Attached files

Exhibit 13

Uwharrie Capital Corp

2009

ANNUAL REPORT TO SHAREHOLDERS

30

[This page left blank intentionally]

31

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Description of Business

Uwharrie Capital Corp (the “Company”) is a North Carolina bank holding company. The Company was organized on July 1, 1993 to become the bank holding company for the Bank of Stanly (“Stanly”), a North Carolina commercial bank chartered on September 28, 1983, and its three wholly-owned subsidiaries, The Strategic Alliance Corporation, BOS Agency, Inc., and Gateway Mortgage, Inc., a mortgage origination company. The Company also owns two non-bank subsidiaries, Strategic Investment Advisors, Inc., and Uwharrie Mortgage, Inc.

Stanly engages in retail and commercial banking, with six banking offices in Stanly County. Stanly provides a wide range of banking services including deposit accounts, commercial, consumer, home equity and residential mortgage loans, safe deposit boxes, and electronic banking services.

On January 19, 2000, the Company completed its acquisition of Anson BanCorp, Inc. and its subsidiary, Anson Savings Bank. The savings bank retained its North Carolina savings bank charter and became a wholly-owned subsidiary of Uwharrie Capital Corp as Anson Bank & Trust Co. (“Anson”) and provides financial services to customers through one banking office in Anson County.

On April 10, 2003, the Company capitalized a new wholly-owned subsidiary bank, Cabarrus Bank & Trust Company (“Cabarrus”), located in Concord, North Carolina. As of that date, Cabarrus purchased two branch offices located in Cabarrus County from Stanly to begin its operation. Cabarrus operates as a commercial bank and provides a full range of banking services.

The Company and its subsidiaries are located in Stanly County, Anson County and Cabarrus County. However, the Company intends to prudently expand its service area to include the entire Uwharrie Lakes Region of North Carolina.

Depository services offered by the subsidiary banks include personal and commercial checking, savings, money market, certificates of deposit accounts and individual retirement accounts, all tailored to meet customers’ needs. The banks provide fixed and variable rate loans, which include mortgage, home equity, lines of credit, consumer and commercial loans. The banks also offer internet banking and 24-hour telephone banking, providing customers the convenience of access to account information, rate information and accessibility of funds transfers between accounts. Other services include MasterCard® credit cards and a Visa® check card which functions as a point-of-sale (POS) and automated teller machine (ATM) card. Customers can use the check card for purchases at virtually any merchant accepting Visa® and ATMs displaying the STAR® or CIRRUS® networks regionally and worldwide, respectively.

Strategic Investment Advisors Inc. provides portfolio management services to its customers. The Strategic Alliance Corporation (Strategic Alliance®) is a registered broker-dealer with the Financial Industry Regulatory Authority (FINRA). BOS Agency provides insurance products and is licensed in the state of North Carolina. Through Strategic Investment Group, a DBA for a partnership with UVEST Financial Services, Inc., securities and insurance products are offered including fixed annuities, long-term care, and life insurance products. Group insurance products are offered through an arrangement with Burchfield Insurance Group, Inc. and the Novus Group, Inc. as well as Medicare supplement products.

The Strategic Alliance Corporation. Member FINRA/SIPC.

Securities and insurance products are offered by, and Financial Consultants are registered with UVEST Financial Services, member FINRA/SIPC. UVEST, Strategic Investment Group and Uwharrie Capital Corp affiliates are independent entities. Securities and/or insurance products are not FDIC insured, are not deposits or other obligations of any depository institution, are not guaranteed by any depository institution and are subject to investment risks, including possible loss of the principal amount invested.

Bank of Stanly, Member FDIC, Equal Housing Lender.

Anson Bank & Trust Co., Member FDIC, Equal Housing Lender.

Cabarrus Bank & Trust Company, Member FDIC, Equal Housing Lender.

32

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Financial Highlights

| (Dollars in thousands except per share amounts) | 2009 | 2008 | Percent Increase (Decrease) |

||||||||

| For the year: |

|||||||||||

| Net income |

$ | 690 | $ | 2,029 | (65.99 | )% | |||||

| Net income available to common shareholders |

$ | 48 | $ | 2,016 | (97.62 | )% | |||||

| Basic net income per common share (1) |

$ | 0.01 | $ | 0.27 | (94.81 | )% | |||||

| Diluted net income per common share (1) |

$ | 0.01 | $ | 0.27 | (96.30 | )% | |||||

| Weighted average common shares outstanding (diluted) |

7,474,140 | 7,520,484 | (0.62 | )% | |||||||

| At year-end: |

|||||||||||

| Total assets |

$ | 477,846 | $ | 452,468 | 5.61 | % | |||||

| Total earning assets |

436,012 | 422,709 | 3.15 | % | |||||||

| Loans held for investment |

353,729 | 340,830 | 3.78 | % | |||||||

| Total interest-bearing liabilities |

385,433 | 362,346 | 6.37 | % | |||||||

| Shareholders’ equity |

44,024 | 41,233 | 6.77 | % | |||||||

| Book value per common share (1) |

$ | 4.47 | $ | 4.11 | 8.76 | % | |||||

| Averages for the year: |

|||||||||||

| Total assets |

$ | 471,729 | $ | 422,857 | 11.56 | % | |||||

| Total earning assets |

434,218 | 393,769 | 10.27 | % | |||||||

| Loans held for investment |

346,976 | 335,791 | 3.33 | % | |||||||

| Total interest-bearing liabilities |

378,411 | 342,341 | 10.54 | % | |||||||

| Shareholders’ equity |

43,182 | 32,245 | 33.92 | % | |||||||

| Financial ratios (in percentage): |

|||||||||||

| Return on average assets |

0.15 | % | 0.48 | % | |||||||

| Return on average shareholders’ equity |

1.60 | % | 6.29 | % | |||||||

| Average equity to average assets |

9.15 | % | 7.63 | % | |||||||

| Net interest margin (fully tax equivalent basis) |

4.12 | % | 4.13 | % | |||||||

| Allowance as % of loans at year-end |

1.49 | % | 1.28 | % | |||||||

| Allowance as % of nonperforming loans |

93.71 | % | 111.87 | % | |||||||

| Nonperforming loans to total loans |

1.59 | % | 1.14 | % | |||||||

| Nonperforming assets to total assets |

1.89 | % | 1.48 | % | |||||||

| Net loan charge-offs (recoveries) to average loans |

0.24 | % | 0.04 | % | |||||||

| (1) | Net income per share, book value per share, and shares outstanding at year-end have been adjusted to reflect the 3% stock dividends in 2008. |

Market for the Company’s Common Stock and Related Security Holder Matters

It is the philosophy of Uwharrie Capital Corp to promote a strong base of local shareholders. While bid and asked prices for the Company’s common stock are quoted on the Over the Counter Bulletin Board under the symbol UWHR, trading is sporadic with trades also taking place in privately negotiated transactions. Management makes every reasonable effort to match willing buyers with willing sellers as they become known for the purpose of private negotiations for the purchase and sale of the Company’s common stock.

The Board of Directors adopts a dividend policy on an annual basis. For 2009, Uwharrie Capital Corp did not declare a dividend. The Board of Directors will determine an appropriate dividend, if any, on an annual basis, consistent with the capital needs of the Company.

33

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

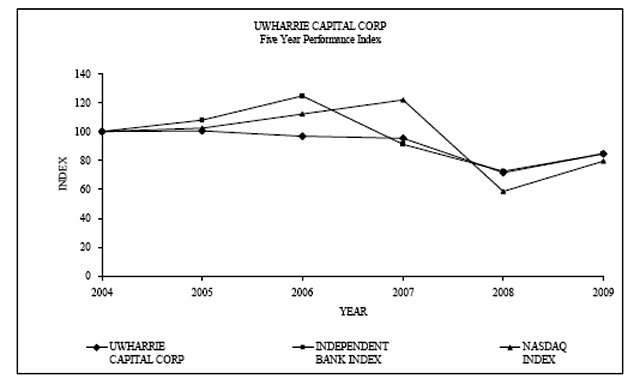

The following graph compares (i) the yearly change in the cumulative total shareholder return on the Company’s common stock with (ii) the cumulative return of The Carson Medlin Company Independent Bank Index, and (iii) the Nasdaq Composite. The graph assumes that the value of an investment in the Company’s common stock and in each index was $100 on December 31, 2004, and that all dividends were reinvested. The performance shown in the graph represents past performance and should not be considered the indication of future performance.

