Attached files

| file | filename |

|---|---|

| EX-31.1 - AMERICAN MEDICAL ALERT CORP | v179072_ex31-1.htm |

| EX-10.(B)(I) - AMERICAN MEDICAL ALERT CORP | v179072_ex10bi.htm |

| EX-23.1 - AMERICAN MEDICAL ALERT CORP | v179072_ex23-1.htm |

| EX-31.2 - AMERICAN MEDICAL ALERT CORP | v179072_ex31-2.htm |

| EX-10.(F)(I) - AMERICAN MEDICAL ALERT CORP | v179072_ex10fiii.htm |

| EX-32.2 - AMERICAN MEDICAL ALERT CORP | v179072_ex32-2.htm |

| EX-32.1 - AMERICAN MEDICAL ALERT CORP | v179072_ex32-1.htm |

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

|

ý ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934 for the fiscal year ended December 31,

2009.

|

OR

|

|

¨ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from ____________ to ____________

Commission

file number 1-8635

AMERICAN

MEDICAL ALERT CORP.

(Exact

name of registrant as specified in its charger)

|

New

York

|

11-2571221

|

|

(State

or Other Jurisdiction of incorporation or organization)

|

(I.R.S.

Employer

Identification

Number)

|

|

3265 Lawson Boulevard,

Oceanside, New York

(Address

of Principal Executive Offices)

|

11572

(Zip

Code)

|

(516) 536-5850

(Registrant’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

Name of Each Exchange on Which

Registered

|

||

|

Common

Stock, $.01 per share

|

NASDAQ

Capital Market

|

Securities

registered pursuant to Section 12(g) of the Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act. Yes o No

x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding

12 months (or for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes x No

o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during

the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large

Accelerated Filer o Accelerated Filer o Non-Accelerated

Filer o Smaller

Reporting Company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No x

The

aggregate market value of the voting common equity held by non-affiliates of the

registrant, computed by reference to the price at which the common equity was

last sold, as of the last day of the registrant's most recently completed second

fiscal quarter, was $38,763,034.

Aggregate

number of shares of Common Stock outstanding as of March 22,

2010: 9,540,514

2

PART

I

Statements

contained in this Annual Report on Form 10-K include “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section

21E of the Exchange Act, including, in particular and without limitation,

statements contained herein under the headings “Description of Business” and

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations.” Forward-looking statements involve known and unknown

risks, uncertainties and other factors which could cause the Company’s actual

results, performance and achievements, whether expressed or implied by such

forward-looking statements, not to occur or be realized. These include

uncertainties relating to government regulation, technological changes, our

contract with the City of New York, and product liability risks. Such

forward-looking statements generally are based upon the Company’s best estimates

of future results, performance or achievement, based upon current conditions and

the most recent results of operations. Forward-looking statements may

be identified by the use of forward-looking terminology such as “may,” “will,”

“expect,” “believe,” “estimate,” “anticipate,” “continue” or similar terms,

variations of those terms or the negative of those terms.

You

should carefully consider such risks, uncertainties and other information,

disclosures and discussions which contain cautionary statements identifying

important factors that could cause actual results to differ materially from

those provided in the forward-looking statements. Readers should carefully

review the risk factors described herein and any other cautionary statements

contained in this Annual Report on Form 10-K. The Company undertakes

no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Item

1. BUSINESS

A. General

Background

American

Medical Alert Corp. (“AMAC” or the “Company”) is committed to providing

solutions that improve healthcare delivery through an expansive portfolio of

home-based Remote Patient Monitoring (“RPM”) technologies and innovative

communication center services. The Company’s business strategy

leverages its ability to design, develop and integrate health and safety

monitoring technologies with its multi-site, U.S. based healthcare communication

infrastructure to provide its customers with lower cost, high touch

solutions that sustain independent living, encourage better self care activities

and improve communications of critical health information.

The

Company’s financial model is the generation of monthly recurring revenues

(“MRR”). Under this model, each operating segment generates prescribed monthly

fees for services and equipment rendered throughout the duration of a service

agreement. For the year ended December 31, 2009, approximately 94% of

the Company’s revenue was generated from MRR. The remaining 6% of

revenue was derived from its clinical trial projects, installation charges and

product sales

3

AMAC

believes that delivering innovation and high-value solutions through its

integrated communications platform is the key to meeting customers’ needs and to

achieve future growth.

The Company markets its products and services directly to healthcare providers,

pharmaceutical companies, managed care organizations and through a network of

distributors. The Company also offers certain products and services directly to

consumers.

The

Company was formed in 1981 as a New York Corporation. As previously

defined herein, the terms “AMAC” or “Company” mean, unless the context requires

otherwise, American Medical Alert Corp. and its wholly owned subsidiaries, HCI

Acquisition Corp., LMA Acquisition Corp., SafeCom, Inc., North Shore Answering

Services, Answer Connecticut Acquisition Corp., MD OnCall Acquisition Corp.,

American Mediconnect Acquisition Corp. and NM Call Center, Inc.

Operating

Segments

The

Company’s activities are reported through two operating segments. The first

segment, Health Safety and Monitoring Services (“HSMS”), is comprised of the

development and marketing of Remote Patient Monitoring (“RPM”) technologies that

include personal emergency response systems (“PERS”), medication reminder and

dispensing systems, telehealth/disease management technologies and safety

monitoring systems to pharmacies. The second segment, Telephony Based

Communication Services (“TBCS”), includes the provision of centralized call

center solutions primarily to the healthcare community including traditional

after hours services, Daytime Services applications, and clinical trial

recruitment call center services and administration.

B. Products

and Services

|

1.

|

Health

and Safety Monitoring Systems

(HSMS)

|

The

ongoing objective of the HSMS division is to create a compelling value

proposition by addressing the fundamental need to allow individuals to age in

place with home based health monitoring technologies through a single monitoring

platform. This RPM platform provides a single source for AMAC’s customers to

access a broad spectrum of technologies, from rudimentary to sophisticated, to

deliver individualized, cost effective monitoring as a patient’s needs

evolve.

|

a.

|

Personal

Emergency Response Systems (PERS)

|

PERS is

the Company’s core product and service offering. The system consists of a

console unit and a wireless transmitter generally worn as a pendant or on the

wrist by the client. In the event of an emergency, the client is able to summon

immediate assistance via the two-way voice system that connects their home

telephone with the Company’s Response Center. The ability to access and obtain

assistance particularly after a fall or during medical emergency has been proven

to reduce overall healthcare costs and increase the ability of an individual to

remain independent at home. In 2000, total direct costs related to fall injuries

exceeded $19 billion in adults aged 65 and older and the financial toll is only

expected to increases as America’s population ages further.

4

In

November of 2009, Apria Healthcare announced an exclusive strategic alliance

with AMAC to provide PERS under an Apria branded service. In first

quarter 2010, ApriaAlert was introduced to selected geographic markets within

Apria’s national footprint. Plans are underway for geographic expansion through

its nationwide branch network which serves over two million patients

annually.

Recognizing

the increased demand for life enhancing monitoring technologies, AMAC in 2009

piloted Healthy Aging Solutions, a comprehensive referral support program and

e-commerce capability to further build market share. This pilot effort resulted

in new referral provider relationships which will continue to build market share

in 2010 and beyond.

