As filed with the Securities

and Exchange Commission on March 26, 2010

Registration

No. 333-164474

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Everyday Health, Inc.

(Exact name of registrant as

specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

7389

|

|

80-0036062

|

(State or other jurisdiction

of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

45 Main St., Suite 800

Brooklyn, NY 11201

(Address, including

zip code, and telephone number, including area code, of

registrant’s principal executive offices)

Benjamin Wolin

Chief Executive Officer

45 Main St., Suite 800

Brooklyn, NY 11201

(718) 797-0722

(Name, address,

including zip code, and telephone number, including area code,

of agent for service)

Copies to:

| |

|

|

|

|

Babak Yaghmaie, Esq.

Stephane Levy, Esq.

Cooley Godward Kronish LLP

1114 Avenue of the Americas

New York, NY

10036-7798

(212) 479-6000

|

|

Alan Shapiro, Esq.

Executive Vice President

& General Counsel

Everyday Health, Inc.

45 Main St., Suite 800

Brooklyn, NY 11201

(718) 797-0722

|

|

Kirk A. Davenport, Esq.

Latham & Watkins LLP

885 Third Avenue

New York, NY 10022-4834

(212) 906-1200

|

Approximate date of commencement of proposed sale to the

public: As soon as practicable after this

Registration Statement becomes effective.

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933, check the

following

box. o

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act

registration statement number of the earlier effective

registration statement for the same

offering. o

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. o

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated

filer” and “smaller reporting company” in

Rule 12b-2

of the Exchange Act. (Check one):

|

|

|

|

| Large

accelerated

filer o

|

Accelerated

filer o

|

Non-accelerated

filer þ

|

Smaller reporting

company o

|

(Do not check if a smaller

reporting company)

The Registrant hereby amends this Registration Statement on

such date or dates as may be necessary to delay its effective

date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the Registration

Statement shall become effective on such date as the Commission,

acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and

may be changed. We and the selling stockholders may not sell

these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This

preliminary prospectus is not an offer to sell these securities

and we are not soliciting any offer to buy these securities in

any jurisdiction where the offer or sale is not permitted.

|

Subject to Completion. Dated

March 26, 2010.

Shares

Common Stock

This is an initial public offering of shares of common stock of

Everyday Health, Inc.

Everyday Health is

offering

of the shares to be sold in the offering. The selling

stockholders identified in this prospectus are

offering shares.

Everyday Health will not receive any of the proceeds from the

sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for our

common stock. It is currently estimated that the initial public

offering price per share will be between

$ and

$ . We have applied to have our

common stock listed on The Nasdaq Global Market under the symbol

“EVDY.”

See “Risk Factors” on page 13 to read about

factors you should consider before buying shares of our common

stock.

Neither the Securities and Exchange Commission nor any other

regulatory body has approved or disapproved of these securities

or passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

| |

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

|

Initial public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to Everyday Health

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to the selling stockholders

|

|

$

|

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the extent that the underwriters sell more

than shares

of common stock, the underwriters have the option to purchase up

to an

additional shares

from Everyday Health at the initial public offering price less

underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in

New York, New York

on ,

2010.

|

|

| Goldman,

Sachs & Co. |

J.P. Morgan |

|

|

| Jefferies &

Co. |

Needham & Company, LLC |

Prospectus

dated ,

2010.

| Helping consumers:Research symptoms Find treatment options Connect with others Eat healthier Live better

Health is a journey. And Everyday Health is there to lead the way, providing consumers with the expert

guidance and advice they need to make better choices, actively manage their conditions and live healthier lives, every day.

www.EverydayHealth.com |

| Because every day counts. Condition Management Prevention Caring Lifestage |

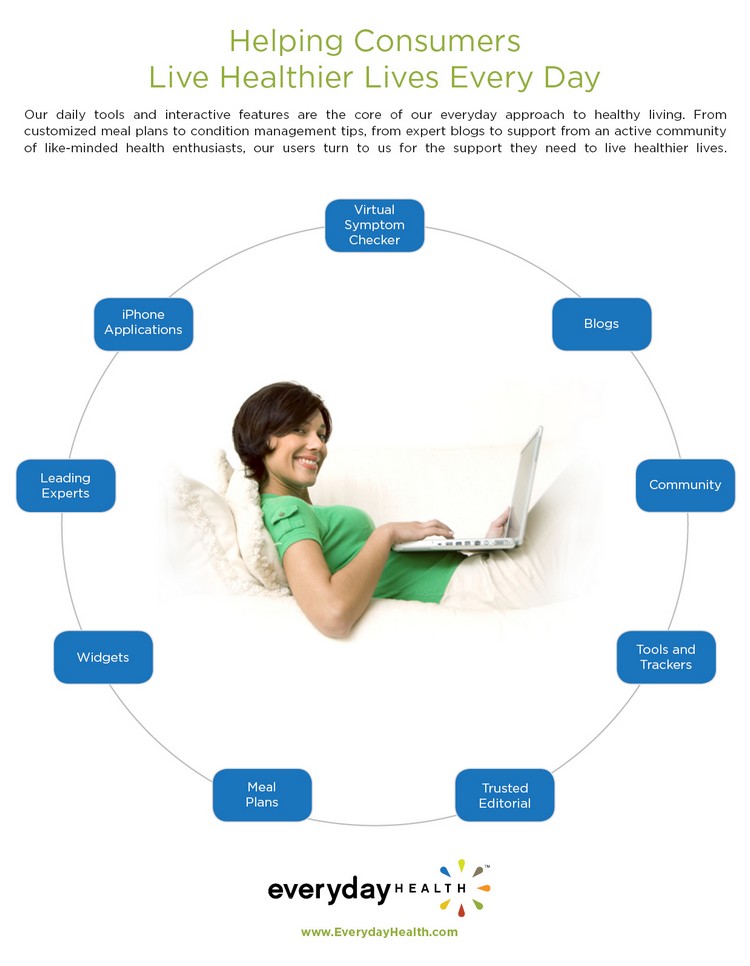

| Everyday Health is a leading provider of online consumer health solutions. Our broad portfolio of

over 25 websites span the health spectrum — from caregiving and condition management to fitness,

nutrition and personal care, we o er users the tools, community and expert advice they need to live

healthier, every day. Treatment Options Connecting Personal Care Fitness and Nutrition |

TABLE OF

CONTENTS

Prospectus

Through and

including ,

2010 (the 25th day after the date of this prospectus), all

dealers effecting transactions in these securities, whether or

not participating in this offering, may be required to deliver a

prospectus. This is in addition to a dealer’s obligation to

deliver a prospectus when acting as an underwriter and with

respect to an unsold allotment or subscription.

