Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-51288

CNL LIFESTYLE PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 20-0183627 | |

| (State of other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 450 South Orange Avenue Orlando, Florida |

32801 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (407) 650-1000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| None | Not applicable |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer x |

Smaller reporting company ¨ | |

| (Do not check if a smaller reporting company) |

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of the common stock held by non-affiliates of the registrant: No established market exists for the registrant’s shares of common stock, so there is no market value for such shares. Based on the $10 offering price of the shares, approximately $2.6 billion of our common stock was held by non-affiliates as of February 28, 2010.

The number of shares of common stock outstanding as of March 15, 2010 was 252,186,979.

DOCUMENTS INCORPORATED BY REFERENCE

Registrant incorporates by reference portions of the CNL Lifestyle Properties, Inc. Definitive Proxy Statement for the 2010 Annual Meeting of Stockholders (Items 10, 11, 12, 13 and 14 of Part III) to be filed no later than April 30, 2010.

Table of Contents

| Page | ||||

| 2 | ||||

| Item 1. |

2-9 | |||

| Item 1A. |

10-20 | |||

| Item 1B. |

20 | |||

| Item 2. |

21-29 | |||

| Item 3. |

29 | |||

| Item 4. |

29 | |||

| Item 5. |

Market for Registrant’s Common Equity and Related Stockholder Matters |

30-34 | ||

| Item 6. |

35-37 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38-64 | ||

| Item 7A. |

65-66 | |||

| Item 8. |

67-105 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

106 | ||

| Item 9A. |

106 | |||

| Item 9B. |

106 | |||

| Item 10. |

107 | |||

| Item 11. |

107 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management |

107 | ||

| Item 13. |

107 | |||

| Item 14. |

107 | |||

| Item 15. |

108-125 | |||

| 126-127 | ||||

| 128 | ||||

| 129-136 | ||||

| 137 | ||||

Table of Contents

STATEMENT REGARDING FORWARD LOOKING INFORMATION

The following information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements generally are characterized by the use of terms such as “may,” “will,” “should,” “plan,” “anticipate,” “estimate,” “intend,” “predict,” “believe” and “expect” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, our actual results could differ materially from those set forth in the forward-looking statements. Some factors that might cause such a difference include the following: continued or worsening economic conditions, the lack of available debt financing for us and our tenants, the fluctuating values of real estate, conditions affecting the CNL brand name, changes in government regulations or accounting rules, changes in local and national real estate trends, our ability to obtain additional lines of credit or long-term financing on satisfactory terms, changes in interest rates, availability of proceeds from our offering of shares, our tenants’ inability to manage rising costs or declining revenues, our ability to identify suitable investments, our ability to close on identified investments, tenant or borrower defaults under their respective leases or loans and bankruptcies, changes or inaccuracies in our accounting estimates and our ability to locate suitable tenants and operators for our properties. Given these uncertainties, we caution you not to place undue reliance on such statements. We undertake no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect future events or circumstances or to reflect the occurrence of unanticipated events.

| Item 1. | Business |

GENERAL

CNL Lifestyle Properties, Inc. is a Maryland corporation organized on August 11, 2003. We operate as a real estate investment trust, or REIT. The terms “us,” “we,” “our,” “our company” and “CNL Lifestyle Properties” include CNL Lifestyle Properties, Inc. and each of our subsidiaries. We have retained CNL Lifestyle Company, LLC, (the “Advisor”), as our Advisor to provide management, acquisition, disposition, advisory and administrative services. Our offices are located at 450 South Orange Avenue within the CNL Center at City Commons in Orlando, Florida 32801.

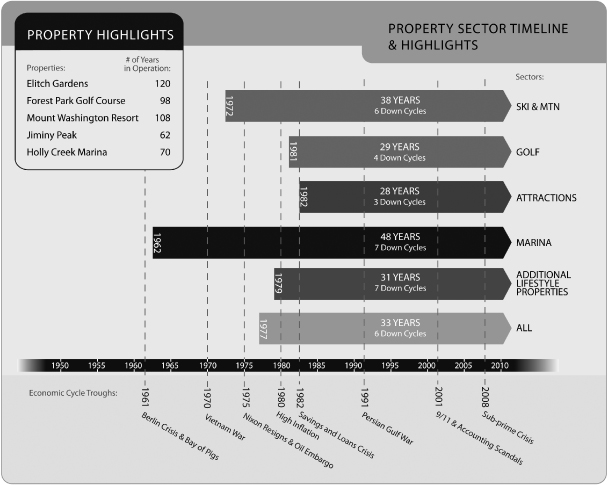

Our principal investment objectives include investing in a diversified portfolio of real estate with a goal to preserve, protect and enhance the long-term value of those assets. We primarily invest in lifestyle properties in the United States that we believe have the potential for long-term growth and income generation. Our investment thesis is supported by demographic trends which we believe affect consumer demand for the various lifestyle asset classes that are the focus of our investment strategy. We define lifestyle properties as those properties that reflect or are impacted by the social, consumption and entertainment values and choices of our society. We generally lease our properties on a long-term, triple-net or gross basis (generally five to 20 years, plus multiple renewal options) to tenants or operators that we consider to be significant industry leaders. To a lesser extent, we also make and acquire loans (including mortgage, mezzanine and other loans) and enter into joint ventures related to interests in real estate.

Following our investment policies of acquiring carefully selected and well-located lifestyle or other income producing properties, we believe we have built a unique portfolio of diversified assets, with established long-term operating histories that have survived many economic cycles. We will continue to focus on the careful selection and acquisition of income producing properties that we believe will provide long-term value to our stockholders, while also concentrating on the management and oversight of our existing assets. We have also maintained a strong balance sheet with a low leverage ratio.

2

Table of Contents

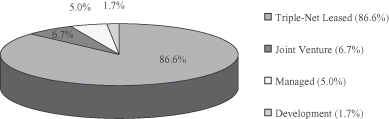

While we invest primarily in properties subject to long-term triple-net leases, we have also invested in joint ventures and made loans (mortgage, mezzanine and other loans) related to real estate. The following is our investment structure by number of properties and loans as of March 15, 2010:

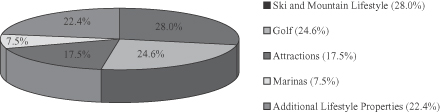

Asset classes and portfolio diversification. As of March 15, 2010, we had a portfolio of 119 lifestyle properties which when aggregated by initial purchase price was diversified as follows: approximately 28.0% in ski and mountain lifestyle, 24.6% in golf facilities, 17.5% in attractions, 7.5% in marinas and 22.4% in additional lifestyle properties. These assets consist of 22 ski and mountain lifestyle properties, 53 golf facilities, 21 attractions, 15 marinas and eight additional lifestyle properties. Eight of these 119 properties are owned through unconsolidated ventures. Many of our properties feature characteristics that are common to more than one asset class, such as a ski resort with a golf facility. Our asset classifications are based on the primary property usage. The pie chart below shows our asset class diversification as of March 15, 2010, by initial purchase price.