Also in

2009, WellAWARE Systems, the leading developer of next-generation wellness

monitoring solutions for senior care providers, announced it has entered a

technology integration collaboration with AMAC to deliver an integrated health

monitoring solution that incorporates AMAC’s PERS technology with WellAWARE’s

sensor-based wellness monitoring solution and is currently pilot testing the

integrated solution with its first joint customer, The Evangelical Lutheran Good

Samaritan Society.

The

Company is currently exploring development and integration of complementary

mobile communication technologies to enhance the next generation of PERS

technology.

AMAC’s

PERS is marketed directly and by third party providers under multiple

brands including VoiceCare®, Walgreens Ready Response™, Response Call™, and most

recently ApriaAlert™.

|

b.

|

Medication

Adherence Appliances

|

The

second component of AMAC’s RPM platform addresses medication adherence,

which has been defined as a critical component of patient self

management. One in two patients do not take their medications as

prescribed, costing the United States an estimated $300 billion per year in

unnecessary healthcare costs and lost revenue. 84% cite simple forgetfulness as

the reason.

MedSmart™

Fourth

quarter 2009 marked the commercial rollout of AMAC’s new monitored medication

management tool. MedSmart is a powerful solution that organizes, reminds and

dispenses pills in accordance with prescribed treatment regimens. Easy to set up

and use, MedSmart improves adherence to medication regimens and reduces the risk

of missed doses and overdosing errors to improve clinical outcomes and quality

of life.

5

With

MedSmart’s innovative event reporting and notification option, family caregivers

and healthcare professionals can proactively support independent living.

MedSmart’s docking base serves as the gateway for remote programming and event

reporting. When connected to a household phone, MedSmart transmits device and

dispensing history to a secure server supported with a web application for

review by authorized individuals, such as relatives or medical professionals.

Through AMAC’s personalized notification system, alerts can be sent to track

adherence, address dosing errors and predict refill requirements. The ability to

communicate these events creates a new capability to easily track adherence,

proactively modify behavior and improve compliance.

The

Company has begun to secure contracts to provision MedSmart with various

healthcare stakeholders and through retail opportunities. The Company believes

it can demonstrate a value proposition including, but not limited to reducing

costs associated with non adherence related hospitalizations, improving disease

management outcomes and increasing pharmacy script yield. The value

proposition of this high touch monitoring enhancement can be experienced by all

stakeholders in healthcare delivery.

Med-Time®

Med-Time

is an electronic medication reminder and dispensing unit marketed under an

exclusive licensing, manufacturing

and distribution agreement which began in 1999. This agreement

originates from PharmaCell AB, a Swedish company, with licensing rights

extending throughout the United States, Canada and Mexico. The initial term of

the agreement was five years requiring the Company to achieve certain purchase

minimums to maintain exclusivity. Thereafter, the agreement converted to an

evergreen with annual purchase minimums of 1,500 units. The Company has met all

the minimums with PharmaCell to date and continues to maintain

exclusivity.

c. Telehealth

systems

Rounding

out AMAC’s RPM portfolio is AMAC’s robust telehealth delivery capability. As a

distributor of the Health Buddy® System, many of the Company’s customers have

successfully demonstrated the value proposition of incorporating disease

management technologies into a patient’s plan of care.

We intend

to broaden our RPM portfolio with lower cost, high touch telehealth solutions.

Towards this aim, in 2010 AMAC plans to release a new low-cost telehealth

solution that combines vital sign reporting and personalized questions about the

patient’s health. This AMAC operated telehealth platform is directed

toward providers who require a low-cost solution, easy installation, reliable

transmission of vital sign data in real-time and ease of use on the patient

side. In 2010, it will commence beta testing with plans for

commercial launch later in the year.

Based on a wide range of feedback from

our providers who have advised the Company that correlating vital signs and

medication adherence data would create an exponentially powerful tool, AMAC

plans to integrate its telehealth monitoring and medication management reporting

feature sets to deliver the most robust solution for our

customers. We envision that our new RPM platform will ultimately

become a universal point of entry for care management activities.

6

The

Company believes the telehealth market will continue to provide opportunities

for AMAC’s expansion as a full source provider of remote patient monitoring

technologies and first line support services.

HSMS

Marketing Channels

The HSMS

product line is distributed to the subscriber base through five primary

marketing channels: AMAC’s Direct to Consumer/Private Label Program; Third Party

Reimbursed Programs; the Distributor Network, made up of Direct Service

Providers; the Purchase and Monitoring Program; and SafeCom, Pharmacy Security

Systems.

Direct to Consumer/Private Label

Program: The Company has embarked upon a mission to increase

consumer utilization of PERS through multiple direct to consumer healthcare

related touch points. Individuals can access the PERS through AMAC’s corporate

sales office, via any regional office or by mail order. AMAC has referral

arrangements with home care agencies and case managers throughout the United

States who introduce and recommend PERS to clients and generate an ongoing

source of new consumer interest.

In

February of 2007, the Company announced it had entered into a relationship with

Walgreen Co. (“Walgreen”) to provide the Company’s flagship PERS under the

Walgreen brand. Walgreens Ready Response™ Medical Alert system is offered though

e-commerce efforts and at Walgreen stores throughout the United States and

Puerto Rico.

In

November of 2009, Apria Healthcare announced an exclusive strategic alliance

with AMAC to provide PERS under an Apria branded service. In first

quarter 2010, ApriaAlert was introduced to selected geographic markets within

Apria’s national footprint. Plans are underway for geographic expansion through

its nationwide branch network which serves over two million patients

annually.

Third Party Reimbursed

Programs: The Company’s PERS are on the Centers for Medicare

and Medicaid list of approved monitoring devices. Payment for PERS equipment and

monitoring services is available through various state Medicaid Home and

Community Based Services waivers programs and other Medicaid funded home care

services programs.

In 2009,

AMAC received renewal notice from the City of New York, Human Resources

Administration for the Provision of Personal Emergency Response Systems,

extending its agreement to provide PERS devices to this agency through June

2011. This program is one of the largest in the country with over 7,000

participants and generates 6% of the Company’s revenue.

Overall, 11% of AMAC’s revenue was derived from contracts with Medicaid

reimbursed programs for PERS services. AMAC believes that the use of home care

will continue to increase, representing an ongoing opportunity for broader use

of the Company’s current and future products.

7

Purchase and Monitoring Program

(“PMP”): AMAC’s PERS is

also utilized by assisted living and senior housing facilities to offer

additional protection to elderly residents. Facilities operate under a PMP

Agreement whereby all necessary equipment is purchased. The facilities provide

primary monitoring for their residents and some employ AMAC’s ERC to serve as

their back-up center. AMAC’s PMP offerings include its console unit, the Model

1100 residential system and ResiLink, an enhanced software package for its

facility monitoring platform.

Distributor

Network: AMAC has developed a network of Direct Service

Providers (“DSPs”) to establish and manage

VoiceCare programs in their local communities. A DSP may be a hospital system,

home health care agency, hospice, senior living facility, durable medical

equipment vendor or one of several other types of entities that interact with

elderly, infirm or disabled individuals.

