Attached files

| file | filename |

|---|---|

| EX-23.1 - LianDi Clean Technology Inc. | v178912_ex23-1.htm |

As

filed with the Securities and Exchange Commission on March 29, 2010

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

REMEDIATION

SERVICES, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

75-2834498

|

3822

|

||

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

|

(IRS

Employer Identification No.)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

4th

Floor Tower B. Wanliuxingui Building, No. 28 Wanquanzhuang Road

Haidian

District, Beijing, 100089

China

86-10-5872-0171

(Address,

including zip code, and Telephone Number, including area code,

of

Registrant’s Principal Executive Offices)

_________

Loeb

& Loeb LLP

345

Park Avenue

New

York, New York 10154

(212)

407-4000

(Name,

Address, including zip code, and Telephone Number, including area code, of Agent

for Service)

__________

With

a copy to:

Mitchell

S. Nussbaum, Esq.

Loeb

& Loeb LLP

345

Park Avenue

New

York, New York 10154

(212)

407-4159

Approximate date of commencement of

proposed sale to the public: From time to time after this

registration statement becomes effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated

filer

¨

|

Accelerated filer

¨

|

Non-accelerated filer

¨

(Do not check if smaller

reporting company)

|

Smaller reporting company x

|

CALCULATION

OF REGISTRATION FEE

|

Title of each class of securities to be

registered

|

Amount of

shares to be

registered (1)

|

Proposed

Maximum

offering price

per share (2)

|

Proposed

maximum

aggregate

offering price

|

Amount of

registration fee

|

||||||||||||

|

Common

stock, par value $0.001 per share

|

993,742 | $ | 3.33 | $ | 3,309,160.86 | $ | 235.95 | |||||||||

|

Common

stock, par value $0.001 per share (3)

|

7,086,078 | 3.33 | 23,596,639.74 | 1,682.45 | ||||||||||||

|

Common

stock, par value $0.001 per share, underlying series A warrants (4)(6)

|

1,968,363 | 4.50 | 8,857,633.50 | 631.55 | ||||||||||||

|

Common

stock, par value $0.001 per share, underlying series B warrants (4)(6)

|

1,968,363 | 5.75 | 11,318,087.25 | 806.98 | ||||||||||||

|

Common

stock, par value $0.001 per share, underlying placement agent warrants

(5)(6)

|

787,342 | 3.50 | 2,755,697.00 | 196.49 | ||||||||||||

|

Common

stock, par value $0.001 per share, underlying placement agent series A

warrants (5)(6)

|

196,836 | 4.50 | 885,762.00 | 63.16 | ||||||||||||

|

Common

stock, par value $0.001 per share, underlying placement agent series B

warrants (5)(6)

|

196,836 | 5.75 | 1,131,807.00 | 80.70 | ||||||||||||

|

Total

|

13,197,560 | $ | $ | 51,854,787.35 | $ | 3,697.28 | ||||||||||

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, this

registration statement includes an indeterminate number of shares as may

become necessary to adjust the number of shares issued by the Registrant

to the selling stockholders resulting from stock splits, stock dividends

or similar transactions involving the common

stock.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee in accordance

with Rule 457(c) under the Securities Act of 1933, as amended, based on

the average of the bid and ask prices on March 24, 2010, as reported by

the OTC Bulletin Board.

|

|

(3)

|

The

shares of common stock registered hereunder are being registered for

resale by selling stockholders named in the prospectus upon conversion of

7,086,078 shares of series A convertible preferred

stock.

|

|

(4)

|

The

shares of common stock registered hereunder are being registered for

resale by selling stockholders named in the prospectus upon exercise of

outstanding series A and series B warrants to purchase common

stock.

|

|

(5)

|

The

shares of common stock registered hereunder are being registered for

resale by selling stockholders named in the prospectus upon exercise of

outstanding placement agent warrants to purchase our common

stock.

|

|

(6)

|

The

registration fee has been calculated in accordance with Rule 457(g) under

the Securities Act of 1933, as

amended.

|

The

Registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said section 8(a),

may determine.

THE

INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING

STOCKHOLDERS MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION

STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS

PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN

OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT

PERMITTED.

|

Prospectus

|

Subject

to Completion, Dated March 29,

2010

|

REMEDIATION

SERVICES, INC.

13,197,560

SHARES OF COMMON STOCK

This

prospectus relates to the resale of 993,742 shares (the “Issued Shares”) of our

common stock, par value $.001 per share (the “Common Stock”), 7,086,078 shares

of Common Stock (the “Conversion Shares”) issuable upon the conversion of shares

of our Series A Convertible Preferred Stock, par value $.001 per share (the

“Series A Preferred Stock”), and 5,117,740 shares of Common Stock (the “Warrant

Shares”) issuable upon the exercise of warrants to purchase shares of our Common

Stock (the “Warrants”). The Issued Shares, the Conversion Shares and

the Warrant Shares (collectively, the “Shares”) are being offered by the selling

stockholders (the “Selling Stockholders”) identified in this

prospectus.

We will

not receive any of the proceeds from the sale of the Issued Shares or the

Conversion Shares by the Selling Stockholders. However, we will receive the

proceeds from any cash exercise of Warrants to purchase the Warrant Shares to be

sold hereunder. See “Use of Proceeds.” The Selling Stockholders may sell their

shares of Common Stock on any stock exchange, market or trading facility on

which the shares are traded or quoted or in private transactions. These sales

may be at fixed prices, at prevailing market prices at the time of sale, at

prices related to the prevailing market price, at varying prices determined at

the time of sale, or at negotiated prices. See “Plan of

Distribution.”

We have

agreed to pay certain expenses in connection with the registration of the

Shares.

Our

Common Stock is quoted on the OTC Bulletin Board under the trading symbol

“RMSI.” The closing price for our Common Stock on the OTC Bulletin Board on

March 24, 2010 was $4.50 per share. You are urged to obtain

current market quotations of our Common Stock before purchasing any of the

Shares being offered for sale pursuant to this prospectus.

The

Selling Stockholders, and any broker-dealer executing sell orders on behalf of

the Selling Stockholders, may be deemed to be “underwriters” within the meaning

of the Securities Act of 1933, as amended. Commissions received by

any broker-dealer may be deemed underwriting commissions under the Securities

Act of 1933, as amended.

