Attached files

| file | filename |

|---|---|

| EX-23.4 - NIVS IntelliMedia Technology Group, Inc. | v178727_ex23-4.htm |

| EX-23.1 - NIVS IntelliMedia Technology Group, Inc. | v178727_ex23-1.htm |

|

As

Filed with the Securities and Exchange Commission on March 26,

2010

|

Registration

No. 333-165222

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 1 ON

FORM

S-1/A

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

NIVS

IntelliMedia Technology Group, Inc.

(Name

of Registrant As Specified in its Charter)

|

Delaware

|

3651

|

20-8057809

|

||

|

(State

or Other Jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer Identification No.)

|

||

|

Incorporation

|

Classification

Code Number)

|

|||

|

or

Organization)

|

NIVS

Industry Park

No.

29-31, Shuikou Road, Huizhou, Guangdong

People’s

Republic of China 516006

86-752-3125862

(Address

and Telephone Number of Principal Executive Offices)

Corporation

Service Company

2711

Centerville Road

Suite

400

Wilmington,

DE 19808

800-222-2122

(Name,

Address and Telephone Number of Agent for Service)

Copies

to

|

Thomas

J. Poletti, Esq.

Anh

Q. Tran, Esq.

K&L

Gates LLP

10100

Santa Monica Blvd., 7th Floor

Los

Angeles, CA 90067

Telephone

(310) 552-5000

Facsimile

(310) 552-5001

|

V.

Joseph Stubbs, Esq.

Scott

Galer, Esq.

Stubbs

Alderton & Markiles, LLP

15260

Ventura Boulevard, 20th Floor

Sherman

Oaks, California 91403

Telephone

(818) 444-4500

Facsimile

(818) 444-4520

|

Approximate Date of Proposed Sale to

the Public: As soon as practicable after the effective date of this

Registration Statement.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. o

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. o

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer þ

|

Smaller

reporting company o

|

CALCULATION

OF REGISTRATION FEE

|

Proposed

|

||||||||

|

Maximum

|

Amount of

|

|||||||

|

Title of Each Class of

|

Aggregate

|

Registration

|

||||||

|

Securities To Be Registered

|

Offering Price(1)

|

Fee

|

||||||

|

Common

Stock, $0.0001 par value per share

|

$ | 23,000,000 | (2) | $ | 1,639.90 | |||

|

Underwriters’

Warrants to Purchase Common Stock(3)

|

n/a | n/a | ||||||

|

Common

Stock Underlying Underwriters’ Warrants, $0.0001 par value per

share(3)

|

$ | 750,000 | $ | 53.48 | ||||

|

Total

Registration Fee

|

$ | 1,693.38 | (4) | |||||

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, this registration statement

shall be deemed to cover the additional securities (i) to be offered or

issued in connection with any provision of any securities purported to be

registered hereby to be offered pursuant to terms which provide for a

change in the amount of securities being offered or issued to prevent

dilution resulting from stock splits, stock dividends, or similar

transactions and (ii) of the same class as the securities covered by this

registration statement issued or issuable prior to completion of the

distribution of the securities covered by this registration statement as a

result of a split of, or a stock dividend on, the registered

securities.

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the amount of the registration in

accordance with Rule 457(o) under the Securities Act of 1933, as

amended. Includes an estimated $3,000,000 proposed maximum

aggregate offering price from the sale of shares of common stock which may

be issued pursuant to the exercise of a 45-day option granted by the

registrant to the underwriters to cover over-allotments, if

any.

|

|

|

(3)

|

The

Registrant will sell to the underwriters for this public offering warrants

to purchase a number of shares of common stock that is equal to 3% the

aggregate number of shares sold in this offering excluding the

over-allotment option. The warrants will be exercisable at a

per share exercise price equal to 125% of the public offering

price. As estimated solely for the purpose of calculating the

registration fee pursuant to Rule 457(g) under the Securities Act, the

proposed maximum aggregate offering price of the underwriters’ warrants is

$750,000, which is equal to 125% of $600,000 (3% of

$20,000,000). In accordance with Rule 457(g) under the

Securities Act, because the shares of the Registrant’s common stock

underlying the underwriters’ warrants are registered hereby, no separate

registration fee is required with respect to the warrants registered

hereby.

|

|

|

(4)

|

Previously

paid.

|

The

Registrant amends this registration statement on such date or dates as may be

necessary to delay its effective date until the Registrant shall file a further

amendment which specifically states that this registration statement shall

hereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933, or until the registration statement shall become effective on such date

as the Commission, acting pursuant to Section 8(a), may determine.

The

information in this prospectus is not complete and

may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission becomes effective.

This prospectus is not an offer to sell these securities and we are not

soliciting offers to buy these securities

in any state where the offer or sale is not

permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION, DATED MARCH 26,

2010

|

$20,000,000

of Common Stock

NIVS

IntelliMedia Technology Group, Inc.

NIVS

IntelliMedia Technology Group, Inc. is offering $20,000,000 of shares of its

common stock. The number of shares that we will offer will be

determined based on the public offering price per share.

Our

shares of common stock are traded on the NYSE Amex under the ticker symbol

“NIV.” On March 25, 2010, the closing sales price for our common stock on the

NYSE Amex was $3.86 per share.

The purchase of the securities

involves a high degree

of risk. See section entitled “Risk Factors” beginning on page

6.

|

Per Share

|

Total

|

|||||||

|

Public

offering price

|

$ | $ | ||||||

|

Underwriting

discounts and commissions(1)

|

$ | $ | ||||||

|

Proceeds,

before expenses, to NIVS IntelliMedia Technology Group,

Inc.

|

$ | $ | ||||||

(1) The

underwriters will receive compensation in addition to the discounts and

commissions as set forth under “Underwriting.”

The

underwriters have a 45-day option to purchase up

to additional

shares of common stock from us solely to cover over-allotments, if

any. If the underwriters exercise this option in full, the total

underwriting discounts and commissions will be

$ ,

and our total proceeds, before expenses, will be

$ . The

underwriters will also receive warrants to

purchase shares

of our common stock in connection with this offering.

The

underwriters are offering the common stock as set forth under “Underwriting.”