3

Table of Contents

Our real estate investment portfolio is geographically diversified with properties in 32 states and two Canadian provinces. The map below shows our current property allocations across geographic regions as of March 15, 2010.

We have invested primarily in ski and mountain lifestyle, golf, attractions and marinas. However, we have also invested or may invest in additional lifestyle properties including, but not limited to, hotels, multi-family residential housing, merchandise marts, medical facilities or any type of property that we believe has the potential to generate long-term revenue.

Our tenants and operators. We generally attempt to lease our properties to tenants and operators that we consider to be significant industry leaders. We consider a tenant or an operator to be a “significant industry leader” if it has one or more of the following traits:

| • | many years of experience operating in a particular industry as compared with other operators in that industry, as a company or through the experience of its senior management; |

| • | many assets managed in a particular industry as compared with other operators in that industry; and/or |

| • | is deemed by us to be a dominant operator in a particular industry for reasons other than those listed above. |

Although we attempt to lease our properties to tenants that we consider to be significant industry leaders, we do not believe the success of our properties is based solely on the performance or abilities of our tenant operators. In some cases, the assets we have acquired are considered unique, iconic or nonreplicable assets which by their very nature have intrinsic value. In addition, unlike our competitors in many other commercial real estate sectors, in the event a tenant is in default and vacates a property, we are able to engage a third-party manager to operate the property on our behalf for a period of time until we re-lease it to a new tenant. During this period, the

4

Table of Contents

property remains open and we receive any net earnings from the property’s operations, although these amounts may be less than the rents that were contractually due under the prior leases. Any taxable income from these properties will be subject to income tax until we re-lease these properties to new tenants.

Our leases and ventures. As part of our net lease investment strategy, we either acquire properties directly or purchase interests in entities that own the properties we seek to acquire. Once we acquire the properties, we either lease them back to the original seller or to a third-party operator. These leases are usually structured as triple-net leases which means our tenants are generally responsible for repairs, maintenance, property taxes, ground lease or permit expenses (where applicable), utilities and insurance for the properties that they lease. The weighted-average lease rate of our portfolio as of December 31, 2009 was approximately 8.9%.

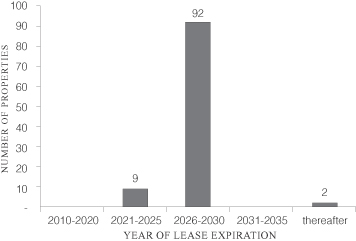

Our leases are generally long-term in nature (generally five to 20 years with multiple renewal options). We have no near-term lease expirations (other than at our one multi-family residential property, which generally enters into one-year leases with its tenants) with the first long-term lease expiring in December 2021, excluding available renewal periods. As of March 15, 2010, the average lease expiration of our portfolio (excluding the multi-family residential and joint venture properties) was approximately 18 years. The following presents the future lease expirations of our portfolio:

We typically structure our leases to provide for the payment of a minimum annual base rent with periodic increases in base rent over the lease term. In addition, our leases provide for the payment of percentage rent normally based on a percentage of gross revenues generated at the property over certain thresholds. Within the provisions of our leases, we also generally require the payment of capital improvement reserve rent. Capital improvement reserves are paid by the tenant and generally based on a percentage of gross revenue of the property and are set aside by us for capital improvements, replacements and other capital expenditures at the property. These amounts are and will remain our property during and after the term of the lease and help maintain the integrity of our assets.

To a lesser extent, when beneficial to our investment structure, certain properties may be leased to wholly-owned tenants that are taxable REIT subsidiaries or that are owned through taxable REIT subsidiaries (referred to as “TRS” entities). Under this structure, we engage third-party managers to conduct day-to-day operations. Under the TRS leasing structure, our results of operations will include the operating results of the underlying properties as opposed to rental income from operating leases that is recorded for properties leased to third-party tenants.

We have entered into joint ventures in which our partners subordinate their returns to our minimum return. This structure provides us with some protection against the risk of downturns in performance but may allow our partners to obtain a higher rate of return on their investment than we receive if the underlying performance of the properties exceeds certain thresholds.

5

Table of Contents

Our loans. As part of our overall investment and lending strategy, we have made and may continue to make or to acquire loans (including mortgage, mezzanine or other loans) with respect to any of the asset classes in which we are permitted to invest. We generally make loans to the owners of properties to enable them to acquire land, buildings, or both, or to develop property or as part of a larger acquisition. In exchange, the owner generally grants us a first lien or collateralized interest in a participating mortgage collateralized by the property or by interests in the entity that owns the property. Our loans generally require fixed interest payments. We expect that the interest rate and terms for long-term mortgage loans (generally, 10 to 20 years) will be similar to the rate of return on our long-term net leases. Mezzanine loans and other financings for which we have a secondary-lien or collateralized interest will generally have shorter terms (one to two years) and higher interest rates than our net leases and long-term mortgage loans. With respect to the loans that we make, we generally seek loans with collateral values resulting in a loan-to-value ratio of not more than 85%.

Our common stock offerings. As of December 31, 2009, we had raised approximately $2.6 billion (260.1 million shares) through our public offerings. During the period January 1, 2010 through February 28, 2010, we raised an additional $34.7 million (3.5 million shares). We have and will continue to use the net proceeds from our offerings to acquire properties, make loans and other investments.

We intend to extend our current stock offering for a period of one year through April 9, 2011 and may have the ability to extend for another six months beyond that date upon meeting certain criteria. On or prior to December 31, 2011, our board of directors will consider an evaluation of our strategic options, which may include, but are not limited to, listing on a national securities exchange, merging with another public company or selling.

Seasonality. Many of the asset classes in which we invest are seasonal in nature and experience seasonal fluctuations in their business due to geographic location, climate and weather patterns. As a result, the businesses experience seasonal variations in revenues that may require our operators to supplement operating cash from their properties in order to be able to make scheduled rent payments to us. In many situations, we have structured the leases for certain tenants such that rents are paid on a seasonal schedule with most, if not all, of the rent being paid during the tenant’s seasonally busy operating period.

As part of our diversification strategy, we have considered the varying and complimentary seasonality of our asset classes and portfolio mix. For example, the peak operating season of our ski and mountain lifestyle assets are staggered against the peak seasons in our attractions and golf portfolios to balance and mitigate the risks associated with seasonality.

Competition. As a REIT, we have historically experienced competition from other REITs (both traded and non-traded), real estate partnerships, mutual funds, institutional investors, specialty finance companies, opportunity funds and other investors, including, but not limited to, banks and insurance companies, many of which generally have had greater financial resources than we do for the purposes of leasing and financing properties within our targeted asset classes. These competitors often also have a lower cost of capital and are subject to less regulation. However, due to the current economic conditions in the U.S. financial markets, the capital resources available to these competitor sources have declined. When capital markets begin to normalize, our competition for investments will likely increase or resume to historical levels. The level of competition impacts both our ability to raise capital, find real estate investments and locate suitable tenants. We may also face competition from other funds in which affiliates of our Advisor participate or advise.

