Attached files

| file | filename |

|---|---|

| EX-21.1 - BIMI International Medical Inc. | v179133_ex21-1.htm |

| EX-31.1 - BIMI International Medical Inc. | v179133_ex31-1.htm |

| EX-14.1 - BIMI International Medical Inc. | v179133_ex14-1.htm |

| EX-32.2 - BIMI International Medical Inc. | v179133_ex32-2.htm |

| EX-31.2 - BIMI International Medical Inc. | v179133_ex31-2.htm |

| EX-32.1 - BIMI International Medical Inc. | v179133_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

xAnnual Report Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the fiscal year ended: December 31, 2009

¨Transition Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

For

the transition period from ______________to ______________

Commission

File Number 000-50155

NF

ENERGY SAVING CORPORATION

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

(State

of Incorporation)

|

02-0563302

(I.R.S.

Employer ID Number)

|

|

21-Jia

Bei Si Dong Road, Tie Xi Qu

Shenyang, P. R. China

(Address

of Principal Executive Offices)

|

110021

(Zip

Code)

|

(8624)

2560-9750

(Issuer’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, par value $.001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes ¨ No

x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes ¨ No

x

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every

Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes ¨ No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of the registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definition of "accelerated filer", "large accelerated filer", and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

Large

accelerated filer ¨

Accelerated filer ¨

Non-accelerated filer ¨ Smaller

reporting company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act.).

Yes ¨ No

x

As of

June 30, 2009, the aggregate market value of the common equity held by

non-affiliates of the registrant was$17,698,544, based on the price of

$2.55 per share which the registrant’s common stock was last

sold..

As of

March 12, 2010 there were 13,315,486 shares of the registrant’s common stock

outstanding.

NF ENERGY

SAVING CORPORATION

FORM

10-K

TABLE OF

CONTENTS

|

Page No.

|

||

|

PART

I

|

||

|

Item

1

|

Business

|

3

|

|

Item

1A

|

Risk

Factors

|

13

|

|

Item

1B

|

Unresolved

Staff Comments

|

22

|

|

Item

2

|

Properties

|

22

|

|

Item

3

|

Legal

Proceedings

|

22

|

|

Item

4

|

[Reserved]

|

22

|

|

PART

II

|

||

|

Item

5

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

22

|

|

Item

6

|

Selected

Financial Data

|

23

|

|

Item

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

23

|

|

Item

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

30

|

|

Item

8

|

Financial

Statements

|

30

|

|

Item

9

|

Changes

In and Disagreements With Accountants on Accounting and Financial

Disclosure

|

55

|

|

Item

9A(T)

|

Controls

and Procedures

|

55

|

|

Item

9B

|

Other

Information

|

56

|

|

PART

III

|

|

|

|

Item

10

|

Directors,

Executive Officers and Corporate Governance

|

56

|

|

Item

11

|

Executive

Compensation

|

60

|

|

Item

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

60

|

|

Item

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

62

|

|

Item

14

|

Principal

Accountant Fees and Services

|

62

|

|

PART

IV

|

||

|

Item

15

|

Exhibits

and Financial Statement Schedules

|

64

|

2

CAUTIONARY

STATEMENT REGARDING FORWARD LOOKING INFORMATION

Certain

statements in this Annual Report on Form 10-K (“Form 10-K”) pursuant to the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), including

statements of our expectations, intentions, plans and beliefs, including those

contained in or implied by "Management's Discussion and Analysis" and the Notes

to Consolidated Financial Statements, are "forward-looking statements", within

the meaning of Section 21E of the Exchange Act that are subject to certain

events, risks and uncertainties that may be outside our control. The words

“believe”, “expect”, “anticipate”, “optimistic”, “intend”, “will”, and similar

expressions identify forward-looking statements. Readers are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of

the date on which they are made. The Company undertakes no obligation to update

or revise any forward-looking statements. These forward-looking statements

include statements of management's plans and objectives for our future

operations and statements of future economic performance, information regarding

our expansion and possible results from expansion, our expected growth, our

capital budget and future capital requirements, the availability of funds and

our ability to meet future capital needs, the realization of our deferred tax

assets, and the assumptions described in this report underlying such

forward-looking statements. Actual results and developments could differ

materially from those expressed in or implied by such statements due to a number

of factors, including, without limitation, those described in the context of

such forward-looking statements, our expansion and acquisition strategy, our

ability to achieve operating efficiencies, our dependence on network

infrastructure, capacity, telecommunications carriers and other suppliers,

industry pricing and technology trends, evolving industry standards, domestic

and international regulatory matters, general economic and business conditions,

the strength and financial resources of our competitors, our ability to find and

retain skilled personnel, the political and economic climate in which we conduct

operations and the risk factors described from time to time in our other

documents and reports filed with the Securities and Exchange Commission (the

"Commission"). Additional factors that could cause actual results to differ

materially from the forward-looking statements include, but are not limited to:

1) our ability to successfully develop, manufacture and deliver our products on

a timely basis and in the prescribed condition; 2) our ability to compete

effectively with other companies in the same industry; 3) our ability to raise

sufficient capital in order to effectuate our business plan; and 4) our ability

to retain our key executives.

Except as

may be required by applicable law, we do not undertake or intend to update or

revise our forward-looking statements, and we assume no obligation to update any

forward-looking statements contained in this report as a result of new

information or future events or developments. Thus, you should not assume that

our silence over time means that actual events are bearing out as expressed or

implied in such forward-looking statements. You should carefully review and

consider the various disclosures we make in this report and our other reports

filed with the Securities and Exchange Commission that attempt to advise

interested parties of the risks, uncertainties and other factors that may affect

our business.

For

further information about these and other risks, uncertainties and factors,

please review the disclosure included in this report under “Part I, Item 1A -

Risk Factors.”

PART

I

ITEM

1. BUSINESS

The

Company

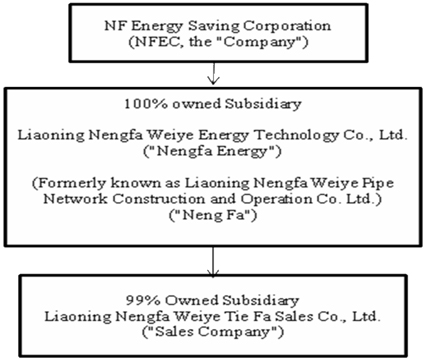

As used

herein the terms “we”, “us”, “our,” “NFEC” and the “Company” means, NF Energy

Saving Corporation, a Delaware corporation, formerly known as NF Energy Saving

Corporation of America, Diagnostic Corporation of America, Global Broadcast

Group, Inc., and Galli Process, Inc. These terms also include our subsidiaries,

Liaoning Nengfa Weiye Energy Technology Company Ltd., a corporation organized

and existing under the laws of the Peoples’ Republic of China (“PRC”), and

Liaoning Nengfa Weiye Tie Fa Sales Co., Ltd., a limited liability corporation

organized and existing under the laws of the PRC.

