Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2009

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT 1934 |

For the transition period from to

Commission file number: 000-53554

DAIS ANALYTIC CORPORATION

(Exact name of registrant as specified in its charter)

| New York | 14-1760865 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 11552 Prosperous Drive Odessa, Florida |

33556 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (727) 375-8484

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12 (g) of the Act:

Common Stock, par value $0.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405) during the preceding 12 months. Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $1,568,919 as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price on the OTC:BB reported for such date. Shares of common stock held by each officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 30, 2010, the Registrant had 29,095,717 outstanding shares of its common stock, $0.01 par value.

Documents incorporated by reference: none

Table of Contents

FORM 10-K

TABLE OF CONTENTS

2

Table of Contents

PART I

INTRODUCTORY NOTE

Information contained or incorporated by reference in this Annual Report may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

This Annual Report on Form 10-K contains forward-looking statements, including statements regarding, among other things:

| • | our ability to continue as a going concern; |

| • | our ability to achieve and maintain profitability; |

| • | the price volatility of the common stock; |

| • | the historically low trading volume of the common stock; |

| • | our ability to manage and fund our growth; |

| • | the short period of time we have employed certain of our executive officers; |

| • | our ability to attract and retain qualified personnel; |

| • | litigation; |

| • | our ability to do business overseas; |

| • | our ability to compete with current and future competitors; |

| • | our short operating history; |

| • | our ability to obtain additional financing; |

| • | general economic and business conditions; |

| • | other risks and uncertainties included in the section of this document titled “Risk Factors”; and |

| • | other factors discussed in our other filings made with the Commission. |

These statements may be found under “Management’s Discussion and Analysis” and “Description of Business,” as well as in other sections of this Annual Report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Annual Report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report will in fact occur. We have no obligation to publicly update or revise these forward-looking statements to reflect new information, future events, or otherwise, except as required by applicable Federal securities laws, and we caution you not to place undue reliance on these forward-looking statements.

3

Table of Contents

| ITEM 1. | BUSINESS |

Dais Analytic Corporation is a nano-structure polymer technology materials company which has developed and is commercializing applications using its materials. The first commercial product is called ConsERV™, a fixed plate energy recovery ventilator which we believe is useful in meeting building indoor fresh air requirements while saving energy in the Heating, Ventilation and Air Conditioning (“HVAC”) industry. We are developing other nano-structure polymer technology products including (i) “NanoAir”, a water based packaged heating and cooling system and (ii) “NanoClear”, a water clean-up process useful in the creation of potable water from sea, brackish or waste water. We further believe that our nano-structure polymer technology may be useful in developing an ultra-capacitor, a device which may be capable of greater energy density and power per pound than traditional capacitors or batteries.

History

We were incorporated as a New York corporation on April 8, 1993 as Dais Corporation. We subsequently changed our name to Dais Analytic Corporation on December 13, 1999. We were formed to develop new, cost-effective polymer materials for various applications, including providing a lower cost membrane material for Polymer Electrolyte Membrane (“PEM”) fuel cells. We believe our research on materials science has yielded technological advances in the field of selective ion transport polymer materials.

In December 1999, we purchased the assets of Analytic Power Corporation, which was founded in 1984 to provide fuel cell and fuel processor design and consulting services, systems integration and analysis services to develop integrated fuel cell power systems, and we were re-named Dais Analytic Corporation. Analytic Power Corporation developed a portfolio of fuel cell and related fuel cell component technologies, including fuel cell stack designs, a membrane electrode assembly process, and natural gas, propane, diesel and ammonia fuel processors for use in creating integrated fuel cell systems.

4

Table of Contents

In March 2002, we sold substantially all of our fuel cell assets to a large U.S. oil company for a combination of cash and the assumption by such company of certain of our obligations. After we sold a substantial portion of our fuel cell assets, we focused on expanding our nano-structured polymer platform, having already identified the Energy Recovery Ventilator (“ERV”) application as our first commercial product.

Financing

From December 2007 to January 2008, we issued (i) 9% secured convertible promissory notes in an aggregate principal amount of $2,950,000 (the principal amount of which may be converted into 14,750,000 shares of common stock, par value $.01 per share) and (ii) warrants to purchase up to 14,750,000 shares of common stock at an exercise price of $.25 per share (the “Financing”). Aggregate gross proceeds to the Company from this Financing were $2,950,000. The notes issued in the Financing matured 12 months from the date of issuance and permitted conversion of all principal and interest into common stock at the option of the holder any time prior to the maturity date at a conversion price of $0.20 per share. The notes include standard default provisions and price protection with regards to issuance by the Company of common stock and common stock equivalents. The warrants issued in the Financing have a five-year term, cashless exercise provisions and anti-dilution protection. The anti-dilution protection in the warrants includes protection for stock dividends or splits, reclassification or capital reorganization as well as protection with regards to additional issuances of common stock or common stock equivalents. During the term each warrant holder has, upon full conversion or payment prior to the maturity date (as defined in the note), the right to exercise the warrant for all warrant shares. However, until such pay-off or full conversion of the note each holder is limited to the extent to which such holder may exercise the warrant to the same percentage to which the holder has converted the note. The exercise price under the warrants is $0.25 per share of common stock.

Pursuant to the terms of the Financing and the Security Agreement entered into in connection with the Financing, we granted investors a first priority security interest in our patents and certain patent applications. The following are each an event of default under the Security Agreement: (a) any material misrepresentation relating to the Security Agreement or the convertible notes on our part, (b) any material noncompliance with or nonperformance of our obligations under the notes or the Security Agreement, (c) if we make (i) an assignment for the benefit of creditors, or are subject to (ii) an attachment or receivership of assets that is not dissolved, or (iii) are subject to the institution of Bankruptcy proceedings, whether voluntary or involuntary, and (d) any event of default under the Notes. Should an event of default occur, the secured parties are required to provide us with written notice detailing the event of default. We have 60 days from receipt of said notice to cure such default. Should we fail to cure within the prescribed time period, the secured parties may at any time thereafter declare the notes in default and all obligations secured thereby immediately due and payable and shall have the remedies of a secured party under the Uniform Commercial Code. There are no other liens currently in effect against such patents or patent applications. The Company was obligated to register the shares of common stock underlying the convertible principal amount of the convertible notes and warrants issued in this Financing pursuant to a registration rights agreement entered into with investors in this Financing. On August 11, 2008, we filed a registration statement on Form S-1 covering the resale of up to 18,110,782 shares of common stock. Such registration statement was declared effective November 12, 2008

Between December 11, 2008 and January 21, 2009, all amounts due under the Convertible Notes matured and became due and payable in full. We have from time to time proposed and are currently proposing that holders of matured Convertible Notes either (i) convert their notes into shares at this time in exchange for additional warrants or (ii) extend the maturity of the Convertible Notes and continue to accrue interest.