SafeCom, Inc. - Pharmacy Security

Monitoring Systems: SafeCom, Inc. offers monitoring technology

products and safety monitoring to drug stores, 24-hour pharmacies and national

and regional retailers. In 2009 SafeCom represented 1% of the Company’s gross

revenue. Under the Silent Partner brand, the Company provides safety,

environmental and device functionality monitoring systems and services

integrating key aspects of audio technology and access control.

2. Telephony

Based Communication Services (TBCS)

AMAC’s

TBCS division offers value added, customizable call center solutions that

enhance the patient/provider communication experience. As part of our business

development strategy, management continues to employ the most advanced telephony

technology and information systems to develop services to respond to shifting

market factors that affect healthcare client needs. In addition to technology, a

critical component for successful expansion is the Company’s professionally

trained call agent staff. The Company allocates resources to enhance

contact agent training and staff development, new communication technology, and

continuous quality control to support TBCS’s expansion efforts. The overall

infrastructure has allowed AMAC to expand its footprint of services beyond

traditional telephone answering services to provide more innovative, clinically

oriented call center offerings. For the year ended December 31, 2009, the TBCS

segment accounted for 48% of the Company’s gross revenues.

The

Company has completed ten acquisitions to date. For 2010, the Company will

primarily focus on growing this segment through internally driven sales and

marketing efforts and will also continue to search for additional acquisition

opportunities.

8

a. After

Hours Answering Services

AMAC’s

after hours services are classified as essential call center services with a

fully-customizable approach to communications support. Basic services in this

offering include traditional after hour answer and customized message delivery

options, contact lists and on-call schedule management, all of which can be

updated at the client’s convenience using the OnCall web

portal. Through this portal, clients can also access the account’s

call history, specifications and messages.

OnCall

supports providers’ unique after-hours and on-call needs with a dependable

service in unpredictable situations. Enhanced ala carte services including

daytime overflow and broadcast messaging services which have proven to enhance

our value and facilitate stronger patient provider relations.

b. Concierge

Services/Daytime Solutions

AMAC’s

Concierge Services focus on the delivery of enhanced communications and help to

streamline workflow within provider organizations. These solutions primarily

serve hospitals and health plans in the Northeast seeking to address staffing

constraints in a variety of areas while extending first-class patient

experience.

Services

range from providing skilled contact agents to support insurance eligibility

verification programs; to enhancing patient self care activities through post

discharge follow-up programs, to specialized emergency department programs with

strict reach guidelines to facilitate better treatment and care. Through more

efficient and effective call processing, these solutions improve patient

satisfaction, reduce cost, and increase revenue by maximizing the ratio of

patients to available resources.

Over the

last eighteen months several significant healthcare organizations have executed

agreements with the Company to provide daytime solutions and

services. The MRR associated with these contracts significantly

exceed the average MRR of traditional after hours answering service clients and

is now providing significant increases within this reporting

segment. Management believes its concierge services/daytime solutions

will continue to contribute material increases in revenue and earnings as we

expand these service offerings to a national audience.

|

c.

|

Pharmaceutical

Support and Clinical Trial Recruitment

Services

|

Our

PhoneScreen clinical trial solutions service is an integral component of our

overall growth strategy to drive revenue enhancement and expand our visibility.

PhoneScreen is a leader in the field of patient recruitment, retention and

contact center services. Using centralized telephone screening of

potential clinical trial study subjects, PhoneScreen provides valuable data to

inform advertising and patient recruitment strategies.

As the

trend towards more individualized healthcare communication becomes the norm,

AMAC is leading this transformation with innovative contact solutions. In 2009,

the TBCS division commenced new relationships with two premiere pharmaceutical

companies. We anticipate our pharmaceutical support programs will be utilized to

deliver enhanced patient-centric healthcare communication experiences on behalf

of certain brands. Based upon new demand, we are recruiting for nurses, health

educators and other healthcare professionals that will allow us to provide

additional turn-key solutions for our clients.

9

TBCS

Marketing Channels

The TBCS

service line is marketed to four primary channels: Individual and multiple

physician; integrated hospital networks; group purchasing organizations; and

pharmaceutical companies and clinical research organizations under the brand

names H-LINK® OnCall, Live Message America (“LMA”), North Shore Answering

Service ("NSAS"), Answer Connecticut Acquisition Corp. ("ACT"), MD OnCall

Acquisition Corp. (“MD OnCall”) and American Mediconnect Acquisition Corp.

(“AMI”) which includes the brands American Mediconnect and

PhoneScreen.

3. Production/Purchasing

The

Company outsources the manufacturing and final assembly of its core product

lines. Sources are selected through competitive bids, past

performance and accessibility to the engineering process. Although

the Company currently maintains favorable relationships with its vendors, the

Company believes that, in the event any such relationship were to be terminated,

the Company would be able to engage the services of alternative vendors as

required to fulfill its needs without any material adverse effect to the

Company’s operations. With the exception of several proprietary

components, which are manufactured to the Company’s specifications, the

manufacturing of the Company’s product lines requires the use of generally

available electronic components and hardware.

4. Call

Centers

As of

March 2010, the Company operates eight (8) call centers:

· Long

Island City, New York

The

Company’s primary communications center is located at 36-36 33rd Street,

Long Island City, New York. In April 2003, the Company opened a

one-hundred seat state-of-the-art call center to centralize the full scope of

communication services offered by AMAC. The call center was built

with system-wide redundancy and can accommodate growth up to three (3) times its

current volume. Phone service to the call center is provided by three separate

carriers and is configured to provide continuous service in the event of

disruption. Phone circuit entry to the building is provided through a

reinforced steel conduit built to UL Central Station Standards. The call

center’s electricity supply is maintained by a comprehensive, three tiered

back-up system. The system consists of dual power supplies at the telephone

switch, an uninterruptible power supply and a diesel generator.

10

The

Company’s call center is staffed by full time Information System (“IS”)

professionals charged with the responsibility to maintain, refine and report on

all data and communications system requirements. Critical systems are equipped

with secure remote access and diagnostic abilities, enabling offsite as well as

on-site access to IS system support 24/7.

· Audubon,

New Jersey

This site

serves as the call center for telephone answering services provided by the

Company’s LMA subsidiary and services the Company’s Southern New Jersey and

Philadelphia customer base.

· Port

Jefferson, New York

This site

serves as the call center for telephone answering services provided by the

Company’s NSAS subsidiary and services the Company’s Long Island TBCS customer

base.

· Newington,

Connecticut

This site

serves as the one of the two call centers for telephone answering services

provided by the Company’s ACT subsidiary and services the Company’s Connecticut

TBCS customer base. This site also serves as the back-up center for

the Company’s PERS Emergency Response Center and Client Services.

· Springfield,

Massachusetts

This site

serves as the one of the two call centers for telephone answering services

provided by the Company’s ACT subsidiary and services the Company’s

Massachusetts TBCS customer base.

· Cranston,

Rhode Island

This site

serves as the call center for the HSMS Direct to Consumer sales activity and

telephone answering services provided by the MD OnCall subsidiary and services

the Company’s Rhode Island TBCS customer base.

· Chicago,

Illinois

This site

serves as the call center for telephone answering services provided by the

Company’s AMI subsidiary, and services the

Company’s Illinois TBCS customer base.

· Clovis,

New Mexico

This site

serves as a second call center location primarily to support AMAC’s ERC center,

H-LINK OnCall and Phone Screen client base.

