Attached files

| file | filename |

|---|---|

| EX-23.1 - American CareSource Holdings, Inc. | e606638_ex23-1.htm |

| EX-31.1 - American CareSource Holdings, Inc. | e606638_ex31-1.htm |

| EX-21.1 - American CareSource Holdings, Inc. | e606638_ex21-1.htm |

| EX-31.2 - American CareSource Holdings, Inc. | e606638_ex31-2.htm |

| EX-32.1 - American CareSource Holdings, Inc. | e606638_ex32-1.htm |

| EX-10.23 - American CareSource Holdings, Inc. | e606638_ex10-23.htm |

| EX-10.22 - American CareSource Holdings, Inc. | e606638_ex10-22.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL

REPORT UNDER SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the Fiscal Year Ended December 31, 2009

|

|

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ___ to ___

Commission

File Number: 001-33094

AMERICAN

CARESOURCE HOLDINGS, INC.

|

|

|

(Exact

Name of Registrant as Specified in Its Charter)

|

||

|

Delaware

|

20-0428568

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

5429

Lyndon B. Johnson Freeway, Suite 850, Dallas, Texas

|

75240

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

|

(972)

308-6830

|

||

|

(Registrant’s

telephone number, including area code)

|

||

|

Securities

registered pursuant to Section 12(b) of the Exchange

Act:

|

||

|

Title

of Each Class

|

Name

of Each Exchange on Which Registered

|

|

|

Common

Stock, par value $.01 per share

|

The

NASDAQ Capital Market

|

|

|

Securities

registered pursuant to Section 12(g) of the Exchange Act:

None

|

|

|

Indicate

by checkmark if the Registrant is a well-known seasoned issuer, as defined

in Rule 405 of the Securities Act of 1933 (the “Securities

Act”).

|

Yes o No x

|

|

Indicate

by checkmark if the Registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange

Act”).

|

Yes o No x

|

|

Indicate

by checkmark whether the Registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Exchange Act during the preceding

12 months (or for such shorter period that the Registrant was required to

file such reports) and (2) has been subject to such filing requirements

for the past 90 days.

|

Yes

x No

o

|

|

Indicate

by check mark whether the registrant has submitted electronically and

posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

|

Yes

o No o

|

|

Indicate

by checkmark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained in this form, and will not be contained,

to the best of Registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

|

x

|

|

Indicate

by checkmark whether the Registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

|

|

o Large

Accelerated Filer o Accelerated

Filer o Non-Accelerated

Filer x Smaller Reporting

Company

|

|

|

Indicate

by checkmark whether the Registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

|

Yes o No x

|

|

The

aggregate market value of the voting and nonvoting Common Stock held by

non-affiliates of the Registrant was $30,230,109, computed by reference to

the price at which the Common Stock was last sold on The NASDAQ Capital

Market on the last business day of the Registrant’s most recently

completed second fiscal quarter (June 30, 2009).

|

|

|

The

number of shares of the Registrant’s Common Stock, par value $.01 per

share, outstanding as of March 22, 2010 was 16,375,604.

|

|

|

DOCUMENTS

INCORPORATED BY REFERENCE

|

|

|

Portions

of the definitive proxy statement for the annual meeting of stockholders

of American CareSource Holdings, Inc. to be held on June 9, 2010 and to be

filed with the Securities and Exchange Commission pursuant to Regulation

14A not later than April 30, 2010, are incorporated by reference into Part

III of this Form 10-K.

|

|

AMERICAN CARESOURCE HOLDINGS, INC.

FORM

10-K

TABLE

OF CONTENTS

|

PART

I

|

|

|

|

Item

1.

|

1

|

|

|

Item

1A.

|

8

|

|

|

Item

2.

|

12

|

|

|

Item

3.

|

12

|

|

|

Item

4.

|

12

|

|

|

|

||

|

PART

II

|

|

|

|

Item

5.

|

13

|

|

|

Item

7.

|

14

|

|

|

Item

8.

|

22

|

|

|

Item

9.

|

22

|

|

|

Item

9A

|

22

|

|

|

Item

9B

|

23

|

|

|

|

||

|

PART

III

|

|

|

|

Item

10.

|

24

|

|

|

Item

11.

|

24

|

|

|

Item

12.

|

24

|

|

|

Item

13.

|

25

|

|

|

Item

14.

|

25

|

|

|

PART

IV

|

|

|

|

Item

15.

|

25

|

|

|

Index

to Financial Statements

|

||

|

F-1

|

||

|

F-2

|

||

|

F-3

|

||

|

F-4

|

||

|

F-5

|

||

|

F-6

|

||

Special

Note Regarding Forward-Looking Statements

This

annual report on Form 10-K contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements can be identified by forward-looking words such as “may,” “will,”

“expect,” “intend”, “anticipate,” “believe,” “estimate” and “continue” or

similar words and discuss the Company’s plans and objectives for future

operations, including its services, contain projections of the Company’s future

operating results or financial condition, and discuss its expectations with

respect to the growth in health care costs in the United States, the demand for

ancillary benefits management services, and the Company’s competitive

advantages, or contain other “forward-looking” information.

Such

forward-looking statements are based on current information, assumptions and

belief of management, and are not guarantees of future

performance. Substantial risks and uncertainties could cause actual

results to differ materially from those indicated by such forward-looking

statements, including, but not limited to, changes in national health care

policy, regulation, and/or reimbursement, general economic conditions (including

the recent economic downturns and increases in unemployment), lower than

anticipated demand for ancillary services, pricing, market

acceptance/preference, the Company’s ability to integrate with its clients,

consolidation in the industry that may affect the Company’s key clients, changes

in the business decisions by significant clients, increased competition, the

Company’s inability to attract or maintain providers or clients or achieve its

financial results, the Company’s inability to manage growth, implementation and

performance difficulties, and other risk factors detailed from time to time in

the Company’s periodic filings with the Securities and Exchange Commission,

including in this annual report on Form 10-K for the year ended December 31,

2009.

Do not

place undue reliance on these forward-looking statements, which speak only as of

the date this document was prepared. All forward-looking statements

included herein are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. Except to the

extent required by applicable securities laws and regulations, the Company

undertakes no obligation to update or revise these forward-looking statements to

reflect events or circumstances after the date of this document or to reflect

the occurrence of unanticipated events.