Shareholders needing information about purchasing or selling shares of Uwharrie Capital Corp should contact Tamara M. Singletary or Lisa E. Hartsell, Investor Relations at Uwharrie Capital Corp, 132 N. First Street, Post Office Box 338, Albemarle, NC 28002.

34

[This page left blank intentionally]

35

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

Uwharrie Capital Corp

Albemarle, North Carolina

We have audited the accompanying consolidated balance sheets of Uwharrie Capital Corp and Subsidiaries (the “Company”) as of December 31, 2009 and 2008, and the related consolidated statements of income, comprehensive income, changes in shareholders’ equity and cash flows for each of the years in the three-year period ended December 31, 2009. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Uwharrie Capital Corp and Subsidiaries as of December 31, 2009 and 2008, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 1 to the consolidated financial statements, effective the quarter ended June 30, 2009 the Company changed its method of accounting for other-than temporary impairment of debt securities as a result of adopting new accounting guidance.

Southern Pines, North Carolina

March 23, 2010

36

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

December 31, 2009 and 2008

| 2009 | 2008 | |||||||

| (dollars in thousands) | ||||||||

| ASSETS |

||||||||

| Cash and due from banks |

$ | 7,521 | $ | 2,931 | ||||

| Interest-earning deposits with banks |

3,338 | 10,353 | ||||||

| Securities available for sale, at fair value |

76,317 | 68,835 | ||||||

| Loans held for sale |

2,628 | 2,691 | ||||||

| Loans: |

||||||||

| Loans held for investment |

353,729 | 340,830 | ||||||

| Less allowance for loan losses |

(5,276 | ) | (4,361 | ) | ||||

| Net loans held for investment |

348,453 | 336,469 | ||||||

| Premises and equipment, net |

13,646 | 11,128 | ||||||

| Interest receivable |

2,077 | 2,027 | ||||||

| Federal Home Loan Bank stock |

3,201 | 2,284 | ||||||

| Bank owned life insurance |

5,714 | 5,511 | ||||||

| Goodwill |

987 | 987 | ||||||

| Other real estate owned |

3,419 | 2,816 | ||||||

| Prepaid assets |

2,617 | 696 | ||||||

| Other assets |

7,928 | 5,740 | ||||||

| Total assets |

$ | 477,846 | $ | 452,468 | ||||

| LIABILITIES |

||||||||

| Deposits: |

||||||||

| Demand noninterest-bearing |

$ | 44,924 | $ | 46,032 | ||||

| Interest checking and money market accounts |

137,708 | 117,325 | ||||||

| Savings deposits |

32,120 | 26,360 | ||||||

| Time deposits, $100,000 and over |

64,736 | 63,321 | ||||||

| Other time deposits |

97,286 | 100,589 | ||||||

| Total deposits |

376,774 | 353,627 | ||||||

| Short-term borrowed funds |

26,940 | 22,249 | ||||||

| Long-term debt |

26,643 | 32,502 | ||||||

| Interest payable |

396 | 502 | ||||||

| Other liabilities |

3,069 | 2,355 | ||||||

| Total liabilities |

433,822 | 411,235 | ||||||

| Off balance sheet items, commitments and contingencies (Note 12) |

||||||||

| SHAREHOLDERS’ EQUITY |

||||||||

| Preferred stock, no par value: 10,000,000 shares authorized; |

||||||||

| 10,000 shares of series A issued and outstanding |

10,000 | 10,000 | ||||||

| 500 shares of series B issued and outstanding |

500 | 500 | ||||||

| Discount on preferred stock |

(400 | ) | (500 | ) | ||||

| Common stock, $1.25 par value: 20,000,000 shares authorized; 7,593,929 shares issued and outstanding |

9,492 | 9,492 | ||||||

| Additional paid-in capital plus stock option surplus |

14,030 | 14,019 | ||||||

| Unearned ESOP compensation |

(667 | ) | (736 | ) | ||||

| Undivided profits |

10,056 | 10,008 | ||||||

| Accumulated other comprehensive income (loss) |

1,013 | (1,550 | ) | |||||

| Total shareholders’ equity |

44,024 | 41,233 | ||||||

| Total liabilities and shareholders’ equity |

$ | 477,846 | $ | 452,468 | ||||

The accompanying notes are an integral part of the consolidated financial statements.

37

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

Years Ended December 31, 2009, 2008 and 2007

| 2009 | 2008 | 2007 | ||||||||||

| (in thousands, except share and per share data) | ||||||||||||

| Interest Income |

||||||||||||

| Loans, including fees |

$ | 21,246 | $ | 22,780 | $ | 23,916 | ||||||

| Investment securities: |

||||||||||||

| US Treasury |

12 | 73 | 98 | |||||||||

| US Government agencies and corporations |

3,106 | 1,853 | 1,401 | |||||||||

| State and political subdivisions |

632 | 689 | 633 | |||||||||

| Other |

— | 84 | 128 | |||||||||

| Interest-earning deposits with banks and federal funds sold |

66 | 85 | 733 | |||||||||

| Total interest income |

25,062 | 25,564 | 26,909 | |||||||||

| Interest Expense |

||||||||||||

| Interest checking and money market accounts |

838 | 1,357 | 2,550 | |||||||||

| Savings deposits |

255 | 301 | 526 | |||||||||

| Time deposits $100,000 and over |

1,980 | 2,453 | 2,316 | |||||||||

| Other time deposits |

2,836 | 3,828 | 4,138 | |||||||||

| Short-term borrowed funds |

316 | 529 | 1,128 | |||||||||

| Long-term debt |

1,472 | 1,360 | 1,218 | |||||||||

| Total interest expense |

7,697 | 9,828 | 11,876 | |||||||||

| Net interest income |

17,365 | 15,736 | 15,033 | |||||||||

| Provision for loan losses |

1,732 | 969 | 15 | |||||||||

| Net interest income after provision for loan losses |

15,633 | 14,767 | 15,018 | |||||||||

| Noninterest Income |

||||||||||||

| Service charges on deposit accounts |

2,360 | 2,238 | 2,188 | |||||||||

| Other service fees and commissions |

2,273 | 2,777 | 3,097 | |||||||||

| Loss on sale of securities |

(711 | ) | — | (76 | ) | |||||||

| Loss on nonmarketable securities |

(172 | ) | — | — | ||||||||

| Loss on securities with other-than-temporary impairment |

(1,807 | ) | (158 | ) | — | |||||||

| Portion of loss recognized in other comprehensive income |

— | — | — | |||||||||

| Net impairment recognized in income |

(1,807 | ) | (158 | ) | — | |||||||

| Income from mortgage loan sales |

3,436 | 1,208 | 957 | |||||||||

| Other income |

445 | 532 | 424 | |||||||||

| Total noninterest income |

5,824 | 6,597 | 6,590 | |||||||||

| Noninterest Expense |

||||||||||||

| Salaries and employee benefits |

11,527 | 10,637 | 10,156 | |||||||||

| Net occupancy expense |

1,071 | 987 | 871 | |||||||||

| Equipment expense |

702 | 645 | 598 | |||||||||

| Data processing costs |

792 | 789 | 742 | |||||||||

| Professional fees and services |

968 | 687 | 720 | |||||||||

| Marketing and donations |

746 | 682 | 639 | |||||||||

| Electronic banking expense |

728 | 792 | 706 | |||||||||

| Software amortization and maintenance |

470 | 455 | 448 | |||||||||

| FDIC insurance |

958 | 128 | 66 | |||||||||

| Other noninterest expense |

2,968 | 2,729 | 2,416 | |||||||||

| Total noninterest expense |

20,930 | 18,531 | 17,362 | |||||||||

| Income before income taxes |

527 | 2,833 | 4,246 | |||||||||

| Income taxes |

(163 | ) | 804 | 1,287 | ||||||||

| Net income |

$ | 690 | $ | 2,029 | $ | 2,959 | ||||||

| Net income |

$ | 690 | $ | 2,029 | $ | 2,959 | ||||||

| Dividends on preferred stock |

(642 | ) | (13 | ) | — | |||||||

| Net Income available to common shareholders |

$ | 48 | $ | 2,016 | $ | 2,959 | ||||||

| Net income per common share |

||||||||||||

| Basic |

$ | 0.01 | $ | 0.27 | $ | 0.39 | ||||||

| Diluted |

$ | 0.01 | $ | 0.27 | $ | 0.39 | ||||||

| Weighted average common shares outstanding |

||||||||||||

| Basic |

7,474,140 | 7,482,488 | 7,603,494 | |||||||||

| Diluted |

7,474,140 | 7,520,484 | 7,706,832 | |||||||||

The accompanying notes are an integral part of the consolidated financial statements.

