Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ADA-ES INC | d8k.htm |

| EX-99.1 - EARNINGS RELEASE - ADA-ES INC | dex991.htm |

Creating a Future with

Creating a Future with Cleaner Coal Cleaner Coal Investor Presentation March 25, 2010 NASDAQ:ADES Exhibit 99.2 |

-2- Please note that this presentation contains forward-looking statements within the

meaning of U.S. securities laws, including statements relating to coal;

future bids, projects, contracts, financing, tax credits, production and

various financial measures; the likelihood, timing and impact of new laws,

regulations and court rulings on our target markets; anticipated sizes of and growth in our target markets; future supply and demand; the new activated

carbon (“AC”) facility ADA Carbon Solutions (“ADA-CS”) is building; ADA-CS’ ability to supply AC; industry support for our products and programs; ownership of future AC facilities and

litigation. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to differ

materially from those anticipated, including changes in laws and

regulations, government funding, prices, economic conditions and market demand; impact of competition and litigation; failure to raise additional financing;

availability, cost of and demand for alternative energy sources and other

technologies; operational difficulties; Clean Coal Solutions’ ability to negotiate acceptable contracts for sale of Refined Coal and to monetize the tax credits; availability of skilled personnel; failure to satisfy performance guaranties; availability of raw materials and equipment; specific risks related to

ADA-CS such as changes in the costs and timing of construction of the AC

facility, failure to satisfy conditions in existing agreements, actions of ADA-CS’ other owner; and other factors discussed in greater detail in our filings with the SEC, including in our Form 10-K

under “Risk Factors.” You are cautioned not to place undue reliance on our forward-looking

statements. These statements are presented as of the date made, and we

disclaim any duty to update them unless required by law to do so.

|

Clean Coal Technology Coal is an abundant, cheap, and secure fuel that provides over 50% of electricity in the US 1,100+ coal-fired boilers in the U.S. ADA provides the technology to burn it cleaner Senior staff are industry recognized experts – 30-year track record of developing and then commercializing technologies Positioned to take advantage of public and political support for Clean Coal Technologies |

-4- Investment Highlights Developing solid sorbent capture technology for greenhouse gas CO2 Started work under $3.2 MM DOE and utility funded program Proposal submitted for $14 MM scale-up funding Supported by major power generating companies CO 2 Control Mercury Control Patented technology designed to improve combustion of PRB Coals in Cyclone boilers while reducing emissions of mercury and NOx Clean Coal Solutions installed two production facilities in December 2009 capable of

producing over 6 MM tons of Refined Coal per year Tests completed to qualify for Section 45 IRS tax credit of $6.20/ton for ten years;

monetization triggers payments to ADA-ES of up to $4 MM from JV

partner, NexGen Congress considering one year extension to allow placement of additional units

Activated Carbon Injection (“ACI”) is deemed maximum achievable control

technology (“MACT”) for the removal of mercury ADA is a market leader for ACI equipment and engineering services ADA Carbon Solutions (“ADA-CS”) building new energy-efficient AC

manufacturing facility in LA; DOE awarded ADA-CS’ subsidiary, Red River Environmental Products, $245 MM conditional loan guarantee to finance the facility. EPA is developing three new MACT regulations that could create $1 B market for AC

ADA-CS is permitting for up to 5 additional AC production plants. ADA

has the rights to own up to 50% through equity contribution in additional

capacity Refined Coal |

Ongoing • ADA-ES • Product: Equipment Sales (ACI, FGC, CyClean, and SO3 Control) • Current: 30% market share on ACI; Possible additional CyClean systems this year; bids out for FGC and SO3 • Future: Federal MACT finalized in 2011, w/full implementation in 2014; 600-800 potential systems, orders for ACI systems will have to be placed in 2011/2012 to meet expected 2014 compliance

deadline 2010- 2020 • Clean Coal Solutions, LLC (50% JV with NexGen) • Product: CyClean (Refined Coal Technology) • Current: Two systems placed-in-service as of 12/31/09 for 6+ MM TPY; expected

to begin producing >$6 MM per year in operating income to ADA starting in Q2 2010, plus up to additional $4 MM from NexGen; • Future: Working to obtain extension of the placed-in-service deadline for

another year to expand business further in 2010. Potential for

10-20 MM additional tons. 2010-20XX • ADA Carbon Solutions, LLC (ADA has a minority interest; joint venture with

ECP) • Product: Activated Carbon • Current: Building largest AC production plant expected to commence commercial

operations in May 2010. • Future: Federal MACT mandates (2014) expected to increase market to >$1 B + per year 2010-20XX • ADA-ES • Product: CO2 Capture Technology • Current: $3.2 MM R&D project with DOE and industry players; Proposal

submitted for additional $14 MM in scale-up funding • Future: Additional funding opportunities from DOE; Commercial implementation in

2015-2020 Timeline for Segment Development & Revenue & Earnings Potential -5- |

Total Solutions Provider Total Solutions Provider The ADA Advantage The ADA Advantage -6- |