11

C. Marketing/Customers

The

Company markets its portfolio of healthcare communication services and

monitoring devices to integrated hospital systems, home healthcare providers,

community service organizations, government agencies, third party insurers, as

well as private pay clients. The Company believes there are several

compelling industry and population trends that will continue to drive

utilization of its products and services. Within our HSMS segment, the aging

population and percentage of individuals with chronic disease conditions will

continue to provide a significant opportunity to utilize our monitoring

solutions to achieve cost control and improve quality of life.

With

respect to our TBCS segment, the Company markets these services primarily to

hospital systems, managed care organizations, pharmaceutical companies and

physicans. We continue to observe increased opportunity with integrated hospital

systems, regional home health agencies and pharmaceutical companies.

Specifically, healthcare organizations are seeking to achieve cost savings by

consolidating services through single source vendor relationships. The Company’s

advanced telephony, call center infrastructure and specialization in healthcare

uniquely positions the Company to effectively compete for new

business.

While the

Company focuses on growth in each reporting segment, customer retention is

equally important. The Company’s customer service, provider relations and

accounts services teams focus on account maintenance and business development

from existing customers.

The

Company’s products and services may be acquired on a single line or bundled

basis and are highly complementary. As demand for our products and services

increases, the Company will add additional sales and marketing personnel, as

needed, to enhance our national presence throughout its respective

businesses.

D. Trademarks

The

Company considers its proprietary trademarks with respect to the development,

manufacturing and marketing of its products to be a valuable

asset. The Company believes that continued development of new

products and services with trademark protection is vital to maintaining a

competitive advantage. The Company’s trademarks include “AMERICAN

MEDICAL ALERT®”, “THE RESPONSIVE COMPANY®”, “WHERE PATIENT AND PROVIDERS

CONNECT®” “VOICECARE®”, “THE VOICE OF HELP®”, “MED-TIME®”,

“H-LINK®”, “MED PASS®”, “MEDSMART®”, “ROOM

MATE®”, “SECURE-NET®”, “CARERING®”, “PERS BUDDY®”, “HEALTH PARTNER®”

“HEALTH MESSENGER®”, “HELP LINK®” “I-LINK®”, CONNECTED AND PROTECTED ® and

“CARE-NET®”, each of which is registered with the United States Patent and

Trademark Office.

12

E. Research

and Development

In a

continuing effort by the Company to maintain state-of-the-art technology, the

Company conducts research and development through the ongoing efforts of its

employees and consulting groups. During 2010 the Company plans to continue to

enhance its disease management monitoring platform and medication management

solution. Expenditures for research and development for the years

ended December 31, 2009, 2008 and 2007 were $307,990, $329,707 and $304,365,

respectively, and are included in selling, general and administrative

expenses. In addition to this, the Company continues to focus its

research and development activities on enhancement of its HSMS products as well

as the development of new products and services specifically addressing disease

management.

F. Impact

of Government Regulations

The

Company derives approximately 11% of its revenues from various Medicaid

programs. Government legislative initiatives, if enacted, could

impose pressures on the pricing structures applicable to the Company’s PERS

services. On the other hand, new reimbursement programs such as those described

in TH/DMM section could provide significant additional sources of reimbursement

from government entitlements. Depending on the nature and extent of any new laws

and/or regulations, or possible changes in the interpretation of existing laws

and/or regulations, any such changes could affect revenue, operating margins,

and profitability. Congress has recently passed legislation to reform the U.S.

health care system by expanding health insurance coverage, reducing health care

costs and supporting other changes. While healthcare reform may increase the

number of patients who are eligible for our products, it may also include cost

containment measures that adversely affect reimbursement for our

products. In addition based on the final regulations, the Company may

also be required to pay additional premiums.

The

Privacy Rule under the Health Insurance Portability and Accountability Act

(“HIPAA”) went into effect in April

2003. These regulations relate to the privacy of patient health information. To

comply with the Privacy Rule, the Company executed required Business Associate

Agreements with its business partners and vendors, appointed a Privacy Officer,

established policies, procedures and training standards, and began to assess its

preparedness for the HIPAA Security Standards.

The

Company’s PERS and related equipment is subject to approvals under the rules of

the Federal Communications Commission (“FCC”) pertaining to radio frequency

devices (Part 15) connected to the telephone system (Part 68). The

Company submits all new product models for approval as required under the rules

of the FCC.

13

G. Competition

In each

business segment, AMAC faces competition, both in price and service from

national, regional and local service providers of PERS, TH/DMM, telephone

answering service and security monitoring systems. Price, quality of

services and, in some cases, convenience are generally the primary competitive

elements in each segment.

HSMS

The

Company’s competition within the HSMS segment includes manufacturers,

distributors and providers of personal emergency response equipment and

services, disease management and biometric carve out companies and a small

number of security companies. The Company’s market research estimates

that approximately 20-30 companies are providers of competitive PERS products,

15-20 companies are providers of TH/DMM and 5-10 companies are providers of

medication management systems. We believe PERS

competitors serve in aggregate approximately 800,000 individuals under the PERS

product line. Because TH/DMM is a new field of healthcare services, clear data

of actual number of users is unavailable. Some of the Company’s competitors may

have more extensive manufacturing and marketing capabilities as well as greater

financial, technological and personnel resources. The Company’s

competition focuses its marketing and sales efforts in the following areas:

hospitals, home care providers, physicians, ambulance companies, medical

equipment suppliers, state social services agencies, health maintenance

organizations, and direct marketing to consumers.

We

believe the competitive factors when choosing a HSMS provider include the

quality of monitoring services, product flexibility and reliability, and

customer support. The Company believes it competes favorably with respect to

each of these factors. The Company believes it will continue to compete

favorably by creating technological enhancements to the core systems that are

expected to establish meaningful differentiation from its

competitors.

TBCS

The

Company believes that it is one of the larger medical-specific telephone

answering service providers competing with more than 3,300 call centers across

the United States, of which fewer than 10 percent are medical-only. The Company

considers its scope of services more diverse than those of traditional sole

proprietorships that make up the greatest portion of the competitive landscape.

While many TBCS organizations compete for after-hours business, AMAC is offering

new services catering to daytime work for large health systems and believes this

application is scalable nationwide.

14

H. Employees

As of

March 22, 2010, the Company employed 567 persons, of which 489 are full

time employees, who perform functions on behalf of the Company in the areas of

administration, marketing, sales, engineering, finance, purchasing, operations,

quality control and research. The Company is not a party to any collective

bargaining agreement with its employees. The Company considers its

relations with its employees to be good.

I. Financial

Information about Segments

Financial

information about our operating segments can be found in Note 12 to the

financial statements included as part of this annual report on Form 10-K,

beginning on page F-24.

Item

1A. RISK

FACTORS

Risks

associated with our business

Our

business may be adversely impacted by new government regulations or changes to

current government regulations.

We derive

approximately 11% of our revenues from Medicaid reimbursed

programs. Government legislative initiatives, if enacted, could

impose pressures on the pricing structures applicable to our

PERS. Our revenue, operating margin and profitability could be

adversely affected by new laws and/or regulations, or changes in the

interpretation of existing laws and/or regulations, or reductions in funding or

imposition of additional limits on reimbursements.