38

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Years Ended December 31, 2009, 2008 and 2007

| 2009 | 2008 | 2007 | ||||||||||

| (in thousands) | ||||||||||||

| Net Income |

$ | 690 | $ | 2,029 | $ | 2,959 | ||||||

| Other comprehensive income (loss): |

||||||||||||

| Unrealized gains (losses) on available for sale securities |

1,637 | (3,315 | ) | 275 | ||||||||

| Related tax effect |

(621 | ) | 1,281 | (105 | ) | |||||||

| Reclassification of losses recognized in net income |

711 | — | 76 | |||||||||

| Related tax effect |

(274 | ) | — | (29 | ) | |||||||

| Reclassification of losses for which credit-related portion other-than-temporary impairment was recognized in net income |

1,807 | 158 | — | |||||||||

| Related tax effect |

(697 | ) | (61 | ) | — | |||||||

| Total other comprehensive income (loss) |

2,563 | (1,937 | ) | 217 | ||||||||

| Comprehensive income |

$ | 3,253 | $ | 92 | $ | 3,176 | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

39

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

Years Ended December 31, 2009, 2008 and 2007

| Number Common Shares Issued |

Preferred Stock Series A |

Preferred Stock Series B |

Discount on Preferred Stock |

Common Stock |

Additional Paid-in Capital |

Unearned ESOP Compensation |

Undivided Profits |

Accumulated Other Comprehensive Income(Loss) |

Total | ||||||||||||||||||||||||||||

| (in thousands, except share data) | |||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2006 |

7,423,550 | $ | — | $ | — | $ | — | $ | 9,279 | $ | 13,541 | $ | (859 | ) | $ | 7,502 | $ | 170 | $ | 29,633 | |||||||||||||||||

| Net income |

— | — | — | — | — | — | — | 2,959 | — | 2,959 | |||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | — | — | 217 | 217 | |||||||||||||||||||||||||||

| Release of ESOP shares |

— | — | — | — | — | 31 | 59 | — | — | 90 | |||||||||||||||||||||||||||

| Common stock issued pursuant to: |

|||||||||||||||||||||||||||||||||||||

| 3% stock dividend |

216,062 | — | — | — | 270 | 916 | — | (1,186 | ) | — | — | ||||||||||||||||||||||||||

| Stock options exercised |

12,764 | — | — | — | 16 | 20 | — | — | — | 36 | |||||||||||||||||||||||||||

| Tax benefit of stock options exercised |

— | — | — | — | — | 3 | — | — | — | 3 | |||||||||||||||||||||||||||

| Repurchase of common stock |

(237,669 | ) | — | — | — | (297 | ) | (1,107 | ) | — | — | — | (1,404 | ) | |||||||||||||||||||||||

| Cash paid fraction shares |

— | — | — | — | — | — | — | (9 | ) | — | (9 | ) | |||||||||||||||||||||||||

| Stock compensation expense |

— | — | — | — | — | 49 | — | — | — | 49 | |||||||||||||||||||||||||||

| Balance, December 31, 2007 |

7,414,707 | — | — | — | 9,268 | 13,453 | (800 | ) | 9,266 | 387 | 31,574 | ||||||||||||||||||||||||||

| Net income |

— | — | — | — | — | — | — | 2,029 | — | 2,029 | |||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | — | — | (1,937 | ) | (1,937 | ) | |||||||||||||||||||||||||

| Release of ESOP shares |

— | — | — | — | — | 14 | 64 | — | — | 78 | |||||||||||||||||||||||||||

| Common stock issued pursuant to: |

|||||||||||||||||||||||||||||||||||||

| 3% stock dividend |

220,738 | — | — | — | 276 | 718 | — | (994 | ) | — | — | ||||||||||||||||||||||||||

| Stock options exercised |

69,742 | — | — | — | 87 | 214 | — | — | — | 301 | |||||||||||||||||||||||||||

| Tax benefit of stock options exercised |

— | — | — | — | — | 26 | — | — | — | 26 | |||||||||||||||||||||||||||

| Repurchase of common stock |

(111,258 | ) | — | — | — | (139 | ) | (432 | ) | — | — | — | (571 | ) | |||||||||||||||||||||||

| Cash paid fractional shares |

— | — | — | — | — | — | — | (7 | ) | — | (7 | ) | |||||||||||||||||||||||||

| Stock compensation expense |

— | — | — | — | — | 26 | — | — | — | 26 | |||||||||||||||||||||||||||

| Adjustment to initially apply ASC 715-60 |

— | — | — | — | — | — | — | (273 | ) | — | (273 | ) | |||||||||||||||||||||||||

| Issue series A preferred stock to the Treasury |

— | 10,000 | — | — | — | — | — | — | — | 10,000 | |||||||||||||||||||||||||||

| Issue series B preferred stock to the Treasury |

— | — | 500 | — | — | — | — | — | — | 500 | |||||||||||||||||||||||||||

| Record Series B warrant expense |

— | — | — | (500 | ) | — | — | — | — | — | (500 | ) | |||||||||||||||||||||||||

| Record preferred stock dividend |

— | — | — | — | — | — | — | (13 | ) | — | (13 | ) | |||||||||||||||||||||||||

| Balance, December 31, 2008 |

7,593,929 | 10,000 | 500 | (500 | ) | 9,492 | 14,019 | (736 | ) | 10,008 | (1,550 | ) | 41,233 | ||||||||||||||||||||||||

40

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (Continued)

Years Ended December 31, 2009, 2008 and 2007

| Number Common Shares Issued |

Preferred Stock Series A |

Preferred Stock Series B |

Discount on Preferred Stock |

Common Stock |

Additional Paid-in Capital |

Unearned ESOP Compensation |

Undivided Profits |

Accumulated Other Comprehensive Income(Loss) |

Total | |||||||||||||||||||||||||

| (in thousands, except share data) | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2008 |

7,593,929 | $ | 10,000 | $ | 500 | $ | (500 | ) | $ | 9,492 | $ | 14,019 | $ | (736 | ) | $ | 10,008 | $ | (1,550 | ) | $ | 41,233 | ||||||||||||

| Net income |

— | — | — | — | — | — | — | 690 | — | 690 | ||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | — | — | 2,563 | 2,563 | ||||||||||||||||||||||||

| Release of ESOP shares |

— | — | — | — | — | — | 69 | — | — | 69 | ||||||||||||||||||||||||

| Stock compensation expense |

— | — | — | — | — | 11 | — | — | — | 11 | ||||||||||||||||||||||||

| Record preferred stock dividend and discount accretion |

— | — | — | 100 | — | — | — | (642 | ) | — | (542 | ) | ||||||||||||||||||||||

| Balance, December 31, 2009 |

7,593,929 | $ | 10,000 | $ | 500 | $ | (400 | ) | $ | 9,492 | $ | 14,030 | $ | (667 | ) | $ | 10,056 | $ | 1,013 | $ | 44,024 | |||||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