The underwriters expect to deliver the shares of common stock to purchasers on

or

about ,

2010.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of anyone’s investment in these securities or

determined if this prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

|

Rodman

& Renshaw, LLC

|

WestPark

Capital, Inc.

|

The Date

of this Prospectus

is: ,

2010

TABLE

OF CONTENTS

|

PROSPECTUS

SUMMARY

|

1

|

|

|

SUMMARY

CONSOLIDATED FINANCIAL DATA

|

5

|

|

|

RISK

FACTORS

|

6

|

|

|

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

29

|

|

|

USE

OF PROCEEDS

|

30

|

|

|

PRICE

RANGE OF OUR COMMON STOCK

|

30

|

|

|

DIVIDEND

POLICY

|

31

|

|

|

CAPITALIZATION

|

32

|

|

|

DILUTION

|

33

|

|

|

SELECTED

CONSOLIDATED FINANCIAL DATA

|

35

|

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

36

|

|

|

DESCRIPTION

OF BUSINESS

|

52

|

|

|

MANAGEMENT

|

66

|

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

74

|

|

|

BENEFICIAL

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

77

|

|

|

CHANGE

IN ACCOUNTANTS

|

79

|

|

|

DESCRIPTION

OF SECURITIES

|

79

|

|

|

SHARES

ELIGIBLE FOR FUTURE SALE

|

82

|

|

|

UNDERWRITING

|

84

|

|

|

LEGAL

MATTERS

|

86

|

|

|

EXPERTS

|

86

|

|

|

ADDITIONAL

INFORMATION

|

86

|

|

|

INDEX

TO FINANCIAL STATEMENTS

|

F-1

|

|

|

PART

II INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

II-1

|

|

|

SIGNATURES

|

II-7

|

Please

read this prospectus carefully. It describes our business, our financial

condition and results of operations. We have prepared this prospectus so that

you will have the information necessary to make an informed investment

decision.

You

should rely only on information contained in this prospectus. We have

not, and the underwriters have not, authorized any other person to provide you

with different information. This prospectus is not an offer to sell,

nor is it seeking an offer to buy, these securities in any state where the offer

or sale is not permitted. The information in this prospectus is

complete and accurate as of the date on the front cover, but the information may

have changed since that date.

i

PROSPECTUS

SUMMARY

Because this is only a summary, it

does not contain all of

the information that may be important to you. You should carefully read the more

detailed information contained in this prospectus, including our financial

statements and related notes. Our business involves significant risks. You

should carefully consider the information under

the heading "Risk Factors" beginning on page 6.

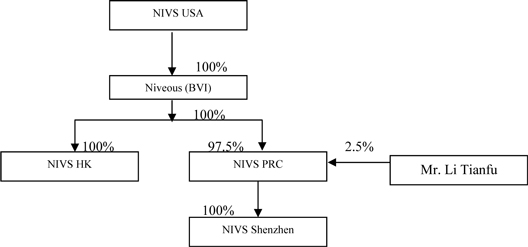

As

used in this prospectus, unless otherwise indicated, the terms “we,” “our,”

“us,” “Company” and “NIVS” refer to NIVS IntelliMedia Technology Group, Inc., a

Delaware corporation. We conduct our business through our subsidiaries, which

include our wholly-owned subsidiary, NIVS Holding Company Limited, a British

Virgin Islands corporation (“NIVS BVI”), and NIVS (Huizhou) Audio & Video

Tech. Co., Ltd., a company organized under the laws of the PRC (“NIVS PRC”),

which is 97.5% owned by NIVS BVI and 2.5% owned by Tianfu Li, our Chief

Executive Officer and Chairman of the Board. “China” or “PRC” refers

to the People’s Republic of China. “RMB” or “Renminbi” refers to the legal

currency of China and “$” or “U.S. Dollars” refers to the legal currency of the

United States.

Our

Company

We are

engaged in the design, manufacture, marketing and sale of consumer electronic

products. Our products primarily consist of audio and video products, including

digital audio systems, televisions, digital video broadcasting (“DVB”) set-top

boxes, DVD players, as well as audio/video peripheral and accessory

products. We have invested substantial resources in the research and

development of our intelligent audio and video consumer products, most of which

utilize our Chinese speech interactive technology to permit users to control our

products through their spoken commands. We recently added mobile

phones and other 3G communication devices to our product

portfolio. In January 2010, we acquired Dongri, a mobile phone

product manufacturer, for a purchase price of up to $23 million. Our

products are distributed worldwide, including markets in Europe, Southeast Asia

and North America.

Our

Industry

We

compete within certain categories in the wholesale consumer electronics

industry, primarily focused on standard and intelligent audio and video

equipment, in addition to the mobile phone industry. Our products in

the standard audio and video equipment category include mid and high-end home

audio products, including premium home theater systems, speakers, shelf-stereo

systems, televisions, DVD players, DVB set-top boxes, portable digital players,

and related products. Growth of this market segment has been driven

primarily due to the increase in consumer demand for flat screen digital

televisions and for audio and visual products that complement flat screen

televisions to create a home theater experience.

The

market for intelligent audio and video products consists of traditional video

and audio products combined with speech-based interface. Our products

that compete in the intelligent audio and video equipment category are based on

the Chinese language and include many of the types of products that we offer in

our line of standard audio and video products, except these products are

equipped with our speech interactive technology. The market for

intelligent audio and video products is less developed than the market for

standard audio and video equipment, and the market for products in this market

based on Chinese language is less developed than products based on Western

languages. The intelligent audio and video electronics market has

experienced growth in part due to consumer demand for simple, convenient

interfaces.

The

mobile phone market in China has experienced rapid growth over the past several

years, driven in part by the country’s strong overall economic

development. China maintains a relatively low mobile phone

penetration rate, which we believe may lead to additional substantial growth in

the sector. The Chinese government has adopted 3G standards, and in

May 2008, it announced a restructuring plan to increase competition in the

telecommunications market by permitting two additional wireless carriers, China

Telecom and China Unicom, to enter the market that was previously dominated by

China Mobile. We believe that increased competition in the mobile

telecom market will stimulate demand for 3G mobile phones and related

accessories in China.

1

Our

Competitive Strengths

We

believe the following strengths contribute to our competitive advantages and

differentiate us from our competitors:

|

|

·

|

Design and manufacturing

capabilities. We utilize an experienced senior design

team, 2.7 million square foot factory, and over 1,600 production employees

to improve the quality of our products, reduce costs, and keep pace with

current standards of the rapidly evolving consumer electronics

industry.

|

|

|

·

|

Market

position. Since the inception of NIVS PRC in 1998, we

have strengthened our ability to bring to the market well-differentiated

products that perform well against competitive offerings based on price,

style, and brand recognition, and our specific Mandarin-speech interaction

technology has broad application to consumer products and has allowed us

to distinguish our products from those of our

competitors.

|

|

|

·

|

Experienced management

team. Led by our CEO, Tianfu Li, with his 20 years of

experience in the consumer electronics industry, our senior management

team has extensive business and industry experience, including an

understanding of changing market trends, consumer needs, technologies and

our ability to capitalize on the opportunities resulting from these market

changes.

|

|

|

·

|

Well-established distribution

channels. Our products are sold domestically in China at

over 8,000 points of sale and internationally through numerous channels,

including independent specialty retailers, international and regional

chains, mass merchants, and

distributors.

|

|

|

·

|

Brand

awareness. Our consumer electronic products marketed

under the NIVS brand, have become a recognized brand name in

China. In September 2009, we were granted a license by the

China Ministry of Industry and Information Technology to manufacture and

market mobile phones under our NIVS

brand.