PART I

Item

1. Business.

Overview

American

CareSource Holdings, Inc. (“ACS,” “Company,” the “Registrant,” “we,”

“us,” or “our,”) is an ancillary benefits management company that offers cost

effective access to a comprehensive national network of ancillary healthcare

service providers. The Company’s clients are national, regional and

local health plans, which include preferred provider organizations (“PPOs”),

third party administrators (“TPAs”), insurance companies, large self-funded

organizations and Taft-Hartley union plans (i.e., employee benefit plans that

are self-administered under collective bargaining agreements), that engage the

Company to provide them with a complete outsourced solution designed to manage

each payor’s obligations to its covered persons. The Company offers

payors this solution by:

|

·

|

lowering

the cost of our payors’ ancillary care costs throughout our network of

high quality, cost effective providers that we have under contract at more

favorable terms than they could generally obtain on their

own;

|

|

|

·

|

providing

payors with a comprehensive network of ancillary healthcare services

providers that is tailored to each payor’s specific needs and is available

to each payor’s covered persons for covered services;

|

|

|

·

|

providing

payors with claims management, reporting, and processing and payment

services;

|

|

·

|

performing

network/needs analysis to assess the benefits to payors of adding

additional/different service providers to the payor -specific provider

networks; and

|

|

·

|

credentialing

network service providers for inclusion in the payor -specific provider

networks.

|

Ancillary

healthcare services encompass a broad array of services that supplement or

support the care provided by hospitals and physicians and include the services

listed under “-- Services and

Capabilities--Ancillary care services” below.

Although

the Company has continued to experience revenue growth in 2008 and 2009, its

results have been impacted by the current economic crisis. First, the

unemployment rate has caused fewer people to participate in insurance programs

with our clients. Second, plan participants, seeking to spend less

money, appear to be making less frequent use of some ancillary

services. Third, the possibility exists that payor and, or provider

consolidation within our industry could adversely affect our

business. To the extent that these trends continue, or become worse,

we may earn less revenue and our profitability and growth could be adversely

affected, depending on the extent of the declines. Finally, as with

any business, the deterioration of the financial condition or sale or change of

control of our significant payor clients (with the two most significant

accounting for approximately 85% of our revenue during the year ended December

31, 2009) could have a corresponding adverse effect on us. Additional

risks that we do not consider material, or of which we are not currently aware,

may also have an adverse impact on us.

ACS was

incorporated under the laws of the State of Delaware on November 24, 2003 as a

wholly-owned subsidiary of Patient Infosystems, Inc. (“Patient Infosystems”) in

order to facilitate Patient Infosystems’ acquisition of substantially all of the

assets of American CareSource Corporation. American CareSource

Corporation had been in operation since 1997. The predecessor company

to American CareSource Corporation, Physician’s Referral Network, had been in

operation since 1995. On December 23, 2005, the Company became an

independent company when Patient Infosystems distributed by dividend to its

stockholders substantially all of its shares of the Company. Ancillary Care

Services, Inc. is a wholly owned subsidiary of the Company.

The

Company’s principal executive offices are located at 5429 Lyndon B. Johnson

Freeway, Suite 850, Dallas, TX 75240. Our Common Stock is listed on The NASDAQ

Capital Market under the symbol “ANCI.” Our telephone number is (972)

308-6830. Our Internet address is www.anci-care.com.

Services

and Capabilities

Ancillary

care services

Ancillary

healthcare services include a broad array of services that supplement or support

the care provided by hospitals and physicians, including the non-hospital,

non-physician services associated with surgery centers, free-standing diagnostic

imaging centers, home health and infusion, supply of durable medical equipment,

orthotics and prosthetics, laboratory and other services.

Ancillary

healthcare services include, but are not limited to, the following

categories:

|

·

Acupuncture

|

·

Long-term Acute Care

|

|

·

Cardiac Monitoring

|

·

Massage Therapy

|

|

·

Chiropractor

|

·

Occupational Therapy

|

|

·

Diagnostic Imaging

|

·

Pain Management

|

|

·

Dialysis

|

·

Physical Therapy

|

|

·

Durable Medical Equipment

|

·

Podiatry

|

|

·

Genetic Testing

|

·

Rehab: Outpatient

|

|

·

Hearing Aids

|

·

Rehab: Inpatient

|

|

·

Home Health

|

·

Sleep

|

|

·

Hospice

|

·

Skilled Nursing Facility

|

|

·

Implantable Devices

|

·

Surgery Center

|

|

·

Infusion

|

·

Transportation

|

|

·

Laboratory

|

·

Urgent Care

|

|

·

Lithotripsy

|

·

Vision

|

The

Company’s clients are health plans including PPOs, TPAs, insurance companies,

large self-funded organizations and Taft-Hartley union plans (i.e., employee

benefit plans that are self-administered under collective bargaining

agreements). The Company has agreements with approximately 4,300

ancillary healthcare service providers operating in approximately 33,000 sites

nationwide. The Company is able to offer payors cost savings by

functioning as a single point of contact for managing a comprehensive array of

ancillary healthcare services. The Company’s services include

analyzing the needs of payors and creating a custom network for them,

credentialing providers, processing provider claims submitted to the payors and

forwarded by the payors to ACS, submitting the processed claims to its client

payors for payment and performing client service functions for payors and

contracted providers, including monthly reporting

services. Contracting with the Company provides payors the capability

of marketing comprehensive, efficient and affordable ancillary healthcare

services to their participants.

Provider

Network

The

Company views its ability to manage, organize and maintain its provider network

and to recruit new providers as critical elements in its long term success

because its network is one of the most important reasons healthcare payors

engage the Company. The Company has contractual agreements with its

network of ancillary healthcare service providers for the purpose of meeting its

contractual obligations to its healthcare payors to make available a

comprehensive and customer-specific ancillary healthcare provider

network. The agreements define the scope of services to be provided

to covered persons by each ancillary healthcare provider and the amounts to be

charged for those services and are negotiated independent of the agreements

reached with the Company’s client payors. The terms of each agreement

between the Company and ancillary healthcare service providers make it clear

that the Company is solely obligated to the service provider under the contract

between them and do not contemplate any contractual relationship between the

service providers and the Company’s payor customers or permit the service

providers to pursue claims directly against the Company’s payors. The

network is comprised of approximately 4,300 ancillary healthcare service

providers that are located in 33,000 sites nationwide.

When

providers initially enter the ACS provider network, the Company credentials them

for inclusion into the Credentialed ACS network. The Company also

re-credentials its providers on a periodic basis. From time to time,

the Company reviews its provider relationships to determine whether any changes

to the relationship are appropriate through sanction monitoring and other

methods. The Company believes that credentialing providers represents

a valuable service to both its payors and the providers in the network, who

would, in the absence of such service, be forced to undergo the credentialing

process with respect to each payor with whom they enter into a service

relationship.