GROWTH AREA #1: Refined Coal Product ADA-ES’ opportunity through joint venture with an affiliate of NexGen Resources Corporation -7- |

Section 45 Refined Coal Tax Credit Clean Coal’s patented refined coal technology, CyClean, is designed to enhance combustion of PRB coals in cyclone boilers – Based upon legal interpretation of IRS guidance, CyClean is not limited to cyclone boilers Two systems placed-in-service in December, meeting Section 45 tax credit deadline for – $6.20 ton/coal (escalates annually) for ten years – Together, facilities are expected to produce greater than 6 MM tons of Refined Coal per year – Reduced NO x by >20% and Hg by >40% Monetized revenue expected to produce > $6 MM in operating income per year for ADA Initial sales of ~$5 MM per facility with possibility of additional $50 MM per unit based on final structure of transactions Monetization will trigger up to $4 MM from NexGen to maintain its 50% of JV Working to obtain extension of the placed-in-service deadline for another year to expand business further in 2010 – If awarded, an additional 10-20 MM tons could be placed in service -8- |

Financial Reporting of Consolidated CyClean Sales ADA Financials Revenues Equipment Monetized Tax Credits Expenses Equipment Chemicals Operations Utility Fee Operating Income Minority Interest Taxes Income One-time equipment sales of ~$5 MM per system. Could include an additional one time $30-50 MM per system if contract includes a fixed note. Monetized revenues of $6.20 per ton of refined coal produced, minus discount fee for monetization and minus fixed note. NexGen 50% share of CCS Income. ADA keeps 60% of cash flow to NexGen until $4 MM is paid for NexGen to retain its 50% interest. CCS/ADA Operating Income of approximately $2/ton. CCS may retain partial ownership of facility to keep sufficient tax credits to offset tax burden. This would proportionally reduce reported revenues. Before tax income and cash flow to ADA of ~ $1 per ton |

-10- GROWTH AREA #2: Mercury Control |

-11- ACI System for Mercury 90% Mercury Control at Approximately 1% of the Retail Cost of Electricity Emission Control Equipment (NO x , SO 2 , Particulate) |

-12- AC Market Drivers: Regulations for Mercury Control Green states with existing rules create $200 - 300 MM AC market |

-13- Activated Carbon Injection (“ACI”) Equipment Sales for Initial Market Contracts for ACI systems for over 150 boilers (55 GW) have been awarded by power companies to date – ADA market share: approximately 30% – The rest are split between 7 or 8 other companies An additional 15-20 contracts are expected for new power plants and current state regulations Working closely with largest utilities in the U.S. and Canada Key supplier of mercury control technology to major air pollution control companies |

ADA

Commercial ACI Systems > 20 GW ADA Commercial ACI Systems > 20

GW ADA Clients -14- Plant burns PRB coal or lignite Plant burns bituminous coal |

-15- Expected Federal Laws that Will Increase Our Markets U.S. EPA MACT for Coal-Fired Boilers – Will cover all 189 Hazardous Air Pollutants (“HAPs”) – Should result in 90% to 95% limit for mercury – Final regulations expected November 2011; 3 years to implement U.S. EPA Industrial Boiler MACT – Will cover larger number of boilers, smaller units – Draft expected April 2010 to be finalized by December 2010 U.S. EPA MACT for Cement – AC needed for both mercury and volatiles – Draft expected this year U.S. Legislation – 3-P Bill could be added to Climate bill by Sen. Carper (D-DE) which includes 90% Hg Canadian-wide mercury standard has been passed |

Market for ACI Equipment Expected from a Federal MACT Standard -16- 0 50 100 150 200 250 300 350 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 State Rules and New Plants MACT High Estimate MACT Low Estimate |

AC

Production Supply / Demand -17- |

ADA-CS New AC Production Building largest AC plant to date: 150 MM lbs/yr Capital cost: approx. $385 MM Plant designed to be low-cost producer 3-5 year development process: Startup target: May 2010 Site permitted for 2 nd production line -18- |

-19- Potential for Up to Six Production Lines Two lines permitted adjacent to Red River Mine in Louisiana Permits filed for two lines at a site near Bismarck, ND Developing additional site near coal sources to minimize feedstock costs Future lines are expected to: Have improved financing options (higher debt and lower equity) due to reduced risks

Have faster ramp up to full capacity due to tighter demand and improved market

position as an established and proven AC manufacturer Be built at lower cost Be timed with Federal MACT regulations Have 50% ADA-ES ownership |

-20- Low-Cost Producer Plant sited in the middle of lignite reserves – Provides access to a long term supply of low-cost feedstock material Minimal transportation costs for lignite Plant design with four furnaces in a single production line minimizes labor requirements Modern, state-of-the-art equipment reduces maintenance costs Production designed for large volume customers, minimizes material handling and labor Energy efficient design with extensive energy recovery – Generates 19 MWs, 6 MW for internal use, 13 MWs to be sold on grid as revenue source |