In general, we perceive there to be a lower level of competition for the types of assets that we have acquired and intend to acquire in comparison to assets in core real estate sectors based on the sheer supply of assets in those sectors, the number of willing buyers and the volume of transactions in their respective markets. Accordingly, we believe that being focused in specialty or lifestyle asset classes allows us to take advantage of unique opportunities. Some of our key competitive advantages are as follows:

| • | We acquire assets in niche sectors which historically trade at higher cap rates than other core commercial real estate sectors such as Apartment, Industrial, Office and Retail. According to data |

6

Table of Contents

| compiled by Real Capital Analytics, the aggregate average cap rate for commercial real estate since 2004 has been approximately 7.0%. Our portfolio of properties was acquired between 2004 and 2009 with an average cap rate of approximately 11.2%. We also evaluate our acquisitions on an unlevered basis, which avoids artificial justification of inflated purchase prices through low cost debt. During 2007, which is generally considered the peak buying period for commercial real estate, we acquired properties at an 11.2% cap rate which is consistent with our six year average. |

| • | Some of our targeted assets classes, such as golf, have experienced a net reduction in new supply to normalize with demand. According to the National Golf Foundation 2010 State-of-the-Industry Presentation, the net growth in supply (openings less closings) of golf facilities has declined in each of the last four years as residential developers have scaled back development of new golf communities and weaker facilities have closed. |

| • | Our asset classes have inherently high barriers to entry. For example, the process of obtaining permits to create a new ski resort or marina is highly regulated and significantly more difficult than obtaining permits for the construction of new office or retail space. Additionally, general geographic constraints, such as the availability of suitable waterfront property or mountain terrain, are an inherent barrier to entry in several of our asset classes. There are also high costs associated with building a new ski resort or regional gated attraction that is prohibitive to potential market participants. |

| • | Our leasing arrangements generally require the payment of capital improvement reserve rent which is paid by the tenants and set aside by us to be reinvested into the properties. This arrangement allows us to maintain the integrity of our properties and mitigates deferred maintenance issues. |

| • | Unlike our competitors in many other commercial real estate sectors that generally receive no income in the event a tenant defaults or vacates a property, applicable tax laws allow us to engage a third-party manager to operate a property on our behalf for a period of time until we can re-lease it to a new tenant. During that period, we receive any net earnings from the underlying business operations, which may be less than rents collected under the previous leasing arrangement. However, our ability to continue to operate the property under such an arrangement helps to off-set taxes, insurance and other operating costs that would otherwise have to be absorbed by a landlord and allows the property some time to stabilize, if necessary, before entering into a new lease. |

| • | Our access to capital through our public offerings allows us unique opportunities to invest in and strengthen our existing portfolio as compared to other owners or operators. Owners and operators in those industry segments often have pressure to grow visitation and revenue through the addition of new amenities. When careful analysis justifies an additional investment in one of our existing properties, such as new feature rides at an amusement park or new high-speed lifts or terrain at a ski resort, our investments are added to the tenant’s lease basis, upon which we earn future additional rent. We believe these investments increase visitation to our properties and enhance the overall competitiveness and value of the portfolio. |

7

Table of Contents

Significant tenants and borrowers. As of December 31, 2009 and 2008 and for the years ended through December 31, 2009, we had the following tenants that individually accounted for 10% or more of our aggregate total revenues or assets.

| Tenant |

Number & Type of

Leased |

Percentage of Total Revenues |

Percentage of Total Assets |

||||||||||||||

| 2009 | 2008 | 2007 | 2009 | 2008 | |||||||||||||

| PARC Management, LLC (“PARC”) |

18 Attractions | 18.3 | % | 21.0 | % | 23.0 | % | 14.3 | % | 15.9 | % | ||||||

| Boyne USA, Inc. (“Boyne”) |

7 Ski & Mountain | 15.3 | % | 19.4 | % | 19.0 | % | 9.2 | % | 9.9 | % | ||||||

| Lifestyle Properties |

|||||||||||||||||

| Evergreen Alliance Golf Limited, L.P. |

43 Golf Facilities | 14.3 | % | 20.6 | % | 9.0 | % | 15.4 | % | 17.1 | % | ||||||

| Booth Creek Ski Holding, Inc. |

3 Ski & Mountain | 8.3 | % | 12.2 | % | 13.2 | % | 6.3 | % | 6.7 | % | ||||||

| Lifestyle Properties | |||||||||||||||||

| 56.2 | % | 73.2 | % | 64.2 | % | 45.2 | % | 49.6 | % | ||||||||

The significance of any given tenant or operator, and the related concentration of risk generally decrease as additional properties and operators are added to the portfolio. As shown above, there were only three tenants that individually accounted for 10% or more of our total revenues or assets as of December 31, 2009.

Tax status. We currently operate and have elected to be taxed as a REIT for federal income tax purposes beginning with the taxable year ended December 31, 2004. As a REIT, we generally will not be subject to federal income tax at the corporate level to the extent we distribute annually at least 90% of our taxable income to our stockholders and meet other compliance requirements. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax on our taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year in which our qualification is lost.

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS

Our current business consists of investing in, owning and leasing lifestyle properties primarily in the United States. We evaluate all of our lifestyle properties as a single industry segment and review performance on a property-by-property basis. Accordingly, we do not report segment information.

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

We have one consolidated property located in British Columbia, Canada, Cypress Mountain that generated total rental income of approximately $6.3 million, $6.7 million and $5.5 million for the years ended December 31, 2009, 2008 and 2007, respectively. We also own interests in two properties located in Canada through unconsolidated ventures that generated a combined equity in losses of approximately $0.3 million during the year ended December 31, 2009 and approximately $0.2 million during both years ended December 31, 2008 and 2007. The remainder of our rental income was generated from properties or investments located in the United States.

ADVISORY SERVICES

We have engaged CNL Lifestyle Company, LLC as our Advisor. Under the terms of the advisory agreement, our Advisor is responsible for our day-to-day operations, administers our bookkeeping and accounting functions, serves as our consultant in connection with policy decisions to be made by our board of directors, manages our properties, loans, and other permitted investments and renders other services as the board

8

Table of Contents

of directors deems appropriate. In exchange for these services, our Advisor is entitled to receive certain fees from us. First, for supervision and day-to-day management of the properties and the mortgage loans, our Advisor receives an asset management fee, which is payable monthly, in an amount equal to 0.08334% per month based on the total real estate asset value of a property as defined in the advisory agreement (exclusive of acquisition fees and acquisition expenses), the outstanding principal amounts of any loans made by us and the amount invested in any other permitted investments as of the end of the preceding month. Second, for the selection, purchase, financing, development, construction or renovation of real properties and services related to the incurrence of debt, our Advisor receives an acquisition fee equal to 3% of the gross proceeds from our common stock offerings and loan proceeds from debt, lines of credit and other permanent financing that we use to acquire properties or to make or acquire loans and other permitted investments.