|

|

|

·

|

Customer service

expertise. We work closely with our major customers in

order to ensure high levels of customer satisfaction by offering flexible

delivery methods and product feedback opportunities. For our OEM

customers, we provide a complete range of services, allowing us to take

customer products from initial design through production to testing,

distribution and after-market

support.

|

Our

Strategy

Our goal

is to become a global leader in the development and manufacture of consumer

electronic products. We intend to achieve this goal by implementing the

following strategies.

|

|

·

|

Expand offering of mobile

phone and speech-controlled products. We plan to continue to

leverage our expertise in product design and development, our intellectual

property platform, and our diverse distribution network by continuing to

develop and introduce mobile phones. We also plan to strengthen

the performance of our Mandarin speech technology to provide users with an

easy-to-use, speech-enabled interaction with consumer audio/visual

products.

|

|

|

·

|

Build partnerships with new

and existing clients. We intend to leverage our Mandarin-speech

interactive technology to develop relationships and strategic alliances

with third-party developers, vendors and manufacturers of mobile phones,

entertainment devices and GPS navigation devices for use in their

products.

|

|

|

·

|

Expand global presence.

We intend to expand our international resources to better serve our

global customers and business associates and to leverage opportunities in

markets such as Hong Kong, the Middle East, India, Great Britain, Germany,

the United States and Argentina.

|

|

|

·

|

Augment marketing and

promotion efforts to increase brand awareness. We

continue to devote our efforts towards brand development and utilize

marketing concepts in an attempt to strengthen the marketability of our

products.

|

|

|

·

|

Expand sales network and

distribution channels. We

intend to expand our sales network in China and develop relationships with

a broader set of wholesalers, distributors and resellers, all in order to

expand the market availability of our products in

China.

|

2

Corporate

Information

We were

incorporated in the State of Delaware on December 7, 2006. On July

25, 2008, we closed a share exchange transaction pursuant to which we became the

100% parent of NIVS BVI, assumed to the operations of NIVS BVI and its

subsidiaries, and changed our corporate name to NIVS IntelliMedia Technology

Group, Inc. NIVS BVI is primarily a holding company. NIVS

PRC was founded in 1998 in Huizhou, Guangdong.

Our

principal executive offices and our manufacturing and product development

facilities are located in Huizhou, Guangdong, People’s Republic of

China. Our corporate offices are located at NIVS Industry Park, No.

29-31, Shuikou Road, Huizhou, Guangdong, People’s Republic of China

516006.

Our

corporate website is located at www.nivsgroup.com/english/.

Information contained on, or that can be accessed through, our corporate website

is not part of this prospectus.

Our

shares of common stock are traded on the NYSE Amex under the ticker symbol

“NIV.”

3

The

Offering

|

Common

stock we are offering

|

shares (1)

|

|

|

Common

stock outstanding after the offering

|

shares (2)

|

|

|

Offering

price

|

$ per

share

|

|

|

Use

of proceeds

|

We

intend to use the net proceeds of this offering for general corporate

purposes. See "Use of Proceeds" on page 30 for more information on the use

of proceeds.

|

|

|

Risk

factors

|

Investing

in these securities involves a high degree of risk. As an investor you

should be able to bear a complete loss of your investment. You should

carefully consider the information set forth in the “Risk Factors” section

beginning on page 6.

|

|

|

NYSE

Amex symbol

|

NIV

|

The

number of shares of our common stock to be outstanding after the closing of this

offering is based on 40,675,347 shares outstanding as of March 25, 2010 and

excludes the following shares potentially issuable as of that

date:

|

|

·

|

4,000,000

shares of common stock reserved for issuance under our 2009 Omnibus

Incentive Plan;

|

|

|

·

|

55,000

shares of common stock issuable upon the exercise of outstanding warrants

with a weighted average exercise price of $4.20 per share;

and

|

|

|

·

|

shares

of common stock available for issuance by us pursuant to the underwriters’

over-allotment option related to this

offering.

|

Except as

otherwise indicated, all information in this prospectus assumes no exercise of

the underwriters’ over-allotment option.

4

SUMMARY

CONSOLIDATED FINANCIAL DATA

The

following summary financial information contains consolidated statements

of income data for the years ended December 31, 2009, 2008, 2007, 2006 and

2005 and the consolidated balance sheet data as of December 31, 2009, 2008,

2007, 2006 and 2005. The consolidated statements of income data

and balance sheet data were derived from the audited consolidated financial

statements. Such financial data should be read in conjunction with

the consolidated financial statements and the notes to the consolidated

financial statements starting on page F-1 and with “Management’s Discussion and

Analysis of Financial Condition and Results of Operations.”

Consolidated Statements of

Income

|

Years ended December 31,

|

||||||||||||||||||||

|

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

|

(all amounts are in thousands except share and per share amounts)

|

|||||||||||||||||||

|

Revenue

|

$ | 185,198 | $ | 143,631 | $ | 77,627 | $ | 37,735 | $ | 21,966 | ||||||||||

|

Other

Sales

|

282 | 415 | 516 | 53 | - | |||||||||||||||

|

Cost

of Goods Sold

|

(142,416 | ) | (109,763 | ) | (58,864 | ) | (28,072 | ) | (17,300 | ) | ||||||||||

|

Gross Profit

|

43,064 | 34,283 | 19,279 | 9,716 | 4,666 | |||||||||||||||

|

|

||||||||||||||||||||

|

Selling Expenses

|

6,761 | 5,376 | 3,270 | 1,792 | 837 | |||||||||||||||

|

|

||||||||||||||||||||

|

General and

administrative

|

||||||||||||||||||||

|

Amortization

|

79 | 69 | 62 | 59 | 137 | |||||||||||||||

|

Depreciation

|

331 | 337 | 328 | 300 | 198 | |||||||||||||||

|

Bad

debts (recovery)

|

(2,745 | ) | 2,531 | 473 | 133 | 81 | ||||||||||||||

|

Merger

cost

|

- | 1,786 | - | - | - | |||||||||||||||

|

Stock-based

compensation

|

- | 765 | - | - | - | |||||||||||||||

|

Other

G&A expense

|

4,850 | 3,172 | 2,548 | 1,126 | 832 | |||||||||||||||

|

Total General and

administrative

|

2,515 | 8,660 | 3,411 | 1,618 | 1,248 | |||||||||||||||

|

Research and

development

|

5,315 | 1,737 | 373 | 417 | 230 | |||||||||||||||

|

Total operating

expenses

|

14,591 | 15,773 | 7,054 | 3,827 | 2,315 | |||||||||||||||

|

Income from

operations

|

28,473 | 18,510 | 12,225 | 5,889 | 2,351 | |||||||||||||||

|

|

||||||||||||||||||||

|

Other income

(expenses)