Our

Model

The

Company’s business model, illustrating the relationships among the persons

involved, directly or indirectly, in the Company’s business and its generation

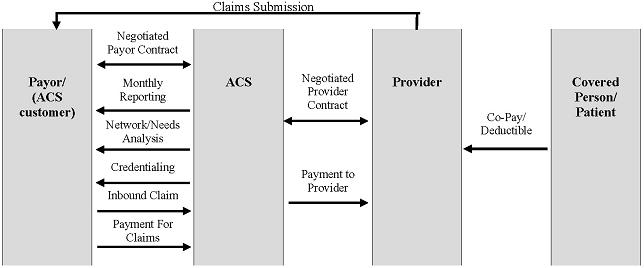

of revenue and expenses is depicted below:

Payors

route healthcare claims to us after service has been performed by participant

providers in our network. We process those claims and charge the

payor according to its contractual rate for the services according to our

contract with the payor. In processing the claim, we are paid

directly by the payor or the insurer for the service. We then pay the

provider of service according to its independently-negotiated contractual

rate. We assume the risk of generating positive margin, the

difference between the payment we receive for the service and the amount we are

obligated to pay the provider of service.

The

Company may also receive a claims submission from a payor either electronically

or via a paper based claim. As part of its relationship with the

payors, the Company may pay an administrative fee to the payors for the

modifications that may be required to the payor’s technology, systems and

processes to create electronic connectivity with the Company, as well as for the

aggregation of claims and the electronic transmission of those claims to

us.

How

We Deliver Services

Ancillary network

analysis. The Company performs an analysis of the available

claims history from each client payor and develops a specific plan to meet each

payor’s needs. This analysis identifies service providers that are

not already in our network. We attempt to enter into agreements with

such service providers to maximize discount levels and capture a significant

volume of previously out-of-network claims.

Ancillary custom

network. ACS customizes its network to meet the needs of

each payor. In particular, when a new payor joins and periodically

for each existing payor, we review the payor’s “out-of-network” claims history

through our network analysis service and develop a strategy to create a network

that efficiently serves the payor’s needs. This may involve adding

additional service providers for a payor or removing service providers if we

determine it is beneficial for them to be excluded from the client’s

network.

Ancillary network

management. The Company manages ancillary service provider

contracts, reimbursement and credentialing for its payors. This not

only provides administrative benefits to our payors, but reduces the burden on

our contracted service providers who typically must supply credentialing

documentation to payors and engage in contract negotiations with separate

payors.

Ancillary systems

integration. The Company has created a proprietary software

system that enables us to manage many different customized accounts and includes

the following modules:

|

·

|

Provider

network management

|

|

·

|

Credentialing

|

|

·

|

Data

transfer management/electronic data

interface

|

|

·

|

Multi-level

reimbursement management

|

|

·

|

Posting,

Explanation of Benefits, check, and e-funds

processes

|

|

·

|

Client

service management

|

|

·

|

Claims

pricing

|

|

·

|

Advanced

data reporting

|

Ancillary

reporting. ACS offers a complete suite of reports to each

payor on a monthly basis. These reports cover contracting efforts and

capture rates, client savings, volumes by service category and complete claims

and utilization reports and other information of value to the

client.

Ancillary healthcare claims

management. The Company can manage ancillary healthcare claims

flow, both electronic and paper based, and integrate with a payor’s process

electronically or through paper claims. The Company has the

capability of performing a number of customized processes that may add

additional value for each payor. As part of the claims management

process, we manage the documentation requirements specific to each

payor. In the event claims are submitted to us by a payor without the

complete required documentation, we will work with the payor and/or service

provider to obtain the required documentation so that the claim will be accepted

by the payor. This service provides a labor cost savings to the

payors and providers.

Ancillary claims collections

management. The Company facilitates an expedited claims

collection process by ensuring receipt of the claim by the payor, providing

information to the payor required for processing the claim, tracking the status

of the claim throughout the process and maintaining a team of customer service

representatives to resolve any issues that might delay the collections

process. The Company believes that the providers in its network are

paid more effectively and efficiently than would otherwise be the

case.

Ancillary data

insights. The Company has developed and continues to develop

an extensive database of ancillary healthcare claims history. The

data provides insights into utilization and pricing across a wide variety of

service categories, geographies, and service providers. The Company

intends to market this data as a value added service to its payors in the design

of custom networks, and the development of ancillary healthcare management

programs.

Business

Strategy

The

Company’s focus is strictly on the ancillary healthcare services market, a

growing market that now accounts for almost 30% of total annual healthcare

spending in the United States and is estimated at $574 billion (as derived from

2006 data published by the Center for Medicare and Medicaid Services, National

Health Statistics Group, U.S. Department of Commerce and Bureau of Economic

Analysis and Census). Ancillary healthcare services are cost

effective alternatives to physician and hospital-based services and ancillary

providers offer services in 28 different categories, including those listed

under “-- Services and

Capabilities--Ancillary care services.” While most efforts are

placed on managing outcomes and reducing healthcare costs associated with

patient care in hospitals and in physician offices, the ancillary healthcare

service market is an often over-looked, but very important emerging segment of

the overall United States healthcare system. As more and more care is

delivered in highly cost effective out-patient and ancillary care settings, the

need for better organization and cost containment will only increase over the

next several years.

We

believe that companies who understand the nuances of the ancillary healthcare

market and develop the expertise to manage this new, de-centralized system of

patient care, are able to capitalize on this market opportunity. For

example, contracting with ancillary healthcare service providers is difficult

without a specific focus on the market. This is due to the disparate

nature of ancillary healthcare services and the fact that these services are

offered by a wide array of providers, ranging from small independent

practitioners, regional specialty practices, national providers and within

hospital systems. Since this market is so diverse, it has not been a

focus of the major health plans and payors. In addition, many health

plans are conflicted because their existing hospital contracts may encourage the

use of the hospital systems’ more expensive in-house ancillary

services. The Company believes that because it has developed a

substantial network of providers, it has established a sustainable advantage in

this market by becoming an aggregator of these services for health plans, and

because it has been retained by substantial payors, it can offer healthcare

providers a substantial number of patients who are entitled to receive services

from payors. In addition, our ancillary only contracting focus allows

us to be independent of any hospital relationships that may encourage retaining

all ancillary services within the more expensive hospital setting.

Because

the Company is solely focused on the nation-wide ancillary healthcare system

designed specifically to help regional and mid-market payors across the country,

expanding and maintaining a nation-wide, high-quality, multiple specialty

ancillary provider network is a critical component of the Company’s

strategy. The Company has invested to develop its ancillary service

provider network both proactively, across geographical and healthcare

specialties, and reactively to address specific client needs. While

we have a national footprint of service providers, our intention is to focus on

specific geographic markets where we can have a significant impact on a service

provider’s patient load. With market strength in specific geographic

areas, the Company has been able to develop favorable rates with ancillary

service providers and create an attractive product offering (healthcare cost

savings) to regionally-based clients.

In order

to enhance its ability to recruit and manage its network of providers, the

Company offers a suite of value added services specifically designed to help

ancillary care service providers lower their cost of doing business by assuming

the responsibility for the most complex and costly interactions with

payors. The services include those listed under “-- Services and

Capabilities--Ancillary care services.” The Company believes

that by becoming an indispensable business partner to the ancillary healthcare

service provider community, it will continue to grow its ancillary healthcare

service provider network and continue to derive favorable contracting terms from

these service providers.