41

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31, 2009, 2008 and 2007

| 2009 | 2008 | 2007 | ||||||||||

| Cash flows from operating activities |

||||||||||||

| Net income |

$ | 690 | $ | 2,029 | $ | 2,959 | ||||||

| Adjustments to reconcile net income to net cash |

||||||||||||

| Provided by operating activities: |

||||||||||||

| Depreciation |

780 | 676 | 625 | |||||||||

| Net amortization of security premiums/discounts |

134 | (202 | ) | (220 | ) | |||||||

| Impairment of securities available for sale |

1,807 | 158 | — | |||||||||

| Net amortization of mortgage servicing rights |

868 | 471 | 407 | |||||||||

| Impairment of foreclosed real estate |

78 | 28 | — | |||||||||

| Provision for loan losses |

1,732 | 969 | 15 | |||||||||

| Deferred income taxes |

(737 | ) | (728 | ) | 205 | |||||||

| Stock compensation |

11 | 26 | 49 | |||||||||

| Net realized loss on sales / calls available for sale securities |

711 | — | 76 | |||||||||

| Income from mortgage loan sales |

(3,436 | ) | (1,208 | ) | (957 | ) | ||||||

| Proceeds from sales of loans held for sale |

144,761 | 55,198 | 45,603 | |||||||||

| Origination of loans held for sale |

(142,727 | ) | (54,328 | ) | (43,748 | ) | ||||||

| (Gain) loss on sale of premises, equipment and other assets |

(1 | ) | 5 | (26 | ) | |||||||

| Loss on nonmarketable securities |

172 | — | — | |||||||||

| Increase in cash surrender value of life insurance |

(203 | ) | (193 | ) | (185 | ) | ||||||

| Loss on sales of foreclosed real estate |

36 | 41 | 2 | |||||||||

| Release of ESOP Shares |

69 | 78 | 90 | |||||||||

| Net change in interest receivable |

(50 | ) | 28 | (280 | ) | |||||||

| Net change in other assets |

(3,652 | ) | 83 | (866 | ) | |||||||

| Net change in interest payable |

(106 | ) | (94 | ) | 93 | |||||||

| Net change in other liabilities |

714 | 584 | 302 | |||||||||

| Net cash provided by operating activities |

1,651 | 3,621 | 4,144 | |||||||||

| Cash flows from investing activities |

||||||||||||

| Proceeds from sales, maturities and calls of securities available for sale |

30,353 | 14,386 | 10,382 | |||||||||

| Purchase of securities available for sale |

(36,208 | ) | (35,329 | ) | (23,744 | ) | ||||||

| Net increase in loans |

(15,598 | ) | (21,837 | ) | (33,588 | ) | ||||||

| Proceeds from sale of premises, equipment and other assets |

1 | — | 87 | |||||||||

| Purchase of premises and equipment |

(3,298 | ) | (3,058 | ) | (758 | ) | ||||||

| Proceeds from sales of foreclosed real estate |

1,243 | 182 | 98 | |||||||||

| Investment in other assets |

(1,089 | ) | (569 | ) | — | |||||||

| Net increase in Federal Home Loan Bank stock |

(917 | ) | (147 | ) | (157 | ) | ||||||

| Net cash used by investing activities |

(25,513 | ) | (46,372 | ) | (47,680 | ) | ||||||

| Cash flows from financing activities |

||||||||||||

| Net increase in deposit accounts |

23,147 | 28,970 | 15,057 | |||||||||

| Net increase (decrease) in short-term borrowed funds |

4,691 | (9,679 | ) | 18,888 | ||||||||

| Net increase (decrease) in long-term debt |

(5,859 | ) | 3,392 | (7,598 | ) | |||||||

| Net proceeds from issuance of junior subordinated debt |

— | 7,419 | — | |||||||||

| Repurchases of common stock |

— | (571 | ) | (1,404 | ) | |||||||

| Net proceeds from issuance of preferred stock |

— | 10,000 | — | |||||||||

| Net proceeds from issuance of common stock |

— | 301 | 36 | |||||||||

| Tax benefit of stock options exercised |

— | 26 | 3 | |||||||||

| Dividend and discount accretion on preferred stock |

(542 | ) | (13 | ) | — | |||||||

| Cash paid for fractional shares |

— | (7 | ) | (9 | ) | |||||||

| Net cash provided by financing activities |

21,437 | 39,838 | 24,973 | |||||||||

| Decrease in cash and cash equivalents |

(2,425 | ) | (2,913 | ) | (18,563 | ) | ||||||

| Cash and cash equivalents, beginning of period |

13,284 | 16,197 | 34,760 | |||||||||

| Cash and cash equivalents, end of period |

$ | 10,859 | $ | 13,284 | $ | 16,197 | ||||||

| Supplemental disclosures of cash flow information |

||||||||||||

| Interest paid |

$ | 7,802 | $ | 9,922 | $ | 11,783 | ||||||

| Income taxes paid |

1,558 | 1,596 | 1,311 | |||||||||

| Supplemental schedule of non-cash activities |

||||||||||||

| Net change in fair value of securities available for sale, net of tax |

2,563 | (1,937 | ) | 217 | ||||||||

| Loans transferred to foreclosed real estate |

1,882 | 2,876 | 60 | |||||||||

| Mortgage servicing rights capitalized |

1,465 | 563 | 331 | |||||||||

| Preferred stock dividend accrued |

(68 | ) | (13 | ) | — | |||||||

| ASC 715-60 charged to retained earnings |

— | (273 | ) | — | ||||||||

The accompanying notes are an integral part of the consolidated financial statements.

42

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies

Nature of Business

Uwharrie Capital Corp (the “Company”) was incorporated under North Carolina law for the purpose of becoming the holding company for Bank of Stanly (“Stanly”). On July 1, 1993, Stanly became a wholly-owned subsidiary of the Company through a one-for-one exchange of the common stock of Stanly for common stock of the Company.

Stanly was incorporated on September 28, 1983, under the laws of the State of North Carolina and began operations on January 26, 1984 in Albemarle, North Carolina. Deposits with Stanly are insured by the Federal Deposit Insurance Corporation (“FDIC”). Stanly is under regulation of the Federal Reserve, FDIC and the North Carolina State Banking Commission. Through its six branch locations in Stanly County, Stanly provides a wide range of deposit accounts, commercial, consumer, home equity and residential mortgage loans, safe deposit boxes and automated banking.

In 1987, Stanly established a wholly-owned subsidiary, BOS Agency, Inc. (“BOS Agency”), which engages in insurance product sales. In 1989, Stanly established a second wholly-owned subsidiary, BOS Financial Corporation, for the purpose of conducting business as a broker/dealer in securities. During 1993, BOS Financial Corporation changed its name to The Strategic Alliance Corporation (“Strategic Alliance”) and was registered as a broker/dealer and is regulated by the Financial Industry Regulatory Authority (“FINRA”).

The Company formed a new subsidiary, Strategic Investment Advisors, Inc. (“SIA”), during 1999 to provide investment advisory and asset management services. This subsidiary is registered as an investment advisor with the Securities and Exchange Commission.

On January 19, 2000, the Company completed its acquisition of Anson BanCorp, Inc. and its subsidiary, Anson Savings Bank. The savings bank retained its North Carolina savings bank charter and became a wholly-owned subsidiary of Uwharrie Capital Corp as Anson Bank & Trust Company (“Anson”), operating out of its main office branch in Wadesboro.

On August 4, 2000, Stanly acquired another subsidiary, Gateway Mortgage, Inc. (“Gateway”), a mortgage origination company.

On April 10, 2003, the Company capitalized a new wholly-owned subsidiary bank, Cabarrus Bank & Trust Company (“Cabarrus”), located in Concord, North Carolina. As of that date, Cabarrus purchased two branch offices located in Cabarrus County from Stanly to begin its operation. Cabarrus operates as a commercial bank and provides a full range of banking services.

On April 7, 2004 Uwharrie Mortgage, Inc. was established as a subsidiary of the Company to serve in the capacity of trustee and substitute trustee under deeds of trust.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, Stanly, Anson, Cabarrus, SIA and their subsidiaries, BOS Agency, Strategic Alliance and Gateway. All significant intercompany transactions and balances have been eliminated in consolidation.

43

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

Use of Estimates

The preparation of financial statements, in conformity with accounting principles generally accepted in the United States of America, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change relate to the determination of the allowance for loan losses.

Cash and Cash Equivalents

For the purpose of presentation in the consolidated statements of cash flows, cash and cash equivalents are defined as those amounts included in the balance sheet captions “Cash and due from banks” and “Interest-earning deposits with banks.”

Investment Securities Held To Maturity

Investment securities classified as held to maturity are debt securities the Company has both the intent and ability to hold to maturity regardless of changes in market conditions, liquidity needs or changes in general economic conditions. These securities are carried at cost adjusted for amortization of premium and accretion of discount, computed by the interest method over their contractual lives. Declines in the fair value of individual held to maturity securities below their cost that are other than temporary would result in write-downs of the individual securities to their fair value. Such write-downs would be included in earnings as realized losses. The Company had no securities held to maturity at December 31, 2009 and 2008.