Investing

in our Common Stock involves risk. You should carefully consider the risk

factors beginning on page 6 of this prospectus before purchasing shares of our

Common Stock.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED OF THESE SECURITIES, OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The date

of this prospectus is ____________, 2010

5

Table

of Contents

|

Page

|

|

|

SUMMARY

|

1

|

|

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

|

4

|

|

THE

OFFERING

|

5

|

|

RISK

FACTORS

|

6

|

|

USE

OF PROCEEDS

|

17

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

18

|

|

DESCRIPTION

OF THE BUSINESS

|

33

|

|

DIRECTORS

AND EXECUTIVE OFFICERS

|

50

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

54

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

56

|

|

SELLING

STOCKHOLDERS

|

58

|

|

PLAN

OF DISTRIBUTION

|

77

|

|

DESCRIPTION

OF SECURITIES

|

80

|

|

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

83

|

|

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

|

85

|

|

LEGAL

MATTERS

|

86

|

|

EXPERTS

|

86

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

86

|

|

FINANCIAL

STATEMENTS

|

F-1

|

i

SUMMARY

This

summary highlights material information about us that is described more fully

elsewhere in this prospectus. It may not contain all of the information that you

find important. You should carefully read this entire document, including the

“Risk Factors” section beginning on page 6 of this prospectus and the financial

statements and related notes to those statements appearing elsewhere in this

prospectus before making a decision to invest in our Common Stock.

Unless

otherwise indicated in this prospectus or the context otherwise requires, all

references to “we,” “us,” “our” and “the Company” or “China LianDi” refers

collectively to Remediation Services, Inc. and its wholly-owned

subsidiaries.

OUR

COMPANY

We

provide downstream flow equipment and engineering services to China’s leading

petroleum and petrochemical companies. Through our four operating subsidiaries

located in the in the People’s Republic of China (the “PRC”) and the Hong Kong

Special Administration Region of the PRC, we: (i) distribute a wide range of

petroleum and petrochemical valves and equipment, including unheading units for

the delayed coking process, as well as provide associated value-added technical

services; (ii) provide systems integration services; and (iii) develop and

market proprietary optimization software for the polymerization process. Our

products and services are provided both bundled or individually, depending on

the needs of the customer.

We are a

pioneer in modernizing China’s delayed coking industry, and, as such, are

strategically positioned to capitalize opportunistically on growth opportunities

as new technologies enter our market. For example, as part of our

many potential expansion alternatives, we plan to install in the fall of 2010,

and are now exploring future opportunities to assemble, clean and safe enclosed

unheading units for the delayed coking process at a Chinese facility (unheading

units are used in delayed coking to “unhead” or open the coke drum for the

removal of the residual coke). Any facility like this would be the first of its

kind in the PRC. As of December

31, 2009, we were involved in approximately 20 total projects in approximately

eight provinces, cities, autonomous regions and municipalities located in

China. Since our inception we have

completed more than 200 projects in approximately 24 provinces, cities,

autonomous regions and municipalities located in China.

Our objectives are to enhance

the reputation of our brand, continue to achieve rapid growth and to strengthen

our position as the leading innovator in clean technology for the petroleum and

petrochemical industry in China. In the next three years we intend to strengthen

our optimization software for the polymerization reaction of ethylene

production, enhancing its function and reliability. We intend to leverage our

current relationships in the petroleum and petrochemical industry to become a

leading player in clean technology by bringing totally enclosed unheading units

to China. We also intend to expand and further develop our long-term

relationships with our customers, helping them to reduce their production costs

and increase the efficiency and safety of their

facilities.

1

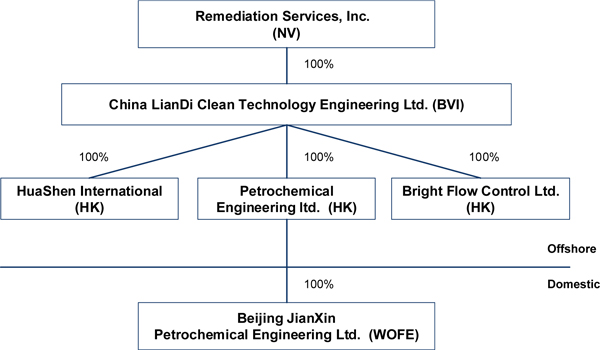

Remediation

Services Organizational Structure

Share

Exchange Agreement

On

February 26, 2010 (the “Closing Date”), we entered into a Share Exchange

Agreement (the “Exchange Agreement”), by and among (i) China LianDi Clean

Technology Engineering Ltd. (“China LianDi”) and China LianDi’s shareholders, SJ

Asia Pacific Ltd., a company organized under the laws of the British Virgin

Islands, which is a wholly-owned subsidiary of SJI Inc., a Jasdaq listed company

organized under the law of Japan, China Liandi Energy Resources Engineering

Technology Limited, a company organized under the laws of the British Virgin

Islands, Hua Shen Trading (International) Limited, a company organized under the

laws of the British Virgin Islands, Rapid Capital Holdings Limited, a company

organized under the laws of the British Virgin Islands, Dragon Excel Holdings

Limited, a company organized under the laws of the British Virgin Islands, and

TriPoint Capital Advisors, LLC, a limited liability company organized under the

laws of Maryland (collectively, the “China LianDi Shareholders”), who together

owned shares constituting 100% of the issued and outstanding ordinary shares of

China LianDi (the “China LianDi Shares”) and (ii) Reed Buley, our former

principal stockholder (“Buley”). Pursuant to the terms of the Exchange

Agreement, the China LianDi Shareholders transferred to us all of the China

LianDi Shares in exchange for 27,354,480 shares of our Common Stock (such

transaction, the “Share Exchange”). As a result of the Share Exchange, we are

now a holding company, which through our operating companies in the PRC,

provides downstream flow equipment and engineering services to the leading

petroleum and petrochemical companies in the PRC.

Immediately

prior to the Share Exchange, 4,690,000 shares of our Common Stock then

outstanding were cancelled and retired, so that immediately prior to the private

placement described below, we had 28,571,430 shares issued and outstanding.

China LianDi also deposited $275,000 into an escrow account which amount was

paid to Buley, owner of the cancelled shares, as a result of the Share Exchange

having been consummated.

2

Private

Placement

On

February 26, 2010 and immediately following the Share Exchange, we entered into

a securities purchase agreement (the “Purchase Agreement”) with certain

investors (collectively, the “Investors”) for the issuance and sale in a private

placement of 787,342 units (the “Units”) at a purchase price of $35 per Unit,

consisting of, in the aggregate, (a) 7,086,078 shares of Series A convertible

preferred stock, par value $0.001 per share (the “Series A Preferred Stock”)

convertible into the same number of shares of Common Stock (the “Conversion

Shares”), (b) 787,342 shares of Common Stock (the “Issued Shares”), (c)

three-year Series A Warrants (the “Series A Warrants”) to purchase up to

1,968,363 shares of Common Stock, at an exercise price of $4.50 per share (the

“Series A Warrant Shares”), and (d) three-year Series B Warrants (the “Series B

Warrants” and, together with the Series A Warrants, the “Warrants”) to purchase

up to 1,968,363 shares of Common Stock, at an exercise price of $5.75 per share

(the “Series B Warrant Shares” and, together with the Series A Warrant Shares,

the “Warrant Shares”), for aggregate gross proceeds of approximately $27.56

million (the “Private Placement”). The issuance of the Units was exempt from

registration pursuant to Section 4(2) of the Securities Act of 1933, as amended

(the “Securities Act”), and Regulation D or Regulation S promulgated

thereunder.

