Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-32393

Environmental Power Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 75-3117389 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

120 White Plains Road, 6th Floor, Tarrytown NY 10591

Registrant’s telephone number, including area code: (914) 631-1435

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| Common Stock, $0.01 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

| Large accelerated filer ¨ |

Accelerated filer ¨ | |||

| Non-accelerated filer x |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2009, was approximately $7.3 million based on $0.52, the price at which the registrant’s common stock was last sold on June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter.

As of February 28, 2010, the registrant had 15,708,591 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s definitive proxy statement on Schedule 14A for the registrant’s 2010 annual meeting of stockholders, to the extent filed pursuant to Regulation 14A within 120 days after the end of the registrant’s fiscal year ended December 31, 2009, are incorporated by reference into Part III of this report. In the event that such proxy statement is not filed within 120 days after the end of the registrant’s fiscal year ended December 31, 2009, the registrant will file an amendment to this report within such 120-day period setting forth the information required by Part III of this report.

Table of Contents

ENVIRONMENTAL POWER CORPORATION

ANNUAL REPORT

ON FORM 10-K

INDEX

Table of Contents

Cautionary Statement Regarding Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995, referred to as the PSLRA, provides a “safe harbor” for forward-looking statements. Certain statements contained or incorporated by reference in this Quarterly Report, such as statements concerning planned manure-to-energy systems, our sales pipeline, our backlog, our projected sales and financial performance, statements containing the words “may,” “assumes,” “forecasts,” “positions,” “predicts,” “strategy,” “will,” “expects,” “estimates,” “anticipates,” “believes,” “projects,” “intends,” “plans,” “budgets,” “potential,” “continue,” “target” and variations thereof, and other statements contained in this Quarterly Report regarding matters that are not historical facts are forward-looking statements as such term is defined in the PSLRA. Because such statements involve risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to:

| • | uncertainties involving our need for additional financing to continue as a going concern, |

| • | uncertainties regarding the ability to obtain additional financing, and the timing, amount and terms of such financing, |

| • | uncertainties regarding our payment defaults under various material obligations we and our subsidiaries have entered into and the remedies our creditors may exercise with respect thereto, |

| • | uncertainties relating to early-stage companies; |

| • | the lack of binding commitments and the need to negotiate and execute definitive agreements for the construction and financing of facilities, |

| • | the lack of binding commitments for the purchase of gas produced by certain facilities, |

| • | the lack of binding commitments for, and other uncertainties with respect to, supplies of substrate, |

| • | uncertainties regarding the costs associated with substrate and other project inputs, |

| • | risks and uncertainties relating to the development of markets for carbon sequestration credits and other marketable renewable attributes, and the level of revenues we may achieve from such sources, |

| • | uncertainties regarding the amount and rate of growth in operating expenses, |

| • | unpredictable developments, including plant outages and repair requirements as well as risks related to weather and the unpredictability of extreme weather events, |

| • | risks related to performance on the part of suppliers of components, goods and services to our facilities, |

| • | financing and cash flow requirements and uncertainties, |

| • | inexperience with the design, construction, startup and operation of multi-digester facilities, |

| • | difficulties involved in developing and executing a business plan, |

| • | technological uncertainties, including those relating to competing products and technologies, |

| • | commodity price volatility, particularly with respect to the price of natural gas, |

| • | the difficulty of estimating construction, development, repair, maintenance and operating costs and timeframes, |

| • | the uncertainties involved in estimating insurance and warranty recoveries, if any, |

| • | the inability to predict the course or outcome of any negotiations with parties involved with our projects, |

| • | uncertainties relating to general economic and industry conditions, |

| • | uncertainties relating to government and regulatory policies, the legal environment, intellectual property issues and the competitive environment in which Environmental Power Corporation and its subsidiaries operate, |

and other factors, including those described in Part I, Item 1A of this Annual Report on Form 10-K under the heading “Risk Factors,” as well as factors set forth in other filings we make with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date that they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

Table of Contents

| Item 1. | Business |

Overview

Environmental Power is a developer, owner and operator of renewable energy production facilities. Environmental Power’s goal is to produce energy that is Beyond Renewable™, which Environmental Power defines as energy that not only is derived from waste materials instead of precious resources, but energy that is also clean and reliable. Environmental Power and its subsidiaries develop and own facilities that, unlike many renewable energy facilities, are intended to be profitable without the need for federal tax subsidies. Any such government assistance would, however, benefit Environmental Power’s facilities by increasing their potential for profitability, while at the same time expanding opportunities for the profitable deployment of such facilities. Environmental Power believes that a number of factors, including volatile energy prices, greater desire for renewable energy sources, more stringent environmental and waste management requirements imposed on farmers and food industry waste producers, and revenue opportunities from carbon sequestration credits will continue to provide favorable market conditions for its business.

In the past, we have operated in two major segments, through Microgy, Inc., as a developer of renewable energy facilities for the production and commercial application of methane-rich biogas from agricultural and food industry and other organic wastes, and through EPC Corporation and its subsidiary, Buzzard Power Corporation, referred to as Buzzard, the holder of a leasehold interest in a waste-coal fired generating facility in Pennsylvania known as the Scrubgrass facility. On May 31, 2007, our board of directors authorized management to enter into negotiations regarding the disposition of the leasehold interest in the Scrubgrass facility. On February 29, 2008, we completed the disposition of the leasehold interest. As a result, for financial reporting purposes, we are now consolidating all segments of continuing operations and reporting the results of Buzzard as “discontinued operations”. We thus now operate only in Microgy’s segment.

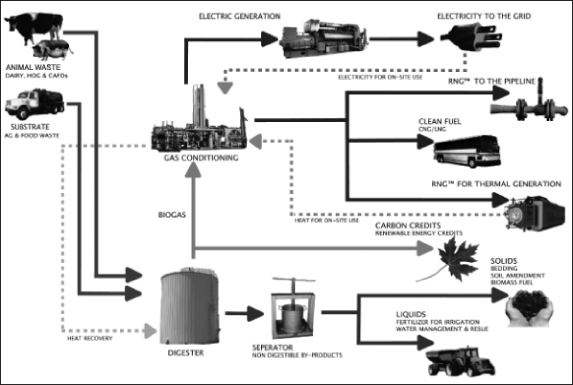

Microgy is a developer of renewable energy facilities for the production and commercial application of methane-rich biogas produced from animal, food industry and other organic wastes. The biogas can be sold to end-users or used to produce pipeline-grade methane, which Microgy refers to as renewable natural gas, or RNG®, liquefied natural gas, or LNG, compressed natural gas, or CNG, renewable electrical energy or thermal energy, as well as other useful by-products. Microgy’s systems utilize a proven European biogas production technology. In addition, Microgy has developed significant engineering, construction and process knowledge regarding these systems.

Due to the increased demand for renewable energy, Microgy believes that its systems can be profitable without the need for federal subsidies, rebates, or grants. Nevertheless, Microgy believes that tax credits and other such incentives may be available in the future to Microgy’s facilities, and such incentives would serve to enhance the potential profitability of its facilities. Future climate change legislation, if any, may enhance the value of Microgy’s products. In addition, the energy output from Microgy’s systems may carry a premium price in some areas, as numerous environmentally responsible entities are seeking renewable energy sources and many states have either passed or are considering legislation requiring utilities to obtain or generate a certain percentage of their power from renewable sources.

