend,” “possible,” “prospects,” “foresee,” “look(ing)

for,” “look to,” and words of similar import, are forward-looking statements

within the meaning of the federal securities laws. Forward-looking

statements appear in a number of places and include statements with respect to,

among other things:

|

|

·

|

forecasts

about our ability to make cash distributions on the

units;

|

|

|

·

|

planned

capital expenditures and availability of capital resources to fund capital

expenditures;

|

|

|

·

|

future

supply of, and demand for, products that will be shipped, supplied or

otherwise supported by our vessels;

|

|

|

·

|

expected

demand in the maritime shipping industry in general and for our vessels in

particular;

|

|

|

·

|

our

ability to maximize the use of our

vessels;

|

|

|

·

|

expected

delivery of the anchor handling tug supply ships and the chemical

tanker;

|

|

|

·

|

estimated

future maintenance capital

expenditures;

|

|

|

·

|

the

absence of future disputes or other

disturbances;

|

|

|

·

|

increasing

emphasis on environmental and safety

concerns;

|

|

|

·

|

our

future financial condition or results of operations and our future

revenues and expenses;

|

|

|

·

|

our

business strategy and other plans and objectives for future

operations;

|

|

|

·

|

any

statements contained herein that are not statements of historical

fact.

|

These

statements are not guarantees of future performance and involve a number of

risks, uncertainties and assumptions. Accordingly, our actual results or

performance may differ significantly, positively or negatively, from

forward-looking statements. Unanticipated events and circumstances are

likely to occur. Important factors that could cause our actual results of

operations or financial condition to differ include, but are not limited

to:

|

|

·

|

inability

to raise sufficient debt or equity capital to secure delivery of the

remaining vessels for which we are obligated or intend to purchase and to

provide capital for operations;

|

|

|

·

|

fluctuations

in charter rates;

|

|

|

·

|

insufficient

cash from operations;

|

|

|

·

|

a

decline in the demand for petroleum products or other products shipped,

supplied or otherwise supported by our

vessels;

|

|

|

·

|

intense

competition in the anchor handling tug supply ship, multipurpose bulk

carrier or chemical tanker

industries;

|

|

|

·

|

the

occurrence of marine accidents or other

hazards;

|

|

|

·

|

fluctuations

in currency exchange rates and/or interest

rates;

|

|

|

·

|

delays

or cost overruns in the construction of new

vessels;

|

|

|

·

|

changes

in international trade agreements;

|

|

|

·

|

adverse

developments in the marine transportation business;

and

|

|

|

·

|

other

financial, operational and legal risks and uncertainties detailed from

time to time in our Securities and Exchange Commission filings, including

those set forth in this Form 10-K under Item 1A. Risk

Factors.

|

All

forward-looking statements included in this Form 10-K and all subsequent written

or oral forward-looking statements attributable to us or persons acting on our

behalf are expressly qualified in their entirety by these cautionary

statements. The forward-looking statements speak only as of the date made

and, other than as required by law, we undertake no obligation to publicly

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

3

PART

I

Item

1. Business

In

accordance with the Securities and Exchange Commission’s (“SEC”) “Plain English”

guidelines, this Annual Report on Form 10-K (this “Form 10-K”) has been written

in the first person. In this document, the words “we,” “our,” “ours” and

“us” refer only to III to I Maritime Partners Cayman I, L.P. and its

consolidated subsidiaries or to III to I Maritime Partners Cayman I, L.P. or an

individual subsidiary and not to any other person.

Our

functional currency is the U.S. dollar (“USD”). However, the functional

currency of many of our subsidiaries is the Euro (“EUR”). All amounts are

stated in USD, and where the amount relates to a subsidiary whose functional

currency is the Euro, the amount has been restated in EUR following the USD

amount. Amounts related to future payments which are payable in EUR have

been stated in USD and translated using the exchange rate as of

December 31, 2009. Amounts shown in narrative statements related to

payments made in the past have been translated using the exchange rate on the

date the transaction occurred. When comparisons are made between balance

sheet dates, the appropriate exchange rate for the given balance sheet date is

used. When comparisons are made related to income statement amounts, the

average exchange rate for the given period is used.

Company

Overview

We own

and operate maritime vessels. Our primary focus is on anchor-handling tug

supply (“AHTS”) vessels, but we also purchased a non-controlling interest in two

multipurpose bulk carrier vessels (“mini-bulkers”) and have entered into an

agreement to purchase a chemical tanker. We are also authorized to engage

in other activities if III to I International Maritime Solutions Cayman Inc., a

Cayman Islands corporation (“General Partner”), believes such activities will

benefit our core business of shipping operations.

We were

formed on October 18, 2006 and, to date, have had limited operating revenues and

operating history. Previously, we had devoted substantially all our

efforts to financial planning, raising capital, debt financing, management

oversight of ship construction and preparation for the operation and chartering

of the ships being constructed. As of December 31, 2009, delivery of three

of our AHTS vessels had occurred from the shipyard, Fincantieri Cantieri Navali

Italiani SpA (“Fincantieri”) in Italy, and we had contracts to purchase six

additional new AHTS vessels currently under construction by Fincantieri.

Delivery of our first three AHTS vessels, UOS Atlantis, UOS Challenger and UOS

Columbia, occurred on February 27, 2009, May 28, 2009 and October 5, 2009,

respectively, with the AHTS vessels immediately placed in service. With

these vessels delivered and operating under charters, our operations have begun

to shift focus from development stage to vessel operations, therefore we are no

longer a development stage company as defined by the topic Development Stage Entities of

Financial Accounting Standards Board Accounting Standards Codification (“FASB

ASC”), FASB ASC 915. Since December 31, 2009, we have taken delivery

of three additional AHTS vessels, for which we are currently seeking

charters. Because of our limited operating history, we have retained

experienced management companies to manage the operations of our

vessels.

Principal

Offices

Our

principal corporate offices are located at 5580 Peterson Lane, Suite 155,

Dallas, Texas 75240. Our telephone number is 972-392-5400.

SEC

Reporting

We file

annual, quarterly and current reports and other materials with the SEC.

You may read and copy any materials we file with the SEC at the SEC’s Public

Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain

information regarding the Public Reference Room by calling the SEC at

1-800-SEC-0330. In addition, the SEC maintains a website at www.sec.gov

that contains reports and other information regarding issuers that file

electronically with the SEC.

We also

provide electronic access to our periodic and current reports on our website,

www.3to1IMS.com. These reports are available on our website as soon as

reasonably practicable after we electronically file such materials with, or

furnish them to, the SEC. The information contained on our website or any

other website is not incorporated by reference into this Form 10-K and does not

constitute a part of this report. A copy of this Form 10-K will be

provided without charge upon written request to Investor Relations at the above

address.