No dealer, salesperson or other person is authorized to give any

information or to represent anything not contained in this

prospectus. You must not rely on any unauthorized information or

representations. This prospectus is an offer to sell only the

shares offered hereby, but only under circumstances and in

jurisdictions where it is lawful to do so. The information

contained in this prospectus is current only as of its date.

All website references in this prospectus are intended to be

inactive textual references only. The content of such websites

is not incorporated by reference in this prospectus.

PROSPECTUS

SUMMARY

This summary highlights information contained elsewhere in

this prospectus. You should read the following summary together

with the more detailed information appearing in this prospectus,

including our consolidated financial statements and related

notes, and the risk factors beginning on page 13, before

deciding whether to purchase shares of our common stock.

Everyday Health,

Inc.

Overview

We are a leading provider of online consumer health solutions.

We provide our consumers, advertisers and partners with content

and advertising-based services across a broad portfolio of

websites that span the health spectrum — from

lifestyle offerings in pregnancy, diet and fitness to in-depth

medical content for condition prevention and management.

The Internet has fundamentally altered the consumer health

market by enabling consumers to readily access a wide variety of

useful information and decision-support tools. Historically,

consumers accessed such information through general portals, and

more recently search engines, each of which serve as gateways to

the Internet. The increased reliance on search engines has

fragmented the online consumer audience and has resulted in the

growth in popularity of highly-specialized websites that are

focused on a specific content category, commonly referred to as

a vertical or a vertical category. This growth in popularity is

particularly pervasive in the consumer health vertical since

consumers have a wide variety of individual health interests and

needs. We have designed the Everyday Health portfolio,

which includes websites that we operate and with which we

partner, to take advantage of this fragmentation by providing

multiple sources of reliable and highly-personalized content to

satisfy the diverse needs of our consumers and advertising

customers. The Everyday Health portfolio consists of over

25 consumer health websites, including

www.EverydayHealth.com, www.RevolutionHealth.com,

www.WhattoExpect.com, www.JillianMichaels.com,

www.SouthBeachDiet.com and www.SparkPeople.com.

The depth, breadth and quality of the content across the

Everyday Health portfolio, including our personalized

tools and community features, have enabled us to serve tens of

millions of consumers each month. During 2009, the Everyday

Health portfolio attracted an average of 25 million

unique visitors per month, according to comScore, Inc., a market

research firm. Since our inception, over 39 million

consumers have registered on our websites to obtain personalized

content and features, such as pregnancy calendars, calorie

tracking tools or

e-mail

newsletters on requested health topics, and over

1.8 million consumers have paid for a premium subscription

service. During 2009, we averaged over 16,000 registrations per

day and sent over 410 million opt-in, content-based

newsletters per month.

The composition of the Everyday Health portfolio,

together with our large consumer audience, database of

registered users and customized content offerings, has created

an attractive platform for national, regional and local

advertisers. The solutions we provide our advertisers include

display advertising, sponsorships of specific content offerings

or areas on a website, commonly referred to as integrated

sponsorships, custom

e-mail

campaigns and lead generation products. We also provide our

advertisers with detailed post-campaign reporting metrics that

enable them to better assess the effectiveness of their

marketing expenditures. We believe this combination of targeted

advertising and results-focused measurability allows us to

compete favorably in the consumer health vertical. Our

advertisers consist primarily of pharmaceutical and medical

device companies, manufacturers and retailers of

over-the-counter

products and consumer-packaged-goods and healthcare providers.

During 2009, we featured over 470 brands on the Everyday

Health portfolio and our customers included 24 of the top 25

global companies ranked by 2008 healthcare revenue as compiled

by MedAdNews and 43 of the top “100 Leading National

Advertisers in 2008” as compiled by Advertising Age.

We have an integrated approach to running our business. This

means that we share development, operations and marketing

resources across the entire Everyday Health portfolio

rather than

1

allocating resources to individual websites in the portfolio.

This approach enables us to efficiently operate our own

websites, in addition to those of our partners that are looking

to expand their consumer audience and to grow their revenues

online. In addition, the Everyday Health portfolio allows

providers of consumer health content with an existing online

presence to leverage our advertising platform to increase their

revenues, while maintaining editorial and operational control

over their content.

We generate revenues primarily from the sale of advertising and

sponsorship services, as well as the sale and licensing of our

premium content, including subscriptions to certain websites in

the Everyday Health portfolio.

Industry

Background

Prior to the widespread adoption of the Internet, consumers were

forced to rely on their physicians, friends and family, and

hard-to-access

resources to address their health questions and concerns. The

Internet, however, has made such information more accessible and

the consumer health vertical has rapidly evolved as one of the

largest and fastest growing content categories on the Internet.

In recent years, fragmentation of the online audience and

decreased consumer reliance on general portals has resulted in

consumers seeking multiple websites to satisfy their diverse

health-related needs. According to comScore, consumers that

interact with health content online visited approximately 3.5

different health websites per month on average during 2009. We

believe that consumers will continue to rely on multiple

websites that are dedicated specifically to health-related

content and which contain more in-depth and personalized

offerings in order to satisfy their diverse health needs. We

also believe that consumer demand for authoritative and

differentiated content will continue to drive the growth of both

free content and subscription-based, premium services in the

online consumer health vertical.