In addition to the value generated from the production and sale of renewable gas, our facilities produce soil amendment products that can be used as a bedding, compost or peat moss and liquid fertilizer that can be used for crop growth. We believe that our facilities can generate additional environmental benefits with significant economic and social value by providing a valuable waste management solution for farms and other producers of organic wastes, such as those in the food industry. Federal and state agencies have either passed or are considering regulations that require concentrated animal feeding operations, referred to as CAFOs, to implement changes to their current waste management practices. We believe that these increasingly stringent environmental regulations will be another factor creating opportunities for the deployment of our systems.

2

Table of Contents

Microgy intends to continue to focus on its strategy of developing large-scale, standardized facilities utilizing an ownership model either entirely or together with financial or operating partners. Under this model Microgy will construct, own and operate facilities and profit from the ongoing sale of biogas or RNG® as well as sales of greenhouse gas sequestration credits or other marketable environmental benefits. This strategy encompasses the construction and operation of stand-alone merchant plants like the Huckabay Ridge facility described below, as well as facilities dedicated to the needs of a single customer at one or more customer locations, such as the Grand Island facility described below. By pursuing this strategy, Microgy intends to accumulate gas production and carbon sequestration capacity over time. In addition, Microgy continues to standardize both its system design and its approach to the marketplace in order to allow for a cost-effective scale-up of its business.

Having constructed both the multi- and single-tank system in four currently operating installations, Microgy intends to own the digester systems it develops, either outright, through an affiliated company, or in substantial part, through HMI Energy, LLC, a joint-venture company formed in January 2010 (discussed further below), in which Microgy owns 30% of the membership interests. Our multi-digester facilities will primarily produce pipeline-quality renewable natural gas, although we will also consider opportunities to produce and sell conditioned biogas, electricity, compressed natural gas, referred to as CNG, or liquid natural gas, referred to as LNG, from our facilities. Microgy’s development efforts are focused on applications of its technology that are resource efficient. Development of smaller scale and single-digester facilities will be targeted toward customers that have multiple sites and opportunities that have shorter development cycles.

Microgy’s efforts have resulted, most recently, in the start of commercial operations at the Huckabay Ridge facility in Stephenville, Texas, which began commercial operations in the first quarter of 2008. Huckabay Ridge consists of eight 916,000-gallon digesters which operate together to process the manure from approximately 10,000 cows and produce 575,000 million British Thermal Units, or MMBtus, of RNG® annually. The gas is treated and compressed to produce pipeline grade methane that is sold and delivered directly into nearby natural gas pipelines. Huckabay Ridge is expected to produce approximately 782,000 MMBtus, of pipeline-grade methane for sale per year once a planned combined heat and power, or CHP, system has been installed and potential modifications made to the gas processing systems.

We have two other multi-digester facilities in development in Texas having expected output of 670,000 MMBtus. We have also announced three proposed multi-digester RNG® facilities in California, and a proposed multi-digester RNG® facility in Colorado. These projects are in various stages of development. In January 2010, Microgy contributed its interest in one of the California projects and the Colorado project to the new joint venture, HMI Energy, LLC, described below.

In addition, Microgy has commenced construction of a multi-digester renewable biogas facility to be located at the flagship Grand Island, Nebraska beef processing plant of JBS Swift & Company, referred to as Swift. Under the terms of the agreement with Swift, Microgy will construct, own and operate the facility and sell its gas output to Swift for use in its operations to offset natural gas utilization pursuant to a 15-year gas purchase agreement. The Grand Island facility will consist of two 1.3 million gallon digesters that will process wastes generated by the Grand Island processing facility and that we expect will be able to produce approximately 235,000 MMBtus per year. We completed $7.0 million in tax-exempt bond financing in Nebraska in July 2008 to finance a portion of the construction costs of the Grand Island facility. However these bonds are currently in default and the trustee or 25% of the bondholders could accelerate the bonds and demand repayment at any time. We are currently seeking a solution to these circumstances, including the financing to complete construction of the facility, but we cannot assure you that we will be successful in doing so on favorable terms, or at all.

In addition, Microgy is operating three single digester facilities in Wisconsin. Microgy sold these projects to the farms on which they are located, and developed them in conjunction with Dairyland Power Cooperative, an electric cooperative utility, referred to as Dairyland. The biogas from these projects is used by Dairyland to

3

Table of Contents

generate electricity. In January 2010, Microgy contributed the rights to the net revenues of the Wisconsin facilities to HMI Energy, LLC, a joint venture between Microgy, Inc. and Homeland Renewable Energy, Inc. Microgy retains a 30% membership interest in the joint venture.

The Microgy Market Opportunity

We believe that facilities based on Microgy’s technology can generate profitable quantities of marketable, renewable gas from animal and food industry wastes and by-products and other organic waste streams. Increased interest in renewable energy sources, as well as a desire for energy not subject to commodity price fluctuations, drives demand for each of these uses of gas produced by Microgy’s systems. Also, we believe that increasingly stringent environmental regulations concerning handling of animal and other wastes motivate demand for Microgy’s systems at or near CAFO and food industry sites. The ultimate opportunity to develop facilities, as well as to manage and/or operate them profitably, depends on numerous factors, including the value that can be derived from the various markets described below.

Gas. While natural gas prices have been and continue to be volatile, we anticipate increases in natural gas prices in the long-term due to considerable increases in demand for gas both domestically and overseas. In the United States, this increase will be due principally to the fuel needs of the power plants that have been built in the past decade, as well as relatively limited increases in natural gas delivery capabilities. In addition, developing countries, including China and India, are becoming large consumers of energy, placing further pressure on prices for fossil fuels. Microgy’s systems produce commercial quantities of biogas with a high percentage of methane, which is then refined to RNG® by processing it with scrubbing devices to remove carbon dioxide, sulfur compounds and other impurities. Microgy’s systems for the production of RNG®, unlike natural gas wells, do not suffer depletion and are consistent sources of output so long as required inputs are available.

Renewable Energy. We believe that market and political forces will continue to drive increased adoption of renewable energy sources, principally due to increasing concerns about the price, volatility, supply stability and environmental impact of conventional fuels. The demand for energy produced from renewable resources may provide our facilities with a variety of benefits, including federal and state renewable power production and investment credits, tax credits and greenhouse gas sequestration credits, as well as a competitive advantage as compared to conventional sources of supply. For example, currently 33 states, including Texas and California and the District of Columbia, have enacted a renewable portfolio standard or other state mandates requiring electric utilities to increase their use of renewable energy resources such as wind, solar, and bioenergy. We believe that the directives embodied in the Energy Policy Act of 2005, the 2008 Farm Bill, and the American Recovery and Reinvestment Act of 2009 and the accompanying tax credits and related benefits should serve to further drive adoption of renewable energy solutions like those provided by Microgy.