In

connection with the Private Placement, we also entered into a registration

rights agreement (the “Registration Rights Agreement”) with the Investors, in

which we agreed to file this registration statement with the Securities and

Exchange Commission (the “SEC”) to register for resale the Issued Shares, the

Conversion Shares and the Warrant Shares within 30 calendar days of the Closing

Date, and to have this registration statement declared effective within 150

calendar days of the Closing Date or within 180 calendar days of the Closing

Date in the event the SEC conducts a full review of this registration

statement. We agreed to keep this registration statement continuously

effective under the Securities Act until such date as is the earlier of the date

when all of the securities covered by this registration statement have been sold

or the date on which such securities may be sold without any restriction

pursuant to Rule144. If we do not comply with the foregoing

obligations under the Registration Rights Agreement, we will be required to pay

cash liquidated damages to each investor, at the rate of 2% of the applicable

subscription amount for each 30 day period in which we are not in compliance;

provided, that such

liquidated damages will be capped at 10% of the subscription amount of each

investor and will not apply to any shares that may be sold pursuant to Rule 144

under the Securities Act, or are subject to an SEC comment with respect to Rule

415 promulgated under the Securities Act.

We also

entered into a make good escrow agreement with the Investors (the “Securities

Escrow Agreement”), pursuant to which China LianDi Energy Resources Engineering

Technology Ltd. (the “Principal Stockholder”), an affiliate of Jianzhong Zuo,

our Chief Executive Officer, President and Chairman, delivered into an escrow

account 1,722,311 shares of Common Stock (the “Escrow Shares”) to be used as a

share escrow for the achievement of a fiscal year 2011 net income performance

threshold of $20.5 million. With respect to the 2011 performance year, if we

achieve less than 95% of the 2011 performance threshold, then the Escrow Shares

for such year will be delivered to the Investors in the amount of 86,115.55

shares (rounded up to the nearest whole share and pro rata based on the number

of shares of Series A Preferred Stock owned by such Investor at such date) for

each full percentage point by which such threshold was not achieved up to a

maximum of 1,722,311 shares. Any Escrow Shares not delivered to any Investor

because such Investor no longer holds shares of Series A Preferred Stock or

Conversion Shares, or because the 2011 performance threshold was met, shall be

returned to the Principal Stockholder.

For the

purposes of the Securities Escrow Agreement, net income is defined in accordance

with US GAAP and reported by us in our audited financial statements for fiscal

year ended 2011; provided, however, that net income for fiscal year ended 2011

shall be increased by any non-cash charges incurred (i) as a result of the

Private Placement, including without limitation, as a result of the issuance

and/or conversion of the Series A Preferred Stock, and the issuance and/or

exercise of the Warrants, (ii) as a result of the release of the Escrow Shares

to the Principal Stockholder and/or the Investors, as applicable, pursuant to

the terms of the Securities Escrow Agreement, (iii) as a result of the issuance

of ordinary shares of the Principal Stockholder to its PRC shareholders, upon

the exercise of options granted to such PRC shareholders by the Principal

Stockholder, as of the date of the Securities Escrow Agreement, (iv) as a result

of the issuance of Warrants to any placement agent and its designees in

connection with the Private Placement, (v) the exercise of any Warrants to

purchase Common Stock outstanding and (vi) the issuance under any

performance based equity incentive plan that we adopt. Net income will also be

increased to adjust for any cash or non-cash charges resulting from the payment

of dividends on the Series A Preferred Stock in connection with the Private

Placement.

3

On the

Closing Date, we and China LianDi Energy Resources Engineering Technology Ltd.,

an affiliate of Jianzhong Zuo, our Chief Executive Officer, President and

Chairman, entered into a lock-up agreement whereby such entity is prohibited

from selling our securities until six (6) months after the effective date of the

registration statement required to be filed under the Registration Rights

Agreement. For one (1) year thereafter, it will be permitted to sell up to

one-twelfth (1/12) of its initial holdings every month.

Executive

Offices

Our

principal executive offices are located at Unit 401-405.4/F, Tower B,

Wanliuxingui Building, 28 Wanquanzhuang Road, Haidian District, Beijing, China

100089, Tel: (86) (0)10-5872 0171, Fax: (86) (0)10-5872 0181.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

The

statements contained in this Form S-1 that are not purely historical are

forward-looking statements within the meaning of Section 27A of the Securities

Act, and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). These

include statements about the Company’s expectations, beliefs, intentions or

strategies for the future, which are indicated by words or phrases such as

“anticipate,” “expect,” “intend,” “plan,” “will,” “the Company believes,”

“management believes” and similar words or phrases. The forward-looking

statements are based on the Company’s current expectations and are subject to

certain risks, uncertainties and assumptions. The Company’s actual results could

differ materially from results anticipated in these forward-looking statements.

All forward-looking statements included in this document are based on

information available to the Company on the date hereof, and the Company assumes

no obligation to update any such forward-looking statements.

4

THE

OFFERING

|

Common

Stock being offered by Selling Stockholders

|

Up

to 13,197,560 shares(1)

|

|

Common

Stock outstanding

|

29,358,772

shares as of the date of this Prospectus

|

|

Common

Stock outstanding after the Offering

|

41,562,590(2)

|

|

Use

of Proceeds

|

We

will not receive any proceeds from the sale of shares by the Selling

Stockholders.

|

|

OTC

Bulletin Board Symbol

|

RMSI

|

|

Risk

Factors

|

The

securities offered by this prospectus are speculative and involve a high

degree of risk and investors purchasing securities should not purchase the

securities unless they can afford the loss of their entire investment. See

“Risk Factors” beginning on page 6.

|

|

(1)

|

This

prospectus relates to the resale by the Selling Stockholders of up

to 13,197,560 shares of our Common Stock, including 993,742 shares of

our Common Stock that are currently issued and outstanding, 7,086,078

shares of our Common Stock (the “Conversion Shares”) issuable upon the

conversion of our Series A Preferred Stock, and 5,117,740 shares of our

Common Stock issuable upon exercise of Warrants. The Warrant Shares are

comprised of (i) 1,968,363 shares of Common Stock issuable upon exercise

of Series A Warrants to purchase our Common Stock, (ii) 1,968,363 shares

of Common Stock issuable upon exercise of Series B Warrants to purchase

our Common Stock and (iii) 1,181,014 shares of Common Stock issuable upon

exercise of placement agent Warrants to purchase our Common Stock issued

to TriPoint Global Equities, LLC, as placement agent in connection with

the Private Placement, and certain of its designees as set forth in this

prospectus.

|

|

(2)

|

Assumes

issuance of all Conversion Shares and Warrant

Shares.

|

5

RISK

FACTORS

An

investment in our Common Stock is speculative and involves a high degree of risk

and uncertainty. You should carefully consider the risks described below,

together with the other information contained in this prospectus, including the

consolidated financial statements and notes thereto, before deciding to invest

in our Common Stock. Additional risks not presently known to us or that we

presently consider immaterial may also adversely affect our Company. If any of

the following risks occur, our business, financial condition and results of

operations and the value of our Common Stock could be materially and adversely

affected.

