Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-52646

GEOVIC MINING CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5919886 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1200 17th Street, Suite 980 Denver, Colorado |

80202 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (303) 476-6455

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

(Title of Class)

Securities registered pursuant to Section 12(g) of the Exchange Act:

Title of each class to be so registered

Common Stock, par value $0.0001 per share

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-accelerated Filer ¨ Smaller Reporting Co. x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No x

The aggregate market value of the Registrant’s common stock held by non-affiliates, computed by reference to the closing price of the common stock as of June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $45,369,424,

At March 24, 2010, there were 103,724,508 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III is incorporated by reference from the Registrant’s definitive Proxy Statement for its 2010 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A, no later than 120 days after the end of the Registrant’s fiscal year.

Table of Contents

2009 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| Page | ||||

| 2 | ||||

| Item 1. |

4 | |||

| Item 1A. |

10 | |||

| Item 1B. |

19 | |||

| Item 2. |

20 | |||

| Item 3. |

40 | |||

| Item 4. |

41 | |||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 42 | ||

| Item 6. |

45 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 | ||

| Item 7A. |

50 | |||

| Item 8. |

51 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

51 | ||

| Item 9A. |

51 | |||

| Item 9B. |

53 | |||

| Item 10. |

54 | |||

| Item 11. |

54 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 54 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

54 | ||

| Item 14. |

54 | |||

| Item 15. |

55 | |||

| 58 | ||||

In this Annual Report on Form 10-K, all dollar amounts are in United States Dollars unless otherwise indicated.

1

Table of Contents

CAUTIONARY LANGUAGE ABOUT FORWARD-LOOKING STATEMENTS

Certain statements in this report constitute “forwarding-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities and Exchange Act of 1934 and applicable Canadian securities laws. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties. All statements other than statements of historical fact, included in this report regarding our financial position, business and plans or objectives for future operations are forward-looking statements. Without limiting the broader description of forward-looking statements above, we specifically note that statements regarding exploration and mine development, construction and expansion plans, costs, grade, production and recovery rates, permitting, financing needs, the availability of financing on acceptable terms or other sources of funding, if needed, and the timing of additional tests, feasibility studies and environmental permitting are all forward-looking in nature.

Statements contained in this annual report that are not historical facts are forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements with respect to the expected completion of the feasibility study update for the Nkamouna Project; the estimation of mineral reserves and mineralized material and the timing of completion of such estimations; our expectations regarding capital required prior to production at the Nkamouna Project; success of exploration activities; permitting time lines; construction and capital costs; operating expenses; currency fluctuations; requirements for additional capital; our expectations regarding processing and marketing of future production from the Nkamouna Project; ability to enter into off-take arrangements; government regulation of mining operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; limitations on insurance coverage; commencement of mine production, anticipated expenditures in 2010; and our plans with respect to future debt and equity financing. In certain cases, forward-looking statements can be identified by the use of words such as “proposes”, “expects”, “is expected”, “scheduled”, “estimated”, “intends”, or variations of such words and phrases or state that certain actions, events or results “will” occur. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, the risk factors discussed below in Item 1A—“Risk Factors,” risks related to operations; actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations in ore reserves, grades, or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labor disputes, other risks of the mining industry, delays in obtaining governmental approvals or financing or in the completion of development or construction activities and other factors as described herein, and in other filings with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this annual report speak only as of the date hereof. The Company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

Geovic Mining Corp. is subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and applicable Canadian securities laws, and as a result we report our mineral reserves according to two different standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum. U.S. reporting requirements are governed by the Securities and Exchange

2

Table of Contents

Commission (“SEC”) Industry Guide 7 (“Guide 7”). These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

We disclose mineral reserves and mineral resources according to the definitions set forth in NI-43-101 and modify them as appropriate to confirm to Guide 7 for reporting in the U.S. In this Form 10-K, we use the term “mineralized material” to describe the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards. This is substantially equivalent to the total measured mineral resources and indicated mineral resources (disclosed as exclusive of reserves), which we disclose for reporting purposes in Canada. U.S. investors are cautioned that, while the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” are recognized and required by Canadian securities laws, rules adopted by the SEC does not recognize them. U.S. investors are also cautioned not to assume that all or any part of measured or indicated resources will ever be converted into Guide 7 compliant reserves.

3

Table of Contents

| ITEM 1. | BUSINESS |

Geovic Mining Corp. was incorporated under the Business Corporations Act (Alberta) on August 27, 1984 and was continued into Ontario on November 8, 2001. On November 21, 2006, we became domesticated as a Delaware corporation and changed our name to “Geovic Mining Corp.” In this Form 10-K, the “Company,” “Geovic Mining,” “we,” “our” and “us” refer to Geovic Mining Corp. and one or more of its subsidiaries as indicated by the context.

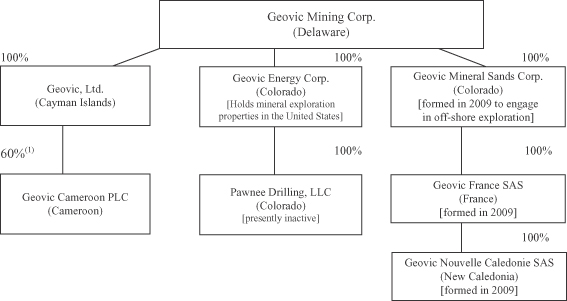

Intercorporate Relationships

We completed a reverse take-over transaction (the “RTO”) on December 1, 2006, with the result that we hold 100% of the issued and outstanding shares of Geovic, Ltd., a Cayman Islands corporation (“Geovic”). Geovic owns 60% of Geovic Cameroon PLC, a private corporation existing under the laws of the Republic of Cameroon (“GeoCam”) which holds our mining prospect in Cameroon. William A. Buckovic (“Buckovic”), the founder of Geovic, holds 0.5% of GeoCam which we hold an option to acquire.

Geovic is our principal operating subsidiary, and employs all our employees. The following chart illustrates the inter-corporate relationships among the Company and its subsidiaries as of March 24, 2010.

| (1) | GeoCam minority interest owners are described below under “GeoCam Shareholders Agreement.” |

