Attached files

Exhibit 10.34

NORTHWEST PARK

LEASE

BY AND BETWEEN

TRUSTEES OF NORTHWEST ASSOCIATES

AND

LEMAITRE VASCULAR, INC.

AT NORTHWEST PARK

BURLINGTON, MASSACHUSETTS

TABLE OF CONTENTS

| TABLE OF CONTENTS |

||||

| ARTICLE 1 REFERENCE DATA |

1 | |||

| 1.1 |

SUBJECT REFERRED TO | 1 | ||

| 1.2 |

EXHIBITS | 2 | ||

| ARTICLE 2 PREMISES AND TERM |

3 | |||

| 2.1 |

PREMISES | 3 | ||

| 2.2 |

TERM | 3 | ||

| ARTICLE 3 IMPROVEMENTS |

4 | |||

| 3.1 |

BASE BUILDING WORK; TENANT IMPROVEMENT WORK | 4 | ||

| 3.2 |

ACCEPTANCE OF THE PREMISES | 5 | ||

| 3.3 |

ALLOWANCE | 5 | ||

| ARTICLE 4 RENT |

5 | |||

| 4.1 |

THE FIXED RENT | 5 | ||

| 4.2 |

ADDITIONAL RENT | 5 | ||

| 4.2.1 |

Real Estate Taxes |

5 | ||

| 4.2.2 |

Personal Property Taxes |

6 | ||

| 4.2.3 |

Operating Costs |

6 | ||

| 4.2.4 |

Insurance |

8 | ||

| 4.2.5 |

Utilities |

9 | ||

| 4.3 |

LATE PAYMENT OF RENT | 9 | ||

| 4.4 |

SECURITY AND RESTORATION DEPOSIT | 9 | ||

| ARTICLE 5 LANDLORD’S COVENANTS |

9 | |||

| 5.1 |

AFFIRMATIVE COVENANTS | 9 | ||

| 5.1.1 |

Heat and Air-Conditioning |

9 | ||

| 5.1.2 |

Electricity |

9 | ||

| 5.1.3 |

Water |

9 | ||

| 5.1.4 |

Fire Alarm |

9 | ||

| 5.1.5 |

Repairs |

9 | ||

| 5.2 |

INTERRUPTION | 10 | ||

| 5.3 |

INTENTIONALLY DELETED | 10 | ||

| 5.4 |

ACCESS | 10 | ||

| 5.5 |

LANDLORD’S INSURANCE | 10 | ||

| 5.6 |

CONDITION OF PREMISES | 10 | ||

| 5.7 |

LANDLORD’S INDEMNIFICATION | 10 | ||

| 5.8 |

ADJACENT USES | 10 | ||

| ARTICLE 6 TENANT’S ADDITIONAL COVENANTS |

10 | |||

| 6.1 |

AFFIRMATIVE COVENANTS | 10 | ||

| 6.1.1 |

Perform Obligations |

10 | ||

| 6.1.2 |

Use |

11 | ||

| 6.1.3 |

Repair and Maintenance |

11 | ||

| 6.1.4 |

Compliance with Law |

11 | ||

| 6.1.5 |

Indemnification |

11 | ||

| 6.1.6 |

Landlord’s Right to Enter |

11 | ||

| 6.1.7 |

Personal Property at Tenant’s Risk |

11 | ||

| 6.1.8 |

Payment of Landlord’s Cost of Enforcement |

12 | ||

| 6.1.9 |

Yield Up |

12 | ||

| 6.1.10 |

Rules and Regulations |

12 | ||

| 6.1.11 |

Estoppel Certificate |

12 | ||

| 6.1.12 |

Landlord’s Expenses Re Consents |

12 | ||

| 6.2 |

NEGATIVE COVENANTS | 12 | ||

| 6.2.1 |

Assignment and Subletting |

12 | ||

| 6.2.2 |

Nuisance |

13 | ||

| 6.2.3 |

Intentionally Deleted |

13 | ||

| 6.2.4 |

Floor Load; Heavy Equipment |

13 | ||

| 6.2.5 |

Installation, Alterations or Additions |

14 | ||

| 6.2.6 |

Abandonment |

14 | ||

| 6.2.7 |

Signs |

14 | ||

| 6.2.8 |

Parking and Storage |

14 | ||

| ARTICLE 7 CASUALTY OR TAKING |

14 | |||

| 7.1 |

TERMINATION | 14 | ||

| 7.2 |

RESTORATION | 15 | ||

| 7.3 |

AWARD | 15 | ||

| 7.4 |

DISBURSEMENT OF INSURANCE PROCEEDS | 15 | ||

| ARTICLE 8 DEFAULTS |

15 | |||

| 8.1 |

EVENTS OF DEFAULT | 15 | ||

| 8.2 |

REMEDIES | 15 | ||

| 8.3 |

REMEDIES CUMULATIVE | 16 | ||

| 8.4 |

LANDLORD’S RIGHT TO CURE DEFAULTS | 16 | ||

| 8.5 |

EFFECT OF WAIVERS OF DEFAULT | 16 | ||

| 8.6 |

NO WAIVER, ETC. | 16 | ||

| 8.7 |

NO ACCORD AND SATISFACTION | 16 | ||

| ARTICLE 9 RIGHTS OF MORTGAGE HOLDERS |

16 | |||

| 9.1 |

RIGHTS OF MORTGAGE HOLDERS | 16 | ||

| 9.2 |

LEASE SUPERIOR OR SUBORDINATE TO MORTGAGES | 17 | ||

| ARTICLE 10 MISCELLANEOUS PROVISIONS |

17 | |||

| 10.1 |

NOTICES FROM ONE PARTY TO THE OTHER | 17 | ||

| 10.2 |

QUIET ENJOYMENT | 17 | ||

| 10.3 |

LEASE NOT TO BE RECORDED | 17 | ||

| 10.4 |

LIMITATION OF LANDLORD’S LIABILITY | 17 | ||

| 10.5 |

ACTS OF GOD | 17 | ||

| 10.6 |

LANDLORD’S DEFAULT | 17 | ||

| 10.7 |

BROKERAGE | 18 | ||

| 10.8 |

APPLICABLE LAW AND CONSTRUCTION; MERGER; JURY TRIAL | 18 | ||

| ARTICLE 11 HAZARDOUS MATERIALS |

18 | |||

| 11.1 |

NO RELEASES OF HAZARDOUS MATERIALS | 18 | ||

| 11.2 |

NOTICES OF RELEASE OF HAZARDOUS MATERIALS | 18 | ||

| 11.3 |

LANDLORD’S RIGHT TO INSPECT | 19 | ||

| 11.4 |

LANDLORD’S RIGHT TO AUDIT | 19 | ||

| 11.5 |

TENANT AUDIT | 19 | ||

| 11.6 |

REMEDIATION | 19 | ||

| 11.7 |

TENANT’S REPORTING REQUIREMENTS; MANAGEMENT AND SAFETY PLAN | 19 | ||

| 11.8 |

INDEMNIFICATION | 19 | ||

| 11.9 |

NOTICE TO TENANT | 19 | ||

| 11.10 |

DELIVERY OF REPORTS | 19 | ||

| 11.11 |

ASBESTOS | |||

NORTHWEST PARK

LEASE

ARTICLE 1

Reference Data

| 1.1 | Subject Referred To. |

Each reference in this Lease to any of the following subjects shall be construed to incorporate the data stated for that subject in this Section 1.1.

| Date of this Lease: | March 23, 2010 | |||

| Building: | The single story Building in Northwest Park in Burlington, Massachusetts (hereinafter referred to as the “Park”) on a parcel of land known as 53 Second Avenue, a description of which is filed in the Middlesex South Registry of the Land Court as Certificate of Title No. 188423 (the Building and such parcel of land hereinafter being collectively referred to as the “Property”). | |||