In

addition, as a provider of services under Medicaid reimbursed programs, we are

subject to the federal fraud and abuse and the so-called “Stark” anti-referral

laws, violations of which may result in civil and criminal penalties and

exclusion from participation in Medicaid programs. Also, several

states have enacted their own statutory analogs of the federal fraud and abuse

and anti-referral laws. While we at all times attempt to comply with

the applicable federal and state fraud and abuse and anti-referral laws, there

can be no assurance that administrative or judicial interpretations of existing

statutes or regulations or enactments of new laws or regulations will not have a

material adverse effect on our operations or financial condition. Congress has

recently passed legislation to reform the U.S. health care system by expanding

health insurance coverage, reducing health care costs and supporting other

changes. While healthcare reform may increase the number of patients who are

eligible for our products, it may also include cost containment measures that

adversely affect reimbursement for our products. In addition, based on the

final regulations, the Company may also be required to pay additional

premiums.

Technological

changes may negatively affect our business.

The

telecommunications industry, on which our business is dependent, is subject to

significant changes in technology. These technological changes,

including changes relating to emerging wireline and wireless transmission

technologies, may require us to make changes in the technology we use in our

products in order to remain competitive. This may require significant

outlays of capital and use of personnel, which may adversely affect our results

of operations and financial condition.

15

Changes in the

general economic environment may impact our future business and results of

operations.

While

there seems to be indications of the beginning of a recovery process,

current economic conditions, including the credit crisis affecting global

financial markets and the possibility of a global recession, could adversely

impact the Company’s future business and financial results. These conditions

could result in reduced demand for some of the Company’s products, increased

order cancellations and returns, increased pressure on the prices of the

Company’s products, increased number of days to collect outstanding receivables

and/or increased bad debts on outstanding receivables, and greater difficulty in

obtaining necessary financing on favorable terms. In 2009, as a result of the

housing and credit crisis, the Company realized a decline in its sale of its

senior living products. Additionally, as a result of these economic conditions,

the Company has experienced the impact of the reduction and termination of

funding being provided to our customers in a State program.

Product

liability and availability of insurance.

Because

our business involves responding to personal emergencies, failures of our

products or errors in the delivery of our services carry a risk of liability

claims. We manage this risk through contractual limits on liability

and damages, and by carrying insurance. However, the contractual

limits may not be enforceable in all jurisdictions or under all

circumstances. While historically we have not incurred significant

liabilities due to such claims, a successful claim may be made for damages which

exceed the coverage under any insurance policy. In the future, our

insurance may become more expensive, and there can be no assurance that

additional insurance will be available on acceptable terms. If one or

more of these occur, it could have an adverse effect on our results of

operations and financial condition.

Risks

associated with our securities

We

have not established a recurring dividend program .

In

December 2009, the Company declared a cash dividend of $0.10 per common share,

which was paid to shareholders in January 2010. During the year ended

December 31, 2008, the Company did not pay dividends on its common shares. The

Company’s Board of Directors is currently exploring the possibility of

issuing additional dividends based on Company’s operational

performace and cash flow requirements, but there can be no assurance that it

will do so, or that it will do so on a regular basis.

Shares

that are eligible for sale in the future may affect the market price of our

common stock.

16

As of

March 22, 2010, an aggregate of 2,524,282 of the outstanding shares of our

common stock are “restricted securities,” as that term is defined in Rule 144

under the federal securities laws. These restricted securities may be

sold only pursuant to an effective registration statement under the securities

laws or in compliance with the exemption provisions of Rule 144 or other

securities laws provisions. Rule 144 permits the sale of restricted

securities by any person (whether or not an affiliate of the Company) after six

months, at which time the sales by affiliates can be made subject to Rule 144’s

volume and other limitations and the sales by non-affiliates can be made without

regard to Rule 144’s volume and other limitations, other than the limitation

regarding public information set forth in Rule 144(c) for an additional six

months. In general, an “affiliate” is a person that directly or

indirectly, through one or more intermediaries, controls, or is controlled by,

or is under common control with the Company. The SEC has stated that

generally, executive officers and directors of an entity are deemed affiliates

of the entity. In addition, 904,785 shares are issuable pursuant to currently

exercisable options or warrants which, upon exercise, would further add to the

number of outstanding shares of common stock. Future sales of

substantial amounts of shares in the public market, or the perception that such

sales could occur, could negatively affect the price of our common

stock.

Item

1B. UNRESOLVED STAFF COMMENTS

None.

Item

2. PROPERTIES

As

described below, the Company leases multiple facilities that the Company

believes are satisfactory and suitable for their intended uses.

The

Company’s executive offices are located in a 5,600 square foot facility at 3265

Lawson Boulevard, Oceanside, New York. On January 1, 1995, the

Company entered into a five-year operating lease with Howard M. Siegel, Chairman

of the Board and Senior Advisor of the Company, who owns this facility(the “1995

Lease”). In February 1998, the lease for this facility was extended

until September 30, 2007. The 1995 Lease was subsequently amended several times,

with the latest amendment bearing a lease term through December 31, 2012. The

amended 1995 Lease currently provides for a base annual rent of $133,963, plus

reimbursements for real estate taxes and other operating expenses.

The

Company entered into a 15-year lease with an unaffiliated third party on January

14, 2002, for an 11,000 square foot property at 36-36 33rd Street,

Long Island City, New York, which it occupied in April 2003. This

location is the home for the Company’s primary communication center. The Company

and the building are eligible for significant Relocation and Employment

Assistance Program (“REAP”) credits and other tax

incentive and cost savings benefits. The lease calls for minimum

annual rentals of $269,500, subject to annual increases of 3% plus reimbursement

for real estate taxes.

17

During

2005, the Company entered into two operating lease agreements with an

unaffiliated third party to lease additional spaces of approximately 10,000

square feet and 5,000 square feet, respectively, at its facility in Long Island

City, New York, for the purpose of further consolidating its warehouse and

distribution center and accounting department into the location which currently

houses its principal New York HSMS and TBCS call center. The leases

expire in March 2018, call for minimum annual rentals of $220,000 and $115,000,

respectively, and are subject to increases in accordance with the term of the

agreements. The Company is also responsible for the reimbursement of

real estate taxes. The Company and the building are eligible for

significant Relocation and Employment Assistance Program (“REAP”) credits and other tax

incentive and cost savings benefits.

In

September 2009, the Company sublet a portion of its space under its operating

lease which was entered into in 2005. The space is being sublet to an

independent third party and calls for minimum annual rentals of $125,000 and is

subject to annual increases in accordance with the terms of the

agreement. The sublease expires in March 2018.

The

Company maintains a marketing and administrative office in Decatur,

Georgia. The Company leases approximately 1,200 square feet of space

from an unaffiliated third party on a month to month basis at a charge of $1,750

per month.

The

Company maintains a marketing and administrative office in Tinley Park,

Illinois. The Company leases approximately 1,700 square feet of space

from an unaffiliated third party pursuant to a five-year lease, which expired on

April 30, 2005. In May 2005, the Company renewed its lease for an

additional three years through April 30, 2008 and subsequently extended the

lease through April 30, 2010. The lease currently calls for minimum

annual rentals of $18,886.

The

Company maintains a marketing and administrative office in Centennial,

Colorado. The Company leased approximately 775 square feet of space

from an unaffiliated party pursuant to a six month lease, which expired on April

30, 2008. The Company currently leases this space on a month to month

basis at a charge of $1,050 per month.