In addition, we reimburse our Advisor for all of the costs it incurs in connection with the services it provides to us. However, in accordance with the advisory agreement, our Advisor is required to reimburse us for the amount by which the total operating expenses (as described in the advisory agreement) incurred by us in any four consecutive fiscal quarters (the “Expense Year”) exceed the greater of 2% of average invested assets or 25% of net income (the “Expense Cap”). For the expense years ended December 31, 2009, 2008 and 2007, operating expenses did not exceed the Expense Cap.

The current advisory agreement continues until April 2010, and thereafter may be extended annually upon the mutual consent of our Advisor and our entire board of directors, including directors who are not directly or indirectly associated with our Advisor (“Independent Directors”), unless terminated at an earlier date upon 60 days prior written notice by either party. As of the date of this filing, the board of directors has approved the extension of the advisory agreement for an additional year through April 2011.

EMPLOYEES

Reference is made to Item 10. “Directors, Executive Officers and Corporate Governance” in our Definitive Proxy Statement for a listing of our executive officers. We have no employees. Our executive officers are compensated by our Advisor.

AVAILABLE INFORMATION

We make available free of charge on our Internet website, www.cnllifestylereit.com, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the “Commission”). The public may read and copy any materials that we file with the Commission at the Commission’s Public Reference Room at Room 1580, 100 F Street, N.E., Washington, D.C. 20549 and may obtain information on the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an internet site that contains reports, proxy and information statements, and other information that we file electronically with the Commission (http://www.sec.gov).

9

Table of Contents

| Item 1A. | Risk Factors |

Real Estate and Other Investment Risks

The current economic slowdown has affected certain of the lifestyle properties in which we invest, and the financial difficulties of our tenants and operators could adversely affect us. A prolonged or expanded period of economic difficulty could adversely affect other of our lifestyle properties. Although a general downturn in the real estate industry would be expected to adversely affect the value of our properties, a downturn in the ski, golf, attractions, marinas and additional lifestyle industries in which we invest could compound the adverse affect. Economic weakness combined with higher costs, especially for energy, food and commodities, has put considerable pressure on consumer spending, which, along with the lack of available debt, has resulted in certain of our tenants experiencing a decline in financial and operating performance. Reductions in consumer spending due to weakness in the economy and uncertainties regarding future economic prospects have adversely affected some of our tenants’ abilities to pay rent to us, resulting in the restructuring of many of their leases with us or in the termination of certain leases. The continuation or expansion of such events could have a negative impact on our results of operations and our ability to pay distributions to our stockholders. In addition, negative events impacting the capital markets may reduce the amount of working capital available to our tenants which may affect their ability to pay rent.

The current economic environment has affected certain of our tenants’ ability to make rental payments to us in accordance with their lease agreement. Some of our tenants have experienced difficulties or have been unable to obtain working capital lines of credit or renew their existing lines of credit due to current state of economy and the capital markets which impacted their ability to pay the full amount of rent due under their leases. As a result, we restructured the leases for certain tenants such that the rents are paid on a seasonal schedule with most, if not all, of the rent being paid during the tenants’ seasonally busy period. In other cases, we restructured the lease terms to allow for rent deferrals or reductions for a period of time to provide temporary relief that then become payable in later periods of the lease term. In addition, we have refunded security deposits which must be replaced up to specified amounts and have provided lease allowances. The rent deferrals granted, the security deposits refunded and lease allowances paid in 2009 directly reduced our cash flows from operating activities during 2009. Other restructures, such as the reductions in lease rates and the future amortization of lease allowances against rental income have reduced and will reduce our net operating results in current and future periods.

Because our revenues are highly dependent on lease payments from our properties and interest payments from loans that we make, defaults by our tenants or borrowers would reduce our cash available for the repayment of our outstanding debt and for distributions. Our ability to repay any outstanding debt and make distributions to stockholders will depend upon the ability of our tenants and borrowers to make payments to us, and their ability to make these payments will depend primarily on their ability to generate sufficient revenues in excess of operating expenses from businesses conducted on our properties. For example, the ability of our tenants to make their scheduled payments to us will depend upon their ability to generate sufficient operating income at the property they operate. A tenant’s failure or delay in making scheduled rent payments to us or a borrower’s failure to make debt service payments to us may result from the tenant or borrower realizing reduced revenues at the properties it operates.

We do not have control over market and business conditions that may affect our success. The following external factors, as well as other factors beyond our control, may reduce the value of properties that we acquire, the ability of tenants to pay rent on a timely basis, or at all, the amount of the rent to be paid and the ability of borrowers to make loan payments on time, or at all:

| • | changes in general or local economic or market conditions; |

| • | the pricing and availability of debt or working capital; |

| • | increased costs of energy, insurance or products; |

| • | increased costs and shortages of labor; |

10

Table of Contents

| • | increased competition; |

| • | quality of management; |

| • | failure by a tenant to meet its obligations under a lease; |

| • | bankruptcy of a tenant or borrower; |

| • | the ability of an operator to fulfill its obligations; |

| • | limited alternative uses for properties; |

| • | changing consumer habits; |

| • | condemnation or uninsured losses; |

| • | changing demographics; and |

| • | changing government regulations. |

Further, the results of operations for a property in any one period may not be indicative of results in future periods, and the long-term performance of such property generally may not be comparable to, and cash flows may not be as predictable as, other properties owned by third parties in the same or similar industry. If tenants are unable to make lease payments or borrowers are unable to make loan payments as a result of any of these factors, cash available for distributions to our stockholders may be reduced.

Our exposure to typical real estate investment risks could reduce our income. Our properties, loans and other permitted investments will be subject to the risks typically associated with investments in real estate. Such risks include the possibility that our properties will generate rent and capital appreciation, if any, at rates lower than we anticipated or will yield returns lower than those available through other investments. Further, there are other risks by virtue of the fact that our ability to vary our portfolio in response to changes in economic and other conditions will be limited because of the general illiquidity of real estate investments. Income from our properties may be adversely affected by many factors including, but not limited to, an increase in the local supply of properties similar to our properties, a decrease in the number of people interested in participating in activities related to the businesses conducted on the properties that we acquire, adverse weather conditions, changes in government regulation, international, national or local economic deterioration, increases in energy costs and other expenses affecting travel, factors which may affect travel patterns and reduce the number of travelers and tourists, increases in operating costs due to inflation and other factors that may not be offset by increased room rates, and changes in consumer tastes.

If one or more of our tenants file for bankruptcy protection, we may be precluded from collecting all sums due. If one or more of our tenants, or the guarantor of a tenant’s lease, commences, or has commenced against it, any proceeding under any provision of the U.S. federal bankruptcy code, as amended, or any other legal or equitable proceeding under any bankruptcy, insolvency, rehabilitation, receivership or debtor’s relief statute or law (“Bankruptcy Proceeding”), we may be unable to collect sums due under our lease(s) with that tenant. Any or all of the tenants, or a guarantor of a tenant’s lease obligations, could be subject to a Bankruptcy Proceeding. A Bankruptcy Proceeding may bar our efforts to collect pre-bankruptcy debts from those entities or their properties unless we are able to obtain an enabling order from the bankruptcy court. If a lease is rejected by a tenant in bankruptcy, we would only have a general unsecured claim against the tenant, and may not be entitled to any further payments under the lease. We believe that our security deposits in the form of letters of credit would be protected from bankruptcy in most jurisdictions. However, a tenant’s or lease guarantor’s Bankruptcy Proceeding could hinder or delay efforts to collect past due balances under relevant leases or guarantees and could ultimately preclude collection of these sums. Such an event could cause a decrease or cessation of rental payments which would reduce our cash flow and the amount available for distribution to our stockholders. In the event of a Bankruptcy Proceeding, we cannot assure you that the tenant or its trustee will assume our lease. If a given lease, or guaranty of a lease, is not assumed, our cash flow and the amounts available for distribution to our stockholders may be adversely affected.