We also believe that the greenhouse gas sequestration credits that Microgy’s facilities are expected to produce will be marketable. Importantly, digester projects that reduce methane emissions compared to baseline conditions produce offsets that qualify under many mandatory and voluntary programs in place. However, the specific methodologies for calculation and monitoring vary widely.

While in many cases we are required to share the benefits of such credits with our business partners and investors, we nevertheless expect such offsets to enhance the economics of our facilities. We believe that our share of the market for greenhouse gas sequestration credits will add value and enhance the financial viability of our facilities.

Climate change legislation currently under consideration, as well as international treaties relating to climate change, may further drive demand for Microgy’s products, including greenhouse gas offsets, or provide further production incentives.

4

Table of Contents

Microgy’s Strategy

Our objective is to become a leader in the renewable energy sector through the production and marketing of pipeline grade gas and biogas and in the development of pipeline gas production capacity and biogas resources, which will constitute gas reserves under our control. Key elements of our strategy include:

Developing facilities in which we will have an ownership interest, thereby developing and growing non-depleting biogas reserves under our management. We intend to continue to focus on an ownership model, in which we own facilities entirely or together with financial or operational partners. We believe that this ownership model will allow us to profit from the sale of biogas or pipeline-grade gas for the operational life of the facilities. By owning and operating such facilities, and by securing the supply of required amounts of manure and substrates, we seek to develop and grow a portfolio of gas reserves under our control. We view our facilities as gas wells but without the typical depletion curve, so long as required inputs are available.

Capitalizing on the environmental attributes, as well as the renewable nature of the energy, generated by our facilities. We believe that the environmental attributes, such as greenhouse gas sequestration credits, generated by our facilities represent a potential source of revenue, and we intend to pursue commercialization of these attributes, through sales into trading markets as well as bi-lateral and revenue sharing arrangements. In addition, we believe that the renewable nature of the gas produced by our facilities will be attractive to certain purchasers, including entities required to achieve renewable portfolio standards, and may result in premium prices in some cases. We intend to aggressively market the renewable quality of our gas to these purchasers.

Focusing development efforts on markets allowing for rapid and cost-effective scale-up of our business. Microgy has now constructed both the multi- and single-tank system in four currently operating installations. Our multi-digester facilities will primarily produce pipeline quality renewable natural gas, although we will also consider opportunities to produce and sell conditioned biogas, electricity, CNG and LNG from our facilities. Microgy’s development efforts are focused on applications of its technology that are resource efficient. Development of smaller scale and single-digester facilities will be targeted toward customers that have multiple sites and opportunities that have shorter development cycles.

Standardizing systems to allow for rapid and cost-effective replication and scalability. We intend to standardize and streamline elements of our systems so that we can drive down their costs and implement them more rapidly. Toward this end, Microgy is refining the design of its multi-tank system based on knowledge gained from its Huckabay Ridge facility, and is pursuing standardization of components, procurement channels, vendors, and design-build contracts to allow for rapid and cost-effective construction.

Pursuing the advantages of our business model, in which we create and manage profitable renewable energy opportunities while alleviating the environmental pressures facing agriculture and food industry participants. We believe we are the leading provider of large scale RNG based anaerobic digesters that is aggressively pursuing a business model of creating and managing profitable renewable energy opportunities while simultaneously addressing customers’ environmental issues. Furthermore, by operating and maintaining the facilities ourselves, we believe that we will be able to maximize gas production and control the supply of required materials. To our knowledge, many other suppliers of anaerobic digestion systems merely supply the equipment, and leave the ongoing operation of the system to the purchaser. By pursuing our business model, we believe we can provide a compelling value proposition to our customers.

Microgy’s Products and Services

With respect to current and future projects such as our multi-digester RNG® facilities in Texas and California, as well as our smaller-scale, multi-digester dedicated facilities, such as the facility being built for Swift, Microgy seeks to own and operate all or part of each facility, thereby profiting from the sale of the gas produced, whether by the sale of gas as a commodity or to end-users or other purchasers pursuant to longer-term

5

Table of Contents

supply agreements. Therefore, we expect our principal commercial product to be the RNG® or biogas produced by our facilities, together with tradable environmental attributes, such as greenhouse gas offset credits. In addition, other by-products of the operation of these facilities may have commercial value as soil amendments, fertilizer and animal bedding.

An analysis of our sales by product for each of the three years in the period ended December 31, 2009 is as follows:

| 2009 | 2008 | 2007 | |||||||

| Gas sales |

$ | 3,836,800 | $ | 2,173,453 | $ | 540,047 | |||

| Operation and maintenance services |

348,222 | 325,339 | 371,344 | ||||||

| Tipping fees |

425,605 | 152,873 | 188,597 | ||||||

| Carbon credit sales |

18,409 | 246,891 | 67,489 | ||||||

| Grant revenue |

82,411 | — | — | ||||||

| Other |

— | 6,482 | 7,470 | ||||||

| Total revenue |

$ | 4,711,447 | $ | 2,905,038 | $ | 1,174,947 | |||

Microgy’s Technology

At the heart of the Microgy system is an enhanced biogas production system. Whereas previous systems had principally focused on the environmental remediation aspects of digestion and produced biogas as a by-product, the Microgy system is designed specifically to maximize biogas production. Methane is the main product of the process, making up approximately 60% of the resulting biogas. Microgy’s system can be easily coupled to standard, generally commercially available gas conditioning equipment in order to clean the biogas to produce RNG®, or the biogas can be burned for use in electric generation or other thermal energy applications. Other by-products of the process can include fertilizers, bedding, compost and other bio-solid products that have economic value and may be marketable.

Microgy’s proprietary process mixes animal manure with additional substrates, such as food industry wastes and by-products containing fats, proteins and carbohydrates, in a process referred to as co-digestion. The manure provides the anaerobic bacteria that are the engine of the biogas production process, while also serving as a buffer that assists in maintaining the reaction at proper levels. A wide variety of materials can provide the proteins, fats and carbohydrates that enhance the biological process in our digesters. Substrates that we might use in our digesters include waste crop oils, spoiled food, animal fats, used greases and cooking oils, brewery waste and cheese waste. These materials are widely available but tend to be concentrated in urban areas. The addition of substrate significantly increases gas production, with the relative contributions of substrate and manure to the production of biogas varying depending upon the type of substrate used. The ability to add substrate with known characteristics to our process helps us to balance the health of the digester while increasing biogas output. The controlled combination of these wastes with the manure, along with our operational controls and technical know-how, represent the essential elements of our proprietary approach to the market.

Some substrate materials are useful inputs into other energy production processes or may even be substitutes for animal feed. As such, the value of those materials may change over time depending on market dynamics, emerging technologies or even tax policy. We have focused our efforts on procuring substrates that do not have alternate uses for which companies typically pay a fee for disposal. In some cases, we are paid “tipping fees” associated with the disposal of these materials, which helps us to mitigate the costs of transporting substrate to our site. Substrate availability, market conditions and transportation requirements can vary significantly by region. As such, project location is an important consideration in determining project feasibility. We have in place a substrate management team that works with our strategic partners to identify and evaluate potential materials and manage logistics.