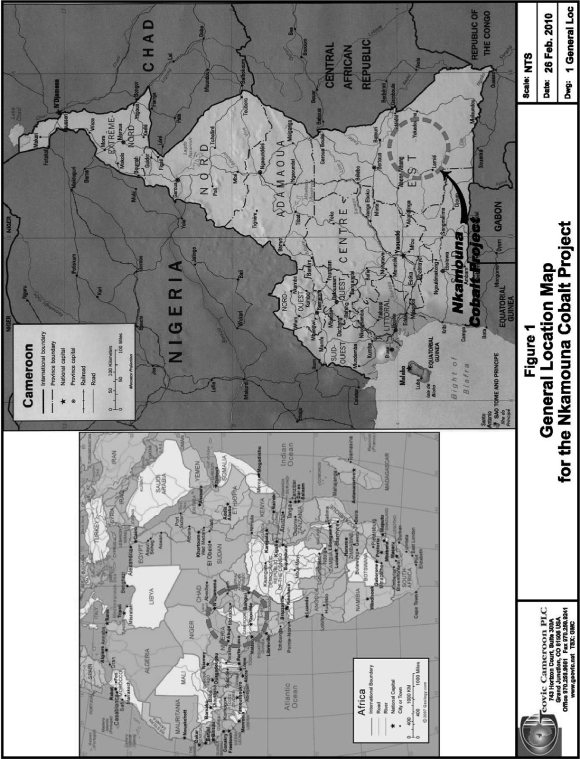

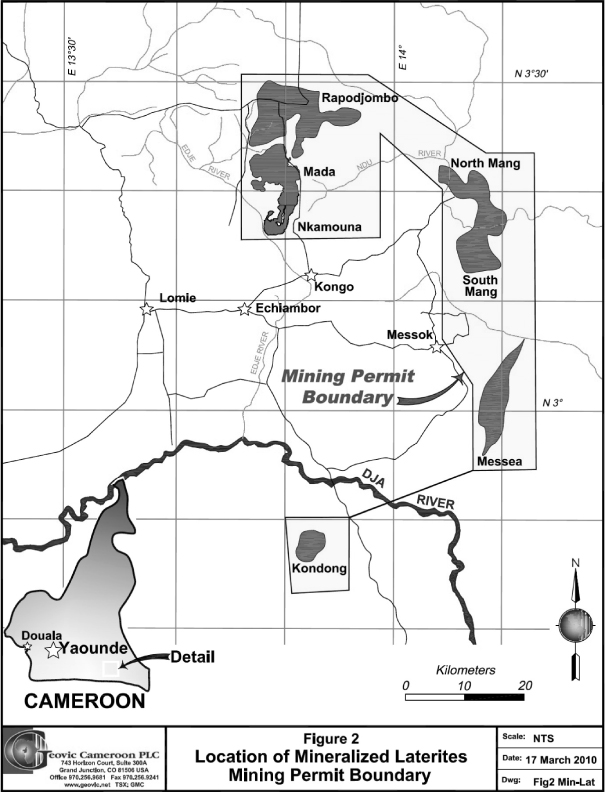

Our principal business is conducted through Geovic in which we hold rights to several cobalt-nickel-manganese deposits in the Republic of Cameroon, Africa through our 60% ownership in GeoCam. Our principal business focus since 1994 has been to advance our interest in the deposits. GeoCam’s Mining Permit (the “Mining Permit”) establishes exclusive mining rights to develop the Nkamouna, Mada and other cobalt-nickel-manganese deposits within a 1,250 square kilometer area in southeastern Cameroon (the “Cameroon Properties”). The Cameroon Properties are described in Item 2. Properties. GeoCam plans to develop and mine the Nkamouna and Mada deposits (together, the “Nkamouna Project”) before the other deposits are developed.

4

Table of Contents

Business Operations

Qualified independent consulting firms identified by Geovic and retained by GeoCam completed engineering pre-feasibility studies and technical reports on the Nkamouna deposit in 2006, a feasibility study in November 2007, a NI 43-101compliant technical report in January 2008, a feasibility optimization study in September 2008 (“2008 OS”), and an updated NI 43-101 compliant technical report on the Nkamouna Project in November 2009 (the “Nkamouna Technical Report”). The studies support construction of a cobalt-nickel-manganese mine and adjoining ore processing plant.

The 2008 OS also addressed production of manganese carbonate and scandium under pre-2009 price levels in those commodities.

Beginning in late 2008, several process improvement programs were initiated to enhance the Nkamouna Project’s economics and reduce technical and financial risks. Preliminary test work was undertaken in 2009 and early 2010 to begin to validate these technologies. Subsequent pilot scale tests commenced in February 2010 and are scheduled for completion by mid-2010.

In mid-2009 GeoCam retained three well-known, highly qualified and experienced metallurgical and chemical engineers to serve as its Technical Advisory Panel (“TAP”). The TAP was engaged to provide high-level metallurgical processing input to the Geovic technical design team as well as provide independent expert feedback to GeoCam. Based on recommendations of the TAP, we are considering the separation of the final refining process from the initial ore leaching process, which would produce two intermediate products (a mixed cobalt and nickel sulfide product, referred to as MSP, and manganese carbonate) at the mine site. These intermediate products would be sold in the international marketplace or shipped offshore for processing into finished products. Separately, the process for refining the MSP into more purified forms of cobalt and nickel is also being investigated. Our present plans do not include production of scandium. We are considering these measures to try to limit initial process plant capital costs and process risk at the remote mine site.

During 2009, we completed assaying and other analysis of samples collected in 2008 from our 2,045-hole, 54,900 meter drill program on the Nkamouna, Mada and Rapodjombo deposits. We undertook this program to accomplish the following:

| • | Reduce the distance between the holes drilled previously at Nkamouna and Mada, thereby adding greater certainty to non-reserve mineralized material estimates; |

| • | More fully delineate the lateral and vertical extents of the deposits; |

| • | Reevaluate the grade and extent of previous mineralized material estimates; |

| • | Reestablish proven and probable reserves; |

| • | Initiate preliminary work toward establishing a non-reserve mineralized material estimate at the adjoining Rapodjombo property; and |

| • | Facilitate initial mine planning. |

During 2009 we completed the assaying and analysis of the samples collected during the 2008 drilling program which enabled us to update our estimates of mineralized material located on the Nkamouna and Mada deposits and facilitate mine and production planning for the Nkamouna Project, which are discussed in more detail in Item 2. Properties. The following summarizes highlights of the updated estimates and related developments:

| • | Combined estimated mineralized material increased to 120.6 million tonnes with average grades of 0.23% cobalt, 0.65% nickel, and 1.34% manganese. |

| • | The 2008 estimate of reserves was made before the completion 2008 drill program and the 2009 estimate referred to above. Updated Proven and Probable reserve estimates at Nkamouna, initial Proven/Probable reserve estimates at Mada, and an initial mineralized material estimate at the adjacent Rapodjombo property are anticipated to be completed in the third quarter of 2010. |

5

Table of Contents

| • | The updated reserve estimates, when completed, are expected to enable higher cutoff grades to be utilized in mining operations, yielding improved project economics. |

Please refer to Item 2. Properties for more detailed information on the Nkamouna Project and other properties held by GeoCam, and by other subsidiaries of the Company.

In December 2009 GeoCam engaged Lycopodium Pty Ltd., an international engineering firm based in Perth, Australia to prepare an independent feasibility study update (“FSU”) and to review an updated mine plan for the Nkamouna Project. The FSU is expected to be completed in the third quarter of 2010 and will include estimated construction and capital costs, operating expenses and future net cash flow from mining operations for the Nkamouna Project. Once the FSU is completed and accepted, we will work with GeoCam to obtain project financing.