11

Table of Contents

Multiple property leases or loans with individual tenants or borrowers increase our risks in the event that such tenants or borrowers become financially impaired. The value of our properties will depend principally upon the value of the leases entered into for properties that we acquire. Defaults by a tenant or borrower may continue for some time before we determine that it is in our best interest to evict the tenant or foreclose on the property of the borrower. Tenants may lease more than one property, and borrowers may enter into more than one loan. As a result, a default by, or the financial failure of, a tenant or borrower could cause more than one property to become vacant or be in default or more than one lease or loan to become non-performing. Defaults or vacancies can reduce and have reduced our cash receipts and funds available for distribution and could decrease the resale value of affected properties until they can be re-leased.

We may rely on various cash flow or income security provisions in our leases for minimum rent payments. Our leases may, but are not required to, have security provisions such as deposits, stock pledges and guarantees or shortfall reserves provided by a third-party tenant or operator. These security provisions may terminate at either a specific time during the lease term or once net operating income of the property exceeds a specified amount. Certain security provisions may also have limits on the overall amount of the security under the lease. After the termination of a security feature, or in the event that the maximum limit of a security provision is reached, we may only look to the tenant to make lease payments. In the event that a security provision has expired or the maximum limit has been reached, or a provider of a security provision is unable to meet its obligations, our results of operations and ability to pay distributions to our stockholders could be adversely affected if our tenants are unable to generate sufficient funds from operations to meet minimum rent payments and the tenants do not otherwise have the resources to make rent payments.

It may be difficult for us to exit a joint venture after an impasse. In our joint ventures, there will be a potential risk of impasse in some business decisions because our approval and the approval of each co-venturer may be required for some decisions. In any joint venture, we may have the right to buy the other co-venturer’s interest or to sell our own interest on specified terms and conditions in the event of an impasse regarding a sale. In the event of an impasse, it is possible that neither party will have the funds necessary to complete a buy-out. In addition, we may experience difficulty in locating a third-party purchaser for our joint venture interest and in obtaining a favorable sale price for the interest. As a result, it is possible that we may not be able to exit the relationship if an impasse develops.

Discretionary consumer spending may affect the profitability of certain properties we acquire. The financial performance of certain properties in which we have invested and may invest in the future depends in part on a number of factors relating to or affecting discretionary consumer spending for the types of services provided by businesses operated on these properties. Unfavorable local, regional, or national economic developments or uncertainties regarding future economic prospects have reduced consumer spending in the markets where we own properties and, when combined with the lack of available debt, have adversely affected certain of our tenants’ businesses. As a result, certain of our tenants have experienced declines in operating results, and a number of our tenants have sought to modify certain of their leases. Any continuation of such events that leads to lower spending on lifestyle activities could impact our tenants’ ability to pay rent and thereby have a negative impact on our results of operations.

The inability to increase or maintain lease rates at our properties might affect the level of distributions to stockholders. Given the nature of certain properties we have acquired or may acquire, the relative stagnation of base lease rates in certain sectors might not allow for substantial increases in rental revenue to us that could allow for increased distributions to stockholders.

Seasonal revenue variations in certain asset classes will require the operators of those asset classes to manage cash flow properly over time so as to meet their non-seasonal scheduled rent payments to us. Certain of the properties in which we may invest are generally seasonal in nature due to geographic location, climate and weather patterns. For example, revenue and profits at ski resorts and their related properties are substantially lower and historically result in losses during the summer months due to the closure of ski operations, while many

12

Table of Contents

attractions properties are closed during the winter months and produce the majority of their revenues and profits during summer months. As a result of the seasonal nature of certain business operations that may be conducted on properties we acquire, these businesses will experience seasonal variations in revenues that may require our operators to supplement revenue at their properties in order to be able to make scheduled rent payments to us or require us to, in certain cases we have or may, adjust their lease payments so that we collect more rent during their seasonally busy time.

Our real estate assets may be subject to impairment charges. We periodically evaluate the recoverability of the carrying value of our real estate assets for impairment indicators. Factors considered in evaluating impairment of our existing real estate assets held for investment include significant declines in property operating profits, recurring property operating losses and other significant adverse changes in general market conditions. Generally, a real estate asset held for investment is not considered impaired if the undiscounted, estimated future cash flows of the asset over its estimated holding period are in excess of the asset’s net book value at the balance sheet date. Investments in unconsolidated entities are not considered impaired if the estimated fair value of the investment exceeds the carrying value of the investment and the decline is considered to be other than temporary. Management makes assumptions and estimates when considering impairments and actual results could vary materially from these assumptions and estimates.

The real estate industry is capital intensive and we are subject to risks associated with ongoing needs for renovation and capital improvements to our properties as well as financing for such expenditures. In order for us to remain competitive, our properties will have an ongoing need for renovations and other capital improvements, including replacements, from time to time, of furniture, fixtures and equipment. These capital improvements may give rise to the following risks:

| • | construction cost overruns and delays; |

| • | a possible shortage of available cash to fund capital improvements and the related possibility that financing for these capital improvements may not be available to us on satisfactory terms; and |

| • | disruptions in the operation of the properties while capital improvements are underway. |

We will not control the management of our properties. In order to maintain our status as a REIT for federal income tax purposes, we may not operate certain types of properties we acquire or participate in the decisions affecting their daily operations. Our success, therefore, will depend on our ability to select qualified and creditworthy tenants and managers who can effectively manage and operate the properties. Our tenants will be responsible for maintenance and other day-to-day management of the properties or will enter into agreements with third-party operators directly or by entering into operating agreements with third-party managers. Because our revenues will largely be derived from rents, our financial condition will be dependent on the ability of third-party tenants and/or operators to operate the properties successfully. We will attempt to enter into leasing agreements with tenants having substantial prior experience in the operation of the type of property being rented, however, there can be no assurance that we will be able to make such arrangements. Additionally, if we elect to treat property we acquire as a result of a borrower’s default on a loan or a tenant’s default on a lease as “foreclosure property” for federal income tax purposes, we will be required to operate that property through an independent contractor over whom we will not have control. If our tenants or third-party operators are unable to operate the properties successfully or if we select unqualified managers, then such tenants and operators might not have sufficient earnings to be able to pay our rent, which could adversely affect our financial condition.