Investment Securities Available for Sale

Investment securities available for sale consist of bonds and notes not classified as trading securities nor as held to maturity securities. Unrealized holding gains and losses on available for sale securities are reported as a net amount in other comprehensive income, net of income taxes. Gains and losses on the sale of available for sale securities are determined using the specific identification method. Declines in the fair value of individual available for sale securities below their cost that are other than temporary would result in write-downs of the individual securities to their fair value. Such write-downs would be included in earnings as realized losses. Premiums and discounts are recognized in interest income using the interest method over the period to maturity.

Loans Held for Sale

Loans originated and intended for sale in the secondary market are carried at the lower of cost or estimated fair value in the aggregate. Net unrealized losses, if any, are recognized through a valuation allowance by charges to income.

Loans

The Company grants mortgage, commercial and consumer loans to customers. The ability of the Company’s borrowers to honor their contracts is largely dependent upon the real estate and general economic conditions in the Company’s market area. Loans that management has the

44

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

intent and ability to hold for the foreseeable future or until maturity or pay-off are reported at their outstanding unpaid principal balances adjusted for charge-offs, the allowance for loan losses, and any deferred fees or costs. Interest income is accrued on the unpaid principal balance. Loan origination fees, net of certain direct origination costs, are deferred and recognized as an adjustment of the related loan yield using the interest method.

The accrual of interest on mortgage and commercial loans is discontinued at the time the loan is 90 days delinquent unless the credit is well-secured and in process of collection. Credit card loans and other personal loans are typically charged off no later than 180 days past due. In all cases, loans are placed on nonaccrual or charged off at an earlier date if collection of principal or interest is considered doubtful.

All interest accrued but not collected for loans that are placed on nonaccrual or charged off is reversed against interest income. The interest on these loans is accounted for on the cash-basis or cost-recovery method until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

Allowance for Loan Losses

The allowance for loan losses is established as losses are estimated to have occurred through a provision for loan losses charged to earnings. Loan losses are charged against the allowance when management believes the uncollectibility of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance.

The allowance for loan losses is evaluated on a regular basis by management and is based upon management’s periodic review of the collectibility of the loans in light of historical experience, the nature and volume of the loan portfolio, adverse situations that may affect the borrower’s ability to repay, estimated value of any underlying collateral and prevailing economic conditions. This evaluation is inherently subjective as it requires estimates that are susceptible to significant revision as more information becomes available. In addition, regulatory examiners may require the Company to recognize adjustments to the allowance for loan losses based on their judgment about information available to them at the time of their assessment.

A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis for commercial and construction loans by either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price, or the fair value of the collateral if the loan is collateral dependent.

Large groups of smaller balance homogeneous loans are collectively evaluated for impairment. Accordingly, the Company does not separately identify individual consumer, residential and other loans for impairment disclosures.

45

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

Servicing Rights

The Company capitalizes servicing rights when loans are either securitized or sold and the loan servicing is retained. The cost of servicing rights is amortized in proportion to and over the estimated period of net servicing revenues. The amortization of servicing rights is recognized in the statement of income as an offset to other noninterest income. Servicing assets are evaluated for impairment based upon the fair value. Fair value is determined using prices for similar assets with similar characteristics, when available, or based upon discounted cash flows using market-based assumptions. Impairment is recognized through a valuation allowance.

Transfers of Financial Assets

Transfers of financial assets are accounted for as sales when control over the assets has been surrendered. Control over transferred assets is deemed to be surrendered when (1) the assets have been isolated from the Company, (2) the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and (3) the Company does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity.

Foreclosed Real Estate

Real estate properties acquired through foreclosure or other proceedings are initially recorded at fair value upon foreclosure, establishing a new cost basis. After foreclosure, valuations are performed and the foreclosed property is adjusted to the lower of cost or fair value of the properties, less costs to sell. Any write-down at the time of transfer to foreclosed properties is charged to the allowance for loan losses. Subsequent write-downs are charged to other expenses. Property is evaluated regularly to ensure that the recorded amount is supported by its current fair value.

Premises and Equipment

Premises and equipment are stated at cost less accumulated depreciation. Land is carried at cost. Additions and major replacements or betterments which extend the useful lives of premises and equipment are capitalized. Maintenance, repairs and minor improvements are expensed as incurred. Depreciation is computed principally by the straight-line method over estimated useful lives, except in the case of leasehold improvements, which are amortized over the term of the leases, if shorter. Useful lives range from five to seven years for furniture, fixtures and equipment, to ten to thirty-nine years for leasehold improvements and buildings, respectively. Upon retirement or other disposition of the assets, the cost and the related accumulated depreciation are removed from the accounts and any gains or losses are reflected in income.

Federal Home Loan Bank Stock

As a requirement for membership, the banks invest in the stock of the Federal Home Loan Bank of Atlanta (“FHLB”). This investment is carried at cost. Due to the redemption provisions of the FHLB, the Company estimated that fair value approximates cost and that this investment was not impaired.

46

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

Goodwill

Goodwill resulted from the 2000 acquisition of Anson BanCorp, Inc. and its subsidiary, Anson Savings Bank. Goodwill is evaluated for impairment annually or more frequently if circumstances indicate potential impairment.

Stock-Based Compensation

The Company recognizes the cost of employee services received in exchange for an award of equity instruments in the financial statements over the period the employee is required to perform the services in exchange for the award (presumptively the vesting period). ASC 718 also requires measurement of the cost of employee services received in exchange for an award based on the grant-date fair value of the award. Excess tax benefits are reported as financing cash inflows in the consolidated statement of cash flows.

Income Taxes

The Company and its subsidiaries file a consolidated Federal income tax return and separate North Carolina income tax returns. The provision for income taxes in the accompanying consolidated financial statements is provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carryforwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Fair Value of Financial Instruments

The Company adopted the provisions of Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures and ASC 825, Financial Instruments on January 1, 2008.

ASC 820 defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. ASC 820 does not require any new fair value measurements, but clarifies and standardizes some divergent practices that have emerged since prior guidance was issued. ASC 820 creates a three-level hierarchy under which individual fair value estimates are to be ranked based on the relative reliability of the inputs used in the valuation.

ASC 820 defines fair value as the price that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities, the Company considers the principal or most advantageous market in which those assets or liabilities are sold and considers assumptions that market participants would use when pricing those assets or liabilities. Fair values determined using Level 1 inputs rely on active and observable markets to price identical assets or liabilities. In situations where identical assets and liabilities are not traded in active markets, fair values may be determined based on Level 2 inputs, which exist when observable data exists for similar assets and liabilities. Fair values for assets and liabilities for which identical or similar assets and liabilities are not actively traded in observable markets are based on Level 3 inputs, which are considered to be unobservable.

47

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

Among the Company’s assets and liabilities, investment securities available for sale are reported at their fair values on a recurring basis. Certain other assets are adjusted to their fair value on a nonrecurring basis, including loans held for sale, which are carried at the lower of cost or market; loan servicing rights, where fair value is determined using similar assets with similar characteristics, when available, or based upon discounted cash flows using market-based assumptions; foreclosed real estate, which is carried at lower of cost or fair market value and goodwill, which is periodically tested for impairment. Deposits, short-term borrowings and long-term obligations are not reported at fair value.

The Company does not record loans at fair value on a recurring basis. However, from time to time, a loan is considered impaired and an allowance for loan losses is established. Loans for which it is probable that payment of interest and principal will not be made in accordance with the contractual terms of the loan agreement are considered impaired. Once a loan is identified as individually impaired, management measures impairment in accordance with ASC 310, Receivables, Loan and Debt Securities. The fair value of impaired loans is estimated using one of several methods, including collateral value, market value of similar debt, enterprise value, liquidation value and discounted cash flows. Those impaired loans not requiring an allowance represent loans for which the fair value of the expected repayments or collateral exceed the recorded investments in such loans. At December 31, 2009, substantially all of the total impaired loans were evaluated based on the fair value of the collateral. When the fair value of the collateral is based on an observable market price or a current appraised value, the Company records the impaired loan as nonrecurring Level 2. When an appraised value is not available or management determines the fair value of the collateral is further impaired below the appraised value and there is no observable market price, the Company records the impaired loan as nonrecurring Level 3.