4

We first

exceeded 500 Class A limited partners on July 30, 2008, and because we had more

than 500 Class A limited partners as of December 31, 2008, we were required to

register our Class A Units with the SEC pursuant to the provisions of Section

12(g) of the Securities Exchange Act of 1934 (the “Exchange Act”). The

sale by our Class A limited partners of our Class A Units is restricted pursuant

to the terms of our Partnership Agreement, and there is currently no public

market for such Class A Units nor is it anticipated that such a market will

develop. We are authorized to issue Class A, Class B, Class C and Class D

limited partner units as well as general partner units. To date we have

issued Class A, Class B and Class D limited partner units and general partner

units.

Formation

History

We were

formed in October 2006 as an exempted limited partnership under the laws of the

Cayman Islands, with III to I International Maritime Solutions Cayman, Inc., a

company limited by shares formed under the laws of the Cayman Islands, serving

as our general partner. Under the law of the Cayman Islands, the reference

to “limited by shares” means that the liability of shareholders in our general

partner is limited to the amount, if any, unpaid on their shares. This

unpaid amount can be called upon at any time, but the member cannot be obliged

to contribute any more than that amount. Our general partner has just one

shareholder, who has met its liability amount in full.

Initially,

we owned approximately 96% of the units of I-A Suresh Capital Maritime Partners

Limited, a limited liability company formed under the laws of Cyprus (our

“Cyprus Subsidiary”). On April 28, 2009, we underwent a reorganization in

order to simplify our ownership structure, streamline the calculation of

allocations and distributions by incorporating economic rights in our

Partnership Agreement that formerly resided in the organizational documents of

our Cyprus Subsidiary and to simplify the financial statements by eliminating

the non-controlling interest component related to the Cyprus Subsidiary.

Pursuant to the reorganization, one of the non-controlling unitholders in our

Cyprus Subsidiary contributed its units in the Cyprus Subsidiary for our newly

created Class D units. Our general partner, the other non-controlling

unitholder, contributed its units in the Cyprus Subsidiary in exchange for the

contribution by the other unitholder and the adoption of the Second Amended and

Restated Agreement of Limited Partnership. Pursuant to our current

Partnership Agreement and the equity contribution agreement, the parties agreed

to treat the contribution and issuance of the Class D units as effective on

April 1, 2009. As a result of the reorganization, we now own 100% of our

Cyprus Subsidiary. Please note that, in an effort to utilize terminology

consistent with that used for domestic limited liability companies, we have used

the terms “units” and “unitholders” above for purposes of describing the equity

interests and equity holders, respectively, in connection with our Cyprus

Subsidiary. However, unlike a domestic limited liability company, for

purposes of describing the equity interests and holders thereof in a Cyprus

limited liability company, the respective use of the terms “shares” and

“shareholders” is consistent with Cyprus law, and we have used the terms

“shares” and “shareholders” in all relevant documentation when necessary to

describe the respective equity interests and holders thereof of our Cyprus

Subsidiary.

In

accordance with FASB ASC 810, Consolidation - Non-controlling Interest in a

Subsidiary, we have treated the acquisition of the non-controlling

interest in our Cyprus Subsidiary as an equity transaction, and have recorded a

decrease in the equity of the Class D unitholders and of the general partner

equal to the negative carrying value of the non-controlling interest

attributable to the acquired interests effective April 1, 2009. The table

below reflects the carrying value of our General Partner, Class D and

non-controlling interests as of December 31, 2009 and March 31, 2009. The

excess of the fair value of the Class D units over the negative carrying value

has also been allocated solely to the Class D limited partners, resulting in no

affect on the financial statements of such excess.

5

|

Class D

|

||||||||||||

|

General

|

Limited

|

Non-controlling

|

||||||||||

|

Partner

|

Partners

|

Interest

|

||||||||||

|

Balance

at March 31, 2009

|

$ | 864,290 | $ | — | $ | 17,350,044 | ||||||

|

Transfer

of non-controlling interest in Cyprus Subsidiary

|

(48,314 | ) | (48,314 | ) | 96,628 | |||||||

|

Contributions,

net of syndication costs

|

(31,274 | ) | (3,846 | ) | 8,166,398 | |||||||

|

Distributions

|

— | — | (71,025 | ) | ||||||||

|

Net

loss

|

(270,564 | ) | (53,093 | ) | (2,528,153 | ) | ||||||

|

Forward

currency exchange contract

|

— | — | 1,274,808 | |||||||||

|

Foreign

currency translation adjustment

|

— | — | 1,265,750 | |||||||||

|

Balance

at December 31, 2009

|

$ | 514,138 | $ | (105,253 | ) | $ | 25,554,450 | |||||

Suresh

Capital Maritime Partners Germany GmbH (our “German Subsidiary”), a German

limited liability company and a wholly-owned subsidiary of our Cyprus

Subsidiary, was formed for the purpose of acquiring, managing and operating our

vessels. Through our German Subsidiary we own a 75% limited partner

interest in nine special purpose entities (each an “SPV”) with the remaining

interest owned by Reederei Hartmann GmbH & Co. KG (“Reederei Hartmann”), a

Hartmann Group company, and affiliates of Reederei Hartmann. The Hartmann

Group is a group of affiliated entities involved in the international shipping

industry that are owned or controlled by Hartmann AG, a German corporation

headquartered in Leer, Germany. Each of these nine SPVs is run by the

general partner, ATL Offshore GmbH (“ATL”), also a member of the Hartmann

Group. While ATL serves as the general partner of each of these nine SPVs,

it does not own any portion of such SPVs and thus does not participate in the

results or assets of such SPVs.

We also

acquired a 49% non-controlling interest in two SPVs, each of which owns and

operates a mini-bulker, with the remaining 51% ownership held by affiliates of

each of Reederei Hesse GmbH & Co. KG (“Reederei Hesse”), whom we have

retained to manage the operations of our mini-bulkers, and the Hartmann

Group. Each SPV is a German limited partnership, Kommanditgesellschaft,

which owns or will own one AHTS vessel or one mini-bulker, as

applicable.

Additionally,

Kronos Shipping I, Ltd (“Kronos”), our wholly-owned subsidiary, was formed

during 2008 to acquire, manage and operate the chemical tanker that we currently

have an option to purchase. In light of the global downturn in the economy

and the resulting decrease in charter rates for chemical tankers, and product

tankers in general, we are currently re-evaluating our intentions with respect

to the chemical tanker, and believe it is unlikely that we will complete the

acquisition of the tanker unless the shipyard constructing the vessel agrees to

significant concessions, to include timing of construction installments and an

adjustment to the overall contract price.

We

previously owned three additional SPVs that each held a contract to purchase an

additional AHTS vessel. However, these SPVs were sold to our affiliate,

FLTC Fund I, in December 2007 for their approximate carrying value.

Additional information is included in this Form 10-K under Item 13. Certain

Relationships and Related Transactions, and Director Independence under the

caption entitled Sale of

Certain AHTS SPVs.

