Attached files

| file | filename |

|---|---|

| EX-21 - Longhai Steel Inc. | v178718_ex21.htm |

| EX-3.3 - Longhai Steel Inc. | v178718_ex3-3.htm |

| EX-2.1 - Longhai Steel Inc. | v178718_ex2-1.htm |

| EX-10.5 - Longhai Steel Inc. | v178718_ex10-5.htm |

| EX-10.2 - Longhai Steel Inc. | v178718_ex10-2.htm |

| EX-10.1 - Longhai Steel Inc. | v178718_ex10-1.htm |

| EX-10.3 - Longhai Steel Inc. | v178718_ex10-3.htm |

| EX-10.6 - Longhai Steel Inc. | v178718_ex10-6.htm |

| EX-10.8 - Longhai Steel Inc. | v178718_ex10-8.htm |

| EX-10.7 - Longhai Steel Inc. | v178718_ex10-7.htm |

| EX-10.4 - Longhai Steel Inc. | v178718_ex10-4.htm |

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report (Date of Earliest event Reported): March 26, 2010

Action

Industries, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-52455

|

11-3699388

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

No. 1

Jingguang Road, Neiqiu County

Xingtai

City, Hebei Province, China

Telephone

- +86 0319-686-1111

(Former

Address)

8744

Riverside House Path

Brewerton,

New York 13029

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see

General Instruction A.2. below):

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a

-12)

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d -2(b))

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e -4(c))

|

This

report contains forward-looking statements. The forward-looking statements are

contained principally in the sections entitled “Description of Business,” “Risk

Factors,” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations.” These statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results, performance

or achievements to be materially different from any future results, performances

or achievements expressed or implied by the forward-looking statements. In some

cases, you can identify forward-looking statements by terms such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,”

“plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar

expressions intended to identify forward-looking statements. Forward-looking

statements reflect our current views with respect to future events and are based

on assumptions and subject to risks and uncertainties. Given these

uncertainties, you should not place undue reliance on these forward-looking

statements. These forward-looking statements include, among other things,

statements relating to:

|

|

·

|

Our

ability to produce steel wire at a consistently profitable margin as we

have historically.

|

|

|

·

|

the

impact that a downturn or negative changes in the steel market may have on

sales.

|

|

|

·

|

our

ability to obtain additional capital in future years to fund our planned

expansion;

|

|

|

·

|

economic,

political, regulatory, legal and foreign exchange risks associated with

our operations; or

|

|

|

·

|

the

loss of key members of our senior management and our qualified sales

personnel.

|

Also,

forward-looking statements represent our estimates and assumptions only as of

the date of this report. You should read this report and the documents that we

reference and filed as exhibits to the report completely and with the

understanding that our actual future results may be materially different from

what we expect. Except as required by law, we assume no obligation to update any

forward-looking statements publicly, or to update the reasons actual results

could differ materially from those anticipated in any forward-looking

statements, even if new information becomes available in the

future.

Use

of Certain Defined Terms

Except

where the context otherwise requires and for the purposes of this report

only:

|

|

·

|

the

“Company,” “we,” “us,” and “our” refer to the combined business of (i)

Action Industries, Inc. or “Action Industries”, a Nevada corporation, (ii)

Kalington Limited, or “Kalington,” a Hong Kong limited company and

wholly-owned subsidiary of Action Industries, (iii) Xingtai

Kalington Consulting Service Co., Ltd., or “Kalington Consulting”, a

Chinese limited company and wholly-owned subsidiary of Kalington, and (iv)

Xingtai Longhai Wire Co., Ltd., or “Longhai ,” a Chinese limited company

which is effectively and substantially controlled by Kalington Consulting

through a series of captive agreements, as the case may

be;

|

|

|

·

|

“Exchange

Act” refers to the Securities Exchange Act of 1934, as

amended;

|

|

|

·

|

“Hong

Kong” refers to the Hong Kong Special Administrative Region of the

People’s Republic of China;

|

|

|

·

|

“PRC,”

“China,” and “Chinese,” refer to the People’s Republic of China (excluding

Hong Kong and Taiwan);

|

|

|

·

|

“Renminbi”

and “RMB” refer to the legal currency of

China;

|

- 2

-

|

|

·

|

“Securities

Act” refers to the Securities Act of 1933, as amended;

and

|

|

|

·

|

“U.S.

dollars,” “dollars” and “$” refer to the legal currency of the United

States.

|

ITEM

1.01

ENTRY

INTO A MATERIAL DEFINITIVE AGREEMENT

On March

26, 2010, we entered into and closed a share exchange agreement, or the Share

Exchange Agreement, with Kalington, the shareholders of Kalington, Goodwin

Ventures, Inc. and Longhai, pursuant to which we acquired 100% of the issued and

outstanding capital stock of Kalington in exchange for 10,000 shares of our

Series A Convertible Preferred Stock (Series A Preferred Stock), which

constituted 98.5% of our issued and outstanding capital stock on an as-converted

to common stock basis as of and immediately after the consummation of the

transactions contemplated by the Share Exchange Agreement.

The

foregoing description of the terms of the Share Exchange Agreement is qualified

in its entirety by reference to the provisions of the agreement filed as Exhibit

2.1 to this report, which are incorporated by reference herein.

ITEM

2.01

COMPLETION

OF ACQUISITION OR DISPOSITION OF ASSETS

On March

26, 2010, we completed an acquisition of Kalington pursuant to the Share

Exchange Agreement. The acquisition was accounted for as a recapitalization

effected by a share exchange, wherein Kalington is considered the acquirer for

accounting and financial reporting purposes. The assets and liabilities of the

acquired entity have been brought forward at their book value and no goodwill

has been recognized.

As a

result of the acquisition, our consolidated subsidiaries include Kalington, our

wholly-owned subsidiary which is incorporated under the laws of Hong Kong,

Kalington Consulting, a wholly-owned subsidiary of Kalington which is

incorporated under the laws of the PRC, and Longhai, a limited liability company

incorporated under the laws of the PRC which is effectively and substantially

controlled by Kalington Consulting through a series of captive

agreements.

FORM

10 DISCLOSURE

As

disclosed elsewhere in this report, on March 26, 2010, we acquired Kalington in

a reverse acquisition transaction. Item 2.01(f) of Form 8-K states

that if the registrant was a shell company like we were immediately before the

reverse acquisition transaction disclosed under Item 2.01, then the registrant

must disclose the information that would be required if the registrant were

filing a general form for registration of securities on Form 10.

Accordingly,

we are providing below the information that would be included in a Form 10 if we

were to file a Form 10. Please note that the information provided

below relates to the combined enterprises after the acquisition of Kalington,

except that information relating to periods prior to the date of the reverse

acquisition only relate to Kalington and its consolidated subsidiaries unless

otherwise specifically indicated.

- 3

-

DESCRIPTION

OF BUSINESS

Business

Overview

Xingtai

Longhai Wire Co., Ltd. (Longhai) was established in August 2008 as a result of

the separation of Longhai from Xingtai Longhai Steel Group Co., Ltd. (the

“Longhai Steel Group”) at that time. Prior to its establishment as a

stand-alone company, Longhai was a division within the Longhai Steel

Group. The Longhai Steel Group was founded in

2003. Longhai is a leading producer of steel wire products in

northeastern China. Demand for our steel wire is driven primarily by

spending in the construction and infrastructure industries. We have

benefited from strong fixed asset investment and construction growth as the PRC

has rapidly grown increasingly urbanized and invested in modernizing its

infrastructure.