Advertisers are increasingly migrating a greater portion of

their spending online as more consumers turn to the Internet as

a preferred medium for accessing information and purchasing

products and services. The growth of online spending in the

health and wellness category, however, has not developed as

rapidly as the overall advertising market. According to a

February 2010 study prepared on our behalf by Forrester

Research, Inc., a market research firm, total online advertising

represented 8.5% and 9.6% of total advertising, excluding direct

mail, during 2008 and 2009, respectively. However, according to

Forrester Research, total online advertising in the health and

wellness category represented only 4.0% and 4.9% of total

advertising in the health and wellness category in 2008 and

2009, respectively. The health and wellness category includes

health products, services and insurance, prescription drugs and

nutritional supplements, personal care and fitness and sports

equipment. Furthermore, according to Forrester Research, total

online advertising in the health and wellness category is

projected to grow at a compounded annual rate of approximately

19.3% from 2009 to 2013. We believe that this projected growth,

combined with our strategy of offering a diverse portfolio of

health-related websites, represents a significant opportunity

for us to increase our advertising and sponsorship revenues.

The Everyday

Health Solution

We believe our success in becoming a leading provider of online

consumer health solutions has been driven by our ability to

address the challenges faced by consumers, advertisers and

partners. Our portfolio of over 25 websites is designed to

enable:

|

|

|

| |

•

|

consumers to readily access a variety of valuable content,

interactive tools and community features across numerous health

categories and empower them to better manage their health

concerns;

|

| |

| |

•

|

advertisers to reach a large and desirable base of consumers in

a targeted and contextually-relevant manner; and

|

| |

| |

•

|

partners to more effectively promote and monetize their content

online.

|

2

Benefits to

Consumers

Premier Portfolio of Trusted Websites. We have

built a portfolio of websites that provides consumers with

reliable and engaging content. We own and operate several health

and wellness websites, including our flagship website,

www.EverydayHealth.com, and we partner with many

well-recognized consumer health content providers. For example,

we are the exclusive online partner with the author of the

What to Expect When You’re Expecting series of

books, the best-selling pregnancy books ever published, to

develop, operate and monetize www.WhattoExpect.com. We

have also partnered with recognized leaders in the health, diet

and fitness categories, including the author and publisher of

The South Beach Diet (www.SouthBeachDiet.com), one

of the best-selling diet books of all time, and Jillian Michaels

(www.JillianMichaels.com), from the NBC television show,

The Biggest Loser.

Engaging Content, Extensive Personalization Tools and

Community Features. Our engaging content,

personalization tools and community features are critical

components of our value proposition to consumers. We have

dedicated significant resources to build a robust and

interactive portfolio of websites that allows consumers to

readily access relevant health and wellness content. For

example, consumers can research symptoms and create personalized

tools such as pregnancy calendars, calorie counters, meal plans

and drug alerts. We utilize the information that our registered

users voluntarily submit to provide them with targeted content,

features and tools that are intended to better meet their

individual needs. We have also created a community environment

that empowers consumers to share information and interact with

each other.

Benefits to

Advertisers

High Quality and Trusted Platform. We believe

that advertisers, particularly large pharmaceutical and medical

device companies and manufacturers of

over-the-counter

and consumer-packaged-goods, are highly sensitive to promoting

their products and services in an environment that will not

diminish the value of their brand. The Everyday Health

portfolio, which features many well-recognized providers of

consumer health content, provides advertisers with a trusted

platform in which to promote their offerings.

Large Audience Scale. The Everyday Health

portfolio attracts a large number of unique visitors, making

it attractive to advertisers in light of the highly-fragmented

nature of the online consumer health market. We believe that the

overall size, scale and composition of the Everyday Health

portfolio, as well as the discrete categories within the

portfolio that engage the audience around specific consumer

health topics, provide advertisers with significant flexibility

to undertake multiple advertising strategies through a single

platform, whether focused on a national, regional or local

audience.

Targeted and Innovative Solutions. Our focus

on customized offerings, in addition to our engaged consumer

base, allows advertisers to effectively target their desired

audience through highly immersive and interactive campaigns. Our

suite of advertising solutions, when combined with our extensive

database of information voluntarily provided by millions of

registered users, can facilitate advertising campaigns that are

directed at specific geographic areas, demographic groups,

interests, issues or user communities. Moreover, we provide our

advertisers with detailed post-campaign reporting that allows

them to measure and evaluate the effectiveness of their

campaigns.

Benefits to

Partners

Online Expertise and Portfolio Integration. A

premier consumer health website requires timely and updated

content, interactive tools and applications and robust community

features. We have expertise in developing content, integrating

new websites and cross-promoting our content offerings across

the Everyday Health portfolio to our consumers. We

believe that such cross-promotion activities, combined with our

extensive user database and experience in operating and

promoting websites, make us well suited to promote our

partners’ content and expand their consumer audience online.

3

Monetization Opportunities. As consumers

become more sophisticated in their use of the Internet and the

use of search engines continues to fragment the online audience,

the Everyday Health portfolio provides an attractive

method for our partners to promote their content and create new

revenue opportunities, which we refer to as monetization

opportunities. The Everyday Health portfolio enables our

partners to benefit from the large and targeted advertising

platform that we have created to increase their exposure to

major advertisers, thereby increasing their revenues, without

relinquishing editorial and operational control over their

content offerings.

Our

Strategy

Our goal is to offer the best content, tools and community

features across the health spectrum, while providing a

compelling platform for an increasing number of advertisers and

partners seeking to engage with our large and growing consumer

base. Key elements of our strategy include:

|

|

|

| |

•

|

developing new and improved offerings to enhance the consumer

experience;

|

| |

| |

•

|

seeking to aggressively grow our advertiser and sponsorship base;

|

| |

| |

•

|

continuing to build and enhance awareness of the Everyday

Health brand;

|

| |

| |

•

|

acquiring complementary businesses; and

|

| |

| |

•

|

expanding into international markets.

|

Preferred Stock

Conversion and Reverse Stock Split

Prior to the consummation of this offering, all of the

outstanding shares of our redeemable convertible preferred stock

will automatically convert

into shares

of our common stock, which we refer to in this prospectus as the

automatic preferred stock conversion. As a result, after this

offering, we will only have common stock outstanding. Prior to

the consummation of this offering, we will also increase our

total authorized number of shares of capital stock, make certain

changes to our charter documents and effect

a

to

reverse stock split, which we refer to in this prospectus as the

reverse stock split.