NF Energy

Saving Corporation was incorporated under the laws of the State of Delaware

under the name of Galli Process, Inc. on October 31, 2000 for the purpose

of seeking and consummating a merger or acquisition with a business entity

organized as a private corporation, partnership, or sole proprietorship. On

December 31, 2001, Galli Process, Inc. became a majority owned subsidiary

of City View TV, Inc., a Florida corporation (“City View”). On February 7, 2002,

Galli Process, Inc. changed its name to Global Broadcast Group, Inc. On

March 1, 2002, City View merged into Global Broadcast Group, Inc., which

was the surviving entity. On November 12, 2004, the Company changed its

name to Diagnostic Corporation of America. On March 15, 2007, we changed our

name to NF Energy Saving Corporation of America, and on August 24, 2009, the

Company further changed its name to NF Energy Saving Corporation, in both

instances to more accurately reflect our business after the Plan of Exchange

(see below). Our principal place of business is 21-Jia Bei Si Dong Road, Tie Xi

Qu, Shenyang, P. R. China 110021. Our telephone number is (8624)

2560-9750.

3

On

November 15, 2006, we executed a Plan of Exchange (“Plan of Exchange”), among

the Company, Liaoning Nengfa Weiye Pipe Network Construction and Operation Co.

Ltd. (“Nengfa”), the shareholders of Nengfa (the "Nengfa Shareholders") and Gang

Li, our Chairman and Chief Executive Officer (“Mr. Li”). At the closing of the

Plan of Exchange, which occurred on November 30, 2006, we issued to the Nengfa

Shareholders 12,000,000 shares of our common stock, or 89.4% of our then

outstanding common stock, in exchange for all of the shares of capital stock of

Nengfa owned by the Nengfa Shareholders. Immediately upon the closing, Nengfa

became our 100% owned subsidiary, and the Company adopted and implemented the

business plan of Nengfa.

On

September 5, 2007, we established a new sales company, Liaoning Nengfa Weiye Tie

Fa Sales Co., Ltd. (“Sales Company”). Sales Company is a subsidiary, which is

99% owned by Liaoning Nengfa Weiye Energy Technology Company Ltd. Sales Company

engages in the sales and marketing of flow control equipments and products in

PRC.

On

January 31, 2008, to better reflect our energy technology business we changed

the name of Nengfa to Liaoning Nengfa Weiye Energy Technology Company Ltd.

(“Nengfa Energy”). Nengfa Energy’s area of business includes research and

development, processing, manufacturing, marketing and distribution of

energy saving flow control equipment; manufacturing, marketing and distribution

of energy equipment, wind power equipment and fittings; energy saving

technical reconstruction; and energy saving technology consulting

services.

On August

26, 2009, the Company completed a 3 to 1 reverse share split of its common

stock. As a result, the total number of shares of outstanding common stock

changed from 39,872,704 pre-split to 13,291,387 post-split. On December 11 and

December 15, 2009, there were certain warrant exercises on a cashless basis that

resulted in the issuance of an additional 24,099 shares of our common stock, and

thus the total number of shares of outstanding common stock increased from

13,291,387 to 13,315,486

The

structure of our corporate organization is as follows:

Business

Description

Nengfa

Energy specializes in the energy technology business. We provide

energy saving technology consulting, optimization design services, energy saving

reconstruction of pipeline networks and contractual energy management services

for China’s electric power, petrochemical, coal, metallurgy, construction, and

municipal infrastructure development industries. We are also engaged in the

manufacturing and sales of the energy-saving flow control equipment. At present,

our valve business holds a leading position in China. Our company has the Det

Norske Veritas Management System Certificate, which certifies that our products

conform to the Management System Standard ISO9001:2000. We have been a member of

Chicago Climate Exchange since 2006. In 2007 Nengfa Energy received contracts

for our products and services to be used in three sections of the prominent

project “Redirect the water from the Rivers in the South to the North water

supply engineering project, Middle Section- Jingshi Section”. This phase of

the project was completed and passed inspection in

2008. In 2008, the Company also received flow control equipment

contracts from seven cities in Liaoning Province for their water supply systems.

In 2009, the Company was awarded several flow control equipment supply

contracts, including one for the Xijiang diversion project of Guandong Province,

and one for Phase 1 of Guangdong Yuedian Huilai Power Plant.

4

Our

principal development focus is to complete the construction of our new energy

manufacturing facility which will enhance the Company’s product lines and expand

the manufacturing capacity. In conjunction with the planned facility

expansion, we also will undertake efforts to optimize the business structure of

the Company, develop other low-carbon technologies, and promote energy-saving

technologies efficiency as part of our sales efforts. We are aiming to become

the navigator of the small to medium sized energy saving service industry by

integrating sources in new energy and energy conservation and environmental

protection.

5

Products and

Services

Our

products and services include the manufacturing and sales of energy-saving flow

control equipment, energy saving technology consulting, optimization design

services, energy saving reconstruction of pipeline networks and contractual

energy management services for China’s electric power, water power,

petrochemical, coal, metallurgy, construction, and municipal infrastructure

development industries.

Production and Sales of

Energy Saving Flow Control Equipment

The

Company’s current principal business is the production and sale of energy-saving

valves, intelligent valves, and flow control equipment. This business

currently accounts for the majority of the Company’s revenues.

Pipeline

transport is one of the basic modes of transportation together with rail

transport, road transport, air transport and water transport. Water, gas, oil,

and heat rely on various kinds of pipelines and pipe networks to be transported

to end users. In the case of water pipelines, such systems are also

used for public health and safety, waste and flood control.

The key

to the efficiency and energy conservation of the pipeline transportation process

is the valve and the flow control equipment. Having unique technology in this

field, Nengfa Energy has obtained a number of patents and applied for other

patents in China for flow control devices, especially in the area of the

bidirectional seal zero revelation installation system with its special

characteristics. Using valves of this type can result in reduced energy

consumption by 20% for customers and has received favorable evaluations

throughout the world. The reduced energy consumption thereby increases the

efficiency of the pipeline system. It is widely used in the fields of electric

power, hydro power, petroleum, and natural gas. The Nengfa Energy valves were

awarded “Number One Energy Saving Value of China” by the Chinese Energy

Conservation Association. These products currently are exported to the United

States, Japan, South Korea, Vietnam, India, Iraq, and Afghanistan.

Because

these technologies are an important revenue source and represent an important

part of the energy efficiency focus of the Company, Nengfa Energy will continue

to develop comprehensive energy conservation and reduction equipment and

services, and to pursue research and development and manufacturing of flow

control and new energy related equipment.