|

||||||||||||||||||||

|

Government

grant

|

576 | 32 | 28 | - | 160 | |||||||||||||||

|

Write-down

of inventory

|

- | (132 | ) | (105 | ) | - | (5 | ) | ||||||||||||

|

Gain

on disposal of assets

|

- | - | - | 1,226 | - | |||||||||||||||

|

Interest

income

|

- | - | 235 | 19 | 11 | |||||||||||||||

|

Interest

expense

|

(1,567 | ) | (2,208 | ) | (1,792 | ) | (863 | ) | (319 | ) | ||||||||||

|

Imputed

interest

|

- | (656 | ) | (527 | ) | (125 | ) | (97 | ) | |||||||||||

|

Sundry

income (expense), net

|

11 | (52 | ) | (111 | ) | (56 | ) | (7 | ) | |||||||||||

|

Total other income

(expenses)

|

(980 | ) | (3,016 | ) | (2,272 | ) | 201 | (257 | ) | |||||||||||

|

|

||||||||||||||||||||

|

Income before Noncontrolling

interest and income taxes

|

27,493 | 15,494 | 9,953 | 6,090 | 2,094 | |||||||||||||||

|

Income

taxes

|

(3,406 | ) | (2,031 | ) | (1,269 | ) | (753 | ) | - | |||||||||||

|

Noncontrolling

interest

|

(630 | ) | (430 | ) | (217 | ) | (135 | ) | (56 | ) | ||||||||||

|

|

||||||||||||||||||||

|

Net Income

|

$ | 23,457 | $ | 13,033 | $ | 8,467 | $ | 5,202 | $ | 2,038 | ||||||||||

Consolidated

Balance Sheets

|

As of December 31,

|

||||||||||||||||||||

|

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

|

(in thousands)

|

|||||||||||||||||||

|

Total

Current Assets

|

$ | 63,122 | $ | 44,963 | $ | 25,309 | $ | 16,768 | $ | 12,287 | ||||||||||

|

Total

Assets

|

140,477 | 118,924 | 88,554 | 37,015 | 34,860 | |||||||||||||||

|

Total

Current Liabilities

|

59,786 | 63,592 | 59,528 | 28,715 | 19,415 | |||||||||||||||

|

Total

Liabilities

|

59,786 | 71,435 | 70,537 | 34,808 | 29,469 | |||||||||||||||

|

Total

Stockholders’ Equity

|

80,691 | 47,489 | 18,017 | 2,207 | 5,391 | |||||||||||||||

5

RISK

FACTORS

Any

investment in our common stock involves a high degree of

risk. Investors should carefully consider the risks described below

and all of the information contained in this prospectus before deciding whether

to purchase our common stock. Our business, financial condition or

results of operations could be materially adversely affected by these risks if

any of them actually occur. The trading price could decline due to

any of these risks, and an investor may lose all or part of his

investment. Some of these factors have affected our financial

condition and operating results in the past or are currently affecting our

company. This prospectus also contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a

result of certain factors, including the risks we face as described below and

elsewhere in this prospectus.

RISKS

RELATED TO OUR OPERATIONS

We

depend on a small number of customers for the vast majority of our sales. A

reduction in business from any of these customers could cause a significant

decline in our sales and profitability.

The

vast majority of our sales are generated from a small number of customers. For

the year ended December 31, 2009, we had four customers that each accounted for

at least 5% of the revenues that we generated, with one customer accounting for

15.9% of our revenue. These four customers accounted for a total of

approximately 34.9% of our revenue for that period. During the years ended

December 31, 2008 and 2007, we had four and five customers that generated

revenues of at least 5% of our revenues, with one customer accounting for 12.7%

and 13.5% of our revenue, respectively. These customers accounted for a total of

approximately 33.4% and 38.4% of our revenue for the years ended December 31,

2008 and 2007, respectively. The loss of any of these customers

could have a material adverse effect upon our revenue and net

income.

In

addition, we believe that one customer will represent substantially all of our

mobile phone product sales in the foreseeable. We entered into a purchase

agreement with Kuanda (Xiamen) Communications Co., Ltd and China PTAC

Communications Services, on behalf of China Telecom, for the purchase by China

Telecom of our two 3G mobile phone products. PRC law currently

permits only three wireless carriers in the China telecommunications market,

China Mobile, China Telecom and China Unicom. The purchase

agreement that we have with China Telecom is contingent on delivery of the 3G

mobile phones representing the aggregate order by March 31, 2010. The

value of the order is approximately $28.8 million; the dollar value of any

additional orders further to this relationship depends on the final number of

delivered products. If we fail to meet the requirements of the order

or otherwise lose China PTAC as a customer could result in a material adverse

effect upon our revenue and net income.

Our

lack of long-term purchase orders and commitments could lead to a rapid decline

in our sales and profitability.

All of

our significant customers issue purchase orders solely in their own discretion,

often only two to four weeks before the requested date of shipment. Our

customers are generally able to cancel orders or delay the delivery of products

on relatively short notice. In addition, our customers may decide not to

purchase products from us for any reason. Accordingly, we cannot assure you that

any of our current customers will continue to purchase our products in the

future. As a result, our sales volume and profitability could decline rapidly

with little or no warning whatsoever.

We cannot

rely on long-term purchase orders or commitments to protect us from the negative

financial effects of a decline in demand for our products. The limited certainty

of product orders can make it difficult for us to forecast our sales and

allocate our resources in a manner consistent with our actual sales. Moreover,

our expense levels are based in part on our expectations of future sales and, if

our expectations regarding future sales are inaccurate, we may be unable to

reduce costs in a timely manner to adjust for sales shortfalls. Furthermore,

because we depend on a small number of customers for the vast majority of our

sales, the magnitude of the ramifications of these risks is greater than if our

sales were less concentrated with a small number of customers. As a result of

our lack of long-term purchase orders and purchase commitments we may experience

a rapid decline in our sales and profitability.

6

Historically,

a substantial portion of our assets has been comprised of accounts receivable

representing amounts owed by a small number of customers. If any of these

customers fails to timely pay us amounts owed, we could suffer a significant

decline in cash flow and liquidity which, in turn, could cause us to be unable

pay our liabilities and purchase an adequate amount of inventory to sustain or

expand our sales volume.

Our accounts receivable represented

approximately 52.6% and 45.3% of our total current assets as of December 31,

2009 and 2008, respectively. As of December 31, 2009, 51.3% of our accounts

receivable represented amounts owed by four customers, each of which represented

over 5% of the total amount of our accounts receivable. As a result of the

substantial amount and concentration of our accounts receivable, if any of our

major customers fails to timely pay us amounts owed, we could suffer a

significant decline in cash flow and liquidity which could adversely affect our

ability to borrow funds to pay our liabilities and to purchase inventory to

sustain or expand our current sales volume.