-21- ADA-CS Interim AC Supply Facility Currently supplying AC to utilities prior to new plant start-up Sourcing high-quality AC AC processing and logistics facility – Processing capacity up to 60 MM pounds per year of Powdered AC – Easy access to rail and barge transportation |

-22- Financing for AC Plant |

GROWTH AREA #3: Control of Greenhouse Emissions: Carbon Dioxide -23- |

Carbon Capture and Storage (CCS) International, Federal, and State Regulations are being proposed requiring 50% to 80% reduction in CO 2 emissions Requires development of technology to capture carbon from existing plants -24- 0 100 200 300 400 1 50% CO2 Reduction New |

ADA-ES CO 2 Capture Technology Designed to capture CO 2 from flue gas in conventional coal- fired boilers Based on regenerable solid sorbents - advantages over competing technologies: – For the customer: lower cost and less parasitic energy – For ADA: continuous revenues from sale of proprietary chemical sorbents $3.2 MM DOE R&D program with extensive industry support – Southern Company, Luminant, American Electric Power, Xcel Energy There has been a significant increase in funding opportunities for CCS technology through DOE -25- |

Next Steps for CCS Technology Current DOE Program through 2010 – Field tests using slipstream device • Bituminous Coal at Southern Company • PRB at Xcel • Lignite at Luminant – Design of conceptual 500 MW system Responded in December to a DOE Funding Opportunity Announcement for scale-up of solid-sorbent based carbon capture technology – $14MM proposal being evaluated Opportunities for DOE and industry funding for full-scale demonstrations are expected in the future -26- |

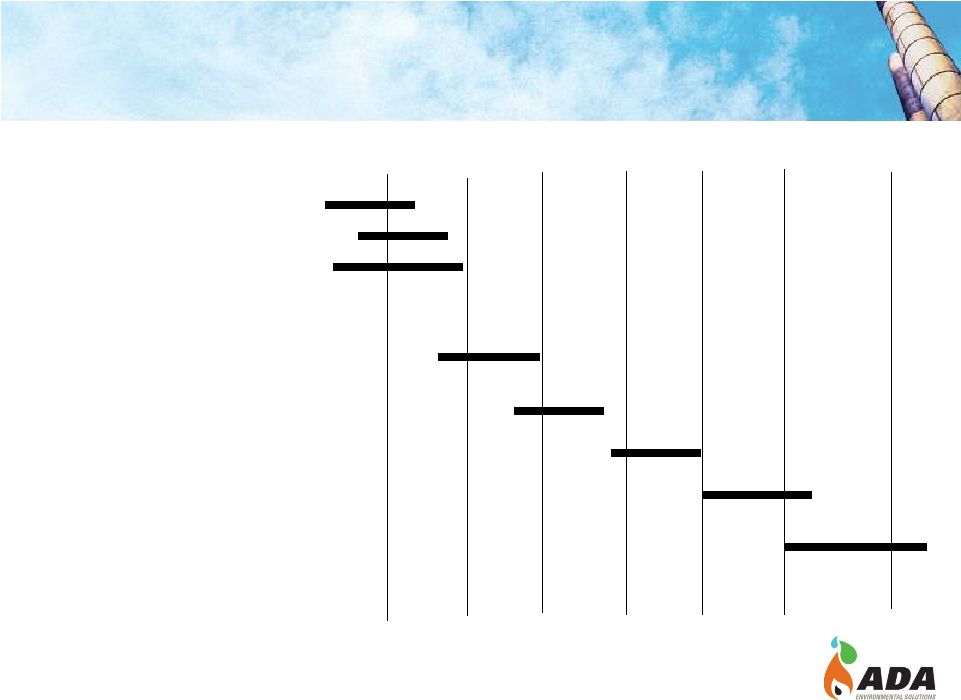

2009 2010 2011

2012 2013 2014 2015 2020 DOE Sorbent Evaluation Lab Screening Field Tests Equipment Review DOE Funded Scale Up Phase 1: 1-5 MW Pilot Phase 2: 40-50 MW Design Construct Operate Commercial Implementation Commercialization of Carbon Capture Technology -27- |

Lawsuits Calgon – Suit based upon a contract Calgon signed with MidWest Generation for AC sales – Calgon and ADA had an MOU that provided a commission on sales of AC bid while the MOU was in place – ADA believes that it is entitled to >$8 MM in commissions on this contract – Discovery complete, trial scheduled for July 2010 Norit – In June, Norit sought an injunction to stop construction of the plant. This was summarily rejected by the Judge. – On October 6, the Judge ruled in favor of a motion ADA filed requiring that the suit be addressed by binding arbitration in Atlanta, GA. • We view this as a very positive development in the case • Arbitration expected this fall -28- |

Financial Highlights Balance sheet highlights (at 12/31/09): – Working capital of $2.2 MM – Shareholders’ equity of $24.4 MM – Cash & equivalents of $1.9 MM Market cap: $49.4 MM (3/23/10) -29- |

A

Leader in Clean Coal Technology © Copyright 2010 ADA-ES, Inc. All rights reserved. NASDAQ:ADES |