Risks

Related to Our Business

Key

employees are essential to growing our business.

Jianzhong

Zuo, Jintai Zhao, Zipeng Zhang and Junheng Su are essential to our ability to

continue to grow our business. They have established relationships within the

industries in which we operate. If they were to leave us, our growth strategy

might be hindered, which could limit our ability to increase

revenue.

In

addition, we face competition for attracting skilled personnel. If we fail to

attract and retain qualified personnel to meet current and future needs, this

could slow our ability to grow our business, which could result in a decrease in

market share.

We

may need additional capital and we may not be able to obtain it at acceptable

terms, or at all, which could adversely affect our liquidity and financial

position.

We may

need additional cash resources due to changed business conditions or other

future developments. If these sources are insufficient to satisfy our cash

requirements, we may seek to sell additional equity or debt securities or obtain

a credit facility. The incurrence of indebtedness would result in increased debt

service obligations and could result in operating and financing covenants that

would restrict our operations and liquidity.

Our

ability to obtain additional capital on acceptable terms is subject to a variety

of uncertainties, including, but not limited to the following, and therefore may

never occur:

|

|

·

|

investors’

perception of, and demand for, securities of similar oil and gas equipment

and services/clean technology companies in

China;

|

|

|

·

|

conditions

of the U.S. and other capital markets in which we may seek to raise

funds;

|

|

|

·

|

our

future results of operations, financial condition and cash

flow;

|

|

|

·

|

PRC

governmental regulation of foreign investment in oil and gas equipment and

services/clean technology companies in

China;

|

|

|

·

|

economic,

political and other conditions in China;

and

|

|

|

·

|

PRC

governmental policies relating to foreign currency

borrowings.

|

Our

failure to protect our intellectual property rights could have a negative impact

on our business.

We

believe our brand, trade name, copyrights and other intellectual property are

critical to our success. The success of our business depends in part upon our

continued ability to use our brand, trade names and copyrights to further

develop and increase brand awareness. The infringement of our trade names and

copyrights could diminish the value of our brand and its market acceptance,

competitive advantages or goodwill. In addition, our information and operational

systems, which have not been patented or otherwise registered as our property,

are a key component of our competitive advantage and our growth

strategy.

6

Monitoring

and preventing the unauthorized use of our intellectual property is difficult.

The measures we take to protect our brand, trade names, copyrights and other

intellectual property rights may not be adequate to prevent their unauthorized

use by third parties. Furthermore, application of laws governing intellectual

property rights in China and abroad is uncertain and evolving, and could involve

substantial risks to us. If we are unable to adequately protect our brand, trade

names, copyrights and other intellectual property rights, we may lose these

rights and our business, results of operations, financial condition and

prospects could be materially and adversely affected.

We

rely on computer software and hardware systems in managing our operations, the

failure of which could adversely affect our business, financial condition and

results of operations.

We are

dependent upon our computer software and hardware systems in supporting our

network and managing and monitoring programs on the network. In addition, we

rely on our computer hardware for the storage, delivery and transmission of the

data on our network. Any system failure which interrupts the input, retrieval

and transmission of data or increases the service time could disrupt our normal

operation. Any failure in our computer software or hardware systems could

decrease our revenues and harm our relationships with our customers, which in

turn could have a material adverse effect on our business, financial condition

and results of operations.

Our

dependence on a limited number of suppliers could adversely impact our

distribution capabilities or increase our costs, which could harm our reputation

or materially and adversely affect our business, results of operations and

financial condition.

We import

high-quality petroleum and petrochemical valves and similar equipment from a

limited number of third-party suppliers, including Cameron, DeltaValve and Poyam

Valves, and distribute them to our domestic clients who are large petroleum and

petrochemical companies located and operating in China. The failure of a

supplier to supply valves and other equipment satisfying our quality, quantity

and cost requirements in a timely and efficient manner could impair our ability

to distribute these products, increase our costs, and have an adverse effect on

our ability to maintain our client network of domestic buyers of this machinery.

The third-party suppliers from whom we import petroleum and petrochemical valves

and similar equipment have not committed, contractually or otherwise, to

distribute their products through us on an exclusive or a non-exclusive basis.

If we fail to maintain our relationships with these suppliers or fail to develop

new relationships with other suppliers, we may only be able to distribute these

products at a higher cost or after lengthy delays, or may not be able to

distribute these products at all. If our suppliers identify alternative sales

channels, they may choose to sell to other buyers or raise their prices. As a

result, we may be compelled to pay higher prices to secure our product supply,

which could adversely affect our business, results of operations and financial

condition.

Although

our continuing relationships with DeltaValve and other manufacturers are

important components of our future growth plan, there can be no assurance that

we will continue to be a distributor for such manufacturers, on an exclusive or

non-exclusive basis, or that we will in the future successfully consummate the

expansion and investment opportunities that we seek.

In the

past, we have had a strong working relationship with DeltaValve and other

manufacturers and have acted as the sole distributor of DeltaValve products in

China. Although we believe that our relationship with DeltaValve and other

manufacturers will continue, there is no assurance that we will retain our

position as sole distributor of certain DeltaValve products, or as a distributor

of other manufacturers’ products. DeltaValve and other manufacturers may

determine to provide licenses to distribute their products to our competitors

and/or may not renew our licenses with them on terms favorable to us or at all.

Furthermore, although we continually explore many potential expansion and

investment opportunities in our industry with third parties such as DeltaValve,

there can be no assurance that the opportunities that we pursue will ultimately

be consummated, or appropriately licensed and approved. In such circumstances,

we may be required to pursue other opportunities at lower margins, which could

adversely affect our business, results of operations and financial

condition.

We

do not have a majority of independent directors serving on our Board of

Directors, which could present the potential for conflicts of

interest.

We do not

have a majority of independent directors serving on our Board of Directors. In

the absence of a majority of independent directors, our executive officers could

establish policies and enter into transactions without independent review and

approval thereof. This could present the potential for a conflict of interest

between us and our stockholders, generally, and the controlling officers,

stockholders or directors.

7

We

have limited insurance coverage.

The

insurance industry in China is still at an early stage of development. Insurance

companies in China offer limited insurance products. We have determined that the

risks of disruption or liability from our business, the loss or damage to our

property, including our facilities, equipment and office furniture, the cost of

insuring for these risks, and the difficulties associated with acquiring such

insurance on commercially reasonable terms make it impractical for us to have

such insurance. As a result, we do not have any business liability, disruption,

litigation or property insurance coverage for our operations in China except for

insurance on some company owned vehicles. Any uninsured occurrence of loss or

damage to property, or litigation or business disruption may result in the

incurrence of substantial costs and the diversion of resources, which could have

an adverse effect on our operating results.

If

we are unable to establish appropriate internal financial reporting controls and

procedures, it could cause us to fail to meet our reporting obligations, result

in the restatement of our financial statements, harm our operating results,

subject us to regulatory scrutiny and sanction, cause investors to lose

confidence in our reported financial information and have a negative effect on

the market price for shares of our Common Stock.