Comprehensive Income

The Company reports as comprehensive income all changes in shareholders’ equity during the year from sources other than shareholders. Other comprehensive income refers to all components (revenues, expenses, gains, and losses) of comprehensive income that are excluded from net income. The Company’s only component of other comprehensive income is unrealized gains and losses, net of income tax, on investment securities available for sale.

As of December 31, 2009 and December 31, 2008, total accumulated other comprehensive income (loss) was $1.0 million and $(1.6) million, respectively. The components of accumulated other comprehensive income at December 31, 2009 included $239,926 of unrealized gains and temporary unrealized losses net of tax, and non credit losses on five other than temporarily impaired investments of $(772,722) net of tax. Accumulated other comprehensive income at December 31, 2008 consisted of unrealized gains and temporary unrealized losses of $(1.6) million net of tax.

Earnings per Common Share

The Company issued 3% stock dividends in 2008 and 2007. There was not a stock dividend in 2009. All references in these consolidated financial statements to earnings per common share and weighted average common and common equivalent shares outstanding have been adjusted for the effect of these stock dividends. In 2009 and 2008 there were 280,715 and 189,866 options outstanding that were anti-dilutive, respectively. There were not any anti-dilutive stock options outstanding in 2007.

48

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

Basic earnings per share (“EPS”) excludes dilution and is computed by dividing income available to common shareholders by the weighted-average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the entity. The ESOP effect is the yearly average of the unallocated ESOP shares.

The computation of weighted average shares used in the calculation of basic and dilutive earnings per share is summarized below:

| 2009 | 2008 | 2007 | |||||||

| Weighted average number of common shares used in computing basic net income per common share |

7,593,969 | 7,618,913 | 7,753,837 | ||||||

| Effect of ESOP shares |

(119,829 | ) | (136,425 | ) | (150,343 | ) | |||

| Adjusted weighted average number of common shares used in computing basic net income per common share |

7,474,140 | 7,482,488 | 7,603,494 | ||||||

| Effect of dilutive stock options |

— | 37,996 | 103,338 | ||||||

| Weighted average number of common shares and dilutive potential common shares used in computing diluted net income per common share |

7,474,140 | 7,520,484 | 7,706,832 | ||||||

Recent Accounting Pronouncements

ASC 105

In June 2009, the Financial Accounting Standards Board issued Accounting Standards Codification ASC 105. The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles as the single source of authoritative U.S. Generally Accepted Accounting Principles (GAAP) recognized by the FASB to be applied by nongovernmental entities. The Codification reorganizes all previous GAAP pronouncements into roughly 90 accounting topics and displays all topics using a consistent structure. All existing standards that were used to create the Codification have been superseded, replacing the previous references to specific Statements of Financial Accounting Standards (SFAS) with numbers used in the Codification’s structural organization. The guidance is effective for interim and annual periods ending after September 15, 2009. After September 15, only one level of authoritative GAAP exists, other than guidance issued by the Securities and Exchange Commission (SEC). All other accounting literature excluded from the Codification is considered non-authoritative. The adoption of the Codification does not have a material impact on the Company’s consolidated financial statements.

ASC 815

In March of 2008, the Financial Accounting Standards Board issued Accounting Standards Codification 815 (“ASC 815”), Derivative and Hedging. ASC 815 amends and expands the disclosure requirement for derivative instruments and hedging activities to provide users of financial statements with an enhanced understanding of the derivative instrument’s purpose,

49

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

how it is accounted for, and its impact on the financial statements. The adoption of ASC 815 on January 1, 2009 did not have a material effect on the Company’s consolidated financial statements.

ASC 855

In May 2009, the Financial Accounting Standards Board issued Accounting Standards Codification (“ASC 855”), Subsequent Events. The guidance establishes general standards of accounting for and disclosure of subsequent events. Subsequent events are events that occur after the balance sheet date but before financial statements are issued or are available to be issued. The guidance is effective for interim or annual periods ending after June 15, 2009. The adoption of this guidance was not material to the Company’s consolidated financial statements.

FSP EITF 99-20-1

On January 12, 2009, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position, Emerging Issues Task Force (EITF) 99-20-1, Amendments to the Impairment Guidance of EITF Issue No. 99-20. FSP EITF 99-20-1 addresses certain practice issues in EITF No. 99-20, “Recognition of Interest Income and Impairment on Purchased Beneficial Interests and Beneficial Interests That Continue to Be Held by a Transferor in Securitized Financial Assets,” by making its other-than-temporary impairment assessment guidance consistent with SFAS No. 115, “Accounting for Certain Investments in Debt and Equity Securities.” FSP EITF 99-20-1 removes the reference to the consideration of a market participant’s estimates of cash flows in EITF 99-20, and instead requires an assessment of whether it is probable, based on current information and events, that the holder of the security will be unable to collect all amounts due according to the contractual terms. If it is probable that there has been an adverse change in estimated cash flows, other-than-temporary impairment is deemed to exist, and a corresponding loss shall be recognized in earnings equal to the entire difference between the investment’s carrying value and its fair value at the balance sheet date of the reporting period for which the assessment is made. This FSP is effective for interim and annual reporting periods ending after December 15, 2008, and shall be applied prospectively. The impact of adoption did not have a material impact on the Company’s consolidated financial statements.

In April 2009, the Financial Accounting Standards Board issued the following three FASB Staff Positions intended to provide additional application guidance and enhance disclosures regarding fair value measurements and impairments of securities:

ASC 820

ASC 820, “Fair Value and Disclosures,” provide additional guidance for estimating fair value in accordance with ASC 820 when the volume and level of activity for the asset or liability have decreased significantly. ASC 820 also provides guidance on identifying circumstances that indicate a transaction is not orderly. The provisions of ASC 820 are effective for the Company’s interim period ending on June 30, 2009.

ASC 825

ASC 825, “Financial Instruments,” requires disclosures about fair value of financial instruments in interim reporting periods of publicly traded companies that were previously only required to be disclosed in annual financial statements. The provisions of ASC 825 are effective for the Company’s interim period ending on June 30, 2009. As ASC 825 amends only the disclosure requirements about fair value of financial instruments in interim periods, the adoption of ASC 825 did not have a material effect on the Company’s statement of operations and balance sheet.

50

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 1 - Significant Accounting Policies (Continued)

ASC 320

ASC 320, “Investments, Debt Equity Securities” amends current other-than-temporary impairment guidance in GAAP for debt securities to make the guidance more operational and to improve the presentation and disclosure of other-than-temporary impairments on debt and equity securities in the financial statements. This ASC does not amend existing recognition and measurement guidance related to other-than-temporary impairments of equity securities. The Company adopted this as of June 30, 2009 and it did not have a material effect on the Company’s statement of operations and balance sheet.

SAB 111

The Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin (“SAB”) No. 111 (FASB ASC 320-10-S99-1) on April 9, 2009 to amend Topic 5.M., “Other Than Temporary Impairment of Certain Investments in Debt and Equity Securities” and to supplement FSP SFAS 115-2 and SFAS 124-2. SAB 111 maintains the Staff’s previous views related to equity securities; however, debt securities are excluded from its scope. The SAB provides that “other-than-temporary” impairment is not necessarily the same as “permanent” impairment and unless evidence exists to support a value equal to or greater than the carrying value of the equity security investment, a write-down to fair value should be recorded and accounted for as a realized loss. The SAB was effective upon issuance and had no impact on the Company’s financial position.

From time to time the FASB issues exposure drafts of proposed statements of financial accounting standards. Such exposure drafts are subject to comment from the public, to revisions by the FASB and to final issuance by the FASB as statements of financial accounting standards. Management considers the effect of the proposed statements on the consolidated financial statements of the Company and monitors the status of changes to and proposed effective dates of exposure drafts.

Reclassification

Certain amounts in the 2008 and 2007 financial statements have been reclassified to conform to the 2009 presentation. The reclassifications had no effect on net income or shareholders’ equity as previously reported.