Energy Saving Reconstruction

Projects

We also

have a business focus on the reconstruction of various industrial boiler/furnace

systems with the objective of modernization and overall efficiency improvement

of existing systems. Efficiency can be expressed in several ways,

such as lower operating costs, reduced energy consumption, recapture of

by-products which can be used for other purposes, and pollution

reduction.

China’s

industrial boilers and furnaces are used mainly in the iron and steel,

metallurgy, building materials, machinery manufacturing, chemical industry and

other high energy consumption industries. Their energy consumption accounts for

about 10% of China’s total energy consumption. Half of the enterprises have

outdated technology and equipment, and experience serious waste of energy. Using

our existing technology, we can reconstruct the boiler’s or furnace’s structure,

its heat source system, combustion system, and control system, and thereby both

improve the overall efficacy of the system and yield important conservation and

pollution control benefits.

One of

the most important opportunities for the Company is to undertake projects that

refurbish or reconstruct industrial boilers and create cogeneration

opportunities for coal fired boilers. In the PRC, 95% of the

industrial boilers are coal fired. The effect of these types of boilers in the

industrial setting is that they are very inefficient because they have the

following problems: (i) they typically have smaller capacities than

required for the purpose for which they are employed, (ii) their output is not

matched to the auxiliary equipment used by the boilers, (iii) they use fuel that

is not optimized for the size and design of the boiler, and (iv) the boilers are

typically at or beyond their estimated useful life. Overall, it is

estimated that these types of boilers are operating at about 60-70% of their

efficiency, which is 20% below that of international standards. The

inefficiency, in part, results from their use of mixed sizes of coal particles

in layer combustion. Among these types of boilers, about 60% of them are

clockwise rotation boilers. The use of the differing sizes of the coal particles

results in a highly inefficient combustion, due to the poor ventilation for the

combustion to be effective and the accumulation of dust which chokes the

combustion. Therefore, the coal is not totally burned and there is a

loss of potential energy. The current methods of coal feed to the boilers and

the current combustion cannot solve this problem. Given the large quantities of

these types of industrial boilers in use, the Company sees a tremendous

opportunity to focus on boiler transformation technology and

projects.

6

The

Nengfa Energy solution is to redesign and reconstruct elements of an existing

boiler or boiler system to improve its overall performance and increase its

optimization rates. This is done in a number of different ways, such

as the following:

a) Boilers

using a pulverized coal fired or a clockwise rotation chain grate system can be

refitted with a circulating fluidized bed combustion technology. This

change has the benefit of permitting the boiler to use a lower grade of coal but

improve the thermal efficiency. The ash from the fluidized bed

combustion system can be used in building materials, which is a valuable

by-product and reduces pollution output.

b) The

control system of a boiler can be either reconstructed or modified to improve

the operations of the unit and system.

c) The

coal feed system of a boiler system can be altered to provide more efficient

coal layer arrangement according to different volume and nature of the coal ,

with the effect that the boiler will fully combust the coal. This

improves the operating cost and fuel optimization.

d) Another

change that can be made to boilers is to improve the ventilation system, with

the result that the combustion of the fuel is improved, efficiency is increased

and operating costs are reduced.

e) One

of the most important improvements that the Company seeks to introduce into

existing and into new boiler systems are methods to reclaim discharged

water. The Company designs recovery equipment which permits recovery

of significant amounts of the waste water used in a traditional

boiler. This recovery can also improve the capture of pollutants by

the boiler system.

f) Another

important improvement is heat recovery of a boiler, whether it is coal, natural

gas or petroleum fueled. By-product heat can be used in a number of

different ways, such as to create steam for other uses or localized heating of

the factory. The further use of the residual heat reduces its emission into the

atmosphere, thereby reducing heat pollution. This can be an additional source of

income or help reduce operating costs.

Nengfa

Energy is capable of designing and introducing steam thermal systems into

existing systems with the effect of recovering the condensed water, eliminating

the leakage losses due to faulty or worn steam trap valves and improving the

heat preservation systems.

Another

area of energy savings is the reconstruction of motor drive systems. In China,

motor drive systems use about two thirds of the total electricity consumption of

the country. About 90% of these motors are AC asynchronous

motors. Nengfa Energy redesigns such systems to convert them so that

they can be used for variable load fans and pumps through frequency conversion

and speed regulation technology. NF Energy focuses on the reconstruction and

energy conservation on the fans of power station boilers, industrial

furnaces and kilns, and the energy-saving pumps in the cold/hot water pipe

system. As we analyze whole industrial project reconstruction projects, we can

also provide power conservation reconstruction in solid material conveyor

systems used in the mining, metallurgy, iron and steel industries.

Approximately

12% of China’s power consumption is for lighting. As one of the most

important energy-saving projects, the Chinese government plans to popularize 150

million energy-saving lamps to the whole country during the "Eleventh Five Year

Plan" period through a fiscal subsidy in an effort to replace the inefficient

incandescent lamps and other lighting products. The government also plans to

reduce the consumption of power by changing the use of lighting through a

rational distribution of public lighting, improving the quality of power

consumption and introducing on-demand controls. Between 2008 and 2009, Nengfa

Energy, as one of the assigned companies by the National Development and Reform

Commission, distributed 2.5 million green lighting products in Liaoning Province

China.

A new

business for the Company is biomass power generation projects. The

Company cooperates actively with different levels of municipal governments,

corporations and strategic partners, to jointly develop potential projects in

this area. At present, the Company is discussing with a municipality a biomass

central gas supply project to a county. This project will use the slurry from

local chicken farms and straw to generate gas and establish a city gas pipeline

supply system.

The

Company believes that the above energy-saving technological transformation

measures have considerable economic benefits after their implementation to the

end-user. As noted, the benefits are not only in the improved

operations, but are also reflected in cleaner operations, pollution reduction,

and lower energy consumption and costs. Some of these elements also

can also make a company eligible to receive pollution credits, which can add

directly to the bottom line of operations of a plant. Additionally,

the by-products may also provide a source of additional income.

7

Comprehensive Energy

Conservation And Emission Reduction Services For

Municipalities

China

State Council, in its 11th Five-Year Plan for 2005 through 2010, set energy

conservation and emission reduction targets to be achieved by local governments

and industries. These initiatives effect the policy decisions of the

national and local governments. It is expected that the next five

year plan of the China State Council will expand the initial objectives for

environmental improvement in China, with increased funding, more stringent

objectives and greater breadth in green initiatives.

2010 is

the last year of the "Eleventh Five-Year" emission reduction targets. It is also

the first year for China to put forward its 40-45% emission reduction target,

which is a point of emphasis for the Chinese government. Mr. Zhang Shaochun, the

Vice Minister of Finance for the central government, has stated that the special

funding for the energy-saving emission reduction industry will be 70% more than

the prior year, which will be up to 500 billion RMB. The state intends to

promote large-scaled energy-saving and efficiency products and will support key

energy-saving emission reduction projects.