Joint venture partners may have different interests than we have, which may negatively impact our control over our ventures. Investments in joint ventures involve the risk that our co-venturer may have economic or business interests or goals which, at a particular time, are inconsistent with our interests or goals, that the co-venturer may be in a position to take action contrary to our instructions, requests, policies or objectives, or that the co-venturer may experience financial difficulties. Among other things, actions by a co-venturer might subject assets owned by the joint venture to liabilities in excess of those contemplated by the terms of the joint

13

Table of Contents

venture agreement or to other adverse consequences. This risk is also present when we make investments in securities of other entities. If we do not have full control over a joint venture, the value of our investment will be affected to some extent by a third party that may have different goals and capabilities than ours. As a result, joint ownership of investments and investments in other entities may adversely affect our returns on investments and, therefore, cash available for distributions to our stockholders may be reduced.

Adverse weather conditions may damage certain properties we acquire and/or reduce our operators’ ability to make scheduled rent payments to us. Weather conditions may influence revenues at certain types of properties we acquire. These adverse weather conditions include heavy snowfall (or lack thereof), hurricanes, tropical storms, high winds, heat waves, frosts, drought (or reduced rainfall levels), excessive rain, avalanches, mudslides and floods. Adverse weather could reduce the number of people participating in activities at properties we acquire and have acquired. Certain properties may be susceptible to damage from weather conditions such as hurricanes, which may cause damage (including, but not limited to property damage and loss of revenue) that is not generally insurable at commercially reasonable rates. Further, the physical condition of properties we acquire must be satisfactory to attract visitation. In addition to severe or generally inclement weather, other factors, including, but not limited to plant disease and insect infestation, as well as the quality and quantity of water, could adversely affect the conditions at properties we own and acquire or develop. Most properties have some insurance coverage that will offset such losses and fund needed repairs.

Our operating results may be negatively affected by potential development and construction delays and resultant increased costs and risks. We may invest in properties upon which we will develop and construct improvements. We will be subject to risks relating to uncertainties associated with re-zoning for development and environmental concerns of governmental entities and/or community groups, and our ability to control construction costs or to build in conformity with plans, specifications and timetables. Our performance also may be affected or delayed by conditions beyond our control. Moreover, delays in completion of construction also could give tenants the right to terminate preconstruction leases for space at a newly developed project. Furthermore, we must rely upon projections of rental income, expenses and estimates of the fair market value of property upon completion of construction before agreeing to a property’s purchase price. If our projections are inaccurate, we may pay too much for a property and our return on our investment could suffer.

If we set aside insufficient reserves for capital expenditures, we may be required to defer necessary property improvements. If we do not have enough reserves for capital expenditures to supply needed funds for capital improvements throughout the life of the investment in a property, and there is insufficient cash available from our operations, we may be required to defer necessary improvements to the property that may cause the property to suffer from a greater risk of obsolescence, a decline in value and/or a greater risk of decreased cash flow as a result of attracting fewer potential tenants to the property and adversely affecting our tenants’ businesses. If we lack sufficient capital to make necessary capital improvements, then we may not be able to maintain projected rental rates for certain properties, and our results of operations and ability to pay distributions to our stockholders may be negatively impacted.

Lending Related Risks

Our loans may be affected by unfavorable real estate market conditions. When we make loans, we are at risk of default on those loans caused by many conditions beyond our control, including local and other economic conditions affecting real estate values and interest rate levels. We do not know whether the values of the properties collateralizing mortgage loans will remain at the levels existing on the dates of origination of the loans. If the values of the underlying properties drop or in some instances fail to rise, our risk will increase and the value of our interests may decrease.

Foreclosures create additional ownership risks that could adversely impact our returns on mortgage investments. When we acquire property by foreclosure following defaults under our mortgage, bridge or mezzanine loans, we have the economic and liability risks as the owner of such property. This additional liability could adversely impact our returns on mortgage investments.

14

Table of Contents

Our loans will be subject to interest rate fluctuations. If we invest in fixed-rate, long-term loans and interest rates rise, the loans will yield a return lower than then-current market rates. If interest rates decrease, we will be adversely affected to the extent that loans are prepaid, because we will not be able to make new loans at the previously higher interest rate.

Lack of principal amortization of loans increases the risk of borrower default at maturity and delays in liquidating defaulted loans could reduce our investment returns and our cash available for distributions. Certain of the loans that we have made do not require the amortization of principal during their term. As a result, a substantial amount of, or the entire principal balance of such loans, will be due in one balloon payment at their maturity. Failure to amortize the principal balance of loans may increase the risk of a default during the term, and at maturity of loans. In addition, certain of our loans have or may have a portion of the interest accrued and payable upon maturity. We may not receive any of that accrued interest if our borrower defaults. A default under loans could have a material adverse effect on our ability to pay distributions to stockholders. Further, if there are defaults under our loans, we may not be able to repossess and sell the underlying properties or other security quickly. The resulting time delay could reduce the value of our investment in the defaulted loans. An action to foreclose on a mortgaged property securing a loan is regulated by state statutes and rules and is subject to many of the delays and expenses of other lawsuits if the defendant raises defenses or counterclaims. In the event of default by a mortgagor, these restrictions, among other things, may impede our ability to foreclose on or sell the mortgaged property or to obtain proceeds sufficient to repay all amounts due on our loan. Any failure or delay by a borrower in making scheduled payments to us may adversely affect our ability to make distributions to stockholders.

We may make loans on a subordinated and unsecured basis and may not be able to collect outstanding principal and interest. Although our loans to third parties are usually collateralized by properties pledged by such borrowers, we have made loans that are unsecured and/or subordinated in right of payment to such third parties’ existing and future indebtedness. In the event of a foreclosure, bankruptcy, liquidation, winding up, reorganization or other similar proceeding relating to such third party, and in certain other events, such third party’s assets may only be available to pay obligations on our unsecured loans after the third party’s other indebtedness has been paid. As a result, there may not be sufficient assets remaining to pay the principal or interest on the unsecured loans we may make.

Financing Related Risks

Continued uncertainty and volatility in the credit markets could affect our ability to obtain debt financing on reasonable terms, which could reduce the number of properties we may be able to acquire. The global and U.S. economy continued to struggle during 2009 and there continues to be uncertainty regarding the duration of the economic downturn as well as the full impact of these events on the global and U.S. economy, including our properties. If mortgage debt is unavailable on attractive terms as a result of increased interest rates, increased credit spreads, decreased liquidity or other factors, our ability to acquire properties may be limited and we risk being unable to refinance our existing debt upon maturity.

There is no guarantee that borrowing arrangements or other arrangements for obtaining leverage will be available, or if available, will be available on terms and conditions acceptable to us. Unfavorable economic conditions have increased financing costs and limited access to the capital markets. In addition, a decline in market value of our assets may have adverse consequences in instances where we borrow money based on the fair value of those assets. A decrease in market value of those assets may result in the lender requiring us to post additional collateral.

Currently, the market for credit facilities is very challenging and many lenders are actively seeking to reduce their balances outstanding by lowering advance rates on financed assets and increasing borrowing costs, to the extent such facilities continue to be available. In the event we are unable to maintain or extend existing and/or secure new lines of credit or collateralized financing on favorable terms, our ability to make investments and our ability to make distributions may be significantly impacted.