Our

principal business is the production of steel wire ranging from 6mm to 10mm in

diameter. We operate two wire production lines which have a combined

annual capacity of approximately nine hundred thousand tons per

year. Our products are sold to a number of distributors who transport

the wire to nearby wire processing facilities. Our wire is then

further processed by third party wire refiners into a variety of products such

as nails, screws, and wire mesh for use in reinforced concrete and

fencing. Our facilities and head offices are located in the town of

Xingtai in southern Hebei.

Our

revenues increased from $238,644,939 in fiscal year 2007 to $511,487,983 in

fiscal year 2008, representing a growth rate of approximately

114%. While our revenues dropped in 2009 to $373,660,461 due to a

sharp decline in the price of steel wire, our gross margins improved markedly as

we improved our operational efficiency.

Action

Industries, Inc. was originally incorporated under the laws of the State of

Georgia on December 4, 1995. On March 14, 2008, the Georgia

corporation was merged with and into a newly formed Nevada corporation also

named Action Industries, Inc. and all of the outstanding shares of the Georgia

corporation were exchanged for shares in the surviving Nevada

corporation. Prior to our reverse acquisition of Kalington, Action

Industries was primarily in the business of providing prepaid long distance

calling cards and other telecommunication products and was in the development

stage and had not commenced planned principal operations.

As a

result of our reverse acquisition of Kalington, we are no longer a shell company

and active business operations were revived. We plan to amend our

Articles of Incorporation to change our name to “Longhai Steel Inc.” to reflect

the current business of our company.

Acquisition

of Kalington Limited

On March

26, 2010, we completed a reverse acquisition transaction through a share

exchange with Kalington and its shareholders, or the Shareholders, whereby we

acquired 100% of the issued and outstanding capital stock of Kalington in

exchange for 10,000 shares of our Series A Preferred Stock which constituted

98.5% of our issued and outstanding capital stock on a as-converted basis as of

and immediately after the consummation of the reverse acquisition. As a result

of the reverse acquisition, Kalington became our wholly-owned subsidiary and the

former shareholders of Kalington became our controlling

stockholders. The share exchange transaction with Kalington and the

Shareholders, or Share Exchange, was treated as a reverse acquisition, with

Kalington as the acquirer and Action Industries, Inc. as the acquired party.

Unless the context suggests otherwise, when we refer in this report to business

and financial information for periods prior to the consummation of the reverse

acquisition, we are referring to the business and financial information of

Kalington and its consolidated subsidiaries.

- 4

-

Immediately

prior to the Share Exchange, the common stock of Kalington was owned by the

following persons in the indicated percentages: William Hugh Luckman (3.51%);

Wealth Index Capital Group LLC (a US company) (7.3%); K International Consulting

Ltd. (a BVI company) (2.08%); Merrill King International Investment Consulting

Ltd. (a BVI company) (0.31%); Shanchun Huang (3.12%); Xiucheng Yang (1.53%);

Jianxin Wang (0.92%); Xingfang Zhang (29.45%); and Merry Success Limited (a BVI

company) (51.78%). Jinhai Guo, a U.S. citizen, owns 100% of the

capital stock of Merry Success Limited. Jinhai Guo and Chaojun Wang,

our Chief Executive Officer, are the directors of Merry Success

Limited. On March 18, 2010, Chaojun Wang, our Chief Executive

Officer, entered into a call option agreement (the “Merry Success Option

Agreement”) with Jinhai Guo, the sole shareholder of Merry Success Limited, our

principal shareholder after the reverse acquisition. Under the Merry

Success Option Agreement, Mr. Wang has the right to acquire up to 100% or the

shares of Merry Success Limited for fixed consideration within the next three

years. The Merry Success Option Agreement also provides that Mr. Guo

shall not dispose any of the shares of Merry Success Limited without Mr. Wang’s

consent. As a result of the Merry Success Option Agreement, Chaojun

Wang, our Chief Executive Officer, beneficially owns a majority of the capital

stock and voting power of Action Industries, Inc., as well as Longhai and the

Longhai Steel Group.

Immediately

following closing of the reverse acquisition of Kalington, certain Shareholders

transferred 625 of the shares of Series A Convertible Preferred Stock issued to

them under the Share Exchange to certain persons who provided services to

Kalington’s subsidiary and/or controlled affiliate.

Upon the

closing of the reverse acquisition, Inna Sheveleva, our sole director and

officer, submitted a resignation letter pursuant to which she resigned from all

offices that she held effective immediately and from her position as our

director that will become effective on the tenth day following the mailing by us

of an information statement, or the Information Statement, to our stockholders

that complies with the requirements of Section 14f-1 of the Exchange

Act. In addition, our board of directors on March 25, 2010 increased

the size of our board of directors to three directors and appointed Chaojun

Wang, Jing Shen and Chaoshui Wang to fill the vacancies created by such

increase, which appointments will become effective upon the effectiveness of the

resignation of Inna Sheveleva on the tenth day following the mailing by us of

the Information Statement to our stockholders. In addition, our

executive officers were replaced by Longhai’s executive officers upon the

closing of the reverse acquisition as indicated in more detail

below.

As a

result of our acquisition of Kalington, we now own all of the issued and

outstanding capital stock of Kalington, which in turn owns all of the issued and

outstanding capital stock of Kalington Consulting. In addition, we

effectively and substantially control Longhai through a series of captive

agreements with Kalington Consulting.

Longhai,

our operating affiliate, was established in the PRC on August 26, 2008 as a

result of the division of the Longhai Steel Group for the purpose of engaging in

the production of steel wire. Chaojun Wang serves as the Chairman of

the Board of Directors and General Manager of Longhai and owns 80% of the

capital stock in Longhai. Longhai’s additional shareholders are

Wealth Index International (Beijing) Investment Co., Ltd. (15% owner) and Wenyi

Chen (5% owner). Chaojun Wang also owns 80% of the capital stock of

and is the chief executive officer of the Longhai Steel Group.

Longhai

leases a five-story office space and the building which houses our production

facilities from the Longhai Steel Group. Longhai purchased 100% of

its steel billet from the Longhai Steel Group until 2008. Since 2009, Longhai

has purchased steel billet from third party vendors. Steel Billet is

the principal raw material used in our production of steel

wire. Longhai also purchases production utilities from the Longhai

Steel Group.

On March

19, 2010, prior to the reverse acquisition transaction, Kalington Consulting and

Longhai entered into a series of agreements known as variable interest

agreements (the “VIE Agreements”) pursuant to which Longhai became Kalington

Consulting’s contractually controlled affiliate. The use of VIE

agreements is a common structure used to acquire PRC corporations, particularly

in certain industries in which foreign investment is restricted or forbidden by

the PRC government. The VIE Agreements included:

- 5

-

|

|

(1)

|

A

Consulting Services Agreement through which Kalington Consulting has the

right to advise, consult, manage and operate Longhai and collect and own

all of the net profits of Longhai;

|

|

|

(2)

|

an

Operating Agreement through which Kalington Consulting has the right to

recommend director candidates and appoint the senior executives of

Longhai, approve any transactions that may materially affect the assets,

liabilities, rights or operations of Longhai, and guarantee the

contractual performance by Longhai of any agreements with third parties,

in exchange for a pledge by Longhai of its accounts receivable and

assets;

|

|

|

(3)

|

a

Proxy Agreement under which the three owners of Longhai have vested their

collective voting control over Longhai to Kalington Consulting and will

only transfer their respective equity interests in Longhai to Kalington

Consulting or its designee(s);

|

|

|

(4)

|

an

Option Agreement under which the owners of Longhai have granted to

Kalington Consulting the irrevocable right and option to acquire all of

their equity interests in Longhai;

and

|

|

|

(5)

|

an

Equity Pledge Agreement under which the owners of Longhai have pledged all

of their rights, titles and interests in Longhai to Kalington Consulting

to guarantee Longhai’s performance of its obligations under the Consulting

Services Agreement.

|

The

foregoing description of the terms of the Consulting Services Agreement, the

Operating Agreement, the Proxy Agreement, the Option Agreement and the Equity

Pledge Agreement is qualified in its entirety by reference to the provisions of

the agreements filed as Exhibit 10.4, 10.5, 10.6, 10.7 and 10.8 to this report,

respectively, which are incorporated by reference herein.