Corporate History

and Information

We were incorporated in Delaware in January 2002 as Agora Media

Inc. We changed our name to Waterfront Media Inc. in January

2004. In January 2010, to better align our corporate identity

with the Everyday Health brand, we changed our name to

Everyday Health, Inc.

Our principal executive office is located at 45 Main Street,

Suite 800, Brooklyn, NY 11201, and our telephone number is

(718) 797-0722.

Our Internet website address is www.EverydayHealth.com.

The information on, or that can be accessed through, any website

in the Everyday Health portfolio is not part of this

prospectus, and you should not consider any information on, or

that can be accessed through, any website in the Everyday

Health portfolio as part of this prospectus.

The names Everyday Health, Revolution Health, CarePages, Daily

Glow and our logos are trademarks, service marks or trade names

owned by us. All other trademarks, service marks or trade names

appearing in this prospectus are owned by their respective

holders.

4

The

Offering

|

|

|

|

Common stock offered by Everyday Health |

|

shares |

| |

|

Common stock offered by the selling stockholders |

|

shares |

| |

|

Common stock to be outstanding immediately after this offering |

|

shares |

| |

|

Use of proceeds |

|

We estimate that we will receive net proceeds from this offering

of approximately $ million,

based on an assumed public offering price of

$ per share, the midpoint of the

price range set forth on the cover of this prospectus, after

deducting the estimated underwriting discounts and commissions

and offering expenses payable by us. We intend to use the net

proceeds from this offering for working capital and general

corporate purposes, which may include financing the development

of new content and advertising-based services, as well as

funding capital expenditures and operating losses. We may also

use a portion of the net proceeds to repay borrowings under our

credit facilities or acquire complementary businesses, products

or technologies. However, we do not have agreements or

commitments for any specific repayments or acquisitions at this

time. We will not receive any proceeds from the sale of shares

by the selling stockholders in this offering. See “Use of

Proceeds.” |

| |

|

Proposed NASDAQ Global Market symbol |

|

“EVDY” |

| |

|

Risk Factors |

|

You should read the “Risk Factors” section beginning

on page 13 and other information included in this

prospectus for a discussion of factors to consider carefully

before deciding to invest in shares of our common stock. |

The number of shares of common stock that will be outstanding

after this offering is based on 30,266,278 shares of common

stock outstanding as of December 31, 2009 after giving

effect to the assumptions in the following paragraph, and

excludes:

|

|

|

| |

•

|

4,751,879 shares of common stock issuable upon exercise of

outstanding options with a weighted-average exercise price of

$4.52 per share;

|

|

|

|

| |

•

|

659,780 shares of common stock reserved for future issuance

under our 2003 Stock Option Plan; provided, however, that

following the completion of this offering, no additional grants

will be awarded under our 2003 Stock Option Plan and such shares

will become available for issuance under our 2010 Equity

Incentive Plan, which we plan to adopt prior to the consummation

of this offering;

|

|

|

|

| |

•

|

shares

of common stock reserved for future issuance under our 2010

Equity Incentive Plan, which we plan to adopt prior to the

consummation of this offering; and

|

5

|

|

|

| |

•

|

222,977 shares of common stock issuable upon the exercise

of outstanding warrants, which includes warrants to purchase our

redeemable convertible preferred stock that will become

exercisable for common stock after this offering, at a

weighted-average exercise price of $5.47 per share.

|

Unless otherwise indicated, all information in this prospectus:

|

|

|

| |

•

|

gives effect to the completion of the reverse stock split;

|

| |

| |

•

|

gives effect to the automatic preferred stock conversion;

|

| |

| |

•

|

assumes no exercise by the underwriters of their option to

purchase up

to additional

shares, consisting of shares to be purchased from us; and

|

| |

| |

•

|

gives effect to the adoption of our amended and restated

certificate of incorporation and our amended and restated bylaws

that will occur immediately prior to the consummation of this

offering.

|

6

SUMMARY

CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data

for the periods presented. The consolidated statement of

operations data for the three years ended December 31, 2009

and the consolidated balance sheet data as of December 31,

2009 have been derived from our audited consolidated financial

statements for the three years ended December 31, 2009

included elsewhere in this prospectus. The consolidated

statement of operations data for the three months ended

December 31,

2008 and 2009 have been derived from our unaudited consolidated

financial statements and have been prepared on the same basis as

the audited consolidated financial statements and notes thereto

and, in the opinion of our management, include all adjustments,

consisting of normal recurring adjustments and accruals,

necessary for a fair statement of the information for the

interim periods. Our historical results for any prior periods

are not necessarily indicative of results to be expected for a

full year or for any future period.

The pro forma balance sheet data as of December 31, 2009

give effect to the automatic preferred stock conversion. The pro

forma as adjusted balance sheet data as of December 31,

2009 give further effect to our issuance and sale

of shares

of common stock in this offering at an assumed initial public

offering price of $ per share, the

midpoint of the estimated price range shown on the cover of this

prospectus, after deducting estimated underwriting discounts and

commissions and offering expenses payable by us and the

application of the net proceeds therefrom as described in

“Use of Proceeds.” The as adjusted information

presented is illustrative only and will change based on the

actual initial public offering price and other terms of this

offering determined at pricing.

On October 7, 2008, we acquired Revolution Health Group LLC and

its subsidiaries, which we collectively refer to as RHG.

Accordingly, the following tables include RHG’s financial

data from the closing date of the acquisition. Our operating

expenses in the fourth quarter of 2008 and the first and second

quarters of 2009 included various transition-related expenses

that we incurred following the closing of the RHG acquisition.