6

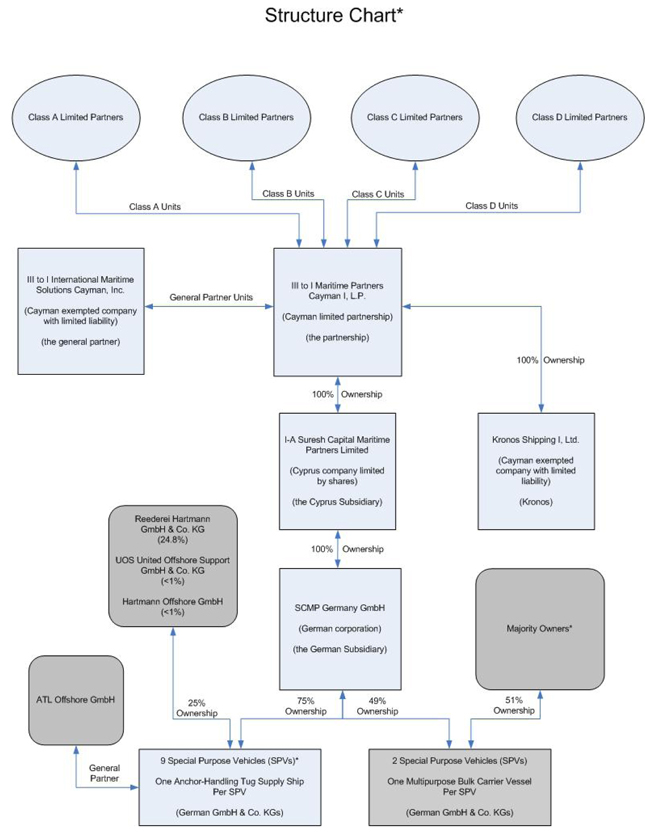

For a

chart showing the ownership structure of our subsidiaries as of March 31, 2010,

see below.

|

*

|

See

charts on the following page for additional detail regarding the ship

management arrangements for the AHTS vessels and the mini-bulkers, as well

as the ownership of the mini-bulker

SPVs.

|

7

8

We have

subcontracted the commercial management of our vessels by entering into ship

management agreements with Hartmann Offshore GmbH (“Hartmann Offshore”), another

Hartmann Group company, with respect to all nine of the AHTS vessels while

Reederei Hesse was retained to provide management services for our

mini-bulkers. The commercial management of each AHTS vessel was

subcontracted by Hartmann Offshore to United Offshore Support GmbH & Co. KG,

an affiliate of Hartmann Offshore and a member of the Hartmann Group (“UOS”),

while the commercial management of the mini-bulkers was subcontracted by

Reederei Hesse to Maritime Transport + Logistik GmbH & Co. KG, a Hartmann

Group company (“MTL”). Additionally, if we decide to purchase the chemical

tanker, we intend to retain Bernhard Schulte Shipmanagement (the “Schulte

Group”), a maritime services company, to manage the operations of the chemical

tanker. The chemical tanker is part of a pool of tankers managed by

Bernhard Schulte (Hellas) SPLLC, the tanker division of the Schulte Group

(“Hanseatic Tankers Pool”). The Hanseatic Tankers Pool is a group of over

20 product and chemical tankers operated in a pool to build name

recognition. Under the ship management agreements, the applicable

management companies are responsible for coordinating all commercial and

technical management of the vessels including crewing, maintenance, repair and

dry docking. We and the other owners of each applicable vessel are

responsible for the costs associated with the ship management agreements and

have certain approval rights for major decisions. Under these agreements,

each applicable management company will be paid based on a percentage of net

daily earnings.

Our

vessels may be employed under a variety of contracts, including both spot market

and time charters of varying durations, voyage charters and affreightment

contracts. We remain responsible for paying the vessel’s operating

expenses which include the cost of crewing, insuring, repairing and maintaining

the vessel and payment of broker’s commissions. When a charter expires,

the commercial manager will assess market conditions in the industry and

determine whether to seek to re-employ the vessel under a time or spot market

charter, voyage charter or affreightment contract.

Our

Ships

Our fleet

currently consists of six AHTS vessels and two mini-bulkers. We have

contracts to acquire three additional AHTS vessels currently under construction

and have an option to acquire a chemical tanker. A brief description of

each type of vessel, including details of our planned fleet is provided

below.

Anchor Handling Tug Supply

Ships

An AHTS

vessel is an offshore supply and support vessel specially designed to provide

anchor handling services and tow offshore platforms, barges and production

modules or vessels. The AHTS vessel is also used in general supply service

for all kinds of platforms, transporting both wet and dry cargo in addition to

deck cargo.

We

acquired our first three AHTS vessels in February 2009, May 2009, and October

2009, and acquired an additional AHTS vessel in February 2010 and two in March

2010, from Fincantieri Shipyards (“Fincantieri”) in Italy. We have

contracts to purchase three additional new AHTS vessels currently under

construction by Fincantieri with delivery of the remaining three AHTS vessels

scheduled for

April 2010,

although we expect delays of one to three months. Each of these contracts

sets forth the terms of our purchase of a newly constructed AHTS vessel, and the

prices for such vessels range from $53,259,995 (EUR 37,159,000) to $61,051,414

(EUR 42,595,000) for a total commitment for all nine AHTS vessels of

$516,488,222 (EUR 360,349,000), with such prices to be paid in multiple

installments upon the completion of various construction milestones. Each

agreement specifies a delivery date for the vessel being constructed, and

contains a liquidated damages provision typically imposing daily fees ranging

from $7,167 (EUR 5,000) to $21,500 (EUR 15,000) resulting from delivery delays

beyond the fifteen day grace period from the date specified in the contracts,

including any amendments thereto. Each such shipbuilding contract also

sets forth the agreed-upon characteristics for the applicable ship, including

cargo capacity, speed, fuel consumption and propulsion machinery, and each

agreement contains liquidated damages provisions which specify the agreed

damages to be paid by the builder in the event the completed vessel fails to

satisfy any of such characteristics as prescribed by the shipbuilding

contract. Our AHTS vessels will support offshore deep sea oil and gas

drilling in any of the following locations: the North Sea, Gulf of Mexico,

Mediterranean Sea, Indian Ocean, Brazil, Africa, Southeast Asia and

Australia.