During the year ended December 31, 2009 eighteen holders converted the principal balance of $2,350,000 plus accrued interest of $361,600 on their Convertible Notes into 13,553,822 shares of common stock. Some of the said note holders converted their Convertible Notes during periods in which we were offering an additional warrant as an inducement to convert. Under said offers we issued additional warrants to purchase 1,665,000 shares of common

5

Table of Contents

stock, exercisable immediately at $0.25 per share and valued at $126,367 (using the Black-Scholes pricing model), and 575,000 warrants, exercisable immediately at $0.75 per share valued at $286,641 (using the Black-Scholes pricing model) which was recorded as interest expense during the twelve months ended December 31, 2009.

During 2009, four investors holding Convertible Notes with an aggregate outstanding principal balance of approximately $450,000 at December 31, 2008 notified the Company that they were asserting their rights to receive payment of the principal and interest pursuant to the terms of the Convertible Notes. In June of 2009, three of these investors, holding an aggregate principal note balance of $250,000, entered into a confession of judgment with the Company. Under that agreement the three investors had the right, should the Company fail to pay all principal and interest due pursuant to their Convertible Notes on or before September 11, 2009, to file the confession of judgment with the court and seek to secure a judgment against the Company in the amount of all principal and interest due under their Convertible Notes together with the reasonable cost and expense of collection. All interest and principal related to the three Convertible Notes, $289,803 in the aggregate, was paid in full by the Company on or before September 11, 2009. In July of 2009, the fourth investor, holding a Convertible Note in the principal amount of $200,000, agreed to extend said note to September 2009. In November of 2009, this investor and the Company modified the Convertible note to extend the maturity date of said note to July 2010, pay the principal amount due in eight monthly installments commencing December of 2009, end the accrual of interest as of November 20, 2009 and convert the $34,861 in interest due under the Convertible Note as of November 20, 2009 into 170,137 shares of Company’s common stock. As of December 31, 2009 the outstanding principal balance of said loan was $175,000.

As of December 31, 2009, $325,000 of principal on the Convertible Notes was outstanding, of which $175,000 has been extended to July of 2010 with the remaining notes currently in default and due and payable in full.

In July 2009 we secured a loan of $300,000 from an investor and issued the lender an unsecured promissory note for the principal amount on December 8, 2009. Pursuant to the terms of the note, we are to pay the note holder simple interest at the rate of seven percent per annum commencing on July 17, 2009 with all interest and principal due there under payable in cash on or before January 16, 2011. If an event of default were to occur the interest rate would increase to ten percent for the duration of said event. Should we not cure the default within 60 days of receiving notice the note holder may, at his option, declare all interest accrued and unpaid and principal outstanding immediately due and payable.

In December 2009 we secured a loan in the principal amount of $1,000,000 from an investor and issued the lender an unsecured promissory note. Pursuant to the terms of the note, we are to pay the holder simple interest at the rate ten percent per annum commencing on the date of issuance with all interest and principal due and payable in cash on or before June 17, 2010. The note has equal standing with all other existing notes with respect to seniority. We may not incur more than $500,000 in additional debt without the holder’s prior approval and said additional debt may not be senior to this promissory note. During the term of the note, the holder has the right to participate, by investing additional funds the total amount of which may not exceed the outstanding balance of the note, in any subsequent financings undertaken by Company. Any such participation shall be upon the same terms as provided for in the subsequent financing. If an event of default were to occur and said default is not cured within the allotted period, the holder may declare all principal and accrued and unpaid interest due and payable without presentment, demand, protest or notice. Further, in addition to all remedies available under law, holder may in the event of a default opt to convert the principal and interest outstanding under the note into any debt or equity security which the Company issued after the date of this note and prior to the date of full payment of this note in accordance with the same terms as the subsequent financing.

The Company secured loans from two of its investors in the principal amounts of $250,000 and $620,000. The loan amounts were received by the Company on December 31, 2009 and February 18, 2010, respectively, and the Company issued the lenders unsecured promissory notes with respect to said loans on February 19, 2010. Pursuant to the terms of the notes, the Company is to pay the holders simple interest at the rate ten percent per annum

6

Table of Contents

commencing on the date of issuance with all interest and principal due and payable in cash on or before June 30, 2010 and August 10, 2010, respectively. The notes have equal standing with all other existing notes with respect to seniority. After receipt of proceeds on the foregoing loans, we may not incur more than $500,000 in additional debt without the holders’ prior approval and said additional debt may not be senior to these promissory notes. During the term of the notes, each note holder has the right to participate, by investing additional funds the total amount of which may not exceed the outstanding balance of the holder’s note, in any subsequent financings undertaken by Company. Any such participation shall be upon the same terms as provided for in the subsequent financing. If an event of default were to occur and said default is not cured within the allotted period, the holders may declare all principal and interest due and payable without presentment, demand, protest or notice. Further, in addition to all remedies available under law, each holder may in the event of a default opt to convert the principal and interest outstanding under its note into any debt or equity security which the Company issued after the date of its note and prior to the date of full payment of its note in accordance with the same terms as the subsequent financing.

Technology

We use proprietary nano-technology to reformulate thermoplastic materials called polymers. Nano-technology involves studying and working with matter on an ultra-small scale. One nanometer is one-millionth of a millimeter and a single human hair is around 80,000 nanometers in width. Polymers are chemical, plastic-like compounds used in diverse products such as Dacron, Teflon, and polyurethane. A thermoplastic is a material that is plastic or deformable, melts to a liquid when heated and to a brittle, glassy state when cooled sufficiently.

These reformulated polymers have properties that allow them to be used in unique ways. We transform polymers from a hard, water impermeable substance into a material which water and similar liquids can, under certain conditions, diffuse (although there are no openings in the material) as molecules as opposed to liquid water. Water and similar liquids penetrate the thermoplastic material at the molecular level without oxygen and other atmospheric gases penetrating the material. It is believed this selectivity is dependent on the size and type of a particular molecule.

Products

ConsERV™

We currently sell one product, our ConsERV™ product, a HVAC energy conservation product which should, according to various tests, save an average of up to 30% on HVAC operating costs and allow HVAC equipment to be up to 30% smaller, reducing peak energy usage by up to 20% while simultaneously improving indoor air quality. This product makes HVAC systems operate more efficiently and results, in many cases, in energy and cost savings. ConsERV™ attaches onto existing HVAC systems, typically in commercial buildings, to provide ventilation within the structure. It pre-conditions the incoming air by passing through our nano-technology polymer which has been formed into a filter of sorts. The nano-technology ‘filter’ uses the stale building air that must be simultaneously exhausted to transfer heat and moisture into or out of the incoming air. For summer air conditioning, the “core” removes some of the heat and humidity from the incoming air, transferring it to the exhaust air stream thereby, under certain conditions, saving energy. For winter heating, the “core” transfers a portion of the heat and humidity into the incoming air from the exhaust air stream thereby often saving energy.