Effective

internal controls are necessary for us to provide reliable financial reports and

effectively prevent fraud. We maintain a system of internal control over

financial reporting, which is defined as a process designed by, or under the

supervision of, our principal executive officer and principal financial officer,

or persons performing similar functions, and effected by our Board of Directors,

management and other personnel, to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting

principles.

As a

public company, we will have significant additional requirements for enhanced

financial reporting and internal controls. We will be required to document and

test our internal control procedures in order to satisfy the requirements of

Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management

assessments of the effectiveness of our internal controls over financial

reporting and a report by our independent registered public accounting firm

addressing these assessments. The process of designing and implementing

effective internal controls is a continuous effort that requires us to

anticipate and react to changes in our business and the economic and regulatory

environments and to expend significant resources to maintain a system of

internal controls that is adequate to satisfy our reporting obligations as a

public company.

We cannot

assure you that we will not, in the future, identify areas requiring improvement

in our internal control over financial reporting. We cannot assure you that the

measures we will take to remediate any areas in need of improvement will be

successful or that we will implement and maintain adequate controls over our

financial processes and reporting in the future as we continue our growth. If we

are unable to establish appropriate internal financial reporting controls and

procedures, it could cause us to fail to meet our reporting obligations, result

in the restatement of our financial statements, harm our operating results,

subject us to regulatory scrutiny and sanction, cause investors to lose

confidence in our reported financial information and have a negative effect on

the market price for shares of our Common Stock.

Lack

of experience as officers of publicly-traded companies of our management team

may hinder our ability to comply with Sarbanes-Oxley Act.

It may be

time consuming, difficult and costly for us to develop and implement the

internal controls and reporting procedures required by the Sarbanes-Oxley Act.

We may need to hire additional financial reporting, internal controls and other

finance staff or consultants in order to develop and implement appropriate

internal controls and reporting procedures. If we are unable to comply with the

Sarbanes-Oxley Act’s internal controls requirements, we may not be able to

obtain the independent auditor certifications that Sarbanes-Oxley Act requires

publicly-traded companies to obtain.

8

We

will incur increased costs as a result of being a public company.

As a

public company, we will incur significant legal, accounting and other expenses

that we did not incur as a private company. In addition, the Sarbanes-Oxley Act,

as well as new rules subsequently implemented by the SEC, has required changes

in corporate governance practices of public companies. We expect these new rules

and regulations to increase our legal, accounting and financial compliance costs

and to make certain corporate activities more time-consuming and costly. In

addition, we will incur additional costs associated with our public company

reporting requirements. We are currently evaluating and monitoring developments

with respect to these new rules, and we cannot predict or estimate the amount of

additional costs we may incur or the timing of such costs.

Risks

Relating to Regulation of Our Business

Uncertainties

with respect to the governing regulations could have a material and adverse

effect on us.

There are

substantial uncertainties regarding the interpretation and application of the

PRC laws and regulations, including, but not limited to, the laws and

regulations governing our business and our ownership of equity interest in

Beijing JianXin. These laws and regulations are relatively new and may be

subject to change, and their official interpretation and enforcement may involve

substantial uncertainty. The effectiveness of newly enacted laws, regulations or

amendments may be delayed, resulting in detrimental reliance by foreign

investors. New laws and regulations that affect existing and proposed future

businesses may also be applied retroactively.

The PRC

government has broad discretion in dealing with violations of laws and

regulations, including levying fines, revoking business and other licenses and

requiring actions necessary for compliance. In particular, licenses and permits

issued or granted to Beijing JianXin by relevant governmental bodies may be

revoked at a later time by higher regulatory bodies. We cannot predict the

effect of the interpretation of existing or new PRC laws or regulations on our

businesses. We cannot assure you that our current ownership and operating

structure would not be found in violation of any current or future PRC laws or

regulations. As a result, we may be subject to sanctions, including fines, and

could be required to restructure our operations or cease to provide certain

services. In addition, any litigation in China may be protracted and result in

substantial costs and diversion of resources and management attention. Any of

these or similar actions could significantly disrupt our business operations or

restrict us from conducting a substantial portion of our business operations,

which could materially and adversely affect our business, financial condition

and results of operations.

Our

PRC operating subsidiary will be subject to restrictions on dividend

payments.

We may

rely on dividends and other distributions from the Beijing JianXin, our PRC

subsidiary, to provide us with cash flow and to meet our other obligations.

Current regulations in the PRC would permit Beijing JianXin to pay dividends to

us only out of its accumulated distributable profits, if any, determined in

accordance with Chinese accounting standards and regulations. In addition,

Beijing JianXin will be required to set aside at least 10% (up to an aggregate

amount equal to half of its registered capital) of its accumulated profits each

year. Such cash reserve may not be distributed as cash dividends. In addition,

if the Beijing JianXin incurs debt on its own behalf in the future, the

instruments governing the debt may restrict its ability to pay dividends or make

other payments to us.

PRC

regulations on loans and direct investments by overseas holding companies in PRC

entities may delay or prevent us to make overseas loans or additional capital

contributions to Beijing JianXin.

Under the

PRC laws, foreign investors may make loans to their PRC subsidiaries or foreign

investors may make additional capital contributions to their PRC subsidiaries.

Any loans to such PRC subsidiaries are subject to the PRC regulations and

foreign exchange loan registrations, i.e. loans by foreign investors to their

PRC subsidiaries to finance their activities cannot exceed statutory limits and

must be registered with the State Administration of Foreign Exchange, or SAFE,

or its local branch. Foreign investors may also decide to finance their PRC

subsidiaries by means of additional capital contributions. These capital

contributions must be examined and approved by the Ministry of Commerce, or

MOFCOM, or its local branch in advance.

9

Under

the PRC Enterprise Income Tax

Law, we may be classified as a “resident enterprise” of China, and such

classification would likely result in unfavorable tax consequences to us and our

non-PRC stockholders.

On March

16, 2007, the National People’s Congress or the NPC, approved and promulgated

the PRC Enterprise Income Tax

Law, which we refer to as the New EIT Law. The New EIT Law took effect on

January 1, 2008. Under the New EIT Law, Foreign Investment Enterprises (FIEs)

and domestic companies are subject to a uniform tax rate of 25%. The New EIT Law

provides a five-year transition period starting from its effective date for

those enterprises which were established before the promulgation date of the New

EIT Law and which were entitled to a preferential lower tax rate under the

then-effective tax laws or regulations.

On

December 26, 2007, the State Council issued a Notice on Implementing Transitional

Measures for Enterprise Income Tax, or the Notice, providing that the

enterprises that have been approved to enjoy a low tax rate prior to the

promulgation of the New EIT Law will be eligible for a five-year transition

period since January 1, 2008, during which time the tax rate will be increased

step by step to the 25% unified tax rate set out in the New EIT Law. From

January 1, 2008, for the enterprises whose applicable tax rate was 15% before

the promulgation of the New EIT Law , the tax rate will be increased to 18% for

year 2008, 20% for year 2009, 22% for year 2010, 24% for year 2011, 25% for year

2012. For the enterprises whose applicable tax rate was 24%, the tax rate will

be changed to 25% from January 1, 2008.