9

Additionally,

each AHTS vessel SPV (“AHTS SPV”) has entered into a contract with Hartmann

Offshore, whereby Hartmann Offshore supervises and manages the technical aspects

and the construction of the vessel to be acquired by the applicable AHTS

SPV. For each AHTS SPV, two contracts are in place during the construction

of the AHTS vessel, one of which covers the technical and commercial management

of the vessel (the “Technical Management Contracts”) and the other which covers

the supervision of the construction of the vessel, the assessment of the

builder’s adherence to the specifications and the assessment of any

modifications pertaining to the vessel (the “Construction Supervision

Contracts”). Under the Technical Management Contracts, Hartmann Offshore

receives fees of $716,650 (EUR 500,000) payable in four equal installments, each

due at (i) the beginning of steel cutting, (ii) installation of the main

engines, (iii) launching of the vessel and (iv) delivery of the completed

vessel. Hartmann Offshore subcontracted the commercial management duties

under the Technical Management Contracts to UOS. Under the Construction

Supervision Contracts, Hartmann Offshore receives fees of $358,325 (EUR 250,000)

payable in two equal installments, each due at installation of the main engines

and delivery of the completed vessel. Additionally, Hartmann Offshore

shall be reimbursed for travel costs and other reasonable out of pocket

expenses.

Our AHTS

vessels are built to deploy and recover mooring systems for deepwater drilling

rigs. These are highly specialized vessels designed to have 16,320 BHP

(brake horsepower), 450 ton main winch capacity and 190 ton BP (bollard

pull). With dynamic positioning capabilities and high cargo capacities,

these powerful vessels double as rig and platform supply vessels that are

capable of supporting various deepwater operations. State of the art

electronics allow these vessels to monitor and maintain equipment throughout all

modes of service.

Each AHTS

SPV has entered into a management agreement with Hartmann Offshore or its

nominee whose performance is guaranteed by Hartmann Offshore. Such

management agreements commence upon delivery of the applicable ship and

terminate when the ship is sold. Under these management agreements, the

ship manager provides a full range of management services, including but not

limited to the following:

|

|

·

|

Crew

management services, whereby the ship manager shall provide suitable

qualified crew for the applicable vessel in accordance with international

standards;

|

|

|

·

|

Technical

management services relating to the operation and maintenance of the

applicable vessel;

|

|

|

·

|

Commercial

management services with respect to the chartering of the applicable

vessel (Hartmann Offshore subcontracted these services to

UOS);

|

|

|

·

|

Arrangement

of insurance policies with respect to the vessel, if so instructed by the

owners of the ship;

|

|

|

·

|

Supervision

of the sale and purchase of the applicable vessel, including the

supervision of the performance of any sale or purchase agreement, the

identification of potential purchasers and the negotiation of the purchase

agreement;

|

|

|

·

|

Supply

of necessary provisions for the vessel;

and

|

|

|

·

|

Arranging

for the provision of bunker fuel as required for the vessel’s

trade.

|

Pursuant

to each such ship management agreement, Hartmann Offshore is paid a fee to

manage the day to day operations of the vessels, which shall be 4% of the net

daily earnings of the applicable vessel, subject to a maximum and minimum of

$2,400 and $750, respectively, per day. The Hartmann Group currently

operates and/or manages more than 170 vessels, including containerships,

bulkers, tankers, liquefied petroleum gas (“LPG”) carriers and multipurpose

ships.

Our AHTS

vessels will operate under time charter leasing arrangements with oil companies

under either short-term “spot market” charters, which are measured in days or

weeks, or long-term charters, which typically range from one to three years,

including renewal options. Under these arrangements, our AHTS SPVs will

typically be responsible for vessel operating expenses such as crew wages, class

costs, insurance on the vessel and routine maintenance, as well as management

fees as described below. A vessel’s net daily earnings will consist of the

revenue earned under that vessel’s charters less that vessel’s operating

expenses, which would not include interest expense on acquisition debt. A

brief description of the current AHTS vessels and their net daily earning during

2009, is set forth below. For a more detailed explanation of their net

daily earnings to date, including a description of various revenues received

other than day rates and expenses, see Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations under the caption

entitled AHTS Vessel Net Daily

Earnings in the Overview section.

10

|

|

·

|

UOS

Atlantis – Our first AHTS vessel, UOS Atlantis, was placed in service upon

delivery on February 27, 2009, and began operating under its current

charter on March 15, 2009. Our net daily earnings for UOS Atlantis

averaged $9,345 for the year ended December 31,

2009.

|

|

|

·

|

UOS

Challenger – Our second AHTS vessel, UOS

Challenger, was placed in service upon delivery on May 28, 2009, and began

operating under its current charter on June 24, 2009. Our net daily

earnings (deficit) for UOS Challenger averaged ($2,543) for the year ended

December 31, 2009.

|

|

|

·

|

UOS

Columbia – Our third AHTS vessel, UOS Columbia, was placed in service upon

delivery on October 5, 2009 in the North Sea spot market. Our

net daily earnings (deficit) for UOS Columbia averaged ($18,515), based on

the date the AHTS vessel was placed in service through December 31,

2009.

|

|

|

·

|

UOS

Discovery – Our fourth AHTS vessel, UOS Discovery, was delivered on

February 16, 2010, and is currently not under

charter.

|

|

|

·

|

UOS

Endeavour – Our fifth AHTS vessel, UOS Endeavour, was delivered on March

11, 2010, and is currently not under

charter.

|

|

|

·

|

UOS

Explorer – Our sixth AHTS vessel, UOS Explorer, was delivered on March 15,

2010, and is currently not under

charter.

|

Our

commercial manager, UOS, is currently pursuing opportunities for our

vessels. The remaining three AHTS vessels are currently scheduled for

delivery during April 2010, although delays in delivery of one or two months are

expected. If the

current environment were to continue or worsen, and we were unable to achieve

adequate utilization of our vessels, the delivery of the additional vessels and

the associated operating costs and debt service will negatively impact our

financial results.

In March

2009, we entered into an agreement with UOS (“AHTS Pool Agreement”) to

participate in a revenue pool comprised of our nine AHTS SPVs and three AHTS

SPVs owned by our affiliate, FLTC Fund I (the “Pool Members,” together the “UOS

AHTS Pool”). The agreement names UOS as the “Pool Manager,” with

responsibility for the management and accounting of the pool and also for

monitoring Pool Members’ compliance with the AHTS Pool Agreement. Under

the AHTS Pool Agreement, each of our AHTS SPVs has agreed to pool its returns

from employment of the vessel less voyage expenses (“Voyage Results”) with the

other Pool Members to achieve an even distribution of the risks resulting from

the fluctuation in the offshore chartering business. The AHTS Pool

Agreement will have no effect on our consolidated revenues until such time as

one of the FLTC Fund I vessels is placed in service, which is expected to be May

2010.

Multipurpose Bulk Carrier

Vessels

A bulk

carrier, bulk freighter or bulker is a merchant ship specially designed to

transport bulk cargo such as grains, fertilizer, quick lime, soda ash, forest

and paper products and cement in its cargo holds. A mini-bulker is a

single hold bulk carrier with maximum cargo capacity of 10,000 metric tons or

less.