6

Table of Contents

Microgy’s system utilizes sophisticated equipment and control systems. This allows us to manage the recipe for digestion in each tank, maintain temperature control and adjust the mixing rate. In addition, the Microgy system is composed of steel tanks and piping, which are durable and nonporous, allowing for calibration of the process within a controlled environment and appropriate management of ongoing gas production and equipment operations. Furthermore, the high level of gas output and its high methane content allows for application of other technologies, such as those used for gas conditioning. Coupled with the technical advantages of the system is a suite of proprietary processes and “know how” to achieve the anticipated levels of biogas production.

License Agreement with Danish Biogas Technology A/S

Microgy licenses the anaerobic digestion portion of its technology from Danish Biogas Technology A/S, referred to as DBT. DBT’s parent, Xergi A/S, referred to as Xergi, is 50% owned by Schouw & Co., a Danish public company and 50% by DDH, a Danish environmental and engineering firm. DBT has been a leader in the development of this technology and has constructed 30 anaerobic digester facilities in Europe over the past 15 years. In Denmark, DBT’s systems have been successful in providing manure management and viable renewable energy for many years.

In May 2000, Microgy entered into a licensing agreement with DBT that granted Microgy a perpetual and exclusive license in North America for the commercial development and use of certain proprietary technologies, including Microgy’s core anaerobic digestion technology. This license agreement was amended in April 2003 and March 2005 to further define certain support obligations of DBT and to amend the structure of the compensation payable to DBT for use of the license.

In April 2009, Environmental Power and Microgy entered into a Cooperation Agreement with DBT and Xergi, referred to as the Cooperation Agreement. The Cooperation Agreement supersedes the license agreement described above. The Cooperation Agreement, while maintaining many of the original business concepts

7

Table of Contents

contained in the original license agreement, restructures the license agreement to reflect Microgy’s shift to a build, own and operate business model from the original digester equipment sales model and better defines the respective roles of the parties to enable them to more efficiently interface going forward.

The Cooperation Agreement addresses anaerobic-digester plants incorporating above-ground digesters with mixers, referred to as the DBT Technology. Pursuant to the Cooperation Agreement, DBT grants to Microgy an irrevocable and perpetual right and license to utilize the DBT Technology in the design, construction, and/or operation by Environmental Power, Microgy and their affiliates of anaerobic-digesters and related systems. This grant is exclusive as to North America for the term set forth in the Cooperation Agreement and is non-exclusive as to North America thereafter, excludes Europe during the term but is non-exclusive as to Europe thereafter. As in the original license agreements, the grant is non-exclusive as to the rest of the world, leaving each party free to pursue projects outside of North America and Europe. The Cooperation Agreement further provides that commencing as of May 2009, Microgy may utilize digester technologies other than the DBT Technology throughout the world.

As part of the Cooperation Agreement, the Company agreed to pay a $500,000 license fee for the Swift Grand Island project. The Company has only paid $200,000 to date and the remaining $300,000 is overdue for payment. While DBT has given us notice of material breach under the Cooperation Agreement as a result of the failure to make this payment, it has not taken any action with respect to such failure.

The Agreement became effective in May 2009 when DBT received an up-front payment of certain license fees for certain Microgy projects of Microgy’s choosing, which were paid for by Environmental Power’s issuance of its 14% Convertible Notes due January 1, 2014, referred to as the 14% convertible notes, in the original principal amount of $3,000,000. The January 1, 2010 interest payment due on the 14% convertible notes issued to DBT, along with interest due on the other $5,000,000 principal amount of 14% convertible notes previously issued, was not paid by EPC. The trustee has given the Company notice of default but to date neither the trustee nor any of the note holders have made any attempt to accelerate payment of these notes.

Facility and Business Development Efforts

Identified Facilities Development

The following table sets forth facilities that we have identified to date as being under development by Microgy and its affiliates, including information with respect to the type of facility, its location, and its anticipated output:

| Facility |

Location | Type Gas | RNG Production(a) | |||

| Rio Leche |

TX | RNG® | 670,000 | |||

| Cnossen |

TX | RNG® | 670,000 | |||

| Hanford Cluster |

CA | RNG® | 618,000 | |||

| Bar 20(b) |

CA | RNG® | 629,000 | |||

| Maddox |

CA | RNG® | 340,000 | |||

| Weld County(b) |

CO | RNG® | 651,000 | |||

| Swift-Grand Island |

NE | Inside-the-Fence | 235,000 | |||

| Total |

3,813,000 | |||||

| (a) | Expected gas production in MMBtu / year at full operation |

| (b) | Ownership transferred in January 2010 to HMI Energy, LLC, in which Microgy has a 30% interest. |

The foregoing table does not include the Huckabay Ridge facility, which commenced operations in 2008.

8

Table of Contents

The HMI Energy Joint Venture

We have been examining various strategic alternatives over the last several months in support of the build-out of Microgy’s project pipeline. In connection with these efforts, in January 2010, Microgy formed a joint development company with Homeland Renewable Energy, Inc., referred to as HRE, whereby Microgy contributed certain assets, as more fully described below, as its equity contribution for a 30% ownership position, and HRE will contribute $1,500,000 in cash as its equity contribution for its 70% ownership position.

We entered into the following agreements relating to the joint venture with HRE, referred to as the JV Agreements:

| • | a Contribution Agreement, dated January 29, 2010, referred to as the Microgy Contribution Agreement, among Microgy, HMI Energy, LLC, referred to as HMI, and Environmental Power; |

| • | a Contribution Agreement, dated January 29, 2010, referred to as the HRE Contribution Agreement, between HRE and HMI; and |

| • | a Limited Liability Company Agreement of HMI, dated January 29, 2010, referred to as the LLC Agreement, between Microgy and HRE. |

Pursuant to the Microgy Contribution Agreement, Microgy contributed to HMI

| • | certain assets relating to its proposed Bar 20 project in California and its proposed Weld County project in Colorado, |

| • | right of first refusal on up to five additional future projects, |

| • | Microgy’s right to receive net revenues from its Wisconsin projects and the rights and obligations relating to such projects, and |

| • | Microgy’s right to net receipts from sales of carbon credits available to Microgy, other than those owned or otherwise available to our other subsidiaries, Microgy Holdings and Microgy Grand Island. |

In exchange for the foregoing assets, Microgy received 30% of the outstanding membership interests in HMI and has received payments from HMI totaling $1,100,000. The remaining $400,000 is due and expected shortly.