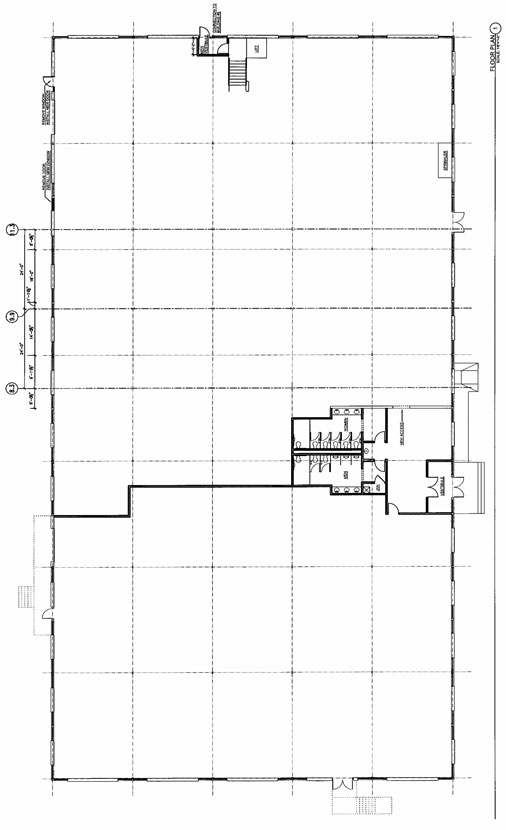

| Premises: | (i) for the period of time from the Commencement Date to the day prior to the Expansion Date (as defined below): A portion of the Building consisting of approximately 16,629 rentable square feet, as shown on Exhibit A attached hereto, and (ii) from and after the Expansion Date, the entire Building consisting of approximately 27,289 rentable square feet. | |||

| Rentable Floor | ||||

| Area of Premises: | (i) for the period of time from the Commencement Date to the day prior to the Expansion Date: approximately 16,629 rentable square feet, as shown on Exhibit A, and (ii) from and after the Expansion Date, approximately 27,289 rentable square feet. | |||

| Landlord: | Roger P. Nordblom and Peter C. Nordblom, as Trustees of Northwest Associates under Declaration of Trust dated December 9, 1971 and filed in Middlesex South Registry District of the Land Court as Document No. 493351 with Certificate of Title Nos. 136761 and 206553. | |||

| Original Notice | ||||

| Address of Landlord: | c/o Nordblom Management Company, Inc. | |||

| 15 Third Avenue | ||||

| Burlington, Massachusetts 01803 | ||||

| Tenant: | LeMaitre Vascular, Inc. | |||

| Original Notice | ||||

| Address of Tenant: | 63 Second Avenue | |||

| Burlington, MA 01803 | ||||

| Commencement Date: | As determined pursuant to Section 2.2 | |||

| Expansion Date: | The date that is two (2) lease years (as hereinafter defined) and sixth (6) months after the Commencement Date. By way of example only, if the Commencement Date were June 30, 2010, then the Expansion Date would be January 1, 2013. | |||

| Expiration Date: | The last day of the seventh (7th ) lease year, it being understood that, as further set forth in Section 2.2 hereof, the term of this Lease shall be co-terminus with Tenant’s lease dated March 31, 2003, as amended, for certain premises located at 63 Second Avenue, Burlington, MA (as amended, the “63 Second Ave Lease”). | |||

| Target Delivery Date: | The date that is one hundred and twenty (120) days after Landlord’s receipt of requisite approvals from the Planning Board for the Town of Burlington regarding Landlord’s Work (subject to Article 3) | |||

| Annual Fixed Rent Rate: | Commencement Date – the day prior to the Expansion Date: | $133,032.00 | ||

| Expansion Date – Expiration Date: | $218,304.00 | |||

| Monthly Fixed Rent Rate: | Commencement Date – the day prior to the Expansion Date: | $11,086.00 | ||

| Expansion Date – Expiration Date: | $18,192.00 | |||

| Security and | ||||

| Restoration Deposit: | $50,000.00 | |||

| Tenant’s Percentage: | The ratio of the Rentable Floor Area of the Premises to the total rentable floor area of the Building, which shall (i) for the period of time from the Commencement Date through the day prior to the Expansion Date shall initially be deemed to be Sixty and Ninety-Four One Hundreths percent (60.94%), and (ii) for the period of time from and after the Expansion Date, shall be One Hundred percent (100%). | |||

| Initial Estimate of | ||||

| Tenant’s Percentage of | ||||

| Taxes for the Tax Year: | $30,792 | |||

| Initial Estimate of | ||||

| Tenant’s Percentage of | ||||

| Operating Costs for the | ||||

| Calendar Year: | $45,696 | |||

| Permitted Uses: | Office, research and development, and light manufacturing | |||

| Public Liability Insurance Limits: | ||||

| Commercial General Liability: | ||||

| $3,000,000 per occurrence | ||||

| $5,000,000 general aggregate | ||||

| 1.2 | Exhibits. |

The Exhibits listed below in this section are incorporated in this Lease by reference and are to be construed as a part of this Lease.

| EXHIBIT A | Plan showing the Premises. | |

| EXHIBIT B | Commencement Date Notification | |

| EXHIBIT C | Base Building Work | |

| EXHIBIT C-1 | Tenant Improvement Work | |

| EXHIBIT D | Work Change Order | |

| EXHIBIT E | Rules and Regulations | |

| EXHIBIT F | Form Tenant Estoppel Certificate | |

| EXHIBIT G | Landlord’s Consent and Waiver | |

ARTICLE 2

Premises and Term

| 2.1 | Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, subject to and with the benefit of the terms, covenants, conditions and provisions of this Lease, the Premises, excluding the roof, exterior faces of exterior walls, the common stairways, and pipes, ducts, conduits, wires, and appurtenant fixtures serving exclusively or in common other parts of the Building (and any areas, such as the space above the ceiling or in the walls, that may contain such pipes, ducts, conduits, wires or appurtenant fixtures), and if Tenant’s space includes less than entire rentable area of any floor, excluding the central core area of such floor. |

Tenant shall have, as appurtenant to the Premises, rights to use in common for the period of time from the Commencement Date until the Expansion Date and exclusively from and after the day prior to the Expansion Date, subject to reasonable rules of general applicability to tenants of the Building from time to time made by Landlord of which Tenant is given notice: (a) the common lobbies, hallways and stairways of the Building, (b) common walkways and driveways necessary for access to the Building, (c) the common parking areas serving the Building, (d) the loading dock serving the Building and (e) if the Premises include less than the entire rentable area of any floor, the common toilets and other common facilities in the central core area of such floor. Tenant shall further have the right to use the space above the suspended ceiling in order for Tenant to install its conduits, cables and pipes, provided said installation is done in compliance with all applicable codes, regulations, ordinances and/or laws and pursuant to the terms and conditions of subsection 6.2.5 of this Lease (it being further agreed by Tenant that said installations shall not constitute “nonstructural, interior installations or alterations” as set forth in subsection 6.2.5 (b)).

There are approximately 94 parking spaces serving the Building. Tenant shall be permitted to use Tenant’s Percentage of said available parking. Subject to the actions of and/or directives or orders from governmental and other controlling authorities, and/or the actions of utility companies, Landlord shall not decrease the size of the existing parking area serving the Building.

Landlord reserves the right from time to time, at reasonable times and upon reasonable prior notice to Tenant, except in the case of emergencies, and without unreasonable interference with use of the Premises: (a) to install, use, maintain, repair, replace and relocate for service to the Premises and other parts of the Building, or either, pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises or Building, (b) to alter or relocate any other common facility, (c) to make any repairs and replacements to the Premises which Landlord may deem necessary, and (d) in connection with any excavation made upon adjacent land of Landlord or others, to enter, and to license others to enter, upon the Premises to do such work as the person causing such excavation deems necessary to preserve the wall of the Building from injury or damage and to support the same. Landlord shall use reasonable efforts to perform the activities permitted under this paragraph during normal business hours, and shall use reasonable efforts not to interfere with Tenant’s business operations in the Premises.

| 2.2 | Term. TO HAVE AND TO HOLD for a term beginning on the Commencement Date, which shall be the earlier of (a) the date on which Landlord’s Work (as defined below) has been substantially completed (or would have been completed, but for a Tenant Delay, as defined below) or (b) the opening by Tenant of its business in the Premises, and ending on the Expiration Date, unless sooner terminated as hereinafter provided. For the purposes hereof, “Tenant Delay” shall be defined as any delay in the completion of Landlord’s Work actually caused by (i) special work or long lead-time items for which Landlord identifies a specified period of delay, or change orders made by Tenant for which Landlord identifies a specified period of delay at the time of its approval (and in either instance Tenant does not withdraw or alter such special work, long lead-time item or change order which avoids such delay), (ii) the delay of Tenant in supplying, submitting or approving any plans, specifications or estimates or giving authorizations or supplying information reasonably required by Landlord or its contractors within such reasonable period of time as shall be typically required for the expeditious prosecution of the work to be performed by Landlord, (iii) any contractors employed by Tenant including, without limitation, entities furnishing communications, data processing or other service or equipment directly to Tenant (and not under Landlord’s contractor(s)), or (iv) any failure to comply with Article 3 of this Lease or any material interference with the performance of Landlord’s Work by Tenant or any of its agents, employees, engineers or contractors |

The term “substantially completed” as used herein shall mean that Landlord’s Work has been completed with the exception of minor items which can be fully completed without material interference with Tenant and other items which because of the season or weather or the nature of the item are not practicable to do at the time, provided that none of said items is necessary to make the Premises tenantable for the Permitted Uses, and a certificate of occupancy (or temporary certificate of occupancy) for the Premises has been issued. When the dates of the beginning and end of the term have been determined, such dates shall be evidenced by a document, in the form attached hereto as Exhibit B, which Landlord shall complete and deliver to Tenant, and which shall be deemed conclusive unless Tenant shall notify Landlord of any disagreement therewith within ten (10) business days of receipt.