We eliminated a majority of these redundant transition-related

expenses by the beginning of the third quarter of 2009. These

transition-related expenses consisted of:

|

|

|

| |

•

|

compensation for product development, sales and marketing, and

general and administrative personnel who were employed by us for

a short period of time following the RHG acquisition; and

|

| |

| |

•

|

third-party product development expenses, such as content

licensing fees, data center costs and other technology-related

expenses.

|

The fourth quarter of 2008 is the first calendar quarter which

reflects the RHG acquisition in our financial results.

Accordingly, the fourth quarter of 2009 is the first calendar

quarter which can be used to compare our quarterly financial

performance subsequent to the RHG acquisition on a

year-over-year basis. In the fourth quarter of 2009, our

revenues were approximately $28.6 million, an increase of

26.0% over our revenues of approximately $22.7 million in

the fourth quarter of 2008. Similarly, our Adjusted EBITDA was

approximately $5.6 million in the fourth quarter of 2009,

as compared to approximately $(1.9) million in the fourth

quarter of 2008.

You should read this information together with our consolidated

financial statements and related notes included elsewhere in

this prospectus and the information under “Selected

Consolidated Financial Data” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.”

7

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

|

|

|

|

Ended

|

|

|

|

|

Year Ended December 31,

|

|

|

December 31,

|

|

|

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(in thousands, except share and per share data)

|

|

|

|

|

Consolidated Statement of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

47,363

|

|

|

$

|

69,412

|

|

|

$

|

90,111

|

|

|

$

|

22,672

|

|

|

$

|

28,618

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

|

30,111

|

|

|

|

35,229

|

|

|

|

39,453

|

|

|

|

8,442

|

|

|

|

8,696

|

|

|

Sales and marketing

|

|

|

7,425

|

|

|

|

14,503

|

|

|

|

20,816

|

|

|

|

6,059

|

|

|

|

6,249

|

|

|

Product development

|

|

|

10,753

|

|

|

|

14,874

|

|

|

|

20,192

|

|

|

|

5,566

|

|

|

|

5,115

|

|

|

General and administrative

|

|

|

6,859

|

|

|

|

12,906

|

|

|

|

16,239

|

|

|

|

5,488

|

|

|

|

3,681

|

|

|

Depreciation and amortization

|

|

|

2,030

|

|

|

|

4,340

|

|

|

|

9,787

|

|

|

|

1,980

|

|

|

|

2,454

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

57,178

|

|

|

|

81,852

|

|

|

|

106,487

|

|

|

|

27,535

|

|

|

|

26,195

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

(9,815

|

)

|

|

|

(12,440

|

)

|

|

|

(16,376

|

)

|

|

|

(4,863

|

)

|

|

|

2,423

|

|

|

Interest expense, net

|

|

|

(323

|

)

|

|

|

(455

|

)

|

|

|

(1,314

|

)

|

|

|

(208

|

)

|

|

|

(491

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before provision for income taxes

|

|

|

(10,138

|

)

|

|

|

(12,895

|

)

|

|

|

(17,690

|

)

|

|

|

(5,071

|

)

|

|

|

1,932

|

|

|

Provision for income taxes

|

|

|

—

|

|

|

|

(293

|

)

|

|

|

(1,331

|

)

|

|

|

(293

|

)

|

|

|

(497

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(10,138

|

)

|

|

$

|

(13,188

|

)

|

|

$

|

(19,021

|

)

|

|

$

|

(5,364

|

)

|

|

$

|

1,435

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(1.57

|

)

|

|

$

|

(2.01

|

)

|

|

$

|

(2.89

|

)

|

|

$

|

(0.82

|

)

|

|

$

|

0.22

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

$

|

(1.57

|

)

|

|

$

|

(2.01

|

)

|

|

$

|

(2.89

|

)

|

|

$

|

(0.82

|

)

|

|

$

|

0.20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma basic (unaudited)(1)

|

|

|

|

|

|

$

|

(0.63

|

)

|

|

$

|

(0.63

|

)

|

|

|

|

|

|

$

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma diluted (unaudited)(1)

|

|

|

|

|

|

$

|

(0.63

|

)

|

|

$

|

(0.63

|

)

|

|

|

|

|

|

$

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: Basic

|

|

|

6,444,696

|

|

|

|

6,559,614

|

|

|

|

6,581,793

|

|

|

|

6,564,654

|

|

|

|

6,617,235

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

6,444,696

|

|

|

|

6,559,614

|

|

|

|

6,581,793

|

|

|

|

6,564,654

|

|

|

|

7,321,932

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma basic (unaudited)(1)

|

|

|

|

|

|

|

20,955,330

|

|

|

|

30,229,627

|

|

|

|

|

|

|

|

30,265,069

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma diluted (unaudited)(1)

|

|

|

|

|

|

|

20,955,330

|

|

|

|

30,229,627

|

|

|

|

|

|

|

|

30,969,766

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Pro forma weighted average shares

outstanding reflects the conversion of our redeemable

convertible preferred stock (using the if-converted method) into

common stock as though the conversion had occurred on the

original dates of issuance.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

|

|

|

|

Ended

|

|

|

|

|

Year Ended December 31,

|

|

|

December 31,

|

|

|

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(in thousands)

|

|

|

|

|

Other Financial Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

(6,795

|

)

|

|

$

|

(5,104

|

)

|

|

$

|

(2,664

|

)

|

|

$

|

(1,858

|

)

|

|

$

|

5,598

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense included in:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