In connection with the transactions contemplated by the Microgy Contribution Agreement and the HRE Contribution Agreement, Microgy and HRE entered into the LLC Agreement, which sets forth:

| • | customary terms for the governance of HMI, consistent with HRE’s majority ownership but providing for certain minority protections for Microgy; |

| • | provisions relating to capital calls for financing the joint venture’s projects, including provision for an effective 12% carried interest for Microgy in any project for which it does not meet the capital call and an effective 21% carried interest for HRE in any project for which it does not meet the capital call; |

| • | provisions relating to the negotiation of a Management Services Agreement, pursuant to which Microgy would provide customary management services to HMI, and an Operations and Maintenance Agreement, pursuant to which Microgy would provide customary operations and maintenance services to projects developed by HMI, each to be on commercially reasonably terms, including reimbursement of costs and market-based fees; |

| • | rights of first refusal on the part of HMI with respect to the development and ownership of Microgy’s next five projects and Microgy’s obligation to use its development efforts exclusively for the benefit of HMI, which rights of refusal and exclusivity obligations terminate upon the earlier to occur of Microgy obtaining all necessary site and manure supply agreements, construction permits and approvals and commercially reasonable offtake agreements for all five such projects or the expiration or termination of the management services agreement and operations and maintenance agreement; and |

| • | the limited right to buy out HRE’s ownership in HMI for 120% of the purchase price paid for the membership interests in HMI in certain circumstances. |

9

Table of Contents

HRE specializes in large scale animal waste remediation in the United States, through the development, construction and operation of renewable energy power plants fueled by poultry litter and other agricultural residues. In addition, HRE markets the ash residue from poultry litter combustion as a nutrient rich fertilizer and develops woody biomass fueled power plants through a joint venture with Laidlaw Energy (OTC: LLEG.PK). Microgy believes that entering into the JV Agreements with HRE will provide it with a business partner that can assist Microgy in accelerating the development of the projects contributed by Microgy to the joint venture.

Customers and Suppliers

Customers

Microgy intends to sell the gas generated by its facilities pursuant to mid- to long-term purchase and sale commitments with fixed or predictable prices, at a premium to the natural gas market. When beneficial, Microgy may elect to sell some of the gas in the spot market, as a commodity with price hedging mechanisms.

Microgy’s smaller-scale multi-digester facilities will be developed to supply the gas needs of a single customer on-site, such as Swift, pursuant to a long-term purchase and sale agreement, though Microgy expects to have the right to market excess gas not used by these customers.

In the twelve months ending December 31, 2009, we recognized $3,763,000 in total revenues from sales of RNG®, tipping fees and a grant at our Huckabay Ridge facility and revenues of $948,000 from gas sales, operations and maintenance services and greenhouse gas sequestration credit sales related to the Wisconsin facilities.

Microgy had two significant customers in 2009, Dairyland and Pacific Gas & Electric Company. In 2009, Pacific Gas and Electric accounted for 70% of revenues and Dairyland accounted for 19% of revenues. We believe our relationship with these customers is good.

In March 2009, we signed a 10 year renewable natural gas supply agreement with Xcel Energy. The agreement, which has an additional 10 year option, provides that the Microgy RNG® will be sold to Xcel on a fixed price basis at a premium to the current market price for traditional natural gas. The production will come from a facility in Colorado on which we intend to commence construction when we have obtained the necessary permits, equity and debt financing.

Suppliers

Microgy and its affiliates generally obtain the construction materials and equipment necessary to construct and operate their facilities from commercial sources pursuant to purchase orders and similar arrangements. Microgy believes these materials and equipment to be generally commercially available. Microgy and its affiliates generally enter into manure handling agreements with the farms on which their facilities are located for the supply of manure for the operation of such facilities, or arrangements for the operation by third parties of manure composting operations on land owned by Microgy affiliates. Microgy generally seeks to locate its large-scale multi-digester facilities in areas with a high concentration of manure from diverse sources.

Substrate for a facility can be obtained from a variety of sources, either on an opportunistic basis, pursuant to informal supply relationships, or from the operations of the consumer of the gas, in the case of the smaller-scale, single customer installations. Substrate can also be obtained via long-term contract, such as the agreement in place with Liquid Environmental Solutions Corp.

Discontinued Operations

Buzzard Power Corporation, referred to as Buzzard, is a subsidiary of our wholly-owned subsidiary, EPC Corporation. Buzzard formerly leased a generating facility from Scrubgrass Generating Company, L.P. The Scrubgrass plant, referred to as Scrubgrass, located on a 600-acre site in Venango County, Pennsylvania, is an approximate 83 megawatt waste coal-fired electric generating station. Buzzard completed the disposition of its leasehold interest in this facility on February 29, 2008.

10

Table of Contents

Competition

Microgy plans to generate revenue from the development and ownership of facilities that market renewable, “green” energy in addition to providing pollution control features to the agricultural and food industry markets. Microgy’s “green” competitors include other energy producers using biomass combustion, biomass anaerobic digestion, geothermal, solar, wind, new hydro and other renewable sources. These companies represent a significant class of competitors because they will compete with Microgy for sale of marketable renewable energy credits and participation in various renewable portfolios and other programs.

Competition in the traditional energy business from electric utilities and other energy companies is well established, with many substantial entities having multi-billion dollar, multi-national operations. Many of these companies are beginning to compete in the alternative fuels and renewable energy business with the growth of the industry and the advent of many new technologies. Larger companies, due to their greater financial and other resources, will be better positioned than Microgy to develop new technologies and to install existing or more advanced renewable energy facilities, which could harm Microgy’s business. Microgy also faces many forms of competition with respect to the resources required to operate its facilities. Such competition includes other providers of pollution control, including environmental engineers, providers of pollution control systems, private companies, public companies, associations, cooperatives, government programs, foreign companies, and educational pilot programs. Furthermore, there are many companies that offer anaerobic digester systems. A number of competitors have more mature businesses and have successfully installed anaerobic digester systems in the United States. Microgy may be forced to compete with any of these competitors for access to equipment, construction supplies, skilled labor for the construction and operation of its facilities and the supplies of manure and substrate required to operate its facilities. In addition, Microgy may also have to compete for access to substances that make desirable substrates with other users of these substances, such as recyclers of waste grease and producers of biodiesel and other biofuels. The effect of such competition could be reflected in higher costs associated with obtaining access to these resources, as well as an insufficient supply of these resources for the profitable operation of Microgy’s facilities.

Environmental Regulation

Our present and any future projects are and will be subject to various federal, state and local regulations pertaining to the protection of the environment, primarily in the areas of water and air pollution and waste management. Microgy intends to build plants in various states. These facilities will be subject to federal, state and local regulatory requirements in all the locations where they may operate.

In many cases, these regulations require a lengthy and complex process of obtaining and maintaining licenses, permits and approvals from federal, state and local agencies. We also have and will have significant administrative responsibilities to monitor our compliance with the regulations. As regulations are enacted or adopted in any of these jurisdictions, we cannot predict the effect of compliance therewith on our business. Our failure to comply with all new applicable requirements could require modifications to operating facilities. During periods of non-compliance, our operating facilities may be forced to shut down until the compliance issues are resolved. We are responsible for ensuring the compliance of our facilities with all the applicable requirements and, accordingly, we attempt to minimize these risks by dealing with reputable contractors and using appropriate technology to measure compliance with the applicable standards. The cost of environmental regulation, including the associated asset retirement obligation, does and will continue to affect our profitability.