The

Company markets its services to PPOs, TPAs, insurance companies, large

self-funded organizations and Taft-Hartley union plans (i.e., employee benefit

plans that are self-administered under collective bargaining

agreements). The Company believes that there is a large

market opportunity involved in providing a highly competitive ancillary care

solution to the standard service offered by the major national insurers in

select regional markets across the country. The combination of our

regionally specific networks of providers and the resulting contractual cost

savings we are able to generate helps ACS’ payor customers compete more

effectively against the major national insurers in their local

markets.

As of

early 2010, the Company’s contracts span approximately six million covered

lives. As a rapid aggregator of significant patient volume, the Company believes

that it will be able to continue to drive favorable contracting terms from the

selected service providers in the ACS Network by directing patient volume to

their practices and it will have the ability to negotiate exclusive contracts

that will allow the Company to manage the full spectrum of a payor client’s

ancillary healthcare benefit offerings. The volume of collective

lives that we manage allows us to obtain more favorable pricing than our clients

can generally obtain on their own.

Sales

and Marketing

The

Company markets its services to PPOs, TPAs, insurance companies, large

self-funded organizations and Taft-Hartley union plans (i.e., employee benefit

plans that are self-administered under collective bargaining

agreements). The Company utilizes both a new business sales

organization of three senior sales professionals as well as an account

management team of three professionals to contract with new payor organizations

and then maximize the revenue and margin potential of each new

payor. The new business sales team uses a variety of channels to

reach potential customers including professional relationships, direct marketing

efforts, attendance at industry-specific trade shows and conferences, and

through strategic partnerships with market partners, independent brokers, and

consultants. The account management team gets engaged with each new

payor to help manage the implementation process. In addition, an

Account Manager is generally assigned to each new payor organization and is

responsible for all aspects of the Company’s relationship with the entity

including the expanded utilization of the Company’s services over time and the

enhancement of the Company’s relationship with the payor.

In early

2009, the Company invested in a Sales Force Automation/Customer Relationship

Management (“SFA/CRM”) software program to help improve the reach and efficiency

of both the new business sales and the account management teams. The

SFA component is being used to help track, analyze, and optimize the new

business sales team’s direct sales efforts and provides a strategic account

management tool for the account management team. In addition, the CRM

component is utilized for targeted direct marketing campaigns to prospective and

current customers by both teams.

The

Company invests in on-going market research with its customers and maintains an

informal customer advisory group with a number of senior leaders in managed care

organizations. In the first quarter of 2009, the Company

engaged a strategic marketing services company to conduct a “Market Pulse” which

involved in-depth interviews with senior managers/decision-makers in current ACS

customer organizations. The purpose of the “Market Pulse” was to gain

customer feed-back on the Company’s optimal product messaging by market segment,

differentiated “go-to-market” strategies, and new product ideas. The

outcome from these sessions was used to formulate a solid base of sales,

marketing and new product priorities for the next several years.

Customers

The

Company’s healthcare payor clients engage the Company to manage a comprehensive

array of ancillary healthcare services that they and their payors have agreed to

make available to their insureds or beneficiaries or for which they have agreed

to provide insurance coverage. The typical services the healthcare

payor customers require the Company to provide include:

|

·

|

providing

a comprehensive network of ancillary healthcare services providers that is

available to the payor’s covered persons for covered

services;

|

|

·

|

providing

claims management, reporting, and processing and payment

services;

|

|

·

|

performing

network/needs analysis to assess the benefits to payor customers of adding

additional/different service providers to the payor-specific provider

networks; and

|

|

·

|

credentialing

network service providers for inclusion in the payor -specific provider

networks.

|

The terms

of the agreement between the Company and the payors do not contemplate that the

payors will have any relationship with the service providers and, in fact,

prohibit payors from claiming directly against the service

providers. The agreements between the Company and the payors provide

that it is the Company’s obligation to deliver or make available the agreed-upon

services. The Company is responsible irrespective of the existence or

terms of any agreement the Company has with the service

providers. The terms of the Company-payor agreement provide that the

Company is obligated to provide or arrange for the provision of all of the

services under the Company-payor agreement and the Company is responsible for

ensuring that the contractual terms are met and such services are provided

(whether the services are those performed directly by the Company, such as

claims management, processing and payment service, network/needs analysis and

credentialing, or those performed by a service provider contracted by the

Company).

The

Company’s most significant payors include (i) HealthSmart (“HealthSmart”), which

consists of HealthSmart and its affiliates, American Administrative Group

(“AAG”), Interplan Health Group (“IHG”), Emerald Healthcare, and HealthSmart

Accel Network (“Accel”), and (ii) Viant Holdings Inc. (“Viant”), consisting of

Texas True Choice, Inc. and Beech Street Corporation. For the year

ended December 31, 2009, ACS derived 47% of its total revenue from HealthSmart

(including its affiliates) and 38% of its total revenue from Viant (including

its affiliates). For the year ended December 31, 2008, ACS derived

59% of its total revenue from HealthSmart and 39% of its total revenue from

Viant.

On

December 31, 2008, the Company entered into an amendment to its provider service

agreement with HealthSmart. The purpose of this amendment was, among

other things, to facilitate and accelerate the integration into the Company’s

business model of IHG, with which HealthSmart became affiliated in September

2007, adjust the administrative fees outlined in the previous amendment, define

and clarify the exclusivity and levels of cooperation contemplated by the

previous amendments, and extend the partnership between the Company and

HealthSmart and the duration of their provider service agreement to December 31,

2012. Under a strategic contracting plan that the amendment requires

the parties to develop, the Company would be the exclusive outsourced ancillary

contracting and network management provider for HealthSmart’s group health

clients and any third party administrators (TPAs).

In

accordance with the amendment to the HealthSmart agreement, in April 2009 the

Company paid HealthSmart $1.0 million for costs incurred in connection with the

integration of and access to the Company’s network by members of the IHG

network, including, but not limited to, costs associated with salaries,

benefits, and third party contracts over the extended contract term through

2012. The Company will continue to pay a service fee to

HealthSmart designed to reimburse and compensate HealthSmart for the work that

it is required to perform to support the Company’s program. The

Amendment provides for adjustments to such fee upon certain events.

In

November 2009, HealthSmart completed a recapitalization with a private

investment company and HealthSmart’s other lenders. We are uncertain

of how this transaction will impact our contract with HealthSmart and the volume

of claims that is generated from our relationship with HealthSmart.

The

client contract with Viant expires on May 20, 2011 and automatically renews for

successive one-year periods unless either party delivers a written notice of

non-renewal at least 90 days prior to expiration. Such contract may

be terminated for convenience by Viant upon two years notice to us or upon

thirty (30) days’ notice in the event of a breach. In addition, in

March 2010, Viant was acquired by MultiPlan, Inc., a provider of PPO network and

related transaction-based solutions.