$

|

276

|

|

|

$

|

812

|

|

|

$

|

815

|

|

|

$

|

278

|

|

|

$

|

217

|

|

|

Product development

|

|

|

64

|

|

|

|

492

|

|

|

|

548

|

|

|

|

168

|

|

|

|

106

|

|

|

General and administrative

|

|

|

650

|

|

|

|

1,692

|

|

|

|

1,662

|

|

|

|

579

|

|

|

|

398

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stock-based compensation expense

|

|

$

|

990

|

|

|

$

|

2,996

|

|

|

$

|

3,025

|

|

|

$

|

1,025

|

|

|

$

|

721

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2009

|

|

|

|

|

|

|

|

|

|

|

Pro Forma

|

|

|

|

|

Actual

|

|

|

Pro Forma

|

|

|

As Adjusted

|

|

|

|

|

(in thousands)

|

|

|

|

|

Consolidated Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

16,360

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

129,389

|

|

|

|

|

|

|

|

|

|

|

Deferred revenue

|

|

|

6,930

|

|

|

|

|

|

|

|

|

|

|

Long-term debt (including current portion)

|

|

|

17,000

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

46,203

|

|

|

|

|

|

|

|

|

|

|

Redeemable convertible preferred stock

|

|

|

130,420

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity (deficit)

|

|

|

(47,234

|

)

|

|

|

|

|

|

|

|

|

Definition and

Discussion of Other Financial Data

Definition of

Adjusted EBITDA

We define Adjusted EBITDA as net loss plus net interest (income)

expense; income tax expense; non-cash charges including

depreciation, amortization and stock-based compensation expense;

and compensation expense related to acquisition earnout

arrangements.

Discussion of

Adjusted EBITDA

Adjusted EBITDA is a measure of operating performance that is

not calculated in accordance with generally accepted accounting

principles, or GAAP. The table below provides a reconciliation

of Adjusted EBITDA to net income (loss), the most directly

comparable financial measure calculated and presented in

accordance with GAAP. Adjusted EBITDA should not be considered

as an alternative to net income, income from operations or any

other measure of financial performance calculated and presented

in accordance with GAAP. Our Adjusted EBITDA may not be

comparable to similarly titled measures of other companies

because other companies may not calculate similarly titled

measures in the same manner as we do. We prepare Adjusted EBITDA

to eliminate the impact of items that we do not consider

indicative of our core operating performance. We encourage you

to evaluate these adjustments and the reasons we consider them

appropriate, as well as the material limitations of non-GAAP

measures and the manner in which we compensate for those

limitations.

Our management uses Adjusted EBITDA:

|

|

|

| |

•

|

as a measure of operating performance;

|

| |

| |

•

|

to allocate resources to enhance the financial performance of

our business;

|

| |

| |

•

|

to evaluate the effectiveness of our business strategies;

|

| |

| |

•

|

in communications with our board of directors concerning our

financial performance;

|

| |

| |

•

|

for planning purposes, including the preparation of our annual

operating budget; and

|

| |

| |

•

|

as a factor when determining management’s incentive

compensation.

|

Management also uses Adjusted EBITDA to evaluate compliance with

the debt covenants in one of our credit facilities, which

includes an EBITDA maintenance covenant. This credit

facility’s definition of EBITDA is substantially similar to

our definition of Adjusted EBITDA. See “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” for a description of our credit facilities.

Management believes that the use of Adjusted EBITDA provides

consistency and comparability with our past financial

performance, facilitates period to period comparisons of

operations, and also facilitates comparisons with other peer

companies, many of which use similar non-GAAP financial

9

measures to supplement their GAAP results. Management believes

that it is useful to exclude non-cash charges such as

depreciation, amortization and stock-based compensation from

Adjusted EBITDA because:

|

|

|

| |

•

|

the amount of such non-cash expenses in any specific period may

not directly correlate to the underlying performance of our

business operations; and

|

| |

| |

•

|

such expenses can vary significantly between periods as a result

of new acquisitions, or the timing of new stock-based awards, as

the case may be.

|

More specifically, we believe it is appropriate to exclude

stock-based compensation expense from Adjusted EBITDA because

non-cash equity grants made at a certain price and point in time

do not reflect how our business is performing at any particular

time. While we believe that stockholders should have information

about any dilutive effect of outstanding options and the cost of

that compensation, we also believe that stockholders should have

the ability to view the non-GAAP financial measure (which

excludes these costs) that management uses to evaluate our

business. The determination of stock-based compensation expense

is based on many subjective inputs, many of which are not

necessarily directly related to the performance of our business.

Therefore, excluding this cost gives us a clearer view of the

operating performance of our business. Because of varying

available valuation methodologies, subjective assumptions and

the variety of award types that companies may use under the

authoritative accounting guidance for stock-based compensation,

as well as the impact of non-operational factors such as our

share price, on the magnitude of this expense, management

believes that providing a non-GAAP financial measure that

excludes this stock-based compensation expense allows investors

and analysts to make meaningful comparisons between our

operating results and those of other companies. Stock-based

compensation has been a significant non-cash recurring expense

in our business and has been used as a key incentive offered to

our employees. We believe such compensation contributed to the

revenues earned during the periods presented and also believe it

will contribute to the generation of future period revenues.

Stock-based compensation expense will recur in future periods

for GAAP purposes. There are material limitations to our

exclusion of stock-based compensation from Adjusted EBITDA,

primarily that these expenses reduce our GAAP net income. See

below for a further discussion of these limitations on our use

of Adjusted EBITDA as an analytical tool, as well as the manner

in which management compensates for these limitations.

We believe it is appropriate to exclude depreciation and

amortization from Adjusted EBITDA because depreciation is a

function of our capital expenditures which are included in our

statements of cash flows, while amortization reflects other

asset acquisitions made at a point in time and their associated

costs. In analyzing the performance of our business currently,

management believes it is helpful also to consider the business

without taking into account costs or benefits accruing from

historical decisions on infrastructure and capacity. While these

matters do affect the overall financial health of our company,

they are separately evaluated and relate to historic decisions

that do not affect current operations of our business on a cash

flow basis. Further, depreciation and amortization do not result

in ongoing cash expenditures. Investors should note that the use

of assets being depreciated or amortized contributed to revenues

earned during the periods presented and will continue to

contribute to future period revenues. This depreciation and

amortization expense will recur in future periods for GAAP

purposes. There are material limitations to our exclusion of

depreciation and amortization from Adjusted EBITDA, primarily

that these expenses reduce our GAAP net income and the assets

being depreciated or amortized will often have to be replaced in

the future, resulting in future cash requirements. See below for

a further discussion of these limitations on our use of Adjusted

EBITDA as an analytical tool, as well as the manner in which

management compensates for these limitations.