In a 2010

government report from the office of the Chinese Premier, Wen Jiabao, it was

stated that: "We shall put greater efforts on development of low-carbon

technologies, promotion of efficient energy-saving technologies, and actively

develop new energy and renewable energy…." The report further stated

that the country "…should attempt to engage in construction characterized by

industrial carbon emissions system and consumption patterns.” This indicates

that in 2010 and thereafter low carbon initiatives "…will become a new impetus

and engine for economic development, and it will become a new weathervane for

construction of leading industrial systems and consumption

patterns.”

The Ministry of Finance is

increasing investment in the development of a low-carbon economy. The government

sees promotion

of energy-efficiency resulting in economic

benefits and promoting growth in higher value technologies and industries. Therefore the expectation is

that government support for energy saving projects will be widespread and touch

on many aspects of the economy, including geo-water sources, energy management

contracts, efficient motors and other

energy-saving elements in the industry. This will

promote the development of energy efficiency,

industrial energy efficiency and energy-efficient power transmission and

distribution.

Nengfa

Energy already has experience in energy project management in

China. Going forward, the Company will further develop its business

model and regularly will seek projects to

develop comprehensive energy conservation and emission reduction solutions for

building energy

conservation.

Wind Power

Systems

An

important part of the Chinese government’s 11th Five

Year Plan is to encourage the development of wind power as a significant source

of energy for the country. This is due in part to the growing

recognition that fossil fuels are becoming more difficult to locate and develop.

Such fuel is becoming more expensive as it becomes subject to greater world-wide

demand, and China will become one of the largest energy consuming countries as

its industrial output increases and the standard of living of its population

improves.

To

address this potential market opportunity, the Company conducted research during

2007 and 2008 into wind production equipment and concluded that it could

effectively compete in this segment of the energy industry. To that

end the Company designed and is building a production facility to produce new

energy equipment. This facility is expected to be operational in the

second quarter 2010. The current product includes a 1.5MW wind power equipment

system (the hub, forward engine room foundation, bearing seat, and the principal

axle). The planned facility is anticipated to have the capacity to provide 300

sets of wind power equipment of this configuration per year. We

believe that the market for the equipment will be both to users in China and to

users in different countries.

Cooperation and Technology

Agreements

General Electric

Alliance

Nengfa

Energy signed a Strategic Cooperation Agreement with GE Enterprise Development

(Shanghai) Co. LTD ("GE") in July 2009.

The GE

technology which Nengfa Energy will employ in the blast furnace waste recovery

project at the Iron & Steel Co. is a proven technology which differs from

other types of waste heat recovery technologies because it is capable of using

the low heating value blast furnace waste flue gas to produce steam for electric

power generation. If not for the GE technology, blast furnace flue gas with low

heating value would either be let go into the open air, causing pollution and

leaving the heat unused, or have to be mixed for power generation with the flue

gas from coking furnaces, which contains higher heating value and other usable

chemicals. The GE waste heat to power technology is applicable in most steel

plants in China and Nengfa Energy's project of using the GE technology in the

Iron & Steel Co. creates a cooperative relationship between Nengfa Energy

and GE with great opportunities for duplicating the success into many other

Chinese steel mills.

8

Recently,

the Company and GE jointly approached a company with the intention of

implementing a bio-mass power generation project by using cow dung, chicken

manure, pig manure and other biomass.

Global Environmental

Facility (GEF) / World Bank (WB) / National Development and Reform Commission

(NDRC)

The

GEF/WB/NDRC China Energy Conservation Promotion Project began in 1997. It was

sponsored by the GEF--the Global Environmental Facility and implemented by the

World Bank in cooperation with the Chinese government. The project's goal is to

help China promote energy conservation and energy efficiency with a free market

mechanism—the “Energy Performance Contract,” which has been successful in

Western developed countries.

The

senior managers of Nengfa Energy, especially Mr. Gang Li and Mrs. Lihua Wang,

have more than ten years of experience in leading one of the pilot and

demonstration companies of the GEF/WB/NDRC China Energy Conservation Promotion

Project, and have succeeded in achieving investment, energy saving and

environmental protection objectives in more than 200 major industrial energy

efficiency enhancement projects. Nengfa Energy has developed a full range risk

assessment and mitigation system for energy efficiency projects, from energy

saving potential assessment, customer credit evaluation, technical solution

design, technology and product procurement, engineering construction quality

control, project operation management, to project financing and payment

collection. Nengfa Energy's experience in energy efficiency project profit

maximization and risk mitigation have been used as training materials by China

Energy Management Companies Association (EMCA) in its training programs for new

energy service companies.

Municipal Government of Zibo

City, Shandong Province

Nengfa

Energy signed an Energy Conservation and Emission Reduction Cooperation

Framework Agreement with the municipal government of Zibo City, Shandong

Province in November 2009. The two parties plan to set up a joint venture in

Zibo City with total investment of RMB100 million. The joint venture’s main

business is carrying on energy saving projects through an Energy Management

Contract (“EMC”) basis, i.e. including energy saving planning, consulting,

energy auditing, providing energy saving solutions, engineering design, project

financing, project management, energy saving technology development and

production of energy saving products.

Osaka Gas,

Japan

In July

2007, Nengfa Energy signed an agreement with Osaka Gas, Japan on an experimental

project of concentration technology of low concentration coal bed methane in a

Mining Administration Bureau, China. The project has continued for two years and

is expected to obtain provincial and national identification on its energy

conservation performance in 2010. After which, the technology will be

promoted in domestic coal companies.

The

explored reserve of coal bed methane in China is 0.1 trillion cubic meters, but

only 2.3 billion cubic meters are pumped from coal mines, within which, only

about 40% is utilized and the rest, about 60% of low concentration coal bed

methane, is wasted due to technology constraints. Therefore, the Company

believes that using low concentration coal bed methane in power generation has a

large market potential. It is expected that Nengfa Energy will be engaged in

these projects in the future. However, there is no assurance that Nengfa Energy

will be the project partner at this time.

Schneider Electric

SA

Nengfa

Energy signed a cooperation agreement with Schneider Electric (China) Investment

Co., Ltd. in 2008 to establish a strategic partnership to develop integrated

energy saving and reconstruction projects. Schneider Electric is responsible for

project development, and Nengfa Energy provides energy saving and reconstruction

solutions regarding the heat, water and cooling systems, and is the project

contractor of these reconstruction projects in China.

Patents and

Technology

Nengfa

Energy currently has been issued two invention patents and has applied for

eleven new patents in the PRC. We rely on our patents and pending

patents for market differentiation and to compliment our ability to bid on and

win contracts for the large industrial projects in which we typically

participate. We expend a certain amount of time and economic

resources in developing and maintaining our leading position in the flow valve

industry.