See

“Related Party Transactions” for further information on our contractual

arrangements with these parties.

Because

of the common control between Kalington, Kalington Consulting and Longhai, for

accounting purposes, the acquisition of these entities has been treated as a

recapitalization with no adjustment to the historical basis of their assets and

liabilities. The restructuring has been accounted for using the “as if” pooling

method of accounting and the operations were consolidated as if the

restructuring had occurred as of the beginning of the earliest period presented

in our consolidated financial statements and the current corporate structure had

been in existence throughout the periods covered by our consolidated financial

statements.

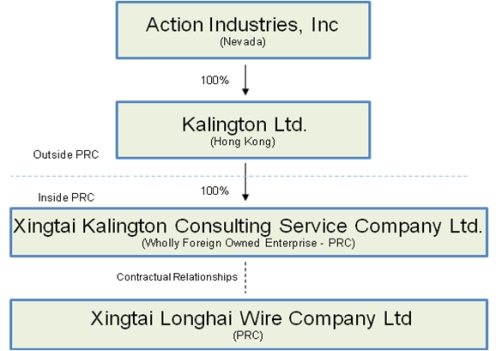

Our

Corporate Structure

All of

our business operations are conducted through our Hong Kong and Chinese

subsidiaries and controlled affiliate. The chart below presents our corporate

structure.

- 6

-

Our

Industry

China is

the world’s largest producer of steel and it is estimated that annual

production capacity in 2009 was over 660M metric tons. Japan,

the second largest producer, produces less than 30% of that

figure. In total, China accounts for roughly 45% of global steel

production. China’s steel industry, while enormous in total scale, is

a fractured industry where a great number producers account for a small

amount of total output. China’s steel industry includes a wide range

of producers, including smaller, inefficient backyard operations,

huge state owned enterprises burdened with unnecessarily large, unionized

labor forces and their accompanying pension burdens as well as newly

constructed steel plants possessing the facilities built according to the

highest technology and efficiency standards in the world.

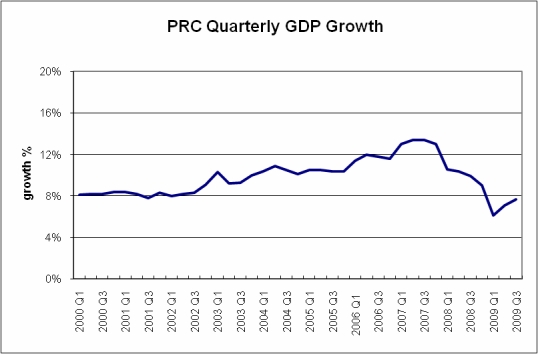

PRC

Macroeconomic Drivers:

The steel

industry is a fundamental cornerstone of the economy and growth in the

steel industry has coincided with consistent and strong growth in the PRC

economy as a whole. It is estimated that real GDP year over year

quarterly growth has been well over an average of 9% since 2000, with a low of

6.1% in the first quarter of 2009:

- 7

-

We

believe that GDP growth will gradually slow but remain positive on the whole as

China industrializes further.

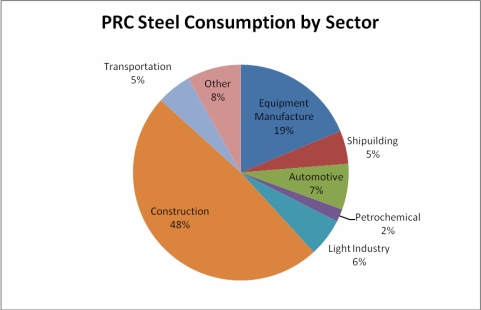

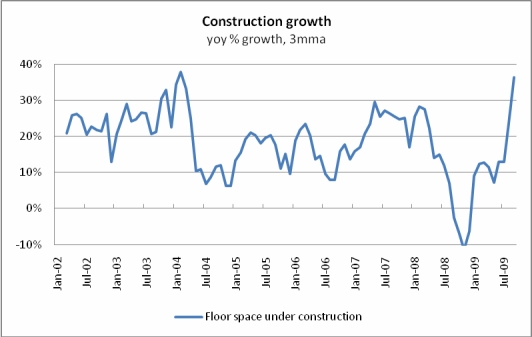

Steel

Consumption, Construction and Fixed Asset Investment:

Steel

consumption in the PRC is highly correlated with nominal fixed asset

investment. Construction is the largest driver of steel usage in

China. The following table details steel consumption by economic

sector, construction a consumes the most steel by a wide margin.

Construction

growth has been strong and has rebounded from the financial downturn in late

2008 robustly. We expect to continue to benefit from the housing and

commercial needs created by urbanization trends and infrastructure trends in the

furture:

- 8

-

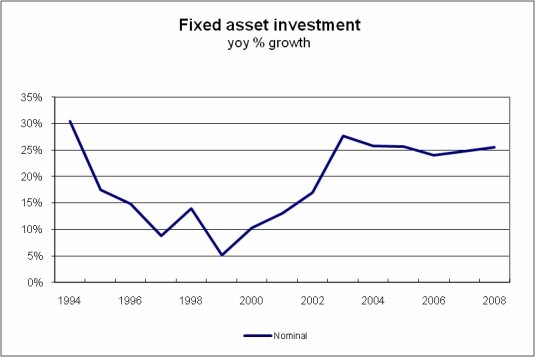

There is

also a close relationship between steel consumption and fixed asset investment

(FAI) in China. The PRC’s fixed asset investment as a portion of GDP

has been historically strong and growing. It is estimated that in

2009, fixed asset investment comprised as much as 70% of GDP. The

graph below details the rapid and strong growth in FAI:

The

Steel Wire Market:

China is

estimated to have produced roughly 80MMT of steel wire rod in

2009. Steel wire is used in a variety of products and serves the

construction industry.

- 9

-

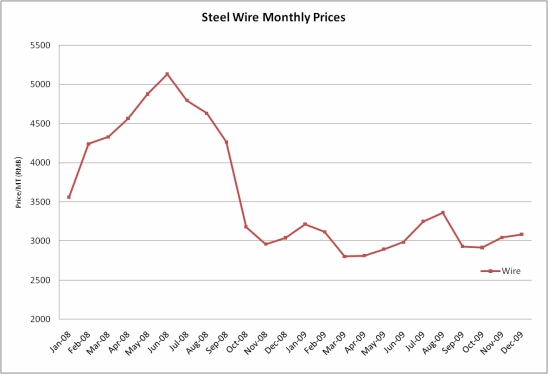

The chart

below details average steel wire prices we experienced over the past two years

in our local market:

Steel

wire prices, along with the majority of other commodities, had a strong run up

in prices leading to a large collapse in 2008. Throughout the rapid

increase and decline in commodity prices, we were able to maintain positive

gross and net margins. We believe steel wire prices have stabilized and we

expect them to rise over 2010 as demand increases due to new and ongoing

construction projects.