We

acquired a non-controlling interest in two new mini-bulkers which were acquired

from Nanjing Huatai Co. Limited in China in August and December 2007,

respectively. Each of our mini-bulkers is managed by Reederei Hesse as

technical manager and MTL as commercial manager, and is held in a separate SPV,

of which we indirectly own 49% with the remaining 51% owned by affiliates of the

Hartmann Group and Reederei Hesse. Pursuant to each ship management

agreement, the managers receive 4% of the net daily earnings of the applicable

vessel. Our mini-bulkers currently operate in liner services between the

Baltic area and Northern Spain, Portugal, the Mediterranean Sea, Greece, Turkey

and Israel.

Chemical/Product Tanker

Ships

A

chemical tanker is a type of tanker designed to transport bulk cargos like

chemicals, clean petroleum products and vegoils. The Schulte Group paid

deposits of $8,300,000 to Nantong Mingde Heavy Industry Stock Co., Ltd. and

Jiangxi Topsky Technology Co., Ltd., the sellers of a chemical tanker currently

under construction. In connection with our potential acquisition of such

chemical tanker, we paid $3,000,000 to the Schulte Group and agreed to repay

$5,300,000 to Conway Shipping, Ltd. (“Conway”), an affiliate of the Schulte

Group owned by certain members of the Schulte family, to whom the Schulte

Group’s rights in the chemical tanker were subsequently transferred. The

$5,300,000 that we have agreed to repay Conway represents a portion of the first

construction installment due to the sellers of the chemical tanker that was

previously advanced by the Schulte Group in connection with the acquisition of

the chemical tanker.

11

If

acquired, the operations of the chemical tanker would be managed by the Schulte

Group. The Schulte Group provides shore and ship-based maritime and

engineering expertise and manages a large fleet of ships. If acquired, the

chemical tanker would be held in a separate SPV owned by Kronos. We may,

in the future, sell or assign the chemical tanker or the rights to acquire it,

or we may elect to abandon the purchase of the chemical tanker thereby incurring

certain liquidated damages. Under our current agreement with Conway, the

liquidated damages would total $3,000,000 payable to Conway and would be settled

from funds we have already paid as deposits on the potential tanker acquisition,

and we would not be required to repay the $5,300,000 owed to

Conway.

At the

present time, we are re-evaluating our intentions with respect to the chemical

tanker, and believe it is unlikely that we will complete the acquisition of the

tanker unless the shipyard constructing the vessel agrees to significant

concessions, to include timing of construction installments, and an adjustment

to the overall contract price. We have therefore recorded an impairment to

the deposit on asset acquisition on our balance sheet to reduce the carrying

value of this asset, resulting in the recognition of a loss on impairment of

$9,874,907. If we do formally forfeit our option to acquire the tanker, we

expect to recognize gain on the extinguishment of debt of $5,300,000 in a future

period, as under the terms described above, we would not be required to repay

the $5,300,000 to Conway. The net result of this would be a loss of

approximately $4,574,907, which in the end represents liquidating damages of

$3,000,000 plus our capitalized costs approximating $1,574,907.

Additional

information related to the Schulte Group, Conway and Kronos is included in this

Form 10-K in Part II, Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations under the caption entitled Financing Arrangements in the

Liquidity and Capital

Resources.

The

decision to sell, assign or acquire the vessel will include an evaluation of,

but not limited to, the following:

|

|

·

|

World

economy;

|

|

|

·

|

Demand

and supply of cargoes and trades;

|

|

|

·

|

Demand

for product and chemical tankers;

|

|

|

·

|

Supply

of product and chemical tankers;

|

|

|

·

|

Freight

rates for product and chemical tankers with less than 30,000 deadweight

tonnage; and

|

|

|

·

|

Secondhand

price projections.

|

The

expected/actual construction commencement date and expected/actual completion

date, as applicable, for each of the vessels are as follows:

|

Type of Vessel

|

Hull No.

|

Vessel Name

|

Construction

Commencement Date

|

Expected

Delivery Date

|

||||

|

2

Multipurpose Bulk

|

MPP

1

|

MS

Laakdiep

|

Delivered

|

Delivered

|

||||

|

Carriers

|

MPP

2

|

MS

Larensediep

|

Delivered

|

Delivered

|

||||

|

9

Anchor Handling Tug

|

6160

|

UOS

Atlantis

|

Delivered

|

Delivered

|

||||

|

Supply

Vessels

|

6161

|

UOS

Challenger

|

Delivered

|

Delivered

|

||||

|

6162

|

UOS

Columbia

|

Delivered

|

Delivered

|

|||||

|

6163

|

UOS

Discovery

|

Delivered

|

Delivered

|

|||||

|

6168

|

UOS

Endeavor

|

Delivered

|

Delivered

|

|||||

|

6169

|

UOS

Enterprise

|

Oct-08

|

Apr-10

|

|||||

|

6171

|

UOS

Explorer

|

Delivered

|

Delivered

|

|||||

|

6172

|

UOS

Freedom

|

Mar-08

|

Apr-10

|

|||||

|

6173

|

UOS

Liberty

|

Nov-08

|

Apr-10

|

|||||

|

1

Chemical Tanker

|

MD2007-11-12

|

Anthos

|

Jun-10

|

Oct-11

|

The

expected construction commencement and delivery dates set forth above are based

on current information from the shipbuilders. These dates are estimates

and may change prior to vessel completion.

12

Transactions

with Affiliates and Related Parties

The table

below sets forth the material agreements under which our affiliates and other

related parties provide services to us and/or receive fees or other

payments. The agreements in the table are categorized as either “Vessel

Construction Phase Contracts,” “Vessel Operating Phase Contracts” or “Non-Vessel

Specific Contracts.” Vessel Construction Phase Contracts relate to

matters during the period when the applicable vessel is under construction,

while Vessel Operating Phase Contracts are agreements relating to matters after

the applicable vessel has been delivered. Non-Vessel Specific Contracts

are more general in nature and do not specifically relate to any vessel or

related stage of construction or operation.

|

Agreement

|

Counterparty Receiving

Fees/Payments

|

Relationship of

Counterparty

|

Aggregate

Payments

|

|||

|

Vessel

Construction Phase Contracts

|

||||||

|

Contract

for Financial Services (9 total)

|

Suresh

Capital Consulting & Finance Ltd.;

Maritime

Funding Group LLC;

Churada

Investments

|

Under

common control with Suresh Capital Partners, LLC, one of our limited

partners

|

$716,650

(EUR 500,000) per AHTS vessel;

$6,449,850

(EUR 4,500,000) total(1)

|

|||

|

Contract

for Construction Supervision (9 total)

|

Hartmann

Offshore GmbH

|

Non-controlling

interest holder in our AHTS SPVs

|

$358,325

(EUR 250,000) per AHTS vessel; $3,224,925 (EUR 2,250,000) total(2)

|

|||

|

Contract

for Technical and Commercial Management (9 total)

|

Hartmann

Offshore GmbH; commercial

management subcontracted to United Offshore Support GmbH & Co.