The

invention patents include the following:

a) Processing

technology of butterfly valve seal (ZL2006 1 0152644.8), which expires on

September 26, 2026; and

9

b) Butterfly

valve body dynamic seal ring pointing device (ZL2007 1 0159250.X), which expires

on December 28, 2027.

The

patents that we have applied for include the following:

a) An

energy-saving heat-sink used in heating (ZL2008 2 0218146.3), with an

application date of September 23, 2008

b) A

device used in energy-saving boiler combustion ( ZL2008 2 0218145.9), with an

application date of September 23, 2008;

c) Butterfly

valve sealing ring instruction device (ZL2007 2 0185293.0), with an application

date of December 12, 2007;

d) Butterfly

valve with block for opening butterfly plate (ZL2007 2 0185289.4), with an

application date of December 12, 2007;

e) Piston

flow-adjusting valve with removable piston sealing ring (ZL2007 2 0185288.X),

with an application date of December 12, 2007;

f) J-shaped

large dimension butterfly valve hard sealing ring (ZL2007 2 0185292.6), with an

application date of December 12, 2007;

g) Composite

valve sealing ring (ZL2007 2 0185290.7), with an application date of December

12, 2007;

h) Multi-level

buffering full oriented valve fuel tank (ZL2007 2 0185287.5), with an

application date of December 12, 2007;

i) Fluid

control valve on-off speed control device (ZL2007 2 0185286.0), with an

application date of December 12, 2007;

j) T-shaped

large dimension butterfly valve rubber sealing ring (ZL2007 2 0185291.1), with

an application date of December 12, 2007; and

k) Butterfly

valve with butterfly plate adjusting device (ZL2008 2 0231340.5), with an

application date of September 23, 2008;

In

addition to the patent protection that we seek, we also rely on the

confidentiality of our operations, proprietary know-how and business

secrets. Although we do not have formal agreements with our

employees, we do consider our employees work to be proprietary and owned by the

Company. Where necessary, we will take steps to protect our

intellectual property interests under the laws of the PRC. There can be no

assurance that we will be able to enforce our rights if they are improperly

taken by our employees or adopted by our competitors outside of sanctioned use

and royalty agreements with the Company.

Certain

of our service offerings will not be patentable or otherwise registrable as

intellectual property. Therefore, the Company will rely solely on

such services being proprietary. As such the Company will have to

rely on the services being more advanced or better than its competitors’

offerings or rely on trade secret laws and protections. Such

protections in the PRC are considered rather weak and are difficult if not

impossible to enforce. Consequently, it may be possible for our

competitors to obtain our information and to copy, adopt or adapt our methods,

services and technical aspects to their own business with no assurance that we

will be able to prevent them from using the intellectual property in competition

with us.

The

Company does not have any significant trademarks in use at this

time. As our business develops, we will consider the advantage of

developing specific trademarks for our products and services and seeking

registration of those marks with the PRC government authorities for their

protection.

10

Markets and

Customers

The

South-North Water Diversion Project is a multi-decade project undertaken by the

Chinese government to better utilize water resources available to China. Part of

this massive project was brought forward to provide additional water supply for

the 2008 Olympics in Beijing. While the main task is to divert water from the

Yangtze River to the Yellow River and Hai River, other spin-off plans are also

loosely included. Among these, a plan calling for the capture and diversion of

water from Brahmaputra River, located in Yarlung Zangbo Grand Canyon north of

India, has been under study for years. This is because the heavily

industrialized Northern China has a much lower rainfall and its rivers are

running at reduced rates as demand increases for industrial water and general

population usage. For example, the Yellow River and Hai River have experienced

significant flow reduction and at times during certain years have been

dried.

Currently,

the Grand Canal is being upgraded, as the Eastern route for diverting water to

the North. Water from the Yangtze River will be drawn into the canal in Jiangdu

City, where a giant 400 m³/s. pumping station was built in the 1980s, and will

then be fed uphill by pumping stations along the Grand Canal and through a

tunnel under the Yellow River, from where it can flow downhill to reservoirs

near Tianjin. Construction on the eastern route officially began in December

2002, and water is supposed to reach Tianjin by 2012.

The

central route for the water diversion project is from Danjiangkou Reservoir on

Han River, a tributary of the Yangtze River, to Beijing. This route is built on

the North China Plain and, once the Yellow River has been crossed, water can

flow all the way to Beijing by gravity. The main engineering challenge is to

build a tunnel under the Yellow River. Construction on the central route began

in 2004. In 2008 the 307 km-long Northern stretch of the central route was

completed at a cost of $2 billion. Water in that stretch of the canal does not

yet come from the Han River, but from various reservoirs in Hebei Province south

of Beijing. Farmers and industries in Hebei have had to cut back their water

consumption to allow for water to be transferred to Beijing. The whole project

was expected to be completed around 2010. This has recently been set back to

2014 to allow for more environmental protection elements to be built into the

system. A major difficulty in completion of the central route has been the

resettlement of approximately 250,000 persons around Danjiangkou Reservoir and

along the route. Another consideration that has to be accommodated in the

implementation of the central route is the effect of removing approximately one

third of the water from Han River and the effect of that reduction on the

environment and other users that currently depend on the Han River. One

long-term consideration to reduce the effect on the Han River basin is to build

another canal to divert water from the Three Gorges Dam to Danjiangkou

Reservoir.

The

western route for the water diversion project is to divert water from the

headwaters of the Yangtze River into the headwaters of the Yellow River. In

order to move the water through the drainage divide between these rivers, huge

dams and long tunnels are needed to be built to cross the Tibetan-Qinghai and

Western Yunnan Plateaus. The feasibility of this route is still under study and

this part of the project will not start anytime soon.

To date,

the Company has participated in the water diversion project by being a supplier

of valves for various parts of the water flow infrastructure. And as

part of providing that equipment, the Company has also provided design and

related services. Contracts related to this project represented approximately

29.45% of the gross revenue of the Company for 2009. We anticipate

that revenues related to this project will continue to represent a significant

portion of the Company revenues for 2010. The Company intends to continue to

provide long term after-sale and consultant services in connection with such

contracts.

In

addition to the water diversion project, the Company also supplies valves and

related equipment to the power generation industry (thermal, hydroelectric, wind

and nuclear). Customers in these market segments are well-established, larger

state and private corporations. Combined, these markets represent approximately

70.55 % of the revenues of the Company for 2009.