Upon full execution of the Lease, Tenant may, prior to the Commencement Date (but following coordination with Landlord as to the timing), enter the Premises without payment of rent, but otherwise

subject to all the terms and conditions of this Lease, for the purpose of installing Tenant’s furniture, fixtures and equipment, as well as performing any installation of wiring and cabling approved of by Landlord pursuant to the terms of this Lease (including but not limited to Section 6.2.5), provided that (i) Tenant shall not interfere with any work then being performed by or for Landlord, (ii) Tenant shall immediately cease its activities in the Premises in the event that Landlord notifies Tenant (which notice may be given orally) that Tenant is interfering with Landlord, and (iii) provided Tenant shall reimburse Landlord for Landlord’s actual costs incurred in connection with Tenant’s pre-commencement entry and/or work. All such work shall be done in accordance with, and Tenant shall comply with, the provisions of Section 6.2.5 hereof.

The parties agree that this Lease and the 63 Second Ave Lease are co-terminus, and therefore, in the event Tenant terminates the 63 Second Ave Lease pursuant to the terms thereof, Tenant shall have the right to simultaneously terminate this Lease upon written notice to Landlord. Further, in the event that the landlord terminates the 63 Second Ave Lease pursuant to the terms thereof, this Lease shall also be simultaneously terminated by Landlord, such termination to be effective without the necessity of any notice or other documentation; provided, however, that in the event such termination is an exercise of the landlord’s rights under Article 7 of the 63 Second Ave Lease, then Tenant may elect, by written notice given within ten (10) business days following Tenant’s receipt of Landlord’s notice of termination of the 63 Second Ave Lease, to allow this Lease to continue and not be terminated simultaneously with the 63 Second Ave Lease (in which event, following such notice from Tenant, such simultaneous termination of this Lease shall be deemed null and void and the same shall continue pursuant to the terms hereof, recognizing that the term of this Lease will no longer be co-terminus with the 63 Second Ave Lease).

The term “lease year” as used herein shall mean a period of twelve (12) consecutive full calendar months. The first lease year shall begin on the Commencement Date if the Commencement Date is the first day of a calendar month; if not, then the first lease year shall be deemed to commence upon the first day of the calendar month next following the Commencement Date, but shall include the partial month in which the Commencement Date occurred. Each succeeding lease year shall commence upon the anniversary commencement date of the first lease year.

ARTICLE 3

Improvements

| 3.1 | Base Building Work; Tenant Improvement Work. A. Landlord shall cause to be performed the base Building work required by Exhibit C (such work, the “Base Building Work”). The Base Building Work shall be done in a good and workmanlike manner employing good materials and so as to conform to all applicable building laws. Tenant agrees that Landlord may make any changes in such work which may become reasonably necessary or advisable, other than substantial changes, without approval of Tenant, provided written notice is promptly given to Tenant; and Landlord may make substantial changes in such work, with the written approval of Tenant, which shall not be unreasonably withheld or delayed. |

B. Landlord shall cause to be performed the alterations and improvements desired by Tenant to prepare the Premises for Tenant’s use (such work the “TIW”) substantially in accordance with Exhibit C-1. The Base Building Work and the TIW are collectively referred to herein as “Landlord’s Work.” Landlord shall use diligence in pursuing the requisite approval for Landlord’s Work from the Planning Board from the Town of Burlington, and following receipt of the same shall use diligence to cause Landlord’s Work to be substantially completed by the Target Delivery Date, subject to the provisions of Section 10.5 hereof and Tenant Delays. If Landlord’s Work is not substantially complete by the date that is forty-five (45) days after the Target Delivery Date (the “Outside Date”), provided that Landlord’s Work does not include long-lead time items, and provided further that such delay is not caused by a Tenant Delay, and subject to Section 10.5 of this Lease, then Tenant shall be entitled to one (1) day of free rent for each day in the period commencing on the Outside Date and continuing until the day before the date on which the Landlord’s Work is substantially complete. In addition, if Landlord has not commenced Landlord’s Work on or before August 15, 2010 (the “Outside Work Commencement Date”), provided such failure is not caused by a Tenant Delay, and subject to Section 10.5 of this Lease, then Tenant shall be permitted to terminate this Lease upon written notice to Landlord, such notice to be delivered to Landlord no later that five (5) days after the Outside Work Commencement Date and such termination to be effective ten (10) days following the delivery of such notice; provided however, that such termination will be rendered ineffective if, prior to the expiration of said 10-day period, Landlord shall have commenced Landlord’s Work. The TIW will be performed at Landlord’s expense up to the Initial Allowance (as defined in Section 3.3), with the balance of the cost of the TIW to be paid for as follows: (a) an amount equal to fifty (50%) percent of the anticipated cost of the TIW in excess of the Initial Allowance upon Tenant’s execution of this Lease; (b) forty (40%) percent of the anticipated cost of the TIW in excess of the Initial Allowance on the Commencement Date; and (c) the balance of the cost of the TIW in excess of the Initial Allowance upon Landlord’s submission of the final bill. The TIW shall be done in a good and workmanlike manner and in compliance with all applicable building laws. Landlord agrees that Tenant may make changes to the TIW with the approval of Landlord and the execution by Landlord and Tenant of a Work Change Order, in the form attached hereto as Exhibit D. Landlord shall use diligence to cause the TIW to be substantially completed by the Delivery Date, subject to the provisions of Section 10.5 hereof and Tenant delays.

C. Landlord shall, subject to site plan approval, at its expense, construct a covered walkway (the “Walkway”) connecting the Building to the building located at 63 Second Avenue, Burlington, Massachusetts. Landlord shall construct the Walkway in a good and workmanlike manner, and in compliance with all laws. Landlord shall use diligent efforts to complete the construction of the Walkway

prior to the expiration of calendar year 2010, subject to obtaining all governmental approvals required in connection with the same, and further subject to Section 10.5 of this Lease and any Tenant Delay. Landlord shall be responsible for maintaining and repairing the Walkway, and for the removal of snow and ice from the same, all of the costs of which shall be included as part of Operating Costs.

| 3.2 | Acceptance of the Premises. Tenant or its representatives may, at reasonable times, enter upon the Premises during the progress of the work to inspect the progress thereof and to determine if the work is being performed in accordance with the requirements of Section 3.1. Tenant shall promptly give to Landlord notices of any alleged failure by Landlord to comply with those requirements. The Base Building Work and the TIW shall be deemed approved by Tenant when Tenant occupies the Premises for the conduct of its business, except for items of the Base Building Work and the TIW which are uncompleted or do not conform to Exhibit C and as to which Tenant shall, in either case, have given written notice to Landlord prior to such occupancy. A certificate of completion by a licensed architect or registered engineer shall be conclusive evidence that the Base Building Work and TIW have been completed except for items stated in such certificate to be incomplete or not in conformity with Exhibit C. To the extent that Landlord receives any warranties in connection with any portion of Landlord’s Work, Tenant shall have the benefit of the same. |

| 3.3 | Allowances. Landlord shall provide Tenant with an initial allowance of up to $75,000.00 (the “Initial Allowance”) to be used towards the cost of the TIW, and a secondary allowance of $25,000.00 (the “Secondary Allowance”) for further work within the Premises to be undertaken by Tenant pursuant to the terms hereof following the Expansion Date (the “Secondary Work”). When Tenant has incurred costs for the Secondary Work, Tenant shall submit to Landlord from time to time (but no more frequently than monthly) requisitions for payment setting forth any costs incurred for the Secondary Work, together with waivers of lien from all contractors and subcontractors, invoices from contractors, subcontractors and suppliers, and other reasonable documentation evidencing the costs, including fees of architects and engineers, incurred by Tenant for Tenant’s Work, to the reasonable satisfaction of Landlord. Landlord shall, within thirty (30) days following Landlord’s receipt thereof, pay to Tenant ninety (90%) percent of the amount of each such requisition (or of such lesser amount as is approved by Landlord) with ten (10%) percent to be retained. Such payments, in the aggregate, shall not exceed an amount equal to ninety (90%) percent of the Secondary Allowance. Landlord shall pay to Tenant the ten (10%) percent retained as aforesaid within thirty (30) days following the submission by Tenant of a written statement from Tenant’s architect or engineer that Tenant’s Work has been completed in accordance with the approved construction plans, a final lien waiver executed by Tenant’s general contractor, and a final certificate of occupancy for, and any other required governmental approvals of, Tenant’s Work. The costs the Secondary Work shall include all costs incurred by Tenant for construction and installation of improvements (but excluding any trade fixtures or personal property), including the costs of all labor and materials, and all contractor’s fees. Tenant shall be responsible for paying for all costs of the Secondary Work not included in the Secondary Allowance and for all costs in excess of the Secondary Allowance. Tenant shall not be entitled to any rent credit or refund for any unused portion of the Initial Allowance and/or the Secondary Allowance. |