Competition

The

Company faces four types of direct competitors.

|

·

|

The

first group of competitors consists of larger, national health plans and

insurers such as Aetna, Blue Cross/Blue Shield plans, Cigna, Humana, and

United HealthCare. These larger carriers offer nation-wide,

standardized products and often compete on a local level based of the

cost-effectiveness of their national

contracts.

|

|

·

|

The

second group of competitors is more regionally-focused and consists of

smaller regional PPOs, payors and community-based provider-owned

networks. These regional competitors are generally managing

their own home-grown network of ancillary care providers and are more

likely to offer customized products and services tailored to the needs of

the local community. These regional groups will often use their

ownership and/or management of the full continuum of care in a local

market to direct patients to the provider groups within their

network.

|

|

·

|

The

third group of competitors focus on managing patients within a single

ancillary specialty (e.g. dialysis, imaging or infusion), and offer

comprehensive payor and provider services within their chosen ancillary

category.

|

|

·

|

The

fourth group of competitors is our own payors. Our payors have

selected us based on our extensive network of service providers and

cost-savings potential. However, they may choose to develop

their own network instead of outsourcing ancillary management services to

us in the future.

|

Research

and Development

The

company invests in its information technology infrastructure to enhance the

capabilities of its databases, data retrieval tools, data exchange capabilities

and claims processing engine. In addition, the Company believes that

its extensive claims database of ancillary healthcare services and costs is a

strategic asset. The Company’s capitalized development costs totaled

approximately $628,000 during 2009.

Government

Regulation

The

healthcare industry is extensively regulated by both the Federal and state

governments. A number of states have extensive licensing and other

regulatory requirements applicable to companies that provide healthcare

services. Additionally, services provided to health benefit plans in

certain cases are subject to the provisions of the Employee Retirement Income

Security Act of 1974, as amended (“ERISA”).

Furthermore,

state laws govern the confidentiality of patient information through statutes

and regulations that safeguard privacy rights. The Company is subject

to the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”),

which provides national standards for electronic health information transactions

and the data elements used in such transactions. ACS and its clients

may be subject to Federal and state laws and regulations that govern financial

and other arrangements among healthcare providers. Furthermore, the

Company and its clients may be subject to federal and state laws and regulations

governing the submission of false healthcare claims to the government and

private payors, mail pharmacy laws and regulations, consumer protection laws and

regulations, legislation imposing benefit plan design restrictions, various

licensure laws, such as managed care and third party administrator licensure

laws, drug pricing legislation, and Medicare and Medicaid reimbursement

regulations. Possible sanctions for violations of these laws and

regulations include minimum civil penalties of between $5,000-$10,000 for each

false claim and treble damages.

Proposed

changes to the U.S. healthcare system, including potential national healthcare

reform, may increase governmental involvement in healthcare and ancillary

healthcare services, and otherwise change the way payors, networks and service

providers conduct their businesses. Healthcare organizations may react to these

proposals and the uncertainty surrounding them by reducing or delaying purchases

of cost control mechanisms and related services such as those provided by the

Company.

The

Company must continually adapt to new and changing regulations in the healthcare

industry. If we fail to comply with these applicable laws, we may be subject to

fines, civil penalties, or criminal prosecution. If an enforcement

action were to occur, our business and financial condition may be adversely

affected.

Employees

As of

March 22, 2010, the Company had 69 full-time employees and one part-time

employee.

Item

1A.

Risk Factors.

The

Company’s stockholders and any potential investor in the Company’s Common Stock

should carefully review and consider each of the following risk factors, as well

as all other information appearing in this Annual Report on Form 10-K, relating

to investment in our Common Stock. The Company’s business faces

numerous risks and uncertainties, the most significant of which are described

below. If any of the following risks actually occur, the business,

financial condition, results of operations or cash flows of the Company could be

materially adversely affected, the market price of the Company’s Common Stock

could decline significantly, and a stockholder could lose all or part of an

investment in the Company’s Common Stock.

Proposed

health care reforms could materially adversely affect our revenues, financial

position and our results of operations.

Both

houses of Congress have recently passed bills relating to health care reform,

which have not yet been reconciled with each other and signed into law. Examples

of health care reform proposals include policy changes that would change the

dynamics of the health care industry, including having the federal or one or

more state governments assume a larger role in the health care system such as

competing with private health insurers, imposing new and potentially significant

taxes on health insurers and health care benefits, guaranteed coverage

requirements, elimination of pre-existing condition exclusions or annual

lifetime maximum limits.

The

enactment of health care reforms at the federal or state level may affect

certain aspects of our business, including contracting with ancillary healthcare

service providers; administrative, technology or other costs; provider

reimbursement methods and payment rates; premium rates; coverage determinations;

mandated benefits; minimum medical expenditures; claim payments and processing;

drug utilization and patient safety efforts; collection, use, disclosure,

maintenance and disposal of individually identifiable health information;

personal health records; consumer-driven health plans and health savings

accounts and insurance market reforms; and government-sponsored

programs.

We cannot

predict if any of these proposals will ultimately become law, or, if enacted,

what their terms or the regulations promulgated pursuant to such laws will be.

Any health care reforms enacted may be phased in over a number of years but, if

enacted, could reduce our revenues, increase our costs, expose us to expanded

liability and require us to revise the ways in which we conduct business or put

us at risk for loss of business. In addition, our results of operations, our

financial position, including our ability to maintain the value of our goodwill,

and cash flows could be materially adversely affected by such

changes.

The

Company has a history of losses and has only achieved profitability in the past

two years.

Although

the Company achieved its second consecutive profitable year in 2009, it incurred

losses in each year between its spinoff in 2003 through 2007 and has an

accumulated deficit of approximately $1.5 million as of December 31,

2009. The Company will need to maintain similar levels of claims

volume and revenue as it had in 2009 in order to continue

profitability. No assurances can be given that the Company will be

able to continue to grow at the current pace or to continue to operate

profitably in the future. The Company’s prospects must be considered

in light of the numerous risks, expenses, delays and difficulties frequently

encountered in an industry characterized by intense competition, as well as the

risks inherent in the development of new programs and the commercialization of

new services, particularly given its operating history through

2007.

The

Company has a limited number of clients, a few of which account for a

substantial portion of its business, and failure to retain such clients could

have a material adverse effect on its business and results of

operations.

Our two

largest clients, HealthSmart Preferred Care, Inc. (“HealthSmart”) and Viant

Holdings, Inc. (“Viant”), accounted for an aggregate of approximately 85% of our

revenue during 2009; of which 47% was derived from

HealthSmart. In 2008, our two largest clients accounted for 98% of

our revenue, of which 59% was generated from HealthSmart. The loss of either one

of these clients or significant declines in the level of use of our services by

one or more of these clients (as would be the case, for example, if our clients

decide to contract directly with ancillary healthcare service providers),

without replacement by new business, would have a material adverse effect on the

Company’s business and results of operations.