Under the

New EIT Law, an enterprise established outside of China with “de facto

management bodies” within China is considered a “resident enterprise,” meaning

that it can be treated in a manner similar to a Chinese enterprise for

enterprise income tax purposes. The implementing rules of the New EIT Law define

de facto management as “substantial and overall management and control over the

production and operations, personnel, accounting, and properties” of the

enterprise. Because the New EIT Law and its implementing rules are new, no

official interpretation or application of this new “resident enterprise”

classification is available. Therefore, it is unclear how tax authorities will

determine tax residency based on the facts of each case.

If the

PRC tax authorities determine that we are “resident enterprises” for PRC

enterprise income tax purposes, a number of unfavorable PRC tax consequences

could follow. First, we may be subject to the enterprise income tax at a rate of

25% on our worldwide taxable income as well as PRC enterprise income tax

reporting obligations. In our case, this would mean that income such as interest

on offering proceeds and non-China source income would be subject to PRC

enterprise income tax at a rate of 25%. Second, although under the New EIT Law

and its implementing rules dividends paid to us from our PRC subsidiaries would

qualify as “tax-exempt income,” we cannot guarantee that such dividends will not

be subject to a 10% withholding tax, as the PRC foreign exchange control

authorities, which enforce the withholding tax, have not yet issued guidance

with respect to the processing of outbound remittances to entities that are

treated as resident enterprises for PRC enterprise income tax purposes. Finally,

it is possible that “resident enterprise” classification could result in a

situation in which a 10% withholding tax is imposed on dividends we pay to our

non-PRC stockholders and with respect to gains derived by our non-PRC

stockholders from transferring our shares.

Dividends

we received from Beijing JianXin may be subject to PRC withholding

tax.

The New

EIT Law provides that an income tax rate of 20% may be applicable to dividends

payable to non-PRC investors that are “non-resident enterprises” and that do not

have an establishment or place of business in the PRC, or which have such

establishment or place of business in the PRC but the relevant income is not

effectively connected with the establishment or place of business, to the extent

such dividends are derived from sources within the PRC. The income tax for

non-resident enterprises shall be subject to withholding at the income source,

with the payer acting as the obligatory withholder under the New EIT Law, and

therefore such income taxes are generally called withholding tax in practice.

The State Council of the PRC has reduced the withholding tax rate from 20% to

10% through the Implementation

Rules of the New EIT Law. It is currently unclear in what circumstances a

source will be considered as located within the PRC. We are an offshore holding

company. Thus, if we are considered as a “non-resident enterprise” under the New

EIT Law and the dividends paid to us by our subsidiary in the PRC are considered

income sourced within the PRC, such dividends may be subject to a 10%

withholding tax.

The new

tax law provides only a framework of the enterprise tax provisions, leaving many

details on the definitions of numerous terms as well as the interpretation and

specific applications of various provisions unclear and unspecified. Any

increase in our combined company’s tax rate in the future could have a material

adverse effect on our financial conditions and results of

operations.

10

Beijing

JianXin is obligated to withhold and pay PRC individual income tax on behalf of

our employees who are subject to PRC individual income tax. If we fail to

withhold or pay such individual income tax in accordance with applicable PRC

regulations, we may be subject to certain sanctions and other penalties and may

become subject to liability under PRC laws.

Under PRC

laws, Beijing JianXin, our PRC subsidiary, is obligated to withhold and pay

individual income tax on behalf of our employees who are subject to PRC

individual income tax. If the PRC Subsidiary fails to withhold and/or pay such

individual income tax in accordance with PRC laws, it may be subject to certain

sanctions and other penalties and may become subject to liability under PRC

laws.

In

addition, the State Administration of Taxation has issued several circulars

concerning employee stock options. Under these circulars, our employees working

in the PRC (which could include both PRC employees and expatriate employees

subject to PRC individual income tax) who exercise stock options will be subject

to PRC individual income tax. Our PRC subsidiary has obligations to file

documents related to employee stock options with relevant tax authorities and

withhold and pay individual income taxes for those employees who exercise their

stock options. While tax authorities may advise us that our policy is compliant,

they may change their policy, and we could be subject to sanctions.

Regulation

of foreign currency’s conversion into RMB and investment by FIEs may adversely

affect our PRC Subsidiary’s direct investment in China

On August

29, 2008, the SAFE issued a Notice of the General Affairs Department of the

State Administration of Foreign Exchange on the Relevant Operating Issues

concerning the Improvement of the Administration of Payment and Settlement of

Foreign Currency Capital of Foreign-Invested Enterprises or Notice 142, to

further regulate the foreign exchange of FIEs. According to Notice 142, FIEs

shall obtain verification report from a local accounting firm before converting

its registered capital of foreign currency into Renminbi, and the converted

Renminbi shall be used for the business within its permitted business scope.

Notice 142 explicitly prohibits FIEs from using RMB converted from foreign

capital to make equity investments in the PRC, unless the domestic equity

investment is within the approved business scope of the FIE and has been

approved by SAFE in advance.

Regulations

of Overseas Investments and Listings may increase the administrative burden we

face and create regulatory uncertainties.

On August

8, 2006, six PRC regulatory agencies, including MOFCOM, the CSRC, the SASAC, the

SAT, the SAIC and SAFE, jointly amended and released the New M&A Rule, which

took effect as of September 8, 2006. This regulation, among other things,

includes provisions that purport to require that an offshore special purpose

vehicle (SPV) formed for purposes of overseas listing of equity interest in PRC

companies and controlled directly or indirectly by PRC companies or individuals

obtain the approval of the CSRC prior to the listing and trading of such SPV’s

securities on an overseas stock exchange.

On

September 21, 2006, the CSRC published on its official website procedures

regarding its approval of overseas listings by SPVs. The CSRC approval

procedures require the filing of a number of documents with the CSRC and it

would take several months to complete the approval process.

The

application of the New M&A Rule with respect to overseas listings of SPVs

remains unclear with no consensus currently existing among the leading PRC law

firms regarding the scope of the applicability of the CSRC approval

requirement.

11

It is not

clear whether the provisions in the new regulation regarding the offshore

listing and trading of the securities of a SPV applies to an offshore company

such as us which owns equity interest in the PRC Operating Entity. We believe

that the New M&A Rule and the CSRC approval are not required in the context

of the Share Exchange under our transaction because (i) such Share Exchange is a

purely foreign related transaction governed by foreign laws, not subject to the

jurisdiction of PRC laws and regulations; (ii) we are not a SPV formed or

controlled by PRC companies or PRC individuals; (iii) the PRC Operating Entity

is a PRC wholly foreign owned enterprise, which is not owned or controlled by

PRC individuals or entities; (iv) we are owned or substantively controlled by

foreigners; and (v) there is no clear requirement in the New M&A Rule that

would require an application to be submitted to the MOFCOM or the CSRC for the

approval of the listing and trading of our company on the U.S. securities

market. However, we cannot be certain that the relevant PRC government agencies,

including the CSRC, would reach the same conclusion, and we still cannot rule

out the possibility that CSRC may deem that the transactions effected by the

Share Exchange circumvented the New M&A Rule, the PRC Securities Law and

other rules and notices.