ARTICLE 4

Rent

| 4.1 | The Fixed Rent. Tenant covenants and agrees to pay rent to Landlord at the Original Notice Address of Landlord, or at such other place or to such other person or entity as Landlord may by notice in writing to Tenant from time to time direct), at the Annual Fixed Rent Rate, in equal installments at the Monthly Fixed Rent Rate (which is 1/12th of the Annual Fixed Rent Rate), in advance, without notice or demand, and without setoff, abatement, suspension, deferment, reduction or deduction, except as otherwise expressly provided herein, on the first day of each calendar month included in the term; and for any portion of a calendar month at beginning of the term, at the rate for the first lease year payable in advance for such portion. It is the intention of the parties hereto that the obligations of Tenant hereunder shall be separate and independent covenants and agreements, that the Annual Fixed Rent, the Additional Rent and all other sums payable by Tenant to Landlord shall continue to be payable in all events and that the obligations of Tenant hereunder shall continue unaffected, unless the requirement to pay or perform the same shall have been terminated pursuant to an express provision of this Lease. |

If Landlord shall give notice to Tenant that all rent and other payments due hereunder are to be made to Landlord by electronic funds transfers, so called, or by similar means, Tenant shall make all such payments as shall be due after receipt of said notice by means of said electronic funds transfers (or such similar means as designated by Landlord), provided, however, that Tenant shall have the right to suspend such electronic funds transfers for just cause for a reasonable period of time, which cause and period of time must be consented to by Landlord (which consent shall not be unreasonably withheld or delayed).

| 4.2 | Additional Rent. Tenant covenants and agrees to pay, as Additional Rent, insurance costs, utility charges, personal property taxes and Tenant’s Percentage of taxes and operating costs with respect to the Premises as provided in this Section 4.2 as follows: |

| 4.2.1 . | Real Estate Taxes. Tenant shall pay to Landlord, as additional rent, for each tax period partially or wholly included in the term, Tenant’s Percentage of Taxes (as hereinafter defined). Tenant shall remit to Landlord, on the first day of each calendar month, estimated payments on account of Taxes, such monthly amounts to be sufficient to provide Landlord, by the time real estate tax |

| payments are due and payable to any governmental authority responsible for collection of same, a sum equal to the Tenant’s Percentage of Taxes, as reasonably estimated by Landlord from time to time on the basis of the most recent tax data available. The initial calculation of the monthly estimated payments shall be based upon the Initial Estimate of Tenant’s Percentage of Taxes for the Tax Year and upon quarterly payments being due to the governmental authority on August 1, November 1, February 1 and May 1, and shall be made when the Commencement Date has been determined. If the total of such monthly remittances for any Tax Year is greater than the Tenant’s Percentage of Taxes for such Tax year, Landlord shall promptly pay to Tenant, or credit against the next accruing payments to be made by Tenant pursuant to this subsection 4.2.1, the difference; if the total of such remittances is less than the Tenant’s Percentage of Taxes for such Tax Year, Tenant shall pay the difference to Landlord at least ten (10) days prior to the date or dates within such Tax Year that any Taxes become due and payable to the governmental authority (but in any event no earlier than ten (10) days following a written notice to Tenant, which notice shall set forth the manner of computation of Tenant’s Percentage of Taxes). |

If, after Tenant shall have made reimbursement to Landlord pursuant to this subsection 4.2.1, Landlord shall receive a refund of any portion of Taxes paid by Tenant with respect to any Tax Year during the term hereof as a result of an abatement of such Taxes by legal proceedings, settlement or otherwise (without either party having any obligation to undertake any such proceedings), Landlord shall promptly pay to Tenant, or credit against the next accruing payments to be made by Tenant pursuant to this subsection 4.2.1, the Tenant’s Percentage of the refund (less the proportional, pro rata expenses, including attorneys’ fees and appraisers’ fees, incurred in connection with obtaining any such refund), as relates to Taxes paid by Tenant to Landlord with respect to any Tax Year for which such refund is obtained. If Landlord does not pursue a tax abatement during the Tax Year in question, Tenant shall have the right to do so in Landlord’s name and Landlord shall reasonably cooperate with Tenant in such effort, provided however, that Tenant shall give prior written notice to Landlord that Tenant elects to seek an abatement and provided, further, that all abatement proceedings are entirely at Tenant’s sole cost and expense.

In the event this Lease shall commence, or shall end (by reason of expiration of the term or earlier termination pursuant to the provisions hereof), on any date other than the first or last day of the Tax Year, or should the Tax Year or period of assessment of real estate taxes be changed or be more or less than one (1) year, as the case may be, then the amount of Taxes which may be payable by Tenant as provided in this subsection 4.2.1 shall be appropriately apportioned and adjusted.

The term “Taxes” shall mean all taxes, assessments, betterments and other charges and impositions (including, but not limited to, fire protection service fees and similar charges) levied, assessed or imposed at any time during the term by any governmental authority upon or against the Property, or taxes in lieu thereof, and additional types of taxes to supplement real estate taxes due to legal limits imposed thereon. If, at any time during the term of this Lease, any tax or excise on rents or other taxes, however described, are levied or assessed against Landlord with respect to the rent reserved hereunder, either wholly or partially in substitution for, or in addition to, real estate taxes assessed or levied on the Property, such tax or excise on rents shall be included in Taxes; however, Taxes shall not include franchise, corporation, estate, inheritance, succession, capital levy, transfer, gift, income or excess profits taxes assessed on Landlord, or penalties for delinquent payment of Taxes assessed against Landlord provided such late payment is not caused by or a result of any acts or omissions of Tenant. Taxes shall include any estimated payment made by Landlord on account of a fiscal tax period for which the actual and final amount of taxes for such period has not been determined by the governmental authority as of the date of any such estimated payment.

| 4.2.2 | Personal Property Taxes. Tenant shall pay all taxes charged, assessed or imposed upon the personal property of Tenant in or upon the Premises. |

| 4.2.3 | Operating Costs. Tenant shall pay to Landlord the Tenant’s Percentage of Operating Costs (as hereinafter defined) incurred by Landlord in any calendar year. Tenant shall remit to Landlord, on the first day of each calendar month, estimated payments on account of Operating Costs, such monthly amounts to be sufficient to provide Landlord, by the end of the calendar year, a sum equal to the Operating Costs, as reasonably estimated by Landlord from time to time. The initial monthly estimated payments shall be in an amount equal to 1/12th of the Initial Estimate of Tenant’s Percentage of Operating Costs for the Calendar Year. If, at the expiration of the year in respect of which monthly installments of Operating Costs shall have been made as aforesaid, the total of such monthly remittances is greater than the actual Operating Costs for such year, Landlord shall promptly pay to Tenant, or credit against the next accruing payments to be made by Tenant pursuant to this subsection 4.2.3, the difference; if the total of such remittances is less than the Operating Costs for such year, Tenant shall pay the difference to Landlord within twenty (20) days from the date Landlord shall furnish to Tenant an itemized statement of the Operating Costs, prepared, allocated and computed in accordance with generally accepted accounting principles. Any reimbursement for Operating Costs due and payable by Tenant with respect to periods of less than twelve (12) months shall be equitably prorated. |