Our

Growth Strategy

We

believe that the market for high quality steel wire will continue to grow in the

PRC. The PRC has placed a temporary moratorium on new steel wire

plant construction in an effort to encourage consolidation, therefore our

expansion plan is to build capacity through the acquisition of facilities at

attractive prices from competitors who lack our management experience and

efficient labor force. We plan to continue to improve margins through

increased efficiencies in our production process.

We intend

to pursue the following strategies to achieve our goal:

|

1)

|

Identify

and acquire high quality producers at low valuations compared to earnings

and assets to increase our market

share.

|

|

2)

|

Expand

operations to greater capitalize on economies of scale to produce at

higher margins and leverage suppliers and producers for greater cost

control.

|

|

3)

|

Expand

downstream and capitalize on vertically integrated product synergies to

capitalize on higher margins.

|

Our

Products:

Our

products are steel wires of diameters ranging in diameter from 6.5mm to

10mm. All our wires are manufactured in accordance to ISO9001-2000 quality

management system standards, and those of 6.5mm in diameter meet national

standard GB/700-88. We ensure a low quantity of oxide in our

wire to provide our downstream customers the highest quality wire for further

processing. Our end customers process the wire into a variety of end

products vital to construction and infrastructure, including but not limited to

nails, screws, wire mesh, and fencing.

- 10

-

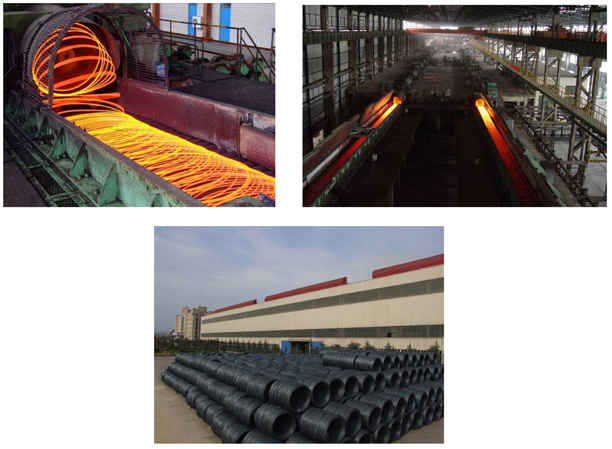

Longhai

Steel Wire Products coming off production line and loading onto

transport trucks

The

principal raw material used in our products is steel billet. In 2009, steel

billet accounted for more than 95% of our production costs. We

generally purchase billet only after a customer has made a wire order, and

therefore avoid a large inventory of billet. This insulates us from

commodity price fluctuation risk associated with holding large quantities of raw

materials. We are generally able to pass higher costs due to

fluctuations in raw material costs through directly to our

customers.

Until

2008, we purchased 100% of our billet from the Longhai Steel

Group. The Longhai Steel Group is controlled by our CEO Chaojun Wang.

Since 2009, Longhai has purchased steel billet from third party vendors. Our

purchasing team monitors and tracks movements in steel billet prices daily and

provides regular guidance to management to respond quickly to market conditions

and aid in long term business planning.

We sell

our products to a number of distribution companies. These companies

are responsible for pickup and transport of our wire to nearby wire

processors. Our products are manufactured on an on-demand basis and

we usually collect payment in advance. This allows us to

maintain a low inventory of both wire and billet, and protects us from exposure

to commodity price volatility. During the year ended December 31,

2009, our top five distributers accounted for 39% of our

revenues. In order to increase sales and be competitive in the

market, we occasionally offer discounted wholesale prices to larger

purchasers. Our sales efforts are directed toward developing long term

relationships with customers who are able to purchase in large

quantities. We pride ourselves on our ability to meet our customers’

demand for high quality products, fast turnaround and timely delivery, and

customer support. We believe that our ability to consistently meet or

exceed these standards is critical to our success and market share. Our

sales department currently has 20 full time employees.

Sales

prices are set at the market price for wire on a daily basis. Our

customers generally prepay for their orders, and the final price may be

adjusted to the market price on the day of manufacture and pick

up. We sometimes provide discounts to newer or larger customers at

our discretion to encourage higher sales volumes.

- 11

-

We sell

100% of our products in the PRC. Within China, the biggest market for

our products is in Hebei Province, where approximately 80% of our products

are sold. The industrial area in and around the nearby city of

Hengshui contains one of the largest collective wire processing

capacities in the world. Much our wire is distributed in

this area for further processing. Domestic economic growth is

a demand driver of our products. More specifically, fixed asset investment

in construction and infrastructure projects is the major macroeconomic driver of

our growth.

The table

below contains a breakdown of our current employees by department as

of December 31, 2009:

|

Department

|

Staff

|

|

|

Management

|

10

|

|

|

Administrative

|

12

|

|

|

Accounting

|

14

|

|

|

Sales

|

20

|

|

|

Production

|

402

|

|

|

Total

|

458

|

We

believe we are in material compliance with all applicable labor and safety laws

and regulations in the PRC, including the PRC Labor Contract Law, the PRC

Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity

of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC

Interim Regulation on the Collection and Payment of Social Insurance Premiums

and other related regulations, rules and provisions issued by the relevant

governmental authorities for our operations in the

PRC. According to the PRC Labor Contract Law, we are required to

enter into labor contracts with our employees and to pay them no less than local

minimum wage.

Intellectual

Property Rights

We

protect our intellectual property primarily by maintaining strict control over

the use of production processes. All our employees, including key

employees and engineers, have signed our standard form of labor contracts,

pursuant to which they are obligated to hold in confidence any of our trade

secrets, know-how or other confidential information and not to compete with

us. In addition, for each project, only the personnel associated with

the project have access to the related intellectual property. Access

to proprietary data is limited to authorized personnel to prevent unintended

disclosure or otherwise using our intellectual property without proper

authorization. We will continue to take steps to protect our

intellectual property rights.

Our

facilities are in located in Xingtai, Hebei. We lease a 5 story

office space and the building which our production facilities occupy from the

Longhai Steel Group. In total, the area covered by our facilities is

more than 107,000 square meters. The production facilities include a

fifth generation Morgan steel rolling mill. We utilize a double

chamber heating furnace which feeds one coarse and one intermediate rolling

mill, and then splits into two wire production lines arranged in a Y-shaped

layout. We believe our rolling and drawing facilities are among the

most advanced in the world. We have a capacity of approximately nine

hundred thousand metric tons of wire per year.

- 12

-

Longhai

Facilities:

Competition

Competition

within the steel industry in the PRC is intense. There is an

estimated capacity of 600MMT of steel capacity in China. Our

competitors range from small private enterprises to extremely large state owned

enterprises. Our operating subsidiary, Longhai, is located in

Xingtai, Hebei. Hebei is the largest producer of steel by province in

the PRC, therefore we are located near to numerous wire

facilities. We are the largest non state owned steel wire

manufacturer in Hebei.

The table

below details our major competitors:

|

Company

|

Production Lines

|

Est. Capacity

|

Line Speed (m/s)

|

Ownership

|

||||

|

Xingtai

Steel Company

|

2

|

2MMT

|

90

|

State

Owned

|

||||

|

Hebei

Xinjin Company

|

1

|

0.5MMT

|

90

|

Private

|

||||

|

Wuan

Minglao Steel Company

|

1

|

0.5MMT

|

75

|

Private

|

||||

|

Yongnian

Jianfa Company

|

1

|

0.3MMT

|

49

|

Private

|

In

comparison, we operate two production lines with a combined yearly capacity of

nine hundred thousand metric tons, line speed of 90 meters per second and the

most advanced production equipment on the market.