The

Company maintains a marketing and administrative office in Redondo Beach,

California. The Company leases approximately 1,500 square feet of

space from an unaffiliated party pursuant to a month to month

lease. The lease provides for monthly rents of $2,695.

The

Company maintains a telephony based call center in Audubon, New

Jersey. The Company leases approximately 2,000 square feet of space

from an unaffiliated party pursuant to a lease which expired on December 31,

2006 and was subsequently amended for an additional three years. The lease

was sequently extended through December 31, 2012. The lease currently

calls for minimum annual rentals of $33,510 throughout the extended term of the

lease.

The

Company maintains a telephony based call center in Port Jefferson, New

York. The Company leases approximately 1,500 square feet of space

from an unaffiliated party pursuant to a five-year lease, which expires on

September 30, 2010. The lease calls for minimum annual rentals of

$78,000 subject to annual increases of 3%.

18

The

Company maintains a telephony based call center in Newington,

Connecticut. The Company leases approximately 3,000 square feet of

space from an unaffiliated party pursuant to a four-year lease, which expires on

December 31, 2009. The

Company is in the process of entering into a new lease and is currently leasing

this space on a month to month basis at a charge of $4,000 per

month.

The

Company maintains a telephony based call center in Springfield,

Massachusetts. The Company leases approximately 1,500 square feet of

space from an unaffiliated party pursuant to a lease which expires on July 31,

2009 and was subsequently extended to July 31, 2011. The lease calls

for minimum rentals of $850 per month throughout the term of the

lease.

In 2007,

the Company entered into an operating lease with an unaffiliated third party for

its telephony based call center in Cranston, Rhode Island. The lease,

which has office space of approximately 3,900 square feet, commenced on January

1, 2008 and expires on December 31, 2012. The lease calls for minimum annual

rentals of $70,200, and is subject to increases in accordance with the term of

the agreement.

The

Company maintains a telephony based call center in Chicago,

Illinois. The Company leases approximately 3,350 square feet of space

from an affiliated party pursuant to a lease which expires on August 31,

2017. The lease calls for minimum annual rentals of $61,980 subject

to annual increases of 3%.

The

Company maintains a telephony based call center, primarily to support H-LINK

OnCall and Phone Screen client base, in Clovis, New Mexico. During

2007, the Company entered into an operating lease agreement with an unaffiliated

third party to lease office space of approximately 6,600 square feet in Clovis,

New Mexico. The lease term is for three years and commenced on April

17, 2008, the date in which the Company took possession of the

premises. The lease calls for minimum annual rentals of

$27,000.

Item 3. LEGAL

PROCEEDINGS.

The

Company is aware of various threatened or pending litigation claims against the

Company relating to its products and services and other claims arising in the

ordinary course of its business. The Company has given its insurance

carrier notice of such claims and it believes there is sufficient insurance

coverage to cover any such claims. Currently, there are no litigation

claims for which an estimate of loss, if any, can be reasonably made as they are

in the preliminary stages and therefore, no liability or corresponding insurance

receivable has been recorded. In any event, the Company believes the

disposition of these matters will not have a material adverse effect on the

results of operations and financial condition of the Company.

Item

4. (Removed and Reserved).

19

PART

II

Item

5. MARKET

FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES.

Market

Information

The

Company's Common Stock is traded on NASDAQ

(Symbol: AMAC). The high and low sales prices of the

Common Stock, as furnished by NASDAQ, are shown for the fiscal years

indicated.

|

High

|

Low

|

||||||||

|

2009

|

First

Quarter

|

$ | 5.20 | $ | 3.80 | ||||

|

Second

Quarter

|

6.15 | 5.18 | |||||||

|

Third

Quarter

|

6.25 | 5.51 | |||||||

|

Fourth

Quarter

|

6.93 | 5.70 | |||||||

|

2008

|

First

Quarter

|

$ | 7.83 | $ | 5.26 | ||||

|

Second

Quarter

|

7.03 | 5.77 | |||||||

|

Third

Quarter

|

6.51 | 5.05 | |||||||

|

Fourth

Quarter

|

5.15 | 3.15 | |||||||

Holders

As of

March 22 2010, there were 272 record holders of the Company's Common

Stock.

Dividends

On

December 16, 2009, our Board of Directors declared a special cash dividend of

$0.10 (ten cents) per common share. The dividend was paid on or about

January 15, 2010 to shareholders of record as of the close of business on

December 28, 2009. The Company received a waiver from the lender

under its existing credit facility, as pursuant to the Company’s credit facility

arrangement, the Company is prohibited from declaring and paying any dividends

until such time that the loans under the credit facility have been satisfied in

full. During the year ended December 31, 2008, the Company did not

declare or pay dividends on its Common Stock. The Company’s Board of

Directors is currently exploring the possibility of

issuing additional dividends based on Company’s operational

performace and cash flow requirements, but there can be no assurance that it

will do so, or that it will do so on a regular basis.

Securities

Authorized for Issuance Under Equity Compensation Plans

20

The

information required by Item 201(d) of Regulation S-K is presented in Item 12 of

Part III of this annual report on Form 10-K.

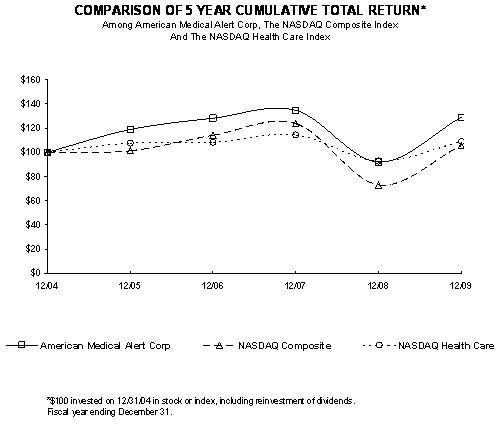

Performance

Graph

Set forth

below is a line graph comparing the annual percentage change in the cumulative

total return on the Company's Common Stock with the cumulative total return of

the NASDAQ Composite Market Index (U.S. Companies) and the NASDAQ Healthcare

Index for the period commencing on December 31, 2004 and ending on December 31,

2009.

Comparison

of Cumulative Total Return from December 31, 2004 through December 31,

2009:

Recent

Sales of Unregistered Securities

None.

21

Purchases

of Equity Securities by the Issuer and Affiliated Purchasers

None.

Item

6. SELECTED FINANCIAL DATA

The

following table sets forth selected consolidated financial data for the Company.