Management believes it is appropriate to exclude compensation

expense associated with acquisition earnout arrangements because

this expense results from activities that are not part of our

normal operations. There are material limitations to our

exclusion from Adjusted EBITDA of earnout expenses associated

with acquisitions, primarily that these expenses reduce our GAAP

net income.

10

See below for a further discussion of these limitations on our

use of Adjusted EBITDA as an analytical tool, as well as the

manner in which management compensates for these limitations.

We believe Adjusted EBITDA is useful to investors in evaluating

our operating performance because securities analysts use

Adjusted EBITDA as a supplemental measure to evaluate the

overall operating performance of companies. We anticipate that

our investor and analyst presentations after we are public will

include Adjusted EBITDA.

Material

limitations of non-GAAP measures

Although measures similar to Adjusted EBITDA are frequently used

by investors and securities analysts in their evaluations of

companies, these measures, including Adjusted EBITDA, have

limitations as an analytical tool, and you should not consider

Adjusted EBITDA in isolation or as a substitute for analysis of

our results of operations as reported under GAAP.

Some of these limitations are:

|

|

|

| |

•

|

Adjusted EBITDA does not reflect our future requirements for

contractual commitments or our cash expenditures or future

requirements for capital expenditures;

|

| |

| |

•

|

Adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital;

|

| |

| |

•

|

Adjusted EBITDA does not reflect interest income or interest

expense;

|

| |

| |

•

|

Adjusted EBITDA does not reflect cash requirements for income

taxes;

|

| |

| |

•

|

Adjusted EBITDA does not reflect the non-cash component of

employee compensation;

|

| |

| |

•

|

although depreciation and amortization are non-cash charges, the

assets being depreciated or amortized will often have to be

replaced in the future, and Adjusted EBITDA does not reflect any

cash requirements for these replacements; and

|

| |

| |

•

|

other companies in our industry may calculate similarly titled

measures differently than we do, limiting their usefulness as

comparative measures.

|

Management compensates for the inherent limitations associated

with using the Adjusted EBITDA measure through disclosure of

such limitations, presentation of our financial statements in

accordance with GAAP and reconciliation of Adjusted EBITDA to

the most directly comparable GAAP measure, net income (loss).

Further, management also reviews GAAP measures, and evaluates

individual measures that are not included in Adjusted EBITDA

such as our level of capital expenditures, equity issuance and

interest expense, among other measures.

11

The following table presents a reconciliation of Adjusted EBITDA

to net income (loss), the most comparable GAAP measure, for each

of the periods indicated:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

|

|

|

|

|

|

|

|

Ended

|

|

|

|

|

Year Ended December 31,

|

|

|

December 31,

|

|

|

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

2008

|

|

|

2009

|

|

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA to Net Income (Loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(10,138

|

)

|

|

$

|

(13,188

|

)

|

|

$

|

(19,021

|

)

|

|

$

|

(5,364

|

)

|

|

$

|

1,435

|

|

|

Interest expense, net

|

|

|

323

|

|

|

|

455

|

|

|

|

1,314

|

|

|

|

208

|

|

|

|

491

|

|

|

Income tax expense

|

|

|

—

|

|

|

|

293

|

|

|

|

1,331

|

|

|

|

293

|

|

|

|

497

|

|

|

Depreciation and amortization expense

|

|

|

2,030

|

|

|

|

4,340

|

|

|

|

9,787

|

|

|

|

1,980

|

|

|

|

2,454

|

|

|

Stock-based compensation

|

|

|

990

|

|

|

|

2,996

|

|

|

|

3,025

|

|

|

|

1,025

|

|

|

|

721

|

|

|

Compensation expense related to acquisition earnout

|

|

|

—

|

|

|

|

—

|

|

|

|

900

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

(6,795

|

)

|

|

$

|

(5,104

|

)

|

|

$

|

(2,664

|

)

|

|

$

|

(1,858

|

)

|

|

$

|

5,598

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

RISK

FACTORS

Investing in our common stock involves a high degree of risk.

You should carefully consider the following risk factors, as

well as the other information in this prospectus, before

deciding whether to invest in our common stock. Our business,

prospects, financial condition or operating results could be

materially adversely affected by any of these risks, as well as

other risks not currently known to us or that we currently

consider immaterial. The trading price of our common stock could

decline as a result of any of these risks, and you could lose

part or all of your investment in our common stock. When

deciding whether to invest in our common stock, you should also

refer to the other information in this prospectus, including our

consolidated financial statements and related notes and the

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations” section of this

prospectus. You should read the section entitled “Special

Note Regarding Forward-Looking Statements” immediately

following these risk factors for a discussion of what types of

statements are forward-looking statements, as well as the

significance of such statements in the context of this

prospectus.

Risks Related to

Our Business

We have a

limited operating history.

Our company has been in existence since 2002. We have a limited

operating history and participate in new markets that are

changing rapidly. Our limited operating history may make it

difficult for you to evaluate our current business and our

future prospects. Moreover, our business has undergone

significant changes during its short history as a result of:

|

|

|

| |

•

|

changes in our content and

advertising-based

service offerings;

|

| |

| |

•

|

changes in the revenue mix derived from such offerings;

|

| |

| |

•

|

acquisitions;

|

| |

| |

•

|

technological changes; and

|

| |

| |

•

|

changes in the markets in which we compete.

|

We expect our business to undergo further changes, making it

difficult to forecast our future financial performance. Many

companies seeking to provide consumer health products and

services through the Internet have failed to become profitable,

and some have ceased operations. We cannot assure you that our

current strategy will be successful or that our business and

revenues will continue to grow.

We have

incurred significant losses since our inception and expect to

incur losses in the future.

We have accumulated significant losses since our inception. We

generated revenues of $90.1 million and recorded net losses

of $19.0 million in the year ended December 31, 2009.

As of December 31, 2009, our accumulated deficit was

$58.2 million. We expect to continue to incur significant

operating expenses and, as a result, we will need to generate

significant revenues to achieve or maintain profitability. We

may not be able to achieve or sustain profitability on a

quarterly or annual basis in the future.