KG

|

Non-controlling

interest holders in our AHTS SPVs

|

$716,650

(EUR 500,000) per AHTS vessel; $6,449,850 (EUR 4,500,000) total(3)

|

|||

|

Vessel

Operating Phase Contracts

|

||||||

|

Standard

Ship Management Agreement (9 total)

|

Hartmann

Offshore GmbH; commercial management subcontracted to United Offshore

Support GmbH & Co. KG

|

Non-controlling

interest holders in our AHTS SPVs

|

See

details below(4)

|

|||

|

Contract

Carrier Agreement (2 total)

|

Reederei

Hesse GmbH & Co.; commercial management subcontracted to

MTL

Maritime Transport + Logistik GmbH & Co. KG

|

Under

common control with the majority interest holders in the SPVs which own

the mini-bulkers

|

See

details below(5)

|

|||

|

Pool

Agreement AHTS-Moss 424

|

ATL

Offshore GmbH & Co. “Isle of Fehmarn” KG;

ATL

Offshore GmbH & Co. “Isle of Memmert” KG;

ATL

Offshore GmbH & Co. “Isle of Mellum” KG

|

Subsidiaries

of our affiliate, FLTC Fund I

|

See

details below(6)

|

|||

13

|

ATL

Offshore GmbH & Co. “Isle of Fehmarn” KG;

ATL

Offshore GmbH & Co. “Isle of Memmert” KG;

ATL

Offshore GmbH & Co. “Isle of Mellum” KG

|

Subsidiaries

of our affiliate, FLTC Fund I

|

See

details below(7)

|

||||

|

Non-Vessel

Specific Contracts

|

||||||

|

Second

Amended and Restated Agreement of Limited Partnership

|

III

to I International Maritime Solutions Cayman, Inc.;

Suresh

Capital Partners, LLC;

The

Maritime Funding Group, Inc. Irrevocable trust

|

Our

general partner;

Our

Class D limited partners

|

See

details below(8)

|

|||

|

Second

Amended and Restated Agreement to Perform Administrative and Professional

Services

|

Dental

Community Management, Inc.

|

Owned

in part by Jason M. Morton, a director and the Chief Financial Officer of

our general partner

|

$1,200,000/year

|

|||

|

(1)

|

This

amount represents the total amount due under the contract. There are

four equal payments of EUR 125,000 due under each of these contracts based

on predetermined progress points, the first being the date steel cutting

begins, the second being the installation of the main engines, the third

being the launching of the vessel and the fourth being the delivery of the

vessel. It is anticipated that $4,658,225 (EUR 3,250,000) will be

paid for financial services during the year ended December 31, 2010.

During the year ended December 31, 2009, no financial services fees were

paid due to cash flow issues. For a detailed description of these

agreements, see Item 13. Certain Relationships and Related Transactions,

and Director Independence under the caption The German Subsidiary

Financial Services

Agreements.

|

|

(2)

|

This

amount represents the total amount due under the contract. There are

two equal payments of EUR 125,000 due under each of these contracts based

on predetermined progress points, the first being the installation of the

main engines and the second being the delivery of the vessel. It is

anticipated that $1,254,138 (EUR 875,000) will be paid during the year

ended December 31, 2010 for construction supervision. During the

year ended December 31, 2009, $1,612,463 ($1,125,000) was paid for

construction supervision. See Item 13. Certain Relationships and

Related Transactions, and Director Independence under the caption Payment of Construction

Administrative and Technical and Commercial Management

Fees.

|

|

(3)

|

This

amount represents the total amount due under the contract. There are

four equal payments of EUR 125,000 due under each of these contracts based

on predetermined progress points, the first being the date steel cutting

begins, the second being the installation of the main engines, the third

being the launching of the vessel and the fourth being the delivery of the

vessel. It is anticipated that $1,612,463 (EUR 1,125,000) will be

paid during the year ended December 31, 2010 for technical and commercial

management. During the year ended December 31, 2009, $2,508,275 (EUR

1,750,000) was paid for technical and commercial management. See

Item 1. Business under the caption Our

Ships.

|

|

(4)

|

It

is not practicable to accurately quantify the annual fees to be payable

pursuant to these agreements, as the amounts payable pursuant to these

agreements are based on a percentage (4%) of the net daily earnings of the

relevant vessel, subject to a maximum and minimum of $2,400 and $750,

respectively, per day. See Item 1. Business under the caption Our

Ships.

|

14

|

(5)

|

It

is not practicable to accurately quantify the annual fees payable pursuant

to these agreements, as the amounts payable pursuant to these agreements

are based on a percentage (4%) of the net daily earnings of the relevant

vessel. See Item 1. Business under the caption Our

Ships.

|

|

(6)

|

It

is not practicable to quantify the annual fees payable pursuant to this

agreement, as the amounts allocable to each vessel in the pool will vary

depending on the aggregate revenues generated by the vessels’

operations. For a detailed description of this agreement, see Item

1. Business under the caption Our Ships and Item 13.

Certain Relationships and Related Transactions, and Director Independence

under the caption The

AHTS Vessel Pooling

Agreement.

|

|

(7)

|

It

is not practicable to quantify the annual amounts payable pursuant to this

agreement, as the amounts payable thereunder are contingent obligations

arising pursuant to the indemnification provisions contained

therein. For a detailed description of this agreement, see Item 13.

Certain Relationships and Related Transactions, and Director Independence

under the caption Cross-Collateralization of

Nord/LB Loan Facility.

|

|

(8)

|

Pursuant

to the terms of our Partnership Agreement, our general partner and Class D

limited partners are entitled to receive a portion of distributions that

would otherwise be distributed to certain of our other limited

partners. Additional information is provided in our Second Amended and Restated Agreement

of Limited Partnership, included as Exhibit 3.4 to this Form 10-K,

and in Item 1A. Risk Factors under the caption entitled There may be conflicts of

interest as a result of our general partner’s carried

interest. Because any amounts received by our general partner

or our Class D limited partners pursuant to our Partnership Agreement

depend on the amounts that are actually distributable to our limited

partners, it is not practicable to accurately quantify the amounts to be

paid to our general partner and Class D limited partners for a given

period pursuant to this agreement.

|

Because

we have entered into the foregoing agreements with certain of our affiliates and

other related parties, these agreements were not negotiated at arms’ length and

therefore may not be on terms that are as fair to us as might be obtained by

entering into such agreements with non-affiliated third parties. See Item

1A. Risk Factors under the caption entitled We have entered into contracts with

our affiliates that were not negotiated at arms-length.

Insurance

The

operation of any ocean-going vessel carries an inherent risk of catastrophic

marine disasters and property losses caused by adverse weather conditions,

mechanical failures, human error, war, terrorism and other circumstances and

events. In addition, the transportation of crude oil and other

contaminants is subject to the risk of spills and business interruptions due to

political circumstances in foreign countries, hostilities, labor strikes and

boycotts.