In

addition, our business is characterized by long periods for collection from our

customers and short periods for payment to our suppliers, the combination of

which may cause us to have liquidity problems. We experience an

average accounts settlement period ranging from one month to as high as four

months from the time we sell our products to the time we receive payment from

our customers. In contrast, we typically need to place certain deposits and

advances with our suppliers on a portion of the purchase price in advance and

for some suppliers we must maintain a deposit for future orders. Because our

payment cycle is considerably shorter than our receivable cycle, we may

experience working capital shortages. Working capital management, including

prompt and diligent billing and collection, is an important factor in our

results of operations and liquidity. We cannot assure you that system problems,

industry trends or other issues will not extend our collection period, adversely

impact our working capital.

The

growth of aging receivables and a deterioration in the collectability of these

accounts could adversely affect our results of operations.

We provide for bad debts principally

based upon the aging of accounts receivable, in addition to collectability of

specific customer accounts, our history of bad debts, and the general condition

of the industry. Our doubtful account allowance at December 31, 2009 was $0.6

million, compared to $3.4 million at December 31, 2008 and $0.7 million at

December 31, 2007. During 2008 and earlier portions of 2009, we have experienced

increases in doubtful account reserves in the past due to an increase in the

aging of our accounts receivable, the growth of the outstanding balance of

receivables, the general decline in the domestic and global economy, and other

factors. Our general and administrative expenses for the year ended December 31,

2009 include a bad debt reversal of approximately $(2.7) million as

compared to $2.5 million bad debt expense for the prior year. We

believe that the reversal of bad debt allowance was justified due to an

improvement in the Chinese economy in late 2009, stable collection of accounts

receivable in 2009 and our efforts to collect outstanding old accounts

receivables in 2009. Due to the difficulty in assessing future trends, we

could be required to further increase our provisions for doubtful

accounts. As our accounts receivable age and become uncollectible our

cash flow and results of operations are negatively impacted.

Our

history of negative working capital could adversely affect our ability to raise

additional capital to fund our operations and limit our ability to react to

changes in the economy or our industry.

We

had working capital of approximately $3.3 million and negative working

capital of approximately, $18.6 million and $34 million as of December 31, 2009,

2008 and 2007, respectively. The negative working capital was largely caused by

the substantial increase in financing from bank loans and notes. Our

substantial leverage could adversely affect our ability to raise additional

capital to fund our operations, limit our ability to react to changes in the

economy or our industry, expose us to interest rate risk to the extent of our

variable rate debt and prevent us from meeting our obligations under the Notes

and Credit Facility. Our high degree of leverage could have important

consequences for you, including:

|

|

·

|

increasing

our vulnerability to adverse economic, industry or competitive

developments;

|

|

|

·

|

requiring

a substantial portion of cash flow from operations to be dedicated to the

payment of principal and interest on our indebtedness, therefore reducing

our ability to use our cash flow to fund our operations, capital

expenditures and future business

opportunities;

|

|

|

·

|

exposing

us to the risk of increased interest

rates;

|

|

|

·

|

making

it more difficult for us to satisfy our obligations with respect to our

indebtedness and any failure to comply with the obligations of any of our

debt instruments that we may have or obtain, including restrictive

covenants and borrowing conditions, could result in an event of default

the agreements governing such other

indebtedness;

|

|

|

·

|

restricting

us from making strategic acquisitions or causing us to make non-strategic

divestitures;

|

7

|

|

·

|

limiting

our ability to obtain additional financing for working capital, capital

expenditures, product development, debt service requirements, acquisitions

and general corporate or other purposes;

and

|

|

|

·

|

limiting

our flexibility in planning for, or reacting to, changes in our business

or market conditions and placing us at a competitive disadvantage compared

to our competitors who are less highly leveraged and who therefore, may be

able to take advantage of opportunities that our leverage prevents us from

exploiting.

|

Our

acquisition of Dongri in January 2010 may not result in the benefits and revenue

growth we expect.

In

January 2010, our wholly-owned subsidiary, NIVS Holding Company Limited,

acquired 100% of the equity interest in Huizhou Dongri Digital Co., Ltd., a

company organized under the laws of the People’s Republic of China (“Dongri”)

for a purchase price of up $23 million. Our acquisition of Dongri and

its manufacturing facility could expose us to potential liabilities, some of

which may not be disclosed by the seller, and there are no assurances that our

acquisition of Dongri will enhance our future financial condition. We

may continue to acquire additional businesses in the future. This acquisition

and future acquisitions involve substantial risks, including:

|

·

|

integration and management of the

operations;

|

|

·

|

retention of key

personnel;

|

|

·

|

integration of information

systems, internal procedures, accounts receivable and management,

financial and operational

controls;

|

|

·

|

diversion of management’s

attention from other ongoing business concerns; and exposure to

unanticipated liabilities of acquired

companies;

|

|

·

|

uncertainty as to whether PRC

governmental authorities will question the structure of the acquisition

and require approval of PRC authorities that would have the ability to

seek to void the

transaction;

|

|

·

|

unforeseen tax liability in

connection with our possession and operation of the Dongri;

and

|

|

·

|

failure to realize anticipated

financial results or

benefits.

|

These and

other factors could harm our ability to achieve anticipated levels of

profitability or realize other anticipated benefits of an acquisition and could

adversely affect our business and operating results.

Adverse

capital and credit market conditions may significantly affect our ability to

meet liquidity needs, access to capital and cost of capital.

The

capital and credit markets have been experiencing extreme volatility and

disruption for more than twelve months. In recent weeks, the volatility and

disruption have reached unprecedented levels. In some cases, the markets have

exerted downward pressure on availability of liquidity and credit capacity for

certain issuers. We have historically relied on credit to fund our

business and we need liquidity to pay our operating expenses. Without sufficient

liquidity, we will be forced to curtail our operations, and our business will

suffer. Disruptions, uncertainty or volatility in the capital and

credit markets may also limit our access to capital required to operate our

business. Such market conditions may limit our ability to replace, in a timely

manner, maturing liabilities and access the capital necessary to operate and

grow our business. As such, we may be forced to delay raising capital or bear an

unattractive cost of capital which could decrease our profitability and

significantly reduce our financial flexibility. Our results of

operations, financial condition, cash flows and capital position could be

materially adversely affected by disruptions in the financial

markets.

8

We

have significant outstanding short-term borrowings, and we may not be able to

obtain extensions when they mature.

Our notes payable to banks for

short-term borrowings for the years ended December 31, 2009 and 2008 were

approximately $51.7 million and $54.7 million, respectively. Generally, these

short-term bank loans mature in one year or less and contain no specific renewal

terms. However, in China it is customary practice for banks and borrowers to

negotiate roll-overs or renewals of short-term borrowings on an on-going

basis shortly before they mature. Although we have renewed our short-term

borrowings in the past, we cannot assure you that we will be able to renew these

loans in the future as they mature. In January 2010, the Chinese government took

steps to tighten the availability of credit including ordering banks to increase

the amount of reserves they hold and to reduce or limit their lending. If we are

unable to obtain renewals of these loans or sufficient alternative funding on

reasonable terms from banks or other parties, we will have to repay these

borrowings with the cash on our balance sheet or cash generated by our future

operations, if any. We cannot assure you that our business will generate

sufficient cash flow from operations to repay these borrowings.