Private

steel product manufacturers in China generally focus on low-end products. Many

of our competitors are significantly smaller than we are and use outdated

equipment and production techniques. Due to our

high quality equipment, economies of scale and management experience, we produce

steel wire at higher efficiencies and lower prices

than these competitors. The larger state owned enterprises with whom

we compete often have oversized, unionized labor forces and associated pension

and healthcare liabilities and cannot match our production

efficiency. We distinguish ourselves in the market based on our

extremely fast turnaround, high quality and low prices.

- 13

-

Regulation

Because

our principal operating subsidiary, Longhai, is located in the PRC, our business

is regulated by the national and local laws of the PRC. We believe our conduct

of business complies with existing PRC laws, rules and regulations.

General

Regulation of Businesses

We

believe we are in material compliance with all applicable labor and safety laws

and regulations in the PRC, including the PRC Labor Contract Law, the PRC

Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the

PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for

Maternity of Employees, PRC Interim Provisions on Registration of Social

Insurance, PRC Interim Regulation on the Collection and Payment of Social

Insurance Premiums and other related regulations, rules and provisions issued by

the relevant governmental authorities from time to time, for our operations in

the PRC.

According

to the PRC Labor Contract Law, we are required to enter into labor contracts

with our employees. We are required to pay no less than local minimum wages to

our employees. We are also required to provide employees with labor safety and

sanitation conditions meeting PRC government laws and regulations and carry out

regular health examinations of our employees engaged in hazardous

occupations.

Foreign

Currency Exchange

The

principal regulation governing foreign currency exchange in China is the Foreign

Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB

is freely convertible for current account items, such as trade and

service-related foreign exchange transactions, but not for capital account

items, such as direct investment, loan or investment in securities outside China

unless the prior approval of, and/or registration with, the State Administration

of Foreign Exchange of the People’s Republic of China, or SAFE, or its local

counterparts (as the case may be) is obtained.

Regulation

of Income Taxes

On March

16, 2007, the National People’s Congress of China passed a new Enterprise Income

Tax Law, or the New EIT Law, and its implementing rules, both of which became

effective on January 1, 2008. Before the implementation of the New EIT Law, FIEs

established in the PRC, unless granted preferential tax treatments by the PRC

government, were generally subject to an earned income tax, or EIT, rate of

33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The

New EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all

domestic-invested enterprises and FIEs, unless they qualify under certain

limited exceptions.

- 14

-

In

addition to the changes to the current tax structure, under the New EIT Law, an

enterprise established outside of China with “de facto management bodies” within

China is considered a resident enterprise and will normally be subject to an EIT

of 25% on its global income. The implementing rules define the term “de facto

management bodies” as “an establishment that exercises, in substance, overall

management and control over the production, business, personnel, accounting,

etc., of a Chinese enterprise.” If the PRC tax authorities subsequently

determine that we should be classified as a resident enterprise, then our

organization’s global income will be subject to PRC income tax of 25%. For

detailed discussion of PRC tax issues related to resident enterprise status, see

“Risk Factors – Risks Related to Our Business – Under the New EIT Law, we may be

classified as a ‘resident enterprise’ of China. Such classification will likely

result in unfavorable tax consequences to us and our non-PRC

stockholders.”

Our

future effective income tax rate depends on various factors, such as tax

legislation, the geographic composition of our pre-tax income and non-tax

deductible expenses incurred. Our management carefully monitors these legal

developments and will timely adjust our effective income tax rate when

necessary.

Dividend

Distribution

Under

applicable PRC regulations, FIEs in China may pay dividends only out of their

accumulated profits, if any, determined in accordance with PRC accounting

standards and regulations. In addition, a FIE in China is required to set aside

at least 10.0% of its after-tax profit based on PRC accounting standards each

year to its general reserves until the accumulative amount of such reserves

reach 50.0% of its registered capital. These reserves are not distributable as

cash dividends. The board of directors of a FIE has the discretion to allocate a

portion of its after-tax profits to staff welfare and bonus funds, which may not

be distributed to equity owners except in the event of liquidation.

The New

EIT Law and its implementing rules generally provide that a 10% withholding tax

applies to China-sourced income derived by non-resident enterprises for PRC

enterprise income tax purposes unless the jurisdiction of incorporation of such

enterprises’ shareholder has a tax treaty with China that provides for a

different withholding arrangement. Kalington Consulting is considered an FIE and

is directly held by our subsidiary Kalington in Hong Kong. According to a 2006

tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in

China to the company in Hong Kong who directly holds at least 25% of the equity

interests in the FIE will be subject to a no more than 5% withholding tax. We

expect that such 5% withholding tax will apply to dividends paid to Kalington by

Kalington Consulting, but this treatment will depend on our status as a

non-resident enterprise.

Our

manufacturing facilities are subject to various pollution control regulations

with respect to noise, water and air pollution and the disposal of waste and

hazardous materials. We are also subject to periodic inspections by local

environmental protection authorities. Our operating controlled affiliate

Longhai has received certifications from the relevant PRC

government agencies in charge of environmental protection indicating that

their business operations are in material compliance with the relevant PRC

environmental laws and regulations. We are not currently subject to any

pending actions alleging any violations of applicable PRC environmental

laws.

Insurance

Insurance

companies in China offer limited business insurance products. While business

interruption insurance is available to a limited extent in China, we have

determined that the risks of interruption, cost of such insurance and the

difficulties associated with acquiring such insurance on commercially reasonable

terms make it impractical for us to have such insurance. As a result, we could

face liability from the interruption of our business as summarized under “Risk

Factors – Risks Related to Our Business – We do not carry business interruption

insurance so we could incur unrecoverable losses if our business is

interrupted.”

- 15

-

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should

carefully consider the risks described below, together with all of the other

information included in this report, before making an investment decision. If

any of the following risks actually occurs, our business, financial condition or

results of operations could suffer. In that case, the trading price of our

common stock could decline, and you may lose all or part of your investment. You

should read the section entitled “Special Notes Regarding Forward-Looking

Statements” above for a discussion of what types of statements are

forward-looking statements, as well as the significance of such statements in

the context of this report.

We

have a short operating history.

We were

founded in 2008 and our predecessor business has been in the steel business

since 2003. We may not succeed in implementing our business plan

successfully because of competition from domestic and foreign market entrants,

failure of the market to accept our products, or other reasons. Therefore, you

should not place undue reliance on our past performance as they may not be

indicative of our future results.

We face risks

related to general domestic and global economic conditions and to the current

credit crisis.

Our

current operating cash flows provide us with stable funding capacity. However,

the current uncertainty arising out of domestic and global economic conditions,

including the recent disruption in credit markets, poses a risk to the PRC

economy, and may impact our ability to manage normal relationships with our

customers, suppliers and creditors. If the current situation deteriorates

significantly, our business could be materially negatively impacted, as demand

for our products and services may decrease from a slow-down in the general

economy, or supplier or customer disruptions may result from tighter credit

markets.

Our

business is subject to the health of the PRC economy and our growth may be

inhibited by the inability of potential customers to fund purchases of our

products and services.

Our

products are dependent on the continued growth of infrastructure and

construction projects in the PRC. There is no guarantee that the PRC

will continue to invest in infrastructure and construction.

In order to grow

at the pace expected by management, we will require additional capital to

support our long-term growth strategies. If we are unable to obtain additional

capital in future years, we may be unable to proceed with our plans and we may

be forced to curtail our operations.