This data should be read in conjunction with the Consolidated Financial

Statements and related Notes, as well as Management’s Discussion and Analysis of

Financial Condition and Results of Operations, included herein.

|

Years

Ended December 31,

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Selected

Statement of Operations Data

|

||||||||||||||||||||

|

Revenue:

|

||||||||||||||||||||

|

Service

|

$ | 38,523,756 | $ | 37,317,274 | $ | 35,054,093 | $ | 30,406,636 | $ | 22,176,799 | ||||||||||

|

Product

|

933,180 | 1,269,546 | 591,172 | 387,752 | 270,843 | |||||||||||||||

|

Total

Revenue

|

$ | 39,456,936 | $ | 38,586,820 | $ | 35,645,265 | $ | 30,794,388 | $ | 22,447,642 | ||||||||||

|

Net

Income

|

$ | 2,889,513 | $ | 1,439,601 | $ | 1,514,232 | $ | 1,262,529 | $ | 932,436 | ||||||||||

|

Net

Income Per Share - Basic

|

$ | 0.30 | $ | 0.15 | $ | 0.16 | $ | 0.14 | $ | 0.11 | ||||||||||

|

Net

Income Per Share - Diluted

|

$ | 0.30 | $ | 0.15 | $ | 0.16 | $ | 0.13 | $ | 0.10 | ||||||||||

|

Cash

Dividend Declared Per Common Share - $950,364

|

$ | 0.10 | - | - | - | - | ||||||||||||||

|

Weighted

Average Number of Common Shares:

|

||||||||||||||||||||

|

Basic

|

9,482,351 | 9,426,912 | 9,276,712 | 8,948,328 | 8,452,435 | |||||||||||||||

|

Diluted

|

9,710,071 | 9,670,563 | 9,732,386 | 9,386,142 | 9,124,905 | |||||||||||||||

|

Selected

Balance Sheet Data as of December 31

|

||||||||||||||||||||

|

Total

Assets

|

$ | 35,828,624 | $ | 34,366,264 | $ | 34,953,221 | $ | 32,607,745 | $ | 26,595,336 | ||||||||||

|

Long-term

Liabilities

|

$ | 3,078,603 | $ | 4,646,708 | $ | 6,211,663 | $ | 7,233,964 | $ | 3,715,626 | ||||||||||

|

Shareholders’

Equity

|

$ | 27,916,383 | $ | 25,551,177 | $ | 23,670,665 | $ | 21,345,190 | $ | 18,383,926 | ||||||||||

Item

7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Overview:

The

Company’s primary business is the provision of healthcare communication services

through (1) the development, marketing and monitoring of health and safety

monitoring systems (“HSMS”)

that include personal emergency response systems, medication management systems

and objective and subjective data/telehealth/ monitoring systems; and (2)

telephony based communication services and solutions primarily for the

healthcare community (“TBCS”). The Company’s products and services

are primarily marketed to the healthcare community, including hospitals, home

care, durable medical equipment, medical facility, hospice, pharmacy, managed

care, pharmaceutical companies and other healthcare oriented

organizations. The Company also offers certain products and services

directly to consumers.

22

About

HSMS:

Personal

Emergency Response Systems (PERS)

The

Company’s core business is the sales and marketing of our Personal Emergency

Response System. The system consists of a console unit and a wireless activator

generally worn as a pendant or on the wrist by the client. In the event of an

emergency, the client is able to summon immediate assistance via the two-way

voice system that connects their home telephone with the Company’s Response

Center. The Company sells three PERS devices for use in either private homes or

independent and assisted living facilities. AMAC’s

PERS is sold through its primary brand VoiceCare® and direct to consumer under

Walgreens Ready Response™, Response Call™, and most recently

ApriaAlert™. In 2009 the company derived 52% of its revenue from the

sale of PERS.

MedSmart

The

second component of AMAC’s RPM platform addresses another serious healthcare

need--medication adherence. During the fourth quarter of 2009, the Company

commercially released AMAC’s new monitored medication management tool,

MedSmart™. MedSmart is a system that organizes, reminds and dispenses pills in

accordance with prescribed treatment regimens. With MedSmart‘s event reporting

and notification option, family caregivers and healthcare professionals can

monitor a clients adherence to their medication regimen. MedSmart’s docking base

serves as the gateway for remote programming and event reporting. When connected

to a household phone, MedSmart transmits device and dispensing history to a

secure server supported with a web application for review by authorized

individuals. Through AMAC’s personalized notification system, alerts can be sent

to track adherence, address dosing errors and predict refill requirements. The

Company plans to market MedSmart directly to consumers and through itits national

business to business network.

Telehealth

systems

Rounding

out AMAC’s RPM portfolio is AMAC’s telehealth delivery capability. As a

distributor of the Health Buddy® System, many of the Company’s customers have

successfully demonstrated the value proposition of incorporating telehealth

technologies into a patient’s plan of care. In 2010, AMAC plans to release a new

low-cost telehealth solution that combines vital sign reporting and personalized

questions about the patient’s health. This AMAC operated telehealth

platform is directed toward providers who require a low-cost solution, easy

installation, reliable transmission of vital sign data in real-time and ease of

use on the patient side. Moving forward, AMAC plans to integrate its

telehealth monitoring and medication management reporting feature sets to

deliver the most robust solution for our customers.

About

TBCS

Telephony

Based Communication Services (TBCS)

23

AMAC’s

TBCS division offers call center solutions that enhance the patient/provider

communication experience. As part of our business development strategy,

management continues to employ advanced telephony technology and information

systems to develop services. In addition to technology, a critical component for

expansion is the Company’s professionally trained call agent

staff. The overall infrastructure has allowed AMAC to expand its

services beyond traditional telephone answering services to provide more

innovative, clinically oriented call center offerings. At 2009 year end, the

TBCS segment accounted for 48% of the Company’s gross revenues. The Company’s

TBCS division is comprised of three service offerings:

After

Hours Answering Services

AMAC’s

after hours services are classified as essential call center services. Basic

services in this offering include traditional after hour answer and customized

message delivery options, contact lists and on-call schedule management, all of

which can be updated at the client’s convenience using the OnCall web

portal. Through this portal, clients can also access the account’s

call history, specifications and messages. Enhanced ala carte services including

daytime overflow and broadcast messaging services which have proven to enhance

value and facilitate stronger patient provider relations.

Concierge

Services/Daytime Solutions

AMAC’s

Concierge Services focus on the delivery of enhanced communications and help to

streamline workflow within provider organizations. These solutions primarily

serve hospitals and health plans. Services range from supporting insurance

eligibility verification programs; to enhancing patient self care activities via

post discharge follow-up programs, to specialized Emergency Department programs

with strict reach guidelines to facilitate better treatment and care. Through

more efficient and effective call processing, these solutions improve patient

satisfaction, reduce cost, and increase revenue by maximizing the ratio of

patients to available resources.

Pharmaceutical

Support and Clinical Trial Recruitment Services

Our

PhoneScreen clinical trial solutions service is an integral component of our

overall growth strategy to drive revenue enhancement and expand our visibility.

PhoneScreen is a leader in the field of patient recruitment, retention and

contact center services. Using centralized telephone screening of

potential clinical trial study subjects, PhoneScreen provides valuable data to

inform advertising and patient recruitment strategies.

In 2009,

the TBCS division commenced new relationships with two premiere pharmaceutical

companies. We anticipate our pharmaceutical support programs will be utilized to

deliver enhanced patient-centric healthcare communication experiences on behalf

of certain brands. Based upon new demand, we are recruiting for nurses, health

educators and other healthcare professionals that will allow us to provide

additional turn-key solutions for our clients.

24

The

Company has completed ten acquisitions to date to facilitate growth within the

TBCS division. For 2010, the Company will focus on growing this segment through

internally driven sales and marketing efforts and will also continue to search

for additional acquisition opportunities.