Depending on the location of each individual plant, the federal Clean Water Act and state implementation plans of the federal Clean Air Act, as well as other state and local laws, may apply to Microgy’s projects. The primary federal law affecting manure management on animal operations is the Clean Water Act, under which the National Pollutant Discharge Elimination System, or NPDES, program covers concentrated CAFOs.

Federal NPDES permits may be issued by the EPA or any state authorized by the EPA to implement the NPDES program. The EPA has certified 45 states to issue their own NPDES permits. Furthermore, in December

11

Table of Contents

2002, the EPA issued new rules to regulate manure run-off on farms, one of the nation’s leading causes of water pollution. The new rules apply to an estimated 15,500 livestock operations across the country. These farms will need to obtain permits, submit an annual report, and develop and follow a plan that will ensure that measures are being instituted to minimize runoff from wastewater and manure. We believe that these requirements represent a significant opportunity for Microgy, insofar as a Microgy system can play a useful role in any animal waste management program.

We expect that all of our facilities will be required to obtain various state and local environmental and other permits and approvals. For example, grease-trap waste from restaurants and other food service providers is a desirable and highly available form of substrate for our facilities in Texas. The Texas Commission of Environmental Quality (TCEQ) environmental authorities classify grease-trap waste as Municipal Solid Waste (MSW) and such waste is managed as a non-hazardous municipal waste. Microgy is required to obtain a solid waste permit for each of our planned facilities in Texas to the extent we desire to use grease-trap waste as substrate in the operation of such facilities, and have obtained such a permit for the Huckabay Ridge facility. In addition, we have obtained water discharge permits for each of our planned California facilities, and obtaining such permits is a lengthy process. To date, our experience in obtaining such permits has been positive but future projects may, however, present unique circumstances, and the timing and cost of permits may be uncertain.

We expect that any climate change legislation, or any international treaties relating to climate change, may have a positive effect on our business to the extent that they increase demand for our projects or enhance the market for the greenhouse gas offsets and credits produced by our facilities.

Energy Regulation

As evidenced by the facilities developed by Microgy in Wisconsin, Microgy’s anaerobic digester facilities can be used for the generation of electricity. In the event that Microgy were to pursue applications of its technology for the generation of electricity for sale by Microgy into the electric grid, any such generating facility would become subject to the complex matrix of federal and state regulation of the energy sector, including the federal Public Utility Regulatory Policies Act, the Federal Power Act and the regulation and oversight of state public utility commissions. Microgy, itself, does not currently produce electricity for sale into the electric grid.

Employees

As of December 31, 2009, we had thirty-one full and part-time employees, including executive officers and other marketing, finance, engineering and administrative personnel. None of our employees are represented by a collective bargaining agreement, and we consider our relations with our employees to be good. Eleven of the thirty-one employees are operating personnel at our Wisconsin or Texas facilities.

Available Information

We maintain a website with the address www.environmentalpower.com. We are not including the information contained on our website as part of, or incorporating it by reference into this annual report. We make available free of charge on or through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission.

12

Table of Contents

| ITEM 1A. | RISK FACTORS |

Investing in our securities, involves a high degree of risk. You should carefully consider the risks and uncertainties described below before purchasing our securities. The risks and uncertainties described below are not the only ones facing our company. Additional risks and uncertainties may also impair our business operations and adversely affect our prospects. The order in which such risks are presented does not necessarily reflect the relative importance of such risks or the likelihood that any of the events or circumstances described below will occur or exist.

If any of the following risks actually occur, our business, financial condition or results of operations would likely suffer. In that case, the trading price of our common stock could fall and you may lose all or part of the money you paid to buy our common stock.

Risks Relating to Our Business

We have experienced losses to date, and we anticipate that we will continue to experience losses through at least 2012, which means that we will have to raise significant additional financing during the first half of 2010 in order to continue our business operations. The opinion from our independent auditors as of December 31, 2009, stated that there is substantial doubt at December 31, 2009, about our ability to continue as a going concern.

We are a company that has been pursuing an aggressive and novel business approach to the construction and operation of renewable energy facilities and the production of renewable natural gas. As noted below, our sole operating business, Microgy, is in the early stages of its development. As a result, we have a history of losses. For the twelve months ended December 31, 2009, we incurred a net loss from continuing operations of $36,112,000 including a non-cash write-down for the impairment of certain assets of $26,070,000. For the year ended December 31, 2008, we incurred a net loss from continuing operations of $22,996,000 which includes a non-cash, non-recurring expense for the impairment of goodwill of $4,913,000. For the year ended December 31, 2007 we incurred a net loss from continuing operations of $11,161,000. We expect to continue to incur losses, reduce our earnings or, as the case may be, add to our deficit as we seek to further develop our business. We currently expect that these ongoing losses will adversely affect our financial condition through at least 2012. Future losses are likely to continue unless we successfully implement our business plan. As a result of these losses, we anticipate that we will, in all likelihood, have to rely on external financing for most of our capital and operational requirements. We will need to raise substantial financing in order to fund ongoing general and administrative expenses associated with our corporate overhead, debt service and dividend requirements to continue as a going concern. While we have raised $1,100,000 in cash to date from the contribution of certain assets to a joint venture, these funds will not be sufficient to meet our operating needs during the first half of 2010. We currently have no commitments for any additional financing. We cannot assure you such financing will be available on reasonable terms or in a timely fashion, or at all, particularly in the current economic environment, in which capital raising activities are especially challenging. Our inability to obtain adequate financing would likely result in the need to cease our business operations and would materially impair the value of your investment in our securities.

As a result of our failure to make certain payments, we and our subsidiaries are currently in default under various obligations, and we cannot determine the remedies our creditors may exercise.

We failed to make the payment in respect of the January 1, 2010 interest payment on our 14% Convertible Notes due January 1, 2014, referred to as the 14% convertible notes. In addition, we failed to make certain payments to Xergi, A/S, referred to as Xergi, under our Cooperation Agreement, dated April 23, 2009, referred to as the Cooperation Agreement, among us, our subsidiary, Microgy, Inc., Xergi and Danish Biogas Technology, A/S, referred to as DBT. Our subsidiary, Microgy Holdings, LLC, referred to as Microgy Holdings, failed to make the payments in respect to the December 1, 2009 interest payments on the remaining Texas tax-exempt bonds and California tax-exempt bonds on which it and its subsidiaries are obligated from its own funds. In

13

Table of Contents

addition, our subsidiary, Microgy Grand Island, LLC, failed to make payments in respect to the December 1, 2009 interest payments on the Nebraska tax-exempt bonds on which it is obligated from its own funds, and has other creditors which remain unpaid. We have been given notice of default under the indenture for the 14% convertible notes, but neither the holders nor the trustee thereunder have taken any further action with respect to such default. We have been given notice of default under the indentures for the Texas and California tax-exempt bonds, and the holders of the Texas and California tax-exempt bonds have accelerated the obligations associated with the bonds in full, but have not taken any further action to enforce their rights in any collateral. We have not been given notice of default under the indenture for the Nebraska tax-exempt bonds, and neither the holders nor the trustee thereunder have taken any action with respect to such default. Finally, we have been given notice of material breach of the Cooperation Agreement, but neither Xergi nor DBT has taken any further action with respect to such breach. We currently have outstanding past due and unpaid obligations of $560,000 in respect of the 14% convertible notes, $23,088,000 in respect of the Texas tax-exempt bonds plus accrued interest from December 1, 2009, $8,356,000 in respect of the California tax-exempt bonds plus accrued interest from December 1, 2009, and $300,000 in respect of payments owed to Xergi under the Cooperation Agreement, and $1,334,000 in dividends on our series A preferred stock, among other amounts owed to other creditors. We currently do not have sufficient funds to pay any of these amounts.