51

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 2 - Investment Securities

Carrying amounts and fair values of securities available for sale are summarized below:

| December 31, 2009 |

Amortized Cost |

Gross Unrealized Gains |

Gross Unrealized Losses |

Fair Value | ||||||||

| (dollars in thousands) | ||||||||||||

| U.S. Treasury |

$ | 3,024 | $ | — | $ | 5 | $ | 3,019 | ||||

| U.S. Government agencies |

20,736 | 246 | 11 | 20,971 | ||||||||

| Mortgage-backed securities and CMO’s |

34,186 | 1,056 | — | 35,242 | ||||||||

| Private label CMO’s |

7,468 | 117 | 85 | 7,500 | ||||||||

| State and political subdivisions |

9,276 | 309 | — | 9,585 | ||||||||

| Total securities available for sale |

$ | 74,690 | $ | 1,728 | $ | 101 | $ | 76,317 | ||||

| December 31, 2008 |

Amortized Cost |

Gross Unrealized Gains |

Gross Unrealized Losses |

Fair Value | ||||||||

| (dollars in thousands) | ||||||||||||

| U.S. Government agencies |

$ | 10,469 | $ | 229 | $ | 55 | $ | 10,643 | ||||

| Mortgage-backed securities and CMO’s |

33,149 | 691 | 225 | 33,615 | ||||||||

| Private label CMO’s |

11,351 | — | 3,570 | 7,781 | ||||||||

| State and political subdivisions |

16,396 | 417 | 17 | 16,796 | ||||||||

| Total securities available for sale |

$ | 71,365 | $ | 1,337 | $ | 3,867 | $ | 68,835 | ||||

At December 31, 2009 and 2008, the Company owned Federal Reserve stock reported at cost of $778,850 and $568,850 respectively and is included in other assets. Also at December 31, 2009 and 2008, the Company owned Federal Home Loan Bank Stock (FHLB) of $3.2 million and $2.3 million, respectively. The investments in Federal Reserve stock and FHLB stock are required investments related to the Company’s membership and borrowings with these banks.

Results from sales and calls of securities available for sale for the years ended December 31, 2009, 2008 and 2007 are as follows:

| 2009 | 2008 | 2007 | |||||||||

| (dollars in thousands) | |||||||||||

| Gross proceeds from sales and calls |

$ | 9,535 | $ | — | $ | 4,643 | |||||

| Realized gains from sales |

$ | 219 | $ | — | $ | — | |||||

| Realized losses from sales |

(930 | ) | — | (76 | ) | ||||||

| Net realized gains (losses) |

$ | (711 | ) | $ | — | $ | (76 | ) | |||

At December 31, 2009, 2008 and 2007 securities available for sale with a carrying amount of $11.4 million, $13.2 million and $15.2 million, respectively, were pledged as collateral on public deposits and for other purposes as required or permitted by law.

The following tables show the gross unrealized losses and fair value of investments, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position, at December 31, 2009 and 2008. These unrealized losses on investment securities are a result of temporary fluctuations in the market prices due to a rise in interest rates, which will adjust if rates decline in a volatile market and are in no way a reflection of the quality of the investments. At December 31, 2009, the unrealized losses related to three U.S. Treasury notes, three U.S. Government Agencies and five mortgage backed securities and collateralized mortgage obligations “CMOs”.

52

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 2 - Investment Securities (Continued)

| Less than 12 Months | 12 Months or More | Total | ||||||||||||||||

| December 31, 2009 |

Fair Value |

Unrealized Losses |

Fair Value |

Unrealized Losses |

Fair Value |

Unrealized Losses | ||||||||||||

| (dollars in thousands) | ||||||||||||||||||

| Securities available for sale temporary impairment |

||||||||||||||||||

| U.S. Treasury |

$ | 3,019 | $ | 5 | $ | — | $ | — | $ | 3,019 | $ | 5 | ||||||

| U.S. Gov’t agencies |

10,327 | 11 | — | — | 10,327 | 11 | ||||||||||||

| Mortgage-backed securities and CMO’s |

— | — | 134 | — | 134 | — | ||||||||||||

| Private label CMO’s |

— | — | 1,625 | 85 | 1,625 | 85 | ||||||||||||

| State and political subdivisions |

— | — | — | — | — | — | ||||||||||||

| $ | 13,346 | $ | 16 | $ | 1,759 | $ | 85 | $ | 15,105 | $ | 101 | |||||||

| Other than Temporary Impairment |

||||||||||||||||||

| Private label CMO’s |

$ | — | $ | — | $ | 3,667 | $ | — | $ | 3,667 | $ | — | ||||||

| $ | — | $ | — | $ | 3,667 | $ | — | $ | 3,667 | $ | — | |||||||

| Less than 12 Months | 12 Months or More | Total | ||||||||||||||||

| December 31, 2008 |

Fair Value |

Unrealized Losses |

Fair Value |

Unrealized Losses |

Fair Value |

Unrealized Losses | ||||||||||||

| (dollars in thousands) | ||||||||||||||||||

| Securities available for sale temporary impairment |

||||||||||||||||||

| U.S. Gov’t agencies |

$ | 3,010 | $ | 55 | $ | — | $ | — | $ | 3,010 | $ | 55 | ||||||

| Mortgage-backed securities and CMO’s |

3,996 | 212 | 633 | 12 | 4,629 | 224 | ||||||||||||

| Private label CMO’s |

10,506 | 3,076 | 657 | 66 | 11,163 | 3,142 | ||||||||||||

| State and political subdivisions |

2,648 | 17 | — | — | 2,648 | 17 | ||||||||||||

| $ | 20,160 | $ | 3,360 | $ | 1,290 | $ | 78 | $ | 21,450 | $ | 3,438 | |||||||

| Other than Temporary Impairment |

||||||||||||||||||

| Private label CMO’s |

$ | 188 | $ | 429 | $ | — | $ | — | $ | 188 | $ | 429 | ||||||

| $ | 188 | $ | 429 | $ | — | $ | — | $ | 188 | $ | 429 | |||||||

The Company routinely conducts reviews to identify and evaluate each investment security to determine whether OTTI has occurred using several economic models. To determine if the unrealized loss is other-than-temporary, the Company projects total estimated defaults of the underlying troubled and non performing assets (mortgages) and multiply that calculated amount by an estimate of realizable value upon sale in the marketplace (severity) in order to determine the projected collateral loss. The Company also evaluates the current credit enhancement underlying the bond to determine the impact on cash flows. If the Company determines that a given position will be subject to a write-down, loss or decline in yield, the Company records the expected credit loss as a charge to earnings. In addition, the Company estimates the expected loss by taking into account observed performance of the underlying securities, industry studies, market forecasts, as well as our view of the economic outlook affecting bond collateral.

Based on these evaluations, the Company determined that five private label collateralized mortgage obligations were other-than-temporarily impairment at December 31, 2009, and reduced the carrying value of these instruments to fair value through a $1.8 million charge to earnings. These instruments were subsequently sold at a further loss of $93,621 during the first quarter of 2010.

53

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 2 – Investment Securities (Continued)

The following table summarizes cumulative credit other-than-temporary impairment losses recognized on debt securities held by the Company:

| 2009 | ||||

| (dollars in thousands) | ||||

| Balance, beginning of the period |

$ | — | ||

| Impairment losses recognized during the year |

1,807 | |||

| Realized losses from sales |

(124 | ) | ||

| Balance, end of year |

$ | 1,683 | ||

As of December 31, 2009 there are no unrealized loss components for these impaired securities and accumulated other comprehensive income.

Note 3 – Loans Held for Investment

The composition of net loans held for investment as of December 31, 2009 and 2008 is as follows:

| 2009 | 2008 | |||||||

| (dollars in thousands) | ||||||||

| Commercial |

$ | 51,723 | $ | 45,470 | ||||

| Real estate - construction |

44,976 | 50,661 | ||||||

| Real estate - residential |

144,154 | 139,346 | ||||||

| Real estate - commercial |

95,938 | 89,561 | ||||||

| Consumer |

16,628 | 15,499 | ||||||

| Other |

172 | 121 | ||||||

| 353,591 | 340,658 | |||||||

| Less: |

||||||||

| Allowance for loan losses |

(5,276 | ) | (4,361 | ) | ||||

| Deferred loan (fees) costs, net |

138 | 172 | ||||||

| Loans held for investment, net |

$ | 348,453 | $ | 336,469 | ||||

Although the subsidiary banks’ loan portfolios are diversified, there is a concentration of mortgage real estate loans, primarily one to four family residential mortgage loans, which represent 40.77% of total loans. Additionally, there is concentration in commercial loans secured primarily by real estate, to finance manufacturing buildings, shopping center locations, commercial land development, commercial buildings and equipment that comprise 27.13% of total loans. There is not a concentration of a particular type of credit in this group of commercial loans.