Failure to

maintain and enhance our brands could have a material adverse

effect on our business.

We believe that our brand identity is critical to the success of

our business and in helping us achieve recognition as a trusted

source of consumer health solutions. We also believe that

maintaining and enhancing our brands are vital to expanding our

consumer base and growing our relationships with advertisers. We

believe that the importance of brand recognition and consumer

loyalty will only increase in light of increasing competition in

our markets. Some of our existing and potential

13

competitors, including search engines, media companies and other

online content providers, have well established brands with

greater recognition and market penetration. We have expended

considerable resources on establishing and enhancing the

Everyday Health brand and the other brands in the

Everyday Health portfolio. We have developed policies and

procedures that are intended to preserve and enhance these

brands, including editorial procedures designed to control the

quality of our content. We expect to continue to devote

significant additional resources and efforts to enhance our

brands. However, we may not be able to successfully maintain or

enhance awareness of our brands, and events outside of our

control may have a negative effect on our brands.

If we are

unable to deliver content that attracts and retains consumers to

websites in the Everyday Health portfolio, our ability to

attract advertisers will be adversely affected, which in turn

will negatively impact our business.

We generate a significant percentage of our revenues from

advertising fees. Our future success depends on our ability to

deliver timely, interesting, relevant and valuable content to

attract and retain consumers to websites in the Everyday

Health portfolio. Our ability to successfully develop,

produce and license highly-specialized consumer health content

is subject to numerous uncertainties, including our ability to:

|

|

|

| |

•

|

successfully anticipate and respond to rapidly changing

developments and preferences to ensure our content offerings

remain appealing to our consumers;

|

| |

| |

•

|

attract and retain qualified editors, writers and technical

personnel;

|

| |

| |

•

|

license quality content from third parties;

|

| |

| |

•

|

fund new development projects to further broaden our content

offerings; and

|

| |

| |

•

|

successfully expand our content offerings and advertising-based

services into new platforms and delivery mechanisms.

|

If the content on the Everyday Health portfolio is not

perceived as sufficiently appealing or valuable to our

consumers, we will be unable to retain or grow our consumer

base. If we cannot maintain and grow our consumer base, or if we

experience a decline in traffic levels or the number of page

views by our consumers, our ability to retain and attract

advertisers will be adversely affected. This would in turn

negatively affect our business and revenues.

Our inability

to enter into new, or otherwise extend our existing, licensing

arrangements for proprietary content or the decline in the

popularity of a public figure that is associated with our

partners would adversely affect our ability to grow our business

and revenues.

We are highly dependent on the proprietary content that we

license from third parties to attract and retain consumers to

the Everyday Health portfolio. We believe that such

proprietary content is an important element of our business and

helps to differentiate us from our competitors. Moreover, we

have historically derived a portion of our revenues from

subscriptions to certain websites in the Everyday Health

portfolio that are based on licensed proprietary content. We

anticipate that a meaningful portion of our revenues in the

foreseeable future will continue to be derived from both

advertising and subscription arrangements associated with these

websites.

Our licensing arrangements have varying duration and renewal

terms. As these arrangements expire, renewals on favorable terms

may be sought; however, third parties may outbid us for the

rights to such content. In addition, owners of such content may

elect to create their own online presence in lieu of granting us

a license. Furthermore, renewal costs could substantially exceed

the original contract cost and reduce the profitability of these

agreements to us. Our inability to renew our existing licensing

arrangements, or to otherwise enter into new licensing

arrangements, in each case on commercially favorable terms,

could adversely affect the appeal of our content offerings to

our consumers, which in turn would negatively impact the traffic

and page views of the Everyday Health

14

portfolio and its attractiveness to our consumers, advertisers

and partners. The loss of the licensing arrangements associated

with www.JillianMichaels.com or

www.SouthBeachDiet.com, each of which accounted for more

than 10% of our consolidated revenues for the year ended

December 31, 2009, may have a material adverse effect on

our business and revenues. In addition, the loss of the

licensing arrangement associated with www.WhattoExpect.com

may also have a material adverse effect on our business and

revenues.

In addition, we rely on the popularity and credibility of public

figures that are associated with certain websites in the

Everyday Health portfolio. These individuals may not

retain their current appeal or may become subject to negative

publicity. The popularity and credibility of the websites

associated with these public figures or content providers also

depend on the quality and acceptance of competing content

released into the marketplace at or near the same time, the

availability of alternative sources for the information, general

economic conditions and other tangible and intangible factors,

all of which are difficult to predict. Consumer preferences

change frequently and it is a challenge to anticipate what

offerings will be successful at a certain point in time. Any

decline in the popularity of the content offerings, or any

negative publicity, whether individually or with respect to the

content offerings associated with the websites associated with

these public figures or content providers, may have an adverse

impact on our business and revenues.

Our failure to

attract and retain consumers in a cost-effective manner could

compromise our ability to grow our revenues and become

profitable.

Our continued success is highly dependent on our ability to

attract and retain consumers in a cost-effective manner. In

order to attract consumers to the Everyday Health

portfolio, we must expend considerable amounts of money and

resources for online and offline advertising and marketing. We

use a diverse mix of marketing and advertising programs to

promote the websites in our portfolio, and we have spent, and

expect to continue to spend, significant amounts of money on

these initiatives. Significant increases in the pricing of one

or more of these initiatives will result in higher marketing

costs. Our failure to attract and acquire new, and retain

existing, consumers in a cost-effective manner would make it

more difficult to maintain and grow our revenues and ultimately

to achieve profitability.

Our revenues

are subject to fluctuations due to the timing and amount of

expenditures by our advertising customers.

Advertising and sponsorship revenue comprises a significant and

growing component of our revenues. Our advertising and

sponsorship revenue accounted for approximately 64.5% of

our total revenues for the year ended December 31, 2009.

Advertising spending in the markets in which we compete can

fluctuate significantly as a result of a variety of factors,