We will

require additional working capital to support our long-term growth strategies,

which includes identifying suitable points of market entry for expansion growing

the number of points of sale for our products, so as to enhance our product

offerings and benefit from economies of scale. Our working capital requirements

and the cash flow provided by future operating activities, if any, may vary

greatly from quarter to quarter, depending on the volume of business during the

period. We may not be able to obtain adequate levels of additional financing,

whether through equity financing, debt financing or other sources. Additional

financings could result in significant dilution to our earnings per share or the

issuance of securities with rights superior to our current outstanding

securities. In addition, we may grant registration rights to investors

purchasing our equity or debt securities in the future. If we are unable to

raise additional financing, we may be unable to implement our long-term growth

strategies, develop or enhance our products and services, take advantage of

future opportunities or respond to competitive pressures on a timely

basis.

- 16

-

We have

concentration risk in our supply chain as we have historically sourced 100% of

our raw materials from one supplier. Should we encounter problems

with the quality of products or their availability we may be forced to source

billet from another supplier or suppliers, which could adversely affect our

profit margins.

If

we are unable to attract and retain senior management and qualified technical

and sales personnel, our operations, financial condition and prospects will be

materially adversely affected.

Our

future success depends in part on the contributions of our management team and

key technical and sales personnel and our ability to attract and retain

qualified new personnel. In particular, our success depends on the continuing

employment of our Chief Executive Officer, Mr. Chaojun Wang, our Chief

Technology Officer, Ms. Dongmei Pan, and our Chief Financial Officer, Mr. Heyin

Lv. There is significant competition in our industry for qualified managerial,

technical and sales personnel and we cannot assure you that we will be able to

retain our key senior managerial, technical and sales personnel or that we will

be able to attract, integrate and retain other such personnel that we may

require in the future. If we are unable to attract and retain key personnel in

the future, our business, operations, financial condition, results of operations

and prospects could be materially adversely affected.

We are

subject to risk inherent to our business, including equipment failure, theft,

natural disasters, industrial accidents, labor disturbances, business

interruptions, property damage, product liability, personal injury and death. We

do not carry any business interruption insurance or third-party liability

insurance or other insurance to cover risks associated with our business. As a

result, if we suffer losses, damages or liabilities, including those caused by

natural disasters or other events beyond our control and we are unable to make a

claim again a third party, we will be required to bear all such losses from our

own funds, which could have a material adverse effect on our business, financial

condition and results of operations.

Our

quarterly operating results are likely to fluctuate, which may affect our stock

price.

Our

quarterly revenues, expenses, operating results and gross profit margins vary

from quarter to quarter. As a result, our operating results may fall below the

expectations of securities analysts and investors in some quarters, which could

result in a decrease in the market price of our common stock. The reasons our

quarterly results may fluctuate include:

|

|

·

|

variations

in the price of steel and steel

wire;

|

|

|

·

|

changes

in the general competitive and economic conditions;

and

|

|

|

·

|

delays

in, or uneven timing in the delivery of, customer

orders.

|

Period to

period comparisons of our results should not be relied on as indications of

future performance.

Our

limited ability to protect our intellectual property, and the possibility that

our technology could inadvertently infringe technology owned by others, may

adversely affect our ability to compete.

We rely

on a combination of trade secret laws and confidentiality procedures to protect

the technological know-how that comprises our intellectual property. We protect

our technological know-how pursuant to non-disclosure and non-competition

provisions contained in our employment agreements, and agreements with them to

keep confidential all information relating to our customers, methods, business

and trade secrets during and after their employment with us. Our employees are

also required to acknowledge and recognize that all inventions, trade secrets,

works of authorship, developments and other processes made by them during their

employment are our property.

- 17

-

A

successful challenge to the ownership of our intellectual property could

materially damage our business prospects. Our competitors may assert that our

technologies or products infringe on their patents or proprietary rights. We may

be required to obtain from others licenses that may not be available on

commercially reasonable terms, if at all. Problems with intellectual property

rights could increase the cost of our products or delay or preclude our new

product development and commercialization. If infringement claims against us are

deemed valid, we may not be able to obtain appropriate licenses on acceptable

terms or at all. Litigation could be costly and time-consuming but may be

necessary to protect our technology license positions or to defend against

infringement claims.

Our

business may be subject to seasonal and cyclical fluctuations in

sales.

We may

experience seasonal fluctuations in our revenue in the PRC. Moreover,

our revenues are usually higher in the fourth and first quarters due to seasonal

purchases.

RISKS

RELATING TO THE VIE AGREEMENTS

The

PRC government may determine that the VIE Agreements are not in compliance with

applicable PRC laws, rules and regulations

Kalington

Consulting manages and operates our steel wire production business through

Longhai pursuant to the rights its holds under the VIE Agreements. Almost

all economic benefits and risks arising from Longhai’s operations are

transferred to Kalington Consulting under these agreements. Details of the

VIE Agreements are set out in “DESCRIPTION OF BUSINESS - Acquisition of

Kalington Limited” above.

There are

risks involved with the operation of our business in reliance on the VIE

Agreements, including the risk that the VIE Agreements may be determined by PRC

regulators or courts to be unenforceable. Our PRC counsel has provided a legal

opinion that the VIE Agreements are binding and enforceable under PRC law, but

has further advised that if the VIE Agreements were for any reason determined to

be in breach of any existing or future PRC laws or regulations, the relevant

regulatory authorities would have broad discretion in dealing with such breach,

including:

|

·

|

imposing economic

penalties;

|

|

·

|

discontinuing or restricting the operations of

Longhai or Kalington

Consulting;

|

|

|

·

|

imposing

conditions or requirements in respect of the VIE Agreements with which

Longhai or Kalington Consulting may not be able to

comply;

|

|

|

·

|

requiring

our company to restructure the relevant ownership structure or

operations;

|

|

|

·

|

taking

other regulatory or enforcement actions that could adversely affect our

company’s business; and

|

|

|

·

|

revoking

the business licenses and/or the licenses or certificates of Kalington

Consulting, and/or voiding the VIE

Agreements.

|

Any of

these actions could adversely affect our ability to manage, operate and gain the

financial benefits of Longhai, which would have a material adverse impact on our

business, financial condition and results of operations.

Our

ability to manage and operate Longhai under the VIE Agreements may not be as

effective as direct ownership

We

conduct our steel wire production business in the PRC and generate virtually all

of our revenues through the VIE Agreements. Our plans for future growth are

based substantially on growing the operations of Longhai. However, the VIE

Agreements may not be as effective in providing us with control over Longhai as

direct ownership. Under the current VIE arrangements, as a legal matter, if

Longhai fails to perform its obligations under these contractual arrangements,

we may have to (i) incur substantial costs and resources to enforce such

arrangements, and (ii) reply on legal remedies under PRC law, which we cannot be

sure would be effective. Therefore, if we are unable to effectively control

Longhai, it may have an adverse effect on our ability to achieve our business

objectives and grow our revenues.

- 18

-

As

the VIE Agreements are governed by PRC law, we would be required to rely on PRC

law to enforce our rights and remedies under them; PRC law may not provide us

with the same rights and remedies as are available in contractual disputes

governed by the law of other jurisdictions.

The VIE

Agreements are governed by the PRC law and provide for the resolution of

disputes through arbitral proceedings pursuant to PRC law. If Longhai or its

shareholders fail to perform the obligations under the VIE Agreements, we would

be required to resort to legal remedies available under PRC law, including

seeking specific performance or injunctive relief, or claiming damages. We

cannot be sure that such remedies would provide us with effective means of

causing Longhai to meet its obligations, or recovering any losses or damages as

a result of non-performance. Further, the legal environment in China is not as

developed as in other jurisdictions. Uncertainties in the application of various

laws, rules, regulations or policies in PRC legal system could limit our

liability to enforce the VIE Agreements and protect our interests.