If the

CSRC or another PRC regulatory agency subsequently determines that the CSRC’s

approval is required for the transaction, we may face sanctions by the CSRC or

another PRC regulatory agency. If this happens, these regulatory agencies may

impose fines and penalties on our operations in the PRC, limit our operating

privileges in the PRC, delay or restrict the repatriation of the proceeds from

this Offering into the PRC, restrict or prohibit payment or remittance of

dividends to us or take other actions that could have a material adverse effect

on our business, financial condition, results of operations, reputation and

prospects, as well as the trading price of our shares. The CSRC or other PRC

regulatory agencies may also take actions requiring us, or making it advisable

for us, to delay or cancel the transaction.

The New

M&A Rule, along with foreign exchange regulations discussed in the above

subsection, will be interpreted or implemented by the relevant government

authorities in connection with our future offshore financings or acquisitions,

and we cannot predict how they will affect our acquisition

strategy.

Risks

Associated With Doing Business In China

There are

substantial risks associated with doing business in China, as set forth in the

following risk factors.

Our

operations and assets in China are subject to significant political and economic

uncertainties.

Changes

in PRC laws and regulations, or their interpretation, or the imposition of

confiscatory taxation, restrictions on currency conversion, imports and sources

of supply, devaluations of currency or the nationalization or other

expropriation of private enterprises could have a material adverse effect on our

business, results of operations and financial condition. Under its current

leadership, the Chinese government has been pursuing economic reform policies

that encourage private economic activity and greater economic decentralization.

There is no assurance, however, that the Chinese government will continue to

pursue these policies, or that it will not significantly alter these policies

from time to time without notice.

We

derive a substantial portion of ours sales from the PRC.

Substantially

all of our sales are generated from the PRC. We anticipate that sales of our

products in the PRC will continue to represent a substantial proportion of our

total sales in the near future. Any significant decline in the condition of the

PRC economy could adversely affect consumer demand of our products, among other

things, which in turn would have a material adverse effect on our business and

financial condition.

Currency

fluctuations and restrictions on currency exchange may adversely affect our

business, including limiting our ability to convert Chinese Renminbi into

foreign currencies and, if Chinese Renminbi were to decline in value, reducing

our revenue in U.S. dollar terms.

Our

reporting currency is the U.S. dollar and our operations in China use their

local currency as their functional currencies. Substantially all of our revenue

and expenses are in Chinese Renminbi. We are subject to the effects of exchange

rate fluctuations with respect to any of these currencies. For example, the

value of the Renminbi depends to a large extent on Chinese government policies

and China’s domestic and international economic and political developments, as

well as supply and demand in the local market. Since 1994, the official exchange

rate for the conversion of Renminbi to the U.S. dollar had generally been stable

and the Renminbi had appreciated slightly against the U.S. dollar. However, on

July 21, 2005, the Chinese government changed its policy of pegging the value of

Chinese Renminbi to the U.S. dollar. Under the new policy, Chinese Renminbi may

fluctuate within a narrow and managed band against a basket of certain foreign

currencies. As a result of this policy change, Chinese Renminbi appreciated

approximately 0.09% against the U.S. dollar in 2009 and 3.35% in 2008. It is

possible that the Chinese government could adopt a more flexible currency

policy, which could result in more significant fluctuation of Chinese Renminbi

against the U.S. dollar. We can offer no assurance that Chinese Renminbi will be

stable against the U.S. dollar or any other foreign currency.

12

The

income statements of our operations are translated into U.S. dollars at the

average exchange rates in each applicable period. To the extent the U.S. dollar

strengthens against foreign currencies, the translation of these foreign

currencies denominated transactions results in reduced revenue, operating

expenses and net income for our international operations. Similarly, to the

extent the U.S. dollar weakens against foreign currencies, the translation of

these foreign currency denominated transactions results in increased revenue,

operating expenses and net income for our international operations. We are also

exposed to foreign exchange rate fluctuations as we convert the financial

statements of our foreign subsidiaries into U.S. dollars in consolidation. If

there is a change in foreign currency exchange rates, the conversion of the

foreign subsidiaries’ financial statements into U.S. dollars will lead to a

translation gain or loss which is recorded as a component of other comprehensive

income. In addition, we have certain assets and liabilities that are denominated

in currencies other than the relevant entity’s functional currency. Changes in

the functional currency value of these assets and liabilities create

fluctuations that will lead to a transaction gain or loss. We have not entered

into agreements or purchased instruments to hedge our exchange rate risks,

although we may do so in the future. The availability and effectiveness of any

hedging transaction may be limited and we may not be able to successfully hedge

our exchange rate risks.

Although

Chinese governmental policies were introduced in 1996 to allow the

convertibility of Chinese Renminbi into foreign currency for current account

items, conversion of Chinese Renminbi into foreign exchange for capital items,

such as foreign direct investment, loans or securities, requires the approval of

the State Administration of Foreign Exchange, or SAFE, which is under the

authority of the People’s Bank of China. These approvals, however, do not

guarantee the availability of foreign currency conversion. We cannot be sure

that we will be able to obtain all required conversion approvals for our

operations or that Chinese regulatory authorities will not impose greater

restrictions on the convertibility of Chinese Renminbi in the future. Because a

significant amount of our future revenue may be in the form of Chinese Renminbi,

our inability to obtain the requisite approvals or any future restrictions on

currency exchanges could limit our ability to utilize revenue generated in

Chinese Renminbi to fund our business activities outside of China, or to repay

foreign currency obligations, including our debt obligations, which would have a

material adverse effect on our financial condition and results of

operations

We

may have limited legal recourse under PRC laws if disputes arise under our

contracts with third parties.

The

Chinese government has enacted laws and regulations dealing with matters such as

corporate organization and governance, foreign investment, commerce, taxation

and trade. However, precedent and experience in implementing, interpreting and

enforcing these laws and regulations is limited, and our ability to enforce

commercial claims or to resolve commercial disputes is unpredictable. If our new

business ventures are unsuccessful, or other adverse circumstances arise from

these transactions, we face the risk that the parties to these ventures may seek

ways to terminate the transactions, or, may hinder or prevent us from accessing

important information regarding the financial and business operations of these

acquired companies. The resolution of these matters may be subject to the

exercise of considerable discretion by agencies of the Chinese government, and

forces unrelated to the legal merits of a particular matter or dispute may

influence their determination. Any rights we may have to specific performance,

or to seek an injunction under PRC law, in either of these cases, are severely

limited, and without a means of recourse by virtue of the Chinese legal system,

we may be unable to prevent these situations from occurring. The occurrence of

any such events could have a material adverse effect on our business, financial

condition and results of operations.