The term “Operating Costs” shall mean all costs and expenses incurred for the operation, maintenance, repair, upkeep and exterior cleaning of the Property, and the portion of such costs

and expenses with regard to the common areas, facilities and amenities of the Park which is equitably allocable to the Property, including, without limitation, all costs of maintaining and repairing the Property and the Park (including snow removal, landscaping and grounds maintenance, operation and maintenance of parking lots, sidewalks, walking paths, access roads and driveways, security, operation and repair of heating and air-conditioning equipment, elevators, lighting and any other Building equipment or systems) and of all repairs and replacements (other than repairs or replacements for which Landlord has received full reimbursement from contractors, other tenants of the Building or from others) necessary to keep the Property and the Park in good working order, repair, appearance and condition; all costs, including material and equipment costs, for cleaning the exterior of the Building (including without limitation window cleaning of the Building); all costs of any reasonable insurance carried by Landlord relating to the Property; all costs related to provision of heat (including oil, electric, steam and/or gas), air-conditioning, and water (including sewer charges) and other utilities to the Building (exclusive of reimbursement to Landlord for any of same received as a result of direct billing to any tenant of the Building); payments under all service contracts relating to the foregoing; all compensation, fringe benefits, payroll taxes and workmen’s compensation insurance premiums related thereto with respect to any employees of Landlord or its affiliates engaged in security and maintenance of the Property and the Park; attorneys’ fees and disbursements (exclusive of any such fees and disbursements incurred in tax abatement proceedings or the preparation of leases) and auditing and other professional fees and expenses; and a management fee.

There shall not be included in such Operating Costs: (a) brokerage fees (including rental fees) related to the operation of the Building; (b) interest and depreciation charges incurred on the Property; (c) expenditures made by Tenant with respect to (i) janitorial type cleaning, maintenance and upkeep of the interior of the Premises (provided said janitorial and cleaning services are not being provided by Landlord), and (ii) the provision of electricity to the Premises; (d) the cost of any item for which Landlord is reimbursed by insurance proceeds; (e) payments which exceed arms-length competitive market prices for services rendered to the Premises paid to any person, firm or corporation affiliated with Landlord to the extent that the payments for such services exceed the competitive costs that would have been paid to parties unaffiliated with Landlord; (f) costs incurred by Landlord due to a breach by Landlord of the terms and conditions of this Lease but only to the extent such costs do not arise from or are attributable to the acts or omissions of Tenant; (g) costs of correcting defects in the original construction of the Premises; (h) costs resulting from the gross negligence or willful misconduct of Landlord or Landlord’s agents; (i) legal fees incurred in tenant disputes, including litigation and arbitration, to the extent said fees are not related to the operation and/or maintenance of the Building, and/or are not related to the relationship (contractual or otherwise) which exists or may exist between Landlord and Tenant; and (j) costs or expenses related to the removal, abatement or remediation of hazardous materials in or about the Building and/or the Property which is existing as of the date hereof, to the extent said costs or expenses are not attributable to or arise from the acts or omission of Tenant or Tenant’s agents, employees, invitees, servants or contractors (which costs and expenses shall be paid for by Tenant).

If, during the term of this Lease, Landlord shall replace any capital items or make any capital expenditures (collectively called “capital expenditures”) the total amount of which is not properly included in Operating Costs for the calendar year in which they were made, there shall nevertheless be included in Operating Costs for each calendar year in which and after such capital expenditure is made the annual charge-off of such capital expenditure. (Annual charge-off shall be determined by (i) dividing the original cost of the capital expenditure by the number of years of useful life thereof [The useful life shall be reasonably determined by Landlord in accordance with generally accepted accounting principles and practices in effect at the time of acquisition of the capital item.]; and (ii) adding to such quotient an interest factor computed on the unamortized balance of such capital expenditure based upon an interest rate reasonably determined by Landlord as being the interest rate then being charged for long-term mortgages by institutional lenders on like properties within the locality in which the Building is located.) Provided, further, that if Landlord reasonably concludes on the basis of engineering estimates that a particular capital expenditure will effect savings in Operating Costs and that such annual projected savings to Operating Costs will exceed the annual charge-off of capital expenditure computed as aforesaid, then and in such events, if Landlord shall make such capital expenditure, the annual charge-off shall be determined by dividing the amount of such capital expenditure by the number of years over which the projected amount of such savings shall fully amortize the cost of such capital item or the amount of such capital expenditure; and by adding the interest factor, as aforesaid.

If during any portion of any year for which Operating Costs are being computed, the Building was not fully occupied by tenants or if not all of such tenants were paying fixed rent or if Landlord was not supplying all tenants with the services being supplied hereunder, the variable components of actual Operating Costs incurred shall be reasonably extrapolated by Landlord to the estimated Operating Costs that would have been incurred if the Building were fully occupied by tenants and all such tenants were then paying fixed rent or if such services were being supplied to all tenants, and such extrapolated amount shall, for the purposes of this Section 4.2.3, be deemed to be the Operating Costs for such year.

Tenant and its representatives, at Tenant’s sole expense, shall have the right, during customary business hours, to inspect at Landlord’s offices, Landlord’s books and records relating to Operating Costs for the immediately preceding calendar year. As a condition to performing any such inspection, Tenant and its examiners shall be required to execute and deliver to Landlord an agreement, in form reasonably acceptable to Landlord, agreeing to keep confidential any information which Tenant and the examining party discovers in connection with such examination, except for disclosures required by law, court order or regulatory authorities, or to Tenant’s attorneys, accountants, auditors, or potential purchasers of the Tenant company. If Tenant elects to exercise such right, it must provide reasonable prior written notice to Landlord given no later than one hundred and twenty (120) days following Tenant’s receipt of Landlord’s Statement of Operating Costs for any calendar year and it must complete any such inspection within 60 days of commencement. Landlord agrees to reasonably cooperate with Tenant to enable Tenant to complete its inspection within the time period specified in the preceding sentence. Tenant shall give Landlord a complete copy of the results of its inspection. If it is determined that Tenant is entitled to a refund, then such refund shall either be in cash or applied as a credit to the next due installment of Rent, at the election of Landlord. If it is determined Tenant has underpaid, then Tenant shall pay such amount within thirty (30) days of Landlord’s invoice therefor. Tenant agrees to use for such inspection a firm that is reasonably acceptable to Landlord and that is not being paid on a contingency fee basis. If Tenant’s audit demonstrates, to Landlord’s reasonable satisfaction, that Operating Costs were overstated by more than five percent (5%), then Landlord shall reimburse Tenant the reasonable cost of the audit (it being agreed that if Tenant’s audit does not show such overstatement, Tenant shall reimburse Landlord for all reasonable costs incurred by Landlord in connection with such audit).

| 4.2.4 | Insurance. Tenant shall, at its expense, as Additional Rent, take out and maintain throughout the term the following insurance protecting Landlord: |

| 4.2.4.1 | Commercial general liability insurance naming Landlord, Tenant, and Landlord’s managing agent and any mortgagee of which Tenant has been given notice as insureds or additional insureds and indemnifying the parties so named against all claims and demands for death or any injury to person or damage to property which may be claimed to have occurred on the Premises (or the Property, insofar as used by customers, employees, servants or invitees of the Tenant), in amounts which shall, at the beginning of the term, be at least equal to the limits set forth in Section 1.1, and, which, from time to time during the term, shall be for such higher limits, if any, as are customarily carried in the area in which the Premises are located on property similar to the Premises and used for similar purposes; and workmen’s compensation insurance with statutory limits covering all of Tenant’s employees working on the Premises. |

| 4.2.4.2 | Special Risk property insurance with the usual extended coverage endorsements covering all Tenant’s furniture, furnishings, fixtures and equipment, and business interruption insurance, with extra expense coverage. |

| 4.2.4.3 | All such policies shall be obtained from responsible companies qualified to do business and in good standing in Massachusetts, which companies and the amount of insurance allocated thereto shall be subject to Landlord’s approval. Tenant agrees to furnish Landlord with certificates evidencing all such insurance prior to the beginning of the term hereof and evidencing renewal thereof at least thirty (30) days prior to the expiration of any such policy. Each such policy shall be non-cancelable with respect to the interest of Landlord without at least ten (10) days’ prior written notice thereto. In the event provision for any such insurance is to be by a blanket insurance policy, the policy shall allocate a specific and sufficient amount of coverage to the Premises. |