During 2008 and 2009 GeoCam, under our supervision, completed the following activities to advance the Nkamouna Project:

| • | Improved and maintained 23.6 kilometers of access roads between the nearest town, Lomie, and the Nkamouna Project; |

| • | Installed and maintained a 72-meter tower to provide nearly all required long-distance communication and information technology links for the Project, as well as the local region; |

| • | Expanded the field compound at Kongo camp near the Nkamouna Project; |

| • | Completed the preliminary engineering design of the tailings storage facility to receive tailings from the physical upgrading of ore and the leaching concentrates; |

| • | Advanced the engineering and planned infrastructure for on-site processing facilities; |

| • | Received final approval and permits authorizing stream diversion and water reclamation for the project; |

| • | Received a permit from the Cameroon Ministry of Forestry and Wildlife to collect and use wood resources from the deforestation of a 150 hectare area in the vicinity of the Nkamouna Project; |

| • | Cleared approximately 120 hectares of land to accommodate early construction activities, and processed the lumber for future use in construction; |

| • | Conducted development drilling of 2,045 drill holes totaling 54,952 meters of total depth on the Nkamouna, Mada and Rapodjombo deposits, and assayed and analyzed over 48,000 samples from the holes; and |

| • | Provided social and educational assistance to persons and groups in the area near the Nkamouna Project. |

GeoCam Shareholder and Other Agreements

In April 2007 Geovic entered into a shareholders agreement with the other GeoCam shareholders, Societe Nationale d’Investissement du Cameroun (“SNI”) (the owner of 20%), four Cameroonian individuals (collectively, the owners of 19.5% and represented by SNI), and Buckovic (the owner of 0.5%) (the “Shareholders Agreement”). The Shareholders Agreement reflects the historic ownership and management arrangements among the shareholders and sets forth the terms, conditions and fiscal arrangement for continued participation by the shareholders in GeoCam. The Shareholders Agreement includes provisions in accordance with Cameroon business laws for all shareholders to contribute their proportionate share of future GeoCam capital required to meet its annual operating budgets, as approved by the GeoCam Board of Directors. As provided in the Shareholders Agreement, in 2007 GeoCam began to operate independently from Geovic. Geovic and GeoCam also have entered into annual Technical Services Contracts under which Geovic provides certain staff to perform services and management to assist GeoCam to carry out its budgeted work program at rates set forth in the Technical Services Contract. SNI also provides services to GeoCam under similar annual agreements.

6

Table of Contents

Additionally, in December 2007, Geovic and GeoCam, with approval of GeoCam minority shareholders, resolved treatment of past advances from Geovic to GeoCam. From inception of GeoCam through 2006, the advances made by Geovic to or on behalf of GeoCam had preliminarily been treated as loans by Geovic. The parties agreed that approximately $23.1 million of past advances by Geovic would be credited toward Geovic’s share of future capital increases of GeoCam. In addition, approximately $9.0 million, plus an amount equal to the interest that would have been accrued at two percent above the Banque des Etats de l’Afrique Centrale (“BEAC”) interest rate, will be paid by GeoCam to Geovic in the nature of a production payment over a four-year period, beginning one year after commencement of commercial production. This amount is subordinated to all GeoCam debt and repayment is subject to approval by holders of GeoCam’s future secured debt.

All the Cameroon Properties are held by GeoCam, and the Mining Convention and Mining Permit are issued to GeoCam. Pursuant to the shareholders agreement the GeoCam Board of Directors consists of five directors, three of whom are elected by Geovic and two by the Cameroonian minority shareholders. Under the Shareholder Agreement, Geovic is entitled to select the General Manager/Managing Director and one Deputy General Manager while other shareholders are entitled to select one of the two Deputy General Managers. Although we are a majority shareholder and our representatives form a majority of the Board of Directors of GeoCam, we generally obtain concurrence from the minority shareholders in substantially all policy and other material operational decisions.

Nkamouna Project Financing Activities

During 2007 GeoCam engaged an international banking institution as financial advisor and began to survey the availability of project debt financing for the Nkamouna Project. During 2008 GeoCam began to build up its infrastructure and to hire additional employees in anticipation of commencement of mine construction activities in 2009. By late 2008 the Company and the advisor concluded that volatility in worldwide financial and commodities markets, falling prices for cobalt and nickel and the building world-wide economic recession would likely make project financing unavailable on terms acceptable to Geovic. The advisors engagement was terminated in early 2009.

Geovic and GeoCam then undertook to re-examine certain technical aspects of the planned metal processing operations and estimated capital costs in an effort to reduce technical risks and improve potential financial viability of the Nkamouna Project. Continued deterioration of the economy and low commodities prices led Geovic Mining and the minority shareholders of GeoCam in February 2009 to decide to significantly reduce the level of operations at GeoCam, including reductions in staffing and postponement of many pre-construction activities at the Nkamouna Project area. During this slowdown, GeoCam has proceeded to test various enhancements to the planned metal recovery and processing, and continued to attempt to reduce capital requirements.

In December 2009, we engaged Standard Chartered Bank as the Company’s financial advisor in connection with preparing and planning for project financing, reviewing documentation, considering early-stage efforts to locate potential purchasers of the MSP and manganese carbonate products we expect to produce, and related activities. During early 2010 we met with various large international businesses that have indicated an interest in the future off-take from the Nkamouna Project.

Cameroon Properties

Our business plan is to use our best available management, technical expertise and talent to develop our interests in the Cameroon Properties into a high quality mining and mineral production operation, commencing with the Nkamouna Project. The remaining steps to production include testing and finalization of ore processing technology and processes, completing the FSU to support the construction of mining and processing facilities at the Nkamouna Project, securing project financing and completing the mine and plant construction. We expect to complete construction of the initial mine and facilities in a socially responsible manner. We will continue to focus on the Nkamouna Project where our present plan is to begin initial mine production by late 2012 and full scale plant operation in early 2013, assuming external financing in sufficient amounts is available.

7

Table of Contents

When in full production, we believe that the Nkamouna Project will be one of the largest primary cobalt producing mines in the world.

We presently have no current revenue from operations and we expect to continue to generate losses and negative cash flows until after mine and milling operations begin on the Nkamouna Project. See Item7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Other Mineral Properties

We are also evaluating other mineral properties and prospects in the United States and elsewhere to diversify our business activities. We believe that opportunities exist to acquire interests suitable for mineral exploration and development. Geovic Energy Corp. (“Geovic Energy”) has acquired uranium leases and claims in Colorado and Wyoming. Over 78% of the net acreage is on private lands. In 2009 we surrendered some mining claims in Wyoming. The following table gives further details on our present holdings:

| Gross Acres | Net Acres | |||||||

| LEASES | CLAIMS | TOTAL | TOTAL | |||||

| COLORADO |

||||||||

| Weld County |

57,007 | 57,007 | 16,557 | |||||

| WYOMING |

||||||||

| Goshen County |

95,227 | 200 | 95,427 | 46,940 | ||||

| TOTALS |

152,234 | 200 | 152,434 | 63,497 | ||||

Through Geovic Energy we also hold 8,218 net acres of leases and mining claims in Southeastern Arizona where we are exploring for gold.

In 2009 we formed Geovic Mineral Sands Corp. and two other subsidiaries and commenced prospecting activities in New Caledonia.