We cannot predict what actions our creditors may take. Relevant agreements with Texas and California bondholders, entered into prior to the acceleration of obligations underlying the bonds, provide for cross-collateralization of all of the assets associated with our Huckabay Ridge facility, our Rio Leche and Cnossen projects in Texas, and our Riverdale and Hanford projects in California. The Nebraska tax-exempt bonds are secured by the assets associated with our Grand Island facility. Our other obligations are unsecured. The holders of the Texas, California and Nebraska tax-exempt bonds may take steps to foreclose on their collateral, although to date none has done so. Our creditors could also seek to initiate involuntary proceedings under the United States Bankruptcy Code, or we may determine that it is in our best interest to initiate such proceedings voluntarily. While we are in discussions with some of these creditors and other parties with respect to these obligations, we cannot assure you that any such discussions will result in a favorable resolution of these obligations. The foregoing circumstances, and the actions our creditors may elect to take with respect to them, are likely to result in a material adverse effect on our business as well as a material impairment of the value of your investment in our securities.

Our sole operating business, Microgy, has limited operating history from which to evaluate its business and products.

Our sole operating business, Microgy, was formed in 1999 and remains in the early stages of its development. Microgy is developing facilities that use environmentally friendly anaerobic digestion and other technologies to produce biogas from animal and organic wastes. Although Microgy has developed and operates three single digester facilities in Wisconsin and the multi-digester Huckabay Ridge facility, Microgy still has limited experience in the construction and operation of multiple digester facilities such as those Microgy is currently constructing or intends to construct, and limited experience in gas conditioning or the sale of gas as a commodity. In addition, Microgy experienced challenges during the startup and initial operation of the Huckabay Ridge facility that resulted in outages for corrective measures. We took advantage of such an outage to complete comprehensive upgrades to process-instrumentation and controls, the gas conditioning system, and the gas-collection system in order to achieve anticipated performance levels. While we gained valuable knowledge as to our processes and incorporated the lessons learned into future projects, we cannot assure you that similar challenges will not be encountered with respect to future facilities. Because of Microgy’s limited experience, there is a risk that Microgy may never be profitable.

Microgy cannot predict when any facility will be completed, what Microgy’s costs will be or, consequently, whether Microgy or any facility developed by Microgy will be profitable.

Development of Microgy’s facilities is an inherently risky activity, subject to significant uncertainties and a lengthy development cycle. Uncertainties and risks include those relating to costs and availability of supplies and

14

Table of Contents

labor, costs and quality of facility components and installation services, fluctuations in the prices available for the sale of facility output and timing of completion of construction and commencement of commercial operations. Furthermore, obtaining the large number of agreements, permits and approvals necessary to develop, install, operate and manage any of Microgy’s facilities, as well as to market the energy and other co-products and to provide necessary related resources and services, involves a long development cycle and decision-making process. Microgy is required to enter into or obtain some or all of the following in connection with the development of its facilities:

| • | Off-take interconnection agreements; |

| • | Site agreements; |

| • | Supply contracts; |

| • | Design/build or other construction-related agreements; |

| • | Off-take agreements for gas produced; |

| • | Power sales contracts for facilities dedicated to the generation of electricity; |

| • | Agreements for the sale of greenhouse gas sequestration credits or other tradable environmental attributes; |

| • | Various co-product sales agreements; |

| • | Waste disposal agreements; |

| • | Environmental and other permits and licenses; |

| • | Government approvals; and |

| • | Financing commitments required for the successful completion of facilities under consideration. |

Microgy’s failure to accomplish any of these objectives could materially increase the cost, or prevent the successful completion of, development or operation of facilities and incur the loss of any investment made. Many of these objectives are dependent upon decisions by third parties. Delays in such parties’ decision-making process are outside of our control and may have a negative impact on our development costs, cost of operations, receipt of revenue and revenue projections. We expect that, in some cases, it may take a year or more to obtain decisions on permits and approvals and to negotiate and close these complex agreements. Such delays could harm our operating results and financial condition.

As a result of the foregoing uncertainties we are unable to project with certainty Microgy’s organizational, structural, staffing or other overhead costs, the construction or operating costs associated with any facility, or whether any facility, or Microgy as a whole, will generate a profit. If Microgy fails to generate a profit, your investment in our securities will be materially, adversely affected.

If we are unable to obtain needed financing for Microgy’s facilities, the value of our Microgy investment may be reduced significantly.

Because we have not yet generated sufficient positive cash flow, and do not expect to do so until at least 2012, we do not have adequate funds on hand to complete construction of the facilities we currently have planned. We are seeking and will require corporate, project or group financing to fund the cost of any development we may decide to pursue for Microgy’s facilities. This financing may be difficult or impossible for us to obtain particularly in the current economic environment, in which capital raising activities are especially challenging. If we are unable to obtain such financing, the value of our Microgy investment may be reduced significantly, and we may be required to substantially curtail our business or completely cease construction or operation of any facilities. The availability of additional financing will depend on prospective lenders’ or investors’ review of our financial capabilities as well as specific facilities and other factors, including their

15

Table of Contents

assessment of our ability to construct and manage each facility successfully and the current state of the economy. Such financing may not be available to us on acceptable terms, or at all. If we are unable to obtain the required financing, we will have to reduce the number of projects we construct and may even have to curtail or cease our business operations, which would have a material adverse effect on your investment in our securities.

If Microgy is unable to obtain sufficient manure and substrate for its facilities at an acceptable cost, such facilities, and Microgy as a whole, will likely not be profitable.

The performance of Microgy’s facilities is dependent on the availability of large quantities of animal manure and substrates derived from animal and other organic waste resources to produce raw energy and meet performance standards in the generation of renewable natural gas. A substantial portion of the gas production of Microgy’s facilities is derived from the co-digestion contribution enabled by substrate. While Microgy has or is expected to have agreements relating to the supply of manure and substrate, these agreements may not cover all of Microgy’s requirements for such resources, and Microgy will be subject to the ability of the counterparties to such agreements to perform their obligations thereunder. Lack of manure or substrate or adverse changes in the nature or quality of such waste resources or the cost to supply or transport them would seriously affect the ability of Microgy’s facilities to produce gas at profitable levels and, consequently, its ability to develop and finance facilities and to operate efficiently and generate income. As a result, its revenue and financial condition would be materially and negatively affected. We cannot assure you that the waste resources Microgy’s facilities require will be available in the future in acceptable quantity or quality, for free or at prices that make them affordable or accessible.