In

connection with its work on the water diversion project and some of the power

plan projects, the Company has a preferred provider agreement with Nengfa Weiye

Tieling Valve Joint Stock Co., Ltd. (“Tieling Valve”) under which Nengfa Energy

is the preferred provider of the valves and other related flow control equipment

that Tieling Valve required in its own work on the water diversion

project. The agreement is in the manner of a right of first refusal

whereby Tieling Valve is obliged to offer supply opportunities to Nengfa Energy

within its scope of product offerings and expertise, but Tieling Valve is not

prohibited from developing other supply arrangements. Tieling Valve

and Nengfa Energy have agreed to cooperate to develop and market their

respective technologies, equipment, products and services for their respective

and mutual benefit, and will work together to examine and expand their

respective businesses. Under the agreement, each party retains full

right to their respective intellectual property. The agreement

terminates in 2013, but by its terms will automatically extend for additional

one year terms unless notice of termination is given by one party to the other

at least six months prior to the then termination date.

The

Company will focus its marketing to the wind power generation and the

boiler/furnace industry through participation in and addressing government

organizations and industry associations related to energy conservation and

emission reduction. Marketing will also focus on equipment suppliers

and end-users such as the larger and medium sized high energy consumption

enterprises that provide or use the kinds of products and services that the

Company currently offers or plans to offer. The focus will not only

be to sell the products and services, but also to learn of the customers needs

so that the Company can develop and adapt its products and services to the needs

of its customer base. Another important aspect of the marketing

strategy will be to participate directly in the consulting and reconstruction

services of energy conservation projects organized by government agencies.

Nevertheless, the Company plans to continue to participate in the bidding

process for government projects, in an effort to enhance its market

position.

11

The

Company’s marketing and sales strategy also relies on the use of exclusive

agents throughout China who act as marketing agents and after sale service

providers. The Company currently has 23 exclusive agents national

wide. At certain times each year, the Company provides and organizes training

sessions for these agents and their personnel. These sessions provide

the Company with a valuable opportunity to gather feedback and to foster an

exchange of technical ideas. These agents have agreements with the Company to

sell NF flow control equipments and systems, and they are managed by the Sales

Company. The Company evaluates the productivity of these exclusive agents

annually, based on how well they achieve the annual sales target established by

the Company. The Company typically will terminate its agreement with those

agents that miss the sales targets.

Raw

Materials

The major

raw materials for our production are pig iron, steel, copper, and plastic. We

source our materials locally in China. Nengfa Energy is located in Liaoning

Province which is China’s largest production base for iron and steel. We have

stable long term supply arrangements for our principal raw materials based on

long standing business relationships. Since we are located close to the supplies

of many of our essential raw materials, we enjoy price and transportation cost

advantages over our competitors and competing users. Through our advanced

technology and our management of raw materials, we are able to manage and

improve our consumption rates of the raw materials we use in production, which

results in lower operating expense and extension of our

inventories.

Regulatory

Compliance

The

products that represent a majority of our sales are subject to regulatory

standards and code enforcement which typically require that these products meet

stringent performance criteria. Standards are established by industry testing

and certification organizations such as the Ministry of Mechanical and

Electronic Engineering of China, the American Society of Mechanical Engineers

(A.S.M.E.), the Canadian Standards Association (C.S.A.), the Japanese Standards

Association (J.S.A.), the International Association of Plumbing and Mechanical

Officials (I.A.P.M.O.), Factory Mutual (F.M.), and Underwriters Laboratory

(U.L.). These standards are incorporated into state and municipal plumbing and

heating, building and fire protection codes in China.

We

maintain stringent quality control and testing procedures at each of our

manufacturing facilities in order to manufacture products in compliance with

code requirements. Our products are certified to conform to the ISO 9001

standards by the Det Norske Veritas Management System.

Competition

We

believe that the valve products of the Company place it in a leading position in

the flow control equipment production industry in China. For

super-size mid-low pressure energy-saving flow control equipment and systems,

the Company has an extensive competitive advantage compared to Chinese domestic

manufactures. Other manufactures that are focusing on the development of

different products may finally enter into this competition. Our potential

competitor is China Valve Technology.

In the

other areas of the Company’s business, there are many different competitors with

differing focuses and strengths. To some extent, boilers and furnaces

are specialized to particular industries and output

requirements. This specialization engenders specialization in the

design, manufacture and installation of new equipment and retrofit

solutions. Therefore, there are many engineering and manufacturing

companies that focus on certain types of boilers and furnaces resulting in a

relatively fragmented market for these services. The same is true for the

retrofit and reconstruction of other industrial systems for improved energy

efficiency, as well as for the localized projects for energy conservation and

biomass utililization, and similar projects. Therefore, the competition that the

Company faces tends to be localized companies with no dominant players at this

time.

In the

wind power equipment market, the Company believes that there are other companies

that provide similar equipment to what the Company intends to commence

manufacturing and selling in 2010. Many of the suppliers may be

international companies. Because this is a newer industry, the market

participants are somewhat fragmented, and there are no discernable market

leaders at this time in the China market. Also, because of the

expected demand for this type of equipment, there are not anticipated to be

identifiable competitors in the short term.

12

We plan

to compete based on our ability to address a wide spectrum of solutions in our

various market areas. We believe our competitive advantages result from our

patented technologies, our strategic relationships with engineering companies,

our marketing and our business relationships. We plan to continue to

expand these aspects of our business to further grow our core businesses and

provide solutions for the energy savings and green energy

projects. We intend to participate actively in the government

sponsored projects and government contracting.

Research and

Development

The

research and development expenses are to develop new products or new production

technologies, including significant improvements to existing products. The

research and development expenses include the materials and labor costs. We

incurred research and development expenses to study the possibility of using the

Company’s existing manufacturing facilities and valve production expertise to

produce equipment and fittings for wind power plants. The R&D expense for

2008 and 2007 were $111,030 and $370,633, respectively. Due to the integral

relationship between the R&D on the design of products during the process of

satisfying customer requirements and manufacturing our flow control equipment,

the cost for R&D for 2009 was relatively low and we recorded the R&D

cost as part of the cost of production in fiscal year 2009.

Employees

As of

December 31, 2009, there were 225 employees including 31 management personnel

working in our subsidiaries located in China. We believe we have a good

relationship with our employees.

Other

Our

internet website address is http://www.nfenergy.com . Through our website, we

make available, free of charge, our annual report on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K and any amendments to those

reports, proxy and registration statements, and all of our insider Section 16

reports, as soon as reasonably practicable after such material is electronically

filed with, or furnished to, the Securities and Exchange Commission, or SEC.

These SEC reports can be accessed through the “Investors” section of our

website.

ITEM

1A. RISK FACTORS

Investors

should carefully consider the following risk factors, in addition to other

information included in this annual report, in evaluating NF Energy Saving

Corporation and our business. If any of the following risks occur, our business,

financial condition and operating results could be materially adversely

affected.