The

client contract with Viant expires on May 20, 2011 and automatically renews for

successive one-year periods unless either party delivers a written notice of

non-renewal at least 90 days prior to expiration. Such contract may

be terminated for convenience by Viant upon two years notice to us or upon

thirty (30) days’ notice in the event of a breach. In addition, in

March 2010, Viant was acquired by MultiPlan, Inc., a provider of PPO network and

related transaction-based solutions. The client contract with

HealthSmart, which was set to expire on July 31, 2009, was amended on December

31, 2008. The term was extended four years and will expire on

December 31, 2012. There can be no assurance that any client will

maintain its contract with us after the expiration of the then-current term or

that it will renew its contract on terms favorable to

us. Consequently, the Company’s failure to retain such clients could

have a material adverse effect on our business and results of

operations. Additionally, an adverse change in the financial

condition of any of these clients, particularly HealthSmart or Viant, including

an adverse change as a result of a change in governmental or private

reimbursement programs, could have a material adverse effect on our

business.

The

current financial crisis may reduce our revenue and profitability and harm our

growth prospects.

Although

the Company has continued to experience revenue growth from 2008 to 2009, its

results have been impacted by the current economic crisis. First, the

unemployment rate has caused fewer people to participate in insurance programs

with our customers. Second, plan participants, seeking to spend less

money, appear to be making less frequent use of some ancillary

services. Third, the possibility exists that client and, or provider

consolidation within our industry could adversely affect our

business. To the extent that these trends continue, or become worse,

we may receive less revenue and our profitability and growth could be adversely

affected, depending on the extent of the declines. Finally, as with

any business, the deterioration of the financial condition or sale or change of

control of our significant customers could have a corresponding adverse effect

on us.

Large

competitors in the healthcare industry could choose to compete with us, reducing

our margins. Some of these potential competitors may be our current

clients.

Traditional

health insurance companies, specialty provider networks, and specialty

healthcare services companies are potential competitors of the

Company. These entities include well-established companies that may

have greater financial, marketing and technological resources than we have.

Pricing pressure caused by competition has caused many of these companies to

reduce the prices charged to clients for core services and to pass on to clients

a larger portion of the formulary fees and related revenues received from

service providers. Increased price competition from such companies’

entry into the market could reduce our margins and have a material adverse

effect on our financial condition and results of operations. In fact,

our clients could choose to establish their own network of ancillary care

providers. As a result, we would not only lose the benefit of revenue

from such clients, but we could face additional competition in our

market.

The

Company is dependent upon payments from third party payors who may reduce rates

of reimbursement.

The

Company’s profitability depends on payments provided by third-party

payors. Competition for patients, efforts by traditional third party

payors to contain or reduce healthcare costs and the increasing influence of

managed care payors, such as health maintenance organizations, have resulted in

reduced rates of reimbursement in recent years. If continuing, these

trends could adversely affect the Company’s results of operations unless it can

implement measures to offset the loss of revenues and decreased profitability.

In addition, changes in reimbursement policies of private and governmental

third-party payors, including policies relating to the Medicare and Medicaid

programs, could reduce the amounts reimbursed to the Company’s clients for the

Company’s services provided through the Company, and consequently, the amount

these clients would be willing to pay for the Company’s services.

The

Company is dependent upon its network of qualified providers and its provider

agreements may be terminated at any time.

The

development of a network of qualified providers is an essential component of our

business strategy. The typical form of agreement from ancillary

healthcare providers provides that these agreements may be terminated at any

time by either party with or without cause. If these agreements are

terminated, such ancillary healthcare providers could enter into new agreements

with our competitors which would have an adverse effect on our ability to

continue our business as it is currently conducted.

For

any given claim, the Company is subject to the risk of paying more to the

provider than it receives from the customer.

The

Company’s agreements with its payors, on the one hand, and the service

providers, on the other, are negotiated separately. The Company has

complete discretion in negotiating both the prices it charges its payors and the

financial terms of its agreements with the providers. As a result,

the Company’s profit is primarily a function of the spread between the prices it

has agreed to pay the service providers and the prices the Company’s payors have

agreed to pay the Company. The Company bears the pricing/margin risk

because it is responsible for providing the agreed-upon services to its payors,

whether or not it is able to negotiate fees and other agreement terms with

service providers that result in a positive margin for the

Company. For example, during 2009 and 2008, approximately 8% and 9%

of claims were “loss claims” (that is, where the amount paid by the Company to

the provider exceeded the amount received by the Company from the corresponding

payor for that particular claim) and these loss claims, in the aggregate,

comprised approximately $1.2 million and $998,000, respectively. There can be no

assurances that the loss claim percentage will not be higher in future

periods. If a higher percentage of the Company’s claims resulted in a

loss, its results of operations and financial position would be adversely

affected.

The

Company has significantly increased in size and may not be able to effectively

process the claims submitted by its providers in a timely manner.

Our size

and the volume of claims has increased dramatically in the last few

years. As a result, we have had to increase the size of our

processing capabilities and our staff. If we are unable to

effectively increase our processing speed and integrate new providers, we may be

unable to process properly all claims submitted and this could have a negative

impact on our relationships with clients, which in turn could lead to a loss of

business.

An

interruption of data processing capabilities and telecommunications could

negatively impact the Company’s operating results.

Our

business is dependent upon our ability to store, retrieve, process and manage

data and to maintain and upgrade our data processing capabilities. An

interruption of data processing capabilities for any extended length of time,

loss of stored data, programming errors, other computer problems or

interruptions of telephone service could have a material adverse effect on our

business.

Changes

in state and federal regulations could restrict our ability to conduct our

business.

Numerous

state and federal laws and regulations affect our business and operations. These

laws and regulations include, but are not necessarily limited to:

|

·

|

healthcare

fraud and abuse laws and regulations, which prohibit illegal referral and

other payments;

|

|

·

|

the

Employee Retirement Income Security Act of 1974 and related regulations,

which regulate many healthcare

plans;

|

|

·

|

mail

pharmacy laws and regulations;

|

|

·

|

privacy

and confidentiality laws and

regulations;

|

|

·

|

consumer

protection laws and regulations;

|

|

·

|

legislation

imposing benefit plan design

restrictions;

|

|

·

|

various

licensure laws, such as managed care and third party administrator

licensure laws;

|

|

·

|

drug

pricing legislation;

|

|

·

|

Medicare

and Medicaid reimbursement regulations;

and

|

|

·

|

Health

Insurance Portability and Accountability Act of

1996.

|

We

believe we are operating our business in substantial compliance with all

existing legal requirements material to the operation of our business. There

are, however, significant uncertainties regarding the application of many of

these legal requirements to our business, and there cannot be any assurance that

a regulatory agency charged with enforcement of any of these laws or regulations

will not interpret them differently or, if there is an enforcement action, that

our interpretation would prevail. In addition, there are numerous proposed

healthcare laws and regulations at the federal and state levels, many of which

could materially affect our ability to conduct our business or adversely affect

our results of operations.