Competitive Conditions

We expect that GeoCam will compete with other cobalt and nickel producers around the world, including those with projects now under development. World prices for cobalt and nickel increased significantly until 2008, when world production began to increase to meet the expected growing demand. 2008 saw the commencement of worldwide recession with accompanying significant reductions in demand and prices for mineral commodities, including cobalt, nickel, manganese and uranium. Other producers with ongoing operations have established production and demonstrated feasibility and have greater financial strength than we do. These competitors include such current producers as Xstrata Nickel, CVRD Inco, Sherritt and Murrin Murrin (Minara-Glencore and Sherritt). Significant mines expected to begin producing in the next few years include Ambatovy (Sherritt, Sumitomo, Korea Resources and SNC Lavalin), Weda Bay (Eramet), Goro Nouvelle-Calédonie (CVRD-Inco) and Tenke Fungurume (Freeport McMoRan-Tenke Mining Corp.-Gecamines). Operating expenses, reserve quantities and qualities, operating efficiencies, and location may affect the long-term success of all competing producers, including Geovic Mining.

Applicable environmental protection requirements will affect the financial condition and operational performance and earnings of the Company as a result of the capital expenditures and operating costs needed to meet or exceed these requirements. These expenditures and costs may also have an impact on our competitive position to the extent that our competitors are subject to less burdensome requirements. Through 2009 the effect of these requirements was limited due to the early stage of Cameroon Properties, but they are expected to have a larger effect in future years as we move toward and commence production at the Nkamouna Project.

8

Table of Contents

Social and Environmental Policies

In 2004 Geovic, on behalf of GeoCam, commissioned a site-specific environmental study of the Nkamouna area, which was performed by the consulting firm Knight Piésold and Co. The findings from the study were summarized as an Environmental and Social Assessment including an Environmental and Social Impact Assessment, and Environmental and Social Action Plan for the Nkamouna area. These documents were approved by the Cameroon Government in May 2007. An updated assessment must be completed in 2010. We will also be required to develop a similar, site-specific environmental study of the northern part of the Mada area before any development can commence on that part of the deposit. See “Item 2. “Properties” for additional information about our planned mineral development activities in Cameroon.

Geovic collaborates with GeoAid International (“GeoAid”), a non-profit entity for which the primary purpose is to provide socioeconomic and humanitarian services and support to areas and peoples likely to be impacted where the Company or its affiliates may carry on mining or similar activities. Since approximately 2000, GeoAid, with financial and other resources provided by Geovic and GeoCam, has provided medical support and training, education and other services and assistance to indigenous peoples in the area surrounding the Cameroon Properties. Certain of these programs and services are required under provisions of permits held by GeoCam. Commencing in 2007, GeoAid provided the services and programs under separate service agreements with GeoCam, and in 2008 a consultant to Geovic served as full time Executive Director for GeoAid. In late 2008, GeoAid engaged a full time independent Executive Director, and established a board of directors, a majority of which are not affiliated with the Company. Expenditures in Cameroon by GeoAid in 2009 totaled approximately $0.6 million. GeoCam is subject to ongoing obligations under its mining and environmental permits to provide social and educational assistance to persons and in areas impacted by the mining activities. These obligations will be handled both directly and by engaging third parties, such as GeoAid, to provide specified services.

Employees

All of our employees are employees of Geovic and our executive officers are also officers of Geovic. Geovic has 19 full time employees in its offices in the U.S., and at year-end 2009, GeoCam had 30 full time employees and 6 contract workers in its administrative offices in Yaoundé and 100 contract workers at the Nkamouna Project operations location in the East Province in the Republic of Cameroon.

Offices

Our principal corporate head office is located at 1200 17th Street, Suite 980, Denver, Colorado 80202, Telephone (303) 476-6455. We also maintain an operations office in Grand Junction, Colorado. GeoCam maintains its head office in the capital city of Yaoundé and a mine area office at Kongo Camp in the East Province, both in the Republic of Cameroon.

Available Information

Our website address is www.geovic.net. Available on this website under “Investor Relations” free of charge, are links to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Forms 3, 4 and 5 filed on behalf of directors and executive officers and amendments to those reports as soon as reasonably practicable after such materials are electronically filed with or furnished to the SEC.

Also posted on our website, and available in print upon request made by any stockholder to the Secretary, are charters for the Board’s Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Copies of the Code of Business Conduct and Ethics (“Code”) and our Whistleblower’s Policy are also posted on our website under the “About Geovic-Committee Charters” section. Within the time period required by the SEC, we will post on our website any modifications to the Code and any waivers applicable to senior officers as defined in the Code, as required by the Sarbanes-Oxley Act of 2002.

9

Table of Contents

| ITEM 1A. | RISK FACTORS |

We consider the risks set out below to be the most significant risks facing the Company, although these risks should not be considered to be comprehensive. If any of these risks materialize into actual events or circumstances or other possible additional risks and uncertainties of which we are currently unaware or which we consider not to be material in relation to our business, actually occur, our assets, liabilities, financial condition, results of operations (including future results of operations), business and business prospects, are likely to be materially and adversely affected, and as a result, the trading price of our common stock and warrants could be materially and adversely impacted. These risk factors should be read in conjunction with other information set forth in this report, including our Consolidated Financial Statements and the related Notes.

We are an exploration stage company and have no operating history as an operating company. Any future revenues and profits are uncertain.

We have no history of mining or refining any mineral products or metals and none of our properties is currently producing. There can be no assurance that the Nkamouna Project will be successfully placed into production, produce minerals in commercial and processing quantities or otherwise generate operating earnings. We will continue to incur losses at least until mining activities have successfully reached commercial production levels, which is currently estimated to be early 2013. There is no certainty that we will produce revenue from any source, operate profitably or provide a return on investment in the future. If we are unable to generate revenues or profits, our stockholders might not be able to realize returns on their investment in our common stock. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly, annual or sustaining basis.

We expect that the Company will continue to incur losses unless and until such time as the Nkamouna Project is placed into commercial production and generates sufficient revenue to fund continuing operations. The development of the Nkamouna Project will require the commitment of substantial financial resources. The amount and timing of expenditures will depend on a number of factors, some of which are beyond the Company’s control. There can be no assurance that the Company will ever achieve profitability.

We will be subject to all of the risks associated with establishing new mining operations and business enterprises including: the availability of funds to finance construction and development activities, timing and cost of the construction of mining and processing facilities; the efficacy of planned mineral processing; the availability and costs of skilled labor and mining equipment; the availability and cost of appropriate processing materials and equipment; the need to obtain in a timely manner additional governmental approvals and permits; the availability of off-take agreements or metal sales contracts; potential opposition from non-governmental organizations, environmental groups or local groups in Cameroon which may delay or prevent development activities; and potential increases in construction and operating costs due to changes in the cost of fuel, power, materials and supplies. Further, the costs, timing and complexities of mine construction and development are increased by the remote location of the Cameroon Properties. Accordingly, our activities may not result in profitable mining operations and we may fail to successfully establish or maintain mining operations or profitably produce metals at any of our properties.

The actual capital costs and mine operating costs to be incurred in connection with opening the Nkamouna Project may be significantly higher than anticipated.

At the time our preliminary feasibility study was completed in March 2006, we expected to experience increasing capital and operating costs at moderately rising rates. However, capital and anticipated operating expenses for mining and processing operations increased significantly faster than we or others in the mining industry anticipated. The feasibility study completed for GeoCam in December 2007 and the 2008 OS, both concluded that significantly higher initial capital and future operating costs would be incurred for the Nkamouna Project above those estimated by the preliminary feasibility study. These increases were due in part to a much

10

Table of Contents

higher demand for mining and processing equipment through mid-2008 reflecting the start-up and/or expansion of other unrelated projects resulting from the generally strong commodity prices experienced during 2007 and early 2008. These and similar cost and expense increases are beyond our control, and will require significantly more capital to bring the Nkamouna Project into production and result in a decrease in our anticipated return from operations. Although commodity prices for cobalt and nickel have decreased significantly since mid-2008, our estimated capital and operating cost estimates have not decreased significantly. The FSU now underway will include an updated estimate of future capital costs, which may be higher than past estimates. Our actual capital costs and operating costs may be higher than anticipated by the FSU.