The

payment arrangement under the VIE Agreements may be challenged by the PRC tax

authorities

We

generate our revenues through the payments we receive pursuant to the VIE

Agreements. We could face adverse tax consequences if the PRC tax authorities

determine that the VIE Agreements were not entered into based on arm’s length

negotiations. For example, PRC tax authorities may adjust our income and

expenses for PRC tax purposes which could result in our being subject to higher

tax liability, or cause other adverse financial consequences.

Our

Shareholders have potential conflicts of interest with our company which may

adversely affect our business

Chaojun

Wang is our chief executive officer, and is also the largest shareholder of

Longhai. There could be conflicts that arise from time to time between our

interests and the interests of Mr. Wang. There could also be conflicts that

arise between us and Longhai that would require our shareholders and Longhai’s

shareholders to vote on corporate actions necessary to resolve the conflict.

There can be no assurance in any such circumstances that Mr. Wang will vote his

shares in our best interest or otherwise act in the best interests of our

company. If Mr. Wang fails to act in our best interests, our operating

performance and future growth could be adversely affected

We

rely on the approval certificates and business license held by Kalington

Consulting and any deterioration of the relationship between Kalington

Consulting and Longhai could materially and adversely affect our business

operations

We

operate our steel wire production business in China on the basis of the approval

certificates, business license and other requisite licenses held by Kalington

Consulting and Longhai. There is no assurance that Kalington Consulting and

Longhai will be able to renew their licenses or certificates when their terms

expire with substantially similar terms as the ones they currently

hold.

Further,

our relationship with Longhai is governed by the VIE Agreements that are

intended to provide us with effective control over the business operations of

Longhai. However, the VIE Agreements may not be effective in providing control

over the application for and maintenance of the licenses required for our

business operations. Longhai could violate the VIE Agreements, go bankrupt,

suffer from difficulties in its business or otherwise become unable to perform

its obligations under the VIE Agreements and, as a result, our operations,

reputations and business could be severely harmed.

If

Kalington Consulting exercises the purchase option it holds over Longhai’s share

capital pursuant to the VIE Agreements, the payment of the purchase price could

materially and adversely affect our financial position

Under the

VIE Agreements, Longhai’s shareholders have granted Kalington Consulting

an option for the maximum period of time allowed by law to purchase all of

the equity interest in Longhai at a price equal to the capital paid in

by the transferors, adjusted pro rata for purchase of less than all of the

equity interest, unless applicable PRC laws and regulations require an appraisal

of the equity interest or stipulate other restrictions regarding the purchase

price of the equity interest. As Longhai is already our contractually

controlled affiliate, Kalington Consulting’s exercising of the option would not

bring immediate benefits to our company, and payment of the purchase prices

could adversely affect our financial position.

- 19

-

RISKS

RELATED TO DOING BUSINESS IN CHINA

Changes in

China's political or economic situation could harm us and our operating

results.

Economic

reforms adopted by the Chinese government have had a positive effect on the

economic development of the country, but the government could change these

economic reforms or any of the legal systems at any time. This could either

benefit or damage our operations and profitability. Some of the things that

could have this effect are:

|

|

·

|

Level

of government involvement in the

economy;

|

|

|

·

|

Control

of foreign exchange;

|

|

|

·

|

Methods

of allocating resources;

|

|

|

·

|

Balance

of payments position;

|

|

|

·

|

International

trade restrictions; and

|

|

|

·

|

International

conflict.

|

The

Chinese economy differs from the economies of most countries belonging to the

Organization for Economic Cooperation and Development, or OECD, in many ways.

For example, state-owned enterprises still constitute a large portion of the

Chinese economy and weak corporate governance and a lack of flexible currency

exchange policy still prevail in China. As a result of these differences, we may

not develop in the same way or at the same rate as might be expected if the

Chinese economy was similar to those of the OECD member countries.

We

conduct substantially all of our business through our operating subsidiary and

affiliate in the PRC. Our principal operating subsidiary and controlled

affiliate, Kalington Consulting and Longhai, respectively, are subject to laws

and regulations applicable to foreign investments in China and, in particular,

laws applicable to foreign-invested enterprises. The PRC legal system is based

on written statutes, and prior court decisions may be cited for reference but

have limited precedential value. Since 1979, a series of new PRC laws and

regulations have significantly enhanced the protections afforded to various

forms of foreign investments in China. However, since the PRC legal system

continues to evolve rapidly, the interpretations of many laws, regulations and

rules are not always uniform and enforcement of these laws, regulations and

rules involve uncertainties, which may limit legal protections available to you

and us. In addition, any litigation in China may be protracted and result in

substantial costs and diversion of resources and management attention. In

addition, all of our executive officers and all of our directors are residents

of China and not of the United States, and substantially all the assets of these

persons are located outside the United States. As a result, it could be

difficult for investors to affect service of process in the United States or to

enforce a judgment obtained in the United States against our Chinese operations

and subsidiary and/or controlled affiliate.

- 20

-

You may have

difficulty enforcing judgments against us.

We are a

Nevada holding company, but Kalington is a Hong Kong company, and our principal

operating subsidiary and affiliate, Kalington Consulting and Longhai,

respectively, are located in the PRC. Most of our assets are located

outside the United States and most of our current operations are conducted in

the PRC. In addition, most of our directors and officers are nationals and

residents of countries other than the United States. A substantial portion of

the assets of these persons is located outside the United States. As a result,

it may be difficult for you to effect service of process within the United

States upon these persons. It may also be difficult for you to enforce in U.S.

courts judgments predicated on the civil liability provisions of the U.S.

federal securities laws against us and our officers and directors, most of whom

are not residents in the United States and the substantial majority of whose

assets are located outside the United States. In addition, there is uncertainty

as to whether the courts of the PRC would recognize or enforce judgments of U.S.

courts. The recognition and enforcement of foreign judgments are provided for

under the PRC Civil Procedures Law. Courts in China may recognize and enforce

foreign judgments in accordance with the requirements of the PRC Civil

Procedures Law based on treaties between China and the country where the

judgment is made or on reciprocity between jurisdictions. China does not have

any treaties or other arrangements that provide for the reciprocal recognition

and enforcement of foreign judgments with the United States. In addition,

according to the PRC Civil Procedures Law, courts in the PRC will not enforce a

foreign judgment against us or our directors and officers if they decide that

the judgment violates basic principles of PRC law or national sovereignty,

security or the public interest. So it is uncertain whether a PRC court would

enforce a judgment rendered by a court in the United States.

The PRC

government exerts substantial influence over the manner in which we must conduct

our business activities.

The PRC

government has exercised and continues to exercise substantial control over

virtually every sector of the Chinese economy through regulation and state

ownership. Our ability to operate in China may be harmed by changes in its laws

and regulations, including those relating to taxation, import and export

tariffs, environmental regulations, land use rights, property and other matters.

We believe that our operations in China are in material compliance with all

applicable legal and regulatory requirements. However, the central or local

governments of the jurisdictions in which we operate may impose new, stricter

regulations or interpretations of existing regulations that would require

additional expenditures and efforts on our part to ensure our compliance with

such regulations or interpretations.

Accordingly,

government actions in the future, including any decision not to continue to

support recent economic reforms and to return to a more centrally planned

economy or regional or local variations in the implementation of economic

policies, could have a significant effect on economic conditions in China or

particular regions thereof and could require us to divest ourselves of any

interest we then hold in Chinese properties or joint ventures.