Our ConsERV™ product is the primary focus of our resources and commercialization efforts. When compared to similar competitive products, we believe based on test results conducted by the Air-Conditioning, Heating and Refrigeration Institute (“AHRI”), a leading industry association, ConsERV™ is twice as effective in managing latent and sensible heat. We expect ConsERV™ to continue to be our focused commercial product through 2010 with a growing emphasis on moving the development of the NanoClear and NanoAir technologies towards commercialization.

7

Table of Contents

How ConsERV™ Works

Most building codes mandate commercial structures to provide certain levels of ventilation determined by use and occupancy. ERVs are systems used by HVAC manufacturers to increase energy efficiencies in HVAC units by transferring heat and humidity between air flows. They do this by capturing a portion of the energy already used to heat or cool air that is being released to the outside and use such released air to condition the incoming air stream. In an air conditioning application, heat and humidity that are part of the incoming air stream are transferred to the cool, dry exhaust air, thereby “pre-conditioning” the incoming air before it reaches the building’s air conditioning system. By pre-conditioning the incoming air, ERVs should increase the operating efficiency of the HVAC unit, thereby lowering the overall costs associated with heating and cooling buildings and potentially reducing the size and initial capital cost of the overall HVAC unit.

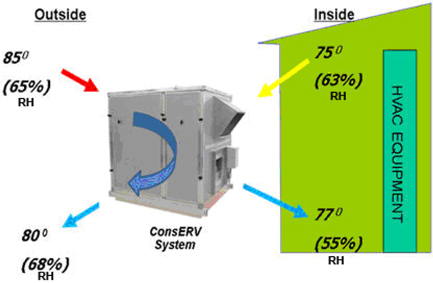

ConsERV™ has a “core” component made using our nano-structured material and may be described as a high-performance ERV. It is used in conjunction with a building’s HVAC equipment. The ConsERV™ energy recovery ventilator employs nano-technology based materials to create an exchange of sensible (temperature) and latent (humidity) energy between the two air streams using HVAC equipment to provide building ventilation. The first air stream typically exits a building at the temperature and relative humidity level set by the buildings air conditioning and heating equipment. The second air stream comes from the outside environment at a different temperature and relative humidity level and is used to bring outdoor air to the occupants of the building. The ConsERV™ product uses the energy found in the first air stream (air already cooler or heated) to condition the second air stream (the outdoor air coming in) before the second air stream (outside air) enters the HVAC equipment. The ConsERV™ product may save energy, in that it often reduces the required energy and size of the HVAC equipment and thereby may lower the cost of providing ventilation. In addition, it may lower carbon dioxide emissions because the HVAC equipment may not need to be used as frequently and often times can be reduced in size to provide the same levels of comfort indoors. The process is shown in the picture below.

Given third-party test data, our ConsERV™ product, with its nano-structured materials, offers better total performance than other fixed plate ERV products of which we are aware, with no moving parts and little or no cross-air stream contamination.1 Our ConsERV™ core product has received UL 900 recognition and Air-Conditioning, Heating and Refrigeration Institute (“AHRI”) standard 1060 certification. Our ConsERV™ product is compatible with most commercial HVAC units and requires only a small amount of additional HVAC technical expertise to install. We believe the purchase and installation costs of our ConsERV™ product are comparable to the costs of many competing energy recovery products and our ConsERV™ product is more efficient in transferring moisture with lower life cycle maintenance costs.

| 1 | Air-Conditioning, Heating, and Refrigeration Institute (“AHRI”) – May 2008 test results. This study is publicly available and was not prepared for our benefit or funded by us. |

8

Table of Contents

Achieving increased sales revenue growth from our ConsERV™ product is predicated on the success in five key areas:

| • | Achieving continued technological improvements in key materials to lower our ‘per unit’ cost structure. |

| • | Implementing ‘Lean Manufacturing’ techniques for in-house assembly processes as well as monitoring existing outsourced manufacturing and assembly relationships which lower our ‘per unit’ cost structure. |

| • | Securing HVAC equipment manufacturers, as well as ERV Original Equipment Manufacturers (“OEM”) (or Licensees), with presence in existing and evolving sales channels as our customers or partners to sell worldwide “in-country or region”. |

| • | Recruiting and retaining the necessary people and infrastructure to support sales growth of ConsERV™ and other products as they are introduced into their respective sales channels. |

| • | Obtaining capital in a timely manner for the necessary steps outlined above to continue without interruption. |

Our Other Nano-Structured Products

We are devoting varying amounts of time to other uses of our nano-structured products in ways which are not disruptive to the key ConsERV™ effort. To date, insignificant revenues have been generated from these non-ConsERV™ related applications.

These product applications and activities include:

| • | Water Clean-up or “NanoClear”: We expect that this application would function to remove quantities of salt and other impurities from water to produce potable water using an environmentally friendly design that would use less energy and be less expensive than current methods. We have developed a functional table-top demonstration unit which highlights the basics of how this system works using the Company’s nano-structured materials to produce potable water. This demonstration unit is being used as the basis for the product’s next planned inflexion point: a 10m3 (26,500 gallons per day) pilot plant projected to be set up at a local County waste water treatment facility. The NanoClear product is currently in the late stages of prototype development. |

| • | Water Based packaged HVAC system or “NanoAir”: We expect this application would function to dehumidify and cool air in warm weather, or humidify and heat in cold weather. This NanoAir application may be capable of replacing a traditional refrigerant loop based heating/cooling system. The Company has a small prototype showing fundamental heating, cooling, humidification, and dehumidification operation of this evolving product. The NanoAir product is in the middle to late stages of prototype development. |

| • | Ultra-capacitor: Based on initial tests conducted by a third party, we believe that by applying a combination of our nano-materials we may be able to construct a device which stores energy similar to a battery with projected increases in energy density and lifetimes. We believe the key application for such a device would be in transportation. We have not invested significant resources to date in the development of this product. |

9

Table of Contents

As previously mentioned, aside from our ConsERV™ product, the Company has three additional products under development. The Company intends to sell polymer membrane or polymer membrane incorporated into an application appropriate form, or to license the application. We do not intend to build and market the entire product. The three product applications include:

| Application |

Current Stage |

Estimated Funding Required to Ready for Full Scale Commercialization 1 |

Estimated Time to Initial Market Entry (post funding) | |||

| Water Clean-up (NanoClean) - A process using a low temperature, low pressure approach to process brackish and salt water into potable water. |

3rd Stage Alpha/Beta | $8 Million | 12 – 30 months | |||

| Advanced Heating, Ventilating, and Air Conditioning (NanoAir)- A process using the nano-technology materials to create an advanced heating, ventilating, and air-conditioning system. |

3rd Stage Alpha/Beta | $6 Million | 12– 24 months | |||

| Ultracapacitor –if fully developed, may have a greater energy density and power per pound than traditional capacitors or the batteries on the market today. |

Base materials testing underway by third party to confirm the effectiveness of the Company’s materials in the application.