Risks

Related to Our Business

We

have a relatively short operating history and are subject to the risks of any

growing enterprise, any one of which could limit our growth and our product and

market development.

Our

operating history makes it difficult to predict how our businesses will develop

and where the Company will find success. This is especially true in

respect of our expansion into areas other than flow valve technology and their

design, sales and installation. Accordingly, we face all of the risks

and uncertainties encountered by companies in earlier stages to development and

initial expansion, such as: (i) uncertain and continued market acceptance for

our product extensions and our services; (ii) the evolving nature of the wind

energy equipment industry in the PRC, where significant consolidation may occur,

leading to the formation of companies which may be better able to compete with

us than is currently the case; (iii) the fragmented nature of the boiler and

furnace business which may limit our ability to penetrate the market and provide

comprehensive solutions on a sufficiently wide basis to make the business

profitable; (iv) changing competitive conditions, technological advances or

customer preferences could adversely effect the sales of our products or

services; (v) maintaining our competitive position in the PRC and competing with

Chinese and international companies, many of which have longer operating

histories and greater financial resources than us; (vi) continuing to offer

commercially successful products to attract and retain a larger base of direct

customers and ultimate users; (vii) maintaining effective control of our costs

and expenses; and (viii) retaining our management and skilled technical staff

and recruiting additional key employees.

If we are

not able to meet the challenge of building our businesses and managing our

growth, the likely result will be slowed growth, lower margins, additional

operational costs and lower income.

13

We

may be unable to generate sufficient cash flow from operations or obtain

financing in the future to support our operations and expansion.

Having

access to sufficient operating funds and capital funds for expansion will affect

our ability to execute our business plan. We finance our business mainly through

internally generated funds and, from time to time, selling equity securities to

raise additional capital. There is no guarantee that we will always have

internal funds available for our future development or that we will be able to

raise capital from investor financing and loans granted by investors and

financial institutions in the future. In addition, there may be delays in the

process of selling our securities, which may require us to cut back on our

operations or expansion activities. Our access to debt or equity financing

depends on the investors’ and banks’ willingness to lend to and invest in us,

our financial condition and on general conditions in the capital

markets. We may not be able to secure additional sources of financing

on commercially acceptable terms, if at all. Any shortfall in our

cash flow and capital needs may result in our having to curtail our business

plans or have an adverse effect on our financial condition.

We

believe that we need to raise additional capital for the expansionary elements

of our business plan, which financing may not be available or available on terms

favorable to us.

During

the next phase of our business development, as we continue our planned expansion

into the wind energy equipment segment and other aspects of the energy savings

industry, we believe that we will need to raise additional capital from outside

sources during the next year or two. We cannot be certain that we

will be able to obtain additional financing on favorable terms, if at

all. One possible impediment to raising capital is the tightening

credit policies of the Chinese banks and the continued effects of the global

credit and financial crisis of 2008-2009. If we cannot raise additional capital

on acceptable terms, we may not be able to develop or enhance our services, take

advantage of future opportunities or respond to competitive pressures or

unanticipated requirements. We cannot be sure that we will be able to secure all

the financing we will require, or that it will be available on favorable terms.

If we are unable to obtain any necessary additional financing, we will be

required to substantially curtail our approach to implementing our business

objectives. Additional financing may be debt, equity or a combination of debt

and equity. If equity is used, it could result in significant dilution to our

shareholders.

We

have pledged our assets in connection with a debt financing completed in early

2010, which may limit our ability to raise debt based financing in the

future.

In

connection with the private placement of notes to two investors in early 2010,

the Company pledged its assets in China as security for the debt of

$960,000. The debt is due in one year, but is repayable with

equity. While the debt is outstanding and the lenders hold the

security in our assets, our ability to obtain additional debt financing from

individual investors and institutional lenders who demand similar security

through our assets may be limited. The current holders of the secured

debt are not required to subordinate their security interest to other lenders

and may not be willing to do so if requested.

Efforts

to protect our intellectual property rights and to defend against claims against

us can increase our costs and will not always succeed. Any failures could

adversely affect our sales and results of operations or restrict our ability to

conduct our business.

Intellectual

property rights are important to many aspects of our business. We

actively pursue patent protection in our flow valve business, and we expect to

pursue intellectual property rights in our other business endeavors as we

develop unique solutions to business demands. We, however, may be

unable to obtain protection for our intellectual property. Even if protection is

obtained, competitors may raise legal challenges to our rights or illegally

infringe on our rights, including through means that may be difficult to

prevent, detect or defend. In addition, because of the rapid pace of

technological change and the confidentiality of patent applications in some

jurisdictions, competitors may be issued patents from applications that were

unknown to us prior to issuance. The patents of others could reduce the value of

our commercial or pipeline of products or, to the extent they cover key

technologies on which we have unknowingly relied, require that we seek to obtain

licenses at a financial cost to us or cease using the technology, no matter how

valuable the patents may be to our business. We cannot assure you we would be

able to obtain such licenses on acceptable terms. Also, litigation may be

necessary to enforce our intellectual property rights, protect our trade secrets

or determine the validity and scope of our and the proprietary rights of others.

There is a risk that the outcome of such litigation will not be in our favor.

Such litigation may be costly and may divert management attention as well as

expend other resources which could otherwise have been devoted to our business.

An adverse determination in any such litigation will impair our intellectual

property rights and may harm our business, prospects and reputation. In

addition, we have no insurance coverage against litigation costs and would have

to bear all costs arising from such litigation to the extent we are unable to

recover such costs from other parties. The occurrence of any of the foregoing

may harm our business, results of operations and financial

condition.

Finally,

implementation of PRC intellectual property-related laws has historically been

limited, primarily because of ambiguities in the PRC laws and difficulties in

enforcement. Accordingly, intellectual property rights and confidentiality

protections in China may not be as effective as in the United States or other

countries, which increases the risk that we may not be able to adequately

protect our intellectual property.

14

For

aspects of our business we rely on strategic relationships, and there is no

assurance that we will be able to renew these arrangements.

We have

several strategic relationships which provide us with access to technology and

provide us with a competitive advantage. These include the relationships with GE

Enterprise Development (Shanghai) Co. LTD., Global Environmental Facility

/ World Bank / National Development and Reform Commission,

Osaka Gas, Japan, and Schneider Electric (China) Investment Co, Limited. There

is no guarantee that any of these agreements and arrangements will provide the

benefits that we hope will result or that the relationships will be renewed.

Moreover, there is no assurance that any steps we have already taken or might

take in the future will ensure the successful renewal of any or all our rights

or the granting of further new rights or that the terms of any renewals would

not be significantly less favorable to us than the terms of our current

agreements. The loss of such arrangements or diminution of the rights

may have an adverse impact on our business development, including product

offerings, research and development and competitive position.