We

may need additional capital to implement our current business strategy, which

may not be available to us, and if we raise additional capital, it may dilute

your ownership in us.

We

currently depend on bank loans and net revenues to meet our short-term cash

requirements. In order to grow revenues and sustain profitability, we will need

additional capital. In addition to this offering, we completed a

public offering of shares of common stock in March 2009, and we may conduct

additional financing transactions in the future. Obtaining additional

financing will be subject to a number of factors, including market conditions,

our operating performance and investor sentiment. These factors may make the

timing, amount, terms and conditions of additional financing unattractive to us.

We cannot assure you that we will be able to obtain any additional financing. If

we are unable to obtain the financing needed to implement our business strategy,

our ability to increase revenues will be impaired and we may not be able to

sustain profitability.

Consumer

electronics products, mobile phones in particular, are subject to rapid

technological changes. If we fail to accurately anticipate and adapt to these

changes, the products we sell will become obsolete, causing a decline in our

sales and profitability.

Consumer

electronics products are subject to rapid technological changes which often

cause product obsolescence. Companies within the consumer electronics industry

are continuously developing new products with heightened performance and

functionality. This puts pricing pressure on existing products and constantly

threatens to make them, or causes them to be, obsolete. Our typical product's

life cycle is extremely short, generating lower average selling prices as the

cycle matures. If we fail to accurately anticipate the introduction of new

technologies, we may possess significant amounts of obsolete inventory that can

only be sold at substantially lower prices and profit margins than we

anticipated. In addition, if we fail to accurately anticipate the introduction

of new technologies, we may be unable to compete effectively due to our failure

to offer products most demanded by the marketplace. If any of these failures

occur, our sales, profit margins and profitability will be adversely

affected.

Moreover,

changes in mobile phone industry standards and technologies, customer

preferences and government regulation could limit our ability to sell our mobile

phone products. The mobile phone market is particularly characterized

by changing consumer demands for cellular telephone functions and applications,

rapid product obsolescence and price erosion, intense competition, evolving

industry standards, and wide fluctuations in product supply and demand. These

factors require us to continuously develop new products and enhance our existing

products to stay competitive. The market has recently experience

rapid transitions from widespread market adoption of 2G, 2.5G, 2.75G and 3G

technologies, and continued changes in industry standards may make our existing

products obsolete or negate the cost advantages we believe we have in our

products.

Mobile

communications, information technology, media and consumer electronics

industries are also converging in some areas into one broader industry leading

to the creation of new mobile devices, services and ways to use mobile devices.

As a result, new market segments within the mobile communications industry have

begun to emerge and we have made significant investments in new business

opportunities in certain of these market segments, such as our acquisition of

Dongri, a mobile phone manufacturer. However, a number of the new market

segments in the mobile communications industry are still in early stages of

their development, and it may be difficult for us to accurately predict which

new market segments are the most advantageous for us to focus on. As a result,

if the segments on which we have chosen to focus grow less than expected, we may

not receive a return on our investment as soon as we expect, or at all. We may

also forego growth opportunities in new market segments of the mobile

communications industry on which we do not focus.

9

In

addition, we form alliances or business relationships with, and make strategic

partnerships with, other companies to introduce new

technologies. This is particularly important to the development and

enhancement of our Chinese interactive speech technology. In some cases, such

relationships are crucial to our goal of introducing new products and services,

but we may not be able to successfully collaborate or achieve expected synergies

with our partners. We do not, however, control these partners, who may make

decisions regarding their business undertakings with us that may be contrary to

our interests. In addition, if these partners change their business strategies,

we may fail to maintain these relationships.

Our

expansion into the mobile phone industry will depend on the continued growth of

the mobile communications industry, and if the mobile communications industry

does not grow as we expect, our sales and profitability may be adversely

affected.

We have

recently made significant investments to enter into the mobile phone industry,

and sales of our mobile phone products depend on continued growth in mobile

communications in terms of the number of existing mobile subscribers who upgrade

or simply replace their existing mobile devices, the number of new subscribers

and increased usage. As well, our sales and profitability are affected by the

extent to which there is increasing demand for, and development of, value-added

services, leading to opportunities for us to successfully market mobile devices

that feature these services. These developments are outside of our control. For

example, we are dependent on operators in highly penetrated markets to

successfully introduce services that cause a substantial increase in usage of

voice and data. If operators are not successful in their attempts to increase

subscriber numbers, stimulate increased usage or drive replacement sales, our

business and results of operations could be materially adversely

affected.

We

do not carry any business interruption insurance, products liability insurance

or any other insurance policy except for a limited property insurance

policy. As a result, we may incur uninsured losses, increasing the

possibility that you would lose your entire investment in our

company.

We could

be exposed to liabilities or other claims for which we would have no insurance

protection. We do not currently maintain any business interruption

insurance, products liability insurance, or any other comprehensive insurance

policy except for property insurance policies with limited

coverage. As a result, we may incur uninsured liabilities and losses

as a result of the conduct of our business. There can be no guarantee

that we will be able to obtain additional insurance coverage in the future, and

even if we are able to obtain additional coverage, we may not carry sufficient

insurance coverage to satisfy potential claims. Should uninsured losses occur,

any purchasers of our common stock could lose their entire

investment.

Because

we do not carry products liability insurance, a failure of any of the products

marketed by us may subject us to the risk of product liability claims and

litigation arising from injuries allegedly caused by the improper functioning or

design of our products. We cannot assure that we will have enough

funds to defend or pay for liabilities arising out of a products liability

claim. To the extent we incur any product liability or other

litigation losses, our expenses could materially increase

substantially. There can be no assurance that we will have sufficient

funds to pay for such expenses, which could end our operations and you would

lose your entire investment.

We

may be exposed to monetary fines by the local housing authority and claims from

our employees in connection with NIVS PRC Light’s non-compliance with

regulations with respect to contribution of housing provident funds for

employees.

According

to the relevant PRC regulations on housing provident funds, PRC enterprises are

required to contribute housing provident funds for their employees. The monthly

contributions must beat least 5% of each employee’s average monthly income in

the previous year. NIVS PRC has not paid such funds for its employees since its

establishment and the accumulated unpaid amount is approximately $870,000. Under

local regulations on collection of housing provident funds in Huizhou City where

NIVS PRC is located, the local housing authority may require NIVS PRC to rectify

its non-compliance by setting up bank accounts and making payment and relevant

filings for the unpaid housing funds for its employees within a specified time

period. If NIVS PRC fails to do so within the specified time period, the local

housing authority may impose a monetary fine on it and may also apply to the

local people’s court for enforcement. NIVS PRC employees may also be entitled to

claim payment of such funds individually. We accrued the entire $870,000 amount

in our financial statements as of December 31, 2009. If we receive

any notice from the local housing authority or any claim from our current and

former employees regarding our non-compliance with the regulations, we will be

required respond to the notice and pay all amounts due to the government,

including any administrative penalties imposed, which would require us to divert

our financial resources and/or impact our cash reserves, if any, to make such

payments. Additionally, any administrative costs in excess of the payments, if

material, may impact our operating results.