If

the Company fails to comply with the requirements of HIPAA, it could face

sanctions and penalties.

HIPAA

provides safeguards to ensure the integrity and confidentiality of health

information. Violation of the standards is punishable by fines and, in the case

of wrongful disclosure of individually identifiable health information, fines or

imprisonment, or both. Although we intend to comply with all applicable laws and

regulations regarding medical information privacy, failure to do so could have

an adverse effect on our business.

Limited

barriers to entry into the ancillary healthcare services market could result in

greater competition.

There are

limited barriers to entering our market, meaning that it is relatively easy for

other companies to replicate our business model and provide the same or similar

services that we currently provide. Major benefit management companies and

healthcare companies not presently offering ancillary healthcare services may

decide to enter the market. These companies may have greater financial,

marketing and other resources than are available to us. Competition

from other companies may have a material adverse effect on our financial

condition and results of operations.

The

Company may be unsuccessful in hiring and retaining skilled

employees.

The

future growth of our business depends on our ability to hire and retain skilled

employees. The Company may be unable to hire and retain the skilled

employees needed to succeed in our business. Qualified employees are

in great demand throughout the healthcare industry. Our failure to attract and

retain sufficient skilled employees may limit the rate at which our business can

grow, which will result in harm to our financial performance. During

the last month, each of the Chief Financial Officer and the Senior Vice

President of Sales and Marketing of the Company has resigned. The

extensive nature of the changes could result in instability to the management of

the Company to the extent new personnel cannot be identified and integrated

adequately.

An

inability to adequately protect our intellectual property could harm the

Company’s competitive position.

We

consider our methodologies, processes and know-how to be proprietary. We seek to

protect our proprietary information through confidentiality agreements with our

employees, as well as our clients and contracted service

providers. The Company’s policy is to have its employees enter into a

confidentiality agreement at the time employment begins, with the

confidentiality agreement containing provisions prohibiting the employee from

disclosing our confidential information to anyone outside of the Company,

requiring the employee to acknowledge, and, if requested, assist in confirming

the Company’s ownership of new ideas, developments, discoveries or inventions

conceived by the employee during his or her employment with the Company, and

requiring the assignment by the employee to the Company of proprietary rights to

such matters that are related to our business. There can be no assurance that

the steps taken by the Company to protect its intellectual property will be

successful. If the Company does not adequately protect its intellectual

property, its competitors may be able to use its technologies and erode or

negate the Company’s competitive advantage in the market.

Fluctuations

in the number and types of claims processed by the Company could make it more

difficult to predict the Company’s revenues from quarter to

quarter.

Monthly

fluctuations in the number of claims we process and the types of claims we

process will impact the quarterly and annual results of the

Company. Our margins vary depending on the type of ancillary

healthcare service provided, the rates associated with those services and the

overall mix of these claims, each of which will impact our

profitability. Consequently, it may be difficult to predict our

revenue from one quarter to another quarter.

Future

sales of the Company’s Common Stock, or the perception that these sales may

occur, could depress the price of the Company’s Common Stock.

Sales of

substantial amounts of our Common Stock, or the perception in the public that

such sales may occur, could cause the market price of the Company’s Common Stock

to decline. This could also impair the Company’s ability to raise

additional capital through the sale of equity securities. As of March

22, 2010, the Company had 16,375,604 shares of its Common Stock

outstanding. The outstanding shares are either freely tradable

without restriction or further registration under the Securities Act, unless the

shares are held by one of our “affiliates” as such term is defined in Rule 144

of the Securities Act, or are “restricted shares” as that term is defined under

the Securities Act and may be sold from time to time pursuant to a registration

statement which was declared effective on February 8, 2007 by the Securities and

Exchange Commission (the “SEC”), or in reliance upon an exemption from

registration available under the Securities Act. At March 22, 2010,

warrants to purchase 955,710 shares of Common Stock of the Company were

outstanding, and options to purchase 2,188,620 shares of Common Stock of the

Company had been granted and were outstanding under the Company’s Amended and

Restated 2005 Stock Option Plan and the 2009 Equity Incentive

Plan. At March 22, 2010, restricted stock units (“RSUs”), which are

convertible into 90,999 shares of common stock were outstanding under our 2009

Equity Incentive Plan. In addition, 1,907,601 shares of the Common

Stock of the Company remain available for future grants of RSUs and options to

purchase shares of the Common Stock of the Company under the Company’s Amended

and Restated 2005 Stock Option Plan and the 2009 Equity Incentive

Plan. If all of the outstanding warrants are exercised, all options

available under the Company’s Amended and Restated 2005 Stock Option Plan are

issued and exercised and all RSUs are converted, there will be approximately

18,374,204 shares of Common Stock of the Company outstanding.

Some

of our existing stockholders can exert control over us and may not make

decisions that further the best interests of all stockholders.

As of

March 22, 2010, our officers, directors and principal stockholders (greater than

5% stockholders) together control beneficially approximately 50.0% of the

outstanding Common Stock of the Company. As a result, these

stockholders, if they act individually or together, may exert a significant

degree of influence over our management and affairs and over matters requiring

stockholder approval, including the election of directors and approval of

significant corporate transactions. Furthermore, the interests of

this concentration of ownership may not always coincide with our interests or

the interests of other stockholders and, accordingly, they could cause us to

enter into transactions or agreements which we would not otherwise

consider. In addition, this concentration of ownership of the

Company’s Common Stock may delay or prevent a merger or acquisition resulting in

a change in control of the Company and might affect the market price of our

Common Stock, even when such a change in control may be in the best interest of

all of our stockholders.

We

are subject to the listing requirements of the Nasdaq Capital Market and there

can be no assurances that we will continue to satisfy these listing

requirements.

Our

common stock is listed on The NASDAQ Capital Market, and we are therefore

subject to continued listing requirements, including requirements with respect

to the market value of publicly-held shares and minimum bid price per share,

among others, and requirements relating to board and audit committee

independence. If we fail to satisfy one or more of the

requirements, we may be delisted from The NASDAQ Capital Market. If

we are delisted from The NASDAQ Capital Market and we are not able to list our

common stock on another exchange, our common stock could be quoted on the OTC

Bulletin Board or on the “pink sheets”. As a result, we could face significant

adverse consequences including, among others, a limited availability of market

quotations for our securities and a decreased ability to issue additional

securities or obtain additional financing in the future.

Item

2.