15

Table of Contents

Anticipated borrowing creates risks. We have borrowed and will likely continue to borrow money to acquire assets, to preserve our status as a REIT or for other corporate purposes. We generally mortgage or put a lien on one or more of our assets in connection with any borrowing. We intend to maintain one or more revolving lines of credit of up to $150 million to provide financing for the acquisition of assets, although our board of directors could determine to borrow a greater amount. We may repay the line of credit using equity offering proceeds, including proceeds from our stock offering, proceeds from the sale of assets, working capital or long-term financing. We also have and intend to continue to obtain long-term financing. We may not borrow more than 300% of the value of our net assets without the approval of a majority of our Independent Directors and the borrowing must be disclosed and explained to our stockholders in our first quarterly report after such approval. Borrowing may be risky if the cash flow from our properties and other permitted investments is insufficient to meet our debt obligations. In addition, our lenders may seek to impose restrictions on future borrowings, distributions and operating policies, including with respect to capital expenditures and asset dispositions. If we mortgage assets or pledge equity as collateral and we cannot meet our debt obligations, then the lender could take the collateral, and we would lose the asset or equity and the income we were deriving from the asset.

Defaults on our borrowings may adversely affect our financial condition and results of operations. Defaults on loans collateralized by a property we own may result in foreclosure actions and our loss of the property or properties securing the loan that is in default. Such legal actions are expensive. For tax purposes, a foreclosure would be treated as a sale of the property for a purchase price equal to the outstanding balance of the debt collateralized by the property. If the outstanding balance of the debt exceeds our tax basis in the property, we would recognize taxable income on the foreclosure and all or a portion of such taxable income may be subject to tax and/or required to be distributed to our stockholders in order for us to qualify as a REIT. In such case, we would not receive any cash proceeds to enable us to pay such tax or make such distributions. If any mortgages contain cross collateralization or cross default provisions, more than one property may be affected by a default. If any of our properties are foreclosed upon due to a default, our financial condition, results of operations and ability to pay distributions to stockholders will be adversely affected.

Financing arrangements involving balloon payment obligations may adversely affect our ability to make distributions. Some of our fixed-term financing arrangements may require us to make “balloon” payments at maturity. Our ability to make a balloon payment at maturity is uncertain and may depend upon our ability to obtain additional financing or sell a particular property. At the time the balloon payment is due, we may not be able to raise equity or refinance the balloon payment on terms as favorable as the original loan or sell the property at a price sufficient to make the balloon payment. These refinancing or property sales could negatively impact the rate of return to stockholders and the timing of disposition of our assets. In addition, payments of principal and interest may leave us with insufficient cash to pay the distributions that we are required to pay to maintain our qualification as a REIT.

Increases in interest rates could increase the amount of our debt payments and adversely affect our ability to make distributions to our stockholders. We may borrow money that bears interest at a variable rate and, from time to time, we may pay mortgage loans or refinance our properties in a rising interest rate environment. Accordingly, increases in interest rates could increase our interest costs, which could have a material adverse effect on our operating cash flow and our ability to make distributions to our stockholders.

We may borrow money to make distributions and distributions may not come from funds from operations. In the past, we have borrowed from affiliates and other persons to make distributions, and in the future we may continue to borrow money as we consider necessary or advisable to meet our distribution requirements. Our distributions have exceeded our funds from operations in the past and may do so in the future. In the event that we make distributions in excess of our earnings and profits, such distributions could constitute a return of capital for federal income tax and accounting purposes. Furthermore, in the event that we are unable to fund future distributions from our funds from operations, the value of your shares upon the possible listing of our stock, the sale of our assets or any other liquidity event may be negatively affected.

16

Table of Contents

Lenders may require us to enter into restrictive covenants relating to our operations, which could limit our ability to make distributions to our stockholders. When providing financing, a lender may impose restrictions on us that affect our distributions, operating policies and ability to incur additional debt. Loan documents we enter into may contain covenants that limit our ability to further mortgage a property or affect other operational policies. Such limitations hamper our flexibility and may impair our ability to achieve our operating plans.

We may acquire various financial instruments for purposes of “hedging” or reducing our risks which may be costly and/or ineffective and will reduce our cash available for distribution to our stockholders. Use of derivative instruments for hedging purposes may present significant risks, including the risk of loss of the amounts invested. Defaults by the other party to a hedging transaction can result in the hedging transaction becoming worthless or a speculative hedge. Hedging activities also involve the risk of an imperfect correlation between the hedging instrument and the asset being hedged, which could result in losses both on the hedging transaction and on the asset being hedged. Use of hedging activities generally may not prevent significant losses and could increase our losses. Further, hedging transactions may reduce cash available for distribution to our stockholders.

Tax Related Risks

We will be subject to increased taxation if we fail to qualify as a REIT for federal income tax purposes. We believe that we have been organized and have operated, and intend to continue to be organized and to operate, in a manner that will enable us to meet the requirements for qualification and taxation as a REIT for federal income tax purposes, commencing with our taxable year ended December 31, 2004. A REIT is generally not subject to federal tax at the corporate level to the extent that it distributes annually at least 90% of its taxable income to its stockholders and meets other compliance requirements. We have not requested, and do not plan to request, a ruling from the IRS that we qualify as a REIT. Based upon representations made by our officers with respect to certain factual matters, and upon counsel’s assumption that we have operated and will continue to operate in the manner described in the representations and in our prospectus relating to our common stock offerings, our tax counsel, Arnold & Porter LLP, has rendered an opinion that we were organized and have operated in conformity with the requirements for qualification as a REIT and that our proposed method of operation will enable us to continue to meet the requirements for qualification as a REIT. Our continued qualification as a REIT will depend on our continuing ability to meet highly technical and complex requirements concerning, among other things, the ownership of our outstanding shares of common stock, the nature of our assets, the sources of our income, the amount of our distributions to our stockholders and the filing of TRS elections. No assurance can be given that we qualify or will continue to qualify as a REIT or that new legislation, Treasury Regulations, administrative interpretations or court decisions will not significantly change the tax laws with respect to our qualification as a REIT.

You should be aware that opinions of counsel are not binding on the IRS or on any court. The conclusions stated in the opinion of our tax counsel are conditioned on, and our continued qualification as a REIT will depend on, our company meeting various requirements.

If we fail to qualify as a REIT, we would be subject to additional federal income tax at regular corporate rates. If we fail to qualify as a REIT, we may be subject to additional federal income and alternative minimum taxes. Unless we are entitled to relief under specific statutory provisions, we also could not elect to be taxed as a REIT for four taxable years following the year during which we were disqualified. Therefore, if we fail to qualify as a REIT, the funds available for distribution to stockholders would be reduced substantially for each of the years involved.