Current activities are moving us closer to the optimization of materials. An alpha prototype would then be required. |

$12 Million | 36 – 48 months | |||

The Company has identified other potential products for its materials and processes. Some have basic data to support the needed functionality and market differentiation of a product based on using our nano-technology based inventions. Such applications include immersion coatings and performance fabrics. These other products are based, in part, upon the known functionality of the Company’s materials and processes.

Patents

We own the rights to seven U.S. patents, five pending U.S. patent applications, and one Patent Cooperation Treaty (“PCT”) application. National stage applications based on the PCT application have been filed in the U.S., China and Europe. In addition, we co-own two PCT applications with Aegis Biosciences LLC, a biomaterials drug delivery technology company. National stage applications based on one of the co-owned PCT applications have been filed in the U.S., China and Europe, and a National stage application based on the other co-owned PCT application has been filed in the U.S. and China. These patents relate to, or are applications of, our nano-structured polymer materials that perform functions such as ion exchange and modification of surface properties. The polymers are selectively permeable to polar materials, such as water, in molecular form. Selective permeability allows these materials to function as a nano-filter in various transfer applications. These materials are made from base polymer resins available from a number of commercial firms worldwide and possess what we believe to be some unique and controllable properties, such as:

| • | Selectivity: Based on our research, we believe that when the polymer is made there are small channels created that are 5 to 30 nanometers in diameter. There are two types of these channels: hydrophilic (water permeable), and hydrophobic (water impermeable). The channels can be chemically tuned to be highly selective for the ions or molecules they transfer. The high selectivity of the polymer can be adjusted to efficiently transfer water molecules from one face to the other using these channels. |

| 1 | This step is defined as completing pilot or beta site performance and benchmark testing, obtaining (if needed) industry certification(s), and securing initial fundamentals to scale for production. |

10

Table of Contents

| • | High transfer rate: Based on in-house testing protocols and related results, we have found that the channels created when casting the materials into a nano-structured membrane have a transfer rate of water, or flux, greater than 90% of an equivalent area of an open tube. This feature is fundamental to the material’s ability to transfer moisture at the molecular level while substantially allowing or disallowing the transfer of certain other substances at a molecular level. |

| • | Unique surface characteristic: The materials offer a surface characteristic that we believe inhibits the growth of bacteria, fungus and algae and prevents adhesives from attaching. |

The molecular selectivity, transfer rate and surface coating properties, coupled with our ability to produce the nano-structured materials at what we believe is an affordable price, distinguishes our technology and value-added products. By incorporating our nano-structured materials into existing products, we strive to address current real-world market needs by offering what we believe to be higher efficiencies and improved price performance. For example, there are other energy recovery mechanisms available for HVAC that use coated paper or desiccant technology instead of our highly efficient nano-structured polymer materials.

Manufacturing

We do not have long term contractual relationships with any of our manufacturers or vendors. The only product or service which we could not have purchased elsewhere and used in the on-going growth of the ConsERV™ business is the plastic based sheet good. In progress is a project aimed at lessening the Company’s exposure in this sheet good area. All purchases to date of raw materials and related services have been on a purchase order basis using non-disclosure agreements. Our manufacturing process is described below.

Polymer Membrane

Commercially available styrene based polymer resin in flake form and industrial grade solvents are mixed together using a proprietary process involving heat, industrial mixers, and solvents. The resin and the solvents are commercially available from any number of chemical supply houses, or firms such as Dow and Kraton (formerly Shell Elastomers then part of Royal Dutch Shell). Our process changes the molecular properties of the starting styrene based polymer resins into a liquid material which we believe gives the attribute of being selective in what molecules it will allow through the plastic, which includes water molecules. This process, called ‘sulfonation’, is done at facilities around the world known as Toll Houses. These are firms which specialize in making small lot (by industry standards) runs of specialty chemicals.

Plastic Based Sheet Good

A thin coating of the liquid polymer material is applied on one side of the sheet good by a ‘tape casting’ firm of which there are many in the United States. The coated sheet good is heated to rapidly dry the liquid material thus bonding the polymer solution and rolled sheet good together. The resulting ‘modified sheet good’ is then re-coiled into rolls and shipped to us. Currently this is provided to us by one vendor. Additional vendors for this component have not been sought by the Company. However, we have identified other entities making similar types of products and believe such entities and products may provide alternatives should one be required. As noted above the Company is actively working one project to lower its exposure.

The “Core”

The modified sheet good is cut into defined dimensions and glued to a PVC formed spacer. This ‘spacer/glued modified sheet good’ is a single layer. Multiple layers are stacked one on top the other until a certain height is achieved. Once the proper height is achieved, these layers are then fitted with a galvanized sheet metal plate on the top and bottom of the stack along with galvanized sheet metal ‘Y’ shaped bracket on each of the four corners of the

11

Table of Contents

assembly. This assembly is called a ‘core’. The galvanized sheet metal is a world-wide commodity material formed to our specifications by local and out-of-town sheet metal forming companies. We have no long term contractual relationships with firms making the PVC spacers, supplying the glue, supplying rivets to hold the structure together, and the sheet metal firms making the top and bottom plate as well as the side rails.

Completion

For the complete ConsERV™ system, one or more cores are placed inside of aluminum or steel boxes built by us or a vendor. The box may or may not also be fitted with an electric motor, fan, electric relay, and electrical disconnect. Inclusion or exclusion of the electric motor and fan is dictated by the customers’ needs and current HVAC system. Once outfitted with cores, the product is complete. We have no long term contractual relationships with firms providing the aluminum or steel parts used to build the box, the motors, the fans, the relays, or the electrical disconnects.

Licensing

While we have earned licensing revenue under agreements licensing our technology in the past, we may not receive any material revenue from these agreements in the near or foreseeable future.

Research and Development

The Company has spent approximately $6,600 and $36,000 on research and development during each of the last two fiscal years.