| 4.2.4.4 | All insurance which is carried by either party with respect to the Building, Premises or to furniture, furnishings, fixtures, or equipment therein or alterations or improvements thereto, whether or not required, shall include provisions which either designate the other party as one of the insured or deny to the insurer acquisition by subrogation of rights of recovery against the other party to the extent such rights have been waived by the insured party prior to occurrence of loss or injury, insofar as, and to the extent that, such provisions may be effective without making it impossible to obtain insurance coverage from responsible companies qualified to do business in the state in which the Premises are located (even though extra premium may result therefrom). In the event that extra premium is payable by either party as a result of this provision, the other party shall reimburse the party paying such premium the amount of such extra premium. If at the request of one party, this non-subrogation provision is waived, then the obligation of reimbursement shall cease for such period of time as such waiver shall be effective, but nothing contained in this subsection shall derogate from or otherwise affect releases elsewhere herein contained of either party for claims. Each party shall be entitled to have certificates of any policies containing such provisions. Each party hereby waives all rights of recovery against the other for loss or injury against which the waiving party is protected by insurance containing said provisions, reserving, however, any rights with respect to any excess of loss or injury over the amount recovered by such insurance. Tenant shall not acquire as insured under any insurance carried on the Premises any right to participate in the adjustment of loss or to receive insurance proceeds and agrees upon request promptly to endorse and deliver to Landlord any checks or other instruments in payment of loss in which Tenant is named as payee. |

| 4.2.5 | Utilities. Tenant shall pay all charges made by public authority or utility for the cost of gas and electricity furnished or consumed on the Premises, all charges for any utilities supplied by Landlord pursuant to Subsections 5.1.1 and 5.1.3 which are separately metered, and all charges for telephone and other utilities or services not supplied by Landlord pursuant to Subsections 5.1.1 and 5.1.3, whether designated as a charge, tax, assessment, fee or otherwise, all such charges to be paid as the same from time to time become due. Except as otherwise provided in Article 5, it is understood and agreed that Tenant shall make its own arrangements for the installation or provision of all such utilities and that Landlord shall be under no obligation to furnish any utilities to the Premises and shall not be liable for any interruption or failure in the supply of any such utilities to the Premises. |

| 4.3 | Late Payment of Rent. If any installment of rent is paid after the date the same was due, and if on a prior occasion in the twelve (12) month period prior to the date such installment was due an installment of rent was paid after the same was due, then Tenant shall pay Landlord a late payment fee equal to five (5%) percent of the overdue payment. |

| 4.4 | Security and Restoration Deposit. Currently, Landlord is in possession of a Security and Restoration Deposit in the amount of $100,000.00 under the 63 Second Ave Lease. Pursuant to an amendment to the 63 Second Ave Lease being executed concurrently herewith, the parties agree that Landlord shall transfer $50,000.00 of the Security and Restoration Deposit currently being held under the 63 Second Ave Lease for Tenant’s account under this Lease, such that said amount shall be the Security and Restoration Deposit required under Section 1.1 of this Lease. Said deposit shall be held by Landlord as security for the faithful performance by Tenant of all the terms of this Lease by said Tenant to be observed and performed. The security deposit shall not be mortgaged, assigned, transferred or encumbered by Tenant without the written consent of Landlord and any such act on the part of Tenant shall be without force and effect and shall not be binding upon Landlord. |

If the Fixed Rent or Additional Rent or any other sum payable hereunder shall be overdue and unpaid or should Landlord make payments on behalf of the Tenant, or Tenant shall fail to perform any of the terms of this Lease, then Landlord may, at its option and without prejudice to any other remedy which Landlord may have on account thereof, appropriate and apply said entire deposit or so much thereof as may be necessary to compensate Landlord toward the payment of Fixed Rent, Additional Rent or other sums or loss or damage sustained by Landlord due to such breach on the part of Tenant; and Tenant shall forthwith upon demand restore said security to the original sum deposited. Within forty-five (45) days following Tenant’s yield-up of the Premises in accordance with the terms hereof, Landlord shall refund to Tenant said deposit, or so much thereof as may remain after application toward any satisfaction of any obligation of Tenant.

In the event of bankruptcy or other creditor-debtor proceedings against Tenant, all securities shall be deemed to be applied first to the payment of rent and other charges due Landlord for all periods prior to the filing of such proceedings.

ARTICLE 5

Landlord’s Covenants

| 5.1 | Affirmative Covenants. Landlord covenants with Tenant: |

| 5.1.1 | Heat and Air-Conditioning. To furnish to the Premises heat, ventilation and air-conditioning (“HVAC”), reserving the right, at any time, to change energy or heat sources, sufficient to maintain the Premises at comfortable temperatures (subject to all federal, state, and local regulations relating to the provision of heat), during such hours of the day and days of the year as Tenant determines. The electricity and gas required for the HVAC for the Premises shall be as provided for, below. Tenant shall have direct control over the HVAC system serving the Premises. |

| 5.1.2 | Electricity and Gas. To furnish to the Premises, separately metered and at the direct expense of Tenant as hereinabove provided, reasonable electricity as specified in Exhibit C for Tenant’s Permitted Uses. To furnish gas for use the HVAC system, which, prior to the Expansion Date, be billed to Tenant as part of Operating Costs, and from and after the Expansion Date shall be separately metered and at Tenant’s direct expense. |

| 5.1.3 | Water. To furnish water for ordinary cleaning, lavatory and toilet facilities, and otherwise as shown in the plans for Landlord’s Work. |

| 5.1.4 | Fire Alarm. To maintain fire alarm and sprinkler systems within the Building. |

| 5.1.5 | Repairs. Except as otherwise expressly provided herein, to make such repairs and replacements to the roof, exterior walls, floor slabs and other structural components of the Building, and to the common areas, facilities and plumbing, electrical, heating, ventilating and air-conditioning systems of the Building as may be necessary to keep them in good repair and condition (exclusive of equipment installed by Tenant and except for those repairs required to be made by Tenant pursuant to Section 6.1.3 hereof and repairs or replacements occasioned by any act or negligence of Tenant, its servants, agents, customers, contractors, employees, invitees, or licensees). |

| 5.2 | Interruption. Landlord shall be under no responsibility or liability for failure or interruption of any of the above-described services, repairs or replacements caused by breakage and accidents beyond the control of Landlord, strikes, repairs beyond the control of Landlord, inability to obtain supplies, labor or materials, or for any other causes beyond the control of the Landlord, and in no event for any indirect or consequential damages to Tenant; and failure or omission on the part of the Landlord to furnish any of same for any of the reasons set forth in this paragraph shall not be construed as an eviction of Tenant, actual or constructive, nor entitle Tenant to an abatement of rent, nor render the Landlord liable in damages, nor release Tenant from prompt fulfillment of any of its covenants under this Lease. Notwithstanding the foregoing, if Landlord fails to provide any service that it is required to provide above so that Tenant’s ability to conduct business at the Premises is materially adversely affected for a period of five (5) consecutive business days after written notice thereof from Tenant to Landlord, then, provided that such failure or Landlord’s inability to cure such condition is not (i) due to a cause beyond Landlord’s reasonable control and/or (ii) generally affecting other buildings in the vicinity of the Premises (such as a neighborhood power outage or a water main break) or a fire or other casualty or taking (which shall be governed by Article 7 below) or the fault or negligence of Tenant or any of its agents, employees or contractors, then as Tenant’s sole remedy the Fixed Rent and Additional Rent shall be equitably abated based upon the impact thereof on Tenant’s ability to conduct business in the Premises until such service(s) is restored to their level prior to the interruption. |

| 5.3 | Intentionally Deleted. |

| 5.4 | Access. Tenant shall have access to the Premises at all times. |

| 5.5 | Landlord’s Insurance. Landlord shall take out and maintain throughout the term (i) all-risk casualty insurance in an amount equal to 100% of the replacement cost of the Building, including Landlord’s Work, but specifically excluding any other improvements installed by Tenant during the term, and (ii) comprehensive general liability insurance with respect to the Property in commercially reasonable amounts. Landlord shall not be required to carry insurance of any kind on any improvements in the Premises other than Landlord’s Work. |

| 5.6 | Condition of Premises. As of the date of this Lease, Landlord represents and warrants that (i) the Building is in compliance with the applicable local building code but makes no representation or warranty as to whether the Building is in compliance with the Americans With Disabilities Act; and (ii) the heating, ventilation and air conditioning system and other mechanical systems serving the Building will be in serviceable working order as of the Commencement Date. |