Impaired loans, which consisted of nonaccrual loans and other loans identified by management as impaired, totaled $24.1 million and $12.5 million at December 31, 2009 and 2008, respectively. The nonaccrual status of these loans had the effect of reducing net income by $246,395 in 2009 and $93,750 in 2008. Of the $24.1 million in impaired loans at December 31, 2009, $16.5 million carried allowances totaling $3.0 million while $7.6 million were evaluated and required no specific allowance. Of the $12.5 million in impaired loans at December 31, 2008, $9.0 million carried allowances totaling $2.3 million while $3.5 million required no specific allowance. There were credit card loans 90 days past due and still accruing of $16,635 and $2,710 at December 31, 2009 and 2008, respectively.

Restructured loans at December 31, 2009 totaled $2.4 million of which $2.3 million are included in impaired loans above.

54

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 3 – Loans Held for Investment (Continued)

The carrying value of foreclosed properties held as other real estate was $3.4 million and $2.8 million at December 31, 2009 and 2008, respectively.

The Company’s loan policies are written to address loan-to-value ratios and collateralization methods with respect to each lending category. Consideration is given to the economic and credit risk of lending areas and customers associated with each category.

Note 4 – Allowance for Loan Losses

Changes in the allowance for loan losses for the years ended December 31, 2009, 2008 and 2007 are presented below:

| 2009 | 2008 | 2007 | ||||||||||

| (dollars in thousands) | ||||||||||||

| Balance, beginning of year |

$ | 4,361 | $ | 3,510 | $ | 3,171 | ||||||

| Charge-offs |

(871 | ) | (288 | ) | (224 | ) | ||||||

| Recoveries |

54 | 170 | 548 | |||||||||

| Provision charged against income |

1,732 | 969 | 15 | |||||||||

| Balance, end of year |

$ | 5,276 | $ | 4,361 | $ | 3,510 | ||||||

Note 5 – Servicing Assets

Loans serviced for others are not included in the accompanying consolidated balance sheets. The unpaid principal balances of mortgage and other loans serviced for others were approximately $289 million and $228 million at December 31, 2009 and 2008, respectively. The carrying value of capitalized servicing rights, net of valuation allowances, is included in other assets. A summary of mortgage servicing rights follows:

| 2009 | 2008 | 2007 | ||||||||||

| (dollars in thousands) | ||||||||||||

| Beginning of year mortgage servicing rights: |

$ | 1,293 | $ | 1,321 | $ | 1,244 | ||||||

| Amounts capitalized |

1,465 | 563 | 484 | |||||||||

| Amortization |

(868 | ) | (471 | ) | (407 | ) | ||||||

| Impairment |

— | (120 | ) | — | ||||||||

| End of year |

$ | 1,890 | $ | 1,293 | $ | 1,321 | ||||||

Amortization expense is estimated as follows:

| Year ending December 31, | |||

| (dollars in thousands) | |||

| 2010 |

$ | 305 | |

| 2011 |

264 | ||

| 2012 |

224 | ||

| 2013 |

183 | ||

| 2014 |

142 | ||

| Thereafter |

772 | ||

| Total |

$ | 1,890 | |

55

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 6 – Premises and Equipment

The major classes of premises and equipment and the total accumulated depreciation at December 31, 2009 and 2008 are listed below:

| 2009 | 2008 | |||||

| (dollars in thousands) | ||||||

| Land |

$ | 4,081 | $ | 3,207 | ||

| Building and improvements |

10,012 | 8,402 | ||||

| Furniture and equipment |

5,598 | 5,391 | ||||

| 19,691 | 17,000 | |||||

| Less accumulated depreciation |

6,045 | 5,872 | ||||

| Total |

$ | 13,646 | $ | 11,128 | ||

Note 7 – Leases

The Company’s subsidiary, Bank of Stanly, had a noncancelable operating lease for a branch location in Albemarle that expired in 2008, with annual rental payments of $18,575. The lease has one five year renewal option at the expiration of the initial term. Bank of Stanly elected to go into a month to month lease and entered into an agreement to purchase the building for $300,000 in 2009. The lease payment remained the same during the finalization of the purchase. Bank of Stanly has also entered into a noncancelable operating lease for a branch location in Locust that expires in 2010 with annual rental payments of $41,856. The Company’s subsidiary, Cabarrus Bank and Trust has entered into a noncancelable operating lease for an administrative office location in Concord that expires in 2017 with annual rental payments of $59,850. The lease has two five year renewal options at the expiration of the initial term.

Future minimum lease payments under these leases for years subsequent to December 31, 2009 are as follows:

| Year ending December 31, | |||

| (dollars in thousands) | |||

| 2010 |

$ | 95 | |

| 2011 |

60 | ||

| 2012 |

60 | ||

| 2013 |

60 | ||

| 2014 |

60 | ||

| Thereafter |

159 | ||

| Total |

$ | 494 | |

Total rental expense related to the operating leases was $106,350, $120,281, and $76,449 for the years ended December 31, 2009, 2008 and 2007 respectively, and is included in occupancy expense.

56

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 8 – Deposits

The composition of deposits at December 31, 2009 and 2008 is as follows:

| 2009 | 2008 | |||||||||||

| Amount | Percentage of Total |

Amount | Percentage of Total |

|||||||||

| (dollars in thousands) | ||||||||||||

| Demand deposits |

$ | 44,924 | 12 | % | $ | 46,032 | 13 | % | ||||

| Interest checking and money market |

137,708 | 37 | % | 117,325 | 33 | % | ||||||

| Savings |

32,120 | 8 | % | 26,360 | 8 | % | ||||||

| Time deposits $100,000 and over |

64,736 | 17 | % | 63,321 | 18 | % | ||||||

| Other time deposits |

97,286 | 26 | % | 100,589 | 28 | % | ||||||

| Total |

$ | 376,774 | 100 | % | $ | 353,627 | 100 | % | ||||

The maturities of fixed-rate time deposits at December 31, 2009 are reflected in the table below:

| Year ending December 31, |

Time Deposits $100,000 and Over |

Other Time Deposits | ||||

| (dollars in thousands) | ||||||

| 2010 |

$ | 53,500 | $ | 78,857 | ||

| 2011 |

9,583 | 15,676 | ||||

| 2012 |

1,044 | 1,659 | ||||

| 2013 |

507 | 494 | ||||

| 2014 |

102 | 590 | ||||

| Thereafter |

— | 10 | ||||

| Total |

$ | 64,736 | $ | 97,286 | ||

57

UWHARRIE CAPITAL CORP AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note 9 – Short-Term Borrowed Funds

The following tables set forth certain information regarding the amounts, year-end weighted average rates, average balances, weighted average rate, and maximum month-end balances for short-term borrowed funds, at and during 2009 and 2008

| 2009 | 2008 | |||||||||||

| Amount | Rate | Amount | Rate | |||||||||

| (dollars in thousands) | ||||||||||||

| At year-end |

||||||||||||

| Federal funds purchased |

$ | — | 0.00 | % | $ | — | 0.00 | % | ||||

| Securities sold under repurchase agreements |

— | 0.00 | % | 1,463 | 0.92 | % | ||||||

| Master notes |

11,482 | 0.50 | % | 8,903 | 1.00 | % | ||||||

| Notes payable |

58 | 3.80 | % | 8 | 6.00 | % | ||||||

| Short-term line of credit |

— | 0.00 | % | 2,600 | 2.25 | % | ||||||

| Short-term advances from FHLB |

15,400 | 0.36 | % | 9,275 | 0.46 | % | ||||||

| $ | 26,940 | 0.42 | % | $ | 22,249 | 0.92 | % | |||||

| 2009 | 2008 | |||||||||||

| Amount | Rate | Amount | Rate | |||||||||

| (dollars in thousands) | ||||||||||||

| Average for the year |

||||||||||||

| Federal funds purchased |

$ | 273 | 1.05 | % | $ | 1,245 | 2.93 | % | ||||

| Securities sold under repurchase agreements |

669 | 0.89 | % | 1,354 | 1.37 | % | ||||||

| Master notes |