Key Relationships

We have strategic relationships with leaders in the energy industry who have entered into sales, marketing, distribution and product development arrangements with us and, in some cases, hold equity in our Company. They include:

Electric Power Research Institute (“EPRI”)

We have an on-going relationship with a number of utilities through EPRI. The EPRI participants include Public Service Company of New Mexico, Kansas City Power & Light, Reliant Energy Incorporated, Alliant Energy Company, Omaha Public Power District, Wisconsin Public Service Corporation, Southern California Gas Company, EDF Electricite de France, Consolidated Edison of New York, Tokyo Gas Co., Ltd., CINERGY Corporation, Northern States Power Company, American Electric Power Company, Inc., Sierra Pacific Power Company, Public Service Electric & Gas Company (“PSE&G”), and Tennessee Valley Authority. The EPRI users group has been helpful in creating opportunities for us to define specifications and applications for our nano-structured materials that address existing energy related challenges while possibly opening new sources of revenue.

Genertec America, Inc.

On August 21, 2009, we entered into an Exclusive Distribution Agreement with Genertec America, Inc (“Genertec”), under which we are to supply and Genertec is to distribute, on an exclusive basis, three of our nanotechnology-based membrane products and related products in Great China, including main land China, Hong Kong, Macau and Taiwan. The agreement provides that during the initial term of the agreement, Genertec will order and purchase these products in the aggregate amount of Two Hundred Million U.S. Dollars. A minimum quantity of said products is to be purchased by Genertec during each contract year of the initial term. In the event Genertec fails to purchase the minimum amount of products in any given year, we may convert the exclusivity provided to Genertec to a non-exclusive or terminate the agreement. Genertec has agreed to engage and appoint authorized person(s) or firm(s), to install, engineer, perform maintenance, sell and use the products within the defined distribution area and neither Genertec nor its designated buyer is permitted to alter, decompile or modify our products in any way. As consideration for entering into this agreement, Genertec agreed to pay us a deposit in

12

Table of Contents

monthly installments beginning in September 2009 and continuing through April, 2010. Since September 2009, we have received three monthly deposit payments under this agreement. The third payment was received on December 14, 2009. All such payments are to be applied to products purchased by Genertec. During the initial term of the agreement, the parties are to negotiate in good faith a royalty bearing license agreement whereby Genertec may be granted a license to manufacture certain portions of the our products in the designated territory. The initial term of the agreement shall be for a period of five (5) years, commencing on August 21, 2009, unless earlier terminated. Unless notice of termination is delivered to the respective parties 180 days prior to the expiration of the initial term, the Agreement will automatically renew for consecutive one year periods. We may terminate this agreement in the event: (1) Genertec fails to pay the deposit as indicated, (2) Genertec does not purchase the minimum amount of our designated products during any contract year, (3) breach by Genertec of its obligations under the Agreement, or (4) at our discretion immediately upon the transfer of fifty percent (50%) or more of either the assets of the voting stock of Genertec to any third party. Genertec may not assign the Agreement to any party without our prior written consent.

ConsERV™ - Sales and Marketing Strategies

We market our ConsERV™ product in North America principally through alliances with local independent manufacturer representatives. We currently have 30 independent commercial sales representatives in various locations throughout North America selling the ConsERV™ product. We intend to increase the number of commercial independent sales representatives to approximately 40 to properly cover the North American commercial sales territory. We are also working to secure ongoing relationships with leading industry HVAC manufacturers and other ERV manufacturers. Other potential and targeted sales channels for the ConsERV™ product are energy service companies and HVAC product distributorships. We continue to leverage our relationship with EPRI and a group of 16 utility companies (consisting of EPRI members and some of our minority shareholders) into expected sources of future product sales through the introduction of demand reduction incentives. In January 2010, the Company hired David Longacre, who possesses 25 years of experience in the HVAC industry, as our Vice President of Sales.

Future Products – Sales and Marketing Strategies

Our intended sales and marketing strategy will require us to create alliances with companies having strong, existing channel presence in the target industries. We believe working with industry leaders at the development level allows us to better address the market’s needs and possibly accelerate the time to market cycle.

Competition and Barriers to Entry

We believe the efficacy of our value-added products and technology has the ability to decrease sales of competing products, thus taking business away from more established firms using older technology. We believe that our ConsERV™ product may become a functional component of newer, more efficient OEM products. Our key challenge is to educate channel decision makers of the benefits of products made using our materials and processes to overcome the strength of the current product sales.

There are a number of companies located in the United States, Canada, Europe and Asia that have been developing and selling technologies and products in the energy recovery industry, including but not limited to: Semco, Greenheck, Venmar, Bry-Air, dPoint, Renewaire and AirXchange.

We will experience significant competition regarding our products because certain competing companies possess greater financial and personal resources than us. Future product competitors include, but are not limited to:

| Products |

Current and Future Competitors | |

| ConsERV |

Semco, Greenheck, Venmar, Bry-Air, dPoint, Renewaire and AirXchange. | |

| NanoClear |

Dow, Siemens, , GE | |

| NanoAir |

AAON, Trane, Carrier, York, Hier | |

| Ultracapacitor |

EEstor Maxwell |

13

Table of Contents

We believe that the combination of our nano-material platform’s characteristics (high selectivity, high flux rate, manufacturability, et al.), growing patent position, and possible ‘first to market’ position, are competitive advantages, which may allow us time to execute our business plan. Competitors may experience barriers to entry in these markets primarily related to the lack of similarly performing proprietary materials and processes.

Intellectual Property

As stated above, we have seven granted U.S. patents, including patents covering the composition and structure of a family of ion conducting polymers and membranes and applications of the polymer. We believe some of these patents make reference to applications relating to the materials we are developing. Please see the “Risk Factors” Section of this Annual Report. A list of our existing patents follows:

| 1. | Patent No. 6,841,601- Cross-linked polymer electrolyte membranes for heat and moisture exchange devices. This patent was issued on January 11, 2005 and expires March 12, 2022. |

| 2. | Patent No. 6,413,298 – Water and ion-conducting membranes and uses thereof. This patent was issued on July 2, 2002 and expires July 27, 2020. |

| 3. | Patent No. 6,383,391 – Water and ion-conducting membranes and uses thereof. This patent was issued on May 7, 2002 and expires on July 27, 2020. |

| 4. | Patent No. 6,110,616 – Ion-conducting membrane for fuel cell. This patent was issued on August 29, 2000 and expires on January 29, 2018. |

| 5. | Patent No. 5,679,482 – Fuel Cell incorporating novel ion-conducting membrane. This patent was issued on October 21, 1997 and expires on October 20, 2014. |

| 6. | Patent No. 5,468,574 – Fuel Cell incorporating novel ion-conducting membrane. This patent was issued on October 21, 1995 and expires on May 22, 2014. |

| 7. | Patent No. 7,179,860 – Cross-linked polymer electrolyte membranes for heat, ion and moisture exchange devices. This patent was issued on February 20, 2007 and expires on March 11, 2022. |

We have provisional and patent applications in the following areas: Advanced Polymer Synthesis Processes, Reversible Liquid to Air Enthalpy Core Applications and Construction, Nanoparticle Ultra Capacitor and Water Treatment and Desalination.