Our leases may be recharacterized as financings which would eliminate depreciation deductions on our properties. We believe that we would be treated as the owner of properties where we would own the underlying land, except with respect to leases structured as “financing leases,” which would constitute financings for federal income tax purposes. If the lease of a property does not constitute a lease for federal income tax purposes and is

17

Table of Contents

recharacterized as a secured financing by the IRS, then we believe the lease should be treated as a financing arrangement and the income derived from such a financing arrangement should satisfy the 75% and the 95% gross income tests for REIT qualification as it would be considered to be interest on a loan collateralized by real property. Nevertheless, the recharacterization of a lease in this fashion may have adverse tax consequences for us. In particular, we would not be entitled to claim depreciation deductions with respect to the property (although we should be entitled to treat part of the payments we would receive under the arrangement as the repayment of principal). In such event, in some taxable years our taxable income, and the corresponding obligation to distribute 90% of such income, would be increased. With respect to leases structured as “financing leases,” we will report income received as interest income and will not take depreciation deductions related to the real property. Any increase in our distribution requirements may limit our ability to invest in additional properties and to make additional mortgage loans. No assurance can be provided that the IRS would recharacterize such transactions as financings that would qualify under the 95% and 75% gross income tests.

Excessive non-real estate asset values may jeopardize our REIT status. In order to qualify as a REIT, among other requirements, at least 75% of the value of our assets must consist of investments in real estate, investments in other REITs, cash and cash equivalents and government securities. Accordingly, the value of any other property that is not considered a real estate asset for federal income tax purposes must represent in the aggregate not more than 25% of our total assets. In addition, under federal income tax law, we may not own securities in, or make loans to, any one company (other than a REIT, a qualified REIT subsidiary or a taxable REIT subsidiary) which represent in excess of 10% of the voting securities or 10% of the value of all securities of that company or which have, in the aggregate, a value in excess of 5% of our total assets, and we may not own securities of one or more taxable REIT subsidiaries which have, in the aggregate, a value in excess of 25% of our total assets.

The 25%, 10% and 5% REIT qualification tests are determined at the end of each calendar quarter. If we fail to meet any such test at the end of any calendar quarter, and such failure is not remedied within 30 days after the close of such quarter, we will cease to qualify as a REIT, unless certain requirements are satisfied.

Despite our REIT status, we remain subject to various taxes which would reduce operating cash flow if and to the extent certain liabilities are incurred. Even if we qualify as a REIT, we are subject to some federal, state and local taxes on our income and property that could reduce operating cash flow, including but not limited to: (i) tax on any undistributed real estate investment trust taxable income; (ii) “alternative minimum tax” on our items of tax preference; (iii) certain state income taxes (because not all states treat REITs the same as they are treated for federal income tax purposes); (iv) a tax equal to 100% of net gain from “prohibited transactions;” (v) tax on gains from the sale of certain “foreclosure property;” (vi) tax on gains of sale of certain “built-in gain” properties; and (vii) certain taxes and penalties if we fail to comply with one or more REIT qualification requirements, but nevertheless qualify to maintain our status as a REIT. Foreclosure property includes property with respect to which we acquire ownership by reason of a borrower’s default on a loan or possession by reason of a tenant’s default on a lease. We may elect to treat certain qualifying property as “foreclosure property,” in which case, the income from such property will be treated as qualifying income under the 75% and 95% gross income tests for three years following such acquisition. To qualify for such treatment, we must satisfy additional requirements, including that we operate the property through an independent contractor after a short grace period. We will be subject to tax on our net income from foreclosure property. Such net income generally means the excess of any gain from the sale or other disposition of foreclosure property and income derived from foreclosure property that otherwise does not qualify for the 75% gross income test, over the allowable deductions that relate to the production of such income. Any such tax incurred will reduce the amount of cash available for distribution.

We may be required to pay a penalty tax upon the sale of a property. The federal income tax provisions applicable to REITs provide that any gain realized by a REIT on the sale of property held as inventory or other property held primarily for sale to customers in the ordinary course of business is treated as income from a “prohibited transaction” that is subject to a 100% penalty tax. Under current law, unless a sale of real property qualifies for a safe harbor, the question of whether the sale of a property constitutes the sale of property held primarily for sale to customers is generally a question of the facts and circumstances regarding a particular

18

Table of Contents

transaction. The 2008 Housing and Economic Recovery Act changed the safe harbor rules such that a REIT, among other things, is required to hold the property for only two years rather than four years. We intend that we and our subsidiaries will hold the interests in our properties for investment with a view to long-term appreciation, to engage in the business of acquiring and owning properties, and to make occasional sales as are consistent with our investment objectives. We do not intend to engage in prohibited transactions. We cannot assure you, however, that we will only make sales that satisfy the requirements of the safe harbors or that the IRS will not successfully assert that one or more of such sales are prohibited transactions.

Company Related Risks

We may have difficulty funding distributions solely from cash flow from operations, which could reduce the funds we have available for investments and your overall return. There are many factors that can affect the availability and timing of distributions to stockholders. We expect to fund distributions principally from cash flows from operations; however, if our properties are not generating sufficient cash flow or our other operating expenses require it, we may fund our distributions from borrowings. If we fund distributions from borrowings, then we will have fewer funds available for the acquisition of properties and your overall return may be reduced. Further, to the extent distributions exceed earnings and profits calculation on a tax basis, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain in the future.

Yields on and safety of deposits may be lower due to the extensive decline in the financial markets. Until we invest the proceeds of the offering in properties, we generally hold those funds in permitted investments that are consistent with preservation of liquidity and safety. The investments include money market funds, bank money market accounts and CDs or other accounts at third-party depository institutions. While we strive to hold these funds in high quality investments with quality institutions, there can be no assurance that continued or unusual declines in the financial markets will not result in a loss of some or all of these funds or reductions in cash flows from these investments.

We may not be able to pay distributions at an increasing rate. In the future, our ability to declare and pay distributions at our current or an increasing rate will be subject to evaluation by our board of directors of our current and expected future operating results, capital levels, financial condition, future growth plans, general business and economic conditions and other relevant considerations, and we cannot assure you that we will continue to pay distributions on any schedule or that we will not reduce the amount of or cease paying distributions in the future.

We may be unable to invest the proceeds we receive from our common stock offerings in a timely manner. We have and expect to continue to raise capital through our current and future common stock offerings. If we experience delays in using this capital to acquire properties or make loans, it may reduce the rate at which we pay distributions to our stockholders as a result of the dilution that occurs from uninvested offering proceeds. Additionally, if we are unable to locate suitable third-party tenants for our properties, it may further delay our ability to acquire properties.

Offering Related Risks

The price of our shares is subjective and may not bear any relationship to what a stockholder could receive if their shares were resold.

We determined the offering price of our shares in our sole discretion based on:

| • | the price that we believed investors would pay for our shares; |

| • | estimated fees to be paid to third parties and to our Advisor and its affiliates; and |

| • | the expenses of this offering and funds we believed should be available for us to invest in properties, loans and other permitted investments. |

19

Table of Contents

There is no public market for our shares on which to base market value and there can be no assurance that one will develop. However, eighteen months following the completion of our last offering, we will be required to provide an estimated value of our shares to our stockholders.