Market events and conditions may adversely affect our business and the mining industry.

Continued weakness in the Canadian, United States and international credit markets and other financial systems and the Canadian, United States and global economic conditions, could, among other things, impede access to capital or increase the cost of capital, which would have an adverse effect on our ability to fund the working capital and other capital requirements of GeoCam. Since 2007, the U.S. credit markets have experienced serious disruption which has caused a loss of confidence in the broader U.S. and global credit and financial markets and the collapse of, and government intervention in, some major banks and other financial institutions and insurers. These unprecedented disruptions in credit and financial markets had a significant material adverse impact on a number of financial institutions and limited access to capital and credit through 2009 for many companies, particularly resource companies such as the Company. These disruptions could, among other things, make it more difficult for GeoCam to obtain, or increase its cost of obtaining, capital and financing for construction and for operations. Access to capital and financing may not be available on terms acceptable to the Company or at all. Nkamouna Project development modifications may be necessary or desirable to secure lending commitments which would also delay the completion of any financing. All delays in completing financing for the project will delay mine construction, anticipated production activities and future revenue.

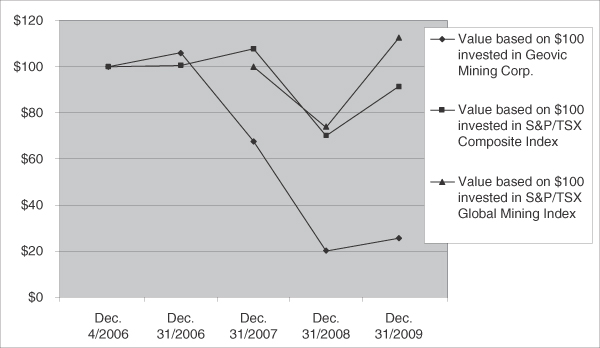

The share prices of junior natural resource companies such as Geovic Mining experienced large declines in value and there has been a significant decline in the number of buyers willing to purchase such securities. As a consequence market forces may render it difficult or impossible for the Company to raise capital on terms which will not lead to severe dilution to existing stockholders, or at all. Therefore, there can be no assurance that significant fluctuations in the trading price of the Company’s common stock will not continue, or that such fluctuations will not materially adversely impact on the Company’s ability to raise equity.

General economic conditions may adversely effect our growth and profitability.

A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, interest rates, and tax rates, may adversely affect our growth and profitability. Specifically:

| • | the global credit/liquidity crisis could impact the cost and availability of financing and our overall liquidity; |

| • | the volatility of commodity prices would impact our revenues, profits, losses and cash flow; |

| • | volatile energy prices, commodity and consumables prices and currency exchange rates would impact our production costs; and |

| • | the volatility of global stock markets would impact the valuation of our equity and other securities. |

These factors could have a material adverse effect on our financial condition and results of operations.

11

Table of Contents

GeoCam may fail to secure Nkamouna Project financing if lenders or their advisors conclude that changes to the complex ore processing techniques being considered in the FSU are too risky or are otherwise not feasible.

In response to observations that raised questions about the efficacy of a few aspects of planned ore processing considered in the 2007 feasibility study and the 2008 OS, we modified certain of the metallurgical processes planned to be utilized and tentatively decided that GeoCam may not refine final metal products from the Nkamouna Project ore at the project site. If potential lenders are not ultimately assured that the modified metallurgical processes will allow the processing facilities to operate successfully as designed, Nkamouna Project debt financing may be delayed until further testing enhancement is performed or funding could be unavailable altogether.

If we lose key personnel or are unable to attract and retain additional experienced personnel, we may be unable to establish and develop our business.

Our development in the future will be highly dependent on the efforts of key management employees, namely, John E. Sherborne, Barbara Filas, William A. Buckovic, David C. Beling, Gary Morris, Greg Hill, and Brian Briggs (currently Chief Executive Officer, Executive Vice President and Chief Administrative Officer, Executive Vice President, Chief Operating Officer, Senior Vice President, Chief Financial Officer, and Senior Mine Planner, respectively) and other key employees that we or GeoCam may hire in the future. Loss of any of these executives could have a material adverse effect on our operations and future success. We do not have and currently have no plans to obtain key man insurance with respect to any of our key employees.

The GeoCam minority shareholders may fail to pay their share of future GeoCam capital.

Under the Shareholders Agreement, minority interest owners agreed to fund their share of operating costs. However, it is possible that the minority shareholders will be unable or unwilling to provide their respective share of future GeoCam funding, and we may be required to delay the project or advance all the shareholder funds necessary to place the Nkamouna Project into production, pursuant to a loan agreement or other arrangement between Geovic and GeoCam.

Our lack of operating experience may cause us difficulty in managing our growth.

Geovic has owned a majority interest in GeoCam since its inception more than a decade ago. Geovic employees have managed the exploration of the GeoCam deposits and negotiated the terms of the required Cameroon government approvals and permits and financings we have completed. Under Technical Services Contracts with GeoCam we will continue to provide many of such services. Our ability to manage our continued growth will require us to improve and expand our management and our operational and financial systems and controls. If our management is unable to manage our growth and the development of the Cameroon Properties effectively, our business and financial condition could be adversely affected.

Our dependence on many outside service providers to place the Nkamouna Project into production may delay mine opening or operation.

Our ability to place the Nkamouna Project into production will be dependent to a large part upon using the services of appropriately experienced employees, consultants and contractors working under our supervision and agreements with other major resource companies that can provide required expertise or equipment. We also expect to recruit and hire senior management for GeoCam with senior level mining experience. Also, a significant local work force will be trained, few of whom currently have any related experience. We may not have available to us, or we may be unable to retain on satisfactory terms, the necessary expertise, equipment or local workers to build the GeoCam facilities and place the Nkamouna Project into production.

12

Table of Contents

Our acquisition, exploration and development activities may not be commercially successful.

We currently have no producing properties. Substantial expenditures are required to develop the Nkamouna Project, to drill and analyze for additional ore reserves, to construct facilities to implement the metallurgical processes to extract metal from the mined ore and to develop the mining and processing facilities and infrastructure at each deposit site chosen for mining. Our existing cobalt-nickel-manganese deposits may prove not to be in sufficient quantities to justify commercial operations, and future financing required to commence mining operations may not be obtained on a timely or cost-effective basis or on terms acceptable to us.

The prices of cobalt, nickel and manganese are subject to fluctuations which could adversely affect the realizable value of our assets, future results of operations and cash flow.