The following is a partial list of the patent applications publicly visible:

| 1. | WO20080316678 – Nanoparticle Ultra Capacitor |

| 2. | WO/2008/039779 – Enhanced HVAC System and Method |

| 3. | WO/2008/089484 – Multiphase selective Transport Through a Membrane |

| 4. | WO/2008/141179 – Molecule Sulphonation Process * |

| 5. | WO/2009/002984 – Stable and Compatible Polymer Blends* |

| 6. | WO2009/002984 – Novel Coblock Polymers and Methods for Making Same |

| * | Patent applications jointly owned with Aegis Biosciences, LLC. |

Patents may or may not be granted on these applications. As noted above, two of these applications are jointly owned with Aegis Biosciences, LLC. We also seek to protect our proprietary intellectual property, including intellectual property that may not be patented or patentable, in part by confidentiality agreements with our current and prospective strategic partners and employees.

14

Table of Contents

Government Regulation

We do not believe the sale, installation or use of our nano-structured products will be subject to any government regulation, other than perhaps adherence to building codes, military specifications, and water safety regulations governing products used in HVAC, military clothing, immersion coatings, and water treatment and desalination. We do not believe that the cost of complying with such codes and regulations, to the extent applicable to our products, will be material.

We do not know the extent to which any existing or new regulations may affect our ability to distribute, install and service any of our products. Once our products reach the commercialization stage and we begin distributing them to our target markets, federal, state or local governmental entities may seek to impose regulations.

We are also subject to various international, federal, state and local laws and regulations relating to, among other things, land use, safe working conditions, and environmental regulations regarding handling and disposal of hazardous and potentially hazardous substances and emissions of pollutants into the atmosphere. Our business may expose us to the risk of harmful substances escaping into the environment, resulting in potential personal injury or loss of life, damage to or destruction of property, and natural resource damage. Depending on the nature of the claim, our current insurance policies may not adequately reimburse us for costs incurred in settling environmental damage claims, and in some instances, we may not be reimbursed at all. To date, we are not aware of any claims or liabilities under these existing laws and regulations that would materially affect our results of operations or financial condition.

Employees

As of December 31, 2009, we employed 15 full-time employees and one part time employee in our Odessa, Florida facility. Of the 16 employees, 4 are technicians, 2 product managers, 1 polymer chemist, 2 engineers, 1 development vice president, 2 administrative assistant, 1 administrator, 1 sales Vice President, 1 accountant and 1 president and chief executive officer. None of the employees are subject to a collective bargaining agreement. We consider our relations with our employees to be good.

Principal Offices

Our principal office is located at 11552 Prosperous Drive, Odessa, FL 33556.

| ITEM 1A. | RISK FACTORS |

You should carefully consider the risks described below. Our business, financial condition, results of operations or cash flows could be materially adversely affected by any of these risks. The valuation for the Company could also decline due to any of these risks, and you may lose all or part of your investment. This document also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of several factors, including the risks faced by us described below and elsewhere in this Annual Report. In assessing these risks, you should also refer to the other information contained in this Annual Report, including our financial statements and related notes.

Risks Related to Our Business

$325,000 of our 9% convertible secured promissory notes have matured, which may cause us to go out of business if Judgments are obtained.

At December 31, 2009, as a result of the Financing transaction, the Company had 3 note holders holding $325,000 in principal amount 9% convertible secured promissory notes together with the interest thereon outstanding. One of the note holders, whose note at year end accounted for $175,000 of the aforementioned aggregate principal amount, agreed to extend the term of his note to July 15, 2010. The two remaining notes have matured and remain

15

Table of Contents

outstanding. As of the date hereof the aggregate principal amount outstanding with respect to the two matured notes is $150,000. The Company has from time to time proposed and is currently proposing that holders of matured notes either (i) convert their notes into shares at this time in exchange for additional warrants or (ii) extend the maturity of the Convertible Notes and continue to accrue interest. If we are unable to reach an agreement with all the note holders and the note holders elect to obtain a judgment against the company, we may be forced out of business. The Company will find it difficult to continue its business, including financing its operations, where a default continues.

We may be unable to repay or secure an extension on the $2,170,000 in unsecured promissory notes outstanding as of the date hereof.

The Company does not currently have and does not expect to attain adequate funds for repayment from its current operations. Although the Company intends to continue to finance its operations, including the repayment of these notes, primarily through private sales of debt and equity securities it may not be able to secure additional financing to repay the notes on acceptable terms, if at all. Further, many of these notes contain a limitation on the amount of debt the Company can incur prior to repayment of the note. Hence, unless the note holders waive the debt limit we may not be able to avail ourselves of sufficient financing should it be available. Further many of these notes provide the holders with the option of participating in any additional financing we may undertake which could substantially dilute existing shareholders. If we are unable to secure financing to repay the notes we will seek to re-negotiate the notes. However, there is no guarantee that all note holders will accept any offer we may make and some or all of the note holders may request additional concessions from the Company for any accommodation we do secure. Any such additional consideration would likely be offered to all such note holders. Any terms we may be able to secure may not be favorable to the Company. Unfavorable terms would adversely impact our business, financial condition and/or results of operations. In the event we are unable to secure additional financing sufficient to pay the notes prior to the maturity date and we are not able to renegotiate the terms of the notes the note holders will have the option to foreclose which would likely result in the failure of our business or they may opt to convert the principal and interest outstanding under the note into any debt, equity or equity linked security which Company issued after the date of the note in accordance with the same terms as the subsequent financing which could result in substantial dilution to existing shareholders.

We may lose all our patents and the majority of our patent applications if we are unable to repay or convert the principal and interest on the outstanding 9% secured convertible notes issued in the Financing transaction or obtain an agreement for extension of the maturity dates.

The Company may not have adequate funds to repay the $325,000 of Convertible notes and does not expect to attain adequate funds for repayment from operations. The notes are secured by all of the Company’s patents and the majority of the Company’s patent applications. Our success depends, to a significant extent, on the technology that is incorporated in our product and the underlying patents and patent applications securing the notes. The Company intends to continue to finance its operations, including the repayment of the notes, primarily through private sales of debt and equity securities. The Company may not be able to secure additional financing to repay the notes on acceptable terms, if at all. There is no guarantee that all note holders will accept any offer the Company will make with regard to extending or converting these notes. Further, some note holders may request additional concessions from the Company in return for extending or converting their note. Any such additional consideration would likely be offered to all note holders. Any re-negotiated terms we may be able to secure may not be favorable to the Company. Unfavorable terms, in either a financing transaction or debt renegotiation, would adversely impact our business, financial condition and/or results of operations. In the event (i) we are unable to secure additional financing sufficient to pay the notes, (ii) the notes are not converted into shares of our common stock, or (iii) we are not able to negotiate extensions to the maturity dates of the notes, note holders will have the option to foreclose on all of our patents and those patent applications securing the notes, which would likely result in the failure of our business.