Environmental

legislation, imposing potentially unlimited liability upon owners, operators and

bareboat charterers for oil pollution incidents, has made insurance more

expensive for ship owners and operators. We believe that our current

insurance coverage, maintained at the SPV level, is adequate to protect us

against the principal accident-related risks that we face in the conduct of our

business.

Permits

and Authorizations

We are

required by various governmental and quasi-governmental agencies to obtain

permits, licenses and certifications with respect to our vessels. The

kinds of permits, licenses and certificates required depend upon several

factors, including the commodity transported, waters in which the vessel

operates, nationality of the vessel’s crew and age of the vessel. We

expect to be able to obtain all permits, licenses and certificates currently

required to permit our vessels to operate. However, we may not be able to

obtain the necessary permits or, if able, may not be able to obtain such permits

without incurring unreasonable expenses and/or lengthy delays. In

addition, laws and regulations, environmental or otherwise, may be changed or

adopted which could limit our ability to do business or increase our costs of

doing business.

15

Regulations

Government

regulations significantly affect the ownership and operation of our

vessels. We are subject to international conventions in addition to

national, state, provinces and local laws and regulations in force in the

countries in which our vessels operate or are registered.

A variety

of government and private entities subject our vessels to both scheduled and

unscheduled inspections. These entities include local port authorities,

classification societies, flag state administrations and charterers.

Certain of these entities require us to obtain permits, licenses and

certifications for the operation of our vessels. Failure to maintain

necessary permits or approvals could require us to incur substantial costs or

temporarily suspend the operation of one or more of our vessels.

Increasing

environmental concerns have created a demand for vessels that conform to

stricter environmental standards. We are required to maintain operating

standards for all our vessels that emphasize operational safety, quality

maintenance, continuous training of our officers and crews and compliance with

international regulations. We believe the operation of our vessels is in

compliance with applicable environmental laws and regulations applicable to us

as of the date of this Form 10-K.

International

Maritime Organization

The

International Maritime Organization (“IMO”) has negotiated international

conventions that impose liability for oil pollution in international waters and

a signatory’s territorial waters. The IMO adopted Annex VI to the

International Convention for the Prevention of Pollution from Ships to address

air pollution from ships effective May 2005. Annex VI sets limits on

sulfur oxide and nitrogen oxide emissions from ship exhausts, prohibits

deliberate emissions of ozone content fuel oil and allows for special areas to

be established with more stringent controls on sulfur emissions. As of

December 31, 2009, we believe our vessels were in compliance with Annex

VI.

The

operation of our vessels is also affected by the requirements set forth in the

IMO’s Management Code for the Safe Operation of Ships and Pollution Prevention

(“ISM Code”). The ISM Code requires ship owners and bareboat charterers to

develop and maintain an extensive “Safety Management System” that includes the

adoption of a safety and environmental protection policy setting forth

instructions and procedures for safe operation and dealing with

emergencies. Failure to comply with the ISM Code may subject us to

increased liability, decreased insurance coverage for the affected vessels and

result in a denial of access to, or detention in, certain ports.

Employees

As of December 31, 2009, our

AHTS SPVs employed 138

seafarers. Management considers relations with its employees to be

satisfactory.

Industry

Overview

Shipping

is a global industry with prospects closely tied to the level of economic

activity in the world. The maritime shipping industry is fundamental to

international trade because it is the only practicable and cost effective means

of transporting large volumes of many essential commodities and finished

goods. There are five main segments in the shipping industry:

|

|

·

|

tankers,

which carry such cargo as crude oil and petroleum

products;

|

|

|

·

|

bulk

carriers, which carry items such as coal and

grain;

|

|

|

·

|

containerships,

which carry only containers;

|

|

|

·

|

gas

tankers, which carry mostly LPG and liquefied natural gas (“LNG”);

and

|

|

|

·

|

offshore

support vessels, including AHTS vessels and platform supply

vessels.

|

Our

primary focus is in offshore support vessels. However, we also purchased a

non-controlling interest in two mini-bulkers and may acquire a chemical

tanker.

16

The

offshore support vessel industry is engaged in supporting various stages of

exploration, development and production of oil and gas from offshore

locations. Therefore, the supply and demand characteristics of the broader

oil and gas industries are central to the development of the offshore support

vessel market. In general, global economic growth generates rising demand

for power and fuel. Offshore exploration, drilling and production are

crucial to satisfying this demand. We believe that these broader market

dynamics combined with the age of the existing global fleet and the demand for

sophisticated vessels should provide substantial employment opportunities for

our vessels; however, global economic contraction or stagnant growth may reduce

the demand for power and fuel, in turn reducing the demand for our

vessels. As a result, we may be unable to charter our vessels at

profitable day rates or at all.

The

following table outlines the development of an offshore oil field and is broken

down into three distinct phases, each requiring the use of AHTS

vessels:

|

Term

|

Activities

|

Key

Factors

|

Support

Services

|

|||||

|

Exploration

|

3-5

years

|

· Collection,

analysis and interpretation of seismic data

· Discovery

of oil and gas reserves

|

· Oil

price levels

· Proven

reserve replenishment

|

· Refueling

· Transportation

of crew and supplies

· Rig

relocations

|

||||

|

Development

|

2-4

years

|

· Construction

and installation of production infrastructure in preparation for

production

|

· Current

and planned platform construction

|

· Anchor

handling

· Transportation

of bulk and deck cargo

· Towing

· Transportation

of crew and supplies

|

||||

|

Production

|

10-55

years

|

· Management

of production of oil and gas

· Maintenance

|

· Production

volumes

|

· Anchor

handling

· Transportation

of bulk and deck cargo

· Transportation

of crew and supplies

· Inspection

and maintenance support

services

|

Competition

Competition

for charters is intense and based on price; vessel location, size, age,

condition, acceptability and quality; and on the vessel operator’s quality and

reputation. Historically, the majority of AHTS vessel owners were focused

on regional markets; however, expansion and joint ventures have enabled the

larger owner groups to establish a global presence. The principal markets

for AHTS vessels follow offshore exploration and development and include: the

Gulf of Mexico, the North Sea, the Indian Ocean, Southeast Asia, Australia,

Africa, Brazil and the Middle East.

With

respect to mini-bulkers, the fleet ownership is even more diverse than the AHTS

fleet, as are the principal markets for such vessels. Mini-bulkers are

able to operate virtually anywhere, and are not as dependent on offshore

exploration and development. However, it is not uncommon for owners of

such vessels to establish and operate liner services in certain geographic

areas, depending on the cargos to be shipped. For both AHTS vessels and

mini-bulkers, vessel migration between operating locations may be limited by,

among other things, mobilization costs, vessel suitability and government

statutes prohibiting foreign-flagged vessels from operating in certain

waters.