Future inflation

in China may inhibit our ability to conduct business in

China.

In recent

years, the Chinese economy has experienced periods of rapid expansion and highly

fluctuating rates of inflation. During the past ten years, the rate of inflation

in China has been as high as 20.7% and as low as -2.2%. These factors have led

to the adoption by the Chinese government, from time to time, of various

corrective measures designed to restrict the availability of credit or regulate

growth and contain inflation. High inflation may in the future cause the Chinese

government to impose controls on credit and/or prices, or to take other action,

which could inhibit economic activity in China, and thereby harm the market for

our products and our company.

Restrictions on currency exchange may limit our ability to receive

and use our revenues effectively.

The

majority of our revenues will be settled in RMB and U.S. dollars, and any future

restrictions on currency exchanges may limit our ability to use revenue

generated in RMB to fund any future business activities outside China or to make

dividend or other payments in U.S. dollars. Although the Chinese government

introduced regulations in 1996 to allow greater convertibility of the RMB for

current account transactions, significant restrictions still remain, including

primarily the restriction that foreign-invested enterprises may only buy, sell

or remit foreign currencies after providing valid commercial documents, at those

banks in China authorized to conduct foreign exchange business. In addition,

conversion of RMB for capital account items, including direct investment and

loans, is subject to governmental approval in China, and companies are required

to open and maintain separate foreign exchange accounts for capital account

items. We cannot be certain that the Chinese regulatory authorities will not

impose more stringent restrictions on the convertibility of the

RMB.

- 21

-

Fluctuations in

exchange rates could adversely affect our business and the value of our

securities.

The value

of our common stock will be indirectly affected by the foreign exchange rate

between U.S. dollars and RMB and between those currencies and other currencies

in which our sales may be denominated. Appreciation or depreciation in the value

of the RMB relative to the U.S. dollar would affect our financial results

reported in U.S. dollar terms without giving effect to any underlying change in

our business or results of operations. Fluctuations in the exchange rate will

also affect the relative value of any dividend we issue that will be exchanged

into U.S. dollars as well as earnings from, and the value of, any U.S.

dollar-denominated investments we make in the future.

Since

July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s

Bank of China regularly intervenes in the foreign exchange market to prevent

significant short-term fluctuations in the exchange rate, the RMB may appreciate

or depreciate significantly in value against the U.S. dollar in the medium to

long term. Moreover, it is possible that in the future PRC authorities may lift

restrictions on fluctuations in the RMB exchange rate and lessen intervention in

the foreign exchange market.

Very

limited hedging transactions are available in China to reduce our exposure to

exchange rate fluctuations. To date, we have not entered into any hedging

transactions. While we may enter into hedging transactions in the future, the

availability and effectiveness of these transactions may be limited, and we may

not be able to successfully hedge our exposure at all. In addition, our foreign

currency exchange losses may be magnified by PRC exchange control regulations

that restrict our ability to convert RMB into foreign currencies.

Restrictions

under PRC law on our PRC subsidiary’s ability to make dividends and other

distributions could materially and adversely affect our ability to grow, make

investments or acquisitions that could benefit our business, pay dividends to

you, and otherwise fund and conduct our businesses.

Substantially

all of our revenues are earned by Kalington Consulting, our PRC subsidiary. PRC

regulations restrict the ability of our PRC subsidiary to make dividends and

other payments to its offshore parent company. PRC legal restrictions permit

payments of dividend by our PRC subsidiary only out of its accumulated after-tax

profits, if any, determined in accordance with PRC accounting standards and

regulations. Our PRC subsidiary is also required under PRC laws and regulations

to allocate at least 10% of our annual after-tax profits determined in

accordance with PRC GAAP to a statutory general reserve fund until the amounts

in said fund reaches 50% of our registered capital. Allocations to these

statutory reserve funds can only be used for specific purposes and are not

transferable to us in the form of loans, advances or cash dividends. Any

limitations on the ability of our PRC subsidiary to transfer funds to us could

materially and adversely limit our ability to grow, make investments or

acquisitions that could be beneficial to our business, pay dividends and

otherwise fund and conduct our business.

In

October 2005, SAFE, issued the Notice on Relevant Issues in the Foreign Exchange

Control over Financing and Return Investment Through Special Purpose Companies

by Residents Inside China, generally referred to as Circular 75, which required

PRC residents to register with the competent local SAFE branch before

establishing or acquiring control over an offshore special purpose company, or

SPV, for the purpose of engaging in an equity financing outside of China on the

strength of domestic PRC assets originally held by those residents. Internal

implementing guidelines issued by SAFE, which became public in June 2007 (known

as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the

establishment or acquisition of control by PRC residents of offshore entities

which merely acquire “control” over domestic companies or assets, even in the

absence of legal ownership; (2) adding requirements relating to the source of

the PRC resident’s funds used to establish or acquire the offshore entity;

covering the use of existing offshore entities for offshore financings; (3)

purporting to cover situations in which an offshore SPV establishes a new

subsidiary in China or acquires an unrelated company or unrelated assets in

China; and (4) making the domestic affiliate of the SPV responsible for the

accuracy of certain documents which must be filed in connection with any such

registration, notably, the business plan which describes the overseas financing

and the use of proceeds. Amendments to registrations made under Circular 75 are

required in connection with any increase or decrease of capital, transfer of

shares, mergers and acquisitions, equity investment or creation of any security

interest in any assets located in China to guarantee offshore obligations, and

Notice 106 makes the offshore SPV jointly responsible for these filings. In the

case of an SPV which was established, and which acquired a related domestic

company or assets, before the implementation date of Circular 75, a retroactive

SAFE registration was required to have been completed before March 31, 2006;

this date was subsequently extended indefinitely by Notice 106, which also

required that the registrant establish that all foreign exchange transactions

undertaken by the SPV and its affiliates were in compliance with applicable laws

and regulations. Failure to comply with the requirements of Circular 75, as

applied by SAFE in accordance with Notice 106, may result in fines and other

penalties under PRC laws for evasion of applicable foreign exchange

restrictions. Any such failure could also result in the SPV’s affiliates being

impeded or prevented from distributing their profits and the proceeds from any

reduction in capital, share transfer or liquidation to the SPV, or from engaging

in other transfers of funds into or out of China.

- 22

-

We have

advised our shareholders who are PRC residents, as defined in Circular 75, to

register with the relevant branch of SAFE, as currently required, in connection

with their equity interests in us and our acquisitions of equity interests in

our PRC subsidiary and affiliate. However, we cannot provide any assurances that

their existing registrations have fully complied with, and they have made all

necessary amendments to their registration to fully comply with, all applicable

registrations or approvals required by Circular 75. Moreover, because of

uncertainty over how Circular 75 will be interpreted and implemented, and how or

whether SAFE will apply it to us, we cannot predict how it will affect our

business operations or future strategies. For example, our present and

prospective PRC subsidiary’s and affiliate’s ability to conduct foreign exchange

activities, such as the remittance of dividends and foreign currency-denominated

borrowings, may be subject to compliance with Circular 75 by our PRC resident

beneficial holders. In addition, such PRC residents may not always be able to

complete the necessary registration procedures required by Circular 75. We also

have little control over either our present or prospective direct or indirect

shareholders or the outcome of such registration procedures. A failure by our

PRC resident beneficial holders or future PRC resident shareholders to comply

with Circular 75, if SAFE requires it, could subject these PRC resident

beneficial holders to fines or legal sanctions, restrict our overseas or

cross-border investment activities, limit our subsidiary’s and affiliate’s