13

We

must comply with the Foreign Corrupt Practices Act.

We are

required to comply with the United States Foreign Corrupt Practices Act, which

prohibits U.S. companies from engaging in bribery or other prohibited payments

to foreign officials for the purpose of obtaining or retaining business. Foreign

companies, including some of our competitors, are not subject to these

prohibitions. Corruption, extortion, bribery, pay-offs, theft and other

fraudulent practices occur from time-to-time in mainland China. If our

competitors engage in these practices, they may receive preferential treatment

from personnel of some companies, giving our competitors an advantage in

securing business or from government officials who might give them priority in

obtaining new licenses, which would put us at a disadvantage. Although we inform

our personnel that such practices are illegal, we can not assure you that our

employees or other agents will not engage in such conduct for which we might be

held responsible. If our employees or other agents are found to have engaged in

such practices, we could suffer severe penalties.

Changes

in foreign exchange regulations in the PRC may affect our ability to pay

dividends in foreign currency or conduct other foreign exchange

business.

The

Renminbi is not a freely convertible currency currently, and the restrictions on

currency exchanges may limit our ability to use revenues generated in Renminbi

to fund our business activities outside the PRC or to make dividends or other

payments in United States dollars. The PRC government strictly regulates

conversion of Renminbi into foreign currencies. Over the years, foreign exchange

regulations in the PRC have significantly reduced the government’s control over

routine foreign exchange transactions under current accounts. In the PRC, the

State Administration for Foreign Exchange, or the SAFE, regulates the conversion

of the Renminbi into foreign currencies. Pursuant to applicable PRC laws and

regulations, foreign invested enterprises incorporated in the PRC are required

to apply for “Foreign Exchange Registration Certificates.” Currently, conversion

within the scope of the “current account” (e.g. remittance of foreign currencies

for payment of dividends, etc.) can be effected without requiring the approval

of SAFE. However, conversion of currency in the “capital account” (e.g. for

capital items such as direct investments, loans, securities, etc.) still

requires the approval of SAFE.

The

Chinese government exerts substantial influence over the manner in which we must

conduct our business activities.

China

only recently has permitted provincial and local economic autonomy and private

economic activities, and, as a result, we are dependent on our relationship with

the local government in the province in which we operate our business. Chinese

government has exercised and continues to exercise substantial control over

virtually every sector of the Chinese economy through regulation and state

ownership. Our ability to operate in China may be harmed by changes in its laws

and regulations, including those relating to taxation, environmental

regulations, land use rights, property and other matters. We believe that our

operations in China are in material compliance with all applicable legal and

regulatory requirements. However, the central or local governments of these

jurisdictions may impose new, stricter regulations or interpretations of

existing regulations that would require additional expenditures and efforts on

our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to

continue to support recent economic reforms and to return to a more centrally

planned economy or regional or local variations in the implementation of

economic policies, could have a significant effect on economic conditions in

China or particular regions thereof, and could require us to divest ourselves of

any interest we then hold in Chinese properties.

Future

inflation in China may inhibit our activity to conduct business in

China.

In recent

years, the Chinese economy has experienced periods of rapid expansion and high

rates of inflation. These factors have led to the adoption by Chinese

government, from time to time, of various corrective measures designed to

restrict the availability of credit or regulate growth and contain inflation.

High inflation may in the future cause Chinese government to impose controls on

credit and/or prices, or to take other action, which could inhibit economic

activity in China, and thereby harm the market for our products.

We

may have difficulty establishing adequate management, legal and financial

controls in the PRC.

We may

have difficulty in hiring and retaining a sufficient number of qualified

employees to work in the PRC. As a result of these factors, we may experience

difficulty in establishing management, legal and financial controls, collecting

financial data and preparing financial statements, books of account and

corporate records and instituting business practices that meet Western

standards. We may have difficulty establishing adequate management, legal and

financial controls in the PRC.

14

You

may experience difficulties in effecting service of legal process, enforcing

foreign judgments or bringing original actions in China based on United States

or other foreign laws against us and our management.

We

conduct substantially all of our operations in China and substantially all of

our assets are located in China. In addition, some of our directors and

executive officers reside within China. As a result, it may not be possible to

effect service of process within the United States or elsewhere outside China

upon some of our directors and senior executive officers, including with respect

to matters arising under U.S. federal securities laws or applicable state

securities laws. It would also be difficult for investors to bring an original

lawsuit against us or our directors or executive officers before a Chinese court

based on U.S. federal securities laws or otherwise. Moreover, China does not

have treaties with the United States or many other countries providing for the

reciprocal recognition and enforcement of judgment of courts.

Because

Chinese laws will govern almost all of our business’ material agreements, we may

not be able to enforce our rights within the PRC or elsewhere, which could

result in a significant loss of business, business opportunities or

capital.

The

Chinese legal system is similar to a civil law system based on written statutes.

Unlike common law systems, it is a system in which decided legal cases have

little precedential value. Although legislation in the PRC over the past 25

years has significantly improved the protection afforded to various forms of

foreign investment and contractual arrangements in the PRC, these laws,

regulations and legal requirements are relatively new. Due to the limited volume

of published judicial decisions, their non-binding nature, the short history

since their enactments, the discrete understanding of the judges or government

agencies of the same legal provision, inconsistent professional abilities of the

judicators, and the inclination to protect local interest in the court rooms,

interpretation and enforcement of PRC laws and regulations involve

uncertainties, which could limit the legal protection available to us, and

foreign investors. The inability to enforce or obtain a remedy under any of our

future agreements could result in a significant loss of business, business

opportunities or capital and could have a material adverse impact on our

business, prospects, financial condition, and results of operations. In

addition, the PRC legal system is based in part on government policies and

internal rules (some of which are not published on a timely basis or at all)

that may have a retroactive effect. As a result, we may not be aware of our

violation of these policies and rules until some time after the violation. In

addition, any litigation in the PRC, regardless of outcome, may be protracted

and result in substantial costs and diversion of resources and management

attention.

Risks

Related to our Securities

Insiders

have substantial control over us, and they could delay or prevent a change in

our corporate control even if our other stockholders wanted it to

occur.

Our

executive officers, directors, and principal stockholders hold approximately

81.06% of our outstanding Common Stock. Accordingly, these stockholders are able

to control all matters requiring stockholder approval, including the election of

directors and approval of significant corporate transactions. This could delay

or prevent an outside party from acquiring or merging with us even if our other

stockholders wanted it to occur.

We

cannot assure you that the Common Stock will become liquid or that it will be

listed on a securities exchange.

Currently,

we are quoted on the OTC Bulletin Board, where an investor may find it difficult

to obtain accurate quotations as to the market value of the Common Stock. In

addition, if we fail to meet the criteria set forth in SEC regulations, by law,

various requirements would be imposed on broker-dealers who sell its securities

to persons other than established customers and accredited investors.