| 5.7 | Landlord’s Indemnification. Landlord shall indemnify, defend and save Tenant harmless from and against all claims brought by, liability imposed by, or loss or damage arising from the actions of (including the cost of any cleanup or remediation) a governmental authority having jurisdiction over the Property and/or the Park caused by a release or threat of release of Hazardous Materials (as defined in Section 11.1 below) from or at the Property and/or the Park prior to the Commencement Date or, if after the Commencement Date, to the extent caused by Landlord’s use, handling, holding, transporting, storage or disposal of Hazardous Materials including, without limitation, liability under any federal, state or local laws, requirements and regulations; provided, however, that this indemnity shall not apply to the extent such claim, liability, loss and/or damage is attributable or pertains to the following: (i) in the event (but only in the event) Tenant uses, stores, handles, holds, transports or disposes at, on or under the Property the Hazardous Materials which are the subject of such claim, liability, loss and/or damage, unless Tenant provides evidence reasonably satisfactory to Landlord that the Hazardous Materials which are the subject of such claim, liability, loss and/or damage are not caused by or attributable in whole or in part to Tenant, (ii) in the event Tenant or its agents, employees or contractors causes or contributes to the release or threat of release of Hazardous Materials, or (iii) to any claim brought or liability imposed under any law, regulation or ordinance, or common law, arising out of any personal injury or damage suffered or alleged to have been suffered by Tenant’s employees, agents, invitees or contractors. The provisions of this Section 5.7 shall survive the expiration or earlier termination of this Lease. |

| 5.8 | Adjacent Uses. Landlord shall not knowingly lease the vacant space in the Building adjacent to the Premises leased by Tenant during the period of time from the Commencement Date through the day prior to the Expansion Date to another tenant who actively uses and stores Hazardous Materials as a primary component of such tenant’s business operation, excluding, however, Hazardous Materials used or stored in connection with general office purposes (for example, and by way of example only, customary office and cleaning supplies, or the toner and other fluids in a printing or facsimile machine). |

ARTICLE 6

Tenant’s Additional Covenants

| 6.1 | Affirmative Covenants. Tenant covenants at all times during the term and for such further time (prior or subsequent thereto) as Tenant occupies the Premises or any part thereof: |

| 6.1.1 | Perform Obligations. To perform promptly all of the obligations of Tenant set forth in this Lease; and to pay when due the Fixed Rent and Additional Rent and all charges, rates and other sums which by the terms of this Lease are to be paid by Tenant. |

| 6.1.2 | Use. To use the Premises only for the Permitted Uses, and from time to time to procure all licenses and permits necessary therefor, at Tenant’s sole expense. Notwithstanding the foregoing, Landlord shall be responsible for obtaining the initial Certificate of Occupancy in connection with Landlord’s Work. With respect to any licenses or permits relating to or affecting the Property for which Tenant may apply, pursuant to this subsection 6.1.2 or any other provision hereof, Tenant shall furnish Landlord copies of applications therefor on or before their submission to the governmental authority. |

| 6.1.3 | Repair and Maintenance. To maintain the Premises in neat order and condition and to perform all routine and ordinary repairs to the Premises and to any plumbing, heating, electrical, ventilating and air-conditioning systems located within the Premises and installed by Tenant such as are necessary to keep them in good working order, appearance and condition, as the case may require, reasonable use and wear thereof and damage by fire or by unavoidable casualty only excepted; to keep all glass in windows and doors of the Premises (except glass in the exterior walls of the Building) whole and in good condition with glass of the same quality as that injured or broken; and to make as and when needed as a result of misuse by, or neglect or improper conduct of Tenant or Tenant’s servants, employees, agents, invitees or licensees or otherwise, all repairs necessary, which repairs and replacements shall be in quality and class equal to the original work. (Landlord, upon default of Tenant hereunder and upon prior notice to Tenant, may elect, at the expense of Tenant, to perform all such cleaning and maintenance and to make any such repairs or to repair any damage or injury to the Building or the Premises caused by moving property of Tenant in or out of the Building, or by installation or removal of furniture or other property, or by misuse by, or neglect, or improper conduct of, Tenant or Tenant’s servants, employees, agents, contractors, customers, patrons, invitees, or licensees.) |

| 6.1.4 | Compliance with Law. To make all repairs, alterations, additions or replacements to the Premises required by any law or ordinance or any order or regulation of any public authority; to keep the Premises equipped with all safety appliances so required; and to comply with the orders and regulations of all governmental authorities with respect to zoning, building, fire, health and other codes, regulations, ordinances or laws applicable to the Premises, except that Tenant may defer compliance so long as the validity of any such law, ordinance, order or regulations shall be contested by Tenant in good faith and by appropriate legal proceedings, if Tenant first gives Landlord appropriate assurance or security against any loss, cost or expense on account thereof. |

| 6.1.5 | Indemnification. To save harmless, exonerate and indemnify Landlord, its agents (including, without limitation, Landlord’s managing agent) and employees (such agents and employees being referred to collectively as the “Landlord Related Parties”) from and against any and all claims, liabilities or penalties asserted by or on behalf of any person, firm, corporation or public authority on account of injury, death, damage or loss to person or property in or upon the Premises and the Property to the extent arising out of the use or occupancy of the Premises by Tenant or by any person claiming by, through or under Tenant (including, without limitation, all patrons, employees and customers of Tenant), or arising out of any delivery to or service supplied to the Premises requested by or on account of Tenant, or on account of or based upon anything whatsoever done on the Premises, except to the extent the same was caused by the gross negligence, fault or misconduct of Landlord or the Landlord Related Parties. In respect of all of the foregoing, Tenant shall indemnify Landlord and the Landlord Related Parties from and against all costs, expenses (including reasonable attorneys’ fees), and liabilities incurred in or in connection with any such claim, action or proceeding brought thereon; and, in case of any action or proceeding brought against Landlord or the Landlord Related Parties by reason of any such claim, Tenant, upon notice from Landlord and at Tenant’s expense, shall resist or defend such action or proceeding and employ counsel therefor reasonably satisfactory to Landlord. Landlord shall not settle any such claim without first consulting with Tenant and obtaining the consent of Tenant, which consent shall not be unreasonably withheld, conditioned or delayed. |

| 6.1.6 | Landlord’s Right to Enter. Upon reasonable prior notice from Landlord (except in emergencies), to permit Landlord and its agents to enter into and examine the Premises at reasonable times and to show the Premises (other than to prospective tenants, except as otherwise set forth in this Section 6.1.6), and to make repairs to the Premises, and, during the last six (6) months prior to the expiration of this Lease, to show the Premises to prospective tenants and to keep affixed in suitable places notices of availability of the Premises. Landlord shall use reasonable efforts to perform such showings during normal business hours. |

| 6.1.7 | Personal Property at Tenant’s Risk. All of the furnishings, fixtures, equipment, effects and property of every kind, nature and description of Tenant and of all persons claiming by, through or under Tenant which, during the continuance of this Lease or any occupancy of the Premises by Tenant or anyone claiming under Tenant, may be on the Premises, shall be at the sole risk and hazard of Tenant and if the whole or any part thereof shall be destroyed or damaged by fire, water or otherwise, or by the leakage or bursting of water pipes, steam pipes, or other pipes, by theft or from any other cause, no part of said loss or damage is to be charged to or to be borne by Landlord, except that Landlord shall in no event be indemnified or held harmless or exonerated from any liability to Tenant or to any other person, for any injury, loss, damage or liability to the extent prohibited by law. |

| 6.1.8 | Payment of Landlord’s Cost of Enforcement. To pay on demand Landlord’s expenses, including reasonable attorneys’ fees, incurred in enforcing any obligation of Tenant under this Lease or in curing any default by Tenant under this Lease as provided in Section 8.4. |

| 6.1.9 | Yield Up. At the expiration of the term or earlier termination of this Lease: to surrender all keys to the Premises; to remove all of its trade fixtures and personal property in the Premises; to deliver to Landlord stamped architectural plans showing the Premises at yield up (which may be the initial plans if Tenant has made no installations after the Commencement Date); to remove such installations made by it as Landlord may request (including computer and telecommunications wiring and cabling, it being understood that if Tenant leaves such wiring and cabling in a useable condition, Landlord, although having the right to request removal thereof, is less likely to so request) and all Tenant’s signs wherever located; to repair all damage caused by such removal and to yield up the Premises (including all installations and improvements made by Tenant except for trade fixtures and such of said installations or improvements as Landlord shall request Tenant to remove), broom-clean and in the same good order and repair in which Tenant is obliged to keep and maintain the Premises by the provisions of this Lease, loss by fire or other casualty excepted. Any property not so removed shall be deemed abandoned and, if Landlord so elects, deemed to be Landlord’s property, and may be retained or removed and disposed of by Landlord in such manner as Landlord shall determine and Tenant shall pay Landlord the entire cost and expense incurred by it in effecting such removal and disposition and in making any incidental repairs and replacements to the Premises and for use and occupancy during the period after the expiration of the term and prior to its performance of its obligations under this subsection 6.1.9. Tenant shall further indemnify Landlord against all loss, cost and damage resulting from Tenant’s failure and delay in surrendering the Premises as above provided. Tenant shall not be required to remove any of Landlord’s Work, but Tenant may, at its option and with at least thirty (30) days prior notice to Landlord, remove any of the fixtures, property or equipment that are a part of the TIW provided that, following such removal, Tenant repairs all damage caused by removal and the portion of the Premises from which such item was removed is left in a fully functional condition. |