Microgy is expected to derive a significant portion of its revenues from the sale of renewable natural gas; as a result it may have some exposure to volatility in the commodity price of natural gas.

Microgy is expected to derive a significant portion of its revenues from the sale of renewable natural gas. Microgy typically enters into medium to long-term off-take arrangements for the gas produced by its facilities as part of the planning and development of such facilities, and may enter into other hedging arrangements, in order to mitigate the associated commodity price risk. Furthermore, our subsidiary, Microgy Holdings, is required by the terms of its tax-exempt bonds to maintain certain gas price protection arrangements for specified periods of time. We believe that these arrangements will be considered normal purchases and sales and will not be subject to derivative accounting. However, there may be times when such off-take and hedging arrangements expire or otherwise terminate before new arrangements are put in place, and such arrangements are subject to the creditworthiness of the counterparties to them. In addition, we cannot assure you that any such risk management vehicles will always be available or successful. Because renewable natural gas commands a premium over, but still tracks prices for, conventional natural gas, Microgy will be exposed, to the extent not covered by long-term contracts, to market risk with respect to the commodity pricing of conventional natural gas. Historically, natural gas prices have been volatile and Microgy expects such volatility to continue.

We expect revenues from sales of greenhouse gas sequestration credits and other environmental attributes, but the market for such attributes is nascent and may not develop in a manner that allows us to profit from the sales of such credits to the level projected, or at all.

The multiple digester facilities that we plan to implement through Microgy Holdings and our other subsidiaries are expected to produce greenhouse gas sequestration credits and other marketable environmental attributes. While there exist trading markets for these attributes, and additional trading markets or other commercial avenues may develop, the existing trading markets are new and experience thin trading and price volatility, which can hinder sales of credits and make their value unpredictable. The quantity of credits that may be generated are a function of the carbon credit offset characteristics as determined by protocols used to document and verify the carbon offset value. These protocols continue to evolve, and changes in these protocols could substantially diminish further carbon credit eligibility. Furthermore, much of the participation in these markets is voluntary, in response to social and environmental concerns, as opposed to being driven by regulatory

16

Table of Contents

requirements. While many states and the federal government are pursuing or are considering carbon emissions limits and related initiatives that may spur greater development of and participation in these markets, we are unable to determine the effect of these initiatives on these markets. We cannot assure you that these trading markets will develop further, or even that they will continue to exist. In addition, many of our agreements with our business partners and investors require us to share such credits or any revenues we derive from sales of such credits, and agreements we negotiate in the future may also include such requirements. As a result of the foregoing, we may recognize significantly smaller revenues than we anticipate from the sale of greenhouse gas sequestration credits or other environmental attributes.

In connection with financial closings on projects, we have pledged all of our interests in our facilities in Texas and California as security for the loans relating to Microgy Holdings’ tax-exempt bond financings in those jurisdictions, and our subsidiary, Microgy Grand Island, LLC, has entered into a financing lease with respect to the Grand Island facility. We are in default on these loans and the bondholders could seek to initiate foreclosure proceedings on these assets.

We have invested, and expect to invest, substantial funds and resources in the Huckabay Ridge facility and the other multi-digester, renewable natural gas facilities in Texas, California and Nebraska. In connection with initial financial closings on the projects, we pledged all of our interest in the Huckabay Ridge facility, as well as the Rio Leche, Cnossen and Mission facilities in Texas as collateral security for the loan to our subsidiary, Microgy Holdings, from the Gulf Coast Industrial Development Authority of Texas relating to the $60 million tax-exempt bond financing we completed in November 2006. The outstanding principal amount of these bonds has been reduced to $23,088,711. We pledged all of our interest in the Riverdale and Hanford facilities in California as collateral security for the loan to our subsidiary, Microgy Holdings, from the California Statewide Communities Development Authority relating to the $62.425 million tax-exempt bond financing we completed in September 2008. The outstanding amount of these bonds has been reduced to $8,355,699. Both the Texas and California bonds are now in default and have been accelerated. While these loans are non-recourse to Environmental Power, in certain circumstances Environmental Power is required to provide at least 20% of the construction costs of these facilities, as well as to cover any cost overruns in construction and certain other significant costs, which if applicable would represent a substantial investment of corporate resources. Because Microgy Holdings is in default on these loans, bondholders by foreclosure proceedings could seek to seize some or all of our investment in the Texas and California facilities, which if successful would have a material adverse effect on our business, financial condition and results of operations as well as your investment in our securities. In addition, our subsidiary, Microgy Grand Island, LLC, has entered into a $7.0 million sale and leaseback transaction with the City of Grand Island, Nebraska in connection with its tax-exempt bond financing in Nebraska to finance the construction of the Grand Island facility, and has guaranteed the City’s obligations under the tax-exempt bonds. Environmental Power has equity contribution and support obligations with respect to the Grand Island facility that are substantially similar to those under the Texas and California financings. Microgy Grand Island is in default on its guarantee obligations to the City of Grand Island, and we may lose some or all of our investment in the Grand Island facility, which would have a material adverse effect on our business, financial condition and results of operations.

Microgy faces competition in the renewable energy market as well as for the resources necessary to operate its facilities.

Microgy plans to generate revenue from the development and ownership of facilities that market renewable “green” energy in addition to providing pollution control features to the agricultural and food industry markets.

Microgy’s “green” competitors include other energy producers using biomass combustion, biomass anaerobic digestion, geothermal, solar, wind, new hydro and other renewable sources. These companies represent a significant class of competitors because they will compete with Microgy for sale of marketable renewable energy credits and participation in various renewable portfolios and other programs.

17

Table of Contents

Competition in the traditional energy business from electric utilities and other energy companies is well established, with many substantial entities having multi-billion dollar, multi-national operations. Many of these companies are beginning to compete in the alternative fuels and renewable energy business with the growth of the industry and the advent of many new technologies. Larger companies, due to their greater financial and other resources, will be better positioned than Microgy to develop new technologies and to install existing or more advanced renewable energy facilities, which could harm Microgy’s business.

Microgy also faces many forms of competition with respect to the resources required to operate its facilities. Such competition includes other providers of pollution control, including environmental engineers, providers of pollution control systems, private companies, public companies, associations, cooperatives, government programs, foreign companies, and educational pilot programs. Furthermore, there are many companies that offer anaerobic digester systems. A number of these competitors have more mature businesses and have successfully installed anaerobic digester systems in the United States. Microgy may be forced to compete with any of these competitors for access to equipment, construction supplies, skilled labor for the construction and operation of its facilities and the supplies of manure and substrate required to operate its facilities. In addition, Microgy may also have to compete for access to substances that make desirable substrates with other users of these substances, such as recyclers of waste grease and producers of biodiesel and other biofuels. The effect of such competition could be reflected in higher costs associated with obtaining access to these resources, as well as an insufficient supply of these resources for the profitable operation of Microgy’s facilities. If Microgy cannot obtain and maintain these supplies, or cannot obtain or maintain them at reasonable costs, the profitability of Microgy’s business will be adversely affected.

Extreme weather events may have a material adverse effect on the operation on our facilities.