We

derive a substantial part of our revenues from several major customers,

therefore if we lose any of these customers or they reduce the amount of

business they do with us in the future, our revenues may be

affected

Our two

largest customers, Nengfa Weiye Tieling Valve Joint Venture Company, Ltd and

Shenyang Baotong Gate Company, accounted for 72% of our revenues for the year

ended December 31, 2009 and accounted for 70% of our revenues for the year ended

December 31, 2008. Our largest customer, Nengfa Weiye Tieling Valve Joint

Venture Company, Ltd., accounted for 62% of our revenues in the year ended

December 31, 2009. These customers may not maintain the same volume of business

with us in the future. If we lose any of these customers or they reduce the

amount of business they do with us, our revenues may be materially adversely

affected. Although we have a preferred provider agreement with our

largest current customer with a term ending in 2013, which is automatically

renewable, there can be no assurance that the customer will continue to have the

current level of demand or will not seek to modify, terminate or breach the

agreement.

Our

technology may not satisfy the changing needs of our customers.

With any

technology, including the technology of our current and proposed products, there

are risks that the technology may not successfully address our customers'

needs. Certain of our product offerings in relation to the wind

energy equipment will be new for the Company. While we have already established

successful relationships with our customers, their needs may change or vary.

This may affect the ability of our present or proposed products to address all

of our customers' ultimate technology needs in an economically feasible

manner.

We

may not be able to keep pace with rapid technological changes and competition in

our industry.

While we

believe that we have hired or engaged personnel and outside consultants who have

the experience and ability necessary to keep pace with advances in technology,

and while we continue to seek out and develop "next generation" technology

through our research and development efforts, there is no guarantee that we will

be able to keep pace with technological developments and market demands in this

evolving industry and market. In addition, our industry is competitive in

various aspects. Although we believe that we have developed strategic

relationships to best penetrate the China market, we face competition from other

manufacturers of product similar to our products and services. Some of these

companies have significant advantages over us with respect to their products,

marketing and services, and their financial resources and customer

relationships.

If

we are not as successful as our competitors in our target markets, our sales

could decline, our margins could be negatively impacted and we could lose market

share, any of which could materially harm our business.

We depend

on our productivity capacity to complete existing orders and provide delivery on

time. If we are unable to finish the production when needed we would experience

delays in realizing our sales objectives and our financial results could be

adversely affected. The first phase of our new production facility, which will

include expansion for a number of our business lines, including our wind energy

equipment business, is under construction and expected to be completed in 2010.

If there is a delay on completing the new facility, it will negatively impact

our predicted production capability, which in addition negatively affects our

financial results.

We

may experience high account receivables balances from time to time, which may

have an adverse effect on our operating profitability and cash flow and

financing needs.

Although

we generally have a 30 to 90 day accounts receivable period, if our customers

extend the period in which they pay, we will experience a reduced cash flow,

which could have an adverse effect on our ability to fund our operations and

growth. One result may be that we will have to obtain outside

financing and our operating expense will increase. Extension of the

accounts receivable period may also result in reduced collections, which will

adversely affect our operations and profitability.

15

To the extent

that we depend on government projects, our business is dependent on government

policy and, to some extent, government funding and government

contracts.

Although

we do not characterize our business as a government contractor, some aspects of

our business are indirectly dependant on government policy, government funding,

and government contracts. For example, the water diversion project is largely a

government funded project, and our customers are contractors with the

government. It is possible that our wind energy equipment business

will also be highly dependent on government funding, if not government

contracts. Much of the pollution control and green industries are

dependent on government policy to implement societal

improvements. Our business has a number of aspects that are dependent

on the government and our products, services and revenues are dependent on

policies that can change if the government officials determine to redirect

attention and investment to other aspects of society and industrial

development. Therefore, if there is change or modification in

government policy concerning any of the areas of our business, we may suffer a

reduction in demand for our products and services and a reduction in our

revenues.

Additionally,

as a number of our customers are dependant on the government for their revenues

through the provision of products and services on government contracts or

government funded projects, there may be delays in our receiving payment for our

products and services.

Fluctuation

in the availability and cost of our raw materials may have an adverse effect on

our operations and results of operations.

A portion

of the inventory of raw materials and parts may be affected by fluctuations in

the availability of the items and the price. Such things may include

steel, electronic components, power systems, paints and welding

rods. We do not generally have long term supply contracts with our

suppliers, but rely on long standing relationships. To the extent

that we are not able to obtain the requirement materials and parts necessary to

enable us to fabricate our products, or we are required to pay more for such

items, then there could be an adverse effect on our operations and our results

of operations.

We

may be unable to effectively manage our growth.

As we

expand our business into several different areas of energy savings and green

industry, we will need to manage our growth effectively, which may entail

devising and effectively implementing business plans, training and managing our

growing workforce, managing our costs, and implementing adequate control in our

reporting systems in a timely manner. We may not be able to successfully manage

our growth. Our failure to do so could affect our success in executing our

business plan and adversely affect our revenues, profitability and results of

operations.

If

we fail to successfully manage our planned expansion of operations, our growth

prospects will be diminished and our operating expenses could exceed budgeted

amounts.

Our

ability to offer our services in an evolving market and in different markets

requires effective planning and management process. We have expanded

our operations rapidly since inception, and we intend to continue to expand them

in the foreseeable future. This rapid growth places significant demand on our

managerial and operational resources and our internal training capabilities. In

addition, we plan to increase our total work force. This growth will continue to

substantially burden our management team. To manage growth effectively, we must

implement and improve our operational, financial and other systems, procedures

and controls on a timely basis and expand, train and manage our workforce,

particularly our sales and marketing and support organizations. We cannot be

certain that our systems, procedures and controls will be adequate to support

our current or future operations or that our management will be able to handle

such expansion and still achieve the execution necessary to meet our growth

expectations. Failure to manage our growth effectively could diminish our growth

prospects and could result in lost opportunities as well as operating expenses

exceeding the amount budgeted.

16

If

we fail to establish and maintain an effective system of internal control, we

may not be able to report our financial results accurately or to prevent fraud.

Any inability to report and file our financial results accurately and timely

could harm our business and adversely impact the trading price of our common

stock.

We are

required to establish and maintain internal controls over financial reporting,

disclosure controls, and to comply with other requirements of the Sarbanes-Oxley

Act and the rules promulgated by the SEC thereunder. Our management, including

our Chief Executive Officer and Chief Financial Officer, cannot guarantee that

our internal controls and disclosure controls will prevent all possible errors

or all fraud. A control system, no matter how well conceived and operated, can

provide only reasonable, not absolute, assurance that the objectives of the

control system are met. In addition, the design of a control system must reflect

the fact that there are resource constraints and the benefit of controls must be

relative to their costs. Because of the inherent limitations in all control

systems, no system of controls can provide absolute assurance that all control