Our principal assets are deposits of cobalt, nickel and manganese in the Nkamouna and the other six deposits. All of these rights are held by GeoCam. Our potential future revenue is expected to be, in large part, derived from the mining, processing and sale of cobalt, nickel and related minerals from the Cameroon Properties or from the outright sale or joint venture of some or all of these properties. The value of these reserves and deposits, and the value of any potential production therefrom, will vary in proportion to significant changes in cobalt, nickel and manganese prices. The prices of these commodities have fluctuated widely, declined significantly in 2008 and only partially recovered in 2009. These commodity prices are affected by numerous factors beyond our control, including, but not limited to, worldwide economic conditions, international economic and political trends, realized or expected levels of inflation, currency exchange fluctuations, central bank activities, interest rates, global or regional consumption patterns and speculative activities. The effect of these factors on the prices of cobalt and nickel, and therefore the economic viability of any of our projects, cannot accurately be predicted. Continued significant decreases in the prices of cobalt and nickel, and to a lesser extent, manganese, would adversely affect asset values, cash flows, potential revenues and profits of the Cameroon Properties if they are placed into production.

GeoCam may not be able to produce and sell mineral products at profitable prices. Our future operations are therefore more exposed to the impact of future decreases in commodity prices. Conversely, forward sales contracts would limit potential upside market swings. Such upside price swings could have a significant benefit to companies that take added market risk and sell produced mineral product on the open spot metals market. If cobalt or nickel prices decrease significantly at a time when our properties are producing and we have not completed forward sales arrangements, we would realize reduced revenue. GeoCam may enter into metal sales agreements for process plant off-take with one or more companies. If we contract to sell our planned intermediate products, the selling price would be related to prevailing market prices at time of delivery. Selling intermediate products produced at mine site, while reducing process risk and required capital expense, will also likely result in lower operating profit and cash flow from the mining and processing operations. There may be little demand or no market for intermediate products that may be produced at the Nkamouna Project site which could adversely affect prices for such products and operating results.

Our mining exploration, planned development and operating activities are inherently hazardous and may not be insured or insurable.

Mineral exploration involves many risks and hazards that even a combination of experience, knowledge and careful evaluation may not be able to overcome. The business of mining is subject to certain types of risks and hazards, including reserve and resource estimates, processing risks, environmental hazards, metallurgical and process risks, industrial accidents, flooding, fire, metal theft, personal injuries, accidents, and periodic disruptions due to force majeure events and inclement weather. Workers are subject to risks associated with large mining equipment operations, slope instability, exposure to indigenous disease, steam and hazardous chemicals, as well as local social unrest. Disruption of exploration, development and production operations may occur. Operations in which we have direct or indirect interests will be subject to all the hazards and risks normally incidental to exploration, development and production of minerals, any of which could result in work stoppages, damage to

13

Table of Contents

property and possible environmental damage. The nature of these risks is such that liabilities might exceed any liability insurance policy limits. It is also possible that the liabilities and hazards might not be insurable, or, that we could elect not to insure Geovic Mining or GeoCam against such liabilities due to high premium costs or other reasons, in which event, we could incur significant costs that could have a material adverse effect on our financial condition.

Our present mineralized material and future reserve estimates may be inaccurate which could adversely affect our future mining activities.

There is a high degree of uncertainty attributable to the calculation of mineralized material and future reserves and ore grades dedicated to future production because such estimates are expressions of judgment based on knowledge, experience and industry practice, and estimates of reserves may prove to have been inaccurate. Estimates which were valid when made may change significantly when new information becomes available. Accordingly, development and mining plans may have to be altered in a way that adversely affects the Company’s operation and profitability. An historical 2008 estimation of reserves and future production from the Nkamouna Project, prepared before the 2008 and 2009 drilling program was completed and analyzed, is included in Item 2. Properties. These estimated reserves were changed to mineralized material pending completion of the FSU. Metallurgical testing on mineralization at the Cameroon Properties performed by the independent consultants and the Company in late 2009 concluded that revisions to planned processing methods assumed in the 2008 estimate should be made to reduce risk. These revisions are expected to affect the calculations of the GeoCam reserves. There is a risk that full scale production activities may indicate technical and commercial shortcomings to whatever processing methodology is installed. Consequently, actual results may vary materially and adversely affect projected values given to reserves.

Until reserves are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of reserves and ore may vary depending on metal prices. Any material change in the quantity of reserves, grade or overburden stripping ratio or price of cobalt and nickel may affect the economic viability of our properties. In addition, cobalt and nickel recoveries or other metal recoveries in pilot-scale tests may not be duplicated during production.

Our previously reported 2008 estimated reserves were based on assumptions and drilling data that are different from our 2009 estimate of mineralized material and are likely to be revised.

The estimated proved and probable reserves at the Nkamouna deposit that were previously announced and which are presented in this Annual Report on a historical basis were prepared by independent consultants in January 2008 using drill data obtained before 2008, then-current cost estimates and other information and assumptions described in the Technical Report, Nkamouna Cobalt Project, Feasibility Study dated January 18, 2008 (the “2008 PAH Report”). In November 2009, a different consultant, SRK, completed an estimate of mineralized material at the Nkamouna and Mada deposits, also prepared in compliance with N.I. 43-101 (the “Nkamouna Technical Report”). This estimate relied on additional information from 2,045 drill holes and over 48,000 additional assay samples that were completed after the 2008 reserve estimate was completed and reflected only mineralized material, with no estimate of reserves.

We expect that SRK will prepare estimates of proven and probable reserves for the Nkamouna and Mada deposits later in 2010 after completion of the pending feasibility study update. Because we expect to use a higher cut-off grade for cobalt when we mine the deposits than was used in completing the 2008 PAH Report, and because other project parameters and assumptions have changed, the estimated reserves for the Nkamouna and Mada deposits will likely be different than the historic estimate included in the 2008 PAH Report and previously reported.

14

Table of Contents

We face intense competition in the mining industry.

The mining industry in general, and cobalt and nickel mining in particular, are intensely competitive in all phases. A significant number of new cobalt and nickel projects have been announced in recent years and if placed in production, the resulting increased supplies of those commodities could adversely affect prices available for our expected production. Competitors include large established mining companies with experience and expertise and with greater financial and technical resources, and as a result we may be unable to obtain financing, or sell mined and processed products on terms we consider acceptable. We compete with other mining companies in the recruitment and retention of qualified managerial and technical employees and capital. If we are unable to raise sufficient capital, our exploration and development programs may be jeopardized or we may not be able to develop or operate our projects. Also, our decision to produce and sell intermediate products is likely to reduce significantly the number of customers for our metals produced.

There presently is a lack of required infrastructure in Cameroon which could delay or prevent completion of our mine development activities or increase operating costs.

Completion of the development of the Nkamouna Project is subject to various infrastructure requirements, including the availability and timing of acceptable arrangements for power, water, housing, transportation, air services and other facilities. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay development. There can be no assurance that the development will be commenced or completed on a timely basis, if at all, that the resulting operations will achieve the anticipated production or that the construction costs and ongoing operating costs associated with the development will not be higher than anticipated.

Unless we obtain significant additional external financing, enter into a strategic alliance or sell a property interest, we will be unable to develop the Nkamouna Project.