Properties.

The

Company occupies a total of 16,449 square feet of office space, all of which is

leased. The leased space comprises our principal executive offices,

which is located at 5429 Lyndon B. Johnson Freeway, Suite 850, Dallas, TX 75240,

pursuant to a lease that expires on March 31, 2013. Included in the 16,449

square feet are 7,100 square feet of space added to our original lease by means

of an amendment to the lease executed in February 2009. The Company does not

own or lease any other real property and believes its offices are suitable to

meet its current needs.

Item

3.

Legal Proceedings.

None.

Item

4.

Reserved.

PART II

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases ofEquity

Securities.

|

Market

Information

The

Company’s Common Stock has traded on The NASDAQ Capital Market (“NASDAQ”) under

the symbol ANCI since September 29, 2008. Between October 19, 2006 and

September 26, 2008, our stock traded on the American Stock Exchange (“Amex”)

under the symbol XSI and between December 28, 2005 and October 19, 2006, public

trading for our Common Stock occurred on the OTC Bulletin Board.

The

following table sets forth, for the fiscal periods indicated, the range of the

high and low sales prices for our Common Stock on the Amex from January 1, 2008

through September 26, 2008 and the high and low sales prices for our Common

Stock on NASDAQ from September 29, 2008 through December 31, 2009.

|

High

|

Low

|

|

|

2009

|

||

|

Fourth

Quarter Ended December 31(NASDAQ)

|

$4.49

|

$1.95

|

|

Third

Quarter Ended September 30 (NASDAQ)

|

$4.73

|

$3.57

|

|

Second

Quarter Ended June 30 (NASDAQ)

|

$8.74

|

$3.50

|

|

First

Quarter Ended March 31 (NASDAQ)

|

$8.18

|

$6.40

|

|

2008

|

||

|

Fourth

Quarter Ended December 31(NASDAQ)

|

$9.50

|

$4.02

|

|

Third

Quarter Ended September 30 (NASDAQ)*

|

$9.50

|

$4.40

|

|

Second

Quarter Ended June 30 (Amex)

|

$4.75

|

$2.85

|

|

First

Quarter Ended March 31 (Amex)

|

$3.60

|

$2.40

|

*

Represents price on NYSE Amex through September 26, 2008 and on NASDAQ from

September 29, 2008.

The

closing price on NASDAQ for our Common Stock on March 22, 2010 was

$1.88.

Holders

As of

March 22, 2010, in accordance with the records of our transfer agent, there were

146 record holders of ACS Common Stock.

Dividends

We have

not declared cash dividends on our Common Stock. We intend to retain

all earnings to finance future growth and do not anticipate that we will pay

cash dividends for the foreseeable future.

Repurchases

of Securities

There

were no repurchases of the Common Stock of the Company by or on behalf of the

Company or any affiliated purchasers during the fourth quarter of the Company’s

fiscal year ended December 31, 2009.

Item

7.

Management’s Discussion and Analysis of Financial Condition and Results of

Operations.

The focus

of the following discussion is on the underlying business reasons for

significant changes and trends affecting our revenues, net income and financial

condition. The following discussion should be read in conjunction

with our consolidated financial statements, which present our results of

operations for the twelve month periods ended December 31, 2009 and 2008 as well

as our financial position at December 31, 2009 and 2008, contained elsewhere in

this Annual Report on Form 10-K. Some of the information contained in

this discussion and analysis or set forth elsewhere in this Annual Report on

Form 10-K, including information with respect to our plans and strategy for our

business, includes forward-looking statements that involve risks and

uncertainties. You should review the “Special Note Regarding Forward Looking

Statements” and “Risk Factors” sections of this Annual Report for a discussion

of important factors that could cause actual results to differ materially from

the results described in or implied by the forward-looking statements contained

in the following discussion and analysis.

Overview

American

CareSource Holdings, Inc. (the “Company”, “ACS”, “we”, “us”, or “our”) is an

ancillary benefits management company that offers cost effective access to a

comprehensive national network of ancillary healthcare service providers. The

Company’s customers include self-insured employers, indemnity insurers, PPOs,

HMOs, third-party administrators and federal and local governments that engage

the Company to provide them with a complete outsourced solutions designed to

manage each customer’s obligations to its covered persons. The

Company offers its customers this solution by executing the

following:

|

·

|

providing

payor customers with a comprehensive network of ancillary healthcare

services providers that is available to their covered persons for covered

services;

|

|

·

|

providing

payor customers with claims management, reporting, and processing and

payment services;

|

|

·

|

performing

network/needs analysis to assess the benefits to payor customers of adding

additional/different service providers to the payor customer-specific

provider networks; and

|

|

·

|

credentialing

network service providers for inclusion in the payor customer-specific

provider networks.

|

The

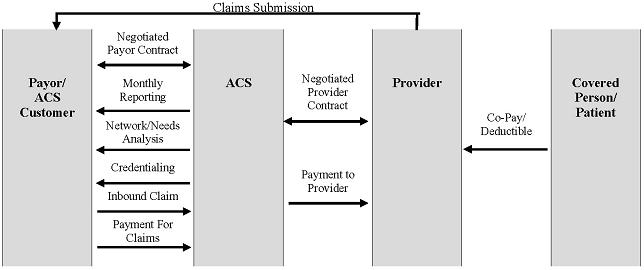

Company’s business model, illustrating the relationships among the persons

involved, directly or indirectly, in the Company’s business and its generation

of revenue and expenses is depicted below:

Our

clients route healthcare claims to us after service has been performed by

participant providers in our network. We process those claims and

charge the client/payor according to its contractual rate for the services

according to our contract with the client/payor. In processing the

claim, we are paid directly by the client or the insurer for the

service. We then pay the provider of service according to its

contractual rate. We assume the risk of generating positive margin,

the difference between the payment we receive for the service and the amount we

are obligated to pay the original provider of service or member of its

proprietary network.

The

Company recognizes revenues for ancillary healthcare services when services by

providers have been authorized and performed, the claim has been billed to the

payor and collections from payors are reasonably assured. Cost of

revenues for ancillary healthcare services consist of amounts due to providers

for providing ancillary health care services, client administration fees paid to

our client payors to reimburse them for routing the claims to us for processing,

and the Company’s related direct labor and overhead of processing invoices,

collections and payments. The Company is not liable for costs incurred by

independent contract service providers until payment is received by us from the

payors. The Company recognizes actual or estimated liabilities to independent

contract service providers as the related revenues are recognized.

The

Company markets its products to preferred provider organizations (“PPOs”), third

party administrators (“TPAs”), insurance companies, large self-funded

organizations and Taft-Hartley union plans, such as employee benefit plans that

are self-administered under collective bargaining agreements.

The year

ended December 31, 2009 marks the second full year in which we realized net

income. For the year ended December 31, 2009 our net income was $2.3