17

Item

1A. Risk Factors

Investing

in us involves a degree of risk, including the risks described below. Our

financial condition and operating results have been, and will continue to be,

affected by a wide variety of risk factors, many of which are beyond our

control, that could have adverse effects on our financial condition and

profitability during any particular period. Additional risks and

uncertainties not currently known or deemed to be immaterial may also materially

and adversely affect our business operations. If any of the following

risks were to actually occur, our business, financial condition or results of

operations could be materially and adversely affected. Limited partner

units are inherently different from the capital stock of a corporation, although

many of our business risks are similar to those that would be faced by a

corporation engaged in a similar business.

Risks

Relating to Our Business

There

are operational risks inherent to the shipping industry.

The

operation of any vessel involves the inherent risk of catastrophic marine

disasters, adverse weather and sea conditions, mechanical failure, collisions,

property losses to ships and business interruption due to political action in

countries other than the United States. Any such event may result in a

reduction in our investment returns or an increase in costs. We currently

insure our vessels for their estimated market value against damage or loss,

including war, terrorism acts and other risks. In addition, the operations

of our vessels are covered by workers’ compensation, maritime employer’s

liability, general liability and other insurance customary in the shipping

industry. We intend to obtain similar coverage for all future vessels;

however, there can be no assurances that such insurance coverage can be

maintained on current vessels, obtained on future vessels or that such coverage

will be adequate should we incur a significant loss.

We

depend on our management companies and certain affiliates to assist us in our

business operations.

Each of

our vessels is or will be owned by an individual SPV, which is single ship

operating offshore entity. Each AHTS SPV is run by the general partner,

ATL, which is an affiliate of the Hartmann Group. The mini-bulker SPVs,

ATL Reederei GmbH & Co. MS “Larensediep” KG and Hesse Schiffahrts GmbH &

Co. MS “Markasit” KG, are run by ATL Reederei GmbH and Hesse Schiffahrts GmbH,

respectively, as the general partner. Additionally, in order to provide

added certainty with respect to our operations, we entered into ship management

agreements for technical and commercial management with Hartmann Offshore with

respect to the AHTS vessels and Reederei Hesse with respect to the

mini-bulkers. The commercial management of each AHTS vessel was

subcontracted by Hartmann Offshore to UOS while the commercial management of the

mini-bulkers was subcontracted by Reederei Hesse to MTL. Additionally, we

intend to retain the Schulte Group to manage the operations of the chemical

tanker that we may acquire, which would operate in the Hanseatic Tankers

Pool. Under these ship management agreements, the applicable management

company or its affiliates will provide certain management services including

identifying crews and chartering the ships to customers. In addition,

Reederei Hartmann and its affiliates are non-controlling owners of 25% of each

AHTS SPV, and affiliates of the Hartmann Group and Reederei Hesse collectively

own 51% of each mini-bulker SPV.

In

addition, our ownership of each SPV owning an AHTS vessel or mini-bulker is held

through our Cyprus Subsidiary. The holders of our Class D units have

certain rights to approve certain of our actions with respect to vessels held

through our Cyprus Subsidiary.

If our

relationships with these third parties are terminated, we may not be able to

establish relationships with other persons experienced with the operation of

international shipping vessels, and our operations could suffer. In

addition, the terms of our relationship with any replacement third party may be

less favorable to us. In addition, the economic interests of these third

parties may not always be aligned with our interests and they may not always act

in our best interests.

We

have entered into contracts with our affiliates and other related parties that

were not negotiated at arms-length.

We have

entered into various contracts with our affiliates and other related parties

that were not negotiated as arms-length transactions. Additional information is

provided in this Form 10-K in Item 1. Business under the section entitled Transactions with Affiliates and

Related Parties. As a result, the terms of such agreements may not

be as favorable to us as if they had been negotiated with unrelated

parties.

18

The

bankruptcy of our management companies, shipyards, charter parties or financing

sources could have a material adverse effect on our operations.

As

indicated above, we depend on our management companies to manage our vessel

operations. We also depend on the shipyards that construct our ships to

deliver these vessels in a timely manner and on the ability of our charter

parties to pay us the agreed upon charter rates for each applicable vessel

pursuant to the relevant charter agreement. Additionally, we depend on our

third party financing sources to provide the capital necessary to acquire and

operate our vessels. If, in the future, any of these entities were the

subject of a bankruptcy or other insolvency proceeding, they might be unable to

perform their respective obligations under the management agreements or loan

documents, as applicable, which could result in a material adverse effect on our

results of operations and prohibit us from completing the planned acquisition of

additional vessels. In addition, we may be unable to recover any amounts

advanced to such parties for the construction of the vessels or

otherwise.

Our

operations, growth, investment returns, and stability in the value of our

vessels depend on the demand for offshore oil and gas drilling and capital

spending by the oil and gas industry.

The

majority of the vessels we plan to acquire are AHTS vessels, which are primarily

used for the installation, maintenance and movement of oil and gas

platforms. With a majority of our vessels focused on the oil and gas

business, our operations, growth, investment returns, and the stability in the

value of our AHTS vessels, which represent the majority of our assets, depend on

the demand for offshore oil and gas drilling and the related level of capital

spending by oil and gas exploration and production companies who are the

principal users of our AHTS vessels. The charter rates of such vessels are

highly dependent on the level of capital spending by oil and gas

companies. The level of capital spending is substantially related to the

demand for oil and gas and prevailing oil and gas prices, each of which can be

affected by many factors, including the following:

|

|

·

|

fluctuations

in the actual or projected price of oil and

gas;

|

|

|

·

|

global

and regional demand and perceptions about future

demand;

|

|

|

·

|

the

ability of the Organization of Petroleum Exporting Countries (“OPEC”) to

control oil production levels and pricing, as well as the level of

production by non-OPEC countries;

|

|

|

·

|

significant

weather events or conditions;

|

|

|

·

|

governmental

restrictions placed on exploration and production of natural

resources;

|

|

|

·

|

refining

capacity and its geographical

location;

|

|

|

·

|

political

and economic uncertainties, particularly in oil and gas consuming regions,

which could reduce energy consumption or its

growth;

|

|

|

·

|

increases

in the production of oil and gas in areas linked by pipelines to consuming

areas;

|

|

|

·

|

extension

of existing or development of new pipeline

systems;

|

|

|

·

|

conversion

of existing non-oil or gas pipelines to oil or gas

pipelines;

|

|

|

·

|

decreases

in the consumption of oil or gas due to increases in its price relative to

other energy sources;

|

|

|

·

|

development

or increased use of alternative fuel

sources;

|

|

|

·

|

advances

in exploration and development technology;

and

|

|

|

·

|

the

cost of exploration for and production of oil and gas that can be affected

by environmental regulations.

|

The

current global economic climate contributed to a significant decline in oil and