The Nkamouna Project requires significant capital expenditures to construct mining and processing facilities and related infrastructure. We will require external debt and equity financing to fund development of the project and to construct mining and processing facilities. The sources of external financing that we may use for these purposes include secured project debt incurred by GeoCam, convertible debt of the Company or GeoCam and equity placements by GeoCam or the Company. In addition, we may consider a sale of an interest in one or more of the other Cameroon Properties, we could enter into a strategic alliance with a complementary company or we may utilize some combination of these alternatives. We intend that GeoCam will seek financing from international institutions with significant experience in financing large natural resource ventures in remote locations such as southeastern Cameroon. Such financiers could require GeoCam and its owners to comply with costly conditions as a requirement to completion of project financing, including significant additional equity contributions to GeoCam. The financing options chosen may not be available on acceptable terms, or at all. The failure to obtain adequate financing on a timely basis will have a material adverse effect on our growth strategy, results of operations and financial condition.

Challenges to our title to mineral properties in which we may have an interest could affect our exploration or development rights.

GeoCam could inadvertently be deemed noncompliant with terms or conditions of its Cameroon mining and other permits and authorizations. There may be challenges to title to other mineral properties that we currently control or which we may acquire in the future. Our prospecting activities in New Caledonia may not lead to required exploration permits from the government. If there are title defects with respect to any of our properties, we might be required to satisfy additional government requirements, compensate other persons or perhaps reduce our interest in the affected property or lose our interest completely. Also, in any such case, the investigation and resolution of title issues would divert our management’s time from ongoing exploration and development programs.

15

Table of Contents

Our exploration and development operations are subject to continuously evolving environmental regulations, which could result in incurrence of additional costs and operational delays.

All phases of our operations are subject to environmental regulation. Environmental legislation is evolving in countries and local jurisdictions in a manner which will likely require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulation, if any, could adversely affect our projects.

Acquisition of mineral rights from governmental agencies in the United States requires compliance with applicable regulations and could add costs and delays to future development.

We intend to continue to acquire properties or mineral rights in the United States. All mineral development in the United States is subject to regulation and compliance regardless of land tenure. Development projects are regulated at the state level, and in some states, also at the county level, and we must comply with the regulations relating to mining; land use; air quality; water quality, quantity and supply; and solid and hazardous wastes in the state within which the properties are located. If a state does not have an established program for regulating air, water and waste (pursuant to the federal Clean Air Act, Clean Water Act and the Resource Conservation and Recovery Act), then the U.S. Environmental Protection Agency will have direct regulatory jurisdiction. Depending on the state, there may be other applicable federal regulatory programs that also apply beyond those enacted by the state.

Mineral development (and other) actions on public lands managed by federal land management agencies such as the Bureau of Land Management (BLM) or the United States Forest Service (USFS) are obliged to file an acceptable plan of operations which is then subject to an environmental impact evaluation under the National Environmental Policy Act (NEPA). The NEPA process requires the completion of either an environmental assessment or an environmental impact statement prior to approval of the plan of operations. Whether on public or private land, mining companies must comply with all relevant federal, state and county requirements and will be required to post a bond or other surety to guarantee the cost of post-mining reclamation.

Federal, state, and local regulatory requirements, or changes to these requirements, could add significant additional cost and delays to any mining project we undertake in the United States. Permitting rules and/or discharge limits established at the federal, state, or local level may impose limitations on our production levels warranting additional capital expenditures in order to comply with the rules.

Provisions of the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) impose strict joint and several liability on parties associated with releases or threats of releases of hazardous substances. Our mining operations may produce hazardous substances which could accidentally be released to the environment, and in the United States may be subject to provisions and attendant liabilities of CERCLA. Such liabilities could include the cost of removal or remediation of the release of the hazardous substance and damages for injury to the surrounding property.

We may develop conflicts of interest with other natural resource companies with which one of our directors may be affiliated.

Certain of our directors are also directors and officers of other natural resource companies. Consequently, there exists the possibility for such directors to be in a position of conflict. We expect that decisions made by any of such directors relating to the Company will be made in accordance with their duties and obligations to deal fairly and in good faith with the Company and such other companies.

16

Table of Contents

Many factors beyond our control could adversely affect our future profitability.

The costs, timing and complexities of mine construction and development are increased by the remote location of the Cameroon Properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, mine start-up and ramp-up to full designed commercial production. Also, ongoing cost and expense increases being faced throughout the mining and natural resources industries are beyond our control. Accordingly, our activities may not result in timely or profitable mining operations, and we may fail to successfully establish mining operations or profitably produce metals at any of our properties. In addition, the progress of ongoing exploration and development, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, and the Company’s acquisition of additional properties will also impact the magnitude of the cost and timing of Company expenditures.

If we are unable to comply readily with present or future laws and regulations of the Republic of Cameroon, development activities could be delayed and profitability not achieved or reduced.

The current and future development of the GeoCam deposits requires permits from various Cameroon governing authorities. Future operations will be subject to a number of existing laws and regulations such as labor standards, environmental reclamation, land use and safety. Other permits required to construct and operate a mining and processing facility may contain terms and conditions that are difficult or expensive to meet. Such laws and regulations may adversely affect the profitability of GeoCam’s operations.

General and Cameroon economic conditions could adversely affect our future results.

Cameroon, as well as United States and world economic conditions may affect the future performance of the Company. Inflation or deflation, changing tax laws, and fluctuating interest rates may make mineral resource development more difficult. These factors have had a significant effect on Cameroon’s economy in recent years. Economic conditions may have an adverse effect on the overall performance of the Company. In addition, various economic conditions could increase the risk that financial projections for the Nkamouna Project may not be realized as expected.

Political unrest or changes in Cameroon or nearby countries could interfere with our operating or financing activities.

The political risk in sub-Saharan Africa is significant. GeoCam’s rights to explore and develop mineral deposits in Cameroon are always subject to the continued political stability of the Republic of Cameroon and its government. In March 2008 Cameroon experienced some domestic strikes and political unrest that subsided within weeks. The election for Presidency in Cameroon will be held in 2011. Also, political unrest or upheaval in adjoining countries could adversely affect our mining and development activities, and, if significant, would likely increase the costs of long term financing of the mining and processing activities. Further, GeoCam may not be able to finance or operate the Cameroon Properties at all if future state or regional political upheavals occur in Cameroon.

Potential violations of the Foreign Corrupt Practices Act (FCPA) by GeoCam, its agents or representatives could have a material adverse impact on our financial condition and results of operations.

The FCPA prohibits payments of, promises to pay, or authorizations to pay, money, gifts or anything of value to officials of foreign governments, in order to “obtain or retain” business. Payments or gifts to a third party, such as an agent or sales representative, while knowing (or having reason to know) that all or part of the money or gift will be offered or given to such an official, are also prohibited. If employees violate the FCPA, the violation creates severe potential criminal and civil liability for themselves and the affiliated U.S. Company. The types of conduct prohibited by the FCPA are not always clear. As a result, caution is required when doing business through foreign consultants, commercial representatives or agents, or with businesses that are owned, in

17

Table of Contents

whole or in part, by foreign governments or that have personal or family ties to government officials. We do not oversee the day to day operations of employees or representatives of GeoCam. Although we emphasize compliance with the FCPA to all our employees and representatives and those of GeoCam, there remains a risk of violation in Cameroon or in the other countries where we may have operations.