If we fail to raise additional capital we will be unable to continue our business.

Our commercialization and development efforts to date have consumed and will continue to require substantial amounts of capital in connection with our nano-technology material based products (including but not limited to ConsERV™, water desalination, immersion coatings, and performance fabrics). Our channel penetration and product development programs require substantial capital outlays in order to reach full product commercialization. As we enter into more advanced product development we will need significant funding to complete product development and to pursue product commercialization.

16

Table of Contents

Additionally, our auditors have expressed substantial doubt about our ability to continue as a going concern. Our ability to continue our business and our research, development and testing activities and commercialize our products in development is highly dependent on our ability to obtain additional sources of financing, including entering into and maintaining collaborative arrangements with third parties who have the resources to fund such activities. Any future financing may result in substantial dilution to existing shareholders, and future debt financing, if available, may include restrictive covenants or may require us to grant a lender security interest in our assets not already subject to an existing security interest. To the extent that we attempt to raise additional funds through third party collaborations and/or licensing arrangements, we may be required to relinquish some rights to our technologies or products currently in various stages of development, or grant licenses or other rights on terms that are not favorable to us. Any failure by us to timely procure additional financing or investment adequate to repay our outstanding promissory notes, including but not limited to the 9% convertible notes, and to fund our ongoing operations, including planned product development initiatives, clinical studies and commercialization efforts, will have material adverse consequences on our business operations, financial condition, results of operations and cash flows.

We have a history of operating losses, and we expect our operating losses to continue for the foreseeable future and we may not continue as a going concern.

We have incurred substantial losses since we were funded in 1993 and have not achieved profitability in any year to date. We have only one product developed and marketed, ConsERV™, and anticipate all other products will take at least 12 to 48 months to develop. We expect our operating losses to continue for the foreseeable future as we continue to expend substantial resources to expand the ConsERV™ business while working to bring additional products to the market including research and development, design and testing, obtaining third party validations, identifying and securing collaborative partnerships, and executing to enter into strategic relationships. Furthermore, even if we achieve our projection of selling a greater number of ConsERV™ units in 2010, we anticipate that we will continue to incur losses until we can cost-effectively produce and sell our products o a wider market. Our accumulated deficit was $32.0 million as of December 31, 2009. The reports from Cross, Fernandez and Riley, LLP, our independent registered public accounting firm, related to our December 31, 2009 financial statements contains their opinion that our net losses from operations, negative working capital and stockholder’s deficit raised substantial doubt about our ability to continue as a going concern. There has been no change in the Company’s position relative to the foregoing statements. It is possible that we will never generate sufficient revenue to achieve and sustain profitability. Even if we achieve profitability, we may not be able to sustain or increase profitability.

The Company financed its operations since inception primarily through private sales of its common and preferred stock, issuance of convertible promissory notes; issuance of unsecured promissory notes, cash received in connection with exercise of warrants, license agreements and the sale of certain fuel cell assets in 2002. As of December 31, 2009, the Company had $1,526,619 of current assets.

Even if the Company is successful in raising additional equity capital to fund its operations, the Company will still be required to raise an additional substantial amount of capital in the future to fund its development initiatives and to achieve profitability. The Company’s ability to fund its future operating requirements will depend on many factors, including the following:

| • | ability to obtain funding from third parties; |

| • | progress on research and development programs; |

| • | time and costs required to gain third party approvals; |

| • | costs of manufacturing, marketing and distributing its products; |

| • | costs of filing, prosecuting and enforcing patents, patent applications, patent claims and trademarks; |

17

Table of Contents

| • | status of competing products; and |

| • | market acceptance and third-party reimbursement of its products, if successfully developed. |

In the event the lease on our corporate office and production space is terminated, we may not be able to acquire a lease on another suitable property, or a lease on a suitable property at a comparable cost.

The lease on our corporate office and production space may be terminated upon 30 days prior written notice by either party. If this lease is terminated, we may not be able to acquire another lease for another suitable property or a lease on a suitable property at a comparable cost in a timely manner, which could materially disrupt our operations. Even if we are able to relocate into another suitable property at a comparable cost in a timely manner, we would incur significant moving expenses.

Our future indebtedness could adversely affect our financial health.

We have and may continue to incur a significant amount of indebtedness to finance our operations and growth. Any such indebtedness could result in negative consequences to us, including:

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | requiring a portion of our cash flow from operations be used for the payment of interest on our debt, thereby reducing our ability to use our cash flow to fund working capital, capital expenditures and general corporate requirements; |

| • | limiting our ability to obtain additional financing to fund future working capital, capital expenditures and general corporate requirements; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business; |

| • | placing us at a competitive disadvantage to competitors who have less indebtedness; and |

| • | as the majority of our assets are pledged to current debt holders, the failure to meet the terms and conditions of the debt instruments, or a failure to timely rearrange the current terms and conditions of the notes, if so required, will result in the Company having no access to certain portions of its own technology. |

The recent economic downturn has affected, and is likely to continue to adversely affect, our operations and financial condition potentially impacting our ability to continue as a going concern.

The recent economic downturn has resulted in a reduction in new construction and less than favorable credit markets, both of which may adversely affect the Company. Certain vendors from which we currently secure parts for our ConsERV product have and may continue to either reduce or eliminate payment terms. Hence, more capital is required to secure parts necessary to produce our products. In addition, our products are often incorporated in new construction which has experienced a decided down turn in project starts over the past year and such trend is expected for 2010. Although the portion of new construction most affected is home sales, which represents a minority of our sales, commercial construction has also experienced a reduction in starts with some projects being delayed and possibly eliminated. If the commercial construction market stagnates or decreases in volume or project size, our operations and financial condition could be negatively impacted. Expenditures under the United States economic stimulus plan appear to have targeted energy products. ConsERV™ may qualify under said program and the Company may potentially benefit from such program. However, when and if we will experience any increase in sales or investment due to this program is uncertain. In the interim, we may need additional capital to address these external conditions. An internal program to reduce personnel costs including the reduction of some salaries and limited furloughs was undertaken in 2009. Such a program may impact our ability to retain personnel and produce our products; however, we do not expect the impact of our internal program to be significant or long in duration. As noted above, we intend to continue to finance operations, including the repayment of all outstanding debt, including but not limited to the convertible notes and unsecured promissory notes, primarily through private sales of debt and equity securities. In light of the recent economic downturn the Company may not be able to secure additional financing on acceptable terms, if at all. Unfavorable terms for a financing transaction would adversely impact our business, financial condition and/or results of operations. In the event we are unable to secure additional financing our business may fail.