Operating

Segments

For the

fiscal year ended December 31, 2009, HSMS accounted for 52% of the Company’s

revenue and TBCS accounted for 48% of the Company’s revenue. The

Company believes that the overall mix of cash flow generating businesses from

HSMS and TBCS, combined with its emphasis on developing products and services to

support demand from customers and the emerging, home-based monitoring market,

provides the correct blend of stability and growth opportunity. The Company

believes this strategy will enable it to maintain and increase its role as a

national healthcare communications provider. Based on the Company’s

growth strategy and the complimentary nature of if its operating divisions,

management believes the Company’s outlook is very positive. Management also

believes that while the details of the newly enacted healthcare legislation is

awaiting regulation, the Company’s products and services should be in greater

demand over the next several years.

Components

of Statements of Income by Operating Segment

The

following table shows the components of the Statement of Income for the years

ended December 31, 2009, 2008 and 2007.

|

In

thousands (000’s)

|

Year

Ended Dec 31,

|

|||||||||||||||||||||||

|

2009

|

%

|

2008

|

%

|

2007

|

%

|

|||||||||||||||||||

|

Revenues

|

||||||||||||||||||||||||

|

HSMS

|

20,582 | 52 | % | 19,599 | 51 | % | 17,353 | 49 | % | |||||||||||||||

|

TBCS

|

18,875 | 48 | % | 18,988 | 49 | % | 18,292 | 51 | % | |||||||||||||||

|

Total

Revenues

|

39,457 | 100 | % | 38,587 | 100 | % | 35,645 | 100 | % | |||||||||||||||

|

Cost

of Services & Goods Sold

|

||||||||||||||||||||||||

|

HSMS

|

8,440 | 41 | % | 8,588 | 44 | % | 7,869 | 45 | % | |||||||||||||||

|

TBCS

|

10,031 | 53 | % | 10,069 | 53 | % | 9,733 | 53 | % | |||||||||||||||

|

Total

Cost of Services & Goods Sold

|

18,471 | 47 | % | 18,657 | 48 | % | 17,602 | 49 | % | |||||||||||||||

|

Gross

Profit

|

||||||||||||||||||||||||

|

HSMS

|

12,142 | 59 | % | 11,011 | 56 | % | 9,484 | 55 | % | |||||||||||||||

|

TBCS

|

8,844 | 47 | % | 8,919 | 47 | % | 8,559 | 47 | % | |||||||||||||||

|

Total

Gross Profit

|

20,986 | 53 | % | 19,930 | 52 | % | 18,043 | 51 | % | |||||||||||||||

|

Selling,

General & Administrative

|

16,364 | 41 | % | 16,652 | 43 | % | 15,992 | 45 | % | |||||||||||||||

|

Interest

Expense

|

76 | 1 | % | 280 | 1 | % | 481 | 1 | % | |||||||||||||||

|

Loss

on Abandonment

|

- | - | 887 | 2 | % | - | - | |||||||||||||||||

|

Other

Income

|

(269 | ) | (1 | )% | (335 | ) | (1 | )% | (1,090 | ) | (3 | )% | ||||||||||||

|

Income

before Income Taxes

|

4,815 | 12 | % | 2,446 | 6 | % | 2,660 | 7 | % | |||||||||||||||

|

Provision

for Income Taxes

|

1,925 | 1,007 | 1,146 | |||||||||||||||||||||

|

Net

Income

|

2,890 | 1,439 | 1,514 | |||||||||||||||||||||

25

Results

of Operations:

Discussion

and analysis of the Company’s two operating business segments, HSMS and TBCS,

are as presented below.

Year Ended December 31, 2009

Compared to Year Ended December 31, 2008

Revenues:

HSMS

Revenues,

which consist primarily of monthly rental revenues, increased approximately

$983,000, or 5%, for the year ended December 31, 2009 as compared to the same

period in 2008. The increase is primarily attributed to:

|

·

|

The

Company increased revenue from its arrangement with Walgreen to provide

the Company’s PERS product under the Walgreen brand name directly to the

consumer. The revenue increase from this program accounted for

approximately $320,000 in 2009 as compared to 2008. During

2009, the Company entered into another similar private label program with

Apria Healthcare and continues to pursue other opportunities within this

area as the Company believes private label marketing channels will help to

facilitate greater revenue growth.

|

|

·

|

The

Company also recognized an increase in its PERS service revenue of

approximately $741,000 in 2009 as compared to 2008 through the execution

of new agreements and growth within its existing PERS subscriber base.

This growth was primarily facilitated through additional and increased

third party reimbursement and long-term care programs. The Company

anticipates that its subscriber base and corresponding revenue will

continue to grow through its continued sales and marketing efforts and

strategies. However, with respect to an agreement with a west coast

managed care organization, the Company anticipates this growth will be

partially offset by a decrease in revenue of approximately $300,000 to

$500,000 in 2010 from 2009 levels. This decrease is a result of

the termination of funding received by this managed care organization from

the State of California; nevertheless the Company expects it will be able

to maintain many of the existing subscribers but at a reduced monthly

rate.

|

|

·

|

In

2009, the Company experienced growth in its subscriber base with respect

to its telehealth offering which resulted in an increase in revenue of

approximately $117,000 as compared to

2008.

|

26

These increases were partially offset by a decrease in product sales of approximately $336,000. As a result of the housing and credit crisis encountered during current year, the Company recognized a decrease in sales of approximately $416,000 of its enhanced senior living products. This decrease in product sales was partially offset by approximately $142,000 of sales generated from the MedSmart medication and management systems which was commercialized during 2009.

TBCS

The

decrease in revenues of approximately $113,000, or 1%, for the year ended

December 31, 2009 as compared to 2008 was primarily due to the

following:

|

·

|

The

Company experienced a decrease in traditional after hours service revenue

of approximately $478,000, primarily due to customer attrition.

Approximately $356,000 of this decrease is from one of its call center

locations as a result of certain account realignments which took place as

part of the Company’s overall consolidation process. The

Company has since modified its action plan and has stabilized the client

base at this location and does not anticipate any further

attrition.

|

|

·

|

The

Company also realized a decrease in revenue within its clinical trial

recruitment service of approximately $267,000 in 2009 as compared to 2008,

as a result of certain customers reducing their spending in this area

during 2009. The Company has executed agreements with new customers for

work to be performed in the second half of 2010 and believes this will

facilitate improved results within this business

component.

|

These

decreases were partially offset by revenue growth within its non-traditional

day-time service offering of approximately $632,000 in 2009 as compared to

2008. The

increase was primarily due to a hospital organization customer expanding their

services with us. Further expansion by this and other hospital organizations is

anticipated to continue into 2010.

Costs Related to Services and Goods Sold:

HSMS

Costs

related to services and goods sold decreased by approximately $148,000 for the

year ended December 31, 2009 as compared to the same period in 2008, a decrease

of 2%, primarily due to the following:

|

·

|

The

Company realized a decrease in depreciation expense of approximately

$123,000 in 2009 as compared to 2008 primarily as a result of the Company

obtaining an alternative supplier to purchase its PERS equipment at

reduced prices.

|

27

|

·

|

A

decrease in cost of goods sold of approximately $117,000 was primarily due

to a corresponding reduction of sales of enhanced senior living

products. This decrease in cost of products sold was partially

offset by an increase in cost of products sold related to MedSmart

medication and management systems which was commercialized during

2009.

|

These