We may fail to maintain the adequacy of internal control over financial reporting as required of the Sarbanes-Oxley Act.

In 2008 we documented and tested our internal controls and procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”). SOX requires an annual report by management of the effectiveness of the Company’s internal control over financial reporting and an attestation report by the Company’s independent auditors addressing internal controls over financial reporting. Management evaluated the Company’s disclosure controls and procedures and concluded that they were not effective as of December 31, 2008. Also, the Company’s Chief Executive Officer and Chief Financial Officer evaluated our internal control over financial reporting and determined that material weaknesses existed of December 31, 2008.

We implemented a number of activities during 2009 to remediate the weaknesses and improve our internal control over financial reporting. Our management evaluated our disclosure controls and procedures and our internal controls over financial reporting as of December 31, 2009 and concluded that disclosure controls and procedures were effective and that internal control over financial reporting was effective to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of our financial statements in accordance with US GAAP.

We could be unable to ensure in the future that we have effective internal controls over financial reporting or effective disclosure controls and procedures as defined by applicable rules. Because the financial statements of GeoCam are consolidated, GeoCam financial reporting is also subject to SOX. Our failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of our financial reporting and disclosure, which in turn could harm our business and negatively impact the trading price of our common shares. In addition, difficulties in maintaining satisfactory controls and procedures could harm our future reported operating results or cause us to fail to meet our reporting obligations. Any future acquisitions of other businesses may provide us with challenges in implementing the required internal processes, procedures and controls in the acquired operations. Acquired companies may not have effective disclosure control and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to us.

No evaluation can provide complete assurance that our internal control over financial reporting will detect or uncover all failures of our personnel to disclose material information otherwise required to be reported. The effectiveness of our controls and procedures could also be limited by simple errors or faulty judgments. In addition, should we expand in the future, the challenges involved in implementing appropriate internal controls over financial reporting will increase and will require that we continue to improve our internal controls over financial reporting. Although we intend to devote substantial time and incur substantial costs, as necessary, to ensure compliance, we cannot be certain that we will be successful in complying with Section 404 on an ongoing basis.

Risks related to ownership of our stock

The market price of our common stock and warrants may be adversely affected by market volatility due in part to the current instability in the financial markets.

As a result of the current instability in the financial markets, our common stock price and warrant prices have decreased significantly since 2007. We cannot predict if or when current adverse economic conditions will be resolved and what the affect this instability will continue to have on the price of our common stock and warrants.

18

Table of Contents

Conditions beyond our control may cause wide price fluctuations in the market price of our common stock and warrants.

The market price of our common stock and warrants may be subject to wide fluctuations in response to many factors, including worldwide economic conditions and commodities prices, variations in our operating results, divergence in financial results from analysts’ expectations, changes in performance estimates by analysts, changes in our business prospects, changes in mineral reserve or resource estimates, results of exploration, changes in results of mining operations, legislative changes, and other events and factors outside our control.

Future sales of our securities in the public or private markets could adversely affect the trading price of our common stock and warrants and our ability to continue to raise funds in new stock offerings.

Future sales of substantial amounts of our securities in the public or private markets, or the perception that such sales could occur, could adversely affect prevailing trading prices of our common stock and warrants and could impair our ability to raise capital through future offerings of securities.

We do not intend to pay cash dividends in the near future.

Our Board of Directors determines whether to pay cash dividends on our issued and outstanding shares. The declaration of dividends would depend upon our future earnings, our capital requirements, our financial condition and other relevant factors. Our Board does not intend to declare any dividends on our shares for the foreseeable future. We anticipate that we will retain any future earnings to finance the growth of our business and for general corporate purposes.

Provisions of our Certificate of Incorporation, By-laws and Delaware law could defer a change of our management which could discourage or delay offers to acquire us.

Provisions of our Certificate of Incorporation, By-laws and Delaware law may make it more difficult for someone to acquire control of us or for our stockholders to remove existing management, and might discourage a third party from offering to acquire us, even if a change in control or in management might be beneficial to our stockholders. For example, our Certificate of Incorporation allows us to issue different series of shares of preferred stock without any vote or further action by our stockholders and our Board of Directors has the authority to fix and determine the relative rights and preferences of each series of preferred stock. As a result, our Board of Directors could authorize the issuance of a series of preferred stock with holders having the preferred right to our assets upon liquidation, preferred voting rights, preferred dividends before dividends are paid on common stock and/or redemption preferences or other preferred rights.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

19

Table of Contents

| ITEM 2. | PROPERTIES |

Glossary of Certain Terms

Ferralite. Limonitic laterite, sometimes pulverulent, mottled, with varied shades of black, yellow, brown and red. Often foliated, reflecting relict serpentinite textures. Thickness varies from a few meters to tens of meters, averaging near 8 meters. Main ore unit, consistently mineralized with good metal grades near the top where black manganese zones occur, moderate to low cobalt grades lower in the unit.

Ferricrete breccia. Beneath the Upper Laterite is a nearly ubiquitous horizon of iron-rich concretions, ranging in size from one or two centimeters across, to blocks larger than a meter across. The ferricrete breccia averages 6 to 8 meters thick, and was often divided into two or three units by project geologists. A unit can contain very high cobalt grades, particularly at the base.

Hectare. A land measurement. One hectare is equal to 100 square meters, or approximately 2.47 acres.

Hydrometallurgical processing. One of several metallurgical processes that uses water and other liquids for the leaching and recovery of soluble metals from ore.

Lateritic soil. A soil containing laterite, or any reddish tropical soil developed by intense tropical weathering.

Manganese precipitate. Manganese compounds produced by precipitation from leach solutions.

Mine Permit. Republic of Cameroon Mining Permit Decree, dated April 11, 2003.

Mining Convention. Mining Convention between The Republic of Cameroon and Geovic Cameroon, S.A., dated July 31, 2002.

Nickeliferous laterite deposit. A nickel-bearing laterite deposit, occurring beneath the cobalt-nickel deposit at the Nkamouna Project.

Proterozoic granite-gneiss-schist. Proterozoic age (Pre-Cambrian) rock units of igneous granite, metamorphic gneiss and schist, or the terrain found in the vicinity of the Nkamouna laterite deposits.

Serpentinite. Bedrock, olive green to dark green, may be fractured and fissile, with silica-filled fractures. Uniformly low metals grades except in rare cases where garnierite-like nickeliferous silicates fill fractures.

Tailings facility. A containment system comprised of a compacted, earthen structure or dike and a prepared basin area that is used to contain solid tailings and water from the mineral process.

Tailings disposal. A method for disposing of tailings, waste rejects, and water from a processing operation into the tailings facility.

Terrain or terrane. A term applied to a general geologic unit or grouping with no specific definition or formal designation.

Tonne. One metric tonne is 1000 kilograms, or 2,204.6 pounds.

Upper laterite. A purplish-red, highly magnetic, powdery clay-like soil. Ubiquitous, normally 4 to 8 m thick, except where removed by erosion at the borders of laterite plateaus.

Water table. The depth below the surface where the rocks are water saturated. Geovic recorded a water table depth in several test drill holes which varied from approximately 12 to approximately 25 meters below surface at the Nkamouna Project site.

20

Table of Contents

Description of Mineral Projects

THE NKAMOUNA PROJECT