18

Table of Contents

If we fail to successfully address the challenges, risks and uncertainties associated with operating as a public company, our business, results of operations and financial condition would be materially harmed.

We have and will continue to incur a significant increase in costs as a result of operating as a public company, and our management has and will be required to devote substantial time to new compliance initiatives. Until November of 2008 we had never operated as a public company. In preparation for and since reporting as a public company, we have and expect to continue to incur significant legal, accounting and other expenses that we did not incur as a non-reporting company. In addition, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as new rules subsequently implemented by the Securities and Exchange Commission (the “SEC”) and various stock exchanges, has imposed many new requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel have and will continue to devote a substantial amount of time to these new compliance procedures.

We have and will continue to incur significant increased costs as a result of operation as a public company, and our management has and will continue to be required to devote substantial time to new compliance initiatives.

As a public company, we are now subject to the reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), the Sarbanes-Oxley Act and the rules promulgated by the SEC and the NASDAQ Global Market in response to the Sarbanes-Oxley Act. The requirements of these rules and regulations have and will continue to significantly increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and may strain our systems and resources. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls for financial reporting. In particular, commencing in 2010, we must perform system and process evaluation and testing of our internal controls over financial reporting to allow management and our independent registered public accounting firm to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. Our testing, or the subsequent testing by our independent registered public accounting firm, may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. We expect to incur significant expense and devote substantial management effort toward ensuring compliance with Section 404. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, we currently do not have an internal audit function, and we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. If we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal controls that are deemed to be material weaknesses, the market price of our stock could decline and we could be subject to sanctions or investigations by SEC or other regulatory authorities, which would entail expenditure of additional financial and management resources.

These rules and regulations could also make it more difficult for us to attract and retain qualified independent members of our Board of Directors. Additionally, we have found these rules and regulations make it more difficult and more expensive for us to obtain director and officer liability insurance. We have, and may be required once again, to accept reduced policy limits and/or coverage or incur substantially higher costs to obtain the same or similar coverage. NASDAQ rules also require that a majority of our Board of Directors and all of the members of certain committees of the Board of Directors consist of independent directors. We cannot assure you that we will be able to expand our Board of Directors to include a majority of independent directors in a timely fashion to comply with the requirements of these rules.

19

Table of Contents

Our ConsERV™ product is in small volume production, we have no long term experience manufacturing our products on a commercial basis and may not be able to achieve cost effective large volume production.

Our ConsERV™ product is built in small volumes. Our ability to achieve commercial production of that product is subject to significant uncertainties, including: completion of necessary product automation, developing experience in manufacturing and assembly on a large commercial scale; assuring the availability of raw materials and key component parts from third party suppliers; and developing effective means of marketing and selling our product.

We are in the process of assembling our ConsERV™ product at our facility in Odessa, Florida. Initial production costs of this product line are high with no or a lower than desired profit margin. As a result, we believe we will need to reduce unit production costs, including the nano-structured materials themselves made to our specifications by third parties, over time in order to offer our products at a profitable basis on a commercial scale. Our ability to achieve cost reductions in all areas of nano-structured materials and value added products depends on entering into suitable manufacturing relationships with component suppliers, as well as increasing sales volumes so that we can achieve economies of scale. A failure to achieve a lower cost structure through economies of scale and improvements in engineering and manufacturing in a timely manner would have a material adverse effect on our business and financial results. There can be no assurance that we will obtain higher production levels or that the anticipated sales prices of our products will ever allow an adequate profit margin.

We may not be able to meet our product development and commercialization milestones.

We have established internal product and commercialization milestones and dates for achieving development goals related to technology and design improvements of our products. To achieve these milestones we must complete substantial additional research, development and testing of our products and technologies. Except for our ConsERV product, we anticipate that it will take at least 12 to 48 months to develop and ready for scaled production our other products. Product development and testing are subject to unanticipated and significant delays, expenses and technical or other problems. We cannot guarantee that we will successfully achieve our milestones. Our business strategy depends on acceptance by key market participants and end-users of our products.

Our plans and ability to achieve profitability depend on acceptance by key market participants, such as vendors and marketing partners, and potential end-users of our products. We continue to educate designers and manufacturers of HVAC equipment with respect to our ConsERV™ product. More generally, the commercialization of our products may also be adversely affected by many factors that are out of our control, including:

| • | willingness of market participants to try a new product and the perceptions of these market participants of the safety, reliability and functionality of our products; |

| • | emergence of newer, possibly more effective technologies; |

| • | future cost and availability of the raw materials and components needed to manufacture and use our products; |

| • | cost competitiveness of our products; and |

| • | adoption of new regulatory or industry standards which may adversely affect the use or cost of our products. |

Accordingly, we cannot predict with any certainty that there will be acceptance of our products on a scale sufficient to support development of mass markets for those products.

We are dependent on third party suppliers and vendors for the supply of key components for our products.

We are dependent on third parties to manufacture the key components needed for our nano-structured based materials and value added products made with these materials. Accordingly, a supplier’s failure to supply components in a timely manner, or to supply components that meet our quality, quantity and cost requirements, technical specifications, or the inability to obtain alternative sources of these components on a timely basis or on terms acceptable to us, would create delays in production of our products or increase unit costs of production. Certain of the components contain proprietary products of our suppliers, or the processes used by our suppliers to manufacture these components are proprietary. If we are required to replace any of our suppliers, while we should be able to obtain comparable components from alternative suppliers at comparable costs, this would create a delay in production. If we experience such delays or our third party suppliers and vendors fail to supply us with components that meet our quality, quantity, or cost standards, we may lose our customers or be subject to product liability claims.

20

Table of Contents

Our applications require extensive commercial testing and will take long periods of time to commercialize.

Our nano-structured materials and associated applications need to undergo extensive testing before becoming commercial products. Consequently, the commercialization of our products could be delayed significantly or rendered impractical. Moreover, much of the commercial process testing will be dependent on the efforts of others. Any failure in a manufacturing step or an assembly process may render a given application or our nano-structured material(s) unsuitable or impractical for commercialization. Testing and required development of the manufacturing process will take time and effort.

We have not devoted any significant resources towards the marketing and sale of our products, we expect to face intense competition in the markets in which we do business, and expect to rely, to a significant extent, on the marketing and sales efforts of third parties that we do not control.