10

We

could be liable for damages for defects in our products pursuant to the Tort

Liability Law and Product Liability Law of the PRC.

The Tort

Liability Law of the People’s Republic of China, which was passed during the

12th Session of the Standing Committee of the 11th National People’s Congress on

December 26, 2009, states that manufacturers are liable for damages caused by

defects in their products and sellers are liable for damages attributable to

their fault. If the defects are caused by the fault of third parties such as the

transporter or storekeeper, manufacturers and sellers are entitled to claim for

compensation from these third parties after paying the compensation

amount.

We

may incur design and development expenses and purchase inventory in anticipation

of orders which are not placed.

In order

to transact business, we assess the integrity and creditworthiness of our

customers and suppliers and we may, based on this assessment, incur design and

development costs that we expect to recoup over a number of orders produced for

the customer. Such assessments are not always accurate and expose us

to potential costs, including the write off of costs incurred and inventory

obsolescence if the orders anticipated do not materialize. We may also

occasionally place orders with suppliers based on a customer’s forecast or in

anticipation of an order that is not realized. Additionally, from time to time,

we may purchase quantities of supplies and materials greater than required by

customer orders to secure more favorable pricing, delivery or credit terms.

These purchases can expose us to losses from cancellation costs, inventory

carrying costs or inventory obsolescence, and hence adversely affect our

business and operating results.

Allegations

of health risks from the electromagnetic fields generated by mobile devices, and

the lawsuits and publicity relating to them, regardless of merit, could affect

our operations negatively by leading consumers to reduce their use of mobile

devices or by causing us to allocate monetary and personnel resources to these

issues.

There has

been public speculation about possible health risks to individuals from exposure

to electromagnetic fields from the use of mobile devices such as mobile phones,

which we manufacture and sell. While a substantial amount of

scientific research conducted to date by various independent research bodies has

indicated that these radio signals, at levels within the limits prescribed by

public health authority safety standards and recommendations, present no adverse

effect to human health, we cannot be certain that future studies,

irrespective of their scientific basis, will not suggest a link between

electromagnetic fields and adverse health effects that would adversely affect

our sales and share price. Research into these issues is ongoing by government

agencies, international health organizations and other scientific bodies in

order to develop a better scientific and public understanding of these

issues.

Although

our products and solutions are designed to meet all relevant safety standards

and recommendations globally, no more than a perceived risk of adverse health

effects of mobile communications devices could adversely affect us through a

reduction in sales of mobile devices or increased difficulty in obtaining sites

for base stations, and could have a negative effect on our reputation and brand

value as well as harm our share price.

We

are subject to market risk through our sales to international

markets.

A growing

percentage of our sales are being derived from international markets. These

international sales are primarily focused in Europe,

Southeast Asia, and North America. These operations are subject to risks that

are inherent in operating in foreign countries, including the

following:

|

·

|

foreign

countries could change regulations or impose currency restrictions and

other restraints;

|

|

·

|

changes

in foreign currency exchange rates and hyperinflation or deflation in the

foreign countries in which we

operate;

|

|

·

|

exchange

controls;

|

|

·

|

some

countries impose burdensome tariffs and

quotas;

|

|

·

|

political

changes and economic crises may lead to changes in the business

environment in which we operate;

|

|

·

|

international

conflict, including terrorist acts, could significantly impact our

financial condition and results of operations;

and

|

11

|

·

|

economic

downturns, political instability and war or civil disturbances may disrupt

distribution logistics or limit sales in individual

markets.

|

In

addition, we utilize third-party distributors to act as our representative for

the geographic region that they have been assigned. Sales through distributors

represent approximately 70% of total revenue. Significant terms and conditions

of distributor agreements include FOB source, net 30 days payment terms, with no

return or exchange rights, and no price protection. Since the product transfers

title to the distributor at the time of shipment by us, the products are not

considered inventory on consignment. Our success is dependent on these

distributors finding new customers and receiving new orders from existing

customers.

If

our third party sales representatives and distributors fail to adequately

promote, market and sell our products, our revenues could significantly

decrease.

A significant portion of our product

sales are made through third party sales representative organizations, whose

members are not our employees. Our level of sales depends on the effectiveness

of these organizations, as well as the effectiveness of our own employees. Some

of these third party representatives may sell (and do sell), with our

permission, competitive products of third parties as well as our products.

During our fiscal years ended December 31, 2009, 2008 and 2007, these

organizations were responsible for approximately 15%, 17% and 18%, respectively,

of our domestic net revenues during such periods. If any of the third party

sales representative organizations engaged by us fails to adequately promote,

market and sell our products, our revenues could be significantly decreased

until a replacement organization or distributor can be retained by us. Finding

replacement organizations and distributors can be a time consuming process

during which our revenues could be negatively impacted.

Our

speech-controlled products may not achieve widespread acceptance or may have

bugs, which could result in delayed or lost revenue, expensive correction,

liability to our customers or claims against us.

We have

invested and expect to continue to invest heavily in the research, development

and marketing of our Mandarin-speech technology consumer products. The market

for these products are is relatively new and rapidly evolving. Our ability to

increase revenue in the future depends largely on acceptance of

speech-controlled consumer electronic products in general and our products in

particular. The continued development of the market for our current and future

speech solutions will also depend on:

|

•

|

consumer

and business demand for speech-enabled products and

applications;

|

|

•

|

continuous

improvement in speech interactive technology;

and

|

|

•

|

development

by third-party vendors and manufacturers of applications using speech

technologies.

|

Sales of

our speech-controlled products would be harmed if the market for such products

does not continue to develop or develops more slowly than we expect, and,

consequently, our business would be harmed and we may not recover the costs

associated with our investment in our speech interactive

technologies.

In

addition, complex software applications, such as our Chinese speech interactive

technology, often contain errors, defects or bugs. Defects in the solutions or

products that we develop and sell to our customers could require expensive

corrections and result in delayed or lost revenue, adverse customer reaction and

negative publicity about us or our products and services. Customers who are not

satisfied with any of our products may also bring claims against us for damages,

which, even if unsuccessful, would likely be time-consuming to defend, and could

result in costly litigation and payment of damages. Such claims could harm our

reputation, financial results and competitive position.

We

are subject to intense competition in the industry in which we operate, which

could cause material reductions in the selling price of our products or losses

of our market share.