If the Tenant remains in the Premises beyond the expiration or earlier termination of this Lease, such holding over shall be without right and shall not be deemed to create any tenancy, but the Tenant shall be a tenant at sufferance only at a daily rate of rent equal to two (2) times the rent and other charges in effect under this Lease as of the day prior to the date of expiration of this Lease.

| 6.1.10 | Rules and Regulations. To comply with the Rules and Regulations set forth in Exhibit E, and with all reasonable Rules and Regulations of general applicability to all tenants of the Building hereafter made by Landlord, of which Tenant has been given notice; Landlord shall not be liable to Tenant for the failure of other tenants of the Building to conform to such Rules and Regulations. |

| 6.1.11 | Estoppel Certificate. Upon not less than ten (10) business days’ prior written request by Landlord, to execute, acknowledge and deliver to Landlord a statement in writing, which may be in the form attached hereto as Exhibit F or in another form reasonably similar thereto, or such other form as Landlord may provide from time to time, certifying, to the extent true and accurate, all or any of the following: (i) that this Lease is unmodified and in full force and effect, (ii) whether the term has commenced and Fixed Rent and Additional Rent have become payable hereunder and, if so, the dates to which they have been paid, (iii) whether or not Landlord is in default in performance of any of the terms of this Lease, (iv) whether Tenant has accepted possession of the Premises, (v) whether Tenant has made any claim against Landlord under this Lease and, if so, the nature thereof and the dollar amount, if any, of such claim, (vi) whether there exist any offsets or defenses against enforcement of any of the terms of this Lease upon the part of Tenant to be performed, and (vii) such further information with respect to the Lease or the Premises as Landlord may reasonably request. Any such statement delivered pursuant to this subsection 6.1.11 may be relied upon by any prospective purchaser or mortgagee of the Premises, or any prospective assignee of such mortgage. Tenant shall also deliver to Landlord such financial information as may be reasonably required by Landlord to be provided to any mortgagee or prospective purchaser of the Premises, provided such mortgagee or prospective purchaser first executes a non-disclosure agreement with Tenant reasonably acceptable to Tenant. |

| 6.1.12 | Landlord’s Expenses Re Consents. To reimburse Landlord promptly on demand for all reasonable legal expenses incurred by Landlord in connection with all requests by Tenant for consent or approval hereunder. The foregoing shall not apply to consents sought from Landlord in connection with Landlord’s Work. |

| 6.2 | Negative Covenants. Tenant covenants at all times during the term and such further time (prior or subsequent thereto) as Tenant occupies the Premises or any part thereof: |

| 6.2.1 | Assignment and Subletting. Not to assign, transfer, mortgage or pledge this Lease or to sublease (which term shall be deemed to include the granting of concessions and licenses and the like) all or any part of the Premises or suffer or permit this Lease or the leasehold estate hereby created or any other rights arising under this Lease to be assigned, transferred or encumbered, in whole or in part, whether voluntarily, involuntarily or by operation of law, or permit the occupancy of the Premises by anyone other than Tenant without the prior written consent of Landlord. In the event Tenant desires to assign this Lease or sublet any portion or all of the Premises, Tenant shall notify Landlord in writing of Tenant’s intent to so assign this Lease or sublet the Premises and the |

| proposed effective date of such subletting or assignment, and shall request in such notification that Landlord consent thereto. Landlord may terminate this Lease in the case of a proposed assignment, or suspend this Lease pro tanto for the period and with respect to the space involved in the case of a proposed subletting, by giving written notice of termination or suspension to Tenant, with such termination or suspension to be effective as of the effective date of such assignment or subletting. If Landlord does not so terminate or suspend, Landlord’s consent shall not be unreasonably withheld, conditioned or delayed to an assignment or to a subletting, provided that the following conditions are met: |

| (i) | the assignee or subtenant shall use the Premises only for the Permitted Uses; |

| (ii) | the proposed assignee or subtenant has a net worth and creditworthiness reasonably acceptable to Landlord; and |

| (iii) | the proposed assignee or subtenant is not then a tenant in the Building or the Park, or an entity with which Landlord is negotiating or has negotiated within the preceding six months regarding the possibility of leasing space in the Building or the Park. |

Tenant shall furnish Landlord with any information reasonably requested by Landlord to enable Landlord to determine whether the proposed assignment or subletting complies with the foregoing requirements, including without limitation, financial statements relating to the proposed assignee or subtenant.

Tenant shall, as Additional Rent, reimburse Landlord promptly for Landlord’s reasonable legal expenses incurred in connection with any request by Tenant for such consent. If Landlord consents thereto, no such subletting or assignment shall in any way impair the continuing primary liability of Tenant hereunder, and no consent to any subletting or assignment in a particular instance shall be deemed to be a waiver of the obligation to obtain the Landlord’s written approval in the case of any other subletting or assignment.

If for any assignment or sublease consented to by Landlord hereunder Tenant receives rent or other consideration, either initially or over the term of the assignment or sublease, in excess of the rent called for hereunder, or in case of sublease of part, in excess of such rent fairly allocable to the part, after appropriate adjustments to assure that all other payments called for hereunder are appropriately taken into account and after deduction for reasonable marketing expenses of Tenant in connection with the assignment or sublease, to pay to Landlord as additional rent fifty (50%) percent of the excess of each such payment of rent or other consideration received by Tenant promptly after its receipt.

If at any time during the term of this Lease, there is a name change, reformation or reorganization of the Tenant entity, Tenant shall so notify Landlord and deliver evidence reasonably satisfactory to Landlord documenting such name change, reformation or reorganization.

Notwithstanding the foregoing provisions of Subsection 6.2.1, Tenant may assign this Lease or sublet the Premises or any portion thereof, without Landlord’s consent, to any corporation which controls or is controlled by Tenant, or to any corporation into which or with which Tenant is merged or consolidated, or to any corporation which purchases all or substantially all of the assets of Tenant’s business, or to any corporation resulting from another form of corporate reorganization, provided that (a) the assignee or sublessee agrees to assume and perform, in full, the obligations of Tenant under this Lease by written instrument reasonably satisfactory to Landlord (which instrument shall be delivered to Landlord fifteen (15) days prior to the effective date of any such transaction), (b) Tenant remains fully and primarily liable under this Lease, (c) the use of the Premises remains unchanged, and (d) the successor to Tenant will have on the effective date of the assignment or sublease a net worth at least equal to or greater than the net worth that Tenant had immediately prior to the merger, consolidation, acquisition, transfer or transaction permitted herein, and provided further that proof satisfactory to Landlord of such net worth shall have been delivered to Landlord at least fifteen (15) days prior to the effective date of any such transaction.

| 6.2.2 | Nuisance. Not to injure, deface or otherwise harm the Premises; nor commit any nuisance; nor permit in the Premises any vending machine (except such as is used for the sale of merchandise to employees of Tenant) or inflammable fluids or chemicals (except such as are customarily used in connection with standard office equipment); nor permit any cooking to such extent as requires special exhaust venting; nor permit the emission of any objectionable noise or odor; nor make, allow or suffer any waste; nor make any use of the Premises which is improper, offensive or contrary to any law or ordinance or which will invalidate any of Landlord’s insurance; nor conduct any auction, fire, “going out of business” or bankruptcy sales. |

| 6.2.3 | Intentionally Deleted. |

| 6.2.4 | Floor Load; Heavy Equipment. Not to place a load upon any floor of the Premises exceeding the floor load per square foot area which such floor was designed to carry and which is allowed by law. Business machines and mechanical equipment which cause vibration or noise shall be placed and maintained by Tenant at Tenant’s expense in settings sufficient to absorb and prevent vibration, noise and annoyance. |