The

consumer electronics industry is highly competitive, especially with respect to

pricing and the introduction of new products and features. Our products compete

in the medium- to high- priced sector of the consumer electronics market and

compete primarily on the basis of reliability, brand recognition, quality,

price, design, consumer acceptance of our trademark, and quality service and

support to retailers and our customers.

12

In recent

years, we and many of our competitors, have regularly lowered prices, and we

expect these pricing pressures to continue. If these pricing pressures are not

mitigated by increases in volume, cost reductions from our supplier or changes

in product mix, our revenues and profits could be substantially reduced. As

compared to us, many of our competitors have:

|

•

|

significantly

longer operating histories;

|

|

•

|

significantly

greater managerial, financial, marketing, technical and other competitive

resources; and

|

|

•

|

greater

brand recognition.

|

As a

result, our competitors may be able to:

|

•

|

adapt

more quickly to new or emerging technologies and changes in customer

requirements;

|

|

•

|

devote

greater resources to the promotion and sale of their products and

services; and

|

|

•

|

respond

more effectively to pricing

pressures.

|

These

factors could materially adversely affect our operations and financial

condition. In addition, competition could increase if:

|

•

|

new

companies enter the market;

|

|

•

|

existing

competitors expand their product mix;

or

|

|

•

|

we

expand into new markets.

|

An

increase in competition could result in material price reductions or loss of our

market share.

The

consumer electronics industry is subject to significant fluctuations in the

availability of raw materials and components. If we do not properly anticipate

the need for critical raw materials and components, we may be unable to meet the

demands of our customers and end-users, which could reduce our competitiveness,

cause a decline in our market share and have a material adverse effect on our

results of operations.

As the

availability of raw materials and components decreases, the cost of acquiring

those raw materials and components ordinarily increases. If we fail to procure

adequate supplies of raw materials and components in anticipation of our

customers' orders or end-users’ demand, our gross margins may be negatively

impacted due to higher prices that we are required to pay for raw materials and

components in short supply. High growth product categories have experienced

chronic shortages of raw materials and components during periods of

exceptionally high demand. If we do not properly anticipate the need for

critical raw materials and components, we may pay higher prices for the raw

materials and components, we may not be unable to meet the demands of our

customers and end-users, which could reduce our competitiveness, cause a decline

in our market share and have a material adverse effect on our results of

operations.

Unanticipated

disruptions in our operations or slowdowns by our suppliers and shipping

companies could adversely affect our ability to deliver our products and service

our customers which could materially and adversely affect our revenues and our

relationships with our customers.

Our

ability to provide high quality customer service, process and fulfill orders and

manage inventory depends on:

|

•

|

the

efficient and uninterrupted operation of our distribution centers;

and

|

|

•

|

the

timely and uninterrupted performance of third party suppliers, shipping

companies, and dock workers.

|

Any

material disruption or slowdown in the operation of our distribution centers,

manufacturing facilities or management information systems, or comparable

disruptions or slowdowns suffered by our principal manufacturers, suppliers and

shippers could cause delays in our ability to receive, process and fulfill

customer orders and may cause orders to be canceled, lost or delivered late,

goods to be returned or receipt of goods to be refused. As a result, our

revenues and operating results could be materially and adversely

affected.

13

We

rely heavily on the founder of NIVS PRC and our current Chief Executive Officer,

Tianfu Li. The loss of his services could adversely affect our ability to source

products from our key suppliers and our ability to sell our products to our

customers.

Our

success depends, to a significant extent, upon the continued services of Tianfu

Li, who is the founder of NIVS PRC and our current Chairman of the Board and

Chief Executive Officer. Mr. Li has, among other things, developed key personal

relationships with our suppliers and customers. We greatly rely on these

relationships in the conduct of our operations and the execution of our business

strategies. The loss of Mr. Li could, therefore, result in the loss

of favorable relationships with one or more of our suppliers and/or customers.

We do not maintain "key person" life insurance covering Mr. Li or any other

executive officer. The loss of Mr. Li could significantly delay or prevent the

achievement of our business objectives and adversely affect our business,

financial condition and results of operations.

We

may not be able to effectively recruit and retain skilled employees,

particularly scientific, technical and management professionals.

Our

ability to compete effectively depends largely on our ability to attract and

retain certain key personnel, including scientific, technical and management

professionals. We anticipate that we will need to hire additional skilled

personnel in all areas of our business. Industry demand for such employees,

however, exceeds the number of personnel available, and the competition for

attracting and retaining these employees is intense. Because of this intense

competition for skilled employees, we may be unable to retain our existing

personnel or attract additional qualified employees to keep up with future

business needs. If this should happen, our business, operating results and

financial condition could be adversely affected.

Our

labor costs are likely to increase as a result of changes in Chinese labor

laws.

We expect

to experience an increase in our cost of labor due to recent changes in Chinese

labor laws which are likely to increase costs further and impose restrictions on

our relationship with our employees. In June 2007, the National People’s

Congress of the PRC enacted new labor law legislation called the Labor Contract

Law and more strictly enforced existing labor laws. The new law, which became

effective on January 1, 2008, amended and formalized workers’ rights concerning

overtime hours, pensions, layoffs, employment contracts and the role of trade

unions. As a result of the new law, we have had to increase the salaries of our

employees, provide additional benefits to our employees, and revise certain

other of our labor practices. The increase in labor costs has increased our

operating costs, which increase we have not always been able to pass through to

our customers. In addition, under the new law, employees who either have worked

for us for 10 years or more or who have had two consecutive fixed-term contracts

must be given an “open-ended employment contract” that, in effect, constitutes a

lifetime, permanent contract, which is terminable only in the event the employee

materially breaches our rules and regulations or is in serious dereliction of

his or her duties. Such non-cancelable employment contracts will substantially

increase our employment related risks and limit our ability to downsize our

workforce in the event of an economic downturn. No assurance can be given that

we will not in the future be subject to labor strikes or that we will not have

to make other payments to resolve future labor issues caused by the new laws.

Furthermore, there can be no assurance that the labor laws will not change

further or that their interpretation and implementation will vary, which may

have a negative effect upon our business and results of operations.

Our

business could be materially adversely affected if we cannot protect our

intellectual property rights or if we infringe on the intellectual property

rights of others.

Our

ability to compete effectively will depend on our ability to maintain and

protect our proprietary rights. We own a trademark related to the sale of our

products, which is materially important to our business, as well as our

licenses, other trademarks and proprietary rights that are used for certain of

our home entertainment and consumer electronics products. Our trademarks are

registered in China. However, third parties may seek to challenge, invalidate,

circumvent or render unenforceable any proprietary rights owned by or licensed

to us. In addition, in the event third party licensees fail to protect the

integrity of our trademarks, the value of these marks could be materially

adversely affected.

Our

inability to protect our proprietary rights could materially adversely affect